MADE FOR CANADA, BY CANADA

FROM ONE NEIGHBOUR TO ANOTHER—WE BELIEVE IN BETTER

WE ARE PROUDLY MADE IN CANADA

As Canada’s sole polypropylene producer, we provide top-tier products to keep Canadian businesses competitive globally.

WE ARE SUSTAINABLE

Built with sustainability in mind, our Alberta production facility is designed to produce 525,000 tonnes of PP per year using locally sourced propane stock.

WE ARE BUILT TO DELIVER

Our 1,600 railcars and distribution network ensures reliable flow of highperformance polymers to fuel Canadian manufacturing.

Because when we build here, we build stronger. When we invest here, we invest in each other. And when we choose Canadian, we choose a future we can all be proud of.

At Heartland Polymers, we believe in the strength of Canadian industry, in the resilience of our workers, and in the power of innovation built right here at home.

From the very heart of Alberta’s diverse energy sector to the manufacturing hubs across the nation, our polypropylene isn’t just a product—it’s a promise. A promise of quality, reliability, and of a future where Canadian businesses thrive through strategic partnerships.

SUPPORT CANADIAN MADE

2025

84 • NUMBER 4

FROM THE ARCHIVES

The January 1997 issue of Canadian Plastics reported on the coming introduction of the new QS-9000 quality management system standard. Developed during the early 1990s by Ford, General Motors, and Chrysler – the “Big Three” – the standard was based on ISO-9000 but included additional requirements tailored for automotive suppliers. QS-9000 focused on defect prevention, continuous improvement, and reducing variation and waste in the supply chain. All suppliers to the Big Three had to be registered to QS9000 by Dec. 31, 1997, our story noted.

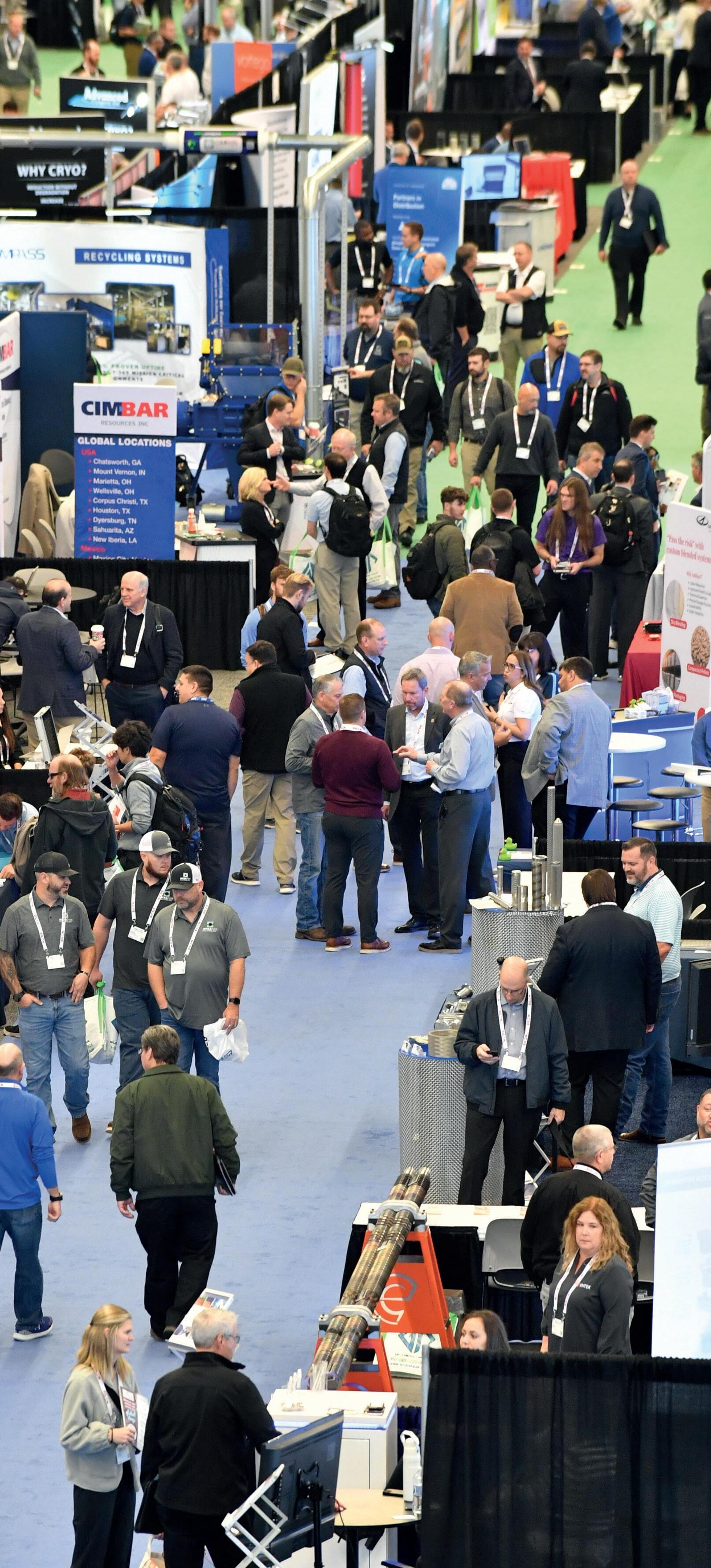

Number of the month: 27*

*The number of exhibitor presentations at two K 2025 preview events held in Germany and the Netherlands in June. (See pg. 16)

cover story

10 T HERMOFORMING: Taking stock of thermoforming

4 Editor’s View: Is AI fantastic for plastic?

5 Ideas & Innovations:

3D printing resin enables simultaneous printing of solid and dissolvable objects

6 News:

• Plastics treaty talks fail in Geneva

• W&H buys blown film equipment supplier Addex

• MontClerc invests in Polykar to support company’s growth

• Supplier News a nd People

24 Technology Showcase

25 A dvertising Index

26 Technical Tips: Increasing the life of your mold

Advances in machinery, resins, and tooling are enabling the use of t hermoforming in new applications. But some challenges remain to this well-established process.

features

16 K 2 025 PREVIEW: Advance notice

At media events in Germany and the Netherlands, exhibitors previewed some of the highlights that await show attendees at the massive K 2025 trade show in Düsseldorf this October.

22 RECYCLING: Sustane-able

Halifax-based cleantech firm Sustane Technologies has developed a disruptive solution that turns hard-to-recycle waste plastic into engineered feedstock for virgin plastic production.

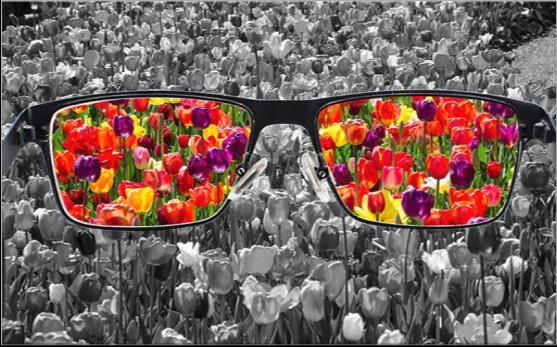

Is AI fantastic for plastic?

Irecently attended media events in Europe where exhibiting companies at the upcoming K 2025 trade show previewed their K plans (see the report beginning on pg. 16). T here was a Q&A session after each presentation, and I’d conservatively estimate that onethird of all queries directed at the machinery makers dealt with artificial intelligence (AI) – specifically, was said company either incorporating or planning to incorporate AI into its machines? (Editor’s note: they all answered yes.)

This comes as no surprise: AI continues to revolutionize industries, and the plastics sector is no exception. Far from coming, AI is already here, and just in the nick of time: during a period in manufacturing where labour is hard to find, train, and keep; when machine uptime and optimization is more important than ever; and where product quality and consistency is non-negotiable.

These are still early days, and most AI in the plastics industry has been limited to machine learning, which uses data to make predictions. But the outlines of what AI can contribute to our sector overall are becoming clear: AI has the potential to enhance precision and productivity, increase uptime, transform supply chain management, and bridge the skills gap. For processing, AI enables predictive maintenance, reduces scrap and energy usage, and shortens time to market – AI’s capacity to analyze datasets and derive actionable insights enables molders to optimize production processes and maximize output; by leveraging AI, they can fine-tune production parameters in real time, optimizing resource allocation and enhancing overall productivity. For recycling, AI can identify plastics by type for efficient sorting, reducing contamination and improving recycling rates (AI is already being used for mapping and tracking marine plastic, for

example). And for materials, AI technologies can enable the development of smarter, more innovative resins, as advanced algorithms can help researchers identify new polymer combinations that were previously unexplored.

Are there downsides? Probably, at least i n t he short t erm. T hese would include data security and privacy concerns, the high cost of implementation and integration, and the possibility of algorithmic bias. And some people probably worry about over-reliance on AI technology, especially given that some AI algorithms – particularly deep learning models – aren’t transparent in their decision-making process, making it hard to understand how they arrive at their conclusions. People won’t accept what they don’t understand, in other words. Related to this, there are concerns that over-reliance on AI can lead to a decline in human expertise and decision-making capabilities.

If this last point sounds familiar, that’s because it is: similar concerns were raised about the rising use of industrial automation in the years before the pandemic – that it would lead to job losses in manufacturing as machines take over tasks previously performed by humans. It hasn’t worked out that way –numerous studies have all found that (a) robots aren’t replacing humans at the rate most people think, and (b) people are prone to severely exaggerate the rate of robot takeover. But it’s a deep-seated concern that echoes all the way back to the Industrial Revolution, when people believed the appearance of rudimentary machines would take over industries such as textile production and agricultural work. It did the opposite.

Time will tell, but I think AI will also do the opposite – that it will increase the efficiency of our industry, and of the people at the heart of it.

Reader Service

Print and digital subscription inquiries or changes, please contact Angelita Potal

Tel: 416-510-5113

Fax: 416-510-6875

email: apotal@annexbusinessmedia.com

Mail: 111 Gordon Baker Rd., Suite 400 Toronto, ON M2H 3R1

EDITOR M ark Stephen 416-510-5110 mstephen@canplastics.com

ASSOCIATE PUBLISHER Stephen Kranabetter C: 416-561-5362 W: 416-510-6791 skranabetter@annexbusinessmedia.com

MEDIA DESIGNER Alison Keba akeba@annexbusinessmedia.com

ACCOUNT COORDINATOR Kristine Deokaran 416-510-6774 kdeokaran@annexbusinessmedia.com

AUDIENCE DEVELOPMENT MANAGER Layla Samel 416-510-5187 lsamel@annexbusinessmedia.com

GROUP PUBLISHER/VP SALES Paul Grossinger pgrossinger@annexbusinessmedia.com

CEO Scott Jamieson sjamieson@annexbusinessmedia.com

PRINTED IN CANADA ISSN 008-4778 (Print) ISSN 1923-3671 (Online)

Publication Mail Agreement #40065710

2025 SUBSCRIPTION RATES

5 issues Canadian Plastics, plus Dec. 2025 Buyers’ Guide: CANADA: Single copy $12.00 plus applicable taxes

1 Year $79.05 plus applicable taxes

2 Years $125.97 plus applicable taxes

USA: $179.52 (CAD) / year FOREIGN: $205.02 (CAD) / year

Occasionally, Canadian Plastics will mail information on behalf of industry related groups whose products and services we believe could be of interest to you. If you prefer not to receive this information, please contact our audience development department in any of the four ways listed above.

Annex Privacy Officer privacy@annexbusinessmedia.com • Tel: 800-668-2374

No part of the editorial content of this publication can be reprinted without the publisher’s written permission ©2025 Annex Business Media. All rights reserved. Opinions expressed in this magazine are not necessarily those of the editor or the publisher. No liability is assumed for errors or omissions.

All advertising is subject to the publisher’s approval. Such approval does not imply any endorsement of the products or services advertised. Publisher reserves the right to refuse advertising that does not meet the standards of the publication.

MEMBER: Magazines Canada, Canadian Plastics Industry Association.

Mark Stephen, editor mstephen@canplastics.com

3D printing resin enables simultaneous printing of solid and dissolvable objects

One-pot recipes – which are meals made entirely in one cooking vessel, start to finish – make preparing meals quick and easy. Researchers in California have developed an approach they say can do the same for additive manufacturing.

Supported i n part by f unding f rom the U.S. D epartment of E nergy, t he research team – composed of scientists from University of C alifornia Santa Barbara and Lawrence Livermore National Laboratory, in Livermore, Calif. – has demonstrated a new resin that simultaneously creates solid objects and dissolvable structural supports, depending on what type of light the r esin is exposed t o. T he approach could increase the applications for 3D-printed objects, including tissue engineering scaffolds, joints, and hinges.

The p roblem t he t eam t ried t o solve centres around vat polymerization, which is a 3D printing process that uses a vat or container of liquid photopolymer resin and selectively cures it with light, layer by layer, to build a 3D object. T his 3D p rinting method is t ypically fast and inexpensive but it has downsides, including the fact that intricate items usually require supports such as temporary scaffolds, which get attached when the original object is dipped into a second batch of resin –this second step adds time and expense to the process because of the extra resin and extra effort required to remove the temporary supports.

The C alifornia r esearchers h ave developed a one-pot method of vat polymerization by formulating a single resin that hardens into permanent and dissolvable materials when exposed to ultraviolet (UV) and visible light, respectively. T hey a lso c reated a special 3D printer that emits both types of light, allowing them to print an object

and its supports simultaneously.

The r esearchers m ixed d ifferent components, including acrylate/methacrylate and epoxy monomers, as well as photoreactive substances that absorb both visible and UV light, to create their one-pot resin. During initial tests with the photoreactive substance, they observed that under visible light the acrylate monomers solidified and formed dissolvable, anhydride-based support materials. Under UV light, but not visible light, the epoxy monomers hardened into the permanent portion of the object.

To d issolve t he support m aterial, the researchers added the objects to a sodium hydroxide solution at room temperature, and the permanent object was revealed within 15 minutes. Importantly, the researchers note that the anhydride-based scaffolds degraded into nontoxic compounds.

In subsequent demonstrations of the new approach, the team created increasingly complex structures: a checkerboard pattern, a cross, interlocking rings (pictured), and two balls in a h elix. T hese o bjects would b e challenging to fabricate with layerbased vat polymerization printing methods, the researchers noted, as they’re not structurally supported by previous layers. “Vat photopolymerization is known for its fast and highresolution printing, but one of the most nerve-wracking parts after printing is manually removing supports for intricate interlocking and overhang structures,” said Maxim Shusteff, a g roup leader at Lawrence Livermore National Laboratory. “We’re very excited that we can use simple chemistry to solve this issue while also broadening the range of accessible 3D-printable materials and geometries.” CPL

Elaborate multipart objects, like this chain, can be 3D-printed all at once using a new vat polymerization technique.

Plastic treaty talks fail in Geneva

The global plastics treaty negotiations in Geneva, Switzerland have ended without a deal, as countries remained divided over production limits and how to tackle the issue of plastic waste.

The 10-day summit, which ended on Aug. 15, was the sixth session of the Intergovernmental Negotiating Committee (INC) and was held at the United Nations headquarters and attended by delegates from more than 180 countries. Originally, the negotiations were supposed to conclude during the fifth round of I NC talks in South Korea in December 2025 – wrapping up a two-year process to create a legally binding document to stop plastic pollution – but those discussions fell apart mostly over the issue of production cuts.

During the Geneva session, a coalition of 100 European, A frican, a nd South American nations, along with Canada, Mexico, South Korea, Japan, a nd small island states, called for legally binding caps on plastic production. Many also demanded action to tackle toxic chemicals in plastics. But as in the past, oilproducing Middle East nations, the U.S., Russia, India, and some other nations lined up against production limits, arguing the treaty should focus more on recy-

cling, reuse, and redesign than production caps or a phase-out of chemicals.

Luis Vayas Valdivieso, the chair of the INC, wrote and presented two drafts of treaty text based on the views expressed by the countries, but representatives from 184 countries rejected both as a basis for their negotiations. Plastics industry groups have opposed including production limits and chemical toxicity provisions in the treaty, but have supported a treaty that keeps plastics out of the environment. “The plastics industry came to Geneva ready to work toward a practical, science-based agreement

W&H buys blown film equipment supplier Addex

Windmoeller & Hoelscher Corp. (W&H) has acquired Addex Inc., a supplier of blown film extrusion equipment with a special emphasis on bubble-cooling technology, for an undisclosed price.

Newark, N.Y.-based Addex will continue to operate independently under its current name, according to an Aug. 1 news release. The company – which was founded in 1989 – will maintain its existing product lines and customer relationships, with a continued focus on the Canadian and U.S. markets.

Brad Humbolt, who served as sales director of corporate accounts at W&H, has assumed the role of Addex president

from Addex co-founder Bob Cree, who has transitioned into a new role as director of special projects.

focused on the original purpose of these talks: keeping plastic out of the environment,” said Matt Seaholm, president a nd CEO of the Washington, D.C.-based Plastics Industry Association. “Unfortunately, significant gaps remain, and there was an unwillingness among some participants to focus on addressing plastic waste, instead pushing approaches that made it impossible to reach consensus. This was a missed opportunity.”

