WRITTEN BY: ANDY NIXON

“THISAPPWASCREATEDTOEMPOWERAIRCRAFTOPERATORSBYALLOWING THEMTOREQUESTANDBOOKTHESERVICESTHEYNEEDINATRANSPARENT, COMPETITIVE,ANDEFFICIENTMANNERTHATWILLULTIMATELYSAVEMONEY BYREMOVINGTHIRD-PARTYANDPASS-THROUGHEXPENSES.”

Using our technology, I wouldn’t be out of line predicting yearly variable cost savings of 10%-20% The Alpha Wingman app has created a competitive marketplace for all things aviation Premiums are placed on needed services from parts to fuel, and maintenance to catering. Many will say it’s just the cost of doing business, but we entered the aviation technology space to help aircraft operators trim expenses by removing unnecessary fingers in the pot; all from the palm of your hand

One thing is certain, operating a plane is expensive Small GA aircraft up to a Global Express cost handfuls of money each flight hour. As someone passionate about flying and aviation, the last thing I like to hear is someone getting out of aviation due to the expenses being “higher than I was led to believe”

Our app helps with the day-to-day services your aircraft needs. If your aircraft is under management and enrolled on Alpha Wingman, you can switch to the “management-lite” version and use our app to procure the goods and services you pay premiums to have managed Let’s take an AOG event for example - you ping out with Alpha Wingman in the palm of your hand, receiving multiple provider quotes in minutes You select a provider based on ETA, hourly rate, billable travel time, and reviews. Your AOG is completed and you pay the vendor directly.

Take that scenario with a management company and you will wait several hours while they call, email, or send carrier pigeons to their Excel spreadsheet of vendors. Once they finally have a provider, the work will be performed, and you will have spent hours longer on the ground AND you will pay a pass-through expense to the management company because they arranged support on your behalf Think of another industry where this is done

Scheduled maintenance coming due? Alpha Wingman automatically goes to multiple vetted shops with that aircraft make and model on their FAA capabilities list. You’ve just saved money taking that first step; competition has begun to earn your business. You go directly to the MRO so no kickbacks will be paid; another win-win for aircraft owners and a change desperately needed in business aviation

The major takeaway I’ll leave you with is that while necessary for some aircraft owners, a full-blown management program is no longer needed to receive competitive pricing, superior customer service, or options when sourcing your aviation needs Some management companies have done a terrific job, continue gaining customers, and continue to prosper. Others come and go which muddies the water for new and existing aircraft owners. As Alpha Wingman continues growing, we will swiftly move into volume discounts for our users, adding more savings and advantages to our network You do it in many aspects of your life, so why not do it with such an expensive asset?

Wondering about what the next steps are? Reach out and we can show you how intuitive our app is, or visit our resources page to learn more.

CONTACT US

Alpha Wingman is more than just an application; we are a community dedicated to advancing the aviation industry. Our vision extends beyond immediate needs, aiming to foster a network where innovation thrives & quality service is standard As we continue to expand & evolve, we invite you to be part of this journey By joining Alpha Wingman, you become a part of a forward-thinking community that values collaboration, efficiency, & excellence. Together, we can achieve new heights in aviation support, ensuring that every flight is safe, efficient, & enjoyable. Your trust & feedback are invaluable as we shape the future of aviation, making it more accessible & reliable for everyone involved

WRITTEN BY: MICHAEL RIEGEL

Let’s take a look at how new aircraft deliveries are going during the first half of 2024. I’ll start by summarizing deliveries by year and manufacturer Then, I’ll review fleet deliveries for 2024 YTD for the major fleet operators

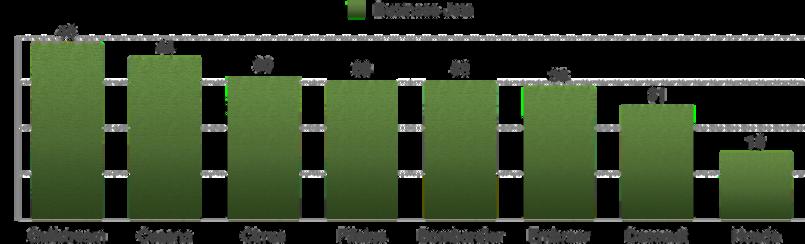

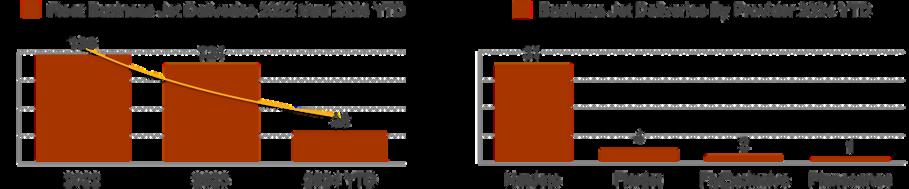

Business jet deliveries currently (July 7th 2024) stand at 34% of 2019 deliveries and 38% of deliveries during 2023. I track manufacturer output for consistency, looking for manufacturers that are rear-end loading their 2024 production, which is a risky tactic The graph below shows YTD 2024 deliveries as a percentage of 2023 output and help me to see how the magnitude of the challenge for each manufacturer to reach 2023 output, given YTD deliveries.

OEMs that smooth deliveries throughout the year ought to be close to 50% of 2023 deliveries, except where deliveries have recently commended for new models. Gulfstream face two significant problems Firstly, 2023 deliveries were far lower than expected because of delays with Gulfstream 700 certification Secondly, Gulfstream 2023 deliveries were 36 (24%) aircraft below 2019 levels. Gulfstream predicted heavy Gulfstream 700 deliveries for 2024, with 82 airframes in the delivery pipeline.

Unfortunately, Gulfstream have struggled to boost delivery rates, with just nine Gulfstream 700’s delivered during 2024 YTD: disappointing, given that the Gulfstream 700 is little more than a stretched Gulfstream 650ER with systems transferred from the Gulfstream 400/500/600 platform!

Dassault commenced deliveries of the brand new Falcon 6X in Q4 2023. Their YTD output has been surprisingly low, with just one Falcon 6X delivery in 2024, in addition to reporting weak deliveries for legacy Falcon programs. Embraer are sitting at 36% of 2023 output and have some serious challenges ahead of them Demand for the Phenom 300 remains strong, with YTD deliveries of 29 aircraft The bigger problem remains the Praetor 500, with just four deliveries YTD. Embraer will commence Praetor 500 deliveries to NetJets in 2025. Combine NetJets and Flexjet orders with retail demand and Embraer need to quickly boost output to at least four aircraft per month, a sixfold increase over current 2024 output Honda also appear to be struggling, having delivered 18% of 2023 output, which wasn’t a productive year Honda deliveries suggest that they are struggling to manufacture the updated Hondajet Elite II. Honda’s delivery problems might impact Volato, with 10 Hondajet Elite II serial numbers apparently assigned to Volato. Cessna and Pilatus are maintaining strong and consistent deliveries and appear likely to repeat 2023 output Cessna remain heavily reliant on NetJets, both for the Citation Latitude and the Citation Longitude, with the fractional leader accounting for 19 of 31 deliveries for these two types, or 61%, in 2024!

The above graph demonstrates that 2024 YTD fleet deliveries are far below of the levels we saw in 2022 and 2023 Notably, jet deliveries are substantially down at Flexjet and Planesense, with no deliveries to AirShare or Volato, YTD. I predict a continued decline in new jet deliveries for the remainder of 2024 and through 2025 as shares sales soften. NetJets continue to dominate deliveries, but will likely fall short of their goal of taking delivery of 100 new jets each year

pp g , Hondajet Elite II. Unless Gulfstream can deliver their 82 pipeline G700s at a rate in excess of twelve per month, 2024 financial performance will fall short I see eight Falcon 6X serial numbers, of which at least four are likely to be flight test articles and demonstrators I’m surprised that Dassault have so few aircraft in the delivery pipeline. Finally, I see 22 Hondajet Elite II’s in the delivery pipeline, of which nine have Volato tail numbers. With just four deliveries, YTD, Honda may struggle to deliver aircraft at a rate their customers will like, for the remainder of 2024 Contrary to the flowery narrative I see in trade rags, we have already seen a substantial decline in business jet deliveries and a significant increase in used aircraft inventories. Used aircraft values (from our go-to source VREF) have taken a hit, with a 2015 Gulfstream 650ER falling from $47.54 million to $36.74 million between Q4 2022 and Q2 2024, a decline of 227% Looking at whole aircraft sales, we saw 5,179 transactions in 2022, 4,398 in 2023 and 1,759 for 1H 2024, resulting in a drop from 431 to 293 transactions per month, on average, or 32%. All of the market indicators I monitor are trending well below the 2022 peak with no short-term signs of a reversal. Buckle-up!