16 minute read

Best time to trade XAUUSD in South Africa

from Exness

by Exness Blog

When it comes to trading, timing is everything. For traders looking to maximize their opportunities in the forex market, it is crucial to identify the best time to trade XAUUSD in South Africa. This currency pair, representing the price of gold in US dollars, operates within a dynamic environment influenced by various factors. Understanding these intricacies empowers traders to navigate the complexities of the market effectively.

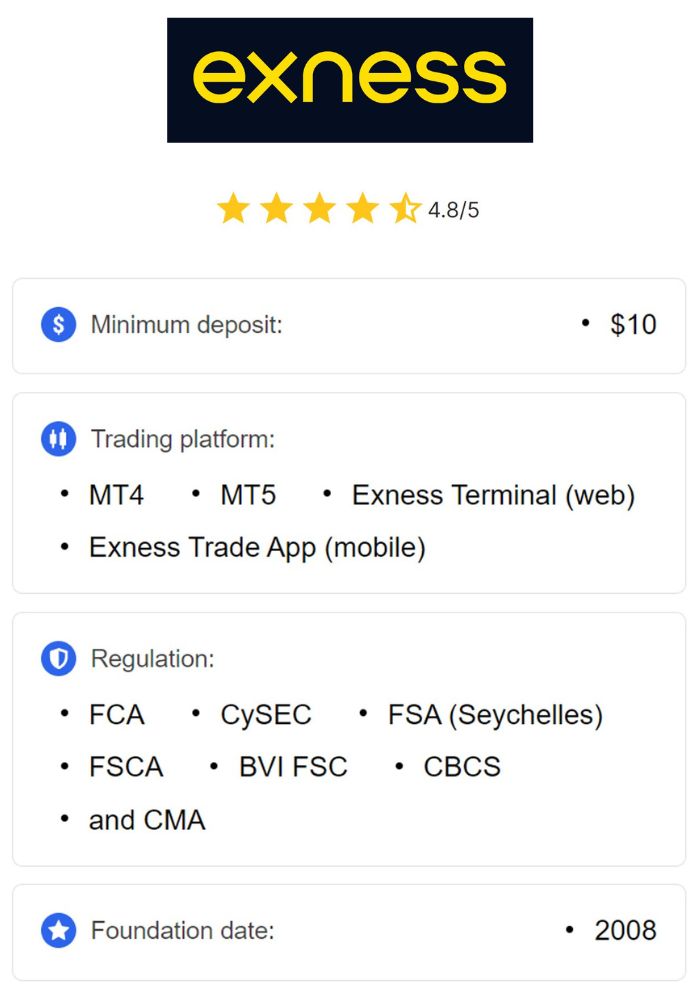

Top 4 Best Forex Brokers in South Africa

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Understanding XAUUSD Trading

XAUUSD trading is not just about buying and selling; it's an intricate process that revolves around numerous economic indicators, market sentiments, and geopolitical events.

What is XAUUSD?

At its core, XAUUSD is the currency pair that denotes the price of gold (XAU) measured against the US dollar (USD). Gold has long been considered a safe-haven asset, particularly during times of economic uncertainty. Traders flock to this precious metal when they are wary of stock market fluctuations or potential currency devaluation.

The appeal of XAUUSD lies in its liquidity and volatility. It is one of the most actively traded pairs on the forex market. Gold behaves differently than other commodities; its value does not depend solely on supply and demand dynamics. Its intrinsic worth, historical significance, and perception as a hedge against inflation contribute significantly to its price movements.

Understanding how geopolitical tensions, interest rates, and economic data releases affect the price of XAUUSD can be crucial for traders aiming to capitalize on the market's fluctuations.

Importance of Gold as a Trading Asset

Gold holds a unique position in the world of finance. Unlike stocks or bonds, its value remains relatively stable due to several inherent characteristics.

First and foremost, gold acts as a store of value. In uncertain economic climates, investors tend to flock to gold as a safeguard against inflation and currency devaluation. Its physical properties, such as durability and divisibility, further cement its role as a reliable asset.

Additionally, gold is a limited resource. Its mining and production processes involve significant challenges, which can lead to scarcity. This scarcity often drives prices higher over time, making it an attractive investment for those anticipating long-term appreciation.

The emotional attachment to gold also plays a role in its trading dynamics. As a traditional wealth protector, gold's reputation as a safe-haven asset encourages investors to buy into it, especially during turbulent periods.

Factors Influencing XAUUSD Prices

The price of XAUUSD is influenced by a multitude of interconnected factors. Understanding these influences is essential for predicting potential price movements.

One primary factor is the strength of the US dollar. The relationship between XAUUSD and the USD is inverse; when the dollar rallies, gold prices generally fall, as it becomes more expensive for holders of other currencies to purchase gold. Conversely, a weaker dollar typically results in rising gold prices.

Interest rates also play a pivotal role. Higher interest rates make gold less appealing because it doesn't generate income like interest-bearing assets do. Similarly, global economic conditions impact investor sentiment. During economic downturns or heightened geopolitical tensions, a spike in gold demand can drive prices higher.

Inflation is another critical consideration. Rising inflation diminishes the purchasing power of currency, prompting investors to seek refuge in gold as a means of preserving their wealth.

Lastly, market sentiment can sway gold prices dramatically. If traders believe gold is on an upswing, buying pressure increases, resulting in price appreciation. Conversely, negative sentiment can lead to widespread selling.

Market Hours and Their Significance

Understanding market hours is essential for any trader, but especially for those focusing on XAUUSD. In a globally interconnected market, knowing when to trade can have a significant impact on profits.

Overview of Global Forex Market Hours

The forex market operates 24/5, allowing traders from around the world to engage in currency transactions at virtually any time. The market is segmented into four main trading sessions: Sydney, Tokyo, London, and New York.

Each session brings its own characteristics and levels of liquidity. During the Sydney session, activity tends to be slower, while the Tokyo session sees increased movement as Asian markets wake up. However, the pinnacle of trading activity occurs during the London and New York sessions, with overlapping hours creating the most volatile and liquid environment.

This continuous nature of the forex market opens up myriad opportunities for traders who can adapt to various time zones and capitalise on major news releases and economic indicators.

South African Trading Hours

For South African traders, understanding local trading hours is paramount. Operating under South African Standard Time (SAST), the local trading day aligns closely with European and UK market hours, making it advantageous for engaging in XAUUSD trades.

Typically, the South African trading day begins at 7:00 AM SAST and runs until 5:00 PM SAST. During this time, ample trading opportunities present themselves, particularly as markets overlap with Europe. The active trading period allows traders to react swiftly to market movements, ensuring they don’t miss out on important price fluctuations.

Overlapping Trading Sessions

A critical aspect of successful XAUUSD trading in South Africa involves leveraging overlapping trading sessions. Understanding when these overlaps occur can help traders optimize their strategies.

The London session overlaps significantly with South African trading hours. From 8:00 AM to 1:00 PM SAST, European traders drive activity in the market, leading to higher liquidity and increased volatility. This environment is perfect for traders seeking quick opportunities, as price movements tend to be sharper.

As the London session winds down, the New York session kicks off at 1:00 PM SAST. This transition often brings renewed excitement and trading volume, presenting additional opportunities for savvy traders.

During the early evening, the Asian session also offers a glimpse of activity but tends to be quieter compared to the earlier sessions. However, for some traders, this window may still yield unique overnight trading opportunities.

Best Times for Trading XAUUSD

Identifying the best times to trade XAUUSD is integral for maximizing profitability. Different market conditions can create varying levels of volatility, which can significantly influence trading strategies.

High Volatility Periods

High volatility periods are characterized by rapid price fluctuations, creating opportunities for traders to profit from swift movements. Certain times offer heightened volatility, particularly in the context of XAUUSD trading.

The London session overlap between 8:00 AM and 1:00 PM SAST stands out as a prime time for traders. With both European and South African traders engaged, the market witnesses substantial activity, leading to significant price swings. This overlap presents an excellent opportunity for day traders and scalpers, allowing them to capitalize on rapid changes.

Moreover, the New York session overlap from 1:00 PM to 5:00 PM SAST is another notable high-volatility period. As US traders enter the fray, trading activity surges, often resulting in larger price movements. This time frame is usually ideal for active traders willing to navigate the quick fluctuations.

Economic data releases also trigger periods of intense volatility. Key announcements related to the US economy, such as job reports or interest rate decisions, can send shockwaves through the XAUUSD market, amplifying price movements, especially during overlapping trading hours.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Low Volatility Periods

While high volatility periods present lucrative trading opportunities, low volatility times are equally important to understand. These tranquil phases can provide a different approach for cautious traders or those employing swing trading strategies.

Typically, early mornings in South Africa, before 7:00 AM SAST, experience reduced trading activity. This period may see smaller price movements, as fewer traders are active in the market. For those preferring a slower pace, this time can be utilized for analysis and preparation.

Late evenings in South Africa, after 5:00 PM SAST, also demonstrate lower volatility as major market participants exit. Though trading may continue, it often lacks the excitement and movement witnessed earlier in the day. Nonetheless, traders can remain vigilant and monitor news developments that could prompt overnight swings.

Weekend trading generally sees decreased activity, which can affect overall volatility. Major market players are often absent, leading to tighter spreads but potentially lower trading volumes.

Key Economic Events Impacting XAUUSD

Staying informed about key economic events is critical for XAUUSD traders. Scheduled announcements can cause sudden price fluctuations, impacting trading strategies.

The US Non-Farm Payrolls (NFP) report is among the most anticipated monthly events. It provides insights into job creation and the health of the US economy. A strong NFP report often leads to a stronger dollar, which can exert downward pressure on gold prices. Conversely, weak employment numbers may boost gold as a safe haven.

Federal Reserve interest rate decisions are also pivotal. Changes in interest rates directly impact the USD and subsequently influence XAUUSD prices. For instance, a decision to raise rates may negatively affect the gold price as investors shift to interest-bearing assets.

Consumer Price Index (CPI) and Producer Price Index (PPI) reports highlight inflation trends, influencing gold trading dynamics. Rising inflation can lead to increased demand for gold as a hedge, driving prices upward.

Moreover, Eurozone economic data indirectly affects XAUUSD prices. Positive or negative data from the Eurozone can impact global market sentiment, affecting the dollar's strength and thus influencing gold prices.

Analyzing Price Movements

In the realm of trading, price movements tell a compelling story. By analyzing these movements, traders can gain insights into future trends and make informed decisions.

Technical Analysis for XAUUSD

Technical analysis forms the backbone of many trading strategies. By examining past price charts and identifying patterns, traders can forecast future movements.

Chart patterns serve as visual cues. Recognizing formations like head and shoulders, double tops, or triangles can signal potential reversals or continuations. For instance, a well-defined head and shoulders pattern may indicate an impending price decline, while a double bottom could suggest a bullish reversal.

Technical indicators also aid traders in decision-making. Moving averages smooth out price data and help identify trends. The Relative Strength Index (RSI) can signal overbought or oversold conditions, providing insight into potential price corrections. Additionally, tools like Bollinger Bands outline price volatility, enabling traders to gauge possible breakouts or reversals.

Understanding support and resistance levels is vital. These levels represent areas where prices tend to consolidate or reverse. By identifying key support and resistance points, traders can better determine entry and exit points during volatile periods.

Fundamental Analysis Impacts

In contrast to technical analysis, fundamental analysis evaluates economic factors that impact XAUUSD prices. This approach focuses on broader economic conditions rather than individual price patterns.

Understanding macroeconomic trends is critical. Interest rate decisions, inflationary pressures, and global economic growth all shape the long-term direction of gold prices. For instance, if inflation expectations rise, gold may emerge as a stronger alternative, leading to increased demand.

Geopolitical events also hold significant weight. Tensions arising from conflicts or trade disputes can fuel demand for gold as a safe haven, driving prices higher. Keeping abreast of global news and economic calendars proves invaluable for traders relying on fundamental analysis.

Moreover, recognizing correlations between major currencies and gold aids in forecasting price movements. Observing how shifts in the dollar correlate with gold pricing helps traders anticipate potential fluctuations.

Historical Trends of XAUUSD Trading

Examining historical trends in XAUUSD trading can provide valuable insights for future strategies. By studying past price movements and market reactions to significant events, traders can develop a comprehensive framework for analysis.

Analyzing historical price patterns allows traders to identify recurring trends. For example, observing how gold prices responded during previous economic crises can inform expectations during similar situations. Understanding seasonal trends can also assist traders in anticipating price fluctuations during specific times of the year.

Furthermore, evaluating the effectiveness of various trading strategies during different market conditions contributes to refining current approaches. Historical data can shed light on what worked well in certain scenarios and what did not.

By leveraging historical trends alongside current market conditions, traders can enhance their decision-making process, improving their overall trading performance.

Strategies for Trading XAUUSD

Developing effective trading strategies tailored to XAUUSD is crucial for success in this dynamic market. Different methodologies cater to various trading styles and risk appetites.

Day Trading vs. Swing Trading

Day trading involves executing multiple trades within a single trading day to capitalize on short-term price movements. Day traders focus on quick entries and exits, capturing small price fluctuations and aiming for rapid profit accumulation. Successful day trading requires constant monitoring of market conditions and real-time decision-making.

Swing trading, on the other hand, takes a longer-term perspective. Swing traders aim to capture price swings over days or weeks. This approach allows for a more measured trading strategy, as traders can analyze broader market trends and avoid the noise of daily fluctuations. Swing trading necessitates patience and careful evaluation of entry and exit points.

Both strategies have their merits, and traders should choose based on their risk tolerance and trading preferences.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Scalping Techniques

Scalping is an advanced trading technique focused on making small profits from frequent trades. Scalpers capitalize on minute price movements, often holding positions for mere seconds or minutes. This method demands quick reflexes and requires traders to execute a high volume of trades throughout the trading day.

Successful scalping relies heavily on precision and speed. Traders utilize technical analysis to identify micro-trends and execute trades almost instantaneously. Given the fast-paced nature of scalping, robust risk management practices are imperative to protect against losses.

Using Indicators for Timing Decisions

Incorporating technical indicators into trading strategies enhances decision-making capabilities. Traders can use indicators to identify optimal entry and exit points, helping to time trades effectively.

For instance, moving averages can clarify trending directions, while oscillators like the RSI may signal potential reversals. Combining multiple indicators often yields more robust signals, increasing the likelihood of successful trades.

Traders should also remain adaptable and continuously assess the changing dynamics within the market. Flexibility allows for adjustments in strategy, ensuring responsiveness to evolving price movements.

Risk Management in XAUUSD Trading

Risk management is an essential aspect of trading that cannot be overlooked. Effective risk management practices help protect investments and ensure long-term sustainability.

Setting Stop-Loss and Take-Profit Levels

Setting stop-loss and take-profit levels is vital for mitigating risk. A stop-loss order automatically closes a position when a predetermined price level is reached, preventing further losses. Conversely, take-profit orders lock in profits once a target price is achieved.

Determining appropriate stop-loss and take-profit levels requires careful analysis of market conditions and price action. Traders should consider volatility levels and historical price behavior to establish realistic targets that minimize risk while maximizing potential rewards.

Position Sizing and Leverage Considerations

Position sizing is another critical element of risk management. Traders must determine the size of their positions based on their overall portfolio size and risk tolerance. A common guideline is to risk no more than 1% or 2% of the trading capital on any single trade.

Leverage plays a double-edged sword in trading. While it can amplify profits, it can also exacerbate losses. Traders must exercise caution when using leverage and ensure they fully understand its implications before applying it in their trading strategies.

Psychological Aspects of Trading Gold

The psychological aspects of trading cannot be understated. Emotions can cloud judgment and lead to impulsive decisions, resulting in adverse consequences. Maintaining a disciplined mindset is essential for successful trading.

Traders should develop a comprehensive trading plan that includes clear goals and strategies. Following this plan helps mitigate emotional responses to price fluctuations. Furthermore, recognizing personal triggers and cultivating emotional resilience enables traders to remain composed during turbulent market conditions.

Tools and Resources for Traders

Leveraging the right tools and resources is crucial for optimizing trading performance in XAUUSD. Fortunately, numerous options are available to assist traders in their pursuits.

Trading Platforms for XAUUSD

Selecting a reliable trading platform is foundational for success. Traders should consider platforms that offer intuitive user interfaces, efficient execution speeds, and comprehensive charting tools. Popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) provide a wealth of features, including customizable indicators and automated trading functionalities.

Additionally, brokers offering competitive spreads and favorable trading conditions enhance the overall trading experience. Comprehensive customer support and educational resources further bolster a trader’s capability.

Economic Calendars and News Feeds

Staying informed about economic events and news releases is vital for XAUUSD traders. Utilizing an economic calendar allows traders to anticipate key announcements and their potential impact on gold prices.

Various financial news platforms provide real-time updates on global economic events. Subscribing to relevant news feeds ensures traders remain aware of critical developments that may influence market sentiment and price movements.

Charting Software for Analysis

Robust charting software is essential for technical analysis. Traders can utilize charting tools to visualize price movements, identify patterns, and apply indicators. Many platforms offer advanced charting features, allowing traders to customize their analysis to suit individual strategies.

Effective charting tools enable traders to dissect complex price movements, facilitating informed decision-making and timely trade execution.

Common Mistakes to Avoid

Even seasoned traders can fall victim to common pitfalls that hinder their performance. Identifying and avoiding these mistakes is essential for long-term success.

Emotional Trading Pitfalls

Emotions can derail even the best-laid trading plans. Fear and greed often drive impulsive decisions that lead to unfavorable outcomes. Traders should strive to cultivate emotional discipline and adhere to established strategies, regardless of market fluctuations.

Recognizing personal biases and triggers is vital for maintaining composure. Implementing a structured trading plan reinforces disciplined decision-making and minimizes the impact of emotions.

Ignoring Economic Indicators

Neglecting key economic indicators can have dire consequences for trading outcomes. Failing to stay updated on central bank decisions, inflation reports, and employment data may result in missed opportunities or unexpected losses.

Incorporating fundamental analysis into trading strategies ensures traders are informed about economic realities that impact price movements. By staying attuned to market-driving events, traders can make informed decisions aligned with prevailing conditions.

Underestimating Market Hours

Misjudging market hours can significantly impact trading success. Engaging in trades during low-activity periods may lead to narrower price ranges and diminished opportunities for profit.

Timely engagement during high-volatility periods is key to maximizing potential gains. Traders should educate themselves on overlapping trading sessions and schedule their trading activities accordingly.

Conclusion

Navigating the complex world of XAUUSD trading requires an understanding of various factors, including market hours, economic events, and analytical techniques. By identifying the best time to trade XAUUSD in South Africa, traders can optimize their strategies and capitalize on lucrative opportunities.

Whether you lean towards day trading, swing trading, or employing scalping techniques, mastering risk management and staying informed is crucial. By utilizing the right tools, resources, and strategies, you can position yourself for success in the ever-evolving forex market.

Ultimately, trading is as much about understanding the market as it is about self-discipline and strategic planning. Approach your XAUUSD trading journey with knowledge, patience, and adaptability, and you'll find yourself equipped to navigate this dynamic landscape.

Read more: Why is forex trading illegal in India?