15 minute read

How to Open a Forex Account in Uganda

from Exness

by Exness Blog

Understanding Forex Trading

What is Forex Trading?

Forex trading, short for foreign exchange trading, involves buying and selling currencies with the goal of profiting from fluctuations in exchange rates. In the forex market, currencies are traded in pairs (like EUR/USD or GBP/JPY), meaning when you buy one currency, you simultaneously sell another. The forex market operates 24 hours a day due to overlapping trading sessions across global financial hubs, making it one of the most accessible financial markets. In Uganda, interest in forex trading has grown, with more individuals exploring it as a potential investment avenue.

Top 4 Best Forex Brokers in Uganda

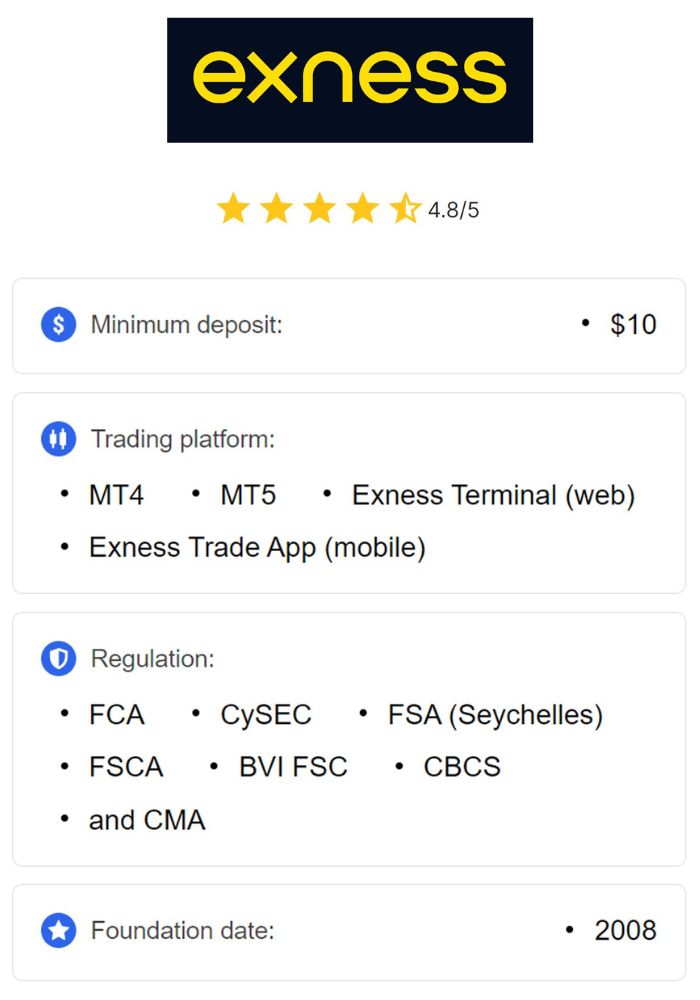

1️⃣ Exness: Open An Account or Visit Brokers 🏆

2️⃣ Avatrade: Open An Account or Visit Brokers 💯

3️⃣ JustMarkets: Open An Account or Visit Brokers ✅

4️⃣ Quotex: Open An Account or Visit Brokers 🌐

Importance of Forex Trading in Uganda

Forex trading offers a way for Ugandans to participate in global markets and diversify their financial portfolios. As internet access and mobile technology expand, more Ugandans are finding opportunities to engage in forex trading, providing the chance to earn additional income. Additionally, forex trading brings exposure to the global economy, which can be an educational experience and increase financial literacy among traders. The market’s liquidity and the potential to trade with leverage make forex attractive, especially in a country where traditional investment opportunities may be limited.

Risks and Rewards of Forex Trading

While forex trading offers substantial earning potential, it also comes with risks. The high volatility of currency pairs can lead to quick gains or losses, making forex trading inherently risky. Leveraged trading, which allows traders to control larger positions with smaller amounts of capital, can amplify profits but also heighten the risk of substantial losses. In forex, effective risk management strategies are essential to protect capital and maintain sustainable trading practices. For Ugandan traders, understanding both the rewards and risks is critical to making informed trading decisions.

Prerequisites for Opening a Forex Account

Age and Identity Verification Requirements

To open a forex trading account, most brokers require traders to be at least 18 years old, though some may have stricter age restrictions. Brokers also mandate identity verification as part of the Know Your Customer (KYC) process to prevent fraud. Documents like a national ID, passport, or driver’s license are commonly accepted for identity verification.

Knowledge of Forex Basics

Before trading, it’s essential to have a foundational understanding of forex basics, including how currency pairs work, how trades are executed, and basic trading terminology. Many brokers offer educational materials, demo accounts, and online courses to help new traders build a knowledge base before entering the live market. Understanding concepts like pips, spreads, and leverage will give you a stronger footing as you start trading.

Financial Resources and Risk Management

Forex trading requires a minimum initial deposit, and while some brokers offer accounts with low deposits, it’s advisable to start with sufficient capital to withstand market fluctuations. Equally important is having a clear risk management plan, which includes deciding how much of your capital to risk per trade and setting stop-loss limits to minimize potential losses. Effective risk management strategies can help preserve your capital and protect you from market volatility.

Choosing a Reputable Forex Broker

Criteria for Selecting a Broker

Selecting a trustworthy broker is one of the most critical steps in forex trading. Key criteria to consider include:

Regulation: Ensure the broker is regulated by a reputable financial authority, as this adds a layer of security and transparency.

Trading Costs: Look for competitive spreads and low commissions, as these can impact your profitability.

Customer Support: Reliable customer service can be invaluable, especially for beginners.

Trading Platform: A user-friendly and stable trading platform is essential for efficient trading.

Deposit and Withdrawal Methods: Ensure the broker supports accessible funding options for Ugandan traders.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Regulatory Framework in Uganda

Forex trading is not heavily regulated in Uganda, and there is no local authority specifically governing forex brokers. As such, Ugandan traders are advised to choose brokers regulated by international authorities, such as the Financial Conduct Authority (FCA) in the UK or the Cyprus Securities and Exchange Commission (CySEC). These bodies enforce stringent regulations on brokers, ensuring higher security for traders’ funds.

Comparing Different Brokers

With numerous brokers to choose from, it’s beneficial to compare factors such as account types, fees, spreads, and available trading instruments. Reading user reviews and consulting forex trading communities can provide insights into each broker’s strengths and weaknesses, helping you select one that meets your specific needs and trading style.

Types of Forex Accounts

Standard Accounts

Standard accounts are the most common type offered by forex brokers and are designed for traders with intermediate to advanced experience levels. These accounts allow trading in standard lot sizes, typically 100,000 units per lot, which provides substantial earning potential but requires a higher capital investment. Standard accounts often come with competitive spreads and leverage options, making them suitable for traders with the financial capacity and risk tolerance to manage larger trades. For Ugandan traders looking to maximize their profit potential, a standard account may be ideal if they have the required capital and experience.

Mini and Micro Accounts

Mini and micro accounts cater to beginner traders or those with limited capital. Mini accounts generally allow trading in smaller lot sizes, such as 10,000 units per lot, while micro accounts trade in even smaller sizes, like 1,000 units per lot. These account types require lower initial deposits, making them accessible to new traders who are still learning about forex trading and want to minimize risk. Mini and micro accounts allow Ugandan traders to gain experience, build confidence, and test strategies without risking significant funds, making them popular choices for those new to forex.

Islamic Forex Accounts

Islamic forex accounts, also known as swap-free accounts, are tailored for Muslim traders who adhere to Sharia law. These accounts eliminate overnight swap fees, which are interest charges incurred for holding positions overnight. Instead, Islamic accounts might implement an administration fee to ensure compliance with Islamic financial principles. For Ugandan traders who observe Islamic beliefs, this account type offers a compliant and ethical way to participate in forex trading. Many brokers offer Islamic accounts upon request, and they often include the same features as standard accounts, minus the swap fees.

The Application Process

Gathering Required Documents

Opening a forex account involves submitting various documents to meet regulatory requirements and verify your identity. The documents required typically include:

Identification Documents: A valid passport, national ID, or driver’s license is necessary for identity verification.

Proof of Address: Documents like a recent utility bill, bank statement, or rental agreement that show your name and current address are usually required.

Financial Information: Some brokers may also request proof of income or a bank statement to assess your financial status, especially for higher-tier accounts.

Submitting accurate and up-to-date documents ensures a smooth account approval process and minimizes potential delays.

Online vs. Offline Application

Most forex brokers offer an online application process, which is convenient and quick. This process typically includes filling out a registration form on the broker’s website, uploading necessary documents, and awaiting verification. However, some brokers with local offices in Uganda may offer offline account opening, where you can visit their office, fill out a form, and submit your documents in person. The online method is generally more efficient, but if you prefer face-to-face interaction, offline application may be an option.

Completing the Application Form

The application form will require basic personal information, such as your name, date of birth, and contact details. Additionally, you’ll choose your preferred account type and may answer questions about your trading experience and financial knowledge. Once the form is complete, double-check all information to ensure accuracy, as errors can delay the approval process. Submitting the form completes the initial application step, and you will then wait for the broker to verify your details.

Funding Your Forex Account

Available Funding Methods

Forex brokers offer various funding methods to cater to the needs of Ugandan traders. Common options include:

Bank Transfers: Direct bank transfers are secure but may take a few days to process, depending on the bank and currency.

Credit/Debit Cards: Most brokers accept Visa and Mastercard payments, allowing quick funding for your trading account.

E-wallets: E-wallet services like Skrill, Neteller, and PayPal provide a fast and convenient funding option with low fees.

Choosing a method that is both convenient and cost-effective can make account management easier and help you access your funds promptly.

Deposit Minimums and Fees

Brokers often have minimum deposit requirements, which vary depending on the account type. Standard accounts usually require a higher deposit than mini or micro accounts. It’s essential to check the broker’s deposit policies and associated fees, as some methods may incur additional charges. E-wallets generally offer lower fees than bank transfers, but each method has its pros and cons.

Currency Considerations

Since some brokers may not accept deposits in the Ugandan shilling (UGX), you might need to deposit funds in a foreign currency, such as USD or EUR. If depositing in a non-local currency, be mindful of currency conversion fees that could impact your capital. Some brokers offer multi-currency accounts, which can simplify transactions and reduce conversion fees.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Setting Up Your Trading Platform

Popular Trading Platforms in Uganda

The most widely used trading platforms for forex include MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are highly popular due to their intuitive design, range of technical analysis tools, and ease of use. Some brokers may also offer their proprietary platforms, tailored specifically to their services. These platforms are accessible from desktop, web, and mobile applications, allowing traders to monitor the market and trade from any device.

Downloading and Installing Software

Once your account is funded, you’ll need to download and install the trading platform provided by your broker. Most brokers offer downloadable software directly on their websites, along with instructions for installation. Mobile versions are available on app stores, allowing for trading on the go. Following the installation, you can log in using your broker’s credentials, configure your settings, and start exploring the platform.

Familiarizing Yourself with the Interface

Take time to navigate the platform’s interface and become familiar with its features, including charting tools, order execution options, and account management. Most platforms offer a variety of technical indicators, chart customization options, and other tools that help in market analysis. Some brokers provide demo accounts that allow you to practice trading without financial risk, which is a helpful way to learn the platform before engaging in live trades.

Trading Strategies for Beginners

Analysis Techniques: Fundamental vs. Technical

New traders often start by learning the two primary forms of analysis in forex trading:

Fundamental Analysis: This involves analyzing economic indicators, news events, and financial reports to predict market movements. For instance, interest rate decisions, employment data, and GDP growth rates are factors that can impact currency values.

Technical Analysis: This approach uses historical price data, charts, and technical indicators like moving averages and RSI to forecast future price movements.

Combining both fundamental and technical analysis provides a comprehensive view of the market, helping traders make well-rounded decisions.

Developing a Trading Plan

A trading plan acts as a roadmap, guiding you through each trade based on pre-defined strategies and risk management principles. A solid trading plan includes:

Risk-Reward Ratio: Defining how much you are willing to risk relative to the potential reward.

Entry and Exit Rules: Setting specific conditions for entering and exiting trades based on your analysis.

Capital Allocation: Deciding how much capital to allocate per trade to avoid overexposure.

Sticking to a trading plan helps traders remain disciplined and avoid emotional decisions.

Demo Accounts and Practice Trading

Before trading with real money, practicing on a demo account is highly recommended. Demo accounts allow you to trade with virtual funds, helping you test strategies and gain confidence without risking actual capital. Most brokers offer free demo accounts, enabling you to simulate real trading conditions and familiarize yourself with the platform.

Legal and Tax Implications

Understanding Forex Regulations in Uganda

While forex trading is gaining popularity in Uganda, it currently operates in a relatively unregulated environment. The Bank of Uganda (BoU) has issued general guidelines about financial practices, but there is no specific regulatory body governing retail forex trading in the country. This lack of direct oversight means that Ugandan traders must take extra precautions when selecting a forex broker to ensure they are working with a reputable and regulated entity. Opting for brokers regulated by established international authorities, such as the Financial Conduct Authority (FCA) in the UK or Cyprus Securities and Exchange Commission (CySEC), provides an added layer of protection and compliance, especially when it comes to fund security and trading transparency.

