15 minute read

How to trade XAUUSD in Exness

from Exness

by Exness Blog

How to trade XAUUSD in Exness is a topic that many traders are eager to explore. XAUUSD represents the price of gold in terms of US dollars and is one of the most traded commodities in the Forex market. As a trader, understanding how to effectively trade this precious metal can lead to successful investment strategies and potentially profitable trades. In this comprehensive guide, we will delve into various aspects of trading XAUUSD using the Exness platform, from understanding the fundamentals to executing trades and avoiding common pitfalls.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding XAUUSD

Before diving into trading XAUUSD on Exness, it’s essential to comprehend what XAUUSD actually is and why it holds significance in the world of financial markets.

What is XAUUSD?

XAUUSD is the currency pair that represents the value of one troy ounce of gold against the US dollar. The designation "XAU" indicates gold as a commodity, while "USD" refers to the United States dollar. When traders refer to XAUUSD, they are essentially discussing how much one ounce of gold is worth in US dollars at any given time.

Gold has historically been viewed as a safe haven asset. This means that during times of economic uncertainty or inflation, investors tend to flock to gold, driving up its price. Traders often utilize XAUUSD as a way to hedge against currency fluctuations and economic downturns, making it an essential instrument in forex trading.

Importance of Gold Trading in Forex Markets

The significance of gold trading in Forex markets cannot be overstated. Gold serves multiple roles— it is not only a commodity but also a form of currency and a store of value. Many traders view gold as a hedge against inflation, geopolitical instability, and currency devaluation.

Trading gold provides diversification in an investment portfolio. Unlike traditional stocks or currencies, gold offers unique characteristics that can mitigate risks associated with other asset classes. For instance, during a recession, while stock prices may plummet, gold often retains its value, leading traders to turn to XAUUSD for stability.

Factors Influencing XAUUSD Prices

Several factors influence the price movements of XAUUSD. Economic data releases, central bank policies, and geopolitical events play pivotal roles in determining gold prices.

Economic indicators such as inflation rates, employment figures, and GDP growth can all impact the demand for gold. For example, high inflation typically leads to increased interest in gold as a protection against eroding purchasing power.

Moreover, the actions of central banks, particularly the Federal Reserve, can significantly affect XAUUSD prices. Interest rate changes, monetary policy decisions, and reserve levels directly influence investor sentiment towards gold. Lastly, geopolitical tensions, such as wars or diplomatic crises, usually result in higher gold prices as investors seek a safe haven.

Getting Started with Exness

Once you have a foundational understanding of XAUUSD, the next step is to get started with trading on the Exness platform. This section will cover everything from creating your account to verifying it for trading purposes.

