From the editor

By Mari-Len De Guzman

By Mari-Len De Guzman

As I write this, the coronavirus (COVID-19) outbreak continues to spread across the globe, killing more than 3,000 and infecting nearly 100,000 worldwide. The toll of this deadly virus has transcended the health care realm and manifested into the global economy – leaving investors uneasy, the stock market plummeting, the manufacturing industry disrupted, supply chains broken, billions of dollars in losses to the travel industry, and putting thousands of jobs at risk.

The effects of this global outbreak to the aquaculture industry are yet to be quantified, but one can surmise it will be considerable. In the U.S., for instance, more than 80 percent of seafood are imported – many of them from countries that have slowed production as a result of the coronavirus outbreak. Production cycles are disrupted as seafood producers and processors in China deal with labour shortages. Shipping and transportation systems are also greatly affected.

Nineteenth century Austrian diplomat Klemens von Metternich popularized the phrase, “When France sneezes, Europe catches a cold.” This statement is eerily true today, with slightly different players and on a bigger scale. If anything, COVID-19 has shown how our world has become smaller. Technological advancements have allowed countries to easily participate in the global economy, with varying time zones and thousand-mile distances no longer serving as barriers. But it comes as a double-edged sword. “When China sneezes, the whole world catches a cold.”

As much as it has become easier to do business with the world, companies have also become susceptible to the negative impacts

of major global phenomena – wars and conflicts, natural disasters, communicable disease outbreaks and global pandemics.

The ripple effects of these global events are certainly making another strong case for increasing domestic production to reduce reliance on seafood imports. Situating close to markets and producing in controlled, bio secure environments are the biggest strengths of RAS operations.

Its potential for addressing some of today’s food supply challenges as well as promoting a more sustainable way of producing food without causing increased stress to our natural resources are why we should be rooting for RAS to succeed.

In previous editorials, I have talked about resiliency in the industry. Risks, whether man-made or natural, are always going to be present. The best-run companies recognize this and are well-prepared with effective, properly tested contingency plans. The same is true for RAS operators.

For all its great potential, RAS – as with other technologies – does not come without risks. The key is the ability to manage those risks. It’s difficult to mitigate risks that are brought about by a natural disaster or global phenomenon. Reducing the potential adverse effects to the business bottom-line of those natural disasters beyond human control is where RAS makes a difference. Growing fish in land-based, closed containment systems increases the chances for fish survival.

It does not eliminate all potential risks, however. There are still the usual human error and systems failures that can affect any production system – whether land-based, net pens or off-shore. But these are risks that can be averted, controlled and corrected.

www.rastechmagazine.com

Editor Mari-Len De Guzman 289-259-1408 mdeguzman@annexbusinessmedia.com

Associate Editor Jean Ko Din 437-990-1107 jkodin@annexbusinessmedia.com

Advertising Manager Jeremy Thain 250-474-3982 jthain@annexbusinessmedia.co

Media Designer Jaime Ratcliffe 519-428-3471 ext 264 jratcliffe@annexbusinessmedia.com

Account Coordinator Morgen Balch 519-429-5183 mbalch@annexbusinessmedia.com

Circulation Manager Urszula Grzyb 416-442-5600 ext 3537 ugrzyb@annexbusinessmedia.com

Group Publisher Todd Humber thumber@annexbusinessmedia.com

COO Scott Jamieson

Printed in Canada

SUBSCRIPTION

RAStech is published as a supplement to Hatchery International and Aquaculture North America.

CIRCULATION email: blao@annexbusinesmedia.com Tel: 416.442-5600 ext 3552 Fax: 416.510.6875 (main) 416.442-2191 Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Occasionally, RAStech will mail information on behalf of industry related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office privacy@annexbusinessmedia.com Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission © 2020 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

Genetically modified salmon developer AquaBounty Technologies has announced a $10 million public offering of its common stocks.

The land-based aquaculture company headquartered in Maynard, Mass. expects to grant the underwriter of the offering a 45-day option to purchase up to an additional $1.5 million of shares of common stocks to cover over-allotments, if any.

AquaBounty intends to use the net proceeds of the proposed offering “for working capital costs associated with growing its first batches of fish at its Indiana and Rollo Bay, Prince Edward Island, farm sites.”

Proceeds will also be for general corporate purposes and to continue construction and renovation activities of its existing facilities .

In April last year, Environment Canada approved the commercial production of genetically modified salmon produced by AquaBounty in a facility in Rollo Bay in eastern P.E.I. The company also secured permission to export GM salmon eggs from P.E.I. to its facility in Indiana to be grown out..

AKVA has reported that its fourth-quarter losses for 2019 could reach less than NOK 100 million or roughly US$10.7 million.

In January, the Norwegian company said its preliminary earnings before interest and taxes (EBIT) for the quarter would be in the range of $2.6 million to $3.2 million. In February, AKVA said it had overstated the results.

“During the finalization of yearend reporting for AKVA’s two subsidiaries in the land-based segment in Denmark, it has been uncovered serious breaches of company policies within project follow up and project accounting. Significant losses in projects have not been reflected in the P&L before reporting to AKVA’s headquarters, thus overstating the results,” a statement from the company said.

Corrections made accounted for additional losses of around $7.5

million. AKVA expects its EBIT for Q4 2019 to be around $10.7 million.

“The underlying causes of the losses are amongst others due to cost overruns in projects,” the company said. “An external review is about to be started to evaluate and identify gaps in competence and then strengthen the organization… The conclusion is that it is reasonable to assume normal margins in the projects currently in the order book, which includes amongst other larger orders for RAS (recirculating aquaculture system) facilities in Norway and internationally.”

AKVA has had some top-level executive changes recently.

In February, the company announced Simon Nyquist Martinsen had resigned as chief financial officer of AKVA. He will continue to serve as CFO through his six months’ notice period.

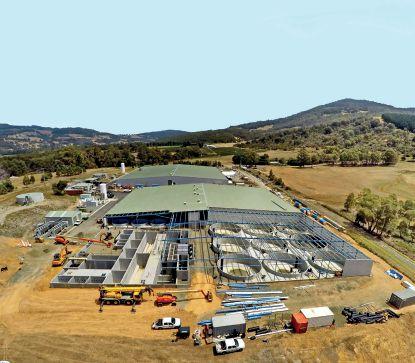

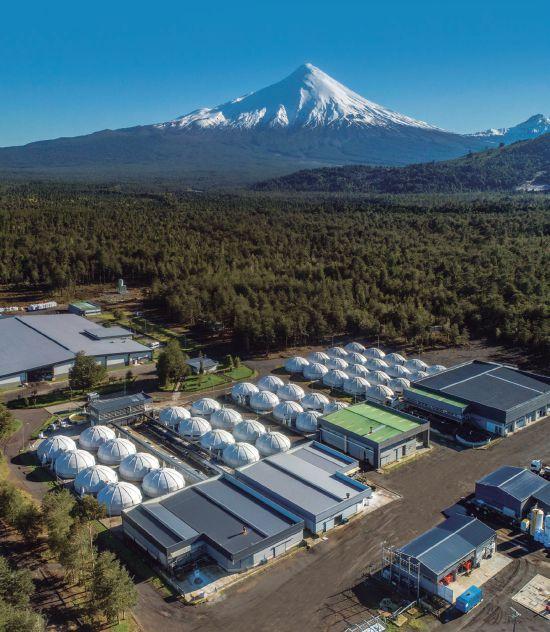

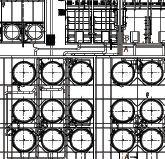

A leading global salmon farm company has plans underway for a recirculating aquaculture system (RAS) facility as part of its project in Newfoundland.

Grieg Seafood ASA of Norway announced that it has acquired Grieg Newfoundland Salmon Ltd. (Grieg NL). The project has a long-term annual harvest potential of 30,000 to 45,000 tons of Atlantic salmon.

The acquisition of Grieg Newfoundland AS strongly underpins the company’s 2025 strategy. The first harvest will be in 2022/23 and the region is expected to contribute 15,000 tons of annual harvest by 2025.

The high-end RAS facility is currently under construction.

The freshwater RAS facility will include a hatchery, a smolt facility and three post-smolt modules with a potential annual capacity of 7,000 tons upon completion.

The project also includes exclusivity for salmon farming in Placentia Bay, which has a farmable area bigger than the Faroe Islands in Denmark. The project currently comprises licenses for 11 sea sites. Three licenses have been approved, three more expected to be approved in 2020.

“For the past few years, we have focused on utilizing our existing licenses with success. This year, we will reach our target of 100,000 tons,” Andreas Kvame, chief executive officer of Grieg Seafood, said in a press release. “Now we are ready for the next step on our growth journey. By developing salmon farming operations in Newfoundland, using cutting-edge technologies at all stages of the production process, we are strengthening our position as a global leader in sustainable salmon farming.”

The U.S. market is the world’s largest and fastest-growing market for Atlantic salmon. However, only a third of U.S. demand is currently met by North American production, Kvame said.

“We already have a position in this market through our operations in British Columbia, where we have attained significant sales and marketing experience. With close proximity to important markets on the East Coast of the U.S., this acquisition significantly strengthens our U.S. market exposure and opens up for synergies with existing operations,” he explained.

— NESTOR ARELLANO

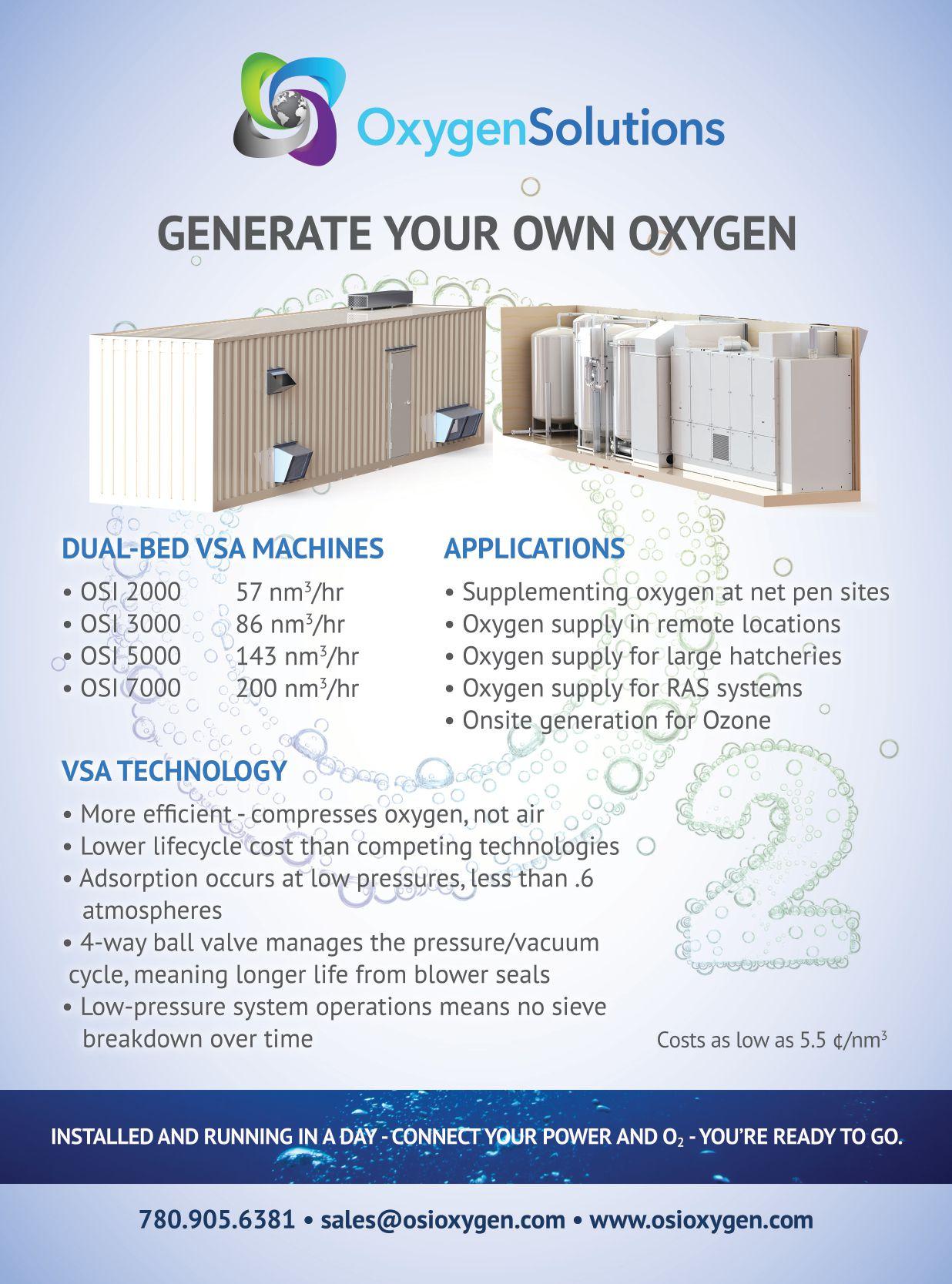

Wenger innovative extrusion solutions deliver clean, durable, nutritional feeds specifically designed for the most e cient RAS operations. Feeds produced on Wenger systems maintain their integrity better and longer, for clean and clear water. So you feed the fish, not the filter.

Learn more about the Wenger RAS advantage. Email us at aquafeed@wenger.com today.

By Nestor Arellano

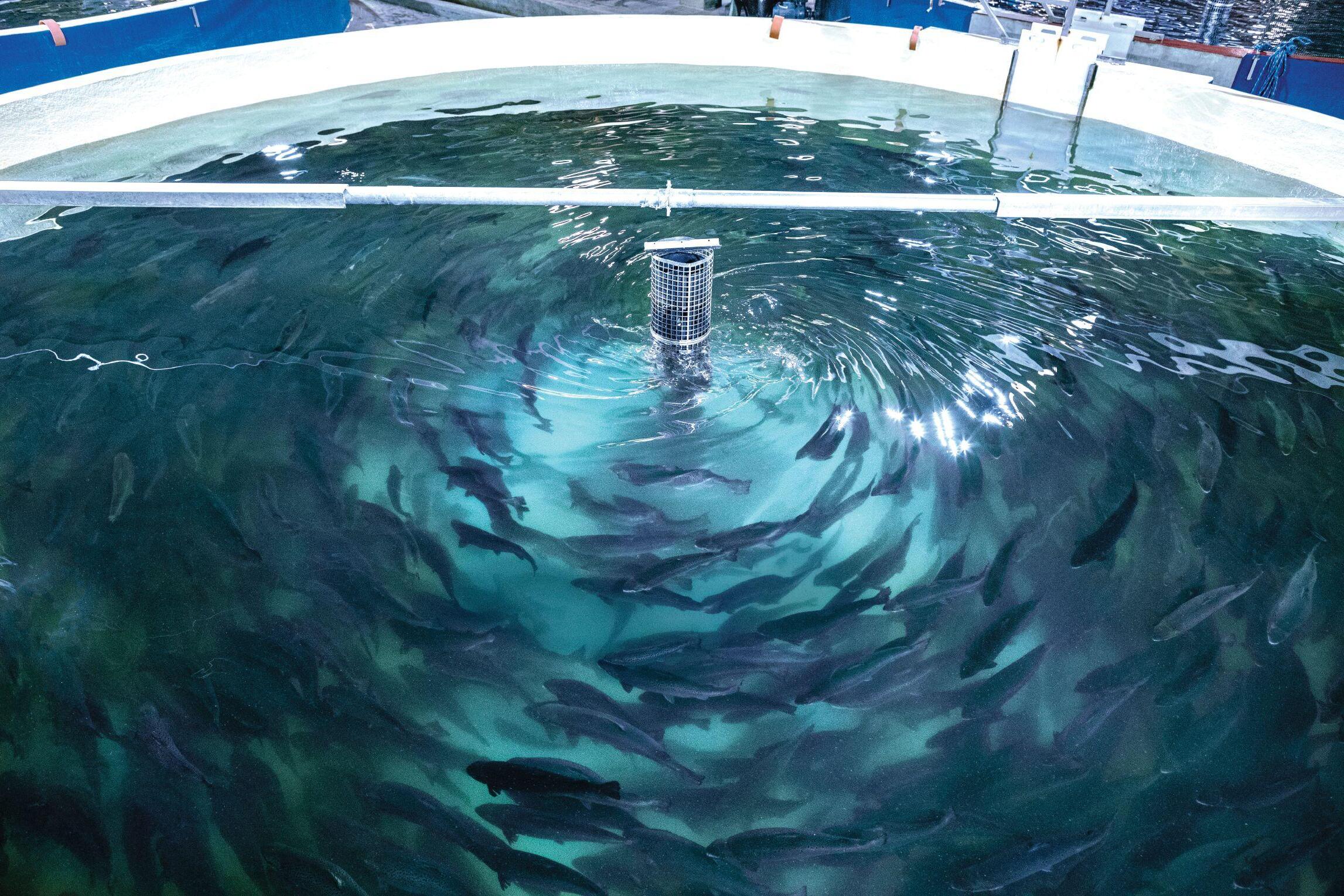

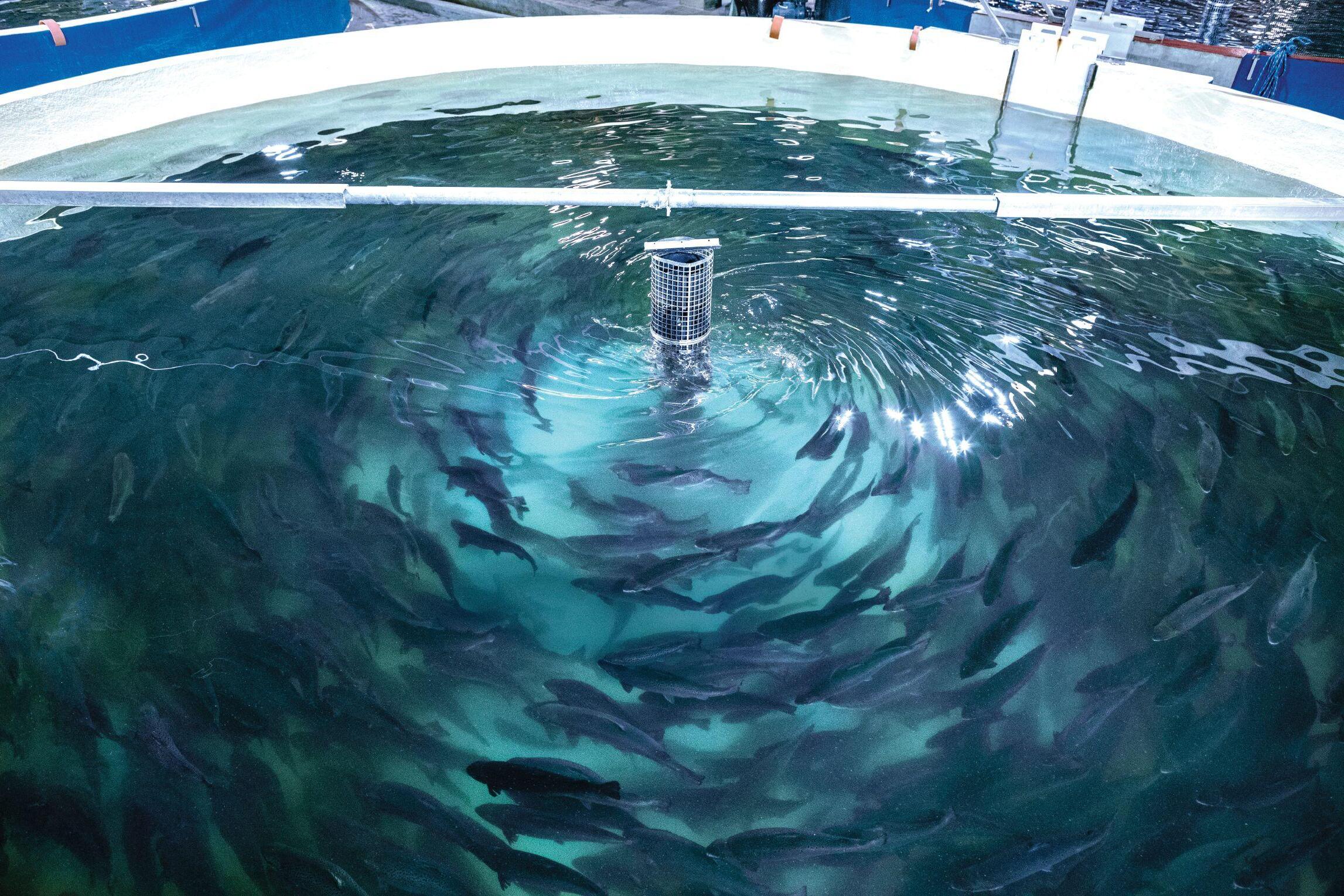

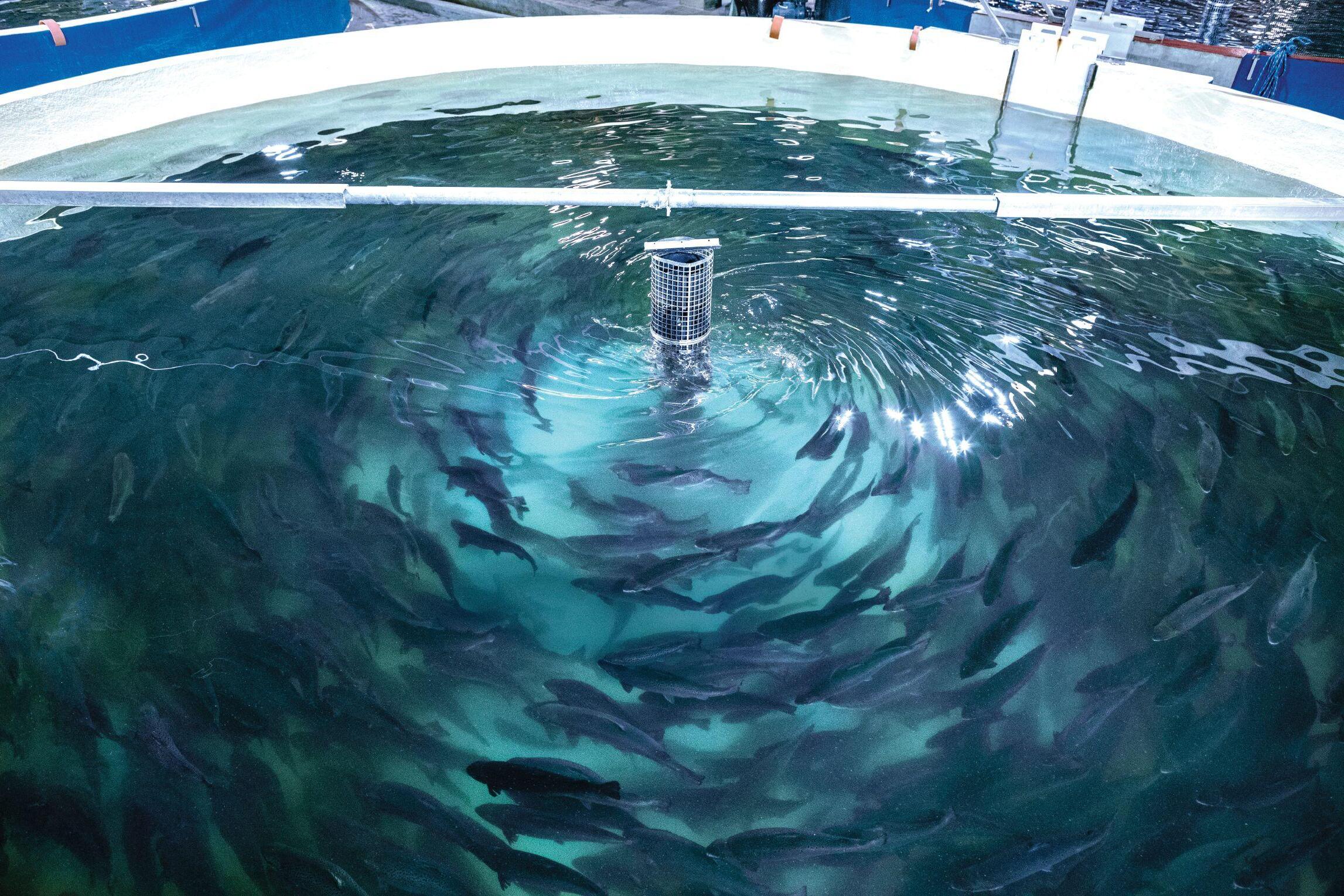

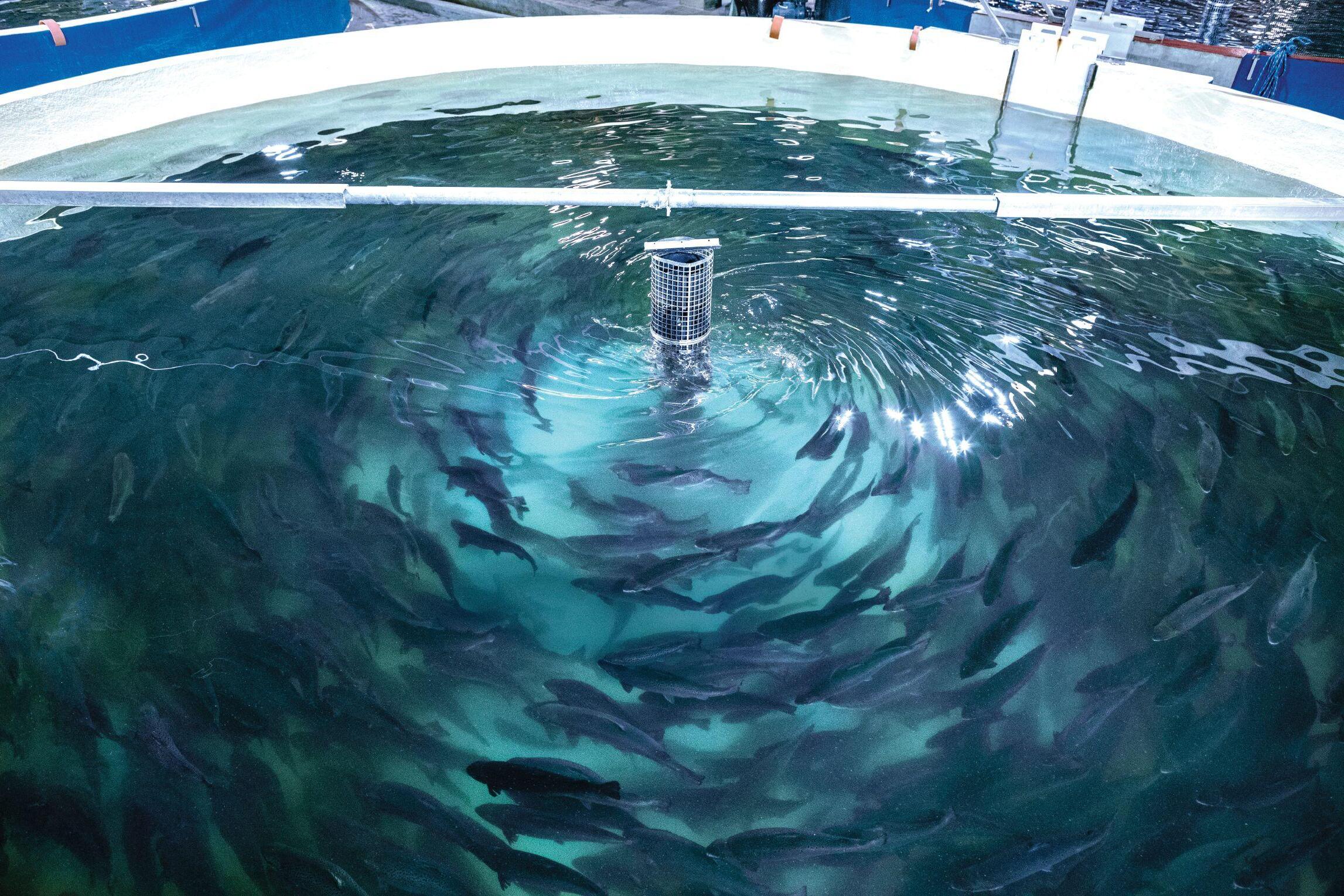

It is generally known that smolt grow faster in recirculation systems when the water current is increased. Researchers for the Norwegian Institute of Food, Fisheries, and Aquaculture Research (known as Nofima) have also found that swimming in strong currents help salmon grow bigger muscles.

Does this mean that operators of recirculating aquaculture systems (RAS) simply need to crank up water velocities in order to increase fish size? Not necessarily so, according to Gerrit Timmerhaus, a fish health researcher for Nofima.

Timmerhaus believes very high water velocities could be detrimental to fish health. It is not realistic to introduce water velocities that are much higher than the present-day standard

in existing recirculation systems, according to the researcher.

That’s because this requires special equipment and powerful pumps suitable for achieving such high velocities. “He also doubts if it would pay off financially for very high settings, even if it did result in further increased growth,” a report from Nofima said.

The researchers divided postsmolt weighing 80 grams into groups that would swim for three months in water flowing at four different velocities. Postsmolt are salmon which just passed through the smoltification stage and have become adapted to the sea.

The researchers wanted to test what happens to salmon physiology at different water velocities and whether or not there are any upper limits for beneficial effects. Water velocity is measured as body length per second.

The velocities that were tested were 0.5 body length/sec (low), 1 (medium), 1.8 (high) and 2.5 (very high). The researchers found that 2.5 body

lengths per second is the highest velocity that has so far been tested on salmon smolt. In commercial recirculation systems, less than one body length per second is most common.

One of the findings in the trial was that weak currents resulted in a low condition factor – a long, narrow body shape. Strong currents resulted in relatively wider fish (a high condition factor) and increased growth rates due to muscle growth.

“Even though producers want a high percentage of muscle and rapid growth, the researchers do not know how this actual type of salmon would manage during the growth phase in the sea, and whether or not a low condition factor would be compensated for in the salmon by muscle growth at a later stage,” according to Nofima.

One finding in a previous trial conducted at Nofima showed that strong currents resulted in increased resistance to diseases.

Salmon swimming in strong currents swim in shoals and the researchers think that this is a sign that they are optimizing their use of energy. However, with increasing velocities, a higher proportion of skin damage was recorded, including scale loss and hemorrhagic patches.

“Based on this research and previous research conducted at Nofima, I believe that it is optimal for post-smolts to swim in water velocities somewhere between 1 and 1.8 body lengths per second,” Timmerhaus said. “Anything below 1 means that their growth potential is not utilized and they do not build up resistance to disease, and at velocities above 1.8 we risk making compromises with the health of the barrier tissue of the fish.”

RAStech is getting on the podcast bandwagon as the publication launches a new series, called RAS Talk. It features discussions on trends and developments in recirculating aquaculture system around the world.

Hosted by RAStech editor MariLen De Guzman and Brian Vinci, director of The Conservation Fund Freshwater Institute, in Arlington, Virginia, RAS Talk releases a new episode every month, plus bonus episodes from industry events.

RAS Talk debuted with Nordic Aquafarms president Erik Heim, who shared his thoughts on the U.S. state of Maine as an emerging hub for RAS. As an early mover in Maine, Heim discussed both the opportunities and challenges the company faces in building a US$500-million RAS farm in Belfast, Maine.

The podcast also featured other hot topics, like the experiences of RAS operators in hiring qualified staff. Cristina Espejo, head of HR & ESAP (environmental and social action plan) at Atlantic Sapphire in Miami, Florida, and Kirk Havercroft, CEO of Sustainable Blue in Nova Scotia, Canada, discussed best practices for hiring, training and retaining skilled talents for RAS operations.

Interested in RAS investments? There’s a podcast for that. In a bonus episode, De Guzman spoke with Kimberley Player, director of research at Equilibrium Capital, about opportunities and challenges for investors in this emerging market.

RAS Talk is available on Sound Cloud, Spotify and on our website at rastechmagazine.com/podcast

Dutch yellowtail (Seriola lalandi) producer Kingfish Zeeland has a new corporate name to reflect the company’s expanding operations in Europe and the U.S. The Kingfish Company will serve as the parent company for Kingfish Zeeland and Kingfish Maine, as it continues to scale up production of yellowtail with its proprietary RAS.

“Our corporate name change reflects our evolution towards a global operation and our planned expansion in both the Netherlands and our new facility in the United States,” said Kingfish Zeeland CEO Ohad Maiman. “Recent investments in our project will allow the Kingfish Company to double the current capacity of our Netherlands facility, as well as fund the permitting process of our U.S. facility in Maine.”

The company recently gained financial boost with a new round of funding from feed company Nutreco, Dutch investment fund Rabo Corporate Investments (Rabobank), and French private equity company Creadev.

The Kingfish Company raises the highvalue yellowtail kingfish in a recirculating aquaculture system within a 5,000-square-meter facility along the

Oosterschelde marine estuary in the province of Zeeland in the Netherlands. It recently announced plans to build a US$110-million land-based production facility in Jonesport, Maine, to bring its yellowtail to the U.S. market.

Kingfish Maine is projected to produce 6,000 metric tons annually upon project completion. The RAS facility is currently in the permit phase.

Kingfish Zeeland produces the only Aquaculture Stewardship Council (ASC) and Best Aquaculture Practices (BAP) certified Kingfish yellowtail. It has been named a “Green Choice” by the Good Fish Foundation.

The company’s fish produce is available fresh and frozen from the Netherlands year-round, with daily deliveries across the EU and regular shipments to the U.S.

In addition to Nutreco’s investment in Kingfish Zeeland, the two companies will also cooperate on further development of “best in class” RAS feeds, which would allow the yellowtail producer to address what has been one of its biggest challenges in producing RAS-grown Seriola lalandi.

Atlantic Sapphire’s Denmark facility has reported massive mortality at its grow-out systems, affecting more than a quarter of a million fish.

In a statement posted on the Oslo Stock Exchange, the Denmark-based salmon producer disclosed on Feb. 29th that it lost approximately 227,000 fish in its grow-out RAS systems. Preliminary analysis indicates that the cause of the mass mortalities was higher than normal nitrogen levels in the system, which has since been addressed in a design modification, according to the company.

“Other systems in the Danish pilot farm and the U.S.-based main facility had already been modified or are in the process of being modified to avoid future events,” the Atlantic Sapphire statement said.

The preliminary analysis of the cause of the event is still subject to further verification, the company said.

• Recirculation System Design, Supply and Construction.

• Commercial Farms, Hatcheries, Aquaponics, Research Labs, Public Aquariums, Live Holding Systems – we do it all!

• Representing leading RAS equipment manufacturers.

In an earlier interview with RAStech ‘s sister publication, Hatchery International, Kingfish Zeeland chief operating officer Kees Kloet said the the company has been looking to collaborate with feed suppliers to develop and achieve the specific feed formulation for the Dutch yellowtail.

According to Nutreco, it’s subsidiary Skretting is delivering juvenile feed to Kingfish Zeeland operations, and the companies will be working towards broader cooperation on the feed moving forward.

“This incident demonstrates the importance and challenges of finishing commissioning of all BluehouseTM systems while already in operation as well as the value of having multiple independent systems for biological risk diversification reasons. At the same time, the company’s strategy to have its Danish pilot farm as R&D facility proves immensely valuable in testing designs and identifying issues in this first and largest ever land-based, RAS salmon farm in the world,” Atlantic Sapphire said.

The company is building its first major landbased Atlantic salmon farm in Miami, Florida, in the U.S. Once fully completed and at full capacity, it will produce up to 90,000 tonnes of Atlantic salmon annually.

Phase 1 of the Miami Bluehouse project is expected to be completed this year, and is expected to produce 10,000 tonnes of head-on, gutted salmon per year. Atlantic Sapphire will have a total of six independent grow-out systems in the U.S. alone, limiting the risk of any systemic contamination to only about 15 percent of total output, the company said.

Q&A with Erik Heim, president, Nordic Aquafarms

All eyes are on the U.S. State of Maine as it becomes an emerging destination for RAS development projects. Because of its geographical access to both fresh and sea water, Maine has established a strong heritage industry in fishing. Its seafood products are globally recognized and the government is looking to RAS as an opportunity to expand the industry, create jobs and grow the state’s economy.

Norwegian seafood producer, Nordic Aquafarms, is one of the first companies to announce a major RAS build in the state. The company is investing about US$500 million to establish an Atlantic salmon RAS farm in Belfast, Maine.

But even with strong support from the government, the company faces staunch opposition from local and state environmentalists who fear a harmful impact caused by the volume of water required to produce 33,000 metric tonnes of fish annually.

In the first episode of the RAS Talk

podcast, RAStech editor Mari-Len De Guzman is joined by Brian Vinci, director of The Conservation Fund Freshwater Institute, to investigate the challenges and lessons learned from Nordic Aquafarms’ RAS project.

Below is a snippet of their conversation

with president Erik Heim about how the company is navigating through the issues and process of being a pioneer of this emerging RAS movement. The full 33-minute conversation can be found online at rastechmagazine.com/podcast

RAS Talk: You’re the first mover to invest in Maine for your land-based farm in the U.S. Why is it that you chose this state over others in the United States?

Erik Heim: We spent a lot of time looking at the access to clean coldwater resources, both fresh and sea water. Another thing that Maine has going for it is a strong seafood heritage and a brand. It has a very nice brand position for seafood that companies can build on. Property access is good in Maine, although it’s not necessarily always easy to find appropriate or large enough properties near the ocean due to other types of development.

And what we discovered as we started exploring is really a strong political support for this kind of development on the local and state level. Regulatory processes is a really important piece of making these things work, and the addition of academic institutions in marine sciences in the state, which is an asset for anybody looking to come here.

So that’s really how we ended up on the final site, after walking probably 20 sites that we assessed to be technically strong. And it’s also a very nice community for staff to bring their families.

RAS Talk: Nordic Aquafarms has faced challenges on the public-facing side of this whole endeavour. What is the company’s strategy for winning public support and maybe even correcting a lot of misinformation that’s out there?

Heim: So, typically, what we do is we stage public meetings, we do newsletters, we always have an open-door policy in our

offices where people come in and, like with many of our other projects, we have a community liaison working on all of these.

Many times, it’s very difficult to predict how those (social) dynamics play out. It’s very important to be sensitive to local issues and work through them. Sometimes these differences can be ideological and that’s when it becomes more challenging because (then) the facts don’t necessarily matter.

Probably some of that we’ve seen in Maine, that nobody really in the State had predicted would emerge, but it did emerge for a number of reasons, ranging from opinions about how the authorities did re-zoning for the property and other issues.

I don’t know, in the end, what we could have done differently at this location, but the pre-emptive element of stakeholder work is extremely important. Also, being resilient in working your way through these things. That’s something that every project should have on their radar.

RAS Talk: Even with these opposing voices, there are many in the community that seem to support the project. Are you able to take advantage of these relationships?

Heim: We have a very good collaboration with scientific and environmental organizations in Maine, both the University of New England and the University of Maine. We work well with the Gulf of Maine Research Institute, the Conservation Law

Foundation and we also have a good history with the Salmon Federation up here. So there’s a lot of enthusiasm and support for this in many places.

We also have a local NGO that was formed in support of aquaculture and facts. If you look at the community we’re in, it’s also a lot of families that are looking for a future where their kids will find good-paying jobs along the coastline of Maine.

RAS Talk: You mentioned how having experienced staff is critical from very early into the process and you have many very experienced aquaculturists on your team. How difficult is it to find and scale

experienced staffing for Nordic Aqua?

Heim: I think the key strategy for companies in this segment is to successfully attract a core of experienced people and scale from that. And so far, I think we’ve done a decent job and we have more ahead of us.

What I generally find in the U.S. is very keen interest from institutions to have conversations about what kind of people we need to educate in the future. What we’ve been emphasizing a lot is integration of practical experience in the programs, so that they educate people who have a practical understanding when they become candidates for hire.

•

•

•

•

By Gijs Rutjes

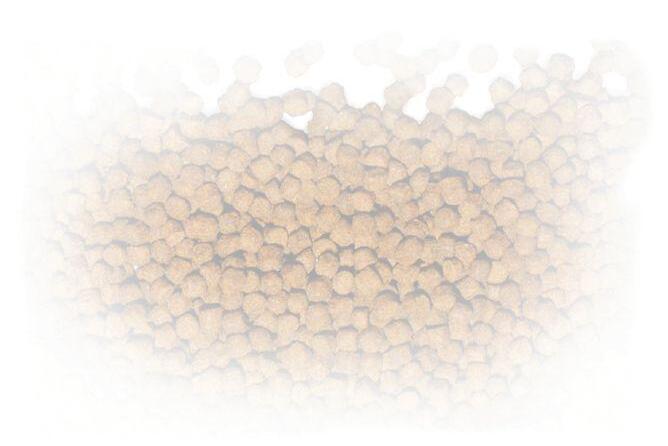

Productivity in a recirculating aquaculture system (RAS) is far superior to traditional farming methods. The profitability of RAS depends on the productivity (kg/m3/ year) of the system and, therefore, RAS requires a high stocking density and growth rate. A well-designed system, the right feed, good management practices and an optimal feeding strategy are fundamental to the success of both your fish and your farm

In terms of water quality in the system itself, a RAS is the most advanced. For optimal control, filters clean and recondition the water after the fish use it. First, the faeces and any spilt pellets are removed. This is done with a mechanical filter, like a sludge cone and/or a drum filter with a fine sieve. Both filters remove a large part of the organic matter. Then the ammonium and CO2 produced by the fish is removed.

This is done through a nitrification filter, in which bacteria like Nitrosomonas and Nitrobacter break down ammonium to nitrate, a molecule that is almost harmless to fish. Biofilters can be a moving bed, where bacteria grow on beads, or trickling filters using a fixed bio medium over which the water is trickled like a shower. After biological filtration, a degasser strips the CO2 from the water, and the oxygen is replaced. Usually, farmers use liquid oxygen in order to reach high levels of oxygen in the incoming water. Finally, in some cases, extra units and like UV or ozone, are used to reduce suspended solids and for hygiene reasons. By using this process, the essential water quality parameters are optimised for the fish, ensuring a consistent, high growth rate and good fish health.

When the provided water quality and, especially, oxygen levels are not limiting, the strategy of growth maximisation provides attractive financial benefits.

In all types of fish farming, RAS especially, the water quality is the basis for healthy fish and optimal performance. Fish eat and grow well when the water quality is excellent and consistent. To a great extent, water quality determines the success of the RAS.

Fish performance is affected by several crucial parameters, such as dissolved oxygen, concentration of carbon dioxide, ammonia levels, nitrite, nitrate, water temperature and pH. All of them interact with one another and impact fish health.

The golden rule for consistent aquaculture farm results is to maintain a constant and optimal water quality. This applies to cage farming, raceway systems and also in RAS. The water quality affects feed uptake, digestion, growth and waste excretion. Keeping these parameters optimal at all times requires a great understanding of fish behaviour and the dynamics of the filters.

Besides a state-of-the-art RAS, the farmer needs firstclass RAS feeds and a proper feeding strategy to fulfil the farm’s full potential and achieve the best results. Being able to maintain a high daily feed rate is obviously what every fish farmer wants. Higher feed intake equals better growth. In Alltech Coppens, we developed a trout RAS guide that offers support to farmers in developing a successful production.

A RAS feed is characterised by high digestibility, leading to minimal amounts of faecal matter, and high protein retention that minimizes ammonia excretions so the filters can work more efficiently. A true RAS feed makes a big difference for the water quality and final productivity of the farm.

In a RAS, the feed quality and feeding regime always have an impact on the quality of the water your fish swim in. The best farm performance, in combination with the lowest impact on your water quality, can only be reached with the best feeds and feeding regime. Overfeeding pollutes the water, but using lower-quality feeds can also increase the pollution levels in your system. The lower digestibility of these feeds increases the levels of expelled waste, and that lowers the system conditions.

The basis of a good RAS feed starts with the selection of only high-quality ingredients. Critical selection criteria include protein level, amino acid profile, energy level, fatty acid profile, digestibility and palatability. Next to that, the composition must allow for maximum growth, which means a high-energy diet. The ultimate goal is to maximize nutrient utilization and minimize nutrient losses for optimal fish growth.

A RAS feed should not only satisfy the nutritional needs of fish, but the physical pellet properties should also minimize water contamination. Feed pellets and faeces must be firm so that they do not dissolve in the water and can be effectively removed by the mechanical filter. This can be checked relatively easily at the tank outflow.

Feed pellets need to be firm and durable so that they

can withstand the friction they are exposed to in feeding and transportation systems. This is essential so that dust generation can be minimized. Fish cannot consume dust; it will pollute the water and possibly irritate the gills. Sinking speed is also important. The pellet should sink slowly so that all individual fish in the tank have enough time to eat the pellets. This helps to distribute the pellets to the whole batch of fish evenly and minimizes uneaten pellets.

Waste control and removal as well as water recycling in RAS are measures for the sustainable future of aquaculture. The amount of water now required to produce trout or other fish is much lower than in traditional systems. RAS can also be located close to the market, significantly reducing transportation costs and carbon footprint.

Although RAS farming has already undergone much intensification and professionalization, further development will result in an even higher level of sustainability. Proper design and management of RAS, optimum RAS feed quality and feeding management are essential for successful and sustainable fish production. In this way, we take proper care of our planet and contribute to a Planet of Plenty™.

Good knowledge of the management practices and feeding routines are fundamental to the success of both your fish and your farm. It is vital to have excellent dayto-day stock control and adequate feed rates. In general, a feed rate near satiation works best for most species, as it allows high performance without the risk of overfeeding. One should bear in mind that even small amounts of uneaten feed, usually of a high nutrient density, will pollute the water and lower the water quality. Only if optimal water quality is maintained can the fish and the system perform well.

To get a greater insight into the optimal operation and function of a RAS, it is crucial to understand the fundamental requirements. Find out more on www.alltechcoppens.com/ras-guide, where you can request a complete guide on trout farming in RAS.

Gijs Rutjes is passionate about fish, feed and fish farming. He studied aquaculture at Wageningen University in the Netherlands, with a Master of Science degree specializing in RAS, fish nutrition and immunity in fish. He did an internship with Marine Harvest (Mowi) in Scotland, where he was involved in selective breeding and supported the feed department with feeding tables and feeding strategies. He worked for a leading African catfish RAS hatchery in The Netherlands and a RAS catfish farm for nearly three years before entering the fish feed industry. In 2003, he joined Alltech Coppens, currently responsible for technical sales support within Coppens and travels extensively to provide on-farm support. Rutjes is strongly committed to the Alltech Coppens motto “dedicated to your performance”

By Maddi Badiola

Maddi Badiola, PhD, is a RAS engineer and co-founder of HTH aquaMetrics llc, (www.HTHaqua.com) based in Getxo, Basque Country, Spain. Her specialty is energy conservation, lifecycle assessments and RAS global sustainability assessments. Email her at mbadiolamillate@gmail.com or contatct her through LinkedIn, Facebook and Instagram.

Irecently joined a roundtable discussion called, “Come Together: Uniting the Farmed and Wild Seafood Sectors,” organized by the Global Aquaculture Alliance (GAA). The GAA is an international non-governmental organization dedicated to advocacy, education and leadership in responsible aquaculture. The main objetive of the discussion was to look for the best way to collaborate as an industry to get people to eat more seafood. And this is where I am focused.

Continuing with my last article, we understand the importance of people’s opinion. Public concern towards aquaculture practices is apparent but the need to make people aware of the need and benefit of seafood consumption is clear.

Customers are the main target

Alpha Aqua A/S & HTH AquaMetricsTM will join forces under Alpha Aqua North America to provide advanced RAS planning, design, construction and full-service packages to the American aquaculture markets.

Taking advantage of HTH AquaMetricsTM experience in the market together with Alpha Aqua A/S unique RAS design, Alpha Aqua North America will rethink the entire value chain, pushing the limits for a better aquaculture by adding new methods, materials, best practices, and innovation

All this is in close cooperation with strategic partners in the international aquaculture industry.

LAND-BASED RECIRCULATING AQUACULTURE SOLUTIONS FOR A SUSTAINABLE FUTURE

• Turnkey solutions

• Modular systems/production units developed in phases

• Faster construction, no fixed concrete structures implying better Return on Investment (ROI)

• Efficient planning, safer production units and lower total costs

Where I come from, in Basque Country in Northern Spain, seafood consumption is one of the highest in the entire world. Because it is one of the most important industries in the region, people are proud advocates for serving wild seafood. You will often hear promos that say, “Here, we only have wild, fresh and tasty. Aquaculture products are not served here,” or “Aquaculture is not the same as wild!”

Customers will prefer to be served wild even though studies have shown again and again that they are rarely able to differentiate which fish is farmed or not. At the same time, people will agree that oceans carry toxic compounds that directly impact fauna in the region. But do they truly understand that these “wild, fresh fish” could carry harmful metals and plastics? Are these fish 100 percent traceable? The doubts are real and the discussion should be open and extensive.

Aquaculture professionals have to play a role in these discussions. And it has to go beyond the existing rivalry between wild and farmed. Wild and farmed fish share the supermarket shelves. They are fish anyway you look at it. The fisheries and aquaculture industries should be working together in order to satisfy the needs and development of both. Aquaculture products are filling the gap that the fisheries can no longer provide, so they are not competitors, not antagonistics. They are equal protagonists of this new blue era.

As customers, we like certifications. We feel more comfortable buying a certified fish, which is why more and more programs are out there. The GAA, for example, through the development

of their Best Aquaculture Practices (BAP) certification standards has become a leading standards-setting organization for aquaculture seafood.

Another program, very well known in the U.S. is the Seafood Watch program (Monterey Bay Aquarium). Their recommendations help consumers choose seafood that is fished or farmed in ways that have less impact on the environment. They even offer pocket-sized guides and an app with the latest recommendations.

Another trendy program is the one offered by the Aquaculture Stewardship Council (ASC), which certifies environmentally and socially responsible seafood. Together with scientists, conservation groups, NGOs, aquaculture producers, seafood processors, retail and food service companies and consumers, ASC encourages responsible aquaculture in order to transform the world’s seafood markets and to promote the best environmental and social aquaculture performance.

The Food and Agriculture Organiza -

tion (FAO) recognizes at least 30 certification programs and eight key international agreements relevant to aquaculture certification. There are also nine initiatives identified addressing sustainability issues and creating a framework for differentiating sources of aquatic products in this respect.

Circular economy, sustainability, efficiency, eco-designing – these are popular tags we use for our business, believing that this would make us successful. I admit that the language is important but there is more to this.

The daily basic actions are the ones that define ourselves and our businesses. The companies and employees who be -

lieve in this industry should go beyond the office walls and talk more about fish. Who has not ended up queuing or waiting to be served in the supermarket and talked about how the fish looks, where they come from and what they eat? I do this every time I can.

I do it on purpose, with a purpose. I ask about the origin, farmed or not. You can create a conversation where you can discuss and know more about consumer opinion. And that is what we need to know – what they think about the aquaculture industry, what their concerns are and how we can improve to make them feel comfortable purchasing farmed seafood.

Certification is needed, traceability is a must, but we also need to talk more with consumers in the place where they buy the fish. Supermarkets, restaurants, festivals and food-trucks are the places where we need to be. Customers will begin to feel confidence if we speak in an informal language, face to face, without technical or complicated terms.

By Jennifer Brown

Is it possible to produce salmon in the desert? In the 2011 movie, Salmon Fishing in the Yemen , actor Ewan McGregor played Dr. Alfred Jones, a fisheries scientist challenged to help fulfill the wish of a Yemen sheik to bring sport fishing to the southern end of the Arabian Peninsula.

Enjoying a fresh fish that didn’t come shipped from Scotland may seem like something out of a Hollywood fantasy, but through the application of recirculating aquaculture systems (RAS), the dream of locally produced salmon has become a reality in Dubai.

About 92 percent of all fish products

consumed in the United Arab Emirates are imported. With the increasing global concern about food security and the general desire to have access to food that is produced more locally, it’s no surprise that those living in Dubai would want to consume fresh fish that didn’t have to be imported.

“We’re trying to make inroads into the 92 percent of imported fish as part of the government’s pledge for food security in the UAE and trying to do it in the most sustainable way possible,” says Nigel Lewis, aquaculture development manager at Fish Farm in Dubai. “When it comes to salmon and other species that are not endemic here, you have to have environmentally-controlled conditions. The only way to do that is RAS. If you put a salmon in a cage here, it will just die within seconds. The temperature is such that even in winter, it’s way above the lethal upper temperature. They will die.”

Producing salmon in the desert is the vision of Sheik Hamdan, Crown Prince of Dubai and Bader Bin Mubarak, the CEO of Fish Farm LLC. Through RAS, they are producing salmon and other species such as king fish, royal sea bream, and seabass on land in Jebel Ali, just outside Dubai.

Two years ago, the facility received

salmon eggs from a hatchery in North West Scotland. Using seawater from the Persian Gulf, the RAS system cools the water to the required temperature for salmon to thrive.

“About three percent of the total [water] needs of the system are brought from the sea, and the other 97 percent is supplied by the recirculation component of the system,” says Lewis. “Then we chill the water quite dramatically for the salmon, sometimes from 30 degrees C in the sea in the summer to 15 degrees C in the RAS system itself. The other species’ temperature is not as critical and runs anywhere from 24 to 28 degrees C.”

The salmon live the first year in fresh water and eventually become smolt. The eggs hatch and the small fish grow in freshwater until they are about 100 to 200 grams in size. They are then transported into saltwater. When salmon go into smoltification, it changes the enzymes in the gills so they can survive in saltwater – if they don’t go through that stage, they will die.

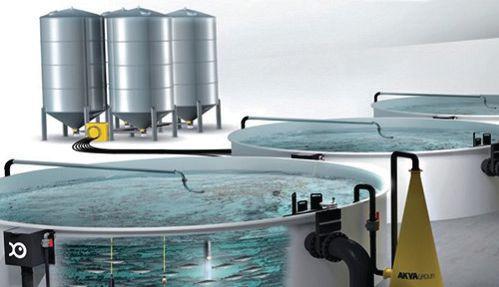

Jacob Bregnballe of AKVA Group in Denmark is a marine biologist who has helped develop and manage the RAS project at the Fish Farm LLC project. He says that to be competitive, operations such as Fish Farm LLC need to grow.

“To be competitive in this market, you should produce upwards of 1,000 tonnes per year and higher. Competitors from the caged industry would easily be producing 5,000 to 10,000 tonnes, so to be competitive, you need to be building facilities in the range of 2,000 tonnes to 5,000 tonnes up to 10,000 tonnes,” says Bregnballe.

“They [Fish Farm LLC] do have plans to expand. In any kind of new business, there are first movers, and they gain a lot of knowledge, and when they then expand, they know much more than others going into the business,” he says.

At the Fish Farm facility, in addition to salmon, they also produce sea bass and king fish, which grows rapidly in the controlled conditions.

“European sea bass is produced in Europe in large quantities, but there is difficulty getting them to a large size because of the winters the Mediterranean region have, during which the sea bass and sea bream don’t grow.

“Because we can control the environment here, we grow them to a large size in about half the time it would take in the Mediterranean, so we’re producing something other people can’t produce,” he says.

“And salmon in the desert – nobody has done it really, and the response to the fish has been good. Everybody is happy to buy UAE locally-produced salmon.”

Fish Farm also has cage farms located in Dibba Al-Fujairah on the Gulf of Oman, and a hatchery in Umm al-Quwainand. The company will soon have two additional hatcheries as it takes over former government-run facilities. The government had two hatcheries for restocking aimed at greater sustainability and protecting the local fishery, which was under threat.

“They wanted to do something with the hatcheries, so they did the study and found a commercial hatchery producing juveniles for fish farms was the way to go because that indirectly protects the environment by reducing fishing pressure,”

says Lewis. “We’ve now taken that on as a private-public partnership.”

The RAS is a component of that integrated project. In the RAS system itself at Fish Farm LLC, there are 15 people working on site.

“We have done the proof of concept and have a good product and good prices in the market, and want to maximize that through expansion,” he says.

There are 34 tanks at the facility, with four used for producing salmon and the balance to produce king fish, European sea bass and sea bream. The goal is to produce 10,000 to 15,000 kilograms of salmon each month. Right now, the total output is annually about 100 tonnes.

“The larger facility is for Atlantic salmon where we have about 200 tonnes capacity and altogether about 300 to 400 tonnes,” says Lewis.

“The challenge is in finding juveniles from across the world and transporting them successfully to the UAE.”

There are two buildings at the location, one that contains three independent RAS systems with about 30 tonnes of capacity.

Most of the employees at the facility are trained in-house, and have aquaculture skills and some rudimentary RAS skills. AKVA has trained the staff onsite as the operation has progressed.

Lewis says it’s an “inevitability” there will be greater interest in RAS systems for the production of salmon and other species because cage farms still have many issues to overcome, such as parasites and where the effluent from the fish farms goes into the sea.

“I do appreciate that a well-positioned cage farm doesn’t have a great environmental impact on the environment. However, there are other things such as sea lice. RAS systems eliminate all those weaknesses in the process,” he says. “But you don’t want to produce sea bream in a RAS system there or anywhere else because you have to be able to compete on cost of production.”

Adsorptech Pg. 28

Advanced Aquacultural Technologies Inc. Pg. 22

Alltech, Inc. Pg. 14, 15

Aquacare Environment Inc. Pg. 19

Aqua Logic Inc. Pg. 13

AquaMaof Aquaculture Technologies, Ltd. Pg. 2

Aquatic Enterprises, Inc. Pg. 29

Aquatic Equipment & Design Inc. Pg. 29

Aqua Ultraviolet Pg. 32

Benchmark Instrumentation & Analytical Services Pg. 31

Billund Aquakulturservice A/S Pg. 5

Biomar A/S Pg. 17

CM Aqua Technologies Pg. 28

Cornell University Pg. 23

Feeding Systems SL Pg. 18

Fresh By Design Pg. 27

Hatchery International Pg. 9, 11, 20

HTH AquaMetrics Pg. 16

IBIS Group Pg. 8

Integrated Aqua Systems Inc. Pg. 12

OxyGuard International Pg. 6

PR Aqua, ULC Pg. 25

Pure Aquatics Pg. 10

Reed Mariculture Inc. Pg. 24

Reef Industries, Inc. Pg. 24

RK2 Systems Inc. Pg. 25

Silk Stevens Pg. 29

Stofnfiskur h.f Pg. 21

Syndel Pg. 27

Wenger Manufacturing Pg. 7

Go for all-female populations to reduce maturation and optimize your production output

Check out our new product range SalmoRAS4+ and SalmoRAS4+IPN, optimized for full-cycle salmon farming in land-based RAS-system. Both products have All-female (only female populations) as standard and are highly selected for strong growth. Triploid is an additional optional treatment that makes the females sterile, resulting in zero maturation. That is what we call Girl Power!

Find out more at www.stofnfiskur.is/products or contact: Róbert Rúnarsson Sales Manager +354 693 6323 robert.runarsson@bmkgenetics.com

By Bonnie Waycott

Thanks to its affordability and high fat content, salmon is becoming increasingly popular in Japan. In 2017, it was ranked the country’s favorite sushi topping for the sixth consecutive year by the seafood firm Maruha Nichiro.

Japan’s commercial salmon market is supported by large-volume imports from countries like Norway and Chile, but to capitalize on the popularity of salmon, regions in Japan have been vying to produce the species themselves. Now, these efforts are beginning to bear fruit with new RAS projects across the country.

Land-based production systems have various advantages – they treat and re-use water, typically use bio-filtration to reduce ammonia toxicity and can be sited closer to urban consumption areas, making it possible to lower transporta -

tion costs and distribute fresh produce. In Japan, RAS is advantageous for another reason. Farming salmon offshore is difficult due to high water temperatures in the summer. This restricts offshore salmon farming to the winter months and farmed salmon must be imported from colder climates.

Tetsuro Sogo, chief operating officer at FRD Japan in Saitama Prefecture north of Tokyo, is tapping into the potential of farming salmon inland. He hopes that his work will lead to cost-effective, landbased farming and homegrown salmon for the Japanese consumers.

“The global demand for seafood has been rising each year, and aquaculture has expanded vastly over the last 30 to 40 years to meet it,” he says. “The global

population is currently around seven billion. If it reaches 10 billion in 40 years’ time, naturally, the global demand for seafood will keep rising. But it’s impossible to farm certain fish at sea now. Salmon farming, for example, is mainly done in Chile and Norway, but even in those countries, only a few new licences are being issued for aquaculture because the sea is already full of cages. Put simply, supply is not catching up with growing demand.”

FRD Japan uses advanced bacteria-based filtration technology to cycle artificial seawater – tap water and added salt – through a closed containment environment. A two-stage filtration device then uses bacteria to break down any build up of ammonia into nitrogen gas, while a separate denitrification tank deoxidizes these nitrates and releases harmless nitrogen from the water.

One advantage of this system is that it stops the entry of bacteria and viruses in seawater that are often the cause of disease, and can be set up anywhere with a tap water source. It also keeps the water temperature steady at 15 degrees celsius, maintaining low electricity costs.

“Salmon farming needs cold water of under 15 degrees celsius,” says Sogo. “If your site is in Asia and the seawater is 30 degrees celsius, you need to chill it and this can incur high electricity costs. This is a huge issue for conventional RAS but we can save on costs by keeping our temperature steady.”

In the long term, Sogo believes that land-based aquaculture will develop the most in Asia, and says new innovations, such as his, will be key to an industry that must make further investments and developments to meet demand and become more sustainable.

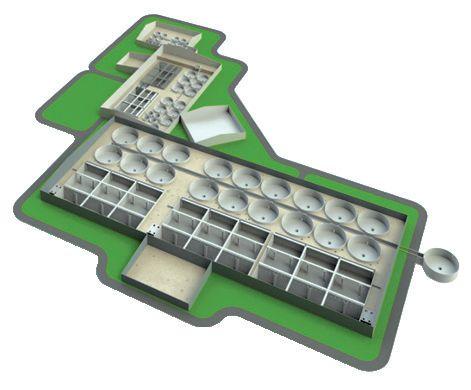

Another entrant to Japan’s RAS salmon market is Pure Salmon. The company is building a 10,000-ton-per annum facility in Japan’s Tsu City using technology from AquaMaof Aquaculture Technologies Ltd in Israel. Atlantic salmon will be produced and sold under the name, “Soul of Japan.”

Construction of the facility is expected to finish in 2021, with fully integrated processing and packaging on site to produce fillets, smoked salmon and other market-ready products.

At 137,000 square metres, it will be Asia’s largest salmon farm.

“RAS is a necessary and supportive technology to the seabased farming industry,” said Shai Silbermann, vice-president, marketing and sales at AquaMaof. “The growing awareness of healthy eating, food safety, traceability and the need for sustainable food production practices highlight RAS’s unique attribution in these domains.

“(RAS’s) technological advances have also pushed the entire seafood industry forward, achieving very good results both financially and operationally and proving that it’s a viable aquaculture discipline.”

Pure Salmon’s facility will recirculate over 99 percent of water using filtration and oxygenation systems. Multiple RAS rearing units will be housed under strict standard operating procedures to maximize growth conditions. Water entering the facility will be collected into settling pools and moved to biofilters for cleaning and treatment. It will then be recirculated back into the pools for rearing.

Eggs from Iceland will be hatched in a biosecure environment before being transferred to pools when they reach the smolt stage. Although initially smaller, the pools will become bigger as fish densities grow. The process will be replicated through all stages of the salmon lifecycle until the fish reach harvest size.

At the core of the technology is efficient power consumption, while the purity of the water will ensure the absence of disease and sea lice and negate the use of antibiotics or pesticides. Optimized feeding modes and an advanced feeding management system will enable better feed conversion ratios (FCR) and operational costs. Automated sensors will measure, observe

and monitor key parameters such as water and temperature. The technology is designed to closely replicate the positive qualities of a salmon’s natural environment.

Erol Emed, Soul of Japan’s CEO, says that establishing a RAS facility in Japan has various benefits.

“It’s a highly advanced country with great infrastructure when it comes to electricity, water and water discharge,” he says, referring to the continuous power supply needs of RAS facilities.

Japan’s strong fish culture and taste for raw fish also haven’t gone unnoticed.

“The Japanese consume roughly 400,000 tonnes of salmon annually and import about 250,000 to 300,000 tonnes. They also understand its good quality.”

Emed says the promise of locally produced premium salmon has caught the interest of customers in the Japanese market, who have been positive, receptive and supportive. Operating to best practice standards and demonstrating

that sustainability is taken seriously, Pure Salmon is aiming to provide safe, environmentally friendly fish.

“In 2018, the marine industry took a big hit from parasitic anisakis, the number one cause of food poisoning,” he says. “Consumers shunned fish because of that. We’re offering a healthy product that’s a highly valued commodity if your target consumers eat fish raw.”

Last year, Soul of Japan signed a distribution agreement with Itochu, one of Japan’s largest trading houses, for a period of six years – a deal that could be worth US$1.2 billion at today’s retail prices.

“Itochu knows there is a 10-year deep wave in the making here, which will favour Atlantic salmon. Supply reliability is key,” says Emed, referring to salmon’s increasing popularity among Japanese consumers. “Open net farming is prone to parasites, uses antibiotics and can be unreliable, while we can deliver healthy fish, and guarantee supply.”

Soul of Japan’s fully integrated processing factory will also conduct pre-rigor processing. The difference in taste will be

significant for those who eat fish raw.

“We already have great FCRs, low mortality and a biosecure environment,” said Emed. “Now we’re looking at improving what we already have – high quality – so producing an even better

taste, making our feed fit the RAS environment, and improving fat content and overall wellness of the fish. The happier and better the fish, the better the taste and, of course, this is better for customers and the environment.”

By Mari-Len De Guzman

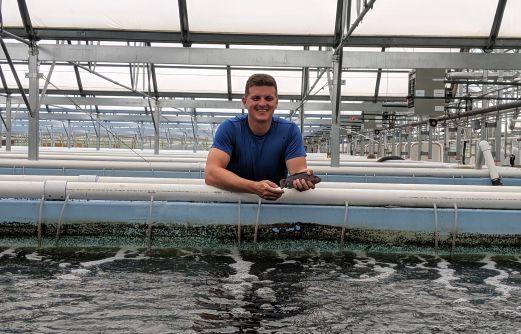

Twenty-eight-year-old Joe Sweeney comes from a family of farmers. He knows a thing or two about raising cattle, horses, pigs, and growing corn and soybeans. Today, he’s raising a different kind of livestock – tilapia (Oreochromis niloticus) – and he’s doing it in the middle of rural Iowa, in the U.S. Midwest.

“We started Eagle’s Catch in 2016,” says the young CEO. “We’ve built one of the largest indoor fish farms in the country. Previously, folks on our team have built or managed five farms across the country, so we are taking a lot of the lessons that we’ve learned in building, raising tilapia and selling tilapia and applying it to Eagle’s Catch.”

The farm, which sits on nearly four acres of greenhouse-covered land, shipped its first batch of harvest in 2019. This year, Eagle’s Catch is looking to expand its operations and increase output to three million pounds of harvest-size tilapia per year, shipping them domestically to as far away as New York.

“Indoor fish farm is really the best approach for us. We are able to produce fish consistently on a year-round basis, and be able to service our customers to the highest degree of quality and consistency possible,” Sweeney says.

Iowa’s agricultural history is vast. The state is well-known as a major producer of food commodities and recognized globally for cutting-edge food production technologies. Among its major produce include soybeans, corn, cattle, pork and eggs. Farming tilapia alongside some of the biggest sources of protein products and run by the most experienced agricultural producers seem to make sense – especially to Eagle’s Catch’s early investors.

“We are pretty fortunate that our investors are primarily Iowa farmers or folks that are once-removed from farming. They understand the need for diversification and they understand the need for growing our ability to produce animal protein,” Sweeney says.

The market for tilapia in the U.S. is dominated by imports, with China and Taiwan as the primary source of these imports. Only about five percent of tilapia sold in the U.S. are produced domestically, according to aquaculture network resource site Aquatic Network.

The ongoing U.S.-China trade conflict, which led to a 25-percent tariff on Chinese imports, has lessened China’s competitiveness as supplier to the U.S. According to the Food and Agriculture Organization of the United Nations, tilapia imports have been one of the most heavily affected by the tariffs that began in 2018. These market forces and the strong sustainability story of farming aquatic species on land, closer to the market and with reduced environmental footprint – all make a good business case for a commercial RAS farm.

The choice to farm tilapia on land was not a difficult one for Sweeney and his partners. It has a long history as a farmed species, high consumer awareness and acceptance with its generally mild flavour, and a relatively short production cycle – it only takes between seven and nine months for them to reach harvest size of about 1.5 to 2 lbs. There is also the potential for increasing domestic production and relying less heavily on imports to supply the increasing domestic market demand.

“The reason why we are looking at recirculating aquaculture system is we are producing tilapia,” explains Sweeney. “They’re not going to survive in Iowa winter (with traditional farming). In many cases, people are worried about escapees. If fish escape our facility – which they physically are unable to – there is no way they would survive in our natural environment. Indoor fish farm is really the best approach for us.”

Eagle’s Catch’s RAS farm is located in Ellsworth, Iowa, with a population of just over 500 people. The facility sources its water from a 30-year old well. Sweeney says his team decided to tap into an existing well rather than dig a new one to ensure the best and most consistent water conditions.

“In Iowa we are very, very fortunate to have a large quantity of water as well as quality water. One of the lessons that we learned was to not dig a new well, because the water quality can be highly variable

especially in those first years of operation. So, we said we needed to use an old well so we moved in with the city of Ellsworth, Iowa,” Sweeney explains.

The system runs somewhere between two and three million gallons of water at any given time. As much as 99 percent of the water is recirculated and re-used. Iowa’s groundwater is naturally cold and contains a high amount of iron, Sweeney explains. With tilapia being a warm water species, the water needs to be warmed, and the iron stripped from it before it enters the tanks.

The farm has been built in a greenhouse infrastructure. Sweeney says the greenhouse proved more effective than an enclosed, concrete, indoor RAS farm.

That decision came about as a lesson from a past experience. “Previously I built a farm close to there and we built it in a different type of structure, and we had all sorts of moisture issues. And we knew that there was no way to really contain those moisture issues and we arrived at deciding to move into a greenhouse,” Sweeney says.

The greenhouse was also ideal for other reasons, he adds. For instance, it’s cheaper to build, on a per-square-foot basis. It is also a lot faster to build. The ability to harness natural light and natural heat in a greenhouse is also an advantage, particularly for a warm water species like tilapia.

“If you look at the heating and infrastructure needs across the years, across the seasons, the couple of months out of

the year where we’re dumping heat into that greenhouse system, but as a yearlong average it’s actually beneficial to us to have it in a greenhouse versus a more tightly controlled building,” the Eagle’s Catch chief executive says.

The facility uses raceway tanks, which was developed with a number of aquaculture and technology experts, Sweeney says. He adds the raceway tanks made sense for them – over circular tanks – as

it better optimizes square footage in the space, and they just find it provides easier access for fish handling.

Around 24 raceway tanks are currently in operation, with each tank containing about 52,000 gallons of water. At full capacity, the RAS farm will be operating 48 raceway tanks with capacity to produce up to five million pounds of tilapia, according to Sweeney.

“A large part of our focus is just making sure that our systems have decreased any production risks possible by removing any moving parts. And it’s a mentality shift for us to consider every moving part now as a failure point and maintaining a very, very low amount of failure points and building multiple redundancies into each of those failure points to reduce any production risks that we may be exposed to,” he says.

Nearly 40 percent of Iowa’s net electricity generation comes from renewable sources, and most of it is from wind

energy. Eagle’s Catch benefits from the state’s renewable energy source allowing it to have lower energy cost in its operations.

“We’re also close to major energy hubs there in North Dakota and other places. So from an electricity standpoint we are very, very competitive in our area, and we’re fortunate to be able to draw onto that. That’s a major strength for Iowa and for our company,” Sweeney says.

The farm’s biggest expense comes from feed. More than 60 percent of Eagle Catch’s production cost comes from feed, and 10 percent of this cost is incurred from transporting the feeds from the feed mills to the Iowa farm.

Sweeney wants to see feed manufacturers consider Iowa and the U.S. Midwest as a location for expansion, which would help fish farmers significantly lower its costs.

“We want to make sure we’re getting the best nutrition (for the fish), and we are highly encouraging each of these feed companies to seriously consider the Midwest as a source for growth because we make all the ingredients right there in Iowa. We are major producers of a lot of commodities and a lot of animal agriculture and grain agriculture. We want to be able to draw on the things that we’re already doing in Iowa and grow that,” Sweeney says.

Having successfully completed its first harvest in 2019, Sweeney says the focus now is to scale. The company hopes to expand its operations and reach its RAS facility’s full capacity of running 48 raceway tanks and producing five million pounds of tilapia per year.

The farm currently buys its tilapia fingerlings from AmeriCulture in New Mexico, U.S.A. Sweeney says there are no immediate plans to establish a hatchery for Eagle’s Catch, but he is not discounting the possibility, either.

“Anybody that scales is going to have to think about that someday, but we want to make sure that we’ve got the right partnerships from a genetics perspective,” Sweeney says. “As we look at the future of the aquaculture industry and the things that we can do applying modern breeding practices – much like AmeriCulture as well as other various institutions in aquaculture have done – we think there’s a lot of opportunity there. We want to make sure that we’re working with the best of the best in terms of developing the genetic potential of not only tilapia but many other species.”

Customized for your fish farm, hatchery or research operation! Our Commercial LSS Packages are custom engineered to meet your specific needs.

• Marine and Freshwater

• Mechanical filtration

• Chemical filtration

• Ultraviolet disinfection

• NEMA enclosed controls

• Bio-filter towers

• De-gassing towers

• Wide variety of flow rates

• Flow control valves

• Protein skimmers

• Variable frequency-drive pumps

• Temperature management

Intensive RAS offer the advantage of providing an optimized environment for the fish. However, water quality conditions in RAS will deteriorate due to failing equipment, deferred maintenance or cleaning schedules, or improper management. Basic troubleshooting knowledge can help correct water quality issues in a timely manner.

Measure and monitor water flow rates and adjust. Reduced flow rates through oxygenation unit processes will result in lower than expected dissolved oxygen delivery to fish culture tanks. Valves and/or pump speeds should be adjusted to achieve design flows or replace failing pumps.

Check liquid levels in liquid oxygen tanks or percent gas phase from oxygen generators product gas daily. If liquid oxygen supply tanks are emptying or under-delivering, oxygen cannot be transferred to the water. Have the supply tanks refilled immediately or service generator equipment.

Confirm that gas flow is unobstructed. A closed valve or clogged supply line, especially at the entry of oxygenation unit processes, can prevent or impede oxygen gas flow. Confirm solenoid valves are functioning properly and clean supply lines as needed.

Check for clogged unit process distribution plates. Water overflowing an oxygenation unit process will dilute dissolved oxygen concentrations downstream of the unit process. Clean entries to these unit processes and clear obstructions from any distribution plate holes to ensure the full flow or entire design flow is being treated.

Measure and monitor water flow rates and adjust. Reduced flow rates will result in higher than expected carbon dioxide return to the fish culture tanks. Valves and/or pump speeds should be adjusted to achieve design flows or replace failing pumps.

Check fan or blower performance. A failed or underperforming fan reduces the

gas to liquid ratio in the CO2 stripper and reduces removal. Replace the underperforming fan or blower.

Confirm stripper media is not clogged. Clogged media can cause water to pool in a stripping tower and prevent blown air from exiting a stripping tower. Clean or replace the media to allow unrestricted water flow through the column.

Check that outside exhaust vents are un-

restricted. Blocked exhaust vents can impede air flow through a stripping tower similarly to pooling water. Open any valves or clear obstructions to achieve full air flow.

Check and reduce ambient air CO2 concentrations. Ambient inside air with high gas-phase CO2 concentrations results in a lower concentration gradient than outside air and could reduce removal efficiency when inside air levels rise. Measure CO2 concentrations in the air and increase building ventilation, if necessary.

Monitor and adjust alkalinity. Nitrification within the RAS biofilter consumes alkalinity. Alkalinity needs to be replenished in tight systems by the addition of sodium bicarbonate or another source to maintain alkalinity greater than 100 mg/L as CaCO3.

If alkalinity is low, add approximately 0.25 kgs of sodium bicarbonate per kilogram of feed to maintain alkalinity and adjust future dosing to meet the system’s specific needs.

Confirm biofilter media levels. Insufficient amounts of media in the biofilter will

not provide enough surface area to “house” a bacterial population needed for adequate nitrification. Measure the static media bed height. Add additional media, if necessary. Correct “dead spots” or hardened sand in the biofilter. Unagitated or unfluidized media in a biofilter can become anoxic, killing established nitrifying bacteria and reducing the total surface area available. Adjust blower plate position and output to agitate all areas of the filter or break-up hard media with a long-handled brush.

Monitor and correct culture tank hydraulics. Water in a circular culture tank should have enough rotational velocity to concentrate solids to the middle bottom drain of the tank for quick and easy removal from the tank. Measure inlet and bottom drain flow rates and make corrections as needed. The orientation and velocity of the inlet water may need to be adjusted to create the rotation desired. Increase velocity by reducing the size and/or number of holes in the inlet. Check for proper solids filter operation. Backwash cycles should be running properly and directing solids to the correct drains or lift stations. Automatic drains should be activating on schedule and removing solids. Correct abnormal filter operations and confirm solids are exiting the system.

Look for holes or tears on filter seals or media screens. Holes in filter media screens will allow solids to pass mechanical filters and can reduce or prevent proper backwash cycles from removing solids from the RAS. Replace any worn screens or plug any holes. Replace any leaky or worn seals.

Flush drain lines to clear collected solids. Flushing collected solids away from the system ensures that they cannot reenter the system water column. Regularly flushing drain lines also helps maintain appropriate flow rates by eliminating potential restrictions. Open sump bottom drain valves or pull standpipes until the water runs clear.

For more information about depuration visit FreshwaterInstitute.org.