By Mari-Len De Guzman

All indications are pointing to more RAS deployments across the globe as markets respond to increasing demand for sustainable food production, and the aquaculture industry realizes its potential to feed a growing global population. According to recent estimates by the United Nations, the global population will reach 9.7 billion by the year 2050, which is expected to increase food demand by up to 98 per cent.

The growing popularity of RAS has created more demand for specialized operational skills. Educational institutions and training programs offered by RAS technology development companies are helping raise the level of expertise of aquaculture practitioners to meet this growing demand. Producing highly qualified labour able to meet the rapidly changing pace of technology development and market requirements is key.

sharing. RAS-focused conferences are an essential part of a RAS practitioner’s skills development playbook.

On-the-job learning is also an opportunity to hone one’s RAS skills. Our Fresh Tips this issue (page 30) – provided by The Conservation Fund’s Freshwater Institute – offers some practical ways aquaculture organizations can help build their staff’s confidence in operating and maintaining RAS.

Advances in digital technology, as our cover story discusses, provide opportunities for learning as virtual environments can be created for staff training and development. The trend toward digitization of the aquaculture industry, by the way, is another reason why continuous professional skills development is needed.

Advances in digital technology provide opportunities for learning as virtual environments can be created for training.

Continuous learning is also important. RAS tools and technology are constantly evolving as investments and breakthroughs in research and development continue to ramp up. Practical knowledge sharing is important as lessons learned from deployments across various markets help shape and mature the industry.

There is no shortage of aquaculture conferences taking place around the world, which provides a great venue for knowledge

In the same way technological innovations have disrupted other major industries (think Airbnb and Uber), the aquaculture industry stands to gain from advancements that aim for more efficient operations. Those organizations that are able to adopt new technologies that will enhance the way they do their business will likely have the competitive advantage – and a highly-skilled, highly-competent labour market will help propel those successes.

Always happy to hear from our readers, so please email me for any comments and story ideas you’d like to see in a future issue of RAStech magazine.

Issue Advertising Deadline

Spring Feb 15, 2019

Summer June 21, 2019

Winter Oct 11, 2019

Subscribe to Hatchery International or Aquaculture North America and get RASTECH free with your subscription. Subscribe at www.hatcheryinternational.com and www.aquaculturenorthamerica.com

Editor Mari-Len De Guzman

289-259-1408 mdeguzman@annexbusinessmedia.com

Associate Editor Tamar Atik 416-510-5211 tatik@annexbusinessmedia.com

Advertising Manager Jeremy Thain 250-474-3982 jthain@annexbusinessmedia.com

Art Director Svetlana Avrutin 416-510-5215 savrutin@annexbusinessmedia.com

Account Coordinator Kathryn Nyenhuis 416-510-6753 knyenhuis@annexbusinessmedia.com

Circulation Manager Barbara Adelt 416-442-5600 ext 3546 amadden@annexbusinessmedia.com

Group Publisher Scott Jamieson sjamieson@annexbusinessmedia.com

President & CEO Mike Fredericks

Printed in Canada

SUBSCRIPTION RAStech is published as a supplement to Hatchery International and Aquaculture North America.

CIRCULATION email: blao@annexbusinesmedia.com Tel: 416.442-5600 ext 3552 Fax: 416.510.6875 (main) 416.442-2191 Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Occasionally, RAStech will mail information on behalf of industry related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office privacy@annexbusinessmedia.com Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission © 2018 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

S k ret ti n g i ntrod u ced re c i rcu l ati n g aq u acu l tu re sys te m s (R AS) d i et s i nto the m a r ket bac k i n 20 09 – a n i nd u s tr y fi r s t S i n ce the n we h ave i ntrod u ced a s pe ci a l i s ed co n ce pt d ed ic ated to R AS, Re c i rcRead y, w h i c h t a ke s i nto ac cou nt g row th a nd wa s te p redi c tio n s, n u tr ie nt re cyc l i n g s o l u tio n s a nd hea l th mo n i to r i n g i n ad di tio n to t a i lo red feed s o l u tio n s S k ret ti n g h a s bee n i nve s ti n g re s ea rc h re s ou rce s i nto R AS ove r m a ny yea r s, wi th th ree d ed ic ated R AS -ba s ed re s ea rc h f ac il i tie s ac ros s the wo r l d, each wi th a u n i q u e fo cu s

Read more at www.skretting.com

Norwegian seafood industry investor Broodstock Capital has purchased significant shares in Malmo, Swedenbased NP Innovation, giving the investment firm 50 per cent stake in the water treatment company, a statement from Broodstock Capital said.

NP Innovation is a global supplier of water treatment technologies for aquaculture systems. Its product range consists of pre-filter, drum filters, disc filters and CO2 degassers for the aquaculture and public sector water treatment industries.

NP Innovation currently employs 13 people. The company regularly supplies fish farming companies in Europe, U.S.A., Chile and Canada. NP Innovation is expected to deliver revenue of approximately SEK50 million (US$5.67 million) in 2018. Approximately 90 per cent of its revenue come from the aquaculture industry, with the remaining 10 per cent from the public sector, according to the Broodstock Capital statement.

The investment in NP Innovation is Broodstock Capital’s fourth in the seafood space. Its funds focus exclusively on investments in small and medium sized businesses within the seafood industry in general and in the fish supplier industry specifically.

Last year, Broodstock Capital purchased Danish firm Billund Aquakultureservice, a supplier of RAS technology and services. The investment company has since expressed its intent to have a significant presence in the RAS space.

Fresh funding received by NP Innovation is expected to deliver nearly US$6 million in revenue in 2018.

By Colin Ley

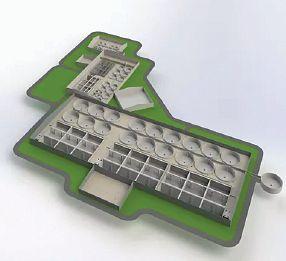

A new 240,000-fish RAS hatchery at the University of Stirling will be producing research-robust stock for use in future research projects across the United Kingdom.

The new unit was due to be fully operational in December 2018, following a 12-month planning and build process to provide researchers with robust Atlantic salmon and rainbow trout, all completely free from any kind of disease or treatment history.

“Building our own hatchery means we will be able to produce a totally clean, reliable source of research-robust fish,” said Alastair McPhee, aquaculture facility manager at the University of Stirling. “By ensuring that the fish used in trials are not challenged by external parasites, or suffering from low-level disease problems, validates the accuracy and reliability of our research.

The new hatchery – developed in conjunction with AquaBioTech –will feature a 24-tray egg incubation area with carrying capacity for 240,000 eggs and an on-growing RAS unit containing 24 tanks of 1.000-litre capacity.

The on-growing facility will be equipped with full temperature controls and photoperiod manipulation, carried out using variable intensity LED lighting. Each tank will also have waste feed and faeces separation, and will be supplied with full computer-controlled feeding systems and an environ -

mental monitoring system, all linked back to an office-based PC.

“While our top level design numbers will allow us to stock up to 240,000 fish every six months, we don’t expect to operate anywhere near that total,” said McPhee. “Because of our research focus, the unit is likely to carry around 80,000 fish every six months. This will be mainly Atlantic salmon and rainbow trout, although we will be able to work with other temperate species if required.”

In addition to producing research-robust fish for use in research within the Stirling site, which includes the globally-renowned Institute of Aquaculture, the hatchery will also provide stock for researchers working at the University’s marine field station at Machrihanish in Argyll.

“Being able to supply the research team at Machrihanish with suitable fish for the saltwater phase of their work on sea lice and other projects will be a major boost,” McPhee said.

“We are also receiving potential supply requests from other UK universities and commercial researchers, all of which will be considered once we’re up and running.”

Current project priorities in Stirling for the new unit, meanwhile, include research on fish oil replacement options and the possible testing of the comparative merits of RAS and flow-through hatcheries.

By Liza Mayer

The government of Newfoundland and Labrador, Canada, has come out solidly behind Grieg NL Seafarms Ltd’s massive aquaculture project with a $30-million investment in the form of repayable loans.

Last fall, the company announced it has received final environmental approval and project release from the provincial government for its $250-million Placentia Bay Atlantic Salmon Aquaculture Project. This release allows the salmon producer to move ahead and complete the application process for licence and permits and other regulatory approvals required to commence construction of its land-based RAS hatchery in the Marystown Industrial Park, as well as the procurement and installation of equipment for its marine-based farms in Placentia Bay, the company said in a statement.

While conservationists have ex-

pressed dismay over the government’s stake in an industry it’s supposed to be regulating, the executive director of the Newfoundland Aquaculture Industry Association, Mark Lane, said government investment in this case is no different than those in other sectors.

“If you look at oil and gas at its beginning 30 years ago in Newfoundland and Labrador, it took an equity investment from the provincial government to encourage people to come and try to produce oil here. Oil and gas is critical to Newfoundland and Labrador’s economy today,” Lane said.

“Those people who would tout that this is a conflict of interest, for the most part, are the same people who just simply don’t support aquaculture,” he said.

Lane believes the province’s $30-million stake will return to the province in terms of jobs and taxes, and contribute to the GDP. “And for every job that’s created directly through the aquaculture project either on the farm or in the hatchery, there’s two-and-a-half to three jobs in spin-off industries.”

The Placentia Bay project is believed to be the largest open net-pen salmon aquaculture development proposed in Canada.

The province produces roughly 25,000 tonnes of farmed Atlantic salmon annually.

and

announced the province’s investment in Grieg NL’s Placentia Bay Atlantic Salmon Aquaculture Project

IAA bankruptcy no impact on Nordic Aquafarms projects: CEO

Nordic Aquafarms’ planned 10,000-sq-meter land-based

Nordic Aquafarms’ two major land-based farm projects in Fredrikstad, Norway and in Belfast, Maine, in the U.S., are forging ahead as planned, according to the company’s chief executive, in light of news reports that one of its major vendors, Inter Aqua Advance (IAA), has filed for bankruptcy protection on August 29.

“We see no material effect on timelines from this (IAA bankruptcy filing) in Norway nor Maine,” Nordic Aquafarms CEO Erik Heim told Hatchery International in an email, adding his company had “no active delivery contracts with” IAA.

“We have a growing internal engineering department that increasingly is taking control of design and delivery,” Heim said.

Northern Harvest Smolt Ltd has received approval to begin expansion work at its Indian Head Hatchery in Stephenville, Newfoundland and Labrador in Canada.

The Indian Head Hatchery provides smolt to licensed sea cages of the Northern Harvest Sea Farms, which is now owned by Marine Harvest.

The $51-million expansion project is intended to improve smolt production capacity to 6.7 million per year, the company said. The expansion also entails upgrades to improve efficiency of the existing facility and new supporting infrastructure such as freshwater and saltwater supply and effluent treatment and discharge. The company said the hatchery will also have “the latest in re-circulating aquaculture system technology.”

The expansion is expected to increase salmon aquaculture production for the province.

– Liza Mayer

IAA has filed for bankruptcy protection in an Arhus, Denmark, court. Established in 1978 and headquartered in Egaa, Denmark, IAA claims to be the first company in the world to develop and supply RAS. It has since built more than 150 facilities worldwide, according to the company’s website.

Last April, Nordic Aquafarms announced a long-term strategic agreement with IAA to develop, design and deliver large RAS facilities for both land-based farm developments in Norway and the U.S. Construction of a new 1.6-million smolt facility in Fredrikstad was expected to start this year, while the 3.5-million smolt facility in Belfast, Maine, was planned for mid-2019. According to Heim, these timelines will continue as planned.

By Michael Ben Timmons

Michael Ben Timmons is a professor in the Department of Biological and Environmental Engineering at Cornell University in Ithaca, NY. He teaches information related to the production of aquacultured products with emphasis on sustainable and environmentally friendly engineering technologies.

It is an immense privilege to be given this opportunity to have an ongoing discussion with the readers of RAStech about RAS design and the future of aquaculture.

I was born in the 40s and grew up on a dairy and hog farm in central Ohio, a short drive from Ohio State University where I majored in agricultural engineering. I always liked science and math and growing things, so it seemed like a natural fit. I also loved fishing as a kid, and have continued fishing ever since. Got a Master of Science degree at University of Hawaii, but did nothing with aquaculture there, and then a PhD from Cornell University in agricultural engineering with a minor in fluid mechanics. Then went to North

Carolina State University into the Agricultural and Biological Engineering Department and focused 100 per cent on poultry housing systems (I have a point). I learned a lot about animal industries being integrated to gain economies of scale and being highly dependent upon appropriate housing systems to maximize economic return to the farmer.

Here is my first major point. I am a great believer in history and the value of studying history to predict the future. When I went to North Carolina in 1979, 100 per cent of the turkey production was done outdoors or range-grown. NC was the second – maybe third – leading turkey producer, behind Minnesota. Talk about two states with major climatic differences!

As part of a research team working with the industry, we promoted a demonstration facility that moved turkey production indoors from the range. By 1983 when I left to go back north to Cornell University, about 50 per cent of the range production had converted to indoor production facilities. By the late 80s, essentially all turkey production was done inside. My point? Dramatic shifts can occur in a relatively short time, once the economic factors line up to accelerate such a change.

If you ask people what the biggest problems facing us today are, the most common answer is the growing population crisis and the need to be able to feed an extra three billion people by the year 2050. Obviously, we need to address food

production. For decades, aquaculture has been touted as a key, if not the key, part of this equation.

John Reid, CEO Water Field Farms in Amherst, Mass., wrote an excellent article that provides a concise review of the problem and what is necessary to address the issue ( Aquaculture Magazine, Dec/ January 2015, pp. 54-59). Properly so, Reid also discusses how global warming is exacerbating the problem. Something needs to be done and relatively fast. But what are our next steps?

In contemplating the topic for this article, I was asked to address technology change and the often-heard comment that we, as an industry, need a standardized design for recirculating aquaculture systems in order to advance. In my opinion, nothing could be farther from the truth. Designs will be adapted and become

Designs will be adopted and become standardized based upon their successes in the marketplace – and success will be measured by economic productivity.

“standardized” based upon their success in the marketplace – and success will be measured by economic productivity. Take the automobile industry as an example. In 1899, 30 American manufacturers produced 2,500 motor vehicles. Some 485 companies entered the business in the next decade. In 1908, Henry Ford introduced the Model T and William Durant founded General Motors. Imagine if we had determined in 1910 that we ought to have just one auto design.

We are somewhat in a similar position today. There are a lot of RAS designs out there competing for what will become the, or at least a dominant, standardized framework. However, we’re not there yet.

Again, look at the other animal industries and how design has changed and evolved over the years. The same is happening with fish systems, but I’m not sure if we are close yet to that final, common design that will propel the industry forward to the next great launch of aquaculture technology. (I will talk about some of them in my next article)

Will the standard design revolve around the mixed cell raceway (see Chun, Chanwoo, Vinci, B.J., Timmons, M.B., 2018 “Computation fluid dynamics characterization of a novel mixed cell raceway,” Aquac. Eng. 81, 19-32), the RAS2020 by Kruger-Veolia, or Nordic Aqua Farms’ raceway system? We shall see what happens.

By Maddi Badiola

Maddi Badiola, PhD, is a RAS engineer and co-founder of HTH aquaMetrics LLC, (www.hthaqua.com) based in Getco, Biscaye, Basque Country, Spain. Her specialty is energy conservation, life cycle assessments and RAS global sustainability asessments. Contact her at mbadiolamillate@gmail.com.

Following the first part of the series of four articles based on the use of energy in recirculating aquaculture systems (RAS), the question is whether or not we measure energy consumption and how. Is the energy consumed within the system monitored? Do we know where in the system it is mostly consumed? Which factors are affecting such consumption?

Aquaculture and RAS are growing dramatically, requiring resources such as land, water and energy. Land and water are finite resources, while energy is not destroyed or created, but transformed. The problem arises when the use of resources for energy transformation goes beyond the limits, becoming unsustainable. Energy use and its associated cost and environmental impact are dependent on several factors like species in production, rearing water temperature, climate and system configuration/design or layout and management. For example, temperature maintenance, depending on the species, can lead to more or less consumption. Local temperature requirements can dictate the overall energy use. Chilling rearing water, for example, is extremely energy intensive so the selection of appropriate devices – properly designed and cost-effective – is pivotal for success. Devices can include energy recovery heat exchangers. These require energy expert cost analysis.

RAS needs continuous energy and its design has implications on the overall efficiency and energy use. Each RAS is different and the technology used in the water treatment loop differs between systems. Operations requiring energy use in RAS and the overall energy requirement will be determined by engineering and operational criteria. Several equipment and processes require energy for water treatment (i.e. water circulation, filtration, biofiltration, oxygenation, temperature control, disinfection) and other activities such as feeding (if automated).

Different methods are used to determine the overall energy consumption of a system, but without any doubt an energy audit will provide the most real and accurate data. In RAS, on-site energy consumption is variable not only daily but hourly, by minute. It follows a time-based pattern consumption (see diagram 1). So, with such fluctuation, how do we provide a detailed recording of continuous energy flow? Through an energy audit; providing

real data (i.e. system-specific) and estimating the energy consumption of a given system throughout a given period. Moreover, the energy audit could proffer the energy model of the system under study by showing the energy consumption pattern of each device forming the system. At the same time, they could help reduce fuel use and electricity costs, and increase predictable earnings to the company, especially in times of high energy price volatility.

An energy audit will not alter the production nor disrupt the operation. It requires five easy steps: (I) identification of energy consuming devices and factors affecting consumption fluctuation; (II) installation of energy measuring equipment; (III) energy monitoring; (IV) data collection, assessment and analysis; and (V) diagnosis (see diagram 2). If the facilities and systems are being designed and constructed, energy measuring systems can be integrated within the technology. If not, portable energy logger systems can be used.

Energy used in a RAS unit has one of the largest environmental and economical impacts, compared with feed, oxygen or juvenile production. In addition, by using large amounts of fossil energy sources, RAS industry increases, among other things, the Global Warming Potential or CO2-eq. Nevertheless, throughout production, variation of the impacts is notori-

ous. Our study found that energy use varies considerably between different periods during the production process, highlighting the importance of having time-based energy consumption information throughout the production cycle. Such energy quantification helps determine when possible energy saving measures can be applied with effective results. An example is the use of frequency controllers (used to change the frequency and magnitude of the constant grid voltage to a variable load voltage. They are shown to help reduce the electricity consumption of pumps; their efficiency is mainly dependent on the number of starts-stops and required water flows. An average of 20 per cent of the consumed energy could be saved this way.

Measuring energy consumption along the production cycle through an energy audit, differentiating consumption peaks, can help in the design on an energy-efficiency plan. This plan should include several re -

newable energy alternatives and energy saving measures. Good practices, both in the design and management of the systems, would aid in: a more energy efficient framework; reducing energy losses; and (adapting existing systems to reach their potential. Furthermore, the system’s engines, pumps and lighting configurations, as well as thermal equipment’s isolation, all contribute to good practices in RAS design, operation and management. The employees’ ability to understand the system and respond to issues effectively is also vital for efficient management and operation.

By using more energy-efficient systems (together with a proper business plan and designed system), species selection may be done based on market demands, instead of prevailing environmental conditions. This will determine whether such demand can be met at expected market prices while keeping the business profitable.

Measure it continuously if you want to decrease environmental impacts and monetary costs. Engage an expert energy consultant in order to start saving money.

The future of profits is unclear in using RAS for producing Atlantic salmon growouts, but one thing is certain: the farmed salmon industry is changing

By Liza Mayer

The jury is still out on whether land-based Atlantic salmon farming will deliver on its promise of profitability, but intense media attention and industry interest in 2018 have made it all seem like a tipping point has been reached.

The latest tally puts salmon grow-out projects around the world operating, or in various stages of construction, at roughly 30. Of this figure, the United States accounts for seven, Denmark five, Canada two (one of which is on hiatus), Norway and China three each, and the rest – nine – are scattered across the rest of the world.

Land-based aquaculture, powered by recirculating aquaculture systems (RAS), is nothing new in Atlantic salmon farming. It is a proven technology in smolt

production. What’s innovative is using the technology in raising fish to market size (typically around 5 kg each) in landbased tanks instead of moving them in the second half of their lifecycle to mature in the ocean. This new “movement” has sparked industry debates, packed rooms in industry conferences with both curious participants and those wanting to learn more, and, judging by the number of projects underway around the world, has attracted big capital.

The big problem with RAS is not the lack of public support or investors; it is the lack of a success story demonstrating profitability. The problem has long been that RAS costs a lot of money. British Columbia-based Kuterra, much-publicized as the “first” in North America to

The big problem with RAS is not the lack of investors; it’s the lack of a success story demonstrating profitability.

farm Atlantic salmon entirely in a landbased facility (there were earlier attempts in B.C.), has ran out of money. Its backers, the Namgis First Nation, declared in 2017 it is “no longer in a position to carry the financial risk of the venture.” The farm suspended its operations in July 2018 for a “maintenance break,” while confirming it was still in exclusive talks with a potential investor to help it get the economies of scale it needs. What the purveyors found was that a land-based salmon farm needs to be scaled to produce at least 3,000 mt/year to yield investment-grade returns. Kuterra yielded 180 mt in its first year of operations in 2015; the plan is to scale it up initially to 300 mt and then to 1,500 mt, if it finds an investor.

RAS projects currently under construction have much bigger ambitions. To name a few: Atlantic Sapphire in Miami expects to see an initial harvest of roughly 8,100 mt head-on gutted (HOG) salmon by the end of 2020, and that includes at least 2,000 mt from its Danish operations. This will ramp up to 90,000 mt/year at full

The BC advantage

capacity in 2026. Nordic Aquafarms in Maine will have the capacity of producing 33,000 mt/year once fully completed, while Whole World Oceans, also in Maine, hopes to see 50,000 mt/year of combined production at several planned facilities in the state.

But the question remains: will landbased aquaculture deliver?

“To date I don’t know of any salmon RAS anywhere in the world that’s attained steadystate profitable production,” Steve Atkinson, president of Taste of BC Aquafarms in Nanaimo, B.C., tells RASTech. “That’s not there yet. We’re very close, there are several others that are close, and there are some who are producing pro forma budgets to say that it can be successful. But is there anybody today that’s showing a profit? I don’t believe there is.” Taste of BC Aquafarms raises steelhead salmon at its Little Cedar Falls land-based fish farm.

Wisconsin-based Superior Fresh made history in July 2018 by becoming the first commercial-scale land-based aquaculture facility in the United States to bring RAS Atlantic salmon to market. Its first harvest yielded 2,000 lbs (less than 1 mt) HOG Atlantic salmon in June.

Event this triumph was not spared from skepticism, however. “A lot of people have produced Atlantic salmon in RAS systems but to date none have been financially viable,” says Brad Hicks, an experienced net pen farmer who installed the first RAS salmon system in B.C. 23 years ago. “All the hype about RAS so far has been about raising money. Very little raising of fish.”

Entrepreneurs behind BC LandAqua Ventures Inc., an aquaculture park being planned on Vancouver Island, B.C., strongly believe in RAS aquaculture and the province’s potential to become a major land-based salmon producing region.

“Many of the operations that critics point to as failures are historic; [they were] using early versions of technology,” says BC LandAqua Ventures spokeswoman Josephine Mrozewski. “The new-generation technology has developed so quickly, and the land-based industry developing quickly along with it, that it’s simply not relevant to make these historic comparisons. Any industry based on

new technology goes through several stages, starting with basic science, then to applied science and R&D, then smallscale proof-of-concept pilots, and finally full-scale commercial implementation.” (See side bar: RAS technology: same dog, different collar?)

Mrozewski expresses concern that B.C., which already has a fully developed seafood industry ecosystem, could miss the boat in this field.

“B.C.’s window to become the centre of salmon supply for the whole Pacific Rim market is to leverage its advantages before U.S., investors have a chance to look to the Pacific Coast for land-based operations,” Mrozewski says.

“Its advantages – expertise, infrastructure and proximity to the Pacific Coast market – mean B.C., can move quickly to establish a land-based industry before areas without the infrastructure, such as the U.S. west coast, can catch up. Most of the U.S. west coast does not have this expertise or all these elements of the value chain.”

The International Salmon Farmers Association report, The Evolution of LandBased Atlantic Salmon Farms, notes the limitations of such a massive endeavor. “Even if it were technically and economically feasible, and if enough coastal land and water were available, the current production in Canada alone would require 28,000 football fields, 33,719 acres, or 136 square kilometers of land to grow fish in appropriate densities and water depths in landbased systems,” the report states.

John Paul Fraser, executive director of the BC Salmon Farmers Association (BCSFA) believes moving B.C.’s salmon industry to land-based facilities – as some conservationists are pushing for – will effectively shut down the industry.

“I don’t think the limitations of landbased aquaculture are fully understood,” Fraser tells RASTech. “The environmental

implications and the costs and the challenges of having to pave over 136,000 square kilometers of land and the four billion liters of freshwater that we would need, and the massive amount of electricity to oxygenate the water, and replicate those conditions. It’s just a massive enterprise,” he says.

“I think as the technology evolves, it’s possible that land-based aquaculture can take on a larger role in helping provide this really healthy important food,” Fraser adds. “But it’s not ‘instead of’ ocean-based aquaculture, it’s ‘in addition to’, and I think we need both. That’s really the message that I’m trying to get out.”

Brad Hicks, a net pen farmer, says Canada’s advantages lie in net pen operations. “Norway, Chile, Scotland and Canada have a clear advantage for net pen operations,” Hicks says. “Parts of the United States, Russia and China still have opportunities to grow some salmon in net pens. None of these regions have any clear advantages for RAS. Should RAS be successful enough to competitively displace the supply of salmon coming from net pens, net pens will be out of the salmon business.”

But Hicks adds, “this will not happen anytime soon. There are currently

It’s not ‘instead of’ ocean-based aquaculture, it’s ‘in addition to,’ and I think we need both.

2.4 million tonnes of profitable net pen salmon in the market compared to two to four thousand tonnes of money-losing RAS salmon operations. RAS has a very long way to go and massive capital requirements to get there.”

Samuel Chen, who helped steer his family’s Hudson Valley Fish Farms in Albany, N.Y., from conceptual stage to the first three crops of RAS steelhead, points out good reasons why there’s building frenzy in the United States, and not in B.C.

“I think it’s precisely because there is an established industry of net pen farming in B.C., and around Canada that makes it less likely for the development of RAS projects,” says Chen, who is now a B.C.based industry consultant. “Because existing players have already adopted a certain technology that they have been using, there is both economic and operational considerations that make it less likely to adopt other technology.”

Chen believes it’s likely going to be new players or players who are expanding in new markets that will try new technologies.

“There is a parallel in the movie theater business and dental offices being built in developing countries,” Chen explains. “You’ll see more movie theaters in those countries with the most-up-to-date projectors and sound systems, or more dental offices with lasers (than in an already mature market). So in Canada, or somewhere like Norway, it’s more likely that you’ll see RAS used to expand smolt facilities in support of their existing net-pen operations.”

Atkinson believes the future in RAS salmon farming lies in building small- to medium-sized farms with capacity of 100 to 400 tonnes. “RAS as a replacement for net-cage salmon culture is a discussion that’s very different than the discussion that I want to have,” he says.

“My suggestion is that we start with two 100-ton modules and grow that ability to grow up to 1,000-tonne with that kind of design. I looked at how the salmon industry in B.C., started; it started in 1980s with 100-tonne farms, family, small business farms. Many of them failed, a few of them succeeded,” Atkinson continues. “Successful ones bought out some of the losers, and by trial and error it led to the development of an industry. Small successes became bigger successes. That’s how you build an industry.”

One aspect of RAS technology that invites skepticism is the “new-generation technology” that’s supposed to have improved to the point where it can be profitable for raising Atlantic salmon to market size.

Isn’t RAS basically reliant on screen filters to remove large solids, biofilters to detoxify ammonia and air to strip carbon dioxide?

“Both perspectives are true and have validity,” says Samuel Chen, a B.C.-based aquaculture industry consultant.

“There have been many incremental improvements and developments in RAS over the last 10 years. Although the key components of the systems have not changed, there have been developments that have lowered the cost, improved efficiency, and enhanced effectiveness of the constituent parts,” Chen says. “As examples, we’ve seen the cost of ozone decrease substantially. CO2 stripping efficiency has also increased.”

“A failure we see a lot less in RAS design has been biofilter sizing,” Chen adds. “In a recirculating system, you are both feeding the fish and the biofilter.

Samuel Chen, a B.C.-based aquaculture industry consultant, says the primary challenge in land-based aquaculture projects is the large capital outlay upfront.

A mass-balance calculation cannot just be based on average daily feed rates or even just the maximum/ minimum feed rates because of the need for stability of the biofilter. Today biofilters are sized with much more buffering capacity.”

How about doubts about RAS being suitable for Atlantic salmon grow-outs?

“I don’t agree that salmon are mal-adapted for RAS nor that technology is the major barrier for success,” Chen says. “This is secondary to the operational and business challenges of the RAS business model.”

Instead, the primary challenge is the large capital outlay upfront, he notes. Compounding this is the

delayed revenue; the need to build sophisticated distribution and marketing channels to retain more margins; unknown and inconsistent regulatory burdens; and the learning curve of farm operations all while there are established players who have developed commodity pricing for the product are probably the bigger challenges.

“But with the right team, sufficient capital and the right time horizon, I believe there is a market segment for RAS seafood production,” Chen adds. “There are many more control points in RAS production that we have yet to fully learn how to use to improve production quality.”

MAY 13-14

(RAStech 2019 is formerly the ICRA Conference hosted by Virginia Tech)

The premier conference on recirculating aquaculture systems is back and it’s bigger!

Formerly the International Conference on Recirculating Aquaculture (ICRA), RAStech 2019 is the venue for learning, networking and knowledge sharing on RAS technologies, design and implementations across the world.

• Hear from leading experts in the global aquaculture industry about the latest developments in RAS technology and design

• Network and share best practices on RAS and sustainable production

• Learn from case studies and success stories

• Access to leading providers of products and services in the global RAS market

• Engineering innovations

• Aquaponics

• Energy management

• Marine species

• Feeds management

• Shrimp culture

• Health and Disease

FOUNDING SPONSOR

PLATINUM SPONSORS

GOLD SPONSORS

SILVER SPONSORS

David Kuhn

Associate professor in the Department of Food Science and Technology at Virginia Tech

Maddi Badiola

Principal at HTH Aqua Group,based in the U.S. and Spain

Steve Summerfelt

Chief science officer at Superior Fresh LLC, an aquaponics facility specializing in the production of Atlantic salmon and steelhead trout

Yonathan Zohar

Professor and chair of the Department of Marine Biotechnology at the University of Maryland Baltimore County

Scott Snyder

Nutritional technology manager at Zeigler Bros

Huy Tran

Aquaculture and aquaponics expert with more than 20 years of experience

Michael Hans Schwarz

Center director of the Virginia Seafood Agricultural Research and Extension Center, at Virginia Tech

Jaap van Rijn

Professor at the Robert H. Smith Faculty of Agriculture, Food and Environment at The Hebrew University of Jerusalem, and currently heads the Department of Animal Sciences

Amy Riedel-Stone

Managing member at Aquatic Equipment and Design

Craig Browdy

Director of research and development at Zeigler Bros., Inc

Paul L. Hundley, Jr.

Principal at HTH Aqua Group, specializing in aquaculture systems and facilities

RAStech 2019 is jointly hosted by Virginia Tech and Annex Business Media, publishers of Hatchery International and Aquaculture North America.

Seats are filling up fast so register early! www.ras-tec.com

For sponsorhip and exhibitor information, contact Jeremy Thain at jthain@ annexbusinessmedia.com

Interested in presenting?

Contact David Kuhn at davekuhn@vt.edu

By Chuck Blumenschein and TJ Willetts

The tide is shifting for the aquaculture industry. The global demand for fish production and the uncertainty of offshore aquaculture is a cause of great concern. As a result, it has become critical to implement sustainable inland fish farms utilizing recirculating aquaculture systems (RAS) to increase fish production to meet this global demand. The tidal shift for the aquaculture industry is in perfect sync with another impactful trend – the industrial digitalization era.

For the last several years, “digitalization” and the “industrial internet of things” (IIoT) have been a leading topic of discussion. Companies that successfully harness this digital power stand to disrupt their current business models and sharpen their competitive edge. Aquaculture is starting to follow suit. Companies looking to build large-scale fish farms are exploring the integration of advanced digital technologies, data analysis and algorithms to create smarter and more sustainable grow-out facilities. Fish farms that successfully in-

Companies that successfully harness this digital power stand to disrupt their current business models and sharpen their competitive edge.

corporate smart RAS technologies will significantly reduce their risks and maximize their operational performance.

Risk mitigation may be the most important driver for companies to adopt smart RAS technologies. “Creating a large-scale RAS is a big investment. The construction costs are expensive, but if the farm is not operated properly, the health of the fish is at risk and the business will be inherently unsuccessful. As a result, companies are looking for ways to identify risks affecting fish health and prevent catastrophes before they occur,” according to Jonathan Moir, an aquaculture consultant based in Newfoundland, Canada.

To help reduce risks, RAS technology providers are looking to help firms protect their biomass by deploying robust digital platforms that offer real-time data and

alarm management. Using data from sensors and equipment within the fish farm, these advanced cloud-based systems can collect and analyze information in a very powerful way. Specific parameters related to water quality, such as pH, temperature, salinity, carbon dioxide, oxygen levels, ammonia levels, nitrate levels, turbidity, flow rates, and so on, can be monitored in real time. In addition, a digital platform at a RAS facility utilizing advanced algorithms to monitor system parameters can generate emergency alerts and initiate emergency response controls, if necessary.

For example, a RAS’s digital platform can be programmed to monitor oxygen levels to ensure they are maintained within a specific range. If the oxygen level drops below a pre-programmed threshold, the system can automatically engage the emergency back-up systems while simultaneously sending alerts to the operator via email and text message to start to remediate the issue. Remote monitoring and alarm management is especially critical in non-peak operating hours at the grow-out facility. It reduces labor needs while simultaneously providing comprehensive 24/7 monitoring of the facility.

These systems can also integrate other key RAS data, such as feed rates. The system can correlate feed information and its impact on the water quality. For instance, if there are periodic spikes in ammonia levels or suspended solids, a smart RAS can help the operator make data-driven decisions to optimize the feeding plan and make the necessary adjustments to enhance the performance of the RAS related treatment equipment, thereby protecting the biomass.

Beyond monitoring and alarm management, the smart RAS can reduce the possibility of equipment failure using advanced predictive maintenance (PdM). Using artificial intelligence, it can analyze complex data sets from the sensors within the RAS, equipment data, and historic information. This computing power will enable operators to prioritize and schedule maintenance and repairs before any equipment failure that can negatively impact the fish farm.

These technologies can also help with another big challenge for the aquaculture industry – filling the shortage of skilled

RAS professionals to operate these next generation fish farms. Machine learning and advanced algorithms specifically related to RAS will continue to become more sophisticated. As a result, companies will be able to modify these systems and develop “virtual RAS systems.” These virtual RASs can be used as a comprehensive, interactive, advanced training tool that can simulate the operations of an inland aquaculture facility.

“Operators can be exposed to realistic scenarios, such as equipment failures or high toxicities within the water. They can then respond to these issues and have

immediate feedback on their decisions and actions, all within this virtual environment,” Moir said.

In addition to risk mitigation, aquaculture firms using large-scale RAS are turning to

digitalization and enterprise IoT technologies to reduce operational costs, increase fish quality and potentially boost production. As the smart RAS begins to operate, it will generate a large amount of data. Parameters such as water quality, fish growth rates, food consumption, oxygen

usage, and equipment data will be tracked and stored in powerful cloud-based computing systems for analysis. Using artificial intelligence complemented with human experience, these systems will be able to quickly identify trends and provide recommendations to the operator to optimize both the RAS and production process. The results will help operators more efficiently use consumables, such as food, oxygen, and chemicals. Similarly, the smart RAS will be able to identify strategies to reduce power and water costs. This will help make fish farms more sustainable and competitive when compared to alternative aquaculture production methods.

As an emerging industry, large-scale RAS companies will benefit from the development and refinement of these technologies from other related industries. Companies like Veolia Water Technologies, a global RAS and water treatment technology

company, has been investing in its advanced digital services platform, Aquavista. Veolia is currently implementing its Aquavista system to seamlessly integrate with its large-scale RAS technologies, the RAS2020 and the Kaldes RAS.

“Aquavista was originally designed to manage very complex municipal water treatment systems and our experience in creating powerful cloud-based tools for these applications will expedite the implementation into Veolia’s RAS offering,” according to Lars Christoffersen, a business developer at Veolia who is working on deploying Aquavista for aquaculture.

He adds, “Though it is possible to retrofit existing facilities, firms will most benefit if the RAS is fully-integrated with the data collection and cloud-based tools.”

Consequently, companies that are currently engaged in developing a new RAS project should discuss this subject with their RAS technology partner and consider incorporating these smart RAS technologies into their project.

There are multiple challenges facing the land-based aquaculture industry as it works to be a solution to meet the increasing global demand for fish production. With any emerging industry, the risk is great. It is critical for companies looking to invest in large-scale grow-out facilities to leverage advanced digital tools to protect them from operational risks. These sophisticated software tools could be a potential solution to help educate the next generation of RAS operators by incorporating advanced simulations that are based on real-word data. The digital revolution will ultimately help fish farms to continually improve their operations and become more competitive.

Companies that can successfully implement smart RAS technologies into their facility will be able to increase their operational performance and help create a faster ROI for their investors. Fortunately, the timing could not be more perfect for the RAS aquaculture industry. The digital

revolution is beyond its infancy stages and companies who are experienced in RAS are currently integrating reliable and powerful cloud-based technologies to ensure the RAS of the future is here for fish farms of today.

Chuck Blumenschein, P.E., BCEE

Aquaculture Business Development Director

Chuck.Blumenschein@veolia.com

Chuck Blumenschein is a professional engineer and board certified environmental engineer who focuses on providing aquaculture firms with advanced recirculating systems to maximize production and biosecurity. He is skilled at developing cost-efficient RAS systems for innovative aquaculture grow-out facilities.

TJ Willetts

Veolia Water Technologies - Aquaculture Marketing Manager

Thomas.Willetts@veolia.com

TJ Willetts is experienced in marketing and business growth initiatives within the aquaculture industry for Veolia Water Technologies North America. He is responsible for supporting the project development and outreach efforts within the aquaculture industry for innovative RAS systems, intake water treatment, and wastewater treatment.

assessments

By Steven Summerfelt and Bendik Fyhn Terjesen

Recirculating aquaculture systems have many advantages that will allow increased farmed fish production in the future. This is especially true for salmon and trout – in locations adjacent to major markets and in a regulatory environment that controls water, wastewater discharge, escapees and land-use.

Producing fish adjacent to major markets saves shipping costs, particularly when the only available option is to ship via airfreight from distant locations.

RAS can reduce issues with sea lice and pathogens and improve fish containment

to prevent escapees. With proper design and management, RAS can maintain a controlled environment that provides optimum conditions (temperature, oxygen, photoperiod, swimming speed, etc.) for growth, survival, welfare and feed conversion.

However, to meet these goals the sector still needs to see significant advances. Going forward, some of the most important advances will include the following.

RAS assessment – A “consumer reports” type of rating system for each type of RAS and its system supplier should be provid-

ed in the future. This would be great for potential RAS owners and operators, but rather difficult to achieve in practice. Even now, however, it is essential that RAS owners perform due diligence on their system supplier.

Owners and operators should define performance specifications on the quality of the production environment at specific feed loading levels to clearly define their requirements for the system supplier and (hopefully) minimize the chances of technology failure. These performance specifications must also contain clear instructions on, for instance, how many samples should be taken, over how long a time, and when, and what variance will be tolerated.

In addition, biological consultants should be required to provide primary evidence to support any claims governing fish growth, survival, and feed conversion, along with specific qualifications for production environment conditions required to meet such objectives.

Without this due diligence and primary evidence, the project is at much greater risk. In addition, fish, feeds and biofilms are biological in nature and thus can create larger variations in performance than one would expect. Thus, RAS production systems and bioplans must be designed rather conservatively and with greater resilience to accommodate at least some of these variations. Technology innovations. More innovations in RAS must take place to improve production efficiency and reduce operating costs. For example, there

are promising new approaches to increase oxygenation efficiency and/or carbon dioxide removal without creating total gas pressure supersaturation problems in the culture tank.

In addition, we fully expect that future improvements in online water quality measurements and SCADA systems will make RAS more reliable and easier to troubleshoot. Industry is also closer to commercially applying machine vision and image analysis systems to help track inventory – both fish numbers and sizes – as well as control feeding and help diagnose fish health and welfare problems. Integration of this online data will give farm managers, owners and investors the ability to better assess performance and operations.

Disinfection and biosecurity – In future, RAS should be designed such that all possible portions can be cleaned and, if necessary, disinfected. Ideally, this should be an automated process.

Innovative solutions do not exist at the moment to solve this problem. Although RAS are built more and more compact, which reduces pipe lengths, this trend also places major treatment processes under floors and makes access for cleaning the various parts difficult for the operators. Therefore, sediments can accumulate, giving potential for later issues with H2S and pathogens.

Clean-outs and access points must be installed at multiple locations. Innovations using remotely controlled robotic cleaners could be a promising approach. This already exists in other industries.

Biosolids management – As RAS production capacity continues to increase, RAS farms must implement better technologies to capture, dewater and reclaim waste bio-solids. Storing bio-solid slurries in lagoons is not a great solution owing to problems with odour, safety and nitrogen loss. We expect more farms to adopt technologies to allow bio-solids to be dewatered to a cake or even a dry powder so that volume can be minimized, nutrients more readily reclaimed, salts pressed out (i.e., from brackish/seawater sludges), and odour issues minimized. In addition, some of these large farms will be applying anaerobic digestion simply to remove over 90 per cent of the sludge volume. This is al-

ready starting, but will likely see more application with increasing farm scale.

RAS feeds – Feed formulations must be highly digestible, meet but not exceed the nutritional (nitrogen and phosphorus) requirements of the cultured fish, and combine ingredients and binders that promote fecal pellet stability.

Although feed efficiency is important for all aquaculture operations, in RAS a low-performing feed (or a feed with low digestibility) can create problems via the increased loadings of waste compounds on the unit processes, such as high TSS, TAN and CO2. Feed formulations that create diarrhea-like fecal matter must be avoided because this can substantially increase concentrations of organics, TSS, and possibly geosmin and MIB off-flavours in RAS. It can also increase ozone demand and oxygen requirements in these systems. These are serious challenges for RAS producers, now and in the future. Feed manufacturers, producers and researchers must work together to develop RAS-optimized feeds.

Biosecure germplasm – RAS is not a good choice for culture applications, where fish or eggs must be brought in from sources that are not certified pathogen-free, such as fingerlings produced in outdoor or pondtype systems. Thus, species such as salmonids that can be sourced as specific pathogen-free eggs are well suited for use in RAS. We think that progress to complete the life-cycle for additional species of fish with-

in controlled RAS where pathogens are excluded, particularly during the broodstock and fry culture stages, will eventually lead to success with a broader range of species than are presently available.

Producers must develop more regional broodstock and fry culture systems to eliminate the need to air-freight them across continents. Fry cannot be iodine disinfected upon arrival and can thus potentially transfer diseases and parasites to RAS facilities that are simply not readily able to control such diseases.

Sterile fish – Developing a safe, reliable and relatively inexpensive process to create sterile fish is important to the future of RAS. It could reduce the negative effects of sexual dimorphism and early maturation on fish growth and size variation, fillet quality, feed conversion and fillet yield. Current methods used to produce all-female and triploid salmonids still have challenges – particularly with Atlantic salmon – that could be avoided with a better approach for creating sterile fish. In addition, farming infertile fish is the most effective genetic-containment strategy.

R & D – The RAS industry, particularly Atlantic salmon producers and suppliers, have benefited from several large and relatively long-term research and development efforts.

Research at The Conservation Fund Freshwater Institute and Cornell University in the United States, Nofima and Sintef in Norway, the Universities of British Colum-

bia and New Brunswick in Canada, DTU Aqua in Denmark, Wageningen University in the Netherlands, the University of Kiel and the Fisheries Research Station of Baden-Württemberg in Germany, and Ifremer in France, plus many others, has been critical to help overcome biological, technical and economic challenges with this rapidly evolving technology.

Future research efforts should focus on building long-term private and public partnerships between industry and academia, as highlighted in the CtrlAQUA centre, which is an eight-year project hosted by Nofima and funded by the Research Council of Norway and the partners. The CtrlAQUA centre is developing and refining environmental and husbandry parameters to optimize production of post-smolt Atlantic salmon in closed-containment systems.

The U.S. Department of Agriculture’s Agriculture Research Service has strongly supported the development of RAS for salmon and trout production with its nearly three decades of funding to the Freshwater Institute. Such funding sup -

port must continue to advance RAS production through 2030 and beyond.

Training – The rapid expansion of RAS globally has already created a serious shortage of trained RAS operators. Experienced operators of RAS are currently in high demand. More training program will be needed, both internal – such as an apprenticeship – and at colleges and vocational schools that partner with industry to provide co-op programs and work-study experiences.

RAS are sophisticated water treatment systems that must create and maintain optimum conditions for fish production and they must perform almost flawlessly, 24/7, to avoid failure.

These systems require trained operators to monitor fish performance, health and welfare, as well as feeding, waste and water chemistry. Other operators must maintain motors, pumps, seals, controls, floats, water levels, and real time sensors with supervisory control and data acquisition systems.

Staff must focus on food safety, product quality, HACCP, harvesting, purging,

processing and marketing. For the best chance of success, RAS must be operated with well-trained staff.

Challenges remain when implementing RAS. The devil is clearly in the details, as many RAS producers still face problems. Yet, continued government and industry support for education and training of future generations, as well as improved technologies and practices through research and development, will be critical to future success.

If investor confidence continues, it’s possible for global annual production of RAS-produced market-sized salmon and trout to reach 100,000-200,000 tons in the not-too-distant future. Production levels of post-smolt salmon in RAS could be similar.

Summerfelt is the

science officer at Superior Fresh, LLC, a land-based aquaponics farm in Wisconsin, U.S.A. Contact him at steve@ superiorfresh.com.

Bendik Fyhn Terjesen is innovation manager at Cermaq Group, based in Oslo, Norway. Contact him at bendik.fyhn.terjesen@cermaq.com.

Despite its roots as the common carp, Cyprinus carpio, and all that fish means in aquaculture, the koi is not a food fish and is outside the scope of mainstream aquaculture. In recent years however, the koi has become associated with recirculating aquaculture systems (RAS). With the rise of aquaponics, the raising of fish in a RAS providing nutrients to a hydroponic system, some producers are choosing to fuel their plants with koi instead of crop fish like tilapia (Oreochromis spp.) Koi provides the aquaponic producer with many of the benefits of aquaponics while focusing their entire effort on plant production.

This concept of aquaponics, without using the fish as a cash crop, seems blasphemous to the commercial fish farmer. The mind rebels at the thought of “leaving money on the table” by not having a crop fish. The use of koi does, however, offer significant advantages to the aquaponic farmer, especially in terms of managing their RAS system. Unlike aquaculture, aquaponics is a plant-based business. For aquaponic businesses, koi are the optimum fish to balance a RAS system for plant growing and have been increasingly embraced by larger scale aquaponic ventures.

The choice of koi offers many advantages. Koi are tough. They are easy to care for and can take lower dissolved oxygen levels than most cultured species. Unlike tilapia, koi can thrive at low temperatures as well as

high greenhouse temperatures. Koi are well-explored and well-researched – information and culture methods are known. Koi are easy to acquire and easy to propagate. Since the value of some individual prize koi can be thousands of dollars, fish health issues are well-explored and disease treatments readily available without a veterinarian prescription.

By choosing koi for an aquaponic RAS system, one has changed the nature of the role of fish in the operation. Koi for your RAS eliminates a lot of husbandry and planning for your fish. The footprint

needed for fish rearing and labour are both greatly decreased. There is less need for splitting fish, weight sampling, shipping, receiving and breeding with koi. Additionally, koi are less likely to breed within the RAS system. There is no production schedule for the fish, only a schedule for the plants. Without harvesting large numbers of fish, the RAS system can be maintained and balanced much easier and much more efficiently. When fish are harvested, a RAS system’s biofilter can suddenly starve and nutrient production for the plants may fall. The harvest schedule must be closely matched to plant needs to keep from a nutrient

Customized for your fish farm, hatchery or research operation!

Our Commercial LSS Packages are custom engineered to meet your specific needs.

• Marine and Freshwater

• Mechanical filtration

• Chemical filtration

• Ultraviolet disinfection

• NEMA enclosed controls

• Bio-filter towers

• De-gassing towers

• Wide variety of flow rates

• Flow control valves

• Protein skimmers

• Variable frequency-drive pumps

• Temperature management

We offer in-house repair service for YSI equipment.

We are your source for professional aquatic and aquaculture products and services.

Our hands-on experience allows us to offer practical solutions to your situation, big or small.

Contact us today to learn more!

(Top) Although not for food consumption, some koi can sell for thousands of dollars. (Bottom) Koi tanks provide a steady source of nutrients for aquaponic plants.

shortfall. Without harvesting, the RAS system gets a steady supply of nutrients from the koi. Koi can be removed and sold off to local stores in small groups as target density is reached.

Russell Easy is an associate professor at Acadia University in Wolfville, N.S., Canada. He is also the aquaponics and research advisor at Aqualitas, a Canadian medical cannabis producer. Aqualitas produces medical cannabis with a state-of-the-art aquaponic RAS. The intent is to grow several strains of high-quality cannabis products from nutrients supplied by the koi.

“There are many advantages to using koi,” Easy says. “One of the biggest is not having to heat the water for the koi as they can thrive at temperatures lower than that required for other fish species such as tilapia. This obviously saves on heating costs and allows us to provide the optimum water temperature to the cannabis.”

Aqualitas developed its technology in conjunction with Acadia and Dalhousie universities, and research continues at Aqualitas.

“The business is focused entirely on the plants and the koi themselves are considered part of the system,” Easy explains.

Essentially, the fish are treated the same as the biofilter – a living part of the RAS. The high value of cannabis as a product is a large competitive advantage over a company that produces vegetables and provides enough income to make the company profitable without a crop fish. The high value of cannabis also provides for large investments in research into RAS technology.

“Much of our research focus is on feed composition, nutrient outflow and diet,” Easy explains. “We are trying to optimize the composition of the fish feed input to get the best results for our plants.”

By manipulating the feed ingredients, Aqualitas can change the nutrient ratios and trace elements produced in the RAS. With the legalization of cannabis in Canada, Aquaponic RAS operators are poised to drive much of the RAS technology research in the future.

Phone: +1 407 995 6490

Web: AquaticED.com

Because koi are an ornamental fish and are not sold for food, layers of bureaucracy, licensing and regulation immediately

disappear. For Todd Croxall of Croxall Farms in Huntsville, Ont., Canada, choosing koi gave his aquaponic business a head start. While waiting for his aquaculture license, Croxall Farms began running koi in their aquaponic RAS. This choice allowed the company to set up their aquaponic business and start operating immediately instead of being caught in the bureaucracy. They focused on establishing the green side of the business, developing the RAS system and working out the usual start-up bugs and troubles involved.

“Choosing koi gave us a big head start,” Croxall says. “Going into the venture we didn’t realize how long it would take to get all the aquaculture licensing in place. Koi were available and affordable and allowed us to begin getting our main product to market in the shortest time. The koi have given us a very stable RAS and our plants are thriving.”

An overlooked benefit of keeping koi in an RAS system is that the koi themselves do have value, and that value can be very high. Koi can sell for thousands of dollars depending on the colour and pattern. The most valuable koi come with pedigree tracing their lineage. For the commercial producer, juvenile koi are easy to obtain, and koi are easy to breed; thus a selective breeding program is easy to set up. As the koi grow they are high graded to keep the RAS at the optimal biomass, but of the highest value fish. These high value koi can be bred selectively or the gametes themselves sold.

“I didn’t realize koi could be so valuable,” Croxall says. His koi are still less than 500g but he has already started to notice some potentially valuable koi in his tanks. “We are starting to see the potential of the koi themselves and are considering keeping koi to drive the RAS, while trying to develop revenue from the koi [instead of bringing in a crop fish],” he says.

With the risks involved in raising crop fish, the ease of raising koi, their ability to maintain a healthy RAS and the potential value of koi may have many aquaponic producers re-examining their fish choices.

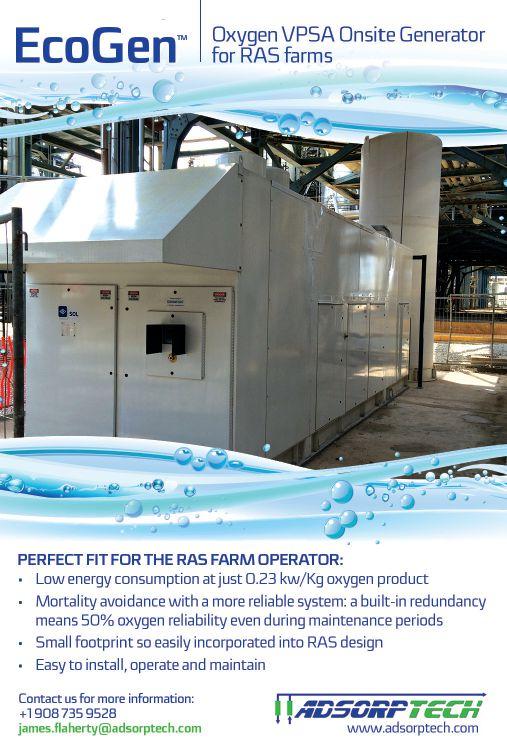

Adsorptech Pg. 8

Advanced Aquacultural Technologies Inc. Pg. 13

Aquacare Environment Inc Pg. 19

Aqua Hill Aeration, Inc. Pg. 29

Aquanetix Pg. 27

Aquatic Enterprises, Inc. Pg. 26

Aquatic Equipment & Design Inc Pg. 26

Arvotec Pg. 20

Benchmark Instrumentation & Analytical Services Pg. 31

Cornell University Pg. 8

Faivre Sarl Pg. 11

Fresh By Design Pg. 20

Global Aquaculture Supply Pg. 21

Hatchery International Pg. 16, 17

HTH aquaMetrics LLC Pg. 21

Integrated Aqua Systems Inc. Pg. 25

KSK Aqua ApS Pg. 27

Lykkegaard A/S Pg. 24

MDM Incorporated Pg. 27

OxyGuard International Pg. 29

Pure Aquatics Pg. 26

Riverence LLC Pg. 24

RK2 Systems Inc. Pg. 15

Skretting North America Pg. 5

Veolia Water Technologies (North America) Pg. 32

Veolia Water Technologies

AB - Hydrotech Pg. 15

Water Management Technologies, Inc Pg. 9

YSI Inc. Pg. 2

Benchmark has commenced production of salmon eggs at its new land-based breeding facility in Salten, Norway.

The Salten facility has been built to the highest standards of technology and biosecurity, and will be the most modern salmon egg production site in the world, Benchmark said in a statement. The increased capacity will allow Benchmark to supply the global market with biosecure eggs year-round, a significant advantage for producers only possible with land-based production.

The announcement is the culmination of a two-year, £40m (approximately US$52 million) investment by the company. The new facility is expected to increase Benchmark’s in-house capacity by 75 per cent. Benchmark currently outsources part of its production to meet growing demand for its products. The new facility will enable Benchmark to bring production in-house enhancing profitability, it said.

“The opening of our new facility in Salten on time is a very important milestone for Benchmark which will allow us to capitalize on our leading market position in salmon genetics and the favourable long term market trends in the industry,” said Benchmark CEO Malcolm Pye.

Sales of fertilized eggs from the Salten facility began November 2018 and additional fish will be brought into the facility to ramp up volumes throughout 2019. Full production capacity is expected by 2021. Salten is located in northern Norway, where the salmon production base is growing fast, according to the company. The new facility will allow Benchmark to serve this growing region as well as the rest of Norway and international markets.

Global demand for salmon has grown by six to seven per cent annually in recent years and is expected to increase substantially over the next decade.

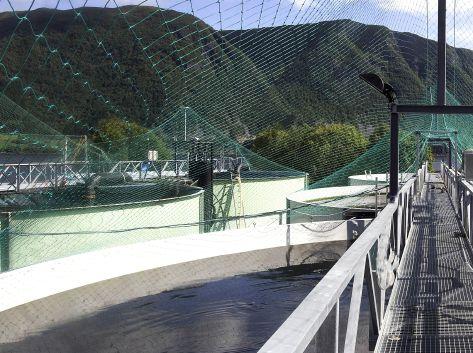

NORWAY – Skretting Aquaculture Research Centre (ARC) has expanded its Lerang Research Station in Stavanger, Norway to include a “state-of-the-art” recirculation hall. The company says the expansion will enable researchers to conduct precise experiments on its latest closed system feed formulations in strict, closely monitored environmental conditions.

The facility will be mostly used to conduct trials for salmon product development within 12 independent RAS, according to a release.

In addition to research on feed and formulations, the facility will also evaluate feed interactions and influences on system performance.

“Attempts to mitigate the biological risks associated with traditional aquaculture is leading to a lot of momentum for closed fish production systems, and this is happening all over the world,” Dr. Paulo Mira Fernandes, researcher and RAS expert at ARC said in the release. “While these are unique systems with their own particular challenges, Skretting has

Skretting Aquaculture Research Centre Lerang Research Station RAS research facility in Norway. been operating within this space for a long time; we brought the first recirc-specific diet to the market in 2009. The knowledge and expertise that we continue to amass along with the R&D facilities that we have in place will prove invaluable as more and more of these systems come on stream.”

Skretting also has recirculation research units in Chile and Australia.

“We know that feeding the fish means feeding the system, and our knowledge in this area ensures that we can help our customers maximise their production capacity,” Fernandes said.

AquaMaof Aquaculture Technologies has ramped up production at its 600-metric-tonper-annum salmon hatchery, smolt and market-size Atlantic salmon recirculating aquaculture system R&D facility near Warsaw, Poland. Since operations commenced in 2016, AquaMaof’s “Global Fish” facility has successfully grown several large batches, ranging from eggs to smolts to 5Kg harvest-size fish, the company said.

David Hazut, CEO of AquaMaof, said, “We see significant growth potential in the supply of recirculating aquaculture systems to salmon production companies. The investment in Poland will serve two main purposes: first, we are operating this facility as an R&D centre, collecting valuable information and analysing it, for further innovation in the RAS area. Secondly, it serves as a training facility for our customers’ staff.”

The Global Fish facility houses multiple

RAS rearing units with tank space ranging from 1-200 m3, all under strict standard operating procedures, which maximize growth conditions for salmon. AquaMaof’s advanced Zero Discharge Technology utilizes proprietary water re-use techniques. At the core of the company’s RAS technology is efficient power consumption, dramatically reducing costs of energy. No antibiotics and no chemicals in the process allow for the production of healthy, natural product, the company said. Biosecurity is paramount, and

complete environmental control ensure that salmons are grown in an environment which promotes the highest health and welfare status. No drum filters require minimal maintenance, while optimized feeding modes and advanced feeding management system – enable reduction of the Feed Conversion Ratio (FCR) and operational costs.

“We are extremely proud of the fact that in such short a time we were able to achieve very good results in growing smolts up to market-size Salmons, in terms of operation costs, FCR and not less important – excellent taste and colour of the fish” continues Hazut.

“Apart from the Global Fish facility, we have several additional projects around the world in different stages, for Smolt and harvest-size Salmon production facilities, implementing our proprietary technology, and we expect more projects to commence in the coming months” concluded Hazut.

The expanding land-based aquaculture industry requires skilled staff, and experienced RAS operators remain in demand. However, there are many opportunities at both new and existing facilities for new operators to develop confidence in operating RAS.

A well-rounded team with diverse expertise including trades, engineering and biology is paramount. Diverse skills increase in-house capacity and ensure a wide range of challenges can be recognized and resolved quickly. Fostering collaboration within the team improves communication between areas of the facility or between shifts, affords opportunity for cross-training, and boosts confidence that the burden of operating the facility is spread over many capable hands. It is important to invest appropriate time and resources to properly train new hires, so work is performed to standard and chances for success of both individuals and the team are maximized.

The construction and commissioning phases at new facilities is a unique opportunity for operators to observe components such as underground piping and electrical service entries that may be important in future facility planning. This opportunity allows staff to observe how system components fit together and provides perspective of equipment in new condition versus future wear-and-tear. Staff participation in commissioning is great training in a low risk setting to learn system manipulations and experience components operating at design specifications.

System startups and shut-downs at existing facilities offer similar opportunities to simulate alarm conditions and practice emergency response. This time should also be used to assess equipment condition and perform intensive maintenance

or replacements, maximizing system reliability for the next cohort of fish.

A maintenance plan with intensive checks on essential equipment increases longevity and reliability of mechanical parts. Performing regular preventative maintenance helps operators become familiar with location, function and normal operating conditions. Checks help identify failing equipment so replacement can be scheduled at opportune times, and not during a crisis with high risk to livestock.

Emergency back-up generators should be checked for vital fluids and error codes, and abnormal conditions addressed immediately. It is important that generators be exercised, and load tested to ensure they will power life support systems or when adding additional load at the facility.

Emergency oxygen diffusers should be tested and cleaned regularly and confirmed to support the most densely stocked tanks, with capacity added if needed. Set points for oxygen activation should be considered and may change based on stocking density. For example, dense tanks may require higher activation settings to prevent dissolved oxygen concentrations from reaching dangerous levels that cannot be recovered in an emergency.

Alarming equipment back-up batteries should be checked and tested to confirm that alarm conditions are detected, but also that they will successfully notify staff. Vital conditions should have redundant sensors or dial out pathways. Install adequate alarms to detect failures but avoid excess that creates nuisance alarms or alarm flooding. Depending on scale, facilities should consider 24/7 on site coverage.

Always check back-up systems and alarming prior to hazardous weather forecasts and have back-up fuel and liquid oxygen tanks topped off if necessary. It is important to establish strong relationships with local vendors that can provide support during emergency situations.

Knowing that back-ups are operational and will sustain livestock are huge confidence boosters.