Getting started? Venture Fundamentals Program

angelschool.vc/venture-fundamentals

● Time: Essential venture skills (10 hrs) + Investment Committee membership

● Covering:

○ Venture Benchmarks

○ InvestmentThesis

○ Cap tables & Dilution

○ Convertible Financings

○ Decision frameworks

○ Case Studies

○ …and More!

● Program Fee: US$500 + $30 / mth (IC Membership)

(July 23) Angel Investing 1st Principles

Session 1Agenda:

(July 30) Venture Math

(August 6) Due Diligence & Decision Making

Intros

InvestmentThesis ● Evaluating your Options ● Guidelines forAngels ● Closing

Quick Intro

About Jed Ng

● Operator: Built world’s largestAPI Marketplace w/ a16z-backed startup.

● Venture Investor: Self-taughtAngel. 2x Seed → Unicorn.

● Syndicate Lead: Backed by 1300+ LPs.

● Founder @

from 1st check

How

Investors / LPs

Angel Investors & Family Offices

Curated Dealflow

● Globalscaledeal sourcing

● FullDiligence& Datarooms

● Buildyourownportfolio

● 0commitmenttoinvest

CapitalAccess

● 1300+LPrelationships

● $100k-$1MNcheck

● Cleancaptable

● AccesstoGlobalexpert network

Investment Thesis

Investment Thesis: Focus to build skill

Geography

(Where does an investor deploy capital?)

Sector/

Domain

(Which industries or verticals do they invest in?)

Stage

(Which stage of companies do they invest in?)

Investment Thesis:Thesis drivers for angel investors

Sector:

● Familiarity: What do you know?

● Affinity: What do you care about?

● Interests: What are you interested in?

Geography

(Where does an investor deploy capital?)

Geo:

● Early stage capital is HIGHLYlocalised.

● Other geos are only relevant if there is some connection. E.g. part of cultural diaspora

Sector/ Domain

(Which industries or verticals do they invest in?)

Stage

(Which stage of companies do they invest in?)

Stage: Primarily a function of capital

● Pre-seed to Seed: $10k - 50k

● Seed toA: $30k - $500k

● A- B: $250k - $ MNs

Angel School’s Investment thesis:

B2B & Software Startups

● SaaS, Enterprise,Tech, Marketplaces

● Why?

→ Credible founders can build, ship, get traction.

Hard w/ sectors like H/W

→ Derisk: no pre-product/ pre-revenue companies

Geography

(Where to source dealflow)

Sector/ Domain

(What do you know? Where are you credible?)

Stage

(How much capital can you move?

# LPs xAvg cheque)

→ ‘Cheap’to scale = less long run dilution

US, Europe andAsia

● 1300 LPs into 3 geos:

→ US (~1300)*launchedQ2‘20

→ Europe (~300)*launchedQ3‘23

→Asia (~300)*launchedQ4‘23

Seed toA (and follow ons)

● Pre-seed: $100 - $250k

● Seed toA: $500k - $1 MN

EvaluatingYour Options

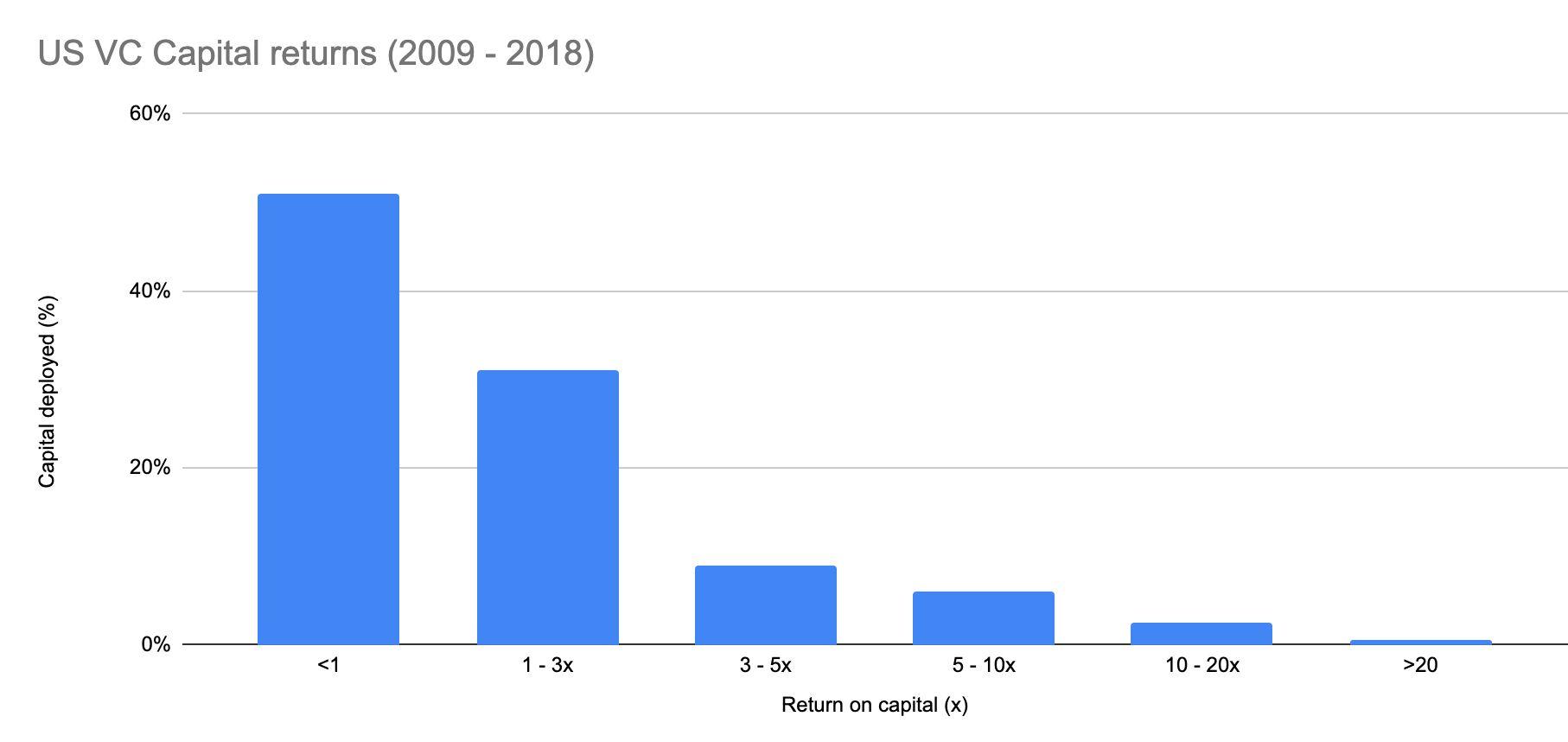

Returns Profile:Angel Investing

Here is what your returns profile looks like as an angel investor investing directly in N Startups

PortCo Return

Portfolio Return

• Each PortCo has uncapped theoretical upside Portfolio return is the sum of ind. PortCo profit / loss

• Loss is limited to 1x

Portfolio (1x Return)

Portco (1x Return)

Portfolio Profit (>1x Return)

Here is what your returns profile looks like as an investor in deals B, D, E

Deal by Deal Syndicate

• ~5% admin costs per deal (SPV + mgmt. fee)

• LPs decide which deals to invest in

LPinvests in deal B, D, E

Deal Level Returns

~95% of capital is deployed, generating returns for investors in each respective SPV

LPReturns

Syndicate LPs receive 100% of original capital + 80% of portfolio profit above that

LPreturns

(80% of profit on SPVs that return >1x capital)

SPV (1x Return)

Returns Profile: Fund LP

Here is what your returns profile looks like as a Fund LP

LPInvestment

Returns

Getting into Venture: Your options as anAngel

Guidelines forAngels

Portfolio construction: Maximizing your odds of success

1. Acceptance of Risk:Assume that whatever you invest in venture will go to 0. Be prepared to walk away.

Do not expect liquidity until an exit event. Even if your shares are valued, there might not be a buyer.

2. Take your time: Dealfow is limitless. Capital is finite.

Get plenty of exposure (see a lot of pitch decks), BUT…be stingy with writing checks. Keep your early euphoria in check.

3. Diversification Matters: You might have 1 winner out of 10 or 20 startups you back. Be committed to building a portfolio.

4. BUT…Diversify over time: Capital is finite. Don’t be in a rush to write checks. You’re in it for the long game.You can diversify by building a portfolio over a period of years. (The implications of Power Law are different forAngels vs VCs)

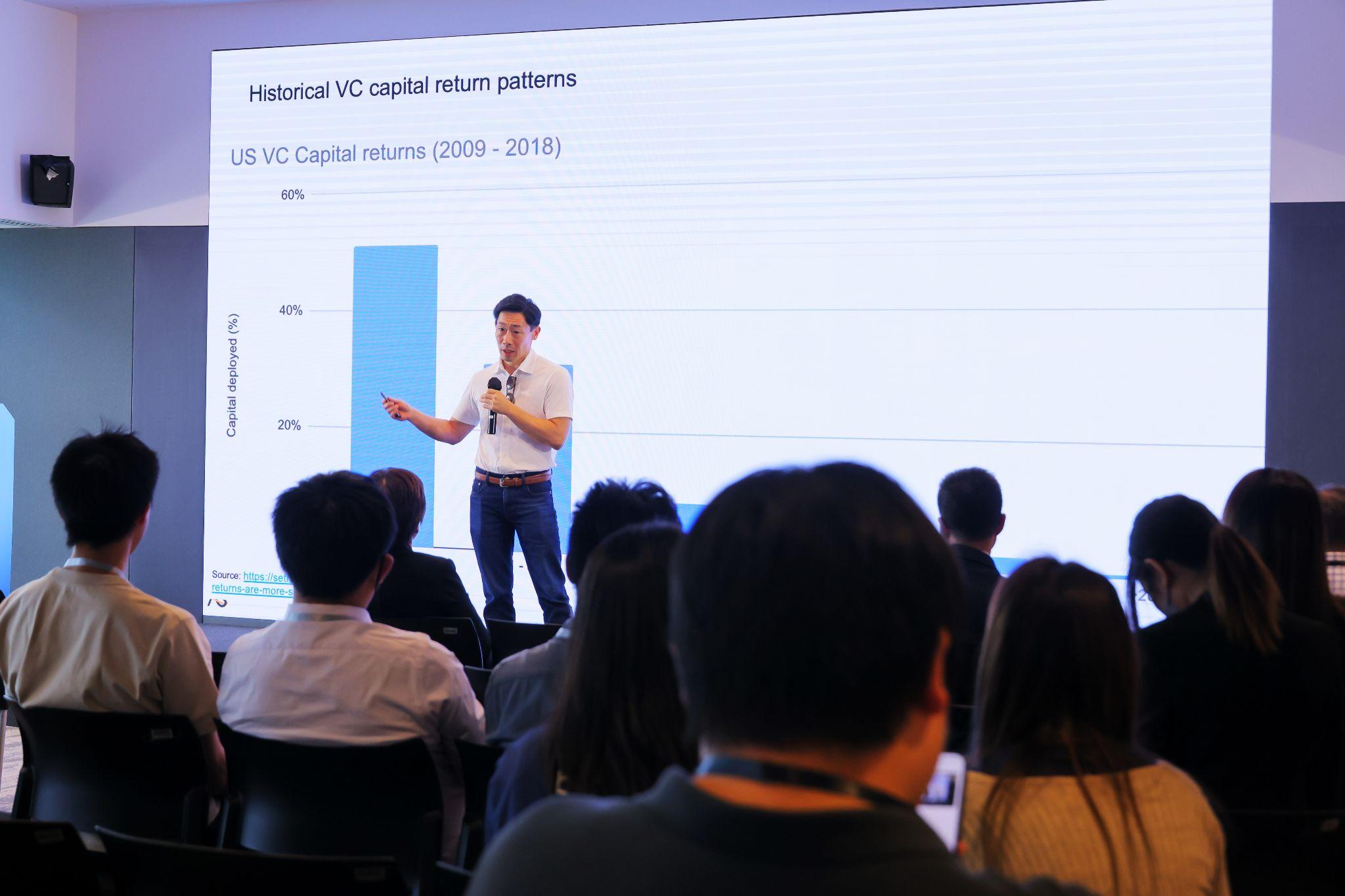

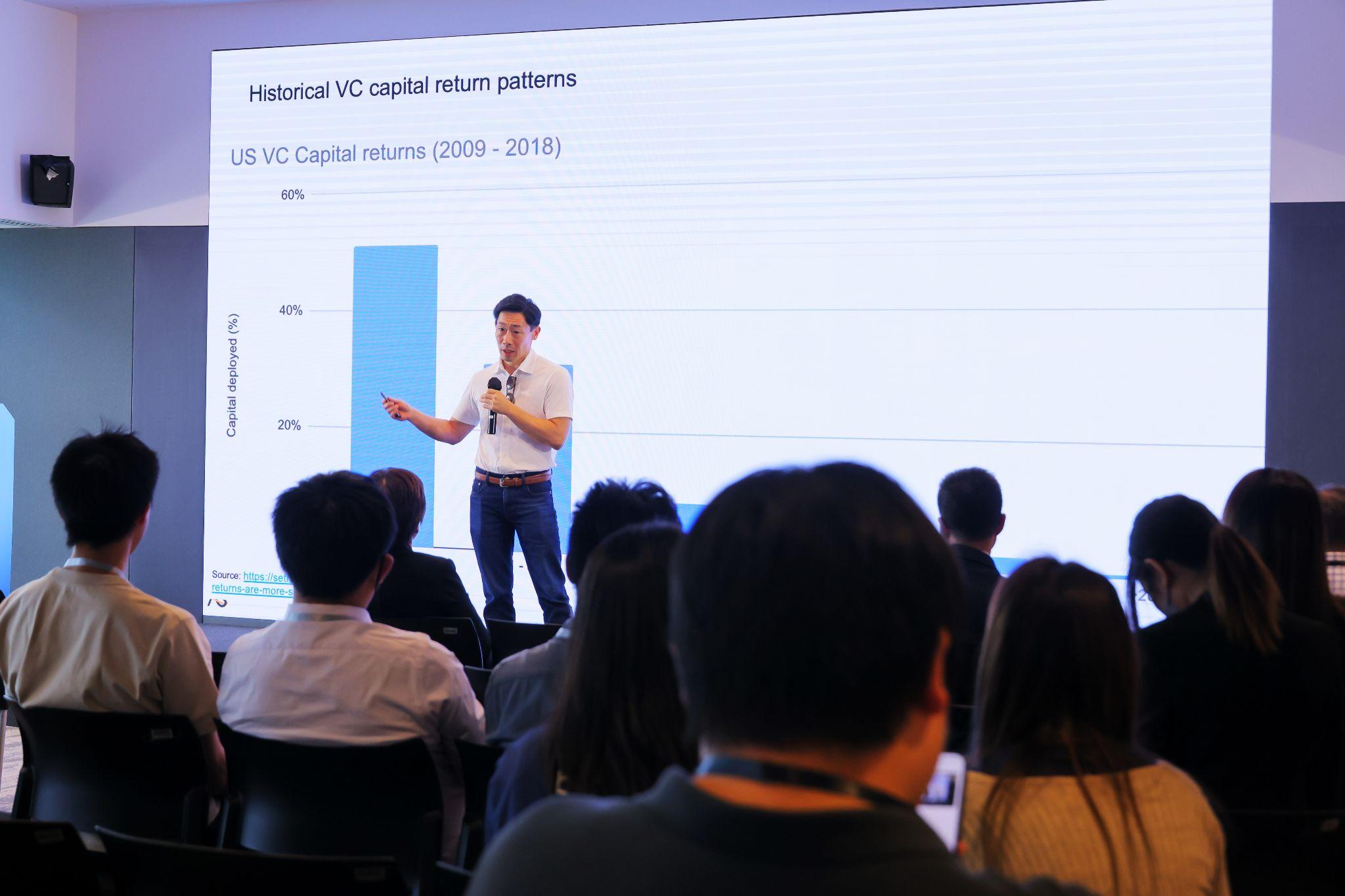

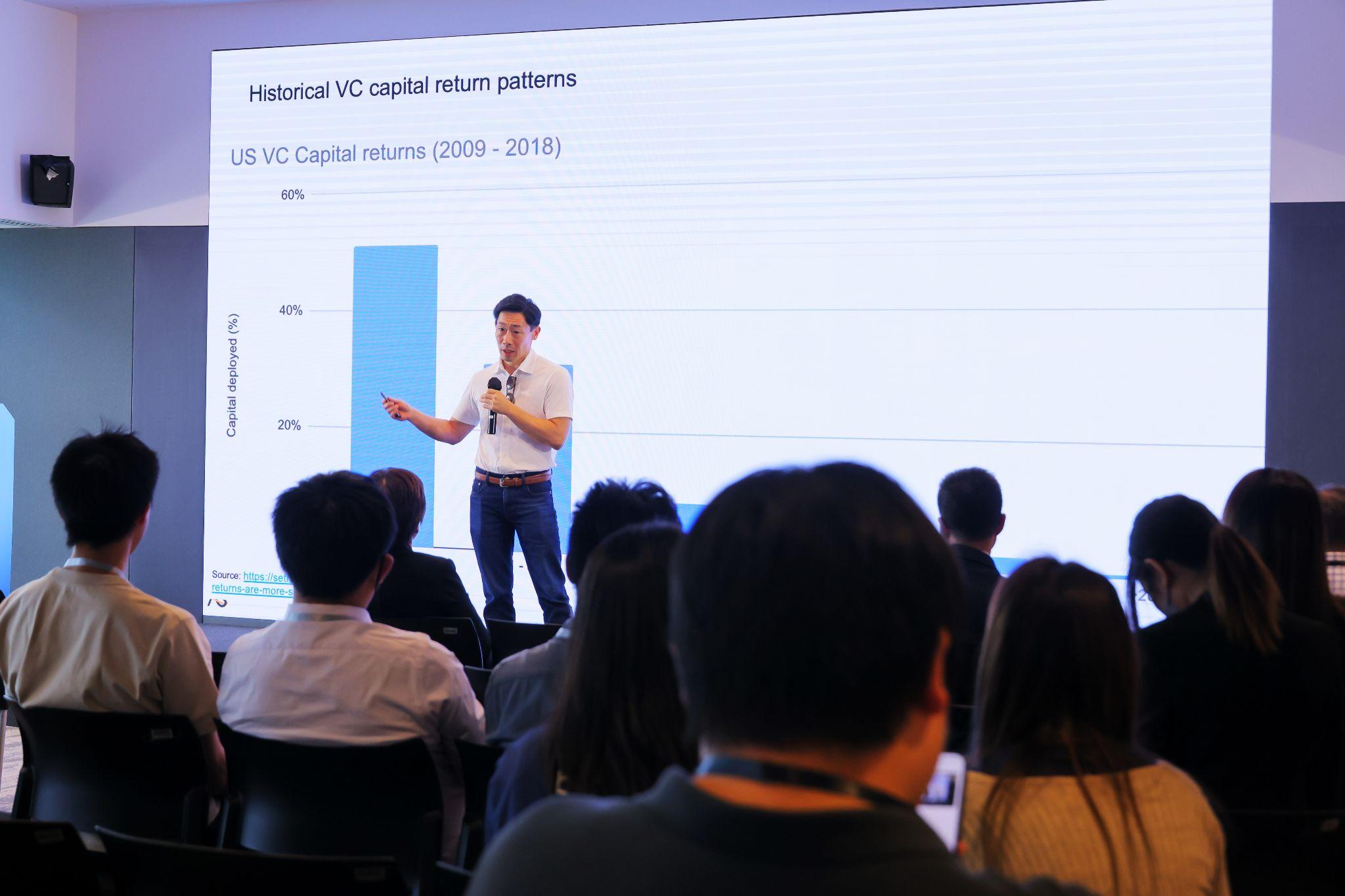

InvestingAxioms: VC is a game of ‘Power Law’ 6 of 6 Theconceptof“PowerLaw”isareframingofthe80/20rule;asmall%ofcompaniesgeneratetheMAJORITYoffund returns.i.e.therewillbefewwinnersandALOToflosingbets.

# Portfolio Companies

Power Law: Diversification vs Skill

Assume you invested in a portfolio of n companies, each with a $1000 check

Portfolio

1 (n = 2)

● Returned: $3,000

● Invested: $2,000 $1000 Profit. 50% ROI

Portfolio 2 (n = 10)

Portfolio

3 (n = 100)

Returned: $101,000

= 2)

Portfolio

5. Reality check: Generally speaking, here is what holds true when you’re starting out:

○ Low on skill and experience.

○ Finite pool of capital for venture (and won’t increase significantly in the near term).

○ Access to dealflow is constrained (largely a capital constraint)

6. Small bets early:The psychology of investing changes once you stake capital. It’s important you experience this.

However, your decision making is poorest when starting out.As such, make undersized bets early (Syndicates help you improve deal access, learn from their diligence, and diversify)

7. Life changing Outcomes: The whole point of venture is to get outsized returns (10x, 20x, 50x, 100x?)

Say you backed a startup that returns 100x. If you invested $1000 → $100k…so what? On the other hand, $10k → $1 MN (much better!)

Portfolio construction: Maximizing your odds of success

8. Invest in your skill: Diligence skill is another success lever. It takes many reps and time to develop. Start working on this early. Great decision making pays off in the long term.

9. Join Syndicates: Let someone else do the heavy lift of sourcing deals and doing diligence on your behalf.You have 100% decision control over your portfolio. (Be aware: not all syndicates have high standards so vet carefully).

10. Outcome levers:You have multiple ways to improve your odds of venture success.Think of them as weapons in your arsenal: more deals, bigger checks, better diligence.

Unicorn 100x probability = 1:10000 (or more)

Source: https://sethlevine.com/archives/2020/10/vc-fund-returns-are-m ore-skewed-than-you-think.html

10x return = ~8% probability

→ $500k avg. cheque

→ $5 MN profit = $1 MN Carry

Our

Contribution to Venture

The ‘Super Network’: 3 Investment Hubs, 1300+ LPs

Our Rockstar Bench of Talent

Yi Ming Kau

Launched & built Grab’s Rental business to $100MN P&L Singapore

Annegien Blokpoel

Founder @ Catalyst Impact Syndicate. Board Member Netherlands

Neil Han

Founder @ Reddio.Twilio APAC’s #3 hire Singapore

Amrita Vir

Syndicate Lead @ Findicate USA

Mark Birch

AWS Global StartupAdvocate. ex-Stack OverflowAPAC Director USA

Vanessa Ho

Founder @ NUSAlumni Ventures. Boleh Ventures VC Singapore

Sabrina Tachdjian

LINE Messaging CVC, Samsung Corporate Strategist Singapore

Lucien Peters

Founder @ OneCart.za. Exited to Walmart SouthAfrica

AcceleratingAngel Investors: From 1st check.….to Super Angel

Venture Fundamentals

Syndicate Blueprint

● Essential venture skills forAngels

● Real deal experience

● Global Investor network

● Build your ownAngel network

● Invest at $100k+ scale

● Earn carried interest

(Incl. Venture Fundamentals for FREE)

Disclaimers

This material has been prepared byAngel School Pte Ltd (the “Company”) and is general background information about the Company’s activities at the date of this presentation.The information in this material is provided in summary form only and does not purport to be complete.This material is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, nor does it constitute an offer to provide investment advisory or other services.This material does not contain all the information that is or may be material to investors or potential investors and should not be considered as advice or a recommendation to investors or potential investors in respect of the holding, purchasing, or selling of securities or other financial instruments and does not take into account any investor’s particular objectives, financial situation or needs.This document may contain forward-looking statements.Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Reliance on this information is at the sole risk of the reader.This document and its contents are confidential and proprietary to the Company. No part of it or its subject matter may be reproduced, redistributed, passed on, or the contents otherwise divulged, directly or indirectly, to any other person (excluding the relevant person’s professional advisers) or published in whole or in part for any purpose without the prior written consent of the Company. If you have received this document in error, you must return it to the Company immediately.The information contained herein has not been independently verified. No representation or warranty, express or implied, is made regarding the material's fairness, accuracy, or completeness and the information contained herein. No reliance should be placed on it.All projections, valuations, and statistical analyses are provided for information purposes only.They may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results, and to the extent they are based on historical information, they should not be relied upon as an accurate prediction of future performance.

AboutAngel School

AngelSchool.vc is the ultimate Accelerator for Angel Investors - from 1st check to leading syndicates as Super Angels. We give emerging venture investors world-class training, build their track record as a memberofourInvestmentCommittee(IC)andaccesstoourglobalalumninetwork.

The AngelSchool.vc Syndicate is backed by 1300+ LPs and deploys $MNs annually. Subscribehere forexclusivedealflow.