7 minute read

Is Exness a Good Broker in Switzerland? A Comprehensive Review

from Exness

by Exness Blog

When it comes to trading in Switzerland, one of the first questions many investors ask is whether Exness is a good broker to trust. The clear answer is yes—Exness has positioned itself as a reliable, transparent, and efficient broker that meets the needs of Swiss traders. Its combination of regulation, strong trading conditions, and a user-friendly platform makes it a solid option for those who want to trade forex, commodities, indices, or cryptocurrencies from Switzerland.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

In this article, I will break down why Exness is considered a good broker in Switzerland, covering regulation, safety, fees, account types, platforms, customer support, and the overall trading experience. By the end, you’ll have a clear understanding of whether Exness aligns with your needs as a Swiss trader.

Regulation and Safety in Switzerland

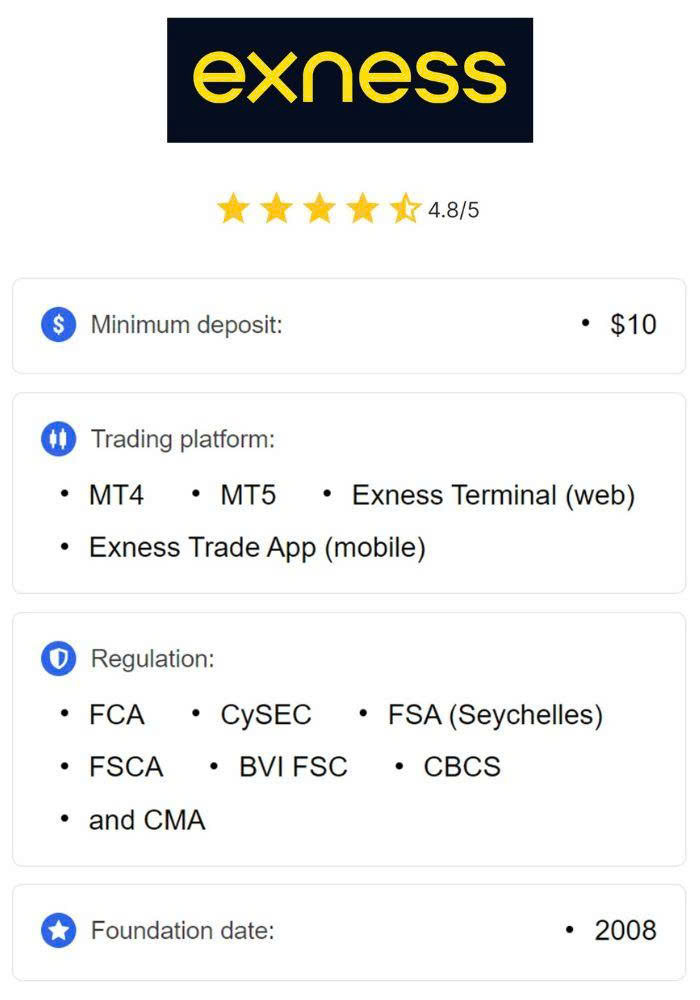

The first thing that Swiss traders look for in a broker is regulation. Switzerland has a reputation for strict financial oversight, and Exness aligns with that expectation. The broker is licensed by several top-tier authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). Although Exness is not directly regulated by FINMA (Swiss Financial Market Supervisory Authority), its international licenses ensure that traders in Switzerland benefit from strong protection standards.

Safety is enhanced by measures such as segregated client funds, negative balance protection, and transparent operational policies. This means that even in cases of market volatility, Swiss traders can have peace of mind knowing their capital is secure. Trust is a cornerstone of trading in Switzerland, and Exness performs well in this regard.

Trading Conditions

Exness is highly regarded for its trading conditions, which are essential for both beginners and professionals in Switzerland. The broker is known for tight spreads, lightning-fast execution, and low commission structures. For example, spreads on major currency pairs such as EUR/USD often start from 0.0 pips depending on the account type.

Swiss traders benefit from stable liquidity, which ensures minimal slippage even during high market activity. This is particularly valuable for algorithmic traders or those using scalping strategies, which are common among advanced Swiss investors.

Leverage at Exness is flexible, with options that suit both conservative traders and those seeking higher exposure. While European regulations generally limit leverage for retail clients, Exness provides professional accounts with expanded leverage options. This flexibility makes it adaptable to the diverse trading styles seen in Switzerland’s trading community.

Account Types for Swiss Traders

Exness offers a variety of account types to match different levels of experience and trading goals. Standard accounts are ideal for beginners in Switzerland who want low entry barriers and commission-free trading. Professional accounts, on the other hand, cater to advanced traders seeking raw spreads and customizable conditions.

Another advantage is the low minimum deposit. With just a small initial investment, Swiss traders can access the global markets without needing to commit significant capital upfront. This inclusivity appeals to young investors and part-time traders in Switzerland who may not want to risk large amounts of money at the start.

Platforms and Technology

For Swiss traders who value technology and precision, Exness delivers with access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well known in Switzerland for their reliability, advanced charting tools, and compatibility with trading robots (Expert Advisors).

Exness also provides its own web and mobile solutions, which are streamlined for convenience. Swiss traders often prefer mobility, and the Exness app allows them to manage trades, deposits, and withdrawals seamlessly on the go. The combination of established platforms like MT4/MT5 and modern proprietary tools ensures that traders in Switzerland have everything they need at their fingertips.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Deposits and Withdrawals in Switzerland

One of Exness’s strongest features is its speed and reliability when it comes to deposits and withdrawals. In Switzerland, traders can fund accounts through international bank transfers, credit cards, and popular e-wallets. Transactions are processed quickly, often instantly, which is an advantage over brokers that require several days for withdrawals.

Importantly, Exness charges no fees on deposits or withdrawals, which is particularly appealing to cost-conscious Swiss traders. With Switzerland’s banking system already known for efficiency, Exness complements this environment by providing financial operations that are smooth and hassle-free.

Fees and Transparency

Transparency is a key part of trading in Switzerland, and Exness excels in this area. The broker clearly displays its fee structures, spreads, and commissions on its website. There are no hidden charges, which aligns with the Swiss expectation of financial clarity.

Trading costs are highly competitive. Standard accounts have no commission, while professional accounts offer raw spreads with a small commission. This setup ensures that Swiss traders can choose the account type that best matches their strategy without facing unexpected costs.

Customer Support for Swiss Traders

Customer support is another factor that determines whether a broker is good in Switzerland. Exness provides multilingual support, available 24/7, which includes English, German, French, and other widely spoken languages in Switzerland. This accessibility makes it easier for traders to resolve issues quickly.

Support channels include live chat, email, and phone, all of which are efficient and responsive. For Swiss traders who prioritize professionalism and quick problem-solving, Exness’s support team meets the mark.

Educational Resources

In Switzerland, many traders value continuous learning and research. Exness offers educational materials such as webinars, articles, market news, and analysis. While these resources may not be as extensive as some of the largest brokers, they are practical and well-suited for beginners and intermediate traders.

Swiss traders who want to strengthen their technical or fundamental skills can benefit from these resources, although advanced traders may prefer to supplement Exness’s materials with external sources.

Trading Instruments

Another reason why Exness is a good broker in Switzerland is its wide range of trading instruments. Traders can access forex pairs, commodities like gold and oil, indices, stocks, and cryptocurrencies.

This diversity allows Swiss traders to diversify their portfolios, hedge risks, and explore opportunities across different markets. With Switzerland’s strong interest in both traditional financial assets and digital innovation, Exness’s instrument selection appeals to a broad audience.

Reliability and Reputation

Exness has built a strong international reputation, serving millions of traders worldwide. In Switzerland, where reliability is non-negotiable, Exness stands out for its consistent service, transparency, and long track record in the market.

The broker’s commitment to transparency—publishing financial reports and trade execution statistics—further enhances its credibility. This level of openness is rare in the industry and aligns well with Swiss values of trust and accountability.

Pros and Cons of Using Exness in Switzerland

Like any broker, Exness has strengths and limitations. Its biggest advantages include regulation by top authorities, competitive trading conditions, fast withdrawals, and excellent transparency. Swiss traders also appreciate its multilingual support and compatibility with advanced platforms.

On the other hand, some traders in Switzerland may find the educational resources less comprehensive compared to other brokers. Additionally, while Exness offers strong regulation internationally, the absence of direct FINMA oversight might be a consideration for those who prefer strictly local regulation.

However, these drawbacks are minor compared to the overall benefits, making Exness a highly attractive option for Swiss traders.

Final Verdict: Is Exness a Good Broker in Switzerland?

Yes, Exness is a good broker for traders in Switzerland. It offers a secure and transparent environment, competitive fees, flexible account options, and robust technology through MT4 and MT5. Its strong international regulation and consistent reliability make it a trustworthy choice for both beginners and experienced traders.

While it may not be directly regulated by FINMA, its adherence to global financial standards ensures safety and professionalism. For Swiss traders seeking a broker that combines efficiency, transparency, and advanced trading conditions, Exness is one of the best options available.

Whether you are new to trading or an experienced investor in Switzerland, Exness provides the tools, support, and security needed to succeed in the global markets.

✅ Trade with Exness now: Open An Account or Visit Brokers 👈

Read more: