Innovation Experience Leadership

The best foundation for the sustainable production of healthy fish

OPTIMAL WATER QUALITY

PEREZ-MALLEA

From the Editor

By Mari-Len De Guzman

Warming up to climate change

The inconvenient truth about climate change is that not only are temperature changes affecting our natural ecosystems, it’s also causing us to rethink the way we do things, both as consumers and as an industry.

Whether it’s in our personal consumption or in the industrial realm, climate change is forcing us to face the reality that we simply cannot go on the way we used to and expect the climate crisis to resolve on its own. Sustainable production, supply and consumption of goods and services need to be more deliberate to have a more meaningful impact.

The recent deaths of some 2.6 million farmed salmon in Newfoundland in Canada brings the devastating effects of climate change closer to home.

Northern Harvest Sea Farms, a subsidiary of Mowi Canada, suffered a significant setback last fall after roughly 5,000 tons of fish died in the net pens, resulting in the temporary suspension of the company’s farming licences. Company representatives blamed the massive mortalities to an extended period of higher-than-usual sea water temperatures that lasted up to 13 days.

If recent climate-related catastrophes are any indication, the Northern Harvest fish mortalities are likely not going to be an isolated incident moving forward. Just as more frequent California wildfires and increasingly stronger hurricane seasons have become the norm every year, rising ocean temperatures will continue to wreak havoc to the species that live in it and, as a consequence, to businesses that rely on the

ocean as a resource. Nothing moves a corporation more than a hit on its bottom line.

Hearing about a natural phenomenon causing millions of fish to die in net pens made me think about land-based, closed containment aquaculture. Raising fish on land, in a controlled, bio-secure environment is really giving the fish a better fighting chance against the devastating effects of global warming. The business case for RAS gets stronger when the alternative is leaving the lives of millions of species – and the future of the industry – at the mercy of the unpredictability of this climate crisis.

I am not suggesting that the industry move away from net pen farming in favour of land-based production. But there is clearly a case to be made for diversifying the commercial production landscape that will lead to a more resilient, climate-proof industry. I agree with many in the salmon farming community that the choice does not have to be either/or, when it comes to net pen versus RAS, because the two can exist and flourish without wiping out the other.

The aquaculture industry, with its potential to help feed the projected 2.3 billion of the world’s population by 2050, surely has an infinite room for diversity: net pen, land-based, as well as offshore, open ocean farming. After all, sustainability is not exclusive, but inclusive.

Sustainable production and consumption is top on the global agenda. But let’s also find ways to cushion the effects of global warming by making the industry as resilient as it can possibly be.

www.rastechmagazine.com

Editor Mari-Len De Guzman 289-259-1408 mdeguzman@annexbusinessmedia.com

Associate Editor Jean Ko Din 437-990-1107 JKoDin@annexbusinessmedia.com

Advertising Manager Jeremy Thain 250-474-3982 jthain@annexbusinessmedia.com

Media Designer Jaime Ratcliffe 519-428-3471 ext 264 jratcliffe@annexbusinessmedia.com

Account Coordinator Morgen Balch 519-429-5183 mbalch@annexbusinessmedia.com

Circulation Manager Urszula Grzyb 416-442-5600 ext 3537 ugrzyb@annexbusinessmedia.com

Group Publisher Todd Humber thumber@annexbusinessmedia.com

COO Scott Jamieson

Printed in Canada

SUBSCRIPTION

RAStech is published as a supplement to Hatchery International and Aquaculture North America.

CIRCULATION

email: blao@annexbusinesmedia.com Tel: 416.442-5600 ext 3552 Fax: 416.510.6875 (main) 416.442-2191 Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Occasionally, RAStech will mail information on behalf of industry related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office

privacy@annexbusinessmedia.com Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission © 2019 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

The next generation of feed for RAS from Skretting. Coming soon.

Artificial salmon gut could cut down feed trial cost

A team of researchers from the University of Glasgow has been working on an experimental artificial fish gut system. Called SalmoSim, the system simulates the workings of a salmon’s digestive tract.

SalmoSim has the potential of helping fish farm operators better understand fish digestion and drastically reduce the cost of feed trials.

Led by scientists at the University of Glasgow, the three-year project, which began in 2016, also includes researchers from The Marine Institute and University College Cork (Ireland), Nofima (Norway), Alltech and Marine Harvest.

The system “represents a powerful tool for carrying out basic and applied research into fish digestion,” according to Dr. Martin Llewellyn, from the University of Glasgow’s School of Life Sciences.

SalmoSim researchers want to do away with food trials.

Gut microbiota is a bacteria that colonize the intestine. They play a vital role in digestion and the absorption of nutrients.

The SalmoSim project aims to understand how gut microbiota aids the absorption of feeds and the development of salmon.

At the recent Aquaculture Europe 2019 conference in Berlin, Raminta Kazlauskaite, a member of the research team, explained that feed trials cost the salmon farming sector about US$14.4 billion annually. A feed trial for a single feed additive could cost approximately $191,000.

Feed trials also take as much as six months long as researchers need to wait for a salmon to grow in size.

— NESTOR ARELLANO

$Farm-raised salmon contributes CA$1.5 billion to British Columbia’s economy.

Salmon farmers react to Liberal win in Canada’s federal elections

The Liberal Party’s victory in the recent Canadian federal elections has renewed concerns over Prime Minister Justin Trudeau’s campaign promise to phase out salmon net pen farming to land-based aquaculture by 2025.

RAS rises in China

RAS builder and designer Nocera has signed a US$5.7-million deal to provide 400 RAS tanks for Chinese firm Dongguan CIMC Intelligent Technology. Since China’s new clean water policy in 2017, Chinese farmers have been moving toward land-based production as the government phased out fish farms in public waters.

In a statement following the announcement of a Liberal minority government, the BC Salmon Farmers Association (BCSFA) said the commitment made by the party has caused “undue stress and pressure for nearly 7,000 families who depend on salmon farming for their livelihoods.”

“The Liberal Party’s campaign promise altered what had been a productive conversation about how our industry can evolve into the future,” said executive director John Paul Fraser. “Now that the election is over, it is time to move forward in a productive manner guided by facts and science.”

During his campaign, Trudeau introduced the Liberal Party’s plans for “Canada’s first-ever Aquaculture Act.” The document outlined, among other things, the Liberal party’s aquaculture agenda to replace British Columbia’s open net pens with closed containment systems in the next six years. The strategy was quickly

labelled “reckless” by an alliance of aquaculture organizations across Canada.

Fraser pointed out that salmon farmers in B.C. share the same priorities as the Liberal government: climate-responsible food production, embracing the principles surrounding the United Nations Declaration on the Rights of Indigenous Peoples, working in concert with coastal Indigenous Nations, protecting wild salmon, and offering opportunity in remote communities.

Fraser called on the government to collaborate with the industry to help address the challenges of climate change and the restoration of wild salmon population while farming the most carbon-friendly animal protein.

“Mandating an uninformed, large-scale change upon a sustainable, responsible industry will not work – instead, we must work together,” Fraser said.

Farm-raised salmon is B.C.’s highest valued seafood product, the province’s top agricultural export, and generates over $1.5-billion towards the B.C. economy, resulting in about 7,000 jobs.

The BCSFA represents over 60 businesses and organizations throughout the value chain of finfish aquaculture in B.C.

Find more RAS-related content online and stay up-to-date on the latest news and developments around the world. www.rastechmagazine.com

Grieg NL RAS build gets underway

By Eric Ignatz

ST. JOHN’S, Newfoundland – Grieg Newfoundland’s massive RAS project in Marystown, Newfoundland and Labrador, is progressing well as construction of two of the five planned facilities are currently underway.

Candice Way, production manager of Grieg Newfoundland (NL), provided an update on the progress being made in Marystown and gave insight into the scope of the Atlantic salmon producer’s ambitious project during the Cold Harvest Conference held in St. John’s last September.

Grieg NL is currently constructing two land-based fa -

cilities in parallel, a hatching first feeding and a smoltification building.

The first of three post-smolt facilities will begin construction shortly. Building will be a phased approach over five years, totalling five facilities and production volume of 33,000 metric tons, Way said.

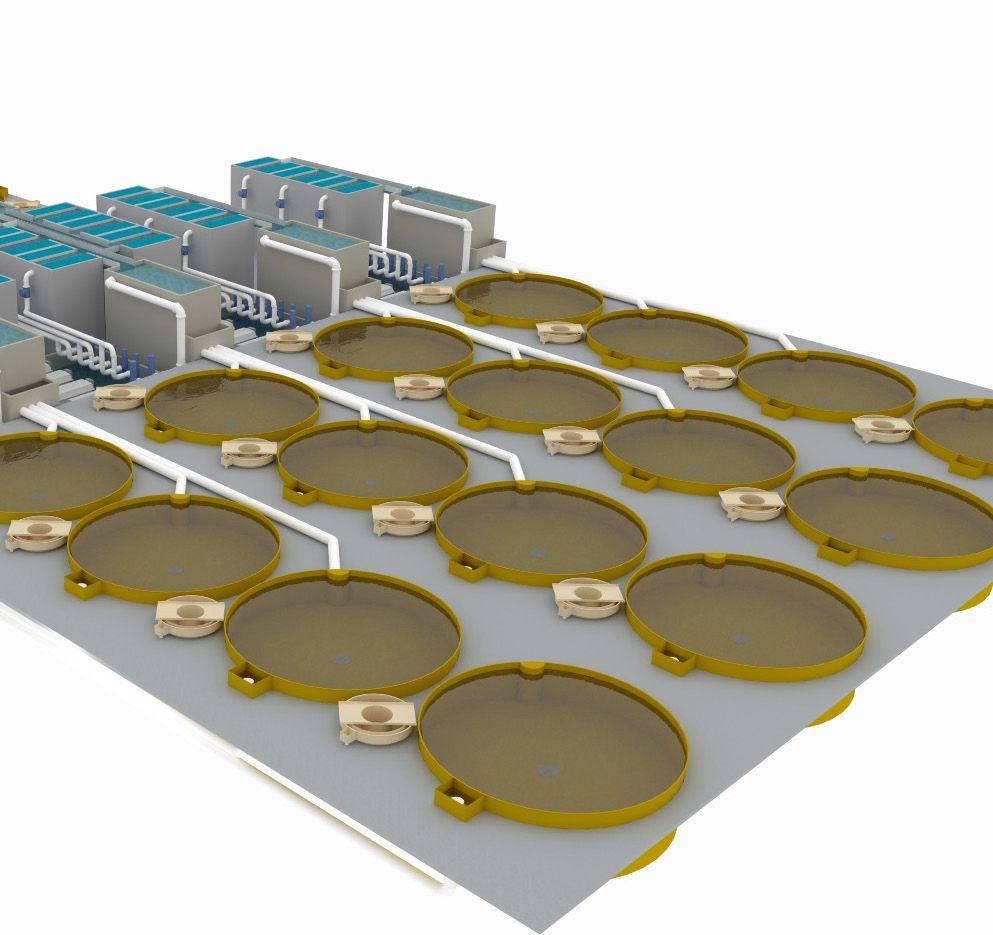

All the facilities will utilize recirculating aquaculture system technology designed by Israeli company AquaMaof.

“They have a different way of approaching it. If any of you have ever been in a RAS system, there are a lot of pumps pushing the water through it. AquaMaof took the perspec-

tive as to why we would push water when we could have gravity working in our favour,” Way explained. She went further to describe the systems as almost 100 per cent recirculation.

Grieg NL will also be taking a different approach with their salmon, Way said. “We won’t be holding any broodstock, so we will receive a CFIA (Canadian Food Inspection Agency) permit to import StofnFiskur eggs. They will be female, sterile, Atlantic salmon eggs that get shipped over from Iceland to our facility.”

With the construction of the three post-smolt facilities, Grieg NL also plans to rear its salmon longer on-land.

“Ordinarily once they get about 50 grams and are smoltified, many facilities take

them to sea. We are holding them on land longer. So, we are doing a mix of not purely land-based right to plate, but we are going to hold them on land longer before they go to sea. What that allows us to do is actually have one winter at sea here in Newfoundland as opposed to two.”

Post-smolt salmon will be transferred to sea cages once they reach a minimum weight of 350 grams, but could remain on land until they are upwards of one kilogram. They will then spend another seven to 16 months at sea before they reach harvest weight.

While many of Grieg NL’s proposed sea cage operations in Placentia Bay are still undergoing environmental assessment, it appears its RAS facilities are full steam ahead.

CLEAN FEED. CLEAN WATER.

Wenger Extrusion Solutions for RAS Feed Production

Wenger innovative extrusion solutions deliver clean, durable, nutritional feeds specifically designed for the most e cient RAS operations. Feeds produced on Wenger systems maintain their integrity better and longer, for clean and clear water. So you feed the fish, not the filter.

Learn more about the Wenger RAS advantage. Email us at aquafeed@wenger.com today.

Indonesian investors partner with Norwegian firm for landbased project

Negotiations between a group of Indonesian firms and Norwegian aquaculture company

Sterner AS could pave the way to a substantial investment in land-based aquaculure in the Asian country.

The agreement between a group of Indonesian companies were led by PT El Rose Brothers and Sterner AS during the 2019 Trade Expo Indonesia (TEI), according to a press statement from the Indonesian Embassy in Oslo.

PT El Rose Brothers intends to begin building a RAS facility in Yogyakarta Province in

2020. The facility will have the capacity to produce 2,500 tons annually of white snappers. Investment in the project could reach US$50 million. PT El Rose Brothers also plans to build a hatchery to support the operation of the RAS facility, according to Ferry Budiman, director of the company.

“We are indeed aiming to become a producer of fishery products with onshore facilities within the next five years that will provide products for the domestic and global markets,” he said. “This partnership project can serve as the basis for integrating Stern -

er’s foreign investment, RAS technology, and clean water management in Indonesia,” said Gisle Larsen, director of Sterner AS.

Sterner is the largest Norwegian water treatment company, based in Ski, Norway. In the 1990s, it began focusing on the aquaculture industry. As a prime supplier, the company offers plants for drying sludge from fish farming to a dry matter content of more than 90 percent so that it becomes stable and can be stored without decay. The company builds modular RAS components.

Ferry Budiman (left), director of PT El Rose Brothers, and Gisle Larsen (right), director of US Sterner, led the signing ceremony, which was held on October 16, 2019.

— NESTOR ARELLANO

StofnFiskur has been producing broodstock in full-cycle land-based systems since 1991. We are the leading worldwide supplier to the emerging land-based industry with Atlantic salmon ova.

We are launching a new product range specializing in full-cycle land-based RAS systems — SalmoRAS4+ and SalmoRAS4+IPN. The products are specially selected for fast growth and highly resistant against Infectious Pancreas Necrosis (QTL-IPN). To reduce or eliminate the risk of early maturation of males, we are offering these products as All-Female (only female fish population) and Triploid where the fish are sterile and not able to mature.

To find out more contact Róbert Rúnarsson Sales

Manager

robert.runarsson@bmkgenetics.com +354 693 6323 bmkgenetics.com

RAS set for growth decade, says new report

By Colin Ley

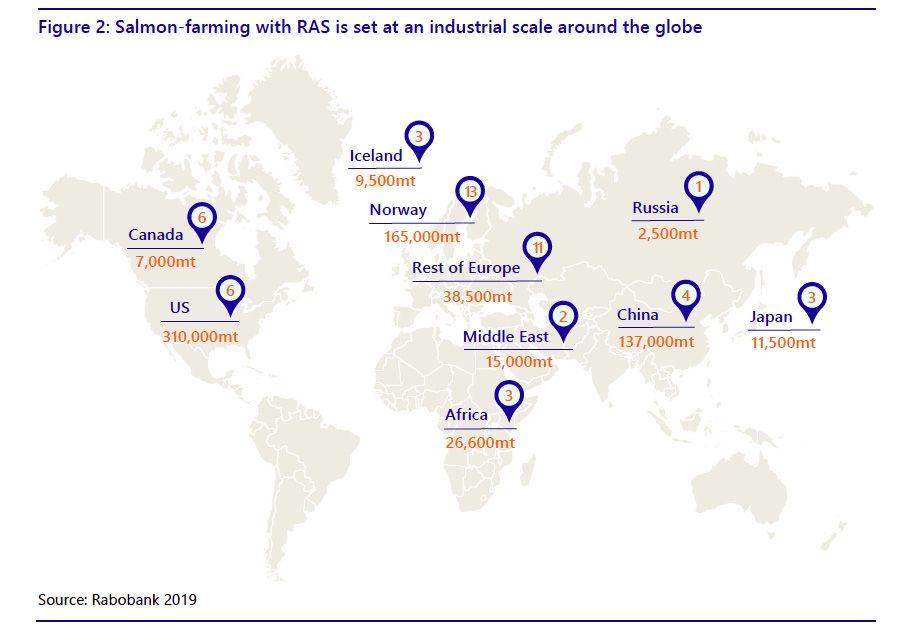

The tide is turning for recirculating aquaculture systems (RAS), according to the Netherlands-based RaboResearch in a new report focusing on the potential for RAS to become an aquaculture game-changer over the next decade.

“An increasing number of proposed RAS projects, particularly for salmon farming, are in the process of building a platform for future success,” said Beyhan De Jong, RaboResearch analyst and author of “Aquaculture 2.0: RAS Is Driving Change – Land-Based Farming Is Set to Disrupt Salmon.”

“We have identified more than 50 RAS proposed projects (and counting) for farm salmon, with an estimated production potential by 2030, which is equal to 25 percent of total current salmon output.”

While accepting that RAS is still under development, with a future that therefore holds uncertainties, De Jong freely predicted a positive future for RAS operations.

“Provided the risks within RAS operations are managed effectively,” he said, “we believe RAS will disrupt aquaculture trade flows, supply chains and the marketing of salmon

within the next decade.”

De Jong is also careful to include a note of caution that RAS technology will continue to have its developmental ups and downs.

“We see the number of proposed RAS projects for farm salmon increasing steadily,” he said, before adding that he doesn’t expect current projections for land-based salmon output to hit 700,000 metric tons over the next 10 years to be achieved.

