13 minute read

Exness withdrawal limit per day in India

from Exness

by Exness Blog

Understanding the Exness withdrawal limit per day in India is crucial for traders who wish to access their hard-earned profits efficiently and effectively. In this article, we will delve into the intricacies of the Exness trading platform and provide a thorough analysis of its withdrawal policies, specifically focusing on Indian traders. By comprehending these policies, traders can make informed decisions that optimize their trading experience.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Introduction to Exness

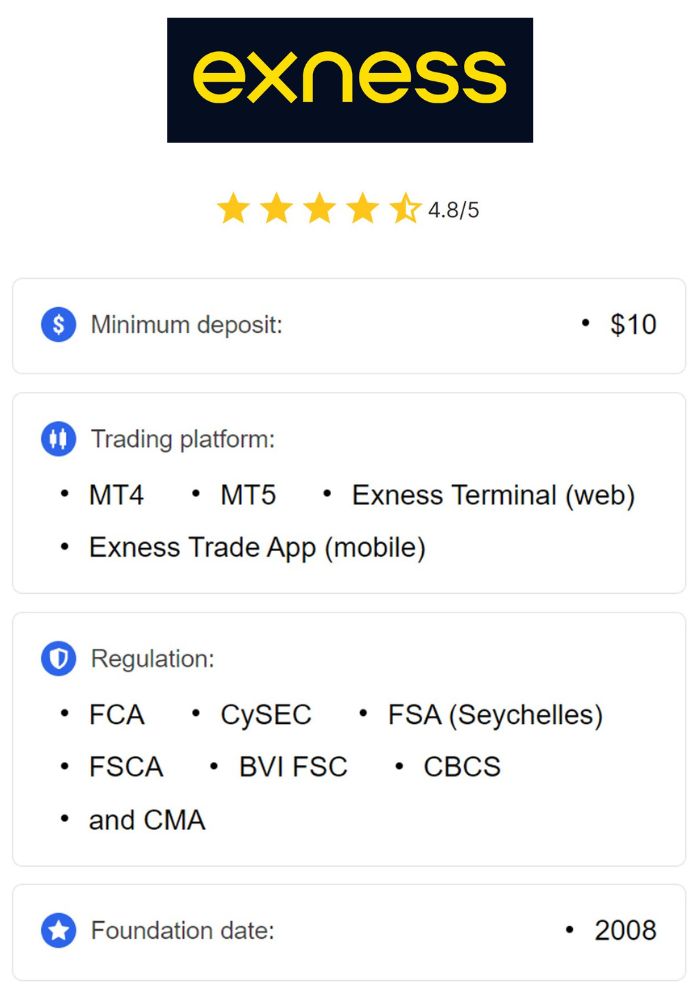

Exness has emerged as a prominent player in the online brokerage industry, gaining recognition from traders around the world, especially in India. The platform caters to diverse trading preferences with a range of instruments, making it an attractive option for both novice and experienced traders.

Overview of Exness as a Trading Platform

Founded in 2008, Exness is an online brokerage firm that offers a wide array of trading instruments, including Forex, commodities, indices, and cryptocurrencies. It has quickly gained traction due to its user-friendly interface, competitive trading conditions, and advanced trading tools. Traders can leverage platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both beloved by the trading community for their robust capabilities.

What sets Exness apart is its commitment to providing varied trading environments through multiple account types. This allows traders to select an account that aligns with their experience level, trading style, and capital investments.

Importance of Withdrawal Policies for Traders

For any trader, the ability to withdraw funds easily and securely is paramount. When dealing with global trading platforms like Exness, understanding the withdrawal procedures, limits, and potential fees is critical for managing risks and making informed trading decisions.

In the context of Indian traders, local regulations play a significant role in determining how smoothly withdrawal processes operate. Transparency and clarity in withdrawal policies create trust between brokers and traders, ensuring that traders know how and when they can access their funds without undue stress.

Regulatory Environment in India

The regulatory landscape governing forex trading in India is complex and multifaceted. Understanding this environment is essential for traders seeking to navigate the intricacies of withdrawing funds from Exness successfully.

Financial Regulations Affecting Forex Trading

Forex trading in India is primarily regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). The RBI plays a vital role in overseeing foreign exchange transactions and maintaining the stability of the Indian rupee. At the same time, SEBI regulates securities markets, including forex trading linked to derivatives or securities.

The Foreign Exchange Management Act (FEMA), enacted in 1999, serves as a cornerstone regulation for forex dealings in India. It outlines guidelines and rules that individuals and entities must follow when engaging in foreign exchange transactions. Understanding these regulations is crucial for traders, as it aids in navigating withdrawal policies within compliant frameworks.

The Role of SEBI in Regulating Forex Brokers

While SEBI's primary focus is on the securities market, its influence extends to the forex sector as well. It ensures that online forex brokers comply with specific standards regarding transparency, risk management, and client protection. SEBI actively monitors forex brokers operating within India to ensure they adhere to established regulations, which includes scrutinizing their withdrawal policies.

This regulatory oversight protects traders' interests while allowing them to make informed choices about selecting brokers. As a result, forex brokers like Exness must maintain transparency in their withdrawal processes to comply with SEBI's regulations.

Overview of Exness Withdrawal Options

Exness has designed its withdrawal options keeping in mind the needs of its Indian clientele. An array of methods is available, each catering to different preferences and requirements.

Available Withdrawal Methods for Indian Traders

Exness recognizes the diverse financial ecosystem in India and thus provides various withdrawal methods to ensure convenience for its traders. The most common withdrawal methods include:

Bank Wire Transfer: A traditional yet reliable method for transferring funds directly to local bank accounts. It is widely accessible to many traders, although it may involve longer processing times.

UPI (Unified Payments Interface): This mobile payment system has gained immense popularity across India for its quick and secure transactions. Traders can receive their withdrawals almost instantly into their bank accounts linked with UPI IDs, making it a favorite choice for many.

E-Wallets (such as Skrill and Neteller): These digital wallets offer a speedy alternative to bank transfers and are preferred by traders looking for flexibility and quick access to their funds.

By offering such a variety of withdrawal methods, Exness aims to create an accessible and convenient experience for Indian traders, alleviating concerns related to fund access.

Processing Times for Different Withdrawal Methods

It is essential for traders to understand the processing times associated with different withdrawal methods. Generally, UPI tends to be the quickest option, often resulting in instant transfer of funds to a trader's bank account. E-wallet withdrawals also experience minimal delays, typically being processed faster than traditional bank wire transfers.

On the other hand, bank wire transfers may take longer, potentially requiring a few business days for funds to reach the trader's account. Exness strives to provide efficient withdrawal processing; however, factors such as peak periods, holidays, and technical issues may occasionally lead to unexpected delays.

Traders should remain aware of these possibilities and plan their withdrawals accordingly.

Exness Withdrawal Limits Explained

One of the key aspects that traders need to grasp is the withdrawal limits imposed by Exness. These limits are put in place to manage risk and ensure operational efficiency on the platform.

Daily Withdrawal Limits Per Method

Exness enforces daily withdrawal limits based on the chosen withdrawal method. Typically, withdrawal limits are consistent across different trading accounts, but they can vary according to the method selected. For instance, a trader using UPI might have a daily withdrawal limit of INR 100,000, while those opting for bank wire transfers may enjoy higher limits.

Such variations are influenced by security protocols and processing times associated with each method. It's important for traders to familiarize themselves with these limits, as they will guide their withdrawal strategies.

To maintain transparency, Exness routinely communicates its withdrawal limits, and traders are encouraged to confirm the specific limits applicable to them via the platform or customer support.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Impact of Account Verification on Withdrawal Limits

The verification status of a trader’s Exness account has a direct influence on their withdrawal limits. Accounts with higher verification levels generally enjoy elevated limits compared to unverified or partially verified accounts.

This is because completed verification validates the identities of traders, reducing the risk associated with high-value withdrawals. For example, traders who have only partially completed verification may face lower withdrawal limits. Conversely, full verification often results in enhanced withdrawal permissions.

This approach encourages traders to complete the necessary documentation for verification, thereby improving security and streamlining withdrawal processes.

Factors Affecting Withdrawal Limits

Several factors contribute to shaping withdrawal limits for traders on Exness. Understanding these elements can help traders strategize their withdrawals effectively.

Verification Levels and Their Influence

As previously discussed, the verification level of a trader’s account profoundly impacts their withdrawal limits. This practice is prevalent among regulated brokers worldwide.

Basic Verification: This initial stage usually comes with lower withdrawal limits, reflecting the limited information available about the trader's identity at this level.

Intermediate Verification: Traders are required to submit more comprehensive documentation, such as proof of address and identity. With this additional verification, there is often an increase in withdrawal limits.

Full Verification: This stage necessitates submitting extensive documentation and personal information. Traders who complete full verification frequently benefit from the highest withdrawal limits, enabling them to engage in more substantial trading activities without the hassle of constant limitation.

This tiered verification system promotes trader accountability while ensuring secure transactions.

Currency Conversion Fees and Their Impacts

Currency conversion fees can impact the amount received during a withdrawal, particularly if funds are withdrawn in a currency different from that in which the account is held. Exness, like many forex brokers, may impose currency conversion fees based on prevailing market rates.

For instance, if a trader holds funds in USD but opts to withdraw in INR, the broker will convert the USD to INR at an exchange rate that includes a fee. Understanding these fees is crucial for managing financial expectations when withdrawing funds across different currencies.

Traders should carefully assess their withdrawal plans to minimize possible losses due to currency conversion fees.

How to Withdraw Funds from Exness

Withdrawing funds from your Exness account is a straightforward process designed to create ease for traders wishing to access their earnings promptly.

Step-by-Step Guide to Making a Withdrawal

To assist traders in successfully withdrawing funds, here is a step-by-step breakdown of the process:

Log in to your Exness Personal Area: Begin by navigating to the Exness website and logging into your trading account.

Navigate to the Withdrawal Section: Once logged in, locate the withdrawal section, typically found under the Financial or Funds tab.

Choose the Withdrawal Method: From the available options, select your preferred withdrawal method, such as UPI, bank wire transfer, or an e-wallet.

Enter the Withdrawal Amount: Specify the amount you intend to withdraw, ensuring that it falls within the allowed daily limit.

Following these steps will enable traders to initiate a withdrawal with minimal difficulty.

Common Issues Encountered During Withdrawal

While the withdrawal process is generally straightforward, traders may encounter some challenges along the way. Common issues include:

Verification Delays: Traders with incomplete verification may face difficulty processing withdrawals. Completing verification before attempting to withdraw is advisable.

Technical Glitches: Internet connectivity issues or temporary server outages can hinder withdrawal requests. Traders should ensure stable connections before initiating transactions.

Compliance Checks: Occasionally, the broker may subject withdrawals to compliance checks for security purposes, which could temporarily delay the process.

By understanding these potential pitfalls, traders can better prepare for a smooth withdrawal experience.

Comparison with Other Forex Brokers in India

Understanding how Exness stacks up against competitors in terms of withdrawal limits and policies is essential for traders considering their options.

Withdrawal Limits of Competitors

Several popular forex brokers operate in India, each with its own set of withdrawal limits. While Exness offers competitive withdrawal limits for various methods, other brokers may present different limitations based on their respective policies.

For example, some brokers may impose stricter limits or lengthy processing times, affecting how quickly traders can access their funds. Therefore, researching and comparing withdrawal limits across platforms is critical for making informed decisions.

Unique Features Offered by Other Brokers

Beyond withdrawal limits, it's essential to consider the unique features offered by other brokers. Some competitors may provide additional benefits, such as loyalty programs, zero withdrawal fees, or enhanced customer support services.

Exploring these unique features helps traders choose the best broker for their individual needs, ultimately leading to a more satisfying trading experience.

Tips for Maximizing Your Withdrawals

Effectively managing withdrawal limits is vital for traders who wish to maximize their access to funds. Here are several tips to enhance withdrawal experiences with Exness.

Strategies to Manage Withdrawal Limits Effectively

To navigate withdrawal limits proficiently, traders should:

Complete Verification Promptly: Ensuring your account is fully verified can lead to increased withdrawal limits and a smoother process overall.

Plan Withdrawals Strategically: Consider timing your withdrawals during off-peak periods to avoid potential delays.

Use Preferred Withdrawals Methods: If you're aware of your limits for each withdrawal method, strategically use the one that allows the highest daily withdrawal to access your funds quicker.

By implementing these strategies, traders can gain greater control over their withdrawal processes.

💥 Trade with Exness now: Open An Account or Visit Brokers 🏆

Timing Your Withdrawals for Best Results

The timing of withdrawals can significantly impact how long it takes to access funds. For example, initiating withdrawals just before weekends or holidays may lead to extended waiting periods.

To achieve optimal outcomes, traders should attempt to request withdrawals during regular business hours to facilitate quicker processing. Being mindful of the financial calendar can help mitigate unnecessary delays.

Understanding Fees Associated with Withdrawals

Fees associated with withdrawals can affect the overall amount received by traders. Knowledge of these fees is advantageous for planning withdrawals effectively.

Breakdown of Potential Fees Incurred

Traders should consider several potential fees that may arise during withdrawals:

Withdrawal Fees: Depending on the selected method, certain withdrawal methods might incur fees charged by the broker.

Currency Conversion Fees: If withdrawing in a different currency than the account holds, traders can expect currency conversion fees based on current exchange rates.

Bank Fees: Banks may apply additional charges for receiving international transfers, which can further impact the final amount credited.

Awareness of these fees can empower traders to choose the most cost-effective withdrawal strategies.

How to Minimize Withdrawal Costs

Minimizing withdrawal costs requires careful planning. Traders can consider the following approaches:

Select Cost-Effective Withdrawal Methods: Research various withdrawal methods to learn which ones are fee-free or offer lower costs.

Consolidate Withdrawals: Instead of making frequent small withdrawals, consider consolidating funds into fewer larger withdrawals to reduce the cumulative impact of fees.

By adopting these strategies, traders can safeguard their profits and ensure they retain as much of their earnings as possible.

Customer Support and FAQs

Reliable customer support can make a significant difference when encountering withdrawal-related issues. Traders should know how to access assistance effectively.

Accessing Support for Withdrawal Issues

Exness offers several channels for traders seeking support regarding withdrawals. Traders can reach out via:

Live Chat: Immediate responses are typically available through the live chat feature on the Exness website.

Email Support: For non-urgent inquiries, traders can send emails detailing their issues and await a response from the support team.

Help Center: The Exness Help Center contains a wealth of resources, including FAQs, articles, and guides on common issues, empowering traders to find solutions independently.

Utilizing these support channels can alleviate concerns and promote a seamless withdrawal experience.

Frequently Asked Questions About Withdrawals

Traders often have questions regarding withdrawals. Addressing these frequently asked questions can provide clarity:

How long does it take to process withdrawals?

Processing times depend on the selected method, with UPI typically being the fastest.

Are there any fees associated with withdrawals?

Fees may vary based on the method chosen and the currencies involved.

Can I change my withdrawal method?

Yes, traders can select different withdrawal methods based on their preferences.

Providing answers to these questions can help traders better understand the withdrawal process and navigate it with confidence.

User Experiences: Withdrawal Stories from India

Real-life experiences can paint a vivid picture of the withdrawal process on Exness, offering valuable insights for potential users.

Positive Experiences with Exness Withdrawals

Many traders in India have shared positive experiences with Exness withdrawals, highlighting the platform's efficient processing times and user-friendly interface. Several traders report successful UPI transactions that resulted in instant fund accessibility, showcasing Exness's commitment to user satisfaction.

Additionally, traders have praised the transparent communication regarding withdrawal policies and limits, contributing to an overall sense of trust in the platform.

Challenges Faced by Traders in the Withdrawal Process

Despite numerous positive experiences, some traders have encountered challenges. Instances of verification delays and occasional processing issues have been reported, leading to frustration among users eager to access their funds.

Moreover, some traders have expressed concerns about currency conversion fees negatively impacting their overall withdrawal amounts, prompting them to seek more favorable withdrawal methods.

Sharing these experiences highlights the need for continuous improvement in withdrawal processes, ensuring that Exness remains at the forefront of meeting traders' needs.

Conclusion

Understanding the Exness withdrawal limit per day in India is essential for traders aiming to optimize their trading experience on this platform. By familiarizing themselves with the withdrawal processes, limits, and associated fees, traders can navigate the complexities of withdrawing funds with confidence.

As the forex trading landscape continues to evolve, awareness of regulatory environments and effective strategies for managing withdrawals will empower traders to make informed decisions. Through diligent research and proactive engagement with support channels, traders can unlock a satisfying and rewarding trading journey with Exness.

Read more:

Is Exness registered in Pakistan?