Tax Obligations for Forex Traders

Forex trading profits may be subject to taxation under Ugandan tax laws, though specifics can vary based on income levels and the country’s evolving financial regulations. It is advisable for traders to treat forex earnings as taxable income and consult a tax professional for guidance. Understanding the tax requirements helps ensure compliance and avoids any unexpected legal or financial issues in the future. The tax advisor can assist in determining which tax forms apply, clarifying any deductions that may be available, and helping to calculate net earnings for accurate reporting.

Reporting Requirements

Proper record-keeping is essential for Ugandan forex traders, both for tax reporting purposes and for tracking trading performance. Maintaining accurate records of each trade, including dates, amounts, profit/loss, and any fees associated with transactions, can simplify the tax filing process. Additionally, organized records make it easier to review trading history, evaluate strategies, and identify patterns in trading behavior. Some traders use digital trading journals or accounting software to streamline this process, which can further improve efficiency in both tax reporting and performance evaluation.

Common Mistakes to Avoid

Overleveraging Your Account

Leverage can be a powerful tool in forex trading, but it also poses one of the biggest risks for traders, especially beginners. Overleveraging occurs when traders take positions that are too large relative to their account size, amplifying both potential profits and potential losses. High leverage can quickly lead to significant financial losses if the market moves against a trader’s position. It’s crucial to use leverage conservatively, ideally at a ratio that aligns with your risk tolerance and trading experience. Limiting leverage reduces the likelihood of experiencing a margin call, where your broker may close out trades if the account balance drops too low.

Emotional Trading Decisions

Emotion-driven decisions are common among traders, but they can lead to impulsive actions that deviate from a planned trading strategy. Fear, greed, and excitement can all impact judgment, causing traders to hold onto losing trades for too long or close winning trades prematurely. To combat emotional trading, it’s essential to stick to a well-thought-out trading plan and set specific rules for entering and exiting trades. Practicing disciplined trading and maintaining a calm, objective approach can help ensure that decisions are based on analysis rather than emotions.

Ignoring Market Research

Entering trades without sufficient market research is a costly mistake in forex trading. Both fundamental and technical analyses play vital roles in understanding market conditions and identifying optimal trading opportunities. Relying solely on luck or speculative advice increases the likelihood of losses, as the forex market is influenced by numerous economic factors, geopolitical events, and technical indicators. Staying informed on current events, analyzing economic reports, and reviewing historical price trends enable traders to make well-rounded and informed decisions.

Educational Resources for Forex Traders

Books and Online Courses

A strong educational foundation is crucial for forex trading success, and many reputable resources are available to Ugandan traders. Books such as “Currency Trading for Dummies” by Kathleen Brooks and “Forex Trading: The Basics Explained in Simple Terms” by Jim Brown cover essential topics for beginners, including market terminology, strategy development, and risk management. Additionally, online platforms like Udemy and Coursera offer comprehensive forex trading courses, allowing traders to learn at their own pace and gain a deeper understanding of trading principles.

Forums and Community Groups

Forex trading communities and forums are valuable platforms for learning, sharing ideas, and gaining support from fellow traders. Websites such as Forex Factory, BabyPips, and Trade2Win provide active discussion boards where traders from around the world share insights on market trends, broker experiences, and trading strategies. Joining these communities can be particularly beneficial for beginners, as they can learn from the experiences of more seasoned traders and get answers to specific questions about forex trading.

Webinars and Live Workshops

Many brokers and educational platforms host regular webinars and live workshops that provide insights into market analysis, trading strategies, and risk management techniques. These sessions are often led by experienced traders or financial analysts who offer practical advice and answer questions in real-time. Some popular brokers even hold localized events and workshops, giving Ugandan traders the opportunity to gain hands-on experience and interact with experts. Participating in these events can accelerate the learning process and offer valuable perspectives on current market conditions.

Conclusion

Opening a forex account in Uganda is a structured yet rewarding process that requires careful consideration and preparation. By understanding the fundamentals of forex trading, choosing a reputable broker, gathering necessary documentation, and funding an account, Ugandan traders can enter the global forex market with confidence. Emphasis on risk management, ongoing education, and adherence to regulatory requirements further enhances trading success and sustainability.

Engaging in continuous learning, utilizing tools for market analysis, and networking with other traders provide additional resources to refine skills and adapt to changing market conditions. Forex trading presents an opportunity for financial growth and engagement with the global economy, and Ugandan traders can thrive by approaching it with discipline, knowledge, and a well-defined strategy. By navigating the forex landscape thoughtfully and responsibly, traders in Uganda can unlock the potential benefits of this dynamic and ever-evolving market.

Read more:

Exness vs Pepperstone Compared: Which is better?