9 minute read

Is Exness banned in Nigeria? A comprehensive guide

from Exness

by Exness Blog

Introduction to Exness

Overview of Exness as a Brokerage

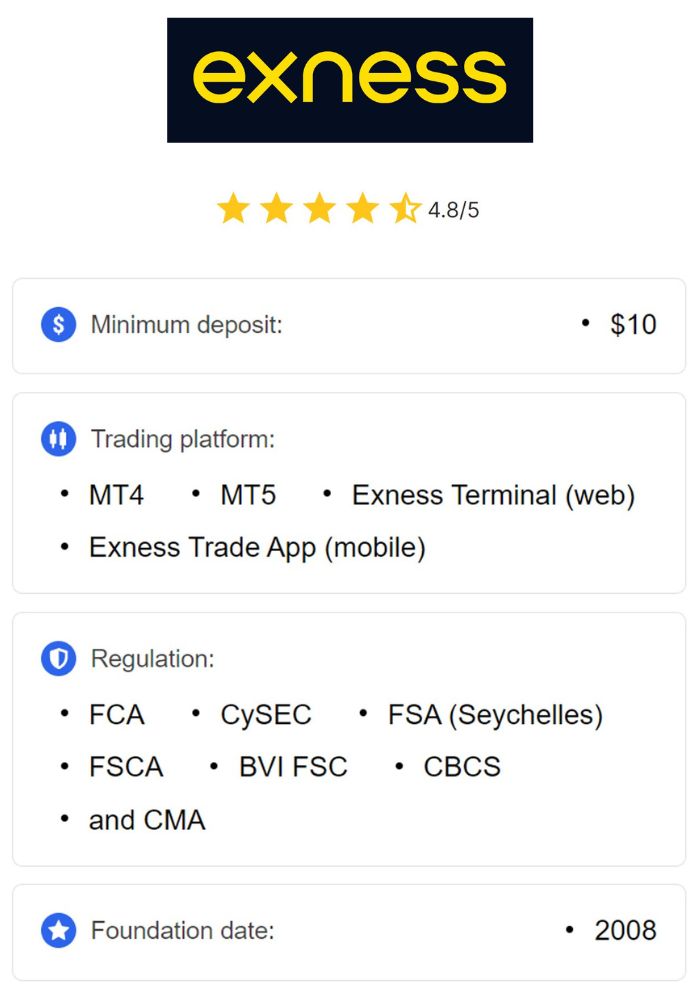

Exness is an internationally renowned Forex and CFD (Contracts for Difference) brokerage founded in 2008. The broker has established a strong global presence, serving millions of traders with a diverse range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies. Exness is known for its competitive trading conditions, transparent pricing, and user-friendly interface. Traders can access Exness’s services through popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), making it a flexible option for both novice and professional traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Over the years, Exness has gained a reputation for its customer-oriented approach, emphasizing security, transparency, and accessibility. With its focus on quality execution and low trading fees, Exness has become a preferred broker for traders worldwide, including a significant user base in Nigeria.

Services Offered by Exness

Exness offers a wide range of services designed to meet the diverse needs of its clients:

Account Types: Exness provides several account types, such as Standard, Pro, Raw Spread, and Zero accounts, each designed to cater to different trading strategies, from beginner to professional.

Trading Platforms: The broker supports both MT4 and MT5, known for advanced charting tools, customizable indicators, and automated trading capabilities through Expert Advisors (EAs).

Educational Resources: To help traders improve their skills, Exness provides educational materials, webinars, market insights, and tutorials on its platform, making it a valuable resource for continuous learning.

Leverage and Spreads: Exness offers high leverage options and competitive spreads, which can vary based on the account type and instrument traded. This flexibility allows traders to optimize their trading strategies and control position sizes.

Deposit and Withdrawal Options: Exness supports a variety of payment methods, including local bank transfers, e-wallets, and cryptocurrency payments, offering fast processing times for Nigerian traders.

Customer Support: Exness provides multilingual customer support to assist traders around the clock with technical issues, account management, and general inquiries, ensuring a smooth trading experience.

These services are designed to create a comprehensive trading environment that attracts traders from different regions, including Nigeria.

Understanding the Regulatory Landscape in Nigeria

Financial Regulatory Authorities in Nigeria

In Nigeria, the financial sector is regulated primarily by two key institutions: the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN). The SEC is responsible for the oversight of investment markets, including securities and foreign exchange services, ensuring that financial activities are conducted with transparency and investor protection. The SEC’s role involves granting licenses to brokers, monitoring compliance, and enforcing regulations to safeguard the interests of Nigerian investors.

The Central Bank of Nigeria (CBN) also plays an essential role in managing foreign exchange policies, setting guidelines that influence capital flows, and stabilizing the Nigerian Naira. For brokers wishing to operate in Nigeria, compliance with SEC regulations and CBN guidelines is essential for maintaining legal standing and credibility within the market.

Importance of Regulation for Trading Platforms

Regulation is crucial for the security and reliability of trading platforms. Regulatory oversight ensures that brokers adhere to specific standards, such as safeguarding client funds in segregated accounts, ensuring transparent pricing, and conducting regular audits. For Nigerian traders, regulation offers protection against potential fraud and enhances the credibility of the broker.

In Nigeria, local regulation provides added assurance that a broker complies with Nigerian laws and prioritizes client protection. While many Nigerian traders choose internationally regulated brokers like Exness, understanding the regulatory environment can help them make informed decisions and mitigate risks.

Current Status of Exness in Nigeria

Official Statements from Exness

Exness has maintained a presence in Nigeria, although it operates without direct regulation from Nigerian authorities such as the SEC. Currently, Exness is regulated by international authorities, including CySEC (Cyprus), FCA (UK), and FSCA (South Africa). These licenses allow Exness to operate under stringent guidelines in various countries, maintaining compliance with global standards for security and transparency.

As of the latest information, Exness has not issued any public statement indicating that it has been banned or restricted from operating in Nigeria. Nigerian traders continue to have access to Exness’s services, and there has been no indication from Exness that its services in Nigeria would be affected. However, traders should stay informed and check for updates, as regulatory changes can happen periodically.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

User Experiences and Reports

User feedback from Nigerian traders suggests that Exness is well-regarded in the local trading community. Many traders appreciate Exness’s reliable trade execution, user-friendly platforms, and efficient withdrawal processes. Online forums and social media platforms show generally positive reviews from Nigerian users, who note the platform’s competitive spreads and ease of access to various payment methods.

While the feedback is largely favorable, it’s essential for Nigerian traders to regularly verify Exness’s operational status and stay updated on any changes. Positive user experiences indicate a solid reputation, but regulatory compliance is also crucial for long-term reliability.

Reasons for Potential Ban of Exness in Nigeria

Lack of Local Regulation

One possible reason for regulatory scrutiny or restrictions on Exness in Nigeria could be the lack of a local SEC license. While Exness holds multiple international licenses, it does not have authorization from Nigeria’s SEC. This absence of local regulation can raise concerns among Nigerian authorities, who may view unlicensed brokers as a potential risk to Nigerian traders.

Without a local license, Exness is not directly overseen by Nigerian regulators, which can complicate legal recourse in case of disputes. Regulatory bodies in Nigeria encourage traders to use brokers that comply with local standards to ensure greater protection and recourse if needed.

Compliance Issues with Nigerian Laws

Foreign exchange trading in Nigeria is subject to specific legal frameworks that require brokers to align with local compliance standards. If Exness’s operational practices were found to conflict with Nigerian foreign exchange policies or capital flow regulations, it could face restrictions. Regulatory compliance in Nigeria requires brokers to adhere to stringent anti-money laundering (AML) and know-your-customer (KYC) protocols to protect financial stability and national security.

While Exness’s global regulatory status demonstrates its commitment to legal standards, adhering to local Nigerian laws is crucial for maintaining unrestricted operations in the country.

Impact of a Ban on Nigerian Traders

Access to Trading Services

A ban or restriction on Exness in Nigeria would affect traders’ access to the platform, limiting their ability to trade currency pairs, commodities, and indices. Restricted access could disrupt trading activities and create challenges in managing open positions. In such cases, traders may be advised to withdraw funds and close positions to avoid complications in accessing their accounts or executing trades.

For Nigerian traders who rely on Exness’s features, the impact of a ban would likely lead to disruptions, making it necessary to seek alternative brokers to continue trading.

Alternative Platforms Available to Nigerians

In the event of a ban on Exness, Nigerian traders would still have access to other reputable brokers that are either regulated by the Nigerian SEC or widely recognized for serving Nigerian clients. Brokers like OctaFX, FXTM (ForexTime), and HotForex have established a strong presence in Nigeria, offering similar trading features and complying with local regulatory standards.

These alternatives provide similar benefits to Exness, such as access to advanced trading platforms, competitive spreads, and multiple payment methods suitable for Nigerian traders. It’s essential for traders to choose brokers that meet their specific trading needs and regulatory expectations.

Reviewing Other Forex Brokers in Nigeria

Comparison of Exness with Competitors

Exness competes with several other brokers in Nigeria, such as OctaFX, FXTM, and HotForex. Exness is known for its fast execution speeds, high leverage options, and low trading fees. In comparison:

OctaFX offers low spreads, local customer support, and convenient deposit/withdrawal options for Nigerian clients.

FXTM (ForexTime) provides educational resources and offers various account types to suit different trading needs.

HotForex is renowned for its advanced trading tools and wide range of account types, catering to both beginners and professionals.

Each broker has its strengths, but Exness’s low fees, flexible account options, and advanced trading tools make it a strong choice among Nigerian traders.

Recommended Brokers for Nigerian Traders

For Nigerian traders, several brokers are highly recommended based on regulatory compliance, customer support, and trading conditions:

FXTM (ForexTime): Known for its localized support and educational resources.

OctaFX: Popular for low spreads and convenient transaction options in Nigeria.

HotForex: Offers a wide range of trading tools and reliable trading conditions.

These brokers are considered reliable and have built strong reputations within Nigeria’s trading community.

Steps to Take if Exness is Banned

Withdrawal of Funds

If Exness were to face a ban in Nigeria, traders should prioritize withdrawing their funds promptly to avoid access issues. Ensure all positions are closed and the withdrawal process is completed before the restriction takes full effect. Exness typically provides a smooth withdrawal process, but in case of disruptions, traders should contact customer support for assistance.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Transitioning to Other Trading Platforms

Transitioning to a new platform involves choosing a reputable broker, opening a new account, and learning the platform’s tools. Nigerian traders can try demo accounts on recommended alternative brokers like OctaFX, FXTM, or HotForex to familiarize themselves with the new platforms before depositing real funds. This approach allows for a smooth transition without major disruptions in trading activities.

FAQs about Exness and Its Status in Nigeria

Is it Safe to Trade with Exness?

Yes, Exness is generally considered a safe platform for trading due to its multiple international licenses from respected regulatory bodies like CySEC, FCA, and FSCA. However, Nigerian traders should remain cautious due to the lack of local SEC regulation. For enhanced safety, traders should monitor Exness’s regulatory status and adhere to best practices for secure trading.

How to Verify Information on Exness Legitimacy?

To verify Exness’s regulatory status, traders can visit the official websites of its regulators (e.g., CySEC, FCA) and check for Exness’s license numbers. Additionally, traders can consult Nigerian financial news sources or contact local regulatory bodies for the latest updates on Exness’s status in Nigeria.

Conclusion

Exness is not currently banned in Nigeria, but it operates without direct SEC regulation, which may pose certain risks for local traders. While Nigerian users continue to access Exness’s services, staying informed about any regulatory changes is essential. In case of a ban, Nigerian traders have reliable alternatives in OctaFX, FXTM, and HotForex. By staying vigilant and making informed choices, Nigerian traders can maintain a secure and profitable trading experience.

Read more: