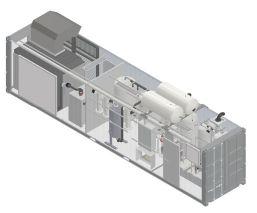

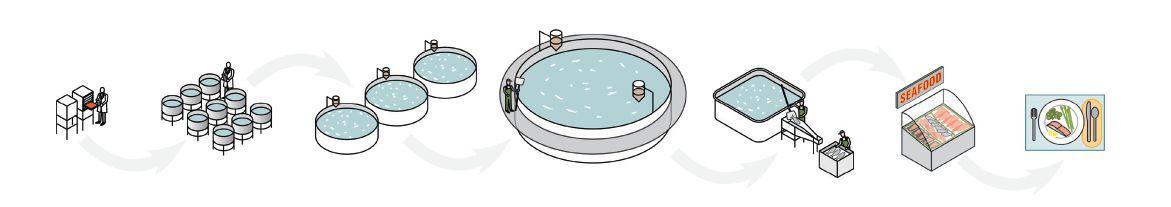

ModulRAS is the most compact and cost-effective RAS concept in the market, constructed for use with both fresh water and seawater. Energy-efficient technology and advanced control systems ensure optimal operation, environmental friendliness and the best possible fish welfare.

• Standardized and modular

• High-quality components

• Polyurea coated surfaces

• Short construction time

• Thorough training of operating personnel

• Comprehensive operating manuals

• Control system with predictions

Kari Attramadal Head of R&D

Robert Hundstad CEO

THE EXPERT 20

RAS made not so simple

filtration – a poorly understood but very important aspect of any

Avoid these remote monitoring mistakes

CRAZE

ARELLANO

By Jean Ko Din

Tthe new season is for new beginnings and for the RAS industry, it seems that things are looking up. What we may have described as a return to optimism at the RASTECH 2024 conference last summer is now being followed by some results from key players. There are some promising production reports coming out at the beginning of this year that I think the whole industry hopes will become signal of a changing tide.

The past few years have been difficult to say the least. Actually for some RAS companies, this past year might have been some of its most trying times. But then, at the same time, this past year has also become an opportunity to make way for new frontrunners to gain some ground, specifically in the hybrid flowthrough space.

Hybrid flowthrough, also known partial RAS or partial re-use, was the talk of the town this past year and it looks like the companies that have adopted this landbased technology is continuing that momentum into 2025.

In this issue, we explore this new interest in an old technological concept – both its advantages and its risks. We also explore the reasons why full recirculating aquaculture is still here to stay. The key is (and has always been) to bring in experts who know how to balance the different demands of a successfully operating facility.

Speaking of experts, we have been hard at work in the background to bring our RAStech Magazine audience some new resources through our online RAS Academy. Freshwater Institute research scientist, Rakesh Ranjan, is our newest online instructor on “Precision Technologies and AI in RAS.” This online module is designed to

give users a solid understanding of Computer Vision and Artificial Intelligence (AI) to optimise land-based aquaculture systems. The course features in-depth case studies and current commercial AI products and services that demonstrate how this technology can improve efficiency and sustainability within real-world applications.

Rakesh Ranjan has a PhD in Biological and Agricultural Engineering from Washington State University, a Master’s degree in Technology from the Indian Institutes of Technology (IIT Kharagpur) and a Bachelor’s degree in Technology from the College of Technology in Pantnagar, India, both in Agricultural and Food Engineering.

Suffice to say, he is a leading expert in this field, most especially in integrating advanced sensing technologies, machine learning algorithms, and big data analytics. We’re excited to have him on board because this course will be essential knowledge that will power the next generation of landbased systems.

The RAS Academy was first launched in 2023 with the intention to make RAS knowledge more accessible to more aquaculture professionals. Our RAStech team believes that our role as industry media is not simply to observe and report. Through our many different projects – our RAS Talk podcast, our webinars, RAS virtual summits, our annual RASTECH conference, and this, the RAS Academy – we also believe we have a role to play in facilitating knowledge exchange that will drive progress. We are constantly listening to understand the gaps in the sector and how we can provide our media expertise to help fill that gap.

If you have ideas for our team, send me an email and let’s brainstorm at jkodin@ annexbusinessmedia.com.

www.rastechmagazine.com

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Audience Development Manager Tel: 416-510-5113

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Editor Jean Ko Din 437-990-1107 jkodin@annexbusinessmedia.com

Associate Editor Seyitan Moritiwon 519-429-5204

smoritiwon@annexbusinessmedia.com

Associate Publisher Jeremy Thain 250-474-3982 jthain@annexbusinessmedia.com

Account Manager Morgen Balch 519-429-5183 mbalch@annexbusinessmedia.com

Account Coordinator Catherine Giles 416-510-5232 cgiles@annexbusinessmedia.com

Group Publisher Anne Beswick 416-410-5248 abeswick@annexbusinessmedia.com

Audience Manager Urszula Grzyb 416- 510-5180 ugrzyb@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

Printed in Canada

Subscription Rates

Canada $37.00, United States – $48.00 CAD, Foreign - $62.00 CAD

All prices are for 1yr subscription and in Cdn funds.

ISSN 2817-7266 - Print

ISSN 2817-7274 - Online

Occasionally, RAStech will mail information on behalf of industry related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office privacy@annexbusinessmedia.com Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission © 2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

The Middle East’s “largest Salmon Production Excellence Center” has been inaugurated in Saudi Arabia.

Prince Abdulaziz bin Saad bin Abdulaziz, governor of the Hail Region, inaugurated the centre which aims to produce 100,000 tons of salmon yearly. The centre could reduce Saudi’s reliance on salmon imports of 23,000 tons annually.

The project was led by the Ministry of Environment, Water, and Agriculture in collaboration with King Abdulaziz University. It is designed to strengthen the kingdom’s aquaculture sector and promote local fish production.

According to information from King Abdulaziz University, the 10,000 square metres facility is located in the Al-Qa’id area of Hail, the Excellence Center incorporates technologies, including recirculating aquaculture systems and an integrated aquaponics unit.

It has hatcheries with a capacity of 5 million salmon juveniles yearly, a fish farming unit producing 100 tons of commercial-size salmon, and an aquaponics system that can produce 10 tons of vegetables and fruits annually in its first phase. There are plans to expand production to 30 tons in the second phase.

“This project exemplifies the goals of Vision 2030 by enhancing food security, promoting sustainable development, and creating economic opportunities,” said Prince Abdulaziz during the inauguration. “It positions Hail as a model for innovative agricultural investments.”

Norwegian land-based salmon farmer, Proximar Seafood AS, has announced its fourth quarter 2024 production update with a standing biomass of 1,058 metric tonnes despite experiencing two biofilter incidents.

The company said it saw no abnormal mortalities in these incidents and implemented an ozone system to solve the issues of high turbidity in the water. Even though the reduced feeding following the turbidity issues and biofilter incidents impacted growth rates, fish health continues to be good, Proximar reports.

“As for the biological performance and water quality, we remain optimistic on our production going forward. Unfortunately, we experienced two incidents in Q4 related to construction- and material weakness. We are now taking measures to repair the damages and will also review the rest of our facility to address any weaknesses and take necessary action where needed,” said CEO Joachim Nielsen.

This is the company’s sixth update after the initiation of the production

of Atlantic salmon in its Oyama facility in Japan in October 2022 and trial harvest on Sept. 30, 2024. The biomass recorded is up from the 735 metric tonnes it recorded at the end of Q3 2024.

During the fourth quarter, the company harvested 28 tonnes head-on-gutted (HOG), with an average net selling price of NOK 123 (US$10.73). The average weight of the harvested fish was about 4.17 kilograms HOG.

With 20 batches and about two million individuals in production, the company’s targeted long-term harvest level is 5,300 tonnes HOG per year in Phase 1.

Based on the performance of the system and biology, the company appears on track to reach the target utilization in 2027.

“The price achievement and feedback clearly show how Fuji Atlantic Salmon has been positively received in the Japanese market. The feedback on the quality and taste is very positive, and we are looking forward to supplying more volumes as we now enter 2025,” said Nielsen.

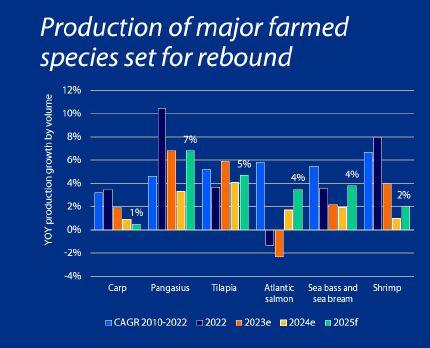

A new report from RaboResearch states that the global aquaculture industry should see improved production growth for certain species in 2025.

According to the report, Finfish production could have the greatest growth, while shrimp, which faces relatively low prices, is expected to grow just two per cent yearly. Lower feed prices and better demand may benefit producers. However, increasing tariffs and trade restrictions may hinder the industry.

“Atlantic salmon production is expected to experience mild growth from 2024 to 2026, following two consecutive years of decline,” said Novel Sharma, seafood analyst at RaboResearch.

Sharma said Norway is poised to lead the growth with yearly increases projected at 2.2 per cent in 2025 and 5.3 per cent in 2026. The resulting estimated output is 1.56 million and 1.64 million metric tons, respectively.

“This growth is contingent on stable biological conditions and improving harvest weights,” Sharma added.

Chile is expected to gradually return to a growth trajectory, with a 1.4 per cent yearly production increase expected in 2025 and 3.2 per cent in 2026. Production volumes may not surpass 2020 levels before 2026.

production is expected to be slow, with growth rates dropping to two per cent in 2024 due to lower prices. However, growth could increase to four per cent in 2025 as the oversupply situation eases.

“Despite relatively low prices, we expect global shrimp production growth will remain positive,” said Sharma. After years of strong growth, shrimp production is slowing, with volumes projected to increase by only one per cent yearly in 2024 and two per cent in 2025.