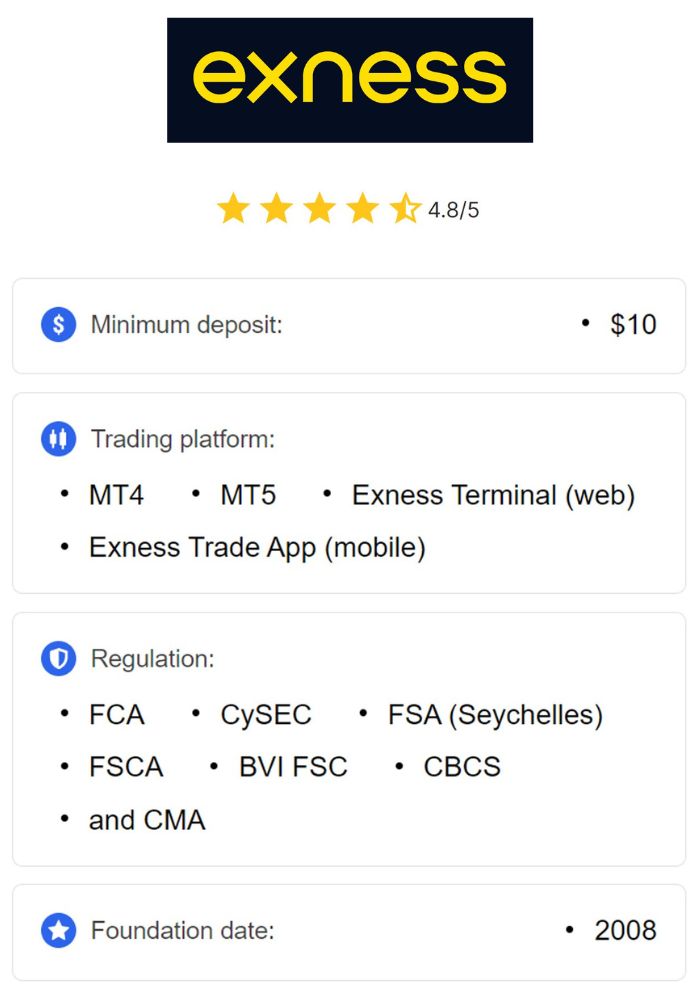

Overview of Exness Trading Platform

Exness is a well-known online brokerage that offers access to a wide range of financial instruments, including XAUUSD. The platform is recognized for its user-friendly interface, fast execution speeds, and competitive spreads. With both the MT4 and MT5 trading platforms available, traders can choose the software that best meets their needs.

The Exness platform is equipped with various features that support traders of all experience levels, including analytical tools, a demo account for practice, and educational resources. Overall, Exness aims to provide an optimal trading environment for its users.

Creating an Account on Exness

Creating an account with Exness is a straightforward process. The first step involves visiting the Exness website and clicking on the “Sign Up” button. From there, you will need to fill out a registration form, providing basic information such as your email, password, and contact details.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Once you've completed the initial registration, you’ll receive a confirmation link via email. Click the link to verify your email address and gain access to your new trading account. It’s worth noting that Exness offers multiple types of accounts, so you can select the one that aligns with your trading style and goals.

Verifying Your Exness Account

After creating your account, the next crucial step is verification. Verification is essential for ensuring compliance with regulatory standards and protecting your account against fraud. To verify your Exness account, you’ll need to submit identification documents, which may include a government-issued ID, proof of address, and possibly additional documentation depending on your location.

Once submitted, the verification process typically takes a short period, and you will be notified via email once your account is verified. Having a verified account allows you to deposit funds, withdraw earnings, and trade without restrictions.

Setting Up Trading Tools

Having established your account with Exness, the next logical step is to set up the necessary trading tools that will aid you in trading XAUUSD effectively.

Choosing the Right Trading Platform

Choosing the right trading platform is critical. Exness supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5)—two of the most popular trading platforms worldwide. MT4 is known for its simplicity, making it ideal for beginner traders, whereas MT5 offers more advanced features such as additional timeframes, built-in economic calendars, and more technical analysis tools.

Selecting the appropriate platform is largely dependent on your trading preferences. If you are just starting, MT4 may be the better option due to its ease of use. However, if you are looking for advanced functionalities, MT5 could enhance your trading experience.

Installing Trading Software (MT4/MT5)

After deciding on a platform, the next step is to install it on your device. You can download MT4 or MT5 directly from the Exness website. The installation process is fairly simple; after downloading the installer, double-click it and follow the prompts provided.

Once installed, open the platform, and input your login credentials—this will grant you access to your Exness trading account. Both platforms provide options for desktop and mobile versions, allowing you to trade XAUUSD on-the-go.

Utilizing Analytical Tools and Indicators

Analytical tools are essential for informed trading. Both MT4 and MT5 come equipped with numerous analytical capabilities to help traders make educated decisions. You can access various technical indicators—such as Moving Averages, Bollinger Bands, and RSI, among others—that can signal potential market movements.

Additionally, both platforms support custom indicators and automated trading strategies through Expert Advisors (EAs). You can analyze historical data and trends, enabling you to execute well-informed trades on XAUUSD.

Fundamental Analysis for XAUUSD

Fundamental analysis is key to understanding the broader economic factors that influence XAUUSD prices. This section explores the economic indicators, central bank policies, and geopolitical events that can affect gold trading.

Economic Indicators Affecting Gold Prices

Economic indicators are statistical data that represent the economic health of a country. Several indicators can affect the prices of XAUUSD, with inflation rates being one of the most significant. Rising inflation usually increases demand for gold, pushing prices upward.

Other important indicators include non-farm payroll data, consumer confidence indices, and manufacturing reports. These metrics give insight into the overall economic conditions and may lead to speculation about future gold price movements. For traders, staying updated on these indicators is crucial for understanding market sentiment surrounding XAUUSD.

The Role of Central Banks and Interest Rates

Central banks play a vital role in influencing gold prices. Specifically, their monetary policies and interest rate decisions can have lasting effects on XAUUSD. When central banks raise interest rates, the opportunity cost of holding gold increases, often leading to a decrease in demand for the commodity. Conversely, lower interest rates typically boost gold prices as the appeal of non-yielding assets increases.

Additionally, central banks often hold significant amounts of gold reserves, and their buying or selling activities can sway market sentiment dramatically. Keeping abreast of central bank announcements and policy shifts can provide valuable insights for traders looking to capitalize on XAUUSD price movements.

Geopolitical Events and Their Impact

Geopolitical events, such as elections, conflicts, and trade wars, can create volatility in the markets, often leading to increased demand for gold. During times of uncertainty, traders often turn to gold as a “safe haven,” which drives up its price.

Understanding global affairs and their potential implications for XAUUSD is essential for any trader. Engaging with reliable news sources and following expert analyses can help traders anticipate price movements linked to geopolitical events.

Technical Analysis Techniques

Technical analysis is a method of forecasting future price movements based on past market behavior. For traders looking to capitalize on XAUUSD, mastering technical analysis techniques is essential.

Key Technical Indicators for Gold Trading

There are several technical indicators that traders commonly use when analyzing the XAUUSD chart. Among them, the Relative Strength Index (RSI) is particularly useful for identifying overbought or oversold conditions in the market.

Another significant indicator is the Moving Average Convergence Divergence (MACD), which helps traders determine momentum and potential trend reversals. Additionally, Fibonacci retracement levels can offer insight into potential support and resistance areas, guiding decision-making when trading XAUUSD.

Utilizing these technical indicators effectively requires practice and familiarity with chart patterns. The more comfortable you become with various indicators, the better equipped you will be to identify profitable trading opportunities.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Chart Patterns Relevant to XAUUSD

Understanding chart patterns is pivotal for executing successful trades on XAUUSD. Common chart patterns such as head and shoulders, double tops, and triangles can indicate potential reversals or continuations in price movement.

For example, a head and shoulders pattern may suggest a forthcoming bearish trend, prompting traders to consider short positions. On the other hand, a double bottom pattern typically signals bullish sentiment, indicating the potential for price increases. Familiarizing yourself with these patterns can greatly enhance your ability to predict future movements in XAUUSD prices.

Support and Resistance Levels

Support and resistance levels are integral to technical analysis. Support refers to price levels where the market tends to find buying interest, preventing further decline. Conversely, resistance levels are where selling pressure emerges, limiting price increases.

Identifying these levels on the XAUUSD chart can assist traders in making informed decisions. For instance, if a price approaches resistance, traders might consider placing sell orders, anticipating a price reversal. Conversely, approaching strong support could prompt buy orders, as the price may bounce back.

Developing a Trading Strategy

Developing a robust trading strategy is crucial for successful XAUUSD trading. Whether you prefer day trading or swing trading, having a clearly defined approach can help you manage risk and maximize profits.

Day Trading vs. Swing Trading for XAUUSD

Day trading involves executing multiple trades within a single day, capitalizing on small price fluctuations. This type of trading is suited for those who can dedicate substantial time to monitoring the markets and making quick decisions. Since XAUUSD can experience volatility, day traders often leverage this by entering and exiting positions rapidly.

In contrast, swing trading focuses on capturing longer-term price movements. Swing traders typically hold positions for several days to weeks, aiming to profit from larger price swings. This strategy may be more appealing to those who cannot constantly monitor the markets, as it allows for a more patient and analytical approach to trading XAUUSD.

Risk Management Strategies

Effective risk management is paramount in trading. Employing strategies such as setting stop-loss orders can help protect your capital from significant losses. A stop-loss order automatically closes a position when the market reaches a predetermined price level, minimizing emotional decision-making.

Additionally, employing proper position sizing is critical. Determine what percentage of your trading capital you are willing to risk on each trade, and adhere to that limit. By controlling your exposure and managing your risk appropriately, you can navigate the unpredictable nature of XAUUSD trading more confidently.

Setting Entry and Exit Points

Establishing clear entry and exit points is essential for successful trading. Before entering a trade, outline your desired price levels for both entry and exit. This foresight helps prevent impulsive decisions driven by emotions.

Traders should also consider using trailing stops—these allow for locking in profits as the market moves favorably. By dynamically adjusting your stop loss level, you can secure gains while giving your trade room to grow.

Executing Trades on Exness

Now that you’ve developed a solid trading strategy, it’s time to execute trades. Understanding the mechanics of placing orders on Exness is crucial for smoothly navigating the trading environment.

How to Place a Trade on Exness

Placing a trade on Exness is straightforward. After logging into your MT4 or MT5 platform, select the XAUUSD pair from the market watch list. Once selected, click on "New Order," which will open a configuration window.

In this window, you can choose whether to buy or sell XAUUSD, set your lot size, and specify stop-loss or take-profit levels. After reviewing your parameters, click on the "Place Order" button to execute the trade. It’s essential to ensure all details are accurate before finalizing your order.

Understanding Lot Sizes and Leverage

In Forex trading, understanding lot sizes and leverage is crucial. A standard lot is equivalent to 100 ounces of gold. However, Exness offers flexible lot sizes, allowing traders to choose micro or mini lots, which can help manage risk effectively.

Leverage amplifies your trading potential, allowing you to control larger positions with a smaller amount of capital. For instance, a leverage ratio of 1:500 means you can control $500,000 worth of XAUUSD with just $1,000 in your account. While leverage can magnify profits, it also increases risk, so it’s crucial to use it wisely.

Monitoring and Adjusting Active Trades

Monitoring active trades is essential for optimizing your trading strategy. Using Exness's platform features, you can easily track real-time performance and assess market conditions.

If market dynamics change or if your analysis suggests that a trade might not perform as expected, be prepared to adjust your stop-loss or take-profit levels accordingly. Staying alert to market trends and being adaptable can make a significant difference in your overall trading success.

Common Mistakes to Avoid

Even seasoned traders can fall into common traps that hinder their trading performance. Being aware of these mistakes can pave the way for more successful trading experiences.

Emotional Trading Pitfalls

Emotional trading is one of the biggest challenges traders face. Allowing fear or greed to dictate your decisions can lead to poor outcomes. For instance, fear of missing out (FOMO) may push you to enter a trade without adequate analysis, while panic might cause you to close a position too early.

To overcome emotional trading, stick to your predefined strategy and trust your analysis. Setting strict rules and maintaining discipline in your trading approach will help mitigate the influence of emotions.

Ignoring Market News and Updates

Staying informed about market news and updates is essential for successful trading. Major events—such as economic data releases or geopolitical developments—can quickly alter market sentiment and influence XAUUSD prices.

Ignoring these developments may lead to unforeseen losses. Make it a habit to check reliable news sources regularly and integrate economic calendars into your analysis routine. This practice will enhance your awareness of potential market-moving events.

Overleveraging Your Trades

While leverage can enhance potential profits, overleveraging poses considerable risks. Trading with excessive leverage can lead to rapid losses that exceed your initial investment. It's crucial to maintain a balanced approach to leverage and ensure that your trading decisions align with your overall risk management strategy.

Aim to keep leverage at a manageable level and avoid using maximum leverage on every trade. By practicing prudent leverage usage, you can safeguard your capital while still enjoying the benefits of margin trading.

Utilizing Exness Features

As a trader on the Exness platform, you have access to several features that can enhance your trading experience. Exploring these features can yield numerous advantages.

Exploring Different Account Types

Exness offers multiple account types tailored to different trading styles and experience levels. From standard accounts that offer competitive spreads to professional accounts with enhanced features like zero spreads, you can choose an account that aligns with your trading preferences.

Understanding the differences between account types can help you optimize your trading experience. Consider your trading frequency, strategy, and risk tolerance when selecting the most suitable account option.

Benefits of Using Exness Promotions

Exness frequently runs promotions that can benefit traders. These may include bonus programs, referral rewards, and deposit bonuses, which can provide additional capital for trading.

Taking advantage of these promotions can enhance your trading capacity and amplify your potential returns. Always stay informed about current promotions and consider how they could complement your trading strategy.

Customer Support and Resources

One of the strengths of Exness is its customer support. The platform provides various channels for assistance, including live chat, email support, and a comprehensive knowledge base. Access to quality customer service is essential for resolving issues promptly.

Additionally, Exness offers extensive educational resources to help traders improve their skills. From webinars to trading guides, these materials can bolster your understanding of XAUUSD and refine your trading techniques.

Conclusion

In conclusion, learning how to trade XAUUSD in Exness involves multiple steps ranging from understanding the fundamentals of gold trading to executing trades effectively. By applying fundamental and technical analysis, developing a robust trading strategy, and leveraging the features offered by Exness, you can navigate the complexities of the XAUUSD market with confidence.

Remember that trading is a continuous learning journey; staying informed, disciplined, and adaptable will be key to your long-term success in trading XAUUSD on the Exness platform. Embrace the challenges and strive for improvement, and you may find that trading XAUUSD becomes a rewarding endeavor.

Read more: