5 FROM THE CO-CHAIRS

6 URBAN INSTITUTE

10 HOPE

12 MORTGAGE BANKERS ASSOCIATION

14 NATIONAL ASSOCIATION OF REALTORS®

16 NATIONAL ASSOCIATION OF REAL ESTATE BROKERS

18 NATIONAL FAIR HOUSING ALLIANCE

20 NATIONAL HOUSING CONFERENCE

22 NATIONAL URBAN LEAGUE

24 SPONSORS CREDIT UNION, ENTERPRISE CORPORATION, POLICY INSTITUTE

The Black Homeownership Collaborative has worked tirelessly to bridge the gap in homeownership rates, ensuring that more Black families can achieve the dream of owning a home.

Bryan Greene Vice President Policy Advocacy National Association of REALTORS®

Cy Richardson Senior Vice President for Programs National Urban League

Courtney Johnson Rose President National Association of Real Estate Brokers

Dear Friends and Partners,

As co-chairs of the Black Homeownership Collaborative, we are honored to share this year’s annual report and reflect on the ongoing journey towards closing the racial homeownership gap.

Black homeownership remains a critical measure of progress toward economic justice and generational wealth. While Black families continue to demonstrate resilience and determination in pursuing homeownership, persistent barriers—including rising housing costs, limited inventory, and disparities in access to credit—pose significant challenges. These threats underscore the urgent need for sustained action and effective solutions.

This past year, we have seen both the promise and the pressures facing Black homebuyers. The current housing market, marked by affordability concerns and systemic inequities, demands sustained commitment to ensure long term sustainability. We are encouraged by the growing conversation around housing, as more people recognize the urgency of safe, affordable, and accessible homes for all.

As part of our advocacy, we proudly support the Neighborhood Homes Investment Act, which would provide vital resources to revitalize distressed neighborhoods and create new pathways to homeownership for families who have long been excluded. We believe this legislation represents a meaningful step toward addressing the root causes of the homeownership gap and building stronger, inclusive communities.

We are grateful for the dedication and partnership of our stakeholders, supporters, and allies. Your commitment sustains our work and inspires hope for the future. Together, we will continue to champion policies and programs that open doors for Black families and ensure that homeownership is within reach for all.

In 2019, the 30-point gap between white and Black households’ homeownership rates (72% vs 42%, respectively) was larger than in 1960, when overtly discriminatory practices and policies were allowed in the selling and financing of homes. Urban Institute research projected that, without an effort to close it, this gap will grow

The Black Homeownership Collaborative was launched in 2020 with the goal of increasing the number of Black homeowning households by 3 million by 2030. This could result in 9.46 million Black homeowners and move the Black homeownership rate above 50% for the first time.

At the start of the COVID-19 pandemic, advocates feared that the Black-white homeownership gap would widen further, as it did during the Great Recession, when Black households experienced the greatest decline and slowest recovery in homeownership among all racial and ethnic groups. Despite this, timely interventions such as forbearance on governmentbacked mortgages and pandemic relief measures that resulted in faster-than-expected job market recovery helped many Black households to sustain and access homeownership.

From 2019 to 2023, the Black homeownership rate increased by 2.7 percentage points, adding around 675,400 net new Black homeowners to the market. The Black-white homeownership gap slightly narrowed from 29.9 percent to 28.2 percent.

However, gains in Black homeownership have slowed in recent years. Persistent high interest rates have posed additional challenges for Black renters in accessing homeownership. Home purchase mortgage originations to Black households dropped by 17 percent from 2021–22 and by 21 percent from 2022–23. Denial rates increased, with 18.6 percent of Black mortgage applicants in 2023 being denied (8.2 percentage points higher than the overall denial rate), the highest of all racial and ethnic groups. High debt-to-income ratios became the dominant reason for mortgage denials (48 percent of denials) among Black applicants, followed by credit history (26 percent of denials).

High interest rates and housing supply shortages are likely to persist, at least in the near future. As a result of the tight market, the typical homebuyer is putting down a higher down payment than in previous years, which could indicate tighter credit standards and efforts to alleviate their mortgage cost burden. Black households, who on average have lower wealth and income, face greater challenges in meeting the higher upfront costs of homeownership.

Reaching the 3 by 30 goal will require robust, targeted policy and programmatic strategies. If we continue at the pace we did between 2019 and 2023, the number of Black homeowning households will reach around 8.2 million in 2030, 1.25 million short of the 3 by 30 goal.

Data to guide strategies to close the racial homeownership gap can be found in this dashboard for the Black Homeownership Collaborative’s efforts.1

› Heirs’ Property a new body of research examines how heirs’ property threatens the closure of racial wealth and homeownership gaps. Older Black homeowners are the most likely of any racial or ethnic group to be at risk of passing on heirs’ property. This is driven in large part by the fact that they are less likely than their white counterparts to have estate plans. Existing Black homeowners are more likely to live in inherited homes, which are older and of poorer quality, undermining property values and wealth. The findings call for action at all levels—promoting estate planning, funding home repairs, and reforming partition laws to protect against involuntary property loss.

› Can Increasing Housing Supply Advance Racial Equity in Homeownership? This study finds that while Black and Hispanic homeownership rates have historically risen along with the increase in housing supply, racial homeownership gaps have remained stagnant, indicating the importance of demand-side policies alongside increasing supply.

› Potential Implications of the Great Wealth Transfer for the Black-White Homeownership Rate Gap The sizable transfer of wealth from older to younger generations is likely to cement or widen

the Black-White homeownership gap, due to significantly greater wealth to be transferred from senior white households, and less inheritance expected to be received among young Black renter households.

› The Great Inequality Transfer As the United States continues through what is expected to be the greatest generational wealth transfer in the country’s history, Urban researchers dig into the relationship between homeownership status and intergenerational transfers across demographic groups. The results suggest that the racial disparities that we see today in homeownership and wealth are likely to repeat and compound across generations, suggesting the need for comprehensive public policies that address longstanding disparities in the accessibility of assets and capital gains.

› Preserving Household Wealth through Economic Shocks: Lessons Learned from the COVID-19 Pandemic for Homeowners of Color (forthcoming). This report documents how the COVID-19 pandemic threatened the sustainability of homeownership along multiple channels and provides recommendations to help vulnerable households stay homeowners before, during, and after a crisis.

Despite some volatility, the Black homeownership gap in both the Detroit metropolitan area and city narrowed between 2019 and 2023.

Between 2019 and 2023, the Black homeownership rate increased 7.5 percentage points (43.3 percent to 50.8 percent) in the Detroit metro area and 6.7 percentage points (46.7 percent to 53.4 percent) in the city. In this period, the number of Black homeowners increased by about 25,000 in the metro area and 5,700 in the city.

While the Black-white homeownership rate gap remains large in the Detroit metro area, it declined by 6 percentage points (35.5 percentage points to 29.5 percentage points). The city of Detroit has a significantly lower gap—6.2 percentage points in 2023—than the metro area and the nation as a whole, but the gap did increase from 3.2 percentage points in 2019, driven by a larger increase in white homeownership during this period.

Learn more

See the Market and Disparity Data Analysis Toolkit for more Detroit housing market data. THE BLACK-WHITE HOMEOWNERSHIP

Black, Detroit Metro

Detroit Metro

Source: American Community Survey Note:

Black, Detroit City

Detroit City

HOPE (Hope Enterprise Corporation, Hope Credit Union and Hope Policy Institute) provides financial services; leverages resources; and engages in advocacy that strengthens the financial health of people in under-resourced Deep South communities. Since 1994, these efforts have benefitted more than three million people in Alabama, Arkansas, Louisiana, Mississippi and Tennessee, and influenced billions in investments in persistent poverty communities nationwide. In 2024, HOPE launched its current strategic plan which includes the goal to eradicate the Black / white Homeownership gap in the Deep South states of Alabama, Arkansas, Louisiana, Mississippi and Tennessee

lending impact in its history closing 321 mortgages for a total of $37,551,944. Of the homeowners supported 3 out of 4 mortgage borrowers were people of color, 61% were women and 87% were first time homebuyers (Figure 1). Importantly, HOPE extended homeownership opportunities to mortgage borrowers with credit scores that were well below national levels with a charge off rate of less than 0.24%.

In 2024, HOPE quantified the Deep South Black/ white Homeownership gap at 500,000 renters – the number of Black households currently renting, that if moved to homeownership, would bring the Black homeownership rate to regional levels. Leaning into this goal, HOPE has substantially ramped up its mortgage lending capacity by deepening its executive and senior leadership and expanding its network of mortgage originators. In 2024, HOPE achieved the deepest mortgage

To achieve this level of impact, HOPE offers an inhouse mortgage product, the Affordable Housing Program (AHP). HOPE’s AHP product was designed to address the challenges faced by HOPE’s membership to advance homeownership among people to whom it may not be readily accessible. Some of the challenges include a lack of savings, credit history, loan to value and mortgage insurance restrictions and rising costs of goods, services and insurance. Through the AHP, mortgages are manually underwritten, and nontraditional sources of credit are considered in the underwriting process. The product also discounts deferred student debt, does not require mortgage insurance, and considers credit scores as low as 580. The AHP allows for a loan-to-value (LTV) of 100%—eliminating the need for a down payment. HOPE often pairs the AHP product with various affordability assistance programs to reduce barriers to homeownership. Affordability assistance programs are funded through philanthropy, bank partners and various units of government.

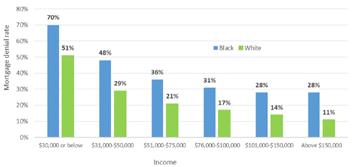

HOPE’s mortgage program responds to systemic gaps in the Deep South where one out of two Black households own a home in contrast to three out of four white households. Across the region, homeownership gaps by race persist in every state (Table 1). A major factor contributing to the homeownership gap includes inequitable access to mortgage financing. Even controlling for

income, black borrowers are more likely to be denied mortgages. In the Deep South, Black borrowers experience higher mortgage denial rates than white borrowers at every income level (Figure 2).

Source: U.S. Census Bureau, U.S. Department of Commerce. “Demographic Characteristics for Occupied Housing Units.” American Community Survey, ACS 5-Year Estimates Subject Tables, Table S2502, https://data.census.gov/table/ACSST5Y2023. S2502?q=s2502&moe=false. Accessed on 6 Jun 2025.

Source: 2022 HMDA data

Yvette Burke Ezebuiro refers to HOPE mortgage originator Abby Virgil, who shepherded her through the process of becoming a first-time homeowner, as “my angel.”

After 14 years of renting a house in New Orleans, Ezebuiro decided it was time to fulfill her dream of buying a home. As a disabled person who works part-time as a cashier at the Superdome, she had been receiving rental assistance from the Housing Authority of New Orleans (HANO), funded by the U.S. Department of Housing and Urban Development. Ezebuiro applied to HANO’s homeownership program, intent on using the subsidy to buy a house rather than continuing to rent. She enrolled in two HANO classes for would-be buyers, Financial Fitness and Homebuyer’s Education.

Ezebuiro’s friend referred her to HOPE, where she initially learned that she needed to eliminate much of her debt to qualify for a mortgage. So Ezebuiro buckled down, determined to attain her dream.

“Every time I got paid, I paid the credit cards. I don’t know how I made it. God helped me because nothing ever got cut off. I pinched here, pinched there, and I made sure everything got paid,” Ezebuiro said, adding that HOPE told her in detail what she needed to do, whereas another bank might have dismissed her outright as unable to meet the credit requirements.

When her debt was paid off, Ezebuiro returned to HOPE and began working with Virgil to apply for a 30-year, fixed-rate mortgage. In addition to the federal assistance for her monthly mortgage payments, Ezebuiro received a forgivable loan from the city of New Orleans and a $15,000 Hope Enterprise Corporation grant to help with the down payment. As HOPE does with many first-time home buyers, Virgil spoke to Ezebuiro about the importance of budgeting and managing her credit.

Meanwhile, Ezebuiro looked at homes with a realtor. Unable to afford large-scale repairs, she needed a house that was ready for her to move in with her daughter, Missy, and their dog. She was outbid on her ideal house, but then it came back on the market, albeit for a higher price than she had anticipated.

“And I said, ‘Lord, where am I going to get that money from?’ I didn’t know where I’d get it from, but I told my realtor, ‘Put that house in because I’m going to get this house.’ I’m in the house I wanted,” she said. It’s a 3-bedroom, 2-bath home with a yard where Ezebuiro is excited to host her son and two grandchildren for barbecues.

When Ezebuiro closed on the house in November 2022, she called Virgil excitedly and sent pictures holding keys to her new home. Virgil said she got goosebumps. “It’s so exciting. Because there are some people out there who don’t even believe that they can own a home,” Virgil said. “It does take some legwork, but it’s there. It is available. It can happen.

MBA is committed to providing thought leadership, market-based solutions, advocacy, and strategic partnerships to increase homeownership opportunities. Through efforts like our CONVERGENCE place-based programs, MBA will continue to share best practices, information, and resources that will help the real estate finance industry create a pathway for homeownership and the wealth building benefits that come with it.

CONVERGENCE® is a collective impact initiative uniting local and national partners from the private, public, and nonprofit sectors. By enhancing existing services and piloting innovative, community-driven solutions, CONVERGENCE strives to expand access to homeownership opportunities. The initiative operates

in three cities: Memphis, TN; Columbus, OH; and Philadelphia, PA—where a local nonprofit organization, aligned with CONVERGENCE’s mission, serves as the host. These organizations foster collaboration among stakeholders across the housing ecosystem to tackle their community’s unique housing challenges.

In the past year, stakeholders within the CONVERGENCE network were actively engaged, organizing events, implementing pilot programs, and designing innovative approaches to broaden homeownership opportunities.

CONVERGENCE Memphis advanced its mission to increase housing supply and support emerging developers with groundbreaking initiatives. A construction pilot program in a target neighborhood made significant progress, utilizing an evidencebased design tool to help nonprofit developers create affordable entry-level single-family homes. In addition, CONVERGENCE Memphis is in the early phases of a pilot to introduce 3D-printed homes to the Memphis market. This innovative approach aims to deliver sustainable and affordable housing.

CONVERGENCE Columbus is driving innovation to increase housing supply and affordability with a focus on Accessory Dwelling Units (ADUs) and community engagement. In collaboration with the Columbus City Council and the city’s Building and Zoning Services, CONVERGENCE Columbus developed an informative ADU infographic, available on Bloom614.org. The resource consolidates essential information on ADU development, including the variance process, utility considerations, and financing options. To further empower community involvement, the team introduced a zoning “Party in a Box”—a toolkit designed to engage residents in meaningful discussions about Columbus’ zoning code reform. These efforts aim to expand housing options while fostering a more inclusive dialogue about the future of the city’s housing landscape.

Through targeted initiatives, CONVERGENCE Philadelphia worked to provide valuable education for housing professionals. The team organized a successful virtual and in-person educational and networking event series tailored to loan officers, real estate agents, and housing counselors. The series delivered insights on programs, products, and emerging housing trends, equipping attendees with tools to thrive in the evolving market. The series included a convening on the growing challenge of “tangled titles”, which can prevent property sales, block insurance access, and restrict eligibility for assistance programs. The timely event educated attendees about how tangled titles affect their work and it showcased key resources for preventing and resolving these challenges.

In late 2024, MBA, along with key industry leaders, unveiled the CONVERGENCE Collaborative, a powerful initiative aimed at bridging the information, trust, market, and resource gaps that prevent consumers from achieving homeownership.

The CONVERGENCE Collaborative will deploy more than $1 million annually to expand the impact of place-based CONVERGENCE sites and advance homeownership across the country.

The CONVERGENCE Collaborative brings together influential partners that will leverage their collective resources and expertise to develop innovative, evidencebased tools and strategies.

Through the expansion of the CONVERGENCE network, the CONVERGENCE Collaborative will create a robust “knowledge community” that will drive new solutions, inform industry best practices, and help industry stakeholders better serve aspiring minority homeowners across diverse markets.

National Association of REALTORS® (NAR) remains a proud and committed partner of the Black Homeownership Collaborative’s 3by30 Initiative. NAR is poised to continue to work to help families achieve the dream of homeownership and to begin building wealth. Advancing housing affordability, attainability, and supply remain priorities for NAR as it continues to work with the federal government, state and local leaders, and industry stakeholders to ensure that housing remains possible for all.

Over the past year, NAR has continued its focus in educating and empowering consumers while also working to provide significant impact and value to members through advocacy, training, education, and support.

NAR continues to produce educational resources both for consumers and REALTORS®. Recently, NAR:

› Launched Fairhaven 2.0, a dynamic fair housing education simulation based on storytelling that helps REALTORS® understand fair housing history and why it’s relevant today. During their trip to Fairhaven, REALTORS® delve into critical fair housing issues, including how to avoid steering when clients ask about neighborhoods and schools; best practices in fair housing marketing;

tactics to interrupt implicit bias; and how to stand up for clients when they face discrimination. This course satisfies NAR’s new fair housing training requirement that took effect January 1, 2025.

› Introduced a fair housing training specifically for Appraiser Members that explores the history of housing discrimination and emphasizes best practice to avoid discriminatory appraisals.

› Offered Bias Override, an award-winning certificate course that helps REALTORS® interrupt stereotypical thinking so they can avoid fair housing pitfalls and provide equal professional service to every customer or client. Between January 1st and April 30th of 2025, over 1400 members have taken the course.

› Brought Undesign the Redline, an interactive exhibit created by Designing the We to our May and November conferences. The show explores how segregated communities developed in the 20th century and the residual, lasting effect of redlining and other public policies and invites visitors to learn, share, and take action to build more inclusive communities.

› Teamed up with the DC History Center to provide walking tours to members at our legislative meetings offering a new perspective on DC’s historic neighborhoods.

› Issued new consumer guides to help consumers navigate the homebuying process with ease and to understand optionality and their rights at facts.realtor.

› Recognized Fair Housing Champions who are community leaders and advocates who have taken action to advance fair housing and who are invested in expanding homeownership opportunities.

› Working with the NAR Appraisal Valuation Committee to develop resources for members and consumers to combat appraisal bias.

› Created a Pathways to Homeownership webpage, which is focused on supporting first-time and firstgeneration home buyers.

› Developed the Fair & Attainable Housing Ideas Forum workshop to expand internal resource sharing and capacity building for inspiring ideas for local initiatives.

› NAR issued its 2025 Snapshot of Race and Homebuying Report with Black Homeownership experiencing the greatest annual increase since 2023 with ownership at 44.7 percent.

› NAR issued the Home Buyers and Sellers Generational Trends Report, which provides insights into differences and similarities across generations of home buyers and sellers.

› Between 2024–2025, NAR awarded 1,100 Community Outreach grants totaling over $4 million to support local and state REALTOR® associations-led partnership initiatives such as fair housing education and events, down payment education, affordable housing summits, housing fairs, heirs’ property classes, home repair workshops, rural planning updates, transit initiatives, and adaptive reuse studies.

› NAR is a proud partner of The Convergence Collaborative and has pledged to work along with the Mortgage Bankers Association (MBA) and other industry stakeholders in working to expand homeownership access and impact.

› NAR has supported the following bills in Congress:

f The More Homes on the Market Act (H.R. 1340) to decrease the equity penalty and incentivize more long-term owners to sell their homes.

f The Housing Supply Framework Act (H.R. 2840/ S. 1299) to create a national strategy for boosting housing production and affordability by reducing barriers to new housing development.

f The Revitalizing Downtowns and Main Streets Act (H.R. 2410) to convert underused commercial properties into residential and mixed-use housing.

f The Uplifting First-Time Homebuyers Act (H.R. 3526) to increase the amount that can be withdrawn penalty-free from IRAs for a down payment on a first home.

f The Fair and Equal Housing Act to add sexual orientation and gender identity as protected classes under the Fair Housing Act, codifying the application of the Supreme Court’s Bostock v. Clayton County decision to the Fair Housing Act, to help ensure equal housing protections for all Americans.

f Advocated in support of the HOME Investment Partnerships Program and Community Development Block Grant Program.

For Reference: 2023–2024 BHC Annual Report

Over the past year, the National Association of Real Estate Brokers (NAREB) has expanded its efforts to help African American families and individuals navigate pathways toward building wealth and purchasing homes. NAREB initiatives broke new ground on the inheritance of heirs’ property and appraisal bias, two barriers that Black families frequently face in achieving wealth and improving their family’s economic security.

Additionally, NAREB’s ground-breaking Building Black Wealth Tour, a significant milestone in our efforts, attracted more than 50,000 families at 210 events in less than two years. This tour was a platform for participants to gain valuable insights through seminars, workshops, and one-on-one sessions about homeownership, property investment, heirs property, and other wealthbuilding opportunities. NAREB established National Community Building Wealth Day, when 100 NAREB Local Chapters held events each April in 100 cities across the country, further amplifying the impact of the tour.

With home equity comprising 65% of the median net worth for Black households, home ownership is the primary driver of Black wealth for our families. As a result, appraisal bias, heirs’ property management, and other discriminatory acts have been significant factors in restricting Black wealth over the decades.

NAREB’s comprehensive study of the appraisal process found improvements in appraisal bias following the establishment of the White House’s Federal Interagency Task Force on Property Appraisal and Valuation Equity (PAVE) in 2021 and the release of the PAVE Action Plan on March 23, 2022, which proposed policy measures to lessen the occurrence and impact of appraisal bias. Notably, the study found there was significant progress in specific cities. In reviewing data from 20 metropolitan areas with the largest Black populations, the study found that in Houston, the Black median appraised home undervaluation gap narrowed by 31 percentage points, falling from 41% in 2021 to 10% in 2023. The undervaluation gap plunged 14% in the Washington, DC, metropolitan area, from 35% in 2021 to 21% in 2023. The median appraised home undervaluation gap also narrowed in the Atlanta, Chicago, Dallas, Detroit, Philadelphia, Richmond, and Virginia Beach metropolitan areas. However, there were other locations where the gap increased. In Los Angeles, the Black appraised undervaluation gap grew 17 percentage points, from 31% in 2021 to 48% in 2023. The gap also rose by four percentage points in Baltimore and Miami. It increased by up to three points in the Charlotte, Cleveland, Memphis, New York, St. Louis, and Tampa metropolitan areas while remaining the same in Orlando.

It tells us there is more work to be done.

Our heir’s property study documents the discriminatory policies and practices that have facilitated the loss of property, farmland, and generational wealth for African Americans from the end of slavery to the present day. These policies and practices include limited access to legal advice, discriminatory actions by federal, state, and local governments, and violence and hate crimes. When land is maintained as heirs’ property, all descendants hold fractional ownership, making the property vulnerable to legal challenges, forced sales, and exploitation by developers or outside parties. The study confirms that

exploitative and frequently illegal actions resulted in Black families losing 90% of the land held in 1910.

NAREB is doing more than identifying issues and problems. We also move proactively to enhance opportunities for more community control over land.

The NAREB Developer Academy expanded from 50 to 244 graduates in 2025. This growth solidifies the Academy’s position as a unique training ground and a catalyst for change, equipping aspiring Black real estate professionals with a comprehensive curriculum, strategic partnerships, and a community-focused approach to development. The Academy graduates can make a lasting impact as developers in their communities. The Academy’s rigorous curriculum, strategic alliances, and community-focused approach position emerging developers to succeed as developers in their communities.

A Grove Impact report determined that many Black and Hispanic real estate developers are in a crisis - a revenue gap for mid-sized Black developers, revenue cliffs, and a lack of representation in the field. The study found that Black developers represent 0.40% of the industry, while Hispanic developers represent 0.16%.

NAREB seeks to expand the pool of Black developers, which can bolster Black development firms and Black communities, addressing racial disparities in wealth and homeownership. Clearly, people of color have been denied access to opportunities in the real estate industry, leading to a significant wealth gap between with our white counterparts. By increasing the representation of Black developers in this field, more opportunities for economic advancement can be created for Black communities. Already, the NAREB Development Academy is making a positive impact on communities.

One such inspiring success story is that of a Houston company, YesToRealEstate Texas, which is building 38 affordable Tiny Homes in LaMarque, TX. The homes are small, sustainable, and efficient living spaces that cater to individuals and families seeking housing solutions that prioritize functionality and innovative design. This project has been a resounding success, providing hope for the future of affordable housing. Andre Beraud, owner of YesToRealEstate, is a testament to this success, as he credits the NAREB Developers Academy for providing valuable insights and inspiring the cohorts with the potential for positive change.

In Buffalo, NY, Paul Perez is an investor and partner in

the Loads of Love project, a two-story building with a laundromat and five affordable residential units in the African American Heritage Corridor. Perez joined the inaugural Academy class as part of the Barrett & Benitez Development team. He describes his experience in the program as transformative, stating that it has significantly enhanced his development skills in areas such as proforma design, joint venture strategy, and navigating the intricate language of development agreements.

These success stories from the Academy, including a special cohort curated for Southern California to address the development needs caused by the devastating wildfires, exemplify the transformative impact of the Academy on both communities and individual developers. This initiative inspires hope and demonstrates the potential for positive change in the real estate industry. Because of the Academy, NAREB has launched the NAREB Development Fund, a loan fund designed to provide microlending and community development to emerging developers.

NAREB is also addressing the new barriers to Black homeownership, such as institutional investors becoming influential and controversial actors in the U.S. housing market, particularly through their growing ownership of single-family homes. Once overwhelmingly owned by individual families and small-scale landlords, large corporate entities have increasingly acquired these properties, including private equity firms, hedge funds, and publicly traded real estate investment trusts (REITs).

Although many of these homes are operated as rentals, NAREB is examining the impact of large-scale acquisition and long-term ownership of single-family homes by institutional investors. This transformation of America’s housing stock raises urgent questions about affordability, displacement, neighborhood stability, and the role of financial capital in shaping community life. We will provide the public with the answers as we study this new phenomenon.

And this fall, NAREB will unveil a new version of the State of Housing in Black America (SHIBA) report, which outlines each year the state of Black homeownership in America and the challenges that our families must overcome to achieve a piece of the American Dream of homeownership.

National Fair Housing Alliance (NFHA) leads the fair housing movement and works to ensure equitable housing opportunities for all people and communities through its education and outreach, member services, public policy, advocacy, housing, community development, tech equity, enforcement, and consulting and compliance programs. Our priority is to advance equity by developing and promoting strategies that not only eliminate bias in our society but also increase equity and create healthy, vibrant, wellresourced neighborhoods where people can thrive.

A changing federal administration meant a pivot from promoting policies to advance homeownership and financial access for people of color to protecting fundamental civil liberties and democratic principles. The administration has issued anti-diversity, equity, inclusion, and accessibility Executive Orders (EOs) and taken other actions designed to stop lawful efforts to advance equitable opportunities. NFHA immediately acted to catalyze advocates and partners with a plan to safeguard established rights and freedoms, promote fair and affordable housing for all, support robust civil rights protections for automated systems, including artificial intelligence (AI), and preserve checks and balances.

These policy priorities are informed by NFHA’s 2024 Fair Housing Trends Report, which highlights the economic and personal devastation housing and lending discrimination causes to people of color, women, people with disabilities, families with children, and others. These harmful practices negatively impact the American economy, resulting in underperformance and reduced productivity. The report highlights that private, nonprofit fair housing organizations process over 75 percent of fair housing complaints nationwide. Funding for those organizations is under threat from the administration, which will have devastating consequences for individuals and families facing illegal, discriminatory actions in housing. NFHA is using all available resources to advocate for the preservation of both critical funding and the laws and regulations that ensure fairness.

Often, enforcement actions result in settlements that include monetary relief, which can be reinvested through grants to communities harmed by discriminatory practices. These grants, administered through NFHA’s Inclusive Communities Fund, help stabilize neighborhoods and improve the quality of life for residents. With these grant funds, NFHA was able to support four nonprofit lending institutions with Special Purpose Credit Programs or First-generation down payment assistance programs. These programs created 187 new homeowners in Atlanta, Baltimore, Columbus, and Las Vegas. Additional settlement funds resulted in 544 new homeowners, 345 units of affordable housing, 143 foreclosures prevented, and 117 vacant homes rehabilitated for homeownership or community benefit.

Shawquista achieved her dreams of homeownership through an SPCP administered by NFHA partner Homeport in Columbus, Ohio.

NFHA’s Responsible AI Lab (RAIL) is committed to dismantling and preventing any barriers in automated systems in the housing and lending sectors. The team published a paper, From Policy to Practice: Essential Competencies for Federal Chief AI Officers in July 2024. This report provides guidelines for governance and risk management that are essential to ensure the responsible selection and use of public AI. RAIL

staff also participated in the National Institute of Standards and Technology’s GenAI Text-to-Text (T2T) Discriminator Challenge, which aimed to develop methods for distinguishing between AI-generated and human-generated text and published a corresponding report in October 2024. Finally, the second annual Responsible AI Symposium, hosted in April 2025, drew over 200 participants across three days. It included NFHA’s first AI Pitch Competition, in which startups presented their solutions to win the Innovation Impact Award in Government Solutions or Real Estate & Fintech categories.

The National Housing Conference (NHC) convenes diverse leaders to develop solutions for America’s biggest housing challenges, working across partisan lines to promote best practices and share ideas. Advancing Black homeownership remains of critical importance, as it is essential for addressing longstanding inequities, building intergenerational wealth, and strengthening community resilience for all.

NHC continues its commitment to advancing Special Purpose Credit Programs (SPCPs) because we recognize that a thriving, inclusive housing market benefits all Americans. SPCPs are legal under the Equal Credit Opportunity Act of 1974, which allows lenders to offer targeted products to groups that have been impacted by exclusionary lending practices. By promoting policies that expand access to credit and homeownership opportunities, we can ensure that there are appropriate products to serve all communities fairly and equitably.

NHC strongly supports enactment of the Neighborhood Homes Investment Act (NHIA), a bipartisan solution which proposes a new federal tax credit to encourage building and revitalizing singlefamily homes and small condominiums throughout the country. This tax credit would cover a portion of the development and rehabilitation cost for 500,000

homes. The bill was reintroduced in Congress in April 2025 and NHC and other housing advocates are pushing for its inclusion in the final reconciliation bill.

NHIA is also the only piece of legislation the Collaborative has unanimously endorsed. The proposal could be transformative for addressing the Black homeownership gap, as it supports efforts to address the valuation gap between development cost and market sales price, boost housing supply, and promote greater housing equity nationwide.

NHC launched the Housing Resource Center, a dynamic destination for all your federal housing policy needs. The platform is packed with over 2,500 curated resources including research papers, case studies, policy briefs, blogs, podcasts, and more. Whether you’re a policymaker, journalist, lender, advocate, or housing professional, the

Housing Resource Center makes navigating complex housing issues easier and more accessible than ever.

Updated weekly, the platform covers a wide spectrum of topics—from climate and community development to racial equity and homeownership. NHC’s Housing Resource Center is designed to empower you with the tools and knowledge to drive meaningful change and foster equitable housing opportunities nationwide.

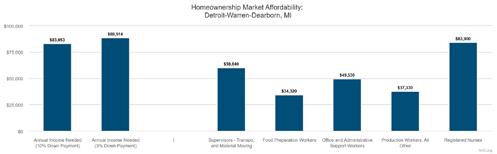

The Paycheck-to-Paycheck resource is a powerful, interactive tool that reveals whether everyday workers like teachers, nurses, firefighters and more can afford

fall short by nearly $50,000. That is a $20,000-$50,000 difference for mid-wage workers, emphasizing a major affordability gap.

This gap has critical implications for workforce retention, pathways to generational wealth, and fuels demand-side pressures in an already tight market. Without meaningful intervention—through down payment assistance, affordable mortgage products, and increased supply of starter homes—homeownership will remain out of reach for many, further exacerbating the existing racial homeownership gap.

These estimates, however, may still understate the true cost of homeownership. Rising homeowners’ insurance, property taxes, and maintenance expenses further increase the income needed to buy and sustain a home—key hurdles that shape who can truly access homeownership.

to rent or buy homes where they live. Updated regularly, this database compares wage data for nearly 300 occupations against current housing costs in 390 metro areas. This tool brings the housing affordability crisis into sharp focus, showing just how much income is needed to keep up with rising rents and home prices in communities nationwide.

The data presented demonstrates market affordability for five sectors in the Detroit-Warren-Dearborn, MI metro area—transportation and material moving (supervisors), food preparation workers, office and administration support, production, and registered nurses.

In Detroit, the annual income needed to afford a medianpriced home is $83,053 with a 10% down payment and $88,514 with a 3% down payment. Among five common local occupations, only registered nurses ($83,900) earn enough to meet either threshold. Supervisors in transportation and material moving fall short by over $23,000, while food preparation and production workers

Initiatives like the Black Homeownership Collaborative are important now more than ever to ensure we work together to close the gap and make homeownership accessible for more families.

In an effort to shine a light on the affordable housing crisis in America, NHC launched a podcast titled Beyond Four Walls: Conversations on Affordable Housing. The podcast is hosted by NHC President and CEO David Dworkin who navigates conversations to bring you up close with the nation’s top housing leaders, policymakers, and changemakers as they tackle America’s most urgent housing challenges and share the real stories and solutions shaping our communities.

