PRINTACTION

WIDE FORMAT RESOURCE GUIDE

PLUS

Rise of digital textiles P.4

Why large-format printers matter for AEC firms P.10

Dozens of new wide-format technologies P.17

Allvisualthings

Juan Lau builds a multifacted identity for ICON Digital P.14

Rise of textilesdigital

The growth of digital technologies is now starting to make a major impact on the textiles sector, where new business models are opening up a world of possibilities

By Victoria Gaitskell

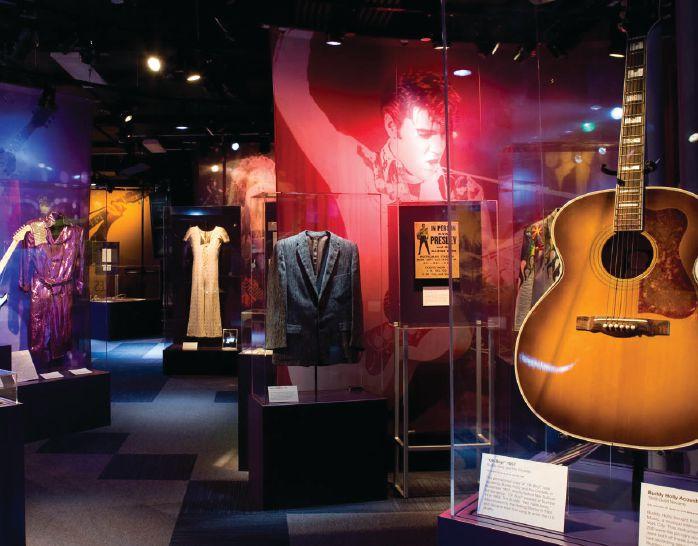

If you don’t believe that digital textile printing has gone mainstream in North American fashion circles, ask Sophie Grégoire Trudeau. On March 10, 2016, in Washington, D.C., she wore a dress made with Canadian-manufactured digitally printed fabric to no less august an occasion than the welcoming ceremony for the first official visit of her husband, Canadian Prime Minister Justin Trudeau, to the White House.

To create the dress, Toronto-based designer Lucian Matis applied decorations made of silk that was digitally printed with a hand-painted pattern of pink and purple orchids onto a background of solid crimson crepe. Fashion media instantly erupted into raves about the dress, some commentators even going so far as to claim that its sensational colours stole the show away from the Prime Minister and the Trudeaus hosts, U.S. President Barack Obama and his wife, First Lady Michelle Obama.

In fact, Michelle Obama had already climbed on the digital textile printing (DTP) bandwagon seven years ago in May 2009, when she made fashion headlines by wearing a piece by U.K.-based DTP-pioneering designers Basso & Brooke to an evening of poetry and music at the White House. (Actually, her stylist shortened Basso & Brooke’s design for a digitally printed, Swarovski-crystal-beaded dress into a top which the American First Lady wore over white cropped pants. Another Basso & Brooke garment is the first digitally printed piece in the permanent collection of the Metropolitan Museum of Art’s Costume Institute in New York.)

Equipped with these revelations about the wardrobes of celebrity political wives and a tip from a fashionista friend, I tracked down the printer who manufactured the sumptuous silk fabric used in Grégoire Trudeau’s Washington-arrival-ceremony

dress: The Emerson Group Inc. of Mississauga, Ontario. Company President Michael Hawke confirmed that the distinctive material was one of their recent jobs and speaks at length in this report about the evolution of his DTP business over the past eight years.

Global growth statistics

Via e-mail I also contacted Ron Gilboa, a Director of Functional Printing and Packaging at InfoTrends (Weymouth, Massachusetts) a worldwide market research and strategic consulting firm for the digital imaging and document solutions industry. While I was writing this article, Gilboa was preparing to deliver an overview of the DTP market and trends at the FESPA Digital Textile Conference on September 30, 2016, in Milan, Italy. FESPA (formerly the Federation of European Screen Printers Associations) is a global federation of 37 national associations for the screen printing, digital printing, and textile printing community.

The Milan conference is one of a series of educational events on DTP that FESPA has organized since 2008. According to FESPA’s Website, Milan is the largest DTP market in Europe, and the nearby Como region a textile manufacturing and decorating hub that accounts for 55 percent of the European digital textile market and produced more than 180 million square metres of digitally printed textiles in 2015.

In an online description of the Milan conference, FESPA CEO Neil Felton comments: “Today, digital accounts for only a small proportion of all textile printing, but this is forecast to grow substantially in the years ahead, with estimates suggesting that digital could account for 5 percent of textile printing by 2020, up from 2 percent today. Clearly that’s a significant diversification opportunity for printers already invested in digital output technology and supporting workflows.”

Gilboa kindly furnished me with a statistical report he wrote with InfoTrends Research Analyst James Hanlon, entitled “Digital Textile Printing Market Overview,” that further explains and predicts the extent of the new global commercial opportunities cropping up in this up-and-coming segment of digital print. Their report expects DTP to reach an estimated global product value of over $30 billion by 2020, based on driving factors that include technology

maturity, supply chain consideration, brand ability to develop new products, and a significant and positive environmental impact.

Additionally, although Gilboa and Hanlon predict DTP’s future growth will be concentrated in the Asia Pacific and other areas of the world where the most cutting and sewing is conducted, they add that “one of the trends we are observing keenly is the formation of localized production that includes print, cut and sew that are digitally enabled and automated. These allow for in-country production and consumption and new revenue streams for customized high value products,” as Hawke’s case exemplifies.

Emerson’s 8-year curve

Hawke’s business,The Emerson Group Inc. is a family-owned, integrated communications company whose current services, aside from DTP, include marketing and design. His father, John, first started the business as a prepress film company in 1986, and Hawke, now 52, jumped in soon after. His brother, Chris, joined them a year later and now runs production. Hawke’s wife, Kara, also joined them in 2000 and now works as Vice President of Sales.These days, even at age 75, John still keeps an occasional hand in the business.

As it evolved and the rise of computerized prepress caused demand for prepress film to shrink, the Hawkes bought a small design company and converted it into an advertising agency. Then eight years ago, after they first saw digitally printed fabric being produced in Europe, they decided to get involved in soft signage production. Hawke says they reached this decision in part because returning to some form of manufacturing seemed a more comfortable fit than staying with prepress and design work alone.

They started doing DTP with one largeformat printer 3 metres wide and within the next three years added two more printers, both 1.8 metres wide. All three machines, manufactured under DuPont’s Artistri brand, are no longer available for sale. Hawke clarifies: “Although we do also own a dye-sub printer as a backup, we don’t do dye-sub” (short for dye-sublimation printing, a common process for decorating apparel, signs, and novelty items such as cell phone cases or coffee mugs. In dye-sub specialized processes apply sublimation

Canadian designer Lucian Matis received major attention for the digitally printed dresses he created for Sophie Trudeau during her most-recent visit to Washington.

dyes first to transfer sheets, then onto another polyester or polymer-coated substrate using heat.) Rather, all Emerson’s DTP work is printed directly to fabric.

Right now Hawke’s business employs 25 staff, six of whom work in the front end with the rest divided between two production shifts on weekdays. Production staff also routinely work overtime and on weekends during peak periods, which nowadays Hawke says fall practically all year round, except for summers and at Christmastime, when orders tend to slow.

Presently their DTP operation produces both large-format print on synthetic fabrics and textiles in natural fibres for fashion and interior décor. Their customers are located all over North America, many in the United States. Textile orders typically involve relatively small runs of 200 to 500 metres of printed cotton, linen, silk, viscose, or blends based on these fibres. Large-format orders include not only the usual signs, banners, trade show displays, and backdrops, but also frequent novelty items for theatrical performances, festivals, special events, weddings, and large parties.

One especially challenging job Hawke recalls was a wall covering for the theatre of the NASCAR Hall of Fame in Charlotte, North Carolina--a project requiring them to print and sew together three separate panels into a gargantuan 30-feet-high-by435-feet-long scene simulating the grandstand at a NASCAR race. Another was a tent for a corporate banquet with paintings by Old Masters printed on the interior walls, and a 50-feet-wide-by-165-feet-long roof printed on the inside to look like a ballroom ceiling decorated with elaborate crown molding.

“We are getting more and more orders for soft fabric walls and trade show displays,” says Hawke. “Although vinyl has traditionally been the main substrate for these products, fabric is so much easier to use in many ways: it’s lighter, more resistant to creases, easier to move around, and easier to handle and store.”

DTP details

Hawke recounts that they have previously tried to run four different types of textile dyes on their equipment: acid dye, pigment dye, disperse dye, and reactive dye. Now, however, they specialize in only the latter two: disperse dye, which they run on their large-format printer for synthetic fibres,

and reactive dye, which they run on the other two printers for natural fibres.

Reasons for limiting their production to this two-dye system include that washing the printers repeatedly to change over dyes is costly, plus the only fabrics they cannot print are nylon-based ones (because the dye won’t stay on the fabric.) Hawke specifies that the process of applying disperse dye to synthetics requires heat, while applying reactive dyes to natural fibres uses steam to avoid burning the fabrics. He adds that when using reactive dye, the type used to print the silk for Grégoire Trudeau’s dress, textiles turn out softest to the touch and their colours look the best.

“We try to offer our clients a range of about 20 different synthetics and 30 different natural fabrics that will work for a variety of projects, including displays, upholstery, drapes, household linens, dresses, and accessories,” Hawke continues, adding that textile orders for pillows and scarves seem to be especially popular. Designers can also bring in their own fabric for printing, providing it does not contain nylon, for the reasons explained above. After printing, both synthetic and natural fabrics go through a washing system to remove excess dye, then a post-treatment to apply water and dirt repellent or fabric softener, then larger fabrics are laser-cut to size.

Online and other advantages

“We don’t do a lot of advertising,” says Hawke. “Instead, a lot of our business comes by word of mouth, Internet searches, and our blog on DesignYourFabric. com, an online business we’ve operated for about a year, where designers can upload their own designs to print whatever quantity they want of their own fabrics. We’ve had some hiccups along the way, but since we got the bugs out six months ago, we’re seeing the on-line business grow.”

He explains that to obtain textiles via traditional screen- or rotary-screen printing methods from places like Europe, South America, China, or India, customers have to order at least eight weeks ahead and commit to a minimum order of 100,000 to 500,000 metres. “If they don’t use up all the fabric, they’re stuck having to sell off their inventory. But our on-line ordering system fits the way people shop now, there’s no minimum, we can usually fill orders in seven to ten days--and those time frames are shortening. In eight years, print heads have improved, so whereas we used to get 200 droplets out of one head, now we get 1500 droplets, and the newer heads can print four to five times faster than we used to.”

Gilboa and Hanlon’s report provides further supporting details on how digital inkjet technology has dramatically improved in recent years to facilitate a multitude of applications, ink types, print quality improvements, and faster production speeds.

Hawke comments: “It’s nice because DTP is starting to bring textile production back to North America. Printing small orders on demand is where the growth is going to be here, because customers can buy

locally, they don’t have to buy minimums and don’t have long waits for their orders.”

The Emerson Group, in addition to textiles, produces a range of wide-format applications.

Significantly, Gilboa and Hanlon’s observations on new opportunities mirror Hawke’s Web strategy and bode well for his business model: “New software and technology developments allow for greater brand, producer and consumer interaction. Web based applications are being developed that enable an individual to create designs and patterns for textiles, manage orders, and track fulfillment more easily. All of these combine to facilitate a streamlined supply chain while reducing operation cost.

Digital solutions help products reach the market faster, reduce overall inventory, and make purchase activated manufacturing possible. This is great benefit for both the consumer as well as the brand that are now able to develop new products at speeds not possible with traditional printing. Brands, with digital textile printing, can react faster to consumer needs, localize products faster, and produce in small batches and custom products. This all leads to the democratization of design, and helps support upcoming designers, as there is minimal inventory obsolescence risk associated with digital production. Areas of textiles where these benefits shine through include fast fashion, high fashion, sports apparel, home textiles, and outdoor furnishing. Major fashion brands such as Zara and H&M are deploying digital print to improve and reduce their supply chain complexity.”

Hawke continues: “Another of the nice things about our DPT business is that our dyes are all water-based, you can recycle polyester, and natural fibres break down in landfill, so our process is pretty green.” Gilboa and Hanlon’s report also emphasizes that “digitally printed textiles have one other key advantage over current methods, and that is a drastic reduction in overall environmental impact. Digital systems are able to produce the same printed textiles with significant reductions in water consumption during the printing process, sometimes up to 90 percent when compared to rotary screen-printing. Reductions are also seen in energy consumption as well as CO2 emissions, where steaming, washing and drying occur.”

New textile steps

The business resources Hawke continues to rely on include the Canadian Textile Industries Association (CTIA) and ITMA, a global textile and garment machinery exhibition held every four years, next scheduled in 2019 in Barcelona, Spain.

His advice to DTP novices: “Prepare for a big learning curve--for one thing because, compared to other substrates, fabric undergoes a lot of changes. It’s not stable. It shrinks, for example, and batches of fabric

can vary from one to another, so it’s important to locate suppliers who give you a consistent product.”

Hawke’s future plans for his own business: “We’ve reached the stage where we’re maxed out for both space and electricity. So we have a choice of either moving to another building or trying to get more space and more electrical power at our current address. Once we’ve secured more of both these resources, we’ll take another step forward by purchasing more equipment.”

Printed Coroplast Signs

$ We cater exclusively to trade customers and resellers across Canada

2.55 per sign for as low as Maximize Your Print Profits

Coroplast Signs

Posters

Sintra Signs

Business Cards Vinyl Banners

Window Graphics

Postcards Pull

Banners

Adhesive

Why large-format printers matter to AEC firms in Canada

New innovations in printed designs for Canadian AEC firms provide opportunity

By Danny Ionescu

The demise of printed designs in the Canadian architecture, engineering and construction (AEC) industry may have been greatly exaggerated.

With the sector rather stagnant, increasing numbers of AEC firms are now looking to print for its potential value to their businesses as opposed to a troublesome cost centre that needs to be reduced or eliminated. Indeed, a recent ARC Document Solutions study found that only 38 percent of AEC firms plan to go paperless.

What’s behind the surprising fondness for hard copy design drawings? It turns out that recent large-format printing innovations are making it possible for AEC firms in Canada – especially SMBs – to efficiently and cost-effectively churn out high-quality printed materials that differentiate them in the market. At the same time, these new innovations are bringing the costs down when those firms turn to their local print service providers.

In fact, according to the recently released 2015-2020 Wide Format Forecast from InfoTrends, media

New generation large-format inkjet systems are allowing printers to apply new colour for AEC needs and to break out of the monochrome margin malaise.

revenue in North America is now growing at a compound annual rate of 12.8 percent compared to 10.1 percent for the rest of the world. There are some key reasons why many smaller Canadian AEC firms are turning to large format printers. While larger enterprises have entire departments responsible for managing and maintaining large-format printers, many smaller and midsized AEC shops haven’t traditionally been able to afford that. The costs of acquiring printers, maintaining them and training staffs would sim-

ply be too high – especially where colour was involved.

Smaller firms often leaned on print shops for every single geographic information systems (GIS) map, drawings and rendering they needed to produce.

Today, however, more options are available. Prices for large-format printers have dropped considerably, making them much more affordable options for the average AEC firm looking to reduce their outsourcing spend. At the same time, savvy large-format print shops are en -

abling AEC companies to produce high-quality black-and-white and colour jobs at a faster speed from a single printer. Previously, companies had to buy both monochrome and colour printers to accomplish the same task or work with a print shop that had multiple devices.

And this capability is particularly important to AEC firms today as many Canadian municipalities require design drawings to be submitted in colour. These regulatory requirements underscore where the industry is headed, as AEC firms are designing in colour. Keeping these details and documentation in colour lets designers move this knowledge through colour coding from their screens right into the field.

We’re seeing AEC firms across the globe purchasing wide-format colour multi-function printers over monochrome-only solutions and Canada is certainly no exception.

Another key reason for the AEC adoption of large-format is simply for faster turnaround times. Canadian AEC companies are increasingly required to turn around designs and blueprints on the fly – both at their offices and on job sites. Modern wide-format printers are faster than previous generations –up to 60 percent faster in some cases – and are suitable for use in the field and office.

Additionally, a broad range of applications and technological innovations that expedite workflow are now available for use in conjunction with the wide-format printers. New workflow software for managing the print process from end to end makes large-format printing much more efficient. For example, such software allows AEC shops to spontaneously detect and correct corrupted PDFs, automatically switch between small- and large-format pages, and enable onscreen document proofing. Coupled with the speed of the new printers, this can significantly enhance efficiency.

This improved efficiency also contributes to a lowered cost, which

is an increasingly important factor for the many AEC firms operating in slowed down economies such as Alberta’s oil sector, for example.

In terms of quality, large-format printing is not the same as making office copies. Control over quality is key because the large-format documents that an AEC firm must produce are mission-critical.

CALENDAR

August 10, 2017

OPIA Toronto Golf Classic

Angus Glen, Markham, ON

August 18, 2017

Canadian Printing Awards Early Bird Entry Deadline

According to the “2015-2020 Wide Format Forecast” from InfoTrends, media revenue in North America is now growing at a compound annual rate of 12.8 percent compared to 10.1 percent for the rest of the world.

For example, customers often assume they’ll be able to receive brilliant, colourful printed materials because powerful computer-aided design (CAD) software has made that so commonplace. These designs are also incredibly complex. For AEC firms to compete in this environment, they must have the ability to deliver on that expectation.

Fortunately, an emerging generation of large-format printers excel at producing colour documents with crisp lines, fine detail and smooth grayscales that are arguably superior to LED prints. Newer pigments also provide dark blacks, vivid colours, and moisture and fade resistance –even on uncoated bond paper at high speeds.

For Canadian AEC firms to compete in these challenging economic times, they need to be focused on producing the highest quality printed materials as efficiently and costeffectively as possible. The ability to do that has never been greater.

Small and midsized AEC firms no longer have to invest in huge fleets of printers to keep pace with larger competitors.

So, paper lives on as an important instrument in their tool belts – now and for the foreseeable future.

IONESCU is the North America Technical Segment Sales Director for HP Inc., where he has provided thought leadership in print for more than 20 years. He currently manages a North American team of large format printing specialists focused on sales, strategic planning, and development of go to market initiatives for HP’s Designjet and PageWide XL technologies.

Canadianprintingawards.com

September 10-14, 2017

Print 17

McCormick Center, Chicago, IL

September 20-23, 2017

Pack Print International Bangkok, Thailand

September 14

Canadian Printing Awards Entry Deadline

CanadianPrintingAwards.com

September 25, 207

Pack Expo Las Vegas Las Vegas, NV

September 25-28, 2017

Label Expo Europe Brussels Expo, Brussels, Belgium

September 27-29, 2017

SFI Conference

The Westin, Ottawa, ON

October 4-6, 2017

PSDA 2017 P2P Technology + Innovation Summit 2017 Sheraton Hotel, New Orleans, LA

October 10-12, 2017

SGIA Expo 2017

New Orleans, LA

October 23-25, 2017

Digital Packaging Summit 2017

Ponte Vedra Beach, FL

October 27-28, 2017

Sign Expo Canada

International Centre

Mississauga, ON

October 31-November 3

IPEX 2017

Birmingham, UK

DANNY

All visualthings

The evolution and rebranding of ICON Digital Productions positions a large-format-imaging pioneer as one of North America’s most unique and powerful visual communications companies

By Jon Robinson

On the top floor of ICON Digital Productions’ 90,000square-foot manufacturing facility, tucked into a dimmed backroom, three technicians sit in front of a dozen screens grouped together on the wall like the Network Operations Centre of a cable news network. They are monitoring some of the highest profile static print and dynamic digital signs controlled by ICON’s newly minted Media division, including all the visuals hanging in Toronto’s Dundas Square and way-finding screens directing passengers at Pearson Airport.

Responsible for thousands of digital signs across Canada for Blue Chip clients like Shoppers Drug Mart, ICON Media illustrates the reach behind one of the country’s most unique visual communications companies. Designed to deploy national signage networks by procuring all of the necessary hardware, developing business plans and ultimately managing ever-changing content for clients, ICON Media is well-positioned to take advantage of an evolving wireless world. It provides the company with an irresistible vehicle for C-suite strategy discussions with clients. The bedrock of the parent company, however, is formed by ICON Visual with one of Canada’s most powerful technological infrastructures for large-format imaging.

ICON Visual dominates the company’s Markham, Ontario, facility, which any grizzled graphics pro would recognize by its curvedglass façade as the former home of Apple Canada. This division generates more than half of the parent company’s annual revenue,

ICON Digital’s Chief Financial Officer Alex Christopoulos (left to right) with ICON Digital’s cofounders Juan Lau and Peter Evans.

Juan Lau and Peter Evans in ICON Digital’s lobby which is newly branded for the company’s All Things Visual mantra, focused around Print, Media and Visual divisions.

which in its most recent fiscal year amounted to just under $40 million, by pumping out static display graphics with print qualities demanded by the likes of Fortune 500 cosmetic and fragrance clients, Hudson’s Bay Company and Maple Leaf Sports and Entertainment.

ICON Print is the third pillar of the company’s All Things Visual strategy, developed through a divisional rebrand in December 2016. After years of outsourcing the production of offset-print jobs for its Blue Chip clients, ICON in January acquired Toronto Trade Printing, bringing decades of 40-inchoffset expertise in-house. The move creates a multifaceted communications manufacturing company powered by ICON Media, ICON Visual and ICON Print.

Visual evolution

Last year alone, ICON oversaw the printing of more than 20-million direct-mail pieces in addition to a range of offset-produced marketing collateral. The company’s executive team has spent the past several months looking at both commercial and trade printing operations to purchase in the Greater Toronto Area. “We look at print not so much as old technology. We look at it as just another communications medium. In fact, our numbers tell us there is a lot of growth in print still,” says Juan Lau, President of ICON Digital, who co-founded the company in 1995 with Peter Evans and Peter Yeung. “The last three or four years we kept looking at our financial statements and, ironically, the fastest growing service sector was commercial printing – and we were not even trying.”

Without a direct need to acquire book of business from a commercial shop, which is the primary M&A driver in today’s printing market, ICON’s executive team was focused on finding the best lithographic-manufacturing fit for its existing AAA client base. Lau explains his priority was to purchase a well-established printer to immediately provide the offset knowledge ICON lacks after two decades of building a roll-fed digital printing operation.

Approximately 80 percent of what ICON

Visual now prints is produced with Durst roll-fed machines. Lau describes this as a key differentiator for ICON because its production has been built around a squaremetre pricing model, driven as much by finishing and fabrication as by print production. “From a pricing model we are able to get more yield [using] rolls – just a pricing thing.We can get that buttoned down pretty quick. Printers getting into our space still go off the rate-card mentality,” says Lau, describing what he sees as traditional offset pricing based on number of sheets produced.

“We know a lot of commercial printers are trying to get into our space now,” says Lau. “To get into our line of work, they are going to blow their minds out on the finishing end… anyone can print, but it is the finishing that really makes or breaks a project.”

Most commercial printers getting into largeformat imaging also turn to flatbed machines, continuing to focus on cost-per-sheet pricing models.

Lau explains he never set out to build ICON as a traditional printing operation when the partners founded the company. In 1995, the Internet had not yet penetrated the minds of most people, fax machines and phones were the dominate business tools of the day, and modems were limited to speeds of under 20k. Still, Lau wanted the company name to hold the word digital, as well as production, because he initially wanted to start a video-production company. The key word ICON came to him one day when a radio host referred to Madonna or Michael Jackson, he cannot recall which, as the Icon of Pop.

Prior to opening ICON, Lau was running a photo-enlargement company producing monochrome engineering drawings and architectural blueprints, generating slim margins, pennies per sheet. Lau describes

his large-format eureka moment arriving in the early 1990s after seeing new colour imaging technologies at a tradeshow: “The idea of taking a file and outputting largerthan-life graphics on just about any surface, whether it is vinyl or textiles, or what have you, nobody was really doing it.”

ICON’s first large-format machine was a Xerox electrostatic printer and, Lau explains, he and Evans decided to put a stake in the ground as a new type of printing operation. “We printed on sheets alright, but we printed it to transfer media and that allowed us to, with lamination, transfer it directly onto any substrate.”

The technology was slow, outputting two or three posters per hour, and not a realistic investment choice for offset-based commercial printers. Lau explains he was driven to own the market that ICON would serve, akin to McDonalds being synonymous with burgers, Coke with soda, and Rolex with watches. Advertising agencies were immediately drawn to the new output possibilities ICON could provide with one-off largeformat printing, even if they would often turn to offset or screen technologies for longer runs. “We started to establish a name in the business to do mockups, ideas, innovative stuff,” says Lau, noting ICON initially produced a lot of tradeshow graphics ideal for one-offs.

“What we were bringing on was really, by today’s standards, considered disruptive technology,” Lau says. “We didn’t know it at the time, but I think we were disruptors.” He explains it took about a decade after ICON’s founding for large-format imaging technologies, shifting from heavy solvents to UV, to evolve into a viable printing process for new entrants. “We went through a metamorphosis ourselves around 2005,” Lau says. “A key turning point in our company because it

“Because they want to do new things with digital, they are very open-minded to talk about the other print things we offer.”

allowed me to do what I do best and that is go downstairs and take care of the operations, because our sales had never declined since 2005.”

Lau was trained as a programmer and holds great affinity for taking a processminded approach to business. He felt ICON’s challenge was not about topline sales and he began to search for more efficiencies in the facility. “Once I got my hands on the operations side, the process and all of that – [we previously had the] same level of sales, $10 million, for a while – our bottom line increased tremendously.”

ICON brought on a new customized ERP system, internally branded as Cyrious, and a much-needed scheduling system for what had become a very busy large-format shop. ICON also brought in a new Chief Financial Officer, Alex Christopoulos, who Lau credits with greatly improving cash flow and the company’s overall financial health.

Media evolution

Lau describes the years from 2005 to 2008 as a “pivotal time” for ICON as he and Evans also decided to stop producing trade work for other printers and instead sell direct into the commercial market. “Part of the improvement on our bottom line was we made a conscious decision to shift and go after end-user markets,” explains Lau. “If we look back right now, we could have a few chuckles over that. It was one of the best decisions we could have made.”

Around the same time, ICON’s future would be influenced by the arrival of significant developments in large-format digital imaging technologies with a new wave of UV-based inkjet systems. ICON threw out all of its older-generation, heavy-solvent inefficiencies and made significant investments in UV technology, which Lau also credits with improving the company’s bottom line. ICON’s attention to the bottom line through the latter half of the decade would soon prove critical as The Great Recession of 2008 fast approached, all but

strangling print sales for months.

A year before the printing industry plunged into the throes of frozen marketing budgets, Lau points to the significance of another technological marvel on ICON’s future. “2007 was a pivotal year from a technology standpoint, because when the iPhone came out [it] launched wireless technology in my opinion,” he says. “With all of the apps, [Apple] launched a whole slew of development in wireless technology.”

The economic ecosystem that quickly developed around wireless technologies would serve as a catalyst for the growth in screen-based digital signage. Lau explains wireless technologies broke down barriers that had been fortified for years by the need to run so much cable and obtrusive hardware. Less than two years after the arrival of Apple’s iPhone, ICON purchased a two-person AV company called Gridcast in 2009, when digital signage was still very much in its infancy. ICON had previously worked with Gridcast on a project for the Bank of Montreal, which wanted to integrate a digital projection within a large banner with a cutout. “It went really well and that was another eureka moment with Gridcast,” recalls Lau, describing ICON’s first project to integrate both print and digital mediums.

“Gridcast was very AV-oriented – hangand-bang hardware. We saw very quickly in the first year that the model wasn’t really going to be a sustainable model,” says Lau. “Not only did we develop it by feeding it through ICON’s customer base, we actually changed [it] into a consulting model.”

Multifaceted evolution

The Gridcast division, rebranded in December 2016 as ICON Media, has been a significant driver for the company. “Our business in Media is an annuity. We will charge you a three-year management deal,” says Christopoulos, as an example of how the company can work with a client to fi-

nance a network of in-store screens, while ICON is truly interested in ongoing content management services.

Christopoulos explains the company, to a much lesser extent, hopes to take the same approach with some of ICON Visual’s work, where they might provide a client with a free banner stand with a commitment to print work to cover it – ideally, changing out the print regularly – over the next several months. With The Bay, ICON Visual is also starting to print on magnetic sheets that can be applied to painted walls, speaking to the division’s growing attention on developing repeatable visual systems with clients. The continuing innovation in both ICON Visual and Media have developed a strong reputation south of the border, where the company now produces around seven percent of its work.

“[It isn’t] so much because we are a better printer.They have local guys down there. It was actually our Media division because they are a lot more proactive when it comes to new innovations,” says Lau. “Because they want to do new things with digital, they are very open-minded to talk about the other print things we offer. So that is how we have been using digital media, more as a way to penetrate organizations from the top down, as opposed to starting with procurement and working our way up.” ICON Media has been using Virtual Reality for almost two years to show clients, like Sport Chek’s CMO for example, what their stores will look like with large-format print.

As ICON Print is developed, the company plans to leverage strong C-Suite relationships to drive work onto litho presses. In fact, Lau envisions an emerging media procurement approach that will benefit the rebranded position of ICON’s three divisions: “I am hoping as more Millennials get into positions of power and decision-making, they are going to say, ‘Why do we need a separate print budget. This is a media budget. We need to line up all of our marketing together.’ I think those budgets are going to change. We are kind of placing a little bit of a bet that way.”

Under ICON’s new multifaceted media vision, Lau explains it is important to hold a true offset-printing presence beyond outsourcing. “We have only touched the surface of the excitement the Media division is going bring,” says Lau. “It is huge. The ICON rebranding of All Things Visual is going to take us to the next level.”

Wide-format-inkjet imaging continues

to be one of the most

engaging sectors of the industry for all types of printing operations

Canon Océ Colorado 1640

In March, Canon Canada introduced its first UVgel-enabled Canon system is the 64inch Océ Colorado 1640, a roll-to-roll inkjet printer for producing both indoor and outdoor graphics. At the heart of the Océ Colorado 1640 is Canon’s recently unveiled UVgel technology. The company describes the Océ Colorado 1640 as the fastest 64-inch printer on the market, with a top speed of 1,710 square feet per hour (f2/hr) and another setting to produce high-quality, point-of-purchase prints at 430 f2/hr.

Canon explains UVgel combines a radically new Canon UV curable ink that instantly gels on contact with the media, advanced self-aware piezoelectric printhead technology, an LED-based UV system that cures without adding any damaging heat to the media, and continuous printhead nozzle monitoring and performance compensation. As UVgel ink instantly gels on contact with media, Canon explains this results in precise dot gain and positional control, repeatable

images, and instantly cured, durable prints. The system’s low temperature LED-UV curing technology moves independently from the printing carriage to help establish uniform post-print UV curing that contributes to print speed and quality.

Fujifilm Acuity LED 3200R

This September, Fujifilm will make the North American debut of two presses: the Acuity LED 3200R and the Inca Onset B1 format press (page 19). The Acuity LED 3200R is a superwide format roll press in a CMYK configuration with lower LED energy usage. Fujifilm explains users can double efficiency by leveraging its twin roll printing function with two 60-inch (1.52 m) media rolls.

The Acuity LED 3200R saves time, media and ink on backlit applications using a high density mode and LED lightbox for proofing while printing.

Epson SureColor P20000

create packaging and three-dimensional displays from folding carton, corrugated cardboard, honeycomb/corrugated display board, ACM, PP and PVC. Now on version 3.0, ZDC provides a library of templated designs. The software includes a 3D preview tool to consider measurements, logos, patterns and other graphic elements.

HP Latex 3600/3200

The Epson SureColor P20000 is a professional 64-inch photographic printer with high-performance 9-colour archival pigment for high-volume photographic printing environments. It uses the new PrecisionCore MicroTFP print head utilizing 8,000 nozzles, for print speeds up to twice as fast as the previous generation. Epson UltraChrome PRO archival ink technology produces strong colour prints that last up to 200 years, along with four levels of gray for accurate transitions with very low grain, even at the fastest print modes.

Zünd Design Center

Zünd Design Center (ZDC) is an Adobe Illustrator plug-in to

HP Latex 3600 can handle work levels of up to 35,000 square metres per month.

In May 2017, HP introduced the new HP Latex 3600 and 3200 printers based on technology first launched in 2009. The 3.2 metre HP Latex 3600 and HP Latex 3200 printers support higher volume printing and an improved monthly duty cycle. The HP Latex 3200 is geared toward PSPs that want to produce a range of applications like retail/outdoor advertising, events/exhibitions, vehicle graphics and interior décor.

The HP Latex 3600 is designed for larger PSPs needing long-run, uninterrupted printing. It can handle production peaks of up to 35,000 square metres per month and is well suited for dedicated application production, such as banners, backlits, wallcoverings, and retail or event signage. The new HP Latex 3600 and HP Latex 3200 printers offer a

Canon explains the Océ Colorado 1640’s UVgel technology features ink consumption that is as much as 40 percent lower than competitive technologies.

The Acuity LED 3200R is a super-wide-format roll press for high-quality work.

SureColor P20000 uses Epson’s new PrecisionCore MicroTFP print head.

Zünd Design Center is an Adobe Illustrator plug-in for creating packaging work.

Innovative systems, Unsurpassed productivity.

Zünd G3 2017 – better than ever.

• Now with high-performance 3.6KW RM-L router module and ARC tool changer for industrial routing

• Available fully automated loading/robotic off-loading or tandem processing for ultimate productivy

• Available as dual-beam machine (D3) with up to 6 independent cutting tools (3 on each beam) for twice the throughput

Click here to see the Zünd G3 in action. On display at SGIA, Oct 10 - 12, New Orleans.

Why Zünd?

• State-of-the-art cutting solutions

• Widest range of tool & automation options

• Modular, upgradeable, easy to use

• Reliable non-stop cutting/finishing

• Unsurpassed ROI & longevity

tiling mode. The company explains users can save up to one linear metre per roll, using the HP Latex Media Saver, while a single operator can manage up to four printers simultaneously.

Mutoh ValueJet 1948WX

In May 2017, Mutoh America introduced its new 75-inch, four-head, dye-sublimation printer, called ValueJet 1948WX, with print speeds up to 2,199 f2/hr and dual heaters for fast dry times. The VJ1948WX also comes with adjustable pressure rollers, 4or 8-colour ink capabilities, and automatic sheet off. It is equipped with Intelligent Interweave printing technique, DropMaster ink technology and ValueJet Status Monitor for smart printing.

Mimaki TX500P-3200DS

In April, Mimaki commercially released its TX500P-3200DS machine, described by the company as a complete digital fabric printing system. The 3.2-metre-wide direct-to-textile printer features an inline colour fixation unit for soft signage, exhibit graphics, and décor applications. Direct to fabric dye sublimation printing requires fixation of inks through a dry heat process, a step that is traditionally per-

swissQprint adds new curing options with the Impala LED and Nyala LED.

formed separately. The TX500P-3200DS printer’s inline colour fixation unit allows for simultaneous printing and colour fixation, thereby reducing two steps to one in a single device. Additionally, the TX500P-3200DS printer provides efficient finishing by linking the printer and the heater units. This enables synchronization, explains Mimaki, so that the printer is initiated when the heater reaches the optimum fixation temperature.

swissQprint Impala LED and Nyala LED

In May, swissQprint introduced two updated large format printer models with new curing options in the Impala LED and Nyala LED. The company explains there are also a range of mechanical improvements in Impala LED and Nyala LED. The beam architecture has been reworked for better stability, and swissQprint explains the flatbed is perfectly flat over its entire surface – 3.2 × 2 metres with Nyala LED and 2.5 × 2 metres with Impala LED.

The Nyala LED achieves a maximum speed of 206 m2/hr and the Impala LED reaches 180 m2/hr. Impala LED and Nyala LED are also available

standard CMYK inks, Durst offers light cyan, light magenta, light black, plus its Process Color Additions (orange and violet) for use with the Rhotex 500.

Acco Graphics Seal 65 Pro MD

The Seal 65 Pro MD can run both hot and cold applications.

with a roll-to-roll option. swissQprint in early 2017 also launched what the company calls a 4×4 version of its existing Impala and Nyala series, configured with quadruple CMYK.

Durst Rhotex 500

In September 2016, Durst debuted its 5-metre Rhotex 500 soft-signage inkjet printer, which employs the company’s Durst Water Technology. Durst states the Rhotex 500, designed for fabrics-based advertising and information media, is the first production printer to produce seamless soft signage and other large-format fabric output – for point of sale, trade shows, arenas, event venues, public spaces – up to 16.5 feet (5 metres) wide.

Durst Water Technology is based on what the company describes as eco-friendly, odourless, water-based dispersion inks and an imaging process that delivers photo-realistic print quality and high fidelities on uncoated and coated polyester fabrics. It prints in a variety of selectable drop sizes (7, 14 and 21 picolitres) and achieves output speeds of more than 3,300 f2/hr with quality production mode exceeding 1,300 f2/hr. Besides

The Seal 65 Pro MD is described as a high production, versatile wide-format laminator that can run both hot and cold applications. Reaching speeds of more than 15 feet per minute, GBC explains the 65 Pro MD is capable of running thermal film at two to three times the speed of other laminators on the market. It also carries ETL certification in the United States and Canada.

Agfa Jeti Ceres RTR3200 LED

Jeti Ceres, leveraging Agfa’s UV LED inks and thin ink layer technology, is a dedicated 3.2-metre roll-to-roll printer.

Launched at the beginning of 2017, the Jeti Ceres RTR3200 LED is a roll-to-roll printer for what the company describes as mid- to high-end applications. The new engine can include a combination of optional white printing and primer for producing higher-end image quality and durability. The engine preprints a layer of primer automatically before depositing ink, preparing the top layer for surface tension to better receive ink. The Jeti Ceres, leveraging

The ValueJet 1948WX has print speeds of up to 2,199 square feet per hour.

Mimaki’s TX500P-3200DS.

Agfa’s UV LED inks and thin ink layer technology, is a dedicated 3.2-metre roll-to-roll printer capable of printing on single- and dual-roll medias at speeds of up to 186 m2/hr. The Ceres can print on heat-sensitive medias like self-adhesive sheets and PVC without warping or wrinkling.

AXYZ International

Trident, explains AXYZ, is a hybrid CNC production system combining heavy-duty routing with fast knife cutting for processing a range of materials in print finishing, signmaking, foam and graphics applications. The AXYZ Series, according to the company, is one of the most versatile CNC router systems in the industry. AXYZ Series CNC Routers are available with a variety of head and tooling configurations. They are suitable for use in many different application areas and for processing all types of woods, plastics and non-ferrous metals. It is available in widths from 28 to 128 inches.

RS PX-181

PX-181 is described by RS International as a high-quality affordable calender heat transfer system specifically designed for sign and print shops seeking to expand their product offerings. By adding on the optional work table, users can transition

between roll-to-roll production and per-piece production. The PX-181 features what the company describes as a heavy-duty steel frame construction. It also leverages infrared heating technology as a transfer system.

Veritiv AlumiGraphics

AlumiGraphics is an aluminum-based foil decal print media, exclusive to Veritiv Canada, available in two finishes, including: GRIP for asphalt, brick and cement walkways and Smooth for exterior brick, stucco and concrete walls, among a range of possible applications. AlumiGraphics, which create images that look like they are painted directly to the surface they are applied to, can be cut with scissors, die-cutters or plottercutters. AlumiGraphics is designed for simple peel and stick installation, based on a sweep and press on, with typically no residue remaining on the surface with peel-off removal. GRIP holds a reflective quality on any area left unprinted. For large graphics, Alumigraphics SMOOTH can be overlapped or butted up against each other.

EFI Pro 16h LED UV

Making its North American debut in April, the EFI Pro 16h is positioned as an entry-level hybrid roll/flatbed LED printer. The new Fiery Driven printer includes white ink and on a new

The Maglev 1228 can accommodate heavy materials up to 400 kg, including stone, marble and glass.

platform with some print modes offering up to 30 percent greater throughput compared with other EFI entry-level hybrid production systems. The Pro 16h LED UV prints flexible and rigid substrates up to 65 inches (165 cm) wide and two inches (5.08 cm) thick.

It produces up to 1,200 x 1,200 dpi and near-photographic images, saturated colours, and smooth gradations with four-level, variable-drop greyscale print capability. Its production quality printing mode reaches speeds of up to 476 f2/hr (44 m2/hr). Its express printing mode reaches speeds of up to f2/hr (90.7 m2/ hr), while high quality printing mode reaches speeds of up to 119 f2/hr (11 m2/hr).

Canon imagePROGRAF

The Canon imagePROGRAF 60-inch PRO-6000S and 44inch PRO-4000S large-format printers using an 8-colour LUCIA PRO ink system designed for applications like production signage, commercial photography and proofing. The LUCIA PRO ink set adopts newly formulated, micro-encapsulated pigment inks for what the company describes as strong colour reproduction, image clarity and fine lines. Canon explains these reproduction characteristics are well suited for creating posters and advertising displays.

Fujifilm Inca Onset B1

The Inca Onset B1 format press, built on the same platform as the Onset X Series and the SpyderX, has been developed to offer a high quality, short run B1 solution for the offset, screen and industrial printing markets.

IQDEMY Maglev 1228 UV-LED

IQDEMY Holding’s recently introduced Maglev 1228 UVLED printer features a print table of 1.2 x 2.8 metres and can accommodate heavy materials up to 400 kg, including stone, marble and glass. Its honeycomb table is divided into six vacuum zones operated independently to help reduce power consumption when only some parts of the table are used. The UV-LED printer is equipped with levitation technology, which enables printing without noise, according to IQDEMY.

The printing system uses eight different dot sizes achievable via a combination of Variable Dot technology and Technology of Invisible Dots. Able to print with eight colours (CMYK+W+LM+LC+V) the Maglev also has a white ink recirculation system and 10 tanks for ink supply featuring ink level sensors. Its LEDs, according to the company, can operate for up to 10,000 hours without having to be replaced.

EFI’s Pro 16h LED UV features six printing modes from Ultra Quality to Express Mode.

EFI VUTEk 3r and 5r

In early 2017, EFI launched two new high-volume, roll-toroll inkjet printers with the VUTEk 5r and VUTEk 3r. The 3-metre-wide VUTEk 3r reaches speeds up to 3,715 f2/ hr and the 5-metre 5r reaches speeds up to 4,896 f2/hr. In addition to LED curing, the new printers feature resolutions up to 1,200 dpi and EFI UItraDrop technology leveraging 7-picoliter print heads with multi-drop addressability. This system uses a colour distribution algorithm aimed at providing economic advantages with ink usage, explains EFI, whereby one litre of ink can cover up to 1,600 square feet, on average, across all print modes.

Roland ErgoSoft RIP

more than 40 new features and enhancements. A new dithering method increases rasterization speed and improves dot placement accuracy resulting in what the company describes as 40 percent faster RIP times and smoother gradients. Roland explains a new PDF engine displays colour-accurate previews of PDF files. The RIP also includes up to eight simultaneous RIP Servers to reduce processing time when working with high-capacity data or multiple print jobs.

GBC Catena 65

The GBC Catena 65 roll laminator is described as an easy-to-use and efficient system targeted at small print shop, office or institution environments. This updated laminator encapsulates and mounts jobs up to 27 inches wide. Its increased ¼-inch mounting gap, explains GBC, helps in mounting to foamcore. New features of the Catena 65 include an open design, pivoting table, AutoSpeed and programmable presets.

HP Latex 1500

f2/hr) in outdoor production mode and up to 45 m2/hr (480 f2/hr) in indoor mode.

Mutoh-VJ-1624

In March, Roland DG released the ErgoSoft Roland Edition 2 RIP software for its Texart dyesublimation transfer printers. ErgoSoft has developed the RIP specifically for the Texart XT-640 and RT-640 to support high-fidelity digital textile printing of sports and fashion apparel, soft signs such as polyester banners and flags, curtains and other interior décor, as well as promotional goods and personalized gifts. ErgoSoft Roland Edition 2, according to Roland, includes

The HP Latex 1500 is a 126inch (3.2-metre) super-wide printing solution, providing fast turnarounds on a broad range of indoor and outdoor applications, including PVC banners, self-adhesive vinyl, textiles and double-sided prints. It reaches printing speeds of up to 74 m2/hr (800

Targeted at the sign and display market, Mutoh’s 64-inch ValueJet 1624X printer includes features like automatic sheet-off mechanism, an anticockling feature, a smart endof-media-roll feature and a tiltable ink cassette holder. The machine utilizes Mutoh Eco Ultra and UMS inks. Featuring the latest piezo inkjet head technology, ValueJet 1624X is Mutoh’s fourth generation 64-inch-wide single head sign and display printer. It reaches production speeds of up to 20.5 square metres per hour and includes Mutoh’s Intelligent Interweaving (i²) and DropMaster technology.

Epson 3M Ultrachrome

In April, Epson began shipping a new series of co-branded inks called Epson-3M UltraChrome GS3 Inks designed for use in

Epson’s SureColor S-Series roll-to-roll solvent printers, including the SC-S40600, SCS60600 and SC-S80600. The premium inks provide signmakers and print service providers (PSPs) a 3M MCS Warranty for finished graphics created using supported 3M films, clears, overlaminates, and application tapes once they have completed the 3M certification process. The Epson-3M UltraChrome GS3 inks are available in CMYK, Light Magenta, Light Cyan, and Light Black.

Agfa Avinci DX3200

Avinci DX3200 is a dye sublimation printer that brings vibrant colours to indoor and outdoor soft signage.

Introduced in April 2017, Agfa Graphics’ Avinci DX3200 dye sublimation printer for soft signage is a dedicated engine designed to provide high print quality on polyester-based fabrics. The Avinci DX3200 allows users to create prints of up to 3.2 metres wide, at a resolution of up to 1,440 x 540 dpi. The engine features six colours (CMYKLcLm) at a droplet size of 14 picoliters. Avinci DX3200 offers different quality modes, with a speed of up to 173 m2/hr

EFI’s 5-metre 5r reaches speeds up to 4,896 square feet per hour.

HP Latex 1500 reaches speeds of up to 800 square feet per hour in outdoor mode.

Roland’s 64-inch Texart XT-640 was introduced in late 2015.

The 64-inch Mutoh-VJ-1624 features an automatic sheet-off mechanism.

depending on the application.

Avinci DX3200 comes with Agfa Graphics’ Asanti software designed to automate all preparation, production and finishing steps of signage products. . Asanti also includes features for soft signage printers like Integration with Storefront, automated positioning of grommets on banners, and the design of canvas extensions (like air pockets) for flags.

J-Teck3 J-TEX Pigment

In April, J-Teck3 launched a new series of J-TEX textile pigment inks for Epson and Kyocera print heads. J-TEX are water based pigment inks designed to work in printers with piezo-electric printheads. They are designed for direct printing on a variety of fabrics among which cotton, cotton/poly blends, synthetic fabrics and viscose. The most common applications are fabrics for fashion and home furnishings (cloths, sofa covering, cushions, curtains). J-TEX pigments are manufactured in nine colours containing a specific binder which enables strong printability, wash and rub fastness. The use of a specific pre-treatment will increase the printing results allowing for more brilliant colours, higher definition and adhesion to the fabric.

Roland CAMM-1 GR

In April, Roland DGA launched its new CAMM-1

GR large-format cutters, available in 64-, 54- and 42-inch cutting widths, including an “L-shaped” integrated machine and stand design that provides stability even when cutting at speeds of up to 58.5 inches per second (1,485 millimetres per second).The printer provides cutting with up to 600 gf of down force.

Canon Océ Arizona 2200

The Océ Arizona 2200 Series includes flatbed-based UVcurable printing systems designed for producing both rigid and flexible work. Building from an existing Arizona platform, the newest Océ Arizona series, according to Canon, are designed as versatile and highquality imaging systems for mid-volume print producers.

Epson SureColor P5000

The 17-inch, 10-colour SureColor P5000 is a professionallevel desktop inkjet printer for

the production of high-quality photography, fine art, graphic design, and proofing work. Leveraging the Epson PrecisionCore TFP printhead and UltraChome HDX 10-colour pigment ink set, the SureColor P5000 holds what Epson describes as an increased colour gamut, higher-density blacks and twice the print permanence than the previous generation.

Veritiv Ultraflex Systems

Ultraflex Systems UltraMesh Blockout is a 12.5 oz. doublesided mesh material – based on a polyester support material. The blockout mesh material is well suited for applications where complete opacity is required. UltraMesh Blockout is printable on both sides and may be used for billboards, exhibits and event signs. The material is flame resistant and compatible for use with solvent, eco-solvent and UV printing. It is available in widths of 126 inches.

Drytac SynPaper for HP PageWide XL

Drytac, an international manufacturer of self-adhesive materials for the print, label and industrial markets, has announced SpotOn SynPaper for HP PageWide XL printers. The new substrate is a 120µ (4.8 mil) white matte polypropylene film, coated on one side with a dot pattern printed

pressure-sensitive polyacrylate adhesive. The high-quality inkreceptive white synthetic paper has been designed specifically for printing with HP PageWide technology, although it can be used with other aqueous and UV inkjet technologies.

SpotOn SynPaper for HP PageWide XL is suitable for indoor applications, such as those required for trade shows, seasonal sales, point of sale, and more. It can be hand applied – bubble-free – for window, wall and panel applications. It is removable up to six months and residue free.

Roland LEF-200 UV

In January 2017, Roland DGA introduced the VersaUV LEF200 flatbed printer for producing small-lot customization of a range of items, objects and accessories. The UV-LEDbased system, which includes Roland’s VersaWorks Dual RIP software, holds greater media compatibility from previous versions, running CMYK, white and clear ECO-UV inks. The LEF-200 leverages a print bed of 508 x 330 mm (20 x 13 inches) to work with three-dimensional items up to 100 mm (four inches) thick.

The LEF-200 features a new on-board primer ink option for conveniently priming objects. Clear ink can be printed for spot gloss or matte finishes, as well as embossing effects. White ink can be printed as a spot colour or behind CMYK on dark backgrounds or clear materials. VersaWorks Dual enables users to work not only with PostScript files, but also allows for native processing of PDF files to ensure transparency effects are processed accurately. In addition, white or clear ink data can be generated in the RIP, for use in producing transparent personalized accessories with special effects.

The Roland CAMM-1 GR series includes a built-in media basket for easy cut sheet collection.

J-TEX textile pigments target fabrics for fashion and home furnishings.