FOOD BEVERAGE

Reasons why an organization with multiple plants implements a computerized maintenance management system.

The Canadian dairy sector was influenced by two major trends in 2020.

HAVING A DIFFICULT TIME WITH YOUR HEALTH & SAFETY PLAN?

Supplement of

MACHINERY AND EQUIPMENT

Summer 2021

Leah Nacua named as Field Service Advisor for EMC.

Since 2002, EMC has been assisting Ontario manufacturers along their Health & Safety journey.

Our members share to improve, together

PUBLISHER

Paul Burton

pburton@annexbusinessmedia.com (416) 510-6756

EDITOR

Mario Cywinski mcywinski@ annexbusinessmedia.com (226) 931-4194

ASSOCIATE EDITOR

Maryam Farag mfarag@annexbusinessmedia.com (437) 788-8830

NATIONAL ACCOUNT MANAGER

Ilana Fawcett ifawcett@annexbusinessmedia.com (416) 829-1221

BRAND SALES MANAGER

Melanie Morgan mmorgan@annexbusinessmedia.com (437) 218-0941

ACCOUNT CO-ORDINATOR

Catherine Giles cgiles@ annexbusinessmedia.com (416) 510-5232

MEDIA DESIGNER

Graham Jeffrey gjeffrey@ annexbusinessmedia.com

CIRCULATION MANAGER

Beata Olechnowicz bolechnowicz@ annexbusinessmedia.com

COO Scott Jamieson sjamieson@ annexbusinessmedia.com

In Co-operation with

Contact: Kristy McKee Health & Safety Excellence Program kmckee@emccanada.org

PRESIDENT

JP Giroux • jp.giroux@emccanada.org

(519) 376-0470 (866) 323-4362

VICE PRESIDENT AND GENERAL MANAGER

Amanda Doman • adoman@emccanada.org

VICE PRESIDENT, MANUFACTURING SECTOR PERFORMANCE Scott McNeil-Smith • smcneilsmith@emccanada.org

CHAIRMAN OF THE BOARD, TREASURER

Al Diggings • adiggins@emccanada.org

New 2021 Trends in Food and Beverage Industry Brought by COVID-19

It is no secret the food and beverage industry has a unique role in expanding economic opportunity, as it is universal to human life and health. In this diverse landscape, billions of people grow, transform, and so does the industry.

This applies to the Canadian food and beverage processing industry, which, according to the Government of Canada, is the second largest manufacturing industry in terms of value of production, with sales of goods manufactured worth $117.8 billion in 2019; it accounts for 17 per cent of total manufacturing sales and for two per cent of the national GDP. However, it’s only been over a year since the emergence of COVID-19 disrupted lives and businesses. Yet, the accelerated rate of change has made the pre-pandemic past feel like a lifetime ago, and the food and beverage industry has been one of the many things that has seen change over the course of this year.

As we start to envision a post-pandemic future, we expect to see some new trends brought on by COVID-19, and not only within the food and beverage industry, but also within the consumers’ mindsets.

In a 2020 survey conducted by FMCG Gurus, 80 per cent of consumers worldwide indicated they were planning to eat and drink healthier in 2021 as a direct result of COVID-19. Already, 58 per cent of North American consumers say they regularly research different ways to improve their health.

As consumers look to stay healthier for longer, they are adopting a prevention over cure approach to wellness: 67 per cent of global consumers are interested in products that boost immune health even if not suffering from such problems.

The disruption to routines has led to consumers questioning aspects of daily life that they previously took for granted. As such, consumer behavior will increasingly be driven by risk avoidance, with consumers wanting transparency and validation from brands.

As a result, 38 per cent of global consumers say that they have been more attentive to the country of origin of products in the last 12 months, 49 per cent of global consumers say that they have changed their attitudes towards packaging in the last 12 months, and 68 per cent of global consumers say they are now more conscious about other shoppers handling products in-store.

