By Mari-Len De Guzman

For those who are fans of the popular TV show, Friends , the title of this editorial might conjure up an image of characters Ross Geller, Rachel Green and Chandler Bing trying to move an enormous sofa up a flight of stairs in an apartment building. Ross was repeatedly yelling, “Pivot!” to his friends as they try to turn the furniture on a corner, but with no success. The sofa was just too big to manuevre in a narrow stairwell with sharp corners.

Pivoting is what many RAS producers have had to do recently amid the growing impact of business closures and travel restrictions brought on by COVID-19. A “half-glass-full” perspective would point out that the global pandemic, despite its negative consequences, has boosted the argument for local production in food security. The poster child for this in the seafood industry is land-based aquaculture: locally-grown, sustainable production close to markets – in theory.

The reality is that for all its local glory, RAS producers – like many food manufacturers – have had to tweak business strategies to adapt to this new normal. A big chunk of customers for seafood – the restaurant industry – had all but disappeared overnight, leaving producers to re-think their sales and distribution strategies.

With a little innovative thinking and a lot of flexibility, however, many of them have found new market channels to divert their products to. From the more obvious retail and supermarket channels to a less traditional “direct-to-consumer” route, these new market opportunities are not only providing revenue streams in an otherwise uncertain

economy, but it’s also inadvertently increasing the profile of RAS-grown, sustainable seafood to consumers. How the RAS sector will leverage this remains to be seen.

One novel approach is being tested out by Ideal Fish. The company recently started selling its Branzino through its e-commerce platform, directly to consumers. But that’s not what piqued my interest. The company’s sales and marketing director, James MacKnight, tells me he is currently in talks with other RAS producers to bring their own brands into Ideal Fish’s e-commerce program.

“I am a huge believer in RAS in general. Instead of just selling our own fish online, we are reaching out to other domestic RAS company. We’d love to get their fish in here and we want to put it up online with our fish so the consumers could come to Idealfish. com and they are able to buy a phenomenal selection of top quality, domestically produced RAS products,” explains MacKnight. He also envisions a future where supermarkets will have a separate aisle for RASgrown fish.

The technology for RAS has matured and commercial projects are continuing to increase. It’s now time to put some innovative thinking into marketing and raising the sector’s profile among consumers. Buyers can get on board with land-based aquaculture if they are given accurate information. Now more than ever, consumers are more environmentally conscious and increasingly want to learn where their food comes from. It’s up to this industry to tell a compelling story based on the facts.

We are all here because RAS has a great sustainability story to tell. So get your thinking caps on and, pivot!

www.rastechmagazine.com

Editor Mari-Len De Guzman 289-259-1408 mdeguzman@annexbusinessmedia.com

Associate Editor Jean Ko Din 437-990-1107 jkodin@annexbusinessmedia.com

Advertising Manager Jeremy Thain 250-474-3982 jthain@annexbusinessmedia.com

Media Designer Jaime Ratcliffe 519-428-3471 ext 264 jratcliffe@annexbusinessmedia.com

Account Coordinator Morgen Balch 519-429-5183 mbalch@annexbusinessmedia.com

Circulation Manager Urszula Grzyb 416-442-5600 ext 3537 ugrzyb@annexbusinessmedia.com

Group Publisher Todd Humber thumber@annexbusinessmedia.com

COO Scott Jamieson sjamieson@annexbusinessmedia.com

Printed in Canada

SUBSCRIPTION

RAStech is published as a supplement to Hatchery International and Aquaculture North America.

CIRCULATION

email: blao@annexbusinesmedia.com Tel: 416.442-5600 ext 3552 Fax: 416.510.6875 (main) 416.442-2191 Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Occasionally, RAStech will mail information on behalf of industry related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office privacy@annexbusinessmedia.com Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission © 2020 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

A few months ago AKVA Group was poised to deliver on a couple of multimillion-dollar aquaculture contracts. But as the whole world slipped deeper into the chasm of the COVID-19 pandemic, the Norway-based aquaculture services and equipment provider witnessed projects worth nearly $60 million suddenly scrapped.

The company’s subsidiary, AKVA Group Land-Based A/S, had signed a deal last December to provide the technology behind an 8,000-metric-ton recirculating aquaculture system (RAS) project that Nordic Aqua Partners was building in China.

The project’s value was estimated at $47.7 million. AKVA agreed to put in $3.4 million in equity in the project, according to a report in SeafoodSource. com. Financing, however, was cancelled because of the COVID-19 crisis.

Another AKVA subsidiary, AKVA Groupe Chile S.A., was contracted by Cooke Aquaculture Inc. for a RAS project in Chile worth $11.3 million. Citing the challenges and uncertainty brought by the pandemic, however, Cooke Aquaculture decided to cancel the deal last April.

Before the global pandemic, things have been looking rosy for the precision aquaculture market. A report in January by research firm Markets and Markets forecasted that demand for increased efficiency in aquaculture operations will push the precision aquaculture market to grow to an estimated $764 million in 2024 from its previous worth of $398 million in 2019.

However, widespread national lockdowns and international border restrictions implemented by nations in a bid to prevent the spread of COVID-19 have flattened the market. Citing COVID-19 related challenges, AKVA reported that its net profit fell from $1.8 million to losses of $8.1 million.

Fast fact: About seventy percent of women work in the seafood industry, but most are in low-paying jobs and very few are in leadership roles.

Land-based aquaculture producer Stolt Sea Farm reported an operating loss of $9.8 million in the first quarter of 2020, down from a profit of $1.7 million in the last quarter of 2019. The company says the loss was due to a steep drop in market demand caused by COVID-19.

An ongoing recirculating aquaculture system (RAS) pilot program in Lake Victoria in Africa aims not only to optimize the use of the lake’s water for agriculture but also get more women involved in a promising aquaculture sector, according to the European Commission.

VicInAqua is a medium-scale research project funded by the European Union’s Horizon 2020 program. Eleven partners from seven European and African countries are working together through the project to develop an integrated approach to water management. The project is also using treated domestic wastewater to supply a RAS facility in the Lake Victoria region.

Shared by East African countries Kenya, Tanzania and Uganda, and covering an area of over 68,800 square kilometers, Lake Victoria is considered to be the world’s largest inland fishery environment.

“A RAS requires little land, can be used close to home, and is perceived as far less dangerous than capture fishing in the eyes of the local community,” according to a post in the European Commission website. “As a result, women are much more involved. However, despite their leading role, issues concerning women and gender are largely absent from the conversation.”

VicInAqua conducted several roundtable discussions on the issue, exploring a road map for better inte-

gration of women in aquaculture through “participatory consultation.”

“Thanks to partnership with DALF (Department of Agriculture, Irrigation, Livestock and Fisheries of Kisumu County, Kenya), the pilot plant will be maintained and operated as a training and demonstration facility, constituting a sustainable legacy,” said project coordinator Jan Hoinkis of Karlsruhe University of Applied Sciences.

The team has prepared handbooks to help stakeholders with daily use and maintenance of the technologies.

“The pilot, built in Kisumu, Kenya, combines an innovative membrane bioreactor (MBR), utilizing commercial and custom-developed anti-fouling membranes with a RAS,” according to Hoinkis. “The RAS, located next to a wastewater stabilization pond, can recirculate 90 to 95 percent of its water volume.”

He said the MBR and RAS are integrated with smart monitoring technologies and renewable energy sources. The MBR-treated water is used for irrigating a variety of local vegetables and natural by-products are used as fertilizers in agriculture.

Since the pilot project has RAS capacity four to five times greater than originally planned, its operation will significantly reduce pollution, enhance fish production and improve food security in the region, the proponents said.

- NESTOR

Japanese business giant Marubeni Corp. has partnered with marine products firm Nissui Europe, a wholly owned subsidiary of Nippon Suisan Kaisha, to take over the recirculating aquaculture system (RAS) operations of Danish Salmon A/S.

In a joint written statement, Marubeni and Nissui said they had acquired 66.7 percent of Danish Salmon’s shares in order “to grow their business in Europe, and for the purpose of expanding their RAS operation to countries outside of Europe as well.”

“RAS is a farming method with the potential to minimize environmental impact by reducing both the risk of water pollution and the risk of escaped farmed fish. It is for these reasons that RAS is currently drawing attention as a future solution to a potential protein shortage caused by an increased global population,” according to Marubeni and Nissui.

Danish Salmon’s operations in Hirtshals, Denmark, produces 1,200 tons of salmon each year.

The facility was built in 2012, with the aim of producing 2,000 tons of salmon each year. The company had struggled for some time, although it experienced a turnaround when it managed to produce profits in 2018.

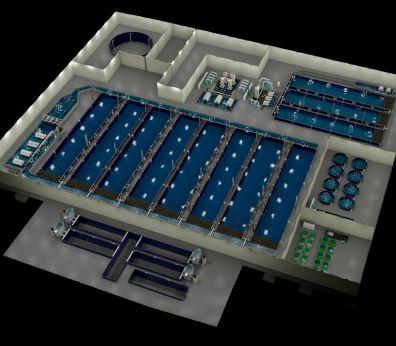

Recirculating aquaculture system (RAS) company, AquaMaof Aquaculture Technologies Ltd., is set to build a new aquaculture facility with a production capacity of 10,000 tons of Atlantic salmon per year.

The RAS facility, which will be built in France, was commissioned by 8F Asset Management, which owns Pure Salmon.

AquaMaof said the project is in its design stage. The first eggs will be introduced to the system by 2021. The first harvest is expected by 2023, according to a press release from the company.

When completed, the facility will bring to 60,000 tons the combined annual production of Atlantic salmon by other facilities built by AquaMaof. The company specializes in indoor aquaculture technology and turn-key projects. From concept to operational fish production facilities, the company’s proprietary RAS technology has been used worldwide.

AquaMaof is working on large-scale Atlantic salmon RAS facilities in Canada, the United States, Japan, Russia, Central Europe, South East Asia, and Chile.

“We are excited to kick off this project that will integrate all the latest advancements in RAS technology,” said Shai Silbermann, vice-president of marketing and sales at AquaMaof. “These projects will provide important local production capabilities to markets that today import the vast majority of their fish and seafood.”

The company has built facilities that are strategically located adjacent to large cities, which dramatically reduces transportation costs, and produce fresh, natural, and high-quality fish at competitive prices, according to AquaMaof.

“Today more than ever, the capabilities of maintaining a clean, bio-secured, disease-free environment in fish and seafood production, as well as enabling local production in a time of disrupted food production and international supply chain and transport, are much sought after. Governments, investors, and big retailers are seeking food-production technologies that promote food safety and local production capabilities,” said Silbermann.

The cardiac health and growth of trout in circular aquaculture tanks can be improved through exercise and enhanced dissolved oxygen (DO) delivery.

These were the findings of a research supported by the United States Department of Agriculture – Agricultural Service. The study was titled: “The effects of swimming exercise and dissolved oxygen on growth performance, fin condition and survival of rainbow trout Oncorhynchus mykiss. draft manuscript of the study was published by John Wiley & Sons Ltd.

Kenney, and Christopher Good.

The researchers also found that “facilities utilizing salmonids and other species with a high metabolic scope and positive rheotaxis may benefit by maintaining dissolved oxygen at saturation and providing moderate swimming exercise in the right balances.”

Both swimming exercise (usually measured in body lengths per second, or BL/s) and

tanks. Each tank was retrofitted with a magnetic pump connected to an inlet and discharge manifold, inducing rotational water velocities for swimming exercise by removing water from the tank and pumping it back through the discharge manifold.

“Our findings confirm better growth performance in oxygen saturated environments, with trout in the high DO treatment

For humans, switching off the lights is one of the key elements of a good night’s sleep – and hopefully, a fresh start in the morning. Not so for some fish species, according to the findings of a research study carried out by the Southeast Asian Fisheries Development Center/Aquaculture Department (SEAFDEC/AQD).

Keeping the lights on, even at night, can help pompano fry grow faster, according to SEAFDEC/ AQD associate researcher, Ma. Irene Legaspi.

Pompano (trachinotus) is a high-value fish in many Asian countries, such as the Philippines. The species is prized for its firm and flaky meat that has a mildly sweet flavour. The pompano is typically cultured in ponds, as well as in open sea and brackish water cages.

According to Legaspi, illuminating the cages of pompanos during their nursery phase helps the fish see their natural prey better.

Pompano feasts on mostly tiny crustaceans called copepods which float near the surface of the water. Natural food, as opposed to artificial feeds, is better for pompano larvae, said Legaspi. With the lights on, juvenile pompano are able to

eat through the night, thus improving their growth and survival.

Researchers found that pompano that received artificial light achieved higher body weight compared to pompano not provided with lighting. Results also revealed that pompano receiving 25 to 50 percent less artificial feed, but provided with artificial illumination, gained as much weight as fully fed pompano with no illumination,

according to a post in the SEAFDEC/AQD website. This means that feed cost can be reduced by as much as 50 percent, said Legaspi.

Previous studies have also shown that illumination not only helps fish see their prey. However, the copepods are attracted to artificial light, between 180 and 300 lux, and instinctively flock right where the young fish can see them.

- NESTOR ARELLANO

By Maddi Badiola

Maddi Badiola, PhD, is a RAS engineer and co-founder of HTH aquaMetrics llc, (www.HTHaqua.com) based in Getxo, Basque Country, Spain. Her specialty is energy conservation, lifecycle assessments and RAS global sustainability assessments. Email her at mbadiolamillate@gmail.com or contatct her through LinkedIn, Facebook and Instagram.

Suddenly, we were confined, in an alarm situation. After seeing how China was shut down, and even underestimating, the social distancing measures, silenced streets and closed shops, the entire world was soon affected by this little creature. After the first case in Spain showed up by the end January, the number of deaths from COVID-19 is over 23,000 in the country. Worldwide, the death toll has reached more than 220,000 as of this writing. Fear and respect are two sentiments that many people are currently feeling – not hugging, not kissing, keeping over two meters distance and wearing masks and gloves. Is this our future? Should we believe that the world has changed? Should we begin looking at a completely changed way of living? I am afraid the answer is, yes.

While all this is happening around us, one of the main sectors remaining active and more important than ever is the food sector. Supermarkets are the objective of people, both as essential place to go or as a reason to get out of their houses. It is obvious that we all need to eat.

We’ve heard different statistics on the news. They are even making comparisons between countries. Flour, chocolate, snacks, beer, other alcoholic beverages are top-ranked items, while experts are calling for healthier choices and a Mediterranean diet. And here is where the aquaculture industry enters and plays a key role. Not only because it is a source of good and healthy protein and fatty acids (in the case of salmon) but also because it employs millions of people, helping families to keep going during such an exceptional situation.

The Aquaculture Stewardship Council has announced a campaign launched by the Seafood Nutrition Partnership to save

an industry that employs more than two million Americans. With the hashtag #EatSeafoodAmerica, they are calling to buy sustainable seafood to support struggling farmers and fishermen.

Another initiative is donating seafood products to those families with real needs during these rough times. Bumble Bee Seafoods has donated $1 million in products to Feeding America organizations in three communities where they operate daily (San Diego and Los Angeles in California and in southern New Jersey).

At the same time, hoping to relieve the pressure on the public health system and provide quicker results for the region’s affected (including remote areas in southern Chile), the Chilean laboratory of Mowi, the largest salmon producer in the world, has been made available to health authorities, free of charge, for three months. They are offering their professional capacity and technical equipment to analyse up to 1,000 samples of COVID-19 daily. As we are aware, countries such as South Korea, whose health strategy was based on early diagnosis of the virus, prioritized widespread testing and early detection – key to successful pandemic containment.

Nevertheless, the most common initiative has been sharing recipes to cook at home – delicious homemade dishes to share with the family and to make children part of the blue revolution, making them concious and aware of the importance of the industry.

At this point, biosecurity is the only way to look forward: no biosecurity, no guarantee. The current pandemic should force all aquaculture stakeholders of all levels to pay greater attention to and invest more money on biosecurity, and this is where the RAS industry stands out.

This is the time when RAS systems are going to become a more important factor

in our food systems. Traceable and biosecure are two parameters that RAS companies share, at least more than the old technologies or farming methods. Every second of a fish’s life stage is accounted for, controlling all inputs and thus, all the advantages. Monitoring, auditing, data analysis and comparison make RAS the most traceable food industry. High technology engineering systems together with good management all come together in RAS.

Of course, improvements are needed and RAS experts should make this case to the investors. Many farms identify setpoints and red lines once they are operating, needing infrastructure modifications afterwards – and having to make that call for more money to your board of directors.

If you are an engineer, design a RAS by thinking as a fish, as an employee and as the different inputs of the system. Question yourself, find the most suitable answer for each of the cases and combine them. Use different colors. This will also be helpful in explaining paths to the investors, who in most cases, are not completely aware of the complexity of this business. They need less technical language and more friendly and colloquial framework. They seek enlightenment, good counsel and good decisions.

Biosecurity is required and essential when designing and planning a RAS project. Biosecurity is crucial in every corner, every industry. This pandemic situation has highlighted the weaknesses for companies, the unsecure side of different sectors. During this crisis, the importance of aquaculture in general, and RAS in particular, has stood out.

Keep your perspectives in the horizon, your priorities clear and be diligent. Your customers, employees, friends and family are counting on you.

By Liza Mayer

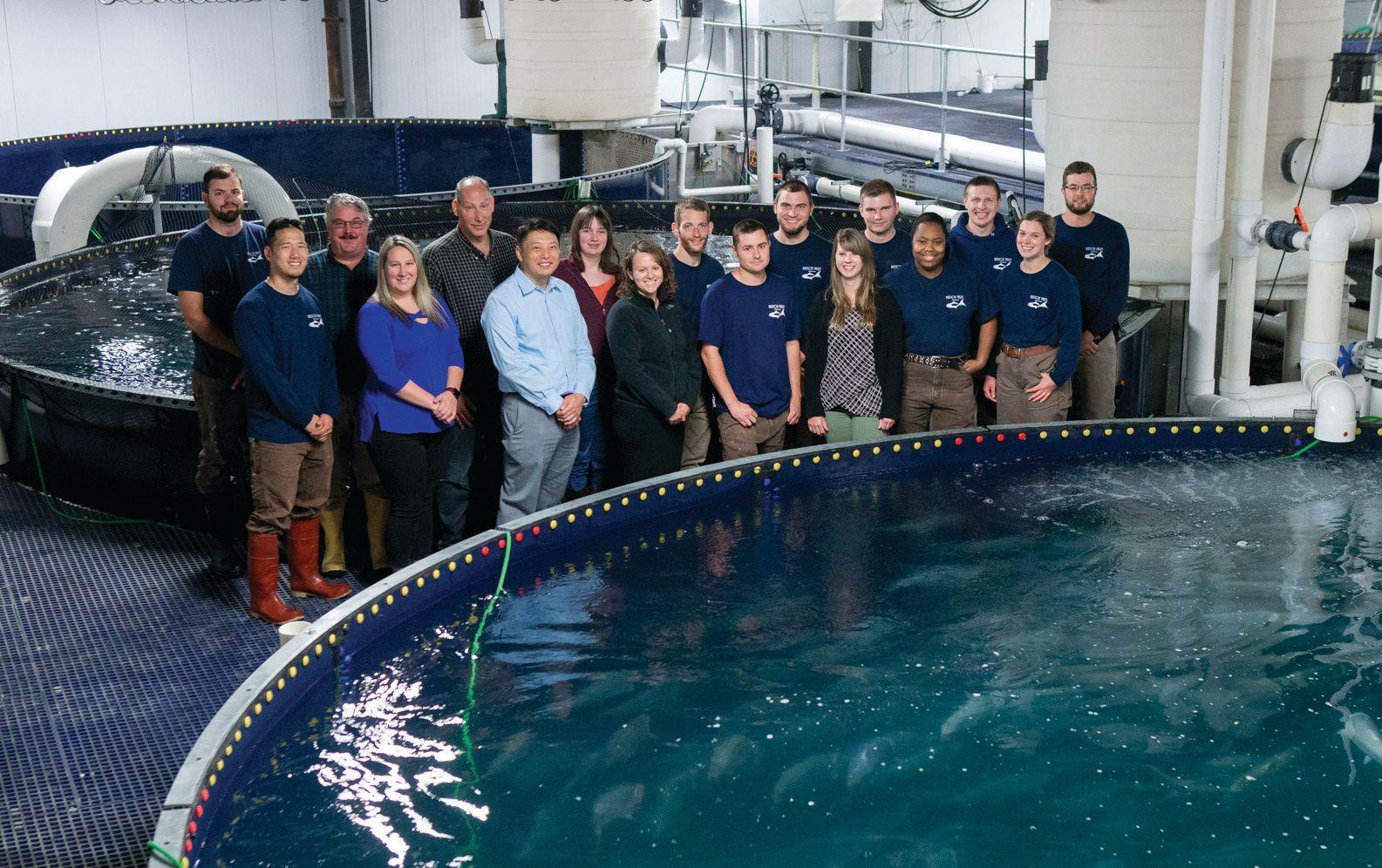

Life doesn’t always go according to plan. Ask John Ng, the entrepreneur behind Hudson Valley Fisheries (HVF), a recirculating aquaculture system (RAS) facility producing steelhead trout in upstate New York. Like many Asian immigrant kids, Ng had his

neurship was strong. That wasn’t surprising as Ng was raised by a businessman father who started a metal recycling business in the late 80s. From its mom-and-pop beginnings, the business has since spawned more than 20 companies across North America.

On the surface, recycling and fish farming seem very disparate industries. Ng will also

chased a defunct indoor tilapia farm in the City of Hudson in 2014. What he knew was that both industries, done sustainably, could have positive impact on the environment.

“We always viewed recycling as an industry that’s positive for our environment and our society,” Ng tells RASTech. “Metal recycling is not a pretty industry but it is a very

the oceans continue to be overfished. This method of raising seafood on land in these systems is a window to the future. It spoke to some of our core principles.”

This, coupled with his understanding that the world has “unlimited appetite” for seafood, led him to aquaculture.

While site cleanup was underway, Ng was deciding which species to farm. He eventually went with steelhead trout (Oncorhynchus mykiss), a hardy fish known for its ability to “pack on weight and they pack it in fast.” It also has a good track record in RAS systems.

Building the facility took roughly two years. A lot of the farm’s technology is off-theshelf. What’s proprietary are the “processes on how we do things, how we use that equipment,” says Ng.

By the time the farm started operations, Ng had retained some of the staff involved in the construction phase. “I was lucky to have found excellent talent to operate the fish farm. They grew up with us and now they’re part of the actual fish farming operations. That speaks to how my team is,” he says.

HVF made its first “true-market-ready” harvest (5,000 lbs of steelhead) in the second quarter of 2018. Looking back at the four years since acquiring the defunct fish farm, Ng considers them as opportunities for learning.

“We worked through a number of struggles,” he says. He recalls being roused from sleep on the wee hours of a Saturday when a faulty oxygen valve killed the very first batch of eggs put into the system.

Such stories are not uncommon in landbased farms. Ng says they speak to the complexity of these systems.

“The more complex something is, the more prone it is to issues on the mechanical

side,” he says. “We work with a total of seven independent systems for our fish, from nursery stage all the way to grow-out. Every one of those systems is complex so we put each one through what we call a ‘shakedown’ or a testing period, where we make sure everything’s working. We run a small group of fish through it to test it. We don’t want to take the risk of building a system that didn’t work in the final hour.”

Another issue that had to be addressed was the hard water in the Hudson Valley. It was “okay for the fish” but it wreaked havoc on the equipment. “We brought in a large system to soften the water. That’s been a significant challenge. We decided to do something about it because we’re driven to complete our goals,” he says.

Ng says the biggest challenge for him is not the technology but the consumer perception

of farmed fish.

“Farmed fish still has a dark cloud over it. People hear that we are a farmed product and assume that we have the same issues. But the fact of the matter is our product has none of the detriment of the traditional farmed products. We don’t use antibiotics in our growing operations, no vaccine, no herbicides to keep nets clean. We’re safe for the environment. You can’t tell me you don’t use vaccine when you run a net-pen operation where the fish are exposed to the environment,” he says.

In the early days, Ng was also up against the northeast market’s unfamiliarity with steelhead. However, he started seeing a shift in consumer acceptance over the past year as its brand “New York Steelhead” gained traction in both mainstream and social media.

“I don’t think I’ve ever interviewed once when I was operating a scrap company,” he

says, smiling. Nowadays, public speaking and facing the media is something he has become accustomed to.

“Our biggest outreach has been publications picking up our story as well as social media. The most notable one is The New York Times. They did a little story on sustainable seafood and mentioned land-based steelhead,” he says. “That’s where one of our biggest challenges has been and continues to be. It is to expose the market that what we’re doing.”

HVF delivers its fish to surrounding markets – New York, Boston, Philadelphia and

Washington, DC – within 24 hours of harvest if it is head-on gutted (HOG), or within 48 hours if it is filleted.

Seeing his product in supermarket display cases is a source of pride for Ng. “Our product is always so much brighter in color and tender because it is fresher. Every time I see our product in the display case next to a salmon or next to another trout, by appearance alone I think our product is superior.”

After overcoming trials and errors, Ng now has the confidence that was sorely lacking when the project first started. He is

now looking at ramping up production, taking it from the current 30 percent of capacity to the full 1,200-ton capacity, annually.

He is also looking at replicating the pilot facility in other locations, pretty much following the same trajectory of his father’s recycling business.

“We never thought of it is as a one and done,” Ng says of the HVF operation. “We saw this as a prototype, a model, because we want to deliver fresh local product to the market. Our target would be to build similar facilities throughout the major markets in the U.S. and around the world.”

One advantage he has over other RAS operations that has to raise funds in order to proceed to the next phase, is that Hudson Valley Fisheries is entirely self-funded. “We don’t have to consult a whole board of six different voices to make effective decisions. Beyond me, it’s my father, so the buck stops right here,” he says.

Ng is also setting his sights on building an aquaponics farm in the same Hudson Valley

property. The 130-acre landholding has 20 acres that’s tillable and 16,000 square feet of indoor space that can accommodate a greenhouse.

“I’ve always had the aim of building an aquaponics operation from the very beginning. We just did not want to start off with building two systems and take that risk. We wanted to build a substantial fish farm first. Now that we’ve built a fish farm I have confidence to look into building an aquaponics farm,” he says.

The “explosion” of the hemp industry over last three years has prompted Ng to grow hemp in the property. Like the steelhead farm, he plans to develop the hemp farm into a true commercial-scale enterprise.

“There’s never been a better time to look at growing hemp,” he says. “We’re somewhat limited by our tillable farmland but we’re not limited to being a greenhouse operation. There’s plenty of property to put up additional greenhouses.”

In 2019, he had six acres of the farmland and some greenhouse space planted with hemp. Fish nutrient water from the RAS

farm was used to water the hemp field. More than 24,000 lbs of hemp were harvested from that pilot planting.

“We had exceeded our expectations in terms of the biomass that we grew as well as the CBD content of our harvest both in the greenhouses and the fields. Typically, I think people expect to harvest 2,500 pounds per acre. We hit nearly 4,000 pounds an acre,” he said.

Ng has big plans to accomplish over the next five years.

“I see an expansion of our agricultural products beyond hemp into produce, which we already planned. I see growth into a different facility and maybe a different species. But definitely growth including value-added products like smoked product. It doesn’t stop there. My aim is to use every bit of the fish as we can.”

The HVF chief executive also wants to educate future fish farmers. “Every article you read these days say the talent pool for aquaculture worldwide is somewhat limited. I’ve heard a lot about the ageing

population of the farming industry, how skills are not being handed down from one generation to the next, that the younger generations are leaning towards more tech jobs. But here I got a farm in upstate New York where the majority of the staff is below the age of 30. It wasn’t our goal when we started but it is now – to help train the next generation of fish farmers.”

This is not farfetched. The farm already offers internships to schools in the area that have aquaculture courses, such as SUNY Cobleskill which is just a 1.5-hour drive away, and Cornell University which has been offering a RAS course for the past 25 years.

Hudson Valley Fisheries also helps educate the young generation of chefs about what sustainable seafood looks like. It has offered lectures at the Culinary Institute of America and the College of Culinary Arts at Johnson & Wales University.

“We are not in the investing game to just build it, sell it and we walk away. We’re doing this not only so that our children will have food to eat but also so that my children will take this on,” he says.

By Mari-Len De Guzman

If there is one insight to be gleaned from the global pandemic that has rocked the world this year, it is the need to strengthen domestic, sustainable food production.

Fish and fish products are the most heavily traded products in the world, according to the United Nations Food and Agriculture Organization. China is the largest exporter and third largest importer of seafood globally. The U.S. imports 80 percent of its total seafood.

Undoubtedly, international travel restrictions have resulted in significant reduction in the number of cross-border flights, making a huge dent on seafood import and export – both from the supply and demand side. This has re-ignited the call for strengthening domestic food production and reducing reliance on imports.

“In general, one of the key strengths of RAS is the local production,” says Ohad Maiman, founder and CEO of The Kingfish

•

•

•

•

•

•

•

Company (formerly Kingfish Zeeland). “It’s often been referred to only in saving the cost of carbon footprint in transport, but I also think now it’s shining a new light on local, reliable, year-round production.”

The Kingfish Company farms Dutch Yellowtail (Seriola lalandi) in a land-based aquaculture farm in Kats, The Netherlands. The RAS facility currently produces up to 600 tons of the species, with plans to expand capacity to 5,000 tons. The company is also in the permitting process to build a new RAS facility in Maine, on the U.S. east coast.

Like the rest of the world dealing with COVID-19, The Netherlands has implemented public health and safety protocols, including physical distancing, that led to the closure of many public establishments, including restaurants and bars – a huge market for seafood producers.

RAS operators, however, are finding that when one door closes, another door – and several windows – start to open. Despite restaurant closures and orders from wholesale distributors slowing down or even coming to a halt, retail and e-commerce have thrived, opening up new market opportunities for fish producers.

“When the (COVID-19) virus hit, what it did is it shun a flashlight on the fact that we, as a country, are very vulnerable – in many different areas – but especially with our food security. We’ve been forced to look at our domestic production, both on the aquaculture side and also the wildcaught (sector), and people are becoming far more aware,” says James MacKnight, sales and marketing director for Waterbury, Connecticut-based Branzino producer Ideal Fish.

With RAS operations seemingly immune – at least, for the time being – to the downward sales trend seen in other seafood sectors in the wake of COVID-19, perhaps the common denominator is scale. To date, much of the fully operational and commercial-ready RAS farms are on the low side of the production scale – with outputs less than 1,000 tons per year.

Aquaco Farms, which grows Florida Pompano (Trachinotus carolinus) in RAS, was just about to complete its very first harvest in April. But when the global pandemic began showing signs of prolonged economic downturn, the company’s CEO Joe Cardenas and his farming team decided to hold off the harvest for another month.

“We are somewhat in a unique position where we’re just starting – we don’t have an existing sales cycle yet,” Cardenas points out. “We’re facing the challenges without having to switch; we’re just changing gears and moving our product to a new market.”

Its first harvest was originally planned for distribution to restaurants and resorts but while those orders have decreased in light of restaurant and other closures in the food service sector, the company is finding alternative avenues for getting its pompano to market. For a small-scale RAS farm like Aquaco, which is only at a 50-ton-peryear capacity, pivoting its sales strategy is not a huge undertaking.

“There are consumers who still like

good seafood,” Cardenas says. They might not be ordering it at a restaurant, they might not be getting it at the hotel on vacation, but they are either cooking it at home or they’re getting it at a take-out. You just have to change your channels, and that’s easier for some than others to do based on scale. For us, and other small or mid-size operators, it’s a lot of hard work but it’s not impossible.”

Small for now, but Aquaco is full steam ahead on plans to expand its RAS production capacity tenfold to 500 tons per year, with start of construction expected by the

first quarter of 2021.

The Kingfish Company is also tweaking its sales and distribution strategy, but overall the market for the high-value Dutch Yellowtail does not seem to have dwindled, just the balance between fresh and frozen produce has changed.

Kingfish CEO Maiman says the retail market for fresh fish continues to move but with the restaurant market at a standstill, some of his company’s produce are being frozen to its high-value clients’ specifications.

“We do the liquid nitrogen sashimi-grade

for the U.S. so it allows us to balance between fresh sales now and build up a bit of inventory as well,” Maiman explains. He adds a key component that allowed his company to adopt to the changing marketplace is its post-harvest processing capability.

“It was very important that it caught us when we were vertically integrated, so we had the processing, packing and freezing capacity to shift immediately from fresh sales to restauranst that were in lockdown, to container loads of existing clients in the U.S. that we were struggling to supply volume for previously.”

Farming high-value species seems to have its own advantages during a global crisis, as well. While the price of salmon has dropped from around the usual $8 per kilo to nearly $5 per kilo since COVID-19 hit, the price for certain high-value crops does not seem to be affected by the market downturn.

That’s certainly true for Kingfish’s Yellowtail produce. “Price has not been an issue, but that is also our strategy,” Maiman points out. “It’s a page out of the Tesla playbook, doing Yellowtail as a model. In relative terms, this is a niche in volume and we are also on the higher end so the price

relativity seems to be less of an issue.”

He adds that the challenge currently is not so much with price, but “where it is consumed and how do we get it there,” as this fish product has traditionally been enjoyed at restaurants. The company’s integrated post-harvest processing capability will allow it to process and package to market requirements – whether fresh, boneless and skinless portions, or frozen.

For Ideal Fish, which produces Branzino (Dicentrarchus labrax) in RAS, the international travel restrictions have caused the price for importing seafood to skyrocket, which in turn opened up local market opportunities, says MacKnight.

“In our case with the Branzino, the only country that’s really open for business right now is Turkey, and even though they are open to business, there is a bottleneck. They can produce as much fish as they want but if they have no way of flying that fish across the Atlantic, it’s not going to happen.”

Ideal Fish delivers its products to multiple retail chains in New York and Boston – a market that hasn’t changed despite the COVID-19 slowdown. The RAS producer also offers UPS delivery for small-volume orders for retail stores across the U.S. Most recently, the company began selling direct to consumers through Amazon and

through its own, recently launched corporate e-commerce platform.

“The retail side is going off a lot because people are staying and eating at home now,” MacKnight says.

The effects of COVID-19 to global supply chains may have given RAS investors a bit of confidence boost on the strengths of their RAS projects, particularly the smaller scale, high-value-product operations, which seem to be thriving.

“In this climate of uncertainty towards the future, it may become easier to fund smaller, local projects, as opposed to these gigantic projects that are supposed to feed an entire country and beyond,” comments

André Bravo, co-founder at UK-based investment firm Devonian Capital, which focuses on land-based aquaculture projects.

And this has been Devonian’s investment strategy from day one, Bravo adds. “It’s lower risk. If you have to invest $10 million in something that you’re not sure is going to work, or if you have to invest $100 million in something that you also don’t know if it’s going to work – at this time, maybe it’s easier to get an investment of $10 million.”

Still, in these times of crisis, some RAS

operations are performing better in sales than others – and a contributing factor is product. For example, Bravo works with two companies in Portugal – one produces oysters and the other produces seabream.

“The one that’s growing oysters is deeply concerned because the oyster market has basically stopped. Portuguese oysters go to France, from France they mostly go to China, and everything is blocked at the moment so they have no sales.”

The seabream producer, on the other hand, is seeing a huge increase in demand for its product as most imports of the fish into the country have been blocked, boosting local sales. “So you can see different dynamics depending on what you’re doing and where you’re doing it,” Bravo notes.

RAS producers with niche, high-value products may be at an advantage, particularly when market prices are making an impact on profitability, says Jamie Stein, also a co-founder at Devonian Capital.

“The impact on price does remind investors that RAS projects still are more

operationally leveraged than sea cage (operations),” notes Stein, citing the dropping price of salmon in Europe, for example.

“Investors are really looking at the downside scenarios. There will always be, for niche producers and producers of a really high-quality product… the ability to attract a slight premium on price, and there will also be producers who are very, very focused on pushing their prices down overtime even in a RAS environment – and those, we think, are two interesting strategies for RAS,” Stein explains.

RAS producers may be working on a slight advantage in the face of this global pandemic, but these financial experts emphasize some key strategies to ensure companies maximize their competitive advantage.

If they were selling directly to restau rants prior to COVID-19, they might now be having to start negotiating with retail ers. All signs indicate to prolonged clos ures of restaurants or if they even open, it is likely they will be implementing

physical distancing measures that will reduce occupancy for the foreseeable future. Supermarkets, on the other hand, will continue to sell fish.

According to Bravo, some questions RAS producers should be asking and answering now is: Can they sell fish to supermarkets? Do they have enough volume? Can they sell at a price which is appealing to the supermarket client?

A prolonged period of low prices, however, will be one of the biggest concerns for seafood producers, says Stein.

“If you’ve got a business plan that is focused on selling locally… then you’re probably going to do pretty well,” he says. “The restaurant trade will be hurt but if you can divert towards supermarkets then you’re probably OK.”

By Liza Mayer

Martin Fothergill has an impressive resume as wealth manager. His background includes 18 years at Deutsche Bank, where he was most recently a managing director. In 2016, he co-founded 8F Asset Management, a global investment group that develops land-based fish farms using

recirculating aquaculture system (RAS) technology.

Fothergill and partners at 8F Asset Management have set an ambitious goal: to change the future of salmon farming by harnessing the potential of RAS.

8F is an impact investor. Impact investing, or socially-responsible investing, started to gain a profile in the capital market lexicon

over the past 10 years. Fothergill can claim comfortably that land-based aquaculture checks a lot of the boxes that impact investment requires; many see it as a socially and environmentally responsible way of growing fish protein. But he knows, too, that at the end of the day, it has to deliver a fair return on capital – something that operators in this young sector have yet to see.

“8F is extremely focused on risk management in addition to financial returns and creating positive impact,” London-based Fothergill tells RASTech. “To have a market impact, and ultimately trigger a major change in the overall salmon farming industry, it is critical that first-movers like Pure Salmon are successful.”

Pure Salmon is 8F’s first venture into aquaculture. 8F owns a 50-percent stake in Pure Salmon Poland, previously known as Global Fish. Israeli firm AquaMaof Aquaculture, a RAS technology developer, owns the other 50 percent.

All eyes are on Pure Salmon and other large-scale RAS operations being built around the world. Investors are waiting for signals showing the operators are commercially successful. But while RAS technology is maturing, much learning needs to happen in the operation of RAS systems. There are still cohorts of fish that suffer catastrophic outcomes when toxicities develop in the systems. Recent fish mortalities in some facilities (not Pure Salmon) have been linked either to hydrogen sulphide or nitrogen.

The Pure Salmon-AquaMaof alliance is unique in the industry and is a key part of Pure Salmon’s strategy. “Each party brings different important capabilities to the partnership. 8F/Pure Salmon brings extensive experience in finance, risk management and salmon farming, while AquaMaof brings its knowhow in RAS technology and fish biology,” says Fothergill.

Similar support is available to AquaMaof’s technology clients. Shai Silbermann, vice-president of marketing and sales at AquaMaof, says the company has built a comprehensive plan to support users of its technology in several ways.

“First, we offer to train their staff at our

Global Training Center (see side bar) in Poland. This is, to the best of our knowledge, the only existing training center specializing in market-size salmon production. Secondly, all our contracts include one year of multidisciplinary support. That is extremely unique in the industry, since the support includes not only water specialists, but also biologists, feed experts, and technologists that are of service to our customers for a truly comprehensive production support. Thirdly, continuous service and management contracts are also available, where AquaMaof RAS operations specialists are managing the day-to-day operations and production of our customers’ RAS facilities,” Silbermann says.

Such alliance between a farmer and technology provider may hold the key to de-risking the sector, suggests Roy Høiås, founder and CEO of global advisory firm Lighthouse Finance. The Oslo-headquartered firm provides financing solutions to the seafood industry and is currently involved with around 10 RAS-related entities.

“The supplier of RAS technology is becoming a part of the value chain with their clients. That’s a very promising development because we have seen that some tech suppliers that are operating their own R&D facilities have the knowledge of, for example, salmon farming in their own environment, with their own equipment,” says Høiås (For the full interview, see Aquaculture North America’s July/August issue).

Pure Salmon’s roadmap entails building facilities with capacity ranging from 10,000 to 20,000 tons in major consumer centers worldwide. In the current RAS building boom, a 20,000-ton facility is relatively small. But Fothergill says this model “avoids

Harvard instructor and communications coach Carmine Gallo hit the nail on the head when he wrote in Forbes that Apple’s magic formula is not its products, but its people – “How they are hired, trained and taught to engage the brand’s customers.”

In more ways than one, AquaMaof Technologies, an Israel-based provider of RAS technology, is following the Apple Store model whether unwittingly or not. It becomes the technology partner of users of its systems and becomes their trusted advisors.

A financier involved in early land-based RAS facilities built in Scandinavia more than 10 years ago believes this model – where tech providers become a part of the value chain with their clients – may hold the key to de-risking RAS.

AquaMaof’s version of Apple’s Genius Bar tech support is at Pure Salmon Poland. The Global Training Center, as the R&D site is called, is where the company proved its technology to farm salmon. It’s also where staff of Pure Salmon and AquaMaof’s technology clients are trained in its RAS systems.

“As far as we know there are no other similar centers in the world. For our customers, it makes all the difference because it means they can rely on our training support for their staff. Furthermore, we use this facility as an R&D center where we get to try out all new technology advancements, so we are able to offer periodical training updates on the latest developments in AquaMaof RAS technology,” says Shai Silbermann, VP of marketing and sales at AquaMaof.

A typical 20,000-ton-per-year Pure Salmon facility will employ about 220 people across multiple disciplines from production and processing to sales and finance. The company has been able to attract experienced staff to the company but like any operation, many had to be trained in-house.

The training program is split into two components: theory and practical training on-site at Pure Salmon Poland. As other Pure Salmon facilities become operational, training may be located at those other facilities as well, says Pure Salmon’s Martin Fothergill. For now, recruitment will be done in their respective locations, and staff relevant to operating the systems will be sent to Poland for training.

“Staff training is critical,” he says. “There is no doubt that this forward-thinking is a key point in the development of Pure Salmon globally over the coming years.”

Good circulation is decisive for profitable aquaculture. Do you want unequalled operational reliability, energy savings, and operating efficiency many years ahead?

Specialists in corrosionresistant propeller pumps, closely adapted to the needs of the individual customer.

www.lykkegaard-as.com

the risk of a large wipe-out due either to a production loss or natural disaster, however unlikely that may be.”

“It also means that the overall business is not concentrated in any one particular consumer market and hence does not become dependent on, or too large a proportion of, that market. We believe that downside risk projection far outweighs any potential complication of locating sites across multiple jurisdictions,” he adds.

Silbermann says the scalability of AquaMaof technology offers clients the ability to expand their facilities if they so wish. “The AquaMaof technology is designed as separated groups of independent modules. Once you decide to scale up the facility it is a matter of adding more modules to the layout with some modifications to the technology design,” he says.

Whether in Japan, France or the U.S. –which comprise the first batch of Pure Salmon’s land-based salmon farming projects in addition to Poland – each facility will essentially have the same “template” to allow a more efficient and cost-effective roll-out of Pure Salmon globally.

Each new facility will not just grow salmon, but will also include full processing capabilities to produce a wide range of end-products tailored to the needs of the local market.

Since 2018, Pure Salmon Poland has been delivering harvest-size salmon to market.

This makes it the most advanced among 8F’s RAS salmon projects. In March 2020, 8F fund-raised $358.8 million to finance phase one of its projects in Japan, France and the U.S. Poland will be the only project with a 50-percent investment from AquaMaof. AquaMaof will, however, invest five percent of the equity in the other Pure Salmon projects.

“For AquaMaof this investment serves two purposes: first, it is a testament to the complete confidence that we have in our technology. Secondly, we have solid projections that the Pure Salmon facilities will have superb financial results and would like to take part in this success,” says Silbermann.

Pure Salmon is not alone in having to raise funds to finance its growth. But skeptics of RAS technology’s ability to replicate the ideal rearing environment indoors have questioned the wisdom of using other people’s money on a sector that has yet to prove itself en masse.

Fothergill points out, however, that Pure Salmon is not listed on any stock market. Its investors, he says, are those who believe in land-based farming’s potential and under-

stand the risks. The investor base that helped raise the latest round of funds includes family and institutional investors, including several sovereign wealth funds, insurance companies, and pension funds from Europe, Asia, the Middle East and the United States, says Pure Salmon in a statement.

“8F/Pure Salmon is a private investment. It is an institutional risk-managed investment with a sophisticated institutional investor base that understands the salmon market’s dynamics, technical aspects of land-based farming and the Pure Salmon business plan,” says Fothergill.

Stephane Farouze, board director of Pure Salmon and chairman and co-founder of 8F, says the success of the fund raising “shows the level of confidence in the potential of the land-based aquaculture industry and in the ability of Pure Salmon and 8F to successfully deliver their vision.”

Local for local

At this stage in Pure Salmon’s evolution, the company is putting resources into areas such as design and construction of the new facilities, securing distribution and off-take

agreements globally, and production R&D in Poland. Pure Salmon has already signed distribution and off-take agreements, among them with Itochu, for the 10,000-ton Japanese facility, says Fothergill.

The facilities in the first batch are expected to have their first harvests in 2022/2023. Other projects in the pipeline will be in China, Lesotho (Africa), South East Asia and the Middle East.

Pure Salmon’s ultimate goal is to see a combined production of 260,000 tons per year. It aims to realize this from its facilities already in mid-construction as well as those being planned. For the currently announced projects, it sees Japan contributing 10,000 tons; France 10,000 tons; U.S. 20,000 tons; Southeast Asia 10,000 tons; Africa 20,000 tons; and five 20,000-ton facilities in China or a total of 100,000 tons.

“Pure Salmon’s goal is to become the market leader in sustainably grown, land-based salmon across a network of 16 new vertically integrated production and processing facilities worldwide,” says Fothergill.

He highlights the significance of the next five years in the RAS space: “They will be critical for the industry as successful first-movers, such as Pure Salmon, demonstrate what is possible to achieve in RAS, which will contribute to an increasing number of entrants into the market, making RAS the sustainable farming method of choice for the future.”

Silbermann says interest in RAS is certainly growing, particularly in light of the current COVID-19 pandemic. “We have always been very confident about RAS’ role as a gap filler between supply and demand, and as a RAS technology provider we have been experiencing high interest from both industry and non-industry investors.

“The recent COVID-19 situation has caused an increase in that interest, as disruptions in fish supply is highlighting the drawback in relying on importation of fish and seafood. We also see growing consumer awareness for food safety and traceability. We believe that in the next five years we will see many facilities kickoff in countries that now import all or most of their consumed salmon,” he says.

Wenger innovative extrusion solutions deliver clean, durable, nutritional feeds specifically designed for the most e cient RAS operations. Feeds produced on Wenger systems maintain their integrity better and longer, for clean and clear water. So you feed the fish, not the filter.

Learn more about the Wenger RAS advantage. Email us at aquafeed@wenger.com today.

By Matt Jones

SIA Blue Circle (SBC) has begun operations at a new recirculating aquaculture facility for Arctic char (Salvelinus alpinus) in Latvia, with the support of Finland’s Clewer Aquaculture Oy (CAO).

The farm is in a pilot phase currently, with roughly 40 tons of fish on site, but if all goes according to plan the facility should have up to 110 tons yearly production of fish – from egg to slaughter – in the coming years.

SBC managing director Lauris Apsis says

the company was formed for the specific purpose of demonstrating that recirculating aquaculture systems could truly work in Latvia, and could serve either the local or export markets.

“Six years ago, when we started, me and my brother started to think about what the possibilities are to develop fish farming in Latvia,” says Apsis.

“We quickly recognized the future possibilities of RAS systems. This is something new and most of the fish farming is coming inland from the sea and the ocean. These

RAS systems give the possibility that you can theoretically build it anywhere that you have water and electricity.”

Latvia is a country located on the Baltic Sea, bordered by Estonia on the north and Lithuania on the south. Aquaculture accounts for only 0.7 percent of total fish production in this Eastern European country. Most of Latvia’s fish and seafood production are from commercial fishing, with some imports, according to data from the Food and Agriculture Organization of the United Nations.

Lacking direct experience in the industry, SBC sought a partner who could share their expertise with the fledgling operation. Enter CAO, a company that launched formally in 2016 but was the result of a much longer-running partnership between wastewater treatment company Clewer Oy and aquaculture specialists Kalavesi Consultants Ltd. CAO fish biologist Riitta Myyrä says the company was formed to provide reliable, maintenance-free solutions for small and medium sized RAS farms.

“Our principle is based on modules, which can be adapted and combined for different kinds of needs,” says Myyrä. “Modules can always be tailored for different places, fish species and needs. And we have experience working in fish farms, we know what we’re talking about when making designs and guidance for the farmers.”

CAO’s experience and expertise apparently came across very clearly. In recalling the early meetings between the two companies, it became immediately clear for Apsis that the CAO representatives knew exactly what they were talking about and that they could

help SBC achieve its goals.

“They were professional and trustable,” says Apsis. “Here in Latvia we have some RAS system projects, but most of them are not working or not profitable. Clewer provided technology and knowledge.”

The farm, called Jaunciedras, is comprised of two 1,000-square-meter buildings – a ju-

The ALPHA NanoRASTM brings state-of-the-art recirculating aquaculture technology to the US for hatcheries, life support, and R&D.

venile hall and an on-growing hall. The facility draws water from 100-meter deep bores, running through eight liters of water per second. Construction was completed in December 2019 and today there are more than 300,000 fish on site. The system has a 700-kg daily feeding capacity with solids removal, a gas exchange unit, a low-head oxygenation system, UV-filters and ozonation in a combination that ensures balanced

water treatment. CAO developed the design of the farm and provided their Rotating Bed Bioreactors (RBBR), as well as information and training in their use.

CAO’s website says the RBBR’s round shape makes it easier to rotate the carrier mass, allowing filling ratios up to 90 percent and ensuring that air blowing into the reactor moves the entire carrier mass, leaving no dead zones or excess biomass inside. They also tout that the units are self-cleaning and practically maintenance-free.

“That’s something that’s been a problem in RAS farms,” says Myyrä. “Moving or fixed bioreactors, you have to clean those quite often. But our technology circulates the whole mass so you don’t have to clean it. One of the main points is also the solids removal, which is taken care of in both tank and system levels. This can be seen in the good water quality and wellbeing of the fish.”

“They can handle what they promise,” says Apsis about the RBBRs. “That’s the most important thing. As soon as it was possible

to launch the system, we put in as many fish as possible. These bioreactors work as they’re supposed to work, they can handle what is expected.”

Apsis says that there isn’t much that needs to be specifically tailored for farming Arctic char – the facility could as easily grow any other cold water species such as rainbow trout or triploids. But he and the other principals at SBC are thrilled to finally see

the RAS project they dreamed of entering production and in a location that makes logistical sense, for access to clean, fresh water and access to markets.

“We evaluated the location for how close we are to the markets,” says Apsis. “In this position, we can get fish to Nordic countries within 24 hours. We can deliver fresh fish into the market in Finland or Sweden or any other country. We’re also very close to the Russian border and close to Central Europe. That access was a pretty big trigger for us.”

Apsis says that while the facility is still considered in its pilot stage, they are already looking at ideas for expansion. But the company will be careful to temper those ambitions by basing any such decisions on market conditions and sales opportunities.

For CAO, the SBC facility is the biggest project that the company has worked on to date. Myyrä says they have been very encouraged by the collaboration, noting that it is a perfect opportunity for the company to see their solutions at work outside of the research laboratory settings where they had most commonly been used previously.

Myyrä struggles to identify any significant challenges with the project – everything went very much according to plan until the COVID-19 pandemic. CAO had been providing ongoing consultation and training in the early stages of the pilot project, but travel restrictions have prevented them from visiting the site.

Go for all-female populations to reduce maturation and optimize your production output.

Check out our new product range SalmoRAS4+ and SalmoRAS4+IPN, optimized for full-cycle salmon farming in land-based RAS-system. Both products have All-female (only female populations) as standard and are highly selected for strong growth. Triploid is an additional optional treatment that makes the females sterile, resulting in zero maturation. That is what we call Girl Power!

“We had been looking at things for them and helping where needed but we can’t go to another country now,” says Myyrä.

In the meantime, CAO continues to provide support via email and phone. Myyrä says that CAO are also looking at some new ventures which they should be keen to announce officially in the coming weeks.

Find out more at www.stofnfiskur.is/products or contact:

Róbert Rúnarsson Sales Manager

+354 693 6323 robert.runarsson@bmkgenetics.com

Billund Aquaculture is adding 12 more locations to its list of RAS projects around the world.

Its upcoming RAS projects include four construction contracts in Chile, one trout facility in Peru, three salmon smolt and post-smolt facilities in Norway, one kingfish facility in Central Europe and three design contracts for Atlantic slamon grow-outs in Asia and the Middle East.

These additions bring the company to an all-time high first quarter. Billund Group CEO Steffen Busk Jespersen said in a statement that he hopes this achievement will propel the company as a global leader in RAS technology.

Octaform says it is offering watertight tank construction at a fraction of the time with its FrameWork Tanks design.

Octaform’s patented SnapLockTight panel creates a built-in, sealed wall surface that is watertight and gastight. The panel system is approved by the Canadian Food Inspection Agency for a design made ideal for environments sensitive to bacteria, mold and mildew.

The company’s first RAS project was

“The fact that so many companies have chosen us as their technological partners is very gratifying, especially since most of the projects are linked to recurring market-leading customers,” he said. “Despite the difficult times the world is going through, we feel positive and confident about our success moving forward to resume our plans for continued growth.”

Despite the global COVID-19 pandemic, Jespersen said the company has not seen contract cancellations or postponements.

“This milestone is further proof of our experience within RAS, with over 500 RAS built across more than 140 projects worldwide, leaving us in a great position to handle any

created for the National Prawn Company (NPC) in Saudi Arabia. During Phase One of its system build, eight broodtanks were built by NPC contractors in 14 days and required minimal training.

“We liked the idea that a durable, watertight finish would be part of the concrete tank walls from day one of construction,” said Jonathan Moir, general manager of fish production at NPC.

Octaform partnered with NPC to build one of the largest land-based RAS systems in the world.

www.octaform.com

• Marine and Freshwater

• Mechanical filtration

• Chemical filtration

• Ultraviolet disinfection

• NEMA enclosed controls

• Bio-filter towers

• De-gassing towers

•

•

•

•

future challenges to come,” said Bjarne Hald Olsen, COO and Business and Development Manager, in a statement.

Billund Aquaculture has provided design and implementation services for more than 140 projects in 28 countries.

www.billundaquaculture.com

Oddesse Pumpen- und Motorenfabrik GmbH from Germany offers a new solution for water movement for a RAS system.

The Propeller pump series po-upl is a unique pump type suited for high-flow water transport applications. It’s space-saving design has a double-walled housing, open semi-axial impeller and an internal rewindable motor. It allows flow rates of up to 1,200m³/h.

Oddesse pumps have flexible installation options, including horizontal, vertical, submerged or

dry. Tandem and back-to-back arrangements are also possible.

The pumps system offers the option of operation by DOL, soft start or VFD. It is easy to service and has long maintenance-free runnning periods, the company said. The rewindable motor is encapsulated via shaft seal which means there is no mechanical feed-through to the outside. The motors are available as a synchronous PM-version which can improve its efficiency by up to 12 percent.

www.oddesse.de

Adsorptech Pg. 15

Advanced Aquacultural Technologies Inc. Pg. 17

Aquacare Environment Inc. Pg. 20

Aqua Logic Inc. Pg. 16

AquaMaof Aquaculture Technologies, Ltd. Pg. 2

Aquatic Enterprises, Inc. Pg. 28

Aquatic Equipment & Design Inc. Pg. 29

Aqua Ultraviolet Pg. 8

Arvotec Pg. 22

CM Aqua Technologies Pg. 22

Cornell University Pg. 15

Faivre Sarl Pg. 14

Feeding Systems SL Pg. 12

Fresh By Design Pg. 26

RASTECH Pg. 11, 24, 31

HTH aquaMetrics LLC Pg. 25

IBIS Group Inc. Pg. 29

Integrated Aqua Systems Inc. Pg. 7

Lykkegaard A/S Pg. 21

Oddesse Pumpen- und Motorenfabrik GmbH Pg. 9

Only Alpha Pool Products Pg. 5

Oxygen Solutions Pg. 32

OxyGuard International Pg. 13

PR Aqua, ULC Pg. 19

Pure Aquatics Pg. 29

Reed Mariculture Inc. Pg. 19

Reef Industries, Inc. Pg. 25

RK2 Systems Inc. Pg. 24

Silk Stevens Pg. 28

Stofnfiskur h.f Pg. 27

Syndel Pg. 26

Wenger Manufacturing Pg. 23

• Recirculation System Design, Supply and Construction.

Commercial Farms, Hatcheries, Aquaponics, Research Labs, Public Aquariums, Live Holding Systems – we do it all!

• Representing leading RAS equipment manufacturers.

Feed is the primary cost of RAS production. Accordingly, proper delivery of high-quality diets is one of the most important aspects of fish culture for maximizing fish growth and overall efficiency.

Fish feed should be a complete diet providing all necessary nutrients for the species being raised and the corresponding life stage. It should be made up of high-quality digestible ingredients.

Additionally, the RAS environment demands feed that maintains its structural integrity in water and yields intact fecal matter that is easily removed by mechanical filtration unit processes. A slow-sinking feed pellet will be more easily removed through drains and settling structures than floating feeds. Feed should be elevated from the floor and stored in a dark, temperature-controlled (<60 °F) and humidity-controlled (<6 percent) area and used in a first in, first out scheme.

Positioning of stationary, automatic feeders around culture tanks should be carefully considered. Water currents will carry slow-sinking feed pellets a short distance as they sink, so avoid placing feeders adjacent to side wall drains where feed pellets could leave the tank too quickly.

If using multiple feeders, they should be placed at different locations around the tank to expand the area of feeding as much as possible. Observe the rate that feed is dropped into the water by feeders. An excessively fast feeding rate could mean feed sinks to the bottom of the tank too fast for fish to capture all the pellets. In this case, equip feeders with spreaders to broadcast feed over a larger area and provide more opportunity for fish feeding. Position and adjust the spreader so feed is not being thrown outside of the tank or being cracked or damaged. When hand feeding, be sure to throw feed to all areas of the tank in amounts small enough that each scoop of feed is consumed

before reaching the bottom of the tank. Try using smaller scoops or spreading feeding over more time to deliver an appropriate feeding rate as needed.

Use manufacturer-specific feeding charts or historic farm data as a starting ration that can be adjusted to reach satiation over time. Reprogram feeder controls any time changes are made to the speed of the feeder delivery

or the feed pellet size. Adjust programmed ration whenever additional fish are stocked or removed from the tank. Ration on a percent body weight basis and number of feeding events per day will decrease as fish grow. However, at least eight to 12 evenly spaced feeding events per day are recommended to prevent spikes in ammonia and carbon dioxide production and oxygen consumption in RAS systems. This will smooth the water quality profiles in the RAS over a 24-hour period.

Underfed fish will not grow as quickly and can injure other fish and damage fins with aggressive behavior, while overfeeding will result in wasted feed and money.

The first step to achieving satiation is being familiar with the feeding behavior of the

fish species and lifestage. Take time each day to observe how the fish behave during a scheduled feeding event and adjust the programmed ration if fish are feeding over-aggressively or passing up feed pellets.

Additionally, monitor for spitting, head shaking, or gill flaring behavior that may indicate feed is unpalatable or pellet size is too large for consumption. Culture tanks with proper hydrodynamics will remove uneaten feed pellets through the bottom center drain.

If the bottom center drain flow is accessible, a collection basket can be placed in the flow during a feeding event and removed a few minutes after to monitor if any feed is being wasted, and if so, exactly how much. Consider increasing or decreasing the programmed ration if there is no or excessive wasted feed in the bottom center drain flow. A well-placed underwater camera could also be used to observe wasted feed leaving the bottom center drain of the tank.

During daily checks, confirm feed hoppers are filled and feeding rate appears normal. This can be done by observing a feeding event or comparing the amount of feed left in the feed hopper from the day before.

Confirm that spreader equipment is working and positioned correctly. Regularly check that feeders or spreaders are not damaging feed pellets. This will be apparent if excessive fines are accumulating on or around the feeding equipment.

Damaged feed pellets can create a reservoir for bacteria and mold, create water quality problems, and waste money. Routinely clean feeders, spreaders, and hoppers. Maintain an inventory of critical spare parts or a complete spare feeder, especially if lead times from international suppliers are long, to keep the fish properly fed and on pace for production goals.

Several days of underfeeding will negatively impact growth, fish health, and the farm’s bottom line.

For more information about depuration visit FreshwaterInstitute.org.