13 minute read

Is Exness registered in Pakistan? Review Broker

from Exness

by Exness Blog

In the ever-evolving world of financial markets, one question that often arises among prospective traders is: Is Exness registered in Pakistan? Understanding the regulatory landscape surrounding forex brokers like Exness can significantly influence a trader's decision to invest their hard-earned money. This article delves deep into the operations of Exness as a forex broker, its regulatory status, services offered, and everything Pakistani traders need to know about engaging with this globally recognized platform.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Understanding Exness as a Forex Broker

Forex trading has seen a meteoric rise in popularity over the past decade, and Exness stands at the forefront of this movement. As a global online broker, Exness allows traders to explore a range of financial instruments, including currencies, commodities, indices, and cryptocurrencies.

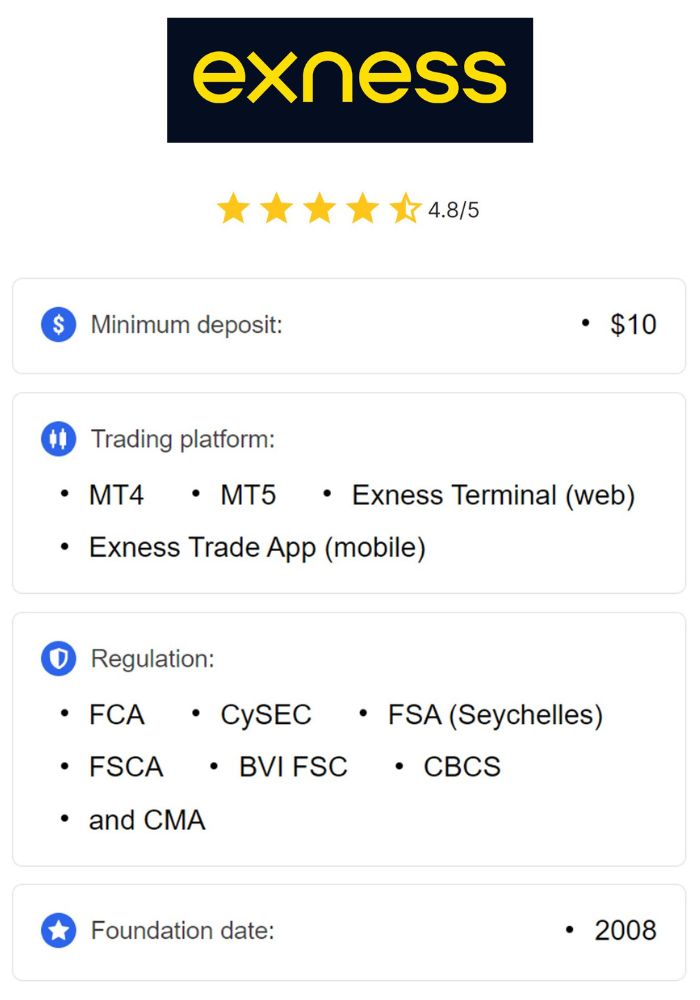

Overview of Exness

Founded in 2008, Exness has established itself as a significant player in the forex trading arena, drawing clients from all corners of the globe. The firm’s commitment to technological advancement has led it to create intuitive trading platforms that cater to both beginners and seasoned traders.

One of the defining attributes of Exness is its emphasis on customer satisfaction, which is reflected in its various account types, competitive spreads, and fast execution speeds. By offering a user-friendly experience backed by advanced technology, Exness empowers its clients to make informed trading decisions and achieve their financial goals.

Services Offered by Exness

Exness provides an extensive array of services tailored to meet the diverse needs of its global clientele.

Multiple Account Types

The broker offers several account types, including Standard, Cent, Raw Spread, and Pro accounts. Each account type is designed to accommodate different trading styles and risk appetites, allowing traders to select the option that best suits their individual preferences.

Variety of Trading Instruments

Traders on Exness gain access to a vast selection of tradable assets. Whether you’re interested in major forex pairs, commodities such as gold or oil, stock indices, or emerging cryptocurrencies like Bitcoin and Ethereum, Exness provides a platform for diversified investment opportunities.

Competitive Trading Conditions

Competitive trading conditions are critical for maximizing profits in the forex market. Exness is widely recognized for its tight spreads, which reduce the costs associated with trading. This aspect can be particularly advantageous for short-term traders who rely on precise price movements.

Leverage and Fast Order Execution

Leverage is a double-edged sword in the world of trading—while it can amplify potential profits, it also magnifies risks. Exness allows traders to utilize leverage effectively, enabling them to control larger positions with a modest initial investment. Additionally, the broker leverages advanced technology to ensure swift order execution, minimizing slippage and delays, which is vital for capitalizing on market opportunities.

Educational Resources

Education plays a pivotal role in successful trading. Exness recognizes this and offers a wealth of educational resources, including webinars, articles, and video tutorials. These materials equip traders with the knowledge and skills needed to navigate the complexities of the forex market confidently.

24/7 Customer Support

To further enhance the user experience, Exness provides round-the-clock customer support through various channels, including email, live chat, and phone. This accessibility ensures that traders receive assistance whenever they need it, fostering a supportive trading environment.

The Importance of Regulation in Forex Trading

Navigating the forex market can be daunting, especially for those new to trading. One critical factor influencing a trader's experience is the regulatory framework governing the broker they choose.

Why Regulation Matters

Regulation serves as a safeguard for traders, providing essential protections against potential risks inherent in the highly leveraged and complex world of forex trading. Regulatory bodies impose standards on brokers, ensuring accountability and transparency within the marketplace.

The significance of regulation cannot be overstated. It fosters trust, encourages participation, and promotes responsible trading practices. Traders who engage with regulated brokers can feel more secure knowing that there are mechanisms in place to protect their interests.

Consequences of Trading with Unregulated Brokers

Opting to trade with an unregulated broker carries substantial risks that could jeopardize one's trading experience and financial security.

Loss of Funds

Unregulated brokers operate outside the purview of established regulations, making them less accountable for their actions. This lack of oversight increases the likelihood of mismanagement or misappropriation of client funds, leaving traders vulnerable to significant losses.

Fraudulent Practices

Without regulatory scrutiny, unregulated brokers may resort to unscrupulous practices. This includes manipulating quotes, executing orders against client interests, or even running Ponzi schemes. Such actions compromise market integrity and can devastate traders’ accounts.

Lack of Investor Protection

Regulatory bodies provide crucial investor protections, safeguarding traders against unfair or abusive practices. Without proper oversight, traders face limited recourse in cases of disputes, raising concerns about fairness and equity in trading.

Market Manipulation and Dispute Resolution Issues

Unregulated brokers might engage in market manipulation, creating an uneven playing field that disadvantages honest traders. Furthermore, resolving disputes with these brokers can be arduous, as traders have fewer legal avenues for claiming compensation due to the absence of a regulatory framework.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Exness's Regulatory Landscape

Understanding Exness's regulatory framework is crucial for traders seeking reassurance regarding safety and compliance.

Global Regulatory Bodies Overseeing Exness

Exness operates under the auspices of several reputable international regulatory bodies, showcasing its dedication to maintaining high standards of transparency and client protection.

The Financial Commission

An independent external dispute resolution organization, the Financial Commission provides a neutral platform for resolving disputes between brokers and clients. This service adds an additional layer of security for traders using the Exness platform.

The Cyprus Securities and Exchange Commission (CySEC)

Exness holds a license from CySEC, which imposes stringent rules and regulations concerning financial stability, operational standards, and client protection. This endorsement is crucial as it demonstrates Exness's commitment to operating within a regulated environment.

The Financial Services Commission of Mauritius (FSC)

Furthermore, Exness is licensed by the FSC, reinforcing its global regulatory framework. This licensing emphasizes Exness's adherence to compliance and ethical practices across various jurisdictions.

Specific Licenses and Registrations

Exness operates through multiple subsidiaries worldwide, each holding the necessary licenses and registrations required by their respective jurisdictions. By conforming to local regulatory requirements, Exness upholds its commitment to compliant and ethical business practices.

Exness Operations in Pakistan

For traders based in Pakistan, understanding how Exness operates within the local context is essential.

Availability of Exness Services in Pakistan

Exness services are generally accessible to Pakistani traders; however, it’s important to note that Exness does not possess a specific license or registration in Pakistan. This means the company operates within the country utilizing its internationally recognized licenses, particularly those issued in Cyprus and Mauritius.

Local Features Tailored for Pakistani Traders

Despite lacking a physical presence or locally registered entity in Pakistan, Exness offers features that cater specifically to Pakistani traders.

# Support for Local Languages

Recognizing the linguistic diversity of its client base, Exness provides customer support in multiple languages, including Urdu and English. This consideration significantly enhances communication and engagement with Pakistani traders.

# Popular Payment Methods

Exness understands the importance of convenient transactions and therefore supports various local payment methods commonly used in Pakistan. Options such as bank transfers and e-wallets facilitate seamless deposits and withdrawals for traders in the region.

# Access to Global Markets

Pakistani traders can leverage Exness to tap into a broad range of financial markets worldwide, despite the absence of local registration. This global exposure allows traders to diversify their portfolios and explore various investment opportunities.

Registration Status of Exness in Pakistan

A critical area of concern for many traders is the registration status of Exness within Pakistan.

Current Registration Status

As stated earlier, Exness is not registered as a brokerage firm with the Securities and Exchange Commission of Pakistan (SECP). The SECP serves as the primary regulatory body overseeing the securities and forex markets in Pakistan, and the absence of registration raises several questions.

Implications of Not Being Registered

While the lack of registration does not imply that Exness is operating illegally in Pakistan, it does convey certain implications that traders must consider.

Lack of Local Regulatory Oversight

Exness’s activities in Pakistan are not subject to the same level of local oversight and regulation as domestically registered brokers. This absence could potentially expose traders to risks that would otherwise be mitigated by local regulatory measures.

Limited Recourse in Case of Disputes

Traders experiencing conflicts with Exness may have fewer options for seeking redress compared to dealing with a locally registered broker under SECP jurisdiction. This limitation highlights the importance of weighing one’s options carefully before engaging with any broker.

Uncertainty Regarding Investor Protection

Although Exness operates under international regulatory frameworks, the specific protections afforded to Pakistani traders may not be as comprehensive as those guaranteed by SECP-regulated brokers. This uncertainty necessitates cautious consideration before committing funds to any trading platform.

Customer Support for Pakistani Clients

Accessibility and responsiveness of customer support are vital aspects of the trading experience. Exness takes pride in its customer service offerings.

Language Options and Accessibility

Exness makes deliberate efforts to ensure its services are accessible to Pakistani traders through multilingual support.

Multilingual Support

By offering customer support in both English and Urdu, Exness addresses the communication needs of a varied client base. This multilingual approach fosters a more comfortable environment for traders to express their concerns and seek assistance.

Multiple Contact Channels

Clients can reach out to Exness through various contact channels, including email, live chat, and telephone. This flexibility enables traders to choose the mode of communication that best suits their needs, enhancing overall user experience.

Contact Channels Available

Pakistani clients can access Exness's support channels similarly to clients from other regions. However, it’s worth noting that geographical differences may lead to slight variations in response times.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Payment Methods Supported by Exness in Pakistan

Payment options are a crucial consideration for traders looking to deposit or withdraw funds from their trading accounts.

Local Deposit and Withdrawal Options

Exness supports a variety of payment methods commonly utilized within Pakistan, catering to the preferences and needs of local traders.

Bank Transfers

Clients have the option to deposit and withdraw funds using local bank transfers to and from their Exness accounts. This familiar method provides stability and comfort to traders.

E-wallets

Exness may also accept popular e-wallets used in Pakistan, streamlining the process of managing funds. This flexibility in payment options caters to the diverse preferences of users and enhances convenience.

Other Options

While bank transfers and e-wallets form the backbone of Exness's payment methods in Pakistan, the platform may also accept other locally relevant payment options, subject to availability and changes in payment processor policies.

Transaction Fees and Processing Times

Transaction fees related to deposits and withdrawals can vary based on the chosen payment method. Traders should conduct research on the applicable fees by checking the Exness website. Additionally, processing times for transactions can differ, with bank transfers typically taking longer than e-wallet transactions.

User Experience and Platform Usability

An engaging and user-friendly trading platform is paramount for traders aiming to maximize their success in the forex market. Exness excels in this regard by providing a suite of robust trading platforms.

Trading Platforms Offered by Exness

Exness offers traders the flexibility to choose from multiple trading platforms, each tailored to suit different preferences and trading styles.

MetaTrader 4 (MT4)

MetaTrader 4 is a widely recognized trading platform known for its user-friendliness and extensive charting tools. Traders appreciate MT4 for its robust technical analysis capabilities, allowing them to devise and execute trading strategies efficiently.

MetaTrader 5 (MT5)

Offering a more advanced set of functionalities, MetaTrader 5 expands upon its predecessor with enhanced order types, a broader range of indicators, and sophisticated charting capabilities. MT5 caters to traders looking for advanced features and tools to refine their strategies.

Exness Terminal

Exness also provides a proprietary web-based trading platform known as Exness Terminal. This platform enables traders to access markets and manage their accounts seamlessly without needing to download software.

Mobile Trading Experience

Recognizing the growing trend toward mobile trading, Exness offers mobile applications compatible with both iOS and Android devices.

Users can execute trades, monitor their accounts, and access market information on-the-go, ensuring they never miss an opportunity regardless of their location.

Risks Associated with Trading on an Unregistered Platform

While Exness operates under international licenses, it’s essential to understand the inherent risks of trading on an unregistered platform.

Financial Risks

Engaging with a broker that lacks regulation can expose traders to financial risks, primarily due to inadequate oversight and accountability. Without local regulatory scrutiny, traders may face challenges retrieving funds in case of disputes.

Legal Implications for Traders

The absence of local registration means that Pakistani traders may face legal uncertainties when dealing with grievances against Exness. This lack of a clear legal framework could complicate matters if issues arise during the trading experience.

Community Feedback on Exness in Pakistan

Gauging the experiences of other traders can provide valuable insights into Exness's reputation and effectiveness as a broker in Pakistan.

Reviews from Pakistani Traders

Many Pakistani traders have shared positive feedback about Exness, highlighting aspects such as user-friendly platforms, responsive customer service, and diverse trading options. These testimonials reflect the platform's strengths and ability to cater to the needs of its clientele.

Challenges Faced by Users

Conversely, some users have voiced concerns related to the absence of local registration. This apprehension centers around the potential risks associated with investing through a platform that lacks SECP oversight, prompting traders to proceed with caution.

Comparison with Other Brokers in Pakistan

Understanding how Exness stacks up against its competitors can help traders make informed decisions.

How Exness Stands Against Competitors

When compared to other brokers operating within Pakistan, Exness often emerges favorably due to its competitive spreads, diverse account options, and robust customer support. These features make it an appealing choice for many traders.

Unique Selling Points of Exness

Exness distinguishes itself through its commitment to innovation and technology. By leveraging advanced trading platforms and offering a wide range of financial instruments, Exness sets itself apart in a crowded market, providing traders with unparalleled access to global markets.

Conclusion on Exness’s Registration Status in Pakistan

In conclusion, the question Is Exness registered in Pakistan? is a pertinent one for prospective traders considering entering the forex market. While Exness offers several advantages, including competitive trading conditions, a comprehensive range of services, and reliable customer support, it’s vital to acknowledge its lack of registration with the Securities and Exchange Commission of Pakistan.

This absence of local oversight presents certain risks and uncertainties that traders must consider. Engaging with Exness can still yield fruitful opportunities, but potential investors should tread carefully, armed with knowledge and awareness of the implications associated with trading on an unregistered platform.

Ultimately, every trader must weigh the pros and cons to find a broker that aligns with their trading objectives while ensuring their financial safety and security.

Read more: