16 minute read

How to Open a Forex Account in Bangladesh

from Exness

by Exness Blog

Understanding Forex Trading

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currency pairs to profit from changes in exchange rates. It is one of the world’s largest financial markets, with daily trading volumes exceeding trillions of dollars. The goal in forex trading is to exchange one currency for another with the expectation that the price will change in your favor. By leveraging price fluctuations between currency pairs like EUR/USD or GBP/JPY, traders aim to profit in both rising and falling markets.

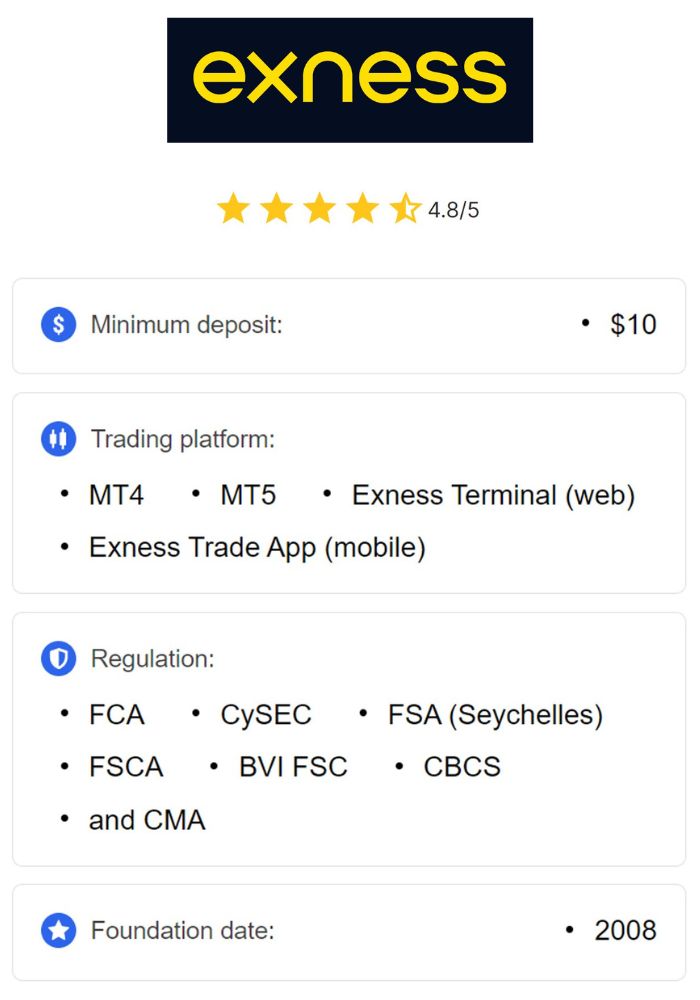

Top 4 Best Forex Brokers in Bangladesh

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Importance of Forex Trading in Bangladesh

In Bangladesh, forex trading has emerged as an attractive investment opportunity for those looking to diversify their income. With an increasing awareness of global financial markets, Bangladeshi traders see forex trading as a chance to participate in the international economy. Many also view it as a way to hedge against inflation and the volatility of local currency. The accessibility of online trading platforms has allowed traders in Bangladesh to engage in forex markets conveniently, empowering them to control their financial growth on a global scale.

Legal Considerations for Forex Trading in Bangladesh

Regulatory Framework Governing Forex Trading

In Bangladesh, the regulatory framework for forex trading is primarily managed by the Bangladesh Bank, the country’s central bank, which oversees financial transactions involving foreign currency. Although Bangladesh has no specific regulations for individual forex traders, traders must work with brokers who comply with international regulatory standards, such as those set by the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC). The Bangladesh Bank monitors forex-related activities to ensure they are in compliance with the country’s financial laws, which aim to protect investors and maintain market integrity.

Central Bank Guidelines on Forex Accounts

The Bangladesh Bank issues guidelines on foreign currency transactions to prevent fraud, money laundering, and capital flight. It’s crucial for Bangladeshi traders to understand these regulations, as some restrictions may affect deposit and withdrawal processes. The central bank requires individuals to transact with authorized dealers for foreign exchange dealings, so many traders opt to work with international brokers that adhere to strict regulatory guidelines, offering added security and transparency.

Choosing the Right Forex Broker

Key Factors to Consider When Selecting a Broker

Selecting a reliable broker is vital for a safe trading experience. Key factors to consider include:

Regulation: Choose brokers regulated by reputable organizations such as the FCA, CySEC, or the Australian Securities and Investments Commission (ASIC), which follow strict guidelines for protecting client funds.

Trading Costs: Compare spreads, commissions, and other fees. Lower costs mean more of your funds can be used for trading.

Trading Platforms: A user-friendly platform with comprehensive tools and features, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), can improve your trading experience.

Customer Support: Look for brokers that offer responsive customer support available in multiple languages.

Deposit and Withdrawal Options: Ensure the broker provides deposit and withdrawal methods that are accessible and convenient for Bangladeshi traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Top Forex Brokers Available in Bangladesh

Bangladeshi traders have access to a range of international brokers that are highly regarded in the industry. Some top options include Exness, XM, and FBS. These brokers offer competitive spreads, reliable customer support, and a variety of trading instruments. Many of these brokers also provide access to demo accounts, allowing beginners to practice trading strategies without financial risk. It’s recommended to research each broker’s reputation, user reviews, and compliance with regulatory standards before making a decision.

Types of Forex Accounts Offered

Standard Accounts

Standard accounts are widely used by intermediate and experienced traders. These accounts allow trading in standard lot sizes (100,000 units) and usually offer lower spreads and fewer fees. Standard accounts often have higher deposit requirements, making them more suitable for traders who have a good understanding of risk management and a larger capital base. This type of account can offer more significant profit potential due to the larger lot sizes traded.

Mini and Micro Accounts

For beginners or those with limited capital, mini and micro accounts are an excellent choice. Mini accounts allow traders to trade in smaller lot sizes (10,000 units), while micro accounts allow even smaller sizes (1,000 units). These accounts have lower deposit requirements, reducing the risk exposure for new traders. Mini and micro accounts enable Bangladeshi traders to learn the basics of forex trading and build confidence without committing a large amount of capital, making them ideal for starting out.

Islamic Forex Accounts

Islamic forex accounts, or swap-free accounts, cater to Muslim traders who seek to avoid interest charges on overnight positions in accordance with Sharia law. These accounts provide the same trading conditions as standard accounts but exclude swap fees. Islamic accounts may charge a small administration fee instead of swap fees. For traders in Bangladesh who wish to observe religious principles, Islamic accounts offer a suitable way to engage in forex trading without compromising their beliefs.

Required Documentation for Opening a Forex Account

Personal Identification Documents

When opening a forex account, providing personal identification is a crucial first step. Forex brokers require proof of identity to comply with regulatory standards and Know Your Customer (KYC) policies. Typically, accepted forms of identification include:

Passport: A universally accepted document for identification due to its detailed personal information and photograph.

National ID Card: This document, commonly used in Bangladesh, should contain your full name, photograph, and other essential details.

Driver’s License: Some brokers may accept a valid driver’s license as a form of ID, provided it includes a recent photo and matches other submitted information.

These identification documents help brokers verify your identity and prevent fraudulent activities, ensuring a secure trading environment.

Proof of Address

In addition to identity verification, proof of address is required to confirm residency. Acceptable documents for proof of address generally include:

Utility Bills: Bills for electricity, gas, or water showing your name and address are widely accepted. They should be recent, typically from within the last three months.

Bank Statements: A bank statement with your name and current address is also valid if it’s from a local or reputable bank.

Rental Agreement: A lease or rental contract can be used, provided it is current and clearly shows your residential address.

Proof of address documentation helps verify the client’s place of residence and further strengthens the security of the trading account.

Financial Information

Some brokers may request additional financial documentation to assess your trading background and financial capacity. These documents might include:

Bank Statements: These show account balances and help verify the origin of funds, especially for higher-capital accounts.

Salary Slips or Tax Records: These provide insight into your financial stability and ability to participate in leveraged trading.

Providing financial information helps brokers align trading services with regulatory requirements and enables them to offer trading conditions that best suit your financial situation.

The Account Opening Process

Step-by-Step Guide to Opening a Forex Account

Opening a forex account with a broker involves a straightforward process. Here’s a step-by-step guide to help you navigate it:

Visit the Broker’s Website: Start by visiting the official website of your selected broker, ensuring it’s secure and legitimate.

Register for an Account: Click on “Open Account” or “Sign Up,” where you’ll need to complete the registration form with basic details such as your name, email, and contact information.

Choose Your Account Type: Select an account type that aligns with your experience level and capital, such as a standard, mini, or Islamic account.

Upload Necessary Documents: Submit your identification and proof of address documents, as well as any additional financial information if required.

Verification: Brokers typically verify your documents within a few hours to a few days. You’ll receive a confirmation email once your account is verified.

Fund Your Account: Once verified, proceed to fund your account through the broker’s available deposit options, including bank transfers, e-wallets, or credit cards.

Following these steps carefully will ensure a smooth and successful account setup, allowing you to begin trading once funds are deposited.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Common Mistakes to Avoid During Registration

During registration, some common mistakes can delay or complicate the process:

Providing Incorrect Information: Ensure that all personal details match your identification documents to avoid discrepancies during verification.

Skipping Document Requirements: Failing to submit the required documents can delay account approval.

Using Unverified Payment Methods: Stick to payment methods that match your registered name and address to streamline the funding process.

By avoiding these errors, you can complete the registration efficiently and start trading sooner.

Understanding Account Funding Options

Popular Deposit Methods in Bangladesh

Forex brokers offer a variety of deposit methods to cater to the needs of Bangladeshi traders. Popular options include:

Bank Transfers: Local bank transfers are secure and straightforward, though processing times may vary.

Credit and Debit Cards: Visa and Mastercard options are widely accepted and offer quick deposit times, allowing you to fund your account within minutes.

E-wallets: Services like Skrill and Neteller are increasingly popular due to their fast processing and relatively low fees.

It’s essential to check each method’s fees and processing times to select the most convenient option for your needs.

Withdrawal Process and Fees

When it comes to withdrawals, brokers often support the same methods used for deposits. It’s important to note any fees associated with withdrawals, as some methods may incur additional charges. Withdrawal processing times vary, with e-wallets being among the fastest and bank transfers taking slightly longer. Make sure you understand the broker’s policies on withdrawals, including minimum amounts and processing durations, to plan your finances effectively.

Trading Platforms and Tools

Overview of Trading Platforms Used in Forex

Most brokers provide access to industry-standard trading platforms, allowing traders to analyze markets and execute trades efficiently. Popular platforms include:

MetaTrader 4 (MT4): Known for its intuitive design and a wide range of technical tools, MT4 is ideal for both beginners and experienced traders.

MetaTrader 5 (MT5): An upgraded version of MT4, MT5 offers additional timeframes, indicators, and analytical tools for advanced trading.

cTrader: Known for its speed and modern interface, cTrader is suitable for traders who prefer faster order execution and customizable layouts.

Choosing the right platform is essential as it will impact your trading experience and access to essential analysis tools.

Essential Trading Tools for Beginners

For new traders, certain tools can enhance trading accuracy and decision-making. Key tools include:

Economic Calendars: These provide real-time updates on major economic events, which often impact currency prices.

Charting Tools: Indicators like moving averages, RSI, and Bollinger Bands allow traders to make more informed decisions based on technical analysis.

Risk Management Tools: Features like stop-loss and take-profit orders help protect capital by setting limits on potential losses or securing gains.

Using these tools enables traders to better manage risks and execute trades with confidence.

Risk Management in Forex Trading

Importance of Risk Management Strategies

In forex trading, effective risk management is essential for long-term success and capital preservation. The highly leveraged nature of forex allows for substantial gains but also exposes traders to significant losses if not managed carefully. Risk management strategies help traders control their exposure to the market and prevent the common pitfalls that can lead to substantial losses. These strategies include understanding position sizing, setting risk limits, and implementing disciplined trading practices. By managing risk effectively, traders can protect their capital and increase their chances of achieving consistent returns.

Utilizing Stop-Loss and Take-Profit Orders

Stop-loss and take-profit orders are two vital tools for controlling losses and locking in profits.

Stop-Loss Orders: A stop-loss order automatically closes a trade when it reaches a predetermined level of loss. This feature helps minimize losses by exiting the trade before the market moves further against the trader’s position. It is particularly useful during times of high volatility, as it helps ensure that a trade does not result in excessive losses.

Take-Profit Orders: Take-profit orders work similarly to stop-loss orders but on the profit side. By setting a take-profit level, traders can secure gains when the market reaches a specific price target. This is especially beneficial for traders who cannot monitor the market continuously, allowing them to lock in profits automatically.

Together, these tools are fundamental for maintaining a balanced risk-reward ratio and preventing emotions from dictating trading decisions.

Education and Resources for New Traders

Recommended Online Courses and Webinars

Forex trading requires a solid understanding of the markets, and continuous learning is crucial for success. Many educational resources are available online, including courses and webinars. Platforms like Coursera, Udemy, and Babypips offer comprehensive courses covering topics from forex basics to advanced trading strategies. Webinars hosted by experienced traders or financial analysts provide insights into market trends and practical trading techniques. Taking advantage of these resources helps traders build a strong foundation and develop effective strategies.

Useful Books and Articles on Forex Trading

Books are another valuable source of knowledge for aspiring forex traders. Some recommended titles include:

"Currency Trading for Dummies" by Kathleen Brooks and Brian Dolan: A beginner-friendly guide covering the essentials of forex trading, including market analysis and strategy development.

"Trading in the Zone" by Mark Douglas: This book delves into the psychological aspects of trading, helping readers understand the importance of mindset and discipline.

"The Little Book of Currency Trading" by Kathy Lien: A comprehensive guide on currency trading with practical advice on strategies and risk management.

Articles and blogs from trusted forex websites can also provide timely insights and updates on market trends, helping traders stay informed.

Developing a Trading Strategy

Fundamental vs. Technical Analysis

A successful trading strategy often incorporates both fundamental and technical analysis.

Fundamental Analysis: This involves analyzing economic indicators, political events, and global news that can affect currency values. In Bangladesh, understanding how factors like inflation, interest rates, and international trade policies influence currency pairs can help traders make more informed decisions.

Technical Analysis: This method focuses on historical price data and trends to predict future movements. Traders use charts, patterns, and indicators such as moving averages and RSI (Relative Strength Index) to identify entry and exit points. Technical analysis is especially useful for short-term traders who aim to capitalize on market trends.

Combining these analyses provides a well-rounded approach, allowing traders to make more comprehensive trading decisions.

Creating a Personalized Trading Plan

A personalized trading plan is essential for discipline and consistency. It should outline your trading goals, risk tolerance, and the strategies you plan to use. A good trading plan includes specifics such as:

Risk-Reward Ratio: Setting a clear risk-reward ratio helps ensure that each trade has the potential to yield higher returns than the risk taken.

Daily or Weekly Targets: Establishing achievable profit goals can keep your trading focused and prevent overtrading.

Entry and Exit Rules: Define the conditions under which you’ll enter or exit trades, such as specific technical indicators or fundamental events.

Having a well-defined trading plan helps eliminate impulsive decisions and keeps trading aligned with your financial goals.

Market Analysis Techniques

Understanding Market Trends

Market trends are the general direction in which currency prices move. Identifying trends is critical for traders as it helps align trades with the market’s momentum. Trends can be short-term, intermediate, or long-term, and they’re typically classified as uptrends, downtrends, or sideways trends. Analyzing trends allows traders to identify the best times to enter or exit trades, minimizing risk and maximizing potential profits. Tools like moving averages and trend lines are commonly used to identify and analyze market trends.

Analyzing Economic Indicators

Economic indicators provide essential insights into a country’s financial health and are highly influential in forex markets. Some key indicators to monitor include:

GDP (Gross Domestic Product): A growing GDP often strengthens a country’s currency.

Inflation Rates: Rising inflation can lead to higher interest rates, potentially boosting a currency’s value.

Employment Reports: High employment rates usually indicate a strong economy, which can positively impact currency strength.

Understanding these indicators and their impact on currency pairs allows traders to anticipate market movements and make well-informed trading decisions.

Staying Informed on Forex Market Updates

Following Reliable News Sources

Staying up-to-date with financial news is crucial in the fast-paced forex market. Reliable sources like Reuters, Bloomberg, and CNBC provide timely information on economic events, political developments, and global market changes. By following reputable news outlets, traders can stay informed about significant events that may impact currency pairs. Being aware of these updates allows traders to respond swiftly to market changes and adjust their strategies accordingly.

Importance of Economic Calendars

An economic calendar is a valuable tool for tracking upcoming financial events and data releases. It highlights major economic reports, including GDP growth rates, inflation figures, and employment data, often with predictions and actual outcomes. Economic calendars allow traders to prepare for potential market volatility associated with these events, helping them make strategic trading decisions. By knowing when impactful data is set to be released, traders can adjust their positions or place trades based on anticipated market reactions.

Community and Support Networks

Joining Forex Trading Forums

Forex trading forums are excellent platforms for exchanging ideas, strategies, and insights with other traders. Popular forums like Forex Factory and BabyPips offer a wealth of information for both new and experienced traders. Participating in discussions can provide valuable perspectives on market trends, broker recommendations, and trading strategies. Additionally, forums offer a sense of community, reducing the isolation often associated with online trading.

Networking with Other Traders in Bangladesh

Networking with local traders in Bangladesh provides insights into region-specific challenges and strategies. Many trading communities in Bangladesh offer in-person meetups, webinars, and online groups where traders can share experiences and discuss market developments. Engaging with fellow traders helps broaden your understanding of forex and offers support, especially during challenging market periods.

Handling Tax Implications of Forex Trading

Overview of Tax Regulations for Forex Traders

In Bangladesh, forex trading income may be subject to taxation, depending on the individual’s income and the country’s tax policies. Traders should familiarize themselves with the tax obligations related to forex income and capital gains. Consulting a tax advisor is recommended, as they can provide guidance on tax rates, deductions, and any applicable exemptions. Properly handling tax obligations ensures compliance and avoids potential legal issues.

Keeping Accurate Records for Tax Purposes

Keeping detailed records of all trading activities is crucial for accurate tax reporting. This includes documenting profits, losses, deposits, withdrawals, and broker fees. Maintaining organized records makes it easier to calculate taxable income and deductions, simplifying the tax filing process. Using trading journal software or accounting tools can also streamline record-keeping, making it more efficient and reliable.

Conclusion

Opening a forex account in Bangladesh involves a series of well-defined steps, from selecting a reputable broker to managing documentation and establishing trading strategies. By understanding the regulatory framework, choosing the right broker, and preparing essential documents, traders in Bangladesh can start trading on a secure platform. Following this guide provides new traders with the foundational knowledge to navigate the forex market confidently. Developing a disciplined approach, staying informed about market updates, and employing risk management strategies can help traders achieve sustained success. With continuous learning and adaptation, forex trading can be a rewarding venture in Bangladesh’s growing financial landscape.

Read more: