By Mari-Len De Guzman

This fall will mark an important milestone that can potentially offer some indication of the future of land-based aquaculture.

The much-anticipated first commercial salmon harvest at Atlantic Sapphire’s Bluehouse facility in Homestead, Florida, is expected to take place this fall. According to recent media statements from the company, it is on track to achieve its planned 10,000-metricton annual harvest volume beginning in the third quarter of 2020.

Also awaiting first commercial output later this year is AquaBounty’s RASraised AquAdvantage salmon, the industry’s first genetically engineered salmon to be sold commercially. This fish is being raised exclusively on land at AquaBounty’s RAS farms in Indiana in the U.S., and in Prince Edward Island, Canada. According to the company, the first commercial batch of AquAdvantage salmon will be harvested in Indiana in the fourth quarter, and then in Prince Edward Island by the beginning of 2021.

If all goes according to plan, the U.S. market will see a significant increase in sales of fresh salmon raised exclusively on land before the end of the year. It is a significant development in this emerging sector of aquaculture. It is also one that is certain to get significant attention from all corners of the industry as well as the investor community.

While this is an important development, it’s worthwhile to note that this is not the first time RAS-grown fish will be sold in the market. In recent years,

we’ve seen a steady flow of fish produced in land-based, recirculation facilities make their way to consumer’s dining tables, and not just Atlantic salmon but also other high-value species like branzino, yellowtail, pompano and steelhead. For the most part, these landbased producers that were ‘first to market’ are painting a bright picture for RAS and the potential for profitability. While they are on a scale much smaller than where Atlantic Sapphire will operate in, these smaller RAS producers have paved the way for the entry of the bigger players. Some of these companies are scaling up their production capacity. The Netherlands’ Kingfish Zeeland, for example, is building a U.S. RAS facility in an attempt to produce and sell Seriola lalandi to the North American market.

As more RAS-grown fish proliferate in the market the need to get consumers interested and buying into the RAS sustainability story becomes a critical component of market success. We’ve all heard market analysts say that 21st century consumers are increasingly becoming interested in the sustainability story of the products they buy and will likely show their appreciation of companies’ sustainability efforts through their wallets. Marketing and and consumer engagement will be critical to the success of RAS-raised fish on the market.

The designers of the technoloy, the investors and the producers are onboard; now all we need are the consumers to hop on because the best part of this journey is about to begin.

www.rastechmagazine.com

Editor Mari-Len De Guzman 289-259-1408 mdeguzman@annexbusinessmedia.com

Associate Editor Jean Ko Din 437-990-1107 jkodin@annexbusinessmedia.com

Advertising Manager Jeremy Thain 250-474-3982 jthain@annexbusinessmedia.com

Media Designer Jaime Ratcliffe 519-429-5191 ext 4191 jratcliffe@annexbusinessmedia.com

Account Coordinator Morgen Balch 519-429-5183 mbalch@annexbusinessmedia.com

Circulation Manager Urszula Grzyb 416-442-5600 ext 3537 ugrzyb@annexbusinessmedia.com

Group Publisher Todd Humber thumber@annexbusinessmedia.com

COO Scott Jamieson sjamieson@annexbusinessmedia.com

Printed in Canada

SUBSCRIPTION

RAStech is published as a supplement to Hatchery International and Aquaculture North America.

CIRCULATION

email: blao@annexbusinesmedia.com Tel: 416.442-5600 ext 3552 Fax: 416.510.6875 (main) 416.442-2191 Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

Occasionally, RAStech will mail information on behalf of industry related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Annex Privacy Office privacy@annexbusinessmedia.com Tel: 800.668.2374

No part of the editorial content of this publication may be reprinted without the publisher’s written permission © 2020 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

Andfjord Salmon debuted at the Oslo stock market last June with an estimated value of $230 million, strengthening the company’s plans to build a giant land-based seawater farm in Kvalnes, Norway.

The Norwegian aquaculture company was the first to ring the bell at the Merkur Market since the market shutdown in March due to the coronavirus outbreak, according to the media outlet E24. Prior to its stock market debut, Andfjord has raised $15.6 million in share issue.

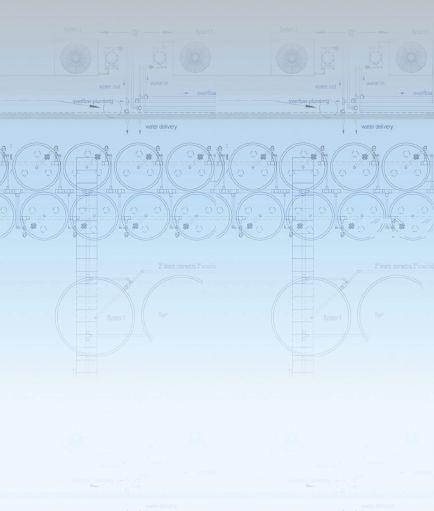

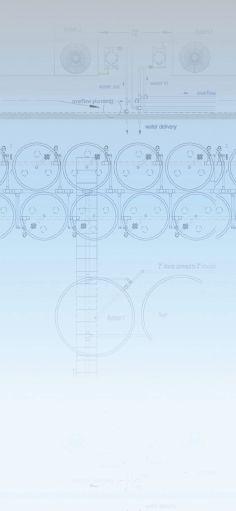

Andfjord Salmon has obtained a licence to produce 10,000 metric tons of salmon annually at Andoya. The sixyear-old company said the project, which involves the construction of large pool pits below sea level in quarries in Andøya Island, is more than 60 percent completed. Andøya is the northernmost island in the Vesterålen archipelago, situated about 300 kilometres inside the Arctic circle.

Plans for the facility calls for the construction of 11 seawater flow-through pools. Each pool has a volume of 35,000 cubic meters measuring 45 by 40 by 20 meters. Seawater inlets are located at 160 meters for the winter and 30 meters for the summer. The company hopes to produce 1,000 tons of salmon by the second half of 2020.

Rearing horseshoe crab in RAS is showing some great benefits to both sustainability and the supply of an important resource for the medical field. Read this story online at rastechmagazine. com

Land-based salmon farming company AquaBounty Technologies Inc. has begun commercial-scale harvest at its Atlantic salmon farm in Indiana, U.S.A.

With this harvest of conventional Atlantic salmon underway, AquaBounty is gearing up for the first commercial harvest of its proprietary, genetically engineered AquAdvantage salmon in the fourth quarter of 2020 at the Indiana farm.

The recirculating aquaculture system (RAS) facility is the company’s first farm in the United States.

The successful harvest, the company said, validates its RAS technology as an efficient and sustainable model for raising Atlantic salmon.

“As the global population increases, we are seeking better ways to efficiently feed a hungry world with a sustainable source of nutritious food,” said AquaBounty’s CEO Sylvia Wulf. “Land-based aquaculture is a reliable method for supplying fresh and healthy salmon. This harvest is the result of

AquaBounty’s almost 30 years of experience in aquaculture and demonstrates our expertise in raising Atlantic salmon.”

AquaBounty is known for developing the first genetically modified (GM) salmon. The company’s AquAdvantage salmon is based on a single, specific molecular modification in fish. The modification results in more rapid growth in early development compared to conventional salmon.

The company raises its GM salmon exclusively in RAS farms in Indiana and Rollo Bay, Prince Edward Island, Canada.

The planned GM salmon harvest in Indiana “will be followed by the first harvest of AquAdvantage salmon at its Canada-based, Prince Edward Island Farm in the first quarter of 2021,” a company press release said. “AquaBounty currently is the first and only provider of genetically engineered Atlantic salmon approved by the U.S. Food and Drug Administration and Health Canada.”

Ireland’s Marine Institute is looking into the viability of employing recirculating aquaculture system (RAS) to raise salmon during its freshwater phase.

The state agency responsible for marine research, technology development and innovation in Ireland has installed a new freshwater RAS at the institute’s Newport Research Facility in Co Mayo.

The four-year research project, SALMSON smolt, is investigating the potential of RAS technology to produce larger Atlantic salmon pre-smolts, according to a recent post in the institute’s website.

The project is funded under the European

Maritime and Fisheries Fund Knowledge Gateway Programme and is administered by Bord Iascaigh Mhara (BIM).

“The aim is to produce smolts that are more robust and also reduce the grow-out time at sea to one year.”

Atlantic salmon eggs are laid in fast flowing, rivers. After one to three years the fish reach smolt stage and swim downstream to begin their journey to the sea.

Salmon farming methods simulate the freshwater stage. Early production begins in freshwater facilities for up to one year. After that, salmon smolts are moved to seabased rearing pens for up to 18 months.

“In many ways, Atlantic salmon farming has incorporated a range of technological advances. However, the production model in Ireland is still based on traditional methods,” said Neil Ruane, aquaculture manager at the Marine Institute.

“The adoption of new technologies and innovations will be vital for Ireland to remain competitive and reinforce our position as a producer of quality, organic farmed Atlantic salmon.”

Numerous countries are now using RAS during the freshwater stage of Atlantic salmon farming. RAS enables operators to control critical parameters such as water temperature and oxygen levels. It has helped producers raise larger smolts and reduce the length of time fish must spend in the sea.

The Marine Institute’s RAS consists of eight 5.5-cubic-meter tanks with a capacity of 44,000 litres.

The litres can produce up to 12,000 Atlantic salmon pre-smolts at a time.

Researchers will observe the performance of the smolts after they are transferred to sea and will be compared with smolts grown in conventional flow-through tanks.

- NESTOR ARELLANO

Wenger innovative extrusion solutions deliver clean, durable, nutritional feeds specifically designed for the most e cient RAS operations. Feeds produced on Wenger systems maintain their integrity better and longer, for clean and clear water. So you feed the fish, not the filter.

Learn more about the Wenger RAS advantage. Email us at aquafeed@wenger.com today.

An alliance of First Nations leaders is calling for an immediate end to open net salmon farming in the waters of British Columbia and the adoption of land-based aquaculture.

Sea lice infestation from net pen farms are destroying wild salmon stocks, according to the First Nations Leadership Council (FNLC), which includes executives of the B.C. Assembly of First Nations, First Nations Summit and the Union of BC Indian Chiefs.

“We’ve been watching wild Pacific salmon slowly go extinct for decades. While it may take more time to tackle climate change or change how we conduct forestry operations in the province, we know for certain that moving salmon farming onto land in closed pens will have a positive impact on salmon populations. Now we just need to make it happen,” said Robert Phillips, a First Nations Summit political executive.

Last October, Prime Minister Justin Trudeau unveiled his plans for “Canada’s firstever Aquaculture Act,” which spelled out the Liberal’s agenda to replace net pens in B.C. with land-based farms in the next six years.

The alliance cited a report by aquaculture companies, Mowi, Cermaq and Grieg, which indicated that as many as 35 percent of salmon farms in the B.C. coast were found to exceed federal government sea lice limits.

The FNLC also cited an independent study by marine biologist Alexandra Morton that found 94 percent of sampled juvenile salmon migrating through Discovery Island were infected with sea lice.

“The federal and provincial governments have been taking a piecemeal approach to this problem, with long timeframes for transition to closed containment pens, and only in a few places,” said Terry Teege,

regional chief of the British Columbia Assembly of First Nations.

Salmon is central to First Nations cultures and economies in much of British Columbia. Salmon stocks have steadily declined at an alarming rate, leaving some runs functionally extinct, the First Nations leaders said.

A variety of factors are responsible for the drop in salmon stocks, including overfishing, climate change, sediment from industrial forestry, natural disasters such as the 2019 Big Bar landslide, the introduction of pathogens, and hazardous levels of sea lice.

“We need a collaborative, cooperative transition to land-based containment with First Nations leading in order to conserve and protect the species vital to our communities,” said Chief Dalton Silver, Sumas First Nation and Union of BC Indian Chiefs Fisheries representative.

Siemens AB is providing the digital technology that will enable Quality Salmon to build and operate a 140-hectare land-based salmon farm in western Sweden.

The German industrial group signed a letter of intent in June with the Swedish aquaculture company and the municipality of Sotenäs to “deliver tomorrow’s digital enterprise to the building of Europe’s largest blue-green industrial park for salmon farming,” a post in the Sotenäs website said.

“The fishing industry is growing and changing which requires the development and deployment of new solutions,” said Mikael Kraft, head of factory automation and digitalization at Siemens AB. “We at Siemens will be able to provide digital solutions and intelligence in the buildings and we are proud to be part of this.”

Roy W. Høiås, chief executive officer of Lighthouse Finance A/S and co-owner of Quality Salmon AB, said he was impressed with the commitment Siemens showed in pushing through the letter of intent.

“We are now facing the next phase with great humility and we look forward to presenting the other partners of the industrial park on an ongoing basis over the next two months,” Høiås said. The development closely follows an agreement signed by the Sotenäs Municipality with Quality Salmon, which allowed the aquaculture company to lease a 140-hectare land from the municipality. Quality Salmon plans to build a recirculating aquaculture system (RAS) facility that is expected to create several thousand jobs in the

Go for all-female populations to reduce maturation and optimize your production output.

Check out our new product range SalmoRAS4+ and SalmoRAS4+IPN, optimized for full-cycle salmon farming in land-based RAS-system. Both products have All-female (only female populations) as standard and are highly selected for strong growth. Triploid is an additional optional treatment that makes the females sterile, resulting in zero maturation. That is what we call Girl Power!

municipality and bring in investments worth $1.8 billion to $2.1 billion.

“We are very happy that they are participating in the establishment in Sotenäs municipality and have good faith that it will benefit us here. As previously mentioned, the municipal management is extremely positive about the opportunities that an establishment will provide for Sotenäs but also for other parts of Bohuslän,” said Mats Abrahamsson a member of the municipal council.

- NESTOR ARELLANO

Find out more at www.stofnfiskur.is/products or contact:

Róbert Rúnarsson Sales Manager +354 693 6323 robert.runarsson@bmkgenetics.com

By Maddi Badiola

Maddi Badiola, PhD, is a RAS engineer and co-founder of HTH aquaMetrics (www.HTHaqua.com) based in Getxo, Basque Country, Spain. Her specialty is energy conservation, lifecycle assessments and RAS global sustainability assessments. Email her at mbadiolamillate@gmail.com or contatct her through LinkedIn, Facebook and Instagram.

According to the Food and Agriculture Organization, it is not yet clear whether the sector will experience a quick or slow recovery once the pandemic is over. Some seafood companies may manage, and some might even benefit from the crisis. At the same time, a level of industry consolidation will occur.

In June, an impactful announcement was made by China – quarantine for imported salmon. Imported salmon was removed from supermarket shelves, as reported by the Chinese press.

It is unknown if the lineage of the virus really is European, or if the “culprit” of the regrowth is salmon or any other imported fish. What was known was that SARS-CoV-2 was detected in a table that a fishmonger used to cut salmon in Xinfadi, the largest wholesale food market in Asia, larger than the one in Wuha.

So, what is the industry’s status and how will this evolve? Let’s answer some questions and doubts.

Digital innovation, accelerated the shift towards web-based applications, online services and improved product traceability and sustainability.

The Food and Agriculture Organization (FAO) recognizes that at a local level, fishers and fish workers are adapting by changing fishing gears, targeting different species or selling their products to the domestic market – with many selling directly to the consumers. However, domestic markets have limits both in terms of demand and price.

The FAO also stated that, in the short term, possible disruptions to economies and livelihoods could come from various factors: labour shortage; direct boat-to-consumer sales; shortages in aquaculture input as well as fishing supplies ; competition for sourcing and transport services (something which is already happening in the agriculture sector); and a lack of funding and cash flow (delayed payment of past orders).

Next to biosecurity, traceability is crucial to the RAS industry.

Due to improving product quality and the rise in safety awareness in recent years, this process has been increasing in importance and spreading into a wide range of fields such as food and aquaculture. Two different concepts need to be clarified: chain traceability and/or internal traceability.

Referring specifically to the RAS industry, chain traceability means that the history from procurement of raw materials to the fish harvest, distribution, and sales can be traced forward or backward. Manufacturers can monitor where their products have been delivered, while companies and consumers downstream can understand where the products they’ve purchased come from.

This provides manufacturers the benefit of easier cause investigation and product recall when unexpected problems occur with their products. At the same time, consumers can use this as a benchmark to select highly reliable products without worries of mislabelling.

Internal traceability will monitor the movement of products within a specific area in the supply chain that is within the company. Benefits are the same: quality control and assurance.

The seafood trade is global in scope, with billions of dollars in exports. Nevertheless, substitution and mislabelling is a globally-recognised issue which warrants consumer awareness towards the safety of the products.

Tracking of the whole production chain in terms of people and their movements and management procedures, equipment, and raw materials has always been important. However, the supply chain has changed and what was important in the past has become crucial in the present.

Tracking every input and output might be tedious but fortunately, the software industry is evolving rapidly (we are not aware of the real develpment) making the tracking easier and more efficient.

By Travis May

Salmon grown in RAS often accumulate off-flavor compounds that can have significant implications to the producer’s business bottom-line.

This off-flavor is produced by a range of bacterial species in microbial biofilms, resulting in an unpleasant “earthy”

or “musty” flavor in the fillet. To mitigate the risk of off-flavored product reaching (and offending) consumers, producers can depurate or “purge” live fish prior to harvest.

During the depuration process, harvest-ready salmon are placed in a biofilm-free flow-through or partial water re-use system and taken off feed for approximately six to 14

Travis May (MBA) is aquaculture production manager at The Freshwater Institute in Shepherdstown, WV. He manages daily operations of all fish culture systems, including preventative maintenance, data collection and analysis, bioplan development and harvest logistics.

days, depending on a number of variables. Fish utilize internal energy stores to sustain them while they metabolize off-flavor compounds during this process. This, in turn, results in weight loss. The ability to quantify these losses can help producers optimize their purging process while increasing the accuracy of bioplanning and financial projections.

The Conservation Fund’s Freshwater Institute recently conducted a study to evaluate how much salmon biomass is lost over the six to 14-day purging period. Seventy-seven harvest-ready, RAS-grown Atlantic salmon (average weight of 7.38 kg), were anesthetized and injected with passive integrated transponders (PIT) for individual fish identification. Once PIT tagged, individual salmon initial weight and length data were collected and identified for Day 0 prior to purge. Salmon were then divided into two groups and stocked into two separate, biofilm-free partial re-use systems with fivecubic-meter culture tanks. Average water temperature was 13.6 °C for the duration of the experiment. The first group, comprised of 17 fish, were all removed from the tank, anesthetized and weighed before being re-

turned to the system on Days 6, 10, and 14 post-stocking. The second group of 60 fish were used to study blood loss and head-on gutted (HOG) loss over the 14-day period. On Days 0, 6, 10, and 14 post stocking, 10 fish were removed from the population, anesthetized, and humanely euthanized by a percussive stunner. Weights of each fish were collected before and after euthanization to capture blood loss, and weighed once again after the fish was eviscerated.

Salmon from Group 1 lost 4.2 percent of their initial bodyweight over the entire 14day purging period. The largest weight loss was from Day 0 to 6, when fish lost 2.1 percent of their body weight. A portion of this initial weight loss can be attributed to the excretion of waste material from the gut.

Weight loss associated with bleeding harvested fish was relatively constant at each sampling point, averaging 1.6 percent of the Day 0 initial body weight. Blood is normally discarded, but has potential to be further processed for use in the medical field. Like blood loss, weight loss from viscera re-

moval remained relatively constant over the purging period and averaged 9.9 percent of the Day 0 initial weight of the fish, accounting for 757.8 g per fish.

Producers that purge their fish for a minimum of 6 days could see as much as 13.1 percent total weight loss. If off-flavor issues remain after 6 days, and purging needs to be extended to a 10-day or 14-day period, the total weight loss increases to 14.9 percent and 15.6 percent, respectively. Producers should therefore minimize the time fish spend in depuration in order to minimize the weight lost. To accomplish this, producers need to have effective standard operating procedures for depuration, in-house quality assurance/quality control for harvested product, and an understanding of the effect that physiological and environmental factors have on off-flavor mitigation.

Weight loss from purging has a direct effect on revenue and potential profits. For example, a 10,000-metric-ton land-based RAS salmon farm that purges their fish for a sixday period every harvest, loses approximate-

ly $1.5 million per year due to product loss equivalent to 2.1 percent of biomass lost. If the farm must increase their purging period to 10 days, they will lose an additional $1.019 million per year in sellable biomass. Projections are based on the year-to-date average price per kg HOG for salmon in the 7-8 kg size class ($7.33/kg HOG).

There is still significant work to be done by researchers and producers to fully understand the impacts of purging on farm productivity and profitability. Producers should optimize their depuration procedure to strike a balance between eliminating off-flavor compounds while minimizing weight loss and, therefore, revenue loss. This requires production managers to create, test, and rigorously follow purging SOPs that eliminate off-flavor compounds as fast as possible. Additionally, researchers should seek to develop technologies that eliminate the need for purging entirely, allowing for fish to be harvested directly from the tank. Eliminating the need for purging will be beneficial to both fish and producer.

By Jean Ko Din

Lukas Havn has a specific vision for the future of aquaculture.

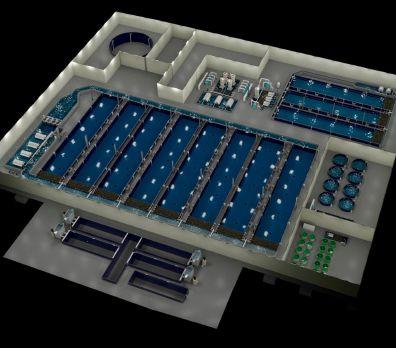

As the CEO of Vikings Label, Havn envisions what he calls “Fish City” – a 50,000-ton RAS compound sustainably producing locally-consumed fish species in the middle of a desert. The project will also include a research center, education center, a feed mill and an algae plant.

The first step of this three-year construction plan is set to begin this October with a 5,000-ton salmon RAS facility worth US$100 million. Havn says his team is looking Oman or in Saudi Arabia for the build. Both are ideal for its close proximity to the company’s Dubai headquarters, where it has been importing Norwegian salmon and other fish species since 2016.

RAStech sat down with Havn about his

company’s plans to bring Scandinavian innovation to the aquaculture market in the Middle East.

RAStech: What is your overall vision for Fish City?

Lukas Havn: I really hope it would be like the heart of modern aquaculture, not just in this region but if you take the centre of the world, Middle East is pretty much the center. We want this to be the start of a sustainable industry that can grow into anything. It can grow into vertical farming, into massive research centers, education centers. We want to build up a life around it. We want to have people actually living there and establish a life; a fully integrated and sustainable village.

RAStech: How has the pandemic affected

the project’s progression?

LH: The engineering team is in Norway and Denmark at the moment. They’re keeping up with the development of the technology remotely. We’re working with engineers here to develop the structure itself in Dubai. We’ve also had good progress on the sites, getting maps and getting reports of the water qualities. I even had a guy in Oman that was helpful enough to drive around and send me a live video. We used to have a target of starting construction in October this year. For now, we’re keeping that target. We’re also not fully funded yet but we’re getting there.

RAStech: What unique challenges do you face to make this build possible?

LH: There’s no issues building in the Middle East compared to anywhere else. Rather, I think there are some advantages. In the beginning, it all started because the market is massive and it’s growing. And when it comes to water, the temperature is not an issue at all. It consumes a lot of electricity to cool it and that’s about it. And we need much thicker insulation to keep

the cooling inside. So we had to look at really smart systems that will manage the environment efficiently. That’s why we have chosen plots where we can go pretty deep, where there’s a lower average temperature. We’re going deep into the ocean and we’ll pump directly into the facility. For the freshwater fish, we will use wells. For saltwater, we’ll use ocean saltwater. It’s actually going to be 90 percent ocean water. We are also looking into wind energy but the solid plan right now, is to adapt solar. We’re going to use as much solar as possible. We have looked at all the best solutions we could find before we look at how much it costs. We decided that we need a facility that’s going to be the best in the world and it costs what it costs, so we’ve been looking at it from that angle.

RAStech: How has the government played a role in choosing the perfect site?

LH: Especially in Oman, they are supporting us beyond what we would expect. The reason we actually ended up looking at Oman as an option is because the government brought us there. They laid out

everything; how we could cooperate with lands, facilitating the project. They’re very flexible. It gives us a very straight path to building. We don’t have to go through many hurdles to get to the construction stage. In Saudi, it’s the same. They have been helpful. It’s a bit more complicated, a bit more politics. But both of these countries have very clear targets in increasing their aquaculture production. And both have gone public with their targets, so that’s also one of the reasons.

RAStech: What’s the feedback from the local community?

LH: We always get the same questions and a little bit of skepticism about the hot temperatures, and things like that. But nothing negative. Just mostly excitement, especially because we are working on bringing in the locals, to work on the project, train them and make them a part of it. People really stand behind the government here. If the government says they want to increase aquaculture production, they get excited. They want to create a new economy in the country.

This Q&A features Thomas Epple, president/CEO and co-owner of Trivector Manufacturing and its subsidiary company, Structural Armor WRS LLC, which supplies building materials for permanent installations to the aquaculture industry.

Q: WHAT IS STRUCTURAL ARMOR WRS?

Structural Armor WRS (Water Retainment Systems) are componentized fiber reinforced composite wall systems with concrete flooring and an interior coating with a NSF / ANSI 61 compliant and PH neutral polymer. The combination of these technologies makes this product ideal for hatchery and fish farming holding tanks.

Q: WHAT IS YOUR COMPANY’S HISTORY, AND HOW DID STRUCTURAL ARMOR WRS GET INTO THE AQUACULTURE INDUSTRY?

My business partner, Tim Saxer and I have been in the manufacturing of building materials for the swimming pool industry for over 36 years. After 20 years of working for a leading manufacturer within that industry, Tim and I started our own company (Trivector Manufacturing) with the desire to develop different lines of building materials utilizing the latest technologies in design, materials and manufacturing processes. One of the products we envisioned had to be extremely strong, lightweight, non-corrosive, and resistant

to salt. Working with engineers associated with the auto industry, we jointly developed a fiber reinforced compression molded componentized product that had the same design and material specifications as the Toyota pickup truck bed. Considering the harsh use and drastically different harsh climates that Toyota pickup trucks endure, it was a perfect design and technology for our needs. At that point we added some patented features for the ease of building, and we ended up with a componentized retaining wall system with the physical properties of concrete, yet lightweight, with an easy and quick install. We started asking ourselves, where else could our product be used? We attended and displayed at the 2020 Aquaculture Show in Honolulu and that is where our vision started becoming a reality.

Q: AFTER VISITING THE 2020 AQUACULTURE SHOW IN HONOLULU, HOW DOES STRUCTURAL ARMOR WRS BENEFIT THE AQUACULTURE INDUSTRY?

The first thing we recognized is that the industry seemed to be very “techy” regarding the rearing of fish, the water

filtration systems, the fish genetics, etc. However, from the construction and building material side, there is noticeably far less attention on technology. We thought we had the right product but really didn’t understand some of the dynamics taking place within the industry, especially the RAS side of things. After talking with attendees at the show, including Jeremy Thain from RAStech magazine, we were able to get a better understanding of the newer RAS and how our product could be adopted to fill a need of quality building materials for water retainment.

Q: WHAT EXACTLY DOES STRUCTURAL ARMOR WRS OFFER TO COMBAT THE CHALLENGES IN THE AQUACULTURE INDUSTRY?

Through our research of the industry, we found a reoccurring “theme” of size and depth being restricted. Being componentized and premanufactured in a controlled setting, our retaining walls are 6’ linear to 6” linear and can be manufactured to any straight configuration and any radius configuration down to a 2’ radius. Being 42” in height, they are stackable (patented design) and in most cases, can be manufactured to be any depth needed. Being able to offer depth and any shape with our componentized fiber reinforced composites, we feel our product really raises the bar in building materials technology for the industry.

Q: ARE THERE ANY LIMITATIONS TO THE TANKS?

Yes. Our systems are permanent structures that are componentized and built on sight. They do require a concrete bottom and a concrete footing. They also can have up to 36” of the wall system exposed above ground. That’s about it. As we integrate ourselves more into the industry, I am sure we will find a project or two that will get us to get our wheels turning, but the basics of our technology is fit for the use, especially in the RAS factory setting. I view our tanks as nothing more then customized “machines” being permanently installed in a factory.

Q: HOW ARE THE TANKS WATER-PROOFED?

Actually, that is one of the best parts of the product. Another subsidiary company of ours and sister company to Structural Armor WRS LLC is Only Alpha Pool Products LLC, which was a result of our partnership with Kevin Lane at Eco Finish about 10 years ago. After a three-year R&D process where we combined both companies’ technologies, we

revolutionized that industry with our Alpha Evolution product line and are the only company that can offer a pre-manufactured componentized system with an in-thefield spray-on waterproof coating. Eco Finish has a NSF/ ANSI 61 compliant internal coating material that is available in a variety of colors. It can even have a pebble or granite look. It really is a perfect fit.

Q: HOW IS THE PRODUCT INSTALLED?

The process is quite easy. Upon request, we would design and draw the layout. We would then break that layout into individual water retaining structures, and quote per structure and total job. Upon approval and order, we would then assign an onsite project manager to the project and he/she would oversee the entire build process with the general contractor. The panels would be built to order in our factory and shipped on our trucks to the jobsite. And then, in as little as a week after the structures are built, our coating company, Evolution Coatings LLC, would arrive and coat the entire project. In the real world, it is never that easy, but outside of working with the general contractor and his contracting labor, we control the entire process from start to finish.

Q: WHAT MOST EXCITES YOU ABOUT THE AQUACULTURE INDUSTRY?

I listened to one of the first RAStech podcasts and found it very enlightening. They were explaining that the industry has a long history of R&D and that it is now scalable. They also mentioned that the raising fish for food where the population centers are the future and investment is taking notice. To me, when you have the right product for the application, have “state of the art” technology with it, and you have multiple patents on it, you have to engage it. And that is exciting.

Q: HOW CAN SOMEONE GET IN TOUCH WITH YOUR COMPANY?

You can contact Daniel Epple at d.epple@structuralarmor. com, Tim Saxer at t.saxer@structuralarmor.com, even myself at t.epple@structuralarmor.com. Visit us at 4404 Engle Ridge Drive, Fort Wayne, Indiana, 46804 or feel free to call our sister company Only Alpha Pool Products at 260637-0141. Any of us can get the process started and answer any questions you might have.

By Jennifer Brown

Food supply chain and climate change concerns are giving developers of aquaponic systems greater reason to believe their indoor operations — that bring together the production of fish and growing of vegetables under one roof — can help feed the planet.

Aquaponics has been an emerging area of environmentally sustainable food pro -

duction since the mid-1990s, as people become more concerned about how their food is produced and how far it has to travel. Proponents of the technology behind the process are seeing greater adoption. In fact, aquaponics is set to see a 12.8 percent compound annual growth rate, according to a 2019 report from Meticulous Research.

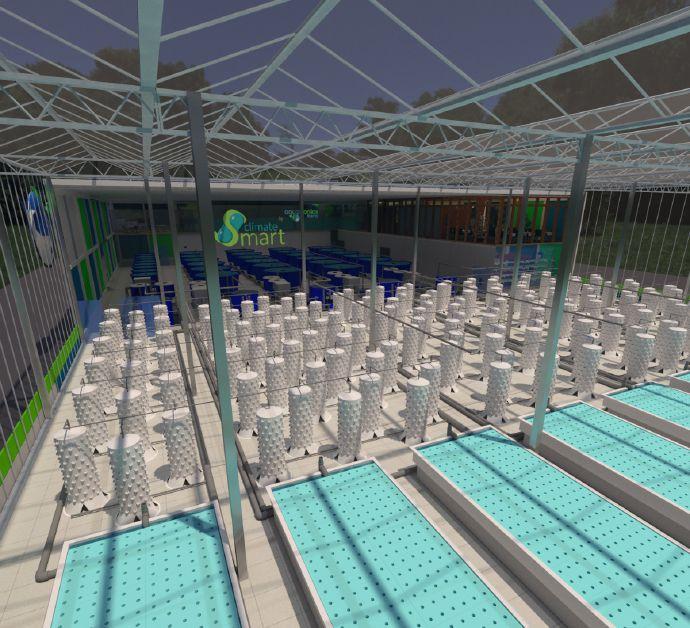

Aquaponics combines recirculating aquaculture systems (RAS) with hydroponics within the same closed water system.

This provides an opportunity, says João Cotter, CEO of Aquaponics Iberia, for urban areas to have a local fresh food source, producing vegetable crops and protein source year-round all without the threat of drought or other effects of a changing climate.

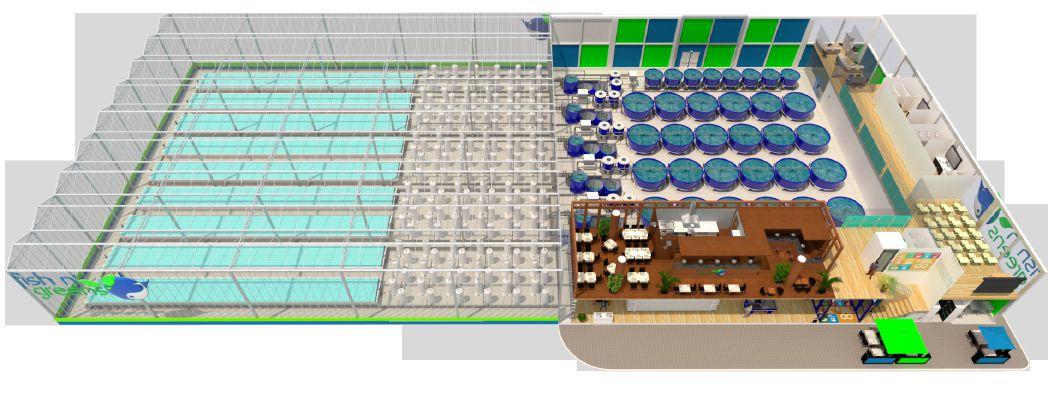

Imagine an aquaponics restaurant on the roof of a condominium or as part of a community center. Cotter’s Fish n’ Greens concept incorporates the growing of fish

Specialists in corrosionresistant propeller pumps, closely adapted to the needs of the individual customer.

www.lykkegaard-as.com

and vegetables in one facility one step further as a destination for those who want to see how their food is grown before enjoying a meal.

Based in Torres Vedras, Portugal, Aquaponics Iberia has developed Fish n’ Greens to be an aquaponic food production and immersive consumer experience for urban locations. The “smart farming for smart cities” concept will include a food store and restaurant, guided tours of the facilities, and research conducted onsite.

As proposed, the facility will have the capacity to produce up to 45 tons of fresh fish and 130 tons of greens per year, says Cotter.

“It can grow more, but we are being quite conservative, initially. It is safer to run 40 to 50 kilos per cubic meter, and that can grow 45 tons of fish per year and 130 tons of vegetables from one facility.”

“We are integrating land-based and urban aquaculture with healthy produce into a unique ecosystem,” says Cotter.

Some of the fish that will be produced include Basa catfish.

The company has been developing the project since 2013. The facility will feature a RAS with 24, 10-cubic-meter tanks.

“We are still trying to get funding and looking for investors for the first unit,” says Cotter.

According to Meticulous Research based in India, “high initial start-up costs and critical management requirements are the key factors hindering the adoption of aquaponics farming.”

The company has applied for funding from the European Commission and is participating in other programs to finance and get grants for the financing required for

the capital equipment investment, which is estimated to be €1.8 million (US$2 million) for the first production cycle.

“We are partnering with the municipalities - they are renting us the land in urban areas. We are proposing to provide programs in common with them, such as school visits and workshops for food education and good food habits with guided tours on sustainability,” says Cotter.

Lethbridge College senior research scientist Nick Savidov has been involved in aquaponics for more than a decade and says success with these kinds of projects demands the use of the latest water and waste treatment processes.

“I would say aquaponics is the future,” says Savidov. “But you need to use modern technology in fish production, plant production and most importantly the water and waste treatment.”

To be successful, Savidov says commercial aquaponic operations have to utilize

modern water treatment methods similar to the water regeneration used in RAS, but the nutrients must be preserved.

Aquaponics Iberia’s Climate Smart modular technology uses solid filtration, aerobic biodigesting (conversion to fertilizer), and O2 management and control. Cotter says the system allows for higher productivity with lower inputs in terms of water, energy consumption and maintenance requirements.

“It is a bit different than regular aquaponics,” says Cotter. “What we have noticed is that in common aquaponic systems – particularly in Europe – most of the systems have issues with solid waste management. We have applied more of the technology used in RAS, and put in biofiltration and biodigesters to take care of the solid waste coming from the filtration system.”

With the biodigester, Cotter says most solid waste can be converted into liquid fertilizer and put it back into the system according to the nutrient levels.

“We take most of the solids out of the

system and use it for other purposes such as irrigation agriculture or organic agriculture – it’s a by-product that is valued,” he says.

Savidov says the use of aerobic biodigesters is not common but he has advocated its use in aquaponic projects for years.

“I’m very glad this concept has started spreading around the world. I started using aerobic bioreactors 16 years ago and went around the world to convince people. Now

we see people using biodigesters, and I’m especially glad they’re doing it in Europe,” he says.

About 50 percent of the waste coming from the system ends up being solid waste used as compost for organic agriculture and isn’t returned to the aquaponic system.

Aquaponics uses up to 95 percent less water than traditional farming with no pesticides or synthetic fertilizers. Fish waste is converted into a natural fertilizer

that feeds the plants. By consuming the nutrients, the plants leave the water cleaner and ideal for the fish to thrive.

It is estimated the global aquaponics market could be worth $1.4 billion by 2025, growing at a compound annual growth rate of 12.8 percent, according to a report issued in July 2019 from Meticulous Research. The report cited changing climate change con-

NEWS:

There is more to RAS aquaculture than the RAS itself: A proven fast delivery concept.

Alpha Aqua A/S builds the full production unit at the factory site to ship it as one delivery. Installed on a standard flat concrete slab offering a variety of advantages for the customer:

Pre-test by FAT (Factory Acceptance Test)

Adaptable to existing buildings or dedicated ones

Faster construction - no fixed concrete structures implying better Return on Investment (ROI)

Floor mounted tank system – no underground pipes or specific concrete foundations in the system

High flexibility to adapt to the market changes

l l l l l

Want to know more? Contact: Paul Hundley - phundley@alpha-aqua.com www.alpha-aqua.com

ditions around the world as the primary driver behind the growth of the market for fish and vegetables being grown in a soilless environment.

The market is segmented by equipment (grow lights, pumps and valves, fish purge systems, in-line water heaters, aeration system, and other equipment), product type (fish, vegetables, herbs, and fruits), application (commercial, home production and other applications), and geography.

North America had the largest share of the global aquaponics market in 2018, followed by Europe and Asia Pacific. China, India and Australia are expected to see the highest rate of adoption over the next five years.

Savidov notes that large commercial aquaponics facilities, such as Superior Fresh in Wisconsin, have been quite successful. They are producing four million pounds of organic greens, salmon and

Steelhead each year.

Urban food production

“By using our technology and taking care of solid waste in a more efficient way with the biodigester, we can get an additional 20 percent savings on top of what is common with aquaponics. We can get 95 percent water savings compared to conventional farming methods,” says Cotter.

Cotter hopes the concept of Fish n’

Greens is embraced as a sustainable food option in Europe where it is less understood than in the United States.

“The difference between Europe and the U.S. is the fact that here, aquaponics cannot be certified as organic as it has to be grown in soil for that designation. When we sell to the supermarket, we can’t have that differentiation, so the best way we do it is to locate the system in the city and let the customer visit and create awareness of aquaponics and try to let them understand the difference,” he says.

Cotter hopes that when consumers see the symbiotic ecosystem at play, they will understand what is different about aquaponics, and they will give it a try.

Despite the high start-up costs, Cotter says he believes it will eventually be an in-demand product at a reasonable price.

“For the first one to three years, the price will be aligned to saltwater aquaculture fish like Atlantic sea bass and Mediterranean sea bream – about €6 to €7 per kilo,” he says.

By Christian Pérez-Mallea

In the early days, only a few individuals would work within any given fish farm. All variables were controlled by humans, and tasks such as feeding, treatments, samplings and harvesting were performed manually. The focus was set on the biology of the fish. Subsequently and due to the success of aquaculture, farming volumes were increased, and automation was needed.

•

•

•

Routine machine operations were established and different robots were included in the production chain. The focus, this time, was set on the economics of the farm.

Lately, the sole presence of machines and routines has proven itself insufficient to control different variables simultaneously. Its dependence on human control combined with the probable need to refocus more efforts on biological aspects have fostered the arrival of digital applications to aquaculture.

Computational fluid dynamics (CFD) can be described as a set of mathematical models used to simulate how gas and liquids flow. For fish farming purposes, this might be especially useful in land-based facilities where it allows users to predict the behavior of water flow in the tank.

Jorge Contreras, project manager at Scale AQ Chile, say they use this combination of applied mathematics, physics and computational software to simulate a new project. “It allows us to predict the behavior of the water flow in the farming tank and the quality of the water as well. The water quality is controlled by quickly extracting the unconsumed feed and the feces.”

The focus on water quality is the core of Scale AQ’s Optifarm concept, he explains. That is the mixture of their exclusive designs of ponds (Optitank), filters (Optitrap), and self-cleaning systems (Optiflow).

Beyond just extraordinarily complex algorithms and machine-to-machine communication, there is the Industrial Internet of Things (IIoT) which could be distinguished from domestic-use IoT, thanks to the intersection of information technology and operational technology.

Meanwhile, blockchain uses data structure or chain of records in the form of blocks, that ensures security, transparency and decentralization.

Breeding and genetics company Benchmark Genetics is implementing these new technologies. “We use IoT technology to register different environmental factors and to monitor animal welfare and security factors on our farms. The implementation of blockchain technology is on our drawing table and we are working closely with one of our customers to establish a first version. We will make a formal announcement when we can offer our customers this service,” says the head of strategic business systems, Bára Gunnlaugsdóttir.

She explains that using IoT to register data eliminates human error and allows them to use manpower in a more productive way. Likewise, using this technology

to monitor operations speeds up both the reaction time and decision process.

“Blockchain technology will reinforce the trust of our production and give our product traceability a higher credibility in the ‘One World, One Market’. Consumer requirements to make an informed purchase is only getting stronger, thus we need to have a technology in place that can support and adapt to those requirements,” she adds.

Visual perception and decision-making are AI tasks already helping aquaculture to grow stronger.

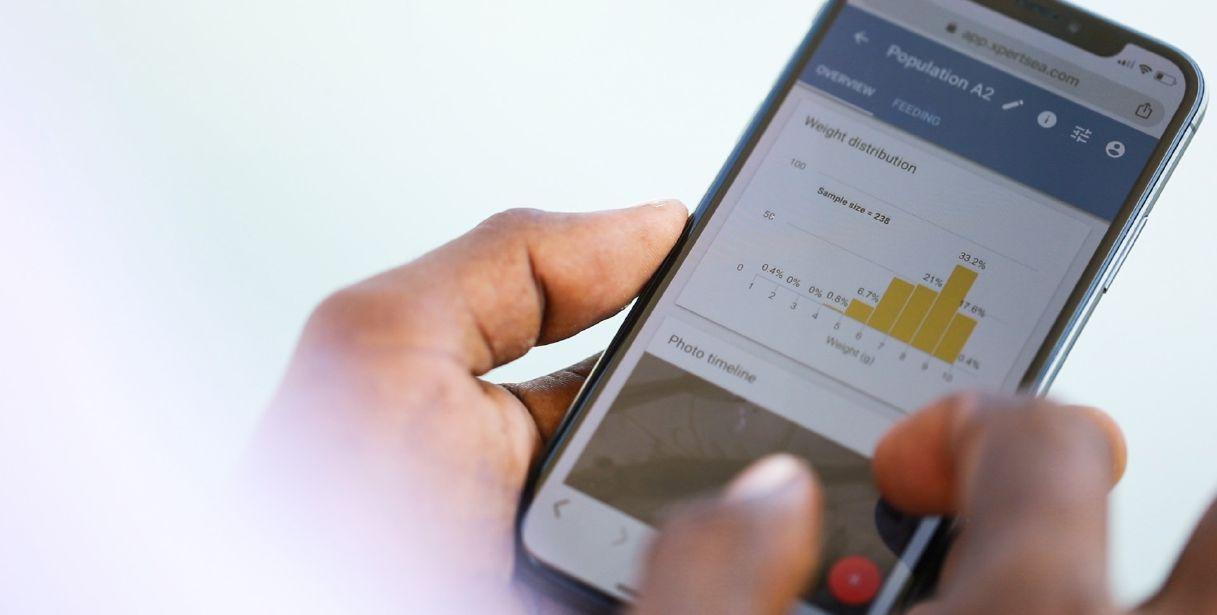

CEO and co-founder Valerie Robitaille explains that XpertSea has developed a platform that gathers data about health and quality of the fish from a distance. It can predict growth and simulate different farming and feeding strategies. Most of

her customers are shrimp farmers in South America and Southeast Asia.

“We start early in the cycle, so we give a solution that counts, measures and weighs the shrimp larvae. And then, throughout the growth cycle, we keep gathering some information using AI, so we collect pictures of these organisms and then we use machine-learning to extract all types of valuable information about the shrimp,” she explains.

Her company is also working on an application that helps to detect any type of sanitary issues or diseases in shrimp. For example, they are already able to detect changes in pigmentation, necrosis and deformities.

Gunnlaugsdóttir explains that to be able to utilize AI you need to have access to vast amounts of relevant structured data. “We have already re-structured our data and databases to accommodate the implementation of AI. We have also implemented business intelligence tools to give us real-time access to analysed data. The plan is to incorporate AI information into some of our decision-making pro -

cesses within the end of 2021,” she says. Implementing AI on top of Benchmark Genetics’ business intelligence tools should improve their analytical capabilities and possible scenario predictions, resulting in faster learning along with swifter and more informed decision making, she says.

For four decades, Aqua Ultraviolet has been the premier manufacturer of ultraviolet sterilizers and bio-mechanical filtration.

Several companies, such as Scale AQ, CageEye, 3SE, Observe Technologies and AquaByte are already offering different AI solutions for fish farms at the fattening stage. They cover either feeding or sanitary aspects, and even both. Yet, they do not have any digital application for freshwater. For example, Bryton Shang,

CEO of Aquabyte, explains that his cameras typically capture the fish half a meter underwater so they could be used in a freshwater tank. “However, our focus is on the sea cages right now,” he says.

AI can potentially be used to help land-based aquaculture operate more cost-effectively. Gunnlaugsdóttir comments that the highest expense for freshwater land-based farms (incubation centres, hatcheries and smolt farms) is usually the cost of energy needed to operate.

“Implementing AI on energy usage is probably some years away but for now, the biggest advantages would be in optimizing production plans, management processes and predicting challenges before they happen,” she says.

The founder and CEO of 3SE, Víctor Valerio, believes that AI is becoming cheaper and more accessible every day, as more professionals develop more simple algorithms and better cameras and sensors are used. However to date, AI is not still not affordable.

For freshwater land-based farms, he

says the required investments might be worthwhile especially in the fattening stage. This technology could also help in the physiological and morphological changes in the fish. Smoltification and parr marks in salmon could be noticed with artificial vision and image process -

ing, while sexing could be performed with a laser during the vaccination process.

“We could also register the mucus cell counts of those fish going to the sea. When you transfer fish highly advanced into smoltification, probably your first barrier (mucus) is severely affected and, from an immune point of view, they are much more susceptible to diseases,” he explains.

In a similar thought, XpertSea’s Robitaille comments that “no matter what you do, no matter how much data or treatments you have, even if you have the best feed in the world, if you do not have good quality fry or larvae then you do not get good results.”

Evidently, the digital transformation in the aquaculture industry still represents a major economic undertaking that must be contrasted with all its benefits and potential advantages. It should also be considered that the growing volumes and sometimes remoteness of fish farms seem to be an ideal application of all these technological advances.

Peak Gas Generation has launched its first oxygen gas generator, the i-Flow O2.

The i-Flow O2 joins the ranks of the company’s range of i-Flow nitrogen gas generators. It was engineered based on Pressure Swing Adsorption (PSA) technology that utlilizes a synthetic zeolite molecule sieve in order to produce high-quality, industrial-grade oxygen gas with up to 95 percent purity at a maximum flow rate of 576 litres per minute.

The i-Flow O2 offers a modular and expandable gas generator system that is designed to deliver on-demand oxygen supply with future-proof capacity.

“The i-Flow O2 offers flexibility for additional capacity should customer demand increase over time,” said Michelle Goldie, head of product management. “Facilities do not only get to meet their current needs but can also upgrade their infrastructure in a controlled and predictable way that is more cost-effective than relying on the volatile prices of bulk gas delivery.”

The i-Flow O2 also features such a standby mode, a PurityGuard gas purity safeguard system, and remote monitoring capabilities. www.peakgas.com/oxygen-generators

•

•

•

25

Water treatment supplies CM Aqua and Ratz Aqua have been acquired by Nofitech Holding AS.

The Norwegian tech company announced the merger on June 4 with the intention of co-operating more closely with the new sister companies for more cost-efficient solutions and pre-manufactured modular sections in the company’s product range.

In the statement, managing directors, Kurt Carlsen (CM Aqua in Denmark) and Andre Pechura (Ratz Aqua in Germany), expressed their excitement with the merger which they said would “give CM and Ratz financial strength to take on even bigger projects globally, and access to Nofitech’s R&D competence.”

Fresh By Design Pg. 21

HTH aquaMetrics LLC Pg. 20

IBIS Group Inc. Pg. 29

Integrated Aqua Systems Inc. Pg. 14

Lykkegaard A/S Pg. 18

As part of the transaction , the four owners of CM Aqua and Ratz become shareholders in Nofitech.

Nofitech CEO Robert Hunstad says the company will look to expand its market by selling their products to more species than the only salmon. “This should open further opportunities for Nofitech’s ModulRAS,” says Asbjørn Reinkind, chairman of Nofitech Holding. “The companies will operate independently and CM/ Ratz will continue to serve other RAS suppliers.”

Nofitech’s ModulRAS facilities have been designed from the beginning for both seawater and freshwater usage and have HEX filters installed in all units. www.nofitech.com

Customized for your fish farm, hatchery or research operation!

Only Alpha Pool Products Pg. 5, 16,17

OxyGuard International Pg. 19

PR Aqua, ULC Pg. 27

Pure Aquatics Pg. 24

RASTECH Pg. 31, 32

Reed Mariculture Inc. Pg. 10

RK2 Systems Inc. Pg. 22

Silk Stevens Pg. 29

Stofnfiskur h.f Pg. 9

Syndel Pg. 22

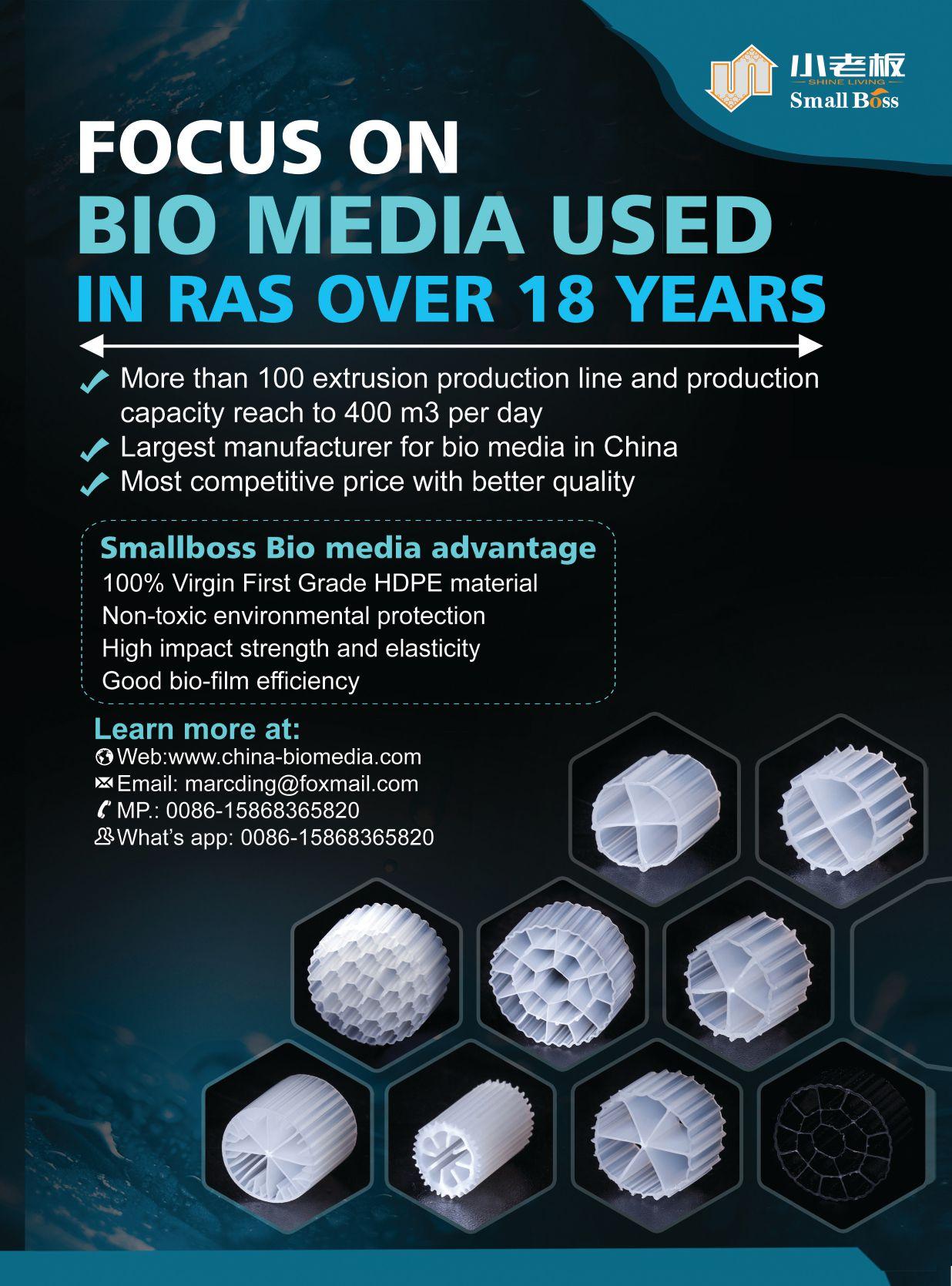

Tongxiang Small Boss Special Plastic Products Ltd. Pg. 23

Wenger Manufacturing Pg. 7

Our Commercial LSS Packages are custom engineered to meet your specific needs.

• Marine and Freshwater

• Mechanical filtration

• Chemical filtration

• Ultraviolet disinfection

• NEMA enclosed controls

• Bio-filter towers

• De-gassing towers

• Wide variety of flow rates

• Flow control valves

• Protein skimmers

• Variable frequency-drive pumps

• Temperature management All our systems are pre-plumbed and fully water tested

Pathogens introduced in RAS systems can quickly proliferate, slow fish growth, and inflict heavy losses. All RAS facilities should have biosecurity plans for their farms to help prevent the introduction and spread of pathogens. Every biosecurity plan will be unique but should focus on preventing pathogens from entering, preventing spread in the facility, and reducing the susceptibility of the fish housed on site.

Preventing pathogens from entering the facility in the first place will prevent an outbreak. Pathogens can enter the facility through source water, on eggs or fish, and through human and vehicle traffic.

Identifying biosecure source water when siting a new facility is ideal. However, the reduced water use of RAS systems can make installing retroactive disinfecting measures, such as UV light, on incoming water viable options to reduce pathogen loads. Additional measures should be taken to protect source waters from wild animals by covering or enclosing.

When stocking your facility with fish, it is preferable to start with eyed eggs from specific pathogen-free certified providers. Another advantage to receiving eyed eggs is that they can be disinfected prior to bringing them into the facility. If stocking live fish is unavoidable, the facility should have quarantine systems, located away from the main production areas, to monitor fish for clinical signs of disease for up to a month before introducing them to the production facility.

Human vectors like vehicles and visitors as well as employees themselves can introduce pathogens. Prevent trucks from approaching main culture buildings by loading with tractors or forklifts from designated loading docks. Disinfect tires and undercarriages of trucks that

must approach closely to receive fish. A pump sprayer with disinfectant and handled scrub brush provides simple, even disinfectant coverage. Minimize outsider access to the farm but be prepared for essential visitors. Plan tours far in advance and notify visitors of your biosecurity practices before they arrive, instructing them to wear clean clothing and appropriate footwear that has not been in contact with fish or water from other facilities. Have disposable coveralls and shoe covers handy as an additional protective measure. Staff members should be aware of outside work activities and avoid wearing potentially contaminated clothing or footwear to the facility. Farms should consider providing dedicated boots and wet gear for employees to wear at the farm to minimize risk of pathogen introduction.

Preventing the spread of pathogen between areas or systems in the facility can keep disease outbreaks from infecting all the fish on site and reduce the risk of heavy loss across the facility. Responsibility for most prevention measures rest on fish husbandry staff and should be taken seriously.

Ideally, fish at different life stages with different degrees of immunocompetence should be housed in different areas with physical barriers and moved through the facility in an all-in, all-out manner. Likewise, husbandry staff should be dedicated to these areas as much as possible and avoid moving from one area to another each day. When this is not practical, staff should work through daily tasks starting with the most fragile life stages, moving toward more robust fish (starting in the nursery and progressing to grow-out). Any systems with known health concerns should be visited at the end of the day after all other areas have been provided for and employees should wash in and wash out. When moving from one area

to another, employees should change their boots and gear, step through disinfecting footbaths, and wash or sanitize their hands to reduce the risk of pathogen transfer. Footbath and hand cleaning stations should be regularly checked and refreshed with chemical.

Areas or individual systems should have dedicated equipment including nets and brushes or any other equipment that contacts fish or system water and be disinfected after each use with a disinfectant dip or spray. Create easily accessible storage areas for each system to encourage keeping equipment in dedicated areas. Larger equipment like crowder walls or transfer equipment that must be shared should be cleaned and disinfected between use.

Unthrifty fish or those displaying clinical signs of disease should be culled from the population promptly. Keep common therapeutants on hand to quickly administer treatments before an outbreak gains momentum.

Even if all pathogens were excluded from the facility, ubiquitous pathogens will be present in culture water. By selecting robust stocks of fish, providing optimal nutrition and culture conditions including good water quality and appropriate stocking densities, and employing gentle handling techniques, fish will be less susceptible to opportunistic infections. This, in turn, will reduce the overall risk of disease spread through the facility and avoid loss of income from reduced growth, morbidity and mortality.

Although every biosecurity plan will be unique, preventative measures will only be as effective as the farm’s commitment to adhering to them. Biosecurity plans should be revisited often and updated to refine techniques and address evolving challenges.

For more information about depuration visit FreshwaterInstitute.org.