One of the things that will grow in popularity are plant-based alternatives, as consumers take a more proactive approach to addressing health and sustainability issues. Taste and texture will be major issues that must be addressed over the next couple of years, as consumers increasingly expect plant-based products to mimic the experience of eating animal produce.

There has never been a better time to have a foothold in the sector, and even though projecting trends isn’t a sure science, but what seems to be certain is that the online and retail food and beverage industries has changed for good.

Maryam Farag, Associate Editor Food & Beverage Engineering & Maintenance mfarag@annexbusinessmedia.com

FOOD BEVERAGE& NEWS

TETRA PAK CALLS FOR MORE WOMEN TO JOIN THE FOOD AND BEVERAGE MANUFACTURING INDUSTRY

Tetra Pak identified an opportunity for more women to join the food and beverage manufacturing industry and bring more diversity.

“Manufacturing industries have not always been the most attractive career choice for women, owing to the stereotypes and legacies of this heavily male-dominated sector. But now there is a brilliant opportunity for more diversity and for female innovators to help protect our global food supply chains for generations to come,” said Laurence Mott, Executive VP, Development and Engineering, Tetra Pak.

According to Tetra Pak, a big variety of skillsets is required to boost innovation in the food packaging industry, ranging from mechanical

and automation engineering to microbiology and food science. According to the World Economic Forum’s

Gender Gap report, women make up a third of roles in the manufacturing sector, dropping to 21 per cent at a senior executive level.

“Our global food systems are facing many challenges, in terms of climate change, food safety and hygiene and distribution. We can make a difference in all of these areas, but our impact will be far more effective if we involve more women in the movement,” said Marie Sandin, Vice-President, Engineering and Plant Automation, Tetra Pak. “The COVID-19 pandemic has shone a light on critical environmental issues as well as the importance of food safety and availability and we need all hands on deck to address these evolving challenges.”

“I see an opportunity for women

to enter the food science discipline and make an impact,” said Abigail Dagadu, Food Science Lead in U.S. and Canada, Tetra Pak. “Drawing from my own experience, my role is to look for innovative solutions to some of the world’s most important issues today: from food insecurity and famine to metabolic diseases, like obesity and diabetes, it’s a chance to drive real societal change, and I would encourage all young women with science, technology, engineering and mathematics qualifications to consider a career in the F&B industry.”

FBO APPOINTS NEW CEO

Food and Beverage Ontario has appointed Chris Conway as the organization’s new CEO. Conway has led three associations, most recently as CEO for Career Colleges Ontario and prior to that President of Concrete Ontario. He has over 15 years of experience in provincial government relations and began his career on Parliament Hill. Former CEO, Norm Beal, is

stepping down to take an active role in his business, Peninsula Ridge Estates Winery.

“I want to thank Norm for successfully launching FBO,” said Michael Burrows, Chair, FBO and CEO, Maple Lodge Farms. “We are very excited about Chris joining as our second CEO to land food and beverage processing in the “new normal” and further realize our

Chris Conway.

potential as the leading manufacturing sector in Ontario and contributor to a thriving economy.”

CANADIAN FOOD INDUSTRY COLLABORATIVE ALLIANCE TO DEVELOP A CODE OF PRACTICE

In November 2020, Federal-Provincial-Territorial (FPT) Agriculture and Food Ministers announced the creation of an FPT Working Group to identify potential measures to safeguard balance in the food system’s commercial relationships.

Several associations came together to form the Canadian Food Industry Collaborative Alliance and developed a framework that proposes a process for food industry leaders to develop a Canadian Food Industry Code of Practice.

The members of the Alliance represent thousands businesses in the Canadian food supply chain and include: Canadian Federation of Independent Grocers, Canadian Produce Marketing Association, Food and Beverage Canada, The Quebec Food Processing Council, Quebec Food Retailers Association, and Retail Council of Canada.

The Alliance believes that any Code of Practice must be developed in Canada for Canada, hence it must be developed by industry for industry and must reflect and respect the unique elements of Canada’s food supply chain and federated system of government. Therefore, there must be just one Code of Practice throughout the country administered uniformly to ensure consistency.

