Texas is one big state, and it takes a big reach to keep its mortgage origination pros in the game. Only Lone Star LO gets the job done. We round up the data, insight and products that let Texans win the mortgage rodeo.

Vincent M. Valvo

CEO, PUBLISHER, EDITOR-IN-CHIEF

Beverly Bolnick

ASSOCIATE PUBLISHER

Sarah Wolak EDITOR

Katie Jensen, Erica Drzewiecki, Ryan Kingsley

STAFF WRITERS

Alison Valvo

DIRECTOR OF STRATEGIC GROWTH

Julie Carmichael

PROJECT MANAGER

Meghan Hogan

DESIGN MANAGER

Christopher Wallace, Stacy Murray

GRAPHIC DESIGN MANAGERS

Navindra Persaud

DIRECTOR OF EVENTS

William Valvo

UX DESIGN DIRECTOR

Andrew Berman

HEAD OF CUSTOMER OUTREACH AND ENGAGEMENT

Matthew Mullins, Krystina Coffey

MULTIMEDIA SPECIALISTS

Alan Nero

MEDIA SPECIALIST

Melissa Pianin

MARKETING & EVENTS ASSOCIATE

Kristie Woods-Lindig

ONLINE ENGAGEMENT SPECIALIST

Nicole Coughlin

ADVERTISING ASSOCIATE

Lydia Griffin

MARKETING INTERN

These days in the mortgage industry, a lot of “F” words are getting tossed around. “Frantic” is one. “Frenetic” follows suit. “Frightful” keeps reappearing. And, too many times, “failed” is the word of the day.

But there’s another “F” word that also keeps flexing its muscle: Fighter.

Think of the frigates of old, where storms were an inevitability and crews had to brave through severe conditions to keep their ships afloat. Lashed by wind and water – the very elements that propelled them to fortune – the hands on deck would work furiously to trim sails, secure the holds and keep the vessel from flailing uncontrollably through the seas. That’s not unlike what’s been happening in the mortgage world. The interest rate ocean, once calm and comforting, has become an undulating menace, while gusts of buyers who once gave speed to the market now are in the doldrums.

It's enough to make anyone fearful.

The promise of substantial interest rate reduction seems continually out of reach. The real estate sales market was already in a dread state before the National Association of Realtors agreed to a legal

settlement that will upend how consumers purchase homes. The government seems helpless to institute programs or policies to buttress the residential real estate market in its time of need. Where once home financing was a feast, it's now famine.

And yet …

When we look around, we see those in the industry who are fighting these elemental forces and winning. There are rookies putting up substantial sales numbers because they never got stuck in the old ways. There are mavens who are making bank because they’ve been through stormy markets before and are confident in the skills they’ve learned to succeed.

Here, we tell those stories. We feature those whose fortitude inspires and motivates. In our work life, these are our friends and family, the ones we can lean on and learn from, the ones who help us find the way.

Eventually, all storms ebb, and the one tossing the mortgage market will, too. Together, we will stay ready as this market finds its footing. And when it does, the future will no longer look quite so forbidding. It won't be long, frankly, before the “F” word we’re using is “fantastic.”

VINCENT M. VALVO CEO, Publisher, Editor-in-Chief vvalvo@ambizmedia.com

VINCENT M. VALVO CEO, Publisher, Editor-in-Chief vvalvo@ambizmedia.com

Lone Star News Roundup

A look at the news that’s important for the mortgage industry across the state of Texas.

Not All Title Companies Play Equal

Title-company-affiliated law firms could mar loan transactions.

DPA Isn't Out Of Reach

Texas’ array of down payment assistance programs swoop in and salvage deals.

10

Going the Unconventional Route

At the peak of her career, Jennifer Guidry decided to stop originating and test out a new path.

Opening The Homeownership Arena

Texas down-payment assistance programs unlock potential for would-be buyers.

People On The Move

A Roundup of Texans landing new jobs or being awarded promotions.

The LO Down

Learn some facts about the leading real estate markets in Texas.

Events Calendar

Connect and learn from the very best in the business.

Tuesday, June 11, 2024 Courtyard by Marriott San Antonio

Ultimate Mortgage Expo — New Orleans

Wednesday, July 10, 2024 Hotel Monteleone

Thursday, September 5, 2024 DoubleTree by Hilton Dallas Galleria

Housing manufacturers in Texas reported a surge in sales, per the January Texas Manufactured Housing Survey (TMHS). The increase follows a two-month slump in new orders, and shortly after housing manufacturers accelerated hiring activity in preparation for a comeback. As a result, the TMHS labor-cost-expectations index hovered around a two-year high amid preparations for increased demand.

“Manufacturers are showing a lot of optimism with orders, backlogs, and hiring expectations over the next six months all hitting series highs in the TMHS,” said Rob Ripperda, vice president of operations for the Texas Manufactured Housing Association. “Production pulled back sharply in the back half of 2022 and through the first quarter of 2023, but since then run rates have increased for ten straight months. Plant managers feel the trend should continue as the spring selling season begins.”

Higher run rates coincided with a ten-month payroll expansion as reflected in the TMHS.

“As the overall labor market is stabilizing from the post-pandemic boom, housing manufacturers are finding a larger pool of potential workers,” said Wes Miller, senior research associate at the Texas Real Estate Research Center at Texas A&M University (TRERC).

Continued Miller, “Manufacturers are expanding operations without straining the number of hours worked per employee. Wages and salaries have also been relatively stable across the industry for about a year, but there

appears to be upward pressure on the horizon.”

The price of raw materials for manufactured housing started inching up in November after a series of outlandish supply shocks.

“As the overall labor market is stabilizing from the post-pandemic boom, housing manufacturers are finding a larger pool of potential workers.”

> Wes Miller, senior research associate, Texas Real Estate Research Center at Texas A&M University

“Residential material costs are signaling a reversal in their downward trend,” noted TRERC Research Economist Harold Hunt, Ph.D. “After showing an annual decline of almost four percent in June, the St. Louis Federal Reserve’s Producer Price Index for residential construction inputs has turned positive.”

San Antonio-based Frost Bank received 34 Greenwich Excellence and Best Brand Awards – the highest

amount received nationwide for the eighth consecutive year – for providing superior service, advice and performance to small-business and middle-market banking clients. The Greenwich Excellence and Best Brand Awards are awarded annually by Coalition Greenwich, a global researchbased consulting firm in the financial services industry. Coalition Greenwich based the awards on interviews with thousands of executives across the country.

Frost is the only Texas-based bank to receive national recognition for “Overall Satisfaction” and “Likelihood to Recommend” in both the middlemarket and small-business banking categories. This marks the 19th consecutive year that Frost has been recognized by Coalition Greenwich. The 34 awards Frost received for 2023 were nearly evenly split between the middle-market segment (16) and the small-business segment (18).

“We say it often: Frost has the best bankers in the business, and that’s reflected in these awards,” said Frost Chairman and CEO Phil Green. “I’m especially proud of the fact that as we have grown and expanded into new markets, our team has continued providing the highest level of customer service in ways that make people’s lives better.”

Frost received Greenwich Awards in Small Business Banking for:

• Best Brand – Ease of Doing Business

• Best Brand – Trust

• Best Brand – Values Long-Term Relationship

• Likelihood to Recommend – National

• Overall Satisfaction – National

• Overall Satisfaction with Relationship Manager – National

• Data and Analytics-Driven Insights –

National

• Relationship Manager Proactively Provides Advice – National

• Industry Understanding – National

• Cash Management – Customer Service – National

• Cash Management – Ease of Product Implementation – National

• Cash Management – Overall Satisfaction – National

• Cash Management Overall Satisfaction – West Region

• Overall Satisfaction – West Region

• Likelihood to Recommend – West Region

• Relationship Manager Proactively Provides Advice – West Region

Frost received Greenwich Awards in Middle Market Banking for:

• Best Brand – Ease of Doing Business

• Best Brand – Trust

• Best Brand – Values Long-Term Relationship

• Overall Satisfaction – National

• Likelihood to Recommend – National

• Overall Satisfaction with Relationship Manager – National

• Relationship Manager Proactively Provides Advice – National

• Industry Understanding – National

• Data and Analytics-Driven Insights –National

• Cash Management – Overall Satisfaction – National

• Cash Management – Customer Service – National

• Cash Management – Ease of Product Implementation

• Cash Management – Product Capabilities – National

• Cash Management – Making Commercial Payments Easier –National

• Overall Satisfaction – West Region

• Likelihood to Recommend – West Region

• Relationship Manager Proactively Provides Advice – West Region

• Cash Management – Overall Satisfaction – West Region

January marked a 12.5% surge in preowned home sales in North Texas – the first year-over-year increase in nearly two years. This rise follows a nearly 9% decline in home purchases throughout 2023, as reported by the Texas Real Estate Research Center at Texas A&M University, North Texas Real Estate Information Services, and the MetroTexas Association of Realtors. Real estate agents in North Texas managed to sell 5,335 homes in

Months

of inventory rose from 2.6 months at the end of 2022 to 3.4 months by the end of 2023, as reported by

Texas Realtors.

