EASY- TO-USE | CONSISTENT QUALITY INPUT

TRACEABILITY OF ALL PRODUCTS | TECHNICAL GROWING SUPPORT

CANNA COCO A & B is an easy-to-use 2-part fertilizer specifically designed for the unique characteristics of coco substrates. It has all the essential elements required for your plants to see the most optimal results throughout the entire plant life cycle. All CANNA nutrients are manufactured from the highest quality materials, as we recognize the vital role of clean and consistent inputs, as well as keeping it simple!

Trust CANNa, a leader in the industry for over 30 years, to deliver on our promise that “Quality proves itself!”

By Haley Nagasaki

With the decline in alcohol consumption statistics, and adult use cannabis sales on the rise, it’s clear that the work being done in this field is championing a profound cultural shift to which we’re all bearing witness. But this charge is a tall order, and consumers demand transparency and consistent, quality products to elicit the brand loyalty we all covet. Beyond the stale rooms of legislation, why else is quality assurance at the forefront of each cannabis operation? Beyond stringent regulatory compliance, the QAP is responsible for meeting the highest product standards; turning consumers into fans. It’s not just about getting people high, it’s about the experience, the story, the engagement with industry –be it at events or over social –and knowing that what you’re consuming is none other than the best.

Our Spring issue digs into themes of quality assurance – a thread we at Grow Opportunity will continue to trace using the results of our Industry Survey that I will present live at our virtual summit taking place mid-May beneath the broad QA umbrella. I would also like to take a moment to welcome Mariana Black, QAP at GlassHouse Botanics, as a new columnist (and future event speaker) who, in this issue, shares key lessons from the EU-GMP certification process.

Retail makes an appearance this season as Denis Gertler returns to speculate on behalf of some of the bold moves potentially underway in the Ontario cannabis retail sector, as “the Ontario government shows a willingness to upend retail more generally,” he says. And as the collective gatekeepers of the cannabis market, the custodians of the good vibes, we welcome back our Budtenders column, this time with Marigold CEO Katie Pringle presenting findings from their latest survey on the eve of Tether’s B-Week taking place later this month.

To the budtenders helping guide the cannabis experience with expertise and enthusiasm, we salute you!

Laurie takes us through a labyrinth of drug laws, offering insights, anecdotes and perhaps a dash of irreverence to keep things interesting.

Also on the docket this month, a new podcast with cannabis lawyer Rob Laurie, founder of Ad Lucem Law Corporation, as a pilot to perhaps a larger series on, well, drugs, in attempts to better understand and unravel the tangled legal tapestry. Laurie takes us through a labyrinth of drug laws, offering insights, anecdotes and perhaps a dash of irreverence to keep things interesting. Stay tuned for the first episode to drop near the end of March.

A big thank you to Michael Forbes as well for sharing his business narrative, from top to bottom. Speaking of good stories, the Forbes Group certainly belongs in that category. What I find most striking about Forbes’ journey is the state of health spectrum covered by his companies, from basic human necessities to essential therapies such as cannabis and psilocybin, and the extracurricular self-care modalities (embodied by Ageless Living) that couldn’t be more fitting for our modern era and contemporary priorities.

Forbes also proposes a simpler solution to the regulation of psilocybin mushrooms, rather than reliving the complexities of the Cannabis Act. He outlines the possibility of mushroom production in cannabis facilities and the sale of psilocybin and psilocin-containing products in cannabis retail dispensaries, instating a Cannabis and Psilocybin Act. Logical, right?

As we look ahead in anticipation of the rest of a fantastic year in cannabis, with in-person events now coupled with new advancements on sampling and consumption in the West, there is much to be excited about.

We’ll see you at Grow Up Conference & Expo back in Toronto later this Spring for the Executive Summit and another round of awards. And until next time, stay positive, stay curious and stay true to the spirit of cannabis!

In progress & possibility.

Spring 2024 Vol. 8, No. 1 growopportunity.ca

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal, Customer Services Administrator Tel: (416) 510-5113

Email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400, Toronto, ON M2H 3R1

EDITOR

Haley Nagasaki hnagasaki@annexbusinessmedia.com 416-510-6829

PUBLISHER

Adam Szpakowski aszpakowski@annexbusinessmedia.com 289-221-6605

NATIONAL ADVERTISING MANAGER Nashelle Barsky nbarsky@annexbusinessmedia.com 905-431-8892

ACCOUNT COORDINATOR Kathryn Nyenhuis knyenhuis@annexbusinessmedia.com 416-510-6753

MEDIA DESIGNER

Lisa Zambri

AUDIENCE DEVELOPMENT MANAGER Shawn Arul sarul@annexbusinessmedia.com

GROUP PUBLISHER

Paul Grossinger pgrossinger@annexbusinessmedia.com

PRESIDENT/COO

Scott Jamieson sjamieson@annexbusinessmedia.com

MAILING ADDRESS

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES 1 year subscription (4 issues: Spring, Summer, Fall, Winter): 1 year offers: Canada $26.01 + Tax USA $47.94 CDN FGN $54.57 CDN GST # 867172652RT0001

ANNEX PRIVACY OFFICE privacy@annexbusinessmedia.com Tel: 800.668.2374

ISSN: 2561-3987 (Print) ISSN: 2561-3995 (Digital) PM 40065710

Occasionally, Grow Opportunity will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

Cannaray Limited, a leading European medical cannabis company headquartered in London, has signed a definitive agreement to merge with Aqualitas Inc., a Nova Scotia-licenced, medical cannabis cultivator and processor and drug establishment license (DEL) holder, with EU GMP, cGMP, GAP & Clean Green® organic certifications. Aqualitas has developed an innovative cultivation system using living soil and aquaponic fertilization from the nutrient dense waste of 3,000 koi carp fish, which has produced award-winning medical cannabis products.

This landmark merger marks a pivotal moment in the European medical cannabis sector, emphasizing commitment to providing high quality medical products for patients in need.

The company’s diverse product portfolio comprises 30 products with approximately 10 key products across four categories, which are integral to its success in Quebec. The company recently submitted products for approval and received authorization for eight new additions, with four set to become key launches in April/May 2024.

Delta 9 Cannabis (TSX:DN) among actively traded companies on the TSX: Up half a cent, or 25 per cent, to 2.5 cents on 8.7 million shares

15.8%

Recreational cannabis sales have increased almost 16% in 2022/2023, according to Statistics Canada

(Health) Food for Thought: Will Canada’s Bill C-47 – reclassifying natural health products using pharmaceutical standards – affect the cannabis marketplace?

Last month, amendments to Canada’s cannabis regulations saw a change in British Columbia’s outdoor consumption policy, while Alberta followed through on a shift regarding sampling regulations for cannabis vendors. These changes will help to encourage the growth and status of cannabis events and tourism, while continuing to destigmatize the plant through public displays of cannabis use for those keen to integrate.

Jaclynn Pehota executive director of the Licensed Retail Cannabis Council of B.C. (LRCCBC), along with her team, believes “the changes to the outdoor consumption and changes to advertising placed to consume cannabis regulations are small but positive steps towards reducing stigma and supporting B.C.’s potential for cannabis tourism.” Government may now be paying more attention to the lucrative potential of the tourism market, while the LRCCBC is “optimistic that

these are the first few steps towards a more comprehensive cannabis consumption strategy.” The council continues to encourage regulators “to explore further support for the budding tourism industry.”

On the Alberta front, Omar Khan, chief communications and public affairs officer for retail chain High Tide commends the Alberta Gaming, Liquor and Cannabis Commission (AGLC) for its proactive approach and a “number of positive changes in 2023.” Khan believes “providing samples is another tool for LPs to utilize when interacting with budtenders, which in turn provides a better customer experience.” With Minister Nally’s “direct approach to stakeholder engagement,” Khan looks forward to future changes that will “continue to set Alberta apart” in the adult use cannabis market, and in the meantime, praises the recent shifts as granting the Alberta cannabis market “some much needed breathing room.”

By Mariana Black International

Even before we laid the foundation for our GlassHouse Botanics facility in Whitewater Region, Ontario, our objective was to produce European Union – Good Manufacturing Practices (EU-GMP)-certified medicinal cannabis. Nearly five years after our initial Health Canada licensure, we were thrilled to achieve GMP certification, effective January 2024.

What we learned along the way:

1. You can produce superior quality cannabis with consistent THC and excellent microbial levels without irradiation, even in a greenhouse.

At GlassHouse Botanics, we achieve consistent cannabinoid values by using consistent inputs; following established irrigation/fertigation and plant maintenance schedules, and controlling light exposure, ventilation, and CO2 application levels. While painstaking, by adhering to GMP during cultivation, we can ensure a consistent THC. Irradiation is not necessary to achieve good microbial levels. Our flower is mechanically trimmed and manually manicured. Even when each bud is handled, we consistently meet microbial specifications – we employ strict sanitary controls throughout our production process to reduce risk of contamination.

2. You cannot “partially” operate under GMP: Adherence to GMP means consistent, comprehensive application of its principles. Think of GMP as a symbiotic microorganism that spreads throughout all processes – it seeps from post-harvest steps into

cultivation practices. One day, you discover that every facet of your operation aligns with its standards.

3. You can adjust processes for better yields & higher THC while maintaining GMP certification: To remain profitable and meet market demands in the fast-paced, ever-evolving cannabis industry, you must introduce new cultivars, improve production practices, and stay efficient. GMP principles are compatible with value-added changes, if you manage them and validate them. Adhering to GMP may slow down the pace of your change implementation, but it will force you to assess changes before acting on them, resulting in a controlled process with little room for failure.

4. Not all GMP-certified companies apply GMP principles across operations AND not all products exported into EU-GMP-regulated markets meet GMP requirements: Unfortunately, a number of cannabis producers – even some GMP-certified companies – have found regulatory loopholes and ways to exploit them. Some loopholes can be attributed to the newness of the cannabis

industry and relative inexperience of inspectors in applying GMP to cannabis. Still, others are related to export partners, and varying laws and leniency in countries of export.

At GlassHouse Botanics, our objective has never been to get our product out the door at all costs. We are committed to doing business the right way, and that means earnestly following GMP to produce highquality cannabis that meets or exceeds specifications every time.

True compliance means never having to worry about 1) being caught shirking rules; 2) loopholes being closed once inspectors catch on; or 3) your product clearing customs. For us, finding a business partner with equivalent integrity and high standards to support us through the certification process in Germany was essential.

True compliance means never having to worry about 1) being caught shirking rules; 2) loopholes being closed once inspectors catch on; or 3) your product clearing customs.

5. GMP is not for everyone: Earning certification involved meticulous refinement of our processes over the course of several years. It required the creation of state-of-theart facilities with pharmaceutical-grade processing rooms; continually purified airflow through HEPA filters; and constantly sanitized walls, floors, ceilings, and equipment. It meant developing stricter SOPs and equipping our capable team to implement them.

Not all companies have the capital needed for the initial and ongoing investment. There are higher laboratory fees, and the cost of hiring and training additional staff to run a more complex quality management system (QMS). There are costs associated with stability studies, calibration activities, qualification of equipment and HVAC, for example.

Ultimately, earning GMP certification was worth the cost. It opens a broader market and provides assurance of consistently safe product.

By Denis Gertler

While Ontario residents were busy celebrating New Year’s, a new regulation took effect, allowing single companies to operate up to 150 recreational cannabis retail stores, double the previous number of 75. With almost 1,800 cannabis Retail Store Authorizations issued, Ontario has the largest retail distribution in Canada by a wide margin, and that of course excludes the Ontario Cannabis Store’s online sales platform. Changes in Ontario retail affect the whole country, as all licensed producers can potentially sell into Canada’s largest and most valuable market. Much of the speculation about the new policy suggests that there will be further consolidation of the province’s cannabis retail sector. If that’s so, how will this development affect the cannabis industry, particularly independent retailers, and consumers?

Independents are already challenged to compete on price against chains, especially in the value cannabis segment, where the business model is set on delivering your high at the lowest price. With their economies of scale and broader reach, chains are better positioned to sell at low margins, although that doesn’t necessarily translate into success as the closure of retail chain Fire and Flower attests.

Tellingly, though, the defunct chain’s 90 stores were acquired by Fika Cannabis, another chain that already operated 22 stores in the province, plus brands Friendly Stranger and Firebird Delivery.

Then too, Canadian retail prices seem to have reached a floor as store numbers have stagnated, making price compression a fact of life for everyone in the business. Low prices and sluggish growth mean tight competition for market share. With broader name recognition and accessibility than independents, chains bring recognizable store brands to the battle, which is important in a marketplace where LPs are hampered in branding their products, thanks to federal advertising and packaging restrictions.

Smaller retailers are also crying foul over alleged data deals where some LPs offer payments for bulk product purchases and preferred placements as part of these arrangements. While buying data is permitted, deals that require proprietary shelf positioning and large inventory buys are not, according to guidelines by the Alcohol and Gaming Commission of Ontario (AGCO). It’s difficult to know how well prohibitions on such inducements are being enforced, however, as complaints persist.

90

stores were acquired by Fika Cannabis, another chain that already operated 22 stores in the province, plus brands Friendly Stranger and Firebird Delivery.

Some industry participants see an opportunity for independents and small chains to offload their assets to larger operations. But consultants brought in to help sell stores report that many owners struggle to find a buyer, and if they sell it’s often at a loss. Of course, stores with strong cashflow in good locations may choose not to sell, but there’s not much preventing a chain from opening nearby to try to muscle them out. Independent specialty stores and small chains with loyal clientele will likely continue in the retail ecosystem but these operators will need to compete by selling products closely matched to their customers’ preferences. “Certain clientele appreciates and, in fact, prefer their independent neighbourhood stores [over larger chains], particularly if they are able to curate their products to meet local demand. However, with all retailers buying from the same wholesaler, differentiating themselves is not always an easy task” according to cannabis consultant, David Wasserman of DW Regulatory Solutions.

Retail takeovers may not be the only game in town, though. Grocery giant Loblaws is said to be lobbying the Ontario government to allow cannabis sales in supermarkets. My sense is that their gambit won’t succeed in the same way that beer and wine is presently being sold in stores. While beverage alcohol is also a restricted product, it doesn’t carry the same stigma as cannabis, nor is it prohibited from viewing by minors. There may come a day when cannabis is sold more openly—for example, TV ads for online

gambling sites are now seen by everyone – but casino gambling and tobacco remain hidden from public view.

Business consultant and publisher of Cannabis Management Review, Mitchell Osak, remarked in a recent interview that grocery’s business model may be ill-suited to cannabis retail. As Osak noted, you can’t display or merchandise it instore as you would offer cheese samples. The grocery model is also heavily price-driven, requiring grocers to buy food in bulk and turn it over quickly. Will there be enough wiggle room on prices? Hard to say, Osak admits. There is an option for grocers like Loblaws to get involved, however, with an approach similar to how specialty tobacconists operate.

While Loblaws is unable to openly sell specialty tobacco items inside its stores, they are permitted to run adjacent stores under a different corporation with a separate entrance. Provided such an outlet complied with all existing requirements, it could be branded and operated in ways consistent with current legislation.

In addition to such developments, the Ontario government has shown a willingness to upend retail more generally. During the pandemic it allowed the creation of private bottle shops for wine and beer, and recently announced it will not renew its long-standing agreement with the Beer Store, allowing convenience stores, gas stations, big box outlets and more supermarkets to sell wine

and beer and set their own prices. The roles of the Beer Store and LCBO will change, focusing on bottle recycling and wholesale distribution respectively. The LCBO will remain the sole vendor of spirits but will compete with a growing number and widening field of low-alcohol purveyors to include an estimated 8,500 locations.

Even Service Ontario, the government offices providing motor licences and health cards, is being re-imagined. On February 3, 2024, six service centres opened in Staples Canada stores and three more are coming later this year. Ontario has already formed retail partnerships with Canadian Tire, IDA, and Home Hardware. The three-year Staples pilot is pro -

jected to save $1 million while providing customers expanded parking and longer operating hours. Could this model be adapted for cannabis sales, perhaps in the health products category?

It may be too early to know exactly how changes to cannabis retail will play out, but it’s likely that the sector will look quite different in a few years than it does today. And if these changes lead to stronger sales and a greater share for legal retailers, producers, and government it will be difficult to argue against. After all, it wasn’t so long ago that one had to fill out a paper slip to purchase beverage alcohol from behind the counter and buy bags of “grass” from illicit dealers.

By Haley Nagasaki

Michael Forbes, recently named one of Canada’s top 50 leaders in cannabis, cultivated his business acumen long ago. With a background in medicine and experience developing pharmacies and clinics in Western Canada, Forbes found success in the real estate market, eventually paving the way for his licensed cannabis producers and retail chains. The many verticals he oversees with their overlapping interests collectively known as the Forbes Group, demonstrates the validity of his leadership in cannabis, while highlighting an eclectic business narrative engineered with social consciousness at its core.

After receiving a BSc in Pharmaceutical Sciences from UBC, Forbes began his career as a pharmacist in Calgary, and later, “after numerous failed attempts,” finally opened his own pharmacy in Langford, B.C. – his home province. “It took me six months of savings to make it (without drawing any income), and it took nine months to make a dollar,” he says. Forbes conducted himself frugally at the time, while also raising his son. “Those days really shaped my business sense and taught me to only spend on what’s needed.”

During the first nine months of operations, “I literally had to pick and choose between keeping the lights on and ensuring we had enough medications in stock ” he says. “I was janitor, CEO and pharmacist all in one.” From there he opened a second and third location, by “incorporating savings to increase cash flow,” which is how he got into real estate and cannabis businesses.

“The second store was a methadone pharmacy,” says Forbes. In 2010, he was approached by the CDC and the Vancouver Island Health Authority (VIHA), asking if he

“I’ve been in the trade of helping people for a long time.”

would run a pilot project called the Pandora Needle Exchange in Victoria’s downtown. “It’s common sense,” he says. “If you prevent patients from sharing needles, you’re going to reduce diseases entering the general population.”

Though he was doing it for free, still contentious illicit drug use sounded the alarm and incited the involvement of law enforcement and the subsequent harassment of patients on his clinic’s doorstep. Forbes eventually responded and relieved police pressure through dialogue with them. “I’ve been in the trade of helping people for a long time,” he says.

When cannabis legalization entered onto the scene, Forbes was approached by prospecting industry players. Interested in the medical side of cannabis, in 2013 he submitted an application for micro producer Sitka Weed Works – now Sitka Legends. Due to “government bureaucracy,” it wasn’t until 2017 that Sitka was licensed.

After establishing two cannabis retail chains, Honeycomb and Clarity, Forbes also became involved with large scale cannabis extractor Adastra. “I knew the shareholders,” he says, “and it was facing some issues.”

One of the shareholders asked for help, “so I bootstrapped that and turned it around. It wasn’t easy, and I don’t know why I did it other than I just wanted to help.” Forbes attributes the growth in sales and putting Adastra on the map to “the hard work of the team for achieving this amazing turnaround story.”

With an influx of Canadian cannabis companies amending their licenses for the research and production of psychedelics and other controlled substances, Forbes and Adastra – due to bootstrapping abilities and frugality – were among the first to do this.

“When you see other companies building facilities, I scratch my head,” he says, asking “why aren’t you simply integrating it into the existing cannabis infrastructure?” Forbes points out that amending licenses comes at little cost to the license holder.

While psilocybin is not commodified the way cannabis is and hemp was prior to prohibition, the market conditions for the production and sale of the natural substance remains unclear due to consumption volume and therefore the demand among consumers. However, Forbes argues that when comparing the safety profiles of cannabis and psilocybin, psilocybin is actually safer. “There’s less risk of addiction or abuse,” he says.

It seems the regulation of psilocybin-containing mushrooms is on the horizon in Canada, and Forbes proposes a simpler solution than reliving the legal complexities experienced during the introduction of the Cannabis Act. This approach would bypass the need to further amend subsidiary laws such as driving and residential for specific psychedelic use.

Psilocybin can be grown in a cannabis facility, and dispensaries could in theory sell mushroom products next to cannabis. Instating a Cannabis and Psilocybin Act would mean “dovetailing it all the way through the same infrastructure,” says Forbes. “While I’m against the recreational legalization of some of the other potentially stronger synthetics for Canadians, I do support the legalization of psilocybin.”

If regulators adopted this approach, it could help alleviate the struggling cannabis industry by enabling producers to sell psilocybin. “I like psychedelics, I just think some of them have bigger risks than others,” says Forbes. “So, we have to look at what’s safe; what makes sense. I believe that psilocybin stands separately from the other ones.”

Can industry and social justice intersect?

Last year alone, Adastra made the Canadian federal government well over 10 million in excise taxes. “Do you think that they’ve done enough to curb the illicit market?” asks Forbes. Meanwhile, Sitka stands out as possibly Canada’s only micro-cultivator park, “licensed for individual growers to produce premium craft flower in personal, customized units.” The development of 10 nurseries assists legacy growers in their transition to the legal market, introducing leading talent into the regulated market, and merging industry with tradition.

The Forbes Group also encompasses two cannabis retail chains, and at one point, he held 77 licenses in Canada, saying “ethically, I think it’s much better than owning a liquor store.” Another distinctive quality of these companies is the cultivation of female entrepreneurial leadership. Forbes comments on the team approach at his operations, where the company “plays into everybody’s unique strengths,” and in doing so, has built a desirable work culture by being kind to people.

Forbes sees a potential future merging of psychedelics into the existing cannabis space, “and I see the clinical side of psychedelics merging into longevity; that’s what I’m working on doing.” Transcending the struggle for basic necessities and social equities is the prevalent desire for longevity and wellness into old age. Forbes’ passions also includes self-care through the expression of Ageless Living – a tri-location B.C. clinic offering treatments for healthy hormones, biohacking and support for achieving personalized goals.

At one point, Forbes held 77 licenses in Canada, saying “ethically, I think it’s much better than owning a liquor store.”

The commonalities shared among these verticals reflect West Coast culture, with its ties to legacy growing, drug history and the pursuit of safe supply. Despite gaps in government contributions and the worsening opioid and mental health epidemic, advocates for the proper use of drugs as tools for harm reduction and healing will continue to dominate, eventually moving from grass roots advocacy to destigmatized mainstream programs with the intent of saving and bettering lives.

Individual states of health are vast as they are subjective, and legislative change must occur to achieve these fundamental treatments, “and hopefully with a new government we will see that because it is a legal, viable business,” he says.

For cannabis businesses in 2024, Forbes recommends pacing yourself through the hardships. He says, “I go where the problems are, unfortunately,” though prefers to spend his time in nature: Stanley Park, specifically.

While Forbes works with a spectrum of drugs of all different rankings, in response to our societal disconnection from nature, it is advocacy for plant medicine over synthetics that he pinpoints as a potential remedy for our collective malaise.

By J. Lynn Fraser

Stringent quality assurance (QA) systems, and having highly trained personnel in place are the hallmarks of a QAP’s responsibility. Some of the defining characteristics of QA in cannabis operations and laboratories include standard operating procedures (SOPs) for guidance; a working lab functions according to requirements, including compulsory record keeping, data analysis and internal audits; record keeping and individuals tasked with correcting problems; and personnel who must deliver high-quality performance. Within Canada’s cannabis industry, the objective is to provide a safe supply to consumers, dependent upon strict quality control and consistent product quality.

Av Singh, PhD, PAg, agronomist and cannabis consultant, believes “the easiest way to work into a QA program is by conducting a self-audit,” he says. “With most clients, we use a weekly checklist we employ as we walk through a facility and do a quick Good Documentation Practices review to make sure we are capturing deviations from our SOPs and recording other Change Control measures. In walking through, it becomes easy to point out that we think a SOP is attaining the desired goal.”

As a burgeoning industry navigating regulatory compliance, “the cannabis industry had to “steal” professionals from the food industry, from pharma, even from labs,” comments Mariana Black, QAP and chief compliance officer at Ontario LP GlassHouse Botanics. Black notes QAPs come from “quality management systems” and “farm food safety programs.”

As the industry is new, the personal attributes of an individual are also important.

Kevin Clark, director of operations and QAP at Eco Canadian Oganic Inc. says “a strong QAP requires experience in consumer goods such as food and beverage with enhanced education and/or several years of managerial experience in science, process-

ing, manufacturing practices, and food processing.”

QAPs, Black says, “have a broad scope of work within the operation of a licensed producer. They are responsible for ensuring compliance to regulations and for approving the procedures that outline how these activities are carried out.”

While an ability to uphold rules and standards is important, so is the ability to be intellectually agile as duties and the marketplace change. A QAP’s responsibilities vary. They must possess strong problem-solving, communication and analytical skills, along with emotional resilience to handle challenges effectively. “The role can expand to managing production, packaging design, negotiating pricing, value engineering and client management,” comments Clark.

On a day-to-day basis, Black is “overseeing compliance to regulations and conformance to procedures.” She says, “my duties involve deviation and CAPA management; batch review for release; managing the change control process; managing communications with our buyer’s quality staff; and managing the quality team.”

Clark’s day begins with “a meeting with my staff followed by a meeting with my owners to prioritize our day and confirm weekly requirements.” Daily, Clark will “supervise activities in the facility and/or participate. I then would connect with my farmgate manager and consult on inventories and begin documentation review and planning scheduling to meet production requirements to strategic business development.”

Black’s monthly responsibilities involve ensuring that “we stay compliant to Good Production Practices (GPPs), Good Agricultural Collection Practices (GACPs), and Good Manufacturing Practices (GMP).”

If a company did analytical testing on their premises, Black notes, “the QAP would ensure that the testing is conducted as per procedures in a manner to ensure they are accurate and

remain in validated status and/ or are completed as per compendial methods.”

Clark’s monthly duties range from “planning scheduling, human resources, hiring, product development, packaging design, sales, production management, material procurement, and managing relations with our patients, clients and customers.”

Fluency in technology is an essential part of a QAPs’ skill set. “To comply with GPPs you need to understand how to properly manage equipment so that it functions as intended.” Black comments.

QAPs have well-developed social intelligence wherein diplomatic skills are essential. At the same time, there is an element of emotional toughness to being a QAP. Black observes: “as QAP you are that one person that tends to tell operations and senior management that something cannot be done.”

“Everything,” Clark states. “In a leadership role, your executives rely on your foresight. What keeps me up at night – ‘the what if’ scenarios – which helps me plan and execute actions more effectively.”

Experts in security, GardaWorld and JH & Associates, weigh in on the industry’s needs

By Matt Jones

Any business must consider safety and security; however, the exact security requirements of those businesses vary greatly depending on the type of business. Cannabis is no different, with the industry having its own security needs as well as security standards, which have been prescribed by regulators and authorities. But what are the intricacies of providing security for the cannabis sector? Grow Opportunity spoke with some experts in the field to find out.

GardaWorld: Guards meets tech “I think the industry at large is riskbased and that drives a number of levels of security, enhancement protection, target hardening,” says Doug Sales, GardaWorld’s senior director commercial systems sales for Ontario and the West. “In the Greater Toronto Area, where you’ve got a large manufacturing and/or distribution center, just the sheer scale of the building that that would be in, the compliance with the prescribed security requirements makes it a little bit more of a harder target and a harder solution.”

Sales says that when facilities are in outlying or remote areas, smaller towns or even smaller cities, there is a much lower level of risk perceived.

So, while you will still find electronic security systems in those areas, they tend to be less sophisticated. There will still be security cameras and an intrusion system, but there may just be a door strike for access control.

Sales notes therefore that the security needs of the industry will scale – a 300,000 square foot facility will need 100 cameras, while a 400,000 square foot facility would need more. With a mind to both internal and external risks, GardaWorld would provide devices for screening employees, such as metal detectors or x-ray technology. Access control is also crucial.

“You’ve got to be able to audit the people trail so [you can keep track of] people coming through the building,” says Sales. “And then you’ve got your intrusion detection; that’s your burglar system. That is going to be an Underwriters Laboratories of Canada (ULC) rated system, as opposed to a non-ULC – so a higher standard of care for installation and a higher standard of installation.”

In the distribution end of the industry, Sales says that hybrid solutions are common – combining the electronic systems with guarded gates on the perimeter of the facility.

“Garda plays in that space quite well, providing guard and technology to work together,” says Sales. “Some efficiencies there in terms of costs,

GardaWorld senior director of commercial systems sales for Ontario and West, Doug Sales, says that security targets for the cannabis sector are still fairly stringent, but compliance does seem to be there.

where you might have cameras looking where traditionally a guard might have been working.”

Overall, Sales emphasizes that the security targets are still very hard in the industry, but compliance does seem to be in place from his experience.

“I haven’t been to every grow op across the country, obviously,” says Sales. “But the ones that I participated in, both in the development and the installation, they’re state-ofthe-art solutions.”

An important update to note is that Health Canada has reduced the physical security and visual element requirements that applicants or licence holders must meet. As of Jan. 23, 2024, applicants need no longer submit photos of the site perimeter, the exterior of the buildings, changed areas, close-up images of surfaces, outdoor grow areas or a guided video tour showing the physical security of the building.

“It is important to note that this is only a change in what must be sub -

mitted to Health Canada for review; there has been no change in the requirements to comply with the physical security elements of the Cannabis Regulations at a site,” says a representative of Health Canada. “The change was made following a review of cannabis industry compliance and risk related to physical security requirements, Health Canada identified a number of review elements that were low risk. These changes reduce the effort required for new applications and license amendment requests relating to physical security, both on the part of the applicant or license holder preparing the submission and for Health Canada in performing the review.”

Jeff Hannah, security consultant and owner of JH & Associates, says that the rule change was overdue – from his perspective, the security requirements on the cannabis industry were overly onerous, as government felt that in order to protect the public interest, the standards had to be stringent. This is a situation that he

feels wouldn’t have been the case if we weren’t discussing a product which had been illegal until that point.

There is data to support Hannah’s assertion. According to data provided by Health Canada, some 2,219 kgs of died cannabis was stolen or lost between 2018 and 2022 – a drop in the bucket compared to the over four million kgs of cannabis produced in Canada in that same time frame. As such, security standards for cannabis producers in Canada have been driven by the requirements, not by actual thefts or losses.

“Very, very few facilities over the past ten years have been built to exceed the regulatory standard,” says Hannah. “They probably exceeded what we might have identified as a result if we had done it the old-fashioned way and just allowed a risk assessment to dictate a holistic approach to security in each facility on an individual basis. But when you’re starting a new industry, that sort of holistic approach is not practical, and it wouldn’t work.”

Looking at the specific security

needs of the cannabis sector, Hannah says that in a processing facility, there will be camera coverage over everything, particularly as it relates to the perimeter of the facility. Inside the facility, requirements are more relaxed, though still more intense than in other agricultural sectors.

“One of the things they were able to pull back over the years was there used to be blanket security coverage of fields of wet plants that wouldn’t have been of any use to anybody,” says Hannah. “And there used to be motion sensors protecting live plants, which was crazy – the movement of the plants would set off the motion sensors. In the early days there was a requirement that a security cleared supervisor must be in the room and witness every time human hands touch cannabis.”

Hannah says that the emphasis that Health Canada put on the perimeter of the facility was unique –you don’t often see other applications that would use the amount of layered permitter protection that was prescribed for cannabis.

An important update to note is that Health Canada has reduced the physical security and visual element requirements that applicants or license holders must meet.

“Some pretty complex fence mounted sensors, cameras, video analytics, motion sensitive lighting and all kinds of crazy stuff,” says Hannah. “When the Cannabis Act came out, previous versions referenced the Health Canada directive on physical security measures for controlled substances and the expanded upon it. Look at an oxycodone or opiate manufacturing facility –you can argue that there’s some that are not as well-secured as a cannabis facility, which is crazy.”

Hannah says that cannabis producers were the bulk of his business for about eight years, but he has seen a decline in the number of new entrants. With the new rule change, he expects cannabis to become an even smaller part of his portfolio.

Matt Jones is a freelance writer based in Fredericton, N.B.

By Katie Pringle Budtenders

Budtenders are frontline educators who hold the key to consumer preferences, product knowledge and ultimately, sales. In an industry with restricted marketing avenues, engaging with Budtenders and retail decision-makers is a strategic imperative. By understanding and leveraging insights from Budtenders, Canadian licensed producers can position themselves for success and bridge the gap between consumers and cannabis products.

Tether, a Canadian Budtender community of close to 5,000, recognizes the vital role that Budtenders play in driving the success of cannabis operations. This is why every year Tether surveys 200+ Canadian Budtenders as critical research for the industry’s development.

Educating Budtenders about your products is essential. 34 per cent of Budtenders surveyed identified terpenes as the area of cannabis they want to learn more about, with genetics coming in second at 18 per cent. Equipping Budtenders with training materials that include detailed product information, recommended usage guidelines and potential effects, empowers them to offer informed recommendations to consumers. In Tether’s 2023 survey, the most common customer questions were dosage/potency, strain selection, product type, and total/ dominant terpenes.

In-store visits, virtual sessions and pop-ups can keep Budtenders informed by enhancing customer satisfaction and strengthening the

credibility and reputation of brands. Engaging with Budtenders provides opportunities for feedback and also demonstrates commitment to supporting their success. Beyond sampling, Budtenders can learn about products through brand ambassadors and LP reps (up 31% from 2022) and by attending brand pop-ups and events (up 15% from 2022).

Sampling has emerged as a powerful tool for Budtender education, with 95 per cent of those surveyed requesting products first-hand. Sampling empowers Budtenders to become authentic advocates, capable of conveying unique product qualities to consumers. Plus, tastings and sampling events allow growers, reps and ambassadors an opportunity to discuss product education in a relaxed environment and showcase the team behind the brand. This is the perfect mix of community-building and education – an environment in which Budtenders thrive.

Encourage Budtenders to share their experiences and insights through product reviews, feedback surveys and social media. Facilitate knowledge sharing sessions or forums where Budtenders can provide feedback directly to your team.

The preferences of Budtenders reflect broader shifts in consumer behaviour with traditional consumption methods like pre-rolls and bongs still favoured by 80 per cent of surveyed individuals. However, dabs and extracts are gaining popularity year after year. Capturing and understanding Budtender and consumer insights through sales trends, B2B surveys and demographics helps drive product development, branding and marketing efforts.

The green revolution

Budtenders’ insights shed light on the pressing need for sustainability in the Canadian cannabis industry, with 64 per cent of Budtenders surveyed saying it’s an area the industry can improve on and 84 per cent mentioning packaging. Sustainability measures could include eco-friendly packaging, waste reduction, responsible cultivation methods and sustainable sourcing – investments into the future of the industry and our planet.

Budtenders are more than sales associates, they are brand ambassadors with the potential to shape consumer perceptions and drive market trends. Invest in them and empower them to drive mutual success. Tether is celebrating Budtenders during its third annual Budtender Appreciation Week (B-Week), March 24-31, 2024.

PO Box 53574, RPO Broadmead, Victoria BC V8X 5K2 Canada

Tel: 877-313-2442

e-mail: info@airmed.ca

Website: airmedcloud.com

Twitter: twitter.com/AirMedSoftware

Description: AirMed is an award-winning enterprise cannabis management system that helps producers across the globe meet compliance while improving their processes. We provide the tools you need to boost efficiency and improve quality while reducing risks. AirMed is the only business solution you need in the office, the greenhouse and on the loading dock.

105 Donly Dr. S., PO Box 530, Simcoe ON N3Y 4N5 Canada

Tel: 519-429-5196

Toll free: 877-267-3473

e-mail: sdefields@annexbusinessmedia.com

Website: www.annexbookstore.com

Facebook: www.facebook.com/AnnexBookstore. ABM

LinkedIn: www.linkedin.com/company/annex-publishing-&-printing-inc

Description: The Annex Bookstore provides education and training materials, books, texts, and other products to industry professionals across Canada, providing the information they need to train, operate, and successfully grow in their industry.

675, montée St-François, Laval QC H7C 2S8 Canada

Tel: 450-664-4844

Toll free: 877-384-9376

e-mail: info@biofloral.com

Website: www.biofloral.com

Twitter: twitter.com/biofloral_ca

Facebook: www.facebook.com/biofloral

LinkedIn: www.linkedin.com/company/biofloral

10237 Yellow Circle Dr., 10237 Yellow Circle Dr., Minnetonka MN 55343 United States

Tel: 406-671-2509

e-mail: claire.erickson@bovedainc.com

Website: bovedainc.com

Twitter: @BovedaInc

Facebook: www.facebook.com/bovedausa

LinkedIn: www.linkedin.com/company/boveda-inc-/mycompany

1170 #305 Kensington Crescent NW, Calgary AB T2N 1X6 Canada

Tel: 403-998-8092

e-mail: info@canadiancannabisx.com

Website: canadiancannabisx.com

Twitter: twitter.com/cannabis_x?lang=en

LinkedIn: www.linkedin.com/company/canadian-cannabis-exchange/?viewAsMember=true

Description: The Canadian Cannabis Exchange (CCX) is Canada’s Trusted B2B Wholesale Cannabis Platform. With over $87 million in total transacted sales and +100,000 kg in transacted volume, CCX facilitates hundreds of trades every month to help licensed producers fill SKUs and gain capital on their cannabis productions. CCX’s live voice-brokers are dedicated to offering personalized services to go above and beyond the needs of every LP. CCX gives LPs the opportunity to move their products at fair market pricing under standard contracts, expand to international markets, and access new distribution channels.

CANNA CANADA

2100 Bloor St W Suite 6290, Toronto QC M6S 5A5 Canada

Tel: 877-312-2662

e-mail: info@canna.ca

Website: www.canna.ca

Facebook: www.facebook.com/ CannaCanadaOfficial

LinkedIn: www.linkedin.com/company/canna-canada

Description: CANNA is the premier provider of nutrient and cultivation solutions for fast-growing crops for 30+ years. With decades of experience & deep understanding of growers’ needs, we pride ourselves on offering user friendly complete feeding solutions. We recognize the importance of clean, consistent, and traceable inputs, all while keeping things simple!

2927 Kingsview Blvd SE, Airdrie AB T4A 0C9 Canada

Tel: 403-945-5954

e-mail: info@cannagreenpak.com

Website: cannagreenpak.com

LinkedIn: www.linkedin.com/company/canna-green-packaging/?viewAsMember=true

Description: CannaGreen Packaging is a Canadian manufacturer of child-resistant, eco-friendly, and Health Canada compliant cannabis packaging. Our product portfolio includes tubes, pouches, bulk bags, and other innovative custom packaging solutions. Our stocking program gives LPs access to just-in-time inventory that can be shipped within one business day.

408 Mersea Rd 3, Leamington ON N8H 3V5 Canada

Tel: 519-322-2515

e-mail: sales@climatecontrol.com

Website: www.climatecontrol.com

Twitter: twitter.com/GreenhouseAtm

Facebook: www.facebook.com/greenhouseautomation

LinkedIn: www.linkedin.com/company/climatecontrolsystemsinc

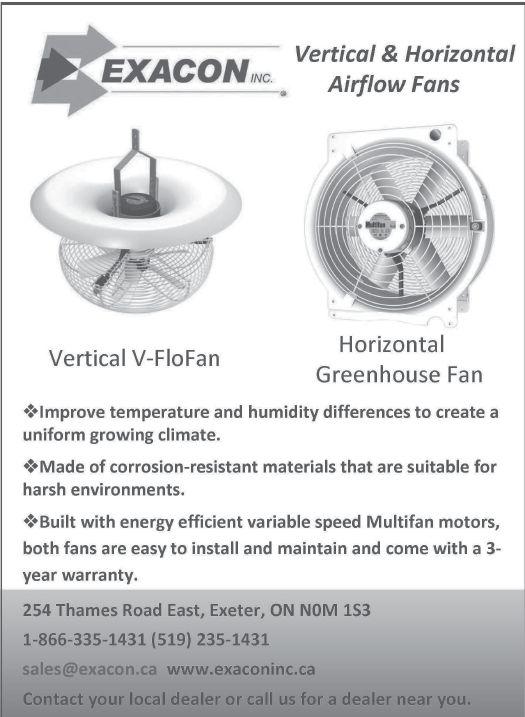

254 Thames Road East, Exeter ON N0M 1S3 Canada

Tel: 519-235-1431

Toll free: 866-335-1431

Fax: 519-235-2852

e-mail: sales@exacon.ca

Website: www.exaconinc.ca

Facebook: www.facebook.com/exaconinc

Description: Exacon Inc. is your “ONE

SOURCE” provider for ventilation in the Canadian Agricultural, Industrial, and Greenhouse markets, providing innovative, high-quality products to meet your needs. Products include Exhaust Fans, Horizontal & Vertical Airflow Fans (Multifan Greenhouse and V-Flo Fans), Environmental Control Systems and Forced Air Heaters.

4129 Commercial Center Dr., Suite 450, Austin TX 78744 USA

Tel: 512-212-4544

e-mail: marketing@fluence-led.com

Website: fluence-led.com

Twitter: twitter.com/fluence_led

Facebook: www.facebook.com/FluenceLED

LinkedIn: www.linkedin.com/company/fluence-led

1-1570 Kipling Ave., Etobicoke ON M9R 2Y1 Canada

Tel: 778-581-7295

e-mail: info@greenamber.ca

Website: www.greenamber.ca

Twitter: twitter.com/GreenAmberCA

40 Executive Court, Toronto ON M1S 4N4 Canada

Tel: 855-892-7500

e-mail: andrew@groweriq.ca

Website: groweriq.ca

Twitter: twitter.com/groweriq

Facebook: www.facebook.com/GrowerIQ

LinkedIn: www.linkedin.com/company/groweriq

241 Hanlan Rd, Unit 7, Woodbridge ON L4L 3R7

Canada

Tel: 416-864-6119

e-mail: client.care@highnorth.com

Website: www.highnorth.com

Twitter: twitter.com/HighNorthLabs

Facebook: www.instagram.com/highnorthlabs

LinkedIn: www.linkedin.com/company/highnorth

Description: Canada’s #1 Analytical Cannabis Laboratory

High North has been servicing the Canadian cannabis industry since 2016 with speed, quality, and the highest level of cannabis expertise in the cannabis testing market. Our GMP & ISO facility is the largest dedicated cannabis laboratory in Canada and has all the services your business needs for cannabis.

1894 Seventh Street, P.O. Box 910, St. Catharines ON L2R 6Z4 Canada

Tel: 905-641-5599

Toll free: 800-665-1642

Fax: 905-684-6260

e-mail: info@jvk.net

Website: www.jvk.net

Description: Lambert soilless mixes, containers, plug trays, Oasis foam media, Preforma engineered media, growing pots and trays.

34 Seneca Road, Leamington ON N8H 5H7 Canada

Tel: 519-326-2978

e-mail: bmellon@koppert.ca

Website: retail.koppert.ca

Twitter: twitter.com/koppertca

Facebook: www.facebook.com/KoppertCanada

Description: Koppert combines an integrated system of specialist knowledge with safe, natural products that improve plant health.

Our solutions include beneficial insects and traps for biological pest control as well as bumblebees for natural pollination.

box 223, OKANAGAN FALLS BC V0H 1R0

Canada

Tel: 250-212-2195

e-mail: jeff@legitexotics.ca

Description: Elite autoflowers, high test photoperiods, disease resistant seeds for cultivators who demand the best.

1170 #305 Kensington Crescent NW, Calgary AB T2N 1X6 Canada

Tel: 403-681-6741

e-mail: info@loudlionsupply.com

Website: loudlionsupply.com

Twitter: twitter.com/LoudLionSupply

LinkedIn: www.linkedin.com/company/loud-lion-supply/?viewAsMember=true

Description: Loud Lion Supply (LLS) is a global, free to list e-commerce platform for cannabis professionals, businesses, and consumers. LLS partners with trusted brands to offer great member-only pricing on new and lightly used equipment and packaging. With over $3 million in sales in 2023, LLS connects you with thousands of buyers and sellers and provides you with personalized support in purchasing and shipping. LLS allows you to bid on lightly used items to help you save big on purchases.

3500 South Service Road, Vineland Station ON L0R2E0 Canada

Tel: 905-562-4411

Fax: 905-562-5533

e-mail: info@paulboers.com

Website: www.paulboers.com

Facebook: www.facebook.com/paulboersltd

LinkedIn: ca.linkedin.com/company/paul-boers-ltd

Second generation cannabis grower Kyra Horvath learned to cultivate after her mother-in-law. She quickly took to the craft and in 2020, Horvath and her husband/business partner Laine Keyes began the build of their 10,000 sq ft facility in Oliver, B.C. While their focus is on the domestic market, specifically British Columbia & Ontario, Pineapple Buds finds differentiation in their taste and preferences for the sensory appeal of their product – recognizing a distinctly millennial twist to their practices and consumer demographic.

GO: What were the main practices you took away from your mother-in-law’s methods?

KH: Every single time I bring people into the facility and train them, the first thing that comes to mind is everything that Laine’s mom taught me. When we first started out, we were in soil, and one of the funniest things is his mom is really into feng shui. When I went in to water, she told me I couldn’t water in a zig zag, it had to be a figure eight to have the right feng shui for the plants. That’s one of my best memories and it’s always in the back of my mind: how would she do this, and how do I incorporate the methods of others? Now being able to use science and all these different resources at our fingertips that weren’t available before – I keep that in mind.

GO: What growing methods have you adapted using science and contemporary research?

KH: One of the first facilities that Laine co-founded was on his farm growing cannabis with fish.

That’s naturally how we went from soil to what would be considered deep water culture, just without the fish component. One of the reasons we decided to stay with hydro is because the growth rates have always been really strong for us; the plant vigor. Transplanting out of soil is time consuming. So instead, the plants go in, they stay, they grow for their entire lifetime, then they get cut down with only the necessary maintenance required.

GO: What provinces are you in and how many SKUs do you have?

KH: We are in B.C. and we sell through direct delivery and central, and then Ontario too. In B.C., we have eight SKUs and in Ontario we have two general listings, and we were just approved for two more. In B.C. we have four cultivars: Candy Kush (our most recent), Pineapple Haze, Purple Gushers (2023 Karma Cup winner), and Volcanic Haze – a blend of Haze and Gushers.

GO: Are you exporting product?

KH: We want to support our Canadian retailers who have been put through the wringer just as much as LPs have. Retailers have also had a really tough time navigating making a business that has consistent revenue coming in with everybody getting a piece of the pie. So, if we can do our part in not only helping LPs but also being there for retailers and making sure there’s good quality product on the shelves that they can stand behind and sell, that’s really where our focus is. We want to maintain that good relationship with B.C. and make sure that they’re well fed, while also continuing to add on provinces as we grow.

GO: How has Laine’s identity as a young Indigenous man and yours as a young woman informed your cannabis career?

KH: When we immersed ourselves in the legal market, we thought why would people want to have our product over somebody else’s? Obviously craft is a huge part of that, but one of the reflections that both Laine and I had is our age. We put almost a millennial twist on production – how we grow is for the qualities that we would like to consume. We like the flavours; we love the beautiful colours: the purple, the reds, the pinks. Sometimes when we bring in contractors, there is the assumption that because I’m young I don’t know what I’m doing. Back in the day you would leave a lot more leaf and under leaf foliage, and now we use lollipopping, which is a change in pruning technique, and that’s something I would associate with the generational change.

If we can do our part in not only helping LPs but also being there for retailers and making sure there’s good quality product on the shelves that they can stand behind and sell, that’s really where our focus is.