To promote good faith dealings and responsible commercial conduct along the food supply chain, the following principles should be reflected in a Code of Practice:

• Ensuring transparency and contractual certainty in all commercial transactions.

• Ensuring best practice reciprocity throughout the supply chain.

• Promoting fair and ethical dealings in contract negotiations, particularly where there is a significant disparity in negotiating power between the parties.

• Ensuring equitable distribution of food supply.

• Providing supports for small and mid-sized parties to commercial transactions.

• Providing an effective, fair and applicable dispute resolution process.

Simple. Sanitary. Secure.

Introducing Stainless Steel Hygienic Liquid Tight Metallic Conduit and Hygienic Flex Fittings to the Calbrite Flex Family. Calbrite Hygienic Flex products are made from 316 stainless steel, making them ideal for food processing facilities where washdown and high temperatures are required. Calbrite Hygienic Flex products are designed to provide excellent absorption of motion and vibration, protecting electrical wires and cables in any location.

Calbrite offers an extensive line of flex conduit and fitting solutions for every application. Find our product datasheets here: calbrite.com/flex-conduit-and-fittings

STANDARDIZE MAINTENANCE AND ENSURE SAFETY AND COMPLIANCE WITH A CMMS

One of the most common reasons an organization with multiple plants and locations implements a computerized maintenance management system (CMMS) is to standardize maintenance operations and workflow processes.

Often, the company’s plants or facilities do not have a CMMS or use an assortment of software, or the present one is insufficient or antiquated.

Monogram Foods, manufacturers of an extensive line of snack foods, wanted to consolidate and optimize maintenance operations across its nine plants, gain visibility of overall maintenance activities, and enable comprehensive, accurate reporting.

The Memphis, Tennessee-based company needed CMMS software that could:

• Enable a fully transparent view of maintenance activities to executives

• Streamline maintenance management and control spare parts inventory

• Help support the health of its more than 3,554 assets

• Reinforce the company’s 15-year

exemplary food safety record

• Integrate with BI for visualizing multiple data sources at once The organization carried out an extensive search involving various maintenance management software solutions. They selected cloud-based CMMS software and a vendor wellknown for successfully managing countless multi-site rollouts.

The snack foods company also liked that the provider had an impressive assortment of other advanced tools and software that could connect to the CMMS, including vibration monitoring sensors to further its reliability journey. Ultimately, the company’s reputation for exemplary customer service and ability to fully support the company’s unique goals helped clinch the choice.

EXPECT TO ENCOUNTER CHALLENGES

Dee Robison was hired as the CMMS system administrator for Monogram Foods in 2017 and tasked with overseeing CMMS adoption and user training. Robison made training a

critical initiative and became a CMMS expert user by attending the vendor’s online training sessions and in-person learning opportunities.

After fast-tracking her CMMS knowledge, Robison trained Monogram employees to use the system.

Plant maintenance leaders and users needed to understand how to effectively utilize the system to impact the organization’s key performance indicators (KPIs) and overall objectives.

“I oversee the systems, making sure the functionality works, making sure that we get reports for corporate, that we do the training,” said Robison.

“Everybody has a planner in each of their accounts and plant engineer. They’re responsible for loading in all assets, within the guidelines of Monogram Foods.”

Many of the organization’s objectives hinged on personnel inputting data accurately and consistently. Otherwise, the company’s continuous improvement metrics would be unusable and unreliable.

Data usage objectives:

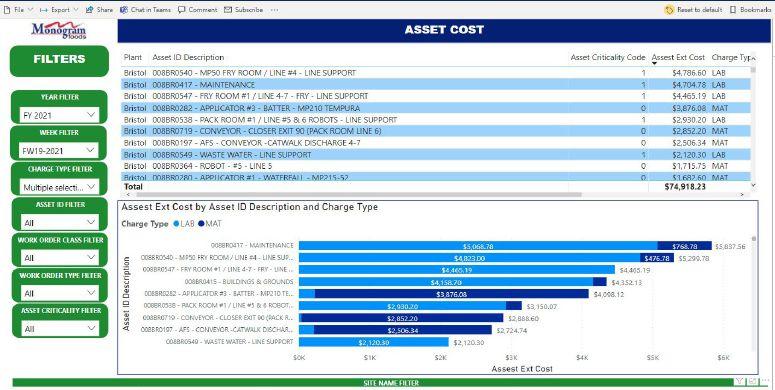

• Track safety and other audits

In addition to adding vibration monitoring sensors to some of its critical equipment to track asset health continuously, the company is also using a power business intelligence (BI) tool and integrating it with its CMMS. The result is an all-up dashboard for visualizing many data sources on one screen enabling comprehensive KPI reporting and the ability to see and close gaps more effectively.

• Monitor continuous improvement metrics

• Enable informed equipment repair and replacement decisions

• Create individual plant maintenance activity reports and consolidated reports for leadership

LEVERAGE CMMS FEATURES TO ENSURE DATA INTEGRITY

Some plants embraced the change to the CMMS, while others resisted or weren’t entering data, including work order completions, consistently. Because the system was highly configurable, the organization overcame several obstacles by maximizing its many features and functions to fit its needs and lock in reliable data capture.

For instance, Robison created

mandatory fields in work requests where a WO could not be completed without proper data. Additionally, the company’s implementation team worked with the CMMS provider to build a custom work order category to ensure audit/safety-related work requests were prioritized.

“We have three different types of work requests: facilities, production, and an audit request,” said Robison. “We have instructed each of the plants that, if this has to do with an audit that they put the work request through as an audit. And that automatically gets categorized as that. We can pull up all of our requests by any audit, and then we can track it easily that way.”

M onogram Foods also worked with the vendor to design a report

that separated and graphed planned, unplanned, and unaccounted work hours. When the employee payroll hours upload into the CMMS each week, depending on the work order type, the CMMS dashboard displays how time was spent.

In just a few months, M&R teams and leadership learned where to focus continuous improvement efforts and optimized other areas of the system, such as generating daily cleaning and sanitizing work orders automatically.

FINE-TUNE YOUR PMS AND MAKE PROCEDURES CLEAR AND CONSISTENT

The organization focused heavily on improving its preventive maintenance (PMs) and work order standardization for equipment plant-wide. A core team met regularly to examine where the PMs needed more details.

“ We’re tightening up on PMs and reviewing the like equipment at our plants and saying, ‘Hey, this needs to be more detailed,’. We are seeing what we’re doing with our

downtime on certain equipment,” said Robison. “We go back, and we review the PMs and find out if we’re missing something by doing a rootcause analysis on it and verifying that we have enough information.”

One of the missing details they

found was that some plants weren’t accounting for the time it took to gather parts to carry out a PM work order. Identifying and correcting erroneous work-hour estimates enabled better planning and maintenance scheduling, and detailed PM

criteria helped boost asset availability and reliability.

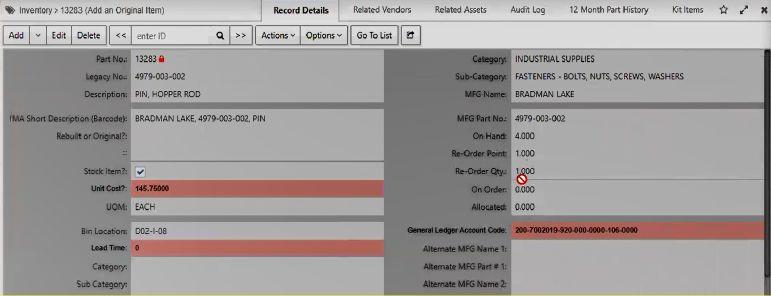

OPTIMIZING THE CMMS INVENTORY FEATURE QUICKENS ROI

The CMMS inventory management feature is one of the most powerful

Figure 1 - The organization configured the CMMS to track planned, unplanned, and unaccounted for hours.

tools when optimized. Unfortunately, many times it is either overlooked or undervalued. It takes time and effort to gain control of inventory, but the payoff is substantial.

M onogram Foods chose to maximize the feature to control purchasing, reduce excess inventory levels and costs, and ensure spare parts availability. When initially trying to capitalize on its benefits, one of the first struggles was getting the plants to enter critical data.

Some of the organization’s larger plants have as many as three people

to manage parts details, including the vendors, reorders, and receiving. Once plants started validating parts, estimates and counts began to improve. “ We have reorder points on our inventory,” said Robison. “The inventory controller has to put in a lead time, bin location, cost, vendor information, and reorder points.

Now that we’re validating, we’re getting a more accurate count of what’s on our shelves. We’re not underestimating or overestimating as much, and we don’t run out of the parts that we need should there be a breakdown.”

ACCELERATING THE RELIABILITY JOURNEY WITH CONDITION MONITORING SENSORS AND POWER BI

M onogram Foods accomplished several objectives by consolidating maintenance of its nine plants, including standardizing PMs and work orders, controlling purchase orders, and managing inventory and parts expenditures.

In addition to adding vibration

monitoring sensors to some of its critical equipment to track asset health continuously, the company is also using a power business intelligence (BI) tool and integrating it with its CMMS. The result is an all-up dashboard for visualizing many data sources on one screen enabling comprehensive KPI reporting and the ability to see and close gaps more effectively.

Article provided by Fluke Reliability.

Figure 2 - The CMMS tracks parts usage and automatically triggers parts reorders when levels fall below a specific number

Figure 3 - Power BI integrates with CMMS enabling comprehensive KPI corporate reporting

The Podcast for MRO Professionals

The podcast features conversations with industry experts about maintenance, reliability, and operations. Topics that are of utmost importance to MRO readers.

Previous guests and topics have included:

• Scott MacKenzie – Maintenance at TMMC Plants with a Focus on the Environment

• Martha Myers – Importance of Networking and Education in Maintenance

• Doc Palmer – Focus on Scheduling and Planning of Maintenance

• James Reyes-Picknell – Managing Maintenance and Reliability

• Shawn Casemore – Engaging Your Employees in a Safety Culture For sponsorship opportunities, contact Paul Burton, Senior Publisher, pburton@annexbusinessmedia.com

For guest/topic suggestions, contact Mario Cywinski, Editor, mcywinski@annexbusinessmedia.com A Podcast brought to you by

CANADIAN DAIRY MARKET AIMS FOR COMPLIANCE AND MEETING MARKET DEMANDS, AIDED BY HYGIENIC DESIGN SOLUTIONS

The Canadian dairy sector was influenced by two major trends in 2020: The COVID-19 crisis and the Canada-U.S.Mexico Trade Agreement (CUSMA).

While the pandemic caused temporary production cuts, the CUSMA agreement improved market access and removed limits to exports of skim milk powder and infant formula. Ultimately, milk production in 2020 exceeded 2019, and the forecast for 2021 is that this upward trend will continue. The reasons for the rising milk revenues are due to the Canadian Dairy Commission announcing an increase in the butter support price, expected re-opening of food services as vaccines become freely available, and higher, more stable U.S. non-fat milk prices. Due to these three factors, revenues are expected to increase by $1.69 - $1.77 per hectolitre in the Canadian milk pools.

