16 minute read

Does Exness work in Ethiopia? Review Broker

from Exness

by Exness Blog

In the realm of online trading, one question that often arises is Does Exness work in Ethiopia? As an Ethiopian trader or a prospective investor exploring foreign exchange and CFD trading opportunities, understanding the capabilities and limitations of platforms like Exness is essential. This article aims to provide a comprehensive overview of Exness, its applicability in Ethiopia, and the associated challenges and opportunities for traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

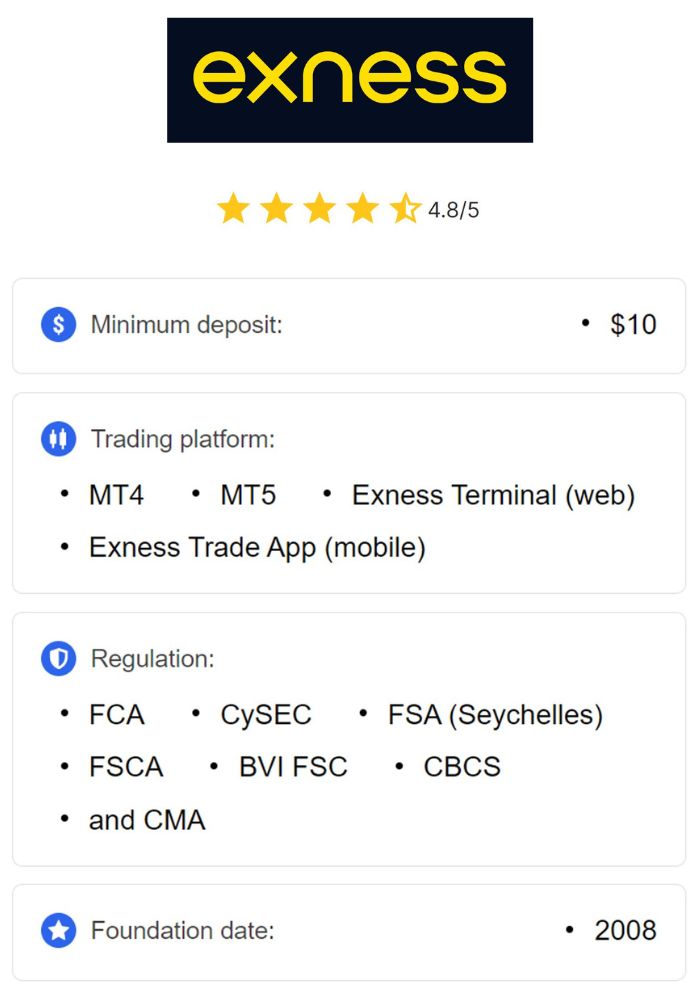

Overview of Exness

Exness has carved a niche for itself in the global brokerage landscape, establishing its presence as a go-to platform for traders worldwide. This section will delve into various aspects of Exness, from its introduction and regulatory framework to the instruments it offers for trading.

Introduction to Exness

Founded in 2008, Exness has rapidly ascended to become one of the premier online brokerage firms specializing in forex and CFD trading. With millions of users globally, Exness has built a reputation that thrives on competitive trading conditions, a broad selection of assets, and a user-friendly interface designed for both novice and seasoned traders alike.

A key aspect of Exness's appeal lies in its commitment to transparency and reliability. The firm operates under various international regulatory bodies, thereby ensuring a secure environment for its clients' investments. This not only enhances user confidence but also aligns with the broader trends toward regulation and oversight in financial markets.

The platform presents a wide array of trading options, enabling individuals to diversify their portfolios effectively. Whether you are interested in forex pairs, commodities, cryptocurrencies, or other financial products, Exness caters to a multitude of preferences.

Regulatory Framework

Regulation is a crucial factor when choosing an online brokerage, particularly for residents of developing countries like Ethiopia. Exness adheres to stringent regulatory standards and holds licenses from several reputable authorities across multiple jurisdictions.

CySEC (Cyprus Securities and Exchange Commission): Exness is licensed under license number 178/12, which indicates compliance with EU regulations.

FCA (Financial Conduct Authority): The FCA reference number 730729 showcases Exness's commitment to protecting client funds and maintaining market integrity.

FSA (Financial Services Authority, Seychelles): License SD028 serves as another layer of regulatory assurance, demonstrating Exness's adherence to local laws while expanding its global reach.

These regulatory frameworks ensure that Exness meets high standards regarding client fund segregation, robust risk management practices, and transparent operational procedures. For Ethiopian traders considering Exness, this regulatory oversight offers a crucial layer of confidence needed in a marketplace that is still evolving.

Trading Instruments Offered

As an expansive brokerage, Exness provides a diverse array of trading instruments that cater to different trading strategies and preferences. Among these are:

Forex Currency Pairs: Covering major, minor, and exotic currency pairs, Exness enables traders to navigate the global currency markets effortlessly. The availability of various pairs allows traders to implement different strategies based on market conditions.

CFD Contracts: Including contracts for indices, commodities, cryptocurrencies, and shares, CFDs enable traders to capitalize on price fluctuations without owning the underlying asset directly. This can be particularly appealing in volatile markets.

Metals: Precious metals like gold and silver have long been considered safe havens during periods of economic uncertainty. Trading these assets through Exness provides a hedge against inflation and market volatility.

Energies: Oil and natural gas contracts offer exposure to the energy sector, allowing traders to engage with markets influenced by geopolitical tensions and supply-demand dynamics.

Ethiopian traders may find these offerings valuable as they seek to explore numerous opportunities within the global trading ecosystem.

Understanding the Ethiopian Market

To grasp how Exness operates in Ethiopia, it is vital to understand the country's current economic climate and the market's overall attitude toward online trading. Factors such as internet accessibility and infrastructure also play a role in shaping the trading experience.

Current Economic Climate

Ethiopia is characterized as a developing nation experiencing rapid economic growth. Despite impressive gains, the economy faces several challenges that could impact trading activities.

Inflation rates in Ethiopia have fluctuated over the years, influencing the purchasing power of the Ethiopian Birr (ETB). For traders operating in such an environment, understanding how inflation can affect currency valuations becomes critical. Inflationary pressures may lead to currency depreciation, impacting trading decisions, especially for those engaged in forex trading.

Currency volatility is another concern. The Ethiopian Birr often experiences fluctuations, which can pose risks for traders dealing with currency conversions. As a result, monitoring these changes becomes a key part of any trader's strategy.

Lastly, foreign exchange regulations present unique challenges for Ethiopians looking to trade online. Obtaining and exchanging foreign currencies may be subject to strict regulations, impacting the ability to fund or withdraw from accounts held with brokers like Exness.

Attitudes Towards Online Trading

The perception of online trading in Ethiopia is gradually evolving. While awareness of forex and CFD trading is increasing, particularly among younger generations who are tech-savvy, the practice remains relatively niche compared to more established markets.

Many Ethiopians view online trading as a potential opportunity to generate additional income; however, misconceptions about the inherent risks often deter participation. A lack of comprehensive education and understanding around trading implications means that many may approach the market with caution.

For traders in Ethiopia, there exists a need for greater awareness and educational resources to help demystify online trading. By fostering understanding, traders can better navigate the complexities of financial markets.

Internet Accessibility and Infrastructure

Internet accessibility is a crucial consideration for any trader, and Ethiopia is undergoing significant improvements in this area. However, challenges regarding internet speed and reliability persist.

Despite advances in connectivity, traders may still encounter issues that hinder seamless trading experiences. Slow internet connections can affect order execution times, potentially leading to missed opportunities or unfavorable trades. High-frequency trading strategies, which depend heavily on reliable internet access, may not be feasible for all Ethiopian traders.

It is essential for anyone looking to engage in online trading in Ethiopia to assess their internet service quality. Traders must invest in a stable, high-speed connection to ensure optimal engagement with trading platforms like Exness.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Legal Considerations for Online Trading in Ethiopia

Before diving into online trading with Exness, Ethiopian traders must familiarize themselves with the legal landscape governing financial activities in the country. Knowledge of existing regulations and compliance requirements is essential to avoid potential pitfalls.

Understanding Ethiopian Financial Regulations

The regulatory framework governing financial markets in Ethiopia remains dynamic and evolving. The National Bank of Ethiopia (NBE) serves as the primary regulatory authority overseeing the financial sector, including foreign exchange and online trading activities.

While the NBE has made strides toward addressing the regulatory needs of online trading, there remain ambiguities surrounding the operation of international brokerage firms like Exness. Traders in Ethiopia must stay informed about changing regulations, particularly as the NBE begins to formulate clearer guidelines for online trading platforms.

Understanding these regulations is vital for avoiding conflicts with local authorities and ensuring compliance with relevant laws. As the landscape evolves, traders must remain vigilant in adhering to new rules and standards.

Compliance Requirements for Traders

Ethiopian traders utilizing Exness should be aware of their responsibility for compliance under local laws. Key areas of focus include:

Tax Compliance: Income generated from trading activities—whether forex, CFDs, or other instruments—may be subject to taxation in accordance with Ethiopian tax laws. Traders should familiarize themselves with applicable tax obligations and ensure proper reporting.

Foreign Exchange Rules: Engaging in cross-border transactions requires navigating the NBE's foreign exchange regulations. Compliance ensures that funds used for trading and withdrawals align with local laws, reducing the risk of sanctions.

Declarations and Reporting: Depending on their trading volume and frequency, some traders may be required to declare their activities to local authorities. Understanding these requirements can prevent future complications.

Risks of Non-Compliance

Traders who fail to adhere to local regulations may face severe consequences. These can include:

Financial Penalties: Violating foreign exchange regulations or tax laws may result in hefty fines, significantly impacting profitability.

Legal Action: In more serious instances, non-compliance can lead to legal prosecution, resulting in reputational damage and financial loss.

Account Suspension: Reputable brokers like Exness may be compelled to comply with local regulations, leading to account suspensions if non-compliance is detected.

To mitigate these risks, Ethiopian traders should prioritize compliance with relevant laws and regulations as they engage in online trading.

Opening an Exness Account from Ethiopia

With a clearer understanding of the legal and market landscape, Ethiopian traders can move forward with opening an Exness account. The following segments discuss the necessary steps involved in creating an account and the documentation required for verification.

Registration Process

Opening an account with Exness is designed to be a straightforward and user-friendly process. Prospective traders need to visit the Exness website and initiate the registration procedure by providing basic personal information.

During registration, traders will be prompted to furnish details such as their name, date of birth, email address, and phone number. Following this initial step, individuals must choose an appropriate trading account type that aligns with their risk tolerance and experience level.

Having multiple account types available adds flexibility for traders, ensuring that they can select the option that best suits their needs while optimizing their trading experience.

Required Documentation

To maintain compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations, Exness mandates that traders provide specific identification documentation during the account setup process. Common documents requested may include:

Proof of Identity: A valid passport or national ID card confirming the trader’s identity must be submitted for verification.

Proof of Address: Utility bills or bank statements displaying the trader's current address serve as crucial documentation for verifying residency.

Payment Method Verification: Depending on the chosen payment method for deposits and withdrawals, traders may also be required to provide additional documentation.

This emphasis on documentation ensures the integrity of the trading environment and protects both the broker and the clients from potential fraud.

Account Verification Steps

The account verification process typically takes a few business days after submission of the required documents. The Exness verification team will assess the provided materials and confirm the trader's identity and residency status.

Upon successful verification, traders gain full access to the features offered by Exness, allowing them to begin trading on the platform. This thorough verification process is integral in building trust between Exness and its clients, ensuring that all parties operate within legal frameworks.

Deposit and Withdrawal Options

Effective management of funds is a critical component of online trading. Exness supports a variety of deposit and withdrawal methods, although the specifics can vary based on the trader’s location and currency preferences.

Available Payment Methods

Exness provides a range of payment methods suitable for Ethiopian traders aiming to deposit and withdraw funds. Some commonly available options include:

Bank Transfers: While potentially convenient, bank transfers may incur longer processing times compared to other methods. Traders should consider the implications of using bank transfers, particularly concerning fees and waiting periods.

Electronic Payment Systems: Platforms like Skrill, Neteller, and Perfect Money facilitate quicker transactions, making them attractive for traders seeking efficiency in funding their accounts.

Cryptocurrencies: For those inclined towards digital currencies, Exness supports certain cryptocurrencies as viable options for trading and deposits, offering an alternative avenue for transactions.

Traders in Ethiopia should compare the pros and cons of each payment method before deciding which to utilize.

Transaction Fees and Processing Times

Transaction fees and processing times can fluctuate depending on the selected payment method. Thoroughly reviewing the applicable fees and timelines on the Exness website prior to initiating transactions is prudent for traders.

Understanding these costs helps traders budget effectively and make informed decisions about their trading activities.

Currency Conversion Issues

Ethiopian traders often encounter challenges related to currency conversion when using Exness. Given that the Ethiopian Birr is not universally accepted, traders may be required to convert their funds to supported trading currencies such as USD, EUR, or GBP.

It is important for traders to stay informed about the exchange rates applied by Exness or payment processors. Fluctuations in exchange rates can significantly influence the final amounts credited or debited to a trader's account, affecting their overall profitability.

Trading Conditions on Exness

Trading conditions are a critical factor that can determine a trader's success. This section explores various trading conditions available on the Exness platform, including leverage, spreads, commission structures, and execution speeds.

Leverage and Margin Requirements

Leverage plays a significant role in the trading experience, enabling traders to control larger positions with smaller capital outlays. Exness provides a flexible range of leverage options across different trading instruments, allowing traders to customize their approach based on individual risk appetites.

While leveraging can amplify profits, it's worth noting that it equally magnifies losses, necessitating careful risk management practices. Traders must thoroughly understand the margin requirements associated with their chosen instruments and employ strategies that protect their capital.

Spreads and Commissions

Spreads represent the difference between the buy and sell prices of a trading instrument—an essential cost factor that traders must account for. Exness prides itself on offering competitive spreads across various instruments, catering to cost-conscious traders who wish to maximize their profit margins.

Depending on the account type and trading volume, traders may also incur commissions on certain instruments. A clear understanding of the specific trading conditions for each instrument enables traders to anticipate costs accurately and adjust their strategies accordingly.

Execution Speed and Slippage

Execution speed refers to how quickly a trading order is processed and filled—a crucial element for traders looking to engage in timely market access. Exness strives to deliver rapid and efficient order execution, minimizing the potential for slippage.

Slippage occurs when an order is executed at a price different from the expected one, often due to market volatility. To mitigate the risks associated with slippage, traders must be mindful of market conditions and execute orders strategically.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Customer Support Services

Accessible and responsive customer support can greatly enhance the trading experience for users. This section investigates the availability and quality of customer support services provided by Exness for Ethiopian traders.

Availability of Support in Ethiopia

Exness recognizes the importance of supporting its diverse clientele, including Ethiopian traders. The platform aims to provide comprehensive support through various channels, ensuring that users receive timely assistance regardless of their geographical location.

Languages Offered

Given Ethiopia’s multilingual population, Exness offers customer support in multiple languages, helping create a welcoming environment for traders. Additionally, language options enhance communication effectiveness, ensuring that users fully understand the assistance provided.

Contact Channels

Traders can reach Exness's customer support team through various contact channels, including live chat, email, and phone support. This multi-faceted approach ensures traders can choose the method that best fits their preferences and needs, enhancing the overall user experience.

Proactive customer support can help resolve issues swiftly, allowing traders to focus on their strategic objectives rather than logistical concerns.

Trading Platforms Provided by Exness

Exness offers a variety of trading platforms tailored to meet the needs of different traders, whether they prefer desktop options or mobile applications. This section examines the platforms provided by Exness, comparing the popular MetaTrader 4 and MetaTrader 5.

MetaTrader 4 vs. MetaTrader 5

MetaTrader 4 (MT4) remains one of the most widely used trading platforms globally, renowned for its user-friendly interface and robust functionality. The platform provides traders with powerful analytical tools, customizable charts, and automated trading options through Expert Advisors (EAs).

Conversely, MetaTrader 5 (MT5) boasts advanced features, including enhanced charting capabilities, more technical indicators, and support for additional asset classes beyond forex. Traders seeking a more comprehensive platform may find MT5 to be a valuable alternative to MT4.

Ultimately, the choice between MT4 and MT5 comes down to personal preference and trading goals. Both platforms offer unique benefits that cater to varying trader styles.

Mobile Trading Applications

For the modern trader, mobile accessibility is paramount. Exness provides dedicated mobile applications compatible with both iOS and Android devices, allowing traders to manage their accounts and execute trades on the go.

Mobile trading apps deliver real-time market updates and notifications, enabling traders to respond promptly to market changes. This flexibility empowers traders to seize opportunities even while away from their primary trading setups.

Web-Based Trading Features

In addition to dedicated applications, Exness offers web-based trading features accessible through browsers. This option allows traders to engage with the platform without needing to download software, further enhancing convenience.

Web-based features complement the desktop and mobile experiences, providing traders with a comprehensive suite of tools to analyze markets, execute trades, and monitor account performance seamlessly.

Educational Resources for Ethiopian Traders

Education is pivotal for success in online trading, particularly for novices looking to build their foundational knowledge. Exness provides various educational resources aimed at empowering Ethiopian traders through information and insights.

Webinars and Tutorials

Exness offers informative webinars and tutorials covering various trading topics, ranging from introductory lessons to advanced strategies. These interactive sessions allow traders to learn from experienced professionals and develop their skills in real-time.

Such educational resources serve as excellent opportunities for Ethiopian traders to expand their knowledge base and improve their trading acumen.

Market Analysis Tools

To aid traders in making informed decisions, Exness provides access to market analysis tools that help interpret data and identify trends. These tools can assist traders in devising well-informed strategies based on current market conditions.

Regular market updates and analyses help traders stay abreast of developments, ensuring they remain proactive in their trading endeavors.

Community Engagement and Forums

Community engagement represents an essential aspect of the trading experience. Exness encourages traders to connect and share ideas through discussion forums and social media channels. Such interactions foster a sense of camaraderie, enabling traders to learn from one another and share valuable insights.

Establishing a supportive trading community can alleviate feelings of isolation often felt by new traders, facilitating continuous learning and growth.

User Experience and Reviews

Examining user experiences and reviews can provide valuable insights into the strengths and weaknesses of Exness, particularly from the perspective of Ethiopian traders.

Trader Testimonials from Ethiopia

Feedback from Ethiopian traders reveals a range of experiences with Exness. Positive testimonials often highlight the platform's user-friendly interface, responsiveness of customer support, and availability of diverse trading instruments.

However, some users may express concerns about currency conversion issues or the limitations of specific payment methods. Gathering these insights helps prospective traders gauge the overall suitability of Exness for their individual needs.

Common Issues Faced by Ethiopian Users

Like any trading platform, Exness is not without its challenges. Ethiopian users may encounter common issues such as slow internet connectivity affecting order executions or difficulties in funding accounts due to foreign exchange regulations.

Understanding these challenges prepares traders for potential hurdles and prompts them to develop strategies to mitigate risks associated with these obstacles.

Overall Satisfaction Ratings

Overall satisfaction ratings can vary among Ethiopian traders, with many appreciating Exness's competitive spreads, quick execution times, and extensive educational resources.

However, some might express dissatisfaction regarding transaction fees or the availability of localized support. Monitoring these ratings provides helpful context for the platform's performance and assists prospective traders in making informed decisions.

Conclusion

In conclusion, the question of Does Exness work in Ethiopia? invites exploration into the multifaceted world of online trading. While Exness presents a robust platform offering a wealth of trading instruments, comprehensive support, and educational resources, traders must remain cognizant of the unique challenges posed by Ethiopia's evolving regulatory landscape, economic conditions, and internet infrastructure.

By familiarizing themselves with the intricacies of trading on Exness, Ethiopian traders can harness the platform's potential while navigating potential pitfalls. Ultimately, a well-rounded understanding of both the opportunities and challenges will empower Ethiopian traders to embark on their trading journeys with confidence.

Read more:

How to Deposit Money on Exness Using Mobile Money