15 minute read

How to Open a Forex Account in UAE

from Exness

by Exness Blog

How to Open a Forex Account in UAE is a question many traders ask as they look to venture into one of the largest financial markets in the world. With its booming economy and modern financial infrastructure, the UAE provides an attractive landscape for forex trading. This article aims to guide you through the steps and considerations involved in opening a forex account in the UAE.

Top 4 Best Forex Brokers in UAE

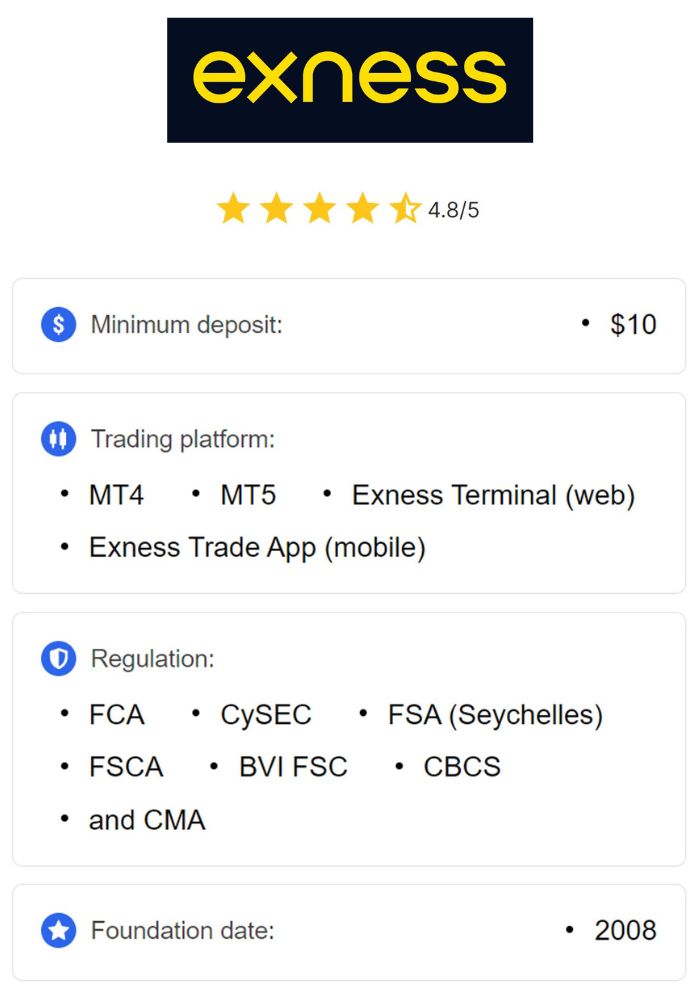

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ JustMarkets: Open An Account or Visit Brokers ✅

3️⃣ Quotex: Open An Account or Visit Brokers 🌐

4️⃣ Avatrade: Open An Account or Visit Brokers 💯

Understanding Forex Trading

Forex trading refers to the buying and selling of currencies on the foreign exchange market with the aim of making a profit. This decentralized marketplace operates 24 hours a day, allowing traders from all over the world to participate regardless of their geographical location.

The significance of forex trading extends beyond just individual profits; it plays a crucial role in global commerce and finance. In the UAE, where international trade is a cornerstone of the economy, forex trading has gained considerable traction.

What is Forex Trading?

At its core, forex trading involves exchanging one currency for another at agreed rates, known as currency pairs. The objective is to capitalize on fluctuations in exchange rates. For instance, if a trader believes that the euro will strengthen against the US dollar, they would buy euros with dollars. If the euro does indeed appreciate, the trader can sell back the euros for more dollars than initially spent, resulting in a profit.

Understanding various concepts such as pips, spreads, and leverage is essential for any aspiring trader. Pips represent the smallest price movement in a currency pair, while the spread denotes the difference between the buying and selling price. Leverage allows traders to control larger positions with a smaller amount of capital, making it possible to amplify both gains and losses.

The Importance of Forex Trading in the UAE Market

The UAE is strategically located between East and West, acting as a significant hub for international trade. With a thriving expat population and a growing number of individuals interested in investing, forex trading has become increasingly popular.

Forex trading in the UAE offers several advantages. Regulatory bodies ensure a secure trading environment, and the presence of numerous reputable brokers enhances accessibility. Moreover, the country's robust banking sector facilitates smooth transactions and fund transfers. All these factors contribute to the ever-growing appeal of forex trading for local investors and international traders alike.

Choosing the Right Forex Broker

Selecting the right forex broker is a critical step that can significantly impact your trading experience. Not all brokers are created equal; hence, understanding what to look for when choosing one is paramount.

Factors to Consider When Selecting a Broker

When evaluating potential brokers, consider aspects like trading fees, available currency pairs, and customer support. Transparent pricing structures are vital; hidden fees can eat into your profits. Additionally, examine the broker’s trading platforms—these should be user-friendly and equipped with essential tools.

Another key factor is the level of regulation the broker adheres to. A well-regulated broker means your funds are safer, and there are established procedures in place to resolve disputes.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulatory Standards for Forex Brokers in UAE

In the UAE, forex brokers must comply with regulations set forth by the Securities and Commodities Authority (SCA) and the Dubai Financial Services Authority (DFSA). These regulatory bodies enforce strict guidelines to ensure transparency and protect traders' rights. As a trader, always confirm that your chosen broker holds a valid license from one of these authorities.

Regulation not only contributes to a fair trading environment but also helps instill confidence in traders, knowing they are dealing with legitimate operators. Being aware of the regulatory framework in which your broker operates is essential for safeguarding your investments.

Popular Forex Brokers Operating in UAE

Several established forex brokers operate within the UAE, catering to both novice and experienced traders. Brokers like IG Group, FXTM, and Admiral Markets are among those recognized for their service quality, comprehensive educational resources, and robust trading platforms.

Choosing a broker that aligns with your specific trading style and requirements will enhance your overall experience. Researching customer reviews and ratings can provide insight into each broker's reliability, responsiveness, and reputation within the trading community.

Requirements for Opening a Forex Account

Once you've selected a suitable broker, you'll need to gather the necessary documentation to open your forex account. Each broker may have slight variations in their requirements, so it's crucial to familiarize yourself with what is needed.

Age and Identification Requirements

To legally trade forex in the UAE, you must be at least 21 years old. Most brokers require proof of age along with identification documents such as a valid passport or national ID. This ensures that the broker is compliant with local laws and is verifying the identity of its clients.

Identity verification is a standard procedure designed to prevent fraud and money laundering in the financial services industry. Therefore, having your identification documents readily available will expedite the account opening process.

Proof of Address Documentation

In addition to identity verification, brokers typically require proof of your residential address. Acceptable documents include utility bills, bank statements, or government-issued letters that display your name and current address. This requirement further supports the broker’s efforts to maintain a secure environment for trading.

Providing accurate and up-to-date information is crucial, as discrepancies or outdated documents may delay your account approval.

Financial Information Needed

Most brokers will also request details about your financial situation, including your employment status, annual income, and trading experience. This information helps them assess your suitability for trading and determine the risk levels associated with your profile.

It's important to answer these questions honestly, as providing misleading information can lead to complications during the account verification process, and may even result in account closure.

The Forex Account Types Available

Forex brokers usually offer various types of accounts tailored to meet the needs of different traders. Understanding the differences between account types will help you make an informed decision based on your trading strategy and goals.

Standard Accounts

Standard accounts are the most common type of forex trading account. They typically require a higher minimum deposit than other account types but offer the full range of trading features. Traders generally enjoy tighter spreads and greater leverage options in standard accounts.

These accounts are ideal for experienced traders who want direct access to the forex market and are comfortable managing larger sums of capital. With more trading instruments available, standard accounts can cater to various trading strategies, from scalping to long-term investing.

Mini and Micro Accounts

For novice traders or those looking to test their strategies without significant financial exposure, mini and micro accounts provide a viable option. These accounts require lower minimum deposits and allow for smaller trade sizes, making them accessible to beginners who want to learn and practice before committing larger amounts of capital.

Mini accounts typically involve trading contracts that are 10,000 units, whereas micro accounts allow trades as small as 1,000 units. This flexibility can make a substantial difference for new traders who are still gaining experience in the market.

Managed Accounts

Managed accounts are designed for investors who prefer to delegate trading decisions to professional managers. In this arrangement, the investor provides capital to a fund manager or investment company that executes trades on their behalf.

This option can be appealing for busy individuals who may not have the time or expertise to trade actively. However, it's essential to conduct thorough research on the track record and reputation of the fund manager to ensure your capital is handled wisely.

Steps to Open a Forex Account

The process of opening a forex account is relatively straightforward, provided you follow the proper steps. By understanding this process, you can avoid potential pitfalls and ensure a smoother experience.

Researching and Comparing Brokers

Your first step in opening a forex account should be comprehensive research. Compare various brokers based on your specific trading needs, focusing on aspects such as fees, customer support, and available trading tools.

Reading reviews and seeking recommendations from fellow traders can provide valuable insights. It’s essential to select a broker that not only meets your expectations but also aligns with your trading style.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Filling Out the Application Form

Once you have chosen a broker, the next step is filling out the application form. This usually requires personal information such as your name, contact details, and financial background. Ensure that all information is accurate and up-to-date, as inaccuracies can prolong the verification process.

Many brokers now offer online applications, making the process more convenient. However, it’s advisable to take your time and double-check everything before submitting the form.

Submitting Required Documentation

After completing the application form, you will need to submit the required identification and proof of address documents. Depending on your broker, this may be done electronically via upload or through email.

Ensure that all documents are clear and legible, as blurry or cropped images could lead to delays. Keep in mind that additional documentation may be requested depending on the broker's policies and regulations.

Account Verification Process

Once your documents are submitted, the broker will initiate the verification process. This can take anywhere from a few hours to several days, depending on the broker's efficiency and workload.

During this stage, brokers may reach out for clarification or additional information, so staying responsive and cooperative is essential. After successful verification, you will receive your account details, enabling you to fund your account and begin trading.

Funding Your Forex Account

Funding your forex account is a pivotal step that determines how you can start trading. Understanding the available payment methods and other funding specifics will help facilitate a seamless transition into the forex market.

Accepted Payment Methods

Most forex brokers offer a variety of accepted payment methods for funding your account. Common options include bank wire transfers, credit and debit cards, and e-wallets like PayPal, Skrill, or Neteller.

Each method comes with its pros and cons regarding transaction speed, fees, and availability in the UAE. It's wise to choose a funding method that suits your preferences and trading requirements.

Minimum Deposit Requirements

Minimum deposit requirements vary widely among brokers. While some may have low thresholds, others may demand considerable initial investments. Understanding these requirements upfront will help you plan your budget accordingly.

If you’re a beginner, opting for a broker with a lower minimum deposit can provide you with the flexibility to start trading without risking large amounts of capital too early in your trading journey.

Currency Options for Deposits

Another important aspect to consider is the currency in which you will fund your account. Many brokers offer multi-currency accounts that allow you to deposit in various currencies, reducing conversion fees if you're using a currency different from the base currency of your trading account.

Being aware of currency options and potential conversion costs will enable you to manage your capital more efficiently.

Leveraging and Margin in Forex Trading

Leveraging and margin usage are significant aspects of forex trading that can magnify returns but also pose risks. A firm grasp of these concepts is essential for effective trading.

Understanding Leverage

Leverage allows traders to control larger positions with a fraction of the capital. For example, a leverage ratio of 100:1 means that for every dollar in your account, you can control $100 in the market.

While leverage can amplify profits, it equally magnifies losses. New traders should approach leverage cautiously and develop sound risk management strategies to mitigate excessive exposure.

Margin Requirements in UAE

Margin refers to the amount of money that traders must deposit as collateral to open a leveraged position. Different brokers and trading strategies will have varying margin requirements.

Knowing the margin requirements of your chosen broker will help you gauge how much capital you need to allocate when entering trades. Remember that maintaining adequate margin levels is crucial to avoid margin calls, where the broker demands additional funds to keep your trade open.

Trading Platforms Overview

A robust trading platform is fundamental to your trading success. With a plethora of options available, understanding the capabilities and features of various platforms is critical for effective trading.

Common Trading Platforms Used

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are the most widely used trading platforms among forex traders. Both platforms offer extensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors (EAs).

Familiarizing yourself with the platform's interface and functionalities will enable you to execute trades efficiently. Additionally, many brokers also provide proprietary platforms designed specifically for their services.

Mobile Trading Applications

In today's fast-paced world, mobile trading applications have gained immense popularity. Most forex brokers offer mobile apps that allow you to monitor your trading activity and execute trades on the go.

These applications often include real-time market data, news updates, and alerts, ensuring you never miss a trading opportunity. Utilizing mobile trading effectively can enhance your ability to respond quickly to market movements.

Risks Involved in Forex Trading

While forex trading offers opportunities for profit, it also carries inherent risks. Understanding these challenges is crucial for developing a sound trading strategy.

Market Volatility

The forex market is characterized by volatility, with currency prices fluctuating rapidly due to various factors, including economic events, political instability, and market sentiment. While volatility can present profitable trading opportunities, it can also lead to sudden losses.

Being aware of upcoming economic announcements and geopolitical developments is essential for managing the risks associated with market volatility. Implementing strategies that accommodate these shifts can help safeguard your capital.

Leverage Risks

As previously discussed, leverage can amplify both profits and losses. While it allows traders to enter larger positions with a smaller initial capital investment, it also increases the potential for significant losses, especially in highly volatile market conditions.

Careful consideration of your risk tolerance and employing appropriate risk management techniques will help mitigate the dangers posed by leveraging. Novice traders should exercise caution and avoid over-leveraging their accounts.

Essential Tools and Resources for Forex Traders

Successful trading goes beyond executing buy and sell orders; it requires utilizing various tools and resources to inform your decisions.

Analysis Tools

Technical analysis tools, such as charts and indicators, play a vital role in forex trading. Traders use these tools to identify trends, support and resistance levels, and potential entry and exit points.

Fundamental analysis is also crucial, involving the examination of economic indicators, interest rate changes, and geopolitical developments. Combining both analytical approaches can provide a comprehensive view of the market, aiding informed decision-making.

Economic Calendars

Economic calendars are indispensable resources for traders, outlining scheduled economic events and announcements that can impact currency prices.

Staying updated on these events can help traders anticipate market reactions and adjust their strategies accordingly. Many trading platforms and forex news websites offer calendars with alerts to keep you informed about relevant data releases.

Educational Resources for New Traders

For those new to forex trading, education is key to building a solid foundation. Numerous resources are available to help you acquire the necessary knowledge and skills.

Online Courses and Webinars

Numerous platforms offer online courses and webinars designed to teach aspiring traders the basics of forex trading. These resources often cover topics like technical analysis, risk management, and trading psychology.

Participating in these learning opportunities can enhance your understanding of the forex market and equip you with practical strategies to navigate it confidently.

Guides and eBooks for Beginners

In addition to structured courses, many educational websites and forex brokers provide free guides, articles, and eBooks tailored for beginners. These materials cover a wide range of topics and can serve as valuable references as you embark on your trading journey.

Taking advantage of these resources will not only strengthen your foundational knowledge but also help you cultivate a mindset geared toward successful trading.

Best Practices for Successful Trading

Developing effective trading practices can make a significant difference in your trading results. Here are some best practices that every trader should consider.

Developing a Trading Plan

A well-structured trading plan serves as a roadmap for your trading journey. It outlines your trading objectives, risk tolerance, and strategies for entering and exiting trades.

Having a concrete plan minimizes emotional decision-making and enhances consistency in your trading approach. Always review and update your plan based on your experiences and market conditions.

Importance of Risk Management

Proper risk management is essential to preserving your capital and ensuring long-term success in trading. Setting stop-loss orders, diversifying your portfolio, and avoiding over-leveraging are key components of effective risk management.

By implementing robust risk management techniques, you can protect yourself from significant losses and improve your chances of achieving sustainable profitability.

Staying Compliant with Regulations

Understanding the legal framework surrounding forex trading in the UAE is crucial for staying compliant and protecting your investments.

Understanding Local Laws

The UAE has established a regulatory framework to govern forex trading, ensuring a secure environment for both brokers and traders. Familiarize yourself with local laws regarding trading practices, reporting, and compliance requirements to avoid any legal issues.

Additionally, being aware of international regulations can help you navigate cross-border trading and interactions with foreign brokers effectively.

Tax Implications of Forex Trading

While the UAE is known for its favorable tax regime, it's still essential to understand any applicable tax implications related to forex trading. Consult with a financial advisor or tax consultant familiar with UAE laws to ensure your trading activities comply with local tax regulations.

Understanding how taxes affect your trading profits can help you develop a comprehensive financial strategy, maximizing your returns while remaining compliant with the law.

Conclusion

Opening a forex account in the UAE presents exciting opportunities for both seasoned traders and newcomers alike. By following the outlined steps and considering the detailed factors discussed throughout this article, you will be well-equipped to navigate the complex landscape of forex trading successfully.

Remember that education, risk management, and strategic planning are paramount to achieving long-term success in this dynamic market. Embrace the journey with confidence, and may your trading endeavors yield fruitful rewards.

Read more: