PRINTACTION

WIDE FORMAT RESOURCE GUIDE

Wide-format printing is destined to rise with ever more applications P.5

PLUS Smithers study shows market outlook shifts for wide-format dye sub printing P.9 Technology Report The seven steps of colour management P.13

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal 416-510-5113

apotal@annexbusinessmedia.com

Fax: 416-510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

Editor

Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

Media Designer

Lisa Zambri lzambri@annexbusinessmedia.com

Account Coordinator

Alice Chen

achen@annexbusinessmedia.com 416-510-5217

Media Sales Manager

Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

Audience Development Manager

Urszula Grzyb ugrzyb@annexbusinessmedia.com 416-510-5180

VP Production/Group Publisher Martin McAnulty mmcanulty@annexbusinessmedia.com

COO

Scott Jamieson

sjamieson@annexbusinessmedia.com

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 printaction.com

Tel: 416-442-5600 • Fax: 416-442-2230

Wide-format printing is destined to rise with ever more applications

By Sabine Slaughter

The wide- and super wideformat market has undergone its digital transition while certain analogue printing technologies, such as screen-printing, continue to complement the overall mix that are offered by large format print service providers (PSPs).

COVID-19 has changed a lot within the printing industry and many new applications, even a new category—social distancing signage—have evolved.

The latest developments at key manufacturers, such as Canon, Epson, HP, Mimaki, Roland DG, Konica Minolta, and Agfa are all aimed at driving new business op-

portunities for PSPs. Predicted to reach a volume of USD11.2 billion by 2025 (Markets and Markets), the wide-format printing market is mature, but it has certainly not yet reached its heyday.

Hand-painted signage was always a rare sight and is even more so nowadays. Developments in digital technologies, starting with the first digital wide-format printer introduced in 1999, have since accelerated and come a long way. Even so, for PSPs today there are more and more new feats to be accomplished as client-demand increases for more surprising, more individual means of communication, faster turnaround and for even more applica-

tions to be created. You could say, in this sense, inkjet has no limit.

While long print runs are still more viable overall on analogue machinery, they are not being ordered as often as in former times. The digital transition means more and more applications will become digital and this itself leads to highly specialized wide and super wide printers. Such printers can deal with

traditional applications, but, more interestingly, they enable innovative PSPs to showcase their ability to cater for new and unexpected market-niche jobs, as well as viably produce short runs, personalized and customized projects—even oneoffs—that help brand owners to do things not previously possible so that their marketing efforts reach their full potential.

Large-format printing allows PSPs to offer clients a myriad of unique applications such as home furnishings.

Another big growth factor in this sector is, of course, the environmental agenda. As the world tries to reduce its negative climate impact, printer manufacturers, PSPs and clients are all considering how they can contribute to the environmental imperative.The global pandemic has accelerated these client-driven requirements. Many brands are willing

COVID-19 created the new category of social distancing signage.

to pay the extra dollar to obtain a more sustainable product. This trend will continue and is likely to be reinforced by new regulations.

Wide- and super wide-format printers have been mainly developed to cater to the signage, advertising, marketing, and communications industries.

The first digital wide-format printer was introduced in 1999.

jobs later to be carried out on analogue machinery. Some can even make forays into areas that were formerly covered by lithographic equipment such as solar, printed electronics, RFID, and all kinds of conductive products.

quiring specialized know-how. The list is long and varied, be it vehicle wraps, posters, art, interior or exterior signage, PoP and PoS, decor printing, directional way-finding, home furnishings, wallpapers, murals, displays, event and floor graphics, or one-off signage from a large order that must be customized to

fit the exact location where it will be installed (e.g. bus stops with specific directions, info or offers). Digital printing enables cost-effective, fast turnaround of orders while at the same time offering environmentally friendly solutions with no or next-to-no waste. Additionally, it is starting to make inroads into the in-

However, they can also make an entrance or even a slight dent in other markets, thanks to their versatility, which enables certain (mainly short run) jobs within the commercial, packaging and label industries, as well as proofing

For the digital printing community and those considering entering the large-format market, it is important to understand this market is based on a myriad of unique applications re-

Digital printing enables cost-effective, fast turnaround of orders while at the same time offering environmentally friendly solutions with zero or next-to-no waste.

The wide-format printing market is predicted to reach a volume of USD11.2 billion by 2025.

dustrial printing sector, and there is no sign yet that it is slowing down.

Social distancing signage as a new category within the wideformat sector developed rapidly during the pandemic. In many cases it meant and still means that certain jobs must be produced immediately at short lead times, quite often with regional or individual customization. Those kinds of jobs will continue to be in demand for some time as the world battles the SARS-COV-2 virus.

