2025 INFRASTRUCTURE REPORT

BUILDING BRIDGES, NOT BARRIERS

The construction industry continues to experience a pivotal transformation fuelled by ongoing government investment in infrastructure, growing demand for resources, and a push for sustainable building practices. However, these opportunities come with challenges, including shifts in manufacturing capacity and evolving environmental regulations that shape project planning and execution.

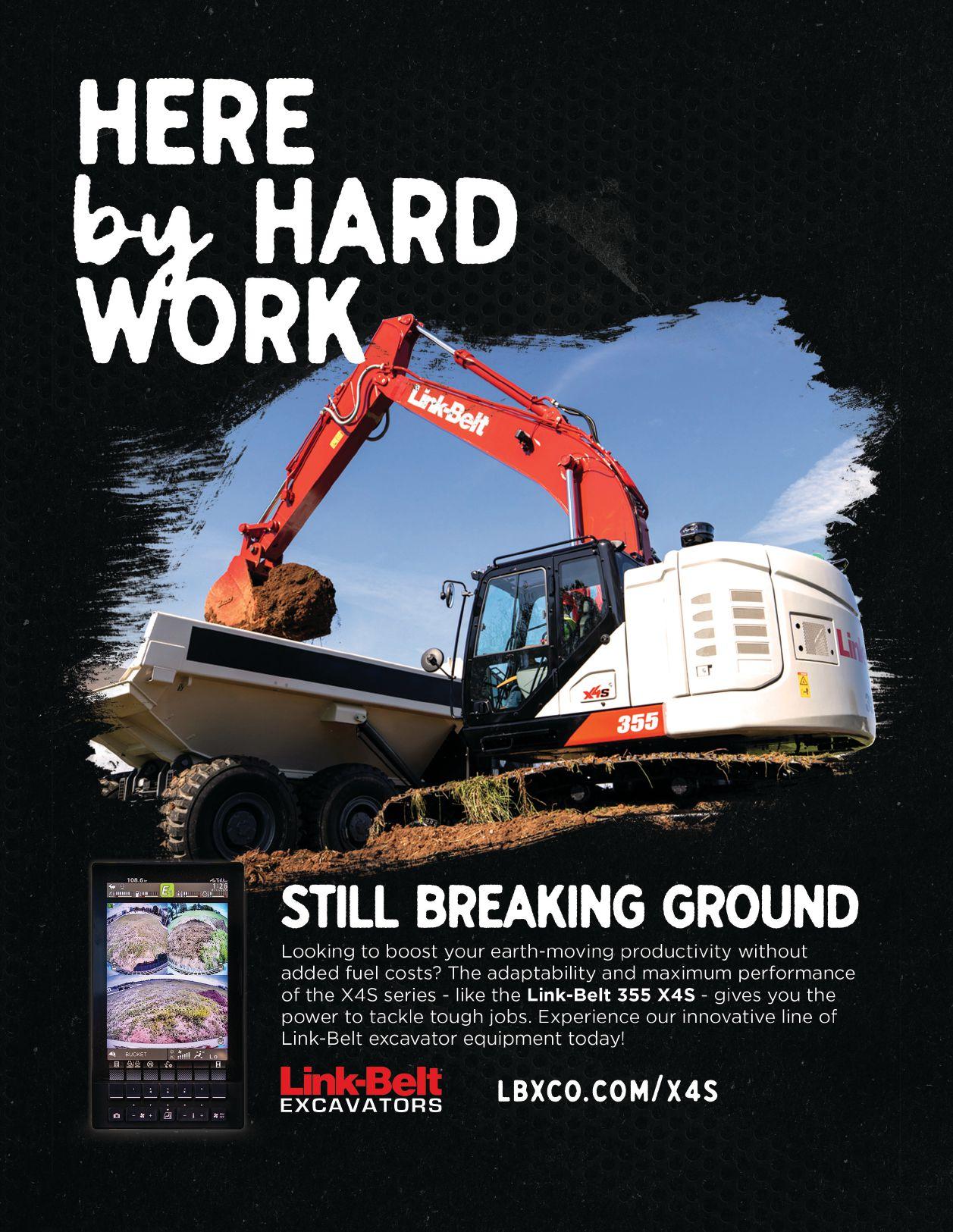

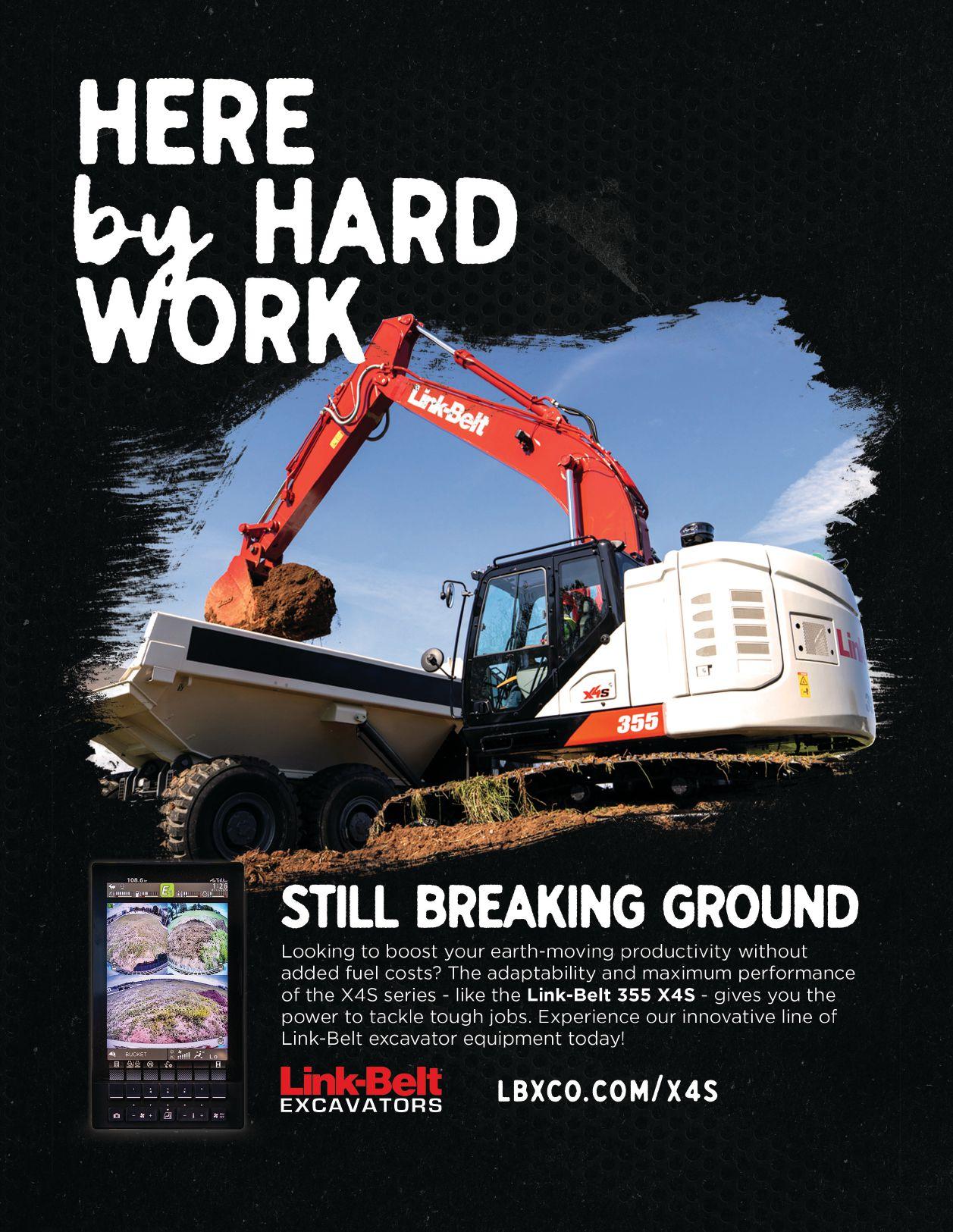

For more than 150 years, the Link-Belt brand has remained steadfast in its commitment to progress, delivering innovative solutions that enhance efficiency across construction operations. Today, we continue that tradition by integrating cutting-edge technologies into our excavators, empowering operators with unprecedented control, real-time insights, and reduced environmental impact.

At Link-Belt Excavators, our purpose extends beyond machinery. We are dedicated to strengthening our communities by fostering strong dealer partnerships, delivering reliable equipment, and cultivating a company culture that embraces progress and customer success. These values ensure we remain a trusted partner in the evolving construction landscape—now and for future generations.

We are proud to support On-Site Magazine’s 2025 Canadian Infrastructure Report and recognize the importance of collaboration in overcoming industry challenges. By working together, we can drive efficiency, support critical infrastructure development, and build a stronger future for Canada’s construction sector.

Chris Wise Director of Marketing & Distribution Development

Link-Belt Excavators

BY SAUL CHERNOS

With a trade war with the U.S. undermining economic certainty, there’s no better time to build bridges. These may be challenging times, but highway, rapid transit and other transportation activities are alive and kicking north of the border. The infrastructure sector is poised for another year of growth ahead, as new projects are flowing in as several major projects progress towards their completions.

One of the biggest projects in the country, the $6.4-billion Gordie Howe Interna-

tional Bridge between Detroit and Windsor, Ont., is slated for completion this September. As that looks to wind down, multiple projects are coming to the fore in Ontario. The re-election of the Conservatives to a majority provincial government in late February lends near-certainty to the path forward on the construction of Highway 413. That highway is charted to run 60 kilometres through suburbs north and west of Toronto. The federal government has withdrawn a planned federal environmental assessment, and preliminary planning and

design are underway. As such, early works are anticipated soon.

Also proceeding is the 16.3-kilometre Bradford Bypass, which will link Highways 400 and 404 north of Toronto. Some early preparatory works are completed on its western leg, and the central and eastern sections are likely to come to market this year.

In northwestern Ontario, work on the first phase of twinning Highway 17 is nearly finished, with 6.5 kilometres from the Manitoba border to Highway 673 widened from two to four lanes. Preliminary design

for phase two, an 8.5 kilometre stretch between Highway 673 to Rush Bay Road, is underway, and a third phase that will run 25 kilometres from Rush Bay Road to Highway 17A also lies ahead.

Multiple other projects are also waiting in the wings. The province issued a request for proposals last year for the Garden City Skyway on the Queen Elizabeth Way between St. Catharines and Niagara-onthe-Lake. Plans call for a new four-lane, 2.2-kilometre bridge across the Welland Canal and the rehabilitation and full deck replacement of the current bridge. Each span will have four lanes, with the new one carrying Toronto-bound traffic and the upgraded span being used for Niagara-bound vehicles.

Also coming up is twinning 68-kilometres of Highway 69 north of Parry Sound. With single lanes in each direction currently separated by a small culvert divider, plans call for one additional lane in each direction, separated by a full concrete safety barrier. The addition of a centre passing lane for the two-lane Highway 11 south of Sudbury is also being explored.

Rapid transit is equally active. The Ontario Line project is underway. That’s a downtown Toronto relief subway route expected to cost up to $19 billion, possibly opening by 2031. Also happening in Ontario’s capital city is tunnel boring for a 7.8-kilometre, three-station extension of the Scarborough Subway line. This started in 2023, with a possible 2030 launch. It has an estimated cost of $5.5 billion.

Not too far away, to the west of the city, is the $5.6-billion, 18-kilometre Hazel McCallion LRT. That project is underway between Port Credit and Brampton. Looking a little farther west, early works started last year on a 14-kilometre LRT line in Hamilton, with request for proposals for major works expected this year.

“This government is laser-focused on generating economic prosperity, and they believe the vehicle to achieve economic competitiveness is through expansion of rapid transit and relief of congestion through

expansion of our highway networks,” says Ontario Road Builders’ Association spokesperson Steven Crombie.

In Quebec, the government has started rebuilding the Île d’Orléans Bridge northeast of Quebec City. More than 12,000 vehicles cross daily, but the 90-year-old span doesn’t meet modern safety standards and lacks capacity for heavy trucks. The new cablestayed bridge will include two traffic lanes and space for cyclists and pedestrians. With a current estimated cost of $2.759 billion, completion is expected in 2028.

Construction also continues on the new $2.3-billion Île-aux-Tourtes Bridge, which will replace a troubled 1960s-era crossing that accommodates 87,000 vehicles daily between Montreal’s West Island and Vaudreuil-Dorion. Two new structures, one in each direction, will each include three lanes for motor vehicles, plus one each for cyclists, pedestrians and emergency vehicles. The province says it expects the new structures to open starting in late 2026.

Also in that province, repairs to the Louis-Hippolyte-La Fontaine bridge-tunnel underneath the Saint Lawrence River near Montreal will involve major structural work, modernization of operating equipment, and redevelopment of service corridors. The projected cost is $2.5 billion, with completion slated for 2027. On Route 136 in Montreal, meanwhile, major repairs to the Ville-Marie and Viger tunnels are pegged at just over $2 billion and should wind down by 2030.

Highway work is also ongoing. An $899-million extension of Highway 19 between Highways 440 and 640 in Laval is slated for completion in 2027, and Phase 3 of $883 million in upgrades to Route 185 between Saint-Antonin and Bas-Saint-Laurent near New Brunswick will likely end later this year.

Public transit projects are also active in Quebec. An extension of the Metro Blue Line in Montreal, awarded in 2023 and currently estimated at $7.6 billion, is expected to reach substantial completion by 2031. And one leg of a $6.9-billion expansion of the Réseau Express Metropolitain (REM) is slated for substantial completion later this year.

Xavier Turcotte-Savoie, with the Quebec Road Builders & Heavy Construction Association, is particularly enthused about TramCité, a proposed new tramway in Quebec City.

“We’ve been talking about it for something like 10 years, and it was finally

announced last summer,” he says. The Caisse de dépôt et placement du Québec is planning the line, but the project includes federal funding, and a looming election leaves some uncertainty.

Overall, Turcotte-Savoie considers the workload steady. An $11 billion provincial deficit might impact spending, but Premier François Legault has talked about investing in infrastructure to help boost the provincial economy in the face of tariffs.

The provincial government is also planning a new agency dedicated to major new projects for transportation infrastructure.

“It was adopted by the National Assembly last fall and they’re working on it right now,” Turcotte-Savoie says, anticipating a possible launch this year. “The concept of the agency is a good thing, but we want to make sure the money we put into new projects doesn’t come at the expense of repairs to infrastructure we already have.”

Last year, British Columbia put the $4.15-billion Fraser River Crossing in motion. Plans call for a 2,625-foot-long, eight-lane immersed tube to replace the current four-lane George Massey Tunnel carrying Highway 99 under the Fraser River between Richmond and Delta, south of Vancouver.

The new tunnel looks to meet modern seismic performance standards and offer three vehicle lanes and a dedicated transit lane in each direction, with a separated active transportation corridor for cyclists and pedestrians. Plans also include replacing Deas Slough Bridge between Deas Island and Delta. An environmental assessment, as well as design and early peripheral construction work, are underway, and proponents say they hope major construction can begin next year and conclude by 2030.

Work also continues on the Fraser Valley Highway 1 Corridor Improvement, with $5 billion projected to widen and improve the Fraser Valley section of the Trans-Canada and ease growing congestion. The planned widening spans 21 kilometres and would add an HOV lane to two existing lanes in each direction. It would also add a

bus-on-shoulder lane in each direction to improve rapid transit.

Kelly Scott, CEO of the B.C. Road Builders and Heavy Construction Association, says both projects are key, and the improvements stand to ease commuting times throughout the Fraser Valley south of Vancouver.

“Traffic can be very congested on this corridor. It is the key artery for the economy. This is a huge investment to open the corridor from Chilliwack to Surrey, ease the congestion, and keep the economy moving.”

In the north, a series of small, $30 to $50-million projects are underway as part of the Caribou Road Recovery Program, to address recent flood damage.

On the public transit front, shovels hit the ground late last year on early works for the 16-kilometre elevated Surrey-Langley SkyTrain extension, including pilings and foundation construction. The project has experienced a slight delay, with the initial planned opening moved from 2028 to late 2029 and the cost rising 50 per cent, from $4 billion to just shy of $6 billion.

Scott says he’s pleased construction is also underway on the Broadway SkyTrain line, which will run underground.

“These are both exceptionally large projects. Our members are busy relocating utilities and preparing the ground works for the overhead railway and stations for the Surrey-Langley extension.”

Also on tap are significant investments from Port Vancouver, BC Hydro, Vancouver International Airport, and Metro Vancouver.

With the completion of other major projects, including the Kicking Horse highway, the industry has the capacity for new work, says Scott. “The need to invest in an efficient, effective transportation system that moves our economy west to east has never been more important. These projects align nicely for the industry to continue investing in people, equipment, and local communities.”

In Alberta, the Yellowhead Trail Freeway Conversion in Edmonton is well underway. That is the largest roadworks program in northern Alberta and has a value of just over $1 billion. Extensive upgrades are also underway in Calgary along Deerfoot Trail, with new bridges, interchanges and other components.

“It’s an immense program,” says Alberta Roadbuilders & Heavy Construction Association CEO Ron Glen, who estimates the project’s current work program at roughly $800 million, with additional funding expected as the project carries on. “At the end of the day it will be more than the Yellowhead conversion program.”

Also underway is a $180-million twinning along a 45-kilometre stretch of Highway 3 in the south that passes through Medicine Hat and Lethbridge. “This was put out as a design-build two years ago and it’s now in full swing,” Glen says, adding that work could be completed by 2026.

A significant number of bridges, culverts

and other road-related infrastructure also require attention and, with roads important politically in rural areas, Glen says the recent provincial budget has stood pat on infrastructure spending, so he’s hopeful.

While roads thrive, early work on Calgary’s Green Line has come to a grinding halt. The 46-kilometre, 29-station LRT looked to become the largest public infrastructure project in Calgary’s history, but wrangling over routing, tunnels, development around stations, and escalating costs came to a head last year when city council voted to shorten the first phase due to cost overruns. The province responded by pulling its funding, and the city in turn decided to halt work, at least for now [and as of press time].

“It’s been a boondoggle,” Glen says, noting that initial plans to go underground failed to address complex geotechnical challenges, and routing should have instead been above-ground.

“They need to completely revisit the alignment, which is now happening,” he explains. “But they’re also going to have to revisit the governing structure and the procurement process. And it’s now going to be impacted by the global situation and the tariffs because there are American companies involved or who would like to be involved, and there’s American product that would be involved. So, the budget is now going to be under even further constraint.”

Glen says the current trading environment and uncertainty with the U.S. warrants dedicated attention to infrastructure.

“This is a potentially existential moment for this country,” he says. “Everything we do needs to improve the transportation of goods to market. We need to get our ports and pipelines built so we can get our products to the coasts and into other parts of Canada, because we can’t rely on the United States anymore.”

Saul Chernos is a freelance writer and author and is a regular contributor to On-Site Magazine.

Distributors

Other

BY ON-SITE STAFF

Canada has a significant need of investment in infrastructure, with particular focus on housing- and trade-enabling infrastructure. While there are projects underway, more are needed, and not just in or around the nation’s largest cities. Infrastructure expansion is needed in all regions of the country, and in all segments of the infrastructure sector.

To foster the discussion about Canada’s infrastructure needs, On-Site Magazine welcomed representatives of key construction organizations to a webinar in March to explore current projects, upcoming projects, and the sector’s prospects going forward.

The panel, moderated by Adam Freill, editor of On-Site Magazine, and sponsored by LBX Company, included LouisPhilippe Champagne, vice-president of public affairs and industry practices at the Canadian Construction Association (CCA), Aneil Jaswal, director of portfolio strategy at Canada Infrastructure Bank, and

Lisa Mitchell, president and chief executive officer of the Canadian Council for Public-Private Partnerships.

“We are starting with an infrastructure gap in this country,” said Mitchell. “Not only are we trying to build new infrastructure to enable more housing starts in new communities, but the existing ones are already maybe a little bit behind the eight ball.”

The building of new projects, and the expansion of existing infrastructure components, will likely open opportunities for construction companies for the foreseeable future, said the panellists. Two of the key drivers for the sector will be housing and trade. While trade is in the spotlight due to the trade war, housing has been a core focus for the past several years.

“The price of a home is too high compared to the available incomes of Canadians.

What happened in the 20 years from 2005 to 2025 is the average income doubled, meanwhile the price of a home tripled. That discrepancy has made it more challenging for new owners to get into the market,” explained Champagne. “In order to bring that price down, the only real solution is to change the supply.”

That’s not an easy task, since annual Canadian home completions are typically between 200,000 and 250,000 units per year, peaking at barely more than 250,000, he explained.

“In order to increase the housing starts, a number of things need to happen. We need to have the workforce to build it. We need to have the procurement process be efficient, and we need infrastructure to support it,” he said. “You can’t just build a home in a field. You need streets to get there. You need sewers and water mains to get to the house. You need utilities, you need schools in that new neighbourhood, et cetera, et cetera.”

There is a real cost to building all of this housing-enabling infrastructure, however, and the expense of these backbone systems may not be recoverable for some time, which can make financing the projects difficult, explained Jaswal of CIB.

“A couple years ago, as the housing crisis was starting to really pick up, we took a deeper look at the needs around infrastructure and housing,” he said. “We spoke to municipalities… and we found that they have to make these big upfront investments for growth that really doesn’t materialize for many, many years.”

He pointed to building of a wastewater plant, since the capacity of the water

system is a critical component of the ability of a municipality to expand its residential development.

“That’s typically paid back through utility rates, but that takes 20, 30, sometimes more, years, and sometimes there’s risk for a city that’s putting a major capital outlay up front,” he stated. “We looked at that and thought, how can we help? We’ve developed a product – our new infrastructure for housing initiative – where we have a standardized product that municipalities can access for pretty low-cost financing that shares in the risk of that future development.”

Longer payback periods can make certain projects more difficult to finance traditionally but he explained that the structure of Canada Infrastructure Bank allows it to take a longer-term approach when investing in such projects.

Beyond housing, investment is also needed as Canada and its regions look for new options to export goods, both interprovincially and to the world.

“Canada, for a long time, for decades, has been in the top 10 of best trading nations in the world. That’s how the world sees us. That’s how we see ourselves. We have a significant amount of natural resources. We have a great manufacturing sector. We have been good partners, especially to the U.S., but also to Europe and more recently to Asia. Shockingly, though, in their latest report, we fell from the top 10 to place 32nd; right after Azerbaijan,” said Champagne. “The problem is that our capacity, in terms of trade infrastructure, is declining.”

He added that the trade war has

changed how Canadians view the trading relationship with the U.S., which is heating up discussions about trade-enabling infrastructure. “While they may remain an important trade partner in the future, especially following the Trump administration, we can’t just be dependent to a single trade partner. We need to diversify on both coasts,” he said.

“There have been a lot of people that I think have been thinking east-west for a number of years now, but I think the situation that we’re in has really prompted a broader view of the need for east-west trade and less on north-south,” added Mitchell.

“We want to buy Canadian. We want to turn away from U.S. suppliers in many industries, construction being one of them, and say, ‘We’ll buy more of our own goods made in Canada, our own wood, our own steel.’ But the fundamental problem is that many of these resources are regional in nature,” said Champagne. “How do we get that these goods from east to west to all the markets in Canada? You need significant road infrastructure, significant railroad, ports, airports, name it. This is where the investment is very much needed.”

“We’ve seen plenty of projects in the trade and transportation industry that have been using the P3 model: highways, roads, bridges. There are opportunities and other types of assets as well, ports and other things,” said Mitchell, who explained that integration across agencies needs to be part of the planning process. She looked to Nova Scotia for an example of how this can work.

“They’ve created an organization called the Joint Regional Transportation Agency.

Their board consists of the airport, the port, transit, the rail, everybody that is in that system and network space. And they’re doing an analysis of what the needs are in the region,” she said. “I think those are the types of things we need to see more of across the country, because things don’t operate in silos.”

Jaswal also brought up multi-jurisdictional planning and projects that would enable movement of goods. He pointed to the CANXPORT project in the Port of Prince Rupert in Northern B.C. “They had an issue where they had a lot of empty export containers. This is a problem at many ports in Canada where we’re sending off containers that are empty. So, there’s tons of export capacity in many ways, but how do you access it? We invested in a project that is called a transloading hub. Basically, it allows bulk goods to be containerized.”

This, he explained, is fostering new export opportunities from Western Canada, allowing, for example, products from Alberta to use the port to reach the rest of the world. “You needed this major multihundred-million-dollar investment to allow those goods to be put onto ships efficiently. That’s going to allow tens-of-billions in major new exports,” he said.

The big-picture vision is one that CCA would like to see in all sectors of infrastructure.

“CCA, for quite some time, has been advocating for the National Infrastructure Assessment, the NIA. It was on the backburner for way too long, in our opinion. But finally, we have the Canada Infrastructure Council, which was announced in December,” stated Champagne. “Their current focus, as requested by the minister, is to look at the challenge of housing-enabling infrastructure, which we think is a great issue to tackle, but we’re really hopeful that in the next phase we hear they may tackle the trade and big infrastructure.”

To view the full discussions from the webinar session, scan the QR Code, or visit On-Site’s YouTube channel.