The Compass Advantage

THE COMPASS ADVANTAGE

ABOUT COMPASS

96

400+ Markets Offices

33K+ Agents

GUIDING YOU HOME WITH THE COMPASS ADVANTAGE

Investing Billions in Tech to Sell Your Home

At Compass, the technology of the future is already shaping real estate today. We’ve invested over $1 billion in our technology platform to help agents make buying or selling a home easier for you This includes Compass One, an all-in-one client dashboard that enhances transparency and keeps you connected with your agent at every step of your journey

A Marketing Strategy for Every Home

As part of Compass, I have access to a dedicated in-house marketing and design agency of over 300 experts nationwide, making it more effective than ever before to reach your buyer how, when, and where it counts most.

A 37K+ Network of Top Agents Nationwide

A network that arms us with privileged access to the homes you ’ ve been waiting to find and the prospects ready to buy.

Residential real estate brokerage in the United States

$216.8B

2024 gross transaction value

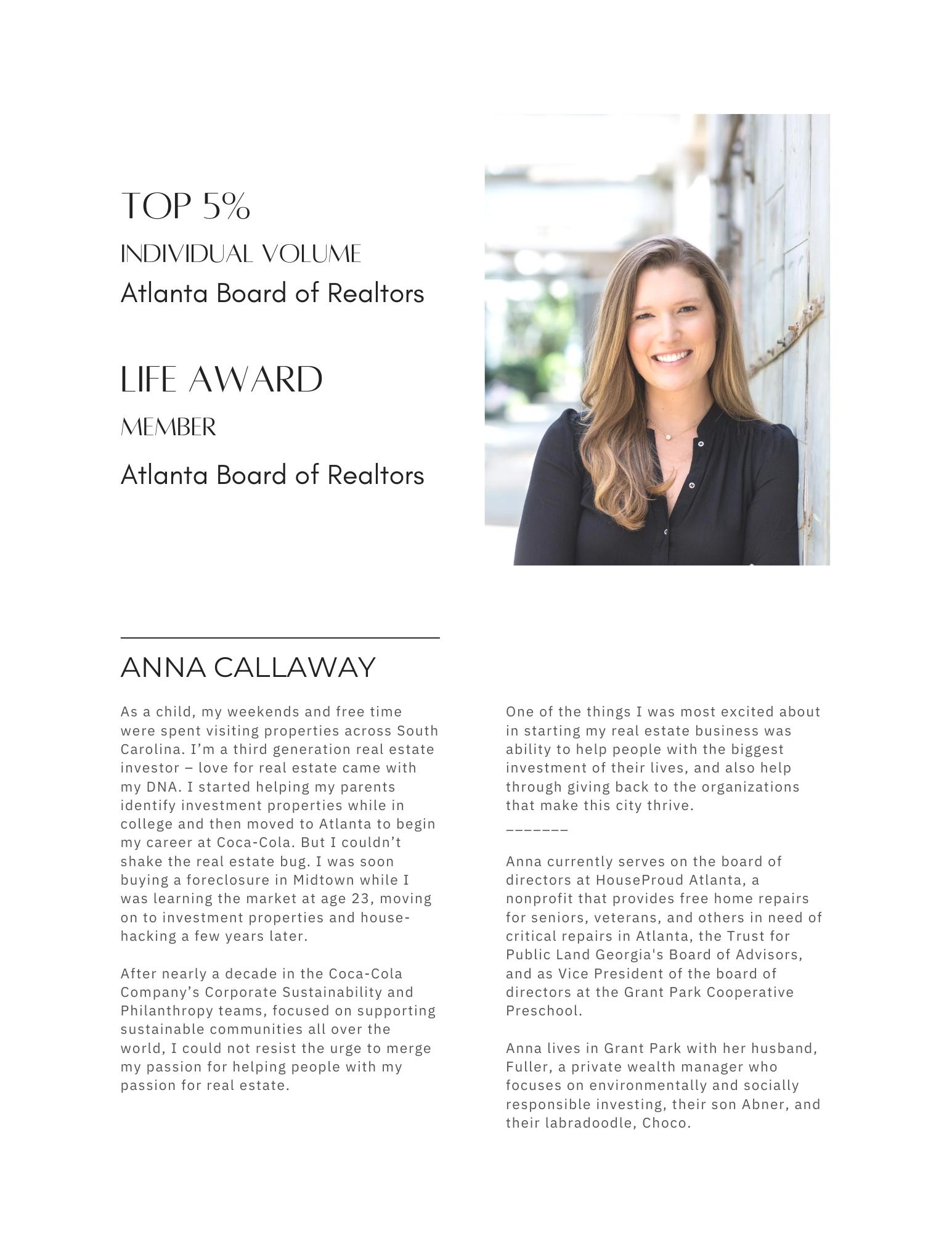

ABOUT ANNA

CLIENT EXPERIENCES

Anna was a spectacular relator, representing me in the purchase of my new home. Patient, especially for first time home buyers who had lots of questions, knowledgeable, and very responsive. You will not be disappointed!

Ian, Inman Park

My husband and I really enjoyed working with Anna. Anna had us list our property higher than we initially thought, and we are so glad we did. It was still listed competitively, but gave us room to work with when repairs needed to be made while under contract. Anna is very quick to respond and great with deadlines. She's always professional, timely, and trustworthy.

Molly, Boulevard Heights

⭐ ⭐ ⭐ ⭐ ⭐

Anna was so great in selling my condo! I moved out of state shortly after listing my unit, and she kept it looking fresh for showings and ultimately found a buyer. Anna was persistent, level headed, and always presented options clearly to me to guide me through decisions. She really knows her stuff!

Alora, Buckhead

⭐

I highly recommend Anna Callaway for your real estate needs. She is very professional and adept at working with both sellers and buyers. Anna takes on her projects with thoroughness and enthusiasm. The end result is success. Anna has a very thorough knowledge of the Atlanta real estate market which enabled her to show us the inventory of homes which matched our very specific requirements and budget. Her research, energy and time was appreciated. After a week of working with the Seller's agent, we had a very amicable Closing.

Lauren, Grant Park

SERVICE PROVIDER VS. PARTNER AGENT

Compass One Moves The Needle

Service Provider

Transaction focused and low value on long term relationships

Mostly reactive; updates clients when prompted Relies on emails and sporadic calls for status checks

Generic marketing pieces or standard brochures Minimal personalization for each property or neighborhood.

Shares listings only on the MLS and available to every buyer on the market

Uses scattered tools: spreadsheets, calendars, and emails.

Clients only see final outcomes or get sporadic updates on progress Rarely offers a transparent window into the process

Typically ends the relationship at closing Little to no follow-up or ongoing resources for the client

Delivers necessary services but lacks a sense of partnership.

Partner Agent

Focused on building long term relationship and delivering luxury client experience through service and technology.

Proactive updates and scheduled touchpoints

Streamlines communication and updates within a single communication portal, ensuring clients know what’s happening and what’s next

Leverages Compass 3 Phase Marketing to launch home 3x – Utilizes a customized marketing suite that tailors campaigns to each listing

Provide priority access to off-market properties through Compass Private Exclusive & Compass Coming Soon

Employs an integrated billion dollar technology platform with built-in checklists and deadlines.

Invites clients to a secure online hub for shared timelines, documents, and milestones Provides a clear view of next steps, deadlines, and any needed client actions creating collaboration and trust

Provides resources and keeps clients informed on market updates and prioritizes long term relationship through being an ongoing resource

Builds client confidence through consistent communication, personalized marketing, and comprehensive progress tracking all aligned with the client’s objectives and timeline.

YOUR STORY DRIVES EVERYTHING

To guide you toward the right home and lifestyle, we start with your story not just your search criteria.

We uncover the personal and practical needs shaping your decisions so we can tailor everything to fit you.

We focus on five areas that matter the most to you

Motivations:

What makes this the right time to make a move?

Most Excited About:

What are your most excited about happening directly as a result of your move?

Expectations:

What are your expectations of an partner agent?

Disappointments:

What past disappointments have you had in previous real estate experiences?

Concerns:

What keeps you up at night about the process and or making a move?

YOUR IDEAL LIFESTYLE

A home isn’t just where you live—it’s how you live. It should reflect your lifestyle, support your goals, and feel like your personal sanctuary at the end of each day.

WHAT IS YOUR FUNCTIONAL FLOW

The goal is to find you a home that fits into your lifestyle

→ How do you live in your home during the week?

→ What do you want weekends to be like in your hom

→ What are three things you wish your current home

→ Do you picture hosting often, or do you prefer solitu

→ How do you like to start and end your day at home

→ Ideally what is your home close to in the community

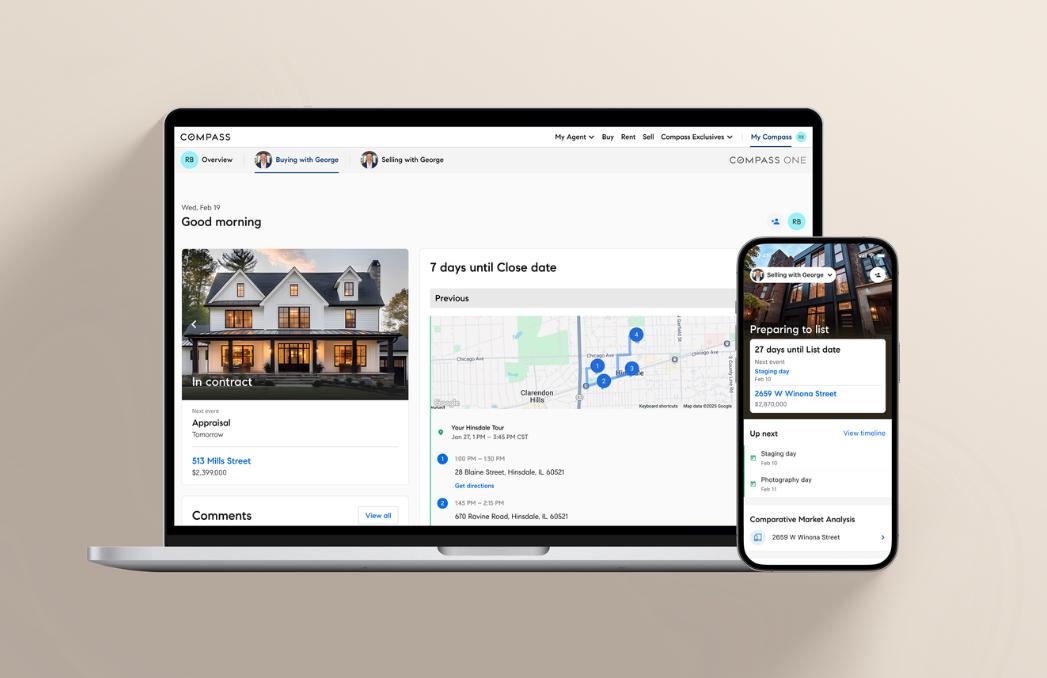

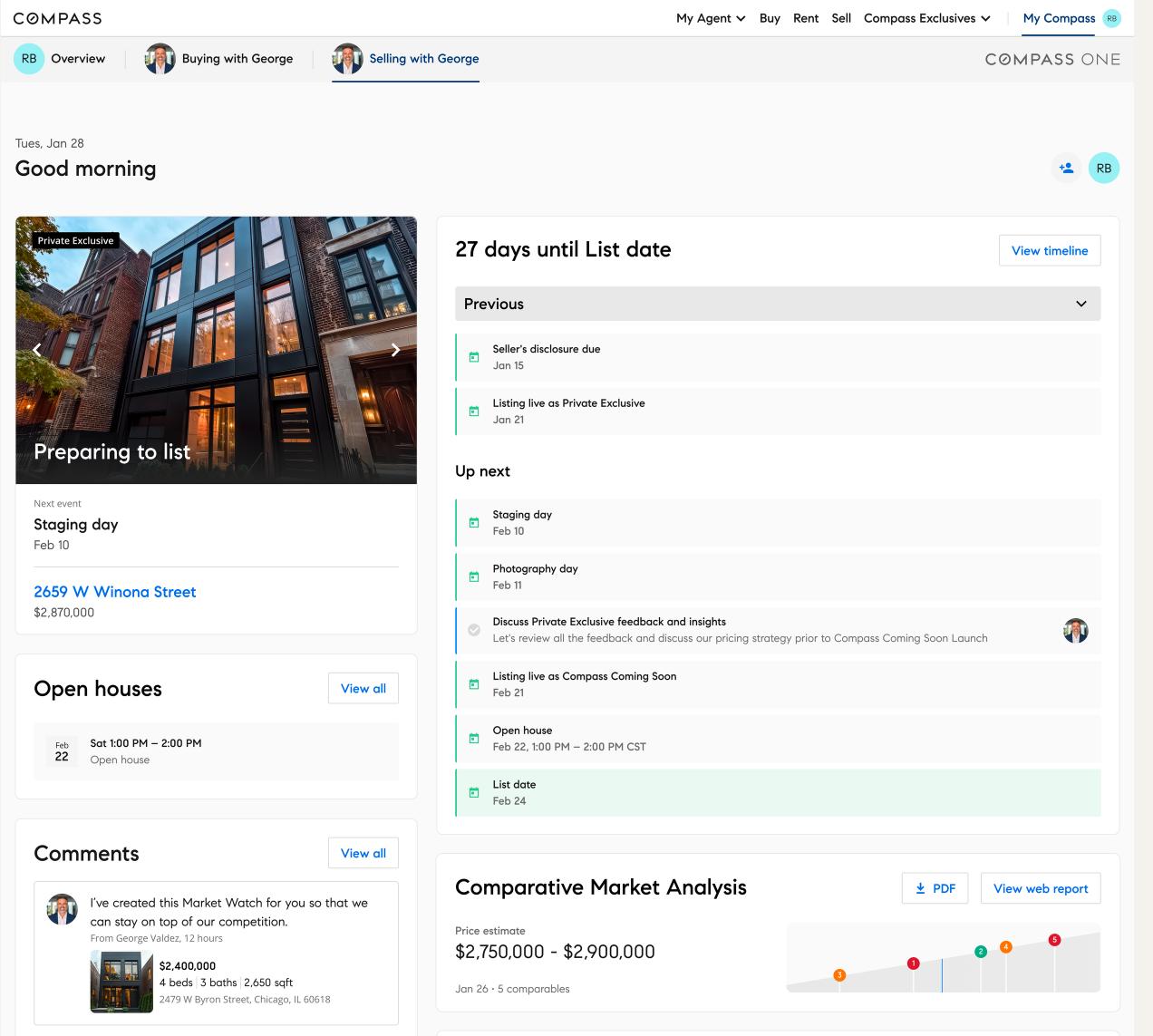

COMPASS ONE

COMPASS ONE

Compass One organizes your home buying experience into one central place. So you will always know what’s happening, what’s next, and where to find it. From property searches and tours to CMAs, offers, documents, and shared notes, it’s all streamlined to make your home buying journey feel simple, organized, and personalized. No guesswork. Just clarity and confidence every step of the way.

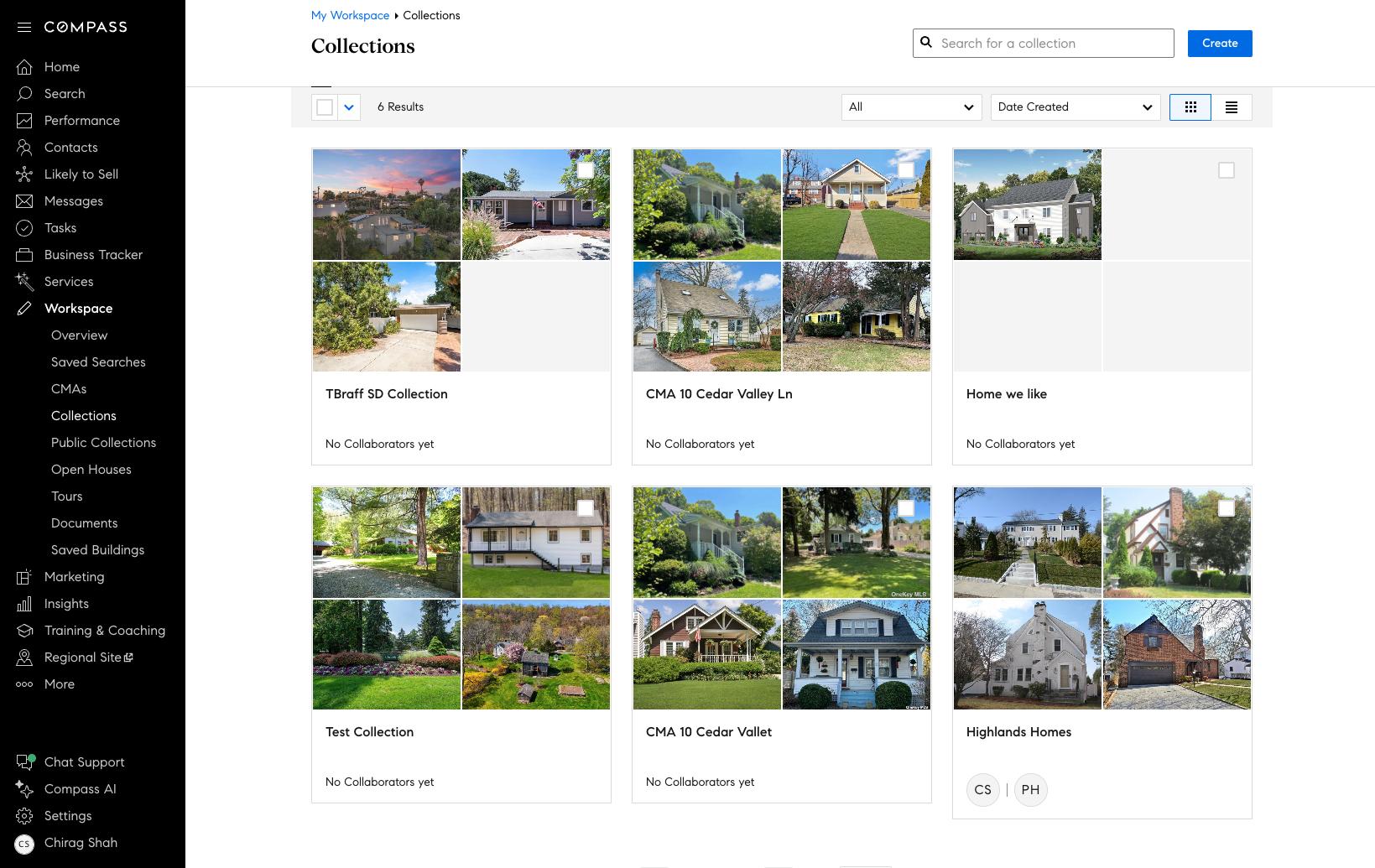

COMPASS COLLECTIONS

Luxury shopping cart of homes hand selected by your agent based on your ideal lifestyle inside and outside of your home.

Collections tool provides real time market updates

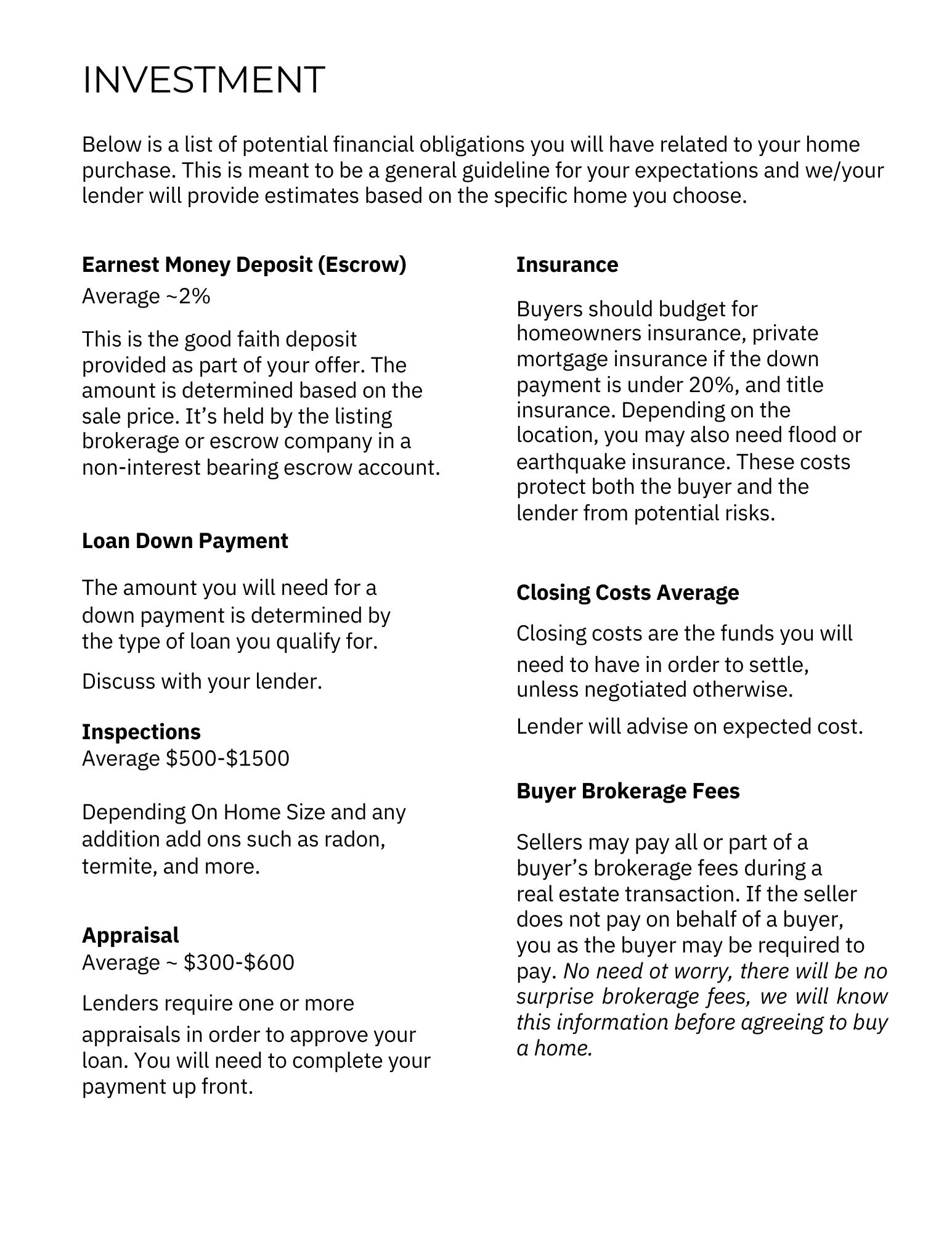

Documents + Resources

Legal documents, disclosures, and all other important documents in one place

Your teams information in one central location Your Team

Always know what is coming next Real Time Collabortation

THE PROCESS

CURATED EXPERIENCE STREAMLINED

We want to help ensure every detail large and small is curated based on your personal preferences, wants, needs, and timeline.

We will collaborate to understand all the details of your move, set up a calendar and weekly check-ins to ensure you stay on track, have referrals when needed, and help take some of the stress out of moving

HOME BUYING TIMELINE

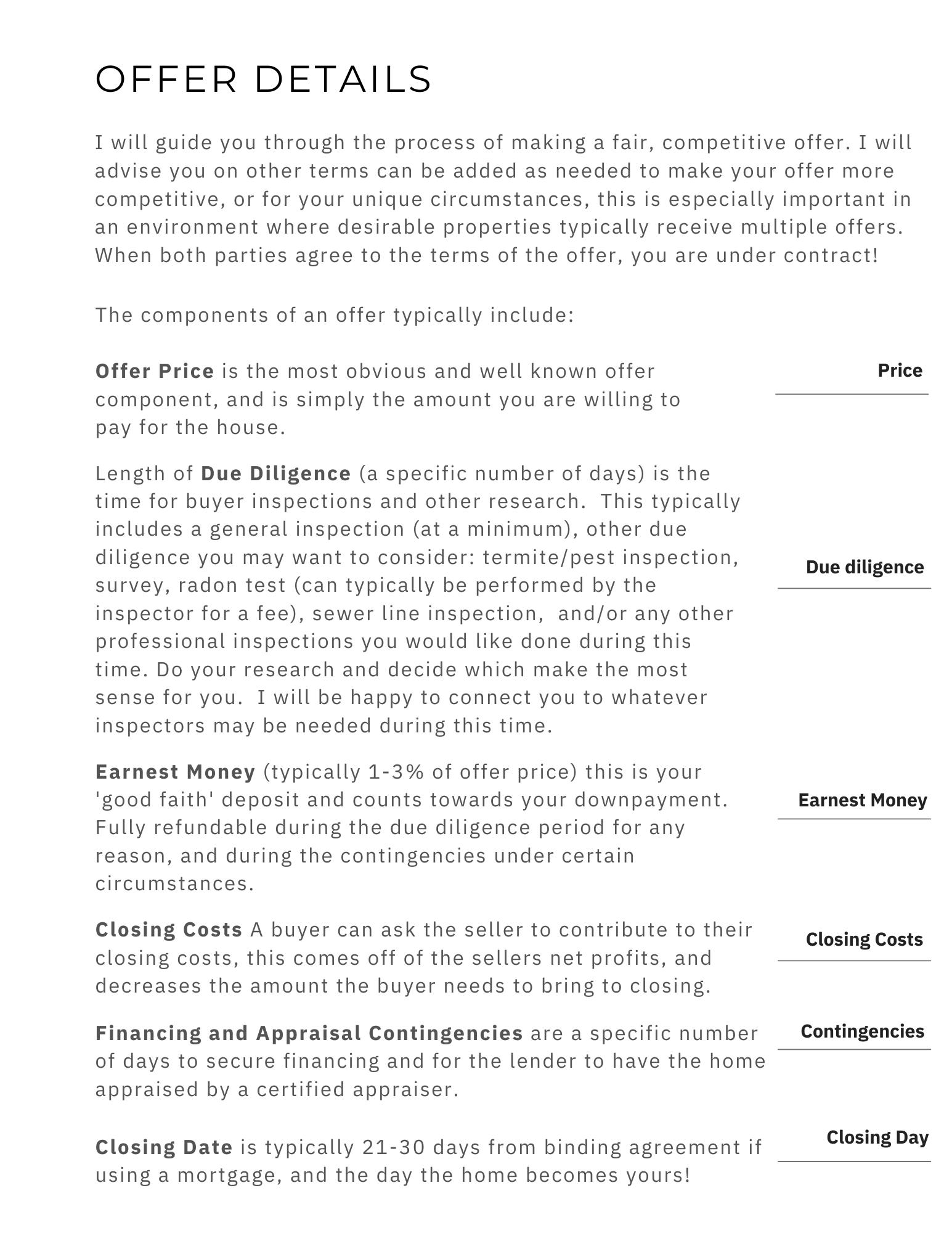

WRITING WINNING OFFERS

A strategic approach to how we position you as a buyer based on several factors

Offer

Financing

Contingencies

Appraisal

Home Inspection

Down Payment

Earnest Money

Closing Costs

Closing Date Flexibility

Due Diligence

Unique Offer Positioning Strategy

MULTIPLE OFFER TOOLS

We’d like to share with you some tools to help your offer stand out in a multiple offer situation

“It is not always the price but the TERMS of an offer that can be the deciding factor”. Think of terms as your tools that we can mix and match depending on the particular details of the multiple offer scenario Knowledge is power so learning more about these tools now will make you more confident and ready for your next offer Let us know if you have any questions

Minimize

Inspection Period Days and/or adhere to "As Is" Condition

It is risky to remove the option period completely, so we do not recommend that, but a small amount of buyers may do this. We usually recommend shortening the days of the due diligence period and increasing the earnest money and/or adding an option fee Adhering to "As Is" Condition means that you are not going to renegotiate the price or request repairs after your inspection. However, if a material defect/hazard comes up in the inspection, you would still have the ability to walk away

Waiving Appraisal Contingency

You can speak with your mortgage broker further on this and the possibilities of adjusting your LTV ratio if an appraisal is to come in short However, waiving this contingency means that if the bank appraisal comes in at $450,000 but you have a contract price of $500,000 then you agree to cover the gap. Waiving your appraisal has become increasingly common There are a few options for an appraisal waiver that benefit the seller: 1) 100% waiver or 2) a partial waiver that the home needs to at least appraise for list price if you are bidding over list price 3) Executing an expedited appraisal to come back during the due diligence period

Waiving "Financing Approval" Contingency or Reducing Amount of Days for Contingency

Waiving your financing approval contingency means that you are choosing to not include the protection in your contract agreement if you are not able to obtain funding If you do not get approved, then you risk your earnest payment, and possible legal issues, so we recommend your lender go beyond pre-qualifying you and actually underwrite you to issue full buyer approval prior to making an offer It is possible to have a buyer approval contingency in a multiple offer situation, but it can make it harder to get your offer accepted If your lender does not feel confident in removing this contingency, ask what their shortest amount of days needed to qualify you Reducing to even 7 days or so would be another option Your mortgage broker will be able to advise on his or her confidence in obtaining your funding.

Higher Earnest Money and/or Down Payment

The more funds you put down or offer as earnest money the stronger you will be perceived by the seller. It also gives the seller more confidence in you as a buyer to close without issues and cover potential appraisal issues should they arise

These are just some examples of the many ways to improve your changes of getting an offer accepted in a multiple offer situation Each buyer and seller will have different circumstances which will require a specific strategy

KEYS TO AN EFFECTIVE PARTNERSHIP

Finding the perfect home in today’s market is achieved through an effective partnership and understanding of what you can control as the buyer, what I can control as the agent, and the things we ’ re both working against that no one can control.

Buyers can control Agents can control

Price offered

Terms offered

Contingencies

Speed

Follow-through

Communications + Customer Service

Finding Off-Market Properties

Interpreting Market Data

Negotiating Strategy

No one can control

World events

Local economy

The stock market

Interest rates

The price other buyers are willing to pay for homes

MY COMMITMENT

OUR COMMITMENT TO YOU

What you can expect from me throughout the process

Act as o r tr sted ad isor bringing strategy, perspective, the way.

nd negotiate through strategy so you’re ed.

ganized, and elevated experience after closing.

gy like Collections, Compass ONE, o streamline and enhance your search

d communication style and schedule oop

home through the lens of your , and investment potential

on and off the market to surface ur unique needs

ching to guide confident, informed m showings to paperwork so the experience is focused on your goals

Mutual commitment

YOUR COMMITMENT TO US

What I ask of you as we partner together

Communicate openly so I can support your goals and ensure you receive the right information prior to making any decision.

Keep me in the loop about your travel plans or if your availability to view homes changes.

If your priorities, preferences, or budget shift at any point, just let me know so we can adjust our strategy and stay aligned.

While buying a home, avoid taking on new debt Talk to your loan officer before making any financial changes or depositing money from non-income sources

If something catches your eye outside of what I’ve sent, feel free to send it my way I’ll ensure we review the home based on your goals, expectations, and ideal lifestyle

If you’re considering new construction, I’d love to join you I can ask the right questions and help position you for success

If you come across a home or detail that sparks interest, send it over I’ll fill in the blanks and help you evaluate it through the right lens

If you see a home advertised that you like, just let me know I’ll contact the listing agent to keep everything organized and aligned with your goals

For open houses, just let me know if you plan to attend I can either join you or notify the listing agent so you’re properly represented

This is a partnership and mutual trust is key I’m committed to you, and I ask for the same in return

COMMUNICATION

OMMUNICATION N YOUR TERMS

ow often would you like to communicate with you:

Weekly

Bi-weekly

Monthly

What is your preferred ethod of communication: Email Phone Text WhatsApp

Video Conferencing

What would you like updates on:

New listings

Price reductions n contract

Check-in calls

eferred method of finding properties: Search on my own

Agent sends me properties

A combination of both

unication Expectations: You will have additional nication from us apart from our regularly scheduled s whenever new information is available like must-see offers, active negotiations, changes to appointments, ons, bank appraisals, significant market changes, etc

Business Hours Buyer FAQ

As a professional service-provider we hold ourselves accountable to providing a higher level of customer satisfaction.

I’m available Monday–Friday from 9 AM – 5 PM, and evenings, Saturdays & Sundays by appointment.

Response Policy

If you reach out between 9–5, you can count on me to respond the same day. I often reply outside of those hours too, but if I don’t, I’ll get back to you the next business day.

If you need to speak or make an appointment outside of working hours, I am happy to accommodate you with at least a 24 hour advance request.

Emergency Policy: At 9PM each night, I will check my texts for emergencies. If something is urgent, I will be in touch promptly. My personal cell is 404-323-1768

What do I do if I go to an open house on my own?

When registering, please share with your agent in advance if possible, that you are going to an open house. Your agent will contact the listing agent on your behalf and collect any preliminary information and follow up afterwards. If you are unable to contact your agent in advance, once arriving at the open house, please let the listing agent know who your agent is

What

do I do if I find a property I want to see in

person?

Email, text, or call me with the property information and I will get the showing coordinated for us.

Thesecommunicationexpectationsandbusiness hoursaremutuallyagreedupon.

WHAT HAPPENS NEXT