Despite the deadlock, the INC committee said negotiations will continue at a future date, but no timetable for this has been announced yet. CPL

The deal builds on a prior business relationship between the two firms: in 2020, W&H reached an exclusive agreement with Addex to incorporate Addex’s Intensive Cooling gauge control technology into some of its blown film extrusion lines. The technology improves the stability of the bubble and allows manufacturers to work with difficult-to-process films more quickly.

W&H, which is based in Lincoln, R.I., is the North American subsidiary of Windmöller & Hölscher Group, a familyowned German supplier of film extrusion lines, printing presses, and converting equipment for the production of flexible packaging.

Delegates consult during the treaty talks in Geneva.

From left: Andrew Wheeler of Windmoeller & Hoelscher Corp.; and Brad Humbolt, Bob Cree, and Rick von Kraus of Addex.

Canada’s E. Hofmann expands to U.S.

E. Hofmann Plastics Inc., a rigid packaging supplier based in Orangeville, Ont., is investing US$43 m illion to establish its first production facility in the U.S.

The plant will be in Madisonville, Ky., and is designed to help the firm meet growing U.S. customer demand a nd strengthen its position in the North American market, according to a June 26 statement from the office of Kentucky Governor Andy Beshear. The investment will include the construction of a 100,000-square-foot building, new equipment, machinery, automation, and molds; and will create 164 jobs.

Construction is expected to begin this year and be completed in 2026.

Plastics design trailblazer Glenn Beall passes away

Plastics pioneer and Plastics Hall of Fame member Glenn Beall – an engineer, consultant, teacher, and editor who played a key role in improving plastic design over his 60-year career – passed away on July 24 at age 92.

Based in Illinois, Beall began his career at Abbott Laboratories, where he helped design disposable drug delivery systems, earning 12 patents. He then founded Glenn Beall Engineering Inc., and later Glenn Beall Plastics Ltd., where his influential designs earned another 23 patents.

He taught more than 650 technical seminars, reaching nearly 30,000 professionals, making complex concepts in design and processing accessible, practical, and widely adopted. His areas of expertise included rotational molding, injection molding, design, additive manufacturing, and thermoforming.

Beginning in 1960, Beall was also a h ighly engaged member of the Society of Plastics Engineers (SPE) a nd served as president of the Chicago chapter in 1967. He was named a n SPE Fellow in 1985; a Distinguished Member in 1990; a nd in 1993, he received SPE’s Award for Outstanding Achievement in Plastics Education.

CPL

E. Hofmann Plastics makes rigid plastics packaging with processes including injection molding, thermoforming, and coextrusion.

In 1997, Beall was inducted into the Plastics Hall of Fame. CPL

Stock Machines Ready for Delivery

MontClerc invests in Polykar to support company’s growth

Packaging supplier Polykar Industries Inc. has secured new backing from Quebec City-based private equity firm MontClerc Capital, which has purchased a minority stake in the company to fund capacity expansion to support Polykar’s growth in North America.

Headquartered in Saint-Laurent, Que., Polykar is developing environmentally friendly flexible packaging solutions to meet growing market demand.

In an Aug. 5 statement, MontClerc Capital said it chose to invest because Polykar has “strong leadership, high-quality products, and solid growth potential.” The firm focuses on supporting Quebec-based companies through strategic growth investments.

Founded in 1987, Polykar specializes in producing polyethylene film for converters, garbage bags, certified compostable bags, food, and industrial packaging. CPL

THE NEED FOR SPEED

Are changeovers slowing you down? Win back precious time with Dyna-Purge! Our commercial purging compounds clean on the first pass, minimizing machine downtime to maximize your productivity. Plus, only Dyna-Purge provides product and technical support built on over 30 years of innovation. Our customers enjoy the industry’s most effective purging product, outstanding customer service and reliable results. Request a free sample of Dyna-Purge and see for yourself.

Discover the Difference. 866-607-8743 www.dynapurge.com

SUPPLIER NEWS

– M ississauga, Ont.-based DiPaolo Machine Tools is now the exclusive representative in Canada and the U.S. for Italy-based Rosa Ermando S.p.A, the maker of Rosa Favretto precision surface grinding machines for high-precision flat surface and profile applications, used by the moldmaking industry.

PEOPLE

– L ondon, Ont.-based plastics recycling technology developer Aduro Clean Technologies Inc. has named David Weizenbach as chief operating officer.

– Marian Van Hoek has been appointed managing director of BASF Canada, the Canadian subsidiary of global chemical maker BASF SE.

– Beaverton, Mich.-based BMG, a manufacturer of thermoforming and automation equipment, has named Tim Carpenter as CEO.

– The Canadian Association of Mold Makers (CAMM), based in Windsor, Ont., has named Natalia Stephen as chair, and Darryl Gratrix as vice-chair.

– Calgary-based polypropylene maker Heartland Polymers has named Kimberly Benedict as vice president of operations.

– Kongskilde Industries, a Danish material handling equipment maker, has named Oscar William Gunner as CEO.

– Chippewa Falls, Wis.-based Nordson Corp.’s Polymer P rocessing Systems division has named Chase Collier as regional sales manager for the EDI line of extrusion dies.

– Brampton, Ont.-based StackTeck Systems Ltd., a manufacturer of high-volume injection molding tools, has appointed Mike Gould as president and CEO.

– Danish collaborative robot maker Universal Robots has appointed Jean-Pierre Hathout as president.

Natalia Stephen

Chase Collier Jean-Pierre Hathout

Tim Carpenter

David Weizenbach

Mike Gould

Marian Van Hoek

Oscar William Gunner

Photo Credit: Polykar Industries Inc.

Kimberly Benedict

Darryl Gratrix

TAKING STOCK OF THERMOFORMING

Advances in machinery, resins, and tooling are enabling the use of thermoforming in new applications. But some challenges remain to this wellestablished process.

By Mark Stephen, editor

College football fans consider the Rose Bowl as “The Granddaddy of T hem All.” T he plastics sector can a rguably hold thermoforming in similar esteem. The process of heating a plastic sheet until it becomes pliable and fitting it around or inside a custom-made mold, thermoforming is considered as one of the oldest methods of forming useful articles of plastic, with roots stretching back to the 1870s, when English entrepreneurs developed a method using steam heat and pressure with steel molds to shape celluloid, creating items like toys and bottles. Modern thermoforming then took shape with the development of vacuum forming machines and the use of materials like polystyrene (PS) and polyvinyl chloride (PVC) beginning in the 1940s.

But despite this august history, thermoforming still feels underappreciated at times, overshadowed by injection molding and extrusion. It shouldn’t be this way, however, because thermoforming is a versatile, low-stress process that enables parts to be produced stronger with fewer concerns of twist or warp, and can create everything from lightweight, thin-wall packaging to heavy-gauge panels and parts for many industries, including auto-

motive, agriculture, construction, medical, kitchen appliance, furniture, and aerospace. Indeed, when it comes to rigid, thin-wall packaging generally, the experts say, thermoforming is the process that enables the thinnest wall thicknesses with high top-load strength values. Equally good, the process offers fast lead times and low initial startup costs, making it an ideal manufacturing option for low-volume orders; can be performed with a wide range of resins, including the latest bioplastics; and benefits from the fact that thermoform tooling has evolved significantly over the years, becoming both more sophisticated and less expensive, now costing roughly a quarter of injection mold tooling.

And as with other forms of plastics

production equipment, thermoforming is evolving to meet the needs of the moment through advancements in technology, tooling, and materials. Here’s a look at how the process works, some of the latest developments, the factors that are driving growth in the sector, and some challenges that remain.

THERMOFORMING 101

Modern thermoforming takes the form of either vacuum or pressure forming. In the former, powerful vacuum pressure pulls the plastic tightly against the mold to create the necessary shape, typically for parts that are relatively simple in design and that don’t require deep texture. Pressure forming, meanwhile, involves suctioning air out from below the plastic to pull it

against the mold while a powerful jet of air is pressing the plastic into the mold from above, and is often used as a lowercost alternative to injection molding as it can often get similar results more efficiently. Digging a bit deeper, the two main thermoforming techniques used for plastic part creation are thin-gauge and heavy-gauge thermoforming. In simple terms, thin-gauge thermoforming involves heating a thin sheet of plastic until it becomes pliable, and is typically used for packaging, medical and healthcare, and disposable items. Heavy-gauge thermoforming, by contrast, uses thicker sheets of plastic to create durable products like automotive components, recreational vehicles and boats, industrial equipment, and electronic enclosures, and it tends to compete primarily with processes such as rotational molding, structural foam, and metal forming.

Advances in resins, sheet, and tooling are enabling the use of thermoforming in new applications. But despite this, industry veteran Jay Waddell – who founded Plastic Concepts & Innovations, a heavy-gauge thermoforming consultancy in 1999 – believes that some in the plastics sector still don’t understand the capabilities of thermo forming. “Many people don’t know the basics of pressure and vacuum forming and heavy-gauge thermoforming, or what can be achieved using those pro cesses,” he said. “They think injection molding is still the better solution.” Eero Laakso, president at Ontario thin-gauge thermoformer Elmes Packaging, says that while the fundamental thermoform ing principle hasn’t changed, advances in materials, equipment, tooling, and controls offer technological and eco nomic benefits. “Modern machines are all servo-controlled and fully electric, and that’s the standard technology now,” he said. “Our older machines are hydraulic or hybrids, and they’re not always fast enough for efficient, eco nomical production in high-volume applications. All-electric machines con sume less energy compared to hydraulic or pneumatic machines, leading to lower

operating costs, higher throughput, and more accurate and complex parts.”

A QUESTION OF CONTROL

Machine controls are also getting smarter, Laakso noted, as they have adapted in recent years to Industry 4.0 protocols and now to Industry 5.0. “The control technol-

ogy with servo machines is definitely superior to older units,” he said. “Better control increases the uniformity of the material thickness throughout the part, which allows for thinner gauge material for the same application, which saves material and money.” Machinery supplier WM Thermoforming has done work to

That happened in 1877.

What has kept our clients happy?

No matter what our competitors say, there’s only one Struktol – producing customized solutions and proprietary blends for:

improve both the machines and the controls. Most recently, the company has introduced upgrades to its FC1000 IM2 thermoformer, including an integrated visual inspection system. The software improvements include multi-user access so that several users can log into it simultaneously to consult machine data; it also has extended diagnostics, and improved graphics and settings that automatically calculate up to 90 per cent of the optimal machine settings and process parameters. Also, users can check machine performance remotely. And as an evolution of the FC1000 series, the company is also introducing the FXL1000 for processors looking to upgrade their thermoforming equipment while maintaining tooling compatibility and maximizing production efficiency.

Providing better control to customers – especially heat control – has always been a pressing concern for the OEMs. Heat control is crucial in thermoforming as it directly impacts the quality and precision of the final product – uniform heating of the plastic sheet is essential for proper softening, accurate shaping, and successful cooling, which minimizes defects like warping and uneven thickness. Monitoring and controlling the temperature throughout the process, using methods like infrared sensors and specialized heaters, ensures consistent results and efficient material usage. “Heat control technology has gotten better as far as giving more efficient energy distribution across the material, which is a key element in any forming operation,” Jay Waddell said. But there’s still work to be done, he noted. “The tools we have now for heavygauge measure only the surface temperature, not the core temperature, so there’s a lot of intuitive guesswork that thermoformers are still forced to do about the core temperature,” he said. “Heat transfer is one of the major issues in heavy-gauge thermoforming, and this is an area that still needs attention.”

As with other types of plastics manufacturing, artificial intelligence (AI) is beginning to make inroads in thermoforming. WM Thermoforming recently intro-

duced an AI-powered vision system, allowing automated inline inspection of thermoformed products instead of manual inspections. Developed by Ausil Systems of Spain, the system continuously improves, WM officials said, learning what’s acceptable and what’s not so that, with each piece inspected, it becomes even more skilled at identifying imperfections. And on the tooling side, AI algorithms can analyze extensive historical data and real-time inputs to accurately predict how plastic sheets will flow within the mold, allowing engineers to adjust mold geometries to avoid problems like air traps, material accumulation, or thin-wall defects. Going forward, some experts say, molds will be able to automatically adjust designs based on production feedback, continuously optimizing performance and production parameters. So look for the use of AI and machine learning to keep growing. “As people become more familiar with AI and its possibilities, it’s going to be integrated more into the heavygauge thermoforming process,” Jay Waddell said. “It’s already there, to a certain degree, in the inline process now, identifying acceptable and unacceptable product characteristics on fast-moving parts. A big current problem with thermoforming is having a trained operator who understands the process: AI can almost foolproof that, but it has to have the right data inputs, and this process is only just beginning.”

GOING GREEN

A big trend that Eero Laakso sees in thermoforming is the growing awareness of sustainability and corresponding growth in the use of materials that can be easily recycled. “The industry is switching to PET [polyethylene terephthalate] f rom other materials that are less easily recycled,” he said. “This trend began several

WM Thermoforming recently partnered with Spain’s Ausil Systems for an AI-powered vision system.

years ago.” Thermoforming with recycled content – where materials are recycled back into similar products – is also on the rise whenever possible, as is the use of biomaterials. For example, the Sulapacbrand biomaterial is making inroads. Made by Sulapac, the material is a woodplastic composite made from biodegradable biopolymers and sustainable fillers such as wood side streams and natural clay minerals, with the bio-based content in all grades ranging from 70 to 100 per cent. According to Sulapac officials, all raw materials are sustainably sourced, food contact compliant, and industrially compostable. Richmond, Ind.-based Primex Plastics Corp., said to be one of North America’s largest sheet extruders, is now making customized sheet based on Sulapac-brand biomaterial, Sulapac officials said. The Primex sheets can be used as a replacement for sheet made f rom PS, polypropylene, and PET.

On the recycled material side, Pacur LLC, an Oshkosh, Wis.-based custom sheet extruder, is now using Eastar Renew 6763 copolyester from Eastman to make rigid, thermoformed sterile barrier packaging. Eastman officials say that the material, produced using molecular recycling, is indistinguishable from the company’s Eastar 6763 copolyester, having the same durability, safety, and performance characteristics. And the new CapFormer system from Origin Materials combines a number of technologies — including a thermoformer, mold, and slitand-fold technology — to make possible the use of PET and recycled PET (rPET) for caps and closures. Origin officials

anticipate the system will be able to produce caps for an array of beverage bottles, as well as food packaging and medical products; with these innovations, users could churn out packaging that’s made entirely from PET, they said, which would aid circularity efforts.

These new recycled a nd bio-based materials are only part of the story. “Material advances have gotten better for thermoforming in general, including virgin sheet material,” said Jay Waddell. “In the polyolefins especially, the suppliers have become more proficient in extruding material and meeting specs.” The development of advanced thermoplastics with enhanced properties, such as flame retardancy and improved thermal conductivity, will open new doors for thermoforming in the electric vehicle sector. “For instance, materials with built-in heat dissipation could revolutionize battery housing designs,” Waddell said.

AUTOMATING IT

The use of automation in thermoforming is also on the rise, owing to such factors as labour availability, higher speed thermoformers that are restricted by the ability to handle parts at high speed, and demands for more stringent quality control. Part removal and handling are key focus areas for thermoforming automation, especially such tasks as sheet feeding, heating, forming, cooling, stacking, and trimming. Almost all suppliers are now offering automation equipment, including BMG’s NAS, which recently launched the Mantis robotic trim press handling system, which replaces manual labour by robotically removing product from the trim press and then transferring it directly to the wrapper/bagger or the next phase of the system in place. Also new is BMG’s C-Rush die-cutter handling system, which automates the process of removing sidewalls from vertical die-cutters and robotically places the sidewalls into work-in-progress containers. And Kiefel’s new Kiefel Speed Automation (KSA) is a modular system that’s matched to the Speedformer K MD series and can be integrated into both new and

existing systems. Kiefel officials say the KSA provides intelligent, modular automation solutions suited to the most common applications, which contain fewer product-specific format parts and can still be optimally adapted to customer requirements.

For shops like Elmes Packaging, using automation is the new reality. “Our lines are now fully automated and only need one operator at the end for packaging,” said Eero Laakso. But behind the drive towards more robotics is a problem that has hampered thermoforming for decades, and which isn’t going away: the skilled labour shortage. And it’s only a partial solution. “Automation can only go so far – it hasn’t yet reached the level of fully automating everything, so we still need skilled workers to set up the molds and run the machines,” Laakso said. “But these workers are hard to replace when they retire because these skills are rare among young people.”

One of the key advantages of thermoforming is the ability to make low-cost tooling – ensuring accurate and consistent angles, lines, texture, and shape to both the design and from one piece to the next – leading to shorter lead times. Which can make the relationship between tooling maker and thermoformer especially important. “We do custom thin-gauge thermoforming, so our tools are specific to each customer’s project,” Laakso said. “An experienced toolmaker in thermoforming can make all the difference by creating unique design and part geometries. Custom shops like ours need to have a very good relationship with excellent thermoforming toolmakers, and this includes working with them on the prototyping stage to solve all the issues before building a production tool.”

The t hermoform m achine – a nd tooling – market took a hit last year when manufacturer SencorpWhite I nc. stopped building new thermoforming machines, citing difficult business conditions. Machinery makers such as Illig, Kiefel, and BMG have stepped up with options for customers looking to replace

Origin Materials’s CapFormer system combines a number of technologies – including a thermoformer, mold, and slit-and-fold technology – to make possible the use of both PET and rPET in the manufacture of caps and closures.

SencorpWhite’s existing thermoforming machines or buy additional equipment while keeping its tooling. Illig, for example, recently unveiled the RDF 85 XL modular thermoforming system, which has an open tool interface to allow customers to r un t he f irm’s Sencorp 2500 tools without prior adaption.

THE ROAD AHEAD

Heading into late 2025, the thermoforming industry continues to grow, driven by technological advancements and expanding applications across diverse sectors. Industries such as automotive and medical are leading the way in leveraging thermoforming’s capabilities to produce lightweight, durable components. Companies are adopting new technologies like automated production systems and advanced material formulations to stay competitive. And there’s a growing emphasis on processes like vacuum forming and twin-sheet forming to meet the evolving needs of industries such as refrigeration and transportation.

But the technical challenges that have always been a part of thermoforming –heat control, difficulties in achieving uniform wall thickness, and constraints on part complexity – have only been partially solved. And may never be, without radical innovation. “Some of these variables are part of the thermoforming process and are being worked on by the

machinery suppliers,” said Jay Waddell. “But others come from the extruders that create the thermoform sheet – from their equipment and their operations that cause some of the variables the thermoformers then have to deal with. T hese a re variations that can’t be solved by the extrusion processes currently in use; it needs the development of different processes, and these are now being explored by extrusion companies.”

And on the business side, there are

When Colour Matters the Most

www.ccc-group.com/plastics info_cccplastics@ccc-group.com

challenges in this economic moment, especially for Canadian shops. “ The political environment in Canada – single-use plastic bans and false concerns about toxicity – is a headwind for us that American shops don’t have,” said Eero Laakso. “And there are cost disadvantages in Ontario, such as high facility costs and energy prices, that can make a difference in whether a converter makes a profit or not. Also, our American customers are concerned about tariffs and would rather deal with a domestic supplier than a Canadian one at the moment.” And, he added, it just seems that, overall, there’s been a seachange in customer priority. “It’s all about price now, at the end of the day: customers will ask about using recycled content in a product so they can market it as sustainable, but if it increases the cost they’re ultimately not interested,” Laakso said. “Price was always an issue, but it’s now the deciding issue.”

RESOURCE

LIST

BMG Canada (Chester, N.S.); www.onebmg.com

Eastman Chemical Co. (Kingsport, Tenn.); www.eastman.com

Elmes Packaging Inc. (Mississauga, Ont.); www.elmespackaging.com

Illig L.P. (Indianapolis, Ind.); www.illig.de

Kiefel Technologies GmbH (Freilassing Germany); www.kiefel.com

Brueckner Group USA Inc. (Dover, N.H.); www.brueckner.com

Origin Materials Inc. (West Sacramento, Calif.); www.originmaterials.com

Plastic Concepts & Innovations LLC (Mount Pleasant, S.C.); www.plasticoncepts.com

Sulapac Ltd. (Helsinki, Finland); www.sulpac.com

WM Thermoforming Machines SA (Stabio, Switzerland); www.wm-thermoforming.com

CPL

Global Corners Inc. (Oakville, Ont.); www.gciextrusion.com

ADVANCE NOTICE

At media events in Germany and the Netherlands, exhibitors previewed some of the highlights that await show attendees at the massive K 2025 trade show in Düsseldorf this October.

By Mark Stephen, editor

The trade winds aren’t called easterlies for nothing. Permanent east-to-west prevailing winds occurring in the Earth’s equatorial region, they’re crucial for global weather patterns and have historically been important for sailing navigation and trade.

Another persistent easterly movement is the flow of new plastics technologies. Europe has long been at the forefront of plastic innovation, traditionally in new machinery and more recently in the areas of recycling and sustainable materials, and it’s a well-established pattern that what first appears there soon migrates east, crossing the pond to North and South America. W hich is why the triennial K show in Düsseldorf, Germany is such a big deal. K is the largest trade show for the plastics and rubber industry in the world, and the upcoming 2025 edition scheduled for Oct. 8 to 15 – which will have more than 3,200 exhibitors from 64 countries – will, as always, give North American processors a heads-up on the latest materials, processing and auxiliary machinery, and more.

And this heads-up got its own headsup at the official prelude to K 2025, a three-day press event in Düsseldorf in June, h eld by t rade show o rganizer Messe Düsseldorf and attended by more than 70 journalists from 33 countries, as well as 15 exhibitors. Also in June, business-to-business marketing firm EMG organized a two-day K preview event in Rotterdam, Netherlands, featuring previews from 12 exhibitors.

Canadian Plastics attended both events. Here, listed alphabetically by location and category, are some highlights from all 27 of those presentations.

MATERIALS (DÜSSELDORF)

At t he D üsseldorf event, Saudi-based Advanced Petrochemical Co. discussed the recent completion of its new propane dehydrogenation plant, located in Jubail I ndustrial City, for production of p olypropylene ( PP). T he facility’s two lines apply LyondellBasell’s Spheripol a nd Spherizone t echnologies to make homopolymer, copolymer, impact, and terpolymer PP. In total, the facility has 1.65 million tonnes of capacity, including 850,000 tonnes of propylene production.

BASF introduced a reduced product carbon footprint (PCF) material range, rPCF, aimed at PCF improvements using renewable electricity and steam alongside the production process; and the new Elastollan RC thermoplastic elastomer (TPE) grades, which include up to 100

per cent recycled content with close to virgin performance by reusing postindustrial and post-consumer thermoplastic polyurethane (TPU) waste. At its K show booth, BASF says it will show reduced carbon footprint applications using its Biomass Balance approach, including a Siemens ci rcuit br eaker applying Ultramid and Ultradur resins, as well as a Kask safety helmet applying Neopor insulation.

Taiwan-based Chimei Corp. discussed its expanded Ecologue portfolio, which includes a mechanically recycled acrylonitrile butadiene styrene (ABS) resin and the world’s first light guide plate made from chemically recycled methyl m ethacrylate ( MMA). T hese materials are designed to lower the carbon footprint of products while meeting stringent performance requirements –

A presentation at the K preview event in Düsseldorf.

Photo Credit: Canadian Plastics

key factors for the packaging industry under increasing regulatory and consumer pressure. T he company also h ighlighted its investments in carbon capture, wherein it retains carbon dioxide (CO2) from its production process and uses it to make polycarbonate (PC).

Covestro discussed its commitment to achieving a fully circular economy, including through Covestro products labelled “CQ” (Circular I ntelligence), which contain at least 25 per cent alternative raw materials. For PC, the company has introduced specific labels to indicate the source of raw materials: “RE” denotes products derived from renewable resources and made with renewable energy, “RP” indicates products made from chemically recycled post-consumer waste, and “R” identifies items that incorporate mechanically recycled materials.

Domo Chemicals presented recycled and bio-based material offerings, noting that it is vertically integrated in polyamides a nd has ISCC Plus certification, with a full portfolio of mass-balanced products. At K 2025, the company will present a collaboration with Siemens on Siemens’s Sentron 5SV1 RCBO ci rcuit breaker. Fully UL-certified, the component consists of 50 per cent recycled nylon, with a 20 per cent lower CO2 footprint and colour match. At the show, it will a lso present Technyl mechanical recycling technology and a collaboration with automotive manufacturer Audi applying recycled fishing nets.

Kuraray GmbH promoted its new per- and polyfluoroalkyl substances (PFAS)-free Genestar grades for automotive applications, which are wearresistant, low-friction, and said to be well-suited for bearings, gears, and sliding systems. Thanks to its electrical conductivity and hydrophobic structure, GC 1201A is suitable for heat management of immersion-cooled batteries, Kuraray officials said, while N1005A features low weight and high resistance to hydrolysis – ideal for humid conditions and installation zones exposed to high thermal loads.

Dutch startup Paques Biomaterials discussed its patented Caleyda polyhydroxyalkanoate (PHA) material, which utilizes organic waste as feedstock. T he natural polymer is recyclable and biodegradable in all environments, according to company officials. T he company is producing pilot test quantities in 2025 and expects to supply Caleyda commercially in 2028. Paques Biomaterials also plans to make resin itself and sell licenses for production, with a goal of 50 licenses to be sold by 2035. T he company, which was spun out of the University of Delph, has seven patents and spent a decade developing a production system.

Röhm discussed how it’s launching what it calls the next generation of MMA technology — the key feedstock for its polymethyl methacrylate (PMMA) resin. The company says the carbon footprint for this process technology is 42 per cent lower than for traditional MMA. In addition, it has a capacity of 250,000 tonnes of MMA annually, with an overall yield of more than 90 per cent and annual water savings of 240 million gallons. The company also announced an alliance for postindustrial PMMA recycling.

