Seven steps of colour management P.18

Spotlight

Rachel Crowther, sales & marketing director, Cober P.22

Seven steps of colour management P.18

Spotlight

Rachel Crowther, sales & marketing director, Cober P.22

With Versafire EP digital printing system, it’s possible to get even the toughest jobs done fast, efficiently, and always with impeccable quality. hheidelberg.com/versafire eidelber g.com/Versafire EP

Heidelberg Canada Graphic Equipment Limited 5900 Keaton Crescent, Mississauga, Ontario L5R 3K2

Phone +1 (800) 363-4800, Email ca.customerservice@heidelberg.com heidelberg.com/ca

ISSN 1481 9287. PrintAction is published six times per year by Annex Business Media. Canada Post Publications Mail Agreement No. 40065710. Return undeliverable Canadian addresses to: Circulation Department, 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1. No part of the editorial content in this publication may be reprinted without the publisher’s written permission. © 2023 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or publisher. No liability is assumed for errors or omissions. All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of this publication. Printed in Canada.

The company recently acquired the Ellis Group

Smithers study shows shifts in market outlook for wide-format dye sub printing

Two Western Canada companies are drumming up business along the U.S. West Coast

GAMUT

5 News, People, Installs

8 Calendar

TECH REPORT

18 The seven steps of colour management

NEW PRODUCTS

20 Introducing new solutions from Printful and Roland DGA

SPOTLIGHT

22 Rachel Crowther, sales and marketing director, Cober Solutions

FROM THE EDITOR

4 Nithya Caleb Resilient manufacturing

MONEY SENSE

8 Bonny Koabel, CGA, CPA

Learn how to reduce your hydro bill 13 22 6 16

Earlier this year, heads of states, economists, and CEOs gathered at Davos, Switzerland, for the World Economic Forum (WEF) 2023. Challenges facing the global manufacturing sector was on the agenda. WEF also published a white paper on that topic in collaboration with the Cambridge Industrial Innovation Policy, University of Cambridge, and the United Nations Industrial Development Organization.

“The Future of Industrial Strategies: Five Grand Challenges for Resilient Manufacturing” white paper offers a framework to facilitate a discussion between public and private sectors about “best practices, priorities and new opportunities for change.”

The manufacturing sector faces five grand challenges in 2023.

The paper highlights the three global mega trends of emerging technologies, climate change and geopolitical tensions that are disrupting the manufacturing sector. The authors believe a “two-pronged approach of short-term adaptation and longer-term transformation from manufacturers and governments” is required to address them.

The Russian-Ukraine War revealed the fragility of the global supply chain. This has forced many governments to explore a more local, near-shoring approach to manufacturing.

The fast pace of technological innovations has resulted in “hyper-competition, accelerating cybercrime and widening an existing technological divide between front-runners and laggards,” say the authors.

The effects of climate change are forcing governments and businesses to look for new decarbonization strategies. The paper also identifies the following five “grand challenges”:

1. Decarbonizing operations.

2. Enhancing supply chain resilience.

3. Accelerating the scaling up and adoption of novel technologies.

4. Securing workforce.

5. Linking business values with social and environmental responsibility.

The authors suggest it’ll be useful for private and public sectors to collabor-

ate on increasing resource efficiency, improving material substitution, enhancing energy efficiency, enabling fuel switching, advancing carbon capture and storage, gathering better data and establishing digital standards, and supporting innovation.

Companies and governments can take steps to minimize exposure to a risky supply chain by improving the end-toend visibility of supply chains, strengthening international co-ordination and collaboration, and encouraging the use of resilience-enhancing technology.

The benefits of innovation can only be reaped if there’s broad deployment in industry. However, many firms “are unable to use even existing technologies due to the lack of technical capabilities, uncertainty about the business case, capital shortage or simply resistance to change.” This can be changed by providing technical assistance to help manufacturers adopt new tech.

A skilled workforce is undeniably one of the most pressing challenges for manufacturers. The paper’s authors offer strategies to create a skilled workforce that includes:

• supporting on-the-job training;

• challenging outdated public perceptions of manufacturing;

• offering reskilling and upskilling programmes; and

• establishing safety nets.

Consumers are expecting companies to actively help create a more equitable, inclusive, and diverse society as well as workplaces. Companies can do so by:

• promoting diversity;

• ensuring the safety, ethics and regulatory security of new technologies;

• using solutions such as predictive maintenance, drones and data analytics to reduce workers’ exposure to safety risks; and

• exploring the potential of new forms of corporate governance.

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal 416-510-5113 apotal@annexbusinessmedia.com

Fax: 416-510-6875

Mail: 111 Gordon Baker Road, Suite 400, Toronto, ON M2H 3R1

Editor Nithya Caleb ncaleb@annexbusinessmedia.com 437-220-3039

Contributing writers

Bonny Koabel, John Nelson, Angus Pady, and Jack Kazmierski

Media Sales Manager

Kim Barton kbarton@annexbusinessmedia.com 416-510-5246

Media Designer Lisa Zambri lzambri@annexbusinessmedia.com

Account Coordinator Alice Chen achen@annexbusinessmedia.com 416-510-5217

Audience Development Manager Urszula Grzyb ugrzyb@annexbusinessmedia.com 416-510-5180

Group Publisher/VP Sales Martin McAnulty mmcanulty@annexbusinessmedia.com

COO Scott Jamieson sjamieson@annexbusinessmedia.com

Subscription rates

For a 1 year

subscription (10 issues): Canada — $43.00 +Tax Canada 2 year — $70.50 +Tax United States —$98.00 Other foreign —$191.00 All prices in CAD funds

Mailing address

Annex Business Media

111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1 Tel: 416-442-5600 Fax: 416-442-2230

Occasionally, PrintAction will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our Audience Development in any of the four ways listed above.

Annex Business Media Privacy Officer Privacy@annexbusinessmedia.com 800-668-2384

PrintAction is printed by Annex Business Media Printing on Creator Gloss 80lb text and Creator Silk 70lb text available from Spicers Canada. ISSN 1481 9287

Mail Agreement No. 40065710 printaction.com

NITHYA CALEB Editor ncaleb@annexbusinessmedia.com

The wide-format division of printer manufacturer Mimaki collaborated with creative professional Anabella Bergero to produce a window installation, printed on Drytac ViziPrint Impress Clear film

Produced for the ‘Constructing Identities’ MUSA exhibition in Miami, Fla., the window mural was designed to recreate a Latinx visual universe, exploring gender identity, religious iconography and Latin American pop art.

Significans Automation and Chalex combine forces to co-market and OEM their solutions. The two companies will focus on the cross-promotion of Significans Automation’s development and integration services together with Chalex’s ArtFlo, a new digital asset management and file sharing service for product information management.

TricorBraun acquires Vancouver-based Merlot Packaging, further expanding its presence in Canada. Merlot Packaging is a rigid packaging distributor specializing in high-quality closures, serving customers in the nutraceutical segment for nearly a decade.

PrismTech Graphics, a large-format digital and screen printing services provider in Burnaby, B.C., achieves G7 Master Qualification after successfully completing training, examination

and a qualification process of their print processes. Awarded by Idealliance, G7 is an industry-leading set of best practice for achieving visual similarity across all types of print processes.

Mitchell Press opens an office in Portland, Ore., led by U.S. general manager, Dianne Bullas. Bullas brings over three decades of print publication operations and sales leadership to lead Mitchell’s U.S. team. Her extensive knowledge of publications, retail catalogs, direct mail, and distribution, adds depth for Mitchell’s U.S. clients.

Printing United Alliance inducts nine industry leaders into its prestigious Ben Franklin Honor Society (BFHS). The society recognizes and honours individuals who have made significant contributions to the advancement and betterment of the printing and graphic communications industry through meritorious service. The 2022 BFHS inductees are:

• Christopher Bernat, Print Mannschaft;

• Paul Cousineau, Cousineau Consulting;

• Gary Field, Cal Poly University;

• Steve Johnson, Copresco;

• Charles “Pat” McBride, Envision Printing;

• Gerry Michael, GA Michael & Associates;

• Jeff Stoudt, The Printing

Industry of the Carolinas;

• Jeff White, Print and Graphics Scholarship Foundation; and

• Trish Witkowski, FoldFactory.com.

ePac Flexible Packaging launches a global integrated network of packaging plants. ePacOne is a proprietary cloud-based manufacturing platform that enables all ePac locations to be connected and managed as a single manufacturing plant. With ePacOne, jobs are automatically produced at the optimum locations based on proximity to customer, size, plant capabilities, and capacity. It also enables ePac to split jobs and produce them simultaneously in multiple locations.

Canadian Print Scholarships award Canadian Printing Industries Scholarships to students in the Graphic Communications Technology Management Program at BCIT. These in-memoriam scholarships have been named after British Columbia print industry leaders. Rachel Cheung has been awarded the Gary Baines In Memoriam Scholarship. Tanner Hockey received the John Kouwenhoven In Memoriam Scholarship. Madison Mills earned the Peter Purcell In Memoriam Scholarship. Also, three Canadian Printing Industries Scholarships were awarded to students in the Graphic Communications Management Program at Toronto Metropolitan University. Danika Poon was awarded the Warren Wilkins Memorial Scholarship. Melissa Chow

got the Don Gain In Memoriam Scholarship. Emma Pereira earned the Jeff Ekstein Honourary Scholarship.

XSYS increases the prices of its Nyloflex flexographic printing plates by six to nine per cent. The industry is facing a perfect storm with record inflation and supply chain constraints.

Xeikon America opens a new North American headquarters in the Chicago suburb of Elgin. Eighty per cent of the 39,000-sf facility is dedicated to customer support functions. The new headquarters will also showcase the company’s software solutions as well as offer warehousing and office space.

Durst P5 Sublifix sublimation inks now have the Eco Passport certification from OEKO-TEX, an independent certification system for chemicals, colourants and auxiliaries used in the textile and leather industry. Certified products are safe to human and environmental health and can be used for ecologically responsible textile production.

Cascades permanently shuts down the corrugator at its Belleville, Ont., facility, as part of the continuing optimization initiatives of the corporation’s containerboard packaging platform in Ontario.

Consulting firm Connecting for Results successfully finds employment for Ukrainian newcomer, Pavlo Mashkov, as digital print operator with R.R. Donnelley and Sons Company.

Erik Norman has been appointed as the new president of SwissQprint America. Norman has spent most of his career within the print and print-related markets as distributor, manufacturer, and print service provider. At SwissQprint America, Norman is heading a team of 16 in service, application, sales and administration, serving the U.S. and the Canadian market.

Printful appoints Alex Saltonstall, former general manager of CastleGate and Partner Operations at Wayfair, as the new CEO. Saltonstall will focus on launching new products and services, building the enterprise-level customer segment, and building relationships with key e-commerce platforms and other strategic partners. Saltonstall will also be joining the Printful’s board of directors.

One, Steinbach, Man., installs a new Kongsberg X24 Edge cutting table and a range of advanced tooling.

Daniel Erni is appointed as managing director of Hunkeler AG Erni has been with Hunkeler since 2016. As chief sales officer and member of the executive board, he has been a major force in the company’s ability to increase sales, earnings, and market share in recent years. Prior to joining Hunkeler AG, Erni held positions as managing director and sales manager in several other companies.

The Gallus Group appoints Dario Urbinati as CEO. With 17 years of experience in the graphic arts industry and as its previous chief sales and service officer, Urbinati will continue to drive Gallus’ mission to turn the narrow web market toward a more sustainable and profitable future. Urbinati first joined Gallus in 2007. He served nine years with the company, including as its managing director for Southeast Asia. He then joined OMET China as its narrow/mid web managing director, before becoming chief sales and marketing officer for Actega Metal Print.

The Essential Image, based in Kitchener, Ont., counts a Jeti Tauro H3300 LED as the latest inkjet engine among its five Agfa printers.

Roland DGA Corporation appoints Amado Lara as its new president. Lara, a sign and graphics industry veteran with more than 30 years of experience, has held various management and executive positions at Roland DGA since joining the company in 1992, serving most recently as vice-president of sales. Now, as Roland DGA’s president, he will take the helm of a successful company coming off a record sales year in 2022.

Optimum Graphiques, Laval, Que., recently invested in an EFI Vutek H3 printer from Electronics For Imaging, Inc.

January 23-26, 2023

eProductivity Software (ePS) Connect 2023

Las Vegas, Nev.

January 27, 2023

AWA Insights Forum Online

February 7, 2023

Futures Edge Summit | PAC Global Awards 2022 New York City, N.Y.

February 27-March 2, 2023

Hunkeler Innovationdays Lucerne, Switzerland

March 2, 2023

Advance: Women in Manufacturing Virtual Summit Online

March 09-10, 2023

Shaping the Future with Packaging Brussels, Belgium

March 12-15, 2023

TAGA 2023 Annual Technical Conference Oklahoma City, O.K.

April 4-5, 2023

SmartMTX

Red Deer, Alta.

By Bonny Koabel, CGA, CPA

n the print industry it is important to analyze all variable costs, and then find ways to reduce and minimize them.

In some provinces, power factor is used to determine delivery charges on hydro bills. Power factor is the ratio of actual energy used divided by the amount of energy your company uses at peak demand, called reactive power. This number varies between 0 and 1 and is displayed as a percentage (0 to 100 per cent) on your hydro bill.

When your power factor is below 100 per cent, your facility is drawing both reactive power and real power. However, the hydro charges (cents per KWh) applied to your account only reflects the cost of providing your facility with the real power you have consumed.

Power factor penalties and surcharges could be driving up your hydro bills.

quality in areas often referred to as “dirty power”.

Most hydro companies begin billing a company power factor surcharges once the factor is below 90 per cent. The first 10 per cent of extra electricity required is free of charge.

when the low power factor is the result of power surging from turning on electrical motors. Capacitors produce a leading power factor to counteract the power surge.

• Harmonics filters – They may be needed if the cause is non-linear load.

Poor power factor quality may be caused by surges from turning on equipment and machinery that have power transformers and electric motor driven loads (i.e. starting up printing presses and packaging machinery in a facility). Also, equipment that does not use a consistent supply of electricity, such as variable speed drives and compressors, computers, compact fluorescent and LED lighting, electrical chargers, and induction furnaces, may also contribute to low power factor. Another cause is poor

The lower a company’s power factor, the more a company pays for hydro, and the surcharges increase rapidly. If your power factor is 87 per cent, you pay a surcharge of four per cent. However, if the power factor drops to 77 per cent for example, the surcharge is 16 per cent.

If your facility is experiencing low power factor, you should contact an electrician specializing in dealing with power factor upgrades. Here are some recommendations for improving power factor:

• Load rating – Sometimes operational changes are all that are needed to improve power factor. For example, you can operate a motor closer to the full-load rating.

There are many reasons for improving power factor such as:

• reducing electricity bills;

• enhancing equipment operation; and

BONNY KOABEL, CPA, CGA, is president of AKR Consulting Canada that specializes in government grants and subsidies. She can be reached via email at bonny@akrconsulting.com. A power factor surcharge is used to recover the cost of supplying reactive power to your facility.

• Install capacitors – Capacitors are recommended

• reducing transformer maintenance or upgrades.

Wide-format dye sublimation print technologies are primarily used for soft visual communication tools such as event banners.

A recent Smithers study shows shifts in market outlook for

By John Nelson

Inkjet dye sublimation printing will continue to grow, according to the latest exclusive research from Smithers, one of the leading consultancies for the paper, print and packaging industry.

Data from its latest expert study, “The Future of Dye Sublimation Printing to 2027,” show that in 2022 the world market reached a projected $13.06 billion. The experience of the COVID-19 pandemic delivered a radical shock to the market and enduring changes will help define this industry through the remainder of the decade. Smithers now forecasts the market will grow at an impressive 9.9 per cent compound annual growth rate (CAGR)

through to 2027, pushing global demand to $20.93 billion in 2027, at constant prices.

Soft visual communications are the main application for wide-format dye sublimation print. With public events—concerts, sports matches and festivals, as well as industry trade shows—cancelled there was a corresponding drop in demand (–7.9 per cent) for flags, banners and other interior or exterior signage in the first year of the pandemic. These items typically have a short service life, and hence have recovered in line with the rescinding of lockdown orders, travel restrictions, and social

distancing rules. Through 2022, most countries revised their attitudes to the newly dominant Omicron strain and shifted to managing COVID as an endemic health problem using vaccinations and isolation, which was reserved for the most vulnerable. The main exception to this was China, which maintained a strict zero-COVID policy well into Q4 2022; but is now attempting an accelerated return to a business-asusual approach.

These trends mean that in 2022 dye sub visual communications reached a projected $824 million worldwide and has a forecast CAGR of 9.5 per cent for the next five years.

North America and Western Europe, followed by fast-growing Asian markets, are the major consumers of dye sublimation printed articles in the visual communications and displays. For North America, the market is projected to be worth $275.6 million in 2022, with growth at 8.6 per cent CAGR driving regional demand to $415.6 million in 2027.

The primary attributes favouring dye sublimation printing techniques are colour fidelity and permanence, especially in outdoor installations.

Inkjet is the preferred technology for short turnaround, low-volume work, making it well suited to visual display print. Since such media are typically oriented toward local circumstances and events, rather than mass markets, most visual communications and displays items are produced near the point of use. This

Dye sub apparel printing is set to increase at a 10.7 per cent CAGR through to 2027.

$415.6M

The North American inkjet dye sublimation printing market is projected to grow at 8.6 per cent CAGR, driving regional demand to $415.6 million in 2027.

can most efficiently be completed by regional or local sign shops and commercial printers, using in-house dye sublimation printers.

This is now benefitting from the trend toward localisation and reshoring of some print work. The disruption of the pandemic has highlighted the vulnerability of supply chains, especially those spanning the Pacific, with many major buyers now keener to buy and print locally.

The exception to this will be lowcost items with agreed formats and are not subject to change (e.g.national flags), which will continue to be mass-produced by textile companies and shipped internationally.

Some clothing types, especially swimwear and athletic wear has long made heavy use of dye sublimation print to deliver colour-fast moisture resistant garments. The market has since diversified into less specialised apparel, and several leading dye sub manufacturers have even teamed up with fashion labels to target haute couture goods.

There are few applications for wide-format presses in clothing. Home furnishings, the other major e-commerce boom segment for dye sub, has greater potential. Household dye sublimation print was worth $625.6 million in 2022 and is again benefitting from the increased interest in the online ordering of bespoke items.

Many soft furnishings—cushions, furniture, bed linen, etc.—are best produced on smaller machines. There is potential for wider-format press operators in other sub-segments, such as wallpapers, decorative accent panels, wall hangings, and flooring laminates.

Carpeting is another element of this market, although hitherto dye sub systems have achieved a limited market share. This is because disperse dyes used in dye sublimation have difficulty binding to the polyamide (nylon) fibres that are used to make carpets.

Technical textiles are the smallest segment of the market and have the slowest growth. Many of these products, such as protective equipment and medical nonwovens, are unsuited to wide-format systems.

There are some applications in sails, tents, awnings, and automotive upholstery. These sectors are also recovering at their own rates. Automotive printing is less accessible, as it is largely the preserve of a set of fewer specialist suppliers.

The market outlook for dye sublimation print in visual display media and other applications is examined and quantified authoritatively in the new Smithers study, “The Future of Dye Sublimation Printing to 2027.” This study is available to purchase now from Smithers.

Smithers forecasts the inkjet dye sublimation printing market will grow at 9.9 per cent CAGR through to 2027. 9.9%

Another post-COVID trend that has directly boosted dye sublimation print is the frequency and familiarity with which consumers are ordering goods online. The example of Amazon Merch and similar businesses are showing the advantages of printon-demand models for garment production and customisation, with faster order fulfilment, and less risk for retailers. Worth $5.60 billion in 2022, dye sub apparel printing is set to increase at a 10.7 per cent CAGR through to 2027.

Visit www.smithers.com/en-gb/ services/market-reports/printing/ the-future-of-dye-sublimationto-2027.

JOHN NELSON is an award-winning editor and journalist working in the market reports and consultancy business of Smithers where he covers market and technology developments across multiple segments including paper, packaging, sustainability, inks, and printing. He can be reached via email at jnelson@smithers.com.

By Nithya Caleb

In early Fall 2022, Max Solutions, a differentiated specialty packaging company, acquired the Ellis Group, Canada’s largest family owned and operated folding carton company.

Founded more than 40 years ago, the Ellis Group has three manufacturing facilities in Ontario. The acquisition was a surprise as the Ellis Group was and is a thriving business with an active clientele. I interviewed Marc Shore, CEO of Max Solutions, to unpack this major industry development.

As it turns out, in January 2022, the Ellis family initiated a process to explore the opportunity to find an

acquirer that made sense for their business and to take the Ellis Group to the next level. A strong cultural fit was very important to Bill Ellis, CEO of the Ellis Group, and his family. Max Solutions checked all the boxes.

“We knew how important it was to find a partner that shared our commitment to excellence, service, and to our valued employees. I am extremely proud of the company we built and have great appreciation for everyone who has contributed to its success. Max Solutions has the expertise and experience to take the Ellis Group to the next level,” said Bill Ellis in a media release sent to

announce the acquisition.

“The Ellis family has built a strong legacy of innovation, stateof-the art technology, and exceptional customer support over the past 40 years. Together, we will leverage our complementary capabilities, product portfolio and end-market expertise to provide unmatched service, speed-to-market, zero-defect quality, and the highest levels of contingency planning to our customers,” explained Shore. “Historically, we’ve sought to serve our customers in a scaled, and global, way. Ellis allows us to better serve our customers in North America and expand into additional regions.”

Shore started his print and packaging career at Shorewood Packaging where he worked for over 28

Max Solutions focuses on specialty packaging solutions for health care and consumer segments.

years. He was named president of Shorewood in 1991 and CEO in 1995. During his tenure, Shorewood’s sales grew from USD60 million to USD700 million. Shorewood was sold to International Paper in 2000, where he continued to work as president of Shorewood and an officer of International Paper until 2004. In 2005, he founded Multi-Packaging Solutions (MPS), another specialty packaging platform, with private equity backing. He grew the company to over 70 factories in 14 countries and $2 billion in revenue. MPS went public in 2015 and was eventually acquired in 2017 by WestRock (WRK). Shore stayed at WRK until August 2020.

In November 2021, Shore founded Max Solutions along with industry veteran Dennis Kaltman, who is now the president of Max Solutions. Kaltman has more than 20 years

of experience in the print and packaging industry. He started his career with Queens Group, where he was senior vice-president from 1990 to 1998. When Queens Group was acquired by Shorewood Packaging in 1998, he was named senior vice-president. Following the acquisition of Shorewood by International Paper, Kaltman served as senior vice-president of the home entertainment packaging division. Kaltman joined Shore at MPS in May 2005, a few months after it was founded. He first served as executive vice-president and COO but was then named president in August 2007 and given responsibility for the global branded consumer market in February 2014.

Needless to say, Shore and Kaltman have extensive experience in the global specialty packaging segment, especially in the consumer and healthcare segments. At Max, they’ve made significant investments in next-generation technology. Their Bristol, P.A., facility opened in July 2022 and their Concord, N.C., facility opened in December 2022.

Both Shore and Kaltman have been operating in Canada since 1982.

In a press release, Kaltman said, “Both Marc and I have operated in Canada for many years with Multi Packaging Solutions and before that, Shorewood Packaging, dating back to 1984. We’re thrilled to be back. The Ellis family has made significant investments in technology and capabilities over the years. They’ve built a talented team with valuable skill sets and we look forward to working closely with them to continue their legacy of innovation and exceptional customer service.”

According to Shore, the Ellis Group will eventually become Max Solutions Canada.

“We recognize – and appreciate –the equity Ellis has with customers and within the industry. So we’ll work to make the transition as seamless and thoughtful as possible and limit confusion for the customer,” said Shore.

For now though, all the three Ellis locations are operating normally as they were pre-acquisition. Shore and Kaltman have made some organizational changes,

“which embrace a lot of the senior leadership within Ellis.”

“Max Solutions will continue to invest in the Toronto facilities to enhance manufacturing, planning, and scheduling capabilities to better serve and communicate with our customers. Additionally, we will leverage our supply chain relationships to ensure raw materials are always available,” added Shore.

From a facility footprint and capability standpoint, the acquisition has expanded Max’s ability to serve the market and the breadth of its customer base. The company will also enjoy greater scale with respect to working with suppliers.

09/2022

Max Solutions acquires the Ellis Group in September 2022.

In November 2021, Marc Shore and Dennis Kaltman establish Max Solutions.

Two Western Canada firms are drumming up business along the

By Jack Kazmierski

While some Canadian companies dream about success beyond our borders, few find the opportunities that would make the move viable, and fewer still manage to take the plunge successfully.

One of the companies that has made the move successfully is Hemlock Printers. In October 2022, Hemlock purchased Los Angeles-based Paper Chase Press, and according to Richard Kouwenhoven, Hemlock president & CEO, the acquisition was a good fit because both companies have similar clients and “similar market positioning around

quality and technology.”

Based in Burnaby, B.C., Hemlock is focused on new business possibilities with clients on the West Coast.

The company has 175 employees in Canada, as well as sales teams working out of Seattle and San Francisco.

“We [also] have a wholly owned U.S. subsidiary based in Washington State, and we’ve been selling into the U.S. for over 25 years now,” adds Kouwenhoven.

Paper Chase was particularly attractive as an acquisition because of their focus on e-commerce and their digital knowhow. “What was really interesting about them is that they

An exterios shot of Paper Chase Press.

Mitchell Press has 105 employees.

have grown through e-commerce,” Kouwenhoven explains, “and we have no real direct e-commerce business. So we can learn from what Paper Chase has done both in the e-commerce and the digital marketing side, which we see as areas we’d like to grow in the years ahead.”

Kouwenhoven says he sees both short- and long-term benefits to his acquisition. “We now have a new sales channel that is coming from the United States,” he explains.

“The Paper Chase team and the U.S. Hemlock team can work to develop business together. So that’s the immediate benefit. The longer-term benefit is the growth and expertise in e-commerce, which also drives all kinds of opportunities from a workflow automation standpoint, and the introduction of those kinds of services into the Canadian market.”

Hemlock Printers has been selling in the U.S. market for more than 25 years.

Over the next 12 months, Kouwenhoven plans to align and integrate the processes employed by both companies, and thereafter to focus on growing their combined product offering. He feels that this acquisition gets Hemlock into new markets with new opportunities.

“The Southern California area is a giant commercial market,” he adds.

The Paper Chase acquisition will benefit Hemlock and boost business on both sides of the border, Kouwenhoven explains. “It’s great news for our U.S. sales team because they have a new ally and a new tool at their disposal. On the Canadian side, it’s the expertise in e-commerce and social media and digital marketing that we feel will

We noticed gaps in the marketplace, especially in the publication and catalogue production areas. – Scott Gray

We can learn from what Paper Chase has done both in the e-commerce and the digital marketing side, which we see as areas we’d like to grow in the years ahead. – Richard Kouwenhoven

be important for Hemlock’s longterm success.”

Like Hemlock, Mitchell Press, Burnaby, B.C., is also eager to boost business along the West Coast. With customers both in Canada and the U.S., Mitchell Press’ executive vice-president Scott Gray says his company is focused on growing their client base south of the border.

“We’ve been working in the States for years,” Gray says, “mostly through historic relationship with a ‘drive down, fly down’ approach to doing business. However, during the pandemic we saw a lot of activity from Eastern U.S. brokers, and we realized that there was a lot of opportunity being missed, especially in the States.”

One of the key benefits of working with American customers, according to Gray, is the big orders they tend to place. “Run sizes in the States are two to three times what they are in Canada,” he explains, “so it doesn’t take as much to make us busier.”

Although Mitchell Press was able to take on several larger projects with the help of brokers, Gray says he saw opportunities that were especially well-suited for a West Coast company like Mitchell. “We noticed gaps in the marketplace, especially in the publication and catalogue production areas because a lot of the competition that we have is either in Eastern Canada, or the Midwestern United States. There’s not a lot on the West Coast. They keep disappearing because they’re more focused on super-high-volume [projects] at a cheap cost.”

Mitchell Press, on the other hand, is focused on quality, and on providing top-notch service to their West Coast customers, Gray explains. “When you’re talking about publications, content is king, and it has to be a quality publication,” he adds. “We got back about $4 million worth

of business in the last two years from clients that had been printing back east, and just felt they weren’t the number one [client] anymore.”

This West Coast-focused approach to business is why Mitchell Press opened sales offices in Portland, Ore., in October 2022. With one full-time employee in Oregon, along with two manufacturer’s reps, Mitchell is eager to drum up new business, “up and down the West Coast, predominantly from Northern California to Washington State,” Gray adds.

The West Coast is important to companies based in Western Canada simply because of geography, Gray explains. “The Rockies separate the West Coast from the rest of the world,” he adds. “What we’ve noticed, especially with all these extreme weather events, is that the West Coast can get cut off for days at a time. So people are trying to bring their product a little closer to home if they can, and running up and down the coast, as opposed to going inland and outland, has its advantages.”

The goal, Gray says, is sustainable growth. “A lot of competition up and down the West Coast has either gone out of business, or they’ve mothballed equipment, or they just didn’t see it was going to fit their billion-dollar dreams,” he adds. “We’re not a massive printer, but we’re big enough that we can play with the big kids.”

Fully aware the economy is still unpredictable as we enter 2023, Gray says he isn’t overly ambitious as he looks at his company’s potential in the U.S. “We want sustainable growth,” he explains. “With 105 employees, we have 105 families to feed. We want to expand, but we don’t want to be uncomfortable with how busy we are. We want to be able to make sure we’re profitable, and that we’re delivering on what we say. We always want to make sure we deliver on quality.”

By

Dye sublimation printing involves the transfer of dye onto a substrate using heat and pressure. It is a popular method for printing high-quality images and graphics on a variety of materials, including fabric, ceramic, and plastic.

One of the main challenges of dye sublimation printing is matching the printed image’s colours to the original as closely as possible. In this article, we will look at the process of calibrating your dye sublimation printer, some areas where you can get into trouble and a few techniques to maximize the final result. First, let’s discuss the goal. Obviously, we want to have an accurate colour match. The greys must be neutral and col-

The ideal ink limit is between 300 and 360.

ours vibrant, but not oversaturated. The road to getting there requires a thorough understanding of seven key steps, which can be applied to almost all kinds of printing processes.

Modelled blotches spots usually point to too much moisture in the paper. This is even more pronounced on hard non-porous material. Use additional layers of Kraft paper to absorb excess moisture. Further, your environment should not have a high amount of humidity.

The ink is bleeding, or the paper is moving during the pressing, which

causes a ghosting image. If you pull the paper off too soon or your transfer is done too quickly, you can get rough edges.

These can be alleviated by reducing the pressure. Over time you will learn how much pressure is required for various times and pressure. This is only determined by testing.

One would think a longer transfer time would yield a denser black. The reality is dye sublimation chemistry will reach a point where too much heat and transfer time decreases the ink’s density. If you’re getting brown blacks, first decrease the time in

five-second increments. I always start with time and then pressure.

Every RIP software will walk you through similar steps when creating a new media setup. It’s beyond the scope of this article to discuss every step in detail, but let’s focus on the ones with the biggest impact.

Step 1: Ensure your environment is not too humid, as this can cause issues with dye-sub.

Step 2: Calibrate your device. Check the nozzles and alignment. If your printer has an internal calibration, then that needs to be done.

Step 3: Choose the optimal printer settings, print speed, and dot pattern. My trick is to look at what the manufacturer has done in the past. Their colour may not be ideal for your printer but they usually know the optimal combination of printer settings to use.

Step 4: Determine primary ink restrictions. This is one of the most important steps as it will determine the gamut of your printer. Most printers, when unrestricted, will print too much ink. Your goal is to find the most ink that gives you the highest chroma. If your device that can show you LCH, then you can use the C portion for chroma. As you

One of the main challenges of dye sublimation printing is matching the printed image’s colours to the original.

measure each swatch from light to dark, the chroma will increase. At one point, the chroma will stop increasing and may even decrease. Select the swatch with the highest chroma value. Your RIP may also display a graph where you can toggle from density to chroma. Always use chroma.

Step 5 : Linearization just needs to be measured and I accept the RIP settings here.

Step 6: Determine total ink limit, which is the most difficult one to figure out. Here are a few pointers. If you have over-inking at 200 to 300 per cent, and that area is wet or bleeding, then you need to stop and go back to Step 4 and reduce ink there. Ideally, you want the ink limit to be between 300 and 360. Getting to this stage may mean going back and forth between this step and step 4. When reducing in step 4, start with yellow, as it is the wateriest ink, then cyan, black and, lastly,

magenta.We never have enough magenta. I test the ink limit target by rubbing various areas to see if the ink is wet or damp and if it scuffs easily.

Step 7: When profiling, you want to measure at least 900 patches. More patches will give you more accurate spot-colour matching. I start with the middle GCR setting. Start your backs at 40.

In conclusion, colour management is an essential part of the printing process, as it helps to ensure the colours of the printed image match the original as closely as possible. By following the above steps and using the right equipment, you can improve colour match and achieve excellent results with your printing projects.

ANGUS PADY is a G7-certified expert who has helped customers resolve colour management challenges for over 30 years. Email: angus.pady@fujifilm.com.

Printful adopts unlimited colour embroidery production tech

Printful introduces the new Instant Thread Coloring Unit (ITCU) by Coloreel, a Swedish textile innovation brand. Embroidery has always had a limited colour offering because a single machine can only house a small number of threads, and each thread has its fixed colour. Coloreel’s new ITCU technology removes these limitations.

Roland introduces new holographic prism film

Roland DGA adds a holographic prism film (ESM-HOLO) to its family of premium media offerings. ESM-HOLO is a multipurpose, 6-mil holographic

prismatic film featuring a permanent adhesive. It’s suitable for indoor and short-term outdoor applications, such as labels, stickers and decals, packaging, POP displays, window displays, and signage.

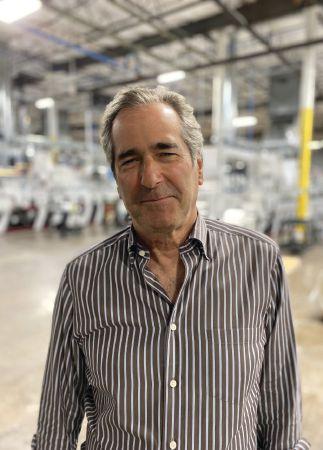

Cober, Kitchener, Ont., is one of Canada’s leading print manufacturers. When Gord Saray, Cober’s long-time sales and marketing director, decided to retire, Cober tapped its consumer-driven sales lead, 40-year-old Rachel Crowther, for the big role. Congratulations, Crowther, on the promotion! We decided to pick her brains on the state of the print industry.

What is the state of the print industry today, in your opinion?

RC: I think the landscape is ever evolving, and that’s a good thing. Print is always founded in traditional applications. However, advancements in literally every facet of the industry—from streamlined manufacturing practices and automation to technology and diversified product channels—is forcing continual growth.

What attracted you to the print industry?

RC: Honestly, it was by chance. My professional background was in a completely different ecosystem. I knew the Cober team through a previous partnership. I clumsily fell into the industry but learned very quickly that the force behind Cober was fierce and dedicated and I wanted to be a part of it. Luckily, they were kind enough to keep me around.

How can the industry attract more young people?

RC: I think the industry is an incredibly exciting, fresh, and innovative landscape for new talent and it’s simply about engaging on a level that resonates. Print is powered by progressive technology and, if you’re lucky, supported by exciting brand partnerships. That’s worth talking about. At Cober, we continue to innovate through technology, investments and cross-functional partnerships. Our team speaks to the industry with legitimate and honest, palpable energy, which translates to talent, regardless of industry or age.

In such a competitive landscape, how can printers win more sales?

RC: We are working to reframe the word, ‘sales,’ in our vocabulary. We can all sell something. We are focused on a larger conversation around partnerships and how we can better

2023

Rachel Crowther promoted as Cober’s sales and marketing director

We continue to innovate through technology, investments and cross functional partnerships.

support the relationships that have allowed us to flourish. We want to show up for the clients and industry partners—current and future—who trust us and provide those relationships value that goes beyond the transactional. At the end of the day, it’s people working with people. So, we celebrate diverse behaviours and ideas, within our team and with our clients. With our mantra of “stay humble, work hard and be kind,” one can’t go wrong.

What are some of the biggest opportunities in the print industry?

RC: Just like the rest of the world, print is powered by technology. Investing in a progressive infrastructure, be it on the shop floor, with your internal talent, or via the systems and programs you create to streamline workflows, smart technology supports solid business. At Cober, we are incredibly fortunate to have teams that respect the place technology has in our business. It has been a game-changing factor in our growth. We also must talk about sustainability, and not just about the ink on paper, but how the business functions. It’s hands down a complicated exploration, but it’s a conversation that must

be had. Businesses and consumers are demanding it. If you can figure out how to make that an honest part of your organization’s MO, and thus understand the value that can add to the partners you support and, potentially, their end users, then you’re checking a lot of boxes.

What do you think is the most exciting thing about print today?

RC: Print is more accessible than it has ever been before. It is literally at your fingertips with one click, a face ID, or thumb print. This is true for both businesses and individual consumers. A massive portion of the opportunities available within the industry can be purchased from couches and kitchen tables. With the strides being made in SaaS and AI, print is no longer a docket-driven economy. It is powered by consumers, progressive online brands, and leadership teams who are willing to step outside their comfort zone and think about the physical differently, which is exciting.

Crowther’s responses were edited for length. For more Q&A Spotlight interviews, please visit www.printaction.com/profile.

There’s a better way.

We get why solvent is king. It’s been around for a while, and other options have not been able to compete with its quality.

But that’s changed. Improved water wash technology has arrived, and Flenex plates are the proof. They process 3x faster than solvent and 1.5x faster than thermal, and the lowest cost-in-use is a true difference maker. Plus, Flenex’s natural flat top dot allows high gradation and superior print quality with the ability to hold a 1%, up to 99% dot.

No more disposing of nasty chemicals.

No more waiting on drying time. Just 30 minutes of total processing.

Learn more and transform your plates at fujifilm.ca/graphics.