Driven by population increases, rising income levels, urbanization, and changes in dietary patterns – particularly in China and India where milk supply is not keeping pace with the growing demand – developing countries offer a compelling opportunity for North American dairy companies able to bridge the gap between supply and demand overseas. However, maximizing that opportunity will require change, including:

• Adoption of digital technologies for consumer engagement and

product innovation;

• Greater use of advanced manufacturing processes and technologies;

• Increased shelf life of milk and related products; and,

• Compliance with international safety and cleanliness requirements and quality standards

CHANGING PRODUCTS

Health-conscious consumers the world over are ditching trans fats and changing what they eat. This is good news for the dairy industry. Consumption of dairy products is on the rise, with organic milk, natural, unprocessed cheeses and Greek yogurt leading the way, dairy consumption continues to rise in spite of plant-based competitors like almond, soy, and rice-based milks. On average, each Canadian consumes about 14.65 kilograms of cheese on an annual basis as of 2018, up from 12 kilograms

in 2004, according to Statista Canada. With the shift in consumer demands to healthier eating, dairy producers have the opportunity to spice up their brand and tailor their products –or create new ones — based on consumer habits. Moreover, the use of digital consumer engagement technologies will make this step even easier. Using big data and analytics to understand consumption patterns can also help tailor production and marketing strategies for better results at optimum costs.

MORE EFFICIENT OPERATIONS

Continued industry consolidation and the resulting formation of mega-farms has created the opportunity to add current-state automation and other efficiency-enhancing technologies to both operations and production. The widespread adoption of automation will change the way milk is produced, improving profitability, milk quality, lifestyle and animal welfare. Greater use of advanced manufacturing processes and technologies will be vital if dairy farmers are to capture share in emerging global markets.

EXTENDED SHELF LIFE – GREATER SAFETY

The use of advanced technologies will also help companies increase the shelf life of their products. Safety considerations will be a high priority

The widespread adoption of automation will change the way milk is produced, improving profitability, milk quality, lifestyle and animal welfare. Greater use of advanced manufacturing processes and technologies will be vital if dairy farmers are to capture share in emerging global markets.

for the extended shelf life (ESL) products and ultra-high temperature (UHT) milk needed to reach customers around the world. In adding these technologies, producers must comply with international safety, cleanliness, and reporting standards similar to the FDA’s Food Safety Modernization Act (FSMA).

The goal of the FSMA is to take a more proactive approach to food safety, shifting from reacting to foodborne illnesses to preventing them before they start. From incoming raw materials through final product distribution, maintaining safety and hygiene will be a priority when complying with FSMA.

Components designed to minimize contamination risk, reduce the use of cleaning and disinfecting agents, and provide secure cover for equipment will be in high demand. Stainless steel terminal boxes and electrical enclosures with sloped tops and sealed access points will prevent chemical intrusion and/or corrosion from wash-downs that could result in electrical failure, unscheduled downtime, expensive repairs and potential product contamination.

The stringent food safety standards demanded by the Canadian Food Inspection Agency (CFIA), the Department of Health Canada (Health Cana da) and the U.S. Food and Drug Administration (FDA) affect almost everyone involved in the North American food supply chain, from manufacturers to shippers to retailers. For food and beverage processors, preventing contamination means aggressive sanitation protocols that ensure equipment is clean at the microbiological level. Enter hygienic design, an approach to enclosure design that puts the concerns of food and beverage manufacturers front and centre.

WHAT IS HYGIENIC DESIGN?

Hygienic design enclosures are stainless steel wallmount housings and free-standing enclosures that are designed and engineered to protect your mechanical and electrical control equipment while preventing food contamination, as well as preventing corrosion from frequent exposure to harsh cleaners and high-pressure hot water and steam. For food and beverage processors, hygienic design is a win-win, leading to lower

risk of contamination and recalls, plus shorter cleaning times with less water and fewer chemicals required. The bottom line: designing for hygiene from the start leads to more uptime in the long run.

UNDERSTANDING HYGIENIC ZONES

Food and beverage plants have different zones that require different levels of hygiene. Some companies, like Rittal, engineer their lines of hygienic design enclosures with these hygiene zones in mind.

• Basic hygiene zones have no open processes where food could be contaminated, and thus no wash-down requirements. These areas include things like building systems and automation, power infrastructure and switchgear, packaging, palletizing, storage, and conveyers for finished product. Typical enclosure requirements are NEMA 12 and either carbon steel or stainless steel.

• Medium hygiene zones involve beverages or food that are contained, mixed, or processed in vats, vessels, tanks, and/or piping. While there are no open processes, the equipment is regularly drained, flushed, and cleaned, along with the floors and other surfaces, which means equipment should have some resistance to water splashing, corrosion, and chemical vapors that may arise during the cleaning process. These are

areas where beverage and bottling operations take place — think milk production, breweries, and distilleries. These areas usually require slope-top enclosures that are NEMA 4X and stainless steel.

• High hygiene zones contain open processes where food is splashed on the machines, floors, and other surfaces. These zones require the highest degree of hygiene — they are sanitized with aggressive cleaning agents plus high-temperature and high-pressure water, which means the equipment must have the highest degree of water and chemical resistance. Typical applications include food processing equipment and conveyers for raw and unfinished product. Typically, enclosures must be IP69, slope-top, brushed stainless steel, and have gaskets made with FDA-approved materials. By selecting the right enclosure for each individual hygiene zone within the plant, food and beverage processors can incorporate hygienic design into every step of the production process.

NINE HYGIENIC DESIGN FEATURES TO LOOK FOR

• When choosing enclosures for a food or beverage processing plant, look for these key hygienic design features:

• No gaps between the enclosure and its door or cover. For example, a continuous silicone seal door gasket will help prevent the intrusion of

water, steam, or contaminants and can be easily replaced when worn.

• A smooth surface grain that eliminates tiny pores that could harbor microorganisms.

• Internal hinges mounted inside the sealed zone to simplify cleaning.

• An integrated, non-detachable rear panel to guarantee reliable hygiene and sealing in an area that is difficult to monitor.

• Side panels that are screw-fastened from the inside to eliminate threads or other crevices that could harbor dirt or bacteria.

• Hexagonal screw fasteners without the head slots that could allow debris to collect and with external seals to keep moisture out of the enclosure.

• Easy-to-clean stainless-steel locks and cable glands.

• Sloped tops and sealed access points to prevent water or cleaning agent infiltration that could result in electrical failure, unscheduled downtime, and expensive repairs.

• An Ingress Protection rating that is consistent with the line’s cleaning protocol. Common IP ratings for F&B applications include IP 66 (dusttight and protected from high-pressure water jets from any direction), and IP 69K (dust-tight and protected from steam-jet cleaning).

Article provided by Rittal.

Excellence in Manufacturing Consortium (EMC), our Food and Beverage Sector Initiative members and participants have been enjoying valuable networking events, sharing best practices, experiencing plant tours, and connecting with each other in group settings and one-to-one, both in person and virtually over the past several years. The topics we address and discuss are all industry specific and have ultimately been focusing on what it takes to be competitive in the food industry today.

WHAT MAKES EMC SPECIAL?

E MC has grown to become Canada’s largest manufacturing consortium and with over one thousand industry events annually, is one of the most active manufacturing organizations in North America.

F or more than a quarter century EMC has been responsible for contributing significant knowledge, expertise and resources towards the success of over 13,000 consortium and online

member manufacturers, representing every province across Canada. EMC’s total manufacturing audience includes 40,000+ employers and 600,000 manufacturing employees.

F ounded in the mid-1980s and incorporated in 1997, EMC facilitates events in

60 consortium regions, across over 450 communities. Offering a broad range of hands-on programs and services, EMC is helping manufacturers to lower costs, access greater opportunities to compete for business and improve efficiencies in dealing with the day-to-day complexities of running a manufacturing operation.

We are often asked what separates us from other organizations who claim to be able to help you achieve the great things you want for your business. Whether you are a business owner, a general manager, a back shift supervisor or a hands-on employee, you all play a part in the success of your operation. You all know it is not always an easy thing to achieve. The speed of commerce, the global economy, social media, etc. are all adding new challenges to what you do every day, in some cases every minute. The good news is - you are not alone. Manufacturers all around you are dealing with the same things right now. They are on your street, in your town, or in your region and they produce a whole range of products. Some are struggling to solve the same puzzle you solved last week, while others may have solved your puzzle last month. The challenge is, how do you get to know these people? You drive by their building everyday on your way to work. In many cases, you may not know what they do in their building, but they are manufacturers and we know many of them. We also respect them as the experts that they are. They have been successful and have the scars to prove it - those are the true experts. We understand that no one company has it all figured out, and we have

seen what can happen when companies and strangers share experiences and swap ideas. Neat things happen, discussions happen, and puzzles are sometimes solved. The biggest challenge for some is getting their heads around the idea that it is okay to explain how your first attempt at something may have failed. Trial and error can happen to anyone and you learned from it. Unlike most other organizations that solely provide informational webinars or training courses, EMC provides opportunities for manufacturers to share learnings with each other through our best-practice roundtable sessions, industry events and Member Needs Help service.

Sharing is a learned skill that comes with practice. Help someone out and they help you. Nobody loses. What is to gain? You become a better, more successful business as a result. Do this a couple of times and you will understand what separates EMC from the rest of the crowd.

Furthermore, EMC’s Field Service Advisors (FSA) located across Canada provides services to manufacturers through hands-on facilitation of knowledge exchange and networking between companies, government and other relevant organizations. Each FSA provides individualized attention to EMC members to assist them with challenges in their organizations and working towards solutions.

Joining EMC as a member or participating in EMC’s Food and Beverage Sector Initiatives and industry events provides a perfect forum for building new ideas, discussing innovative concepts, and forming long-lasting

relationships with other member manufacturers on the same journey as you. Bringing people together at the grassroots level is the foundation of EMC.

We are excited to announce that Leah Nacua, Field Service Advisor for EMC, is taking the lead on our Food Beverage Sector Initiatives. Leah has more than 18 years of hands-on experience in the manufacturing sector. She worked as a process engineer and manufacturing engineer for several years in a wide breadth of industries, including automotive, semiconductor, solar-cells, biotech, plastics extrusion, and food packaging. Nacua primarily supported quality and continuous improvement initiatives and, in addition, supported health and safety initiatives as part of an emergency response team and has been part of joint health and safety teams in multiple organizations. Nacua has experience in conducting internal quality audits. She is also trained in HACCP and food defense and managed a food safety program that led to a company’s initial GFSI certification.

N acua obtained her Chemical Engineering Degree from the University of Waterloo. Prior to joining EMC, she obtained her MBA from Wilfrid Laurier University with a specialization in Strategic Management. She is a licensed Professional Engineer in the Province of Ontario.

B elieving in the power of collaboration, Nacua is passionate about manufacturing, continuous improvement, and sustainability. She enjoys supporting manufacturers in overcoming their challenges, finding ways

to improve their operations, and achieving success.

N acua’s first Food and Beverage Sector Initiative event, coming up on June 3, will focus on Change Management - Overcoming Resistance, Building Buy-In and Getting Real Results. Laura Lee-Blake, Chief People Officer with Pearle Hospitality Inc., will join us to lead a discussion on effective ways human resources leaders can successfully partner with their business leaders to champion change through adversity.

I n addition to our industry events, EMC is offering full and partial funding to manufacturing employers across Canada to implement Manufacturing Essentials Certification (MEC) programs. MEC program streams include production worker, supervisor, leadership, productivity and continuous improvement, health and safety and onboarding. MEC programs provides up to 40 hours (4-5 hours/week over eight weeks) of skills training using industry-validated learning programs, live workshops, facilitated online learning with ongoing support and assistance from professional trainers and a workplace action-based learning project.

If you, or a manufacturer you know down the street, are interested in this opportunity, please reach out to EMC’s Learning Centre. Ontario MEC Leadership sessions start June 22.

In closing, EMC is here for Canadian manufacturers. If you are a member, try to get out to your next local event to meet your neighbours again, in a virtual setting or in-person when the time is right. If you are not yet involved with EMC, get in touch.