How vibration monitoring can increase uptime in

Three core considerations for the food and beverage production industry going into 2022.

pburton@annexbusinessmedia.com (416) 510-6756

Overcoming

829-1221

How vibration monitoring can increase uptime in

Three core considerations for the food and beverage production industry going into 2022.

pburton@annexbusinessmedia.com (416) 510-6756

Overcoming

829-1221

After spending the past few months learning about the food manufacturing industry, it has come to my attention that working in the food manufacturing world can be very interesting.

There are many reasons to love your food-industry job, depending on what you do. One example is you can be on the forefront of up-and-coming trends in the food world that no one knows about. Others like that there are many hands-on jobs where you make real, tangible products.

However, the main reason to really admire this sector is that the food industry is about solving problems: global, sustainability, supply chain and product launches.

Without a doubt, every position in a food manufacturing company serves a purpose, whether it’s a visible position or a ‘behind-the-scenes’ role.

Food manufacturers are on the path of digitization to optimize and unlock operational excellence. However, the majority still have a significant journey ahead of them when it comes to embracing new digital technologies and data driven operations. This means the future holds great potential for growth in this industry.

Companies are always trying to find ways to grow and expand by bringing in new innovative ideas. When growth happens, it happens quickly, which can mean there are new positions being created, so there are opportunities to grow with the company.

The past two years have been rough on the industry, with all the production disruptions, labour shortages, and reduced demand from restaurants. However, the evolving food demand and labour shortages mean more opportunities for businesses operating in this sector.

Afterall, the future growth of the food and beverage industry is always guaranteed. The bounce back will definitely need effort, but the results will almost never dissapoint.

Maryam Farag, Associate Editor Food & Beverage Engineering & Maintenance

mfarag@annexbusinessmedia.com www.mromagazine.com

Comet Bio, a manufacturer of healthy and sustainable ingredients, announced an investment with RE Energy to build a manufacturing facility in Denmark.

RE Energy, a REE Holding company, will upgrade and expand its existing facility in Kalundborg to supply over four million kilograms of Comet Bio’s Arrabina prebiotic fibre per year. RE Energy will operate the new facility under supervision of Comet Bio.

“We have great expectations that we, through the cooperation with Comet Bio, will be able to create and operate an innovative and sustainable manufacturing facility for this exciting new product,” said Henrik Maimann, CEO, RE energy.

Based in Ontario, Canada, and Illinois, U.S., Comet Bio uses its patented upcycling technology to

produce ingredients from crop leftovers. Comet Bio recently completed a $25 million Series C financing and will use some of those proceeds for this investment.

ITS

GeorgeWeston Limited announced the closing of the previously announced sale of its Weston Foods fresh and frozen bakery businesses to affiliated entities of FGF Brands Inc.

Prior to closing, George Weston and FGF agreed on a revised purchase price of $1.1 billion for the transaction, as well as certain other amendments, including an adjustment to the working capital provisions

as a result of seasonal fluctuations in inventory and accounts receivable.

George Weston continues to work toward completing the previously announced sale of its ambient bakery business, comprised of cookies, cones, crackers and wafers, to affiliated entities of Hearthside Food Solutions, LLC.

ICICLE RECOGNIZED WITH FOOD LOGISTICS 2021 TOP SOFTWARE & TECHNOLOGY PROVIDERS AWARD

Food Logistics has named Icicle Technologies Inc. to its 2021 Top Software & Technology Providers Award, which honours software and technology providers that “ensure a safe, efficient, and reliable global cold

Stay connected to the industry by subscribing to MRO Food & Beverage eNewsletter, reaching more than 20,000 subscribers. This monthly eNewsletter is an update of everything you need to know about the maintenance and operations of the Canadian food and beverage manufacturing sector.

Our eNewsletter content mix includes topics covering several news facets, including maintenance in food and beverage manufacturing, machinery and equipment performance and repair, food and beverage industry trends, as well as the latest hires and innovations by companies specializing in food and beverage manufacturing.

SUBSCRIBE NOW!

food and beverage supply chain.”

Icicle was created to improve public health through its paperless, auditready food safety solution. Then, Icicle has evolved into an enterprise resource planning solution with food safety database at its core.

The Minister of Agriculture and Agri-Food Marie-Claude Bibeau announced an investment of $495,000 for the Canadian Centre for Swine Improvement (CCSI).

Through this investment, CCSI is collaborating with project partners on developing a Canada-wide integrated genetic services system to help sheep and goat farmers improve productivity and increase supply.

Farmers will be able to use the new service system to access new developments and industry information on livestock genomics that can improve breeding and provide a more sustainable supply of products along the sheep and goat value chains. The integrated system will include

services such as phenotype measurements on traits such as growth rate and milk yield, training for farmers to adopt new technologies, genetic evaluation, and research and development.

CubicFarm Systems Corporation announced the appointment of G. David Cole to the Company’s Board of Directors.

As Vice Chairman of the Enterprise Strategic Client Group at Royal Bank of Canada, Cole has expertise in strategic business growth, capital markets, financial products and client-centric sales and marketing.

Cole has also been a Board Member of the University of Western Ontario’s Inter national Advisory Council since 2017, and a Board Member of Outward Bound Canada since 2017.

Pontus Protein Ltd. announced Mark Arathoon as Head of Product Development, and the company has secured Blue Ocean Tea Company to advise on contract packing, production

distribution and certifications.

Arathoon is a fourth-generation tea expert who has developed ready-todrink products for Numi Organic Tea, Starbucks, Revolution Tea, Justea Beverages, Wize and other international brands. Blue Ocean will package sachets of Pontus Powder and produce added-value products.

Everyone loves food, and for this reason, the food industry is filled with many opportunities to innovate.

BY MARYAM FARAG

If you’re thinking about starting a business, the food industry is a good option for investment. Why? The main reason is that it’s a basic need. Also, many people lack time to prepare food themselves. Finally, food-related businesses are less likely to experience financial trouble than other businesses.

However, the past two years have been rough on the whole world, including the food and beverage manufacturing sector. Production disruptions, labour shortages, reduced demand from restaurants and social distancing

measures have hindered the industry since spring 2020.

Nonetheless, these circumstances do not change much about the fact that agri-food processing remains the second largest manufacturing industry in Canada, accounting for 17 per cent of total manufacturing sales.

According to a Business Development Bank of Canada’s (BDC) report, Food and Beverage Industry Outlook: How changes in the economy affect Canadian food and beverage manufacturers, the processing industry is an essential part of the Canadian food supply chain.

It purchases about 40 per cent

of Canadian agricultural production, and sells over 70 per cent of its output to Canadian retailers and food service providers.

This industry still has strong growth potential, especially at a time when we are looking to diversify and strengthen the economy in a downturn. As worldwide population is projected to rise to 10 billion by 2050, there are opportunities for manufacturers to supply the growing global demand for food.

“In fact, our report anticipates a robust 15.6 per cent growth in the food and beverage sector domestically over the next five years. Such growth will impact

exports, which currently account for 30 per cent of manufacturing sales, predominantly to the United States,” said Rowda Mohamud, Senior Business Advisor, BDC Advisory Services.

“When major grocery chain shelves were emptied and stores were unable to replenish imported products, like pasta sauce, flavoured carbonated drinks and packaged frozen food, consumers voted with their wallets. Forced to eat at home during lockdown, Canadians helped trigger a 20 per cent increase in year-over-year grocery store sales from November 2019 to November 2020, despite a 27 per cent decline in manufacturing.”

At the same time, demand for food services shifted to retailers. Overall, the industry declined 5.2 per cent to mid-2020, but had already recovered to pre-pandemic levels by the fall of 2020. Not to mention that food processing is the largest manufacturing industry in most provinces; Ontario and Quebec account for most of Canada’s production with 42 per cent and 24 per cent, meaning that, those interested in expanding operations

in Canada, should look at Ontario, as it is fertile ground for growth.

According to Invest Ontario, Ontario’s food and beverage manufacturing sector is the third largest in North America, with manufacturing revenues of more than $48 billion. The sector has more than 3,000 establishments in the province, employing over 104,800 people, including global companies, such as Coca-Cola, Nestle, PepsiCo, Kellogg’s, Unilever and Kraft Heinz, and homegrown companies like Maple Leaf Foods, Dare Foods Limited and Weston Foods.

T hinking about committing to Ontario when opening your food business? Here are some things to consider

O ntario’s primary advantage is its people. The province has a publiclyfunded network of 22 universities and 24 colleges. As a result, 70 per cent of Ontario adult workers have post-secondary education, more than any other country in the Organisation for Economic Co-operation

and Development.

In addition, in manufacturing, the province has a 9.5-year average onthe-job tenure (compared to 5.5 in the U.S.), which translates to lower transition and training costs.

Ontario has low corporate tax rates, therefore, small-and medium-sized manufacturers can save on their aftertax R&D expenditures.

Ontario’s food and beverage manufacturers benefit from trade agreements with 50 countries around the world, including CETA and CUSMA, and is close to many U.S. hubs.

Products can reach the U.S. market, as Ontario’s transportation network includes four international and 300 regional airports, and many border crossings. It also has one of the most internationally connected airports in the world.

However, given the global pandemic, some businesses are struggling

financially, especially farmers. Ontario has launched programs recently to help with funding processors who need support.

• Provincial and federal COVID19 financial supports for farmers: provides a summary of federal and provincial support programs for Ontario’s producers.

• Canadian agricultural partnership: offers cost-share funding to support farmer, processor, other businesses, sector organizations and strategic partnerships. Evolving food demand, labour shortages and a need to keep investing in new technology presents both challenges and opportunities for businesses operating in this sector. However, the recovery and potential future growth of Canada’s food and beverage industry is on the track of getting stronger.

Maryam Farag is the Associate Editor of Machinery and Equipment MRO magazine, Food and Beverage magazine, and Plant Magazine, Annex Business Media. Reach her at mfarag@ annexbusinessmedia.com

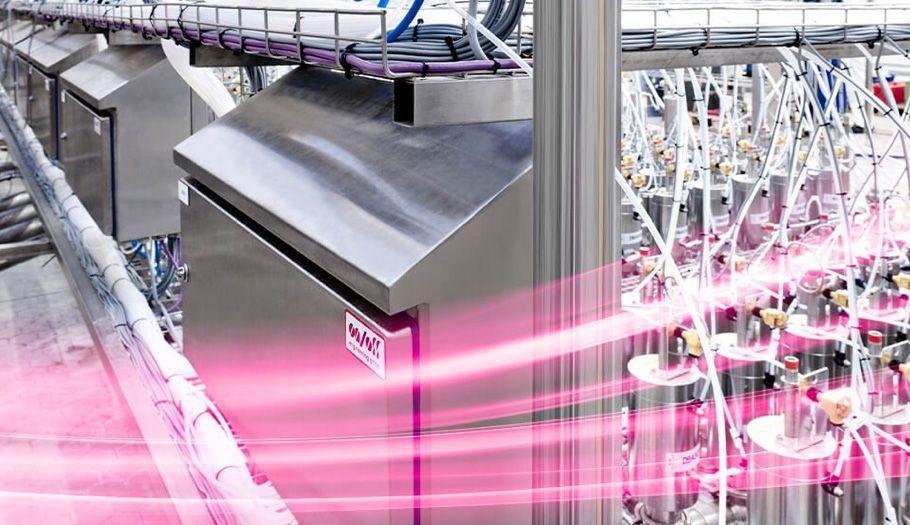

Maintenance teams continuously monitor for common equipment faults to catch potential problems before they stop production.

BY JOHN BERNET

Today, many food and beverage producers are facing heightened pressure to increase uptime. With supply chain issues, increased regulations, and cost reduction and efficiency efforts, there’s a renewed interest in new technologies that can streamline operations.

Even before the COVID-19 pandemic began, a host of Industrial Internet of Things (IIoT) technologies had taken hold in the food and beverage industry as a way of increasing uptime. Maintenance and reliability professionals were experimenting with a variety of connected sensors, tools, software, and equipment for remote condition monitoring. However, the past two years have sped up technology adoption.

During the height of the COVID-19 pandemic, nearly 60 per cent of maintenance teams operated with skeleton crews on site, according to Fluke Reliability surveys. With people working remotely, many maintenance teams

also said they realized they did not have the kinds of connected reliability tools needed to effectively keep machines and equipment in peak condition. By adopting predictive maintenance practices, more food and beverage producers have learned to leverage remote condition monitoring even with more staff working from home.

Amid the renewed interest, remote condition monitoring sensors, and vibration sensors in particular, have been among the most discussed IIoT tools. Vibration sensors are relatively easy to install, and they offer accurate data with minimal upkeep. They also build on concepts long familiar in maintenance.

While the technology behind the latest IIoT sensors may be new, the interest in vibration as a way of increasing reliability is not. From stethoscopes to handheld vibration meters, maintenance leaders have long known that vibration

anomalies are one of the first signs of a pending machine fault. In rotating equipment, vibration changes often accompany common faults like misalignment, looseness, bearing wear or imbalance. If left unchecked, abnormal machine vibration can cause operational problems and severe damage in common food and beverage manufacturing assets like drive motors and driven devices.

However, it’s difficult to catch subtle changes in vibration in the traditional handheld vibration measurement tools maintenance teams have used in the past. With continuous monitoring, that drive for non-stop data has fueled the adoption of wireless IIoT sensors as a way to better understand when repairs are needed.

Wireless vibration sensors generate signals from where they’re mounted on machines, then use network connections like Wi-Fi, LTE, or ethernet to transmit real-time data to software. Maintenance teams use the asset management software to trend and analyze data. Depending on the vibration sensor’s capabilities, it might detect, analyze, and even diagnose machine faults. These vibration measurements are used to monitor the health of rotating machinery like compressors, pumps, belts, gears, shafts, bearings, and other components that make up a mechanical system.

Today, there are two approaches to vibration monitoring; high level screening and deeper level

data analysis. Vibration analysis sensors monitor critical machines with bursts of high-resolution data, and they let maintenance teams conduct vibration analysis for the most common machine faults. In contrast, vibration screening sensors are more scalable and require very little training, but detect basic machine health, like whether the asset is doing good or bad.

In both cases, when wireless vibration sensors detect changes that exceed predetermined

threshold levels, it automatically sends an alert to the maintenance team so they can decide if maintenance is required.

Some wireless sensors also send data to broader maintenance software, like a computerized maintenance management system (CMMS), where the data can be incorporated into daily operations.

After a significant recent expansion to increased

production capacity, the maintenance team at one large Midwest cheese producer employed a combination of wireless vibration sensors and CMMS software to help increase uptime.

The legacy food processor had much more equipment coming in, so the maintenance team knew they needed to step up their broader condition monitoring program to avoid unscheduled downtime. If the equipment goes down while cheese is being made, it stops production and becomes a costly problem.

To move from preventive maintenance to predictive maintenance, they installed continuous

With people working remotely, many maintenance teams also said they realized they did not have the kinds of connected reliability tools needed to effectively keep machines and equipment in peak condition. By adopting predictive maintenance practices, more food and beverage producers have learned to leverage remote condition monitoring even with more staff working from home.

condition monitoring technology on all production equipment and used the alarm notification capabilities to receive immediate alerts when equipment conditions change. In particular, the company puts heightened focus on monitoring the health and wear of critical bearings. By installing wireless screening vibration sensors, they can now

monitor for excess vibration and heat.

Beyond increasing uptime, the wireless sensors helped reduce maintenance routes and extend asset life. By integrating the sensors with their CMMS, they were also able to automatically produce work orders.

Like this cheese manufacturer, other food and beverage producers around the world are going through a similar reliability journey toward increased predictive maintenance. By combining condition monitoring sensors and asset management software with other IIoT solutions, maintenance leaders are helping their organizations compete in today’s changing landscape.

John Bernet is a mechanical application and product specialist at Fluke Reliability, and works with customers from all industries to implement their reliability programs. He has 30 years of experience in the maintenance and operation of commercial machinery and as a nuclear power plant electrician in the U.S. Navy. He holds a Category II Vibration Analyst certification and is a Certified Maintenance Reliability Professional (CMRP).

A proactive and timely response to any emergency where everyone plays their respective role is crucial.

BY JOE MORGAN

It ensures a more controlled situation; one that allows for speedy recovery and mending or remodelling. The food and beverage industry has faced shortages from the disruption in production and distribution caused by labour shortages, catalyzed by the pandemic.

E arly implementation of analytics alarming on breaches of pandemic protocols, such as social spacing, mask identification and elevated temperature monitoring, may have helped to slow the spread in process factories and distribution networks.

N ow, businesses are designing emergency response teams that are familiar with new emergency plan protocols, and their designated roles for addressing each possible

situation. In the year ahead, we’ll see process being updated in production facilities such as barriers, partitioned zones and behavioural people monitoring to help curve the disruption caused by product shortages due to workforce insufficiency.

For continuity, distribution outlets will also increase storage capacities for key staple goods, i.e., milk, eggs, bacon, ground beef, and orange juice to compensate for spike shortages. Indeed, many will never forget the scene of empty shelves in the grocery stores for many of these products, which caused deep panic for everyone. Most of our society is conditioned to on-demand food, either at the store or at a restaurant. If supplies are not there for Canadian families, they have the potential to hoard a product when they do find it. This is what is known as insecure behaviour, and it attributes to the overall problem.

There are three core considerations/ three pillars that are essential for the industry to consider. Physical, process and safety adversely contribute to the supply chain in facilities producing food and beverage products. A deficiency in just one of these areas can disrupt the supply chain, thus creating shortages.

Physical security – Physical security is the most mature area in protecting industry and critical infrastructure from a physical intrusion standpoint. Solutions like perimeter protection, occupancy management, access control with layered situational awareness is well developed and an ideal solution. This is the first line for defence regarding physical risks of intrusion involving persons. A perimeter solution reinforces physical access controls to give industrial facilities an edge where security starts – at the perimeter of their site. Together

with cameras, it provides an effective edge-based system that automatically detects and responds to people and vehicles intruding on the property. When combined with thermal and Pan-Tilt-Zoom (PTZ) cameras, it’s suitable even for high-security locations.

Occupancy estimators are a costeffective and scalable video analytics application that collects real-time data on how many people are at a location.

A pre-set occupancy threshold can also be set to trigger an alert to staff when met. You can also use occupancy

data to strategically plan employee schedules, makes informed business decisions, improve site processes, and determine high traffic zones.

Consider low-touch access control and grant access with the scan of a QR code. This can help facilities unlock entrances with fewer touch points. It also allows approved site visitors to independently enter premises and move through accessible areas while allowing trace activity. Food and beverage can keep critical areas safe from unauthorized people and effectively grant access to secure areas.

security - With the push to automate, there’s more emphasis on remote monitoring of process. Optical and data sensors may be used in place of a maintenance worker, saving thousands in costs. With additional processing power embedded in the sensor, more on edge analytics can be utilized identifying potential problems in an early stage, preventing an unscheduled shutdown. Evaluation and intervention of critical machinery or processes early using sensors

will decrease the risk of a shutdown costing money. A more reliable supply chain process, using advanced sensors and analytics, will reduce risk and cost.

Health and safety security - Health and safety has been monitored and regulated in critical factories for years from a fatality or severe injury standpoint. This ideology is now being used to monitor workers in their environment for safety procedures. An example is using IP speakers for notification when too many workers have congregated in an area that might have pandemic related restrictions on social distancing requirements. A camera detects people in an area, measures the distance between and counts the numbers, if the limits exceed, a pre-recorded message from the audio speaker asks the people to ‘please space according to guidelines’. Meat processing facilities are an example of where workers are in close quarters to each other, in a dynamic environment of constant moving and processing product. Surveillance

There are three core considerations/three pillars that are essential for the industry to consider. Physical, process and safety adversely contribute to the supply chain in facilities producing food and beverage products. A deficiency in just one of these areas can disrupt the supply chain, thus creating shortages.

solutions utilizing cameras with analytics that can detect critical problems in health and safety are being developed. Such analytics include PPE detection (mask, gloves, etc.), harness detection, proper shoe detection, and monitoring for items that should not be in restricted areas, such as cell phones. Also, monitoring equipment for potential problems early could prevent more severe results.

Our push for a global economy in the 80s and 90s was good in theory, but it has exposed holes in the global supply chain. The global model relies on a smooth supply chain and must have contingency plans in place to react to product spikes. It is truly dependent on all global areas operating efficiently. We have learned that country of origins for critical components

adversely affect many products.

That said, there are thousands of new cars sitting in, holding lots at automotive factories, waiting for chips from China. This has caused a severe car/truck shortage, leading to disruption in the food and beverage distribution supply, limiting deliveries, and thus creating shortages.

Surveillance providers are creating solutions using core competencies to help monitor and automate in manufacturing, operational efficiencies, and health safety. Optical material monitoring can now identify shortages. Smoke detection can now sound an alarm on a potential fire or hot spot developing. These types of abilities are examples of smart analytics coupled with exceptional optics that have advanced processing abilities.

Many surveillance technologies have now been developed and integrated for some unique, end-to-end

solutions in food and beverage. Lower cost solutions are creating a tipping point for adaptation.

Companies are looking for solutions to address some of the problems they are encountering.

Using AI and ML sensors to collect data for the bigger picture will facilitate the creation of emergency models and develop automated responses in a factory’s process. This smooths out the supply chain in production, thus minimizing risk associated with the human element.

Joe Morgan is the Segment Development Manager Critical Infrastructure for Axis Communications. He’s been working in industry and critical infrastructure for 34 years, developing optical solutions in security, process, and safety to make it a smarter safer world. Joe has a BA in Education from the University of Texas at Arlington.

The COVID-19 pandemic and the awareness around food production sanitation seem to have forced producers to re-evaluate their processes and practices.

The choices consumers make about the food and beverages they consume is extremely personal. Dietary habits, brand association, affordability, and even political views are just a handful of factors consumers account for when putting a food and beverage item in their shopping cart.

The COVID-19 pandemic and the heightened awareness around the sanitation of food production has only served to reinforce the personal nature

of consumer behaviour in the food and beverage space, which has forced producers to re-evaluate their processes and practices.

In May 2020, Rittal surveyed a wide cross-section of U.S. food and beverage consumers to better understand consumer sentiment, and found that

affordability, availability, quality, and sanitary practices were at top of mind when weighing buying decisions. In addition, 35 per cent of respondents indicated their level of consumer confidence toward food and beverage producers had dropped since the beginning of the COVID-19 crisis.

Fast forward one year, a follow-up to this survey showed that consumers were still very much concerned about the safety of food and beverage production. While the study revealed a positive trend in consumer confidence, only 32 per cent of respondents signaled they felt ‘very confident’ in the safety and sanitation of food production facilities.

This puts producers at a unique inflection point in terms of understanding what the consumer wants and how they can respond, either by altering their production processes or changing how they communicate their practices to consumers. With this in mind, let’s examine how food and beverage producers can leverage consumer sentiment and trends to create production and distribution models that benefit their entire value chain.

While the study revealed a positive trend in consumer confidence, only 32 per cent of respondents signaled they felt ‘very confident’ in the safety and sanitation of food production facilities.

Rittal’s updated consumer insight report indicated that a majority of consumers still have significant reservations about the hygienic state of food and beverage production facilities. This means placing even greater emphasis than ever before on the cleanliness, sanitation, and durability of equipment on the production floor to withstand frequent, high-intensity washdowns and other disinfection processes is paramount in alleviating this pain point for consumers.

The ability to maintain safe and sanitary climate control within the enclosures on the food production floor is also key to how food and beverage producers can alleviate consumer concerns about food safety in production facilities. The capacity to cool the equipment that drives production runs downstream to protecting the integrity of the final product.

Technological advancements like automation and artificial intelligence have significantly changed the way food and beverage producers create, test, warehouse, and distribute their products. The ability to produce, assess overall quality, and route products to the consumer in faster and more

efficient ways than ever before has revolutionized the entire value chain and allowed for increased profitability.

The introduction of highly sophisticated sensors to identify contaminated or spoiled food products and network connectivity to generate and receive data as a product moves through a production or transportation cycle means rethinking traditional

panel and switchgear building processes.

At the end of the day, industrial enclosures, climate control systems, and automation solutions are what food and beverage producers need to address consumer concerns and adapt to a new paradigm in food and beverage production.

Article provided by Rittal North America LLC.

Over the past two years, the Canadian manufacturing sector has faced innumerable challenges, but nowhere do these issues seem more prominent than in food and beverage manufacturing.

Whether it be grappling with heightened manufacturing costs, shipping and transportation delays, or the myriad of issues brought about by the COVID19 pandemic, food and beverage manufacturers have been forced to significantly alter their processes and expectations to remain competitive on both domestic and international shores.

The most pressing obstacle to success in this field, though, is undoubtedly the labour shortage; it has never been more difficult for employers to find workers, let alone properly train and retain them. As such, leaders in this field must adapt and modernize long-held recruitment methods to appeal to today’s job-seekers and should have a thorough and complete understanding of why current workers are abandoning their posts at an unprecedented rate.

Let’s discuss some of the labour challenges in food and beverage production and determine how they can be addressed.

The examination of current data metrics

regarding labour in food and beverage manufacturing is essential to establishing proper contextual awareness. According to EMC ManufacturingGPS Employer LMI Survey, 2020, as of 2020, employers in this field have reported a 22.9per cent increase in their workforces’ voluntary turnover rate as compared to general Canadian industry averages.

This begs the question: why do food and beverage labourers quit their positions nearly one-quarter more than workers in other manufacturing industries do? The answer becomes less ambiguous when we look at average employee wages. According to EMC ManufacturingGPS Employer LMI Survey, 2021, in 2021, labourers in food and beverage manufacturing were paid 9.7 per cent less than the general sector standard.

This problem is present throughout the field’s corporate ladder; production supervisors are paid 11.3 per cent less than the manufacturing sector average, and managers are paid 4.6 per cent less. Wage increases are expected soon, but when forecasted to range between one per cent and 1.9 per cent according to EMC ManufacturingGPS Employer LMI Survey – Food and Beverage Sector, 2021, they will not be enough to alleviate disparities with Canadian manufacturers in other industries.

As issues stemming from the COVID-19 pandemic continue to weigh heavily on workers’ minds and influence their career decisions, it is important for leaders in food and beverage manufacturing to recognize employee demands and expectations, and take the necessary financial measures to meet them.

When asked why positions in the food and beverage manufacturing industry were so difficult to fill, one of the reasons most frequently offered by business leaders was low employee work ethic, according to the EMC ManufacturingGPS

LMI Survey – Food and Beverage Sector, 2021. When demand for labour is high and supply is low, it is the responsibility of employers to motivate and energize their workforce.

Contextual awareness is important here as well. Workers in food and beverage manufacturing must follow a strict set of guidelines unique to this sector and must possess specific knowledge and skillsets to prevent issues with waste or contamination. Employers should also recognize causes of disillusionment outside of the workplace, and should implement methods of either eliminating, alleviating, or offsetting these challenges.

Fortunately, effective workplaces can be maintained without significant expense or modification of existing production methods. Organizations that see low voluntary and involuntary turnover rates have long touted the value of individual respect, unique skill acknowledgement, and high degrees of employee autonomy, and ensure that these ideals are constantly practiced by all levels of management and supervision.

Food and beverage manufacturers would do well to remember that each of their employees is a smart, opinionated individual, and should be treated as such on and off the job, lest they abandon their post for a competing business. Employers partnered with EMC have access to resources focused on strengthening employee work ethic, and through specialized events held exclusively for those in food and beverage manufacturing, fully understand how to keep their labour force positive and productive, regardless of the challenges they may face.

In EMC Senior Manufacturing Management Survey, 2021, business leaders in food and beverage production identified a shortage in skilled labour to be the most significant plant management issue for 2022.

To prevent issues with food safety, lost productivity, and employee disillusionment, leaders in this field must ensure that their teams receive the highest level of training, instruction, and supervision, and should take great strides towards accountability and professionalism at every stage

of the corporate ladder.

Business leaders should always realize the importance of respect and acknowledgement in training, as employees that feel confident and validated are often far more eager to learn and develop their skillsets than those that don’t. Through proper recognition of their individual achievements, workers will better understand the benefits of correct work processes.

Employees at every level of the production process are integral. According to EMC ManufacturingGPS Data — Expected Hires in the next 12 Months, Food & Beverage Sector, 2021, food and beverage manufacturers overwhelmingly intend to recruit production labour in 2022, with positions in food chemistry, science, and design receiving far less attention. In an age when even entry-level jobs are difficult to hire for, industry leaders should keep in mind many of the challenges specific to their sector that only advanced support can navigate through. Issues like rising energy costs, food spoilage, and order fulfillment cannot be solved by managers or production

labourers alone; they require a steady stream of dedicated professionals to thoroughly understand the situations surrounding them and develop effective methods of circumvention. If manufacturers and food processors are unable to find or fill technical roles, candidates are hired for fit and organizations train and teach the skills required for new hires to be successful in their role.

Food and beverage production can often seem like a small-scale version of the Canadian manufacturing sector, but along with having one of the highest growth rates in the sector, as well as being

responsible for purchasing about 70 per cent of Canada’s agricultural output, it faces issues like other industries, a notably increased rate.

In the wake of the COVID-19 pandemic, though, leaders in this space have a unique opportunity to revitalize their businesses through modernized retention processes, effective training, recruitment diversification, and most importantly, employee recognition. By effectively realizing these opportunities, food and beverage manufacturers can sustain productivity, efficiency, and profitability in the long-term, and keep themselves well-prepared and well-equipped to overcome future challenges as they are revealed.

EMC recognizes that success in manufacturing is a collaborative effort, and that strong productivity requires constant cooperation between leaders and their team. The manufacturing industry is an ever-shifting entity, and success in this field can only be found through communication and the mutual sharing of experience.