16 minute read

10 Best Forex Brokers in China: Reviewed and Rated

from Exness

by Exness Blog

When navigating the complex world of forex trading, selecting the right broker is crucial for your success. In this article, we will explore the Top 10 Best Forex Brokers in China. These brokers offer diverse services that cater to both novice and experienced traders while ensuring compliance with local regulations. We’ll delve into their business models, cost structures, available platforms, and customer support systems, providing you with a comprehensive understanding of each option.

Top 4 Best Forex Brokers in China

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

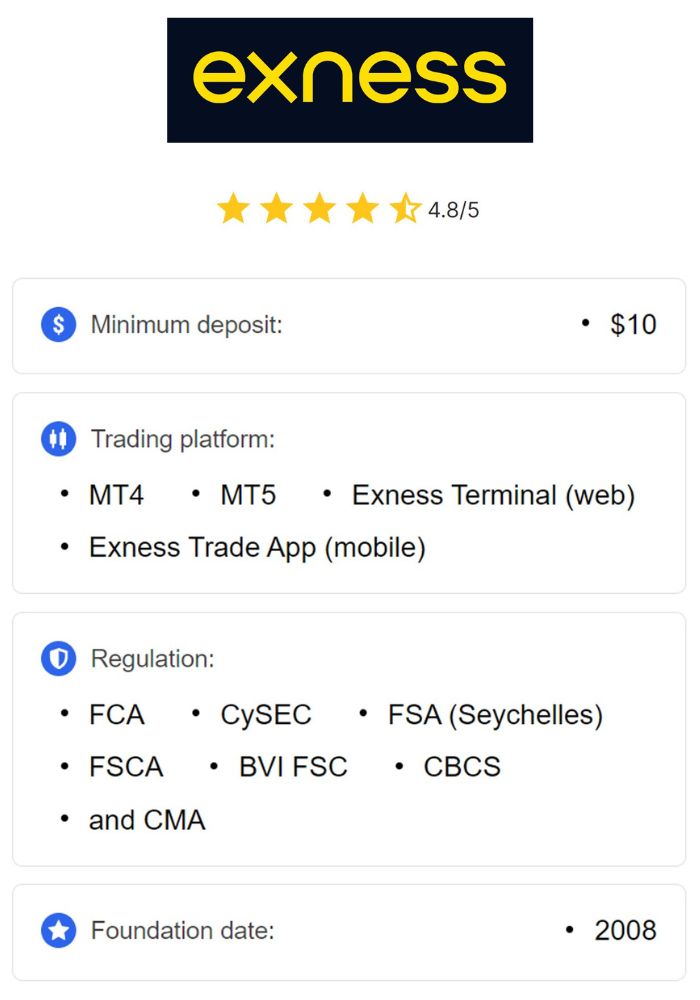

Exness

Exness has established itself as one of the premier choices for forex traders in China. Its reputation for reliability, user-friendliness, and outstanding customer service makes it an attractive option for both new and seasoned traders.

Business Scope

Exness stands out for its wide range of trading instruments, including major, minor, and exotic currency pairs. Beyond forex, the platform provides access to commodities, cryptocurrencies, indices, and stocks, allowing traders to diversify their portfolios effectively.

Additionally, Exness operates under several regulatory bodies, enhancing its credibility. The company's commitment to transparency can also be observed through its clear pricing policies and execution methods, which foster trust among clients.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Cost-Effectiveness

One of Exness's most appealing features is its competitive fee structure. The broker offers low spreads, and in some cases, even zero commission on certain accounts. This cost-effectiveness is particularly beneficial for high-frequency traders who rely on tight spreads to maximize their profits.

Furthermore, Exness employs a flexible leverage policy, allowing traders to choose leverage ratios that suit their risk tolerance. This flexibility can lead to more efficient capital usage, thereby optimizing potential returns.

Platform Quality

The Exness trading platform is renowned for its user-friendly interface and robust performance. Available on both desktop and mobile devices, the platform supports various order types and advanced charting tools that enhance the trading experience.

Moreover, Exness offers a demo account for newcomers to practice without financial risk. This feature is invaluable for those who wish to familiarize themselves with trading strategies before committing real money.

Customer Support

Customer service is another area where Exness excels. With 24/5 multilingual support, traders can reach out via live chat, email, or phone. The quick response time and knowledgeable staff ensure that any issues or inquiries are resolved promptly.

Exness also provides a rich library of educational materials, including webinars and tutorials, which help traders improve their skills and gain a deeper understanding of the market.

FXCM

FXCM is a well-established broker that has garnered a strong following among traders in China. Known for its strategic balance between various aspects, FXCM remains a reliable choice in the competitive forex landscape.

Business Scope

FXCM offers a broad selection of trading instruments, including forex, commodities, indices, and cryptocurrencies. Such diversity allows traders to tailor their approaches based on market conditions and personal preferences.

In addition, FXCM provides several account types tailored to different trader profiles. From standard accounts aimed at beginners to professional accounts designed for seasoned traders, FXCM accommodates a wide array of trading styles and strategies.

Cost Structure

FXCM prides itself on offering competitive spreads and transparent pricing. The broker also adopts a "no dealing desk" model, meaning trades are executed directly in the market, which can minimize conflicts of interest and ensure fair pricing.

Moreover, FXCM often provides promotional offers, such as bonuses for new clients, which can further enhance the overall trading experience by giving traders additional funds to work with.

Platform Quality

With its proprietary Trading Station platform, FXCM delivers an intuitive interface combined with advanced features. Traders benefit from real-time market data, customizable charts, and a variety of technical indicators that allow for in-depth analysis.

Besides, the platform is compatible with various devices, ensuring traders can stay connected to the market, whether they're at home or on the go. Additionally, FXCM supports third-party platforms like MetaTrader 4, providing flexibility for traders who prefer using familiar interfaces.

Customer Support

FXCM’s customer support system is comprehensive and accessible. Clients can reach support representatives through multiple channels, including live chat, phone, and email.

The broker also invests in educational resources, offering webinars, trading guides, and expert insights that empower traders to make informed decisions. These efforts reinforce FXCM's commitment to fostering a supportive trading environment.

Swissquote

Swissquote is another prominent player in the forex market, known for its strong business scope and excellent customer support. Based in Switzerland, this broker brings a wealth of experience and professionalism to traders in China.

Business Scope

Swissquote provides an extensive range of trading options, including over 80 currency pairs, commodities, cryptocurrencies, ETFs, and stocks. This variety enables traders to explore multiple markets and implement diverse trading strategies.

Furthermore, Swissquote's proprietary trading platform is designed to accommodate both beginner and advanced traders alike. The platform includes numerous analytical tools and features that aid in market research and decision-making.

Cost-Effectiveness

While Swissquote may not always have the lowest spreads, its service quality justifies the costs involved. Traders looking for a professional environment and powerful tools will find value in the broker's offerings.

Moreover, Swissquote occasionally offers promotions, such as reduced fees for high-volume traders. Such measures incentivize active trading and provide opportunities for cost savings.

Platform Quality

The Swissquote trading platform is robust and feature-rich, catering to traders of all levels. With advanced charting capabilities, automated trading options, and real-time analytics, the platform ensures traders can seize opportunities as they arise.

Additionally, the mobile application mirrors the desktop version's quality, allowing users to trade seamlessly from their smartphones or tablets.

Customer Support

Swissquote takes pride in its customer service, providing support in multiple languages, including Mandarin. The dedicated team is available via live chat, telephone, or email to assist with any inquiries or issues.

The broker also emphasizes education, offering a wide range of resources, from webinars and market analyses to trading courses, ensuring that traders are well-equipped to make informed decisions.

Forex.com

Forex.com has solidified its position as a trusted broker within the Chinese forex market. Known for its comprehensive offerings, Forex.com provides a blend of efficiency, cost-effectiveness, and user-friendly platforms.

Business Scope

Forex.com provides access to a vast selection of instruments, including over 80 currency pairs, commodities, indices, and cryptocurrencies. This extensive business scope appeals to traders seeking a diverse trading environment.

The broker also supports various account types, allowing traders to choose the one that best suits their needs. Additionally, Forex.com offers competitive pricing and favorable execution speeds, which are critical components for successful trading strategies.

Cost Structure

Forex.com implements a transparent pricing model with competitive spreads. The broker maintains a no-dealing desk execution method, which further enhances transparency and helps to mitigate potential conflicts of interest.

For frequent traders, Forex.com offers commission-free trading on certain account types, thereby reducing the overall cost of trading. This approach makes it easier for traders to engage actively in the market without incurring excessive fees.

Platform Quality

Forex.com boasts a powerful trading platform designed for both novice and experienced traders. With advanced charting tools, customizable layouts, and easy order placement, the platform caters to a broad audience.

Moreover, Forex.com supports integration with popular software like MetaTrader 4, enabling traders who prefer familiar interfaces to utilize the platform seamlessly.

Customer Support

Forex.com prioritizes customer support, providing assistance 24/5 through various channels, including live chat, email, and phone. Their knowledgeable support staff can address queries related to trading, account management, and platform usage.

Moreover, Forex.com invests in educational content, offering an array of resources such as articles, webinars, and video tutorials aimed at helping traders improve their skills and market understanding.

Dukascopy

Dukascopy has carved out a niche as a leading forex broker in China, recognized for its competitive costs and innovative technology. The broker combines these elements to create a compelling trading environment.

Business Scope

Dukascopy offers traders access to a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. This variety ensures that traders can explore different market opportunities and develop versatile trading strategies.

Additionally, Dukascopy provides various account types, accommodating both retail and institutional clients. This inclusivity fosters a diverse trading community and encourages knowledge-sharing among participants.

Cost Effectiveness

Dukascopy is known for its competitive spreads and low commission rates, appealing to traders who prioritize cost efficiency. The broker employs a transparent pricing model, ensuring clients understand what they pay for their trades.

Moreover, Dukascopy's unique liquidity provider model allows traders to benefit from better pricing due to direct market access. This feature enhances the overall trading experience while keeping costs manageable.

Platform Quality

Dukascopy's JForex platform is a major draw for many traders. It provides advanced charting capabilities, automated trading options, and a plethora of technical analysis tools. The platform is versatile and accommodates both manual and algorithmic trading.

Additionally, Dukascopy offers mobile trading applications that replicate the core functionalities of the desktop platform. This feature allows traders to stay engaged with the market regardless of their location.

Customer Support

Dukascopy places great emphasis on customer service. Clients can access support through various channels, including live chat, email, and phone. The focus on responsiveness ensures that traders receive timely assistance when needed.

The broker also fosters educational initiatives, offering webinars and market analysis to help traders refine their strategies and enhance their trading acumen.

LMAX

LMAX has gained recognition as a premium forex broker in recent years, particularly for its superior business scope and cost-effectiveness. LMAX targets professional traders by delivering exceptional trading conditions.

Business Scope

LMAX provides access to a wide array of financial instruments, including over 60 currency pairs, commodities, and indices. This extensive selection empowers traders to diversify their investments and adapt to varying market conditions.

Moreover, LMAX's unique exchange model executes trades on a central limit order book, providing clients with true market depth and transparent pricing. This efficiency promotes confidence among traders.

Cost Structure

LMAX is known for its competitive spreads and attractive commission structures. By operating a fully electronic trading environment, the broker minimizes transaction costs, ultimately benefiting its clients.

Additionally, LMAX's tiered pricing model rewards high-volume traders with better rates. This structure incentivizes active participation in the market while keeping trading costs manageable.

Platform Quality

LMAX's proprietary trading platform is designed with speed and functionality in mind. It offers real-time market data, advanced charting tools, and seamless order execution, making it suitable for traders seeking an edge in fast-moving markets.

Moreover, LMAX provides a mobile trading application that mirrors the capabilities of its desktop platform, enabling traders to remain agile and responsive to market changes.

Customer Support

LMAX takes its customer service seriously, offering 24/5 support through multiple channels, including live chat, phone, and email. The dedicated team is well-trained to handle a variety of inquiries and concerns.

The broker also emphasizes education, providing resources such as webinars, articles, and market analysis to help traders enhance their skills and stay informed about market trends.

Admiral Markets

Admiral Markets is a reputable broker that appeals to traders in China through its balanced offerings in business scope, cost, and platform usability. The broker combines these aspects to create a favorable trading environment.

Business Scope

Admiral Markets offers an extensive range of trading instruments, including over 40 currency pairs, commodities, stocks, and indices. This diversity allows traders to explore various markets and adopt comprehensive trading strategies.

Additionally, the broker provides multiple account types, catering to the specific needs of individual traders and institutions alike. This flexibility ensures that clients can choose a setup that aligns with their trading goals.

Cost-Effectiveness

Admiral Markets is known for its competitive spreads and low commission rates. The broker's transparent pricing model helps ensure that traders know what they're paying for each trade, enhancing overall trust and satisfaction.

Moreover, Admiral Markets often runs promotional campaigns that give traders opportunities for cost savings, further increasing its appeal among potential clients.

Platform Quality

Admiral Markets features the popular MetaTrader 4 and MetaTrader 5 platforms, providing traders with robust functionality and customizability. Both platforms come with advanced charting tools, technical indicators, and automated trading capabilities.

Additionally, Admiral Markets offers a user-friendly mobile app that ensures traders can access their accounts and execute trades while on the go, ensuring continuous engagement with the market.

Customer Support

Admiral Markets places significant emphasis on customer support, offering assistance through live chat, phone, and email. The client support team is knowledgeable and responsive, ensuring that traders can quickly resolve any issues that may arise.

Moreover, the broker provides a wealth of educational resources, including webinars, eBooks, and market analyses, aimed at empowering traders to enhance their skills and increase their chances of success.

Saxo Bank

Saxo Bank is a distinguished name in global finance, and it has made significant strides in the forex brokerage space. Known for its extensive business scope, Saxo Bank is a noteworthy contender among the Top 10 Best Forex Brokers in China.

Business Scope

Saxo Bank offers traders access to a wide range of financial products, including forex, equities, ETFs, bonds, and commodities. This all-in-one solution allows traders to diversify their portfolios effectively and respond to changing market dynamics.

Furthermore, Saxo Bank's advanced trading platform comes equipped with a host of analytical tools, enhancing the trading experience for users seeking in-depth market research and insights.

Cost Structure

While Saxo Bank’s spreads may not always be the lowest, the broker compensates for this with its overall service quality and reputation. Traders can access competitive pricing and transparent commissions, making it easier to understand the costs associated with trading.

Additionally, Saxo Bank offers tiered account types, allowing frequent traders to benefit from reduced trading fees based on their trading volume, enhancing cost-efficiency for dedicated clients.

Platform Quality

Saxo Bank’s trading platform is highly regarded for its intuitive design and functionality. With a wealth of charting tools, technical indicators, and news feeds, traders can conduct thorough market analyses and execute trades efficiently.

The platform is available on both desktop and mobile devices, ensuring that traders can remain connected and responsive to the market, irrespective of their location.

Customer Support

Saxo Bank excels in customer service, offering support in multiple languages, including Mandarin. With various contact options, including phone, email, and live chat, traders can swiftly resolve queries and issues.

Moreover, Saxo Bank prioritizes education, providing a variety of resources, such as webinars, articles, and market insights, to help traders deepen their understanding of the markets and develop effective strategies.

IG

IG is widely recognized as one of the top forex brokers globally, and it has earned a strong presence in the Chinese market. Boasting a solid combination of business scope and cost-effectiveness, IG holds an esteemed position in the forex trading community.

Business Scope

IG offers an impressive range of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies. This diverse product lineup enables traders to explore new opportunities and build diversified portfolios.

The broker also provides various account types tailored to meet the needs of different traders, from beginners to experienced professionals. This flexibility encourages a wide range of trading strategies and approaches.

Cost Structure

IG is known for its competitive spreads, which are particularly attractive for forex traders. The broker operates a transparent pricing model, ensuring that clients are aware of the costs associated with their trades without any hidden fees.

Additionally, IG frequently offers promotional incentives, such as reduced spreads for certain instruments, making it appealing for active traders who seek cost-effective solutions.

Platform Quality

The IG trading platform is widely praised for its ease of use and comprehensive features. Equipped with advanced charting tools, real-time data, and a user-friendly interface, the platform caters to both novice and seasoned traders.

Moreover, IG provides a mobile application that maintains the core features of its desktop platform, allowing traders to manage their accounts and execute trades conveniently from their smartphones or tablets.

Customer Support

IG offers exceptional customer support, with representatives available 24/5 to assist clients with inquiries and issues. Traders can reach support through live chat, telephone, and email, ensuring timely responses and solutions.

The broker also places a strong emphasis on education, offering a rich library of resources, including webinars, tutorials, and market analysis, to help traders hone their skills and improve their performance.

XM

XM is a popular forex broker that has made a name for itself by providing competitive costs and high-quality platforms. With a user-centric approach, XM delivers value to traders seeking a reliable partner in the forex market.

Business Scope

XM offers a broad range of trading instruments, including over 55 currency pairs, commodities, indices, and cryptocurrencies. This extensive selection allows traders to explore multiple markets and employ diverse trading strategies.

Additionally, the broker provides various account types tailored to different trading styles, from micro accounts for beginners to professional accounts for advanced traders. This flexibility promotes inclusivity and encourages traders to find an optimal setup.

Cost Effectiveness

XM is well-known for its competitive spreads and zero commission options on certain accounts. This cost-effectiveness appeals to active traders who seek to minimize operational costs while maximizing their trading potential.

Moreover, XM regularly runs promotional campaigns and bonuses for new clients, providing additional funding opportunities that can enhance their trading experience.

Platform Quality

XM supports the popular MetaTrader 4 and MetaTrader 5 platforms, offering advanced charting tools, technical indicators, and automated trading capabilities. The platforms cater to a diverse audience of traders, from novices to experts.

Moreover, XM’s mobile application ensures that traders can maintain access to their accounts and the markets while on the go, facilitating continual engagement and responsiveness to market fluctuations.

Customer Support

XM places great importance on customer support, offering assistance in multiple languages, including Mandarin. The broker's support team is available 24/5 through live chat, phone, and email, ensuring that clients can get help whenever necessary.

In addition to robust support, XM provides an assortment of educational resources, including webinars, articles, and video tutorials. This commitment to education empowers traders to enhance their skills and develop effective trading strategies.

Conclusion

Selecting the right forex broker is one of the most vital decisions a trader in China can make. The Top 10 Best Forex Brokers in China highlighted in this article offer a mix of features, cost structures, and platforms to accommodate a wide range of trading preferences and goals.

From Exness's outstanding customer support to Saxo Bank's extensive business scope, these brokers have established themselves as leaders in the industry. Whether you are a beginner looking to learn the ropes or a seasoned trader seeking advanced features, there is a broker on this list that can fulfill your requirements.

Consider factors such as cost, platform usability, business scope, and customer service when choosing a broker. Doing so will ensure that you engage in a rewarding trading journey tailored to your specific needs and ambitions.

Read more: