From

By Mari-Len De Guzman

By Mari-Len De Guzman

Anew report from the Canadian Imperial Bank of Commerce predicted that sales of legal cannabis will hit $6.5 billion by 2020, surpassing even liquor sales in the country.

The revenue projections for this soon-to-be major Canadian industry, as analysts predict, are exponential. The number of licensed producers grew from 38 in 2016 to just over a 100 as of this writing –and is expected to reach more than 200 by the end of this year. Licensed producers previously in the medical cannabis space are boosting their grow capacity to make room for the expected surge in demand when recreational cannabis becomes legal. Millions of dollars are being invested into the market in the form of infrastructure development, mergers and acquisitions, marketing, and global expansion.

What seems lost in the conversation is the need to build up reserch efforts and the evidence pertaining to cannabis. Despite huge amounts of anecdotal evidence on the benefits of cannabis for certain medical conditions, strong, objective, verifiable science to support the anecdotal data are simply insufficient and leaves much to be desired.

The flurry of activities on the economic and social side of legalization should be

matched by movement in the scientific and research community. The cannabis industry is going to make an impact on the health and lifestyles of Canadians, and science needs to be part of what will propel this industry to success.

The cannabis industry is going to make an impact on people’s health and lifestyle, and science needs to be part of what will propel this industry to success.

It is understandable that the research has not caught up with the hype. Prohibition has made it difficult for researchers to extensively study this up and coming cannabis superstar. That is slowly changing, however. In recent years, more studies have been published in peer reviewed scientific journals related to cannabis. And with legalization, more studies will be conducted with less restrictions than in the past.

There is increasing effort in the research community to study the long-term effects of cannabis use to the human brain and body. This is currently one of the biggest unknowns when it comes to cannabis. There is also ongoing efforts to gather more evidence on specific health conditions where cannabis is most effective.

That there is a business case for LPs to be investing in research is a no-brainer. Cannabis

producers that are investing in R&D are on the right side of history. And I don’t just mean R&D to develop the next best product – albeit it’s an important component. The research initiatives need to be more than just about making a profit. It should also be about being absolutely certain the product is safe and reliable.

Good science is good PR, too. Efforts to break down the stigma associated with cannabis use can be helped by good, solid evidence. As cannabis is legalized and transitioned to mainstream, more people are going to be asking the same questions they’ve been asking when it was still illegal. It will spur open, mature conversations about everything having to do with cannabis – including perceived benefits and risks. It’s always great to have science on your side in such discussions.

The cannabis community and the research community can work together to continue to build the evidence that will ultimately support the longterm viability of the industry. The anecodotal evidence is already there – people are already finding benefits with cannabis.Let’s get the science to verify and support those claims with objective, scientific proof.

Cannabis producers have the resources while the independent research community has the ability to put those resources to good use. It will be good to see more collaboration between these two.

Spring 2018 Vol. 2, No. 2 growopportunity.ca

EDITOR

EDITOR Mari-Len De Guzman mdeguzman@annexbusinessmedia.com 289-259-1408

Mari-Len De Guzman mdeguzman@annexbusinessmedia.com 289-259-1408

ASSOCIATE PUBLISHER Adam Szpakowski aszpakowski@annexweb.com 289-221-6605

ASSOCIATE PUBLISHER Adam Szpakowski aszpakowski@annexweb.com 289-221-6605

NATIONAL ADVERTISING MANAGER Nashelle Barsky nbarsky@annexweb.com 905-431-8892

NATIONAL ADVERTISING MANAGER Nashelle Barsky nbarsky@annexweb.com 905-431-8892

NATIONAL ACCOUNT MANAGER Sarah Otto sotto@annexweb.com 888-599-2228 ext 237

NATIONAL ACCOUNT MANAGER Sarah Otto sotto@annexweb.com 888-599-2228 ext 237

ACCOUNT COORDINATOR Mary Burnie mburnie@annexweb.com 519-429-5175 888-599-2228 ext 234

ACCOUNT COORDINATOR Mary Burnie mburnie@annexweb.com 519-429-5175 888-599-2228 ext 234

CIRCULATION MANAGER Barbara Adelt badelt@annexbusinessmedia.com 416-442-5600 ext.3546

CIRCULATION MANAGER Barbara Adelt badelt@annexbusinessmedia.com 416-442-5600 ext.3546

MEDIA DESIGNER Brooke Shaw

MEDIA DESIGNER Brooke Shaw GROUP PUBLISHER Martin McAnulty mmcanulty@annexbusinessmedia.com

PRESIDENT & CEO Mike Fredericks

GROUP PUBLISHER Martin McAnulty mmcanulty@annexbusinessmedia.com

MAILING ADDRESS

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

COO Ted Markle tmarkle@annexbusinessmedia.com

PRESIDENT & CEO Mike Fredericks

MAILING ADDRESS

P.O. Box 530, 105 Donly Dr. S., Simcoe, ON N3Y 4N5

SUBSCRIPTION RATES

SUBSCRIPTION RATES 1 year subscription (4 issues: Winter, Spring, Summer, Fall): 1 year offers: Canada $25.00 + Tax USA $35.00 USD FGN $40.00 USD GST # 867172652RT0001

SUBSCRIPTIONS

1 year subscription (4 issues: Winter, Spring, Summer, Fall) 1 year offers: Canada $25.00 + Tax USA $35.00 USD FGN $40.00 USD GST # 867172652RT0001

Roshni Thava rthava@annexbusinessmedia.com Tel: 416-442-5600, ext. 3555 Fax 416-510-6875 or 416.442-2191 111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1

SUBSCRIPTIONS

Roshni Thava rthava@annexbusinessmedia.com

ANNEX PRIVACY OFFICE privacy@annexbusinessmedia.com Tel: 800.668.2374

ISSN: 2561-3987 (Print) ISSN: 2561-3995 (Digital) PM 40065710

Tel: 416-442-5600, ext. 3555 Fax 416-510-6875 or 416.442-2191 111 Gordon Baker Rd., Suite 400, Toronto ON M2H 3R1

ANNEX PRIVACY OFFICE

privacy@annexbusinessmedia.com

Tel: 800.668.2374

Occasionally, Grow Opportunity will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

ISSN: 2561-3987 (Print) ISSN: 2561-3995 (Digital) PM 40065710

Occasionally, Grow Opportunity will mail information on behalf of industry-related groups whose products and services we believe may be of interest to you. If you prefer not to receive this information, please contact our circulation department in any of the four ways listed above.

We recognize the support of the Government of Ontario

With its high perlite content, PRO-MIX® HP BIOSTIMULANT + MYCORRHIZAE™ provides a great growing environment to growers looking for a significant drainage capacity, increased air porosity and lower water retention. The added benefit of fibrous peat moss and coarse perlite makes this formulation ideal for growers who require a superior-quality product adapted to their needs for watering flexibility and crop seasonality.

Delta 9 Cannabis has announced a strategic collaboration agreement with Fort Garry Brewing Company to jointly produce and market a hemp beer in Manitoba, for sales nationally. The beer is expected to be on the market in the summer to mark the expected legalization of recreational cannabis in Canada. The first product will be an alcoholized beer infused with material from hemp seeds, and will contain no cannabis or any other psychoactive agent produced from the cannabis plant. Fort Garry will be responsible for distribution in any province where the brand is sold. Delta 9 will provide the hemp seed used in production of the new product.

Terra Life Sciences began construction of its new 230,000-square-foot Terra Quantum facility in Olds, Alta. – phase two of the company’s medical cannabis cultivation operations. The company’s first cultivation facility, a 50,000-squarefoot building, is nearing completion. Funding for the expansion of the company’s cultivation operations is being provided through a recent $46 million private placement. That funding is also supporting the company’s investments in clinical trials and expansion of its research capabilities, the company said.

The B.C. government has unveiled its plan for regulating the sale of recreational marijuana. Under the legislation, the province would have jurisdiction over wholesale distribution of cannabis and sales would be allowed to buyers who are at least 19 years old. Provincially run cannabis shops would operate as B.C. Cannabis Store. The first government retail store is expected to open by late summer and public sales would also be available online. – THE CANADIAN PRESS

Under B.C. regulation, it would be up to each municipality to determine if and where recreational marijuana can be sold, and whether it is sold in private or government stores, or a mix of both.

Second Cup wants to serve up a different kind of buzz by converting some of its coffee shops into cannabis dispensaries and, when legal, pot lounges

The specialty coffee chain has signed an agreement with marijuana clinic operator National Access Cannabis (NAC) to develop and operate a network of recreational cannabis stores. However, neither currently has a licence to sell marijuana, so the deal is contingent on approval from the governments, as well as from franchisees and landlords.

If and when regulations allow, the two companies also want to open coffee shops for cannabis consumption, said Second Cup’s board chairman Michael Bregman.

“(Cannabis) is going to be an awfully big business in Canada, and we have some amazing

locations,” Bregman said in an interview. “I wish I knew now in what form we would be pursuing and participating. We’re just trying to position ourselves so we can participate as the opportunities arise and the legislation is formed.”

The companies said in a joint release that the NAC-branded stores would initially be located across Western Canada, with plans to expand to additional provinces where legally permissible.

NAC, a private firm that operates a network of marijuana patient advisory clinics, will apply for licenses to dispense cannabis products and work with Second Cup and applicable franchisees to construct stores. NAC has signed marijuana supply agreements with CannaRoyalty Corp. and others.

– ARMINA LIGAYA, THE CANADIAN

PRESS

Entrepreneurs Needed Be a Part of a Growing Billion Dollar Industry register at com

Use promo code GO20 for 20% off passes Join us at the Cannabis World Congress & Business Exposition, a business-to-business trade show event for the legalized cannabis industry. MAY 30TH - JUNE 2ND

In separate deals, Niagara College has inked agreements with Canopy Growth and MedReleaf in a bid to bolster the school’s new commercial cannabis production graduate certificate program. Canopy Growth will open its Tweed Farms to Niagara College students for hands-on learning opportunities via co-op placements or internships. MedReleaf, on the other hand, is offering financial support for students and sharing expertise to help develop the structure and curriculum of the school’s commercial cannabis production program. Niagara College will welcome the first batch of students into this program this fall.

The Yukon Liquor Corporation has signed an agreement with Tilray Canada to supply the territory with an array of non-medical cannabis products in light of the anticipated legalization of recreational use later this year. According to a Canadian Press report, the Nanaimo, B.C.-based cannabis producer will supply about 350 kilograms of cannabis to the liquor corporation in the first year. Yukon’s cannabis market ranges between 800 and 1,000 kilograms per year. In a statement, Tilray said it will fulfill the agreement through its affiliate High Park Company, which was formed to produce and distribute a broad-based portfolio of adult-use cannabis brands and products.

Aurora Cannabis Inc. has delivered the first ever batch of privately exported medical cannabis from Canada to the Italian government through its wholly-owned German subsidiary Pedanios. The products have been distributed to Italian pharmacies.

In January, Aurora and Pedanios had won an Europe-wide public tender to supply 100kg of medical cannabis to the Italian government through the Italian Ministry of Defense, who oversees medical cannabis production and distribution in Italy.

kg of medical cannabis will be supplied to the Italian government by Aurora Cannabis.

VANCOUVER – Aurora Cannabis Inc. has completed its acquisition of CanniMed Therapeutics Inc. The company said it has acquired all the remaining issued and outstanding shares of CanniMed that it did not already own.

CanniMed’s shares were delisted from the Toronto Stock Exchange at the close of business May 1st, a company statement said.

Aurora CEO Terry Booth said CanniMed will operate as a wholly owned subsidiary of Aurora and will spearhead initiatives such as scientific research, education and product development.

In January, Aurora struck a stock-and-cash deal valued at $1.1 billion to buy CanniMed. The agreement ended a sometimes-terse takeover battle between the two companies. – THE CANADIAN PRESS

HALIFAX – Three months after announcing just nine outlets would sell legal marijuana in Nova Scotia, the province said three more will be added by the fall.

Stores in Bridgewater, New Minas, and Antigonish will open as required renovations are completed – adding outlets in areas left out in the first round.

Finance Minister Karen Casey said the Nova Scotia Liquor Corporation (NSLC) has been working since the original announcement on Jan. 30 to “identify additional locations that could be renovated for cannabis sales.”

The new stores are to operate with two outlets in Halifax, and one each in Amherst, Dartmouth, Lower Sackville, New Glasgow, Sydney River, Truro and Yarmouth after legalization comes into effect this summer.

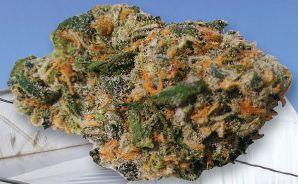

Bret Mitchell, the liquor corporation’s president and CEO, has said prices will vary depending upon the strain and characteristics of the cannabis, but in general they will likely have to be less than $10 per gram.

Product will be sold in enclosed areas by trained staff who will dispense it from behind the counter – there will be no open displays. – KEITH DOUCETTE, THE CANADIAN PRESS

Ashley Short (left), certified holistic nutritionist and clinical herbalist, and Tijen Yalchin, a registered massage therapist, proprietors of Earth Kisses Sky, were spotted at the Women Grow networking event. EKS produces and sells medical cannabis salves.

Canopy Growth president Mark Zekulin (left) and Niagara College president Dan Patterson announcing a new education partnership that will open up co-op placements and internships at Canopy’s Tweed Farms for students in the college’s horticulture and commercial cannabis production programs.

Green Relief farms tilapia fish to power its medical cannabis production – and it’s going swimmingly.

in cannabis

Cannabis activist Lisa Campbell (right) was the guest speaker at a recent Women Grow Toronto networking event. Campbell urges more female representation in the cannabis industry. Women Grow Toronto chairwoman Antuanette Gomez (left) led the forum discussion.

Chef Ronnie Fishman delivers a crash course on edibles at a Hempster/Tweed media event held in Toronto.

Green Relief’s chief executive officer Warren Bravo recently took Grow Opportunity on a tour of its aquaponics-based cannabis farm in Hamilton, Ont. Green Relief combines aquaculture with hydroponics to sustainably grow its medical cannabis, using 90 per cent less water than traditional farming.

HUMIDITY IS KILLING YOUR CROPS. AND YOUR PROFIT MARGIN.

Humidity. It’s the constant threat that no one wants to talk about. However, with our exclusive Agam VLHC technology, air is continuously dehumidified and filtered, capturing and neutralizing fungal spores on contact. You get healthier, more abundant crops, use less fungicides and cut energy costs by about 60%. Start clearing the air today.

Visit envirotechcultivation.com/agam to watch Agam VLHC in action.

By Matt Maurer and Whitney Abrams Legal Matters

Matt Maurer is chair of Minden Gross LLP’s Cannabis Law Group in Toronto. Email him at mmaurer@mindengross.com. Whitney Abrams is an associate at Minden Gross LLP. Email her at wabrams@mindengross.com

Under the federal government’s proposed Cannabis Act, jurisdiction over how retail sales are conducted is left to the province and territories. Each pr ovince and territory has implemented its own distinct process and the retail environment will differ in each jurisdiction. Below is an overview of what each has announced to date.

British Columbia

B.C. will offer its residents an opportunity to purchase recreational cannabis through either privately-run or government-operated retail stores and online sales. Publiclyrun retail stores and the distribution of recreational cannabis will be facilitated by the BC Liquor Distribution Branch (LDB). Meanwhile, the Liquor Control and Licensing Branch will be responsible for licensing and monitoring retail outlets. Retailers will only be permitted to purchase cannabis, wholesale, from the LDB and will not be allowed to purchase directly from licensed producers.

In February 2018, British Columbia released its “Cannabis Retail Licensing Guide.” The government announced it will launch an online application portal for private cannabis retail. Private retailers will not be able to sell cannabis online, but the government has stated that it may be open to allowing it in the future.

Alberta will have private retail stores and governmentoperated online sales. Physical retail locations will be subject to government regulations and the terms of licenses will be granted by the Alcohol Gaming and Liquor Commission (AGLC). The AGLC will also be responsible for regulating distribution to all private retailers. It began accepting retail cannabis store license applications on March 6, 2018 and will continue to do so on a rolling basis. As of this writing, the AGLC has received approximately 140 applications.

To grant a license, the AGLC requires either a development permit approval from the municipality in which the cannabis store is to operate or municipal license approval. Communities in the province are in the process of drafting legislation and by-laws to allow for cannabis retail.

Retail will be privately owned in Saskatchewan. The Saskatchewan Liquor and Gaming Authority (SLGA) will

grant 60 permits for 40 municipalities and First Nations. Initial allocation of permits will be for populations of at least 2,500. Larger communities will be allocated additional permits. Eligible First Nations and municipalities will have an option to opt-out of having a retail cannabis store in their community. Unlike many of the other provinces, wholesaling will also be conducted by the private sector. All wholesaling and retailing activities will be regulated by the SLGA.

Successful cannabis retailers will be required to operate a storefront and will also be able to sell online. Storefront operations must be completely separate from any other business and will only be permitted to sell cannabis and cannabis accessories/ancillary items.

The Liquor and Gaming Authority of Manitoba is responsible for licensing private cannabis stores in Manitoba (LGA). The LGA conducted a request for proposals which concluded in late December

2017. In February, Manitoba announced its conditional acceptance of four proposals. Final proposals will be contingent on reaching all of the necessary agreements and providing all required documents to the LGA.

The organizations that were selected to obtain licenses are the consortium of Delta 9 Cannabis Inc. and Canopy Growth Corporation; National Access Cannabis; Hiku Brands, through its wholly owned subsidiary Tokyo Smoke, in partnership with BOBHQ; and 10552763 Canada Corporation, which featured Avana Canada Inc., Fisher River Cree Nation of Manitoba, Chippewas of the Thames of Ontario, MediPharm Labs, and Native Roots Dispensary.

In Ontario, cannabis sales will be publicly run by the Ontario Cannabis Retail Corporation, a subsidiary of the Liquor Control Board. The stores in Ontario will be branded as the Ontario Cannabis Store (OCS). The government has committed to operate 150 stores across Ontario by 2020.

All sales will be conducted via behind-the-counter service, where retail staff will be trained in properly identifying consumers and ensuring they are at or above the minimum age of 19.

The OCS will also offer online sales, announcing it will use Shopify as its e-commerce platform to facilitate all cannabis online sales in the province.

In Quebec, retail sales will be publicly run and conducted by a subsidiary of the Societe des

Alcools du Quebec (SAQ) known as the Societe Quebecoise du Cannabis (SQC). All distribution will be conducted through the SAQ. The plan is to have 100 stores after three years but the government has indicated it is open to making changes after a year into operation.

Six of Canada’s federally licensed producers –Hydropothecary, Canopy Growth, Aphria, MedReleaf, Aurora and Tilray – have signed letters of intent to supply the SAQ with cannabis for the recreational market.

New Brunswick’s residents will purchase their recreational cannabis through public retail outlets that will operate as a subsidiary of New Brunswick Liquor (NBL). The stores will be coupled with online sales that will either be delivered directly to customers’ homes or to stores for customer pick-up. The stores will operate based on the conditions established by the NBL. Stores will be branded as Cannabis NB.

New Brunswick has signed agreements with Organigram, Canopy Growth Corp, Zenabis, and Nuuvera Inc. for the supply of recreational cannabis in the province. Canopy Growth will also be offering rigorous mandatory training for staff of all Cannabis NB stores.

Retail sales of cannabis will be sold publically, through the Nova Scotia Liquor Corporation (NSLC). Sales will be conducted online and in current NSLC storefronts. Nine locations will sell cannabis in Nova Scotia: Amherst, Dartmouth, two in

Halifax, Lower Sackville, New Glasgow, Sydney River, Truro, and Yarmouth.

These stores will sell cannabis, cannabis oil, cannabis seeds and accessories including grinders, hand pipes, vaporizers, and water pipes. The area where cannabis will be sold will be in a separate part of the store, where only individuals over the age of 19 will be permitted to enter.

The selection process for producers is well underway for the NSLC.

Each province and territory has implemented its own process and the retail environment will differ in each jurisdiction.

The province will also sell cannabis through private retailers. The process, which will beoverseenbytheNewfoundland Labrador Liquor Corporation’s Cannabis NL division (NLC), was conducted via a request for proposals. The RFP organized applications based on four different retail “tiers”: standalone stores; stores within stores (i.e. cannabis sales located in a segregated part of an existing retail operation); dedicated counters within existing retail operations; and behind-thecounter sales similar to the model for tobacco sales.

Initially, 41 licenses will be awarded. The RFP identifies a specific number of licenses to be given per geographic region. The application divides the regions by postal code and were to be submitted on that basis. Licensed cannabis retailer applicants should expect to be

notified of the status of proposals on or before May 7, 2018.

The 41 licenses do not include four retail locations, which will be run by Canopy Growth Corp’s wholly-owned subsidiary, Tweed. Canopy committed to building a local facility by 2019 and will supply cannabis to the NLC prior to that by importing from production facilities elsewhere. In exchange, Canopy was granted four retail locations over and above the other 41 licenses that are to be awarded. The NLC has stated it is still open to additional supply agreements from other licensed producers.

Prince Edward Island

PEI will have publicly-run retail by the P.E.I Liquor Control Commision (PEILCC) in four standalone locations. The PEILCC will also offer online sales with next-day delivery to customer’s homes. The sites for stores have already been announced and will be located in Charlottetown, Summerside, Montague, and West Prince.

Prince Edward Island has signed agreements with Canopy Growth, Organigram, and Canada’s Island Garden for the supply of recreational cannabis.

Recreational cannabis will initially be sold through existing liquor stores operated by the Liquor Commission. The province believes these existing operations are best suited to sell cannabis as they are well versed in the retailing of controlled substances and mail order sales, which includes delivery safeguards. Rural areas or communities without liquor stores will have mail order cannabis available under the recreational market.

Nunuvut released its proposal on regulating cannabis in January 2018. The government is proposing to allow one or more agents to sell cannabis on behalf of the Nunavut Liquor Commission (NULC). The third party, once appointed, would be subject to strong public oversight and control by the NULC.

Accordingly, the government has indicated it will allow telephone or online sales for purchase and shipping to residents’ homes. A platform for these sales has not yet been decided by the government.

The Yukon Territories released a draft legislative summary of its Cannabis Control and Regulation Act. The proposed model will enact a Cannabis Licensing Board, which will be responsible for licensing private retail stores in the province. The draft legislative summary indicates that any parties interested in becoming a licensed cannabis retailer in Yukon would be required to submit a license application to the Distributor Corporation (DC), which will be a role designated to either a new or existing public corporation. The DC will purchase and import cannabis to the territory for commercial retail sale and will wholesale product for private and public stores. It will provide e-commerce sales and delivery of cannabis.

In mid-April, the Yukon Liquor Corporation signed its first supply agreement with licensed cannabis producer, Tilray Canada. It’s subsidiary, High Park, will be responsible for supplying recreational cannabis to Yukoners.

By Mohyuddin Mirza

Dr. Mohyuddin Mirza (drmirzaconsultants@gmail.com) is an industry consultant with more than 37 years of experience in crop development, production and marketing. He specializes in the technical aspects of hydroponics and systems for plant production.

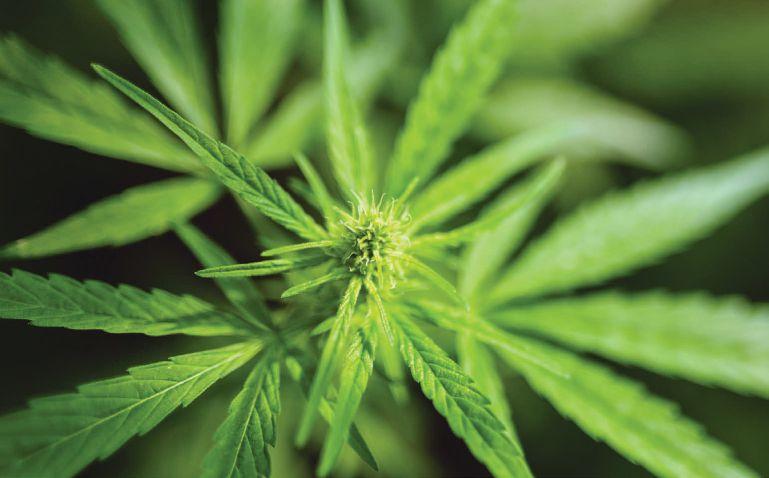

Commercial horticultural crops have basically two stages of growth. The vegetative growth phase is where roots, shoots and branches are produced. This growth is needed for the plant to establish itself and have enough leaf area to carry out adequate photosynthesis. Once the plant has established itself, it enters a generative growth phase, where the growth hardens off and plant produces flower buds. In plants like lettuce, leafy greens and transplants, we need the vegetative growth to dominate and for plants to stay in that stage. On other plants like cucumbers, tomatoes and peppers, we want the plant to be vegetative and generative at the same time.

In cannabis, we want the plant to stay distinctly vegetative in its early stages, and then generative in later stages. We do not want the plant to change direction of growth too soon or reverse from generative to vegetative state.

Vegetative

Light is ON for 18 hours. Duration of light or photoperiod is the biggest factor in keeping the cannabis plants vegetative. The picture of the plant in the beginning of this article shows how the photoperiod of eight hours made the plant generative, and by exposing the plant to more than 12 hours of light induced vegetative growth. Keep the growing medium moist, consistently moist. Sometimes growers are worried with root diseases like Pythium root and stem rot and they go for a wet and dry irrigation regimes. This creates a water stress signal and plant will start showing signs of generative growth. Leaves will turn dark green and size will get smaller.

Make sure there is no nutrient stress on plants. Since we are applying water with nutrient solution on a regular basis, the

chance of a deficiency is minimal

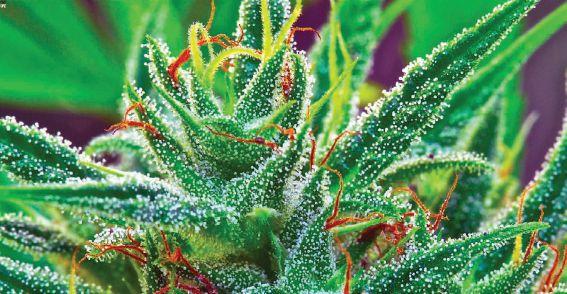

Cannabis plants are very sensitive to electrical conductivity (EC) values of over 2.5 mS. Higher EC values give a generative signal to plants. This can be observed by early development of trichomes on leaves.

Maintain carbon dioxide level of around 800 ppm. Over 1,000 ppm gives a generative signal to plants. There is a misunderstanding about the use of supplemental lights for cannabis. Higher levels are not better. Based on what we have learned from greenhouse vegetable crops, higher than 1,000 ppm causes the stomata to reduce in size and therefore affecting the transpiration. This is evident when top leaves are significantly smaller, compared to lower leaves, and are also thicker. Also, remember the way carbon dioxide is added into the air. On your computer the set point is 800 ppm. When the CO2 sensor senses the level has reached at the set point, the CO2 is shut off. Plant uses the CO2 and the levels drop to 600 ppm and it is injected again. Thus, on a graph it will look like “waves” not just

a very straight line.

Use a nutrient program in which nitrogen to potassium ratio is 1:1, although I have seen growers using 1.2 to 1.0 as well. I prefer to use 1:1.5 N:K ratio so that growth is not soft. If you are growing cannabis in hot climates, adding small amount of ammonium nitrogen, less than 25 ppm, is beneficial for vegetative growth. Plants will grow perfectly if all the nitrogen is in nitrate (NO3) form. Keep the VPD more close to 2 to 4 grams/m3 of air for vegetative growth. Keeping mother plants/stock plants constantly in vegetative state is a challenge because the plants get root bound and that is a generative signal. The side shoots are used for rooting and they can be woody. Higher EC, over 4 mS have been found in mother plants and that will trigger early bud set. Keep these plants vegetative by using the strategies listed above. In addition, do not keep these plants for more than 60 days.

The biggest trigger for inducing generative growth is reducing the photoperiod to 12 hours – that is 12 hours of dark period and 12 hours of light. Proper use of blackout curtains is essential with no light leakage.

The supporting strategies include:

• Constant mild stress on the plants by using drier water regime

• Using a “generative action” vapor pressure deficit. The normal range for generative action is around 5 to 7 grams/m3 of air.

• Avoid climate conditions that promote powdery mildew.

• Use higher potash to nitrogen ratio, closer to 2 to 1.

There are many strategies to keep cannabis plants vegetative or generative, and proper understanding of the effects of these strategies is important in decision-making.

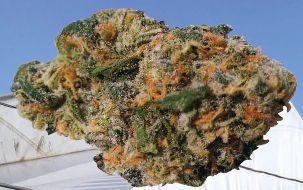

When executives at Bonify were approached ab out a year ago on an initiative to introduce a voluntary standards and certification program for premium quality cannabis products, they immediately warmed up to the idea.

“ We thought this would be an outstanding way to not only meet but exceed existing standards in the country for production of cannabis,” says Jeff Peitsch, CEO of Bonify, a Winnipeg-based licensed producer (LP) of cannabis.

Coinciding with the legalization of recreational marijuana later this year is the launch of an independent, multi-stakeholder standards certification body for high-quality cannabis products. The Growers’ Quality Assurance (GQA) aims to be the gold standard for quality and reliability in cannabis production, says Jon Watson, GQA’s CEO.

“Trust is the currency of the new economy,” Watson tells Grow Opportunity in an interview. “Brands need to be honest and consumers need to know exactly what they are getting.”

GQA is in the process of developing the standards – in consultation with its advisory board, which includes cannabis master

growers – and the certification process that participating LPs will subscribe to.

Ultimately, Watson says, the final standards and certification process will be the resulting consensus among GQA-participating LPs and the expert panel comprising the organization’s advisory board.

“We are talking to people from the cannabis cultivation technology side, from the laboratory side, from the regulatory side of the government, and now licensed producers themselves, which include their quality assurance people, their master growers, their science teams,” Watson explains.

Bonify is one of nearly 100 currently licensed producers of cannabis for medical purposes in Canada. Already, these LPs are subject to rigorous standards imposed by Health Canada. Peitsch believes, however, that the ability to raise the bar even higher and exceed those already meticulous requirements will set Canadian LPs apart – particularly in the emerging and fast-growing global market.

The Bonify CEO views GQA as a stretch goal for firms to bring more energy and effort to standardize processes and incorporate those into their usual operations. “This will ultimately result in a better product, a more secure product from the patient’s standpoint.”

The GQA draws from parallels and the experience of the Canadian wine industry’s Vintners Quality Alliance (VQA), a regulatory system that sets out geographic appellations and imposes strict production standards for Canadian wine growers.

The VQA tag has become a symbol for the consumers that differentiates wines that are made and bottled in Canada, says Peter Gamble, a GQA board member and former executive director at VQA Canada.

Gamble sees some parallels between wine and cannabis growing in terms of the “art” that goes into growing and producing consistent, high-quality products.

“The first thing is the green thumb and the excellent controls

not just in terms of pesticides and safety and sanitation – which the federal governments of the world will address – but in terms of the quality. ‘Is this something I can be confident is going to be good?’ And when you know it’s been grown well, it takes you 90 per cent of the distance,” Gamble explains.

He recalls when the wine industry started the process of establishing a nationwide standard, the Canadian General Standards Bureau required a 58-member multi-stakeholder committee to accomplish the goals.

He says while the GQA composition may not necessarily be as massive, it is important for the organization to have a good

representation of all aspects of the cannabis industry and develop the standards that “everybody – even begrudgingly – agrees on.”

The standards body should also be able to draw the line between what is objective and what is subjective, Gamble says. Standardizing processes and operations would naturally require additional investments and participating LPs should be allowed to decide whether they want to roll out across the board or to a selected part of their business.

“(GQA) needs to be set up so that it works for them as well, so that they are able to do (the GQA certification) and still be able to

compete freely in the commodity part of the sector,” Gamble says.

However, he adds, there needs to be a healthy argument on where to draw the line when it comes to quality and the objective processes and procedures that just can’t be compromised.

The GQA label, according to its proponents, will ultimately provide consumers a level of confidence that they are buying the best quality, Canadian cannabis products.

Consumer education will be an important component of GQA, says Adine Carter, chief marketing officer at Tilray, one of the largest producers and exporters of cannabis in Canada.

Grow Opportunity was given a sneak peek of the logo that will grace all GQA-certified cannabis in Canada. GQA-branded products will be priced at a premium rate.

“Bringing clarity to the consumer is most important,” Carter says. “Consumers deserve reliable information about how cannabis is grown and processed, and accurate information about taste/ aroma, potency, effect, and price.”

Like Gamble, the Tilray executive also hails from the wine industry and experienced first-hand the value of product quality assurance.

“A quality assurance program provides consumers clarity and assurance that what they are buying is safe and reliable, and the GQA program will fill that role for cannabis,” says Carter, who is also a member of GQA’s advisory board.

The GQA hopes to capture the top 20 per cent of cannabis produced in Canada with the highest quality strains.

“When you are identifying the top tier, people at least have the option to try it and say, there is a significant difference here and I’m happy to pay that extra 25 to 30 per cent in order to know that this has been done well and people have reviewed it,” Gamble says.

Canadian LPs are currently governed by standards and testing imposed by Health Canada under the Access to Cannabis for Medical Purposes Regulations. The announcement by the federal

government to legalize recreational marijuana has prompted advocates to push for more public education around cannabis, which is soon going to be available for legal recreational consumption.

In response, voluntary standards and certification programs for the cannabis industry – locally and internationally – have surfaced. The National Institute for Cannabis Health and Education last year announced its CannabisWise certification, a voluntary program that will test and certify businesses based on specific metrics that include quality control, regulatory compliance and promotion of responsible cannabis use.

International standards body ASTM International has also created its own cannabis standards – Committee D37 – last year. It will look at safety and quality, and will develop test methods and standards for cultivation practices, quality assurance, packaging and security, the ASTM website says.

Even within the medical marijuana market, information about cannabis strains, and the effects and benefits are already hard to come by. When recreational cannabis hits the market, information and public education become even more crucial.

“You need organizations to set standards,” comments Dr. Jason Busse, associate professor at McMaster University and co-director

of the Michael G. DeGroote Centre for Medicinal Cannabis Research. “It’s one of the reasons why the government is moving away from prohibition to legalization… to ensure that people are getting a more safe, standardized product.”

Any certification process, he added, would have to be backed by good, strong evidence to direct and support the standards parameters.

“You need researchers involved in that kind of body because otherwise people are going to challenge it,” Busse cautions.

Things are changing rapidly in the cannabis market and Gamble points out it is important to have “the most knowledgeable people” in the industry sitting at the GQA table. “The minute you got a GQA with a technical committee that’s like that, then suddenly you have all these players at the table talking to each other. Suddenly, there’s more and more people doing it and who’s making that improvement.”

GQA will ensure its certification standards are achievable and equitably represents the Canadian cannabis industry.

“We want to make sure the people that are doing the best can sit at the table,” Watson says. “We are cognizant of that in developing our standards to make sure that we can have an achievable standard – whether they are hydroponic or aeroponic or organic farmers they can have a chance to sit at the table together.”

The GQA label will differentiate the higher tier cannabis products, making it easier to compete in the international market. Ultimately, the goal is to ensure GQA standards and processes will transcend national boundaries and enable its quality-assured products to be internationally recognized and compete in the emerging global cannabis market.

A growing list of nations that have moved or are moving toward legalized medical marijuana is creating a global marketplace for legally grown, high-quality Canadian cannabis products. A number of LPs have either already been granted or are seeking export licences from Health Canada. Some are already actively expanding in the global market. Bonify, for one, is looking to expand its footprint beyond Canadian borders, and is currently in the final stages of acquiring an export licence, its CEO tells Grow Opportunity.

“We will continue to build production capacity, not solely for the purpose of Manitobans, whom we hope to be able to continue to serve, and not just Canadians,” Peitsch says. “We have had quite a number of international authorities reach out to us as well.”

According to a report from the International Narcotics Control Board, Canada moved just less than 100 kilograms of legal cannabis across the border in 2016. Exports data for 2017 is expected to top those of previous years.

“Canada is already demonstrating that we are ahead of everybody else, that we’ve got the technical proficiency and we’re doing some incredible things,” Watson says. “GQA essentially makes our industry that much more sophisticated in the eyes of the world… that is going to resonate particularly in places like Germany, Australia, Italy and the U.K.”

Already, the GQA executive has been doing the international

rounds – in the U.K. and Germany, initially – to discuss the potential of GQA-certified cannabis for global recognition.

Watson is no stranger to the world of government liaison –having spent a decade in senior political roles, including as campaign manager for three federal elections, and has represented the Prime Minister in provincial meetings.

“We have an ongoing dialogue with the government of Canada to accept – if we choose to accept it – some support on the development around some of the technology we are using. In many dimensions, we will be involved with the government –provincial and federal – but it’s hard to define some of those things (at the moment) because they are all ongoing,” Watson says.

GQA is developing an interactive app that will allow users to acquire information about GQA-certified cannabis products, including strains, indications, and the company where the product originated. The app will also allow for user reviews, Watson says.

Early this year, the government released proposed regulations that impose restrictions on cannabis labelling, a move that drew criticism from many in the industry. The rich content the GQA app will provide for consumers hopes to address some of the packaging limitations that will be imposed on cannabis products post-legalization, Watson points out.

A close look at how recreational cannabis marketing will play out in the first phase of legalization

By Treena Hein

It’s down to the wire. Licensed producers have sweated and debated over their branding strategies, in some cases for years, and are now putting their finishing touches on both their product and their overall company launches. There are now about 100 LPs in Canada, and none among them wants to be lost in the sea of products about to hit the Canadian market. It’s no exaggeration to say that branding strategies will make or break companies, and there is everything to lose – or gain.

In the view of Mitchell Osak, LPs will choose a go-tomarket approach that either leans heavily toward branding individual products (Tide or Pampers are what’s marketed, for example, and not the firms that make them) or toward a corporate branding focus (the opposite – promoting the whole company such as Microsoft, Victoria’s Secret or Harley Davidson). Which way an LP will go “depends on your product positioning, how many products you have and other factors such as available marketing budget,” notes Osak, the managing director of Strategic Advisory Services at marketing consulting firm Grant Thornton in Toronto. “Both strategies can be successful in achieving meaningful differentiation, if properly implemented.”

As those in the industry know, Canadian law will require that cannabis packaging be very plain, with only a small single brand element (a non-metallic/fluorescent company or product slogan or a logo) allowed, along with the product and company name. For his part, Erik Fletcher, chief marketing officer at Kitchener, Ontario-based LP James E. Wagner Cultivation (JWC) notes “the packaging requirements are not necessarily prohibitive compared to what we currently use. The true challenge here is how we can stand out given that everyone else is now subject to the same design restrictions.”

Health Canada’s draft rules for cannabis labelling is raising concerns in industry calling it “overly prescriptive.”

Indeed, but successful branding of Canadian cannabis products is not only challenging because of plain packaging. Federal law also prohibits any advertising or direct promotion, direct celebrity endorsement or the use of glamour, sex and other exciting elements in any type of indirect promotion.

“Companies will be forced to being very creative and use non-traditional marketing avenues and tools,” Osak says. However, because cannabis marketing is brand new, it also carries some execution risk. “ The government could step in and disallow some tactics or executions as ‘too glamourous’ for example,” Osak explains.

“I think on the whole, we’re going to see companies at the outset aim to establish a reputation for quality, consistency and integrity, not a party animal focus. At the time of recreational cannabis legalization, most LPs will be producing both recreational and medical marijuana. Many of these LPs have a solid and growing medicinal cannabis business so they need to protect that.”

There are many non-traditional marketing tools available to LPs. One popular way to get the spotlight pointed in a firm’s particular direction is to have a celebrity or fictional characters join it. Rap star Snoop Dog was the first, and recent examples include KISS rock star Gene Simmons, members of The Tragically Hip rock band, and characters from the Trailer Park Boys television series. However, as Osak notes, what exactly will be allowed in terms of celebrity marketing activity is not yet truly known, nor is how much company relationships with famous people will lead to sales success.

Another marketing option is to try and co-brand a cannabis firm with the launch of non-cannabis products, such as the new “cannabis-inspired” beer called San Rafael ’71 recently released by MedReleaf and Amsterdam Brewery. The firms state that the beer is “designed to celebrate the spirit of classic cannabis culture…for adults who are discerning and knowledgeable about cannabis products and those who value quality

“The true challenge is how we can stand out given everyone else is now subject to the same design restrictions.”

and an authentic experience.” In other words, older hippies and younger hipsters, please give us a try.

Another non-traditional way to cause a media splash is to sponsor an event. Tweed/Canopy Growth, for example, is sponsoring Fashion Week in Toronto this year. Osak, however is not a believer that this strategy will be a good fit for every LP. “Events have long lead times for planning, plus there are only so many adult-only events to go around,” he notes. “It’s not cheap to sponsor big events, and there has to be a big social media follow up or it’s not worthwhile.”

Osak also anticipates some hesitancy at this point among event organizers and existing sponsors to be seen as affiliated with cannabis firm sponsorship. Bridget Hoffer agrees. “It’s about a values match,” notes the head of strategy and branding at Toronto-based marketing firm Cannabis Communications. “Companies and event organizers have to be aligned. But in the future, I also think the stigma of going to a cannabis firm-sponsored event will drop away.”

Other potential cannabis marketing strategies include providing expert commentary at events and in the media (radio, TV, print, internet) on medicinal benefits, responsible use and more. Interviews and comments then spread through social media, Osak notes. “LPs can also gain exposure through corporate social responsibility initiatives such as sponsoring medical research and youth education,” he adds. “In addition, in some markets LPs could own retail stores. Like Apple and Nike, a strong retail execution is a powerful form of marketing.”

Hoffer also believes the customer service experience provided in these stores will be an important marketing factor. “Overall, it’s about public relations and building a community,” she says. “Companies will seek feedback on social media through surveys and more, about the service they’ve received, and personal opinions of the product, it’s strength, taste and other attributes. They will offer customers and potential customers the option to sign up for newsletters and provide information at events.”

She says it’s up to companies to do a lot of legwork

educating the public about what their brand stands for, such as a recreational experience or high-quality exclusivity.

That approach seems to be one JWC will take to heart. Fletcher notes that while his firm “certainly believes” that the quality of its product will speak for itself and attract an audience by word of mouth, that alone will not be sufficient in establishing national brand recognition.

“JWC takes pride in the authenticity of both our product and our message,” he says, “and for that reason, I don’t see us pursuing celebrity endorsements; rather, I believe the best approach is to work with media groups to keep both medical patients and adult-use consumers well-informed of our product offerings, while also partnering with non-profit groups which advocate for social causes that align with our values and who strive to make a difference in this rapidly evolving industry.”

As the cannabis market had traditionally catered to men, Hoffer predicts this year and going forward, many new products will be specifically marketed to women.

“There are no calories in cannabis compared to alcohol, and that’s a plus for many women – and men,” she notes. “Marketing cannabis to couples as a way to enhance their relationship will also be prominent, as will marketing to Baby Boomers. Millennials will share what they buy with their parents and even grandparents. We may also see people using cannabis as part of entertaining – along with a selection of alcoholic beverages at a party, there may be different cannabis products to try.”

There will also be opportunities to position products along psycho graphic needs or demographics. For example, Osak says many premium products will

be targeted at consumer segments interested in certain lifestyles and social interaction (e.g. Heineken). There may also be lighter potency brands for seniors or for consumers looking to relax or ‘mellow out.’ Looking into the future, Osak says we should also not be surprised to see the emergence of less expensive value brands. “N ot surprisingly,” he explains, “the biggest retailer in the world is not Holt Renfrew, it’s Wal-Mart.”

At this exciting time, Osak notes that “the next few weeks and months is when the rubber hits the road. Companies have raised a lot of money to ramp up production and now its time to sell product. The pressure is on to design creative branding programs that quickly build awareness and communicate meaningful market differentiation.”

By Kevin Cullum

While cannabis has no shortage of pests and diseases to challenge producers working within Health Canada’s guidelines, none has been more front and center than powdery mildew, which has dominated industry news both in terms of contamination of end-product by the mildew itself or illegal fungicides used to treat it.

Powdery mildew is a disease that poses a huge challenge to many cultivated crops and this is only amplified in cannabis, which is limited by far fewer control o ptions, less breeding for resistance to the disease and way lower microbial tolerances than any other crop. Many licensed providers currently rely entirely on irradiation treatments or processing into extracts to bring their end-product within Health Canada microbial specifications.

W hile the science is still somewhat speculative it appears North American cannabis producers are dealing with two or more strains of powdery mildew: Leveillula taurica, which is a common mildew strain on greenhouse peppers in Canada, and Sphaerotheca maculari, common in cannabis’s closest relative hops and possibly something closely related to S.macularis that is specific to cannabis.

To understand the reason’s powdery mildew presents such a challenge to control, it is necessary to understand a couple of important points about its biology. Most important being the haustorium, which is a hyphal thread that e merges from the mildew spore pene -

trating into the plant tissue through an open stomata where it acts similar to a plant’s root system, anchoring the mildew to the plant while providing nutrition by breaking down plant tissue to feed the por tion of the fungus growing on the leaf surface. It is important to understand haustorium because it lives within the plant, while all of the fungicide products registered in Canada for cannabis only control the surface portion of the mildew and have minimal to no effect on haustoria.

Looking to conventionally grown non-cannabis crops, powdery mildew is always controlled by a combination of systemic fungicides (i.e. Myclobutanil) to target the haustoria with more foliar

active products like the ones registered for cannabis targeting surface hyphae and spores. Without having any registered products for cannabis that act systemically, it is essentially impossible to eradicate mildew from the facility once established by means of spraying. In other crops facing similar situations, such as organically grown cucumbers or grapes, growers accept that they will have a level of mildew present in the plants. In cannabis, however, this would mean a failed microbial test – so it is not usually an option. Although we have many tools to utilize in an integrated pest management program for powdery mildew, the most viable one by a long shot is prevention.

Cannabis cultivars vary widely in their resistance to powdery mildew, largely steered by the original source population(s) they were derived from. Much of the mildew problems growers face today is due to the predominance of genetics derived from Afghan/ Pakistani gene pools. Plants from these areas tend to have little genetic resistance to powdery mildew as the very arid conditions they evolved in had little disease pressure.

Early drug cultivar breeders focused on plants from these areas largely due to quick maturation time, dense bud structure and increased photosynthetic efficiency (from higher chlorophyll levels). However, in bringing these genes into seed lines they also brought along an extreme susceptibility to powdery mildew. Plant populations derived from areas with higher disease pressure, such as tropical and sub-tropical locations like Colombia or Thailand, tend to have much higher r esistance to diseases like powdery mildew. Partially, this is due to their more open bud structures which shed water and condensation quicker, minimizing environments conducive to spore germination. More so, it is due to the plant’s ability to mitigate attack by the pathogen on a physical and/ or chemical level.

Several plant traits of resistance to powdery mildew are known; ranging from exclusion where the plant stomata are too small for the haustorium to penetrate to an ability to build denser cell walls in the area surrounding where the haustorium has penetrated preventing further growth. Plant manufactured terpenes or other compounds with fungicidal action may also play a role. Ideally, a combination of these should be stacked into a cultivar to provide multiple layers of horizontal resistance so that if the pathogen evolves to overcome one resistance mechanism it is met by several more.

Plants derived from areas with higher disease pressure, such as tropical and sub-tropical locations, tend to have much higher resistance to diseases.

It may be necessary to go back to landrace NLD cultivars to acquire novel resistant genes to be incorporated into modern, market-driven varieties lacking these traits.

Mildew can come from many sources: clones contaminated by spores or haustoria brought in from other producers, spores carried into facilities from outside by air currents or workers with infected plants at home bringing spores in on their clothing. Potential transmission can be minimized from workers by requiring protective coveralls and shoe covers be worn in the facilities. However, “minimizing” is the key word as eliminating this avenue of entry completely is not a viable option. Influx from air currents can be filtered by hepa and carbon scrubbers in indoor facilities, but this far from eliminates the possibility and in most greenhouse designs this is not a viable option.

The variable most easily controlled is probably also the most common method of entry for powdery mildew into and within a production facility: infected clones brought in from outside sources. Preferably, incoming plant material should be limited to new mother stock only. Using outside propagators is opening your facility to a huge risk factor outside of

your control. Incoming plants should ideally be brought in only as unrooted cuttings and sprayed or dipped with a registered fungicide immediately on arrival to treat for surface spore or fungal material. They must then be kept in a quarantine room until certain they are not infected before being added to mother plant stock.

To take the guesswork out of whether your facility has undetected powdery mildew present, regular DNA sequence tests can be done on all mother stock with any positive plants culled. Ensure production plants can be traced back to the specific mother so that in the event an infected mother is discovered, any production clones sourced from it can be culled as well.

Many growers base the majority of their powdery mildew control strategy

around keeping a good climate. While this for sure should be a primary strategy, the spores of some mildew strains are able to germinate well within the best relative humidity control regimes. In greenhouses, it is often not possible to keep crops within ideal humidity ranges all the time. While environment is a key factor in managing disease, it is not one that can be relied solely upon in the case of powdery mildew. It needs to be integrated with other control measures.

Canopy management can be a key tool in mildew control. Large, dense buds may look impressive but they create a very uneven micro climate, trapping moisture both from transpiration and condensation inside. This type of bud structure is another trait selected from arid climate-adapted Afghan/Pakistani strains, and is uncommon elsewhere in

the world where cannabis has evolved as it makes them very prone to disease. Increasing the number of cola stems per square meter will make a much more disease-resistant canopy due to higher airflow through the buds and minimizing humidity differences caused by decreased airflow in larger buds. Any foliage or buds in areas of the canopy that are not getting sufficient light for saleable bud formation should be removed. Plant tissue from these areas is much more susceptible to powdery mildew attack as it tends to be softer tissue higher in nitrogen levels, both of which are conducive to the disease.

None of the fungicides currently registered for cannabis in Canada will eradicate powdery mildew and should be

Planttissueculturereagents (regulators,antimicrobials,etc.)

MicrobiologyQCStrains • Biochemicals/Buffers • HPLC/MS consumables (Filters,Columns,Resins,etc.) • Analyticalstandards (compounds/chemicals)

viewed only as suppressant in effect. While most are very effective against mildew, they only act on the surface portion and, in some cases, the spore. As none of these products will kill the haustoria, a spray program is limited to reducing spore count and killing surface area mildew for the period the spray is active, which is usually less than a week. Modes of action for these products primarily fall into one or more of several categories:

SPORICIDAL – either kills spore by desiccation or prevents from germinating. Extremely important tool in the event mildew has spor ulated in the greenhouse.

INDUCED SYSTEMIC RESIST-

ANCE (ISR) – many bacteria or fungal s trains present as active ingredients in bio-pesticides or plant stimulants to

trigger the plant’s immune system heightening its protective measures against disease attack. Though the science is still out on exact modes of actions, some examples include cell wall thickening and a quickened stomata closure response to stop fungal penetration.

ANTIBIOTIC – fungal and bacterial based bio-pesticides produce a large array of antibiotics in their exudates that have multiple modes of action and strong fungicidal effect. Many bio fungicides have large amounts of these antibiotic exudates present in the bottle from the production process and these are the primary modes of fungicidal action.

LEAF SURFACE PH – A key mode of action of potassium-bicarbonate-based products is the raising of the leaf surface pH above tolerable levels for powdery mildew. Other products may also follow

this same mode of action.

OXIDIZER – Some bio fungicide products work as oxidizing agents similar to how hydrogen peroxide works.

SULPHUR – Sulphur’s mode of action remains unclear but acts in multiple modes of action on varying life stages of powdery mildew. Caution needs to be taken with sulphur as excess use can completely disrupt biological control programs as well as build up in the resins affecting end flavor of the product especially when concentrated into extracts.

A common myth when it comes to bio fungicides is that the organism can live on the leaf surface outcompeting the pathogen for food and/or directly attacking it. Any of the products currently on the market are all based on soil microbes. While they can persist for long periods in the root zone on the leaf surface they last

ADDRESSING THE NEEDS OF BUSINESSES AS WE CULTIVATE THE SEEDS FOR ENERGY SOLUTIONS

• Direct Purchase Planning

• Asset Optimization

• Strategic Commodity Plan

• Market View

• Forecasting

• Balancing

• LDC Interface

• Recommendations

As an agricultural owned energy co-operative, the only one of its kind in Ontario, we bring a new approach to natural gas and electricity markets

Call for a free energy consultation: 1-866-818-8828 • 519-763-3026 www.agenergy.coop

very short periods of time, which is why they need to be re-applied frequently.

Once established in a plant, powdery mildew can remain invisible to the naked eye until a stress event triggers spore production. Release of spores in a greenhouse or grow room escalates from what may be a single infected plant to a widescale infestation with potential for the spores to travel into adjoining areas and subsequent crops. All avenues to avoid this should be taken.

One of the most common stress events leading to mildew sporulation outbreaks occurs as the plant hits peak flower (typically week 5 or 6 in an 8-week strain). The plant’s nutrient demand is at its highest and the plant is often stressed by minor nutrient deficiencies

and used up carbohydrate reserves. Mildew can spread quickly in these conditions and the combination of dense bud structure and senescing plant tissue provide a beneficial environment for the mildew to take hold. Anything that can be done to keep plants at peak health during this stage is highly beneficial from a mildew resistance standpoint.

While most growers have the climate portion of the equation well dialed in during this stage, the root zone is often not optimized for this peak nutrient-demand period. Utilizing a wide scope of chelates, including the more expensive ones such as EDDHA, DTPA, fulvics and amino chelates, help minimize nutrition problems during this period of peak demand. Many plant-growth-promoting bacteria and fungi products are also proven to enhance a plant’s nutrient

uptake, both by the action of natural chelates produced in the form of exudates as well as from the direct action of fungal threads acting as extensions of the roots better extracting available ions for the roots and breaking down insoluble nutrients into ions suitable for plant uptake. Incorporating silicon, higher calcium levels as well as avoiding excesses of nitrogen are all well proven methods for strengthening plants against powder y mildew attack.

Though an integrated approach to controlling powdery mildew will always be necessary for cannabis grown to meet the residual and microbial standards of Health Canada, developing genetically resistant cultivars, regular DNA testing, and roguing of mildew-infected plants remain the most effective and practical strategies to address this growing challenge.

By Meaghan Seagrave

If the past few years have shown us anything, it’s that there is tremendous opportunity for the biomass industry in Canada, specifically in A tlantic Canada. In thinking of Atlantic Canada, thoughts of our hospitality, friendliness, seafood, and bitterly cold winters might spring to mind. With these sweeping winds come opportunities for growth in biomass-based industries, especially those that have been traditionally under-realized.

With sweeping legislation aimed to come into play this summer, fulfilling an election promise by Prime Minister Justin Trudeau, Canada will be the first large industrialized nation with a broad system permitting recreational as well as medical use of marijuana. What does that have to do with biomass you ask? It’s a case of not seeing the forest for the trees or in this case, missing the greater opportunity of cannabis by only focusing on recreational marijuana. The real opportunity is about understanding the entir e cannabis value chain, from crop science to health research and all the high-value product development opportunities along the way.

One region that has taken the lead on defining its own future related to cannabis is the province of New Brunswick. New Brunswick is typically known for its traditional sectors including agriculture, forestry and fisheries. It is often lovingly referred to as the “Fish and Chips” capital of Canada. With provincial strengths in smar t grid, regional energy generation and distribution, a cluster of

water technologies, underutilized and accessible agricultural land (fewer than five per cent in production), and a robust research community that covers the province geographically and spans numerous disciplines, it is not a stretch to see why the province has taken the lead in developing the North American cannabis market.

With the premier stating that New Brunswick will build a “bestin-class” hub of infrastructure and research clusters to attract new investment, New Brunswick is receiving strong support from its provincial leaders and has task forces dedicated to supporting the entire value chain. Most notable is the team dedicated to mapping private and provincial land as well as indoor growing facilities. This initiative dovetails into the province’s New Farm Entrants Strategy and the r ecent broad Cannabis Strategy, which was released in June of 2017. Outlining the value chain with a long-term strategic investment and integrated facilities and organizations plan, New Br unswick is intent on de-risking investments for producer groups and transformational technologies while helping to develop new target markets and ensuring ongoing economic benefit to the province and the region.

A strategic R&D focus on cannabis has been established in New Br unswick. At l’Université de Moncton, researchers are working on the biology of the cannabis plant. At le Collège communautaire du Nouveau-Brunswick a tr aining program on cannabis cultivation has been established to ensure these new companies have

trained employees and provide job opportunities across the province. It will also serve to create innovation in the sector by linking smallscale entrepreneurship to educational programs and building a hub of infrastructure and research clusters to attract investment.

The real opportunity is about understanding the entire cannabis value chain, from crop science to health research.

N.B.’s Research and Productivity Council (RPC), which has been working in the cannabis field since the late 1990s, is providing testing to more than half of the licensed marijuana producers in Canada. St. Thomas University is home to the first of its kind Health Policy Research Chair on cannabis. Together with almost a dozen licensed hemp and marijuana producers, a broad base of industrial a gricultural growers currently evaluating dozens of cultivars for seed, oil and cannabinoid extracts, New Brunswick has become a region of interest to an increasing number of downstream therapeutic technology players who understand the global opportunity cannabis crops will represent.

New Brunswick is well poised for new businesses looking to establish themselves or expand to a ne w market. Atlantic Canada is ranked among the lowest business-cost locations within G8 countries and is home to mor e post-secondary graduates per capita than the Canadian and U.S. averages, resulting in a highly skilled labour force. As well R&D initiatives are supported through government-funded programs, including competitive regional incentive programs.

Whether it be the production of hemp, nutraceuticals, medical marijuana or cannabis policy research, New Brunswick has established itself as an influential province for the entire cannabis sector. It’s time to change the province’s motto to “Let’s Get Growing.”

Root Wizard® is designed to boost nutrient uptake in the root zone. It contains select strains of beneficial bacteria that enhance bioactivity so your plants profit from nutrition more efficiently. Achieve SIMPLE, EASY SUCCESS with Emerald Harvest.