This issue of Glass Canada features an extensive story on the economy and its impact on the industry. While a downturn in the North American economy is nothing new, the factors behind this one, and the methods that companies are employing to deal with it are unique.

who deals in glass.” Trying times they are indeed.

Win-door North America 2008

Annex Publishing & Printing Inc.

P.O. Box 530, Simcoe, Ontario N3Y 4N5 (800) 265-2827 or (519) 429-3966 Fax: (519) 429-3094

Editor- Chris Skalkos cskalkos@annexweb.com (519) 420-7710

Advertising Manager- Laura Cofell (888) 599-2228, ext 275, lcofell@annexweb.com

Sales Assistant- Laura Price (888) 599-2228, ext 219, lprice@annexweb.com

Production Artist- Brooke Shaw Vice-President/Group Publisher- Diane Kleer (519) 429-5177, dkleer@annexweb.com

Publication Mail Agreement #40065710. RETURN UNDELIVERABLE CANADIAN ADDRESS TO CIRCULATION DEPARTMENT, P.O. BOX 530, SIMCOE, ON N3Y 4N5 e-mail: awebster@annexweb.com

Printed in Canada, All rights reserved. Editorial material is copyrighted. Permission to reprint may be granted on request. ISSN 0843-7041

Circulation

e-mail: awebster@annexweb.com Tel: 866-790-6070 ext. 208 Fax: 877-624-1940 Mail: P.O. Box 530, Simcoe, ON N3Y 4N5

Subscription Rates

Canada- 1 Year $39.00 (with HST/QST $42.12) U.S.A. - 1 Year $54.00 (in US dollars)

From time to time, we at Glass Canada make our subscription list available to reputable companies and organizations whose products and services we believe may be of interest to you. If you do not want your name to be made available, contact our circulation department in any of the four ways listed above.

www.glasscanadamag.com

The most noticeable is that there is no common denominator in this situation. You can travel across Canada and see a dozen different economies affecting businesses in different ways. Window manufacturers and others in the fenestration industry, especially companies that depend on exports to the U.S., have been hit particularly hard.

From currency exchange rates and the sub-prime crisis in the U.S., to rising costs of fuel and raw materials and competition from off-shore products, Canadian manufacturers are facing pressures from several fronts. Glass Canada interviewed several companies across Canada as well as in the U.S. to gauge their opinions about the current economic climate in their markets.

If you think Canada is under the economic gun you should read John Roper’s column, European Scene, also in this issue, where he describes how the “credit crunch” in the U.K. is splitting the industry along material lines as the vinyl window industry is about to start a turf war over who best represents its interests as it struggles to survive.

While currently a unique situation across the Atlantic, what triggered this crisis could easily happen here if some government backed research group singles out one window profile to be more “energy efficient” than the others. You couldn’t blame the others for being a little “green” with envy.

It’s not all doom and gloom, but it’s not hard to predict it will get worse before it gets better. As one glass company bluntly stated: “It’s a very trying time for the glass industry itself and anyone

You can bet the economy will be a main topic of conversation among exhibitors and visitors to the Win-door North America trade show on Nov. 11-13, in Toronto, Ont.

The Canadian Window and Door Manufacturers Association hosts this event, which is a highly focused industry trade show for window and door manufacturers. If you are involved in the fenestration industry it is a valuable venue for meeting a cross section of suppliers from machinery makers to IG unit component suppliers and everything in between. Now in its 13th year, Windoor is the longest running glass industry trade show in Canada. In fact, it’s the only glass show of any sort being held regularly in this country. Don’t miss it!

I would like to part with you with some good news. Actually, with some historic news! In August, the Canadian Glass Association (CGA) officially launched the revised edition of the Glazing Systems Specifications Manual for Ontario. This was a huge undertaking. It took several years and countless volunteer hours from specialists in the industry to modify the manual specifically for Ontario building codes.

Its ultimate goal is to have this manual recognized by architects, building designers, suppliers and glaziers across Canada. It would greatly assist all of them to consistently specify the best products and right installation practices for glass and glazing materials no matter where the project takes place.

You can read about it along with other cutting edge glazing topics in this edition of Glass Canada. ■

Chris Skalkos, Editor

The December issue of Glass Canada is the annual Buyers’ Guide. Don’t miss this valuable directory of ‘who supplies what’ in the Canadian glass industry!

By Chris Skalkos

After several years and countless volunteer hours, the Glazing Systems Specifications Manual has been officially launched for the Ontario glass and glazing industry. The Ontario Glazing Systems Specifications Manual is a comprehensive reference to architectural aluminum and glass products as well as technology, building code requirements and relevant design and performance issues. It is directed toward several audiences including architects and specifiers offering aid in understanding and specifying the kinds of products supplied and installed by glazing contractors. For contractors working in the glass industry, it serves as a reference guide to related issues that affect their suppliers or customers.

In August, members of the Glass and Architectural Glass and Metal Contractors Association (AGMCA), the Ontario Glass and Metal Association, (OGMA) and the Canadian Glass Association (CGA) gathered for the official launch and signing ceremony of the Glazing Systems Specifications Manual for Ontario.

The manual was created by the Glazing Contractors Association (GCA) of British Columbia, a strong and proactive association of contractors and suppliers that was formed in 1983. CGA president, Dave Husson, who was also the president for the GCA at the time, says glaziers in the industry have always discussed the need for a manual to address building code issues and in 1992 the GCA in B.C. designated funds to get it started.

“It was originally going to be an installation manual, but

architects and specifiers wanted it to also include minimum specification guidelines for choosing appropriate products for projects,” he says, adding that it was completed in 1998. “It was made to recognize the design professional’s interest in defining and obtaining work of appropriate quality. It’s our conviction that clear specifications without loopholes creates a level playing field for bidders and serves the long-term interests of the industry,” he says.

Each chapter of the manual is devoted to one section heading of the Construction Specification Canada Master format and consists of commentary followed by a guide specification. The commentary offers a broad discussion of issues relevant to the specifier and glazing contractor. The guide specifications are more detailed than a typical construction specification as they serve a didactic role, highlighting the relevant issues raised in the commentary and showing how they can be addressed in a specification.

In 2000, the Provincial Glass Association of Alberta (PGAA) adopted the Glazing Systems Specifications Manual for its own members. The PGAA is an amalgamated association consisting of the Glass and Architectural Metal Association (GAMA) based in Calgary and the Glass Trades Association (GTA) based in Edmonton.

The following year provincial glass associations from across

ABOVE: The Glazing Systems Specifications Manual is a comprehensive reference to architectural aluminum and glass products as well as technology, building code requirements and relevant design and performance issues.

the country gathered at a glass show in Calgary, Alta., to discuss forming a national association and the Canadian Glass Association was inaugurated in December 2002. One of its priorities was to offer other provincial associations the opportunity to use the Glazing Systems Specifications Manual as a template to adapt to their own building codes. Its president elect at the time, Keith Pynoo, described the manual as a method to improve the communication with the specifiers and create consistency with products used on glass installations. “We would like to see other associations in other provinces come on board and adopt this manual to create uniform manual of standards and practices across Canada,” he said.

The next biggest hurdle was getting the two glass associations in Ontario together to work on adopting it for that province.

The AGMCA and the OGMA formed a committee to revise the manual for Ontario soliciting the help of John Mastrofini, a professional engineer, who specializes in glass and aluminum products. “The difference wasn’t so much in the actual design but in the way the building code is applied and administered,” says Mastrofini, pointing out the Letters of Assurance an engineer produces in B.C. after a building is finished differs from a Certificate of Compliance required in Ontario, for example.

Denis Haatvedt, CGA vice president and a director of the AGMCA explained that some sections had to be modified or created such as the “Structural Glass” and the “Sealant Sections” that the Glazing Systems Specifications Manual for B.C. did not have. “We re-invented the sealant section. The original was too generic and we wanted to focus specifically on glass and glazing,” he adds. “The committee invited the Sealant and Waterproofing Association in Ontario to assist and help guide the Committee in its selection of material for the Sealants Section. Lee Baker a well known and respected industry participant played an important part in the process.”

Barrie Eon, executive manager for the AGMCA says the Glazing

Glass industry professionals in Ontario now have an objective guideline to specifying products and glazing installations.

INSET: Huddled around the manual, are from left, John Mastrofini, Dieter Ringler, Barrie Eon, Dave Husson and Denis Haatvedt.

Systems Specifications Manual is a testament to the progressive thinking of glass associations in western Canada and Ontario who are working together for the betterment of their industry. “There is a lot of experience and knowledge that has been harnessed to put that manual together and now it is being shared across the nation,” he says.

Steve Gusterson (pictured at left), an industry specialist, who was on the Ontario revision committee, says the volunteer hours put into re-working, researching and editing the manual was extensive. “We knew this was going to take a couple of years and a lot of conference calls,” he says, adding that he and the others were driven by a desire to help the industry.

“In Ontario, we don’t have self-governance for our industry and no technical guidelines other than what the manufacturers provide. We needed something that was objective, something that helps set a benchmark of reference or a place to start for people who have questions,” he explains. “It’s essentially a reference tool for everyone in the glazing industry.” ■

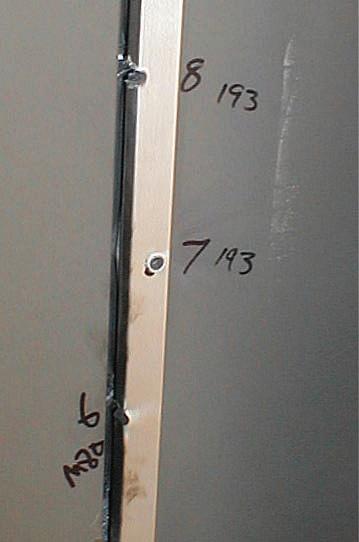

Editor’s note: Special thanks to Mike Carter, training director, and Steve Laird, glazing instructor for the Ontario Industrial and Finishing Skills Centre on Toro Road in Toronto, for lending Glass Canada the facilities and glazing tools for this issue’s cover photo. Thank-you also to Barrie Eon, manager for the AGMCA and Dieter Ringler, Oakville Glass and Mirror, for their assistance in the photo shoot.

By Pat Bolen*

From raw material increases to skyrocketing fuel prices, window manufacturers face pressure from several fronts

With layoffs continuing in the manufacturing sector in both Canada and the United States and fuel prices steadily rising, the outlook for North American economy is uncertain. Glass Canada spoke to representatives of several companies to see how they are coping.

David Devenish general manager of Fenzi North America says over the past two years the manufacturing sector has taken a huge turn in almost all sectors, whether it is automotive, retail or new home construction in the U.S. “Which for us in the glass business is directly related to slow window sales and the Canadian market has slowed as well for many of the same reasons.”

Devenish says the soft housing market caused by the sub-prime crisis has created an oversupply of homes with new home construction down by 40 to 50 per cent in many U.S. markets.

Pressures from outside North America are also effecting the economy says Devenish.

“Some raw material components used in insulated glass (IG) fabrication are being routed to Asia and other emerging markets, making North American fabricators scramble for their supplies. From our perspective, Fenzi has the ability to service our customers’ needs with their requirements for the IG components we supply.”

“The job loss by many workers has created high unemployment of upwards of 5.5 to six per cent as a national average in the U.S. and many consumers have had to delay either moving or any renovation projects they may be planning. You’re seeing an oversupply of raw glass with most manufacturers being below capacity. Over the last 12 months we have seen numerous plant closings as corporations try to consolidate and shift to more efficient locations, some being offshore.

“The Canadian market, while maintaining some positive growth numbers has seen similar closings and this shift to American production plants. The Canadian

You’re seeing an over-supply of raw glass with most manufacturers being below capacity. “ ”

versus American dollar has caused much of this in addition to the imports from Asia. The pressure from fuel increases continues to erode at margins for all manufacturers and I don’t see any relief from this in the near future.”

One factor that has protected the Canadian economy to some extent, according to Devenish is the strong western Canadian markets.

“The 2010 Olympics in Vancouver has also helped and should continue for the next 16 months. As with other manufacturers, western Canadian businesses are subjected to higher costs and lower dollars for exports.

“Raw material increases are common occurrence’s in today’s market, at least from our perspective. We have some suppliers that send in monthly notices, again due to the energy feedstock needed for the chemical businesses. Steel, for example has seen increases of upwards of 40 per cent since January 2008. Our customers don’t see such monthly increases‚ but we continue to do research and development work to improve the quality of our goods to the market.”

Another factor for companies to deal with according to Devenish are labour shortages with the labour pool stressed in most North American markets and some regions not able to support second shifts.

“Some manufacturers have said that recent hires simply don’t show up after a few weeks on the job because they have found a different job at higher pay rates. Such a situation is going to prove quite difficult for those in the manufacturing sector over the next number of years.”

He adds, customers understand that price increases are a fact of the current state of the manufacturing business. Fuel surcharges, raw material increases all affect profit margins, so market increases are needed if manufacturers are to continue to support their customers’ needs.

“Canadian exporters have been hit particularly hard,” says Devenish “because of the higher Canadian dollar and the low demand in the U.S.”

“It’s a pretty simple fact of economics. That, combined with imports from Asia in many commodity type products, have combined to hurt the export of Canadianmade products. The quality of North American products is superior and lead times are certainly much better – but in many cases it comes down to price.”

ABOVE: The quality of North American products is superior and lead times are certainly much better, but manufacturers say that in many cases it just comes down to price.

What killed the residential new construction market?

Larry Johnson, executive vice president of Edgetech I.G. says a major factor affecting the North American economy over the past two years has been the mortgage crisis, which has essentially killed the residential new construction market.

“Fearful of finding themselves in foreclosure, people are not investing in new homes. Consequently, the replacement window market has also been affected by the mortgage crisis because home prices have dropped significantly in many areas, reducing the equity people once had in their homes. Without equity, many do not have extra money to spend on home improvements.”

This is a unique situation. “Typically, the replacement market and new construction market alternate. When one is lucrative the other is slow. However, in this instance, we are experiencing a slow market for both at

one time, making it increasingly difficult for window manufacturers,” Johnson says, adding, “This is the first time that I can recall when both the new construction and replacement markets have slowed at the same time. With both markets down at the same time, the fenestration industry has been greatly affected.”

From a supplier perspective, Johnson says the Chinese demand for raw materials has been insignificant but the manufacturing sector has been hit hard.

“Over the past few years, rising fuel costs have been a major issue for manufacturers. The cost of moving products, whether raw materials or finished goods, has skyrocketed. Rising fuel costs have also increased operating expenses to heat and cool plants.”

“Companies that saved money during better times definitely have a distinct advantage right now. They are better prepared to weather the storm. Many of

these companies are also taking advantage of the downtime to re-examine their products and processes to prepare for the better times ahead. On the flipside, companies that had weak financials before the market turned are not likely to make it through until the market improves.”

Customers have responded in different ways to price hikes, says Johnson.

“Many customers have launched preemptive strikes. They have issued letters saying that they will not accept price increases at this time or they attach a strict list of requirements for any price increases, which may include formal written documentation of the increase and a certain amount of advanced warning before the increase goes into effect.

“Often price increases are easier to swallow when you are offering customers value-added products and services that will help them differentiate themselves in some way versus the competition.

In response to their own rising costs, companies are passing on the increases to customers with different methods.

“A good example for this would be energy surcharges. Because it costs more to ship product, most companies today are adding fuel surcharges to invoices to pass along the additional costs to customers without increasing the cost of the product.”

The commercial market remains strong, despite the downturn in the residential market, says Johnson. “Historically, it has taken approximately 18-24 months for the commercial market to follow the residential market and we are now entering that time period. There is definitely some indication that the commercial market is slowing.”

The Canadian economy is still doing well especially in western Canada, according to Johnson. “We are seeing some minor slowing in certain areas. It is natural for Canada to be affected somewhat by the U.S. economy, but we are hopeful that the downturn will not be as significant in Canada.”

Johnson says the biggest challenge is that there are very few new business opportunities given the economy, so everyone is after the same pool of customers. “Many manufacturers are taking this time to improve upon their products to sell more value to customers. Product differentiation is one of the keys to survival in this economy.”

Labour shortage not limited to the west Betty Ann Ratchelous, sales and estimating at Cole Harbour Glass Limited in

Dartmouth, N.S. says they have not noticed any slowdown in their business in the last two years.

“We are extremely busy here in the Maritimes. Our biggest problem in this industry is qualified labourers. That’s basically been a problem for the last year.”

Ratchelous says she knows of one company in Nova Scotia doing large contract glazing work that announced it was pulling out because of the shortage of skilled workers.

“Many have gone out west,” says Ratchelous. “There just isn’t enough to go around.”

She adds that even paying premium wages is not enough to solve the problem. “They’re not there to get.”

“What we’re finding here is that the building just isn’t stopping,” says Ratchelous.

Without a lot of manufacturing in the Maritimes, Ratchelous says any glass they get is coming from Toronto or Montreal. “So you’re dealing with higher freight costs, including the stuff that comes from the U.S. So that has helped to increase prices. But it hasn’t stopped people from buying.”

Ratchelous says there has probably been a four per cent increase in freight charges as well as the energy surcharge, which is levied by glass distributors and ranges from eight per cent to as high as 13 per cent. “Years ago we didn’t have that kind of thing.”

While Cole Harbour hasn’t turned any work down, Ratchelous says they make a point of telling people it will take longer to get to them, which she says does not seem to be a problem.

Despite the economic growth that some provinces in western Canada are experiencing, manufacturers west of Ontario are still maintaining a degree of caution.

“I’m not going to call things buoyant, but there is certainly less pessimism in our marketplace than in some other areas,” says Al Dueck, president of Duxton Windows and Doors in Winnipeg, Man.

Dueck adds that as long as the global economy and commodities remain strong the overall Canadian economy will probably be stronger than it is usually given credit for.

“We’re working on what should become another good year,” says Dueck, who adds Duxton does more light commercial work than residential.

“We do more of an upscale type of package…we work hard at differentiating

ourselves with those kinds of characteristics that I think are going to continue to grow in demand. Our sense is that in the marketplaces where fibreglass has been a bit of a sleeper, there’s a bit more of a demand there and some of the signs are giving us continued opportunity to grow.”

While Dueck says overall in the United States he has been hearing there has been a substantial decline, in certain segments of the market there has been continued strength.

Dueck says much of the pressure on commodities has been coming from countries such as China, but with the 2008 Olympics over there are signs that demand is softening and the financial problems faced in North America may spread to other countries.

While high fuel prices mean challenges for glass companies with customers looking harder at what projects they may do, Dueck says glass companies need to look at what opportunities the same high prices may bring to give customers a higher performing product such as triple

Both the new construction and replacement markets have slowed at the same time…the fenestration industry has been greatly affected.

“ ”

Regarding price increases, Dueck says there are two sides to the issue with items such as aluminum rising not just due to energy costs, but also because they are measured in U.S. dollars. “Clearly, there are signs that there are upward cost pressures, but they haven’t been huge at this point.”

Dueck says the stability in pricing that companies grew used to in the last 10 to 15 years is changing and the trend will probably continue until the demand for commodities softens. Higher commodity costs are also affecting the cost of finding labour, says Dueck, especially going further west than Manitoba.

Companies that are heavily dependent on the U.S. market have been hit to one degree or another, says Dueck. With the rise of the Canadian dollar and the new residential market shrinking by as much as 50 per cent, “you better be on your toes to make up for that.”

The amount of work that Duxton does in the American market at this stage is relatively small, says Dueck. “We see some opportunity, but again it’s a bit more of a niche market.”

Despite the weakening American market, Dueck notes that even if the market shrinks by a million housing starts a year, it could be offset by a million new housing starts in that same year. “From that point of view, we…need to be on our toes and be aware of the issues and make sure what we’re doing makes sense.”

lite window units.

With Duxton being a young company that started in 2000, Dueck says there are a lot of things it is still learning, “and maybe that gives us some advantage, that we’re not just stuck in our old ways.”

Duxton has had to increase some of its prices, but Dueck says with its focus on a performance oriented, design driven market, “we’re trying to not worry about the race to the lowest price, but trying to make sure we’ve got ourselves focused on a quality product with a good business model.”

Bill Marchitello is director of marketing for Prelco Inc., in Rivière-du-Loup, Que., and describes the current situation as the end of a 10-year cycle which has been good in the fabrication business with approximately 90 per cent of Prelco’s work architectural.

“This year is still a good year, very positive and orders are maintaining and we’re growing.” Marchitello is not so optimistic about 2009 though, which he says will not be terrible with a lot of projects planned, but he does not see big projects being worked on as much as he has seen in the last two years.

“We can see the first half of 2009 as okay. We don’t see much beyond that. If I had to predict, I’d say that the second half of 2009 will probably tail off…we’ve been going through boom years, it’s been very good for the architectural business.”

LEFT: The Canadian versus American dollar has caused much of the pressure in addition to the imports from Asia.

BELOW: Companies that are heavily dependent on the U.S. market have been hit to one degree or another and Canadian exporters have been hit particularly hard.

Marchitello says price increases are currently a common denominator to the business and glass related prices are skyrocketing.

With Prelco covering a wide geographic area, Marchitello says fuel prices have been a factor as well as the U.S. dollar. “It has hurt us somewhat, trying to sell farther than our home base.”

Marchitello says Prelco has been able to avoid most of the pressure from Asian competitors and demand for raw materials. “There has been some, but it hasn’t affected us greatly.”

The biggest challenge for Prelco, says Marchitello is maintaining its market share. “We are a company that likes to offer value added products…and that’s what keeps us abreast of any downturn.”

While there are customers that look for less expensive products, Marchitello says it is less affected than residential markets. “They just don’t buy or they buy the cheaper products. But architects, before buying cheaper products, they think twice.”

Along with most of its competition, Prelco has had to increase its prices. “We don’t have a choice…we’re still spending, we’re still expanding.”

Price hikes are always difficult, says Marchitello. “There are some areas in our business, when we’re quoting projects we are forced to eat some of the price increases and some of it we can pass on. It just depends on the timing of the projects and

we deal with it on a project by project basis.”

“Most customers are in the same world we’re in so they realize that prices are on the way up…that certainly helps the situation.”

Jan Duggan is manager of Ideal Glass in Cannington, Ont., and says within a three month period, glass and mirror prices have increased “quite extensively. It’s hitting at a very difficult time as consumers are hanging onto their money, specifically because the media has put the fear of God into them…it all depends on the consumer as the end result.”

Duggan said Ideal is also fighting offshore pressures from imports as well. “Importing of finished materials or even the importing of raw materials…it makes it very difficult to purchase for instance, domestic products as a raw material, fabricate it and sell it when our customers are going ‘well, I can buy the same thing over here for considerably less money.’ And there is nothing we can do about it, unless we jump on the same bandwagon and purchase from offshore.”

Duggan says the pressure is coming from their customers, “who are saying they need to pay less and less. Which we understand because the end consumer is saying ‘I’m not going to pay this because can I buy something identical for considerably less.” We know that it’s coming offshore as a finished product. It’s very competitive and very difficult and it’s a very trying time for the glass

industry itself and anyone who deals in glass.”

In order to compete, Duggan says Ideal is focusing on new and innovative ideas which cannot be produced overseas as easily, such as the custom side of the market. “You can’t get customization offshore. You could possibly, but you’re looking at six to eight weeks before you’re getting it. And at that point, you’re better off purchasing it locally.”

As well as turn-around times being a strength for Ideal, Duggan says customer service is another selling point for the company. “And I think skill within the staff…some who have been with us for up to 35 years.”

Ideal has also faced drastic price hikes on its raw materials in the last three months that amount to 20 per cent. “That’s large… and we’re forever confronted with the ever rising energy surcharges.

“We have no choice,” says Duggan. “We have to pass them on unless the government puts a tariff on offshore products.”

Cautious optimism seems to be the opinion of many people in the glass industry in many parts of Canada and the United States although there is a reluctance to predict more than a year or so and it appears that Ontario has been hit harder than companies in other parts of the country.

Despite the continuing expectations of a softening economy, recent reports may make companies more optimistic about the future. On Aug. 28, the U.S. Commerce Department said consumer spending and net exports were more vigorous than initially estimated and inventories fell less sharply. The department added that strong exports and consumer spending supported by government stimulus checks drove the U.S. economy up 3.3 per cent annual rate in the second quarter, much faster than first thought. Other factors that may affect the economy in North America are the end of the Olympic cycle in China that may take pressure off raw materials and the coming of the 2010 Olympics in Vancouver that may give Canadian businesses a boost. In the long-term, while the economy will pick up, it appears companies in areas such as the Maritimes will continue to experience labour shortages, resulting in both higher labour costs and the inability of companies to expand. ■

* Pat Bolen is a freelance writer who is based in Blyth, Ont.

PPG introduces glass tints with secondsurface MSVD low-E coatings

As PPG Industries celebrates its 125th anniversary, the company continues to expand its product line by introducing Solarban 70XL and Solarban 60 solar control, tinted glass with low-emissivity coatings on the second surface.

The new product launch marks the latest development from a company that has been on the forefront of glass innovation since its founding as the Pittsburgh Plate Glass Co. in 1883.

All PPG tints from the Oceans of Color collection, including Atlantica, Azuria, Caribia and Solexia glasses, as well as Solargray and Solarbronze tinted glasses, are now offered with Solarban 70XL or Solarban 60 solar control, low-E coating on the second surface of the glass. In addition to providing improved environmental performance, the availability of secondsurface coated tints expands aesthetic options for architects and building owners. The move also allows customers of PPG high-performance glass and members of the PPG Certified Fabricator network, to offer architects and building owners more products with superior energy performance.

Over the 125 years, PPG has carved a legacy of innovation resulting in the development of many products and technologies that remain industry standards, such as Solex (now Solexia) glass, the first heat-absorbing, energyefficient glass was introduced in 1934 to a variety of heat-reflective, spectrallyselective, clear and coated glass products. In 1963 the company became the first U.S. manufacturer to use the float glass process.

Today, PPG is a recognized leader in green building products, not just through the development of environmentally progressive architectural glass products, but also through its continued efforts to refine and enhance glass performance for solar power applications such as photovoltaic glass and large, solarcollecting mirrors.

Vicki Holt, PPG senior vice president, glass and fibre glass, says the company’s long history in the glass industry and its continuing commitment to research and development enables it to remain on the cutting edge of technological development.

“Many people think of glass as a

commodity product, but when you consider its relative abundance, functionality and high-performance coating technologies, you begin to understand its value as a highly functional, building material,” Holt says. “We’re already using highperformance glass to reduce the amount of fossil fuels our buildings consume, but we’re also learning how to produce glass with other critical properties and characteristics that will enable it to conduct a current, or collect and amplify energy from sources such as the sun. At PPG, we’re devoted to ensuring that glass achieves its full potential as a building product, as an energy provider and as an integral part of our future.”

In an independent study, buildings glazed with Solarban 70XL and Solarban 60 glasses were shown to have significantly lower energy consumption, greenhouse gas emissions and HVAC requirements than those glazed with double lite tinted glass and other less advanced glazings.

Edgetech I.G. has announced that its industry sales team will now represent products from sister company, Lauren Manufacturing, in the window, door and insulating glass markets. This strategic integration, effective immediately, brings greater expertise to the market and further establishes both companies’ dedication to providing comprehensive solutions to the industry.

Lauren Manufacturing is a producer of high-quality, pre-packaged retail weather stripping and custom-engineered polymer seals for residential and commercial window, door, storefront and curtainwall applications. With a clear overlap in the Lauren Manufacturing and Edgetech customer bases, the companies began an intensive cross-training program in 2007.

“This diligent training ensures the absolute highest level of expertise and technical knowledge from our sales representatives,” says Larry Johnson, executive vice president of Edgetech I.G. “We look forward to adding Lauren Manufacturing’s products to our comprehensive line of value-added products and solutions.”

According to Scott Peters, Lauren Manufacturing’s vice president of sales and marketing, existing relationships

established by Lauren representatives will stay intact. Any new opportunities in the window, door and insulating glass market will be managed by Edgetech.

“This focused team of sales professionals will further facilitate our ‘Problem Solver, Solution Provider’ service offering to the industry,” Peters says. “Blending the talents and expertise of our sales teams will have lasting and important benefits for all customers; we’re proud of our ability to make these lateral moves within our organization.”

Edgetech sales representatives trained in Lauren products include Ted Hoehn, Rick Matthews, Shawn Hannux, Jim Plavecsky, Tony Palandrani, John Burnett and Roberto Becerril. Some sales agencies will also carry Lauren Products.

In July, Edgetech I.G. announced that its production operations have been certified to the ISO 9001:2000 International Quality Standard. The company’s entire quality system for the manufacturing of Super Spacer products has been audited and certified.

ISO 9001:2000 is a set of standardized requirements that take a systematic approach to managing an organization’s processes so that they consistently manufacture products that satisfy customer expectations.

As an expression of the company’s longterm commitment to sustainability, Kawneer Company, Inc., has launched Kawneergreen.com.

Kawneer is part of Alcoa’s global Building and Construction Systems business unit. The new website will serve as a resource for Kawneer’s green focus featuring products, systems, tools and support to help architects and building professionals achieve their sustainable vision.

The company says it is dedicated to providing high-performance, sustainable solutions and continuing to challenge the status quo, while practicing social and environmental responsibility.

Kawneergreen.com showcases the company’s green products, explores recent Leadership in Energy and Environmental Design (LEED) projects and includes a LEED Certification section that brings Kawneer’s printed LEED Planning Tool to life.

The Sommer & Maca Machinery Division of C.R. Laurence Co., Inc. has introduced a new model of the company’s Automatic Vertical Insulating Glass Production Line.

The company says this newer model is loaded with versatile features that can help door and window manufacturers make their operations more efficient and profitable. For example, the addition of the

new 118 inch (3.0 m) long Flat Platen Press ensures an evenly set PIB film between the glass and spacer frame.

The System’s Manual Spacer Application Station has adjustable automatic index guides to provide accurate spacer positioning. Also, the System’s Washer Section contains six “Low E” brushes in three compartments, and the washer is compatible with de-ionized water.

The double blower compartment features an economizer that shuts off the

top blower if the glass is less than 50 per cent of maximum height.

Somaca’s Vertical Insulating Glass Production Lines are available in working heights of 63 inches (1.6 m), 78 inches (2.0 m) and 98 inches (2.5 m).

All in one

C.R. Laurence has also introduced CRL Euro Retractable window screens in easyto-install complete packages.

The company says these cost-effective retractable window screens answer many needs, as they offer insect, heat and light control in one package. With these screen systems, installers can measure, cut and install all in one visit.

The CRL Euro Retractable window screens are available in four maximum opening widths from 31 inches (79 cm) to 55 inches (140 cm) in three colours, and provide a large maximum inside window height of 66 inches (167 cm). Each kit includes easy-to-follow instructions, powder coated extruded aluminum lineals, durable 18 by 16 inch fibreglass screen wire and quality mounting hardware. Screens are interior, inside jamb mounted and can be left in place all year, eliminating the need for seasonal removal and installation.

They can be inside jamb mounted without even drilling into the window frame which is a great way to add a profitable addition to a glazier’s existing screening service.

C.R. Laurence Company, Sommer & Maca Machinery division: 1-866-583-1377, www.Somaca.com.

C.R. Laurence: 1-877-421-6144, 1-323-588-1281, www.crlaurence.com

Super Spacer nXt from Edgetech I.G. combines the same desiccant and acrylic adhesive as other Super Spacer products with a new proprietary core. Deemed a hybrid technology, nXt is another way Edgetech is helping its customers differentiate themselves in the competitive marketplace.

Providing a virtually seamless seal, Super Spacer nXt is extremely aesthetically pleasing in the window system. It is available in a variety of standard colours with a metallic appearance that mocks the look of a metal spacer, but provides the thermal benefits of Super Spacer warm edge technology.

The company says Super Spacer nXt, which has been thoroughly tested and proven in the field, adds to the company’s comprehensive portfolio of valueadded products and services for the window, door and glass industries.

Edgetech I.G.: 1- 800-233-4383, www.edgetech360.com.

A global supplier in the manufacture of Fenzi Thiover Brand IG polysulphide and Fenzi PIB for insulated glass, Fenzi North

America has added to its product base with the addition of Fenzi Molver 3A IG Desiccant.

Combined with the company’s Alu Pro and Roll Tech spacer profiles, the new addition to the product line allows Fenzi North America to be a complete supplier for the IG component needs of manufacturers.

Fenzi North America: 1-416-674-3831, www.fenzi-na.com.

Venture Tape Corp., is putting a new face on window and door installation by introducing VentureFlash 800, a three-ply zero perm laminate (al.foil/PET/al.foil) coated with a special “CW” cold weather acrylic pressuresensitive adhesive system.

VentureFlash combines quick stick at normal temperatures with superior low temperature performance below freezing. It can be used with all window and door products, including vinyl, aluminum, wood or fibreglass and can be used in metal building construction.

The company says it is a great alternative to rubber-based adhesives because of its cold weather acrylic base which adheres better than butyl, asphaltic, or other rubber-based adhesives that have been used for years. Unlike butyl, asphaltic and rubber-based adhesives, it will stick in cold weather. Typically, rubber-based adhesives are difficult or impossible to install in the cold and can be messy to work with in warmer temperatures as they have a tendency to flow and creep.

VentureFlash 800 is self-adhering and has a moisture and vapour barrier to fight mould, mildew and decay. It adheres to a number of different substrates, (underlayment and house wraps), including plywood, MDF, tyvek, OSB, dens glass, concrete block (CMU), brick, typar, and buffalo board. It is the first in a new series of flashing products by Venture Tape designed for the residential and commercial construction markets.

Venture Tape 1-800-343-1076, www.venturetape.com.

* * *

Window manufacturers Peerless Products and Thermo-Tech keep their competitive edge with Dow Corning InstantGlaze Assembly Sealant, the industry’s first and only silicone hot melt window assembly sealant.

New case studies about each company’s experience with Dow Corning solutions are now available on Dow Corning’s website.

The Peerless Products case study highlights the company’s move from glazing tape to InstantGlaze, which has improved the performance of its windows and enhanced the safety of the manufacturing process. The Thermo-Tech case study highlights the company’s search for a solution to better address the issue of water and air infiltration.

Dow Corning: www.instantglaze.com.

By Bob Cronk*

Contract glaziers and glass shop owners are often called to repair or even replace badly worn hinges on high-traffic doors. Building owners and property managers struggle with the hassle and expense of these repeated repairs, a continuing source of dissatisfaction, and the bad impression a poorly functioning door makes with customers.

Continuous hinges, which use a number of fasteners to attach door to frame from top to bottom, distribute a door’s weight more evenly along the frame and reduce repeated maintenance expense and hassle. They are ideal for high-traffic doors in retail storefronts, schools, convention centres, sports facilities, airports and public buildings.

Continuous hinges can also salvage expensive doors and frames since the full-length hinge leaves cover up cut-outs, screw holes and door frame damage.

The two continuous hinge designs – geared or pin and barrel –are offered by several manufacturers, including Select Products; Markar/Adams Rite Manufacturing, a subsidiary of Assa-Abloy; and Hagar Companies.

Geared continuous hinges

Made of extruded architectural aluminum, geared continuous hinge components mesh together under a cap that runs the length of the hinge. Hinges come in standard lengths from 83 to 120 inches, with custom lengths available.

Several key features give geared hinges an unmatched durability and longevity for high-traffic entrances. Look for pair-matched hinge leaves, manufactured and machined together, that fit doors better and last longer. Also look for lifetime lubrication that helps reduce wear, quiets performance and eliminates periodic maintenance. Anodizing after machining delivers superior wear, durability and corrosion protection.

For architectural appearance, it is possible to match a custom paint colour on the gear cap or the entire hinge. White hinges are commonly in stock and custom colour anodizing is available. To meet building fire codes, these hinges are available with up to a three-hour fire rating.

ABOVE: Stainless steel continuous pin and barrel hinges in a variety of finishes match, contrast or accent your building’s design.

Geared continuous hinges offer durability. A Select hinge endured 25 million open/close cycles (equal to 50 years of use) in independent testing, more than most high-traffic entrances will see in a lifetime.

The U.S. Department of State’s Ballistic Resistance test on a Select geared continuous hinge included 7.62mm (0.308-calibre), M80, military rifle rounds fired directly at the continuous gear hinge. The hinge passed by withstanding all eight shots.

Geared continuous hinges are initially more expensive, around US$75 to US$100 vs. US$50 for three ball-bearing butt hinges, but their durability make the initial investment pay back easily over the long haul.

A Select geared continuous hinge has surpassed 25 million open/close cycles in laboratory testing – equivalent to 50 years of average high-traffic entrance use – which is 10 times beyond the Grade 1 cycle count. The ANSI Physical Endurance test, conducted at Architectural Testing, mounted a full-mortise geared continuous hinge on a standard FRP door to simulate a real-world situation. The hinge completed the 25 million cycles with no loss in performance and a measurable drop of only a few ten-thousandths of an inch.

The U.S. Department of State (DOS) approved a. Select geared hinge for use in its embassies overseas to protect workers from mob activities or terrorist attack based on tests conducted at H.P. White Laboratory. In the first test, attackers fired eight shots from high-powered military rifles directly

Conserving energy, while reducing greenhouse gases, is possible in commercial buildings when manufacturers of fenestration products use the Azon thermal barrier method for aluminum windows and Warm-Light® warm-edge spacer for insulating glass.

Modern daylighting systems produced both Azon structural thermal barrier technologies will yield a fenestration system capable of upholding the highest efficiency and sustainability standards.

at the hinge from 20 feet away. All bullets were stopped, so the entrance was classified as “no penetration.”

Next, attackers used every means at their disposal including 10 and 12 pound sledgehammers, a 9.0 inch by 2-1⁄2 inch wood-splitting wedge, 1.0 inch and 3⁄4 inch cold chisels, pry bars, plus other tools to gain entry. After separate attacks lasting one hour, none had penetrated.

As a result, the Select geared hinge earned 60 minute Ballistic Resistance and Forced Entry certification and this model of hinge is now approved for use on all DOS doors.

Pin and barrel

Pin and barrel continuous hinges use a steel rod that runs the length of the hinge through a series of knuckles. Generally made of stainless steel, they are typically manufactured in lengths from 79 inches to 119 inches, with custom lengths available.

Stainless steel pin and barrel continuous hinges resist corrosion and deterioration, making them a good choice for caustic environments. The stainless steel rod stays flexible and strong in abused openings. Nylon bearings, especially double bearings, create a strong, free moving assembly. Tamper-resistant covers guard against vandalism and reduce the hassle of frequent repairs.

As with geared hinges, pin and barrel hinges are available with up to a three hour fire rating to meet building fire codes. These hinges allow enough flexibility to match, contrast or accent a building’s design with a variety of finishes, including satin on stainless steel and polished, brushed and custom paint on carbon steel hinges.

In the U.S. Department of State’s Forced Entry test, a geared continuous hinge from Select defeated six attackers – using 10 and 12 pound sledge hammers, wedges, chisels, crowbars and more – for 60 minutes.

When selecting hardware, keep in mind that pin and barrel, and geared continuous hinges provide a strong solution to hightraffic entrances. Continuous hinges stand the test of time, while geared hinges stand the test of cycles, sledge hammers, highpowered gunfire and stainless steel pin and barrel resist caustic environments. ■

*Bob Cronk is vice-president of sales and marketing for Select Products in Portage, Mich.

Stadia Industries Ltd. is a growing 24 hour glass and aluminum service company in Concord, Ontario. We have immediate openings for the following position:

We have ongoing openings for career oriented glaziers and door technicians. We engage in new construction, retrofit and service work with curtain wall, windows and skylites. We also install and service swing, balanced, revolving and sliding doors as well as installing and servicing automatic door operators. Our work is steady (year round), our rates are competitive plus we have performance incentives, uniforms and an automatic quarterly rate increase program which means never having to ask for a raise. We provide personal power tools, safety equipment and ongoing training. All positions at Stadia require a commitment to customer service, a good attitude plus a desire for personal improvement and professional development.

www.stadia.ca

By John Roper*

No one is happy…and the vinyl, timber and aluminium sectors are all up in arms

Alot of furore from the vinyl guys lately. It’s complicated. There is an organisation called The Building Research Establishment, BRE for short. It sounds very scientific doesn’t it? Well recently, after much consultation, it published The Green Guide to Specification intended to help specifiers select products based on their green credentials. Its assessment of components is comprehensive – cradle-to-grave they say. In fact, ever since BRE published its Green Guide everyone seems to be unhappy and feeling vulnerable

Much of the information was obtained through consultation with relevant trade associations but, as far as windows are concerned, no one is happy and the derision is vociferous. No material came out well and the vinyl, timber and aluminium sectors are all up in arms.

The timber windows sector, via the Performance Window Group, is raving that PVC gets such a good rating. The aluminium sector is distressed that its material does not get full credit for its recyclability (99 per cent) and the vinyl guys, never ones to take anything lying down, have set up no less than two campaigns to tell the world how great vinyl is. In this case I feel, one’s company, two’s a crowd ’cause that’s where the politics kick in.

The first campaign, PVC Aware, was set up by two of the major vinyl extruders: Veka, which has its origins in Germany and the U.K.’s own home-grown Epwin Group the member companies of which pretty much cover the industry from extrusion to recycling. Then the British Plastic Federation stepped in to say it should be running such a campaign. Then it goes very quiet for a while before jumping up again to take over the running and the web site, www.pvcaware.org.

As I have often said before, the window industry is nothing if not entrepreneurial. So up steps a guy called Martin Randall, a typical double glazing entrepreneur. Martin started

out fitting windows and is now the chairman of a multimillion dollar window fabrication business that he built from scratch. He is a lot more laid back these days splitting his time between his horses and the business but Martin Randall did not get where he is today by relying on other people to do the job. So he launched Fighting Back with Facts on the basis that fabricators and installers should not rely on systems companies to support their cause. See it at www. fightingbackwithfacts.com. The campaigns have the common aim of telling users that vinyl is an ecologically sound material, stable, long-lived and eminently recyclable. Indeed this is a position supported by none other than Dr. Patrick Moore, the founder of Greenpeace.

The problem seems specifically U.K. to me. Nowhere else in Europe do I see the industry splitting along materials lines. Fabricators make windows from vinyl and aluminium in the same factory. Weru, a huge German fabricator, teaches its apprentices to make timber windows before it lets them anywhere near vinyl.

Vinyl has had a lot of bad press over the years, unfairly in my opinion; it is a very good, versatile material. There are far worse plastics around. And right now, we have enough problems in the window industry. It is going through a natural cyclical downturn and on top of that we have to contend with ‘the credit crunch’ as it is called here. The economic downturn caused by the bank’s greed and the wider financial service sector’s manipulation of the sub-prime market to make a quick buck…well, several million quick bucks actually. There is no doubt we need to get our act together. As a publisher covering the industry, I do not have an opinion, I just observe. But I observe that the vinyl window industry in the U.K. is about to start a turf war over whom best represents its interests when it needs to look at how to survive in the long-term. ■

* John Roper is the editor for The Installer, The Fabricator, The Conservatory Installer and Glass Works magazine published in the U.K. His comments reflect his opinions from the U.K. and may not be applicable in Canada.

DATE EVENT PLACE CONTACT

Oct. 6-8

GlassBuild America

Las Vegas, NV www.glassbuildamerica.com

Oct. 21-25 Glasstec 2008 Düsseldorf, Germany 312-781-5180, www.glasstec-online.com

Nov. 11-13 Win-door North America 2008 Toronto, ON 800-282-0003, www.windoorshow.com

Dec. 3-5 Construct Canada Toronto, ON www.constructcanada.com

2009

Feb. 18-20 National Auto Glass Conference Orlando, FL www.glass.org

• 50% FASTER

• PRECISION CONTROL GIVES YOU HIGH QUALITY INSTALLS EVERY TIME

• DESIGNED FOR RESIDENTIAL AND COMMERCIAL APPLICATIONS

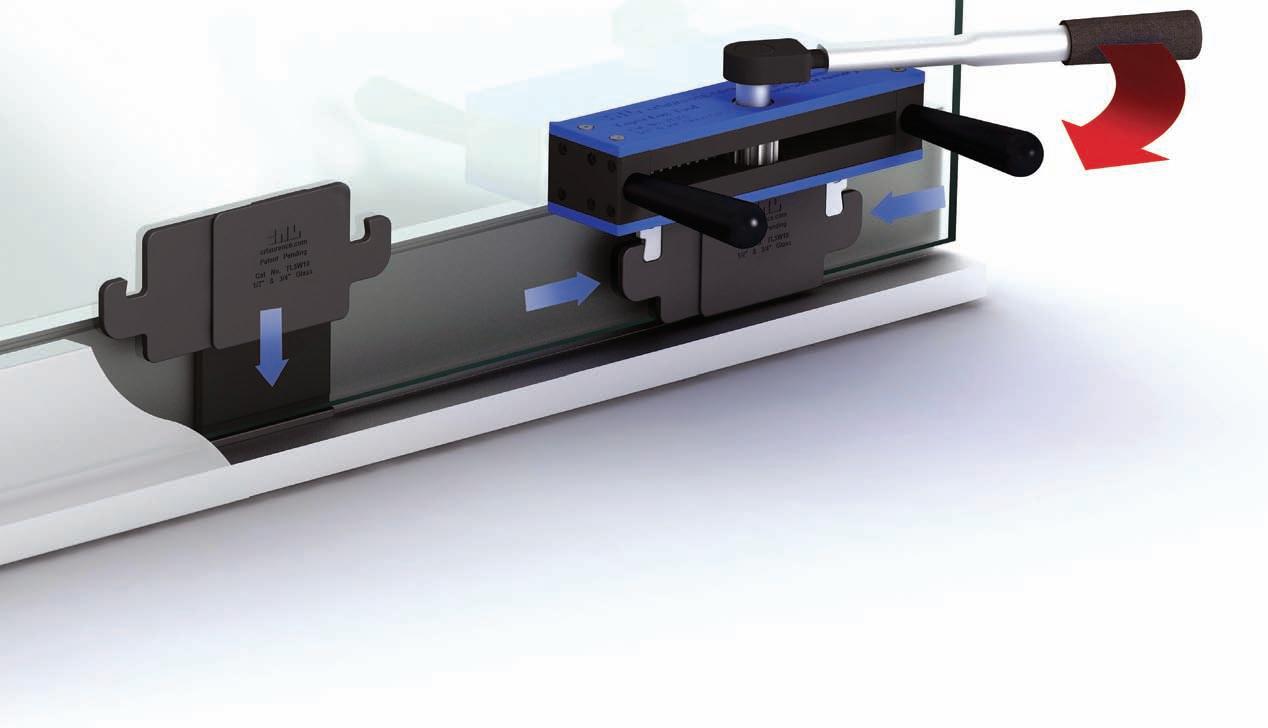

TAPER-LOC™ Tapers insert into the Base Shoe every 14 inches on center

Base Shoe cut-away

The TAPER-LOC™ Installation/Removal Tool compresses the Tapers together to lock the glass in place

• FOR 1/2" (12 mm) AND 3/4" (19 mm) TEMPERED GLASS

• CLEAN (NO MESSY WET

C.R. Laurence Company introduces the innovative GRS Glass Railing Dry Glaze TAPER-LOC™ System designed for residential and commercialtempered glass railing applications. The System includes an Installation/Removal Tool and CRL TAPER-LOC™ Tapers for 1/2” (12 mm) or 3/4” (19 mm) tempered glass applications.

Unique because it uses a horizontal taper lock design, TAPER-LOC™ Tapers are simply installed with CRL’s exclusive Installation/Removal Tool.

This tool mechanically slides the Tapers horizontally in the shoe and compresses them together. When compressed they expand in thickness and lock in place. When the correct lock-up force is applied, the torque wrench will click and break for a few degrees of rotation. The same Tool will also loosen the Tapers for glass alignment or replacement.

The CRL TAPER-LOC™ System supports all mounting methods, and is designed to meet and exceed code standards.