The National Urban League is a historic civil rights organization advancing economic self-reliance, equity, and justice for underserved communities. As a HUD-approved housing counseling intermediary with 20+ years of experience, NUL supports over 30 affiliate partners across 16 states and D.C. Through its Comprehensive Housing Counseling Program, the League increases access to stable housing for African Americans and other marginalized populations—leveling the playing field for renters, homeowners, and the homeless and helping to elevate the standard of living in urban communities.

Through its renowned Comprehensive Housing Counseling program, NUL has consistently demonstrated success in enhancing housing accessibility and sustainability for the Urban League clients. By providing avenues for enhanced economic opportunities, particularly for minority and historically marginalized renters, homeowners, and individuals facing homelessness, NUL has established a strong reputation. Drawing on a wealth of diverse expertise and extensive experience, NUL collaborates with its network to tailor client services to the specific requirements of each community served. These

services are tailored to each individual or family these types of issues:

Preparation for buying a home

services encompass a wide range of areas, such as budget and credit counseling, pre- and post-purchase assistance, foreclosure prevention, rental support, homeless outreach, combating predatory lending, navigating reverse mortgages, promoting fair housing practices, and delivering educational resources and counseling.

Profile addressed since 2009

Default and foreclosure prevention counseling

Budget and credit counseling

Home maintenance

Tenant and landlord rights

Homelessness

In 2024, approximately 21,000 participants enrolled in comprehensive housing counseling services, out of which:

Pre-Purchase Homebuyer (group and one-on-one)

› Approximately 11,000 participants engaged in Pre-Purchase Counseling and Education services

Mortgage Delinquency or Default (group and oneon-one)

› Approximately 2,000 participants engaged in Foreclosure Counseling and Education services

Locating, Securing, or Maintaining Rental Housing

› Approximately 1,400 participants engaged in Rental Counseling and Education services

Financial Literacy

Education

Home Maintenance and Post-Purchase

› Approximately 1,600 participants engaged in Financial Literacy Coaching and Education services

Fair Housing/Predatory Lending Education

2% Shelter or Services for the Homeless

Since 61% of Urban League participants’ yearly earnings reflect less than half the median income level in their area, a key purpose of the National Urban League

Comprehensive Housing Counseling Program is empowering these individuals and families to break down barriers and

obtain economic equality through education, self-reliance, and a greater understanding of financial tools and services.

69% of participants are African American

Comprehensive Housing Counseling Program provides participants with a free, consultation with a housing counselor who procures a thorough assessment to determine individual needs. The counselor then provides participants with custom action plans.

and families receive information and advice on the various programs available to help them acquire and maintain affordable housing.

are offered group workshops, further counseling as needed, necessary referrals.

The National Urban League is a participating intermediary in HUD’s Office of Housing Counseling Homeownership Initiative, which aims to expand access to homeownership - particularly for individuals and families from historically underserved communities. Through this initiative, 14 participating affiliates will guide prospective homebuyers through critical stages of the process, including pre-purchase counseling, the home purchase, and post-purchase support. This work helps break down systemic barriers, equipping clients with the tools and confidence needed to achieve and sustain homeownership.

services are provided to each individual and family to ensure their been adequately addressed. Success Story.

OF RENTING, MS. JOHNETTA ROBINSON decided ready to consider homeownership. She attended a Education Workshop at the Urban League of Greater and took advantage of its counseling services. comprehensive housing counseling, ULGA helped secure down payment assistance.

The National Urban League partnered with DoorDash to launch the Virtual Financial Empowerment Center (VFEC) platform. This first-of-its-kind initiative expands access to the Urban League’s proven financial literacy programs, making them available to any Urban League client with an internet connection—no matter their location or proximity to one of the Urban League’s 92 affiliate locations across the country. VFEC provides free, on-the-go courses to help clients address their financial challenges, meet their unique needs, and

Johnetta purchased a beautiful 3,000-square-foot sustainable interest rate of 2.875% with her total payments landing at an affordable $537.03.

empower them to take control of their financial future. By offering carefully curated, on-demand financial education resources, this platform enables the Urban League to connect with clients wherever they are. Leveraging engaging lessons and short-form video formats, VFEC harnesses the power of technology to deliver financial knowledge in a way that aligns with modern lifestyles. It enhances financial literacy, raises consumer awareness, and fosters better money management habits—key steps in the fight to narrow the racial wealth gap and empowering communities.

IN HER OWN WORDS... “The training taught me how to calculate my mortgage so that I could be comfortable with my monthly payments. It taught me about home repairs, inspections and utilities, what to look for when buying a home, and what to avoid. As a single mother of three, education was critical. During the closing process, I stayed in contact with the counselors and reached out to them whenever I had questions about paperwork I did not understand. This Program is vital to the African American community because it teaches us how to live better by making informed decisions it also helps us to achieve dreams of homeownership.”

Made possible with the generous support of