Even the individual home consumer is not excluded or overlooked when it comes to digital printing applications. PSPs already offer web-based order portals—the so-called online print services—not only for companies, advertising agencies etc., but also for the end consumer who can order individual one-off prints, such as murals, posters, wallpapers, and floor graphics.

Printers are also stretching their own boundaries within the specific area of embellishment, traditionally referred to as the finishing sector. Options include matt, gloss, haptic surface, spot colouring, digital embossing, cutting, and cross-cutting. Nowadays it is not an issue as many PSPs have embraced these abilities. Within the digital wide-format printing market

and distinct from the printer’s very own abilities, inks and consumables are playing another decisive role. Should it be UV or UV LED, aqueous, latex, solvent or even pigment inks? Here the context of the application and its use will decide the ink.

The biggest advantage of a wide or super wide digital printer lies is in its application ver-

satility whether in terms of customization, personalization, individualization (when still viable and cost effective) and its efficiency, all together delivering a final customer impact that conventional technologies cannot achieve.

The boundaries of what digital wide- and super wide-format printing can do is being pushed constantly. The market is ripe for in-

novation, new applications, and new machinery with associated technological enhancements in speed, colours, inks, and substrates.

Sabine Slaughter is a consultant who works closely with printer manufacturers, brand owners and PSPs. This article was originally published as part of Drupa’s Essentials of Print Series.

Smithers study shows shifts in market outlook for wide-format dye sub printing

By John Nelson

Inkjet dye sublimation printing will continue to grow, according to the latest exclusive research from Smithers, one of the leading consultancies for the paper, print and packaging industry.

Data from its latest expert study, “The Future of Dye Sublimation Printing to 2027,” show that in 2022 the world market reached a projected $13.06 billion.

The experience of the COVID-19 pandemic delivered a radical shock to the market and enduring changes will help define this industry through the remainder of the decade. Smithers now forecasts the market will grow at an impressive 9.9 per cent compound annual growth rate through to 2027, pushing global demand to $20.93 billion in 2027, at constant prices.

per cent CAGR through to 2027.

Soft visual communications are the main application for wide-format dye-sublimation print. With public events—concerts, sports matches and festivals, as well as industry trade shows—cancelled there was a corresponding drop in demand (–7.9 per cent) for flags, banners and other interior or exterior signage in the first year of the pandemic. These items

typically have a short service life, and hence have recovered in line with the rescinding of lockdown orders, travel restrictions, and social distancing rules.

Through 2022, most countries revised their attitudes to the newly dominant Omicron strain and shifted to managing COVID as an endemic health problem using vaccinations and isolation, which was reserved for the most

vulnerable. The main exception to this was China, which maintained a strict zero-COVID policy well into Q4 2022; but is now attempting an accelerated return to a business-asusual approach.

These trends mean that in 2022 dye sub visual communications reached a projected $824.0 million worldwide and has a forecast CAGR of 9.5 per cent for the next five years.

North America and Western Europe, followed by fast-growing Asian markets, are the major consumers of dye sublimation printed articles in the visual communications and displays sectors.

For North America, the market is projected to be worth $275.6 million in 2022, with growth at 8.6 per cent CAGR driving regional demand to $415.6 million in 2027.

Wide-format dye-sublimation print technologies are primarily used for soft visual communication tools such as event banners.

The primary attributes favouring dye sublimation printing techniques are colour fidelity and permanence, especially in outdoor installations. Inkjet is the preferred technology for short turnaround, low-volume work, making it well suited to visual display print. Since such media are typically oriented toward local circumstances and events, rather than mass

markets, most visual communications and displays items are produced near the point of use. This can most efficiently be completed by regional or local sign shops and commercial printers, using in-house dye sublimation printers.

This is now benefitting from the trend toward localisation and reshoring of some print work.

The disruption of the pandemic has highlighted the vulnerability of supply chains, especially those spanning the Pacific, with many major buyers now keener to buy and print locally.

Smithers forecasts the inkjet dye sublimation printing market will grow at 9.9 per cent CAGR through to 2027. 9.9%

companies and shipped internationally.

Some clothing types, especially swimwear and athletic wear has long made heavy use of dye sublimation print in order to deliver colour-fast moisture resistant garments. The market has since diversified into less specialised apparel, and several leading dye sub manufacturers have even teamed up with fashion labels to target haute couture goods.

showing the advantages of printon-demand models for garment production and customisation, with faster order fulfilment, and less risk for retailers.

Worth $5.60 billion in 2022, dye sub apparel printing is set to increase at a 10.7 per cent CAGR through to 2027.

There are few applications for wide-format presses in clothing.

$415.6M

The North American inkjet dye sublimation printing market is projected to grow at 8.6 per cent CAGR, driving regional demand to $415.6 million in 2027.

The exception to this convention will be low-cost items with agreed formats and are not subject to change (e.g. national flags), which will continue to be mass-produced by textile

Another post-COVID trend that has directly boosted dye sublimation print is the frequency and familiarity with which consumers are ordering goods online. The example of Amazon Merch and similar businesses are

Inkjet dye sublimation printing will grow to $20.93 billion by 2027, according to latest research from Smithers.

Home furnishings, the other major e-commerce boom segment for dye sub, has greater potential. Household dye sublimation print was worth $625.6 million in 2022 and is again benefitting from the increased interest in online ordering of bespoke items.

Many soft furnishings—cushions, furniture, bed linen, etc.—are best produced on smaller machines. There is potential for wider-format press operators in other sub-segments, such as wallpapers, decorative accent panels, wall hangings, and flooring laminates.

Carpeting is another element of this market, although hitherto dye sub systems have achieved a limited market share. This is because disperse dyes that are used in dye sublimation have difficulty binding to the polyamide (nylon) fibres that are used to manufacture carpets.

Technical textiles are the smallest segment of the market and have the slowest growth. Many of these products, such as protective equipment and medical nonwovens, are unsuited to wideformat systems. There are some applications in sails, tents, awnings, and automotive upholstery. These sectors are also recovering at their own rates. Automotive printing is less accessible, as it is largely the preserve of a fewer specialist suppliers.

The market outlook for dye sublimation print in visual display media and other applications is examined and quantified authoritatively in the new Smithers study – The Future of Dye Sublimation Printing to 2027. This study is available to purchase now from Smithers. Visit www.smithers.com/en-gb/services/ market-reports/printing/the-future-of-dyesublimation-to-2027.

John Nelson is an award-winning editor and journalist working in the market reports and consultancy business of Smithers where he covers market and technology developments across multiple segments including paper, packaging, sustainability, inks, and printing. He can be reached at jnelson@smithers.com.

By Angus Pady

Dye sublimation printing involves the transfer of dye onto a substrate using heat and pressure. It is a popular method for printing high-quality images and graphics on a variety of materials, including fabric, ceramic, and plastic.

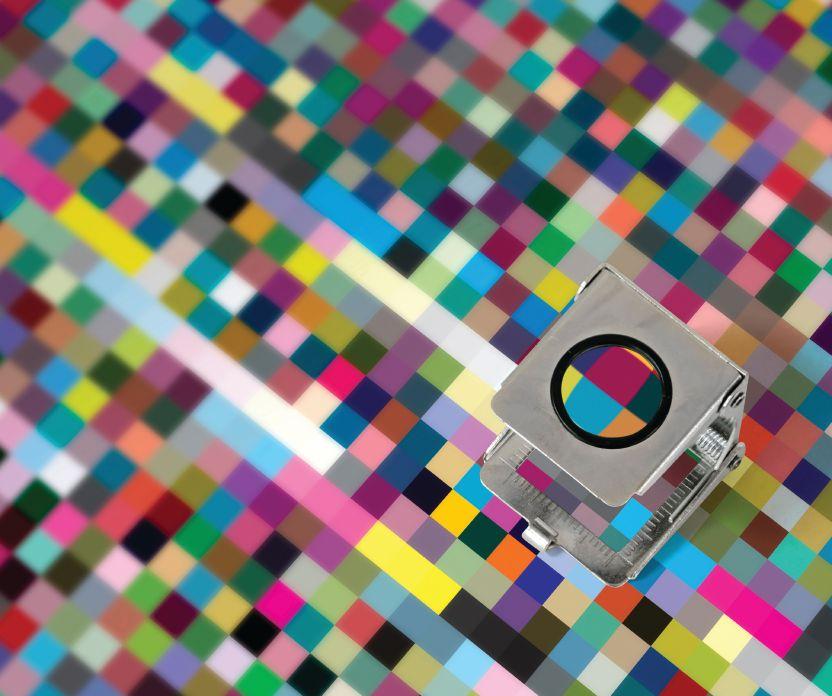

One of the main challenges of dye sublimation printing is matching the printed image’s colours to the original as closely as possible.

The greys must be neutral and colours vibrant, but not oversaturated. The road to getting there requires a thorough understanding of seven key steps, which can be applied to almost all kinds of printing processes.

Modelled blotches spots usually point to too much moisture in the paper. This is even more pronounced on hard non-porous material. Use additional layers of Kraft paper to absorb ex-

cess moisture. Further, your environment should not have a high amount of humidity.

The ink is bleeding, or the paper is moving during the pressing, which causes a ghosting image. If you pull the paper off too soon or your transfer is done too quickly, you can end up with rough edges.

These can be alleviated by reducing the pressure. Over time you will learn how much pressure is required for various times and pressure. This is only determined by testing.

One would think that a longer transfer time would yield a denser black. The reality is dye sublimation chemistry will reach a point where too much heat and transfer time decreases the density of the ink. If you’re getting brown

blacks, first decrease the time in five-second increments. I always start with time and then try pressure.

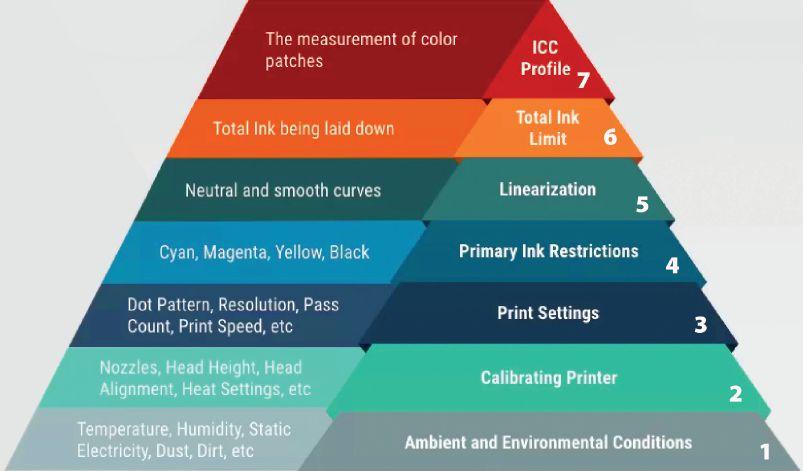

Every RIP software will walk you through similar steps when creating a new media setup. It’s beyond the scope of this article to discuss every step in detail, but let’s focus on the ones that have the biggest impact.

Step 1: Ensure your environment is not too humid. This can cause issues with dye-sub.

Step 2: Calibrate your device. Check the nozzles and alignment. If your printer has an internal calibration, then that needs to be done.

Step 3: Choose the optimal printer settings, print speed, and dot pattern. My trick is to look at what the manufacturer has done in the past. Their colour may not be ideal for your printer but they usually know the optimal combination of printer settings to use.

Step 4: Determine primary ink restrictions. This is one of the most important steps as it will determine the gamut of your printer. Most printers, when unrestricted, will print too

much ink. Your goal is to find the most ink that gives you the highest chroma. If you have a handled device that can show you LCH then you can use the C portion for chroma. As you measure each swatch from light to dark, the chroma will increase. At one point, the chroma will stop increasing and may even decrease. You want to select the swatch with the highest chroma value. Your RIP may also display a graph where you can toggle from density to chroma. Always use chroma.

The ideal ink limit is between 300 and 360.

ink, then cyan, black and, lastly, magenta. We never have enough magenta. I test the ink limit target by rubbing various areas to see if the ink is wet or damp and if it scuffs easily.

Step 7: When profiling, you want to measure at least 900 patches. More patches will give you more accurate spot-colour matching. I start with the middle GCR setting. Start your backs at 40. In conclusion, colour management is an

essential part of the printing process, as it helps to ensure the colours of the printed image match the original design as closely as possible. By following the above tips and using the right tools and equipment, you can improve the colour match and achieve excellent results with your printing projects.

Angus Pady is a G7-certified expert that has helped customers resolve colour management challenges for over 30 years. He can be reached at angus.pady@fujifilm.com.

Step 5: Linearization just needs to be measured and I accept the RIP settings here.

Step 6: Determine total ink limit. If you have done any profiling, you know this is the most difficult one to figure out. Here are a few pointers. If you have over-inking at 200 to 300 per cent, and that area is wet or bleeding, then you need to stop and go back to Step 4 and reduce the ink there. Ideally, you want the ink limit to be between 300 and 360. Getting to this stage may mean going back and forth between this step and step 4. When reducing in step 4, start with yellow, as it is the wateriest

One of the main challenges of dye sublimation printing is matching the printed image’s colours to the original.

Follow these steps for effective colour management.

The Colorado M-series from Canon is a modular 64-in. roll-to-roll printer.

Canon unveils new roll-toroll printer

Canon Canada launches the Colorado M-series, a modular 64-in. roll-to-roll printer with two speed configurations and Canon UVgel white ink.

The scalable series includes two base models (M3 and M5) offering a choice of output speeds (cruising speed of 312 sf/hr and 427 sf/hr and maximum print speed of 1,195 sf/hr and 1,709 sf/hr respectively), with the option to upgrade from one model to the other. Both printers can be upgraded to ‘W’ versions for white ink (M3W and M5W).

With the addition of white UVgel ink and a new media detection

sensor technology, the Colorado Mseries customers can expand their typical product offering using heavy structured, transparent, coloured, reflective and magnetic materials. Customers can also choose the FLXfinish+ option with their Colorado M-series printer, allowing them to add matte, gloss or mixed matte and gloss on the same print, without additional varnish.

Agfa develops new inks for its Onset and Avinci inkjet printers. The Onset 560 ink, which was developed in just six months, “offers excellent print quality and a wide colour gamut combined with low ink consump-

tion,” said a media statement. This is made possible through Agfa’s patented Thin Ink Layer technology,

which uses a unique dispersion method. The Onset 560 ink has also obtained the GreenGuard Gold certification. Another new ink product from Agfa is the new Avinci 110 ink for the Avinci CX3200 dye-sub textile printer. This ink set obtained

Agfa introduces news inks for Onset and Avinci inkjet printers.

the Oeko-Tex Eco passport, which states the ink is free from any harmful substance and can be used to decorate fabrics.

Kyocera releases Forearth, a new inkjet textile printer that aims to eliminate virtually all water use from fabric printing.

Traditional analog textile printing consumes a large amount of water. The new printer is an all-in-one printing system that uses new proprietary pigment ink, pre-treatment liquid, and finishing agent, which are constantly discharged in the same sequence from the inkjet head.

This system eliminates the preand post-processes that are required of conventional dye printing and also reduces water consumption.

Monadnock launches new wide format media

Monadnock Paper Mills introduces its newest wide format and signage materials, Boulevard and Pavilion PC 100.

Boulevard is a moisture-resistant

durable poster paper that is suitable for indoor and short-term outdoor applications. The base paper and scratch-resistant print-receptive coating are engineered for durability.

Pavilion PC 100 is made with 100 per cent post-consumer recycled

waste fibre, and suitable for indoor posters. It is bright white and has a matte coated surface. Pavilion is recyclable in the curbside mix paper waste bin.

Boulevard and Pavilion PC 100, like all Monadnock printing, packaging, and display and wall graphics, are FSC (Forest Stewardship Council) certified.

Xante is launching a new 48-in. rollfed attachment and multi-use cutter for X-55 and X-98 UV flatbed print-

ers. This development is in response to increasing customer request to give greater capability and flexibility to their UV flatbed investment. Although not an automated system, this capability allows Xante customers without UV roll systems to gain flexibility without the need for increased capital investment.

X-Rite and Pantone release the latest version of NetProfiler device optimization software. The cloud-based platform can now be accessed

through a web browser to validate and correct instrument measurement performance. The new online function currently supports the Exact Family of devices, including the new Exact 2.

Crawford Technologies unveils AI-powered print file indexing

Crawford Technologies releases SmartSetup v2.0 with AutoSense that uses artificial intelligence (AI) and machine learning (ML) to simplify the task of indexing and extracting data from print files.

SmartSetup is a no-code software solution designed to fully automate the time-consuming task of indexing. In the past, developers would need to write scripts or programs to accomplish these functions.

Projects that can benefit from SmartSetup include print files for setup, post-composition, data verification, document re-composition, redactions and archiving.

The SmartSetup template builder runs on Windows. The templates are also supported in Crawford Technologies’ Enterprise Output Management and eDeliveryNow platforms.

The all new Acuity range from Fujifilm...including superwide format

With a track record of pioneering innovations, Fujifilm has helped thousands of sign and display printers transform their businesses. But in a world where change is constant, three years ago we decided to go back to the drawing board to define a new blueprint for UV inkjet print performance.

The result is a brand new range of Acuity printers designed and developed by Fujifilm that redefine price/performance and transform print ROI. They bring new meaning to versatility and value and reset the expectations around ease of use. And being developed by Fujifilm, they come fueled by the best UV ink on the market and a guarantee of outstanding quality and reliability.

The new range of Acuity printers designed and developed by Fujifilm.