Financial bottlenecks, the wrong business or marketing strategies, the wrong choice of location or species to farm, alongside postponements to permit delivery, could all delay such an increase in RAS volumes, he suggested, opting instead for 250,000 metric tons of salmon as his personal 2030 growth forecast.

www.freshbydesign.com.au

Those seeking to develop the RAS sector, he continued, will need to overcome a series of financial, marketing and operational risks. RAS developments, for example, will require high capital expenditure.

“The period between investment going in and revenue coming out is relatively long. This requires some financial flexibility, as several unexpected production and technological challenges can occur. Extra financing might also be needed while ramping up production volumes,” he stated in the report.

Another major risk area concerns consumer acceptance of land-based production as opposed to fish raised in more “natural” conditions.

“While RAS farmers argue that their products are local, more sustainable and more environmentally-friendly, sea-based farmers could argue that their fish come from pristine open waters – the natural habitat of salmon,” he stated. “In the end, consumer acceptance will determine who will win this marketing game and get the price premium.”

His conclusion, however, is that landbased salmon farming is poised for the beginning of a new era of production.

“Currently, the focus of RAS is on highvalue, premium, and niche products, such as salmon and, to a limited extent, kingfish, sole, sturgeon, turbot, barramundi, and steelhead,” he stated.

“With technology advancing, there might be opportunities for other seafood categories as well in the future, although the focus will always be on the categories with a higher price point, for some time.

Consolidation marks industry suppliers’ quest for land

By Mari-Len De Guzman

Large suppliers to the aquaculture industry are jumping on the land-based bandwagon with mergers and acquisitions that signal a business strategy to capture a fast-growing segment of the market.

Whether it’s to supplement their existing net pen and offshore offerings or to provide turnkey RAS facilities from egg to harvest, the goal is to become a one-stop shop for aquaculture producers.

InnovaSea in Boston, Massachusetts, has been focusing on open ocean aquaculture through submersible pens. It’s decision to add land-based RAS solutions was driven by customer demand for more consistent and stable supply of fingerling, according to Innovasea’s CEO David Kelly.

“It was an aspect of customer need that we could not fulfill, but it was intimately related to grow-out,” Kelly said. His company purchased Louisiana-based RAS designer and supplier Water Management Technologies in early 2019, which signalled InnovaSea’s entry into the RAS market.

Following the WMT acquisition, it also acquired Norway-based Nortek Akvakultur, combining its expertise with InnovaSea’s Realtime Aquaculture unit to establish the Innovasea Instrumentation team.

“We see increased instrumentation and automation both in hatchery and nursery operations, as well as land-based and oceanbased grow-out solutions,” Kelly explained.

For its land-based side of the business, Innovasea will put more focus on warm water marine species, according to Terry McCarthy, general manager at InnovaSea Land Sytems. “We still view land-based salmon smolt operations as an important market but… the right approach to the future of aquaculture is to focus on high-value marine species.”

Resulting from a series of mergers and acquisitions, AKVA Group, began its journey towards land as early as 2015, with the purchase of Denmark’s Aquatec Solutions.

“With the AquaTech solutions we have a very solid technology from a project delivery point of view and we are very excited about what is coming,” said Mary Ann Rademacher, general manager of AKVA Group Land

Based Americas.

The company recently completed the first-ever salmon RAS farm in the United Arab Emirates. The client, Fish Farms, aims to produce between 10,000 and 15,000 kilograms of salmon each month.

“We believe in the concept of a one-stopshop,” Rademacher said. “We believe that customers want as much as possible to deal

with one supplier. They don’t want to be dealing with many suppliers for just one project.”

The AKVA executive also welcomes the trend toward more consolidation among suppliers, particularly in the RAS market. “It’s good to have good competition. I think it improves the performance of all of us at the end. When you are riding alone, then nothing is stimulating development, innovation and everything.”

A most recent product of supplier consolidation that combines both sea and landbased expertise, and everything in between, is Scale AQ. This new company is a result of the merger of Norway firms Aqualine, AquaOptima and Steinsvik, combining 40 years of industry experience.

There are many opportunities for landbased aquaculture for various species and in different scale, according to Astrid Buran Holan, senior advisor at Scale AQ.

“If you don’t have access to ocean, then land-based will be great all the way up to slaughter,” Holan said. “But if you have access to oceans, with not too strong current, that is the more economical way of producing fish, instead of having the whole lifecycle on land.”

Mary Ann Rademacher, general manager, AKVA Group Land Based Americas

Power Struggle

By Maddi Badiola

Maddi Badiola, PhD, is a RAS engineer and co-founder of HTH aquaMetrics llc, (www.HTHaqua.com) based in Getxo, Basque Country, Spain. Her specialty is energy conservation, life cycle assessments and RAS global sustainability assessments. Email her at mbadiolamillate@gmail.com or contatct her through LinkedIn, Facebook and Instagram.

Sustainability and the bottom line

The Nature Conservancy called aquaculture a “compelling investment opportunity with meaningful impact.” Particularly about recirculating aquaculture systems (RAS), one thing is clear: talking about RAS is talking about sustainability and as such, operating sustainably means that every link of the production chain has to commit to such a statement.

The American Cleaning Institute (ACI) recently launched a sustainability report detailing its strategies for taking bolder collective actions. ACI is typical of many industrial sectors that recognize the driving social, environmental and economical forces that demand increased transparency, reduced emissions, respect for nature, and positive global impacts.

Within these goals and strategies are the pressing opportunities to embrace a more circular/sustainable economy, think bigger, be fearless, and be more innovative – generating returns alongside positive social and environmental impacts.

Many parts of the supply chain are prone to detrimental health and environmental impacts and it is there where the transparency requested by consumers obligate managers to prioritize responsible practices. At the end, great quality fish in the plate means a happy fish in the tank.

And where does efficiently used energy fit

in this process? In the generation of positive global impacts while producing fish.

Making the right choice

Companies now have access to an expanding menu of innovative clean energy alternatives, and choosing the best options depends upon the unique circumstances of each business and project location. But the choice has to be done. Thus, company managers, during planning and design activities should have answers for different questions, such as: energy efficiency with renewable options, is that necessary and/or viable? Is that the best option for my company? Is my company eligible for funding to implement cleaner technologies? Will the company be located in a place with easy access for such alternatives?

It is true that access to government incentives and/or promotions offered by energy

providers are making green projects more viable. The investment required for cleaner technologies is still higher than for the conventional energy sources, although their implementation could be a way to enhance incomes via different marketing strategies. As such, the best option is taking the long view. After the financing pays off, the energy saving benefits continue for years, benefiting company’s profitability economically and globally.

Sustainability planning

One of the most important steps is to be in contact with experts in the field of different energy sources, building insulation, roofing, lighting. Every energy-using component (both active and/or passive elements) has to be taken into account in the designing process.

At the same time, a sustainability plan

including energy efficiency as one of the pillars should answer questions such as: What are the benefits of sustainability and energy-efficiency investments? Will my customers value companies committed to sustainability over others when making purchasing decisions? How much will the expenditure be on building and energy-related equipment maintenance? What federal, state and local tax benefits and other resources are available to companies that invest in energy efficiency and sustainability? Is there any cost-reduction opportunities for my company, including green buildings, energy-efficient lighting, and solar and wind energy options?

There are many questions to be answered but necessary for one’s business development plan to be successful. There are important financial questions and decisions to be made – how will the investment be financed? This will be a solution-based approach customized to the needs of each company. What you need is what you get.

Thus, the assessment of capital options should be comprehensive to ensure that the

company has the best possible solution. Having a wide range of financing alternatives

Making sure the customers understand the full sustainability commitment of the company will be key to creating loyalty within the public.

to consider, the goal is to sort out the most attractive solution, the one that fits best with capital and balance-sheet requirements, as well sustainability goals and objectives.

Public opinion

Incomes and the company’s main objectives are driven by marketing strategies. Many people are content to continue with the old extractive business models. But those that care differently want to hear a truthful and genuine story that supports their desire to care and make a positive impact. Making sure the customers understand the full sustainability commitment of the company will be key to creating loyalty within the public.

Third-party validation

Certification processes and different labels are also important here. There are already some certified RAS companies out there which, through social media’s influence, reach more and more customers not only in the local area but also in farther distances.

Nevertheless, from an expert point of view, it is reasonable to doubt some of the certification processes and the scope and/or factors they take into account when assessing a company. Not all of the programs are equal and not all of the factors are assessed. The limiting factors of each of them must be clear for the customers, including what is and what is not under the scope of study.

Follow my next article to know more about different certificate programs available for RAS.

And do not forget that in a century where customers are concerned about what they are serving or being served in their plates, creating a more sustainable business model represents a significant opportunity for companies.

Engineer’s View

By Michael Ben Timmons

Bringing RAS to China

Two greatest weeks of my life

Ihope you enjoyed your summer since that season has come and gone. At the time of this writing, the leaves are already falling in New York. Time marches on.

In July this past summer, I had the privilege to teach two courses in China at the Communication University of China (CUC) in Beijing. I taught two courses: one on solar energy and the other on entrepreneurship (two of the courses I teach at Cornell University).

Only in its second year, the CUC program had 200 students being taught by 20 professors from the United States. The courses covered a wide range of topics (filmmaking, ornithology, gender issues, my two courses, and others). The intent of all courses was to cover about 50 percent of USA culture and western teaching methods.

I had 17 of the 200 students. I like to do ‘real’ projects with my students so I had the students focus on developing a business plan to implement an aquaponics operation into a SOS Children’s Village (there was a SOS Village in Beijing and one in Nanjing. See www.sos-childrensvillages.org for more info on SOS). My students visited one of the villages to do a site feasibility analysis, and then over the two-week period presented a complete business plan for implementation.

I’m happy to report that the Nanjing SOS Village is now in the process of seeking approval to install an aquaponics system. Wow! Why was this project so quickly

accepted by the Chinese? China has recognized the need to be able to produce food in a sustainable manner and to do it quickly. We have to figure out a way to feed an additional three billion people in the next 40 years or so.

China also recognizes the need to adapt food production methods that do not harm the environment. And guess what? RAS in China is a big deal.

There are several fish projects underway in China and – guess, again – these projects are using the mixed cell raceway (MCR) design that I have previously written about.

It was very gratifying to see an existing farm that is producing over 500 tons per year of Coho salmon using the MCR design. MCR appears to be the system of choice in China, at least by some (probably those who have read my book, Recirculating Aquaculture by Timmons, Guerdat, and Vinci fourth edition, Ithaca Publishing Company).

I participated as a keynote speaker in the first annual Chinese-American Summit on Recirculating Aquaculture on August 3 at Zhejiang University. The event was hosted and organized by Dr. Songming Zhu. This summit was absolutely amazing. I learned so much about China and its current aquaculture industry.

At the end of the day-long conference, much to my surprise, there was a presentation to unveil the Chinese version of our book, Recirculating Aquaculture, and Dr. Zhu is a co-author. This conference was important as it allowed me to make some key contacts

with leading industrial aquaculture companies.

At the conclusion of my China trip, I was asked by the US Soybean Export Council (USSEC) director Jim Zhang to conduct a one-day workshop on the basics of RAS. USSEC has been promoting the intensive pond aquaculture system that was developed by Dr. David Brune when he was at Clemson University. However, the Chinese government is now requiring greater control and scrutiny over all commercial operations that adversely affect the environment. The best way to prevent any environmental degradation caused by fish farming is to implement RAS. So, my charge for the one-day workshop was to explain to the USSEC client base what RAS is, its benefits, and how to implement such systems. The workshop was very well received and concluded with discussion and brainstorming on how to implement 100 RAS farms in China in the near future. When China decides to do something, they often do it in earth shaking form. Maybe China will see the first cluster communities that are formed around RAS. I’m ready to help and am looking forward to our next steps.

So, when I visit next summer, maybe the fourth or fifth MCR system will be under construction. If you want to learn more about RAS or would like one of your employees take my course on RAS, tell them Dr. T referred you and receive a 10 percent discount or 25 percent for teams of three or more. Find out more at www.eCornell. com/fish.

China has recognized the need to be able to produce food in a sustainable manner and to do it quickly.

Show me the money

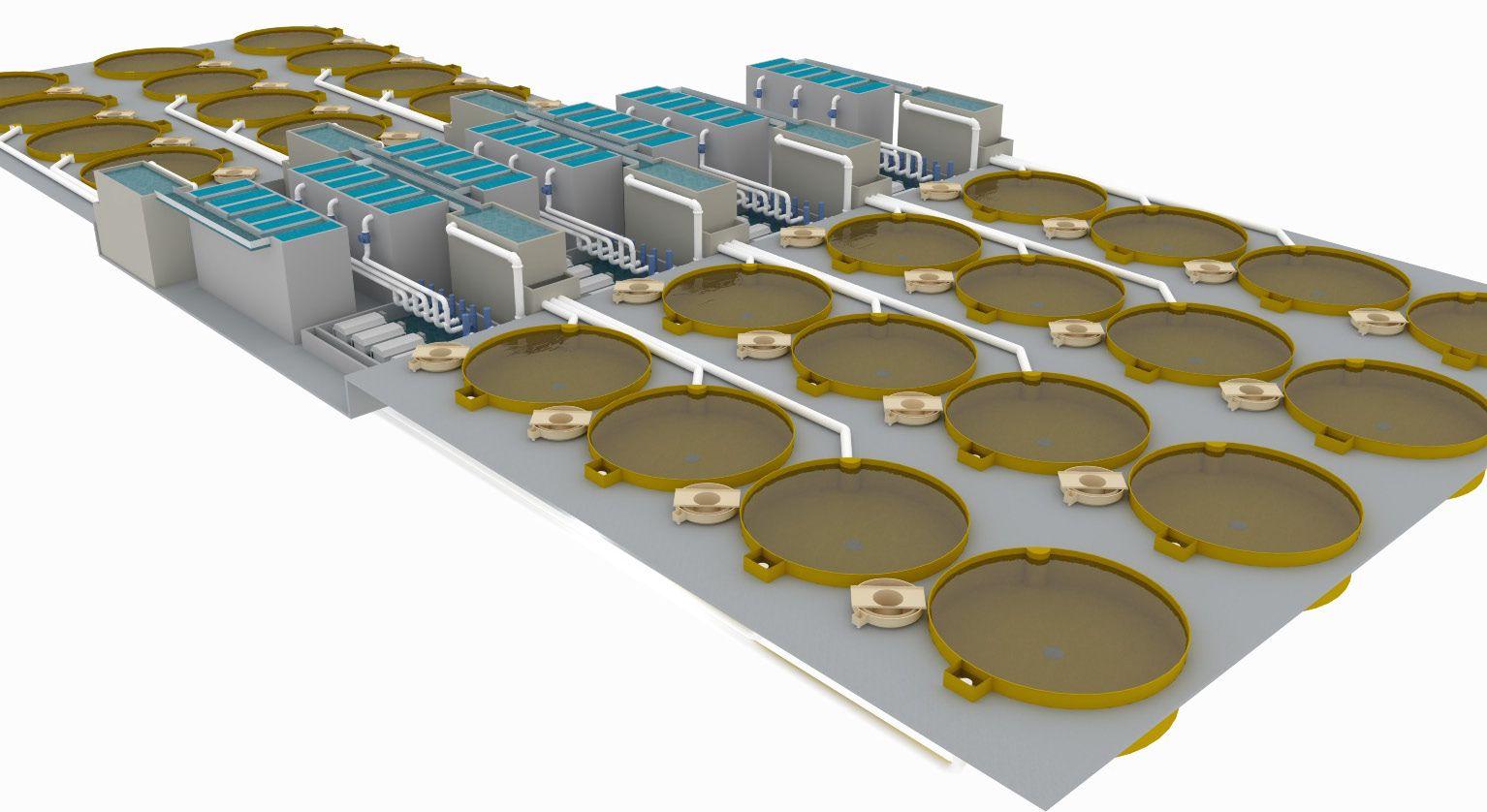

Economies of scale for land-based recirculating aquaculture systems

By Laura Bailey and Brian Vinci

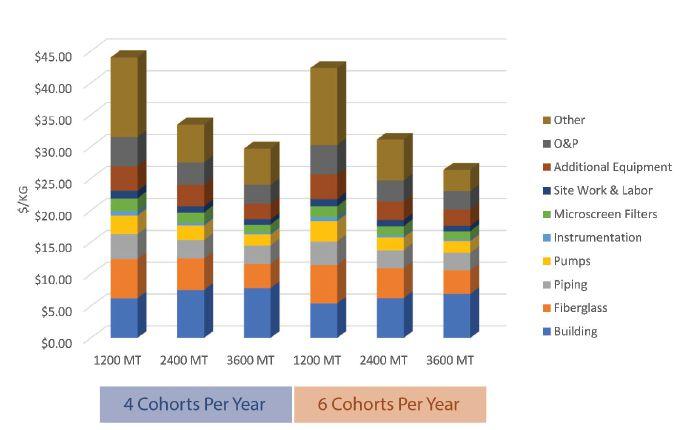

Land-based recirculating aquaculture systems (RAS) are becoming more common for the production of market-sized salmonids. A major obstacle to implementing commercial-scale RAS is the large upfront capital cost. This study analyzed the capital cost of land-based RAS at three annual production levels and determined the impact of scale on capital costs. Additionally, we analyzed the impact of facility utilization, or the number of cohorts per year, on capital cost.

Six concept-level RAS facility designs were developed to produce 1,200, 2,400, or 3,600 tons of Atlantic salmon. Each production level included a design to accommodate six cohorts per year and a design to accommodate four cohorts per year. All designs were based on identical bio planning, which included identical fish growth at each life-

stage and determining all locations and movements of fish throughout the production cycle. The concept level designs were used to develop capital cost estimates based on construction industry standard data and prices provided by aquaculture vendors.

Concept design development

Concept designs were comprised of RAS with dual-drain culture tanks, radial flow settling, microscreen filtration, fluidized sand biofiltration, cascade aeration for carbon dioxide stripping, low head oxygenation for oxygen addition, and water chilling. Additionally, ozonation was included for all grow-out systems. Bio planning for the engineering designs were based on data from The Conservation Fund’s Freshwater Institute. For example, the following feed conversion ratios were used: Fry, 0.85; smolt, 0.90; pre-grow-out, 1.0 and grow-out, 1.1. Max-

imum biomass density of 85 kg/m3 was used for all RAS. The overall mortality rate used was 28 percent, which included two cull events of 10 per cent each.

Each fish production scenario assumed maintenance of the following water quality conditions: total suspended solids <5 mg/L, dissolved oxygen of 100 percent saturation, total ammonia nitrogen <1.3 mg/l, dissolved carbon dioxide between 10-20 mg/l, and nitrate-nitrogen <80 mg/l. Concept designs of facilities were planned to grow market-size salmon of 4.5 kg from egg. All facilities included finishing/depuration systems. The number of tanks and RAS used for each facility design differed depending on the standing biomass and the estimated density.

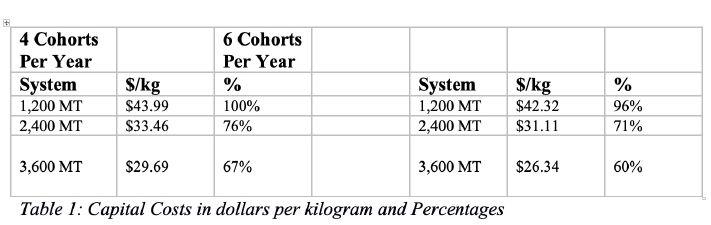

Cost estimates

Standard engineering methodology was used to develop capital cost estimates for

Laura Bailey is a project engineer with The Conservation Fund’s Freshwater Institute, and Brian Vinci is the director of the Freshwater Institute, based in Shepherdstown, West Virginia.

each of the six facility designs. Cost estimates have three main parts: building cost, including basic build-out, backup generator, and feed storage; RAS equipment and installation, including equipment and labor for each of the rearing stages; and additional costs, such as overhead and profit, engineering, construction management, and 10 percent contingency. Cost estimates were intended to be complete delivered project costs. The cost in dollars per kilogram of fish produced was used to compare the total cost between the different production sizes. The $/kg for all facility designs are shown on Table 1. The percentage column shows the scaling effect. The highest capital cost, 1,200 MT at four cohorts per year, is considered 100

percent and the other percentages are based off that value.

Results

Overall, the capital cost per unit of salmon produced decreased as the size of the facility increased. For instance, the cost difference between the 3,600 MT and the 1,200 MT was almost $14/kg. Additionally, RAS facilities producing six cohorts per year resulted in capital cost savings ($/kg) compared to facilities growing four cohorts per year. The 3,600 MT at six cohorts per year is almost $3/kg less than the 3,600 MT at four cohorts per year.

We broke down the capital cost estimates into major expense categories, as shown in Table 1. Major line items that contribute to

the total cost of the systems are the building, fiberglass, piping, recirculating pumps, and microscreen filters. We found the building costs are affected by both scaling and facility utilization. For the facilities with six cohorts per year, the building costs were almost $1/kg less than the systems with four cohorts per year and the building costs were about $1.50 per kg less for the 3,600 MT designs compared to the 1,200 MT designs. Another major capital expense was tank construction, low head oxygenators, CO2 strippers, radial flow settlers, and other RAS equipment. We found fiberglass to be less affected by facility utilization, but more affected by scaling. The fiberglass cost per kg for the six cohorts per year model is relatively close to the four cohorts per year. For piping, the unit cost difference between the six cohorts per year and four cohorts per year system is minimal. The piping cost appears to be impacted by scaling, especially between the 2,400 MT facility and the 1,200 MT facility. The pump costs per kilogram were impacted by facility utilization differently than the other unit costs. The facility designs

at 3,600 MT and 1,200 MT with six cohorts per year required more pumps in order to accommodate fish every two months, and as a result had higher costs compared to the 3,600 MT and 1,200 MT with four cohorts per year. In terms of scaling, the pump cost per kilogram decreases with the larger facilities.

We also compared the capital cost for the

2,400 MT concept design that is based on a fluidized sand biofilter (FSB) RAS to the capital cost of a 2,400 MT concept design that is based on a moving bed biofilter RAS. We found the cost per kilogram for 2,400 MT FSB concept design ($31.11/kg) was higher than the cost of the 2,400 MT MBBR design ($27.71/kg).

Conclusion

Results from this engineering analysis indicate that larger RAS facilities capable of producing more salmon per year and with bio plans designed to maximize tank space with a maximum number of cohorts resulted in a lower capital cost per kilogram of annual production. These results are not surprising; however, we found that scale and facility utilization affected expense items differently. For example, building costs were impacted by both scale and facility utilization, but costs for fiberglass, piping and pumps were primarily influenced by facility scale only.

Announcements for new land-based salmon farms include a range of annual production from 1,000 MT to 220,000 MT, with many at 5,000 MT. The capital cost for these projects are so large that finding savings and efficiencies is critical. This analysis indicates that designers can focus on the interplay between building and tank construction to best take advantage of economies of scale for reduced cost. Innovative solutions to maximize tank volume and minimize building size will have the greatest positive effect.

Table 2: Capital Cost Breakdown

Pumped for pompano

Former banker brings business skills to build commercial RAS farm in Florida

By Liza Mayer

Joe Cardenas recognizes an opportunity when he sees one: demand for seafood is rising and Americans are growing increasingly aware of the origin of the food on their plates.

But while conducting due diligence gave him confidence in aquaculture’s potential, it took some six months before he decided to leave his job as a commercial banker and establish Aquaco Farms, a recirculating aquaculture system (RAS) facility raising Florida pompano (Trachinotus carolinus) in St Lucie, Florida.

“Bankers typically have been the least risk-takers I’ve ever met in my life,” Cardenas says. “They’re very, very conservative financially. And aquaculture is nothing but risk at this stage so it took me quite a long time before I could talk to my wife about quitting my job and taking this on, and luckily she supported it. My

passion for fishing and the outdoors, combined with my experience in commercial banking led me to this great opportunity.”

NO SHORTCUTS

It’s been over four years since that conversation. Cardenas has since raised $3.2 million for the first phase of the privately-funded company, which he acknowledged didn’t get handed to him on a silver platter.

The challenge was finding the right partners and investors who understood the time it took to get a sound aquaculture project off the ground. His vision for a gradual scale-up was slower than what most potential investors would have liked. Some were looking at it purely from an investment play versus an impact-and-sustainability play that has a long-term return on investment.

“They didn’t quite grasp (our vision). They’d ask, ‘Why are you doing a Phase 1 and Phase 2, why not go out and raise $10 million to do it all at once? That’s how they do it in other industries.’ I had a lot of those conversations around and the best way to answer them was that we were operationally focused versus investor focused,” he says.

When the time came to build, the mantra, “Slow but steady wins the race,” also guided Cardenas. Aquaco’s gradual build-up shows a dramatically different picture from the mega RAS facilities being built in other parts of the US. Cardenas won’t have it any other way.

And he would be first to admit that passion alone doesn’t cut it. He made sure he surrounded himself with experts who have worked with fish in commercial settings and “checked

their egos at the door.” That team of seven full-time employees, including Cardenas, did almost the entire build-out inhouse, from creating the design to building the infrastructure and constructing the wells, with the help of two consultants – an engineer and a biologist.

“Nobody led the discussion. It was all groupthink about the best pump company, the best drum filters, the best tank designer to use. It was just a conglomerate of different ideas in agreement,” Cardenas says.

The Aquaco team did everything their way despite the availability of studies on raising pompano in RAS systems. The, “Commercialization of Florida Pompano Production

in Inland Recirculating Systems,” conducted in 2013 by the Harbor Branch Oceanographic Institute at Florida Atlantic University is one of those studies.

“We did not incorporate anything (from the study) because nothing they worked on really focused on a commercial scale. It doesn’t mean there’s no long-term benefit to their work but as far as having soundness of commercial design, or diets, for instance, there just wasn’t anything practical for us to wrap our arms around.”

He is more excited about the institute’s work with selective breeding that’s scheduled to begin in 2020. “That’s really where we will benefit. There really isn’t a lot we’re going to

Top right: Aquaco Farms’ RAS facility in St Lucie, Florida, gives the company a $1.00- to $1.20-per-pound advantage as it does not have to ship its products to get to market. Top left: The company’s seven-member team did almost the entire build-out in-house. Bottom right: Aquaco Farms put its first cohort of 30,000 Florida pompano fingerlings in July 2019. The company expects to harvest them in February.

get from the larval rearing stage or any other points of efficiency other than from a selective breeding program. That’s one area where no one has started work yet on pompano.”

Wanting to do it right delayed the facility’s start but Cardenas was steadfast with his vision. “It was a long patient two years from the time we closed on our site to seeing our first fish swimming around. But I don’t regret it because of the outcome and the quality of it. Other projects have rushed themselves to failure.”

“We developed this farm the right way,” he continues. “There will be no ground injection for waste treatment. We will recirculate 97 percent of the water, keeping our fish healthy by continuously filtering out wastes to ensure clean, clear water.” The collected wastes will be sold for fertilizer.

WHY POMPANO?

The 20,000-square-foot facility took in its first cohort of 30 ,000 Florida pompano fingerlings in July. By October, the fish were being readied for transfer from the nursery to the grow-out tanks. “ They have shown great growth since our stocking in July and will be ready for harvest in

February,” Cardenas happily shares.

Aquaco Farms sourced its first batch of fingerlings from a local vendor. But that could change soon. The company is planning to build its own hatchery to reduce its reliance on outside suppliers. It hopes to eventually source 80 percent of the fingerlings inhouse and the rest from the local vendor.

“The first step is to collect our broodstock from the wild this fall and start building our broodstock program,” Cardenas told RASTech in late summer. “We should have that completed by December and the next step after that is our hatchery.”

Aquaco Farms will eventually be able to sustainably produce one million pounds of fish a year from just 100 fish caught in the wild. The process from egg to harvest weight of between 1.25 to 1.5 lbs. takes nine months. That is a short grow-out period compared to other species, and one of the reasons Cardenas chose to raise Florida pompano. The other selling points are the fact that the species is native to Florida waters and they do well in dense quarters.

“They tend to school in the wild naturally so they school well in a tank. There’s also a lot of flexibility with their toler-

ances; they have a huge salinity range. I’d say their ideal zones of salinity is a trade secret but they can go all the way down to 10 ppt or survive in as high as 35 to 36. So they are a little less fragile than other species,” says Cardenas.

High demand and limited supply from fisheries was also a factor in the choice of Florida pompano. Although Florida dubs itself the “Fishing Capital of the World,” pompano wild catch is seasonal and very inconsistent. “I’ve met with a lot of commercial

fishermen who have never concentrated on it as a career; it’s more of an opportunistic catch,” he says.

Aquaco is currently the only pompano farmer in North America and the only farmer raising the species in RAS on a commercial scale. The closest other producer is Dyer Aqua, a 250-metric-ton-a-year net-pen operation in Panama –it was the first company to supply the US market with fresh farm-raised pompano on a commercial scale, its website says.

Joe Cardenas, founder of Aquaco Farms, says growing Florida pompano from egg to harvest only takes nine months. It’s one of the reasons why he chose the species for his RAS farm.

RAS ADVANTAGE

For Cardenas, the biggest advantage in growing the fish in RAS is logistics. Aquaco’s presence in the east coast of the US puts at its doorstep a potential market of 21.3 million people in Florida alone.

“Chefs have worked with wild pompano; it’s not a new species, but the biggest limiting factor is consistent availability, so that’s what we provide,” he says.

The company’s primary focus is to wholesale fresh, never-frozen pompano for delivery to the customer within 24 to 36 hours of harvest. “Wholesalers will come and pick up their orders. We will avoid processing and distribution for now, and that would be quite a bit of savings in packaging and shipping and going through customs. We have about $1.00 to $1.20-per-pound advantage in having a domestic product here and not having to ship it.”

Reducing environmental risk is another RAS advantage. “We’re indoors, we control all the water quality standards. A lot is in your control as far as temperature, salinity, pH, biosecurity. All that to me was all worth the additional money it took to build the type of system that we have. We know that nothing is 100-percent guaranteed, but we greatly increased the survivability of the fish by doing it the way we did.”

EXPANSION PLANS

Cardenas acknowledges that the initial production of 10,000 lbs. each month in the current first phase will barely scratch the surface. He estimates this volume is only enough to serve 35 restaurants. So he is planning an expansion, one that will see 100,000 lbs. of monthly production beginning in 2021, serving up to 350 restaurants.

That expansion includes the broodstock program, hatchery and the addition of 250,000 square feet to the existing site. Cardenas estimates Phase 2 will need around $7 million to $7.5 million, roughly twice the amount raised to fund Phase 1. The goal is to begin expansion work by February or March 2020.

“This is the time I turn my hat around from an aquaculturist and become a fundraiser again,” he says.

Fundraising for the scale-up is the biggest challenge for Cardenas. “Invest-

ors like to be told they’re going to make their return sooner, but I think people appreciated more that we were truthful from day one versus having to excuse the balance sheet down the road. I presented it very openly and honestly that this was not a two-year-return-on-capital type of project. It’s going to take us, at minimum, three to four years to start that profitability turnaround and start being able to distribute profits.”

That he has something concrete to show this time around could help attract potential investors. “It could be easier now that we have a working blueprint than when I was out there selling my idea to people. This makes it a little bit easier for audiences to understand what we do. Everyone’s been really happy with the results of Phase 1,” he says.

His life may have changed– working 30 hours more than he did as a banker – but he is happy with no regrets. “I’m here at the site probably 80 hours a week to not only do the administrative side, but to learn the aquaculture side. My guys trust me now to actually be around fish. That’s a good sign,” he laughs.

He added: “I’m 42 now and if someone asked me a little while ago if I would have done it 10 years sooner, my honest answer will be no, because I learned so much over the last 10 years.”

Valuable lessons include those he learned during his 15 years as head of commercial traditional lending, where

he met business owners, examined their financials and got a glimpse of various leadership styles and what it took to succeed in various industries.

“There’s no crystal ball to show if we’re going to fail or succeed but I’m really happy with the lessons I have taken from my prior life if only to make sure that our budget was sound,” he says.

Aquaco has stayed within five to 10 percent of budget, he says. “We had budgeted $3 million and we came in at $3.2 million so that’s pretty good because my background was balancing project budgets in the past.”

Phase 2 is expected to be completed over the next 18 months. Aquaco plans to look for additional sites after that.

“I’m a big believer in having multiple locations than having one mega farm that’s cheaper in some sense but also more risky,” he says. “So I’d much rather maintain our headquarters here and expand by having an additional grow-out location in the state.”

He plans to stick with Florida pompano, as he expects current demand will continue to outweigh the supply. “We will stick with the species until the market tells us otherwise, such as when more competition comes down the line, which I’m sure will happen. But right now it’s all pompano. The margins are right. The fish is behaving as we wanted or better, and the pent-up demand has been great.”

Laboratory analysis and lab scale demonstrations highlight extrusion processing conditions critical for high performance RAS feed production

By Dennis Funk, Galen Rokey and Kellen Russell

Physical characteristics of aqua feed pellets have always been important to farmers. For years, high expectations have centered around the requirements of consistent size (diameter), correct buoyance, pellet durability during transportation and handling, and longevity once placed in water, with the farmer’s eye and the fish’s consumption rate and efficiency being the top deciding factors on whether a feed’s performance was acceptable or not. These quality demands have been the measuring stick in the aquaculture farming community for decades but are now seen as insufficient due to the rapid growth and requirements of Recirculation Aquaculture Systems (RAS).

The reason for this is due to the RAS requirement of constant conditioning and filtering of water in order for the system to maintain the proper balance of oxygen, ammonia, and other water quality attributes. The water quality management systems add a significant cost to the overall operation and investment budget (up to 35%)(1) and require consistent oversight and maintenance as a troubled filter system can result in a loss of the entire tank’s fish stock.

Filters capture particles from three main sources – feces, pellet fines or pieces of a disintegrating pellet, and nutrients leached out of the pellet. The feces aspect is impossible to get away from but can be reduced using recipes formulated with creative ingredients to help bind fecal matter, allowing these particles to be more easily and thoroughly removed from the water. This key capture is handled best in the diet formulation and proper processing steps to improve digestibility. Feed or feed particles and nutrients that are not consumed must also be removed from the recirculated water and can be reduced by proper diet formulation and processing. How can these factors be controlled to minimize a negative role in RAS operations?

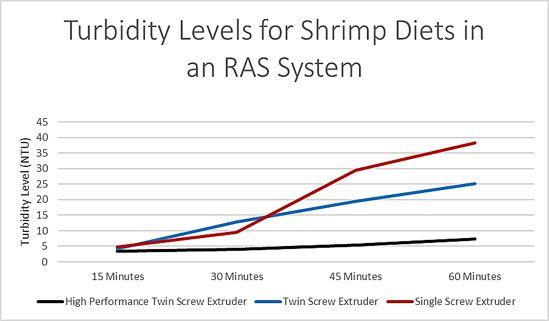

Recent laboratory analysis and lab scale demonstrations have highlighted the pellet integrity and leaching sources are best controlled via the extrusion processing step as well as attention to diet formulation. A wide variety of commercially available and laboratory produced floating, sinking and shrimp feeds were tested in a lab scale RAS system. Feeds

were manufactured and compared from four major extrusion platforms – single screw, traditional twin screw, conical, and the newest twin screw models which utilize deep flighted screws and thermal energy for cooking. The study’s aim was to determine which extrusion platform consistently produced the feed most suited to the strict RAS environment.

The study not only looked at the long held important factors of pellet buoyancy and water integrity but went further and measured turbidity of the water at measured time intervals, as a method to measure how each product’s technical qualities would react inside the RAS, and thus have an impact on the filter and water-conditioning system. High water turbidity was indicative of pellets with too many fines and weak durability and became a key indicator for fat and other nutrients leaching from the pellet.

Results from the study show the finer and smaller internal cell structure within a pellet as one key influencer of pellet integrity and thus, water clarity. The finer and more numerous cells allow for nutrients to be more tightly

secured inside the pellet which significantly limited leaching nutrients. Securing the nutrients inside each pellet has multiple benefits. The fish consumes more nutrition with each pellet resulting in a higher feed conversion rate and allowing the farmer to capture more production profit. At the same time, the reduction of particles and nutrients in the water can reduce the load on conditioning and filtering systems, resulting in lower filter maintenance costs and less opportunity for filter system failures.

The ability of each extrusion platform to produce the finer and smaller cell structure varied significantly. Generally, feed samples made with single screw machines showed the largest and most inconsistent cell structures. These feeds often resulted in the highest level of water contamination once placed into the lab scale RAS systems. This was noticed both by visual appearance and confirmed through turbidity monitors.

Feed samples made with traditional parallel shaft twin screw extruders generally ranked better than single

Figure I: Laboratory Scale RAS Testing: Tank on left with high performance RAS feed and tank on right with feed not optimal for RAS

Funk is the vicepresident, Aqua Feed Division at

Inc.

screw systems in all aspects of cell structure, integrity in the water and turbidity level. Conical twin screw extruded samples showed consistent cell structure development, high integrity in water and lower turbidity levels than those from traditional twin and single screw platforms.

The consistently top-performing feed samples were those produced on twin screw technologies which utilize deep flight geometries and allow for significantly higher levels of thermal energy to replace mechanical energy in cooking of the extrudate. These feeds showed unique cell structure development, exceptional integrity inside the water and the

lowest turbidity numbers, which was easily noticeable by visual inspection of the water. This high-volume twin screw technology coupled with intense preconditioning prior to extrusion resulted in RAS feeds with desirable technical qualities.

The conclusion of the lab scale study is that there is significant importance on the type of extrusion platform used to produce feeds destined for RAS usage. While traditional extrusion systems have been able to supply adequate feeds to help RAS farmers develop their markets, true growth in the RAS sector will be facilitated with the highest performing feeds which supply consistent nutrients to the fish, reduce the load on conditioning and filtering systems which in turn will reduce the costs of maintaining these systems and, perhaps most importantly, mitigate the risks that occurs when conditioning and filtering systems become overloaded and RAS water chemistry becomes toxic for the fish. Advancements in feeds specifically produced for recirculating systems is a critical step in the growth and advancement of the global RAS industry.

(1) A Guide to Recirculation Aquaculture, Jacob Bregnballe, 2015, FAO and Eurofish, pg.50.

Dennis

Wenger Manufacturing,

Galen Rokey is the process technology director at Wenger Manufacturing, Inc.

Kellen Russell is a technical support at Wenger Manufacturing, Inc.

Figure II: Turbidity levels were measured over a time period for shrimp feeds made on different extrusion platforms.

By Matt Jones

Ideal world

Raising high-value branzino in RAS

Ideal Fish is not just a clever name, says president and CEO Eric Pedersen – the name reflects the principles and values that have guided the development of the company.

“It was looking at whether there were disruptive technologies that can be brought to bear on this industry,” says Pedersen. “But what grabbed me wasn’t the potential for technological innovation, although I think there is a big need for that. It was just the extent to which the fundamentals of recirculating aquaculture really address so many of the concerns that we have in this country around seafood supply.”

Pedersen has worked in companies in the water filtration space in the early 2000s and was struck by how combinations of biofiltration and membranes could be applied in aquaculture. With

capture fisheries leading to the depletion of ocean resources and with mixed results from open caged farms in terms of sustainability, Pedersen says he saw a real opportunity for recirculating aqua-

Around 750,000 gallons of water are recirculated daily through Ideal Fish’s closed containment facility.

culture systems to address consumer concerns.

“I think there’s a lot of pushback from the developed shoreline property owners, whether they’re industrial or residential, that will make permitting and getting cage farm operations off the ground very difficult,” says Pedersen. “Recirc, by the same token, can satisfy regulatory requirements much more easily.”

Pedersen says that between a low risk of escapes and discharging waste water to a treatment plant, the company had very little difficulty obtaining the necessary approvals to raise a non-native species in Waterbury, Connecticut. Today, Ideal Fish’s 65,000-square-foot facility, a repurposed button manufacturing factory, is on track to produce roughly 160 metric tons of Branzino or European sea bass (Dicentrarchus labrax) per year by the second quarter of 2020. The system contains roughly 750,000 gallons of water and recirculates 97 percent of that daily.

High-value

There is obviously an opportunity for raising Branzino in North America – virtually all of the species sold in North America are imported. Removing transit times makes for a fresher product. But the species is of high market value and well suited to growth in a recirculating aquaculture system.

“In order for recirculating aquaculture economics to work in the northeast United States, you need to raise a high value fish,” says Pedersen. “Tuna are a high value fish, but nobody’s figured out how to raise them in RAS yet. But Branzino had been raised successfully in recirculating aquaculture facilities. And it’s an ocean-going saltwater fish and commands a lofty price on the ice at fish counters in grocery stores and fish markets.”

The benefits of Branzino in a RAS system are myriad, notes Pedersen. Harvest weight is around 550 grams, so it’s not necessary to raise a very large fish. The breed’s feed conversion ratio is efficient, between 1.5 and 2,

meaning lower feed costs. And, as a temperate species they can adapt to a wide range of temperatures.

“Our fish tend to do really well at human room temperature,” says Pedersen. “So we’re pretty much keeping our facility at a temperature level that’s comfortable for staff. And it’s a fairly robust fish. Like any fish, you have to be careful and gentle when you handle them, but it’s a fairly hardy fish and if you minimize stress, fish will do well and they won’t get sick.”

Well-known

Pedersen says that the species is beginning to catch on in the United States and he expects the market to grow larger in the future. Branzino is also well-known and understood as a farmed fish species –there is very little concern

over stigma about farmed Branzino vs wild-caught Branzino as the wild-caught industry has been steadily shrinking over time.

“Most people who are knowledgeable about eating Branzino know that it’s farmed and can appreciate how getting a local fish that’s farmed in a far more sustainable way, that doesn’t require antibiotics or any other veterinarian additives to keep the fish healthy, is a good thing,” Pedersen points out.

Commercial production of the species in North America is very limited and, to Pedersen’s knowledge, outside of research laboratories there are no facilities anywhere in the world raising the species in a RAS system.

Smoked

While the company has grown

Eric Pedersen, president and CEO of Ideal Fish, is very excited about a new avenue the company is pursuing – a smoked branzino product.

according to the principles that its chief executive initially envisioned, he is very excited about one new development not in his original designs – the company is in the process of launching a smoked Branzino product.

“We believe that this will be a fairly major product line for us, absorbing half or even the majority of our production,” says Pedersen. “The reaction that we’ve gotten in the market to our smoked fish has been exuberant and somewhat unexpected. Branzino smokes very well, it has a wonderful texture. It’s an oily fish, but it’s not very oily. Your hands aren’t dripping after eating it with your fingers. And it just has a wonderful texture and flavor and holds the smoked flavor very well.”

The smoked Branzino product will be introduced towards the end of 2019.

Pedersen says the company currently has the capability and capacity to handle all production inhouse, but will likely look at co-packers if the product catches on as he expects.

Money matters

The company’s biggest challenge has been accessing the necessary capital to grow the business. Aquaculture in general already has fairly low margins and, as Pedersen admits, RAS systems are very capital intensive. While he has seen institutional capital markets starting to look at some very large salmon projects, the return on investment is, as of yet, too low for significant interest in RAS.

Looking to the future, however, Pedersen feels that aquaculture is becoming increasingly ubiquitous, and that someday there won’t be any distinction be -

tween farmed fish and wild fish, there will only be fish. The bloom is already off of the rose of wild fish, he feels.

“Wild fish are typically not very fresh. Trawlers have to go further and further off shore to find fishing grounds and they are away for sometimes weeks at a time, so the fish caught early on in the trawl are going to be old. And the ocean has become our dumping grounds, and the waters are certainly not as pristine as the water that we raise our fishes in at our facility. I think we’re going to begin to see it soon.

“There really is a huge opportunity in this country to create a sustainable, antibiotic-free, hyper-local, traceable industry around fish production,” Pedersen adds. “Recirc aquaculture is going to play a very large role in the development of a robust domestic supply of high-quality seafood.”

With a harvest size around 550 grams, a good feed conversion rate and suitability to a wide range of temperatures, Eric Pedersen says that branzino, a.k.a. European sea bass, is an ideal species for RAS.

From lakes to land

Chile’s innovative smolt farm commits to company-wide sustainable operations

By Christian PérezMallea

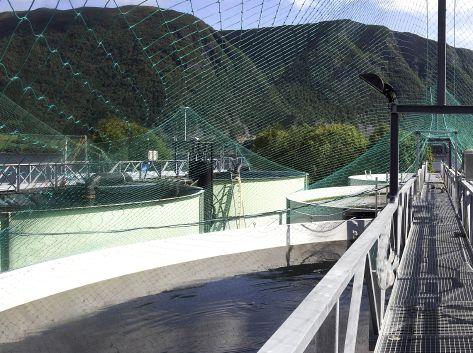

Roughly one out of 10 salmon smolts produced in Chile comes from a RAS smolt farm located on the shoreline of Pargua, 60 kilometers southwest of Puerto Montt. Owned by Chile’s largest salmon producer, AquaChile’s new organization is the result of the earlier integration of four entities now owned by agro-food giant Agrosuper: Los Fiordos, AquaChile, Salmones Magallanes and Friosur.

Currently producing half of the smolts reared by the new AquaChile, the Transference Centre Pargua’s RAS facility has become a symbol of the salmon producer’s commitment toward environmental sustainability

The Transference Centre Pargua officially opened in 2015 with three tanks of 310 m3 each. It has since grown to 40 tanks, all of which are independently equipped with

their own biofilters, rotofilters and degassing towers.

Production capacity

With a total capacity of about 12,400 m3, this farm represents an investment of US$16 million. It is the heart of AquaChile’s smolt production, according to production manager José Schwerter.

The water intake comes from six wells located within the premises, three of which

are obtaining freshwater and the rest for saltwater. “Saltwater is not obtained directly from the sea but suctioned through these wells, being filtered naturally by sand and then, prior to entering the tanks, passes through a UV filter,” Schwerter explains, adding that 99 percent of the water is treated and recirculated.

The Transference Centre Pargua delivers smolts directly to wellboats through a system of pumps and pipes. “Perhaps, we are the

PUMPS FOR AQUACULTURE

www.lykkegaard-as.com

Fish at the Transference Centre Pargua are vaccinated with a pentavalent injection at 60-70g (IPN, SRS, Aeromonas, Vibrio and ISA) and with a monovalent booster against SRS prior to transferring them to sea.

only company in Chile using salmoducts to deliver smolts. We complete loading a wellboat in about two to three hours. It is very friendly with the fish, as it involves less handling. In addition, it is much cheaper,” he says.

This site employs 21 workers who help produce four batches of Atlantic salmon smolts of 150 grams every year. “Our idea is to increase that weight over time and reduce times at the sea in order to minimize environmental risks and improve production yields,” he says.

These fish are transported to different farming sites in the regions of Los Lagos and Aysén, and represent almost half of the smolts required by AquaChile every year.

“We think that having 50 percent of our smolt production in just one place is already a significant number and we also believe that it is prudent to remain in that number and not to continue growing – in this place, at least. However, we do have investment projects to build smolt farms like Pargua in other locations.

Farming strategy

As an integrated company, AquaChile implemented a freshwater model that starts with its genetics facility, which is located in Catripulli. From there, eyed-eggs are grown to fry in open-flow sites, located in Curarrehue and Melipeuco. The fish are then transferred and raised in transference cen-

EQUIPMENT FOR RAS

Rotron Regenerative Blowers offer a reliable solution for moving large amounts of air at low to medium pressures throughout your RAS operation.

Made in the USA and distributed globally to the aquaculture market by Sivat Services, these blowers include:

• Options for multiple electrical configurations and for extreme duty special coatings.

• Large line of accessories: intake filters, inlet/outlet mufflers, sound attenuation cabinets, pressure regulators, moisture separators and VFD’s

Invest in the best equipment for your RAS facility.

• Degas Towers • Sand Filters

• Fractionators • Pumps

• Bio Filters • UV Sterilizers

• Ozone Systems

• Instrumentation & controls

• Heating & Cooling

• Bead Filters • Valves

• Blowers and more!

Contact Sivat Services today! +1-512-206-0608

tres such as Pargua.

Schwerter explains the objective of this smolt farm is to produce fish from 33 grams to 150 grams in 128 days. “In that period, we care to feed the fish and adapt them in the best possible way to the sea. For this purpose, we use freshwater and saltwater, increasing the proportion of sea water as the

www.sivatsi.com

(L-R) Fidel Pardo, site manager; José Schwerter, production manager; Fernando Hott, site production chief

smolts approach their transference stage,” José Schwerter explains.

Within those 128 days, fish are also vaccinated with a pentavalent injection at 60 to 70 grams (IPN, SRS, Aeromonas, Vibrio and ISA) and with a monovalent booster against SRS prior to transferring them to ocean net pens.

“The purpose of this strategy is for the fish to reach the sea as immunized as possible, so that the accumulated thermal units of that second vaccination against SRS cover us as long as possible at the sea. Currently, the process is handmade, but in the medium term, an automatic vaccination system would be incorporated,” he says.

He stresses that the quality of the smolt is vital. “We realized that by mixing freshwater with saltwater the fish is much better prepared and adapts quickly to the sea. That is to say, the body weights and FCRs (feed conversion ratio) that we see when the smolt reaches the sea are better, for example, compared to smolts reared 100 percent in freshwater and that does not go through a transference centre like this one.

“One can also notice that those raised in Pargua have an initial feed consumption much larger than the other fish, which takes longer to adapt to the sea. That is key. Moreover, once we started our production in Pargua, the percentage of runts and laggards had a significant decline in our mix of smolts transferred to the sea,” Schwerter says.

No more lakes

In early June of this year, AquaChile general manager Sady Delgado, along with its president José Guzmán, reported that they have discontinued using lakes to produce fish. This transition required a total investment close to US$35 million in land-based systems. In a similar move, Chilean company Multiexport also announced it will stop operating in lakes by 2020.

Schwerter explains that even before the AquaChile merger, Los Fiordos had stopped fish production in lakes many years ago. Following the merger, a corporate decision was made to cease AquaChile’s production in lakes, as well.

“That is why we have invested so many resources in Pargua, plus another US$16 million, approximately, to buy 50 percent of the freshwater site Reloncaví. Additionally, we have two projects in the pipeline to replicate the Transference Centre Pargua. This is an objective related to our commitment with sustainability and the environment,” Schwerter says. Until June 2019, the Reloncaví freshwater facility was owned jointly by AquaChile and Benchmark Genetics.

He added, “Since we have a great environmental and sustainability commitment, and we work hard on certifications, for example, with the WWF (World Wildlife Fund) from the moment we were integrated as one company, we decided to leave all the lakes and rivers as soon as possible, and we did it between April and May of this year.”

Despite leaving its operations in lakes, Schwerter says the company still holds aquaculture licences in these bodies of water, but those will now be made available for use by universities or other institutions for research purposes.

Since 1958, Faivre has been developing and manufacturing high quality equipments for the aquaculture industry

WARM SEA WATER

Showcase

Commercial Filtration Systems

Customized for your fish farm, hatchery or research operation!

Our Commercial LSS Packages are custom engineered to meet your specific needs.

• Marine and Freshwater

• Mechanical filtration

• Chemical filtration

• Ultraviolet disinfection

• NEMA enclosed controls

• Bio-filter towers

• De-gassing towers

• Wide variety of flow rates

• Flow control valves

• Protein skimmers

• Variable frequency-drive pumps

• Temperature management

Tech transforms wet waste to fertilizer

Wet waste management company is turning residual fish sludge into valuable biofertilizer.

Waister AS, in collaboration with the Norwegian University of Science and Technology, has developed a patented drying technology that claims to transform wet waste into a stable, hygienic and odor-free powder.

Wet organic waste can be a costly and difficult to dispose. Waister Dryer units are currently being used in the aquaculture industry, as well as the brewing industry and the food production industry.

The dryers are available in four sizes with different drying

capacities in kilograms per hour – Waister 15, Waister 40, Waister 60 and the Waister 300. All dryers discharge the dried wet waste into bags, with optional bagging stations.

The Waister 40, 60 and 300 can be fitted into a 20-inch insulated container as a “plug and play” solution, including a feeding tank and bagging stration.

The Wasiter Dryer can operate automatically 24 hours a day without supervision. They can also be accessed remotely via VPN server, facilitating support and surveillance from the dedicated service team.

www.waister.eu

Cargill celebrates farmers as everyday heroes

Cargill’s new digital platform aims to support and celebrate the modern-day animal farmer.

Feeding Intelligence helps farmers “navigate the changing food production landscape.”

about local farmers that are finding success in Cargill products.

The website provides resources and support on the latest, sustainable animal production practices, including within the aquaculture industry. The website is also dedicated to sharing stories

HI_Erwin Sander_RastechWinter19_CSA.indd 1 2019-10-16 8:51 AM

“Cargill is committed to advancing farmers’ operations in a way that aligns with consumer needs—helping farmers become more sustainable, more innovative and more profitable so the cycle can continue,” noted David Webster, president of Cargill’s Animal Nutrition & Health.

www.feedingintelligence.com

Showcase

BioMar to focus on land-based fish farms

Denmark-based fish food manufacturer, BioMar is zeroing in on the growing market for feeding solutions for the recirculating aquaculture system market.

The company said it believes it can help “efficiency and operational stability” for land-based fish farms by providing operators with better feeding solutions.

“RAS for land-based salmon farming is an emerging segment within the aquaculture industry, and there is still a potential to be realized,” Carlos Diaz, chief executive officer of BioMar Group, said in a press statement recently.

BioMar began developing its ORBIT product range in the late 1980s in response to the impact of land-based farming operations on the water quality of rivers and creeks.

The concept behind ORBIT was developed by BioMar Continental Europe for the production of portion trout in RAS. ORBIT for trout has resulted in an increase in production of up to 20 per cent with the same biofilter capacity, according to the company.

ORBIT for salmon is also designed for RAS. It is engineered for high growth and low feed conversion ratio. It reduces the load

on biofilters, provides better water quality and allows increased production using the existing biofilter capacity.

BioMar has created a task for selected based on their local and global results within the RAS industry. Members of this team have as much as 15 to 25 years of experience working as product developers and customer advisors within the aquaculture world.