For the electric vehicle market, Wacker is launching Elastosil R 531/60, which is designed for busbars or flat cables that provide better heat dissipation than round cables. In the event of fire, the product ceramifies and forms an electrically insulating protective layer that reliably prevents short circuits, Wacker said. T he company a lso d iscussed its new Powersil 1900 A/B, a high-consistency silicone rubber to produce hollow-core insulators; the product

is supplied as a 2K system and is suitable for manufacturing processes that involve spiral extrusion.

And Wanhua Chemical showcased its low-residue polyvinyl chloride (PVC) pharmaceutical packaging, and advanced TPU a nd PVC materials designed for medical infusion tubes, to address critical needs for both performance and safety in medical packaging, a sector increasingly aligned with environmental sustainability goals. Also debuting at K 2025 will be Wanhua’s bio-based T PU and polyether block amide (PEBA) products, which offer reduced carbon footprints while maintaining the performance needed for packaging applications in healthcare, consumer electronics, and specialty goods.

MATERIALS (ROTTERDAM)

At the EMG preview, engineering materials giant Envalior – created in 2023 through the merger of DSM Engineering Materials and Lanxess High Performance Materials – talked about a new Pocan polybutylene terephthalate ( PBT) grade designed to meet the demanding requirements of future high-voltage connectors in mobility as well as next-generation electrical and electronic components; a nd its new PFAS-free Stanyl PA 46 grade suited for wear and friction applications in crankshaft balance gears and outdoor power equipment.

Spanish recycler GCR announced a new post-consumer recyclate (PCR) brand that will be added to its Ciclic line of recycled polyolefins. Recently, company officials said, GCR has opened one of Europe’s largest and most advanced

Busbar insulated with Wacker’s Elastosil R 531/60 (orange).

Photo Credit: Wacker

plastic recycling facilities near Barcelona, Spain, with a capacity to produce over 100,000 tonnes of PCR material and 30,000 tonnes of pre-consumer recycled polyolefins annually. In addition, a new company will be added to the GCR Group, which will be focused primarily on automotive applications, with some appliance applications as well.

Styrenics producer Ineos Styrolution discussed its new Styrolution PS ECO 158K BC100, a 100 per cent bio-attributed polystyrene that fully complies with global food contact standards. Additionally, it offers exceptional heat resistance and clarity, Ineos officials said, maintaining both the quality and the visual appeal of the food packaging.

Kisuma Chemicals spotlighted its new Setogem R D, a nucleator a nd acid scavenger for PP that’s designed to help resin producers promote and control the formation of crystals within the polymer,

resulting in PP materials with outstanding stiffness, impact strength, and isotropic shrinkage. It also provides excellent heat-deflection temperature and low creep deformation, they said.

LyondellBasell touted its proprietary MoReTec advanced recycling technology, being built in the company’s hub in Colgne, Germany, which will enable it to convert post-consumer plastic waste into feedstock to produce new polymers. T he advanced recycled feedstock produced by the MoReTec facility will be used to produce polymers sold under the CirculenRevive brand for use in a range of applications, including medical and food packaging. Construction of MoReTec–1 is expected to be completed by the end of 2026.

Hungary’s MOL Group Chemicals updated its continued capacity investments in polyoil, polyolefin feedstock, and polyolefins. MOL is investing US$2

billion to boost its chemicals production capacity by 400,000 tonnes, its propylene capacity by 100,000 tonnes per year to 440,000 tonnes by 2026, and its PP capacity to 535,000 tonnes per year.

OQ, Oman’s global energy group, will b e i ntroducing 17 new p olymer grades at K 2025. Ten of these a re packaging grades, including flexible and rigid; another grade is for rotational molding of large water tanks. OQ has also partnered with Milliken Chemical to develop three new PP grades for rigid packaging, designed using Milliken’s proprietary clarifiers and additives.

Danish specialty ingredients manufacturer Palsgaard A/S highlighted its plantbased Einar series of additives for masterbatches and polymer applications. Einar 987 is an anti-fouling additive specifically designed for PP and polyethylene (PE) polymerization processes, serving as an alternative to traditional ethoxylated

amine chemistry, which has faced regulatory scrutiny in recent years. Palsgaard also offered details about Einar 608, which can be used with PE in film applications, providing cold and hot fog properties while offering anti-static effects in injection molding applications

Polyvantis GmbH – created last year through the merger of Röhm’s acrylic products business unit a nd Sabic’s f unctional forms business – showcased a pair of new products, including a new glass fibre-reinforced PC sheet product, Lexan F8000HR, targeting the aircraft interiors market. T he company claims this lightweight sheet offers superior performance and value compared to other f ully FSTcompliant aircraft interior materials, while also exhibiting good thermoforming capabilities.

Reifenhäuser subsidiary Kdesign GmbH’s new Centro-Freeze 2 is a retrofittable secondary cooling system for blown film.

PROCESSING MACHINERY

Sabic showcased several end-use applications at the event to drive home the point that the company enables more sustainable end products – including the Lumen Nordic Skin Care container, which is 97 per cent bio-based; and lightweight PP solar panels made by Dutch solar panel maker Solarge that are fully recyclable and 50 per cent lighter than conventional glass-based panels.

Brussels-based advanced materials and specialty chemicals maker Syensqo – which spun off f rom Solvay SA in late 2023 – highlighted Amodel PPA HFFR4133 OR, a new grade of its Amodelbrand polyphthalamide (PPA). A 33 per cent glass fibre-reinforced, halogen-free flame retardant, the material has a vibrant orange colour and is designed for critical electric vehicle components such as connectors and busbars.

And global energy company TotalEnergies announced plans to start up a pyrolysis plant in Grandpuits, France this year, as it continues to strive to reach its circular ambition of producing one million tonnes of circular polymers by 2030. And it will continue to invest in new circular polymers production assets worldwide, such as in Carling, France, where its new hybrid compound facility came online in 2024.

At the Düsseldorf preview, battenfeldcincinnati highlighted a number of extrusion developments it’s planning for K 2025, in particular the expansion of its high-performance, single-screw extruder line with the new solEX NG 105, which joins the 45, 60, 75, 90, and 120 models. Targeting pipe extrusion, the NG 105 has a 40:1 L/D ratio and can run at throughputs up to roughly 4,630 pounds per hour. The 105 also features a processing unit consisting of an internally grooved barrel in combination with a matching screw and grooved bush geometry, resulting in a lower axial pressure profile that reportedly reduces machine wear.

KraussMaffei will introduce the new all-electric PX series of injection molding machines, ranging in clamp force from 80 to 200 tonnes and featuring a compact design with a 23 per cent smaller footprint. Boasting improvements in energy efficiency, shot weight consistency, and short cycle times, the PX machines provide a wide range of applications and high overall equipment effectiveness, company officials said. In additive manufacturing, following the launch of the powerPrint at K 2022, KraussMaffei will present the new powerPrint FLEX and printCore variants at K 2025.

The Reifenhäuser Group announced the bundling of its digital solutions under the new Reifenhäuser N EXT br and, which consists of three modular product streams: Next.AI, Next.Learning, and NextData. Together, they’re designed to

enable manufacturers worldwide to integrate artificial intelligence (AI) quickly, efficiently, and precisely into their production processes to deliver measurable efficiency gains and make them less vulnerable to shortages of skilled workers. And Reifenhäuser subsidiary Kdesign GmbH will unveil the Centro-Freeze 2, a secondary cooling system for blown film that can be retrofitted on existing lines to reduce the temperature of the film bubble by up to 30°C or 85°F and boost output by as much as 25 per cent.

Sepro Group showed its new Visual 4 controller, engineered specifically for injection molding. T here a re t hree variations available: Visual 4, Visual 4 Plus, and Visual 4 Pro. In addition to updated cybersecurity features, the new control is more powerful, with the ability to manage up to 10 a xes. T he company will also introduce the new S-Line robot range, which will replace the three-axis S5 a nd f ive-axis 5X. Sepro officials say the S-Line will offer higher speeds, longer strokes, and more payload, with 15 per cent faster movements.

And Sikora AG will launch a measuring system that applies AI and X-rays to enable precise measurement of the hill-valley outer contour of corrugated pipes in the extrusion process. By measuring the wall thickness and eccentricity at an early stage, fast centring is ensured, the company said, and startup scrap is reduced. In addition to reliable process control during production, this continuous quality control enables maximum cost savings. CPL

Photo Credit: Reifenhäuser Group

NOVEMBER 2025 ISSUE

Here’s a look at what’s inside the upcoming November 2025 issue of CanadianPlasticsmagazine:

Size reduction is one of the most crucial steps in plastics processing and recycling, which is why it’s important that shredders and granulators be as user-friendly as possible. Here are the latest developments that can help transform your size reduction process from headache to hassle-free.

ALSO IN THIS ISSUE:

• The newest resins for pipe and profile extrusion

• The K 2025 wrap-up

• How Al technology can impact rotational molding

SUSTANE-ABLE

Halifax-based cleantech firm Sustane Technologies has developed a disruptive solution that turns hard-to-recycle waste plastic into engineered feedstock for virgin plastic production.

By Mark Stephen, editor

It’s painful to admit, but plastic recycling in Canada is failing in many ways. We lack a unified national standard for waste management, resulting in inconsistent collection and processing, which is why less than 10 per cent of plastic waste is actually recycled. The rest is either sent to landfills, incinerated, or exported to other countries where its fate is uncertain.

Few would deny that it’s time for a new approach, and clean technology company Sustane Technologies I nc. has one. T he Halifax-based firm has developed a proprietary disruptive technology that can turn end-of-life plastics – including difficult-to-recycle materials such as agricultural waste, fishing ropes, plastic bags, broken bins, and thin films – into engineered feedstock for virgin plastic production; specifically, into naptha used in the production of new plastics and synthetic diesel to replace fossil fuels.

By diverting up to 90 per cent of waste from landfills, Sustane advances a circular economy model that significantly reduces greenhouse gas emissions and plastic pollution. The company’s 40,000-square-foot plant in the town of Chester on Nova Scotia’s South Shore has ISCC Plus certification, providing chain-ofcustody assurance that the feedstock meets stringent sustainability standards, and Sustane now has projects advancing across North America and Europe. Global petrochemical major BASF, for one, is a believer, having recently signed a long-term offtake agreement to purchase Sustane’s premium recycled plastic feedstock for use in its operations.

BIOMASS BEGINNINGS

Sustane was co-founded in 2013 by current president and CEO Peter Vinall – who was then an executive working in the pulp and paper sector – and two other partners. “I was looking for low-cost energy solutions for industry and visited a pilot plant outside of Madrid, Spain, that was using steam to cook garbage to separate the plastics from the biogenic part of the waste,” Vinall said. “This was a new approach, because other companies had just been pulling out metals and other contaminants and making a refuse-derived fuel by incinerating the remaining biogenics and plastics together. I saw the future differently: I wanted to separate the plastics from the biogenics, and this plant was doing it. I convinced the inventor and an investor to join me in starting a new company in Canada.”

Vinall and his partners soon realized that, of all the waste streams that Sustane was collecting, plastic had the most poten-

Waste material coming into the Sustane plant for separation and processing.

tial to be turned into a fuel through pyrolysis, which uses heat to convert materials such as plastics and organic waste into energy and useful products; and unlike combustion, which requires oxygen for burning, pyrolysis occurs in the absence of oxygen, preventing complete burning. “We started exploring plastic as a source of energy and developed our own pyrolysis technology to convert unsorted, non-recyclable plastic waste into valuable products like synthetic diesel, naphtha, and fertilizer,” Vinall said. “In the early days, our process could separate plastics into resin type; then we shifted to converting polyolefin plastics into fuels and developed a unique hydrocarbon segmentation technology that enabled us to make a very high-purity synthetic diesel and naptha; finally, we skewed the process to make more naptha than diesel, which is when BASF contacted us and asked for samples.” As part of its ambitious sustainability agenda, BASF will integrate Sustane’s pyrolysis oil into its global production network as a recycled feedstock for its portfolio of Ccycled polyamide products, which are used in applications ranging from food packaging to automotive components.

GARBAGE IN, FEEDSTOCK OUT

Sustane has now fully streamlined its process. Waste plastics are collected from a variety of sources and then processed at the plant in Chester. “After unacceptable materials are removed, the plastic is separated, cleaned, shredded into pieces three inches or smaller, taken to the pyrolysis unit and heated until it vaporizes,

and the vapour is then captured and condensed into a liquid,” Vinall said. “Since the vaporization takes place in a closed vessel without oxygen, our process minimizes airborne contaminants.” The liquid is then refined into naphtha that’s used by plastic manufacturers as a feedstock and into synthetic gas that powers the facility’s operations.

Compared to virgin plastics, the feedstock from Sustane’s technology has less than half of the carbon intensity and prevents more plastic waste from entering landfills, Vinall continued. In all, he said, there are 13 different stages of separation that ultimately create the clean products. “Our competitors pyrolyze a particular type of plastic into a single ‘soup’ that contains all sorts of carbon chain lengths, including waxes, diesels, naptha, gasoline, and residual non-condensing gas,” Vinall said. “We use that non-condensing gas to run the whole process both electrically and thermally, but rather than make a soup we make a highly refined product online, which means it doesn’t have to go to a refinery to be upgraded before it can go to an ethylene cracker. It’s a true drop-in naptha replacement that’s a higher quality because of the unique way that we refine it.”

The company currently collects waste plastic from a range of sources: residual products from municipal recycling facilities throughout Atlantic Canada and other low-value plastic streams including agricultural, marine, and some commercial waste. “We’ve tested around 50 different inputs in all and the most abundant material, we learned, was plastic film, because it’s hard to recycle,” Vinall said. “And since China stopped accepting these plastics, Halifax and other jurisdictions have grappled with how to dispose of them.”

Which is why Sustane will be more than t ripling the plastics capacity at its facility in Chester – including installing a new preparation line for transforming film into pellets – thanks to a partnership with Saint-Lambert-de-Lauzon, Que.-based pyrolysis technology developer P yrovac I nc. Sustane is acquiring two of Pyrovac’s reactors that can process plastic waste in an exclusive contract. T he gas created f rom Sustane’s recycling process can be burned to generate electricity, covering all the energy needs of Sustane’s facility when combined with P yrovac’s reactor. T he f irst phase will raise the maximum processing capacity of the first recycling line to 12 tonnes per day, Vinall said, and the second phase, planned for later this year, will add an additional 25 tonnes per day of capacity.

OBSTACLES AND OPPORTUNITIES

Sustane’s goal is to make the second line a template for its future development and growth projects in North America and Europe. “We’ve developed a really good recipe for what works – what we’re focusing on going forward is scaling it,” Vinall said. “Our five-year plan is to build multiple facilities with a base plant size of 75 tonnes of production-per-day capacity and achieving yields of close to 1,000 litres per tonne.” Vinall sees a modular approach as one key to Sustane’s geographic expansion. “The plants will be highly modular, with the separation, distillation,

and pyrolysis components built off-site and then shipped to a location for assembly,” he said.

Sustane also plans to avoid a mistake that has bedevilled some larger North American chemical recyclers. “There’s an assumption that waste plastic is everywhere and easily accessible in huge amounts, but that’s not true – actually, it’s very difficult to aggregate volumes of the right kinds of plastic because it’s highly variable and the markets are fragmented,” Vinall said. As in real estate, in other words, it’s all about location. “We believe there’s a sweet spot on capacity if we put the plants fairly close to large population centres and set reasonable daily collection goals,” he said. At present, Sustane is looking to open new manufacturing plants in Quebec, Ontario, and Alberta. “We also want to expand into the U.S., but obviously there’s uncertainty there at the moment,” Vinall said.

Sustane currently employs approximately 25 workers and –in contrast to many other manufacturing firms – Vinall doesn’t expect to run into problems staffing up when necessary. “We hire young technology graduates from the Nova Scotia Community College, specifically from its power engineering program, who are eager to learn how to run an industrial plant and then go on from there,” he said. “So, when the time comes that we can offer them chances to relocate to other provinces, I think many will be willing.”

Vinall believes that Sustane is now in the right place at the right time. “Traditional plastic recycling hasn’t worked – change is needed, and we see ourselves as part of it,” he said. “Our goal is to transform the lower quality material that’s so hard to recycle – the kinds that typically end up in landfills or incinerators – into virgin-quality plastic feedstock that can be used in chemical production.” The bigger mission, he continued, is to help break the unfortunate Canadian habit of exporting plastic waste to other parts of the world, including to developing nations. “How can Canada claim to be an environmental leader when that’s still our practice?” Vinall said. “It’s wrong, and the days of saying there’s no other solution a re over. There is a solution: our approach of transforming plastic feedstocks through our proprietary process.”

Sustane’s facility in Chester, N.S.

INJECTION MOLDING

Upgraded hybrid series has a new screw

Now available in North America, Nissei’s upgraded FNX-IV series of hybrid injection molding machines has an updated interface and safety features, and a new standard screw.

Available with clamping forces ranging from 89 to 501 tons, the machines feature the company’s servo-hydraulic hybrid X-Pump system and the Internet-ofThings (IoT)-enabled Tact 5 controller. With the Tact 5, the machines collect data in real time, giving users access to remote monitoring, remote maintenance, and predictive maintenance capabilities. The OPC UA-compatible controller also enables connection of auxiliary equipment to the molding machine, allowing display and operation directly on the interface. With remote access and remote maintenance capabilities, it minimizes downtime caused by unexpected failures.

Nissei America Inc. (San Antonio, Tex.); www.nisseiamerica.com En-Plas Inc. (Toronto); www.en-plasinc.com

Just Add Water

EXTRUSION

Turret winder creates jumbo rolls

SML’s new W1300 turret winder is designed for fast, efficient, extended production runs of premium-quality films, including chlorinated polypropylene, chlorinated polyethylene, mono-oriented, and barrier.

Attaining winding speeds of up to 1,476 feet per minute and handling film widths from about 7.9 to 12.8 feet, the winder can work in either gap mode or contact mode. Before the film hits the contact roller, it runs over a continuously adjustable satellite roller, to control the air intake between the individual film layers and to adjust the hardness of the film roll.

Two cross-cutting units are available: a full-width twisting knife for thinner films, and a flying knife for thicker films and oriented films. And handling systems are available for shaftless winding and for winding with shafts.

SML North America Service Inc. (Gloucester, Mass.); www.sml.at

BLOW MOLDING

Kautex revives KEB blow molders

Kautex is relaunching its famous KEB series of extrusion blow molding machines with a new version, dubbed KEB Grey, designed as a flexible, compact, and energy-efficient solution for the extrusion blow molding of complex parts and packaging.

The KEB Grey has a f lexible clamping unit with tie-bar-less scissor design for easy tool changes; adjustable architecture to accommodate processes such as multilayer extrusion, angled neck calibration, integrated cooling stations, and bottom blow; and an ergonomic layout with enhanced accessibility and a processfocused operation station with a 24-inch smart HMI interface.

Benefits include flexibility and energy efficiency in a compact package with minimum maintenance requirements. The KEB Grey line can be configured for post-consumer recyclate, rapid cooling masks or complex post-processing, and is backward-compatible with existing KEB molds and die heads. Kautex Machines Inc. (Flemington, N.J.); www.kautex-group.com

RECYCLING

Customized “Smart Recycling” packages

Wittmann is now offering Smart Recycling packages, consisting of a granulator, a mobile dryer, and a dosing unit, each selected and coordinated to suit the individual requirements of the material, application, and operational circumstances.

Designed to boost efficiency and quality standards for inline recycling of sprues and scrap – producing top-quality regrind – each Smart Recycling solution includes a Feedmax Clean material loader specially developed to meet the requirements of the circular economy. During material conveyance, the Feedmax Clean reaches high separation degrees of up to 80 per cent (of particles less than 1,000 micrometers), removing more dust particles and fine parts from the granulate and ensuring high consistency of quality for injection molding.

Thorough dedusting allows recycled materials to be used safely for demanding applications; the company says automotive customers are among the first to adopt the Smart Recycling concept.

The target group for Smart Recycling generally consists of all plastics processors practicing in-house recycling of sprue and scrap parts.

Wittmann Battenfeld Canada Inc. (Richmond Hill, Ont.); www.wittmann-group.com

Haitian 7 www.absolutehaitian.com

AMI Plastics World Expos 17 www.plasticsworldexpos.com

Canadian Plastics Sneak Peek 21 www.canplastics.com

CCC Plastics 15 www.ccc-group.com

Chillers Inc. 24 www.chillersinc.com

Dyna-Purge Div./Shuman Plastics Inc. 8 www.dynapurge.com

Heartland Polymers IFC www.heartlandpolymers.com

Informa Markets/ADM 13 www.admtoronto.com

Messe Dusseldorf 9 www.k-online.com/join

Method Innovation Partners 19 www.methodinnovates.com

Novatec OBC www.novatec.com/canada

Plastic Process Equipment IBC www.ppe.com

Struktol Canada 11 www.struktol.com

MATERIALS

Advanced odour control solutions

Struktol’s new RP 17 and RP 53 additives are designed to deliver exceptional odour control performance – ensuring products smell better and perform better – while advancing processing efficiency and sustainability in manufacturing environments.

RP 17 and RP 53 can be added during compounding, extrusion or molding to mask or eliminate undesirable odours often associated with the addition of post-industrial or post-consumer recycled polyethylene and polypropylene. These products are suitable for automotive applications where higher process temperatures can make odour more noticeable.

PR 17 is a white pastille and was developed as an odour mask, whereas RP53 is an off-white pastille used as an odour neutralizer at low dosages or to impart a “clean” odour at higher dosages. Both additives have demonstrated effectiveness even at low loading levels – as low as 0.25 per cent in some applications –and both are storage-stable for at least two years under normal conditions.

Struktol Canada Ltd. (Newmarket, Ont.); www.struktol.com

Increasing the life of your mold

By Garrett MacKenzie, plastic411.com

Tool life is key to a plastics processing company’s bottom line and profitability. T his a rticle will outline key settings that are paramount to mold life longevity and the preventive maintenance steps that must be taken to extend the life of the mold.

TONNAGE. First, it’s important to verify that adequate tonnage is being used for each mold. Using too little tonnage can lead to the mold being blown open due to injection pressure exceeding tonnage requirements; while excessive tonnage can cause tool damage by excessive compression on parting lines, vent areas, and mold components.

LOW-PRESSURE CLOSE (LPC). Setting up LPC on the press is a crucial part of mold protection. High-pressure lock-up position should be set no higher than 0.05 above the actual mold touch position. In addition, the mold should be cycled, reducing LPC pressure until the mold is unable to lock up; pressure is then raised slowly, allowing just enough pressure for the mold to transition from lowpressure to high-pressure lock-up; and the mold close timer is then set 0.5 seconds above the actual mold close time requirement. For example, if the actual mold close time is 0.76 seconds, then the mold close timer is set at 1.26.

CORE SETUP. Core pressures and speeds should be limited to the requirements of their application. It’s important to note that pressure can limit speed, but speed doesn’t affect pressure setpoints. And it’s imperative that cores fire based on position, not time, to prevent crash conditions. Core operation will affect the speed of your cycle, but how they operate should be monitored closely for signs that components are setting or pulling erratically by both sounds and sight.

MOLD OPEN/CLOSE. Clamp speeds are definite drivers of cycle time, but faster speeds aren’t better if they endanger or affect tool wear or damage.

Close fast speeds should be monitored for signs of lunging, which risks mold drop and potential misalignment of pins and components. T he t ransition f rom close-fast to close-slow should be smooth, and the close-slow condition should be in effect just prior to component/pin m atch-ups. T he t ransition between mold breakaway and mold open-fast should also be smooth, with the open-fast segment occurring after all components have cleared pins.

EJECTION

SETUP.

Improper setpoints can endanger mold life through over-stroking, or if parts fail to eject properly and are closed up on between the mold halves. Forward positions should be based on how much separation is needed to properly remove parts from the mold. Over-stroking causes excessive strain on ejector pins and lifters. Part extraction should never require bottoming out the ejector plate. Pressure setpoints should utilize only the required amount to reduce stress on ejection components.

HOT RUNNER AND VALVE GATES. Poor startups lead to overpacked cavities, requiring mold teardown and service. Before running parts, valve gates should be fired manually to verify they’re set up properly and are in good working condition. Plastic should be purged through all drops of the hot runner to verify the drops are warm and ready for startup. Hot runner shutdowns should include running the barrel dry and an immediate reduction in hot runner temperatures to reduce the chances of degradation.

MOLD WATERING.

Mold temperatures should be limited to minimum requirements to achieve acceptable part aesthetics. In addition, mold half temperatures should never require more than a 20°F variance between the stationary and movable halves – temperatures above this scope risk causing tool damage due to improper heat-soak conditions

and poor tool-mating conditions. In addition, it’s important to clearly mark circuits, as well as supply and return requirements, to prevent incorrect installation of the mold.

MOLD CLEANING AND CARE.

Molds in production environments should be inspected, cleaned, and greased at least once per shift. Watch for signs of wear, such as galling, parting line wear, burrs, a nd metal shavings. Schedule a regular preventive maintenance procedure, keep service records for the mold, and review repetitive service/repair events to establish preventive maintenance frequencies to reduce the chance of unplanned service events.

Also, verify slide slots are greased, slides function properly, and watch for signs of loose gibs. A rust preventative should be used in cases where a mold will not be used for more than six hours. Also, textured and polished areas should be coated thoroughly to prevent rust damage.

In the end, the difference between success or failure for a company’s tooling approach hinges upon its setup, implementation, and maintenance procedures. By following the suggestions above, a mold’s life can be extended above and beyond the expectations of your company.

CPL

Garrett MacKenzie is the owner/editor of plastic411.com and a consultant/ trainer in plastic injection molding. He has provided process engineering expertise to many top companies, and he was inducted into the Plastic Pioneers Association (PPA) in 2019, where he serves on the Education Committee evaluating applications from college students seeking PPA scholarships. Contact him at garrett@plastic411.com.