For Latin America, shrimp

Ecuador’s shrimp production will also experience a slowdown while China and India are looking good for modest growth in 2025 at 1.7 per cent and two per cent, respectively. Vietnam’s production is forecast to grow by four per cent in 2025, although disease management and high production costs

continue to pose challenges.

Freshwater species are expected to have the highest growth among farmed species with Pangasius production expected to grow up to seven per cent yearly.

RaboResearch’s annual aquaculture survey on finfish and shrimp production, done together with the Global Seafood Alliance (GSA) also showed that the industry is concerned about the market and economic conditions as it heads toward 2025. Ongoing geopolitical uncertainties pose significant challenges.

“Seafood is the most traded animal protein, with a larger trade value than all other animal proteins combined,” said Sharma. “Donald Trump’s presidential victory in the U.S. could mean new import tariffs. This is especially significant for the seafood sector, as the U.S. is the world’s largest importer, relying on imports for over 80 per cent of its seafood consumption. Moreover, the potential trade war is likely to involve China, the world’s largest seafood producer, exporter, and re-processor.”

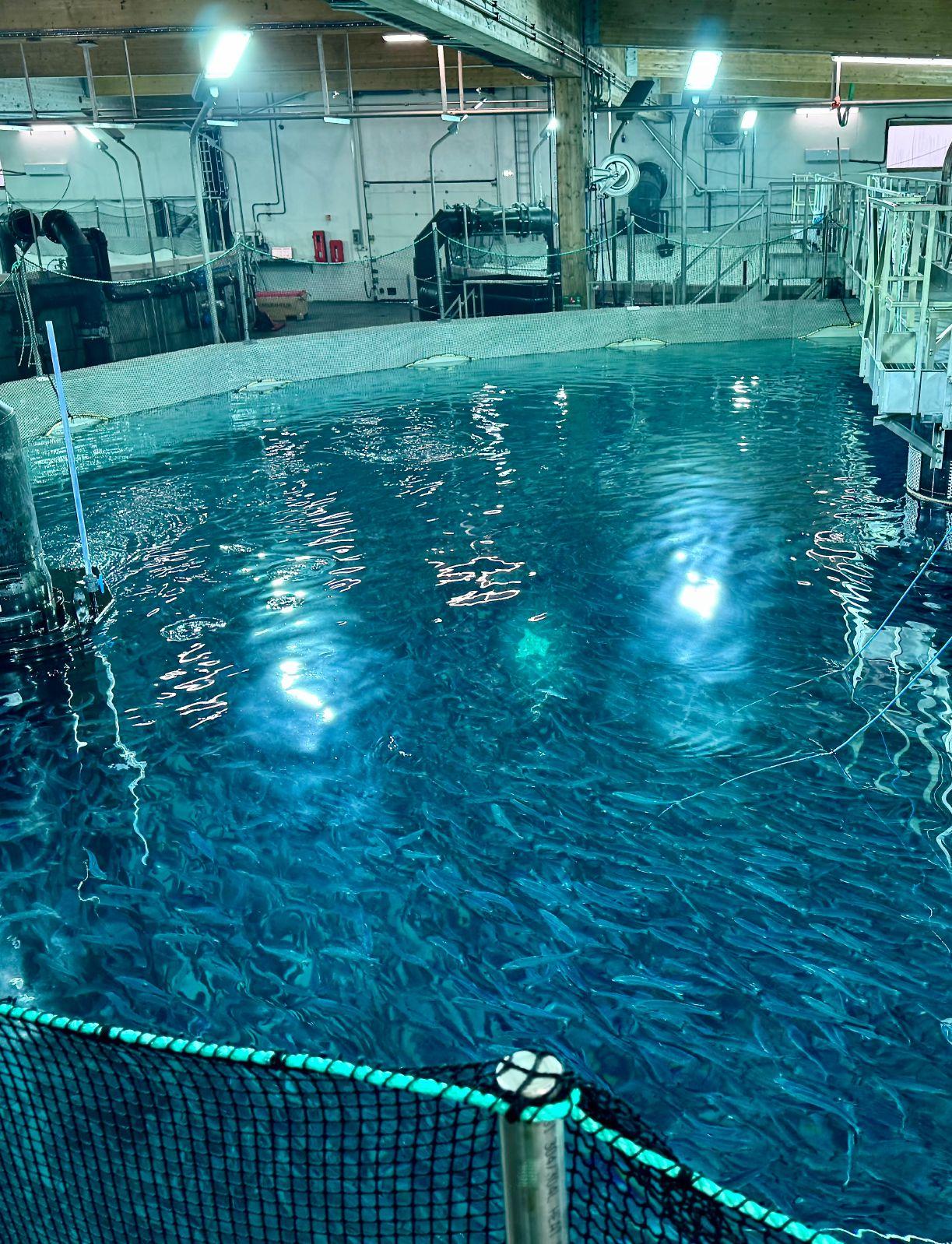

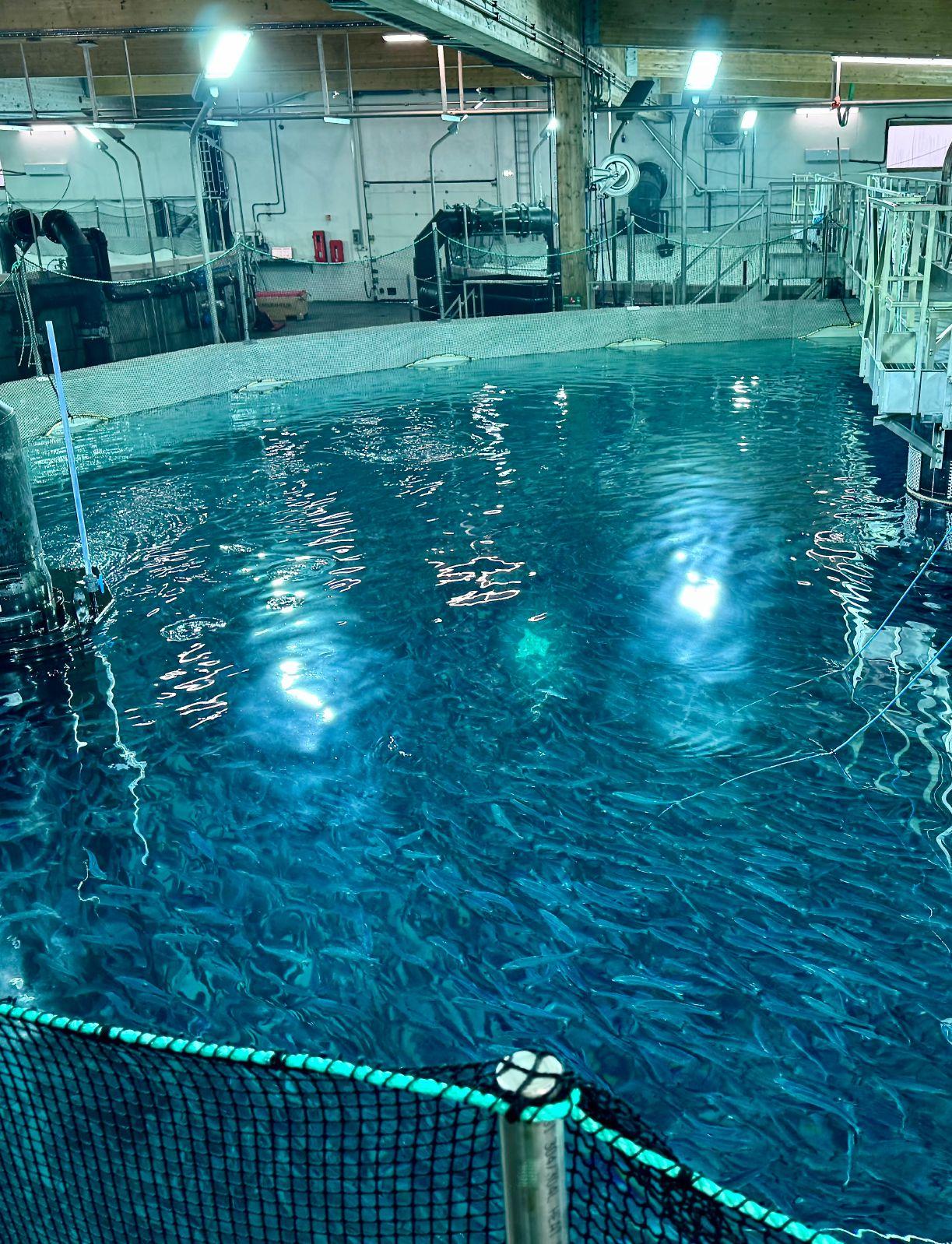

Norwegian land-based salmon farmer, Salmon Evolution, wrapped up its 2024 with a harvest of 1,729 tonnes head-on-gutted (HOG) in Q4.

According to official information from the company, the quarter showed strong feeding and biomass gain, particularly in the second half of November and December.

The harvest included 105 tonnes of live weight post-smolt, making its full-year harvest volume 4,891 tonnes HOG including post-smolt. It recorded an average harvest weight of approximately 3.8 kilograms HOG, up 15

per cent from Q3.

Salmon Evolution saw a biomass production of 1,518 tonnes live weight, the second highest on record and up 11 per cent Quarter over quarter.

“Salmon Evolution achieved significant milestones in 2024 with solid growth in harvest volumes and strong

The Hydrotech Drum Filter Value series focuses on reduced maintenance, increased component quality and simplified operation – all to give your plant maximum filtration performance at a minimum operational cost.

Let us help you!

Call +46 (0)40 42 95 30, or visit www.hydrotech.se

operational progress through the year,” said Trond Håkon Schaug-Pettersen, CEO of Salmon Evolution.

“We are especially proud of our excellent biological results, introducing a new standard of salmon farming and giving us a great momentum going into 2025.”

a

Fla. near Miami, has reported improved biological development with its fish after the fourth quarter of 2024.

In a trading update, it said it experienced stable water quality and temperatures, low mortalities, and increased harvest weight. The realized average harvest weight in the quarter was 2.37 kilograms head-on-gutted (HOG).

The fish farmer said 150 tonnes of small fish were culled to increase future harvest size by adapting the standing biomass to the current feeding capacity. It also recorded a net biomass gain of approximately 1,150 tonnes round living weight (RLW). A standing biomass was 3,180 tonnes RLW, up from 2,830 tonnes from Q3 2024.

It harvested a total volume of about 670 tonnes of HOG in the fourth quarter of 2024. The total harvest volume for the year 2024 was about 4,400 tonnes HOG up from the recorded 1,545 tonnes in 2023.

The company said it has adapted its biomass to current feeding volumes and expects further increased average harvest weight in the first quarter of 2025.

8F Asset Management, a private equity firm, has secured US$460 million in funding for Soul of Japan and Pure Salmon Technology.

In an official statement, the company announced the closing of funding to complete the construction and begin operations of Soul of Japan’s land-based Aquaculture facility in Japan and Pure Salmon Technology, the technology arm of Pure Salmon Group.

The construction of Soul of Japan’s land-based Atlantic salmon farming facility begins on Jan. 25, with the first harvest slated for mid-2027.

The facility is located on a

13.7-hectare site in Tsu City and will have an annual production target of 10,000 tons of Atlantic salmon. The farming and processing facility aims to produce antibiotic- and vaccine-free Atlantic salmon and pet nutrition from salmon offcuts.

“This successful close is

• 100% Titanium Heat Exchangers

• Hot & Cold Water Loop Systems

• Available with Tube Sheet, Helical Coil, or Plate

• Compact Designs

• Easy Installation

• Salt & Fresh Water Safe Chiller & Heat Pump Packages

another significant milestone towards our goal of supplying the world with clean, healthy, locally produced protein,” said Stephane Farouze, chairman and founder of 8F and Pure Salmon.

“The strong support from our investors, including the addition of new Japanese

investors, underscores the growing need for innovative solutions to improve the sustainability of our food systems and meet the rising protein demand in Japan.”

8F held the first close of its third aquaculture fund – 8F Aquaculture Fund Japan I LP. The investors come from a global network of institutional, sovereign and family office investors, including existing 8F and new Japanese investors. The majority of the equity will be allocated towards the Japan facility.

Soul of Japan also secured senior, long-term financing from a syndicate of Japanese banks led by Sumitomo Mitsui Banking Corporation.

By Bonnie Waycott

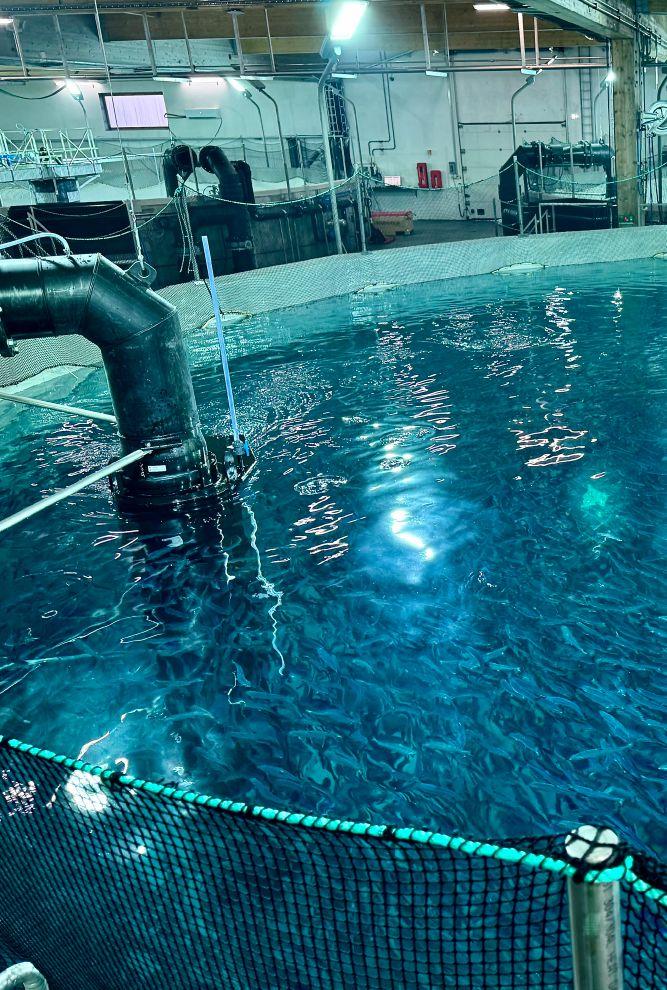

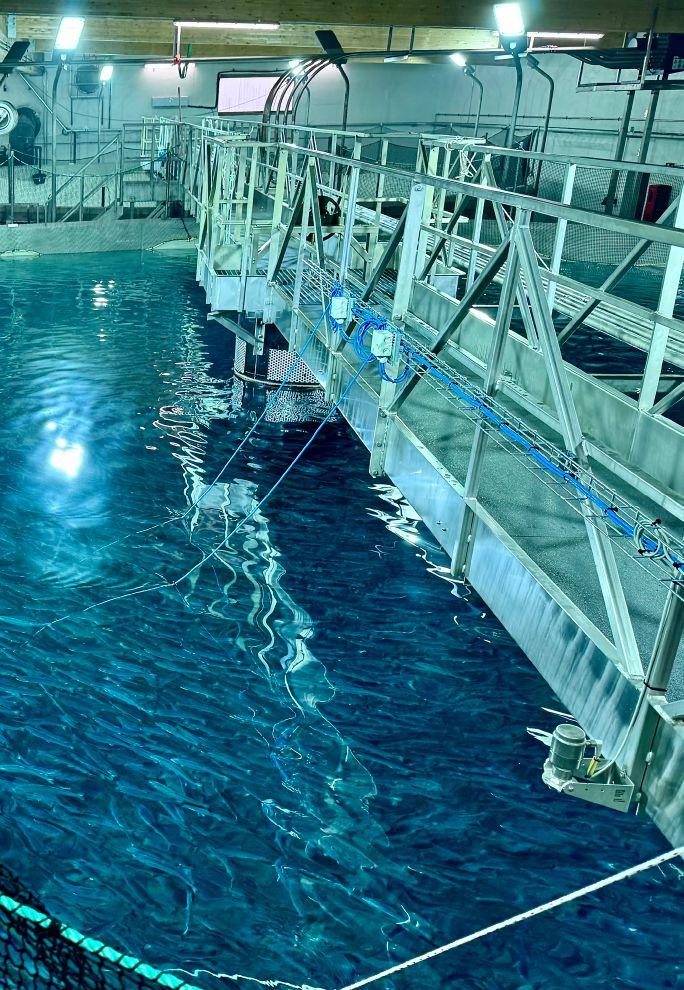

Over the last decade, salmon farms have been producing larger smolts using recirculating aquaculture systems (RAS) and keeping them there for longer periods of time. An extended phase in RAS facilities on land is said to help the fish become larger and healthier, improving growth and welfare at sea. Meanwhile, reducing the length of the marine phase of production is favourable in terms of decreasing the risk of disease, escapes, exposure to sea lice, and other impacts.

Salmon farming is at the heart of the economy in the Faroe Islands. In 2023, they produced around 80,000 metric tonnes (MT) of farmed salmon, with around 90,000 MT expected in 2024. They also have extensive experience of producing larger smolt; the average size of smolts released into the sea is now more than 400 grams.

Faroese farms have been making significant investments to produce larger smolt for some

time. One such farm is Hiddenfjord, which decided to increase the size of its smolts in 2010 in order to reduce sea lice exposure. Following an initial size of 80 to 100 grams, Hiddenfjord now stocks its smolts at around 700 to 800 grams and harvests after approximately 10 months (by comparison, a smolt of around 100g will remain at sea for approximately 18-20 months before reaching market size). Hiddenfjord’s goal for 2025 and the next two to three years is to release smolts of around 800 grams to one kilo and rear them at sea within a year, followed by a fallowing period of one month before the next harvest.

“Our goal is to transfer ten groups of fish to sea by Easter of next year,” said Atli Gregersen, CEO of Hiddenfjord. “Some of these might be around 700 grams, while others could be as much as 1.5 kilograms. Our trials also show that smolts of around 1.5 kilograms will reach market size and be ready for harvest within approximately eight months, while smolts of 700 grams reach market size in around 11 months. Time at sea is significantly reduced, and this is what we are focused on.”

One of the main reasons why farms are keen to produce bigger smolt and shorten production time at sea is to reduce exposure to sea lice, enhancing survival rates and overall fish welfare, said Gregersen. Once sea lice have es -

tablished, they will spread fast, resulting in long-lasting impacts, such as skin erosion, physical damage and osmoregulatory failure, thereby influencing survival rates and feed efficiency, resulting in substantial costs for farmers. Indeed, these costs and the impacts of different chemical treatments are reasons behind the huge efforts being made to address the sea lice issue.

“The longer smolts remain at sea, the more sea lice they will be exposed to,” said Gregersen. “Smolts also act as hosts, which sea lice attach to before quickly producing eggs, so the situation can escalate. We know that a shorter time at sea means fewer biological challenges, and more continuous and safe production. This is the key advantage of producing bigger smolts – they are not so susceptible to sea lice. As a result, there is less need for treatment, and the smolts don’t need to be bathed, handled or pumped back and forth as much. They can be kept happier to a much larger degree. By producing bigger smolts, we reduce the risk and improve the biology of the fish.”

Keeping smolts on land for longer periods of time also brings other advantages related to addressing sea lice, said Gregersen. If sea lice levels are low in one farming site, it will not harm neighbouring sites, resulting in positive ramifications for farming locations. Farmers also do not need to transfer sea lice treat -

ments and equipment from one site to another. This is perhaps the leading cause of disease spreading on farms, but it can be addressed by keeping smolts on land for longer and reducing the time they spend at sea.

Rúni Dam, an aquaculture consultant at Avrik, agrees with Gregersen that delousing treatments can be easily avoided with less production time at sea. His data from a Faroese farming site show that smolts of 98 grams needed three treatments to reduce sea lice count in 2013. However, in 2020, smolts of 607 grams required no treatment at all.

“The trend over the last year has been to produce smolts more slowly on land

in lower temperatures, not only to reduce the time at sea and avoid sea lice exposure, but also because various science reports have shown a possible link between high intensity land production and a less robust smolt, when put to sea,” he said.

Producing larger smolts provides the fish with enhanced potential when they are eventually put into ocean pens for growout. Indeed, there appears to be growing evidence that bigger is better when it comes to size.

Other positive attributes of bigger smolts include more robustness, less

chances of succumbing to any change in environment, stronger swimming abilities and coping better in strong currents, better physical condition overall, and higher survival rates. Gregersen adds that ensuring high-quality smolts is also important, as they will grow quickly at sea regardless of their size.

“If smaller smolts are placed in strong currents, they will struggle more compared to larger smolts,” he said. “When it comes to size, this is, of course, very relevant. Some of our farming sites have strong currents, but we have started to use these more frequently for our bigger smolts. Regardless of size and quality, it’s also important to transfer your

smolts to sea at the right time. We don’t transfer in February as this is the coldest month and the risk of winter wounds –bacteria that harm the fish – is highest. If measures are in place to ensure high quality smolts, these will have a good ability to grow quickly at sea. Fast growth is not a problem for quality, and fast-growing fish have a very good reputation in the market.”

Another Faroese firm that is making significant efforts to produce bigger smolts is Bakkafrost. Over the last 20 years, the company has grown through acquisitions and increased its farming

capacity, gaining access to new fish farming fjords and building hatcheries for smolt production. Like Hiddenfjord, one of its aims is to increase sustainable growth and reduce biological risk. To this end, new hatcheries and an increased focus on large smolt are core aspects of the company’s 2024-2028 investment plan to grow a stronger and more sustainable salmon farming sector in the Faroe Islands and beyond.

“In 2024, we plan to transfer 17.7 million smolts with an average weight of 420 grams, and expect to transfer 18.5 million in 2025,” said Regin Jacobsen,

CEO of Bakkafrost.

“The smolts spend around 13 months at sea and reach an average harvest weight of around five kilograms. Large, high-quality smolt are the key to growth and improvement. Farming cycles get shorter, while there is a reduced biological risk because the sea phase is shorter. Large smolts can significantly enhance operational performance, improve efficiency, and increase organic growth and harvest volumes.”

Bakkafrost has committed to building a new RAS smolt hatchery in Skálavík on the Faroe Islands. The hatchery will

have a total capacity of around 4,000 tonnes yearly, and is expected to be up and running in late 2026. The Skálavík hatchery follows recent expansions in Glyvradal, Norðtoftir, Viðareiði, also on the Faroe Islands, and the ongoing construction of the Applecross hatchery in Scotland. This marks yet another important step toward farming salmon for a longer period on land, said Jacobsen.

“As part of our plan to facilitate sustained growth, we are now introducing our strategy to grow large smolts not just in the Faroe Islands but also in Scotland,” he said. “Equipping sites

with up-to-date tools, including centralised feeding and introducing AI are all part of the plan.”

With clear benefits to producing bigger smolt, it may be tempting to label this as the future of the salmon farming industry on the Faroe Islands. However, Gregersen notes that the future will be defined not only by larger smolt, but also by farms’ ability to address challenges, such as sea lice exposure.

“Bigger smolts will partly lead to strong growth in the Faroe Islands, but

we also need to know how to keep the official regulation of sea lice numbers down,” he said.

“If a farm increases the number of fish in a fjord, it will need to decrease their numbers of sea lice per fish. In this sense, we need to implement a total number of sea lice per site. We currently have a maximum number of fish that can be stocked in each site, and I am working to convince veterinarians to establish a maximum number of sea lice per site. Addressing challenges such as this is just as important as the production of bigger smolt.”

June 9-10 2025 | San Diego, CA

Full RAS future far from dim despite new spotlight on hybrid flowthrough

By Nestor Arellano

Amidst the continued global growth of the land-based aquaculture market, speculations are ripe on which system is poised to rule the market in 2025.

The market for fish farmed on land, valued at US$5.8 billion in 2024, is expected to reach US$18.5 billion globally by 2032. “The landbased aquaculture market has been experiencing substantial growth in recent years due to the increasing demand for seafood and the need for sustainable and eco-friendly methods of aquaculture,” according to Business Research Insights

Allowing aquaculture operators to serve this demand are two contrasting technologies. In one corner are proponents for the reigning champion, recirculating aquaculture systems (RAS). In the other are those cheering for the younger contender, hybrid flowthrough system (HFTS).

In general, RAS is a closed system for growing fish and other seafood on land by recirculating about 9097 per cent of the water through filters to remove waste and other suspended matter. RAS allows for full control of the animal’s environmental conditions and can be installed almost anywhere.

In contrast, full flowthrough systems require a continuous supply of flowing water. This method for growing seafood on land employs a raceway that allows water to move through tanks. During this run, the water provides oxygen to the animals and removes waste. Then the water is discharged as more water flows through the system. This method is employed in intensive culture where fish are stocked densely in

long a narrow pond or tank.

HFTS systems combine elements of traditional flowthrough with RAS. These systems also use continuous supply of water from natural sources, such as rivers or groundwater. The water flows through the systems once and is then discharged. But the system’s RAS component allows up to 65 per cent of the water to be recirculated. The system also reduces pathogens and has a minimal environmental impact. Despite being a newcomer in the salmon land-based aquaculture space, HFTS could provide a new boost to the market, according to a Rabobank Research released in November 2024.

“HFTS technology has the potential to transform the salmon farming industry, provided that the necessary capital and legislative framework are in place,” according to Gorjan Nikolik, senior analyst for sea-

food at RaboResearch.

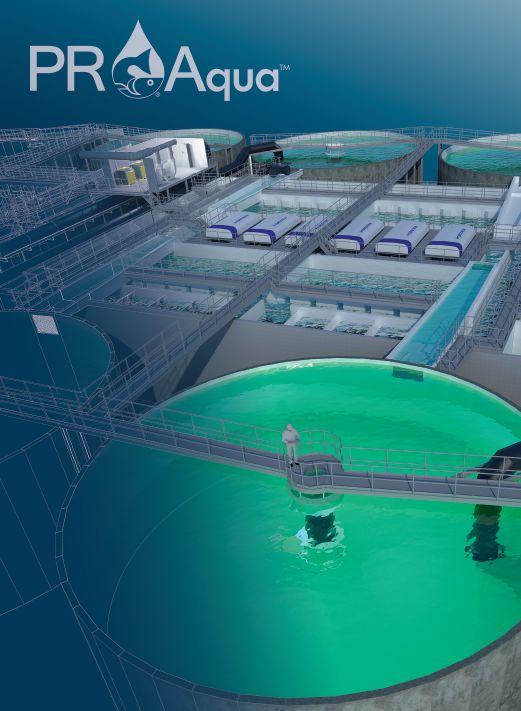

HFTS appears to be trending these days with investors, but the technology is not really new says K.C. Hosler, general manager and chief technology officer of PR Aqua, a RAS design firm based in British Columbia. Hosler sees HFTS as a “rebranding of an old technology developed in the U.S. known as partial re-use system.”

The Conservation Fund’s Freshwater Institute developed the partial re-use system back in the 1980s. The system was designed as an alternative to the flowthrough raceway system but unlike RAS, the partial re-use system did not recycle water completely.

Before that, HFTS were used for growing carp in

East Asia. HFTS were meant to compensate for water shortages during dry season. At that time the technology was just called re-use system.

Today’s HFTS are capable of eliminating high levels of nitrogen as it collects at the bottom of the tank, according to Nikolik. However, this heightened biosecurity can come at a cost. Between one to 8 kWh of energy is needed to produce one kilogram of salmon using HFTS. The advantages of good market price and lower biological cost still outweigh the higher energy expenditure, says Nikolik.

Matt Craze, founder and lead researcher at Spheric Research, agrees. Energy for pumping large volumes of seawater accounts for the biggest operating costs for HFTS.

“But now companies, like Salmon Evolution, have shown that this high energy cost can be balanced out by lower mortality rates, better fish health,” says Craze. “It’s about profitability. They are producing 95 per cent superior quality product.”

The industry’s financial backers are also watching several Icelandic projects in the country’s so-called Laxabraut or Salmon Row area.

“There’s basically a group of fishing companies, like First Water and GeoSalmo, employing the hybrid flowthrough system and proving that they can get funded,” says Craze. “Right now, there is very rapid transformational change.”

Recirculating systems are hindered by two main drawbacks, according to the Rabobank report. High cost of operation and technical difficulties that lead to production risks. Ivar Warrer-Hansen, principal of Denmark-based RAS design and technology company RASLogic, agrees.

Biofilters are another weak spot of most RAS facilities. They have been used for decades because they are effective in removing nitrogenous pollutants in water and are simple to maintain. However, biofilter efficacy is not consistent and depends on levels of dissolved oxygen, organic matter, temperature and other variants. Biofilter biomedia can also host pathogens and off-flavour bacteria.

“There are RAS that are 100 per cent perfect. Then, there are some concepts that are not successful but are still being used,” says Warrer-Hansen. “Atlantic Sapphire is an example of one that didn’t work.”

The Norway-headquartered land-based aquaculture company founded in 2010 was plagued by a series of massive die offs. The company blamed its under-

performance and losses to disease, construction issues, design flaws, lack of skilled workers, slow growth rates, and market volatility.

Chinese shrimp RAS company, Sino Agro, struggled with water quality issues, poor staff training, cost overruns, and limited cash flow and reported a loss of over US$100 million.

These two firms illustrate the difficulties and risks associated with RAS. These are the fails. What RAS needs is more success stories, said Warrer-Hansen.

For instance, he says, there is Danish Salmon. The Denmark-based RAS company now owned by Marubeni and Nissui

Corp., posted its second straight year of positive financial performance in 2024. There is also Skagen Salmon, which recently opened a facility that has a production capacity of 3,600 to 4,000 tons.

In November 2024, Norwegian land based farmer, Andfjord Salmon, closed its third quarter with continued success in the build out at its HFTS facility in Kvalnes, Andoya. This brings the company closer to finishing four new pools that will increase production capacity to 8,000 metric tonnes of head-on gutted salmon in 2025.

Martin Rasmussen, CEO of Andfjord Salmon, said full RAS technology was not considered in building the facility.

“Full RAS is not needed. It’s for areas that lack ideal natural conditions,” he says. “We are situated in an area with abundant, naturally filtered water, with stable salinity and high oxygen content. We are on a natural slope that provides large pools.”

HFTS is excellent as long as you have the right site, according to Hosler. “You need to have an abundant source of water, water at the right temperature, and you need to be able to discharge,” he says.

Norwegian aquaculture company AKVA group has more than 150 land-based systems deployed around the world. Most of these are RAS for growing salmon smolt, according to Jacob Bregnballe, recirculation expert at AKVA group.

For more than 15 years now, AKVA has supported Norwegian fish farming firm MOWI through the immense growth of its smolt project at Nordheim near Tustna, Norway. This started with the use of full RAS technology for incubation of eggs and a start-feeding module followed by parr and smolt systems.

Lately, in 2024, the largest expansion was delivered adding on significant post smolt capacity to reach a total of 38,000 m 3 tank volume and output of 5,800 tons large smolt of 600-800 grams per year for stocking in net pens at sea.

“The deployment of smolt projects using RAS has to do with the conditions we create for the fish in the system. In a traditional flowthrough system water is typically used from a local river meaning fluctuating temperatures, poor water quality during rainfall and such,” Bregnballe explains.

“In a RAS, conditions are fully controllable, and we can

keep it stable all the time. Fish needs stability to grow and be healthy.”

Bregnballe says that a few years ago, the industry was “ramping up” for an expected RAS boom for large salmon produced on land “but this didn’t happen.”

Yet, the RAS expert is confident that within the next few years, we will see a growth in RAS also for large salmon. Regions such as China and other Asian countries together with North America and parts of Europe will be first in line. Bregnballe says funding and regulatory framework would be key factors in adoption.

Research firms covering the industry bolster Bregnballe’s assessment.

A report found that policy changes such as the European Union’s Green Deal, which aims for a cleaner, healthier and climate neutral Europe, could be fueling a RAS aquaculture swell that could propel the market to US$3 billion in 2025. The same study also noted that in water-scarce area such as the Asia-Pacific region, rapid adoption of RAS technology is occurring, with China and India among the top investors.

Geographic Scope and Forecast called North America a RAS technology leader

with the United States accounting for US$200 million each year in water recycling and aquaculture tech

In the Westman Island an archipelago in Iceland’s south coast, Laxey is building a landbased fish farm with the goal of producing 32,000 tons of Atlantic salmon each year.

Rather than using either RAS, flowthrough, or hybrid flowthrough, the Icelandic aquaculture company has decided to employ all three systems in various stages of production, according to Hallgrimur Steinsson, chief technology officer for Laxey.

For hatchery, the company deployed a full RAS setup developed by AKVA Group

A hybrid flowthrough system similar to that used by Salmon Evolution will be used in the company’s growout facility. Laxey’s harvest tank will use a full flowthrough system.

“We are not purists when it comes to technology,” Steinsson explains. “We would rather employ the best features and advantages of a system to the appropriate stage of our production cycle.”

The facility uses the benefits of greater control afforded by a closed RAS system to grow healthy fry rapidly until

they become ready for the grow out site in Viðlagafjara.

The RAS uses biofilters to clean the station’s water for reuse. Waste generated in the process is cleaned from the station’s sewage system and is used for land reclamation and restoration of vegetation cover. AKVA’s Zero Water Concept solution is used in the smolt station to minimize water consumption.

At the growout tanks, Laxey will use an HFTS to access clean sea water reachable via porous ground that also naturally filters the water. In the final stage, the harvest tanks will employ a full flowthrough system.

“There is not much action here. It is like a resting place for fish before they are slaughtered. We can cut cost by using simple flowthrough to provide oxygen and remove waste matter. It also helps us keep cost down,” says Steinsson. “In my personal opinion, I would like to see more mixing together of different technologies and production strategies to achieve a desired goal. This is the Icelandic way.”

Steinsson believes that while 2025 may be that year that HFTS technology grabs the limelight, there is room in the market for other systems as well.

By Mike de Maine, Dryden Aqua

passionate about all the technical aspects of aquariums, aquaculture and aquaponics. He wants to help others solve this unassuming problem of filtration. (mike.demaine@drydenaqua.com)

Media filtration – a poorly understood but very important aspect of any farm

Media filtration in recirculating aquaculture systems (RAS) has been around for centuries, but it is often so poorly understood, missing the required performance mark.

Media filtration can take many forms including slow gravity filtration, rapid gravity filtration, pressure filtration and multimedia pressure filtration.

The main concepts are simple: dirt is trapped between the media grains during the filtration phase and particles adhere to the grains. In both cases, the particles should be ejected during the backwash phase.

I believe that it is the perceived simplicity that has resulted in the underappreciation of the complexity of a well-performing media filtration system.

Filtration velocity

I suppose the interesting question to ask is what is the right filtration velocity? Well, that is very dependant on your water source quality, what you want to remove from that source, the efficiency of removal you want to achieve and what filtration method you

are using.

Below is table with some recommendations and often observed filtration velocities.

Let’s take a step back. Why is velocity so important?

Water source quality: Due to the lack of ionic charges in soft water that prevents the coagulation of particles to a size that can be filtered out, the filtration performance is generally compromised. Ideal alkalinity and hardness values for good filtration performance is 50-150 mg/l alkalinity and 80-200 mg/l hardness.

Particle size: If your velocities are very high and you are trying to remove mostly fines (sub 10 microns), the slower you filter the more chance that you will allow fine particles to settle out between the media. While at the higher velocities the particles flow with the water stream and through the media bed.

Particle density: In any applications where the particles, that you are trying to remove, might be very soft, such as soft organics (notice I separated the aquaculture application in the table above), the higher velocities tend to shear the particles into smaller and smaller pieces while travelling through the media bed, resulting in very little removal.

This same effect is often seen in drum filters too, where the particles are squeezed through the mesh by the differential pressure cause by the water height differences between inside and outside the drum. Our studies have shown that in aquaculture RAS systems the filtration velocities should not be higher than 15m/h or 6 gpm/ft2

Loading rate: In applications where there is a high TSS loading rate (>30mg/l), higher velocities cause a shift from depth filtration to surface filtration and therefore cause a quick increase in the differential pressure across the bed, resulting in particles being sheared into smaller pieces, but also increasing the backwash requirements substantially.

Because media filtration is not a barrier filtration such as cartridges, bags or membranes, it not only relies on surface blockage, but rather, the more media depth you have, the better your filtration efficiency. Of course, this is more important when considering a once through flow, such as seawater intakes, and less impactful on recirculation systems or is it?

Unfortunately, although the overall thought is that in recirc system eventually all the particles are removed, it is more common that the particles are sheared into smaller pieces and the bulk of small micron particles increases overtime, never actually being removed and therefore contributing to an increasing load which can often be seen in the increasing COD and BOD values (chemical and biological oxygen demands).

A minimum bed depth of 750 mm of the filtration media grade will ensure the best possible performance for that particular media.

Often the most underestimated impact on the overall system performance is the backwash velocity to ensure sufficient media bed expansion to allow for the removal of the dirt.

Somewhere along the line, a figure of 1.5 to two times the filtration velocity crept into recommendations and in swimming pools where their filtration velocities are 30 m/h and they are therefore backwashing at 45 m/h or 18 gpm/ft2, it can work to sufficiently expand the media and to lift the dirt out the filter. But when you are filtering at 15m/h or 4 gpm/ft2, then a backwash velocity of 22.5 m/h or even 30 m/h (6 or 12 gpm/ft2) is not even enough to expand the bed to allow for the dirt to move out the media never mind lifting that dirt out the filter.

Each grain size has a different expansion vs. velocity, but below are some generalizations for good backwash velocities used in industries. (See table below.)

However, everything is dependent on the media size and shape you are using. Large grain sizes need higher velocities to get them to the require expansion, while elongated media, often found in some glass media, requires very high velocities to get them to expand due to their shape.

It also depends on the type of particles you need to get rid of, like heavy metal particles (oxidized from intake systems) require >50m/h or 20 gpm/ft2. Without naming products, different bed expansions can be for different materials and even depending on which mine the sand may have come from (red and orange lines are sand media).

The German DIN standard requires a bed expansion of 15 per cent to ensure that the media is separated enough to release the particles from the media, but depending on the specific gravity of the particles, even those that reach the expansion of 15 per cent at lower velocities does not mean that the

particles will be lifted out of the filter. That is why most water treatment applications take 40 m/h or 16 gpm/ft2 as a minimum requirement for backwash velocities.

Over the years and with heavy competition to supply the cheapest filters, the swimming pool industry, aquarium and aquaculture industries have been sucked into using filters that can’t perform to the requirements of the application.

1. A promise of filtration velocities of 50 m/h or 20 gpm/ft2 is not possible to achieve effective filtration performance.

2. Poorly designed laterals that are either too short or too large in diameter to properly distribute the flows to create bed expansion instead of boiling the media. This results in only a portion of the filter surface area being used correctly, resulting in preferential flows through a much smaller surface area and therefore operating at much higher filtration velocities than you have designed for.

To demonstrate an extreme example that we have encountered before:

The client was filtering at the manufacturers recommendation of 50 m/h and backwashing at 50 m/h, but as the laterals were very short, the filter was only clean a third

of the surface area during the backwash, so when recalculating the filtration velocities of the actual surface area being used, the system was filtering at over 110 m/h or 45 gpm/ft2 resulting in no filtration performance, as the particles were just being sheared into smaller and smaller pieces increasing the overall COD and BOD while the water became more and more opaque.

3. Filter laterals that do not have a good enough surface area coverage, like starshaped laterals with too few lateral sections and in large diameter filters (>900 mm). In the worst case, where the laterals are also oversized in diameter, you would be able to see the star shape on the surface of your media.

4. Poorly designed inlet distribution, which causes the media to pile in the middle or around the edges, resulting in preferential flows through a much smaller surface and therefore operating at much higher filtration velocities than you have designed for.

Media filtration can be far more complicated than it sounds, but taking a few basic concepts into account, can dramatically improve the performance of your filtration system, the overall efficiency of your system and future design considerations.

Media filtration is often used in intake water filtration, larval rearing flowthrough filtration, hatchery recirculation, brood stock filtration and wastewater filtration.

However, with the importance of fine solids removal becoming more dominant in the overall efficiency of growout RAS, media filtration is again starting to be considered as a possible side loop solution for cropping out the particles that aren’t being removed by the drum filters and are too big for the protein skimmers.

These particles end up in the biofiltration component and shift the bacterial biome predominantly to the heterotrophs to first break down the particles before any nitrification can happen.

This leads to increasing oxygen demands, pH and alkalinity corrections being needed and the requirement for excessive sludge to be removed from the system frequently.

Author’s note: This article is not meant to be a thesis on media filtration but rather to draw out the main items to be aware of, without using complicated turns and theories. It is not a scientific paper but comes from accumulated experience over many years in the filtration field.

By Matt Craze, Spheric Research

Matt Craze worked for many years as a commodities analyst, helping establish Bloomberg’s agri-commodities pricing coverage, and as a strategy consultant working for Big Four firms. He set up Spheric Research in 2017 as an independent research firm dedicated to the global aquaculture industry. Its yearly Land-based Aquaculture Report is published each year via Undercurrent News, has been featured in The Economist. (matt@sphericresearch.com)

There has been a lot of hype in the land-based aquaculture industry, which includes facilities to grow fish and shellfish in recirculating aquaculture systems (RAS), and hybrid flowthrough systems. To separate reality from the noise, the best way we can see what is going on is to follow the money.

“Following the money” is an expression from the 1976 movie, “All the Presidents Men,” where two journalists analysed financial transactions to uncover a trail of bribes and corruption helping former U.S. President Richard Nixon win a second term in office.

At Bloomberg, where I worked for 11 years setting up news and pricing data on global commodities markets, following the money entailed blocking out the noise on a particular topic and deciphering what was going on by looking only at where money is flowing.

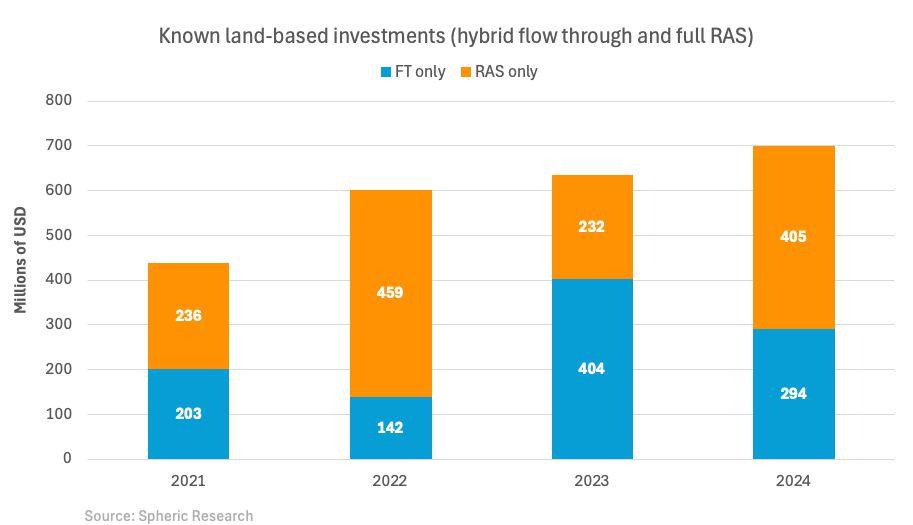

Despite going through periods of euphoria and deception, deal flow in land-based investments has risen steadily over the past four years. Known and identifiable transactions, including debt and equity deals, rose from US$438 million in 2021, when Atlantic Sapphire was in earliest stages of production, to about US$700 million last year, according to Spheric Research data.

Despite the noise, the capital has been raised by less than a dozen companies. Most of these have ties to Norway, either because they are situated there, or because they trade on the Oslo exchange or have a Norwegian management team.

Outside of Norway, only Icelandic and Japanese banks have really engaged with their land-based domestic industry. A concept that we introduced in the country ranking system available in Spheric Research’s Land-based Aquaculture Report, these countries appear to have several char-

acteristics in common: a strong fishing industry heritage, advanced banking systems, wealth, and a desire at a political level to produce more fish protein.

2025 should be the year that the land-based sector crosses a billion dollars in investments, excluding the adjacent industry to grow post smolts for the sea pen salmon industry. Pure Salmon, owned by Abu Dhabi-based private equity firm 8F Asset Management, announced it raised US$460 million in January through the closing of its fund and a JPY 33 billion (US$211 million) syndicated loan deal with a consortium of Japanese banks including Sumitomo Mitsui. The money in part will help Pure Salmon complete 10,000 metric tons a year land-based salmon RAS facility in Japan, adding to the 5,300 tons-a-year salmon farm commissioned by Norway’s Proximar Seafood in 2023.

Some financing deals go under the radar. London-based private equity fund EMK Capital paid an undisclosed sum to take a majority stake in Arctic Seafarm, a new hybrid flow-through farm that will be developed in northern Norway with Kvaroy Fiskeoppdrett, an established sea pen farmer.

Using the same flowthrough technology,

Salmon Evolution closed the year in style, producing more than 5,000 tons at its Indra Havoy facility in Norway, or using more than two thirds of its currently installed capacity (7,900 tons a year).

Flowthrough technology, which was recently highlighted in a research note by Rabobank, will add meaningful volumes to the global salmon market. Andfjord Salmon, using a very different technology, and Gigante Salmon, will deliver volumes in 2025, as will First Water in Iceland. Samherji, a major Icelandic fishing company, has operated this technology for more than two decades using the same technology and is ready to invest in a much bigger facility.

We anticipate that land-based salmon farms, between flowthrough and RAS technology, accounted for more than 20,000 tons of salmon supply in 2024, with about a quarter of that coming from Salmon Evolution. Some of these volumes, however, included tonnages from Atlantic Sapphire that were not fit for human consumption salmon.

Rabobank analyst Gorjan Nikolik estimates that the hybrid flowthrough farms will deliver more than 100,000 tons a year of salmon into the global market by 2030. This

is about three per cent of total farmed supply, so it’s a small yet meaningful number.

Curiously, the flow of money has been quite evenly balanced between full RAS and hybrid flowthrough investments. Arguably, although there is more confidence in hybrid flowthrough technology currently, there are potentially fewer opportunities to invest in this type of technology as they are limited to Iceland and Norway.

One trend I will continue to observe closely in 2025 is the potential for hybrid flowthrough systems in these two countries to be integrated into the regular sea pen industry. With growing challenges at sea and worrying biological challenges such as emergence of jellyfish in northern Norway, there will be added urgency to keep salmon out of ocean for as much as possible.

Andjford Salmon also an-

nounced it will optimize its revenue stream by growing post smolt for the Norwegian sea pen industry, and then retaining some fish in the system for on growing. Bue Salmon, a smaller facility in southern Norway, just announced a similar tie-up with regular sea pen farmer Bolaks.

And let’s not forget that Gaia Salmon, previously announced as a full-scale land-based salmon project, has built its full 8,000 tons-a-year capacity to exclusively supply Norway with post smolt. The same goes for Ardal Aqua, another land-based project which morphed into a mega post smolt farm, which is backed by Grieg Seafood.

The full RAS industry, or better said those facilities that operate with a biofilter, have not yet demonstrated their efficacy fully to investors, although there are some noteworthy exceptions.

Some of the new generations of farms, that started their early

development when results from Atlantic Sapphire were still at the earliest stage, reported setbacks during 2024, albeit under the intense scrutiny of being a publicly traded company in Norway.

Nordic Aqua Partner’s earliest harvest at its salmon RAS facility in Ningbo, China were affected by off-flavour compounds. Proximar, which harvested its first fish in Japan in September 2024, reported a second biofilter incident on Christmas Day, following some turbidity issues, and is expected the update investors in January.

What may enable growth is the apparent interest among strategic non-Norwegian investors in building land-based systems. Finnforel, the Finnish trout producer, received a strategic investment from Mitsubishi in October and planned to build a trout facility in the United Arab Emirates in partnership with ADQ (Abu Dhabi De-

velopmental Holding Company). Saudi Arabia also unveiled the first phase of a major landbased salmon farming operation.

This new generation of projects, more than Atlantic Sapphire, now carry the weight of industry expectations on their shoulders. Danish Salmon and Skagen Salmon, which have yet to reveal production figures for 2024, provides the industry with hope.

In other species, if we follow the money, we observe that there are very few projects getting any love from investors. The Kingfish Company, on the back of several successful generations of yellowtail farming in the Netherlands, raised US$16 million to boost its sales effort in becoming a 4,000 tons-a-year supplier. But generally, developing these huge projects to grow other species is a hard sell, when compared with the compelling economics of the salmon industry.

By Dave DeFusco, Sensaphone

Dave DeFusco is vice-president of engineering at Sensaphone, a developer and manufacturer of remote monitoring and alerting systems. Reach him at ddefusco@sensaphone.com or 1-877-3732700.

Remote monitoring technology optimizes RAS management and condition tracking, eliminating the need for 24/7 on-site staffing. By continuously monitoring equipment and environmental parameters, this technology helps detect and address potential issues before they become hazardous to aquatic life.

With real-time alerts, operators can quickly respond to changes, preventing small issues from escalating into larger problems. Advanced remote monitoring systems use cloud technology, enabling operators to access live status updates via apps or web interfaces. This immediate visibility lets personnel take swift action when the system detects anomalies.

When implementing 24/7 remote monitoring devices and sensors in recirculatory aquaculture systems (RAS), there are several common misconceptions that can reduce system effectiveness and compromise fish health.

Understanding these pitfalls can help operators optimize their systems, ensure accurate monitoring and prevent costly errors. Let’s examine the advantages of incorporating a remote monitoring system as well as a few

of the most prevalent issues that can thwart these benefits and how to avoid them.

Remote monitoring systems are built around a central base unit that continuously gathers data from strategically installed sensors on RAS equipment.

Each tracked condition requires a designated sensor input on the base unit. Advanced systems are designed to integrate seamlessly with equipment managed by programmable logic controllers (PLC) or building automation systems (BAS).

Operators can connect to monitoring systems through internet or wifi connections, or by using units equipped with cellular modems that transmit data via cellular

networks. Many manufacturers manage cellular service internally, eliminating concerns about SIM cards or overage charges. The only requirement is a stable cellular signal at the facility.

Cloud-based remote monitoring provides real-time access to system data from any location by using remote servers for large-scale data storage. Remote monitoring providers prioritize data security by using private cloud networks, restricting public access and continuously overseeing the system to ensure its stability. To guarantee uninterrupted service, multiple backup servers are distributed across different locations.

In RAS, sensors play a critical role in tracking key water quality parameters that

operators must maintain to promote the health and growth of the fish. Additionally, sensors provide insights into the system’s overall performance, helping to identify inefficiencies and potential equipment malfunctions.

Primary conditions to track include water temperature, oxidation-reduction potential, pH levels, dissolved oxygen, toroidal conductivity, ammonia, nitrites, nitrates, vibration, pressure, power failure, and water flow, level and leaks.

Many believe that once installed, sensors will continue to provide accurate data indefinitely. However, most sensors, especially those

measuring parameters like pH, dissolved oxygen and ammonia, require regular calibration and maintenance. Neglecting to check sensors regularly can lead to inaccurate readings. To avoid this problem, develop a maintenance schedule that includes sensor cleaning, recalibration and inspection.

Using just a single sensor for each condition that you want to monitor is not sufficient to ensure system reliability. One point of failure can lead to system-wide issues if a sensor malfunctions.

Redundancy is crucial for parameters critical to fish health, such as dissolved oxygen and water temperature. Using duplicate or backup sensors for critical metrics helps you to cross-check data and ensure accuracy.

Poor sensor placement within the tank or RAS will not provide representative water quality data. For instance, placing a dissolved oxygen sensor near an aeration outlet might give a false reading, or installing pH sensors in highflow areas can cause damage to the sensors. That’s why it is important to position sensors strategically where water is well mixed.

Setting generic alarm thresholds based on system manufacturer recommendations is not sufficient for monitoring your unique RAS application. Each RAS and species has unique requirements. Using inappropriate thresholds can lead to untimely notifications, unnecessary alarms or de -

layed responses. Tailor alarm settings based on species-specific needs and historical data trends, and regularly review and adjust thresholds as conditions change.

Sensor readings do not remain accurate over time. In fact, sensor drift is common, especially for pH, ammonia and nitrate sensors, and can cause a gradual deviation from true values. Therefore, it is important to implement regular calibration protocols and monitor for sudden data shifts that may indicate sensor drift.

Although today’s advanced monitoring systems reduce the need for manual intervention, they don’t completely manage themselves. They still require active oversight, periodic system checks and updates to maintain functionality.

It is recommended that you test your monitoring system weekly to be sure it is functioning properly. Conducting weekly tests ensures that the system will promptly notify the appropriate personnel when an issue occurs, and that the team will be familiar with and ready respond to the alert.

The system can be tested by creating a false alarm on each sensor and allowing the system to run through its alarm process. It’s also a good idea to test the battery backup by unplugging the power to make sure the device continues to function.

Obviously, real-time alerts are important, but historical

data is equally relevant. Longterm data trends can reveal underlying issues – such as slow nitrate accumulation, biofilter performance degradation, pump malfunction and unusual power fluctuations – that real-time monitoring might miss. Regularly review historical data, perform trend analysis and integrate your findings into maintenance schedules and operational adjustments as needed.

Don’t assume that your power supply and internet connection are always stable. Power outages or loss of connectivity can leave the RAS unmonitored, putting fish health at risk. Use an uninterruptible power supply (UPS), backup generators and redundant communication methods, like internet and a cellular connection, to maintain monitoring during disruptions.

An automated alarm doesn’t always prompt an immediate corrective action. Without predefined response protocols, staff may not know how to respond to alarms, leading to delays or incorrect actions. To avoid this mishap, develop standard operating procedures for each type of alert, including who is notified, the immediate actions to take and follow-up steps.

Sensors are not created equal, therefore keep in mind brand, price and data reliability. Sensor quality varies widely, and the low-cost variety may not perform well in harsh aquatic environments or may be more prone to drift and damage. Invest in robust,

proven sensors from reliable vendors for critical parameters, and periodically verify readings against manual tests to confirm accuracy.

Environmental factors like biofouling, temperature fluctuations and water chemistry changes impact sensor performance. These factors can alter sensor readings or cause physical damage to the sensor. Use sensors that can hold up to harsh environments and inspect them regularly.

Water quality parameters are not the only important metrics in RAS monitoring. Other factors, such as fish behavior, biofilter health and system pressure, can be just as critical to system performance. Implement a holistic monitoring strategy that includes behavioral monitoring, biofilter efficiency tracking and system infrastructure health.

Automated remote monitoring systems do not eliminate the need for trained staff. Even the most advanced monitoring systems require knowledgeable personnel to interpret data, maintain equipment and respond effectively to issues. Provide regular training on using the monitoring system, understanding data and acting on alerts.

Avoiding these common misconceptions and addressing these potential mishaps can significantly improve the effectiveness of remote monitoring in RAS, leading to better system stability, healthier fish and optimized operations.

A nitrogen generation solutions company, South-Tek Systems has launched the N2GEN-FLEX Nitrogen Generator to change the way businesses generate and utilize nitrogen on-site.

According to South-Tek Systems’ CEO, Jens Bolleyer, the N2GEN-FLEX saves costs on service and energy.

“Our customers are looking for efficient, cost-effective, and flexible solutions. The N2GEN-FLEX delivers on our promise to provide our customers with the right solution for their applications. This line of products represents the future of nitrogen generation,” said Bolleyer.

The N2GEN-FLEX uses Pressure Swing Absorption (PSA) technology

to deliver air-to-nitrogen ratio in the industry, reducing energy consumption by 20 per cent or more when compared to traditional nitrogen generators.

“The N2GEN-FLEX’s low air requirement and minimal pressure drop allows users to pair it with a smaller compressor than the standard PSA nitrogen generator, saving money in up front cost, electrical demand, and system maintenance,” said South-Tek Systems’ mechanical engineer, Garrett Rinker, Ph.D.

The Nitrogen generator can be used in aquaculture, mining, oil & gas, food & beverage, biopharma & pharmaceuticals amongst others.

Moleaer Inc., a nanobubble technology company, has collaborated with Lødingen Fisk, an aquaculture facility in Norway to adopt Moleaer’s Trinity Nanobubble Generator.

Lødingen Fisk said it achieved notable performance improvements in water quality, fish health, and operational efficiency upon using the nanobubble generator.

Nanobubbles, typically measuring between 80-200 nanometers in size, remain suspended in water for extended periods. Their properties, including neutral buoyancy and strong negative surface charge, allow them to increase oxygen transfer efficiency and improve water quality by removing biofilm and particles from the water.

At Lødingen Fisk’s Recirculating Aquaculture System (RAS), Moleaer’s system was reported to enhance oxygen dissolution, reduce suspended solids, and deliver significant improvements in biofilter performance, resulting in cleaner, more oxygen-rich

water for the fish.

These adjustments led to the following gains at Lødingen Fisk:

• A 94 per cent oxygen transfer efficiency: Increased by 71 per cent compared to conventional methods, enhancing fish health and growth.

• A 23 per cent increase in dissolved oxygen & 30 per cent reduction in water turbidity: Resulting in a 67 per cent decrease in ozone usage and cutting operational costs.

• Enhanced biofilter efficiency: Nitrite accumulation was reduced by 70 per cent, with ammonia nitrification rates improving by over 60 per cent, leading to more efficient waste processing and system optimization.

• Biofilm scrubbing effect: Nanobubbles loosened biofilm from surfaces, increasing suspended solids, which were then filtered out, improving overall water quality.

Moleaer’s study showed that within the first 48 hours of nanobubble integration, there

was an immediate increase in oxygen transfer and biofilm removal. The second set of measurements, taken after 50 days, revealed clearer water and improved nitrification rates, helping to reduce toxic nitrite accumulation by 70 per cent.

“Our work with Lødingen Fisk demonstrates the transformative potential of nanobubble technology to unlock new levels of productivity within the aquaculture industry,” said Jan Eric Haagensen, senior director of Scandinavia at Moleaer.

“The results not only validate our technology but also demonstrate how strategic application can drive substantial improvements, offering a pathway toward improved fish welfare and more efficient, cost-effective, and sustainable aquaculture facilities.”

Moleaer says this case study highlights how its nanobubble technology can achieve beneficial outcomes in RAS processes.

ULTRAAQUA AS, a UV System manufacturer for water treatment, has officially taken over the technical ownership and support for all LIT UV Elektro GmbH equipment, components, and services.

LIT UV Elektro is a manufacturer of ultraviolet and laser lamps. The two companies worked closely together to have a seamless transition of the technical ownership and sup -

port for the LIT UV Equipment.

“As the formal and committed successor of all LIT UV Elektro equipment, ULTRAAQUA is now your primary point of contact for

full-service support, including spare parts supply, technical documentation, equipment validations, and repairs,” a press release from ULTRAAQUA states.

ULTRAAQUA maintains that its mission is to deliver continuous, reliable service and high-quality technical expertise to all LIT UV customers.

Aquaculture technology company, Ace Aquatec, has partnered with Japanese trout producer, FRD Japan, to install its humane stunning device in its closed recirculating aquaculture system (RAS) farm.

Ace Aquatec worked with the trout producer to create a custom system that supports the safe transfer of fish between grow-out and processing facilities while meeting biosecurity protocols. The A-HSU® system will act as a physical bridge between the producer’s grow-out and processing facilities, using pumping technology supplied by MMC First Process.

The system is a 16-inch system for steelhead trout and provides a capacity of 30 tonnes per hour while recycling the water in the system back into the RAS facility.

According to Ace Aquatec, the system will optimize the transfer process, prioritizing fish welfare.

“This collaboration with FRD Japan is a significant development for Ace Aquatec and highlights our commitment to delivering solutions that are tailored to our client and meet the highest standards of innovation and efficiency,” said Tara McGregor-Woodhams, chief sales & market-

Proximar Ltd. has appointed Yoshihito Ito as its new managing director to strengthen its Japanese team.

Ito joins Proximar after working with Nutreco and Skretting for the past 24 years where he was general manager in both companies.

“I am pleased to have Mr. Ito join Proximar. He brings in-depth aquaculture know-how as well as extensive international and Japanese management experience to the company.

Furthermore, his long-term experience from operations and production will be important for Proximar in the ongoing transition from a project company to a production company,” said Joachim Nielsen, CEO of Proximar Seafood AS.

Before working at Skretting, he worked for Nippon Roche K.K. and was a member of the global aquaculture expert team in the Roche Group. Ito holds a Master of Science in Fisheries from Kagoshima University in Japan.

ing officer at Ace Aquatec.

The system will be fully operational in 2027. Ace Aquatec’s A-HSU® can be used for commercial fish species including trout, salmon, tilapia, prawn, bass and bream.

“Working with Ace Aquatec has been a seamless and productive experience. The team has shown high levels of expertise and adaptability, collaborating with us at every stage to design a solution that suits our needs. The result is a device that aligns with our goals while upholding our high biosecurity standards,” said Tez Sogo, at FRD Japan.

Land-based aquaculture company, AquaBounty Technologies, is selling all of its equipment after closing its remaining farm in Prince Edward Island, Canada.

The sale includes new and uninstalled salmon aquaculture plant, LHOs, disc filters, pumps, blowers, new HVAC, electrical, and pre-engineered metal building (PEMB).

The company had been working for over a year to raise capital, including selling its farms and equipment, but it struggled to make enough cash to maintain its operating facilities. In December 2024, the company announced that it was closing up.

The online auction is in partnership with Gordon Brothers and runs from Feb. 4-11.

Some of the items available for sale include:

• Pre-engineered metal building of about 200,000 square feet not erected;

• Two hyperclassic HCM/2500-36-20HP mixers;

• Thirteen new Daikin Roof Top HVAC systems;

• Forty new NP Innovation 22-series frame-type disc filters;

• Thirty new InnovaSea fingerling, pre-growout and growout LHO Tanks;

• Eighty new Allen Bradley Centerline 2100 MCC sections;

• Thirty-nine new in crate grundfos vertical multi-stage centrifugal pumps – models CRN10-7 and CRN10-8.

Customized for your fish farm, hatchery or research operation!

Our Commercial LSS Packages are custom engineered to meet your specific needs.

• Marine and Freshwater

• Mechanical filtration

• Chemical filtration

• Ultraviolet disinfection

• NEMA enclosed controls

• Bio-filter towers

• De-gassing towers

• Wide variety of flow rates

• Flow control valves

• Protein skimmers

• Variable frequency-drive pumps

• Temperature management

By Curtis Crouse

Efficient conversion of feed to biomass is a critical component of success.

Measuring efficiency with feed conversion ratio (FCR) can provide insight for financial calculations, overall fish health, and facility performance. This makes FCR a key performance indicator that all producers should track. However, it is important to understand the context of FCR values in relationship to the life stage of the fish and practical implications for how it is calculated and reported.

In its simplest terms, FCR is the total amount of feed divided by the amount of biomass gained by the animals in the population. This total in and total out approach is the economic FCR. As an absolute measure of input vs production, economic FCR is an important metric for financial performance of each cohort produced.

Pairing the economic FCR with data on the breakdown of categories harvested fish were sorted into can make economic FCR more useful for financial modeling.

For example, if premium Atlantic salmon of a large size fetch a higher price than those of lower quality or smaller size, the return of a cohort with 90 per cent premium fish will be greater than one with 80 per cent premium fish even if the economic FCR is equal.

Though incorporating these measures together can help with modeling, the calculation of economic FCR remains a total in and total out equation.

A more intensive approach is the biological FCR. The biological FCR accounts for factors like excluding wasted feed in

the numerator of the equation or correcting for the biomass lost to culling or mortality in the denominator.

This approach can be more valuable in comparing the actual growth performance of fish in the population. For example, imagine two hatchery RAS consuming 1 kg of feed and gaining 1 kg of total biomass, but one RAS was inadvertently over fed an extra 500g of feed that went uneaten. The economic FCR of the two RAS would be 1 and 1.5. However, if the uneaten feed was excluded, the biological FCR of both RAS would be 1.

Facilities hoping to make useful FCR comparison between cohorts, must stan -

dardize how they will calculate and report FCR.

Feed conversion ratio for Atlantic salmon will change dramatically over the life cycle. Therefore, FCR data must be from fish that were similar size to make meaningful comparisons of cohorts. The Freshwater Institute (FI) has produced many full growout RAS trials of Atlantic salmon.

During three consecutive grow out trials, FCR was tracked from first feeding to market-size. During parr and smolt stages, first feeding to ~85g, the first sampling events when fish are <2 g produce exceptionally high FCR (1.7 and 2.5

for cohort 2 and 3, respectively). However, waste feed and mortality are highest during this stage, and due to difficulty collecting and accurately weighing them, are not factored into FCR calculations at FI.

After the initially high FCR, exceptional conversion followed to reduce the overall FCR to 0.99, 0.84, and 0.95 for cohort 1, 2, and 3, respectively. Total FCR for this stage is typically <1 and encouraging considering that few corrective factors were applied.

Following an artificial S0 winter photoperiod to induce smoltification, post smolts were moved to larger tanks and reared to approximately 700g for Cohorts 1 and 2 and 460g for Cohort 3. This stage typically yields the lowest FCR as post smolts are prepared for rapid growth following smoltification.

Increasing appetite and the increased feed capture time provided by the larger tank makes for easier satiation feeding and less likelihood of wasted feed. Mortality decreases significantly compared to the parr stages, resulting in less loss of biomass. Accurately tracking the weight of mortalities is also more practical with larger fish but is typically only done when appreciable volumes are removed from the population. FCR values of 0.94, 0.82, and 0.9 were recorded for cohorts 1, 2, and 3 during

this phase.

At the next stop in the production cycle, the post-smolts are moved to a semi-commercial scale RAS for grow out to market-size. During grow out, waste feed is minimal, and mortality is lowest but more impactful. Inevitably, FCR begins to increase as the fish get larger and growth becomes less efficient. This is especially true when fish exceed 1.5kg. Prior to this size FCR is approximately 1 but can increase to 1.5 as fish approach market-size. Total grow out FCR for the three cohorts was 1.37, 1.35, and 1.17.

Calculating a full production cycle FCR can be useful for summarizing results. Even though, FCR is low at early stages, more than 80 per cent of the biomass gain occurs during growout. As a result, performance at this stage has a higher impact on FCR. Therefore, averaging the FCR for each stage or time period will not accurately reflect true performance.

Instead, cumulative feed and gain totals should be used. For example, average FCR for the three cohorts discussed would be 1.1, 1, and 1, respectively. However, calculating from cumulative feed totals and biomass gain provides truer FCR measures of 1.3, 1.25, and 1.14 that are more useful for comparison and financial modeling.

So, which cohort performed best? Speaking pure -

ly from an FCR perspective, Cohort 3 would seem that have outperformed the others. However, additional performance metrics must be paired with measures of FCR to refine reporting and define success.

It is important to note that Cohort 3 was harvested more than a 0.5 kg smaller than cohorts 1 and 2. Eliminating this final, relatively inefficient, period of growth may have had a large impact on the total FCR. However, the price fetched by these smaller fish may have also been lower and not have returned as much revenue.

Fish produced in Cohort 1 and Cohort 2 were of similar size. While FCR was lower for Cohort 2, the percentage of early maturing fish from this population was 45 per cent versus 22 per cent in Cohort

1. The larger volume of premium fish produced in Cohort 1 may have offset the higher FCR. While FCR is a key performance indicator, it can not be viewed in a vacuum.

Producers armed with quality data of how their fish are performing, accurate projections of future growth, and demands of the market will have the best chance of making quality decisions and striving toward continued improvement. Standardized approaches to data reporting can make historic comparisons and progress tracking more informative.

Published data of growth performance can be helpful for goal setting, however, the most helpful data and feedback on progress will come from historic records generated at the farm from cohort to cohort.