CAN YOU PREDICT THE FUTURE?

CAN YOU PREDICT THE FUTURE?

WITH LADONNA LOCKARD THE

EXCLUSIVELY ON

WATCH IT ON YOUTUBE

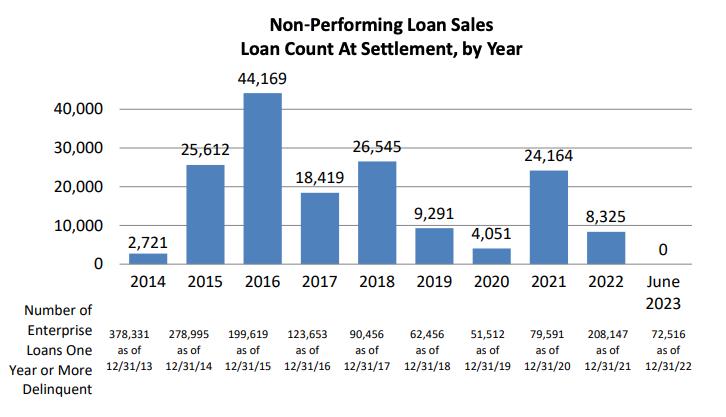

The Federal Housing Finance Agency (FHFA) released the latest report on the sale of nonperforming loans (NPLs) by Fannie Mae and Freddie Mac (the Enterprises). The Enterprise Non-Performing Loan Sales Report includes sales information about NPLs sold through June 30, 2023. Borrower outcomes reflect NPLs sold through December 31, 2022.

The sale of NPLs reduces the number of delinquent loans in the Enterprises’ portfolios and transfers credit risk to the private sector. FHFA and the Enterprises impose requirements on NPL buyers designed to achieve more favorable outcomes for borrowers than foreclosure.

delinquency of 2.7 years, and an average LTV of 90%.

• NPLs in New Jersey, New York, and Florida represent 40% of the NPLs sold.

Borrower Outcomes Highlights:

• The borrower outcomes in the report are based on 160,576 NPLs that were settled by Dec. 31, 2022, and reported as of June 30, 2023.

• Compared to a benchmark of similarly delinquent Enterprise NPLs that were not sold, foreclosures avoided for sold NPLs were higher than the benchmark.

PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Christine Stuart NEWS DIRECTOR

Ryan Kingsley EDITOR

Katie Jensen, Sarah Wolak, Erica Drzewiecki STAFF WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Christopher Wallace, Stacy Murray GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

This report shows that the Enterprises sold 163,297 NPLs with a total unpaid principal balance (UPB) of $30.0 billion from program inception in 2014 through June 30, 2023. The loans included in the NPL sales had an average delinquency of 2.8 years and an average current mark-to-market loan-to-value (LTV) ratio of 84% (not including capitalized arrearages).

NPL Sales Highlights:

• The average delinquency for pools sold ranged from 1.1 years to 6.2 years.

• Fannie Mae has sold 112,730 loans with an aggregate UPB of $20.3 billion, an average delinquency of 2.8 years, and an average LTV of 81%.

• Freddie Mac has sold 50,567 loans with an aggregate UPB of $9.7 billion, an average

• NPLs on homes occupied by borrowers had the highest rate of foreclosure avoidance outcomes (45.6% foreclosure avoided versus 17.9% for vacant properties).

• NPLs on vacant homes had a much higher rate of foreclosure, more than double the foreclosure rate of borrower-occupied properties (76.4% foreclosure versus 28.0% for borrower occupied properties). Foreclosures on vacant homes typically improve neighborhood stability and reduce blight as the homes are sold or rented to new occupants.

• The average UPB of NPLs sold was $184,231.

FHFA will continue to provide reporting on NPL sales borrower outcomes on an ongoing basis.

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Matthew Mullins, Krystina Coffey MULTIMEDIA SPECIALIST

Alan Nero MEDIA SPECIALIST

Melissa Pianin MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Regina Morgan ADVERTISING SALES EXECUTIVE

Nicole Coughlin ADVERTISING ASSOCIATE

Lydia Griffin MARKETING INTERN

If you would like additional copies of Mortgage Banker Magazine call (860)719-1991 or email info@ambizmedia.com

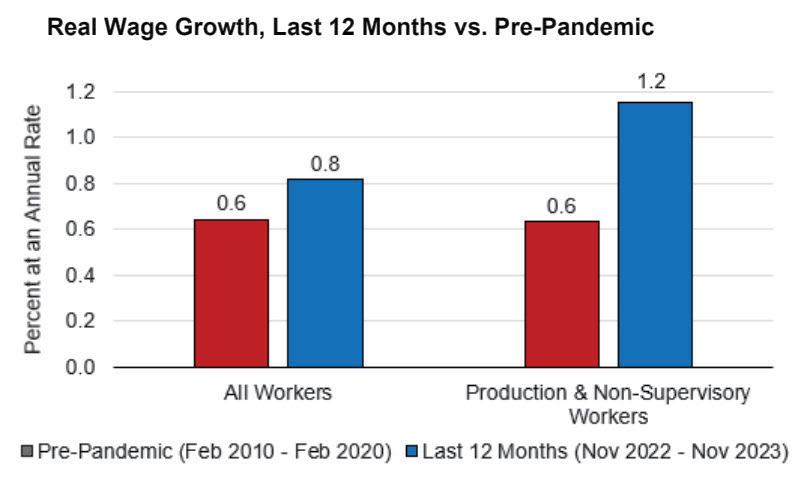

As we move through 2024, the economy is doing OK. Certainly, if one “tortures” the data enough, one can find issues with the economy. At some point, those predicting a recession will be right, just as those predicting an economic expansion will eventually be correct.

But, don’t forget that during the pandemic, and after, the government handed out money. And since inflation is too much money chasing too few goods, when money lessens, so will inflation . . . and so will economic expansion, in theory.

Economies function in cycles, regardless of administration or foreign policy. The “old” definition of a recession being two quarters of negative GDP, while simple and easy to understand, is stale and not accurate. An inverted yield curve does not always predict a recession, as we’ve noticed for the last several months.

The Federal Open Market Committee, which is the “action arm” for many Federal Reserve activities, as well as various Fed Presidents, including Fed Chair Powell, continue to talk about inflation. It remains too strong for the Fed’s liking, and the Gross Domestic Product numbers and other measures hardly point to a slowing economy.

The NBER looks at multiple factors when determining whether the United States economy is in a recession, with domestic production and employment as “the primary conceptual measures of economic activity.” Thus, the Business Cycle Dating Committee emphasizes economy-wide indicators of economic activity, and says “the two most reliable comprehensive estimates of aggregate domestic production are normally the quarterly estimate of real Gross Domestic Product and the quarterly estimate of real Gross Domestic Income, both produced by the Bureau of Economic Analysis.”

Looking at employment, for example, NBER’s Business Cycle Dating Committee views the payroll employment measure, which is based on a large survey of employers, as the most reliable comprehensive estimate of employment.

Recall that the NBER officially declared an end to the economic expansion in February of 2020 as the U.S. fell into a recession amid the coronavirus pandemic. According to the NBER, the recession was the shortest on record ending only two months later in April 2020.

Loan officers should know that recessions mean lower rates but a tougher time qualifying borrowers, and there is no single way to predict how and when a recession will occur.

Volatile components present few indications about subsequent growth and the Fed thinks that there is significant underlying momentum in the domestic economy due to advances in household spending and business fixed investment, combined with the further tightening of labor market conditions. Fiscal policy is intended to act as a natural drag on the economy. At the same time, the supply chain issues were worked out, and a few members noted that there were signs that the pandemic-related strains on labor supply were easing.

While the Fed garners headlines, there is another organization that one should be aware of when talk of a recession comes up. The National Bureau of Economic Research (NBER) is responsible for determining when a recession begins and when it ends. More specifically, it is the Business Cycle Dating Committee within the NBER that decides.

Forget “a recession occurs any time you have two consecutive quarters of negative Gross Domestic Product (GDP) growth.” According to the NBER, “A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators like real GDP, industrial production, and wholesale-retail sales. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough. Between trough and peak, the economy is in an expansion.”

Loan officers should know that a) recessions mean lower rates, but a tougher time qualifying borrowers, and b) there is no single way to predict how and when a recession will occur since economists assess several metrics to determine whether a recession is imminent or is already taking place.

NBER aside, according to many economists, there are some generally accepted predictors that, when they occur together, may point to a possible recession. Leading economic indicators (the ISM Purchasing Managers Index, the Conference Board Leading Economic Index, and the OECD Composite Leading Indicator) are watched, as is the Treasury yield curve.

Officially published data series from various government agencies that represent key sectors of the economy, such as housing stats and capital goods new orders data published by the U.S. Census, are also monitored. Changes in these data may slightly lead or move simultaneously with the onset of recession, partly because they are used to calculate the components of GDP, which will ultimately be used to define when a recession begins.

Last are lagging indicators that can be used to confirm an economy’s shift into recession after it has begun, such as a rise in unemployment rates.

Conflict arises between objective and subjective measures, though. Investors’ and consumers’ feelings play a critical role in perceptions of economic health. If you lost your job or feel that the economy is slowing down, then we’re in a recession, right? Not necessarily, and therein lies the difficulty of saying a recession has started or not, be that in the spring of 2024, or any time.

& A CAN’T-MISS NETWORKING PARTY

FRIDAY NIGHT RECEPTION

FEATURING THESE EXCLUSIVE EVENTS:

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. NMLS Renewal class open to conference attendees only. Exclusive events and networking party are open to registered attendees only.

Mprepares to serve up a new credit scoring program.

While there has been no definitive timeline established for the official implementation of new credit scoring models FICO 10T and VantageScore 4.0, the FHFA has reviewed and approved the two new models and authorized a move from a tri-merge to a bi-merge system. Instead of compiling a credit report using individual data from all three national bureaus, the bi-merge requirement limits it to two of the three at lenders’ discretion.

The agency has said it plans to fully incorporate the model updates into capital and

hope to discern how the credit models will perform through different economic cycles and provide stakeholders information as they prepare to implement the new models.

Several big mortgage companies have already begun using at least one of the

new models. Both Movement Mortgage and CrossCountry Mortgage have adopted FICO 10T for non-conforming loans.

The three national credit reporting agencies –Equifax, Experian, and TransUnion – make up the joint venture of VantageScore 4.0, which they say will expand access to mortgage credit to 4.9 million more borrowers and potentially boost mortgage originations by as much as $1 trillion.

Underwriters are the arbiters of borrowers’ credit histories, determining if they are eligible for financing, and if so, how much. However, LOs usually get the first peek at a potential client’s credit report, and therefore take the first stab at quoting them a rate.

“I don’t think there’s anything they (LOs) can do to prepare because it is still going to be an automated underwriting process regulated by the GSEs, (GovernmentSponsored Enterprises)” National Consumer Reporting Association (NCRA) Executive Director Terry Clemans said. “During the transition period, you’re going to be taking for the consumers a minimum of six scores and maybe nine scores to reduce to a single score and say yes, no, or how much. Figuring it out isn’t easy and if you miscalculate that the mistake is not cheap.”

The new system will change how credit is viewed by loan officers, incorporating up to two years of trended utilization rate data and offering more leniency toward tax liens, judgments, and medical collection debt. Concurrently, the Consumer Finance Protection Bureau (CFPB) is in the midst of

“Just expect that the way you’re operating today will change. We’re going to learn together.”

> Greg Holmes Chief Revenue Officer Xactus

a rulemaking process to remove medical bills from Americans’ credit reports.

While this is part of the FHFA’s plan to allow lenders to collect credit reports from just two of the national consumer reporting agencies instead of all three, some say the numbers don’t add up to an easy solution.

“The two-score model is something that’s going to pose some operational challenges,” Xactus Chief Revenue Officer Greg Holmes told Mortgage Banker Magazine.

Xactus provides credit verifications to more than 6,500 U.S. lenders. Since the “classic” version of FICO was programmed into automated underwriting engines more than 20 years ago, the GovernmentSponsored Enterprises (GSEs) have yet to update the technology to reflect the new models.

“It’s not necessarily going to affect the process of how we deliver the files. We’re just going to be delivering an updated number,” Holmes said. The verifications company is in favor of making this improvement to ensure better accuracy of credit scores. “The general message that we’ve been delivered and how it’s going to affect the market is that higher scores will be higher and lower scores will be lower,” Holmes pointed out.

The biggest to-do for mortgage lenders, he added, will be learning how much scores are affected by changes made to specific line items in the files.

“Lenders have become very smart in understanding how to work scores and they know that if this

balance was lowered or this payment wasn’t there, they can get a pretty good idea of whether or not it’s going to have a positive impact on the score. Xactus is going to work very hard trying to give guidance on how the score moves and what moves the score the most.” While there is no set date for full use of the new system, lenders and the like are preparing themselves for incoming guidance from the GSEs.

“Until we figure out how to operationalize it, how to digest it and understand the scores, it’s probably going to be a lingering date and a moving target,” Holmes said, adding that flexibility and patience will be key.

Xactus does not anticipate the new methodology will offer any relief in terms of the cost of pulling credit.

“Unfortunately – I don’t see it really helping from an expense standpoint – consumers,” Holmes said. “That’s probably the thing the market is hoping for, but I don’t see it happening.”

Furthermore, in Dec. 2023, FICO announced that

it would end its tier-based pricing structure and charge the same, higher price for each score pulled in 2024.

One of the misconceptions circulating is that this move will lead to cost savings to consumers, Holmes added. “The credit score itself costs more than the credit data, which is something that has really materialized as we move into 2024 pricing.”

In its role providing credit reports and verifications to lenders, Xactus is counting the different scores Loan Origination Systems (LOS) companies and APIintegrated credit interfaces will have to swallow. One way or another, those costs are always passed to consumers.

“You’ve got two bureaus instead of three, but now you’ve got two scores instead of one. So if you do simple math, there’s one Equifax, there’s one Experian, one TransUnion, and then three scores. That’s six products in total. There’s going to be an education process for all lenders, and then there is simply the expectation of how it actually plays out through the process and how technology

handles it,” Holmes said. “Those things are still unclear, but we will be on the front side of this and we will bring the most efficient manner for lenders to operate as scores get incorporated. We will definitely be a thought leader on understanding the scores – which is probably the most important thing – and that comes with education.”

Clemans expects full administration of the two new competing scores to be at least a year away, but it could take more time for lenders to become accustomed.

“They’re now in the process of being implemented into mortgage underwriting,” he said. The FHFA is working with the appropriate parties to ensure that programming changes are made to the operational technology. Xactus and other companies are working directly with the agency to understand how the changes will impact the market.

“We’re getting there,” Holmes said, encouraging LOs to prepare for more direction to come. “Just expect that the way you’re operating today will change. We’re going to learn together.”

encourage competition in the quality of the score level and pricing.

Every LOS still needs to be modified by resellers, and programming changes are forthcoming.

Clemans does not anticipate that the use of the new models will generate a major change in scores, though the system will be able to measure the creditworthiness of more consumers.

“Based on anecdotal evidence and knowing the industry the last 30 years I don’t believe the assumption that scoring more people is automatically going to mean more loans,” he said. “The assumption is that the consumers who were unscorable are going to be eligible for loans, but now they will just get a poor score.”

One of the improvements cited in the new system is its ability to assess rent and utility data in credit files, but this data is often only visible for the small margin of consumers who have fallen delinquent on a number of bills.

While Clemans noted that the NCRA is generally supportive of updates to credit scoring, it has also put forward a plea that the agency chooses one instead of both models.

“There’s a lot of heavy lifting by the industry to implement these changes, including overcoming some obstacles that are going to be problematic at best…using both is problematic from a contractual and a statistical perspective.”

Using one of the models for a few years and reviewing its effectiveness, Clemans added, would

One of the improvements cited in the new system is its ability to assess rent and utility data in credit files, but this data is often only visible for the small margin of consumers who have fallen delinquent on a number of bills.

“Reporting negative data to the bureaus is one of the primary ways of the creditor to obtain payment – the vast majority do not report positive payment history,” Clemans pointed out.

“So about 99% of the population will not see any benefit from that scoring model in that particular area. No score model can factor in data that doesn’t exist.”

Regardless, the NCRA is “very encouraging” of credit measurements being updated. In fact, the yardstick that is the classic model is worn and faded.

“The mortgages being underwritten today are using a credit score that was based off of consumer spending habits prior to 2008 – that needs to change,” Clemans said. “For safety and soundness of the loans being underwritten and for fairness to the consumers who are applying for the loans, a more modern score model needs to be used.”

Utah’s top gathering for mortgage pros. Innovate. Educate. Motivate.

“We’ve never lost money in a quarter in company history,” says Aaron VanTrojen, founder and CEO of Geneva FinancialBY RYAN KINGSLEY

, EDITOR , MORTGAGE

As far as banal wall art goes, no one visiting Aaron and Telle VanTrojen’s home at Stellar Airpark in Chandler, Arizona, would see “Be The Change You Want To See In The World” etched on faux-driftwood in the entryway. No “Eat. Sleep. Gym. Repeat.” tagged to the wall in the living room, the kitchen, or the attached hangar – think: garage – where Aaron parks his Epic E1000GX, the fastest single-engine turboprop airplane ever built.

But for a front porch doormat reading, “Be A Good Human,” no reminders are needed in the VanTrojen household.

“Racing is the most expensive sport in the world,” insists Aaron, founder and CEO of the

BANKER MAGAZINE

BANKER MAGAZINE

Chandler-based Geneva Financial. For he and Telle, the company’s chief operations officer and Aaron’s wife and business partner, their daughter Kaylee’s ambition to become a professional race car driver yields all the motivation they need. She practices 12 hours per week at her home track in Glendale and will race more than a dozen times this year across the U.S. and Canada, even once in Spain. “Fortunately, I’m not the one driving. Telle and I can work remotely anywhere in the world, so it miraculously doesn’t interfere with us running the company.”

It helps, too, when the company practically runs itself. That’s no accident, though. Forged in the fires of the Great Recession, Geneva Financial is that rare breed of mortgage company whose value increases when markets get challenging. Aaron VanTrojen is that rare breed of mortgage executive who knows the business so well he designed Geneva to make that the case.

“If you’re bringing more value to the table than you’re getting paid for, that’s a win.”

> Aaron VanTrojen Founder and CEO Geneva Financial

“One of the most intelligent mortgage professionals I’ve ever met,” says Breton Macdonald, a producing branch manager based in Temecula, California. He joined Geneva as a loan officer six years ago and now runs the company’s largest division. “It is the real deal.

I’m my own testimonial for it.” Since mid-2022, many mortgage companies have been chasing volume at the cost of profitability, originating in the red just to keep the lights on. Not Geneva Financial and not VanTrojen, who trains his originators to protect their value by not chasing rates to the bottom.

Over the past two years, “the bigger the branch, the more they’re losing – not the more they’re making,”

VanTrojen says. “My competition’s giving President’s Trophies to these loan officers that have lost them more money than anybody.” For that reason, “there’s probably never been a better market ever for growth opportunities than today,” he continues. “Everybody’s miserable. Everybody’s had their pay cut. Everybody’s looking for a different mousetrap.”

Nevertheless, VanTrojen approaches this market with a similar sense of ambivalence as he did 2008, the year after he founded Geneva Financial. Having over-achieved every goal he had ever set for the company, “I honestly don’t care,” VanTrojen says. “I just want to be profitable as a company and make enough money as a company that we can continue to do all the great things that we do for the employees and our customers.”

VanTrojen was born and raised outside of Seattle, Washington. His father was a career fireman who instilled in Aaron a civil servant’s ethos: do better by yourself by doing better by those around you. He coaches his originators in the belief that when your team succeeds, you succeed, the elegance of which arises from the selfsustaining culture it creates. This mentality is baked into the company’s mantra – “Be A Good Human” – and it’s why, at Geneva, VanTrojen serves the Kool-Aid over ice: Geneva’s originators are VanTrojen’s clients.

Thus, Geneva attracts originators who possess the optimism of rookies and the diligence of veterans, infused with the ambition of entrepreneurs. “Like-minded people that are grateful and positive and ambitious,” as

“To me, it’s hard to find another place that would give you the same opportunities and pay you more money.”

> Sean Uyehara a Las Vegas-based branch manager and area specialist at Geneva Financial

Macdonald describes employees across the company. “If you want to work here and make more money than you’ve ever made before and have the autonomy to do things, then come work here,” says VanTrojen, who encourages his originators and branch managers to adopt the mindset of small business owners.

But, he adds, “I expect you to be a professional. I expect you to be a manager.” As CEO, VanTrojen tries to deliver more value to his employees than what he earns and encourages his originators to do the same with borrowers. “If you’re bringing more value to the table than you’re getting paid for, that’s a win.”

He acknowledges, though, the stakes are higher now. “We have a lot to lose and so it’s more emotional. It’s harder.”

The challenge is relative, though, when the market’s in Geneva’s – and VanTrojen’s – favor.

With the housing market starting to nosedive in late 2007 – three years after VanTrojen earned his pilot’s license – the last thing he wanted to do was start a mortgage company. But, a large mortgage bank had bought the retail shop where he had been originating for more than seven years, Morgan Capital of Arizona, and as a “very competent” originator, branch manager, and salesperson, VanTrojen was growing concerned about the future of the industry.

“They were cutting compensation for the originators, big mortgage banks layered with management, bureaucracy, red tape,” he explains. “I wasn’t going to be able to survive.” Having managed gyms outside of Seattle for nearly a decade during the 1990s and early 2000s, VanTrojen needed room to grow, not a bevy of supervisors to report to. So, VanTrojen founded Geneva Financial with a clearly defined business model and mission.

“The company’s designed not to make very much money per transaction,” he explains, “and push the lion’s share to the originators and the branch managers.” On average, those originators and branch managers net 175-250 basis points. In an industry notorious for high employee turnover, allowing producers to play with the spread defies conventional wisdom, but not VanTrojen’s intuition. Originators drive value for mortgage companies, not corporate. When you stake a company on protecting the value of originators, nothing says ‘I love you’ like cash.

“To me, it’s hard to find another place that would give you the same opportunities and pay you more money,” says Sean Uyehara, a Las Vegas, Nevada-based branch manager and area specialist who joined Geneva in January 2023 after a three-year stint with loanDepot. He entered the mortgage

“I’ve never seen anybody do it the same. Other corporate margins, from what I’ve noticed, are maybe 200 bps, whereas ours is 50. It’s just less – he’s taking less. There’s nobody between a branch manager and Aaron.”> Breton Macdonald, a Temecula, Californiabased branch manager who runs Geneva Financial’s largest division

industry immediately after graduating from Whitworth University in 2006, right on the cusp of the Great Recession. “I mean,” he shrugs, “I can’t imagine where that is.”

While other mortgage executives made “five times more” than VanTrojen did in 2020 and 2021, Geneva’s originators earned “multiples more than any originator in this industry” during that period, VanTrojen says, because the company is designed to keep corporate profitability low per transaction. When mortgage demand plummeted in mid-2022 in the wake of rising interest rates, many mortgage companies continued chasing volume at the cost of profitability, digging wells that they prayed would fill with water. For many mortgage lenders, those wells never filled.

Mortgage Bankers Association (MBA) data show that in the third quarter of 2023, independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported pre-tax net losses of $1,015 per loan, marking the sixth consecutive quarter that the majority of mortgage companies originated in the red.

Low profitability led to the trimming of margins and headcount at companies across the housing finance ecosystem, but not Geneva Financial.

“We didn’t have to do any of those things,” VanTrojen explains, “and of course the company can’t lower margins because we don’t make very much to begin with by design. It’s on the branch managers and the loan officers to decide whether or not their value should go down just because things get challenging. They decided that it wasn’t going to go down.” VanTrojen, who isn’t moved by volume, but profitability, says this differentiates his originators as professionals.

Difficult markets demand diligence and creativity, not desperation. When down markets arrive, he continues, “if you don’t have leadership, if you haven’t put ownership on the branch managers to manage and ownership on the loan originators to be professionals in this industry, you wind up in a race to the bottom, which is what the industry did.” Not all loan officers are equal, and not all loan officers sell the same thing. This differentiation becomes clear, and drives value toward Geneva, when markets get challenging.

“We are profitable,” VanTrojen says. “We’ve never lost money in a quarter in company history.”

VanTrojen says generous compensation motivates his originators to do more transactions “because they realize they can make seven figures working with me.” But, he demands that they originate profitably and compliantly, two aspects of salesmanship he says the industry lacks. For every hundred originators he hires, only a handful fully embrace the training Geneva provides.

“There’s only one of me,” VanTrojen explains, “and while I’m trying to duplicate that, that in and of itself is a challenge.” But, he adds, “I’m moved by helping people obtain success by their definition, not mine.” Character, profitability, aspirations to improve, and a receptiveness to his unflinching transparency matter most to VanTrojen. “What bothers me,” he laments, “is when somebody wants to work for me and they appreciate my transparency, but then they’re not transparent to the people they manage. I think it’s a double standard.”

Demanding compliance makes reprogramming new recruits a persistent challenge for VanTrojen,

No matter the year, no matter the market, VanTrojen’s principled approach to running Geneva Financial has little to do with mortgages. In 2007, he “absolutely did not” want to start his own company. But, he refused to work for his competition and saw an opportunity to differentiate: a business model that holds producers accountable for profitability.

To that end, the most important lesson VanTrojen has learned as Geneva’s chief executive is that more is not always better. “Very rarely is it,” he says, asking rhetorically: “When a branch is doing $10 million in volume, but losing $100,000 a month, certainly more is not better, right?”

who prefers hiring originators from other companies rather than first-timers. Sixteen profitable years have proven to VanTrojen that molding good humans into skilled branch managers has a much higher conversion rate than molding skilled branch managers into good humans. Deride him as obnoxious or an idealist, but VanTrojen offers Geneva’s sustained success as proof that mortgage companies can abide by the letter and the spirit of regulations while originating profitably and doing better by their borrowers and the industry.

“They all assume because they came from a larger mortgage company that violated these laws that I must be the one that’s wrong,” he says, bemused, calling it an industry failure that more originators than not join Geneva believing that their former employers’ noncompliance was, in fact, compliant. From unwinding all

those “bad behaviors,” VanTrojen says, “I literally don’t know of a single mortgage company that is remotely compliant.” By correcting compliance with Geneva’s new recruits, VanTrojen hopes he can raise the standard for originators elsewhere.

“We don’t allow you to get paid on loans in states that you’re not licensed in because it’s not legal. Most of my competition does. When you get into a competitive situation, I’m not going to lower your compensation because it’s illegal.” That kind of leadership, VanTrojen says, is the antithesis to Geneva’s founding principle of protecting originators ability to originate.

“If you are losing money in this environment,” he levels, “I think it’s mismanagement or a lack of.”

A company can usually be more profitable by cutting that volume in half, he explains. Even in this environment of low supply and elevated costs, “I can solve almost everybody’s problems, assuming they’re productive,” VanTrojen continues. “That’s where the more challenging thing is: finding loan officers that actually do loans and finding branches that don’t lose money.”

When he founded Geneva Financial, VanTrojen was the company’s sole originator, so the company was designed to support his needs and priorities. “I was the one that needed to maximize my profitability, not the company,” he says. As the post-Great Recession market recovered, he realized this corporate model “would do just fine, and has done remarkably well in all markets, just trying to aim at the small basis points we try to net off every single transaction and paying the money forward.”

Paying the money forward grants originators the benefit of their ambition and the leeway of the liquidity that their own branches generate.

Despite rising mortgage rates and plummeting originations, the Temeculabased Macdonald has expanded his operations from three to 28 branches

“The biggest mortgage companies right now in our industry are the biggest losers. They shouldn’t be proud of how much volume they did at the greatest losses.”

> Aaron VanTrojen “

over the past 15 months. Recruiting enables Macdonald to study the P&L statements of many of Geneva’s competitors, offering him a glimpse into pricing and compensation structures across the industry. He rarely sees Geneva beat on pricing and never sees Geneva beat on compensation; it’s the best deal for both borrowers and originators.

What’s still killing other companies’ branches, Macdonald explains, are the corporate margins that VanTrojen started Geneva to eliminate. “I’ve never seen anybody do it the same,” says Macdonald. “Other corporate margins, from what I’ve noticed, are maybe 200 bps, whereas ours is 50. It’s just less – he’s taking less. There’s nobody between a branch manager and Aaron.” The thin corporate margin means most of the revenue that branches generate stays within the branch. By VanTrojen’s design, branches report net profitability, not gross production.

“It’s scary,” says VanTrojen. “A lot of people in this industry don’t know the difference between net and gross.” In the balance, he says, is profitability. Despite market challenges, VanTrojen accuses leadership across the industry of failing to protect the value of originators by enabling them to originate at a loss for nearly two years. “You do a couple billion in dollars for a loss, that’s not a winner,” he says. “The biggest mortgage companies right now in our industry are the biggest losers. They shouldn’t be proud of how much volume they did at the greatest losses.”

He also says this isn’t a new problem. Salesmanship in the industry has been diminishing for years. As if measuring his own resolve for 100% transparency, VanTrojen pauses, then continues: “I think it’s disgusting. I would never want to run a business like that. But, it’s just the industry’s mind and I can’t throw stones because those companies – again, assuming they survive – will likely make multiple higher net profits next year or the following year when they jack up their margins and they’ve already cut everybody’s pay.”

VanTrojen empathizes with originators and branch managers at those other

mortgage companies – it happened to him 16 years ago. “When they raise their margins, they won’t raise pay,” he says. “They never raise pay. They’ll always just take more and more and more from the originator, which they’ve been doing since I’ve been in the industry.”

VanTrojen credits his dad, the Seattle firefighter, for the high standards he sets for himself and Geneva Financial. “I was going to follow in his footsteps,” he recalls, but, “life doesn’t always go the direction that you think it’s going to go.”

For that reason, working in the fitness industry taught VanTrojen that “choice” often plays an even more important role in attaining success than opportunity or timing. “I had a mentor that taught me, first and foremost, that I could be successful if I wanted to,” VanTrojen explains. “I could be as successful as I ever wanted to. Nobody had ever taught me that before. I thought rich people and successful people were born that way.”

Working 80-hour weeks for eight years, VanTrojen “learned how to win.” When he walked out the doors of the fitness industry, he slipped and fell into mortgages. “It really didn’t matter the industry that I got into, I would have probably been successful in it,” he

believes, “because I knew how to manage. I knew how to train. I knew how to lead, at least to some degree.”

Being a capitalist, a leader, and a good human is a difficult juggling act, though, so VanTrojen takes cues from Marc Benioff, co-founder and CEO of Salesforce, the cloud-based software company. “If you’ve ever read his book,” Trailblazers, VanTrojen says, “you’ve seen how many times through the success, growth and evolution of that company, where he’s been challenged by the moral things he should be doing when it countered the capitalistic things that he should be doing.” VanTrojen does not care how productive or profitable his originators are if they cut corners with compliance or are “not good humans.”

Too many companies inside and outside the mortgage industry, he says, struggle to manage morally in a capitalist society. Though he often feels like he’s howling into a void, “If the herds go in one direction and you’re the one person saying something different, people will listen.” Geneva’s balance sheet has listened, in any case, proving that, even in this market, a profitable company can be built on the moral high ground.

Success, though, he admits, entails making mistakes. Humbly bragging, VanTrojen claims to have made “more than most, which is probably why I’ve become more successful than most.”

What better place to take a break from the daily grind? Take a day to recharge in a beautiful location and head back to the office with a fresh perspective, new tools and new connections made at Suncoast Mortgage Expo! This valuable, one-day conference is dedicated to helping originators grow and succeed. Interesting sessions, interactive discussions and networking opportunities and an exciting show floor filled with service providers who want to help you – it’s all at Suncoast Mortgage Expo!

Picture this: You arrive at the historic French Quarter of New Orleans, the scent of beignets and freshly brewed coffee mingles with the soulful melodies of jazz drifting from nearby clubs. Your excitement grows as you approach your destination, the iconic Hotel Monteleone.

Nestled in the heart of the French Quarter, the Hotel Monteleone stands as a timeless symbol of elegance and Southern hospitality. Its grand facade, adorned with wrought-iron balconies and lush greenery, exudes old-world charm and allure. As you

pull up to the entrance, you are greeted by the sight of uniformed bellmen bustling about, ready to assist with luggage and offer warm smiles of welcome.

Stepping into the lobby, you’re enveloped in a sense of luxury and history. The opulent decor, with its marble floors, crystal chandeliers, and rich mahogany furnishings, harkens back to a bygone era of glamour and sophistication. Yet, amidst the grandeur, there is an unmistakable sense of warmth and intimacy, as if each guest is being welcomed into the embrace of a dear friend.

As you ascend the grand staircase, you are struck by the buzz of energy that permeates the air. The sound of lively conversation and the clinking of glasses fills the hallway, mingling with the faint strains of jazz music drifting up from the lobby below. Arriving at the conference area, you are greeted by the sight of attendees from all corners of the mortgage industry, engaged in animated discussions and networking opportunities.

The expo hall itself is a bustling hive of activity, with rows of booths showcasing the latest innovations and services in the mortgage industry. From technology solutions to compliance resources, the array of offerings is vast and impressive. The traveler eagerly immerses themselves in the exhibits, eager to glean insights and make valuable connections with fellow professionals.

Throughout the day, you attend informative workshops and panel discussions, gaining valuable knowledge and industry insights from leading experts in the field. You take diligent notes, exchanging ideas with colleagues and forging new connections that will prove invaluable in your professional endeavors.

As the day draws to a close, you reflect on the wealth of information you have acquired and the connections you have made. With a sense of fulfillment and anticipation for the days ahead, you make your way back to your room at the Hotel Monteleone, grateful for the opportunity to participate in such a dynamic and enriching event in the vibrant city of New Orleans.

The Ultimate Mortgage Expo is a two-day event for the Gulf Coast Region’s mortgage professionals. Since 2013, the Ultimate Mortgage Expo has been providing unique opportunities for brokers, originators, and support staff to build their businesses. This year, we’ve expanded the event, with even more sessions on Wednesday, July 10, plus another incredible networking party. The cherry on top is that all of this is free for attendees, thanks to supporters of the show, who you can meet in the exhibit hall on both Wednesday and Thursday. Just use our code OCNFREE on your registration.

If these words come to mind when considering your ideal candidate for our list of Powerful Women of Mortgage Banking, then show your support for today’s female leaders in the mortgage profession and submit your nomination.

Nomination Deadline: July 5, 2024

Mortgage Banker Magazine’s October issue will feature a special section celebrating 2024’s Powerful Women of Mortgage Banking.

Visit nmplink.com/MBMWomen