10 minute read

What time does forex market open in Philippines?

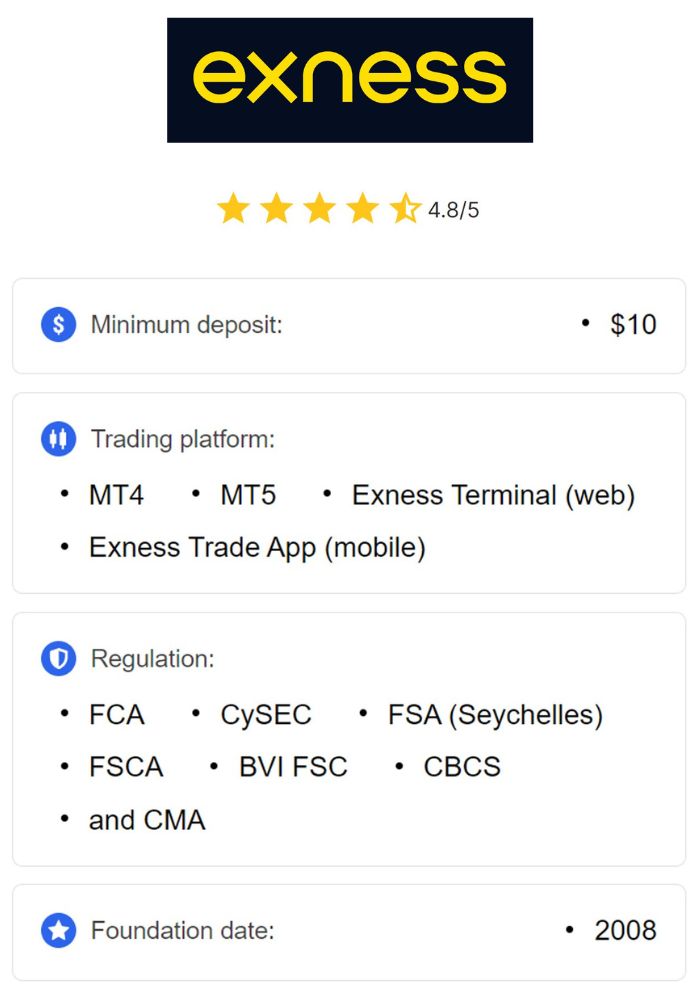

from Exness

by Exness Blog

Understanding the Forex Market

Definition of Forex Market

The foreign exchange (forex) market is a global, decentralized marketplace for trading currencies. Unlike stock exchanges that have specific locations, the forex market operates over-the-counter (OTC), meaning trading occurs directly between parties rather than through a centralized exchange. This setup allows forex trading to occur 24 hours a day, five days a week, as different financial centers around the world open and close at different times.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

In the forex market, currencies are traded in pairs, like USD/PHP (US Dollar/Philippine Peso), where traders speculate on the movement of one currency relative to another. The forex market’s high liquidity and accessibility make it one of the most attractive financial markets globally, drawing millions of traders, including those in the Philippines, who want to capitalize on currency fluctuations.

Importance of Forex Market

The forex market plays a crucial role in the global economy by facilitating international trade, investments, and tourism. Companies, governments, and financial institutions rely on forex to conduct business across borders, manage foreign reserves, and control inflation. For individual traders, the forex market offers opportunities to participate in the global financial ecosystem, potentially earning profits by predicting price movements in currency pairs.

In the Philippines, forex trading has gained popularity due to its potential for returns, accessibility, and the availability of various online trading platforms. Filipino traders can access forex markets 24 hours a day and trade with a range of tools, allowing them to choose the times and strategies that suit their trading goals. Understanding forex market hours is essential for timing trades effectively and maximizing trading opportunities.

Overview of Forex Trading Hours

Global Forex Market Schedule

The forex market operates across four major trading sessions: the Sydney session, Tokyo session, London session, and New York session. Since these sessions overlap, there’s always an active trading market somewhere in the world. The 24-hour nature of the forex market is facilitated by time zone differences, allowing traders from different regions to participate without restrictions.

The forex market officially opens with the Sydney session at 5:00 PM EST on Sunday and closes at 5:00 PM EST on Friday with the New York session. The market transitions from one session to another, creating periods of overlap when two major financial centers are open simultaneously. These overlapping sessions—particularly between London and New York—see heightened trading activity and increased liquidity, offering more trading opportunities.

Market Sessions: London, New York, Tokyo, and Sydney

Each forex trading session has unique characteristics, influenced by the dominant financial center’s currency and economic activity.

Sydney Session (5:00 PM - 2:00 AM EST): The Sydney session marks the start of the forex trading week. Although it’s the least volatile of the sessions, it offers opportunities to trade AUD pairs, as the Australian dollar is actively traded.

Tokyo Session (7:00 PM - 4:00 AM EST): Known as the Asian session, this session is dominated by the Japanese yen (JPY). It’s an excellent time for traders interested in trading JPY pairs, as liquidity and volatility tend to increase.

London Session (3:00 AM - 12:00 PM EST): The London session is one of the most active periods in the forex market. It overlaps with both the Asian and New York sessions, leading to higher trading volume, particularly in GBP, EUR, and CHF pairs. This session sees a lot of price action due to economic data releases from Europe.

New York Session (8:00 AM - 5:00 PM EST): The New York session is known for its high volatility and trading activity, especially during the overlap with the London session. USD pairs are particularly active as the American markets open, making this an ideal time for traders interested in trading major currency pairs.

Forex Market Opening Time in Philippines

Local Time Conversion for Forex Opening

In the Philippines, forex traders need to be aware of the local time corresponding to each global market session. The Philippine Standard Time (PST) is 13 hours ahead of Eastern Standard Time (EST). Therefore, the forex market in the Philippines effectively opens with the start of the Sydney session at 6:00 AM on Monday PST and closes at 6:00 AM on Saturday PST, aligning with the New York session’s close.

Here’s a breakdown of the local times for each session in the Philippines:

Sydney Session: 6:00 AM - 3:00 PM (PST)

Tokyo Session: 8:00 AM - 5:00 PM (PST)

London Session: 4:00 PM - 1:00 AM (PST)

New York Session: 9:00 PM - 6:00 AM (PST)

Comparison with Major Forex Centers

Understanding how the Philippine time aligns with major forex centers can help traders maximize trading opportunities. For instance, the London-New York overlap from 9:00 PM to 1:00 AM PST is an ideal time for Filipino traders to engage in high-liquidity trading, as both markets are active. The Tokyo-London overlap from 4:00 PM to 5:00 PM PST can also offer trading opportunities, especially for JPY and EUR pairs.

The time difference with major financial centers means Filipino traders can participate in volatile market periods conveniently from their local time. This alignment allows Filipino traders to plan their schedules around periods of heightened market activity.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Factors Influencing Forex Market Hours

Time Zones and Daylight Saving Time

Forex trading hours are influenced by global time zones and daylight saving adjustments, which occur in some countries, such as the US and parts of Europe. When daylight saving time starts, trading hours shift forward by one hour. This change can impact trading schedules, as Filipino traders may need to adjust their schedules to align with the new times during these months.

For example, during daylight saving time, the New York session opens at 8:00 PM PST instead of 9:00 PM PST. Staying aware of these adjustments can help Filipino traders remain consistent with their trading routines and avoid confusion in market opening and closing times.

Economic Events Impacting Trading Hours

Global economic events can significantly impact trading hours and activity levels in the forex market. Major economic indicators, such as employment reports, interest rate decisions, and inflation data, are released during specific market sessions and often lead to increased volatility. Filipino traders can use economic calendars to track these events and plan trades around potential market-moving announcements.

For instance, US Non-Farm Payrolls (NFP) data is released during the New York session, typically causing significant volatility in USD pairs. Similarly, European Central Bank (ECB) decisions affect the London session, leading to price fluctuations in EUR pairs. Understanding these patterns can help Filipino traders identify when markets are likely to be more active, allowing them to adapt their strategies accordingly.

Trading Strategies Based on Market Hours

Scalping During Active Trading Hours

Scalping is a strategy where traders aim to make quick profits by executing multiple trades in short periods. This approach works best during highly active trading hours, such as the London-New York overlap, when liquidity and volatility are high. Filipino traders can capitalize on the rapid price movements in major currency pairs, executing short-term trades to capture small price changes.

The best time for scalping is during market overlaps when spreads are narrower, and order execution is faster. Filipino scalpers should prioritize sessions with high trading volume, like the London and New York overlap, to maximize profitability and minimize transaction costs.

Long-Term Trading Considerations

For long-term traders or swing traders, the exact market opening time is less critical since trades are held for extended periods, often days or weeks. However, understanding market sessions can still be beneficial, as it allows traders to anticipate market trends and identify ideal entry points during periods of high liquidity. Filipino swing traders may choose to enter trades during the London session’s opening or the New York session to benefit from price trends driven by economic data.

By aligning long-term trades with active sessions, Filipino traders can increase their likelihood of executing at favorable prices and avoid entering the market during low-liquidity periods when spreads may widen.

Tools and Resources for Forex Traders

Forex Market Calendars

Forex market calendars are valuable tools that provide information on economic events, announcements, and indicators likely to impact the forex market. Filipino traders can use forex calendars to stay informed about upcoming events, such as interest rate decisions, inflation reports, and employment data. This information is essential for timing trades around events that could affect currency pairs.

Many brokers and financial websites offer free forex calendars, allowing traders to customize them based on their time zones, including Philippine Standard Time. By leveraging these calendars, Filipino traders can strategically plan their trading schedules.

Mobile Applications for Real-Time Updates

Mobile apps are essential for forex traders, providing real-time market updates, news, and analysis. Many brokers offer mobile platforms with built-in charts, economic calendars, and alerts, allowing Filipino traders to monitor the forex market from anywhere. Apps like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView offer real-time data and customizable indicators to help traders make informed decisions.

For Filipino traders, mobile applications ensure that they can stay updated on market conditions and respond quickly to economic events or price movements, especially during active trading hours.

Common Misconceptions About Forex Market Hours

The Myth of Continuous Trading

A common misconception about the forex market is that it trades continuously without breaks. While the forex market operates 24 hours a day, five days a week, trading is limited during weekends, and each session has distinct periods of higher and lower activity. Understanding these cycles is essential for Filipino traders, as trading volume and liquidity vary depending on the active session.

Understanding Market Gaps and Liquidity

Market gaps, where price changes sharply between the close of one trading session and the open of another, can occur during weekends or after major economic events. Filipino traders should be aware that gaps can lead to unexpected price movements, impacting their positions if they hold trades over the weekend. Understanding market gaps and liquidity levels can help traders manage risk and plan their strategies accordingly.

Best Practices for Trading During Market Hours

Timing Your Trades Effectively

Effective timing is crucial in forex trading, as liquidity and volatility vary with each market session. Filipino traders should identify the best times to trade based on their strategies. For instance, day traders may focus on the London and New York sessions when the market is most active, while long-term traders may choose quieter periods to avoid noise in the market.

Managing Risk During High Volatility

High volatility during active market hours can increase profit potential but also elevates risk. Filipino traders should manage their risk by setting stop-loss orders, using proper position sizing, and avoiding over-leveraging. By controlling risk during volatile periods, traders can protect their capital and ensure long-term sustainability.

Conclusion

In conclusion, understanding forex market hours and how they align with the local time in the Philippines is essential for successful trading. The forex market operates globally, with four major sessions creating continuous trading opportunities from Monday to Friday. For Filipino traders, identifying high-liquidity periods like the London-New York overlap is crucial for maximizing trading potential. By using tools such as forex calendars and mobile apps, and implementing best practices for timing and risk management, Filipino traders can enhance their trading experience and capitalize on the forex market’s dynamic nature.

Read more:

Why is forex trading illegal in India?