Foodsight Your insight report

Issue 12. April 2023 © allmanhall

Hello and welcome to our latest edition of Foodsight.

Since our New Year edition, by my count, food supply has hit the 10 o’clock news on 3 separate occasions…

The first being that of food inflation reaching headier heights since the turn of the year, with CPI Food inflation registering 18% year on year for February 2023. More recently this week, that figure has risen to over 19%. As was well reported in the media, this was the main cause for the unexpected rise of general inflation for the month. Our opening article, ’Prices and Predictions’ on page 19 expands on this and discusses the future outlook, explains what to expect and suggests a number of actions that can be taken.

With the levels of inflation seen over the last year, budgeting will undoubtedly require an even more considered approach this year. The pros and cons of two main methods of budgeting are explained in our article on page 22. With the levels of inflation experienced, whether that be of food, labour or energy, is it time to move from an incremental budgeting method to a zero based one?

The second topic to grace the headlines is -unfortunately increasingly commonplace in the annual cycle of food production and supply - the impact poor harvests. The recent bare shelves of the major supermarkets illustrated the extent of the situation. This is of significance as fulfilling supply to the retail sector takes priority over catering and foodservice when there are supply challenges. On page 24 we explore some of the key aspects related to these recent fresh produce shortages.

The third way that food has hit the mainstream media in recent weeks is the shameful exposé of food fraud within the butchery sector. These sorts of practices must be stamped out and supply chain transparency is key to ensuring food fraud does not and cannot exist. For more on this topic, please see page 27

Sustainability and our ESG credentials are now an ever constant. They are paramount to allmanhall as an organisation and to us as individuals. We are committed to the UN’s Science Based Targets initiative to achieve net zero, and have also applied to join the UN Global Compact – a commitment to implement universally sustainable principles and, vitally, with an obligation to report on these annually.

At allmanhall we will continue to understand, advise, manage and, where possible, mitigate the macro challenges facing food supply. We maintain and develop relationships on a local level to negotiate terms with our joint suppliers to ensure that we can continue to deliver sustainable value and the most competitive arrangements for your organisation.

Please do not hesitate to contact me, or any or the team, if you have any queries or requests.

I hope that this edition of Foodsight is supportive and insightful. Support and Insight, along with Value and Control, being the key pillars of our offering to deliver more sustainable food supply.

With very best wishes,

The importance of this within the food sector is detailed in our piece on page 29. Connected to this is our piece on the forthcoming ban on single use plastic. Detailed information on what this entails and what it means in practice can be found in our article on page 34. We also take a look at the merits of eating seasonally in the final article on page 38.

Covering the ‘Social’ element of ESG, you’ll find our piece on Ultra-Processed Foods on page 42. From what they are, the latest guidelines and how we should look to improve our approach to them, on both a personal and industry basis and also through Government action.

Oliver Hall Managing Director

What you need to know and what you can be doing

Ultra-processed foods

What’s all the fuss about?

Why is it an important catering consideration? Find a seasonal and sustainable recipe on page 52!

Time for a Cuppa week 1-8 May (but you can hold it on any date that suits you!) is the perfect occasion to get together with friends, family or colleagues over a cuppa and some cake, whilst raising vital funds to help families facing dementia.

On 6 of May, the nation will celebrate the coronation of King Charles III. A perfect way to celebrate is to host a coronation lunch or street party with family, friends, and the local community.

This year’s National Salt Awareness Week will take place between 14-20 March and will shine a spotlight on a simple yet effective approach that will improve our health - asking the food industry to shake their salt habit!

National Vegetarian Week 15-21 May 2023 will be bigger and better than ever with a very clear focus on the climate crisis. The week will highlight how switching to veggie meals can reduce your carbon footprint and help the planet, making your meals better by miles!

Check out our range of Vegetarian recipes for inspiration...

Another event for all the foodies out there is National BBQ Week, taking place from 29 of May through to 4 of June. This event can be celebrated by all, no matter your dietary requirements, so sit back, grab a cold drink, and stick your favourite burgers, sausages, and skewers on the barbeque!

Saturday 13 May - International Hummus Day: Join millions of people around the world in celebrating their love for hummus. Consume, share, celebrate and profess your love for this special food. Fancy trying something new? Check out our Hummus pizza bites.

Monday 29 May - National Biscuit Day: A day for us to appreciate a nation favourite, the biscuit, and all its various types and flavours.

Friday 2 June - Fish and Chips Day: Long recognised as one of the nations favourite dishes, why not help it secure it’s spot there for years to come by ordering it and bringing recognition to it’s name!

Monday 12 - Friday 16 June - Healthy Eating Week: All about supporting and promoting healthier lifestyles, why not join in?

Monday 12 June - International Falafel Day: A day to encourage yourself or others to try falafel if you haven’t before, the healthy treat is not to be missed out on...

Thursday 15 June - World Tapas Day: Celebrating the small Spanish Tapas dish usually served with alcoholic drinks.

Sunday 18 June - National Sushi Day: Celebrates the incredibly delicious meal that is sushi and seeks the raise awareness about the truth & fictions behind it.

Monday 17 - Sunday 25 June - National Picnic Week: Picnics are a great way to soak up some sun and enjoy some great food and company!

Wednesday 19 July - This day celebrates a summertime staple in a bun. Enjoy one piping hot and add some relish and mustard to go!

Meat or plant based, we all love a hot dog!

The price of milk is 30% higher than the 5-year rolling average.

The spring flush occurs as the calving season begins, cows produce more milk and can graze outside meaning prices (usually) decrease. On average a cow’s daily feed weighs around 50kg a day and includes a hearty mix of grass, maize, soya and wheat. The quality of the grass is measured in dryness, energy and protein and determines how much a cow needs to eat. At the end of March on average in the UK, grass contained 19.9% dry matter and 12.3 MJ/kg DM (energy). This would mean that a cow needs to eat around 80kg of grass a day. Whilst feed is a substantial cost to farmers, it is not the only cost they are fighting to absorb. The rising costs of fuel and fertiliser are an ongoing concern on top of chronic labour shortages.

These cost implications have also been affecting other dairy prices such as cream, butter, and skimmed milk powder. Looking ahead we would expect prices to fall and bringing about more stability.

With UK egg prices nearly 35% higher than 5 years before, avian flu continues to drive prices up however this is not the full picture. Whilst avian flu has been hitting the headlines, farmers have been calling for higher prices since last April due to rising costs.

The UK has been facing its largest ever outbreak of avian influenza with more than 300 cases confirmed since October 2021. The risk of avian flu has meant that free-range birds have had to be kept inside and freerange eggs to be relabelled as barn eggs from from 27 February - 18 April.

As a result of rising input prices UK egg production declined by 7.8% in 2022, a reduction of over a billion eggs.

The egg price increases continue worldwide as well as in the UK. In February the average price of EU eggs increased by 1.5%, a 71.3% annual increase.

What was once considered a luxury item, salmon is an increasingly popular fish species. With global consumption tripling since 1980 it now accounts for 4% of the total world seafood market. This increase in consumption is largely down to the growth of the salmon farming industry which now covers 70% of all salmon production.

Salmon farms typically reduce the number of fish they harvest during this time of year when the water is cooler and the fish feed less. Colder than average water temperatures in H1 2023 have reduced harvested volumes further and driven prices up.

High demand coupled with the various supply chain issues are causing prices to rise rapidly and are currently at the same record highs seen in April 2022, 65% higher than the 5-year average.

Prices are likely to remain high for the foreseeable future as the government in Norway, where over 50% of the global farmed salmon market originates, is looking to impose a tax on salmon exports. This tax looks likely to be set at 35% on top of corporation tax which will inevitably mean prices remain higher.

As we move into spring, cod will start to spawn and move into deeper, colder waters. This makes it harder for fishers to locate and catch so the rate of fishing slows at this time of year, reducing availability. Bad weather in Norway and Russia, two key producers, is likely to cause inconsistent supply issues as this has limited trawler activities further and affected flights exporting products.

Annual cod availability has fallen by 45% due to a 20% reduction in quotas to protect from overfishing and inclement weather conditions. Sanctions on Russian fish, which comprises 40% of the global market have led to increases to Norwegian cod of 18%.

Demand for traditional alternatives such as haddock and pollock have increased due to the low availability of cod. This is happening at a time when both species are spawning, which makes them harder for fishermen to locate, hence increasing market prices.

Suitable alternatives include coley and hake. Coley does not present the same spawning issues, so supply should be more consistent. Hake will become more readily available as we move into the summer months, as this is caught using gill nets which cannot be used during periods of strong tidal flows in spring.

Potatoes are typically planted in the spring to be harvested from June through to October. Last year’s dry conditions were disastrous for UK and European potato yields. Not only did the drought conditions stunt growth, but pest presence and incidents of disease increased, and the hard ground made harvesting incredibly difficult in many areas.

Crops harvested last year have not stored particularly well. Quality is generally poor and there is a serious shortage of large bakers, which will only become more difficult as we move through the year, towards the new season’s harvest.

Market prices are currently very high and increasing, UK white potato prices are currently sitting at £245 per metric ton and are up by over 150% year-on-year. It is hoped that high prices will help to improve the amount of land dedicated to potato farming. However, many farmers have already taken the decision to reduce the amount of land they will devote this year, while some have decided to abandon potatoes entirely. Cedric Porter, the managing editor of World Potato Markets, estimates there will be a 10% reduction in the land being used to grow potatoes in 2023.

With production costs escalating and uncertainty about future rainfall levels, British

farmers continue to turn away from growing potatoes, instead choosing to use their land for alternative crops such as wheat, sugar beet or rapeseed oil, which are seen as relatively low risk as they require much less labour, irrigation, disposable packaging and no cold storage.

Early volumes of Jersey potatoes are coming through and reports suggest that crops are performing reasonably well. The muchanticipated Jersey Royal has started to hit the shores of Britain. The famous potato has been grown on the steep slopes of the island of Jersey for over 130 years and the traditional method of covering the crops in local vraic seaweed fertiliser is still observed, although modern methods are more common. During May, the small Channel Island can export up to 1,500 tonnes of the new potatoes daily.

With Ukraine and Russia accounting for 30% of global wheat exports, global wheat prices have been very volatile. The average price in March was roughly £266, around 60% higher than 2018.

The Black Sea Grain Corridor was formed in 2022 to allow for the export of foodstuff including grain from Russia and Ukraine through a safe corridor in the Black Sea. This has been vital in supporting the supply of wheat milling across the world and has allowed over 25 million tonnes of grain and other foodstuffs to be exported. There were concerns that the expiry of the deal, due on 18 March, could lead to higher prices as supply is impacted. Whilst an extension to the deal has been announced, for how long is another question. Ukrainian Deputy Prime Minister of Reconstruction, Oleksandr Kubrakov, said the extension would last for 120 days whilst the Russian Foreign Ministry said Moscow agreed to a 60-day extension of a deal.

Wheat inventories of the world’s largest exporters, including Australia and Canada, are at their lowest levels since 2007/2008. Lack of availability will make markets volatile.

54% of the global rice production is produced by India and China; whilst India, Thailand and Vietnam are the world’s largest exporters accounting for circa 65% of global rice exports. In terms of commodity price dynamics, China and India set the market floor, so what happens in these markets sets the tone for global prices. High fuel, fertiliser and freight costs, alongside greater trade polarisation have led to significant price rises. Over the last twelve months rice prices in India have risen by 21%, Thailand by 16% and Vietnam by 5%. August marks the start of the main harvest in China whilst September marks the new season harvest for Indian Crop.

The outlook for future sugar price movement is uncertain. Prices for sugar cane and beet traded on the Intercontinental exchange have risen by 24% over the last twelve months to levels last seen in 2011. Brazil is the world’s largest exporter accounting for 43% of global exports but assessing future movement is complex as some input costs are reducing such as falling shipping costs, whilst others are counteracting these, such as rising energy costs.

Growing in the natural habitat of the lower storey of the evergreen rainforest, cocoa plants thrive in high temperatures and a hot and humid atmosphere. With plentiful and well-distributed rainfall encouraging crop growth, rain is the climatic factor that can have the largest impact on the yield of cocoa plants. The 2022/2023 cocoa season runs from 1 October to 30 September, and with Cote d’Ivoire, Ghana and Ecuador being the three largest cocoa producing countries, there is much focus on the 2022/2023 midcrop for cocoa which began from 1 April.

Looking back to March 2023, cocoa futures prices rose as reports of low bean arrivals at ports led to concerns that contracts would not be fulfilled. With concerns that the lack of rainfall in key West African growing regions was affecting yields, early data from the 2022/2023 season had shown a decrease in processing activities, although the volumes of cocoa beans arriving at ports in Cote d’Ivoire were only 5% lower than the previous year. Whilst the rain has now returned, boding well for the mid-crop and later main crop, the market remains uncertain as some still perceive there to be a lack of availability of beans, despite bean availability being good. As of the beginning of April 2023, cocoa prices are 20% higher than the five-year average at 2181 GBP per metric tonne versus 1816 GBP in early 2018 (Mintec, Cocoa bean London ICE). There are still some concerns over the quality of some West African crops which has limited any decrease in cocoa prices. With the ongoing war in Ukraine limiting the Russian exports of potash and fertilisers, some cocoa farmers

have struggled with the supply of these which can have a knock-on effect on the crop quality.

With cocoa mass being the main ingredient in chocolate and cocoa powder as a flavouring agent across products such as cakes, ice cream, biscuits and drinks, cocoa products make a considerable contribution to our food and drink choices. Although the growing and processing of cocoa looks to be stabilizing, pricing remains high and as with all commodities, the increases across energy, labour and transport factors continue to drive higher prices across the market.

The last two years have been very challenging for UK pig farmers which has led to a contraction in production, with the UK herd size declining by 15% as farmers scale back or leave the industry. This has been caused by a combination of limited abattoir processing capacity and the highest feed prices on record which now account for 70% of total pig production costs.

As a result, market prices have also reached record highs, and September 2022 saw the first time that farmgate prices broke the £2 kg threshold. Deadweight pig prices are still high reaching £2.13 kg in April.

With self-sufficiency rates at 62.5%, the UK market is reliant upon imports from Europe to fulfil demand. But the European market is also experiencing similar challenges, and prices have been on an upward trajectory for the past year, linked to the sudden rise in feed prices following Russia’s invasion of Ukraine.

We expect prices to remain firm for the foreseeable future, with cheaper meats or cuts in high demand due to the cost-ofliving crisis.

Record UK farmgate beef prices could exceed the £5 kg threshold for the first time in history. Historically high prices have been fuelled by tight supplies, high production costs and strong domestic demand. Looking forward at 2023 supply, prime cattle slaughter is forecast to pick up by 1.2%.

The continued strain on household budgets is expected to have the biggest impact on shoppers’ behaviour with forecasts that shoppers will choose to opt for cheaper proteins and cuts. The out-of-home market, while suffering, may also exacerbate a potential carcase imbalance with value-led quick service retail gaining market share through dine-out and delivered takeaways. Expect cheaper beef products such as mince and diced beef being impacted the most by rising demand driven cost pressure.

Following two years of unprecedented high prices, lamb markets are returning to their five year average. Domestic supply is currently six percent higher than a year ago and expected to rise to almost 16% higher by July.

Unlike beef and pork markets, domestic retail demand remains sluggish, with the latest AHDB report indicating a 9.2% decrease in retail volumes this year. This is unsurprising as lamb is one of the most expensive proteins. During the religious festivals, Ramadan and Easter, short term demand normally acts as upward pressure on pricing however, the longer-term trajectory is lower domestic demand leading to a weakening in prices.

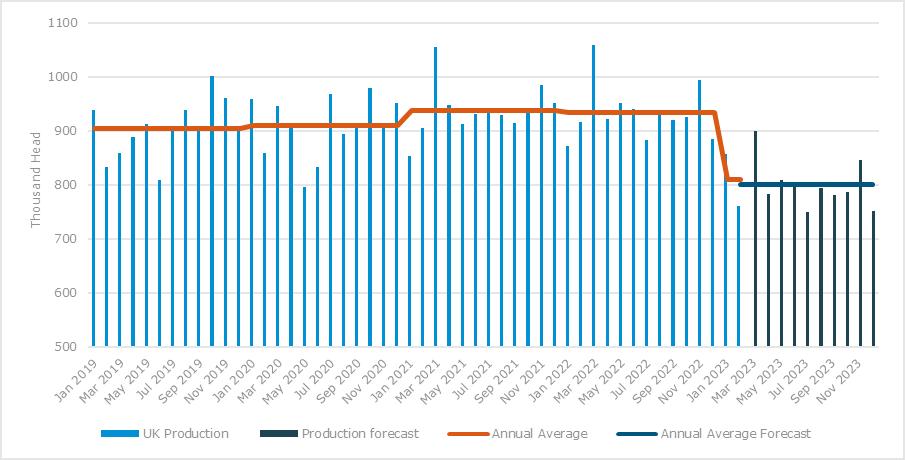

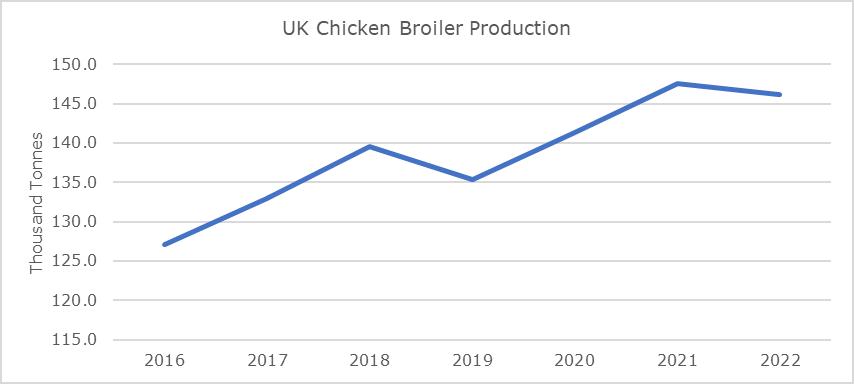

Global Poultry Markets continue to be influenced by avian influenza and high input prices.

With UK poultry self-sufficiency at 65% there is a continued reliance upon EU imports to meet domestic demand. European supply remains constricted, with the latest reports forecasting an annual production downturn in 2023 by up to 3%, or 420,000 tonnes on the 5-year average. Avian influenza and high feed prices are impacting poultry production but the effects of avian flu should ease as we transition to spring.

Unlike the EU, domestic production has steadily increased over the past 6 years and whilst there was a reduction in production towards the end of 2022, attributed to the

higher energy and feed costs, early indications show an increase in expected volume in 2023.

Following the trend with other cheaper protein products, poultry prices are 30% higher than the five-year average, resulting from higher input costs and consumer demand for value. Yet, there are no signs of poultry prices falling in the near-term.

Violife Professional is a range of award-winning dairy free cheese alternatives to make it easier for you to cater for flexitarians or customers seeking a fully plant-based diet.

•Create delicious dishes that can serve every customer.

• Simplif y operations with no more workarounds for dietary and lifestyle requirements.

•A variety of formats, flavours and styles to suit all preferences.

•Uses a quarter of the land to produce versus dairy.**

• Has less than half the climate impact compared to dairy cheese.**

“I need the qualities of cheese for my top dishes, but I also need to serve growing flexitarian demand.”*

A classic flavour that complements a variety of recipes.

Ideal as a topping on pasta, pizza, lasagne and baked dishes.

Ingredients:

Water, Coconut Oil (24%), Modified Starch, Starch, Sea Salt, Flavourings, Olive Extract, Colour: B-Carotene, Vitamin B12.

All our products are free from everything. No allergens, no nuts, no GMO, no preservatives, and they’re Halal & Kosher certified. Plus, they are enriched with Vitamin B12.

For inspiration on recipes, scan the QR code.

Trial Foodsteps for FREE and do just that...

Add up to 5 recipes or food items for FREE and see the carbon impact data, instantly!

Foodsteps is so easy to use and great for communicating and understanding carbon impact assessments of your food. Together, you and your diners can make a difference.

You won’t be able to download the carbon labels under the free trial.

But, if you like what you see, simply ask allmanhall for advice about the best option for you and how to access competitive rates.

Full T&Cs here.

Food inflation is now at over 19%. For the rest of 2023, what is the outlook for food supply chains? Will we continue to see high food prices?

The team at allmanhall provide some insight and updates, to shed some light on what you can expect, to help you plan and adapt to achieve the best value.

Last month we reported that the 12-month rates of inflation for all individual CPI food categories had risen by over 14.9%. The exception was fruit – that increased by 7.7%.

In reverse order, the three highest rising categories were: vegetables (including potatoes) +18%; then in second place milk, cheese & eggs +30.8%. Oils & fats were at 32.1%.

Vegetable oil commodity prices are starting to fall. We would expect to eventually see this flow through to lower product prices for caterers. Spring is a time at which dairy commodity prices begin to soften, leading to an anticipated drop in the average farmgate milk price. For those that can afford lamb, the price of UK old season lamb is lower than a year ago.

Conversely, potato prices are likely to hike up later this year. There are concerns that UK farmers have been restricting crop plantings owing to concerns following February’s record low levels of UK rainfall. Lower UK potato plantings will reduce supply, impacting availability. Which is likely to then drive-up potato prices.

That said, many categories have reached or are close to reaching peak inflation. However, this is not to be confused with cost reductions; really what it means is a slowing of the rate at which prices are increasing.

Despite the ‘rate’ of inflation falling, immediate marketplace inflation continues to be historically high, impacting food prices. While it is likely that we will see the rate of inflation gradually falling over the coming twelve months, in the short run food inflation is anticipated to remain well above the five-year average. The effects of high energy costs and lower global food costs are cascading through the supply chain, and this will keep those food prices stubbornly high for now.

It’s so important to take into consideration the likely future market dynamics. Be cautious about trying to secure long term price holds when commodity market prices are high (as they currently are) and when some are likely to fall. Longer term price fixes are actually more effective when commodity prices are low as the risks associated with overpaying are minimised.

Driving value in your product choices can be done in multiple ways. For example, moving from branded purchases to own label can be highly economical. Particularly if they’re being used in back of house production and where quality standards allow.

One key means of releasing value is by understanding the relative costs of similar product groups and rebalancing purchases to preference of cheaper alternatives. For example, looking at protein at a commodity level, consider the deadweight value of beef vs pork or, especially at the moment, lamb. And non-meat protein alternatives like lentils are even more cost effective. This comparison of the value of protein options is certainly worth considering when planning menus.

Beyond pricing, do make sure you factor in the impacts of cooking on product yield and portion costs for yield loss, shrinkage and consistency.

For more on this and a range of topics, visit https://allmanhall.co.uk/blog.

If you’re an allmanhall client, visit The Pass to stay up to date with the status of all supplier price negotiations taking place on your behalf.

With ONS CPI inflation on food and nonalcoholic drinks climbing to 18% for the 12 months to February 2023 the thought of budgeting for the upcoming financial year is not a pleasant one! Just this week figures of 19%+ have been published.

Spiralling food and energy prices are putting catering operations under huge cost pressure and in turn, a need to find savings wherever possible. The process of identifying and delivering savings opportunities is far from easy and many organisations overlook their budgeting method within this process. A move away from the traditional, incremental, method of budgeting could help.

Is the traditional budgeting method of taking the current year/period performance as a starting point and applying an increase for the new year/period. These increases attempt to cover elements such as inflation, price increases, meal numbers, etc. Incremental budgeting is widely adopted and does have benefits;

• It’s easy to prepare and easy to understand

• Less time-consuming than other methods

• Can be applied consistently across organisations.

There are drawbacks to the incremental method, particularly with the level of macro instability we are currently experiencing;

• A lack of stability can make accurately applying increases tricky

• A lack of clarity on potential increases can make them hard to justify

• Waste is encouraged, by assuming that all current and previous costs are needed, opportunities to remove unnecessary cost can be missed

• Ever-increasing budgets have the opposite effect of encouraging cost reduction

• Encourages a spend it or lose it attitude where budget holders spend up to the maximum to ensure they do not have budgets cut for the following year/period.

Although being efficient to prepare, incremental budgeting falls short during high-cost pressure times when identifying and delivering savings is crucial. So, is there a different approach?

This budgeting method starts from zero. Previous years/periods’ results are not considered, instead, all budget lines are built up from zero with all expenditures requiring scrutiny rather than just the amount of increase. Zero-based budgeting can be particularly beneficial in identifying cost-saving opportunities;

request for an increased budget, but budget holders will have the information required to justify any increases

• Actions taken to mitigate costs are easier to realise

• Less emphasis on spending cost surpluses.

The major drawback of a zero-based budget is the time and knowledge required to carry out the process. There may be an increased cost in the process that should not be overlooked. It may make more sense to apply a zerobased approach to parts of the organisation’s budgets rather than across the board as more stable costs may simply not require or justify increased scrutiny.

• By starting from zero, all costs need to be justified. Any unnecessary cost is removed from the budget from the outset

• By fostering a questioning attitude, budget holders have more ownership

• A zero-based approach may still lead to a

Shortages of fresh fruit and vegetables are nothing new. As we move into summer, we take a look at the factors impacting the availability of fresh produce recently and make forecasts regarding what you can expect to see over the coming months, to help you plan…

Quality standards and availability have always been susceptible during the challenging transitional periods between growing seasons, or due to the variability of our seasonal weather patterns. Farmers are skilled at managing their way through these anticipated scenarios. However, the effects of climate change are making this much harder. With even greater volatility and weather extremes, the Environment Agency have stated that “planning for increasingly more extreme weather is essential in order for everyone to be prepared for the impacts these events cause – both drought and flooding”.

The Met Office reported that February 2023 was remarkable for its dryness, being the UK’s driest February since 1993. This has been compounded reservoir capacity falling to just 49% at the end of September 2022. With only half of UK potato plantings having irrigation systems, the vulnerability surrounding water abstraction, collection, storage and distribution means an intensification of existing uncertainties brought about by the rising costs of producing potatoes and rising energy bills. With reports that the cost of producing potatoes has increased by 20% it is easy to understand that, with added drought fears,

many UK growers may decide against or reduce plantings this spring. What happens this month will to a large extent determine potato prices in July 2023 to May 2024.

Looking at domestic consumption in 2021, 56% of all vegetables ingested were grown in the UK. For this UK figure was only 13%, with 26% from the EU and 61% from further afield.

Food security and resilience are built upon a mixture of strong domestic production and supply from diverse sources. In the case of the recent shortage of tomatoes, capsicum and cucumbers, the exceptionally cold weather in Spain and Morocco was made all the more serious as a result of a significant decline in UK glasshouse production brought about by unaffordable energy costs – a perfect storm that was only ever going to be avoidable with some form of high-level intervention.

Potatoes are not the only crop impacted by concerns of dwindling water supplies. Particularly dry conditions in Southern England and East Anglia, which is a key growing region, are leading to apprehension about future availability and high prices. With main crop drilling in March and April,

any impacts could be long lasting. East Anglia was the driest region in the UK during 2022 which was in itself the eighth driest year since 1836. Groundwater levels and reservoir stocks are below normal levels, whilst soil moisture deficit levels have increased there, fuelling growers concerns in the region. Where these items of produce are suffering low availability, expect to see high prices (supply vs demand economics).

Year-round supply of fresh produce has its environmental downsides. The impact of transport is often overstated and can be minimal in comparison to the intensive production methods used in glasshouses.

Produce grown out of season in glasshouses emits up to five times more carbon than imported produce from overseas, when grown in season and outdoors. In fact, half of all the emissions related to transport come from a very small proportion of products flown in by air. Just 1.5% of all imported fresh produce is airfreighted into the UK, these include Fine Beans from Kenya and Asparagus from Peru.

The summer of 2022 was Europe’s hottest on record, according to the global climate report from the EU’s Copernicus Climate Change Service. These unusually high temperatures continued into autumn and early winter, which in turn led to severe problems early on during the flowering and the production of salad crops. Lower availability is likely to impact salad prices.

High energy costs from both airfreight and glasshouses are likely to lead to high production costs and emissions and high produce costs of these items. Avoiding where possible or at least reducing them in your menu planning will help achieve cost savings as well as supporting the reduction of your carbon footprint – sustainable value!

For more on this, see also our seasonal eating article on page 48

In the wake of the food fraud reports regarding the processed meat industry, the CEO of the Food Standards Agency (FSA) has issued a pragmatic and realistic warning: “…at a time when cost pressures and other challenges mean the risks of food fraud might be increasing, it is vital everyone involved in the food chain works to ensure that food is safe and what it says it is.”

Farmers Weekly have advocated some sensible measures:

• Making digital record keeping mandatory

• Addressing the 15 minute gap between auditors signing in and entering the factory floor

• Displaying whistleblowing lines in factories

• Undertaking independent mass balance assessments between the amount of UK product entering and exiting processors.

clear.

The recent reports of food fraud within the processed meat industry continue to emphasise the critical nature of this mission. And the importance of independently assessed external schemes in helping to map and monitor risk within UK and global supply chains.

Through EcoVadis, allmanhall actively and independently rates suppliers, to assess and validate supplier systems, policies, actions and results, encompassing Ethics, Labour, Human Rights and Sustainable Procurement. Our client and supplier relationships are established on fairness, integrity, longevity, and mutual respect. We require our suppliers to uphold these same values and to commit to bring about transparency in supply chains.

One of our supplier partners made this statement: “We do not tolerate any form of food fraud within our supply chain and take the accuracy of food origin claims extremely seriously.”

allmanhall continues to play our part in bringing transparency and making information readily available. This enables an understanding and appreciation of what lies behind the food we all provide and consume, from a social, safety, environmental and quality perspective. Read our supplier code of conduct.

To read more about the food fraud reports that hit the headlines earlier this spring, take a look at the resources below:

• https://www.theguardian.com/food/2023/ mar/29/inquiry-launched-after-foreign-porkis-allegedly-sold-as-british

• https://www.bbc.co.uk/news/ business-65125811

• https://www.farmersguide.co.uk/thousandsof-tons-of-imported-pork-sold-as-british-inlatest-food-fraud-scandal/

We challenge and transform food supply so informed decisions become

We are facing some very large, complex and interconnected environmental challenges. Challenges that demand our attention. Exponential global population and wealth growth are fuelling our demand for ever more resources and energy, whilst the restorative power of planet remains fixed. allmanhall have just submitted our letter of commitment to join the UN Global Compact for precisely this reason.

As we become more powerful our planet becomes more fragile. Climate change is one of several material environmental challenges facing us, alongside biodiversity loss, pollution, water scarcity, the health of our oceans and the challenge of how to feed a growing global population sustainably, healthily, and equitably.

Here are several simple steps that can help your team to start the journey to redress some of the balance.

1. Global issues require global responses which is why any approach or plan should incorporate the 17 United Nations Sustainable Development Goals as societies, organisations and governments translate these goals into action. Take time to familiarise yourself and your team with these. They are a global call to action for some of our most challenging issues.

2. Take action to tackle climate change. Time is rapidly running out and our actions over the next two decades will determine our future. The IPCC sixth assessment report shows that we will probably reach 1.5˚c of warming within the next two decades and we need to cut emissions significantly to prevent the worst outcomes. 2˚c warming is risky and best estimates show a high emissions pathway leading to a catastrophic 4.4˚c by 2100. Joining the Science Based Targets Initiative, as allmanhall has, is a way to take action.

Whilst these interconnected issues require global system change, we are also obliged to play our part in taking positive steps through the way in which we operate as individuals and as organisations and communities. Change needs to happen quickly and at all levels - top down and bottom up. These challenges also call for a rethink, including how society assigns value to nature and what value society is prepared to place on the health of our people and planet.

3. Up to a third of global greenhouse gas emissions come from our food systems. Your foodservice operation can take these simple measures in relation to food ingredients.

a. Use carbon footprint technology like Foodsteps to calculate recipe emissions. Healthy, tasty, nutritious and climate friendly meals can be identified and labelled as ‘hero’ dishes. It is also a helpful way to enable informed choices as it clearly communicates the carbon intensity of different food types.

b. Recognise that transportation is usually only a small element of the carbon footprint of food. It is about what you eat, not necessarily where it comes from. In climate terms ‘local’ is only good sometimes and the food miles concept is largely defunct – don’t fall into that trap.

c. Change the dietary trend from more meat and dairy to less, which can also help to reduce cost. Livestock alone contributes 14.5% of human produced global greenhouse gas emissions. (FCRN chapter 1 Overview of Food System Challenges).

d. Eliminate airfreighted produce. Only 1.5% of imported fruit and vegetables travel by air but account for 50% of all fruit and vegetable transport related emissions. (Centre for Environmental Strategy, University of Surrey).

Our Seasonality article in this edition of Foodsight, on page 48, has more detail.

f. Appreciate what lies behind our food, the environmental impacts of our food systems and the value of nature.

i. The World Economic Forum estimates that 50% of global GDP is derived from natural resources, so let’s look after it. If we destroy the natural world, we destroy ourselves.

ii. Climate change cannot be tackled without eliminating deforestation and 12 million hectares of forests are destroyed annually.

iii. 70% of tropical deforestation is due to the production of agricultural commodities such as soya, palm oil, beef, pulp, timber and paper.

iv. Ensure that soya, palm oil and paper products are all sourced from certifiable sustainable sources. This should include mapping them as ingredients within more complex products. Soya and palm oil are not the problem, it is how they are grown that is.

e. Out of season produce grown in energy intensive UK greenhouses can have significantly higher environmental impacts than those grown overseas, outdoors and travelling many miles by sea or road.

v. 90% of global fish stocks are fully or over exploited. To combat this, make sure that the fish products used in your foodservice operation is sustainably sourced by choosing products that are on the Marine Conservation Society ‘Fish to Eat’ list and never purchase items on the ‘Fish to Avoid’ list.

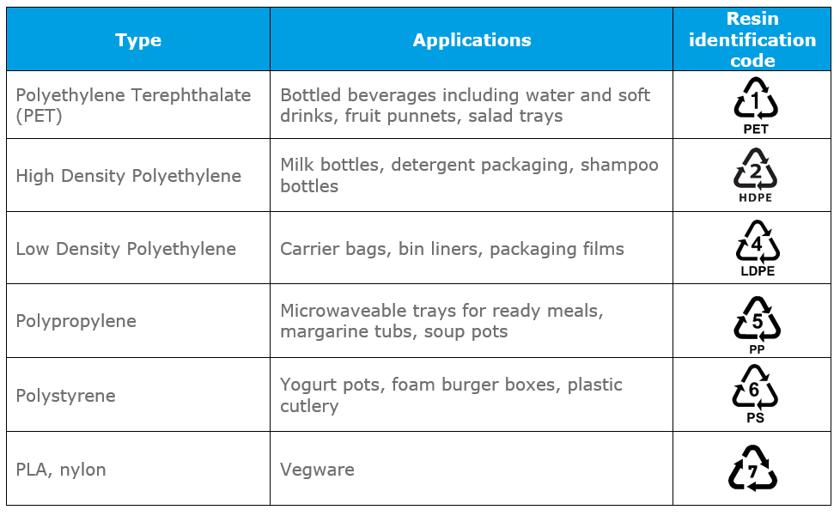

4. Up to a third of all plastic packaging, 47 million tonnes, leak from our collection systems annually (WRAP). Take these simple steps to make a positive difference:

a. Identify and eliminate problematic and single use plastics such as polystyrene, PVC cling film, non-compostable bags, single serving plastic sachets, and plastics that cannot be detected by near infrared (NIR) sorting systems. (See also our Single Use Plastics article on page 34 of this edition of Foodsight).

5. Take food waste seriously - it impacts climate change. The UK foodservice and hospitality sector throws away 1.1 million tonnes of food annually, and seventy-five percent is avoidable (WRAP).

a. One kilo of food waste is equivalent to throwing away three kilos of CO2e (WRAP) and circa 30% of all food produced for human consumption is never consumed (FAO).

b. Measure the amount of catering food waste at each production stage: preparation, spoilage, plate & over production.

c. Segregate all waste streams for recycling.

d. Recycle used cooking oil.

e. Align your waste management to the capabilities of your local recycling facilities.

6. Measure the impact of your actions to assess progress and to communicate the benefits. Setting targets and pledges show good intent though it is key that these good intentions lead to quantifiable improvement. Consider joining schemes like the Science Based Target Initiative (SBTi) mentioned earlier. This will help validate your decarbonisation ambitions and ensure that your climate reduction targets are in line with the latest climate science.

For more information, please do speak to the team at allmanhall. As food procurement experts, who understand the complexities of food supply chains, we will be more than happy to provide support regarding your ESG and value chain planning.

Trial Foodsteps for FREE and do just that...

Add up to 5 recipes or food items for FREE and see the carbon impact data, instantly!

Foodsteps is so easy to use and great for communicating and understanding carbon impact assessments of your food. Together, you and your diners can make a difference.

You won’t be able to download the carbon labels under the free trial.

But, if you like what you see, simply ask allmanhall for advice about the best option for you and how to access competitive rates.

Full T&Cs here.

What you need to know and what you can be doing

As of October 2023, the UK Government is introducing new legislation banning the use of certain single use plastics. This is designed to support and encourage a decrease in the use of plastics in the UK, to help reduce plastic littering and general plastic waste.

The UK’s single-use plastic ban follows the EU directive signed off in 2019, with clear targets to significantly reduce plastic consumption across Europe by 2025.

It works towards the Government’s ambition from the 25 Year Environment Plan to eliminate all avoidable plastic waste by 2042. Plastic pollution takes hundreds of years to break down and inflicts serious damage to our oceans, rivers and land. It is also a major source of greenhouse gas emissions, from its production and manufacture to the way in which it is then disposed.

England is currently estimated to be using 2.7 billion items of single-use cutlery, the majority of which are plastic, plus 721 million single use plates per year. Of these only a very low percentage are estimated to be recycled –circa 10%.

To be included in this ban, the products must satisfy ‘Part 1’ and ‘Part 2’ of the UK’s definitions for polystyrene ban:

Part 1: Polystyrene is a polymer made from styrene monomers that can be used in a vast array of applications. Only polystyrene that has been through a foaming process will be considered in the scope of this ban. Foaming in this context is a method of expansion of the material at any point during its manufacture, by any means, using any blowing agent. For clarity, products made from polystyrene that has been expanded prior to fusion are considered Expanded Polystyrene (EPS) products. Those products made from polystyrene that has first been extruded, then expanded are considered to be Extruded Polystyrene (XPS) products.

Part 2: ‘Food and drinks containers’ in this instance are those used to contain food or drink that is ready to be consumed without further preparation (such as takeaways). There is not presently an intention to ban polystyrene boxes used to transport unprocessed or unprepared food through the supply chain. For example, polystyrene boxes used by fishers to store and transport freshly caught fish are not in scope.

If these 2.7 billion pieces of cutlery were lined up, end to end, they would go around the planet they are so adversely impacting eight and a half times! (based on an average length of 15cm per item of cutlery).

The ban will include single-use plastic plates, trays, bowls, cutlery, balloon sticks, and certain types of polystyrene cups and food containers. From October 2023, people won’t be able to buy these products from any foodservice operation. This includes retailers, takeaways, food vendors and the hospitality industry.

There is some confusion over what items are included in this ban, and in which areas within the UK. To help bring some clarity, we have listed the policies below:

Ban single use plastic cutlery, plates, straws and stirrers (including CPLA cutlery and PLA straws)

Yes, from October 2023

Yes, and extruded polystyrene too from October 2023 No Yes, in place since 2022 Turtle graphic on beverage cups containing plastic

since 1st June 2022 No Included in billin force autumn 2023/2024

since 2022 No No

in force autumn 2023/2024 No No No Yes, in place since 2022 Ban all polystyrene lids for cups or takeaway food containers

NB. Wales is implementing varying stages of the bill over the autumn of 2023 and into 2024, and some elements are already active. Wales will also place a complete ban on plastic bags in 2024.

• Plastic drink stirrers

The items included within the ban, for caterers and foodservice operators to be aware of, are:

• Expanded polystyrene containers, such as takeaway food and drink containers.

The following decisions have been made:

• A ban on the supply of single-use plastic cutlery, balloon sticks, and single-use expanded and extruded polystyrene containers including cups

• The ban on ‘cutlery’ will include singleuse plastic knives, forks, spoons and chopsticks made of plastic, including standard size or mini-size cutlery or a combination of cutlery, such as sporks

• A ban on the supply of single-use plastic plates, trays, and bowls (amidst a concern that if they are not included, there will simply be a switch from using single-use plastic plates to bowls and trays rather than reusable alternatives)

• The ban on the supply of single-use plastic plates, trays, and bowls will not apply to plates, trays, and bowls that are used as packaging, in shelf-ready pre-packaged food items as defined in The Packaging (Essential Requirements) Regulations 2015 regulation 3(b) (such as bowls and platters in a frozen meal). This is to avoid duplication or confusion with our proposals for an extended producer responsibility scheme (EPR) for packaging. For clarity, plastic plates, bowls, and trays that are used as packaging can be used in eat-in and takeaway settings. However, exploring how the use of these single-use items can be reduced is recommended, as is a move to reusable alternatives instead

to the end user. This will allow foodservice operators to purchase empty plates, bowls, and trays to use only as packaging for food, yet individuals won’t be able to purchase these items.

• Any supply of plastic bowls and trays that are not packaging will be a ban on supply

There has been some questioning regarding the proposed bans on compostable plastic applications in closed-loop environments. This is because bio-based, biodegradable and compostable plastics are still plastics. Depending on the polymer, bio-based feedstocks can be used to produce the same plastics as conventional fossil-based feedstocks. As biodegradable and compostable plastics aren’t designed for reuse, they are inherently single-use in nature. There’s also a real lack of evidence regarding these materials consistently breaking down as advertised, when it comes to real world environments. They may therefore be a source of plastic and microplastic pollution.

EPS Expanded polystyrene is a plastic resin derived from crude oil often used for plastic cutlery. It can’t be recycled and flakes easily into micro plastics, often escaping from landfill and traveling long distances. EPS doesn’t break down and has chemically absorbent properties.

Aqueous coatings (or dispersion coatings) are made by suspending fine particles of plastic in a water solution and applying that to the surface of the cardboard. The water is then dried away, leaving behind a fine plastic coating. Because less than 10% of the total weight is the coating, it will still pass home composting and paper recycling tests despite being made from plastic… but not always in industrial composting processes.

Plant-based elements such as sugarcane and corn can be used. But the fact that these are often coated with a plastic or resin doesn’t

necessarily mean they are fully recyclable in today’s systems.

PLA lining (Bioplastics) are sometimes referred to as compostable packaging, which must biodegrade within 12 weeks. However, for food and drink packaging the materials will often only do so in industrial conditions, not in home composting conditions. There are several packaging solutions that are compostable, however by standards these are only industrially compostable should they make it to a facility able to process them.

Instead of being recycled with regular plastic materials, PLA needs to be sorted separately and brought to a ‘closed composting environment’ otherwise it contaminates the recycling stream. With the demanding conditions for industrial biodegradability and the time it takes, and the reliance on consumer disposal habits, it makes it practically impossible for the products to complete their life cycle as marketed.

It is vital that compostable plastics are sent to an industrial composter for them to compost as, if littered in the open environment they will act much like any other plastic. In addition, because they are visibly indistinguishable from non-compostable plastics, even when they are sent to industrial composters there is no guarantee that they will not be stripped out at the start of the process and sent to landfill or incineration plants. The Government has previously put out a call for evidence on this topic. The findings? That there is currently insufficient industrial composting capacity in England to fully manage compostable plastic and so any exemption wouldn’t be viable – it would risk improper treatment.

What all of this means is that the bans, to be effective, have to cover items made from all plastic that is bio-based, biodegradable or compostable.

There are a number of alternatives branching out in the market. allmanhall are currently investigating the product ranges from these companies. The good news? There is certainly now a greater variety available than even a year or so ago!

Vegware, for example, have introduced a range of wooden bamboo cutlery, cups, trays, sandwich boxes and containers and the range continue to expand. However, as shown earlier, this doesn’t necessarily solve the PLA challenge.

allmanhall have identified one company in particularly offering viable alternatives: Notpla.

By the UK Government’s legislation, PLAs could be fully banned over the next few years and alternative solutions demanded…

Notpla is developing a number of products and was recently awarded the Earthshot Prize. Notpla offer a wide variety of disposable products made from seaweed and plants, all of which are totally biodegradable and compostable. They have even designed an edible bubble & bottle made from seaweed. This is designed to replace single-use

packaging for liquids. It is plastic-free, vegan, naturally biodegradable and a fun and unique way of serving a drink. Get hydrated and eat the packaging at the same time… winning!

Shown below are some of the Notpla products, including their edible bubble!

If you’re serving in a dining room setting, the initial impact may seem fairly low. However, it will be necessary to review your food takeaway policies and the products currently being used to facilitate this.

Foodservice operators should be considering an immediate reduction in stock levels of banned products to achieve the October deadline. If a takeaway service is to continue then alternatives to the banned items need to be sourced, stocked and budgeted for. Alternatively, a review of how the foodservice offering is operated may be required.

allmanhall have recently been consulting with Badminton School, an independent boarding school for girls in Bristol. Badminton School have taken the decision to continue their takeaway service with some big changes. Pupils and staff using this facility now have to bring their own containers to facilitate the takeaway. This has already been seen to deliver savings, both in the use of disposables items but also in terms of costs.

The introduction of a “bringing your own bottle” initiative, to encourage refillable vessels, has been well received in many foodservice environments, especially in some of our schools. Again, proactivity like this is a step in the right direction.

and reusable are an option, with the cost of these products being, surprisingly, on a par with the current plastic options. Do take a look at the alternative products section of this article and, in particular, Notpla for inspiration

Other areas that are also being considered by many foodservice teams is the removal of disposable cups, moving instead to branded reusable cups. Great for promotion and also for highlighting sustainability credentials. Polycarbonate alternatives that are washable

Ultra-processed foods (UPF) are getting a lot of airtime at the moment, most of it negative. There are lots of studies now which link ultraprocessed foods to negative health effects such as heart disease, weight gain, cancer and mortality. This is pretty damning considering the UK has one of the highest consumption rates of ultra processed foods. The average person in the UK consumes 63% of their calories through ultra-processed foods with 65% of children’s daily energy intake coming from these foods. There are differing opinions in the scientific world about whether it is the actual processing that causes the negative health effect or the fact the most UPF are higher in fat, salt and sugar. Here we take look into what UPF are, how they are classified, the evidence behind them and what we should be doing about them in our diets.

They called this the NOVA classification system. Whilst there are other classification systems available, this one is still the most widely used. Many research studies have used this classification as the basis of their research into the impact of processed foods on health.

The term UPF was initially developed by the Brazilian nutrition researcher Carlos Monteiro, at the University of São Paulo, Brazil. In 2009, Monterio and his team went on to develop a classification system for defining foods by the level of processing. This went from unprocessed or minimally processed, such as whole fruits and vegetables, to ultra-processed such as readymeals, biscuits and burgers.

Foods are placed into 4 groups: Taken from

It’s group 4, the UPF that we’re interested in here. These tend to include ingredients which may not be used at home such as chemicals, colourings, sweeteners, and preservatives. What lots of people don’t realise is these are often included in common staples in our diet such as breakfast cereals and bread, that we may have perceived as healthy.

For example most granary bread from the supermarket is classed as group 4 ultraprocessed, as are baked beans.

on the adverse associations between UPF intake and a diverse range of health-related outcomes.

These findings strongly point towards aspects of ultra-processing as being important factors that impact health and question the ability to conclude that the adverse outcomes from UPFs can be solely attributed to their nutritional quality.

Ultra-processed foods typically benefit from extended shelf life, an important consideration for the way we eat now and for lower income consumers without reliable access to refrigeration or those not able to shop regularly. A focus on reduced food waste is another factor.

When it comes to UPF, scientists and nutritional experts can’t agree on where the detrimental health effects arise from. Some believe it is not actually the ultra-processing that causes the increased health risk, but the fact that these foods generally tend to be high in fat, salt and sugar. And that they tend to be low in fibre, vitamins and minerals.

But many believe, and observational studies have shown, that it may not be that simple. And that even after adjustments for fat, sugar and sodium intake, or adjustment for adherence to a range of healthy or unhealthy dietary patterns, there is a minimal impact

Among other reasons for the popularity of ultra-processed foods are the inexpensive cost of their main ingredients. They are therefore highly profitable, hence they often have aggressive marketing, especially toward youth consumers and particularly in middle income countries.

In addition, the way they are made makes them highly palatable, easy to eat with minimal preparation needed. Appealing in a time-poor society.

Some countries have gone as far as to change their Government nutrition guidelines. For example, Brazil recommend limiting the consumption of processed food and avoiding ultra-processed food. France aims to reduce their consumption of group 4 ultra-processed foods by 20%.

The World Health Organisation and UNICEF, the United Nations’ Children’s Fund, both recognise the importance of addressing ultra-processed food consumption for ending childhood obesity. The UN Food and Agriculture Organization also recommends limiting UPF consumption.

In the UK it seems we have away to go to reduce UPF…

‘Taking the biscuit’ is a campaign launched by the Soil Association. It highlights examples of the NHS Food Scanner App endorsing ultraprocessed foods, promoting them as good or healthier choice. Examples included: Alpen Light Cereal Bar, Monster zero sugar energy drink and Aero Chocolate Caramel Bubbly Mousse.

Unfortunately there seem to be no changes on the horizon for UK guidelines.

Dimbleby’s National Food Strategy for England raised concerns about ultra-processed foods. The UK Government’s Food Strategy White Paper, published in June 2022, recognised UPFs as contributors to the “overconsumption of high calorie foods”. The Government had announced plans for research funding in this area. However, it’s not clear how (or if) this funding will now be spent.

Examples that suggest it is not being taken seriously include the delays on measures announced in 2021 to introduce a 9pm watershed on TV advertising. Also a delay in the restrictions on paid-for advertising of foods which are high in fat, salt, and sugar online. Work has also been halted on a Health Disparities white paper, previously promised as part of Boris Johnson’s Government’s Levelling Up agenda.

More positively, SACN (Scientific Advisory Committee on Nutrition), who advise the Government on nutritional recommendations, are due to publish a position statement on UPFs later this year. Watch this space!

The BDA released a position statement on processed food in 2021 stating that it is important to think about the context when it comes to processed and ultra-processed foods.

For example, fortified foods are designed to add nutrients to someone’s diet who may otherwise struggle to meet their requirements. The act of food fortification would put a food into the processed or ultra-processed foods category. Take bread for example; the flour used is fortified with added iron, niacin and thiamine in the UK but because of this would be classed as processed or ultra-processed. The dichotomy therefore is that in some cases, processing foods can actually make them healthier. Its this level of understanding and complexity that requires awareness…

A bowl of bran flakes for example is as much a UPF as a chocolate rice cereal or cereal based on choc-chip cookies. Yet this is despite the bran flakes being a good source of fibre and being fortified with numerous vitamins and minerals, and often being relatively low in added sugar or salt.

Processing that preserves food such as tinning, freezing etc, is also something to be valued, especially as it is often a key means for those on lower incomes to eat a more varied diet. It is also a way for all of us to reduce food waste and this has important associated environmental impacts.

Does labelling foods as UPF solve problems or create problems?

Until there is clear agreement when it comes to linking UPF with the nutrient profile, there is a risk it will add confusion rather than transparency. For example, baked beans are often labelled as a healthy choice, high in fibre/ protein but would also have an UPF label on. From the evidence, we know we need to reduce UPFs. We know we need to reduce the amount of sugar, fat, and salt we consume and eat more whole foods. To do this, however, there needs to be a whole cultural shift. We have normalised this way of eating diets high in UPFs.

Political action is also required to force changes within the food industry. This means advertising, cost and availability. Food manufacturers have a responsibility to develop healthier products, making healthy – and sustainable - choices easier, more convenient and accessible, and for them to be affordable. Until these changes happen, we are unlikely to see any big shifts occur.

As individual consumers or as caterers, we can all try to reduce the amount of UPF we eat or serve. Start by focusing on whole foods as much as possible.

1. Parnham, J.C. et al. (2022). The UltraProcessed Food Content of School Meals and Packed Lunches in the United Kingdom. Nutrients, 14(14), 2961; https://doi. org/10.3390/nu14142961.

It is so important that we do not allow ‘processed’ to become a confused and pejorative term when applied to foods such as this.

2. Colombet, Z. et al. (2022). OP12 Social inequalities in ultraprocessed food intakes in the United Kingdom: A time trend analysis (2008–2018). Journal of Epidemiological & Community Health;76:A6-A7. http://dx.doi. org/10.1136/jech-2022SSMabstracts.12.

3. Dicken, S.J. & Batterham, R.L. (2021). The Role of Diet Quality in Mediating the Association between UltraProcessed Food Intake, Obesity and Health-Related Outcomes: A Review of Prospective Cohort Studies. Nutrients 2022, 14(1), 23. https:// doi.org/10.3390/nu14010023.

What is seasonal eating and why is it an important catering consideration?

Many of us have heard the term ‘seasonal eating’ but it is hard to fully understand what that means with the vast choice and array of foods so readily available to us, year-round.

The fresh food items you buy carry labels showing they’re from all over the world… tomatoes from Spain (when they’re available!), sweet potatoes from South Africa and asparagus from Mexico.

Having such a selection of food at our fingertips, all year round, is something we have come to expect. It may seem like something we should be incredibly grateful for, is it really such a good thing?

Let’s take the humble spring onion for example. A huge proportion of spring onions consumed across the UK are imported from Thailand meaning it has travelled approximately 5,900 miles to get to our supermarkets. Egyptian spring onions are also shipped into the UK. From a sustainability perspective, this clearly has an impact on the environment… especially if the mode of transport is airfreight. Long distance travel may mean increased environmental costs for us however it’s important to note that the food miles argument in its most simple state is defunct. The transportation of food only accounts for a small percentage of the value chain when it comes to emissions.

A shipped spring onion will have a lower carbon footprint than one grown out of season in a hot house in the UK, requiring extensive resources to recreate the growing conditions needed. There’s that word again – seasons are important.

Coming back to our little spring onion, when it comes to the quality of the produce, if imported it will mean that by the time we actually eat it in a delicious dish, it will be days, if not weeks old.

In general fruits and vegetables are picked at the peak of their ripeness and also, the peak of their nutritional status. The problem in our spring onion example is that it has had to travel for days to get to the point of being eaten, meaning it has started to age.

Unfortunately, this aging leads fresh foods to lose their nutritional density. This means that you don’t get the same nutritional benefits that you would have if you had eaten it when it was freshly picked. And it is not just a small change or deterioration. One research associate at the University of Austin reported that fruit and vegetables found in supermarkets are anywhere from 5% to 40% lower in vitamins and minerals.

If you can base your menus on food that is both in season and local you are potentially increasing the nutritional density and quality of the meals you serve.

As previously mentioned, with the majority of fresh produce being available almost all year round it can be hard to decipher what is actually in season and what isn’t. To help you easily plan ahead you can buy seasonal posters which can be put on walls, or download resources from The Pass if you’re an allmanhall food procurement client! You can also use allmanhall’s seasonality guide, or you can use one of the resources provided below.

F

• Seasonal UK grown produce - Vegetarian Society (vegsoc.org)

• What’s In Season When? (lovebritishfood. co.uk)

• Seasonal calendar (BBC Good Food)

• allmanhall’s Seasonality Guide

3 top tips from allmanhall when preparing seasonal meals:

1. Get in tune with what is in season when. Speak with us at allmanhall so that they can help you stay informed about what is best at the time or use our seasonality guide as a reference.

2. Use cookbooks based on seasonal eating. This will take the stress out of having to come up with recipes using ingredients you may be less familiar with cooking.

3. Ensure you are providing variety. Although you might be choosing ingredients from a smaller pool, it is still important to focus on variety throughout the week. This will ensure you are delivering a variety of nutrients which will support overall health, including gut health. The more diverse the diet, the more diverse the good gut bacteria will be!

Do also speak with the team at allmanhall. We will be able to advise you regarding what is in season and or what has done particularly well and is abundantly available through suppliers at that point in time.

You may find this produce is better quality and value for money too – nutritional, environmental and budgetary benefits? That is truly welcome all year round!

For recipe inspiration, click here.

Serves 4

• 2 garlic cloves

• 1/4 of a load of bread (chopped into cubes)

• 2 tsp thyme

• 2 tbsp olive oil

• 25g vegan butter

• 3 shallots (finely diced)

• 2 large handfuls of spinach

• 700ml vegetable stock

• 350g asparagus

• Salt and pepper to serve (optional)

Firstly, heat your butter in a large saucepan until bubbling and add in your asparagus tips for 2 minutes, then set aside.

Whilst this is happening preheat your oven to 190° and line a large baking sheet with parchment paper.

Drizzle your bread cubes in olive oil and then sprinkle the thyme over them generously.

Then spread them on the sheet. Bake for around 17 minutes or until visually golden brown. Your croutons are now ready.

Back to the soup, add your garlic, shallots & asparagus stalks to the large saucepan and cook straight for 6-8 minutes.

Add your spinach as well as your vegetable stock and bring to a boil.

Then with a hand blender, blitz any vegetables included.

Season the soup if needed and scatter your asparagus tips and croutons on top with a drizzle of olive oil to serve!

For more insight from allmanhall, click below