MARKETS STILL SHOW DEMAND APPRAISERS WIDELY AVOID ADJUSTMENTS

STOP SCRUBBING HMDA BY HAND

BLURRED LINES

Why DEI Is Now A Revolving Risk For Lenders

MARKETS STILL SHOW DEMAND APPRAISERS WIDELY AVOID ADJUSTMENTS

STOP SCRUBBING HMDA BY HAND

In mid-February, the Federal Financial Institutions Examination Council (FFIEC) issued a statement of principles related to valuation discrimination and bias for member entities to consider in their consumer compliance and safety and soundness examinations. The statement of principles is intended to offer transparency into the examination process and support risk-focused examination work.

Institutions rely on real estate valuations when assessing the level of collateral support in residential credit decisions. Deficiencies in real estate valuations, including those due to valuation discrimination or bias, can lead to increased safety and soundness risks, as well as consumer harm, and have an adverse impact on borrowers and their communities. Examples of such harm are consumers being denied access to credit for which they may be otherwise qualified, offered credit at less favorable terms, or steered to a narrower class of loan products.

The failure of internal controls to identify, monitor, and control valuation discrimination or bias could negatively affect credit decisions, potentially exposing an institution to legal and compliance risks or affecting an institution’s financial condition and operations. Material findings and concerns related to noncompliance with laws and regulations generally negatively affect the supervisory assessment of an institution’s management in a safety and soundness examination.

The Equal Credit Opportunity Act (ECOA) and its implementing regulation, Regulation B, prohibit discrimination in any aspect of a credit transaction based on race, color, religion, national origin, sex (including sexual orientation and gender identity), marital status, age, whether all or part of the applicant’s income derives from any public assistance program, or the applicant’s good faith exercise of any right under the Consumer Credit Protection Act.

The Fair Housing Act (FHA) prohibits discrimination in all aspects of residential real estaterelated transactions based on race, color, religion, sex (including sexual orientation and gender identity), national origin, disability, and familial status. Both ECOA and the FHA prohibit discrimination in residential property valuations.

The Truth in Lending Act (TILA) and its implementing regulation, Regulation Z, govern the way credit terms are disclosed to consumers and include several provisions that address valuation independence in transactions when a consumer’s home is securing the loan. Section 5 of the Federal Trade Commission Act (FTC Act) prohibits unfair or deceptive acts or practices, and the Dodd-Frank Wall Street Reform and Consumer Protection Act prohibits covered persons (e.g., financial institutions) or service providers of covered persons from engaging in unfair, deceptive, or abusive acts or practices.

Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA) and the implementing federal appraisal regulations include requirements promoting the reliability of appraisals in federally related transactions. The provisions of FIRREA address both appraisal standards and appraiser qualifications.

Appraisals in federally related transactions are required to conform to USPAP as promulgated by the Appraisal Standards Board of the Appraisal Foundation and are subject to appropriate review for USPAP compliance. This includes appraiser independence requirements and competency standards for appraisals. The appraisal regulations require evaluations for certain transactions where an appraisal is neither required nor obtained by an institution.

To promote compliance, institutions may establish a formal valuation review program. Review programs enable institutions to identify noncompliance with appraisal regulations or USPAP, inaccuracies, or poorly supported valuations. Review programs can also provide the opportunity for institutions to address deficiencies due to potential valuation discrimination or bias before making a credit decision.

STAFF

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Christine Stuart NEWS DIRECTOR

Keith Griffin

SENIOR EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki, Ryan Kingsley

STAFF WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Matthew Mullins, Krystina Coffey

MULTIMEDIA SPECIALIST

Alan Nero MEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Regina Morgan

ADVERTISING SALES EXECUTIVE

Nicole Coughlin

ADVERTISING ASSOCIATE

Lydia Griffin MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com

Submit your news to editors@ambizmedia.com

www.ambizmedia.com

© 2024 American Business Media LLC. All rights reserved. Mortgage Banker Magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to:

American Business Media LLC

88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

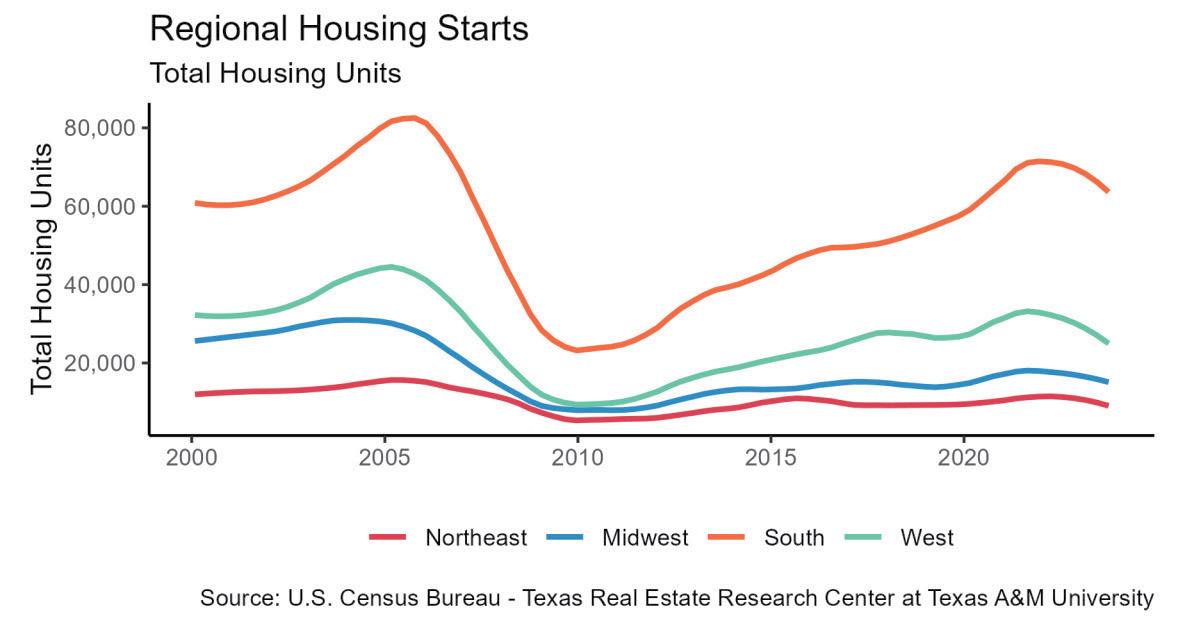

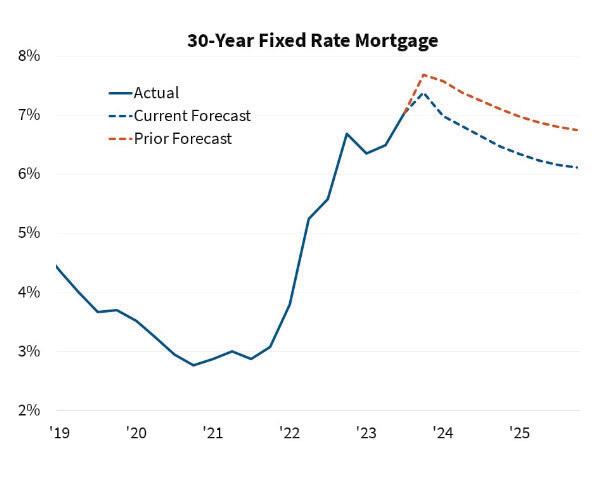

Mortgage rates, Treasury security prices, lakefront properties, Ford Pintos, rare stamps, oil … the list of things whose prices are determined by supply and demand is immense. We mention this because Treasury auctions, used to help finance the U.S. Government (along with taxes), have become quite a hot topic and are impacting lenders. And since the prices of mortgage-backed securities, and therefore mortgage rates, are in part calculated as a spread off of U.S. Treasury securities, the supply and demand of these are important to lenders and their borrowers.

As 2023 progressed, the sizes of these auctions were rather large, particularly for a period of time when we were not in a crisis. The appetite for newly issued Treasury bonds has been waning due to a few large buyers scaling back their purchases, and this, in turn, impacts the auction results and makes investors sit up and notice. If no one wants to buy something that must be sold, the price will drop until someone buys it.

In the case of Treasury securities, when prices drop, yields go up. The industry saw a rise in interest rates throughout 2022 and 2023 until midDecember. As rates rise, so do Treasury yields and coupons on newly issued debt, which increases the expense burden on the federal government and mortgage rates in general.

Although the Treasury auctions have been met with weaker demand, they’re still getting done. And the U.S. is still the most credit-worthy country in the world, so a default or material deterioration seems highly unlikely, not to mention politically disastrous. The three big historical buyers of U.S. Treasury securities (the Federal Reserve, Japan, and China) have reduced their purchases. In fact, the Federal Reserve has become a net seller of fixed-income securities.

ROB CHRISMAN

ROB CHRISMAN

That is the “demand side” of the equation. On the supply side, the amount of debt the U.S. needed to issue started rising in late 2020 to cover COVID-related fiscal stimulus. This carried forward into 2023. The increasing amount of debt that needs to be absorbed without the three primary buyers of U.S. debt is concerning. That said, there is a back-up plan whereby Primary Dealers absorb (buy) whatever isn’t bought by other bidders in a Treasury auction.

Primary Dealers are active in every Treasury auction that takes place. Because there has been less demand from other buyers, the primary dealers have had to absorb an increasing amount of issuance. They, in turn, will sell their holdings to other parties such as insurance companies, pension funds, and money managers. But if the U.S. Treasury auctions continue to become weaker, they could serve as a catalyst for yields to rise again, or at least not drop as much as they could, creating a less friendly environment for stocks and pushing the U.S. interest expense higher.

It is not the role of anyone in capital markets to predict where rates are going and base their hedging activities on any predictions.

Unlike the issuance of mortgage-backed securities (MBS), Treasury auctions are scheduled, the amounts known in advance, and there are few surprises until the results are announced. However, these results are a bellwether for general debt market conditions. Since MBS trade as a spread to Treasuries, their prices will react. MBS prices will always be lower and rates higher than the corresponding Treasury maturities due to credit and prepayment (early pay off) risk, but they do move together.

The primary reason for the Fed turning into a net seller of Treasurys was its quantitative tightening program, intended to reduce the size of the Fed’s balance sheet and fight inflation, which began in mid2022. Recall that in 2020 and 2021, the Federal Reserve stepped in to buy securities, pushing prices higher and rates lower. No more.

This shift had been well-publicized through speeches and communication from the Fed. Still, it was the catalyst that drove Treasury yields higher starting in the summer of 2022, with the 10-year yield going from a yield of .5 percent to about 3.5% and then to 5% in 2023.

For this reason, the capital markets staff of lenders watch the results of the Treasury auctions to ascertain the general appetite and climate of the debt markets. If the demand is flagging, rates may tend to move higher, and lenders may make their mortgage pricing slightly less aggressive than otherwise.

Of course, it is not the role of anyone in capital markets to predict where rates are going and base their hedging activities on any predictions. Any thoughts about the general rate climate must be balanced against where a lender wants to be in a competitive position, as well as covering the company’s overhead and managing the capacity/ability to fund loans.

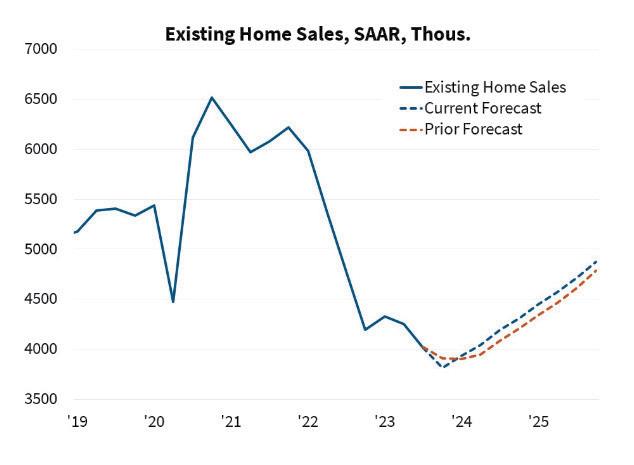

Home purchases can be complicated by an appraisal below the buyer’s contract price offer. For the sale to go through, the buyer typically must renegotiate the purchase price, put more cash down, or accept costlier loan terms.

From 2013–2020, the annual appraisals rate below the contract price ranged from 7 to 9% of transactions. Underappraisal spiked

to 15% in 2021 and 12% in 2022, when house prices grew rapidly. Both house price growth and underappraisal rates returned to more typical levels in early 2023.

Much of this variation occurs because appraisers base valuations on recent sales of comparable properties, which can become outdated quickly during periods of rapid price changes. Low appraisals can also impact refinance borrowers by leading to less attractive loan terms, limiting borrowing amounts, or resulting in

canceled transactions.

In principle, appraisers can consider price changes that have occurred since the time the comparables sold and make adjustments known as market conditions adjustments or time adjustments. Fannie Mae, Freddie Mac, and Federal Housing Administration appraisal guidelines require such adjustments whenever market conditions change.

However, appraisers frequently do not make time adjustments, even when they are likely to impact

the appraised value substantially. This analysis also finds that the adjustments appraisers do make are typically substantially smaller than house price indexes would suggest.

of the analysis period, appraisers time adjusted fewer than 10% of comparable sales. Even during the rapid price increases of 2021, time adjustment frequency rose only to

During much of the analysis period, appraisers time-adjusted fewer than 10% of comparable sales.

During the analysis period, from the third quarter of 2018 through the fourth quarter of 2021, house prices generally rose, especially in 2021. National house prices grew annually from 5 to 18% over this period. For residential real estate, recent sales of comparable properties are commonly used to determine a property’s valuation. Because comparable sales in this analysis are typically six months old at the time of the appraisal, expected time adjustments would range from approximately 2.5% to 9% of the sales price, on average.

However, time adjustments are not very common. During much

about 25%. While adjustments are not necessarily expected in every case, these rates seem to be considerably lower than local price growth would warrant, as discussed in the next section.

When comparable sales are recent, or house price growth is slow or flat, there may be no need for a time adjustment. Thus, to determine whether time adjustments are underutilized, it is insufficient to note that adjustment rates are well below 100%. We need a benchmark that estimates how large the adjustment

for each comparable should be. Here, monthly house price indexes for ZIP codes are used to walk forward the comparable sales amounts. For each comparable in the data, the price indexes are used to calculate a predicted time adjustment corresponding to the age of the comparable and local price trends.

For 20% of comparables, the predicted adjustment was less than 1 percentage point in absolute value. For another 16% of comparables, the predicted adjustment was between 1 and 2 percentage points. Appraisers time adjusted only about 5% of these properties, perhaps because these adjustments are too small to have much impact. However, making no time adjustment amounts to an assumed adjustment of zero, which is unlikely to be accurate.

In addition, a leading appraisal textbook discusses several examples featuring time adjustments close to 1% or even less.3

Thus, it appears that adjustments were unnecessary for, at most, the 36% of properties where the predicted adjustment was between -1 and 2%. This result implies that appraisers should have time-adjusted 64% of comparables, far greater than the 13% they actually adjusted. Appraisers

Low appraisals can impact refinance borrowers by leading to less attractive loan terms, limiting borrowing amounts, or resulting in canceled transactions.

time adjust most of the time only when the predicted adjustment is 20% or larger.

For predicted adjustments from 1 to 3%, actual time adjustments are within a few tenths of a percentage point. However, as the expected adjustment gets larger, the discrepancy grows. When the predicted adjustment is 5%, actual adjustments average 3%. At 10%, actual adjustments average 5%.

This blog documents that appraisers underutilize and underestimate time adjustments but does not attempt to determine the cause or propose potential solutions. One potential reason for underutilization is that these adjustments are some of the more analytically complex calculations appraisers might perform. Also, market information about comparable sales data can be sparse, decentralized, and observed with a lag. The data may also be costly (or at least not always free) and is not always available publicly (which may require paying for access to private databases).

Scott Susin is a senior economist for the FHFA Office of Fair Lending Oversight Division of Housing Mission and Goals. A complete version of this article originally appeared in the FHFA’s Insight Blog.

WHERE IDEAS GO HEAD TO HEAD

The compliance landscape is rapidly changing, with more regulations such as the Dodd-Frank 1071 ruling released in March 2023. Paired with the already intense scrutiny of HMDA data, institutions are feeling the pressure of keeping up with data volume and integrity demands. Lenders and banks have to look hard at their systems, staff, and processes to make sure they can meet these requirements.

The biggest challenge keeping leaders up at night is how HMDA requirements will affect labor costs and their ability to keep high data integrity standards. While examining existing systems and manual scrubbing procedures, financial institutions have realized they are largely underprepared for 1071’s level of scrutiny.

While they have been using automation tools in processes such as credit increase approvals, drive-through tellers, and AI customer service centers, the mortgage compliance processes have been left largely untouched by automation. Institutions must mitigate increased margins and overhead due to too much manual administrative labor.

To deliver accurate and consistent lending data amid increasingly restrictive

compliance guidelines, leaders are turning to machine learning systems to fulfill their compliance tasks.

With increasing regulation in addition to existing HMDA guidelines comes a pressing need for compliance experts to sift through loan data and collect over 110 data points, ensuring all documents are properly accounted for, audited, and verified.

Though crucial for providing quality data, these tasks are often monotonous, timeconsuming, and fraught with human error. Compliance affects loan origination costs, and cost of origination is very closely tracked, more so than other compliance costs.

Frequent errors are not tolerated and must be curbed to thrive in the competitive financial landscape.

Since this data needs to be collected at the beginning of the loan process — regardless of if the loan is funded — this is costing the loan origination process from the beginning.

To keep up with demand, many financial institutions are anticipating

having to increase their compliance department budget to comply with new regulations, which will skyrocket labor costs at a time when lending has slowed down. Additionally, increasing staff does not guarantee data integrity, which is crucial.

Machine learning offers a solution.

Instead of having dozens of experts perform menial tasks

like data scrubbing, machine learning systems can quickly and efficiently automate document processing, extract data automatically from verified documents, and eliminate manual application verifications. An efficient automation system, easily embedded into existing digital onboarding experiences, can also root out fraud false positives and eliminate quality issues associated with outsourced or offshore teams. These manual processes, which usually take teams too long to accomplish or provide subpar data, could be completed to standards in a fraction of the time.

As a result, implementing machine learning tools can dramatically reduce staffing costs while increasing loan margins and allowing compliance professionals more time to concentrate on high-level, profit-producing ventures. Automation takes care of time-consuming and repetitive tasks, which helps leaders avoid staffing headaches from quarter to quarter while guaranteeing consistent data.

However, machine learning is not something that can be implemented overnight, especially if the necessary framework is not put in place. At a time when margins are being squeezed from every direction, reducing labor costs by investing in digital transformation systems as soon as possible will provide a significant advantage as more traditional, “wait and see” institutions struggle to keep up.

Compliance experts are having a difficult time keeping up with regulations with such stringent data rules put in place. They must keep their financial institutions accountable while navigating the massive costs of providing quality data for 1071 in addition to their existing HMDA data. Compliance initiatives are a priority if an institution wants to maintain its reputation; revenue goals are flexible, though unfortunate if missed, but failure to meet compliance guidelines can undoubtedly sink an institution. Frequent errors are not tolerated and must be curbed to thrive in the competitive financial landscape.

Automation offers compliance experts respite from the tedium of manually scrubbing data by quickly and efficiently reading, verifying, and compiling the necessary data to exceed HMDA requirements every time. Machine learning even documents audit trails with time stamps and chains of custody,

ensuring all staff can understand and follow up on any step of the process if need be. This ensures all discrepancies are examined, redundancies are eliminated, and overall processing time is greatly reduced. As compliance data is compared between all financial institutions, everyone must compete to ensure their institution’s data exceeds expectations every time.

Embedding machine learning infrastructure sooner rather than later provides the opportunity to provide customers with stellar lending experiences and deliver quality data to satisfy HMDA requirements. Compliance staff can examine more complex loans or flagged content without the risk of major burnout, while automation systems quality control most data perfectly.

Lenders can always rely on machine learning’s efficient algorithms to decrease overall costs, process more mortgage loans, and accurately produce all necessary data.

The industry is being revolutionized, and leaders should ensure they are at the forefront of this change. The effort to implement machine learning systems should not be underestimated, nor can it wait until circumstances have reached critical levels. Financial institutions must begin their preparations for the HMDA and new stringent guidelines as soon as possible to implement long-lasting, efficient systems and stay ahead of the curve.

Tyler

IIn the wake of last June’s Supreme Court decision in Students for Fair Admissions, Inc. v. President and Fellows of Harvard College (SFFA v. Harvard), which effectively overturned the narrow exception permitting race-based affirmative action in college admissions, mortgage regulators continue investigating lenders using implicitly and explicitly race-based standards.

“I do not see them backing down even in light of the Townstone case and the Supreme Court decision,” says Daniella Casseres, partner and head of the Mortgage Regulatory Practice Group at Mitchell Sandler, a women-managed, majority women-owned law firm serving the financial services industry. Concerning Fannie Mae and Freddie Mac, the government-sponsored enterprises, Casseres continues, “I don’t think the agencies are really contemplating that the Supreme Court decision has an impact on residential mortgage lending.”

With regulators in blinders, lenders and lawyers are spooked, though. The SFFA decision raises questions as to whether, and to what extent, race should play a role in mortgage companies’ hiring and lending decisions. As an attorney representing independent mortgage banks (IMBs) and mortgage lenders in their negotiations with the Consumer Finance Protection Bureau (CFPB) and the Department of Justice (DOJ), Casseres says regulators are blurring the line between redlining allegations and demands for lenders to engage in race-based lending, either in defiance or ignorance of existing fair lending laws and June’s SFFA ruling.

Lacking guidance, lenders are trapped in the lobby, unable to exit regulatory revolving doors.

Joshua Thompson, director of equality and opportunity litigation at the Pacific Legal Foundation (PLF), a public-interest legal organization that exclusively sues the government, believes federal agencies may soon have to defend their own race-based programs. “We’re in a day where we are experiencing the vestiges of sort of historical societal discrimination,” he says, “and I don’t think that those types of programs, if that is the sort of basis that the government is justifying race-based

programs on, will survive after SFFA.” Fundamentally, generalized historical discrimination and ongoing racial disparities do not justify state-sponsored discrimination on the basis of race in any aspect of American life and business, says Thompson.

Meanwhile, Dan Morenoff, executive director of the American Civil Rights Project (ACR Project), a public-interest legal group that advocates for limited government and individual rights, says that he knows of “large lenders who have discriminatory programs that are being looked at quite actively.” Morenoff also says that “there are a whole lot of federal programs which treat races differently and those are, at the very least, problematic and subject to questioning.”

The cold, hard fact of the matter is, Casseres says, “It’s yet to be tested in lending.”

When people talk about the “overturning” of race-based affirmative action in college admissions, “our general rule that you cannot classify people on the basis of race and you cannot make racially based decisions,” explains Morenoff, “had this narrow exception out of deference to the educational expertise of the people running our institutions of higher education.” The June SFFA decision narrowed that exception for race-based affirmative action in college admissions even further, rendering the carve-out “overturned.”

Legally, the “diversity rationale” upheld by the Supreme Court in the 2003 case, Grutter v. Bollinger, to allow for race-based affirmative action in college admissions, never provided a justification for race-based decisionmaking in other areas of business. Instead, the Grutter exception has been widely interpreted as a “generalized trump card for our non-discrimination laws,” Morenoff says. Those laws remain as in force as they ever were, he adds.

What the SFFA decision helps to underscore is how broadly entities across American politics and business

have misread and misapplied that “diversity rationale.” In May 2022, the Hamilton Lincoln Law Institute, a public-interest law firm dedicated to protecting free speech, free markets, and limited government, filed an amicus brief in support of Students For Fair Admissions cataloging how that expansion has occurred, such as through race-based decisions outside of the admissions process at universities, the return of racial considerations when assigning students to K-12 public schools, and a diversity justification for the appointment of class counsel in federal courts.

“That’s not tenable now,” Morenoff claims. “Honestly, it wasn’t tenable before, but there were a lot of institutions that seemingly had accepted that there was this global exception to non-discrimination law, which was never actually there.”

The Supreme Court’s SFFA decision serves as a reminder that the manner in which businesses and government entities pursue increased diversity matters. In SFFA’s aftermath, programs that violate equal protection clauses may find themselves under greater scrutiny. “Not only is the diversity rationale not a basis for an exception to employment law,” Morenoff says, but, “if you’re relying on it, you’re more or less admitting that you’re intentionally violating federal employment law.”

Thompson agrees, citing actions taken by a number of elite U.S. law firms to remove mentions of race, gender, and sexuality from their DEI-oriented recruitment and advancement programs. “It’s a signal by the court and by litigants that we’re not going to tolerate this any longer. It’s their time to step up and hold these institutions to what the law requires them to abide by.”

Soon, the government may have to defend its own race-based programs, Thompson says. He strongly suggests that lenders do not thumb their noses at regulators but

“I don’t think the agencies are really contemplating that the Supreme Court decision has an impact on residential mortgage lending.”

> Daniella Casseres Partner and head of the Mortgage Regulatory Practice Group Mitchell Sandler

maintains that “we are sort of at the precipice of seeing a lot of these racebased requirements go away because they are unconstitutional.” Until that happens, however, the scrutiny of regulators can cripple lenders at a time when many have been in survival mode for eight straight quarters.

In the SFFA decision, Thompson explains, the Supreme Court makes clear that only two state interests justify the

government’s use of racial classifications: to stop race riots in prisons and to remedy specific instances of past racial discrimination. Presumably, those two state interests are the thresholds to pass anytime the government wants to discriminate on the basis of race.

How government funds are assigned and utilized also complicates the legality of race-based programs. In September 2023, the Department of Housing and

Urban Development (HUD) awarded the City of Birmingham, Alabama, a $25.2 million loan guarantee under HUD’s Community Development Block Grant Program, Section 108, meaning funds are intended for “economic and community development projects that primarily benefit low- and moderate-income persons.” The City of

Continued on page 23

On behalf of Townstone Financial, a small mortgage brokerage in Chicago, the Pacific Legal Foundation (PLF), a public-interest legal organization that exclusively sues the government, is currently arguing the redlining case, CFPB v. Townstone Financial.

The regulator sued Townstone in July 2020 for allegedly violating the Equal Credit Opportunity Act (ECOA), which prohibits racial discrimination against applicants for credit.

Specifically, the CFPB claims Townstone violated Regulation B, which extends ECOA’s ban on discrimination to any statements that would discourage prospective applicants from applying for credit due to race.

In February 2023, a district court dismissed the case on the grounds that the CFPB does not have the authority to adopt Regulation B, which the CFPB appealed in April.

Complicating the resolution of Townstone’s case – with major implications for the future of federal regulatory enforcement – the CFPB’s appeal relies on the “Chevron principle,” a long-standing judicial precedent that says courts should defer to federal agencies’ expertise when interpreting and administering federal statutes and regulations. After hearing oral arguments in a separate case in midJanuary, the Supreme Court seems poised to overturn the Chevron principle.

In the Townstone case, regulators claim that a series of comments made by Townstone employees on a radio show would discourage prospective applicants from certain neighborhoods from applying for mortgage loans. The comments they claim constitute redlining were made during a four-year period and account for 10 minutes of air-time out

of 10,000 minutes aired during that period, the PLF says. The radio show in question was launched in 2011 by a business partner of current Townstone Financial CEO Barry Sturner.

The PLF describes Sturner as “an outspoken conservative, an unabashed supporter of former President Trump and the police, and a frequent critic of Elizabeth Warren, the architect of the CFPB.” However, the PLF argues that any listener of Townstone’s radio hour could have found the comments made offensive, and the CFPB does not have the authority to censor creditors’ public discussions of politically relevant, albeit controversial topics. Crime, policing, and Donald Trump are mundane topics, especially in a major metropolitan center like Chicago. Discussing these topics in relation to specific neighborhoods in Chicago does not equate to redlining, even if a listener were to find some comments offensive, the PLF argues.

And yet, the CFPB does not allege that Townstone discriminated against any specific applicants. Allegations of redlining stem from the possibility that anyone who may have heard Townstone’s radio show may have heard the comments and found them offensive. Those listeners may have been prospective applicants and may have been discouraged from applying for a loan, hence the violation of Regulation B. By way of evidence, regulators claim that Townstone must have discouraged prospective applicants because Townstone did not receive enough applications, nor write enough loans, for Black borrowers in majorityminority neighborhoods.

In part, the CFPB’s complaint reads: “Statistical analyses of Townstone’s mortgageloan applications in the Chicago MSA, as compared to its peer lenders during the same period, show disparities between Townstone and its peers in drawing mortgage-loan applications for properties in AfricanAmerican neighborhoods. These disparities are statistically significant and demonstrate that there were applicants seeking mortgage loans for properties in African-American neighborhoods in the Chicago MSA from Townstone’s peers in much higher proportions than from Townstone. Townstone had no legitimate, non-discriminatory

reason to draw relatively few applications for mortgage loans for properties in these majority-African-American areas.”

The CFPB also cites Townstone for not targeting Black borrowers with advertising and not employing “an African-American loan officer” from 2014 through 2017, “even though it was aware that hiring a loan officer from a particular racial or ethnic group could increase the number of applications from members of that racial or ethnic group.”

The ECOA does not require non-bank lenders, let alone brokerages, to write loans, advertise, or hire on the basis of race. The ECOA would be in violation of the equal protection clause of the 14th Amendment to the Constitution if it did. “It requires the opposite, that you don’t utilize those prohibited factors in order to make decisions,” explains Daniella Casseres, partner and head of the Mortgage Regulatory Practice Group at Mitchell Sandler, a women-managed, majority women-owned law firm serving the financial services industry.

Facing these allegations, Townstone had two expensive options: risk the company by anteing millions to litigate (assisted, in this case, by the Pacific Legal Foundation); or, settle with the government, thereby implicitly admitting to engaging in discriminatory lending practices, pay the fines, and hire a marketing firm to rehabilitate the company’s reputation.

“If you’re a private lender of credit,” says Joshua Thompson, director of equality and opportunity litigation at the PLF, “that has got to send shivers down your spine.” Post-SFFA, regulators’ use of enforcement actions to ‘encourage’ mortgage companies to lend on the basis of race should also send shivers down lenders’ spines, absent actionable regulatory guidance.

Deservedly or not, Casseres says many lenders sued by regulators for redlining would rather settle, implicitly admitting to having engaged in discriminatory lending.

“That’s how bad it is,” she insists. “They’d rather deal with bad press for a limited time, hopefully, and try to move on from it because they don’t feel like they’d have the resources

to fight the government on something like this.” At the heart of the problem, she says, is a historical lack of guidance concerning how non-bank lenders and mortgage companies should demonstrate compliance with fair lending laws. That begs the question, though: should responsibility fall on mortgage companies to assert compliance or on regulators to clarify and enforce existing laws?

“Up until probably four years ago, a lot of IMBs didn’t even know that redlining affected them,” Casseres explains. “The antidiscrimination laws were always there, but they had not really been enforced against IMBs that don’t have deposits to reinvest in the community by their very nature.” As non-depository institutions, IMBs are not covered by the Community Reinvestment Act (CRA), signed into law in 1977 to specifically address the discriminatory lending practice of redlining, by which depository lenders avoid extending credit into geographic areas from which those lenders receive deposits.

“Redlined” areas often correlated to higher numbers of racial and ethnic minorities and low-income residents, making allegations of redlining a proxy for racially discriminatory lending. Regulators are conflating redlining and racially discriminatory lending in the investigations that Casseres is seeing. In order to bring redlining cases forward against independent lenders, Casseres says, regulators are using the Equal Credit Opportunity Act and the Fair Housing Act, “that broadly would prohibit redlining and discrimination.”

In recent years, questions of whether IMBs should be held to a CRA-style redlining standard have arisen. Opponents argue that by the nature of IMBs’ business models, IMBs do not have deposits to reinvest in the communities where they operate. In fact, with the disappearance of depositories’ brick-andmortar branches from many underserved communities, IMBs (and brokerages, for that matter) have filled a void, helping to import mortgage credit to lower- and moderateincome, majority-minority areas.

From a legal perspective, Casseres does not think non-depositories should be regulated using statutes to which those institutions are not party. By doing so,

regulators demonstrate a fundamental misunderstanding of how most IMBs operate.

When regulators accuse IMBs of not marketing in certain areas, most respond, “We don’t market to anybody. We’re a referral-based business,” or rather, “We get our business from whatever Realtors we’ve known for 40 years,’” Casseres says. Instead of audits and lawsuits, “the IMBs would actually prefer that there be some rulemaking, and notice, and opportunity to respond, and then they would make concerted efforts to comply.” CFPB actions against IMBs started “kicking into full force” in late 2021, she recalls, yet many of the redlining allegations IMBs face relate to activity from 2014 and 2015.

Either way, a lack of guidance and consistency only makes compliance more difficult. “At least depositories have a regulation to be aware of,” says Casseres. “In the [IMB] case, they’re being examined and basically given the green light, unofficially. Then they’re coming back and getting slapped with an enforcement action.” Casseres has been party to “a lot of” examinations where regulators approved of an independent lender’s business model and practices, only for that lender to now be receiving a proposal for enforcement over the same model and practices, though “nothing really changed” at those companies.

Instead, as if mirroring the increasingly aggressive behavior of anti-affirmative action groups, regulators are simply growing more aggressive in bringing their cases forward, be they legitimate cases of redlining or not. The best argument lenders can make in this situation, says Casseres, is a “policy argument” – that the agency is acting in bad faith by reviewing companies, not writing them up for either acceptable or unacceptable practices, and then doubling back with enforcement actions.

“There’s definitely a lot of banking settlements where people have just settled,” Casseres says, “and some of the allegations are really based on circumstantial evidence, nothing that would really prove intentionality.”

—Ryan KingsleyContinued from page 21

Birmingham intends to use the loan pool for projects that will “support investments in communities and neighborhoods of color, and provide financing to Black, Indigenous, and people of color-led developers, businesses, and organizations.”

Any race-based government programs that Thompson sees are not designed to remedy particular instances of past discrimination, but “to remedy disparities in lending practices or general societal discrimination that they view as more historical.” The extension of non-discrimination and fair lending laws to justify expansive, quasi-remedial, race-based programs is vulnerable to being questioned and litigated. Necessarily, Thompson thinks the burden should fall on the government, not markets or borrowers, to justify the existence of those programs in keeping with those laws allowing for narrow exceptions. Thompson calls it “perfectly sensible” that no one, no matter their racial or ethnic background, should

Continued on next page

want the government to enact racially discriminatory policies untethered to specific instances of discrimination, especially – and ironically, I’ll add –given the government’s long history of racial discrimination. “If the government is going to discriminate against people,” he concludes – and ironically, I’ll add – “it better have a damn good reason to do so.”

To those who argue that racial discrimination in the U.S. is not only historical but institutional, therefore systemic, and therefore ongoing, continuing to produce disparate outcomes for minorities in almost every corner of American life, society, and business, Thompson says, “the Supreme Court is pretty clear that that’s not enough to enact a race-based program.” To those who argue not all racial discrimination is identified or easily identifiable, especially by private dealings, Thompson says that a reliance on top-down government intervention only lets private actors who discriminate off the hook by “putting sort of a corollary discrimination on top of the discrimination that’s already ongoing.”

Entities that discriminate should be made not to through the government’s enforcement of existing nondiscrimination and fair lending laws, he says. However, a historical lack of guidance around existing nondiscrimination and fair lending laws, particularly for non-bank lenders, is undermining regulators’ attempts to enforce those laws now, says Mitchell Sandler’s Casseres.

Casseres is seeing an uptick in DOJ referrals for redlining and discriminatory lending practices, even just in the community of lenders she serves. Though redlining and racial discrimination are statutorily separate, she clarifies, between the SFFA decision and regulators’ increasingly aggressive enforcement actions, “one begets the argument for the other.”

Ironically, though, Casseres sees

“We’re in a day where we are experiencing the vestiges of sort of historical societal discrimination and I don’t think that those types of programs, if that is the sort of basis that the government is justifying racebased programs on, will survive.”

> Joshua Thompson

regulators struggling to bring strong cases of redlining against non-bank mortgage companies. How and whether such companies, as non-depository institutions, should be examined for redlining remains up for debate.

Referring to the SFFA decision, Casseres explains, “If the Supreme Court has ruled that you can’t make decisions about where students attend school, where it really is like, ‘one person in, one person out,’ like somebody didn’t get that spot because you made a racebased decision, I don’t know how the government could step in and say, ‘Well, you have to make race-based decisions

on lending,” not to mention decisions in hiring and marketing, as in the case of ongoing litigation between the CFPB and Townstone Financial Inc., an independent mortgage lender based in Chicago (see sidebar).

The challenge facing these companies, Casseres says, is that “very few” are willing or financially capable of litigating against the federal government. Casseres expects “we will start to see a lot of settlements very soon in this space because a lot of IMBs, particularly now when the market’s not strong, would just rather settle it, and put it behind them than think about litigating against the United States government, with unlimited resources on the other side.”

Which settlements, then, represent legitimate cases of redlining, and which represent government overreach?

“I have been a part of very few investigations where I have actually seen documentation proving intentional redlining,” Casseres says. “There is, in the settlements, a lot of circumstantial evidence about the political views or potentially personal views of the individuals that are involved in sometimes loan origination, sometimes not even really dealing with borrowers. I have not seen documentation that, like, specifically points to the fact that, meant that they were intentionally avoiding trying to get business from any areas.”

In fact, Casseres says she usually sees the opposite: most salespeople just want the sale, no matter where the loan comes from.

“If there was documentation showing a prospective applicant was considering applying for a mortgage but didn’t apply because somebody made some sort of racial commentary to them,” Casseres posits, “I think that would be legitimate.” But, she continues, “I haven’t seen much of that, to be honest.” Instead, what she sees at IMBs are emails between employees with similar political views, or else, inboxes full of spam about controversial issues. Having employees with those views does not entail discriminatory lending or a discriminatory company culture.

Recently, though, Casseres is seeing more pushback from clients as regulators grow more aggressive. “People are just starting to get more emboldened about how to defend themselves,” she says, explaining the shift, “because somebody has to.” The SFFA decision portends a worrying spiral, though. Casseres expects pressure from regulators and the GSEs to lend in specific geographic areas to increase, “and potentially to even lend based on race or ethnicity.”

With the SFFA decision in mind, it is “very possible” that the CFPB could “now come back and question race-based lending programs under this new light,” says Casseres. “There is nothing in the law that technically prevents them from doing that,” raising the question: are lenders liable for engaging in race-based lending if regulators encourage them to do so?

That legal question hasn’t been tested in lending. Direct liability for racial discrimination depends on which non-discrimination or fair lending law has allegedly been violated and the entity that brings the lawsuit, says the American Civil Rights Project’s Morenoff. A borrower could claim in a lawsuit, he says, that the regulatory carve-out for race-based, special purpose credit programs, allowed for under the ECOA, is unconstitutional.

Alternatively, Morenoff says the mortgage industry should be paying close attention to “Section 1981” of the Civil Rights Act of 1866, which prohibits racial discrimination in contracting, such as for employment or loans. “If you are trying to avoid potential liability, you should not assume that you can engage in any race-based contracting, not internally, not externally.”

Instead, lenders should adopt the standing presumption that all race-based decisions involving contracting are illegal, which would include contracts for employment and mortgage lending. Here, the regulatory carve-out that

allows for race-based lending programs under the ECOA appears particularly vulnerable, says Morenoff.

The Fair Housing Act (FHA), administered by the Department of Housing and Urban Development (HUD), includes a blanket ban on racial discrimination in mortgage lending, which the ECOA reiterates with one important distinction: the ECOA has an exception that allows lenders to engage in race-based lending if regulators approve. This carve-out provides only the shakiest of foundations for the government to approve race-based lending, Morenoff thinks.

He reads the ECOA exception like this: “You may put in writing a program to allow you to discriminate based on race if you think that it would improve the access of a group that would otherwise not be so good to credit, and you’re doing so not to get around the generalized prohibition on discrimination based on race. But, you’re only ever writing that because you’re creating a program to discriminate based on race.” As the regulation is written, “literally nothing” can qualify, he says. “Is that constitutional? There’s a very strong argument that it’s not.”

Even more problematically, Morenoff adds, is how HUD administers the FHA by piggybacking off of the CFPB’s regulatory carve-out in the ECOA. He cites a guidance document published by HUD in 2021 that effectively hangs HUD’s regulatory hat on the CFPB’s statutory peg. “It’s very hard for me to imagine how that guidance document from HUD could possibly withstand scrutiny if that ever gets litigated,” he says. “But again, you have to actually have someone litigate it.”

Until such issues are litigated, Casseres recommends that lenders pay attention to how regulators are thinking – and start to think like them.

Casseres has recently been fielding

questions from lenders about the legality of special purpose credit programs (SPCPs) in light of the Supreme Court’s SFFA ruling. She tells clients that SPCPs remain an effective way to penetrate markets that are historically underserved. “But, they may consider eliminating race and ethnicity as part of the program, and instead focus on a geography which will capture certain specific races and ethnicities.”

Similarly, Casseres suggests that lenders who want to hire more diversely should think geographically, not racially. Geography often correlates to race, ethnicity, or religion, but it doesn’t have to. “It’s more inclusive than that,” she explains. Lenders who do 80% of their lending to Hispanic borrowers could consider recruiting within the geographic areas where that 80% of lending occurs, instead of thinking they need to hire more Hispanic loan officers.

That’s easier said than done, though, because “pretty much every CEO” that Casseres talks to whose company has been the target of a redlining investigation says recruiting minority loan officers to serve underserved areas is the most challenging issue they face.

“There are tools that you can use to figure out who’s doing the most loans in those areas,” independent of race or ethnicity,” Casseres says. By trying to target those loan officers, “more than likely,” she continues, “they will correlate to being Hispanic or Black loan officers.”

Casseres cautions lenders and regulators who think SPCPs are the silver-bullet solution for increasing lending to underserved groups in underserved areas. Assuming SPCPs are the most effective method leaves other tools underutilized and underfunded. Lender credits, down payment assistance programs, and inventory shortages are crucial areas needing attention.

“I’m just not sure that all this back and forth, and all this agency enforcement is actually effectively getting people to lend more in these areas.”

If these words come to mind when considering your ideal candidate for our list of Powerful Women of Mortgage Banking, then show your support for today’s female leaders in the mortgage profession and submit your nomination.

Nomination Deadline: July 5, 2024

Mortgage Banker Magazine’s October issue will feature a special section celebrating 2024’s Powerful Women of Mortgage Banking.

Visit nmplink.com/MBMWomen