ISSN 1481 9287. PrintAction is published 12 times per year by Annex Business Media. Canada Post Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, P.O. Box 530, Simcoe, ON N3Y 4N5. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2017 Annex Publishing & Printing Inc. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada.

The emergence of enhancement and embellishment technologies is generating new possibilities for print to capture higher margins and consumer attention

Printers weigh in on the potential of adding production inkjet engines to their production mix, including tech challenges and market opportunities

GAMUT

5 News, People, Calendar, Dots, Installs, Globe, Archive

TECH REPORT

22 2017 InterTech recipients

Fourteen technologies have been judged as innovative and expected to advance the graphic communications industry

NEW PRODUCTS

26 SGIA preview

Technology suppliers provide booth highlights of October’s large-format show

MARKETPLACE

29 Industry classifieds

SPOTLIGHT

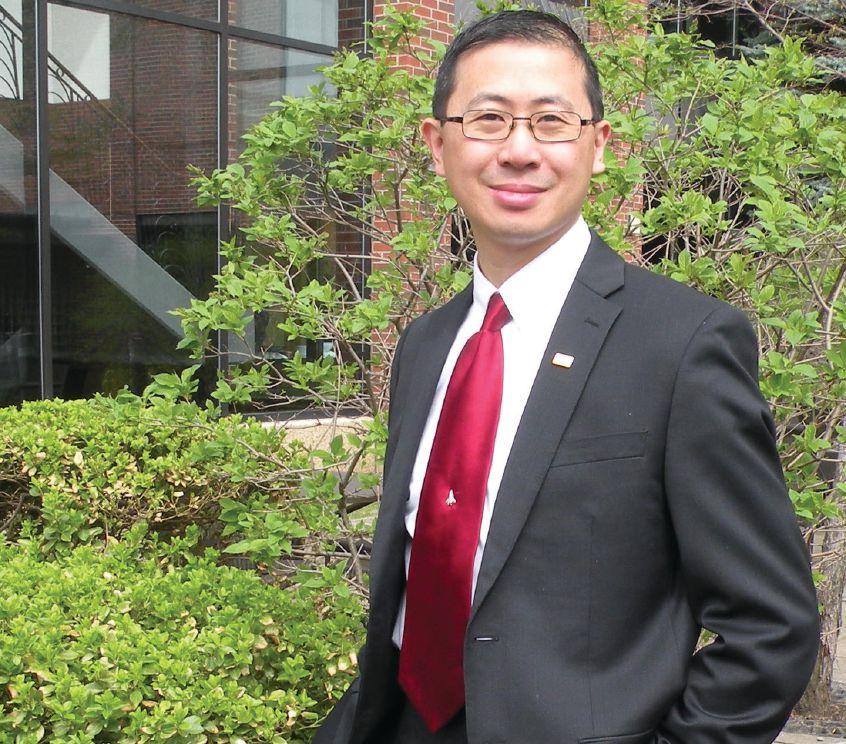

30 William Li, Color Technology Manager, Eastman Kodak, and CoChair, ICC, of Burnaby, BC

FROM THE EDITOR

4 Jon Robinson

A different kind of book

Kickstarter multi-book project aims for new interactivity with Clickable Paper

ENVIRONMENT

10 Neva Murtha

Blueline movers and shakers

Ranking the sustainability performance of North America’s largest printers

DEVELOPMENT

11 Dave Fellman

Print prospecting attitudes

Understanding what prospecting is to foster better sales skills

CHRONICLE

12 Nick Howard

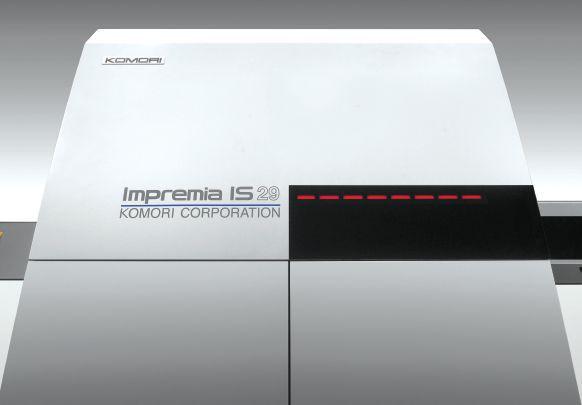

Made in Japan, rise of Komori

Part 1: How a Japanese press builder used innovation to enter the world’s stage

Through late July and August, Cal Poly Professor Emeritus Harvey Levenson – known most recently for his ongoing campaign against patent trolls damaging the printing industry – and former Seybold Editor John Parsons initiated a Kickstarter project to develop the world’s first “multi-book.” The goal of the project, in addition to raising $11,000 through Kickstarter, is to prove that the permanence of print and the vitality of digital media can coexist.

static PDF content that can be updated anytime; HTML eBook content for pretest chapter review; online quizzes and other e-learning modules; live chat and social networking; and email to private discussion lists or to tech support.

A successful August 2017 Kickstarter campaign to reach $11,000 in funding by Harvey Levenson and John Parsons will see their multi-book project come to life, in hopes of creating a new publishing paradigm leveraging Ricoh’s Clickable Paper.

By the time funding closed on August 18, 37 backers had pledged $11,526 to help bring this project to life. From this, the team expects it will take $7,500 for developing and re-writing the existing content for multi-media experiences. Twenty-three percent of the funding is to go toward the cost of printing the prototype and supplying copies of the book as Kickstarter rewards to patrons of various levels, and nine percent ($1,000) goes toward Kickstarter fees.

Levenson and Parsons emphasize the book project is designed to build true interactivity – “No QR Codes!” – where by a reader can scan an printed book page and launch a multi-faceted digital experience. The reader would need to first download a free app for their mobile device to scan any page and then select the media they want to see or hear, or the online interaction they prefer. The prototype book, which is the next edition of Levenson’s Introduction to Graphic Communication, first published in 2007, is to use Ricoh’s Clickable Paper technology to trigger related digital content and interaction with the reader.

“We’re not publishing an eBook,” Parsons said. “This is about a new way to demonstrate the inherent strengths of print. What could be better than a book that’s about graphic communication to show how print can guide and enhance digital media.”

Users will scan pages of the book using the free Clicker app on their tablet or smartphone to engage Ricoh’s Clickable Paper technology as a gateway from each page to multiple, online experiences – “If it can happen online, a multi-book can access it on any mobile device.”

Current planned experiences for the prototype book include: Interactive video using training platforms like Viddler; animation using Adobe After Effects or other 2D and 3D apps; photo galleries, saving space in the printed book, and adding or updating images (or anything else) over time; audio content like summary reviews or online audio-book versions of each chapter (accessibility issues are being explored as a stretch goal);

“This is a pioneering undertaking,” Levenson noted. “It will be the first book ever produced using Clickable Paper technology. It’s going to be history in the making – a model for the entire publishing industry, a book that talks to the reader and performs demonstrations. It will represent a unique learning experience for students studying graphic communication and for industry folks wanting to learn more about their field.”

IntuIdeas, a publishing consultancy and writing firm, will be publishing the book, in partnership with Ricoh, which is working with book printer Edwards Brothers Malloy to print the prototype book on a Pro VC60000 inkjet press. With 600 employees generating revenues of more than US$95 million annually, Edwards Brothers serves publishers of all sizes and specializes in short-run manufacturing with six digital book centres in North America and the U.K. For longer runs, the company has two offset plants with the largest fleet of Timson web presses in the U.S. and numerous sheetfed presses. Book Business ranks Edwards Brothers as the fourth largest book manufacturer in the U.S. and Canada.

At PRINT 17 in Chicago this September, Ricoh planned to produce two chapters of the multi-book for attendees to view. The full book will be printed early next year in small batches, and eventually on-demand, using the Ricoh inkjet press in full colour. The online content will be updated and augmented even after the book is printed.

Levenson and Parsons outlined their stretch goals for the project, which include more interactive content and integrating with a video learning portal, as well as more accessibility. They explain there are almost no limits to the quantity and scope of interactivity that can be added. Existing digital content can be replaced with updated versions, and new links and mobile options can be added to any page scan.

They are focused on creating what constitutes a “Minimum Viable Product’ for this project, but are already planning for Version 2.0 which may catch the attention of the publishing industry as a book strategy for the future.

JON ROBINSON, editor jrobinson@annexweb.com

Editor Jon Robinson jrobinson@annexweb.com

Contributing writers

Zac Bolan, Wayne Collins, David Fellman, Victoria Gaitskell, Martin Habekost, Nick Howard, Neva Murtha, Abhay Sharma

Publisher Paul Grossinger pgrossinger@annexweb.com

416-510-5240

Associate Publisher Stephen Longmire slongmire@annexweb.com 416-510-5246

Media Designer Lisa Zambri

Circulation Manager Barbara Adelt badelt@annexbizmedia.com

Customer Service

Angie Potal apotal@annexbizmedia.com

Tel: 416-510-5113

Fax: 416-510-5170

Mail: 80 Valleybrook Drive, Toronto, ON, M3B 2S9

COO Ted Markle tmarkle@annexweb.com

President & CEO Mike Fredericks

Subscription rates

For a 1 year monthly subscription (12 issues): Canada — $40.95 Canada 2 year— $66.95

United States — CN$71.95

Other foreign — CN$140.00

Mailing address

Annex Business Media 80 Valleybrook Drive Toronto, ON, M3B 2S9 printaction.com

Tel: 416-442-5600 Fax: 416-442-2230 PrintAction

Sydney Stone of Mississauga, Ontario, purchased Vertex Graphic and Business Equipment of Vancouver, BC. With an existing national footprint, Sydney Stone’s acquisition of Vertex provides a stronger customer base in British Columbia and Alberta. Both companies distribute and service a range of print finishing equipment. Sydney Stone was purchased in 2008 by Michael Steele and Dylan Westgate.

Pollard Banknote of Winnipeg, Manitoba, moved to purchase all of the issued and outstanding common shares of INNOVA Gaming Group based in Los Angeles, California. After initially expressing interest in acquiring INNOVA’ shares in March, Pollard Banknote increased its offer to $2.50 per share for a total equity value of approximately $51 million. This represents a 19 percent premium to Pollard’s original offer of $2.10 per Common Share and a 66 percent premium to INNOVA’s closing share price of $1.51 on the TSX on March 9, 2017, the last trading day prior to the public announcement of Pollard’s initial acquisition proposal.

Printing Industries of America released its list of 2017 Premier Print Award winners, which includes four Canadian printers receiving Best of Category Bennys: C.J. Graphics of Toronto, Ontario, which received eight Bennys; Friesens of Altona, Manitoba, one Benny; Pollard Banknote of Winnipeg, Manitoba, one Benny; and PrintWest of Regina, Saskatchewan, two Bennys.

Electronics For Imaging of Freemont, California, at the

bequest of an Audit Committee through its Board of Directors, is conducting an independent review related to the timing of recognition of revenue. EFI explains the assessment is related to certain transactions where a customer signed a sales contract for one or more large-format printers and was invoiced, and the printer(s) were stored at a third party in-transit warehouse prior to delivery to the end user.

In addition, EFI explains it is in the process of completing an assessment of the effectiveness of its current and historical disclosure controls and internal control over financial reporting. EFI expects to report a material weakness in internal control over financial reporting related to this matter. EFI also expects to report that its disclosure controls were not effective in prior periods.

FedEx is closing its FedEx Office stores in Canada after 32 years in the country, according to a report by The Canadian Press, which notes FedEx Office will close its 24 stores, a manufacturing plant in Markham, Ontario, and its head office in Toronto.

FedEx Office stores provide a range of business services like copying and printing, sign making, office supplies sales and packaging services. The stores also serve as pick-up and drop-off sites for FedEx shipping. The move will result in the loss of 214 jobs, but will not affect FedEx’s shipping business in Canada, according to

FedEx Spokeswoman Stacey Sullivan. Eighteen of the stores are in Ontario, five in B.C. and one in Nova Scotia. The closings were to begin in August.

Supremex of Montreal concluded the acquisition of Stuart Packaging, a folding-carton printer based in Mont-Royal, Quebec. This acquisition, according to Supremex, brings its share of total revenues from packaging and specialty products to more than 22 percent on an annual pro-forma basis.

The transaction was concluded for total cash consideration of $17.5 million. Stuart Packaging generated annual revenues of approximately $18 million over the past 12 months. It employs approximately 65 people at a 68,000-square-foot facility.

Jet Label & Packaging of Edmonton, Alberta, described as Western Canada’s largest producer of labels and printed tape, acquired United Label Company of Coquitlam, BC. Jet Label explains the additional space and capacity will allow it to double in size over the next two years, expanding one of its key customer sectors in mass-market retail. United Label’s client roster currently includes a variety of retailers, wholesalers, and pharmacies, among them Costco, IGA, London Drugs and Safeway.

United Label’s facility currently operates four conventional flexographic presses ranging in width from seven to 10 inches with 3- to 8-station colour capabilities, as well as a variety of slitters, rewinders, finishing systems and inspection systems. Jet Label’s Edmonton facility, which operates 24/7 across three shifts, utilizes two HP Indigo presses along with 12 traditional flexographic presses ranging in width from six to 20 inches and 3- to 10-colour station capabilities.

Grimco opened its first office location in Edmonton Alberta, after serving the area with sign and graphics supplies for more than 25 years from its Calgary location. The new office is located at 15427 115A Avenue in Edmonton. Grimco Canada, which also has Canadian locations in Vancouver, Calgary, Toronto, Montreal and Dartmouth, is a wholly owned subsidiary of Grimco Inc., which is based in St. Louis. The company was originally founded in 1875 as a single-location stamp and badge

provider. The sign supply company now operates in 52 locations across the U.S. and Canada.

Rainer Hundsdörfer, CEO, Heidelberg.

Heidelberger Druckmaschinen AG reports its current fiscal year (April 1 to June 30, 2017) began with an increase in sales and earnings; and that it is on course to achieve its annual targets. During the first quarter of the current financial year, Heidelberg sales were slightly higher than the previous year at €495 million (same quarter of previous year was €486 million) and its net result after taxes improved by more than €20 million to €–16 million.

At €629 million, incoming orders were below those of the same quarter of the previous year (€804 million), which saw a particularly high level of incoming orders from the drupa trade show. The order backlog increased by over 20 percent from €497 million at the end of the financial year to €603 million as at June 30, 2017.

Solisco launched a new brand image created by its own agency Maison 1608 by Solisco. Self described as the third largest printer in Canada, Solisco was founded in 1991 and now has a team of more than 400 employees working at its Scott headquarters in Beauce, as well as at Maison 1608 and its Solisco-Numérix division in Quebec City. Solisco recently announced a partnership with Toronto printer Trade Secret Web Printing. Solisco prints 1.2 billion pages per month, binds three million copies and 600,000 books per week, and prints around 400 magazines, books, circulars, and catalogues every month.

Delphax Technologies Canada is in bankruptcy after a declaration by an Ontario court on August 8, 2017. Two days later, Air T Inc. of North Carolina completed a foreclosure on all personal property and rights to undertakings of Delphax Canada. In October 2015, Air T through a sizable investment completed a Securities Purchase Agreement of Delphax Technologies Inc. and its subsidiary Delphax Technologies Canada of Mississauga, Ontario, where the company assembles its elan 500 printing presses.

Aleks Lajtman joins KBA as Regional Sales Manager for the press maker’s sheetfed division. He will be managing Canada’s six eastern provinces of Ontario, Quebec, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador. He will be based in Ontario and will report to Alex Stepanian, KBA’s Sales Director. Lajtman is a seasoned print industry manager who previously spent more than 18 years with Heidelberg Canada in various roles. This included positions as press demonstrator, showroom manager, product manager and most recently as account manager. He is a graduate of George Brown College in Toronto with a degree in printing technology.

Heidelberg Canada and successively took on roles as Manager, Business Development, and then Manager, Business Consulting.

Hide Tsukada becomes President and CEO of Mitsubishi Imaging Inc., a subsidiary of Mitsubishi Paper Mills. Prior to his role as Executive Vice President of Mitsubishi Imaging, Inc. he served as Group Leader, Mitsubishi Paper Mills Digital Imaging Sales. In addition to the appointment of Tsukada, Mitsubishi Imaging announces the formation of two new business divisions to best align with corporate strategies and new product development.

Tony Miller, formerly Roland DGA’s Director of U.S. Sales, has been promoted and will now serve as Director of Sales & Product Management. Miller will be responsible for spearheading Roland DGA’s expansion into new markets, while overseeing the company’s product development and sales efforts across all core markets. He will continue operating out of Roland DGA’s corporate headquarters in Irvine, California. Sid Lambert, who previously served as Roland DGA’s Southeast Regional Sales Manager for the past 10 years, has been promoted to U.S. Sales Manager for Color Products. In addition, Daryl Chaffins, previously a Roland DGA business development manager, has becomes Regional Sales Manager.

Peter Aston becomes Manager, Business Consulting, Prinect, CtP and Versafire at Heidelberg Canada. Aston has been with the German manufacturer’s Canadian operation since January 2003 when he began as Prepress Demonstrator, Group Leader. Two year later, he became Product Manager, Prepress, for

Jillian Acord has been appointed as Senior Vice President, Operations and Corporate Planning, which include Corporate Communications and Public Relations. Acord has held several leadership roles at Mitsubishi Imaging that include responsibility for business performance in Marketing, Operations, General Administration, Human Resources and Information Technologies. Chris Hung will be Vice President, Sales and Product Planning across all product lines. Hung has a long leadership tenor with Mitsubishi Imaging and has been instrumental in bringing new innovative products to market and forging long standing strategic business partnerships with industry leaders.

Edward Dwyer becomes COO of Catalyst Paper based in Richmond, BC, and will oversee the company’s five manufacturing operations in Canada and the United States. Dwyer, who brings more than 30 years of experience in the pulp and paper sector to his new role, holds a Bachelor of Science (Paper Science and Engineering) from the State University of New York and Syracuse University. Om Bhatia becomes Executive Vice President and CFO for the company. Catalyst manufactures diverse papers such as coated freesheet, coated one side (C1S), flexible and industrial packaging, food service, coated and uncoated groundwood, newsprint, directory, as well as market pulp. Catalyst has annual production capacity of 2.3 million tonnes.

Mail-O-Matic Services, founded in 1967 and currently employing 50 staff members in Burnaby, BC, has installed two new Ricoh Pro C 9110 digital presses, along with EFI’s Fiery Graphic Arts Package, Premium Edition, software. The operation is currently led by President Scott Thomson, who joined Mail-OMatic in 1977.

Best Deal Graphics and Printing, a trade printer based in Toronto, Ontario, has added a new Komori Lithrone GL-640 with H-UV system from Komcam Inc. Best Deal explains the Komori press will open new markets and compliment its current fleet of seven sheetfed presses.

Image-X of St. Laurent, Quebec, becomes the first printing company in Canada to install Agfa’s Jeti Mira LED inkjet system, pictured with Danny Jabrayan, Operator (left), and Paul Zeitounian, President. The Jeti Mira features six colours plus white and two rows of Ricoh print heads.

LacherDruck in Memmingen, Germany, was founded in 1963 by Heinrich Lacher, who began the operation in a converted ballroom restaurant. His son Gerhard handed the baton over to longstanding colleagues Walter Demartin and Christian Bittner four years ago. Today, LacherDruck produces a range of commercial and packaging jobs, mainly for the regional B2B market. The company’s portfolio includes a number of specialities such as sheet music.

LacherDruck used to print on a 12-year-old four-colour half-format press. Two years ago, however, the managing directors decided to invest in new five-colour KBA Rapida 75 PRO. “The Rapida 75 PRO was for us the ideal press at the ideal time,” said Walter Demartin, who pointed to the half-format press’ compact design, double-size cylinders and automation for short makeready times and reduced waste. Features of the press include the ability to disengage inking units which are not in use, CleanTronic Synchro washing systems, an ErgoTronic console with ColorDrive and LogoTronic CIPLinkX.

For approximately 40 percent of all jobs, LacherDruck employs the fifth inking unit to apply a protective coating. The company currently uses only Novavit F950 Plus Bio series from Flint Group.

With an Agfa prepress systems, additional single-colour and digital presses, folding machinery, cylinder die-cutting and a booklet stitching line, LacherDruck is equipped to provide a range of services. Around 80 percent of its work is handled in-house.

The genesis of Internet-based promotions giant GotPrint.com, based in Rochester, New York, has been characterized by agility, responding to consumer needs, and capitalizing on market opportunities. During its more than 15-year tenure, GotPrint grew from a small, family-run business in Toluca Lake, California, to its current size: three domestic facilities and two international locations in India and the Netherlands, with more than 500 employees total.

GotPrint specializes in customized, printed promotional materials including business cards, brochures, catalogues, multimedia packaging, signage and banners, as well as home décor and personalized gifts. The process from design and production to delivery centres around the company stated mission: To provide fast, economical and convenient service without sacrificing quality.

“History has shown, as have our projections, that demand will grow in the promotional industry,” said Erina Sookiasian, Marketing Product Manager. “We knew we couldn’t meet that demand with our existing technology, so we looked to Durst to help us remain competitive and expand further into the signage market.”

The organization added the Rho P10 250 HS to its Burbank, CA and Hebron, KY locations. The Rho P10 series, explains Durst, is especially suited for large format specialists who aim for a consistent quality on a variety of advertising and promotional materials, which is the direction into which GotPrint wanted to expand. The system achieves a print quality of up to 1,000 dpi without loss of speed. The compact print machine is designed for non-stop production printing with minimum downtime.

The promotional printing industry grew to $21.3 billion in sales in 2016, according to the Promotional Products Association International, which also notes nearly 20 percent of total industry sales are completed online by companies like Gotprint.com.

Czech-based Colognia Press claims to have achieved 100 percent improvement in press uptime by switching to Asahi Photoproducts’ platemaking system, including the AWP water-washable plate featuring Pinning Technology for clean transfer. “With the flexo plates we were using, we had excessive stop times to clean or replace plates,” said Bohdan Holona, Manager of Desktop Publishing, an in-house design studio at Colognia. “For long-run jobs, this meant half of the time printing the product was downtime. Even for shorter runs, we were not happy with the colour consistency from the beginning to end of the job. Changing or cleaning the plates can often negatively affect the quality of the product.”

Colognia Press uses a tool from Plantyst to gather real-time data. “This allowed us to see any machine’s production efficiency in real time,” Holona stated. “So we know for absolute certainty that these results are accurate. Our press uptime was 20 percent to 25 percent with our previous plates. Now we are seeing uptimes of 50 percent or more on most days.” Pinning Technology enables a clean ink transfer and prevents ink accumulating on the plate surfaces and shoulders in screen areas.

Azar Printing, based in suburban St. Louis, Missouri, will receive the 47th RMGT 9 Series sheetfed offset press purchased in North America, and joins more than 700 installations of this press worldwide since its release in 2008. This also marks the 20th RMGT 9 Series press sold in North America in 2017.

Three-way North American Trade Deal Settled: Canada, the United States and Mexico signed a free trade agreement last month that will “help make Canada a key player in a new integrated North American market,” according to international trade minister Michael Wilson. The North American Free Trade Agreement (NATFA) was announced in Washington on August 13 after two months of intensive negotiations between representatives of the three countries. Canadian Printing Industries Association stated it will be paying close attention to provisions regarding the elimination of tariffs on manufactured items, including printed materials. Another area of concern relates to more open access to government procurement contracts from non-domestic suppliers – NAFTA applies to procurement by federal government departments and agencies of over $50,0000 for goods and services.

More than 20 years experience in the self-adhesive label materials industry.

More than 15 series of products, over 3,000 categories.

Provide high quality Film Materials (PP, PET, PVC, Electrostatic, Holographic), Cast Coated, Aluminum Foil and more.

All printing label materials available.

For Sale (2002 classified): Medium-sized bindery with excellent equipment in the Greater Toronto Area. Asking price $325,000.

High-volume Variable Data Printing For Data Centres: Scitex Digital Printing has introduced the MT6240 digital printing system designed to meet the variable printing needs of service bureaus, high-volume data centres and in-plant billing operations. The MT6240 has a small footprint, fitting well into computer-oriented environments. A full-page spot colour feature helps users to increase document effectiveness. The ability to print 100 percent variable content and spot colour anywhere on the page can reduce or eliminate the need to preprint forms and keep inventory. A fully configured system can print 2,200 pages per minute.

For Sale (1992 classified): Komori 20 x 26-inch, 2-colour with Komorimatics and alcohol dampening. A real gem! This press is extra, extra clean and must be seen in person to appreciate its condition. In position for demonstrations. Serous inquiries only. $134,000.

300 Patents and One Award: An InterTech was awarded to the NexPress 2100 digital production colour press, developed by NexPress Solutions LCC, a joint venture of Heidelberg and Eastman Kodak Company. The NexPress 2100 press is a sheetfed, full-colour, auto-perfecting system that produces 2,100 A3+ sheets per hour at 600 multi-bit dpi. “The non proprietary frontend system is what the industry needs to make digital printing a reality and propel the growth of variable data printing,” says a GATF judge. The press has more than 300 patented innovations, along with thousands of additional patented ideas and technologies inherited from its parent companies.

PNH Solutions of Montreal, Quebec, returned to the annual three-day IndyCar Series race, the Honda Indy Toronto, held from July 14 to 16, as its print service provider for all the signage at the event. As Ontario’s largest annual sporting event and the IndyCar Series second largest running street race, the event this year attracted just over 40,000 live spectators. PNH now has two back to back Honda Indy Toronto events under its belt.

With a combination of mostly trackside decals and vinyl banners throughout the 2.874 km street circuit, at the Exhibition Place, PNH Solutions helped the sponsors of the event gain visibility and brand recognition, while creating a sense of pageantry among its expanding audience.

Just over 900 new trackside decals were installed directly onto the concrete blocks and 300 new vinyl banners were affixed along the bleachers, bridges and tire barriers. Due to their close proximity to the course, they were visible to live spectators and throughout televised footage and highly publicized footage.

PNH Solutions also supplied for the first time over 8,500 square feet of mesh banners to fully brand the Honda grandstand. Attesting to the durability of the printed products, with their fade-resistant vinyl and UV-resistant inks, some of them were reused from previous Honda Indy Toronto events. Court Armstrong, Vice President of Business Development at PNH Solutions, explained, “With metal grommets and reinforced webbing, the vinyl and mesh banners are less likely to tear or become dislodged.”

PNH Solutions explains it produced all the products for the Honda Indy Toronto within a short delay from both its production facilities in Montreal and Toronto, and, when necessary, produced additional items at the eleventh hour.

Armstrong, who oversaw this project, said: “The graphics for the event were supplied right up to the last minute, including Saturday – that’s our sudden service capability.”

In addition to providing more than 900 trackside decals, and 300 vinyl and mesh banners, PNH Solutions also produced rigid signs, promo flags, vehicle adhesives and Nova Hex tents.

September 10-14, 2017

Print 17

McCormick Center, Chicago, IL

September 15, 2017

Canadian Printing Awards Entry Deadline

CanadianPrintingAwards.com

September 20, 2017

OPIA London Golf Classic Pine Knot Golf & Country Club, Dorchester, ON

September 20-23, 2017

Pack Print International Bangkok, Thailand

September 25, 2017

Pack Expo Las Vegas Las Vegas, NV

September 25-28, 2017

Label Expo Europe Brussels Expo, Brussels, Belgium

September 27-29, 2017 SFI Conference The Westin, Ottawa, ON

October 4-6, 2017

PSDA 2017 P2P Technology + Innovation Summit 2017 Sheraton Hotel, New Orleans, LA

October 10-12, 2017

SGIA Expo 2017 New Orleans, LA

October 23-25, 2017

Digital Packaging Summit 2017 Ponte Vedra Beach, FL

October 27-28, 2017

Sign Expo Canada International Centre Mississauga, ON

October 31-November 3, 2017

IPEX 2017 Birmingham, UK

November 9, 2017

Canadian Printing Awards

Gala Palais Royale, Toronto, ON

January 23-26, 2018

EFI Connect

The Wynn Las Vegas, Nevada

Feb 22-24, 2018

Graphics of the Americas Fort Lauderdale, Florida

March 22-24, 2018

Sign Expo 2018

Orlando Convention Center, FL

May 15-18, 2018

FESPA 2018 Global Print Expo Messe Berlin, Germany

By Neva Murtha

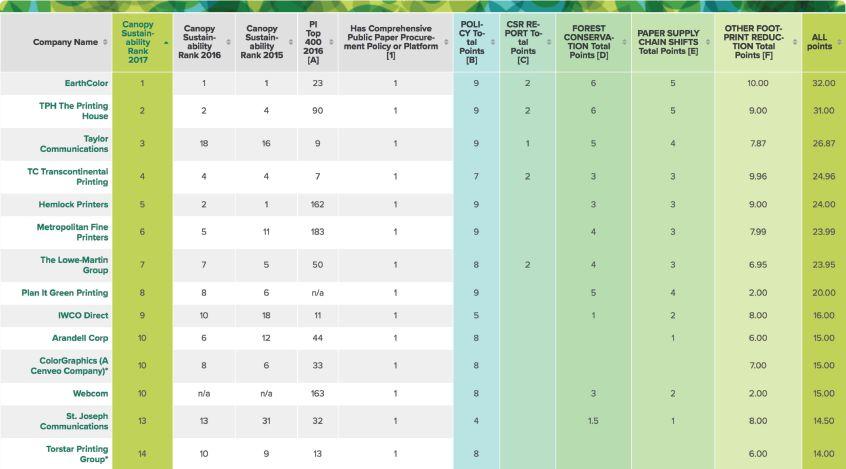

The 2017 edition of Canopy’s Blueline Ranking was released in July, and while this year’s results are consistent with the trends of the past two years, they also show some interesting and surprising new results.

The Blueline Ranking is a widely used customer tool profiling and ranking the sustainability performance of North America’s largest printers. Printers analyzed in this year’s assessment represent $34 billion in annual sales.

The top three ranking printers this year are, in order, EarthColor, The Printing House, and brand new to the Top 10, Taylor Communications. Taylor also wins the title of the fastest rising printer of 2017, moving up 15 spots from 18th place last year. It achieved this major jump through strong sourcing policy updates, and solid work on implementation.

Overall, Canadian printers are leading their peers to the south in sustainable print practices, with six of the Top 10 printers being Canadian-owned. This is in part a response to customer demand within Canada, but also very likely due to Canopy’s long relationships with the Canadian print and publishing sectors. The Printing House, TC Transcontinental, Hemlock Printers, MET Fine Printers, The Lowe-Martin Group and Webcom, all made the Top 10. The Blueline Ranking rates major printers on a set of 32 key sustainability criteria and highlights sector leaders to consumer brands.

Printers that top the ranking are outperforming their peers in areas such as:

• Having a industry-leading eco-paper policy;

• Reducing their use of papers that contain ancient and endangered forest fiber;

• Supporting the advancement of forest conservation solutions in places such as Canada’s Boreal forest, North America’s temperate rainforests, the Amazon, and Indonesia’s rainforests;

• Actively supporting development of new environmental papers such as those made with high recycled content or agricultural fibres such as wheat straw; and

Six of the Top 10 printing companies on the 2017 Blueline Ranking are from Canada, with St. Joseph and Torstar Printing Group also making the Top 15.

Printers analyzed in this year’s assessment represent $34 billion in annual sales in the highly competitive North American print market.

• Transparently reporting their sustainability initiatives progress and implementation.

Printers increasingly understand that to help their customers meet their own sustainability goals (and gain or maintain their business), they have to align with the ambitious environmental goals that brands themselves are setting, as well as provide brands with as much information as possible on their own environmental policies and sourcing efforts.

As a result, we have seen two significant shifts in this year’s Blueline Ranking:

1. There is a definitive move by printers towards adopting more rigorous sustainability policies (as noted with Taylor Communications already, but not isolated to them); and

2. Printers are communicating more transparently on their sustainability practices.

In fact, in three short years, the Blueline Ranking has become a mini phenomenon among environmentally engaged printers, who work hard to meet their sustainable sourcing goals, achieve transparency in their supply chains, and effectively communicate their efforts on these fronts. It’s also become a go-to tool for many North American print customers. Scholastic’s Senior Director of Paper Procurement, Lisa Serra, notes, “As a publisher and distributor of children’s books, Scholastic is committed to the pursuit of environmentally friendly practices and to leading by example. We’re pleased to recommend Canopy’s Blueline Ranking as an invaluable tool for any print customer who shares our goals and wants to reduce their impact on the world’s ancient and endangered forests.”

Active support for forest conservation is another exciting trend in the 2017 ranking. Forty-one percent of Blueline printers now have policies that explicitly state support for ancient and endangered forest conservation and a number of printers actively engaged this year to help advance conservation in a number of key forest landscapes globally. In just under two years, six of North America’s largest printers have developed new policies that include forest conservation language, a trend that we anticipate will grow.

It is well documented that the carbon footprint of printing mainly comes from paper sourcing. Studies have shown that 48 to 79 percent of the carbon footprint of books, magazines and catalogues comes from the manufacturing of paper and only four to 17 percent of the carbon footprint of a major printed product is attributed to the printing process itself.

It is this footprint of most conventional papers that necessitates the need for the development of lower carbon paper and packaging options such as papers made with high-recycled content or straw fibre. Printers have an important role to play in encouraging paper mills to develop these next generation papers as well as support their commercialization by stocking them as house papers.

Print customers have their own CSR goals to achieve, and strong policies and transparency among North America’s largest printers helps them more achieve them more easily.

NEVA MURTHA works with Canada’s magazine publishers and printers to develop visionary procurement policies. neva@canopyplanet.org

It is important for salespeople to better understand exactly what prospecting is to foster better skills

By David Fellman

Are you doing enough prospecting? For 99 percent of all printing salespeople, I think the answer is no. That’s my experience anyway. I hear a lot of talk about wanting to make more money, but I don’t see as much action toward making it happen. And I think there’s a simple equation at work here – more money requires more customers.

Yes, you stand to make more money by increasing your business with your current customers, but there’s a risk attached to that strategy. The bigger they get, the more if hurts when you lose them, and I think it’s been proven in the marketplace that customers are not forever.

So on one hand, if you want to make more money, you should probably be doing more prospecting. The same goes for wanting to minimize the risk of making less money. I’ve seen far too many incomes suffer when a big customer was lost, and there were no potential replacements in the pipeline.

Obviously there are skills involved in effective prospecting, but I think it all starts with your attitude. The following five statements represent the attitude that I would like you to have. I do want to make more money (or minimize the risk of making less). I will make the time to prospect for new customers. I won’t get discouraged if I don’t get immediate gratification. I will identify and pursue worthwhile prospects. I won’t lose sight of my goals.

This all begs a question. Is prospecting fun? In my experience, parts of it are, but most of it isn’t. That begs another question. What is prospecting anyway? Here’s my definition: Prospecting is an activity chain that begins with the identification of suspect companies and ends with the first meeting between the buyer and the seller.

The term suspect refers to a company

More than seven million Canadians use LinkedIn, largely organized from its Toronto office, which has become a beacon of prospecting.

that is not yet a qualified prospect, and here’s what that means. In order to be considered a fully qualified prospect, you have to know – not just think or hope –that the company meets three criteria. First, that they buy, want or need exactly the kind of printing you sell. Second, that they buy, want or need enough of it to make pursuing them worthwhile. And third, that they have some real interest in buying from you.

In truth, we should probably call this process suspecting, but I’m not hopeful I’ll ever succeed in changing the terminology of a whole industry. So let’s call it prospecting, and let’s also recognize that prospecting is all about getting to that first meeting. Which is fun, right? The meetings anyway.

about before, and that leads to another important attitude statement: I won’t let any new business development opportunities fall through the cracks.

Looking beyond prospecting, I like to say that the first meeting is the end of the prospecting stage, the beginning of the convincing stage, and the heart of the opportunity stage.

The opportunity part of this sales cycle is really important.You must understand that most of your first meetings will be held with suspects; in other words, you won’t know when you fist sit down with them whether they are fully qualified prospects.

LinkedIn Sales Navigator taps into a 450M+ member network to help sales professionals find and build relationships with prospects and customers through social selling. On average, social selling leaders see 45% more opportunities created, are 51% more likely to achieve quota and 80% more productive.

It’s the work you have to do to get the meetings that is usually not fun, especially considering that most of your suspects will decline to meet with you, and maybe not even return your phone calls and/or emails. That’s why it’s so important to have a strong prospecting attitude.

What skills are required to be effective at prospecting? The first two are analytic skills, the ability to identify good market niches and the ability to calculate a suspect’s annual volume potential. The next one is a research skill, the ability to identify the decision-maker and the rest of the players or influencers.

The next two are communication and convincing skills, the ability to craft and deliver an introductory message and the ability to deal with a number of predictable early-stage objections; for example, “I’m really busy right now,” or “I’m happy with my current supplier.” The last one is an organizational skill, which I’ve written

So part of the agenda is to determine if they do buy, want or need enough of the kind of printing you sell to make them worth pursuing. The other part of the agenda is to explore their real interest in buying from you.

Remember that being willing to meet with you is often a long way from being ready to buy from you, so the first meeting is your opportunity to learn exactly how you can differentiate yourself from the printer-in-place. More on that topic next month.

DAVE FELLMAN is the president of David Fellman & Associates, a graphic arts industry consulting firm based in Raleigh, NC, USA. He is a popular speaker who has delivered keynotes and seminars at industry events across the United States, Canada, England, Ireland and Australia. He is the author of “Sell More Printing” and “Listen To The Dinosaur.” Visit his website at www. davefellman.com.

In Part I of a two-part series, we look at how a Japanese press builder found its way onto the world stage up to the introduction of its breakthrough Lithrone press

By Nick Howard

Deep inside our Howard Iron Works Museum sits an odd looking offset press. Cast in the frame the words Komori along with the once familiar Bat logo. I managed to finagle this press from the hands of an English dealer. It took years to finally pony up enough cash to get him to sell it to me. For he was a lifelong Komori man and took great pride in having this press displayed in his factory. I was told it was built in 1928, but as hard as I tried, I was never able to verify this.

We had to make a couple gears for it. So after measuring we were all surprised to learn this little machine was built to imperial measurements and not metric. Why such interest? Container Corp.’s director of research said it best: “If you don’t remember the past. And are not conscious of the present, you have no future.” There are literally thousands of lessons to be learned and amazing stories to be told about our industry’s pioneers. Komori is but one excellent example.

You don’t learn much about the early days for this Tokyo-based company and, as with all Japanese engineering firms, Komori is extremely careful with its reputation. It all started on October 20, 1923, when Komori Machinery Works was formed as a private business. The print world was just awakening to the new phenomenon called offset lithography and Komori seemed to take the position – quite rare in Japanese manufacturing –to enter an immature market instead of building what everyone else was, namely letterpress machines.

As near as I can research, the press we

have, which is hand-fed, is a near clone of either the British Furnival or American R. HOE. After the U.S. discovery in 1904, lithographic offset sprang to life in Japan. Prior to 1920, the Harris Automatic Press Company had sold several machines into the empire and to rave reviews. Most likely companies like Komori had taken notice.

During the early 1920s, few westerners knew anything about the Japanese. Besides the arts-and-crafts business, Japan exported very little and travel was rare. In 1925, Komori’s first produced machine was a Planographic hand press (stone printing). This was a copy of America’s Fuchs & Lang lithographic press and of a very simple design. By 1928, Komori built a 32-inch hand-fed offset press –similar to the press in our museum. Early designs stemmed from duplication of English and American machines.

The Komori firm was run by the Komori family who today continue to control a large portion of its equity. The next three decades were rather uneventful and with the country’s military action in Manchuria, soon followed by entry into World War II, Japan was systematically locked out of technological developments that were taking place in America, Britain and Europe. Komori could only sit and watch while they busied themselves servicing the antiquated Japanese printing industry, as well as making attachments to allow automatic feeding of hand-fed machines.

In a 1997, a World Bank report explained, that after World War II, Japan lagged far behind the west technologically and didn’t compete internationally, but imported technology which allowed them to enter a high-speed growth period re-

Komori’s hand-fed offset press, thought to be built in 1928, is a near clone of either the British Furnival or American R. HOE. This press at Howard Iron Works was wrestled away from an English dealer.

ferred to as the Gerschenkron model. This means it was a latecomer enjoying the accumulation of innovations developed in advanced countries. The Japanese word Manabu (to learn) and Manebu (to imitate) are key elements in all well respected Japanese manufacturer’s early beginnings. Komori was no exception and, considering its factory was destroyed by fire during the war, the company had few options but to rebuild, accumulate knowledge and try again. By December 28, 1946, Komori Machinery Works was finally incorporated into a joint-stock or public company.

By 1952, big things started to happen. Komori had finally built an automatic feed offset press. This press was fitted with the American Dexter feeder and delivered to Kyodo Printing Company. By 1956, one of its very first presses, a model KW-2 with a sheet size of 26 x 39 inches was exported to Canada. It went to Montreal. Years later that press made its way to the Quebec city of Sherbrooke and by the late 1970s sold again to a printer in Oakville, Ontario. It was scrapped in the early 1980s. In 1957, Komori Currency was started and a range of Intaglio Simultan-like presses were established. Komori presses have printed Japan’s banknotes ever since much to the chagrin of KBA-Giori.

The company continued to develop products, releasing a four-colour UM-4C in 1957, a five-colour in 1961 and a six-colour in 1963. That same year saw the introduction of the Kony and the Unikom models. Later the monster Kosmo, a unitized press built in the 45and 50-inch formats, was launched. Komori marketed the Kony Super 9, then Super 10, in North America and Europe, but not the Kosmo.

The 1950s opened up Japan as much as the constrained government would allow. This proved beneficial to all manufacturers as many set sail for the engineering capitals of the world. Komori did the same, for the company was already well known in Japan. The period between 1950 and 1970 was an enigmatic time for most westerners when they viewed Japanese industry. In the graphic arts a scattering of firms made mostly facsimiles of almost everything. Even in the early 1970s, the famed English Wharfdale letterpress was still being manufactured in Japan. Hitachi Seiko also made a copy of the Heidelberg OHC cylinder press. As Japanese industrialization geared up, there was a lot going on besides cars and transistor radios. Aside from a few exports there remained no western market for Japanese

printing equipment. In fact, Germany never seemed too concerned about licencing technology to fledgling engineering firms. Sumitomo – a very large corporation – was building Miller-Johannisberg presses. Yoshino, perfect binding and trimming machines from Sheridan and Martini. Even KBA had its little KRO Rapida made for a while by Ryobi. But Japan did have its close neighbours and equipment flowed all over the area from China and Korea to Indonesia and the Philippines. Komori slowly carved out a market even though by the early 70s Mitsubishi, Ryobi, Shinohara, Fuji, Sakurai and Akiyama were playing in the same sandbox. Especially in the domestic market, Mitsubishi MHI proved to be a constant irritant and major competitor. Heidelberg continues to be a major presence in Japan to this day.

But few were building web presses. In 1970, Komori entered this market with the first of its blanket-to-blanket System series presses – System 25. Besides TKS, Hitachi and Toshiba, few dared competing in this segment. Goss for many years had some of its newspaper presses built here and the locals seemed to always prefer machines from the west. The 546mm cut-off remains a favoured size in Japan and most of Asia and Komori

catered to this cut-off, continuing to build this size today.

Also in 1970 someone must have seen the MAN or ColorMetal back printer. Komori added this feature to its Kosmo presses as an option. The back printer, or as Komori called it, reverse printer (RP), became a mainstay and well received addition. The RP continued with the Lithrone and won orders in carton printing for heavy board perfecting without the difficulty of building a perfector.

1970 was indeed a big year. Not only did Komori’s web program arrive, but this was the year of the Sprint series. The Sprint was a 25-inch press that started off as a one- and two-colour and then in 1971 a four-colour. These presses caught fire and featured a German Mabeg Jr. feeder head and electronic in-feed controls made by Omron (now house built as Eyekom). The Sprint series was so popular that it remained in production for more than 35 years. Press operators found it easy to run and it had very creative ancillaries over the years like delivery controlled plate register and Komorimatic continuous flow dampening. The later would graduate to the full line of sheetfeds and web presses. In 1976, the company name was changed to Komori Printing Machinery Co. Ltd.

At 13,000 iph, Komori’s Lithrone eclipsed both Roland and Heidelberg presses by 3,000 impressions per hour in 1981.

Komori’s real breakthrough year was 1981. In that year, after exhaustive study and research, Komori came out with a press like no other, the Lithrone. This would be the moment German builders woke up and started to pay attention. What was this little company running out of three rather small manufacturing sites – Toride,Yamagata and Sekiyado – doing? And how could they possibly? I’m almost sure the former Heidelberg rebuild centre in Waldorf, Germany, was just a bit smaller than Toride.

Over the next four decades, starting with the Lithrone, Komori would drive a range of innovations into the press-building world with offset innovations, factory builds, metals, and now inkjet system transports and partnerships. Part II of Made in Japan, rise of Komori will look at how this Japanese press builder leveraged Lithrone innovation to stamp out a new position and its inkjet interests.

NICK HOWARD, a partner in Howard Graphic Equipment and Howard Iron Works, is a printing historian, consultant and Certified Appraiser of capital equipment. nick@howardgraphicequipment.com

PrintAction’s cover was produced by BOSS LOGO Print & Graphics on its new UltraPro Foil system using Scodix Foil and Sense applications, seen as gold and green effects on this prepress image.

By Jon Robinson

or flood coatings, adding a Pantone colour, metallic inks, opaque whites, fluorescents, security features or any number of CMYK+ features.

The vast majority of these 1.8 trillion enhanced pages are printed offset and finished with conventional methods. In fact, the report found that 46 percent of enhanced offset printed material requires

and Steinemann to apply spot gloss, dimensional, foil and other effects. Beyond CMYK estimates, however, the digital print enhancement market (both inline and offline) only amounts to about nine billion pages annually. “That may seem like a lot, but it’s just a tiny sliver compared to the total 1.8 trillion print-enhanced colour pages produced each year,”

Preparation for producing PrintAction’s cover included Foil and Sense files in addition to a CMYK file, as well as accurately placing four large dots on the sheet to register and apply the enhancements.

Founded in 2007 by Eli Grinberg and Kobi Bar, Israeli-based technology veterans of the graphic arts industry, Scodix now has more than 250 installations worldwide.

Hamilton explains. “The conclusion is pretty clear. There is a significant growth opportunity for digital print enhancement processes.”

The opportunity in digital enhancement outlined by Hamilton helps to describe two of the three strategic pillars leading the development and commercialization of Scodix technology. Founded in 2007 by Eli Grinberg and Kobi Bar, Israel-based Scodix introduced its first digital enhancement system in 2010 and then caught the attention of the printing world at drupa 2012 for its unique application of polymers to enhance print –both offset and digital pages. Today, these polymers can be used in nine different or combined enhancement applications on three system platforms including the Scodix S, Scodix Ultra and the recently introduced 41-inch Scodix E106.

The Value Category, as described in large part by Beyond CMYK’s research focus, was Scodix’ initial push to the market in 2012 based on the ability to apply spot textures on a page through what are now branded as Sense polymers. Scodix’ introduction of a digital foil enhancement module in late-2015 supported its existing value-add approach, but also introduced a Cost Replacement Category of commercialization for the system maker. The third strategic pillar is referred to by Scodix as the Dream Category, which relates to a printer’s ability to attract completely new work based on enhancing pages.

Scodix’ value and dream categories are often hard to quantify because numbers will shift based on the type of application being produced, run length and a printer’s sales ability to create a demand for enhanced pages. Cost replacement, however, provides printers with solid numbers in their application of digital foil relative to the costs of insourcing or outsourcing such analogue work.

“Scodix is building a story about how they have grown and it is closely linked to the availability of what we call digital foil,” says Christian Knapp, owner of Toronto-based CMD Insight, who serves as the Canadian agent for Scodix. He has worked with Scodix for the past two years and been involved with almost half of the 11 Scodix installations in Canada, with a twelfth nearing completion. “[Texture] is very interesting but somewhat limited in its application and adoption by the market. Once Scodix brought out digital foil they opened up the parameters completely… and they experienced substantial growth simply because the market realizes digital foil fits the cost replacement model and that is what most commercial, and in fact other, printers are going for.”

Approximately 150 Scodix systems were sold during drupa 2016. There are around 50 Scodix installations currently

in North America and now more than 250 worldwide. Knapp believes the technology has moved past the early adopter stage, when printers were initially intrigued by texture, into an early majority phase. “Any return on investment calculations for a commercial printer require, on the one hand, to reduce costs in their business and, on the other hand, offer new technology. And digital foil together with texture, what we call Sense printing, gives us that ability,” Knapp says, relating to the set-up time of traditional hot and cold foiling methods suitable only for long runs, and the direct costs of outsourcing. The ability to apply digital foil naturally fits with the digitalization of

plains. It is rare for an offset press to be sold today without a coating unit and coating holds as much customer expectation as sharp CMYK work, as much as service provides client loyalty but not necessarily a premium price.

When discussing value-add, Knapp is directly referring to profit contribution for a printer based on page enhancements. He provides the example of a printing company that generates $10 million turnover, which is a suitable revenue number for Canada’s majority of smallto mid-sized printers. “If you are a good printer, well regarded, and have high productivity, you might make five percent margin so there is $500,000 on a $10

InfoTrends estimates that 30 percent of all printed colour pages have some type of enhancement beyond the four process colours.

prepress and presses, as most commercial printers today face a higher number of daily print-work transactions.

“Once you go from that product life cycle early adopter to early majority, people are starting to look at that in much more detail,” Knapp says. “Now the calculators come out and people need to justify their investments and let’s face it these machines are not inexpensive.”

Knapp explains a base Scodix Ultra system, onto which modules can be added, sells for approximately US$600,000 and the foiling unit is around US$150,000, resulting most often in a machine set up for around US$750,000 all in. “In calculations for customers, I have been able to justify the investment on the foiling unit alone within less than 12 months,” he says, noting the ROI on many full systems can be done in the range of 24 to 28 months. “That is fairly aggressive for a product that is not a small investment.”

In addition to the cost replacement models that help drive Scodix ROI calculations, Knapp also points to the value-add category where printers can simply charge more for print work when it is enhanced. He explains that traditional coating is actually more of an enabling technology relative to true page enhancements applied through systems like those built by Scodix. “Coating enables you to participate in the market, but you cannot really add that much value. Because at that level there is a market price that is highly fought over and there are lot of competitors in this segment,” Knapp ex-

million turnover,” he explains. “Now take the Top 10 percent of your customers and convert that with value-added processes such as Scodix digital foil and digital embossing. For that $1 million, if your profit number is now, to simplify things, 50 percent, you are making $500,000 profit on that volume.”

Knapp explains by maintaining the remaining $9 million of turnover at five percent margin, which is about $450,000 profit, and adding the Scodix profit from VIP clients, a printer might generate around $950,000 for the same $10 million business turnover. “In that example, if you wanted to make $950,000 profit on a five percent margin for a conventional business you would have to produce about $19 million in sales. We all know how difficult it is to grow a commercial print business from $10 million to $19 million.”

The example of achieving 50 percent margin on Scodix print work would certainly need to be adjusted depending on how it is being applied and for what select clients. A high margin figure, however, is not unrealistic for enhanced print. “Special effects printing can be a profitable endeavour,” wrote Hamilton, based on the Beyond CMYK report. “According to InfoTrends’ research, print buyers will pay premiums in the range of 24 to 89 percent for digital print enhancements over CMYK-only work. Interestingly, many buyers expressed a willingness to pay a higher premium for special effects than printers believed they would pay.”

Knapp points to three third-party studies that suggest a premium margin

for enhanced print comes in at anywhere from five to 40 percent. These studies, however, focus on a range of enhancements including lower-value coatings and not exclusively Scodix-level work.

The California Institute of Technology (Caltech) conducted an experiment in which the end user price sensitivity was tested in respect to tactile print enhancement. The researchers concluded that price increases are possible by adding soft-touch tactile features to packaging whereby brands could raise prices to endusers by up to five percent.

The British Royal Mail looked at measuring user interaction with direct mail back in February 2015 in a survey called Private Life of Mail, which included looking at the effects of tactile printing on a reader’s emotional responses. The study states: “Behavioural marketing experts, Decode, scanned recent academic literature for us to see what had been discovered about the importance of touch in human psychology. They demonstrated that there are strong reasons why getting consumers to engage physically with a brand is likely to have a strong effect on them. Multi-sensory stimulation seems to alter the way the brain processes messages – often making processing quicker, which is key for driving emotional response to messages or brands.” The Royal Mail’s study found that a sense of ownership over a printed item derived from sight and touch translates into a 24 percent increase in value.

Earlier this year, Canada Post – through True Impact Marketing – produced its own study called A Bias For Action that used brain imaging and eye-tracking technologies to see into the brains of people interacting with physical (direct mail) and digital (email, display) advertising media. The researchers developed two integrated campaigns featuring mock brands, applying the same creative and messaging across both physical and digital media formats. The 270 participants were later given memory tests to assess their recall of branded material.

True Impact Marketing found that it takes 21 percent less thought to process direct mail over digital messaging, and that the paper product creates a 70 percent higher brand recall – that our brains process paper media quicker than digital media. Researchers found the motivation response created by direct mail is 20 percent higher and even better if it appeals to more senses like vision and touch. “Physical fills a much-needed, and very human, sensory deficit in the virtual world, where we spend most of our time these days...The most important renaissance in advertising has gone largely unnoticed,” wrote Deepak Chopra, CEO of Canada Post, in a guest column for The Globe and Mail about the study.

Research by the Foil & Specialty Effects Association in 2013, in a study called Results of Impact of High Visibility Enhancements , concludes that there are overwhelming responses for what it calls First Fixation of foil stamped packaging. The authors explain, “The ability of a product to attract the shopper’s visual attention has a strong influence on a consumer’s decision to purchase.” The study found that foil can increase sales prices by 10 to 40 percent depending on the end product.

“We have a number of instances where people are charging $30 for 500 business cards, for example,” says Knapp. “Business cards are a dead giveaway market for this type of technology, compared to maybe only $10 for a conventional, standard CMYK business card.” He explains Scodix is currently focused on five target markets where it can add value: Commercial print, Web-to-print (such as business cards), folding-carton convertors (based on the introduction of the 41-inch Scodix E106), book publishing and photo-books.

The cost of polymer, explains Knapp, is always a point of discussion with printers when doing ROI calculations, especially as it relates to value-add, but he does not see it as a significant factor. “We encourage them to not put down too much polymer, because you will then lose the uniqueness, the ability to make this page standout,” he says. Knapp explains the worldwide average of Scodix polymer usage per page on a B2 sheet, 28 x 30 inches, is somewhere in the range of seven percent. “That is fairly low and the cost for a page produced like this is then in the range of 12 to 15 cents U.S. So that is actually not that much, especially if you can sell every one of those pages for a dollar or more, $5 – it depends on the application.”

The third pillar of commercialization for Scodix, beyond value and cost-replacement, is referred to by the company as the dream category, based on a printer’s ability to increase sales outside of existing product offerings and clients. “It doesn’t fly very well in the hard-nosed business world of commercial printers,” says Knapp, who began his printing career by spending more than two decades selling offset technologies. “We mention it to people because we know this happens, but in a return on investment calculation it is very difficult to quantify.”

It is logical, however, that opening up VIP clients to enhanced print with texture and foil can help attract more of their offset or digital printing work, while at the same time provide a route into new accounts through differentiation. This is also fuelled by the development approach of Scodix based on the fact that most of its research effort is put toward polymers to expand beyond its current nine applications, which are branded as Sense

(texture), Foil, Foil on Foil, Spot, Metallic, Glitter, VDP/VDE, Braille, Crystals and Cast&Cure.

Knapp explains Scodix views itself as chemical company more so than just a hardware company, focusing on engineering machine platforms to leverage new polymers and applications. “The future may well have polymers with a specific light frequency that reacts or they may taste or smell,” he says. “There are so many markets where a unique polymer or application would have great benefits. Think of security, foods, packaging in general. There are lots of applications that this technology will go to in the future.”

The polymers are a major differentiator for Scodix in the market relative to traditional inks and coatings, as well as the growth in new electrostatic inks for fifth and sixth imaging units. Knapp explains, “Scodix always determines the ideal and right polymer for the print job. Its modular [system] philosophy is application specific to what the end user needs and it is a very open R&D-centric company.”

A Royal Mail study called The Endowment Effect , which looked at a consumer’s sense of ownership over a printed item derived from both sight and touch, found the addition of touch to traditional print translates into a 24 percent increase in value.

Knapp continues to explain the use of polymers also provides an advantage for the vast majority of commercial printers who produce work-and-turn jobs, because Scodix jobs can be processed quickly with efficient drying. He also points to Scodix’ machine build, weighing around 9,500 pounds, and the registration accuracy of the systems as advantages.

“The underlying theme for Scodix, has always been to make printers more profitable,” says Knapp. “That is how I see their differentiation. I can talk technical Olympics for hours if that is what we need to do, but in the end it really comes down to providing tools for printers to be successful.”

Knapp, owner of CMD Insight, who serves as the Canadian agent for Scodix, displays a range of enhanced print at Graphics Canada 2017.

Printers weigh in on the potential of adding production inkjet technologies to their offset-dominated mix over the next two years, including perceived challenges and opportunities

By Jon Robinson

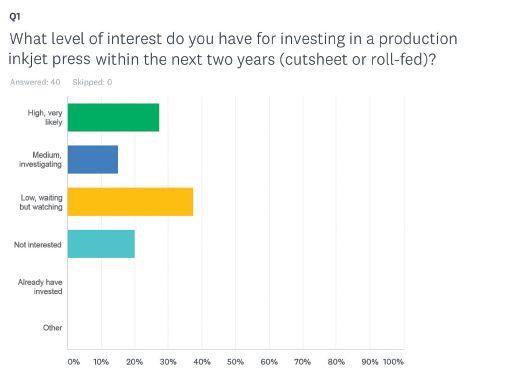

For three weeks over the months of July and August 2017, PrintAction magazine surveyed its readership about their short-term investment plans for installing production inkjet technologies. The questions were targeted at printing company executives with 40 respondents providing insight into one of the most intriguing aspects of printing technology and the potential transfer of offset work onto inkjet presses.

After decades of intense research and development, supported by unprecedented technology partnerships, production-strength inkjet is on the cusp of disrupting commercial printing. There are several examples of companies venturing into this now stable printing process, which is reaching beyond the bleeding edge stage. Technological challenges

around inkjet remain, however, including issues like cutsheet speed, ink costs, substrate range and workflow. These challenges are being met head on by suppliers, but cutsheet presses are still relatively expensive for widespread adoption by commercial printers, many of whom would also be taxed to meet the volume needs of roll-fed machines.

When asked, What level of interest do you have for investing in a production inkjet press within the next two years (cutsheet or roll-fed), 27.5 percent of respondents indicated it was “high, very likely,” which was second behind “low, waiting but watching.” Again, this is mostly likely due to the lack of cutsheet engines available under the $1 million mark, even though there are now production-strength machines venturing below this cost.

Fifteen percent of respondents indicated their interest was “medium, investigating,” while 20 percent indicated they were “not interested” in investing in a production inkjet press within the next two years. One survey respondent commented they were waiting for an affordable 19 x 25-inch duplex machine, which echoes a lot of sentiment about the current high-end level of inkjet systems. This is a reflection of Canada’s printing industry being dominated by small- to medium-sized printers and, therefore, also PrintAction’s audited readership of primarily commercial printers. Many of these shops are likely waiting for smaller, compact inkjet systems that will provide robust printing quality.

When asked what level of interest do you have for investing in a production inkjet press within the next two years, either cutsheet or roll-fed, the highest response from printers indicated it was “low, waiting but watching.” MADE-TO-ORDER. MADE TRUE.™

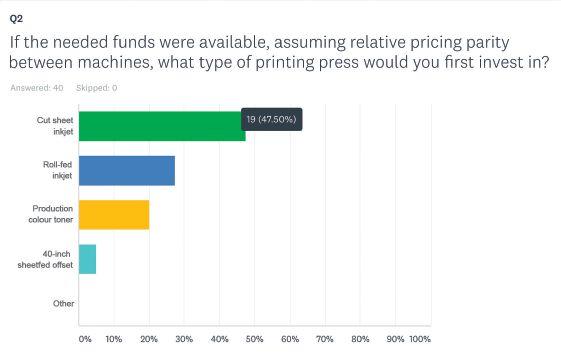

When asked, If the needed funds were available, assuming relative pricing parity between machines, what type of printing press would you first invest in, the vast majority of respondents indicating cutsheet production inkjet at 47.5 percent. This again is indicative of PrintAction’s heavy commercial printer readership. The remaining respondents included: Roll-fed production inkjet at 27.5 percent, followed by production-strength colour toner at 20 percent and five percent for a 40-inch sheetfed offset.

Gemini’s new generation of deep-dimensional formed plastic letters and logos

Form your ideas faster and easier with a 3D solution that’s versatile, affordable and durable. Our formed letters and logos are made-to-order and deliver stronger margins for you with unsurpassed value for your sign customer. And with Gemini, it’s guaranteed for life.

formed sample and information:

geminisignproducts.com/formed 800-538-8377

The lack of interest in sheetfed offset presses is certainly a reflection of the continuing high capacity in the market, which also provides access to lightly used presses and M&A activity. Although it is less discussed, there is also now a large capacity of highend colour toner presses in the market. Inkjet uptime is a also a major advantage over toner production.

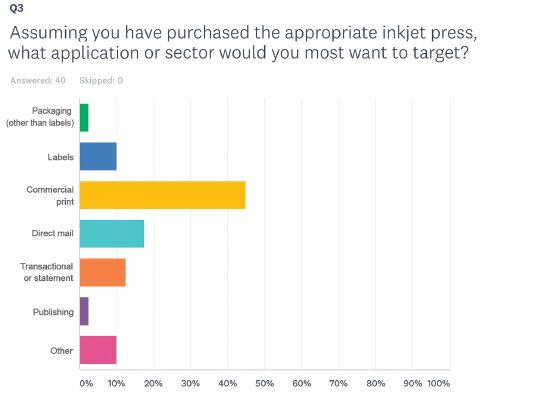

When asked, What application or sector would you most want to target, assuming that you have purchased the appropriate inkjet press, 45 percent of respondents indicated commercial print, which clearly stands to gain the most installation attraction in the years to come.

The remaining respondents indicated: Direct mail at 17.5 percent; Transactional or statement at 12.5 percent; Labels at 10 percent; packaging (other than labels) at 2.5 percent, and publishing at 2.5 percent. Four percent of respondents indicated other print sectors, including B2C applications “which I would not really class as any of the above.”

When asked what do you see as the greatest challenge to making an inkjet investment given the current state of the technology or market, the largest challenge in the eyes of respondents was the “price of the presses.” This again points to the fact that inkjet systems have not yet settled into a commercial printing friendly position of under $1 million.

Thirty-five percent of respondents indicated press price was the biggest challenge, followed by the price of inks at 22.5 percent, quality of work at 20 percent, adding necessary workflow/IT at 10 percent, available substrate range at five percent, and the speed of cutsheet presses at five percent. One respondent shared a comment that is likely on the minds of most printing operations: “We have so much capacity with our current equipment, I couldn’t justify spending money on a different press.”

When asked, if the needed funds were available, assuming relative pricing parity between machines, what type of printing press would you first invest in, the vast majority of respondents indicated cutsheet production inkjet.

Now you have the ability to improve your bottom line with proven ecologically friendly inks and coatings. That’s because Sun Chemical uses a data-driven approach that provides more transparency through continuous monitoring and reporting. See how better data can help you grow a greener bottom line with our 2016 Sustainability Report.

Request your copy of the 2016 Sustainability Report at www.sunchemical.com/sustainability or call 1-708-236-3798.

ourteen technologies have been selected to receive a 2017 InterTech Technology Award, a program of the Printing Industries of America that first began in 1978. The technologies receiving the award have been judged by an independent panel as innovative and expected to advance the performance of the graphic communications industry. The recipient technologies are described below, alphabetically by company..

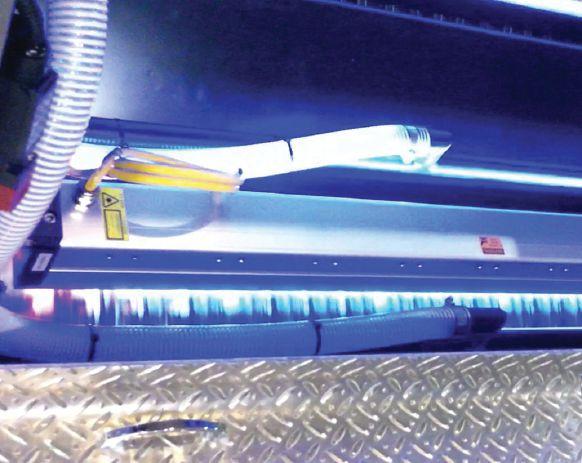

Developed by AMS Spectral UV, A Baldwin Technology Company, the XP Series LED-UV Curing Modules enable faster production speeds, lower energy consumption, and overcome other challenges of traditional UV and IR systems. A patented optic system ensures uniform light distribution and modules integrate readily onto new and used presses. Modules can last more than 30,000 hours, eliminating the need to frequently replace bulbs while providing unprecedented curing consistency. AMS explains its collimated UV LED optics are delivered at the industry’s highest intensity from as close as 5 mm to as far as 150 mm (6 inches) away. One judge commented, “This is absolutely a leap forward from traditional UV curing.”

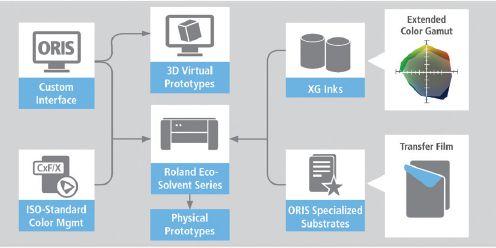

Developed by CGS Publishing Technologies International LLC, ORIS Flex Pack // Web Visualizer is a proofing and prototyping system for packaging mockups produced on flexographic, offset, gravure, and digital presses. Utilizing the ORIS

colour management system, a Roland eco-solvent printer, ORIS XG (extended gamut) inks, and CGS substrates, users can produce colour accurate proofs and prototypes of proposed packaging designs from 3D design to final prototype. The judges praised it as an innovative solution that puts high-quality capabilities within reach of even small firms.

Developed by ColorLogic GmbH, ColorAnt 4.0 advances the quality and reliability of ICC profiles used in a colour management workflow. It measures colour targets used in profiling inkjet, offset, and flexo presses, and, importantly, finds and corrects measurement errors. Judges lauded ColorAnt’s ability to edit primary colours without the need to go back on press to print another test chart (particularly important in packaging), make corrections based on G7 and industry standards, and support all of the popular measurement devices.

Developed by Esko, the XPS Crystal is a digitally controlled LED UV exposure unit supporting photopolymer flexo plates. The unit provides an unprecedent-

AMS’s collimated UV LED optics deliver high intensity from as close as 5 mm to as far as 150 mm away.

ORIS Flex Pack // Web Visualizer is a proofing and prototyping system.

The digital control of Esko’s XPS Crystal allows for new levels of exposure accuracy.

ed level of automation and can be part of a completely automated platemaking line. The LED UV light technology, concurrently preforming both main and back exposures, and the digital control allow for new levels of exposure accuracy. The judges praised Esko’s innovation that both streamlines flexographic platemaking steps and improves plate consistency.

Developed by JUST Normlicht, moduLight technology uses LED arrays that are precisely manufactured to reproduce different portions of the light spectrum. It is the first LED colour viewing technology to achieve certification to the demanding ISO 3664:2009 standard. JUST hardware, software, and optical technologies are integrated to achieve conformance to CIE D50 and D65 illuminants and to remain consistent over time. The judges agreed that the JUST LED moduLight product line reaches a new level of viewing performance.

Developed by MGI Digital Technology, the AIS SmartScanner is a new JETvarnish 3D registration technology solution for enhancing offset, flexo and digital printed material. It automatically adjusts the placement of varnish (clear ink) and foil based on actual ink impressions and substrate characteristics (shrink, skew, stretch, etc.). It eliminates the need for registration marks and optimizes quality by treating each finished piece as a separate print job. A judge commented, “Waste is very expensive and the SmartScaner is an innovative way to avoid it.”

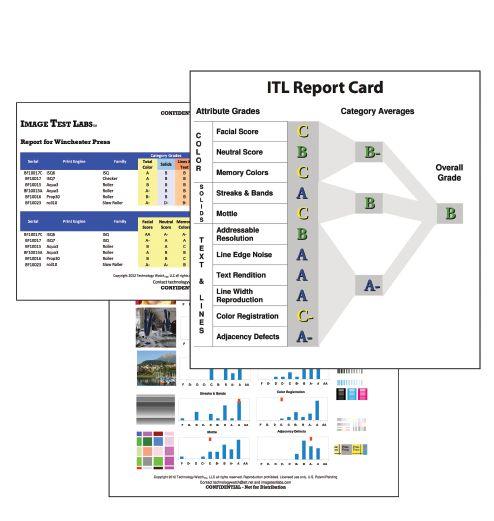

Developed by TechnologyWatch, Image Grader technology offers companies a method to assess – and improve – the image quality of their offset and digital

presses. After printing test pages and sending them for analysis by Image Test Lab’s automated system, companies receive an easy-to-understand report with A, B and C grades for each attribute. The

Image Test Lab’s automated system provides a report with A, B and C grades for each attribute.

The Gallus Labelfire 340 allows for producing inkjet UV labels in one pass.

ing the next job once new plates are automatically mounted. “The Push to Stop approach is a game changer, dramatically improving throughput,” said a judge.