January. “We are seeing a consistent increase in activity due to the interest rates dropping,” said Jim Fite, CEO of Dallas-based Century 21 Judge Fite Co.

Declines in mortgage rates, which peaked near 8% this summer, have sparked sales, per Dallas housing analyst Ted Wilson with Residential Strategies.

“The decline of the 30-year mortgage rate to near 6.6% has been welcomed news for prospective homebuyers,” Wilson said. “The housing industry remains watchful of future rate cuts by the Federal Reserve, and hopeful that this leads to a further decline in the 30-year mortgage rate toward 6%.

Continued Wilson, “Such a move would improve housing affordability and stimulate additional increases in housing activity.”

The biggest annual increase in January sales was in Kaufman County, where the number of homes sold rose 26.2% from January 2023. In Collin County, sales were up 20.5% year-overyear.

New York-based Haus Capital Corporation recently announced a strategic partnership with Calque to provide The Trade-In Mortgage. This collaboration combines the expertise and resources of both companies to create a seamless and convenient option for homeowners looking to upgrade to a new home.

The Trade-In Mortgage allows homeowners to use their current home’s equity as a down payment for their next home, enabling buyers to make competitive non-contingent offers, akin to cash, in today’s competitive real estate market. Buyers can purchase and move into their new home before selling their current one, streamlining the entire moving process for buyers and their families.

“Haus identified Calque as an

innovative solution for homebuyers in a challenging housing market complicated by high-interest rates and limited inventory,” said Samuel DiPiano, president and founder of Haus Capital Corporation. “While homeowners are experiencing record high levels of home equity, they can utilize tools like the Trade-In Mortgage to acquire their next property.

Homeowners can easily purchase and relocate to their new home before selling their current one.”

operating officer at Calque. “Haus is dedicated to prioritizing their customers, and the Trade-In Mortgage offers a superior home buying experience for homeowners who want to tap the equity in their current property to help purchase their next one.”

In Texas, the average maximum price that Black renters can afford for a home is $166,930, compared to nearly $222,000 for white renters

and $179,000 for Latino renters, per the National Association of REALTORS

The collaboration between Haus Capital Corporation and Austinbased Calque benefits homeowners and boosts the real estate market by stimulating more buying and selling activity.

“Calque found an ideal partner with Haus,” said Dan Mugge, chief

According to a report by the National Association of Realtors (NAR), Asian and Latino communities in Texas are experiencing significant increases in homeownership, while Black homeownership continues to lag. The February 20 report highlights that Asians and Latinos in Texas have reached ownership rates of 66% and 59% respectively, reflecting a growing trend among U.S. minorities. In contrast, the rate of Black homeownership in Texas stands at 41%, while white homeownership is at 69%, slightly below the national average of 72%.

Nationally, the Asian community has shown the most substantial increase in home ownership, with a rate of 63.3% in 2021, according to NAR. This trend occurs amidst rising interest rates and record-high home ownership costs, driven by relatively stable home prices but increased borrowing expenses.

Despite the decline in mortgage affordability throughout the last two years, said Orphe Divounguy, a senior economist at Zillow, millions of families have the means to afford a mortgage, the largest share of a homeowner’s cost.

“It’s crucial to recognize the existence of additional barriers beyond monthly cost, including access to funds for a down payment and closing costs — as well as other barriers that significantly contribute to mortgage denials, like insufficient credit scores

and lack of access to credit. These barriers especially impact people of color,” Divoungyuy said.

In Texas, the average maximum price that Black renters can afford for a home is $166,930, compared to nearly $222,000 for white renters and $179,000 for Latino renters. Asian renters have the highest purchasing power, with an average affordability of homes costing upwards of $298,000.

The rate of Latino homeownership in Texas rose to 51.1%, while Black homeownership increased to 44.1%, and white homeownership rates slightly declined to 72%.

While Texas home sales declined nearly 11% in 2023, median prices remained relatively stable across most markets, as reported in the 2023 Texas Real Estate Year in Review released by Texas Realtors on March 12.

The decrease in home sales, totaling 327,921, marked the lowest since 2016, attributed to higher mortgage rates deterring some buyers. Despite a 1.4% dip in the statewide median price to $335,100 compared to the previous year, more metropolitan areas experienced price increases rather than decreases.

Jef Conn, chairman of Texas Realtors, noted, “Although higher mortgage rates dampened buyer activity last year, there’s significant pent-up demand.”

Continued Conn, “Sales have already shown improvement early this year, hinting at an active spring market ahead.”

Months of inventory, a measure indicating how long it would take to sell all homes currently on the

“Sales have already shown improvement early this year, hinting at an active spring market ahead.”

Statewide, homes had an average time on the market of 55 days, 20 days longer than in 2022.

The price per square foot increased by 0.1% statewide, with rises seen in every market except for Austin-Round Rock and San Antonio-New Braunfels. El Paso and the Rio Grande Valley recorded the largest increases in price per square foot.

“Despite challenges posed by

Most of us are unfortunate enough to experience the heartbreaking loss of a client to a “big box” builder’s “preferred lender” and the frustration these situations bring. They offer tens of thousands of dollars in price reductions, paid closing costs, and rate buydowns that the average lenders or brokers can’t even come close to. I have seen great clients leave me at the altar when dazzled by these builder incentives. Some of these clients have been very close friends or people I spent months developing to get them to where they could be pre-approved. After having countless hours of hard work go down the drain and tens of thousands of dollars in hard-earned commissions slip through my fingertips, I had to change my mindset. If I wanted to beat these “preferred lenders” I first needed to understand how they operate. As the great Sun Tzu once said “To know your enemy, you must become your enemy”.

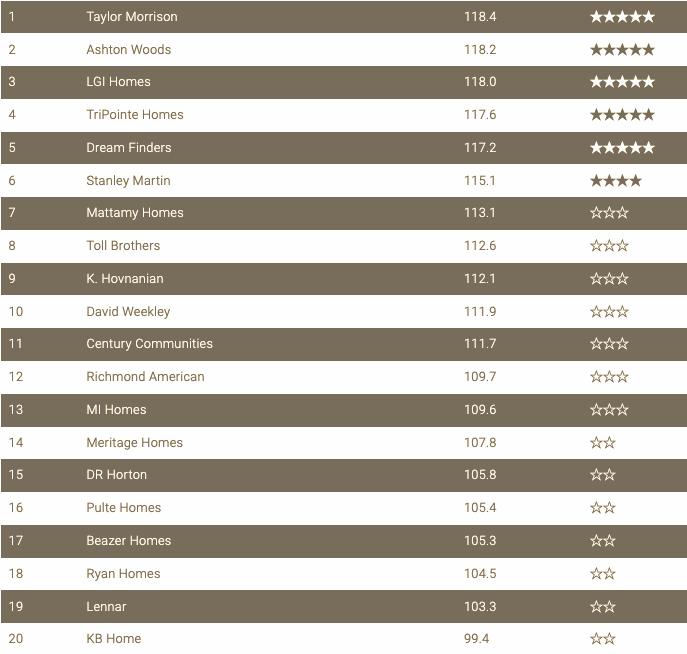

The Top 10 Builders by volume in America in 2023 according to Builderonline.com are listed to the right, in order from 1 ascending to 10:

Some of these have become household names (pun intended) and it’s no surprise considering this Top 10 list built a combined 276,941 closed units in 2022. Now just because these builders can slap some sticks together and throw some shingles in it doesn’t mean they are to be trusted or have quality craftsmanship.

According to Life Story, the chart on page 18 is the ranking of America’s Most Trusted Home Builders for 2023. As you can see these are the top 20 builders which rank from 5 Stars down to 2 Stars.

Are you surprised at the lower two-star ratings for some of the more familiar names like KB Homes, Lennar, Pulte, or D.R. Horton? As you can see the top three per unit builders are among the lowest rated from the list above, only three of the Top 10 per unit volume builders have a four or five-star rating and one of the builders has a threestar rating compared to the list above. So, what does this data tell us? I’ll leave you to unpack that.

These builders sometimes use pushy tactics to entice buyers to use their preferred lenders, but there is ALWAYS a cost. Let’s take a closer look at the pros and cons of using a home builder’s preferred lender.

• Convenience: The homebuilder’s preferred lender will already be familiar with the builder’s process, so the loan application and home buying process may be smoother and more streamlined.

• Incentives: Preferred lenders often offer incentives, such as lowered purchase prices,

closing cost assistance, or lower interest rates, which can save buyers money.

• Limited Options: While the builder’s preferred lender may offer incentives, they may not necessarily be the best lender for buyers. By limiting buyers to the builder’s preferred lender, they may miss out on better rates and terms from competing lenders. Some preferred lenders don’t offer FHA or VA options to buyers and usually don’t have irregular income options like 1099, Bank Statement, or P&L loans.

• Higher Fees: The builder’s preferred lender may charge higher fees and closing costs than other lenders can add up quickly and be used to eat up those incentives.

• Poor Service: Often the preferred lender is cranking out loans beyond a manageable and sustainable volume. I’ve heard stories from buyers of the wrong loan type being set up, not even having a conversation with their Loan Officer, and receiving service that is just unacceptable in my opinion.

It’s pretty simple actually. Often there is a corporate parent that owns the builder, the preferred lender, and the title company buyers are pressured to use or they have an affiliate business arrangement between these parties. They jack up the interest rates and fees, completely control their own market, and generate massive profits. Sure they shave a little off each side of the business to give the illusion of massive savings but it’s no different than them telling you the price of something costs $100, it’s only worth $50 and they give you $50 back.

This is nothing but a modern-day scam and, dare I say, a form of price fixing, which is illegal according to the Federal

Trade Commission. We’re dealing with megacorporations amid a housing inventory crisis in the US, so I don’t see this issue getting much attention on Capitol Hill any time soon.

Let’s first talk about how to handle the client and the buyer’s agent. You’ll want to see the builder’s offer in writing to read the “fine print.” If you’ve provided good service to your client this should be easy for you to obtain. You can read through the offer to see if anything tricky or sticky stands out. I ask myself, “Would I personally take this deal?” If the answer is yes and you can’t compete, it’s time to let it go gracefully. I usually reach out to the buyer’s agent first. If they aren’t already aware, which they usually are, I inform them. I congratulate them, let them know I understand they are doing what they think is best for their buyer, and let them know we can make it up on the next one. I then call my client and congratulate them. I tell them that I’d be a bad advisor if I didn’t tell them to take advantage of these incentives, I’m happy to review any documents, and I will keep their file open in case something goes sideways. In turn, I ask for them to please let me know when they close so I can close out their file. I may not be their loan officer on this transaction, but I’m still their mortgage advisor for life. I thank them for the opportunity and double down on asking for referrals to make up for the time, effort, and care put into them. Most people will genuinely appreciate this approach and it could very well turn into more business for you in the future.

Now let’s talk about taking a page out of their book. Not all builders are mega-corporations and all builders should have a preferred lender. I have personally leveraged my correspondent programs to offer Builder Preferred Lender Programs to help boutique, costume, and luxury builders better market their homes. I offer up to a $10,000 lender credit (tiered out based on

the loan amount) to be used for a rate buydown and/or closing costs. Not a $10,000 lender credit has to be a pretty significant loan amount. Guess what? This is 100% compliant and legal. This approach has earned me relationships, trust, and connections with a whole new group of potential clients and has referral sources. Not only does this open up potential commercial business opportunities with these builders but also access to higherend realtors, clients, and loan amounts with extremely high commission payouts. I’m currently the preferred lender in a $3.3M listing, a $1.7M listing, and a $1.3m listing. I have personal loans in processing for three of my builders and have received several referrals from my builder’s preferred realtors. You know what they say. If you can’t beat them, join them!

“

Every time I’ve lost one of these deals, within minutes, hours, or days, the phone rings with a new opportunity.

At the end of the day, nothing can take away the sting of hard work and potential commissions wasted. It’s important to embrace the emotions that come along with these losses. My rule when this happens is to get angry. I get mad! But I only allow myself to feel those emotions for five minutes. Then I move on. Every time I’ve lost one of these deals, within minutes, hours, or days, the phone rings with a new opportunity. Turn those negative emotions into productive energy. Get creative and learn to play their game, but play it your way. LSLO

Gene

Griffin, Sr. is a mortgage advisor with Summit Mortgage Solutions.

Welcome to The Greatest Mortgage Conference In The Known Universe.

The Originator Connect Conference is the nation’s largest gathering of mortgage professionals, and it returns to Planet Hollywood in Las Vegas this August 15-18 for another fantastic, session-packed event.

LSLOFREE.

Originators attend for FREE using code MBMFREE. TITLE SPONSOR

FRIDAY NIGHT

FEATURING THESE EXCLUSIVE EVENTS:

Lenders new to the Texas market are often surprised that Texas law requires mortgage loan closing documents to be prepared (or reviewed) by a Texas-licensed attorney. Sometimes lenders entering the Texas market will ask a title company for a recommendation and the title company will recommend a law firm that is owned or controlled by the same attorneys that have an ownership interest in the title company. This arrangement with a title-company-affiliated law firm raises two large concerns for lenders to consider before hiring them. First, it creates a conflict of interest because the law firm's loyalty to the title company might affect their ability to give unbiased advice to the lender about transactions the title company is involved in. Second, it is doubtful whether a law firm linked to a title company can

meet the independent counsel standard Texas law requires for preparing loan closing documents.

When a law firm is connected to a title company, there is a potential conflict of interest at any time that firm represents a lender in a deal the title company is insuring. In these situations, the lender should question if the law firm can give them fair advice and advocate in the strongest terms for the lender’s interests. This conflict happens because the title company and the lender are on opposite sides of the transaction. The title company aims to minimize its risk while collecting a premium on the title policies, while the lender wants a loan policy that provides maximum coverage and protection against potential losses. These goals often clash. To achieve its goal, the title company will generally seek to include as many exceptions to the lender’s policy as possible, which runs directly counter to the lender’s goal of having as few exceptions to its coverage as possible. Should the lender suffer a loss, its goal will be to make a successful claim under the title policy, whereas the title company’s goal will be to avoid responsibility if possible. For example, we commonly see title companies include exceptions on the title commitment that make the loan unsellable on the secondary market. One common exception is to the homestead rights of a third party—an unacceptable title impediment by Fannie Mae and Freddie Mac, and a significant risk to the lender’s lien. In such a scenario we will first attempt to negotiate with the title company to eliminate the exception or limit it to the owner’s policy. If that is unsuccessful, we will work with our client to find another title company that may be willing to insure without the exception, which of course means that the initial title company will lose out on the settlement fee and title insurance premium. We have also experienced title companies informing our clients that a loan is “okay to close” when there is an outstanding material legal defect. Why? Because that defect is not something that will be covered under the final loan policy.

This occurs with some regularity on 50(a)(6) home equity loans because the home equity endorsements do not cover loss due violations of “consumer protection laws” and several other requirements of 50(a)(6). Finally, we often assist clients in making claims under the lender’s title policy when a loss arises. Title companies frequently deny the lender’s initial claim, and we must then advocate on behalf of the lender to convince the title company to pay the claim. Such advocacy can include raising the potential for a lawsuit against the title company. We do not see how a title company-affiliated law firm can provide representation that is in the best interests of the lender when

the principals of such firm may suffer a financial loss should the lender be successful in its claim under the policy. For these reasons, we believe that lenders are best served by retaining independent counsel whose only financial interest in the transaction is based on its successful representation of the lender. A titleaffiliated law firm is simply NOT independent for the purpose of advising the lender.

Title-company-affiliated law firms may not comply with Texas’ legal requirements for preparing loan closing documents. In Texas, only attorneys licensed in the state are allowed to prepare loan closing documents, as stated in Section 83.001 of the Texas Government Code. This statute has been in place for a long time, and Texas courts have clarified that attorneys employed directly by a title company do not fulfill this requirement. One notable case is Hexter Title & Abstract Co. V. Grievance Committee, 142 Tex. 506, 179 S.W. 2d 946 (1944) where the Texas Supreme Court ruled that even if a corporation employs licensed lawyers to prepare documents, those lawyers act as agents of the corporation. This means their primary

loyalty lies with the corporation, not the client, and their actions are considered the actions of the corporation, which isn't allowed to practice law.

Likewise, a title company cannot establish a law firm in which the title company itself is a part owner so that such firm can prepare the loan closing packages and participate in the profits.

Such a scheme violates Rule 5.04 of the Texas Disciplinary Rules of Professional Conduct, which prohibits lawyers from splitting fees with non-lawyers. The Rule states that “a lawyer or law firm shall not share or promise to share legal fees with a non-lawyer.” Establishing such a relationship puts the lawyer or lawyers at risk of disciplinary action.

Even the establishment of a separate law firm (without the title company being an owner) may not provide sufficient independence to meet the requirements of Texas law when there is a substantial overlap of employees between the law firm and the title company. In Rattikin Title Co. v. Grievance Committee, 272 S.W.2d 948 (Tex. Civ. App. 1954), the court found that a title company that shared ownership, employees and office space with a law firm was engaged in the unauthorized practice of law, even though the law firm was ostensibly the one preparing the legal documents. The desire to streamline costs and

take advantage of economies of scale means that even today, many title companies run the risk of being found to be engaged in the unauthorized practice of law due to the intermingling of employees, computer systems, and management teams with those of its affiliated law firm. We have very rarely seen a title company-affiliated law firm that operates in total compliance with the requirements spelled out in the Rattikin case.

For these reasons, lenders should avoid engaging such a law firm owned and controlled by the same individuals that own the title company closing the loan and issuing the insurance policy first, because such a firm has an inherent conflict of interest and, secondly, because the law firm may NOT meet the legal requirements of the Rattikin and Hexter cases to satisfy Section 83.001 of the Texas Government Code. Our firm and its attorneys do not operate an affiliated title insurance company precisely because we believe that we could not provide our lender clients with the best representation while simultaneously having an interest in a counterparty to the transaction. LSLO

Peter Idziak is a senior associate at Polunsky Beitel Green, a Texas-based mortgage law firm.

French Quarter

New Orleans

New Orleans

BY JONIEL LEVECQUE , SPECIAL TO LONE STAR LO MAGAZINE

BY JONIEL LEVECQUE , SPECIAL TO LONE STAR LO MAGAZINE

AAccording to a study conducted by Down Payment Resource and the Urban Institute, more than 30% of mortgage loan applications that are denied every year could have potentially been salvaged had the home buyer applied for down payment assistance. The same study revealed that a whopping 43.6% of single-family purchase loans are potentially eligible for down payment assistance. These aren’t numbers to ignore.

Texas currently has 78 active down payment assistance programs, offered through a combination of state and local government entities, nonprofit organizations and financial institutions. However, despite their widespread availability, many Texas home buyers are still either unaware of these programs or mistakenly believe they wouldn’t qualify.

The Texas State Affordable Housing Corporation, the state of Texas’ largest down payment assistance provider, is committed to changing these statistics. The organization, commonly known by the acronym TSAHC, was created by the Texas Legislature in the mid-1990s specifically to create homeownership opportunities for residents living in colonias along the Texas-Mexico border.

Now 30 years later, TSAHC is a robust statewide housing finance corporation that provides mortgage loans, down payment assistance, and mortgage interest tax credits to home buyers; bond financing and loans to affordable housing developers; and grants

43.6 Percent

> Amount of singlefamily purchase loans that are potentially eligible for down payment assistance.

and training opportunities to local housing nonprofits. In 2023, TSAHC helped more than 11,000 home buyers purchase a home in partnership with a network of participating lenders and loan officers.

TSAHC offers down payment assistance through two distinct programs: the Homes for Texas Heroes Home Loan Program and the Home Sweet Texas Home Loan Program. Homes for Texas Heroes is open to teachers, police officers, firefighters, EMS personnel, corrections officers, and veterans. Home Sweet Texas is not profession-specific, and is open to all eligible home buyers, regardless of their profession. Both programs offer a fixed-rate mortgage loan that includes down payment assistance of up to 5% of the loan amount. There is no first-time home buyer requirement for these programs.

However, first-time home buyers (defined as those who have not owned a home in the past three years) can also apply for a Mortgage Credit Certificate (MCC). The MCC is a dollar-for-dollar tax credit that allows home buyers to receive a portion of the mortgage interest they pay back as a tax credit when they file their federal income taxes every year. With an MCC, a homeowner can save thousands of dollars on their income taxes over the life of their loan.

Home buyers have varying wants and needs when it comes to mortgage financing, and what works for one may not work for another. TSAHC therefore strives to provide home buyers with a variety of financing and

down payment assistance options. For example, home buyers can utilize an FHA, VA, USDA or conventional loan. They can also select the amount of down payment assistance they need (between 2-5 percent of the loan amount) and whether to receive the down payment assistance as a grant or 3-year deferred forgivable second lien. However, because the assistance type selected affects their first-lien mortgage interest rate, home buyers must select the option that makes sense for their individual budget. This is where a good loan officer is key. TSAHC relies on its network of knowledgeable loan officers to explain the requirements, costs, and benefits of each assistance type to help home buyers determine which option is best for them.

TSAHC funds its down payment assistance primarily through the packaging and sale of mortgagebacked securities in partnership with its master servicer Lakeview Loan Servicing. While assistance types and interest rates vary based on market conditions, under this structure, the down payment assistance funding source is unlimited and therefore not limited to budget approvals or bond authority.

However, TSAHC does periodically offer a special down payment assistance product funded through the sale of mortgage revenue bonds. This product typically offers a lower interest rate on the first-lien mortgage but is restricted to first-time buyers (again, defined as those who have not owned a home in three years) and is subject to funding availability.

“Texas currently has 78 active down payment assistance programs, offered through a combination of state and local government entities, nonprofit organizations and financial institutions. However, despite their widespread availability, many Texas home buyers are still either unaware of these programs or mistakenly believe they wouldn’t qualify.”

One of the most common misconceptions about down payment assistance is that the eligibility requirements exclude most home buyers from applying. But in reality, the requirements are not so different from traditional mortgage loans.

To qualify for assistance from TSAHC, home buyers must have a minimum 620 FICO score and meet standard mortgage underwriting criteria. The only significant difference is that home buyers must meet specific income requirements, which can vary based on their county. The current income limits as of April 2024 for the major metro areas in Texas are as follows:

Houston: $116,500

Dallas: $128,875

Austin: $146,000

San Antonio: $119,960

El Paso: $112,625

The only other requirements are to apply through a TSAHC-approved lender and to complete an approved home buyer education course prior to closing on the home loan.

TSAHC offers an easy four-step eligibility quiz on its website to help home buyers determine if they meet the eligibility criteria and connect them with approved lenders and home buyer education providers in their area. Working with a prospective buyer you think may qualify? Loan officers and real estate agents also utilize the quiz to determine if their home buyers meet the eligibility criteria. TSAHC does not collect personal information through the quiz, so anyone can take it without fear of unwanted solicitations.

The current higher interest rates have made the assistance offered by TSAHC more important than ever. This is because down payment assistance can help increase the amount of cash available to close. When layered with an MCC, it can also improve a home buyer’s debt-to-income ratio because the loan officer can include the firstyear tax savings in the buyer’s qualifying income. Together, these two factors comprise more than 42% of mortgage application denials, per the study conducted by Down Payment Resource and Urban Institute.

TSAHC also makes it easy to educate potential home buyers about its programs. Loan officers and real estate agents can order brochures free of charge on the website, as well as engage with educational videos and cobrandable collateral material that housing professionals can share with their clients.

TSAHC also has a TRECapproved continuing education course for agents that lenders can host to facilitate connections with agents and spread the word about down payment assistance.

As an organization that serves all 254 counties in Texas, TSAHC relies heavily on its network of loan officers and real estate agents to educate home buyers about the assistance available to them.

TSAHC recognizes its topproducing mortgage companies and loan officers in a variety of ways. TSAHC has a web page dedicated to its top loan officers that is promoted via email and social media. Top loan officers are also invited to participate as members of TSAHC’s Lender Advisory Council, which offers unique opportunities to provide feedback on TSAHC’s programs and participate as subject matter experts on TSAHC’s podcast.

four TSAHC loans annually can also create a profile on TSAHC’s Find a Lender website tool to receive free referrals. Home buyers are connected to this tool when they complete the eligibility quiz.

Together, these opportunities enable TSAHC to spread the word while also connecting potential buyers with the loan officers most knowledgeable about the programs.

“In 2023, TSAHC helped more than 11,000 home buyers purchase a home in partnership with a network of participating lenders and loan officers.”

Loan officers interested in participating in TSAHC’s programs should first determine whether their mortgage company is approved to participate. A list of participating mortgage companies is available on TSAHC’s website.

Signing up as a participating mortgage company is a two-step process. First, the mortgage company must be approved as a correspondent lender by TSAHC’s master servicer Lakeview Loan Servicing. Once approved, the mortgage company must submit the application and participation agreements directly to TSAHC staff.

TSAHC also invites its top loan officers to become certified to teach its continuing education course for REALTORS and represent TSAHC at various home buyer and community events. But loan officers don’t have to be one of the top loan officers to receive recognition and support. Loan officers who close at least

Loan officers can access TSAHC’s on-demand training portal once their mortgage company is approved to participate. Upon completion of all required training, loan officers will receive log-in credentials to TSAHC’s lender portal and may begin reserving TSAHC loans. LSLO

Joniel LeVecque, senior director of single-family programs at Texas State Affordable Housing Corporation (TSAHC).

Picture this: You arrive at the historic French Quarter of New Orleans, the scent of beignets and freshly brewed coffee mingles with the soulful melodies of jazz drifting from nearby clubs. Your excitement grows as you approach your destination, the iconic Hotel Monteleone.

Nestled in the heart of the French Quarter, the Hotel Monteleone stands as a timeless symbol of elegance and Southern hospitality. Its grand facade, adorned with wrought-iron balconies and lush greenery, exudes old-world charm and allure. As you pull up to the entrance, you are greeted by the sight

of uniformed bellmen bustling about, ready to assist with luggage and offer warm smiles of welcome.

Stepping into the lobby, you’re enveloped in a sense of luxury and history. The opulent decor, with its marble floors, crystal chandeliers, and rich mahogany furnishings, harkens back to a bygone era of glamour and sophistication. Yet, amidst the grandeur, there is an unmistakable sense of warmth and intimacy, as if each guest is being welcomed into the embrace of a dear friend.

As you ascend the grand staircase, you are struck by the buzz of energy that permeates the air. The

sound of lively conversation and the clinking of glasses fills the hallway, mingling with the faint strains of jazz music drifting up from the lobby below. Arriving at the conference area, you are greeted by the sight of attendees from all corners of the mortgage industry, engaged in animated discussions and networking opportunities.

The expo hall itself is a bustling hive of activity, with rows of booths showcasing the latest innovations and services in the mortgage industry. From technology solutions to compliance resources, the array of offerings is vast and impressive. The traveler eagerly immerses themselves in the exhibits, eager to glean insights and make valuable connections with fellow professionals.

Throughout the day, you attend informative workshops and panel discussions, gaining valuable knowledge and industry insights from leading experts in the field. You take diligent notes, exchanging ideas with colleagues and forging new connections that will prove invaluable in your professional endeavors.

As the day draws to a close, you reflect on the wealth of information you have acquired and the connections you have made. With a sense of fulfillment and anticipation for the days ahead, you make your way back to your room at the Hotel Monteleone, grateful for the opportunity to participate in such a dynamic and enriching event in the vibrant city of New Orleans.

The Ultimate Mortgage Expo is a two-day event for the Gulf Coast Region’s mortgage professionals. Since 2013, the Ultimate Mortgage Expo has been providing unique opportunities for brokers, originators, and support staff to build their businesses. This year, we’ve expanded the event, with even more sessions on Wednesday, July 10, plus another incredible networking party. The cherry on top is that all of this is free for attendees, thanks to supporters of the show, who you can meet in the exhibit hall on both Wednesday and Thursday. Just use our code OCNFREE on your registration.

Down-payment assistance is bridging the gap between the haves and have-nots

BY SARAH WOLAK , EDITOR, LONE STAR LO MAGAZINE

In today's housing market, there are only two types of homebuyers, John Hudson says, the haves and the havenots. The haves are those with healthy credit scores, a robust financial profile, generational wealth and perhaps previous homeownership experience. The have-nots lack most, if not all, of the aforementioned. And the only way many of those "have nots" can transcend their circumstances is by using down payment assistance programs (DPA).

Hudson, a mortgage loan officer and executive vice president of wholesale for Flower Mound-based Mortgage Financial Services, is a fierce advocate for his buyers to be educated, and take advantage of DPA programs.

“Second to affordability, the next thing on a homebuyer's mind is coming up with a downpayment,” he said.

“In today’s environment, $20 can make the difference of whether you’re getting a mortgage or not. We see examples that thin where a decimal point of .01 on a borrower’s debt-to-income ratio can change their approval status. Assets matter, and unfortunately, we’re in a tight economy.”

Hudson and his company, MFS, are both affiliated with the Texas State Affordable Housing Corporation, or TSAHC, a 501(c) (3) nonprofit organization that was incorporated in 1994. Per the corporation’s website, TSAHC was created at the direction of the Texas Legislature to serve as a self-sustaining, statewide affordable housing provider.

Although home values in

“I see a lot of first-time buyers, depending on the area… I also work with a lot of Hispanic agents and borrowers because many have been told that they can’t buy a house, or have been told by other lenders that it’s not going to work. I’ve also seen many military borrowers either coming home or getting transferred take advantage of programs.”

> Jake West

Texas have ticked down a nearly invisible amount from last year – 0.1%, according to Zillow – there are some regions within the state seeing slightly bigger home price reductions, including San Antonio and Austin.

Still, the lower cost of living in the Lonestar State isn't doing homebuyers many favors, since the average yearly income, $57,300, allows them to just barely scrape by. If they were to set aside 30% of their paycheck for housing costs, they would only be able to afford just over $1,400 a month on mortgage payments

Never mind the affordability crisis, Hudson points out the gap between the “haves” and “have nots” amongst different demographics. Homeowner's net worth is $396,200 compared to renters' $10,400, per the Federal Reserve Board’s Survey of Consumer Finances 2019-2022, released in October 2023. And as Hudson says, “You’re either paying your mortgage, or your landlord’s.” Down payment assistance programs, Hudson argues, are a more viable solution and option to close the gap between the haves and have notes and segue borrowers into a home.

Most Texans, Hudson argues, don’t know about the inner workings of TSAHC down payment programs or that they might qualify for one or two of the programs. What they also don’t know, Katie Claflin adds, is that there are over 1,500 active loan officers affiliated with TSAHC’s programs. That whopping stat means competition for loan officers with the possibility of clients being whisked away with the promise of a better deal. Claflin, who is TSAHC’s senior director

of communications and development, says that for a loan officer to offer down payment programs to a borrower, their company has to sign up for TSAHC as a participating lender, as well as sign up to be a correspondent lender with TSAHC’s servicer.

So what sets TSAHC apart from state programs? “The beauty about these state products is that they come from a nonprofit, and are silent second liens which means no payment, 0% interest, and in the case of TSAHC, forgivable after 3 years,” said Hudson. “A lot of private DPA products have a second lien that is amortized into the debt-to-income ratios…[TSAHC programs] do come with lower interest rates, very forgivable terms, [and are] pretty easy to qualify for.”

The first step is finding and qualifying borrowers, Claflin says, which means at least a 620 credit score and income eligibility depending on the metro. Most qualifications include being a first-time home buyer, a veteran, or people purchasing a home in a targeted area, which is defined as federally designated areas of slow economic growth where you do not have to meet the firsttime homebuyer requirement to qualify for the programs. “A homebuyer will work with one of our participating mortgage lenders and apply to a DPA loan, and attached to that mortgage loan will be 5% of the loan amount as down payment assistance,” she explained. “Homebuyers can elect to receive the DPA as a grant, which means they never have to pay it back, or as a threeyear deferred, forgivable second lien, which means as long as they stay in the home and don’t refinance for three years, it converts into a grant.”

Kayla Butler, a loan consultant with loanDepot based in Katy, says that about 40% of applications she sees come across are asking for some kind of assistance or they're asking for a bond program. “I’m seeing more Hispanic and Black borrowers

that ask for DPAs, as well as people around ages 25 and 27 who are first-time buyers,” Butler said.

Jake West, a loan partner with Gateway Mortgage, agrees.

“I see a lot of first-time buyers, depending on the area… I also work with a lot of Hispanic agents and borrowers because many have been told that they can’t buy a house, or have been told by other lenders that it’s not going to work,” he said. “I’ve also seen many military borrowers either coming home or getting transferred take advantage of programs.”

“The beauty about these state products is that they come from a nonprofit, and are silent second liens which means no payment, 0% interest, and in the case of TSAHC, forgivable after 3 years.”

> John Hudson

West, who was recognized as a top three TSAHC originator for 2023, assisted 50 home buyers last year and originated more than $11.9 million in mortgage loans.

Butler says most borrowers she works with are between ages 25 and 27 first-time buyers

Pam Anderson, a senior loan officer with Supreme Lending, says that the average age of borrowers she

handles when it comes to DPA is around mid-twenties to early thirties. “The good thing is that Texas has different markets, Dallas-Fort Worth homes are getting pricier and inventory is so low still, but people are branching out to those smaller areas with lower prices or targeted areas,” Anderson said.

Lenders who work with borrowers taking advantage of down payment assistance programs acknowledge that the loans aren’t as lucrative as other traditional products. But lower comp is better than no comp at all, especially in a beggars can’t be choosers market. “The max comp to the broker is only 150 basis points, whereas regular loans could be worth up to 275 basis points based on the comp plan. Originators make less on a per-loan basis,” Hudson explained. “I’d argue that

establishing a strong referral relationship with DPA borrowers will supplement your business. Word of mouth is a huge marketing tool.”

Word spreads fast. Hudson’s seen the same families come back to his company, or recommending friends. It’s free referrals, and it’s better if the borrower understands what to ask for based on their friend or family’s experience using a specific program.

Hudson also says that education needs to be improved when it comes to both borrowers and originators knowing the best options. West shares the same observation. “Usually I have lunch meetings with real estate agents [where we] talk about education and about all ways to get someone into a house,” he said. “Now I find that I get calls daily from real estate agents and buyers about DPA…the game changes when you remind people it’s about getting people to stay in Texas and build a community, and build equity.”

Anderson says that working with DPA borrowers sometimes requires hand-holding during the process. “I once worked with a borrower for 6 years and was able to help them buy using DPA after all that time. There have been many situations where I’ve worked with borrowers for years to help them build better credit or improve their financial situation,” Anderson said. “I deal with a lot of firsttime home buyers, and I always tell my borrowers if they qualify for DPA whether they need it or not… in this day and age even buying a new refrigerator breaks the bank…many people can’t afford closing costs.”

Claflin says as someone working on the back end, she’s noticed several myths arise about the programs. “People think it’s too complicated or takes too long and delays closings, but that’s not true. The average closing time w/ TSAHC programs is 30 days,” Claflin says. “It’s a couple of additional forms, but no additional inspections or appraisals.”

Anderson says that most buyers she sees need to be made aware of what DPA even is, which emphasizes the need for originators to educate louder and wider. “Some of them are pretty clueless,” she said. “They walk in and ask ‘What can I get?’ The last thing I saw that was free was back

in the Obama days when every first-time buyer got $8,000 back on their tax returns.”

TSAHC offers several DPA programs, each a bit different than the next, making it easier for a wide amount of borrowers to fit the mold. One of its most popular programs is a bond-funded assistance program, which acts as a deferred, forgivable second lien which is 4% of the loan amount, as well as a lower interest rate on the first lien loan. Claflin explains that since it’s bond-funded, the assistance eventually taps out and is limited supply. This time around, 270 homebuyers took advantage of $80 million in funded loan volume as of Feb 23, 2024, Claflin says. Why so fast? Because eager loan officers are anxiously anticipating programs to re-open and ready for their borrowers to take advantage of.

Other programs offered by TSAHC include a Mortgage Credit Certificate Mortgage Credit Certificate (MCC), a federal program where borrowers get a tax credit matching a certain percentage of the mortgage interest they pay. This credit is given back to the borrower come tax refund season. “The MCC is also cyclical like the bond program, so it runs out,” Hudson explained. “Last year, MCC was worth 20% of the interest a borrower pays, meaning if the interest was $20,000, the borrower would have gotten back $4,000 as a tax credit – not a deduction – but an actual credit that is applied towards their federal income tax returns.”

And the DPA variations continue. TSAHC also has two similar DPA programs called Homes For Texas Heroes, which is for teachers, firefighters and EMS personnel, police and correctional officers, and veterans, and Home Sweet Texas, a loan program for Texas home buyers with low and moderate incomes.

“The bond program is limited but is the best option and my personal pick that I try to get my borrowers in,” said West. “The bond program runs about twice a year… I estimate that over half of my clientele uses DPA programs from TSAHC in general.” LSLO

Dallas Fed’s El Paso Branch Board Elects 2024 Leaders

The board of directors at the El Paso Branch of the Federal Reserve Bank of Dallas elected Tracy Yellen to continue serving as chair and elected Von Washington as chair pro tem for the year 2024.

Yellen became a member of the El Paso Branch board in 2019. She currently holds the position of chief executive officer at the Paso del Norte

Community Foundation, overseeing entities such as the Paso del Norte Health Foundation and El Paso Giving Day and fostering a growing community of philanthropy.

Washington, who joined the El Paso Branch board in 2020, is the CEO and proprietor of IDA Technology, a company specializing in technical services. With over three decades of experience in the aerospace and missile defense sector, he has contributed to major Department of Defense initiatives.

The El Paso board comprises seven members, with four appointed by the Dallas Fed board and three by the Federal Reserve System Board of Governors in Washington, D.C.

Calque Welcomes Michael Bremer as Chief Executive Officer

Austin-based Calque named Michael Bremer as Chief Executive Officer as of March 19.

Bremer has over 25 years of experience in

up the business at Calque; homeowner equity is high, and thousands of owners are ready to start looking for their next property that meets their lifestyle as rates thaw.”

Calque Chairman Jeremy Foster applauded Bremer’s contributions to the mortgage industry. “Michael has a proven track record of scaling the mortgage solutions business, which makes him the ideal candidate to guide Calque through our next growth phase,” said Foster. “With lending partners now live in

the mortgage, real estate, insurance, and risk management sectors. Bremer’s most recent position was at CoreLogic, where he led CoreLogic’s flood insurance product line before taking a role leading business transformation. During this time, Bremer was responsible for ensuring regulatory compliance and implementing scalable solutions that power the mortgage industry.

“I am thrilled at the chance to join a company dedicated to alleviating the challenges homeowners face during the homebuying and selling process,” said Bremer. “Calque can help established lenders and real estate agents meet consumer needs without disintermediating them or disrupting their traditional roles. Instead of displacing all of those involved in the home-buying process, we are committed to empowering them to secure the best outcomes for their business and customers alike. I look forward to scaling

48 states and more launching every week, Michael’s experience leading teams to handle high volume while still providing exceptional lender support will be invaluable.”

Polly Cracchiolo Joins

Click n’ Close’s TPO Team

Polly Cracchiolo joined Click n’ Close’s third-party originator (TPO) sales team as an account executive as of February 26. Cracchiolo, who holds more than two decades of lending experience, specializes in government and conventional loans. She joins

from Eleven Mortgage, where she was a senior account executive. Her background includes various positions at First Guaranty Mortgage Corporation, Mr. Cooper, Banc Home Loans, Kinectra Federal Credit Union and more.

“I’m extremely happy to join Click n’ Close and, more importantly, happy to expand options to future homeowners,” said Cracchiolo.

“Click n’ Close has continuously evolved with cutting-edge loan programs. I’m eager to help lenders leverage these tools.”

In her new role, Cracchiolo will be under Ken Weislak’s leadership, the National TPO Business Development Manager at Click n’ Close.

“Polly has a proven record of helping clients and borrowers find success. With our ambitious plans for 2024, her arrival couldn’t be more opportune,” said Click n’ Close Executive Director, TPO Lending Adam Rieke. “As our TPO program rapidly expands, Polly’s experience is appreciated. We want to provide our clients with seasoned account executives full of expertise to help them navigate the current market.”

Texan who brings more than 15 years of experience in leadership roles, was previously the CEO of the Prescott Area Association of Realtors (PAAR) in Prescott, Arizona. Under Westrum’s leadership, PAAR was recognized by Arizona Realtors with the 2023 Community Outreach Award and by the Prescott Chamber of Commerce with the Business Excellence Award.

Westrum previously worked as the communications director and later the vice president of communications and marketing at the San Antonio Board of Realtors (SABOR).

At SABOR, Westrum led strategic initiatives, oversaw signature events, and helped advance advocacy goals.

“Suzanne is a dynamic leader with a tenured history of association experience that will greatly benefit the future of GFWAR,” said Blake Barry, 2024 GFWAR President. “Her work at SABOR and PAAR illustrates her exceptional abilities, and we’re excited to have her bring those skills to Fort Worth.”

As CEO, Westrum will work closely with the Board of Directors to establish the organization’s strategic direction. Her goals include bolstering GFWAR’s reputation as a Fort Worth business leader, promoting educational opportunities to the membership, strengthening member engagement, and safeguarding private property rights through advocacy efforts.

Greater Fort Worth Association of Realtors Names Suzanne Westrum CEO

The Greater Fort Worth Association of Realtors (GFWAR) appointed Suzanne Westrum as its new CEO. Westrum, a native

“I am very excited to become a part of an organization as impressive as GFWAR,” said Westrum. “I look forward to working with the incredible leadership team to build on the organization’s enduring legacy as together we drive innovation and provide exceptional value to members and the community.” LSLO

Whose side are you on?

Choose your player and watch Vincent Valvo and Andrew Berman duke it out about today’s top mortgage topics. Watch it on YouTube, or subscribe to the NMP Daily to get new episodes delivered to your inbox every week. Go to nmplink.com/daily to sign up.

nmplink.com/daily

In the prime of her career, Jennifer Guidry chose to go with her gut and venture into unfamiliar territory

BY ERICA DRZEWIECKI , STAFF WRITER, LONE STAR LO MAGAZINEWhen Jennifer Guidry, a nearly three-decades-long mortgage loan originator, felt a persistent call to switch up her career, she ignored it. But after finally deciding to acknowledge the call, it signaled a turning point in her career. Despite being at the peak of her success in her late forties, she decided to switch gears. At 47, well ahead of the typical retirement age, Guidry, who had been a topperforming LO in San Antonio, TX for four consecutive years, made the bold choice to transition away from originating loans and pursue a new path: teaching others the lessons she learned in the business.

Reflecting on her decision, Guidry explains, “For years I didn’t want to give up because I was comfortable, at the top of my game. I could easily have stayed in mortgage for the rest of my working years and just coasted, but I gave everything up so that I could do this. I’m taking a leap of faith that people are going to want to hear what I’m saying.”

Originally hailing from upstate New York, Guidry relocated to Southern California during her early adulthood and landed a position as a receptionist at a mortgage company. From there, Guidry became a branch manager for Centex Corporation and Wells Fargo, respectfully, in her early twenties. She eventually held leadership positions at First Horizon National Corporation, PrimeLending, Benchmark Bank, First United Bank, and Guardian Mortgage, a division of Sunflower Bank. By the end of 2023 after 28 years in the mortgage business, the wife and mother of two officially transitioned out of being an LO. Her production for that year was just over $76 million, per Modex data.

Now, as proprietor of The High-Level Life, Guidry has launched an entire, unfamiliar career providing transformational coaching and speaking engagements tailored for mortgage companies and LOs.

“It kept on coming back and pulling me like, ‘this is what you’re supposed to be doing in this next chapter of your life’,” she says of this vocation. “It wouldn’t go away. I felt it with every part of my soul, my

heart, that it was time for me to start giving back those things that I learned.”

Things like being successful without working around the clock.

a pipeline, not a faucet. You don’t turn off and on a pipeline. You keep that thing open all the time.

> Jennifer Guidry ” “

“I want to show other people how to attain success as a high producer, highlevel achiever, but to also have balance in life,” Guidry says. “People in our industry think they have to work 24/7. You don’t have to work 24/7. You can still have an amazing career. You can still be number one. You can still do all these things, but come home to your family after work and enjoy vacations and spend evenings with your kids.”

She discovered this lesson after moving to San Antonio in 2005 and being diagnosed with cancer in 2007. That’s when she realized that she had to slow down and quit working beyond the typical 9-5.

“Once I recuperated and while I was healing I was like, I can’t do this anymore. It’s not worth it to me. It’s not worth killing myself to produce these numbers. So I figured out how to do both.”

In the ‘About’ section of her website, (thehighlevellife.com) visitors find out that “Jen is No Stranger to Adversity, Success and Overcoming” - atop a bulleted list of what can only be described as examples. They discover that she not only survived several close encounters with death, but she was once more than 100 pounds overweight, has originated over seven figures and climbed Mt. Kilimanjaro.

Not a stranger to the spotlight, Guidry served as a host of television’s Financing the American Dream and a local show, Selling San Antonio.

Guidry is a bit of a celebrity around San Antonio, not just as a television personality, but as an author. Her two books. The Storm (2021) and Grit and Gratitude (2023), are described as a memoir and a self-help book for Christian women, respectively.

The Storm was born when Guidry was

out of work for four months. Guidry, who suffers from a blood clotting disorder, didn’t know if she was going to make it.

“I wrote it initially as a legacy piece because I wasn’t sure if I was going to make it or not,” she explains. “It was written to help people that are going through their own storms in life.”

Grit and Gratitude, hailed as “a real-life conversational guide to living the life God has intended for you” received a near-perfect rating on Amazon. “It’s more lighthearted, written for a bit of a younger crowd,” she says.

Guidry grew up Catholic, but she never really considered herself to have a good relationship with God until becoming an adult.

“When I started bringing God with me everywhere I went, everything changed,” she says.

Time management and setting proper expectations are part of the magic formula Guidry prescribes to those in need.

“I’ve never had a plan B. I only have a plan A and it’s to work my butt off until I succeed in the thing that I’m going towards.”

She encourages LOs to find their niche and get really good at it, to the point that they become the go-to professional for that specialty.

Her specialties included VA loans and construction loans, and she was able to make her specialty concrete by teaming up with Lee Randolph, the owner of the homebuilding consultant company U Build It. Guidry was working at First United Mortgage when she and Randolph first met.

“She was not only very knowledgeable but a better communicator than any other lender we had ever worked with,” he recalls. “We’ve been sending her people and she’s been sending us people ever since. We followed her along to different companies.”

Randolph describes Guidry as “one of those people who always goes the extra mile and doesn’t lord it over people how good she is. I don’t know any finer person,” he adds.

Guidry’s credo attests to her success. “It’s a pipeline, not a faucet. You don’t turn off and on a pipeline. You keep that thing open all the time, so you’re constantly building your pipeline. And what happens to a lot of people is they get really busy, then they turn off the faucet and then they stop doing

“

I felt it with every part of my soul, my heart, that it was time for me to start backgivingthose things that I learned.”

all those things. And then their production goes up and down and up and down and up and down. But if you consistently work on putting things into your pipeline, it will come. But you’ve got to work on it every day. You can’t turn it off and on.”

With influencers gaining fame and fortune by sharing their lives on YouTube and TikTok these days, Guidry points out that people often forget the picture that hard work can paint.

“For so many years, people got into the business and didn’t have to think. Loans came in and customers came in and they didn’t do anything to make themselves better. But those that did are the ones that are thriving now when it’s difficult…you have to have grit when it comes to this business. You have to keep at it every single day.”

She considers the accolades and production stats as perks, not letting them define her.

“That’s not the stuff that matters. The stuff that matters is seeing smiles on people’s faces and knowing that you helped change a life by the advice that you gave or just being on a team with someone. That’s the most fulfilling.”

Guidry is particularly interested in changing the conversation women have with themselves and each other far too much.

“I feel like we don’t help each other. We compare, judge, talk behind each other’s backs. But I want to create this society where we help each other out. Like, I’ll pull you aside and say, ‘you probably shouldn’t do that’ instead of talking behind your back.”

When she’s not jet-setting to a speaking engagement, Guidry is most likely with her family at their other house in Sedona, writing or hiking, balancing her busy life with moments of taking it slow. An avid hiker, Guidry has climbed mountains all over the world, but some of her favorite trails are right here in the American Southwest.

“Especially when I was in mortgage, hiking is one of the things that brought me the most Zen and peace. When you get on the trail, you’re focusing on that present moment of time, that journey,” she says. “You don’t think about anything else.”

Guidry passed her book of business onto her former team at Guardian Mortgage in San Antonio, now headed by Sales Leader Kristin Fox. The two worked together for several years and grew close.

“We’re very similar in our values and our work ethic, and that’s really been the foundation of our success,” Fox says of herself and Guidry. “Regardless of how many loans she’s closing in a month or how busy the industry is, she always delivers excellence. And that is definitely what I will carry forward and what I’m doing to honor her and her legacy.”

But outside of loan originating, where Guidry is now, her character shines as well.

“Jen is so genuine,” Fox says. “You know that whenever she is speaking to you, she is speaking the truth. It may come without a filter, but it’s definitely what a person needs to hear when they need to hear it. I think that’s why she’s been so successful in her career is that she just speaks from the heart. She’s honest, transparent, and straight to the point on things. She’s been so encouraging of my growth.” LSLO

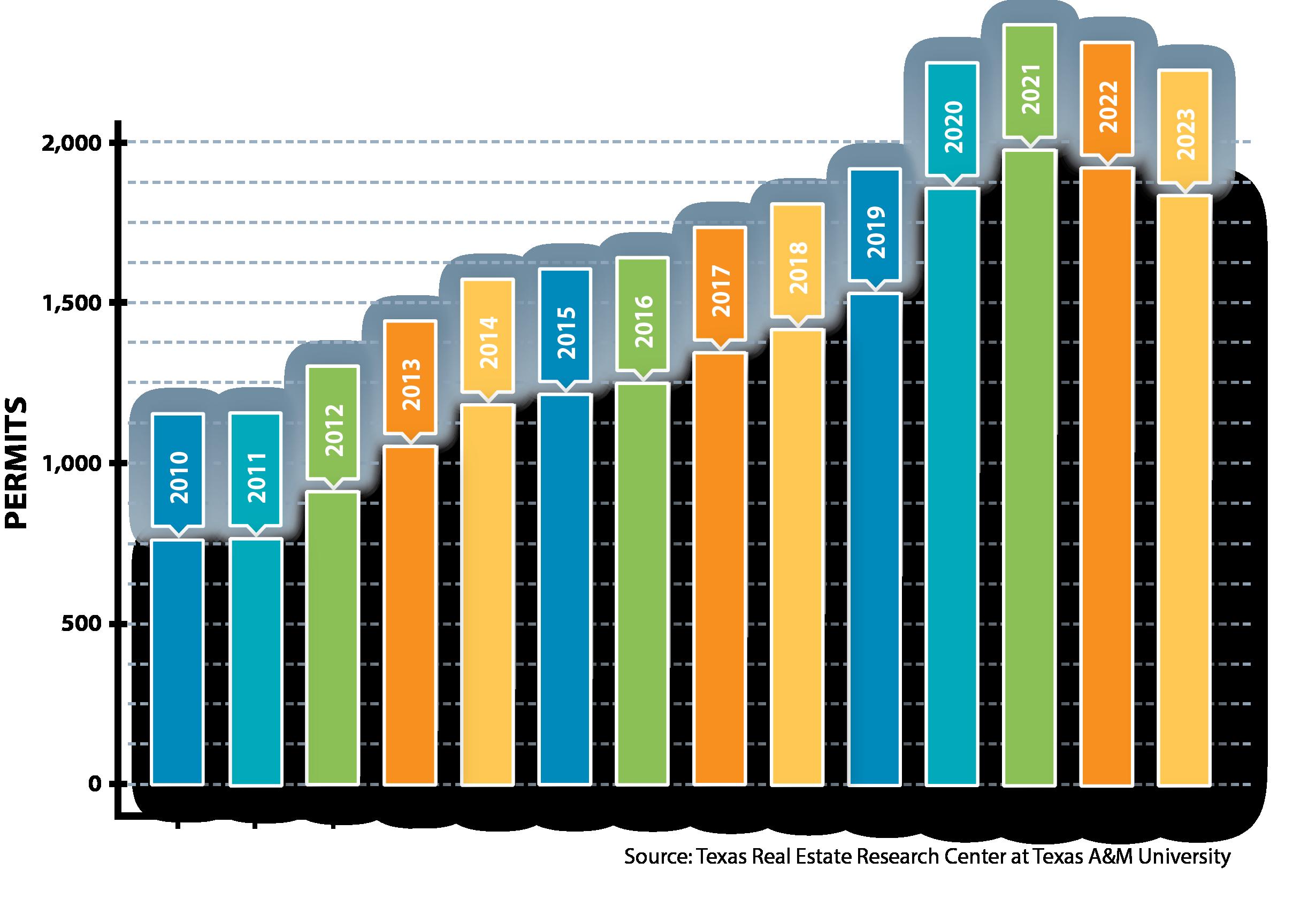

Successful mortgage originators excel by not keeping all their eggs in one basket. These voracious Texan LOs are hungry for information and gathering all that they can learn from diverse sources. For busy LOs who want insights in a small dosage, Lone Star LO provides easily understandable information in every issue of Data Bank. Dive deep into the charts and see the trends for yourself.

The median home price dropped by 0.7% to $332,300. Among the major metro areas, Dallas was the only one to experience a decrease, with prices falling by 1%. On the flip side, Austin saw a significant increase of 4.2%, reaching its highest price level since January. It's worth noting that home prices across the Big Four metro areas are still higher than pre-COVID levels.

Mortgage rates are still on the decline, and although this is good news, they're still hanging at a pretty high level, which is causing a bit of a headache for homebuyers in Texas. Total home sales in the state dipped by about 1.9% compared to last month, landing at 25,430 homes sold.

Something remarkable from the Texas Real Estate Research Center’s Findings for December 2023 was that the average price home price dropped alongside home sales, with homes costing $2,000 less than in November. Homes sat on the market for longer in December as average days on the market reported its first increase since April 2023, indicating a hint of a buyer’s market and lower demand. LSLO

Sources: https://www.recenter.tamu.edu/articles/technical-report/Texas-Housing-Insight https://www.houston.org/houston-data/monthly-update-home-sales

Data from Texas Real Estate Research Center at Texas A&M University

(JANUARY TO DECEMBER)

Connect and learn from the very best in the business. Upcoming Originator Connect Network events you don't want to miss.

JUNE 11, 2024

San Antonio, TX | www.txmortgageroundup.com

The Lone Star State’s top gathering for mortgage pros. The lineup of engaging events centered around networking, skill-building and having a great time with your peers. The Roundup is so big, we have to do it twice! Join us for the San Antonio edition as we gather the best in the business from South Texas.

JULY 10, 2024

New Orleans, LA | www.ultimatemortgageexpo.com

The mortgage industry is going through a significant change. For mortgage origination professionals, it's a struggle to keep on top of all the changes, and to keep your sales strategies and marketing initiatives at their peak. You need to keep your pipeline filled, and you need the tools and directions to stay profitable, efficient, and effective. We've brought together the best in the business to create a top tier event specifically designed for mortgage origination pros.

AUGUST 15 — AUGUST 18, 2024

Las Vegas, NV | www.originatorconnect.com

OCN modestly presents: The greatest mortgage conference in the known universe. Originator Connect returns to Las Vegas this August for another fantastic, session-packed event. It's THE event you won't want to miss. Originator Connect is a 3-day weekend event filled with workshops, sessions, product showcases, and plenty of networking opportunities. Come early for the pre-conference events happening Thursday, August 15, including our long-running Build-A-Broker course, and new staples like the Non-QM Summit, and of course a free in-person NMLS renewal class.

SEPTEMBER 5, 2024

Dallas, TX | www.txmortgageroundup.com

The Lone Star State’s top gathering for mortgage pros. The lineup of engaging events centered around networking, skill-building and having a great time with your peers. The Roundup is so big, we have to do it twice! Join us for the Dallas edition as we gather the best in the business from north Texas.