UNLOCKING SUCCESS WITH CROSS-MARKETING ANECDOTES FROM THE FRONT LINE

HOW TO GET WHAT YOU WANT A BLUEPRINT FOR NEWBIES

THE RISK OF CHASING RATES TO THE BOTTOM

Finding A New Way To Build Up Minority Brokers

A PUBLICATION OF AMERICAN BUSINESS MEDIA Vol. 16, Issue 5 $20.00 MAY 2024

MIND GAP

THE

> Janine Kempfer, president and founder, Prime Mortgage

UNLOCKING SUCCESS WITH CROSS-MARKETING ANECDOTES FROM THE FRONT LINE

HOW TO GET WHAT YOU WANT A BLUEPRINT FOR NEWBIES

THE RISK OF CHASING RATES TO THE BOTTOM

Finding A New Way To Build Up Minority Brokers

A PUBLICATION OF AMERICAN BUSINESS MEDIA Vol. 16, Issue 5 $20.00 MAY 2024

MIND GAP

THE

> Janine Kempfer, president and founder, Prime Mortgage

BEST-IN-CLASS THE PROGRAMS BUILT FOR SELF-EMPLOYED •12-Month Bank Statement •P&L Programs •1099 Only •Investor Cash Flow/DSCR •ITIN •Interest Only INVESTORS PROGRAMS BUILT FOR •Investor Cash Flow/DSCR •Jumbo Non-QM •ITIN •Condotel •Small Balance Multifamily •Business Purpose •Investor Cash Flow/DSCR •Business Purpose •Fix & Flip •Small Balance Multifamily •ITIN •Interest Only FOREIGN NATIONALS PROGRAMS BUILT FOR NON-QM LENDER Acra Lending is a registered dba name of Citadel Servicing Corporation, 3 Ada Parkway, Ste 200A, Irvine, CA 92618; (888)-800-7661 (“CSC”) NMLS ID# 144549, Licensed under Arizona Mortgage Bankers License # 1034431, California Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act license # 41DBO-74196, Finance Lenders License # 60DB0-94450, CA-DRE #01799059, Florida Mortgage Lender Servicer License # MLD523, Georgia Mortgage Lender License/Registration # 23462, Minnesota Residential Mortgage Originator License Other Trade Name #1 MN-MO-144549.1, Nevada Mortgage Company License # 4449, North Carolina Mortgage Lender License # L-160722, Oregon Mortgage Lending License # ML-5599, Tennessee Mortgage License # 125315, Utah-DRE Mortgage Entity License - Other Trade Name #1 12074249, Virginia Lender License # MC-5845. For mortgage professionals only. This is for informational purposes only. For legal and professional advice on applicable state and local licensing requirements that apply to you, please contact an attorney. Acra Lending is an equal opportunity lender. Rates, terms, and programs subject to change without notice. O er of credit subject to credit approval per applicable underwriting and program guidelines, applicant eligibility, and market conditions. Not all applicants may qualify. Not valid in the following states: AK, ND, and SD. CONTACT US TODAY TO GET STARTED! 888-800-7661 EXPERIENCE OUR NEW BROKER PORTAL GLIDE SALES@ACRALENDING.COM | WWW.ACRALENDING.COM GLIDE: ALL-IN-ONE SOLUTION With our portal Glide, you have access to a variety of features! You can upload all your files in one location, view your pipeline in real time, get a speedy income analysis, and price out a scenario with a click of a button. QUICK PRICER PRICE SCENARIO INCOME DESK APPLICATION PIPELINE Not only do we have the best portal, we also have the best programs to go along with it. See some below!

Time For A New Suit It seems like this Spring has brought a bumper crop of lawsuits. 6 Unveiling Real Estate Goldmines Unleash untapped opportunities and turbocharge loan officer success with savvy real estate collaborations. 8 Learn How Strategic Partnerships Can Amplify Your Brand’s Reach How to team up with a company and leverage their audience.

10 Beat It Boomer!

Lew Sichelman cleans his desk of all the mortgage tips and tidbits.

People on the Move See who the movers and shakers are in the mortgage industry.

Your First Million Dollars: Compromise Breeds

business and relationships, it’s best to compromise.

> Keystone Mortgage Academy Class Valedictorian Malcom Quattlebaum during Graduation Jan. 11, 2024.

Benchmarks and Best Practices: Cracking The Communication Code From personalized approaches to compliance, unlock the secrets to keeping clients satisfied and coming back for more.

My Best Deal: A Tale Of Foreclosure Averted Discover how one mortgage lender’s compassion and expertise kept a family in their home amidst financial hardship, forging lasting relationships.

Defying the Odds with $22M in Loans LO Tony Zweras believes in simplicity and it’s getting results.

4

18

Success

21 Non-QM Resource Guide Originator Tech Resource Guide Wholesale Lender Resource Guide

24

26 Data Bank 30

38 Good

56 Non-QM Lender Directory 57 Wholesale

Directory Originator Tech Directory AMC Directory 58 Facebook

Life

Upgrades,

Features nationalmortgageprofessional.com MAY 2024 Volume 16 Issue 5 CONTENTS nationalmortgageprofessional.com SPECIAL ADVERTISING SECTION PAGE 13 AMC Showcase AMC SHOWCASE

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 3

17

In

22

Humans, Good Profits At Geneva Financial LOs choosing production over profits only undermines their value.

Lender

Thoughts:

2.0: Navigating

Glitches, and Unexpected

LETTER FROM THE PUBLISHER

Suit Up

As I write this, the eyes of the world have been trained on a couple of courtrooms in New York City, where historic judicial proceedings have been ploddingly proceeding. For everyone, it’s been a constant reminder that the scales of justice are best measured in the halls of jurisprudence, not the echo chambers of social media. Yet, while it’s important to realize that courts and judges are there specifically to settle disputes — preferably with finality — it’s still sometimes a wakeup call to see them being used so often.

For the mortgage industry, these past few months have been especially litigious. A lot of the filings have involved the nation’s largest lender — United Wholesale Mortgage. On the one hand, that shouldn’t be much of a surprise: big companies make big targets, and there’s a reason they usually have teams of lawyers on staff. On the other hand, being a plaintiff instead of a defendant is a choice to enter the ring. Legal pugilism, it seems, doesn’t really care what corner the fighters start in.

UWM was targeted by one of the nation’s highest profile law firms for class action claims that it manipulated the marketplace, causing consumers to pay more to obtain mortgages than they might otherwise have. It’s an interesting, if not highly suspicious assertion (what, after all, really constitutes the “best deal” for a borrower?), but whether it’s really intended to right a wrong or simply act as a lever on UWM’s stock price has yet to be determined. UWM, meanwhile, has been scoring legal points defending its “all in” initiative — better known as the Ultimatum — in courtrooms. Brokers have folded in their fight against the limitation that they not do business with both UWM and Rocket Mortgage, and in February a federal judge said she just didn’t see the evidence that the Ultimatum unduly restricted competition.

United Wholesale Mortgage has been on a winning streak legally, which may be encouraging it to be more proactive against those it perceives as bad actors. It’s filed its own suit against Florida-based Atlantic Trust, for instance.

All of this has been like fertilizer to flowers in the various online discussion groups. UWM defenders and detractors are all slinging … well, something … at each other, like armchair attorneys, bellowing without benefit of a law degree.

In the end, though, the courts will look at what’s legal and what’s not, what’s provable and what’s hearsay. While fascinating to watch the process roll out, and to read the position papers and briefs, we all do the industry a disservice by trying to circumvent the insight of the lawyers and judges.

Sometimes, it does no good to just go outside and rake up muck. Sometimes, you’ve just got to suit up.

STAFF

Vincent M. Valvo CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick ASSOCIATE PUBLISHER

Erica Drzewiecki, Katie Jensen, Ryan Kingsley, Sarah Wolak STAFF WRITERS

Dave Hershman, Erica LaCentra, Harvey Mackay, Lew Sichelman, Mary Kay Scully CONTRIBUTING WRITERS

Nicole Coughlin ADVERTISING ASSOCIATE

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael PROJECT MANAGER

Meghan Hogan DESIGN MANAGER

Stacy Murray, Christopher Wallace GRAPHIC DESIGN MANAGERS

Navindra Persaud DIRECTOR OF EVENTS

William Valvo UX DESIGN DIRECTOR

Andrew Berman HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Krystina Coffey, Matthew Mullins, MULTIMEDIA SPECIALIST

Alan Nero MEDIA SPECIALIST

Melissa Pianin MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig ONLINE ENGAGEMENT SPECIALIST

Joel Berman FOUNDING PUBLISHER

Submit your news to editors@ambizmedia.com

If you would like additional copies of National Mortgage Professional Call (860) 719-1991 or email subscriptions@ambizmedia.com www.ambizmedia.com

VINCENT M. VALVO Publisher, Editor-in-Chief

© 2024 American Business Media LLC. All rights reserved. National Mortgage Professional magazine is a trademark of American Business Media LLC. No part of this publication may be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Advertising, editorial and production inquiries should be directed to: American Business Media LLC 88 Hopmeadow St. Simsbury, CT 06089

Phone: (860) 719-1991 info@ambizmedia.com

MAY 2024

Volume 16 Issue 5

4 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

Easiest P&L in the Industry

9 out of 10 Approved

Average App to CTC in 22 Business Days

Simple Guidelines

Lending in All 50 States

Join Now 800.400.5451 fnba.com/wholesale Providing Certainty in an Uncertain Market

DAVE HERSHMAN

Seeing The Pillars Of Profit

LOs shouldn’t overlook the opportunities right in front of them

BY DAVE HERSHMAN, CONTRIBING WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

As a manager, one of your most important functions is to help your loan officers see the opportunities to develop relationships and garner referrals. It is a matter of opening their eyes so they can see the opportunities they are missing, many of which are right under their nose. As a matter of fact, in my thirty-plus years of hiring, training and coaching loan officers through my leadership positions, articles, books, training programs, and speeches, this has been one of my most important objectives. If they don’t see the opportunity, they can’t take advantage of the opportunity.

For those working inside or otherwise affiliated with a real estate office (inside the glass house), there is no place in which there are more opportunities, many of which the average loan officer does not see. As a matter of fact, there are so many potential opportunities that opening one’s eyes can be quite overwhelming. This is why I say that such situations are a gold mine, but also can be a curse if not balanced properly. Where are these opportunities? I have divided them up into four pillars:

The loan officer’s personal sphere. This opportunity is no different than any other loan officer’s situation. Only when a loan officer starts serving a real estate office, they tend to leave their personal sphere behind. Not without reason, as a real estate office can have so much activity, it is even tougher to multi-task. But to abandon one’s personal sphere is always a mistake, and more importantly, interactions with their personal sphere can put the loan officer in a position to add even more value to the real estate

The sphere of a real estate office. When I train on personal spheres, I can demonstrate to a loan officer or a real estate agent how their database can grow from 300 to 3,000 by opening their eyes wider and understanding the full extent

of their sphere. If their personal sphere is that extensive, imagine how large the sphere of a real estate office is. Again, when you open your eyes, the opportunity is mind-boggling. No one person could possibly reach every segment of this sphere. In our course, we go deeper into this concept.

The sphere of a transaction. Like the personal sphere, the sphere of a transaction exists for every loan officer. But as a typical loan officer doesn’t fully take advantage of this extensive opportunity, once again the loan officer in a real estate office is more likely to be distracted further when dealing with their pipeline. Thus, it takes even more discipline in order to take advantage of what this opportunity brings to the table.

The sales and listings of the office. I purposely listed this opportunity last because most loan officers and companies are overly fixated on these opportunities. Not that they are not important, but the goal here is for the sales and listings of the office to become a part of the overall opportunity, not the focus of 98% of the loan officer’s efforts.

As a matter of fact, when you look at the extent of these four opportunity segments, even a small real estate office with a few sales per month can support a loan officer. This is a very important concept because I believe a loan officer adding value to a real estate office can help that office grow, something we will delve into more deeply when we discuss the facets of value a loan officer can bring to the table “inside the glass house.”

It is imperative that the loan officer and company see the full extent of these opportunities. Often, we have loan officers vying for desk rentals or other affiliations with a real estate office or even a real estate team. But if they miss out on the wide range of opportunities available, the venture is much less likely to be successful. This is why we are focusing on this topic — to help both loan officers and real estate companies realize the real potential value of this amazing opportunity. n

Dave Hershman is the top author in this industry with six books published as well as the founder of the OriginationPro Marketing System and the OriginationPro’s on-line comprehensive mortgage school. His site is www.OriginationPro.com and he can be reached at dave@hershmangroup.com

6 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 RECRUITING, TRAINING, AND MENTORING CORNER

There are so many potential opportunities that opening one’s eyes can be quite overwhelming.

This is why I say that such situations are a gold mine, but also can be a curse if not balanced properly.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 7

The Power Of Cross-Marketing

Partnerships drive growth with focused messaging and channel synergy

BY ERICA LACENTRA, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

In the mortgage industry, it’s no secret that aligning your company with other complementary businesses and forming strategic partnerships can provide tremendous benefits. However, what you can get out of a strategic partnership really depends on how you leverage that relationship. One of the easiest ways to create a mutually beneficial partnership opportunity is by discussing and developing cross-promotion or crossmarketing strategies. Cross-marketing is a simple concept. It involves collaborating with another

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 THE XX FACTOR ERICA LACENTRA

company to promote each other’s brands, products, or services to their existing audiences. This can be an incredibly powerful marketing tool because, with the right collaborative partner and the right messaging, you can easily increase your brand awareness and drive business from a new customer base that is perfect for your offerings. Then in turn, you can offer a product or service from your partner that can hopefully add additional value to your existing customer base, making the partnership a true win-win. So, if you are considering cross-marketing, where is the best place to start and what channels seem to be most effective?

SETTING THE GROUNDWORK

As previously mentioned, being successful in any cross-marketing initiative first comes down to who you are partnering with. While you may start by looking for companies that have a customer base that would be ideal for your product offerings, remember that you need to also be ready to explain what benefits your company could offer them in return. Even with overlapping audiences, many companies when approached about an opportunity like this will want to know what value you can provide their clients to make it worthwhile for them to promote your business. For example, a lender could find great synergy partnering with a title company or insurance company. Both of these companies are a complement to the lender’s origination process so the services they offer could be extremely beneficial to their existing customer base and in turn, a lender knows that potential clients are within these companies’ marketing audience.

Once you have identified the right partner and recognized there is mutual value, it’s important to work with this partner to develop the right messaging. It’s unlikely that you would do mass marketing without specific messaging to your client base, so why wouldn’t the same apply to your strategic partner’s customer base? You’ll want to discuss the finer details of cross-promotional efforts with your strategic partner. Ask questions like what pain points are your customers experiencing that our products could solve? If you offer multiple products, is it possible to segment their customer lists to offer more targeted messaging? Are there any special promotions or discounts that you could each run that would offer a larger incentive to potential clients?

As these cross-marketing efforts may be some of the first times this audience has seen your products, you want to be extremely targeted and make that carrot at the end of the stick particularly appealing. You want to treat these touch points like you would any first-time marketing effort and build out a natural path for this new client base to follow.

THE RIGHT CHANNELS FOR CROSS-MARKETING

Once you have laid the groundwork for your cross-promotional efforts, it’s time to figure out which channels you and your strategic partners will be using. While there isn’t a one-size-fits-all plan, there are certainly marketing channels and marketing opportunities that seem to lend themselves well to cross-promotional efforts. First, email marketing tends to be a natural fit for co-marketing efforts.

Once you have identified the right partner and recognized there is mutual value, it’s important to work with this partner to develop the right messaging.

This can be for a variety of reasons, like there are great opportunities to send unique messaging to segmented lists that your strategic partner has already developed. You also can have the chance to ease into communication by appearing in something like a company newsletter rather than doing a hard sell email first, which customers might unsubscribe from. Finally, this can be an easy way to send a discount or promotion and track it by directing customers to a specific landing page or tracked URL and bringing customers directly into your sales funnel. The tracking capabilities and reporting you can provide from email marketing make this channel a great fit because you

can easily show the effectiveness of your efforts to your partner and vice versa. Another great marketing channel for cross-promotion is social media. Like email marketing, you have a greater ability to reach your partner’s broader audience and you can tailor content so that you receive greater engagement. Social media can also be great as a collaborative marketing tool. Having representation from both companies in imagery or video content helps to associate the brands more easily, it builds trust with the audience since the content would likely feature familiar faces or branding, and you can even best explain why it makes sense for your companies to team up. Also, just like email marketing, you can easily direct customers to promotions or a call to action that can bring them directly into your sales funnel making it easy to track.

One of the final channels that provides tremendous success for cross-promotional efforts is educational webinars or educational events. Hosting either an online educational webinar with a strategic partner or having an in-person event with an educational component — think a panel — can be a great way to highlight how each company can provide benefits for your overlapping audiences and also provide value beyond a hard sell. It is a great way to combine your customers as well as your partner’s customers into one event while also building trust and credibility. With webinars or in-person events, you can also run unique promos for attendees for each company so that you can easily track any conversions from these efforts.

REAP THE BENEFITS

Like any marketing strategy, crosspromotion is just another tool you need to consider to increase your brand’s reach and grow your client base. While identifying the right partners and building out the right cross-marketing efforts may take a bit more initial legwork, this type of marketing can often provide exponential returns. By leveraging the audience that your strategic partners have already worked so hard to build and providing real value for your partner’s client base, you can see serious increases in brand awareness, rapid expansion of your client base, and dramatic success. n

Erica LaCentra is chief marketing officer for RCN Capital.

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 9

Navigating The Housing Market: Trends, Tips, And Tidbits

Exploring evolving home markets: resilience, value, and fraud

BY LEW SICHELMAN, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

It’s time for a little late spring cleaning, removing the tids and bits which are worthwhile but are not worthy of more than a few paragraphs. But first, a thought. Yes, there will always be families who are going through one of life’s many changes — marriage, childbirth, divorce, old age, and death, to name the most prevalent — and are in need of buying and selling houses, no matter the cost of financing. And those are the people who will be propping up the mortgage market for the foreseeable future.

On the other hand, discretionary buyers, those who would like to make a move but don’t have to and are sitting on mortgages with relatively low rate loans, are not going to jump feet first into the market anytime soon. And remember, nearly nine out of every ten outstanding home loans carry a rate of less than 6%.

These folk are watching rates carefully. But even though rates are down from their peak, they are still bobbing and weaving, dropping a tad one week and floating higher the next. And I believe these people won’t come off the sidelines in any meaningful number until they perceive that rates have hit bottom. Not just when they are falling, but when they have dropped sufficiently enough, remain at that level for some time, and then start to inch back up again. That’s when they’ll pull the trigger and not before.

Some might even hold out until loan costs move back into the 2–3% range, which likely will never happen again, at least in our lifetimes. Even the best predictions are for rates to fall into the high-5s by the end of the year. So they’ll be the ones who

That’s just my two cents.

Now onto cleaning off my desk:

Collectively, owner-occupied homes in the nation’s largest cities are worth a whopping $23 trillion. But ask individual owners what their places are worth and most have no clue.

Nearly three out of four homeowners consistently undervalue the cost of houses in their markets, according to a survey of nearly 1,500 people in 29 of the country’s most populous cities. The trend, said All Star Home, a home improvement outfit based in North Carolina, is particularly pronounced in urban areas.

Some [buyers] might even hold out until loan costs move back into the 2–3% range, which likely will never happen again, at least in our lifetimes.

Residents in some places come in low; in other markets, they tend to overshoot, highlighting, the research said, the difference between public perception and the housing market’s reality.

Surprisingly, about a third of the respondents said they actively educate themselves on local market conditions, looking up prices online at least once a month. Here, Boomers were the most active, suggesting, perhaps, that they are thinking about moving down.

Mo Money: Would-be home buyers could have more takehome pay this year, thanks to the higher tax brackets that took effect Jan. 1. So it might be a good idea to give a second look to people who failed to qualify for financing in 2023.

The Internal Revenue Service makes adjustments every

• • •

THE MORTGAGE SCENE LEW SICHELMAN 10 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

year in the federal tax brackets to avoid pushing taxpayers into high-income slots even though their purchasing power remains essentially unchanged. The phenomenon is known as “bracket creep.” The brackets for 2023 have shifted higher by about 5.4%, creating higher thresholds and saving taxpayers millions, the IRS says. That’s money that can be used to offset higher loan rates and housing prices, if you advise borrowers to adjust •

Note from my granddaughter: “I paid my rent. Now I have a place where I can starve.”

Looking for more business? Consider joining your

There’s one in almost every state, according to the National Real Estate Investors Association, which nationalreia.org). The outfit claims some 120 local chapters and local groups as members, many of which hold monthly meetings with speakers. Join, sign up to speak about local lending trends and conditions, and make your case •

More people are living alone than ever, according to the latest Census Bureau figures. More than 37 million men and women reside all by their lonesome. That’s 29% of all households, and an increase of almost 5 million over the last decade.

The pandemic had something to do with that. The number of one-person households jumped 2.4 million from pre-COVID 2019 levels alone.

There’s no telling whether these folk are happy in their current digs. But if you want to target the singles market — turn them from loners to loaners, if you will — it might be a good idea to aim at women because they buy more often than men, a new LendingTree

Single ladies own 10.95 million houses vs. 8.24 million for single guys. Put another way, single women own nearly 13% of all the country’s owneroccupied houses, whereas single men own just 10.3%.

The only states where male singles own more places than female loners are Alaska and North and •

Some 135 new home buyer assistance programs were introduced last year, according to Down Payment Resource, the Atlanta firm which keeps tabs on such programs. There are now 2,294 assistance programs

The jump in assistance programs represents “a concerted effort by housing agencies to expand opportunities and break down barriers to home ownership,” says DRA’s Rob Chrane.

• •

• • •

• •

• •

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 11

Notably, 804 programs and counting now allow for the purchase of manufactured homes, which typically have a lower point of entry than other housing types. In addition, 686 allow for the purchase of multi-family properties, allowing for buyers to become both owners and landlords to build wealth.

There’s also been a marked increase in the number of assistance programs targeting veterans and service members as well as Native Americans.

More than nine out of every 10 title insurance companies say they were the victims or intended victims of cyber crime and wire fraud in 2023.

> American Land Title Association survey

According to DPR, most of these programs are backed by municipalities, nonprofits and local or state housing finance agencies.

For a complete list of homebuyer assistance programs by state, visit https://downpaymentresource.com/wpcontent/uploads/2024/01/HPI-state-bystate-data.Q42023.pdf

• • •

Fraud Alert: A “significant” number of mortgages produced in the last few years involve appraisals completed by unlicensed people masquerading as the real thing. They unlawfully use the identities of actual appraisers, come up with a valuation, and abscond with your money.

Lenders are being alerted to the problem by Fannie Mae, which is reminding them to do their due diligence when retaining services of appraisers and other outside vendors and utilize all available public records and licensing agencies in determining the validity of third-party documentation within loan files. Red flags include files that fail to include the name and signature of the appraiser, signatures that appear to be forged or otherwise doctored, and names, phone numbers, and e-mail and street addresses that don’t match.

Meanwhile, more than nine out of every 10 title insurance companies

say they were the victims or intended victims of cyber crime and wire fraud in 2023, according to the latest survey by the American Land Title Association. That’s up from 86% during the two-year period from 2020 to 2021.

The study found that title companies are pouring money into their prevention and mitigation efforts, some as much as $25,000 a year.

Maybe it’s the water, which is often cited as the reason New York City’s bagels are the best there is. But maybe it also causes developers in the Big Apple to turn rotten.

First there was DJT, who has been convicted of cooking his books. And now its Nir Meir, a 49-year-old developer and several others who worked with the now shuttered HFA Capital Group and a separate construction firm. They are charged with bilking investors, subcontractors, and the city out of $86 million in a five-year-long fraud scheme. Meanwhile, prominent real estate developer and venture fund manager Grant Cardone is instructing his team to cease investment in The City, declaring that “recent political decisions” — read that the Trump conviction — will lead to price deterioration

• • •

Riddle: What can go a whole year and not age at all? The nation’s housing stock. In 2021, the median age of an-owner occupied house was 40 years. In 2022, it was the same, according to the Census Bureau.

That’s the good news. The bad news is the housing stock “is aging rapidly” as construction of new dwellings “continues to fall behind,” according to Na Zhao, an economist at the National Association of Home Builders. Some 60% of our houses were built prior to 1980; 35%, before 1970.

New construction added nearly 1.7 million units to the housing stock between 2020 and 2022, but that’s a mere drop in the proverbial bucket, accounting for just 2% of all owner-occupied residences.

The Department of Housing and Urban Development has given housing counseling agencies a shot in the arm, and that should do the same for marginalized folks who want to step onto the ownership ladder.

Specifically, HUD is making $40+ million grant funding available to support counseling that helps connect would-be buyers and renters find decent and affordable places to live. The money will be awarded to more than 150 housing counseling agencies and intermediary organizations throughout the country. •

As Bugs Bunny says, “That’s all folks.” Now I can see the top of my desk. n

Lew Sichelman is a contributing writer to National Mortgage Professional magazine. He has been covering the housing and mortgage sectors for 52 years. His syndicated column appears in major newspapers throughout the country.

THE MORTGAGE SCENE

• • •

• •

•

• •

12 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

AMC SHOWCASE

ACT Appraisal, Inc. East Dundee, IL

actappraisal.com

Ron@actappraisal.com (888) 377-8901

AREA OF FOCUS: ACT Appraisal is a nationwide AMC focusing on residential appraisals

DESCRIPTION OF PRODUCTS OR

SERVICES: ACT Appraisal manages the entire residential appraisal process, utilizing a network of certified appraisers nationwide, to complete assignments from an array of mortgage lending institutions. Please contact us for more info.

Class Valuation Troy, MI

classvaluation.com hshipley@classvaluation.com (248) 955-9580

AREA OF FOCUS: AMC

DESCRIPTION OF PRODUCTS OR

SERVICES: Class Valuation is one of the largest nationwide Appraisal Management Companies known for delivering outstanding quality and service. They combine the best people, products, processes, and technology, enabling lenders to empower more borrowers in their dream of homeownership.

Class Valuation is consistently ranked highly with several of the nation’s top 10 mortgage lenders and has been recognized for multiple years as a top workplace. Founded in 2009, Class Valuation is headquartered in Troy, Michigan. For more information, please visit classvaluation.com.

PCV Murcor Pomona, CA

pcvmurcor.com sales@pcvmurcor.com (855) 819-2828

AREA OF FOCUS: Nationwide Real Estate Valuations Management — Appraisal Management Company

DESCRIPTION OF PRODUCTS OR SERVICES: From our in-house experts customizing a strategy with you at every step to our nationwide panel of independent appraisers working in the communities you invest in — PCV Murcor brings a wealth of experience to your business immediately.

An industry leader with over 40 years of experience managing valuation needs for mortgage lending, financial institutions, estate and litigation, real estate investors, and mortgage servicers. Our mission is to help clients and their customers make their real estate needs happen through accountability, connectivity, and performance.

We strive for accurate and timely property valuations. Assessing the quality and promptness of a valuation is something we take to heart. We only succeed when our clients and their customers do. We’ve ensured that our order procedures implement precise knowledge of local resident markets to provide timely, accurate residential valuations to our clients. Our quality control system is engineered to combine a manual review with automated checks to search for and exclude errors on orders before client delivery; this helps to reduce requests for revisions, saving our clients valuable time and money. Our proven processes are designed to mitigate your financial and reputation risk — without missing important deliverables. While our processes and technologies have evolved over the past 40 years, our focus on excellent customer service remains the same; to develop and maintain strong engagement and collaboration with our clients.

Visit pcvmurcor.com/products to learn more about our traditional appraisals, alternative products, commercial appraisals, commercial BOVs, and multi-family products.

SingleSource Property Solutions LLC

Canonsburg, PA

singlesourceproperty.com

marketing@singlesourceproperty.com (866) 620-7577

AREA OF FOCUS: Appraisals, BPOs, AVMs, Hybrid Valuations, and Value Reconciliations

DESCRIPTION OF PRODUCTS OR SERVICES: SingleSource Property Solutions (SingleSource) is a nationwide service provider to many of the largest mortgage origination and loan servicing companies. Our wide range of product and service offerings can be categorized into five lines of business: Property Valuations, Title and Settlement, REO Asset Management, Field Services, and Document Management. With over 20 years of experience, SingleSource has delivered over 5 million valuation reports and has maintained a 97% client retention rate by delivering quality reports along with dependable and helpful customer service.

SingleSource’s approach to fulfilling valuation needs ensures our customers receive customized, accurate and quick valuations services. We understand the valuation is a critical piece to the success of your process. We are committed to providing the highest level of quality and care to your business and customers by utilizing industry-leading tools that include: a proprietary scoring model that grades every valuation report, MLS tools that verify data points in delivered products, use of robotic process automation (RPA), and staff field appraisers in key markets nationwide.

SingleSource is a fully compliant national AMC, able to manage residential appraisal assignments in all 50 states. We offer a full suite of property valuation products, from appraisals to BPOs, hybrid valuations, AVMs, and value reconciliations. We are committed to being a vendor partner of choice to the real estate lending industry, including banks, credit unions, mortgage originators, loan servicers, government agencies, real estate investment firms, and other companies involved in mortgage finance.

SPECIAL ADVERTISING SECTION

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 13

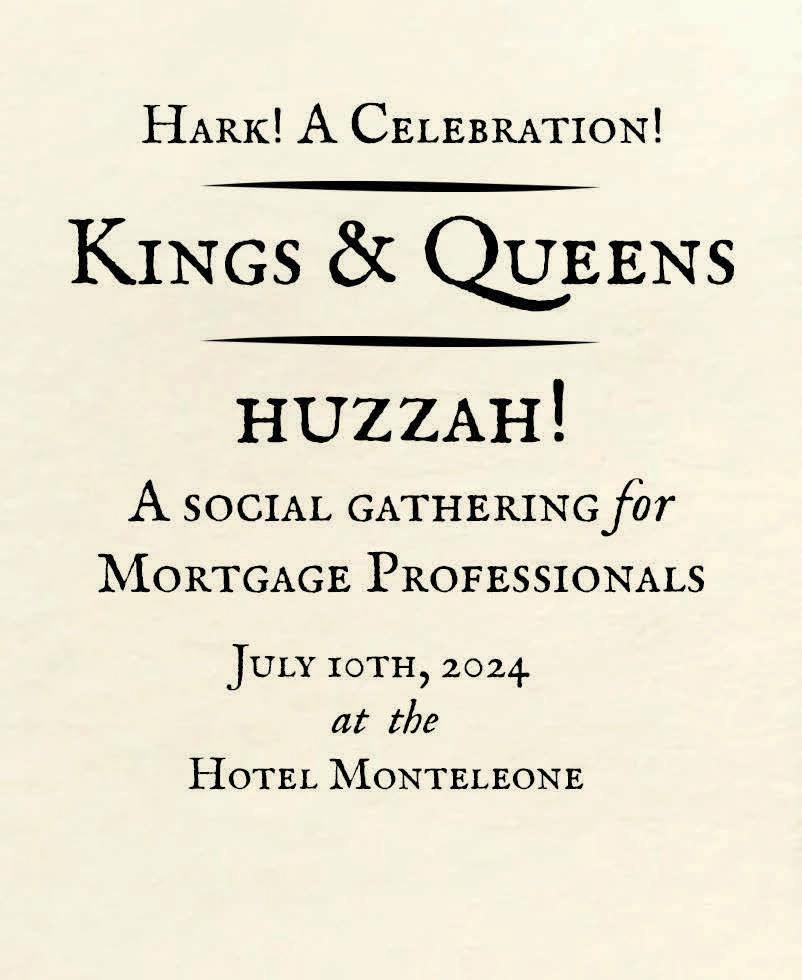

Brokers & Beignets

Build your business in the Big Easy

Picture this: You arrive at the historic French Quarter of New Orleans, the scent of beignets and freshly brewed coffee mingles with the soulful melodies of jazz drifting from nearby clubs. Your excitement grows as you approach your destination, the iconic Hotel Monteleone.

Nestled in the heart of the French Quarter, the Hotel Monteleone stands as a timeless symbol of elegance and Southern hospitality. Its grand facade, adorned with wrought-iron balconies and lush greenery, exudes old-world charm and allure. As you pull up to the entrance, you are greeted by the sight

of uniformed bellmen bustling about, ready to assist with luggage and offer warm smiles of welcome.

Stepping into the lobby, you’re enveloped in a sense of luxury and history. The opulent decor, with its marble floors, crystal chandeliers, and rich mahogany furnishings, harkens back to a bygone era of glamour and sophistication. Yet, amidst the grandeur, there is an unmistakable sense of warmth and intimacy, as if each guest is being welcomed into the embrace of a dear friend.

As you ascend the grand staircase, you are struck by the buzz of energy that permeates the air. The

sound of lively conversation and the clinking of glasses fills the hallway, mingling with the faint strains of jazz music drifting up from the lobby below. Arriving at the conference area, you are greeted by the sight of attendees from all corners of the mortgage industry, engaged in animated discussions and networking opportunities.

The expo hall itself is a bustling hive of activity, with rows of booths showcasing the latest innovations and services in the mortgage industry. From technology solutions to compliance resources, the array of offerings is vast and impressive. The traveler eagerly immerses themselves in the exhibits, eager to glean insights and make valuable connections with fellow professionals.

Throughout the day, you attend informative workshops and panel discussions, gaining valuable knowledge and industry insights from leading experts in the field. You take diligent notes, exchanging ideas with colleagues and forging new connections that will prove invaluable in your professional endeavors.

As the day draws to a close, you reflect on the wealth of information you have acquired and the connections you have made. With a sense of fulfillment and anticipation for the days ahead, you make your way back to your room at the Hotel Monteleone, grateful for the opportunity to participate in such a dynamic and enriching event in the vibrant city of New Orleans.

The Ultimate Mortgage Expo is a two-day event for the Gulf Coast Region’s mortgage professionals. Since 2013, the Ultimate Mortgage Expo has been providing unique opportunities for brokers, originators, and support staff to build their businesses. This year, we’ve expanded the event, with even more sessions on Wednesday, July 10, plus another incredible networking party. The cherry on top is that all of this is free for attendees, thanks to supporters of the show, who you can meet in the exhibit hall on both Wednesday and Thursday. Just use our code OCNFREE on your registration.

UltimateMortgageExpo.com JULY 10 — 11, 2024 NEW ORLEANS *Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. NMLS Renewal class open to conference attendees only. Exclusive events and networking party are open to registered attendees only.

MORTGAGE EXPO

ULTIMATE

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. NMLS Renewal class open to conference attendees only. Exclusive events and networking party are open to registered attendees only. The Mortgage Star Conference for Women returns to the beautiful historic Hotel Monteleone in the heart of the French Quarter of New Orleans. This event brings together the stars of mortgage, for meaningful discussions, insightful presentations, and to celebrate one another. Then, stay for the Ultimate Mortgage Expo, free for Mortgage Star attendees. Star Mortgage CONFERENCE FOR WOMEN — LIVE IN NEW ORLEANS — The most impactful event for mortgage women. Register for free with code NMPFREE mortgage-star.net JULY 10

HOW

> With three decades of experience in the financial services industry, Peter Akwaboah was appointed executive vice president and chief operating officer at Fannie Mae effective May 20, 2024.

> New American Funding hired Mosi Gatling as its senior vice president of Strategic Growth and Expansion to reach Black borrowers in underserved communities.

> Guaranteed Rate said that Jeff Nelson will return to the company as its Southeast Divisional Manager.

> Guaranteed Rate’s Shant Banosian, a leading loan officer, isn’t going anywhere. However, he joined the board of directors at Healing Realty Trust, a real estate investment firm specializing in healthcare properties.

PEOPLE ON THE MOVE //

NMP’S MONTHLY SECTION OF HANDS-ON PRACTICAL ADVICE YOUR FIRST MILLION DOLLARS Crafting Success With Masterful Compromise BENCHMARKS & BEST PRACTICES

To Captivate: Maximizing Client Connections CAREER TICKER People On The Move SPONSORED BY NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 17

Communicate

YOUR FIRST MILLION DOLLARS

Compromise Is NOT A Dirty Word

It’s the key to successful relationships and business deals

BY HARVEY MACKAY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

Abraham Lincoln was a man who believed in compromise.

When he was practicing law in Illinois, a farmer asked for Lincoln’s help in getting a divorce from his wife.

Lincoln asked, “What seems to be the trouble?”

“It’s our house,” said the farmer angrily. “I want to paint it brown, and she wants to paint it white. We got into a big argument about it.”

After calming the man down, Lincoln suggested that

he go back to his wife and try to work out a compromise. The farmer was very doubtful that any such solution was possible, but he agreed to try. Lincoln told him to come back in four weeks.

After four weeks, the farmer returned to Lincoln’s office saying, “There is no need to start proceedings against my wife. We’ve made up — compromise is how we did it.”

A pleased Lincoln asked, “How did you manage it?”

“Well,” said the farmer, “we decided to paint the house white.”

Maybe this is why Scottish novelist Robert Louis Stevenson said, “Compromise is the best and cheapest lawyer.”

I have a similar story about my marriage to Carol Ann. I was recently asked how we have managed to stay together for 64 years. I replied that when we got married, we agreed that Carol Ann would make all the minor decisions, and I would make the major decisions. Luckily, there have never been any major decisions.

All kidding aside, compromise is absolutely vital in both our personal and professional lives. It is the lubricant that keeps the gears

PEOPLE ON THE MOVE //

> Coleen Bogle joined The Money Store as its chief marketing officer.

> Embrace Home Loans promoted Ryan “Buddy” Hardiman from senior vice president of retail and direct sales to president.

> Digital lending platform Mortgage Cadence has added George Morales to its sales team.

> Fairway Independent Mortgage Corporation, which exited the wholesale channel, is promoting Joy Knoch to chief strategy officer.

HARVEY MACKAY

BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

18 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

> Next Level, a coaching company dedicated to training and empowering loan officers, is expanding its reach with the acquisition of Academy 18 and two new partners, Kyle Draper and Landan Hale.

> Rocket Companies named AI and fintech expert, Alex Rampell, as its latest independent director on the Board of Directors.

HAVE A NEW HIRE OR PROMOTION TO SHARE?

Submit the information to editors@ambizmedia.com for possible publication. Announcements should include a headshot.

SPONSORED BY

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 19

“The most important trip you may take in life is meeting people halfway.”

> Henry Boyle, Irish politician

of relationships and business dealings moving smoothly. Without it, we would constantly be at an impasse, unable to move forward.

Henry Boyle, an Irish politician, said, “The most important trip you may take in life is meeting people halfway.”

Understanding what you want and why you want it is crucial to successful compromise. It is about knowing your non-negotiables and being clear about what you are willing to give up. This clarity allows for more effective negotiations and outcomes that are acceptable to all parties involved.

Compromise is essential in business. Compromise is a daily reality in business. Whether negotiating contracts, hiring staff, or closing sales, the ability to find a middle ground is key to success.

Compromise prevents stalemates. Without compromise, we risk losing everything we have in pursuit of what we may never get. The “my way or the highway” approach most often results in a crowded road full of angry drivers.

Compromise facilitates progress. President Harry Truman’s willingness to accept things, one slice at a time,

demonstrates that compromise can lead to incremental progress, which is often better than no progress at all.

Compromise maintains integrity. It is also important to recognize when not to compromise, such as on principles, ethics, or legal matters. Compromise should never come at the cost of honesty or integrity.

Mahatma Gandhi, India’s spiritual leader, said: “All compromise is based on give and take, but there can be no give and take on fundamentals. Any compromise on mere fundamentals is a surrender. For it is all give and no take.”

I have found that the most successful compromises I have reached have resulted from face-to-face meetings, where both sides can read the situation clearly. Depending on the importance of the negotiation, it might be best to choose a neutral location rather than one’s office. Perhaps a restaurant or even a golf game, where the atmosphere can be more casual.

Go into the meeting understanding that no one is going to get everything they want. As long as you know what you absolutely need, you can decide what

you will be willing to give up. And be prepared to come to a different outcome than you had originally considered. Each side needs to respectfully listen to the other’s concerns and requests. No interruptions, no protests, no questions, until it’s your turn.

Stay on topic and resist the temptation to bring in other demands that will only confuse the conversation. Review what you heard and put agreements in writing with deadlines or responsibilities as appropriate.

Finally, shake hands or otherwise leave your meeting (or meetings) on a positive note. Chances are you will be doing business with, or running in the same circles as, or even merging your companies at some point. Spit out the sour grapes and instead look forward to the fruits of your labor.

Mackay’s Moral: Compromise is an attitude, not a pastime.n

YOUR FIRST MILLION DOLLARS BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE

Harvey Mackay is a seven-time New York Times best-selling author with 15 books.

20 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

Acra Lending

Lake Forest, CA

Acra Lending is the leader in NonQM Wholesale and Correspondent lending programs. Offering a range of programs and services geared toward helping mortgage professionals and borrowers achieve their purchase and investment goals. We are committed to providing simplicity, consistency and an optimal customer experience. acralending.com (888) 800-7661 sales@acralending.com

LICENSED IN: AL, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, KS, KY, LA, ME, MD, MI, MN, MT, NE, NV, NH, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, VT, WA, WI, WY

Newfi Wholesale

Emeryville, CA

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com (888) 415-1620 support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

Find the full Originator Tech list on page 56

wemlo Boca Raton, FL

Area of Focus: Loan Processing

Third-party processing service, wemlo, empowers mortgage professionals through transparent, flexible, and efficient loan processing. To better serve our customers and their borrowers, wemlo proudly offers processing support in 47 states (plus Washington DC) for more than a dozen loan products including Conventional, FHA, Jumbo, VA, and Non-QM.

wemlo.io (866) 523-3876 info@wemlo.io

Licensed In: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, ID, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, VT, VA, WA, WV, WI, WY

Zero 1 Solution LLC

Stockton, CA

Area of Focus: Software

1Solution Mortgage allows you to Originate, price a loan scenario with proposal, CRM, Marketing and more …

• Scenario

• Communication

• CRM

• LOS

• Essentials

• Marketing

• HR

1smtg.com (888) 458-0650 info@1smtg.com

Licensed In: All U.S. States, U.S. Virgin Islands

ACC Mortgage Rockville, MD

ACC Mortgage is the oldest NonQM lender that has never stopped lending in 22 years. We specialize in Bank Statement, ITIN, P&L, Foreign National and DSCR lending. Price, Product and Process are what make for Non-QM success.

ACCMortgage.com

LICENSED IN: AZ, AR, CA, CO, CT, DE, DC, FL, GA, ID, IL, IN, KS, MD, MI, NV, NJ, NC, OK, OR, PA, SC, TN, TX, UT, VA, WA

Newfi Wholesale

Emeryville CA

DSCR, Bank Statement, 1099, Asset Depletion, Buydowns, Full Doc Non-QM

No one knows Non-QM like us. Newfi Wholesale is an exception-based Non-QM lender dedicated to helping brokers find success. We offer a full Non-QM product suite including: Full-Doc, Bank Statement, 1099, Asset Depletion, Interest Only, Non-QM ITIN, Non-QM Buydown, DSCR 1-4 & 5-8 Units, DSCR Condotels, Graduated Payment Mortgages, and more. At Newfi about 1/3 of our funded deals have exceptions that we make in-house!

newfiwholesale.com (888) 415-1620 support@newfi.com

LICENSED IN: AL, AK, AZ, AR, CA, CO, CT, DC, DE, FL, GA, HI, ID, IL, IN, IA, KS, KY, LA, ME, MD, MI, MN, MS, MO, MT, NE, NV, NH, NJ, NM, NC, ND, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, WA, WV, WI, WY

Find the full Originator Tech list on page 57

Find the full Wholesale Lenders list on page 57

WHOLESALE LENDER RESOURCE GUIDE ORIGINATOR TECH RESOURCE GUIDE NON-QM LENDER RESOURCE GUIDE

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 21

Talkie, Or Walkie Communication: Will it make or break you?

BY MARY KAY SCULLY, CONTRIBUTOR, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

It continuously blows me away how many borrowers are satisfied with their LO or realtor, but then don’t repeat business when it’s time to sell their home or buy another. There are many likely factors that contribute to this phenomenon, but the biggest cause may just be communication.

A simple communication breakdown can be what makes the difference for referrals and repeat business. With that in mind, let’s talk about how to communicate with your borrowers to ensure they have a great experience that keeps them coming back.

KEEP IT PERSONALIZED

Everyone will have different communication styles and preferences which can be based on everything from age to personal preference. According to Entrepreneur, each generation has a distinct communication style that runs through most of the age group. Baby Boomers, for example, tend to appreciate

phone, or email interactions. They value having background information and details, whereas Gen Xers appreciate less formal communications over email, phone, or text and they value professional etiquette. Millennials, on the other hand, usually want quick communication via text, chat, and email. They value efficiency and convenience through a digital-first approach. Finally, Gen Zers prefer visual communications, often opting for face-to-face or video and, of course, a mobile-only format. But remember, as much as research can help you craft a personalized communication style to start with, it’s up to you to ask your borrowers what they prefer. There will always be a few outliers, so never assume you know what your borrower wants or expects out of your communication style simply based on their age.

KEEP IT THOUGHTFUL

There is no “one size fits all” communications approach. Too often, it’s easy to go on autopilot with emails or follow-ups, but I’d encourage you not to. Keep very close track of your communications and be mindful of the cadence. Make note of who you’ve already followed up with, who has responded to you, who may be out of town or busy at that time, etc. There is nothing worse than getting follow-up after followup when you’ve already responded or receiving countless emails while you’re on vacation. Keeping close track of each individual’s situation goes a long way in making them feel seen and valued.

KEEP IT COMPLIANT

No matter an individual’s preferred

communication style, there are certain things that must be delivered a certain way. For example, you cannot deliver a Loan Estimate or Closing Disclosure via text, no matter how much your borrower may want you to. The borrower can opt for electronic delivery, but it will be via email. It is your job as the loan officer to not only educate them about this option, but to very clearly communicate what they can expect. Doing so will help you set your borrower up for success, even when they are not communicating in their preferred channel.

And even if your borrowers can view their loan status online, be sure to communicate the status through their preferred communication method so they feel informed on what’s happening. Not everyone will be checking regularly. Ultimately, the borrower’s communication style does not trump any compliance rules — you have to know when and where you can tailor your communications and where you can’t. And if you can’t, make sure to explain why you’re deviating from their stated preferences.

Putting some real thought into how you’re communicating is critical for building trust with borrowers, giving them a great experience and making sure you’re effective as a loan officer — and it can also help you get the allimportant referral and build business in the future. n

Mary Kay Scully is the Director of Customer Education at Enact, leading the development of the company’s customer education curriculum.

BENCHMARKS & BEST PRACTICES MARY KAY SCULLY BUILD-A-BROKER: HANDS ON PRACTICAL ADVICE 22 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

You cannot deliver a Loan Estimate or Closing Disclosure via text, no matter how much your borrower may want you to.

SPONSORED BY

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 23

From The Brink Of Foreclosure

Job Title: Senior

Name: Kimberly Tondreau

How much was your best deal

What made it your best

Somebody was going to lose their house to foreclosure. The city was going to foreclose for three years of unpaid taxes. We did a refinance and basically got them to stay in their home. It didn’t make much money for us but it got a family to save their house. They fell behind in their taxes because they weren’t escrowed. They were thinking when notices came they could push them off. They got into

a low-price mortgage with no escrow. We were able to refinance them with their escrows, taxes, and insurance for lower than the payment they were in even with the higher market rates. They are actually saving money.

What else was interesting about the deal?

Now we have everything escrowed. The taxes are escrowed. The insurance is taken care of. We had to stretch their loan out but they were able to stay in their home. If they do decide to sell or refinance, they can. We try to go above and beyond and help people and we develop relationships. n

Business: CorePlus Credit Union

Home Loan Specialist

Have a great story about your best deal? We’re not talking about your biggest deal. We want to hear about your best deal — the one that resonates with you personally, the one that became the story you’ve told again about why you’re in this business. Head over to https://nmplink.com/bestdeal and tell us the details. You could win a $100 Amazon gift card if your story is selected for publication. WIN a $100 Amazon gift card! 24 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. Florida’s top gathering for mortgage pros. MAY 30 TAMPA, FL Embassy Suites Tampa 3705 Spectrum Blvd, Tampa Scan here to register for FREE (promo code MBMFREE) or go to WWW.SUNCOASTMORTGAGEEXPO.COM Join us for the third annual Suncoast Mortgage Expo in sunny Florida that will motivate originators, drive your business forward with new tools, and energize and educate on ways to propel volume to new heights. What better place to take a break from the daily grind? Take a day to recharge in a beautiful location and head back to the office with a fresh perspective, new tools and new connections made at Suncoast Mortgage Expo! This valuable, one-day conference is dedicated to helping originators grow and succeed. Interesting sessions, interactive discussions and networking opportunities and an exciting show floor filled with service providers who want to help you – it’s all at Suncoast Mortgage Expo!

Top Non-Bank Mortgage Lenders Rise Amid Consolidation, Eye Volume Rebound

Amid a landscape of consolidation and exits by smaller players, the largest non-bank mortgage lenders in the U.S. are steadily increasing their market share, buoyed by robust franchises and scalability. Low origination volumes and squeezed margins have prompted many smaller originators to withdraw, with further consolidation anticipated as profitability remains constrained. The largest originators, fortified by their market positions and adeptness at managing rate hikes, are poised to capitalize on the anticipated resurgence in origination volumes. Employment in the non-bank mortgage sector has declined sharply, reflecting the industry's challenging conditions.

Leading market players, bolstered by technological prowess, diversified revenue streams, and manageable leverage, are positioned to maintain and expand their market share, particularly in the correspondent and broker channels. Notably, United Wholesale Mortgage (UWM) and PennyMac Financial (PFSI) have emerged as dominant forces in wholesale-broker and correspondent origination, respectively. UWM's market share surged to 48%, while PFSI captured 22% of the correspondent channel in 2023.

The industry's capacity reduction has been pronounced, with significant exits observed among players like Fairway, Citizens Bank, and loanDepot.

HomePoint and Wells Fargo also made notable exits, reflecting the sector's challenging operating environment. While interest rate forecasts suggest modest declines, the persistently high rates have dampened mortgage origination volumes, with refinance and purchase originations down significantly year-over-year.

Looking ahead, the industry faces ongoing challenges, but optimized cost structures and the potential for volume recovery offer prospects for improved profitability. Despite the headwinds, leading mortgage lenders are expected to maintain their dominance, leveraging their market positions and operational efficiencies to navigate the evolving landscape.

Total Originations ($ in bils) 2022 2023 YoY Change Mkt Share 2022 Mkt Share 2023 1 United Wholesale Mortgage $127.3 $107.9 -15% 5.5% 7.8% 2 PennyMac Financial $108.9 $98.5 -10% 4.7% 7.1% 3 Rocket Mortgage $133.1 $79.9 -40% 5.7% 5.8% 4 AmeriHome Mortgage $47.2 $41.7 -12% 2.0% 3.0% 5 Chase $81.8 $41.4 -49% 3.5% 3.0% 6 U.S. Bank Home Mortgage $56.6 $37.7 -33% 2.4% 2.7% 7 NewRez/Caliber $67.6 $36.5 -46% 2.9% 2.6% 8 Guaranteed Rate Inc. $53.4 $34.4 -36% 2.3% 2.5% 9 Fairway Independent Mortgage $41.9 $27.5 -34% 1.8% 2.0% 10 CrossCountry Mortgage $35.5 $26.2 -26% 1.5% 1.9% Total market originations $2,325 $1,380 -41% Market share — Top 5 24.1% 26.8% Market share —Top 10 36.0% 38.5% 26 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

Total Originations

Note: purchase + refinance = total originations Source: Fitch Ratings.: Inside Mortgage Finance, Copyright 2024

DATABANK Refi Originations Refi Originations ($ in bils) 2022 2023 YoY Change Mkt Share 2022 Mkt Share 2023 1 Rocket Mortgage $84.7 $32.4 -62% 11.7% 16.9% 2 United Wholesale Mortgage $36.5 $13.7 -62% 5.1% 7.2% 3 PennyMac Financial $29.9 $9.6 -68% 4.1% 5.0% 4 Chase $32.8 $7.6 -77% 4.5% 4.0% 5 loanDepot.com $24.4 $5.7 -77% 3.4% 2.9% 6 Mr. Cooper Group $18.9 $5.4 -72% 2.6% 2.8% 7 NewRez/Caliber $20.5 $4.8 -76% 2.8% 2.5% 8 Wells Fargo $36.0 $4.5 -88% 5.0% 2.3% 9 Freedom Mortgage $16.4 $4.5 -73% 2.3% 2.3% 10 AmeriHome Mortgage $16.4 $3.8 -77% 2.3% 2.0% Market refi originations $721.0 $192.0 -73% Market share — Top 5 30.5% 35.9% Market share —Top 10 44.6% 47.9% Purchase Originations Purchase Originations ($ in bils) 2022 2023 YoY Change Mkt Share 2022 Mkt Share 2023 1 United Wholesale Mortgage $90.8 $94.2 4% 6.1% 7.9% 2 PennyMac Financial $79.1 $89.2 13% 5.3% 7.5% 3 Rocket Mortgage $48.4 $47.5 -2% 3.2% 4.0% 4 AmeriHome Mortgage $35.7 $37.9 6% 2.4% 3.2% 5 U.S. Bank Home Mortgage $44.9 $35.2 -22% 3.0% 3.0% 6 Chase $48.9 $33.8 -31% 3.3% 2.8% 7 Guaranteed Rate Inc. $44.5 $32.8 -26% 3.0% 2.8% 8 NewRez/Caliber $47.1 $32.0 -32% 3.2% 2.7% 9 Fairway Independent Mortgage $35.2 $24.8 -30% 2.4% 2.1% 10 CrossCountry Mortgage $20.4 $23.4 15% 1.4% 2.0% Market purchase originations $1,494 $1,188.0 -20% Market share — Top 5 22.7% 25.6% Market share —Top 10 36.6% 37.9%

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 27

Welcome to The Greatest Mortgage Conference In The Known Universe.

The Originator Connect Conference is the nation’s largest gathering of mortgage professionals, and it returns to Planet Hollywood in Las Vegas this August 15-18 for another fantastic, session-packed event.

Originators attend for FREE using code NMPFREE.

TITLE SPONSOR

BROKER BUSINESS IS BUILT ORIGINATORCONNECT.COM AUG 15 AUG 18 HERE.

PRODUCED BY THE ORIGINATOR CONNECT NETWORK 28 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

FRIDAY NIGHT RECEPTION

FEATURING THESE EXCLUSIVE EVENTS:

& A CAN’T-MISS NETWORKING PARTY

*Complimentary registration available to NMLS-licensed active LOs and their support staff. Show producers reserve the right to determine final eligibility. NMLS Renewal class open to conference attendees only. Exclusive events and networking party are open to registered attendees only. +FREE NMLS RENEWAL CLASS

THE NEWCOMER’S BLUEPRINT FOR SUCCESS

30 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

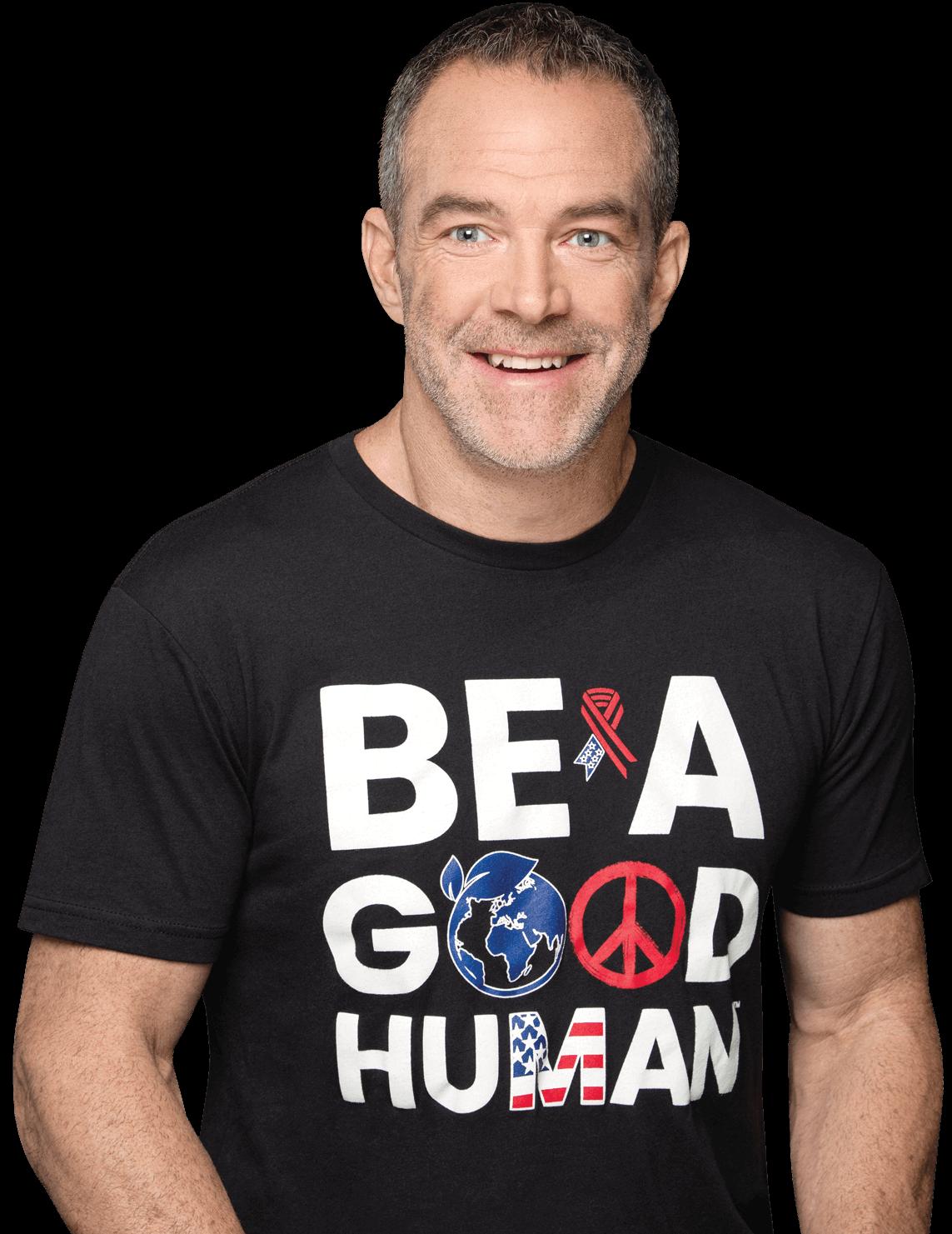

> Tony Zerwas, originator, Edge Loan Finance

How far basic principles and strategies can take any MLO

BY KATIE JENSEN, STAFF WRITER, NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

High interest rates, low housing inventory, and mass layoffs raking through the industry are not considered a recipe for success, but could they be? For those who are pessimistic about what can be achieved in a down market, especially for new originators, meet Tony Zerwas, a Minnesota-based originator for Edge Home Finance, who churned out more loans in his first year than some originators who’ve had decades of experience.

His numbers speak for themselves:

$12.35 million in loan volume and 45 units total in his first 12 months as a loan originator, from September 2022 to September 2023. His pace for closing continues to improve, accomplishing $22 million in loans and 69 units total from January 2023 to January 2024.

for Zerwas to find his own niche in doing VA loans, which allowed him to build a positive reputation among a community of borrowers. The rest happened naturally, with him setting up his own brand, Leverage Lending Team.

It may be hard for some originators to believe basic strategies, like using social media, will continue working in a tough market. But there’s no special product, technology, or lead generation tactic

awry without the client knowing,” Zerwas said. “I think a lot of folks think that we get the application, we get a contract, we click a couple buttons, and onto the next one. And that’s not the case.”

After leaving his police career, Zerwas was recommended by an acquaintance to join Edge Home Finance. He soaked up as much knowledge as possible, starting out as a loan officer assistant to an originator who acted as his mentor and was provided additional resources for training by Edge.

“I think a lot of people overthink social media, and they try to make the perfect post, graphic, or video. Just make the post. It’s not gonna be perfect.”

> Tony Zerwas, originator, Edge Loan Finance

that propelled Zerwas to reach a higher volume. Nothing but a few skills in his arsenal and a simple blueprint that can help any originator’s business grow.

Now, some originators may be thinking that’s an impressive start for a newbie, so how does he do it? Inquirers call him wanting to know whether he buys leads or uses some secret technique to lure in their business.

“No one believes me when I say this,” Zerwas said. “I actually have people argue with me. Everyone’s like, ‘No, really, what are you doing? Are you buying leads?’ No, just go on my Facebook. That is what I’m doing.”

However, Zerwas insists that he follows a simple blueprint for success. He worked as a loan officer assistant (LOA) under a mentor for only a month, focusing mainly on learning the loan process. He then taught himself to use social media as a marketing and leadgeneration tool. It also didn’t take long

FIGHTING BEHIND THE SCENES

Though it’s not the same kind of fighting Zerwas would see during his former career as a police officer, he can attest that a fair amount of fighting happens during the mortgage process before closing.

Admittedly, Zerwas was surprised to learn how intricate and complex the mortgage process was, as most borrowers would be if they stepped behind the curtain and onto the back stage. But Zerwas learned that keeping that curtain open is a huge part of the job to make the client believe that this process is going to be simple.

“I had no idea, before working in this job, how many times a transaction goes

If anyone were to follow Zerwas’s blueprint, they’d start by applying to companies that offer a strong training program and value new talent.

“I don’t think that I would’ve had this success without Edge’s support,” Zerwas said. “We have a culture here that I really enjoy that’s built on giver’s gain and helping each other out.”

DESIRE FOR EFFICIENCY

Zerwas has excessive drive and determination. Ever since childhood, he dreamt of becoming a police officer. Unlike how many of those stories end, he eventually achieved a position in law enforcement in 2015 while serving in the Air National Guard between 2007 and 2019.

“I got three degrees, up to a master’s degree, all in public safety and law enforcement. I thought that that’s what was going to be my career,” Zerwas said. It was for a while, but not one that would sustain his interest throughout most of his life, as he once thought.

In 2020, Zerwas was terminated from the Wyoming (Minnesota) Police

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 31

Department for a policy violation, which he phrased as “a split-second decision.” Zerwas recounted the situation, saying that the suspect he just arrested had jerked away from him, leading him to believe the suspect was resisting or looking to fight. Zerwas quickly took him down.

“Knowing the end result, I would have done it differently,” Zerwas said. “I always prided myself on how I treated people.”

He went to work for a separate police department in 2021, but said he had already lost his passion for the field. He desired a career that would appreciate people who were innovative, independent, and willing to go the extra mile.

“Looking back, it seems to me like government work doesn’t really appreciate innovation or putting in that extra mile,” Zerwas said. “My supervisors were very appreciative of the work, but the entity as a whole just, you know, it didn’t seem like the hard work mattered.”

‘BET ON MYSELF’

Following his departure from law enforcement, Zerwas was somewhat lost professionally. He tried to apprentice as an electrician, but the physical aspect was too much for some preexisting injuries. He also didn’t appreciate slowerpaced work, which was his issue as an assistant superintendent for a country club.

“After experiencing everything and working for the government for so long, it just seemed like effort didn’t equal the result, and it was time to bet on myself,” Zerwas said.

honing in on VA loans.

When Zerwas went to purchase his first home using a VA loan, he remembers being shot down by two lenders before finding a third that was well-versed in that product and got him through to closing.

“When I decided to get into mortgage, I remembered that and thought to myself, ‘How many veterans are being told no, and [are] just giving up?’ ” Zerwas said.

One transaction in particular that Zerwas highlighted as his favorite was for a fellow veteran based in Minnesota. The borrower was meant to close on a house in two weeks before leaving for an overseas deployment. But the borrower’s original lender announced at the last minute that they were no longer lending in that state, leaving him and his family high and dry.

“There was a lot riding on that,” Zerwas said. “His wife and kids were going to be homeless. Plus, everything that could have gone wrong to make this work went wrong. But, you know, we really grouped together, and we got it done.”

Following that, Zerwas began developing a reputation for working with veterans.

“I had a client — I think it was in October we closed — and that listing agent specifically said that they selected our offer because my name was on the paper,” Zerwas said. “They know that if my name’s on the paper, it’s gonna close.”

Zerwas loves the rush of adrenaline in trying to get a deal closed.

“Because let’s face it, there’s gonna be stress involved no matter how easy the transaction is. I think I’m good at managing that stress by trying to anticipate pain points and eliminate them for the client,” Zerwas said.

Tom Ahles, chief growth officer for Edge Home Finance, interviewed Zerwas, along with hundreds of others for the job. Over the course of a year, Edge Home grew from a staff of roughly 450 employees to 1,100. Asked whether he could tell during an interview whether someone would excel at originating or not, he said there really isn’t a tell.

“We hired a lot of people, some of whom I thought would be great that weren’t, some whom I didn’t think would be outstanding that are outstanding,” Ahles said. “He just works hard. He’s smart, and he cares.”

DISCOVERING A NICHE

Seasoned originators often say it’s better to discover a niche organically than seek one out. Being a veteran of the Air National Guard naturally led Zerwas to working with veterans and

Besides sharing military experience with his borrowers, his skills are especially appreciated within that community. Because some VA borrowers may be deploying soon or are currently deployed, they’re not always accessible. Zerwas believes that’s why veterans appreciate speed, efficiency, and having an originator who is competent enough to trust.

DIFFERENTIATE

Creating an independent brand is seen more as an option for overachievers than a necessity, except in Zerwas’s case. For him, it was to avoid confusion with another mortgage originator who had the same first, middle, and last name, lived just a half hour away, and worked for Guaranteed Rate.

“If anyone tries to Google me to use my services, you know, he’s been doing this for like 10 years, so he’s gonna get my leads. So I figured if I branded myself this way, people would be able to find me more directly,” Zerwas said.

It’s a bizarre coincidence and likely the most unique reason for starting one’s own brand, but it forced Zerwas to take that extra step, thereby separating himself from not only his doppelganger but from every other originator in his area. And like his approach to social media, his vision for the brand, Leverage Lending Team, was plain and simple.

The website is neatly formatted and easy to navigate with his picture, name, NMLS number, and contact

32 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

“I had no idea, before working in this job, how many times a transaction goes awry without the client knowing.”

> Tony Zerwas

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024 | 33

information all laid out on the homepage as the first thing people see when they click on his site.

His best assets and his niche for VA loans are both highlighted on his site as well.

On the homepage of his website is a quote from a customer’s five-star review saying, “Great Mortgage broker! Has a large presence with VA buyers,” while another emphasizes his best skills, saying he is “very informative” and “makes the mortgage process seamless.”

“I just knew vision-wise I wanted to convey to people that I am here to be a resource and be helpful. And anything that comes from that is great,” Zerwas said. His message is pretty cut and dry, much like how borrowers want their mortgage process to be.

As for his advice to other originators just entering the industry: “Before you look for training and before you look for mentorships, look within. No one can teach drive, no one can teach curiosity. Those things are very important — those are the folks who are gonna be successful.”

FORMULA FOR SUCCESS

Other than his determined attitude, Zerwas’s steps in learning and developing his skills can also be used as a basic formula for anyone starting out as an originator.

Regarding what originators need to learn first, Zerwas said it depends on the person and what skills they already have in their arsenal. By figuring out which skills you are already proficient at or have an instinct for, you will not have to waste money or time on taking classes dedicated to those topics.

For Zerwas, that skill was using social media to generate leads and promote his business. Since he was already active on Facebook before becoming an originator, he felt comfortable enough to figure out how to use it for his business, which ended up saving him money otherwise spent on social media mastery classes.

“People call and ask how are you doing this business? And I tell them to add me on Facebook and watch what I post because that’s all I do,” Zerwas said. “I add Realtors on Facebook and I post content.”

His Facebook account has 4,300 followers, which he said is enough to get him all the referral connections and clients he has today. Although people often don’t believe him and will accuse him of buying leads, Zerwas firmly stands by the fact he does not make cold calls and rarely sends out cold messages.

“Obviously, I post a good amount of educational content on mortgages, but I don’t post only mortgage-related stuff on my socials. I talk more about my family,” Zerwas said. “I think a lot of people overthink social media, and they try to make the perfect post, graphic, or video. Just make the post. It’s not gonna be perfect.”

As for what training he did need, Zerwas said the most helpful course for new originators to take is on the complete loan process, where he was able to learn the minutiae of structuring a loan. He said that being an expert in how the loan process and products work — which are the basics every originator should know — is what allowed Zerwas to sound competent and therefore trustworthy to clients and referral partners.

“If you don’t structure your file correctly and you get approved eligible findings … the deal’s dead,” he said. “So without working in the industry, you don’t know what you don’t know.” n

34 | NATIONAL MORTGAGE PROFESSIONAL MAGAZINE | MAY 2024

Picture your dream home. Now look down. There’s a bright red line keeping you out. Join host Katie Jensen as we dive into redlining and the legacy of discrimination. You’ll hear first-hand accounts from those who’ve had to fight back to achieve their dreams. And we’ll challenge industry leaders on how to rewrite this legacy.

Listen by following the link or by subscribing wherever you get your podcasts.