13 minute read

Is XAUUSD good to trade? A Comprehensive Guide

from Exness

by Exness Blog

Is XAUUSD good to trade? This is a question that many traders and investors consider when looking at gold as a financial asset. Gold, represented by the symbol XAU in trading platforms, has historically been viewed as a safe haven asset, especially during times of economic uncertainty. Understanding whether trading XAUUSD (the exchange rate between gold and the US dollar) is beneficial requires a deep dive into its characteristics, historical performance, influencing factors, and strategies.

Top 4 Best XAUUSD Brokers

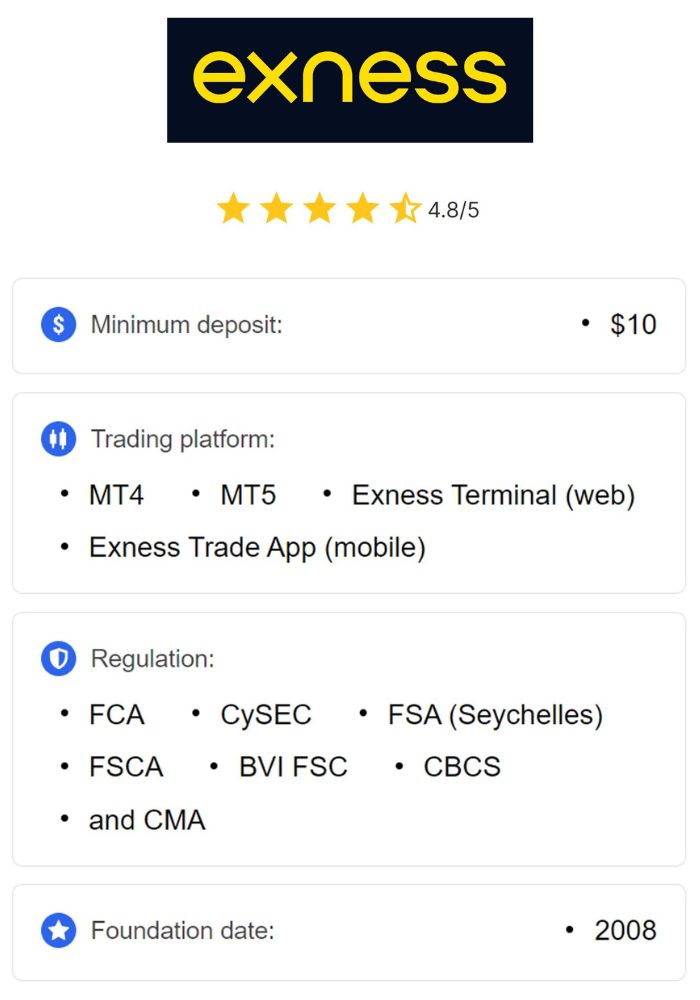

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Understanding XAUUSD

To determine the viability of trading XAUUSD, it’s crucial to first understand what XAUUSD represents and the significance of gold in the trading landscape.

Definition of XAUUSD

XAUUSD is the ticker symbol for the price of one ounce of gold measured in U.S. dollars. The "XAU" code refers to a troy ounce of gold, while "USD" signifies the currency, which is the United States dollar. Traders speculate on the value of gold against the dollar, which makes it an essential commodity in forex trading.

Gold is unique compared to other currencies due to its intrinsic value, historical significance, and role in various cultures as a store of wealth. As a result, the fluctuations in the XAUUSD pair can be influenced by a myriad of factors ranging from geopolitical events to monetary policies.

The Importance of Gold in Trading

Gold serves multiple purposes in the financial markets. It is often seen as a hedge against inflation and currency devaluation. During economic downturns or periods of instability, investors flock to gold, driving up its demand and price.

Moreover, central banks around the world hold gold reserves, making it a vital part of national financial strategies. As such, the XAUUSD pair is not only affected by market sentiment but also by macroeconomic indicators and global developments. Understanding these dynamics is essential for those considering trading XAUUSD.

Historical Performance of XAUUSD

Examining the historical performance of XAUUSD provides insights into its behavior over time and helps traders identify trends and make informed decisions.

Trends Over the Last Decade

Over the past decade, XAUUSD has exhibited significant volatility, with notable upward trends that reflect broader economic conditions. For instance, the price of gold soared dramatically during the COVID-19 pandemic as investors sought refuge from economic uncertainty.

Long-term trends are critical for traders. The historical data show that gold prices tend to rise during periods of high inflation or geopolitical tensions. By analyzing these trends, traders can better anticipate future movements in the XAUUSD pair.

Key Events Impacting Gold Prices

Several key events have had a substantial impact on gold prices throughout history. Economic crises, political unrest, and changes in monetary policy are just a few examples.

For instance, the 2008 financial crisis led to a surge in gold prices as investors turned to safe-haven assets to protect their wealth. Similarly, recent geopolitical tensions in various regions have caused fluctuations in gold pricing, reinforcing the idea that XAUUSD is closely linked to global events.

Factors Influencing XAUUSD

Understanding the factors that influence XAUUSD is paramount for anyone interested in trading this pair. Several interrelated elements can cause fluctuations in the price of gold.

Economic Indicators and Their Effects

Economic indicators play a significant role in the performance of XAUUSD. Data related to inflation rates, employment figures, and GDP growth can all affect market confidence and subsequently drive the demand for gold.

When economic indicators suggest instability or decline, investors often rush to buy gold as a protective measure, pushing up its value. Conversely, strong economic data may lead to a decrease in demand for gold, causing prices to fall. Thus, keeping an eye on these indicators is crucial for successful trading.

Political Stability and Its Role

Political stability directly affects investor confidence, and any signs of instability can lead to increased interest in gold. Countries experiencing political turmoil often see their currencies weaken, leading investors to seek out more stable assets like gold.

Trade agreements, elections, and international relations can all significantly impact the price of gold. Therefore, understanding the political landscape and its implications for gold prices is essential for traders aiming to capitalize on XAUUSD movements.

Market Sentiment and Demand for Gold

Market sentiment can be a powerful influencer in the trading arena. Fear, uncertainty, and doubt often drive investors towards gold when they believe the market is volatile.

This emotional aspect creates cycles of demand and supply that can lead to significant price fluctuations in XAUUSD. Traders must not only analyze hard data but also gauge market sentiment through news reports, analyst opinions, and social media discussions to make informed trading decisions.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Technical Analysis of XAUUSD

Technical analysis offers traders tools to evaluate and predict future price movements based on historical data.

Chart Patterns and Signals

Chart patterns help traders identify potential future movements in XAUUSD. Patterns such as head and shoulders, triangles, and flags provide visual cues about market sentiment and potential reversals or continuations.

Recognizing these patterns early allows traders to position themselves advantageously. A well-timed entry or exit based on chart signals can make a significant difference in trading outcomes, enhancing profitability.

Utilizing Support and Resistance Levels

Support and resistance levels are fundamental concepts in technical analysis. Support levels indicate where buying interest is strong enough to overcome selling pressure, while resistance levels signify the opposite.

Understanding these levels in the context of XAUUSD can provide valuable insights. When prices approach support, traders may look for buying opportunities, while nearing resistance levels may prompt them to consider selling or shorting.

Moving Averages and Their Applications

Moving averages are widely used in technical analysis to smooth out price data and identify trends over specific periods. Traders often use simple moving averages (SMA) and exponential moving averages (EMA) to gauge momentum and potential reversals in the XAUUSD market.

By analyzing the crossover of short-term and long-term moving averages, traders can develop strategies that align with the prevailing trend, thereby enhancing their chances of success.

Fundamental Analysis of XAUUSD

Fundamental analysis evaluates the underlying factors affecting XAUUSD prices, enabling traders to make informed decisions based on broader economic trends.

Central Bank Policies and Interest Rates

Central bank policies greatly influence the value of gold. Decisions regarding interest rates can lead to shifts in currency valuations, impacting XAUUSD. Generally, lower interest rates reduce the opportunity cost of holding gold, making it more attractive to investors.

Furthermore, central banks’ buying or selling actions can also sway market perceptions. When a central bank increases its gold reserves, it sends a signal of confidence in gold as a store of value, boosting demand and prices.

Inflation and its Correlation with Gold Prices

Inflation is closely tied to the value of gold. Historically, gold has been viewed as a hedge against inflation; when inflation rises, so does the appeal of gold as a reliable store of value.

As inflation erodes purchasing power, investors often flock to gold, driving up its price. Monitoring inflation trends and expectations can provide valuable insights for traders looking to capitalize on movements in XAUUSD.

Global Economic Conditions

Global economic conditions, including trade relations, economic growth rates, and overall market stability, can influence gold pricing. A robust global economy typically leads to higher demand for goods and services, which can diminish gold's appeal as an alternative investment.

Conversely, economic slowdowns or recessions usually trigger a flight to safety, resulting in rising gold prices. Recognizing these correlations aids traders in predicting potential trends in the XAUUSD market.

Trading Strategies for XAUUSD

Developing effective trading strategies is crucial for successfully navigating the XAUUSD market.

Day Trading vs. Long-Term Investing

Day trading involves making quick trades to capitalize on short-term price movements, while long-term investing focuses on holding positions for extended periods to benefit from overarching trends.

Each strategy has its own merits and risks. Day trading requires sharp focus and quick decision-making, whereas long-term investing necessitates patience and a keen understanding of market fundamentals. Traders need to choose a strategy that aligns with their risk tolerance and market outlook.

Swing Trading Techniques

Swing trading is aimed at capturing price swings within a medium-term timeframe. Traders utilize technical analysis to identify entry and exit points, aiming to profit from fluctuations in the XAUUSD pair.

In swing trading, it’s important to remain adaptable, as market conditions can change rapidly. Developing a robust trading plan that includes clear rules for entering and exiting trades is essential for success.

Risk Management in XAUUSD Trading

Effective risk management is paramount when trading XAUUSD. This involves setting stop-loss orders, diversifying portfolios, and maintaining appropriate position sizes to mitigate potential losses.

Traders must assess their risk tolerance and develop a plan that protects their capital while allowing for potential gains. Without solid risk management strategies, even the most promising trading plans can quickly unravel.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Tools and Resources for Trading XAUUSD

Utilizing the right tools and resources can enhance trading efficiency and decision-making processes.

Trading Platforms and Software

Selecting a reliable trading platform is foundational for trading XAUUSD effectively. Many platforms offer advanced charting tools, real-time data, and user-friendly interfaces that facilitate the trading process.

Comparing different platforms based on features, fees, and usability is essential in finding the best fit for individual trading styles and preferences.

Economic Calendars and News Feeds

Staying updated on economic events and announcements is crucial for traders dealing with XAUUSD. Economic calendars provide insights into upcoming data releases that could impact gold prices, allowing traders to prepare their strategies accordingly.

Additionally, subscribing to financial news feeds helps traders stay informed about market sentiment and geopolitical developments that could influence gold prices.

Analytical Tools for Better Decision Making

Using analytical tools, such as technical indicators and market analysis software, can provide deeper insights into the XAUUSD market. These tools help traders make more informed decisions by analyzing price patterns, momentum, and volume.

Integrating various analytical tools into a comprehensive trading strategy can improve outcomes and increase confidence in trading decisions.

Pros and Cons of Trading XAUUSD

Every financial market has its advantages and disadvantages, and XAUUSD is no exception.

Advantages of Trading Gold

Trading gold offers several distinct advantages. First and foremost, gold is a tangible asset with intrinsic value, providing a sense of security during volatile market conditions.

Additionally, gold typically has low correlations with equities and other commodities, offering portfolio diversification benefits. Furthermore, the liquidity of the XAUUSD market means that traders can easily enter and exit positions without significant slippage.

Disadvantages and Risks Involved

Conversely, trading XAUUSD comes with its own set of risks. Gold prices can experience sudden volatility due to geopolitical events or economic data releases, potentially leading to significant losses if not managed correctly.

Moreover, external factors such as currency fluctuations and interest rate changes can adversely affect gold prices. Therefore, traders must be vigilant and aware of the risks associated with trading this commodity.

Comparing XAUUSD with Other Currency Pairs

A comparative analysis of XAUUSD with other major currency pairs can provide valuable insights for traders.

XAUUSD vs. Major Currency Pairs

When comparing XAUUSD to major currency pairs, it's essential to recognize that gold acts differently than traditional currencies. While currencies are influenced primarily by economic indicators and central bank policies, gold is also affected by market sentiment and geopolitical events.

As a result, trading XAUUSD tends to require additional considerations beyond typical forex analyses, such as understanding the unique drivers of supply and demand for gold.

XAUUSD vs. Other Commodities

Gold, as a precious metal, behaves differently than other commodities like oil or agricultural products. While oil prices are heavily influenced by supply and production levels, gold responds more to macroeconomic factors, inflation, and currency valuation.

This distinction highlights why traders may choose to focus on XAUUSD rather than other commodities, depending on their trading strategies and market outlook.

Psychological Aspects of Trading XAUUSD

The psychological component of trading plays a pivotal role in determining success or failure.

Trader Emotions and Decision Making

Emotions can cloud judgment and lead to impulsive decisions, especially in the inherently volatile environment of XAUUSD trading. Fear and greed can cause traders to deviate from their established strategies, leading to undesirable outcomes.

Awareness of these emotional triggers is crucial for successful trading. Implementing practices such as journaling trades and setting clear goals can help traders maintain discipline and make rational decisions.

Developing a Trading Mindset

Cultivating a resilient trading mindset is integral to thriving in the XAUUSD market. Successful traders embrace challenges and learn from failures, continuously seeking improvement and adaptation.

Moreover, adopting a long-term perspective can alleviate the pressure of short-term fluctuations, allowing traders to remain focused on their overall strategies and objectives.

Regulatory Considerations for XAUUSD Trading

Navigating the regulatory environment is essential for traders involved in XAUUSD trading.

Understanding Trading Regulations

Regulatory frameworks vary across countries and can significantly impact trading practices. Understanding the regulations governing forex and commodity trading is essential to ensure compliance and protect against potential legal issues.

Traders should familiarize themselves with the regulatory bodies overseeing their trading activities and stay informed about any updates or changes in regulations.

Choosing a Regulated Broker

Selecting a regulated broker is paramount in safeguarding investments and ensuring fair trading practices. Regulatory bodies provide oversight that helps protect traders from fraud and malpractice.

When choosing a broker for trading XAUUSD, traders should evaluate their reputation, regulatory status, and the quality of their trading services. A trustworthy broker can enhance the overall trading experience and contribute to long-term success.

Future Outlook for XAUUSD

The future trajectory of XAUUSD remains a topic of great interest and speculation among traders and analysts alike.

Predictions from Market Analysts

Market analysts offer varying predictions for the future of XAUUSD, often shaped by prevailing economic conditions, geopolitical tensions, and central bank policies. Some analysts foresee continued strength in gold prices as uncertainties persist in global markets, while others caution against potential corrections.

Keeping abreast of expert opinions can provide traders with valuable insights, though it’s essential to conduct independent research and analysis before making trading decisions.

Potential Challenges Ahead

While the outlook for XAUUSD may appear favorable, potential challenges loom on the horizon. Factors such as increasing interest rates, changing monetary policies, and improving economic conditions can exert downward pressure on gold prices.

Traders should remain vigilant and adaptable, ready to respond to shifts in market dynamics and adjust their strategies accordingly.

Conclusion on Trading XAUUSD

In summary, the question of whether XAUUSD is good to trade embodies intricate considerations involving historical performance, influencing factors, and strategic approaches. With its unique characteristics as a safe-haven asset and an integral component of global finance, trading gold presents both opportunities and challenges.

Successful trading in XAUUSD requires a thorough understanding of market dynamics, effective risk management, and the ability to remain disciplined amidst the emotional complexities of trading. By leveraging both technical and fundamental analyses, traders can position themselves to navigate this multifaceted market effectively and make informed decisions that align with their financial goals.

Read more: