Foodsight

Issue 13. Autumn 2023

Issue 13. Autumn 2023

Hello and welcome to the autumn edition of Foodsight!

This is a packed edition that focuses on the two main topics of the food industry right now: food inflation and food sustainability.

However, before I delve into those in more detail and give you a taster of the content of this edition, I wanted to update you on some news that we are extremely proud of at allmanhall. We have recently been awarded the Investors in People Gold accreditation.

This is a globally recognised accolade for supporting, improving and leading in the workplace. I would like to thank the entire team at allmanhall, and especially those that managed the process, for their hard work in achieving this.

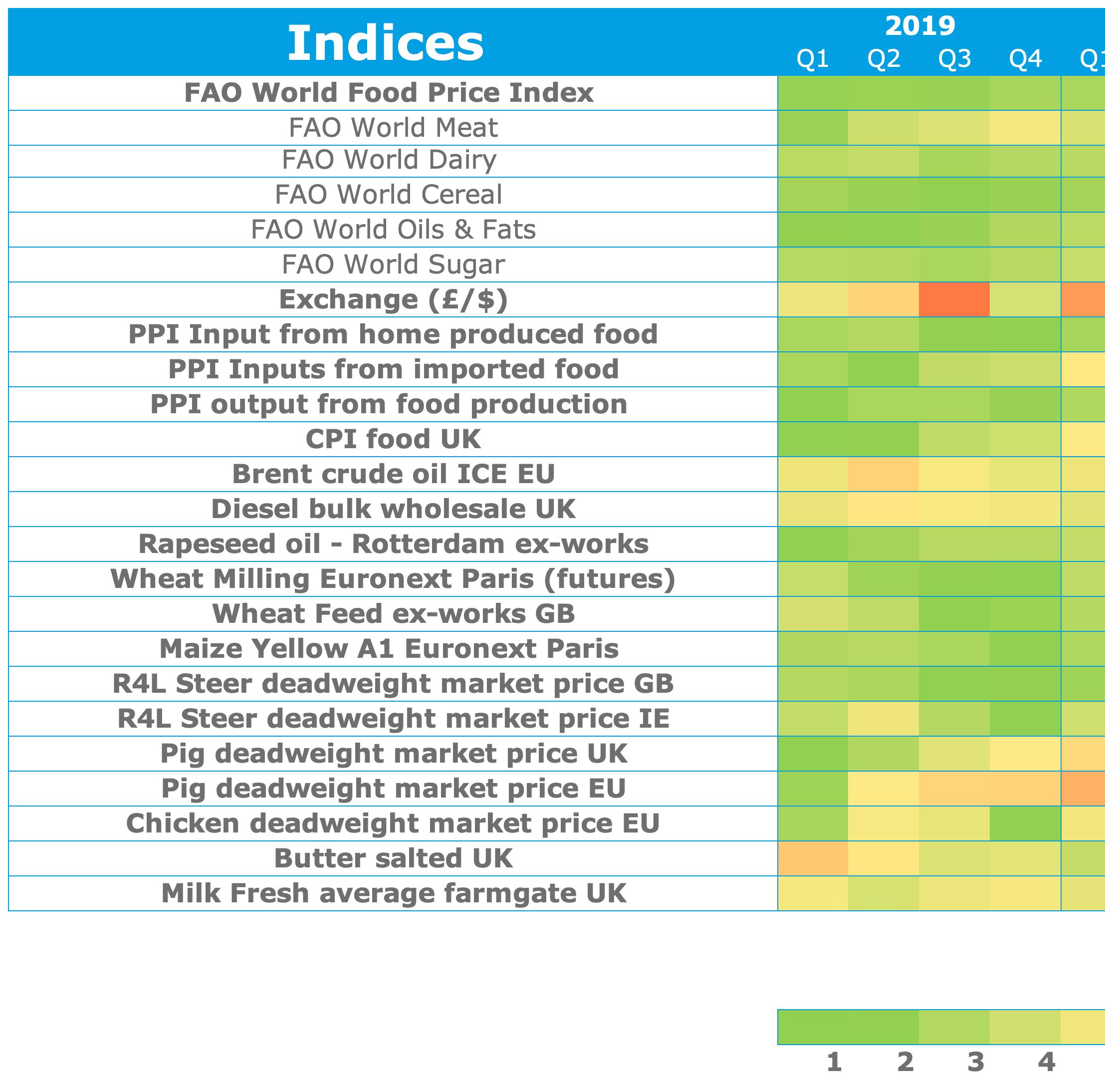

Now onto what you will find in this edition of Foodsight -the first theme covers the topic of food inflation and current food costs updates. Having recently experienced the highest food inflation for over 45 years, our commodity heat map showing the current pricing over a 5-year average of key commodity lines is on page 10.As you’ll see, and maybe cause for optimism, there are fewer reds and more yellows, indicating that prices may start to begin easing.

Oliver Hall Managing Director

We also expand on specific food commodities, detailing the recent events that have impacted pricing and what to expect in the near future.

There is further in-depth guidance, from our Procurement Manager, John Hirst, on page 43 and an outlook for future food inflation from Mike Meek, our Procurement and Sustainability Director on page 62, where he assesses that whilst the worst of food inflation may be over, it could remain stubbornly high in the near term.

Next, we start to look at the sustainability impact of food. With our mission being to deliver sustainable value, believing that good food shouldn’t cost the earth, we explain our recent commitment as a company by signing up to UN Global Compact.

This global initiative is designed to embed corporate responsibility into company operations. A key aspect of this is to enable our clients to make informed decisions about the food that they buy.

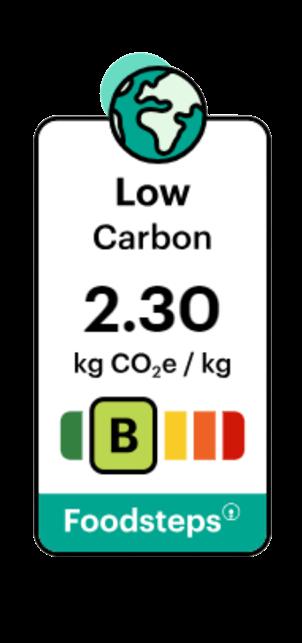

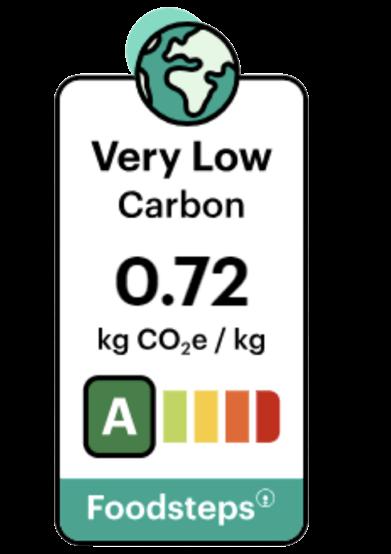

The piece about Foodsteps on page 25 and the article that follows on page 26, explaining why it is now more important from a food sustainability perspective that decisions are made on what is bought, rather than where it comes from, are just a part of what we are doing to enable informed decisions to be made and embed corporate responsibility. This continues on page 34, where we explore regenerative farming, with Joe Evans, one of our Non-Executive Directors and a farmer himself, expanding on this further on page 68. On page 40 there’s an article on sustainable seafood by our Buyer, Tom Codling. Finally, from a sustainability angle, Tess Warnes, our Company Dietitian, details how sustainability is considered in ‘food-based dietary guidelines’ around the world.

Two legislative articles can be found on pages 29 and 30. The first explaining the new Border Target Operating Model, that is due to come into force in the UK from 31 October 2023. In the second, Alastair Cupper, allmanhall’s Group Procurement Manager, details the ins and outs of the UK’s ban on single-use plastic.

A few points to finish on – Jo Hall, Communications and Development Director, outlines a couple of case studies to highlight some of the successful activity that we have undertaken for clients. Make sure you also look out for the food products that we showcase – these have a lighter impact on the environment than their mainstream equivalents. At the start of Foodsight, you’ll find a helpful piece outlining all the food-related events in the lead up to Christmas(!) and at the end of the edition, food for thought with a number of what we call ‘hero-dish’ recipes – these being both nutritionally balanced and better for the planet as explained on page 74. To end, we make some topical reading recommendations.

At allmanhall we will continue to understand, advise, manage and, where possible, mitigate the macro challenges facing food supply. We maintain and develop relationships on a local level to negotiate terms with our joint suppliers to ensure that we can continue to deliver sustainable value and the most competitive arrangements for your organisation.

Please do not hesitate to contact me, or any or the team, if you have any queries or requests.

I hope that this edition of Foodsight is supportive and insightful. Support and insight, along with value and control, being the key pillars of our offering to deliver a more sustainable food supply.

With very best wishes

2023 marks the 10th anniversary of the annual, international sourdough September. The ninth month of the year is when the Real Bread Campaign goes on a mission to help everyone worldwide to discover that: life’s sweeter with sourdough!

Launched in 2013, the main aims of #SourdoughSeptember are encouraging people to:

• Bake genuine sourdough bread

• Buy genuine sourdough bread from small, independent bakeries

• Boost the Real Bread Campaign, the charity behind Sourdough September

Looking to make use of left over sourdough or other bread and reduce waste?

Check out page 73

1st September

#ZeroWasteWeek is an award-winning, grassroots annual awareness campaign that takes place online and on-the-ground. It helps households, businesses, organisations, schools, universities and community groups reduce landfill waste so you can save money, preserve resources and protect the environment.

Click here for more information on how to become part of the solution!

Be inspired with our waste-zapping recipe ideas on pages 70-73.

5th - 11th September

Celebrating the nation’s favourite sweet treat, UK cake week is the perfect week to experiment with your baking skills and make some delicious treats.

What cake will you choose to indulge in?

16th September - 1st October

This is the 22nd year of the national celebration of the diverse and delicious food that Britain produces.

British Food Fortnight 2023 is set to be the biggest and most popular yet with communities and organisations across the country making plans to take part.

The fortnight is the biggest national celebration of British food on the nation’s calendar. Hundreds of activities are taking place across the country this autumn…

1st October

An occasion that is used to promote and celebrate coffee as a beverage, with events now occurring in places around the world.

So don’t forget to raise your favourite mug of coffee in celebration of International Coffee Day, whether it be an espresso, latte, flat white or another caffeinated (or decaf) beverage of choice.

2nd - 8th October

Whether you’re heading out to your local curry house or cooking up a storm using your own special recipe, this week is a chance to treat your tastebuds to some mouth-watering Asian cuisine.

Whats your favourite curry recipe? Why not tell us?

14th - 20th October

Pyrex initially started the holiday back in 2007, along with other baking companies to inspire people of all abilities to try their hand at baking at home. After all, isn’t baking just a piece of cake?

National Baking Week has been cheered alongside the popular TV show “The Great British Bake Off,” giving everyone a week of tasty recipes and good television. What’s not to love?

The spookiest time of the year will soon be upon us, along with trick-or-treaters, pumpkin patches and delicious Halloween recipes & treats.

If you are looking to make the most of your pumpkins this year and reduce the amount of food waste you produce, why not try creating dishes that use up pumpkin innards such as pumpkin pasta, pumpkin pie or even an attempt to create a pumpkin spiced latte...

6th - 10th November

National School Meals Week 2023 is an amazing opportunity to make healthy eating fun and enjoyable for your pupils, help promote regular exersise and emphasise the importance of adopting a healthy lifestyle.

NSMW will focus on the rising food costs, staff shortages, the budgetary constraints on investment, local pressures around targeting free school meals and adhering to the needs of the local government.

For more on national school meals week, click here...

November

Thinking of trying to eat more healthily and save the Earth, at the same time? Then this is the perfect time to begin!

Just spend a mere 30 days avoiding eating meat, removing animal-tested or animal-based products from your household and day-to-day habits, and start using substitutes for dairy products.

What vegan dishes will you be trying in November?

Why not get in touch and let us know?

This week is devoted to raising awareness of malnutrition & dehydration amongst the public, health and social care professionals, policy makers, public sector representatives, local and national Government, third sector and voluntary sector organisations.

With malnutrition affecting over 3 million people in the UK (around 1.3 million over the age of 65) the size of this problem is massive and really does need to be addressed properly.

17th November

Hosted by BBC, Children In Need’s mission is to help ensure that every child in the UK is happy, safe, secure and has the opportunities they need to reach their potential. Money raised from the appeal goes to charities and projects that help remove the barriers preventing children and young people from thriving.

Is it too early to be thinking about Christmas!? We don’t think so. The festive season will soon be upon us, with families and friends coming together, for the best part of it all - Christmas dinner!

For caterers now is the perfect time to begin planning Christmas menus, ensuring operations run smoothly when the time comes...

If you’re an allmanhall client, have you already checked out supplier Christmas catalogues on The Pass?

A Christmas treat!

For mobile viewers, to view the whole commodity heatmap, enter landscape mode...

Read on from page 12, for more detail and insight into specific commodity and likely price changes...

UK farmgate beef prices exceeded £5 kg for the first time in history and peaked in May 2023. High prices were due to tight supplies, high production costs and strong demand. Prices have begun to ease but are still 15% higher than the five-year average. The decrease in prices is due to lower consumer demand due to the cost-of-living prices and consumers looking for more cost-effective proteins.

Uncertainty remains in the market as it is not clear if the ending of the Black Sea Initiative will affect the global supply of grains coming out of Ukraine. If supply becomes restricted, prices of beef will likely be affected negatively and again rise.

As consumers gravitate towards more affordable protein options, the demand remains robust for chicken. Even with other prices dropping, chicken remains one of the cheaper options.

Prices rose earlier in the year, but the inflation rate has begun to ease due to decreases in fuel and other production costs. Yet we must note that prices are still 24% higher than the five-year average. Flock sizes are slowly beginning to increase following the effects of the avian flu outbreak. Despite passing the peak, according to the World Organisation for Animal Health, the threat is still present for farmers, so they remain cautious about growing flock sizes.

Another crucial development is the year-long extension of tariff-free poultry imports from Ukraine to the EU. This extension should further boost EU poultry imports to keep up with demand. Whilst this is positive news for the price of chicken, there are also uncertainties because of the conflict in Ukraine. The IMF’s Chief Economist has said that the collapse of the Black Sea Initiative could potentially trigger up to a 15% surge in global grain prices. Consequently, this could exert negative pressure on chicken prices in the future.

As with all crops, the weather plays a predominant part in determining the quality and yield of the plants and ultimately the harvest. Currently, there is a focus on the El Niño Southern Oscillation and the impact this is having on crops and our food supply. The El Niño Southern Oscillation – known as ENSO – is the balance between the surface temperatures of the sea, specifically the Pacific Ocean, and the temperature in the atmosphere. The relationship between these two factors produces variations of above and below-normal temperatures.

El Niño manifests as above-average sea temperatures, leading to drier and warmer climates in Central America and Southeast Asia, the main growing regions of coffee. In contrast, La Niña shows sea temperatures below average; South America and Southeast Asia are typically wetter, and although cooler in South America, it is typically warmer in Southeast Asia. The United Nations officially declared El Niño with continuing warnings for extreme heat as July 2023 was recorded as the hottest month globally.

For coffee, El Niño weather is having a mixed impact. The Brazilian ‘Arabica’ harvest increased by 12.3% from last year, the second-highest harvest for the past five years. A key producer of Arabica, Brazil accounts for 34% of global coffee crops and 27% of global coffee exports, making it the largest coffee producer worldwide. Arabica trees in many growing regions continue to recover from severe frosts, high temperatures, and below-average rainfall in 2021/22 and 2022/23, coinciding with La Niña weather events.

The Brazilian market price has tumbled in 2023, now 37.3% lower than 12 months previous. However, this follows extreme increases of 185% over the past two years, leading to prices remaining substantially higher than in 2020/21 - the last harvest not impacted by La Niña.

Global ‘robusta’ crop production fell by 1.2%, with the Indonesian crop reducing by 20%. Southeast Asia accounts for 54% of global robusta production. Excessive rain during cherry development lowered yields and caused sub-optimal conditions for pollination, impacting the 2023/24 crop. Reflected in market prices, which are now 1.2% higher than last year and, like Arabica, follow two years of substantial inflation.

Coffee plants need even rainfall, no frost and fertile soil in which to grow. Drier and warmer climates expected from El Niño could be detrimental to the 2024 Arabica harvest, causing poor quality and yield conditions, leading to global price rises.

With Arabica production equating to 55% of the total market share, and being the highest consumed bean in the UK, the El Niño impact could significantly impact UK import prices.

In May 2023, the average milk price was down 4.8% from the previous month; around 30% higher than five years before. Whilst some dairies maintained prices, others announced drops for July, reflecting varying responses to the market.

Milk production trends are also evolving. The AHDB forecasts milk production to reach 12.46 billion litres in the 2023/24 season. A 0.5% increase over the previous year. The rate of decline in the milking herd is slowing, with the smallest annual drop of 0.5% since 2018.

There has been a rise in production thanks to the Spring flush. July 2023 witnessed a 1.9p decrease in the market value of milk, primarily due to declines in wholesale prices for products such as butter. Demand has been lower, partly stemming from reduced consumer spending from the ongoing cost of living crisis and consumers migrating to more plant-based products.

Free range eggs were once again allowed to be labelled as ‘Free Range’ after hens were allowed back outside on 18 April in the UK, after being kept indoors due to avian flu. However, avian flu and rising production costs are still impacting farmers.

In the UK, at the end of June, 204 million dozen eggs were packed. A reduction of 8.2% compared to the same time in 2022. Whilst supply has decreased, demand has increased. Thanks to the ongoing cost of living crisis, eggs have become a quick, easy and relatively inexpensive choice. Egg consumption is growing in the UK by about 3% a year. Due to multiple factors, eggs have become 43% more expensive than a year ago and nearly 80% more expensive than five years ago.

With fewer UK eggs available, some suppliers have moved to procure eggs from European countries. In the UK, the imports of eggs nearly doubled from January to May. In May this year, the UK imported 10% more eggs than in the same month last year.

The increase in imported eggs raises the question of quality. The British Lion Stamp is a mark of quality in the UK. Since its launch in 1998, it has drastically reduced the presence of salmonella in UK eggs due to its stringent food safety controls across the production chain. All hens are vaccinated, and a ‘passport’ system ensures that all hens, eggs and feed are fully traceable.

Following record highs in prices this May, lamb prices are now on a seasonal descent; 17% since last quarter, although they remain a noteworthy 12% above the five-year average. One reason for the high prices is the increased input costs, including feed and fuel. The UK flock size is still recovering from the effects of the “Beast from the East” storm. Flock levels are still below pre-2018 levels.

The Department for Environment, Food & Rural Affairs (DEFRA) indicated a 1% growth in 2022 in flock levels and 2023 lamb stocks look likely to remain stable due to the wet and cold spring. Due to these sustained higher costs, demand from the UK has reduced as consumers face the current cost-of-living crisis. However, due to cultural and religious significance, there is still high demand from Europe. Potentially, this could cause an increase in the percentage of lamb in the UK exports, which might lead to future spikes as seasonal British demand increases in spring 2024.

The vegetable oil market has been volatile since last year, with the sunflower oil supply severely impacted by the war in Ukraine. Low availability and a stop on Ukrainian exports caused buyers to move to alternative oils, driving market prices higher as demand for these, such as rapeseed, increased. With diminished demand for sunflower oil, prices have fallen, and production levels are estimated to be high, including those from Ukraine. That said, there is still caution within the market as continued attacks by Russia on Ukrainian ports have raised concerns over exports, which could cause sunflower oil prices to rise.

Taking advantage of the higher prices of the previous year, farmers have planted increased volumes of rapeseed which has led to high availability across Europe at the start of the year. Rapeseed oil prices fell 8% lower than the five-year average in April. Back in the spring, there were some concerns over the yield of rapeseed crops across areas of Europe, due to the dry weather. However, with the heavy rainfall experienced in the UK, Germany and France of late, there are now concerns that harvesting during the wet weather will detrimentally impact the quality and yield of the crop. It is too early to assess the full impact, although expectations are a diminished supply and price rises.

With a continuous rise over the last year, CPI olive oil prices are circa 122% higher than twelve months previous and 152% higher than the 5-year average. High demand for olive oil through 2022 due to the lack of sunflower oil led to sharp price increases. As the olives are harvested from October to March, recent droughts in olive oil-producing countries such as Greece and Italy could result in lower production volumes. With Spain being the largest producer and exporter of olive oil, reports suggested a decreased production in July and further shortages in the 2023 harvest. This could result in demand far outweighing the drastically low supply of olive oil.

As olive oil prices continue to rise, this could further increase the demand for sunflower oil as buyers choose this as an alternative.

Buying habits are being affected by an increased demand for plant-based dairy products. The European region is the largest producer of vegan cheeses, making up more than 32% of the market. The largest consumers within this region are Germany, contributing 27%, and the UK, closely following with 18%. We’re seeing increased popularity of veganism and an ever-heightened awareness of sustainability, as well as rising cases of lactose intolerance and other food-related allergies.

In 2023, the size of the global vegan cheese market reached a valuation of US$ 3.2 billion and is forecasted to grow by a further 16% from 2022 to 2030. Despite consumers purchasing more plant-based dairy alternatives, plant milk costs about twice as much as traditional cow’s milk. Factors causing the price difference include prices of raw ingredients (oats, almonds and soy), factory operations, labour and transportation. While inflation has impacted prices, the profitability of plant milk remains higher. Plant milk holds around 12% market share, with some consumers switching back to dairy due to taste, cost, and nutrition concerns. The continued growth of the plant milk industry might eventually drive prices down, but affordability remains a key challenge.

In the first quarter of 2023, EU pig meat production was reduced by 7.7%, which caused prices to rise, reaching a historic high of +30% compared to June 2022 and +21% since January 2023. The price increase was due to increased input production costs such as energy and feed. These increased costs caused some farmers to reduce their number of sows, reducing availability further. Due to these factors, there is likely to be a 5.5% drop in pigmeat production in 2023 compared to 2022.

A shift towards cost-effective options like poultry is evident as high prices influence consumer preferences. Analysts forecast a 4.5% drop in EU consumption per capita in 2023 due to reduced availability and high prices.

UK Potato growers have faced numerous challenges leading up to the 2023 harvest. From high energy and fuel prices earlier in the year to the driest February since 1993, followed by the wettest March in 40 years.

The volatility of the weather delayed the planting of potato seeds leading to a delayed harvest. Market insights from World Potato Markets reveal a shrinking potato cultivation area, with the projected total GB potato acreage for 2023 expected to plummet to 101,723 hectares from 117,466 hectares in 2020. Due to the challenging weather conditions, this area is likely to yield less.

Recent figures from the UK’s Department for Environment, Food & Rural Affairs (DEFRA) have revealed a disheartening 6.4% decline in potato production for 2022/23 compared to the previous year, amounting to a significant 4.8 million-tonne decrease. This concerning trend has prompted some farmers to consider less risky crop alternatives like wheat, sugar beet, or rapeseed, potentially leading to there being another drop in potato production figures in 2024.

While falling energy and fertiliser costs might offer some hope, the elevated input costs incurred earlier in the year are already embedded in the 2022/23 crop, contributing to the persistence of high potato prices.

The Indian government’s recent decision to ban the export of non-basmati rice took effect on the 20th June 2023. The ban has been implemented to reduce escalating domestic prices due to concerns over crop damage and transportation disruption caused by monsoon rains. Non-basmati constituted roughly half of India’s rice exports for the 2022/2023 season. As India accounts for 41% of the world’s rice exports, this will affect the global market hugely. The impact of this decision is likely to be felt most acutely in Asia and Africa, regions heavily reliant on Indian non-basmati rice imports.

El Niño is declared when sea temperatures rise 0.5°C above the long-term average in the tropical eastern Pacific. Current forecasts suggest temperatures could rise by 2.3°C in December 2023 above this long-term average.

Historically, El Niño occurrences have triggered below-average rainfall in regions including India, which would negatively affect rice yields and intensify the strain on growers to meet global demand. Rice growers in India heavily depend on the monsoon rains for agricultural success. With prices already sitting 5% higher than the five-year average, these forecasts ring alarm bells for further price hikes.

The farmed Norwegian salmon industry has faced significant challenges following the Covid-19 pandemic, resulting in extreme volatility and soaring prices. The pandemic’s impact on the industry led to reduced production owing to a decreased workforce, disrupting the 2-3 year life cycle. Norway produces over 36% of salmon consumed globally, so these challenges have impacted the global market. Consequently, prices reached all-time highs in March 2023, three years after the initial lockdowns in Europe. However, prices have eased since then.

One contributing factor to the price decline is the reduction in key cost components of salmon production. The expenses associated with fuel and feed, crucial for raising healthy salmon, have decreased, providing some much-needed respite to producers.

Despite the easing of prices, we must note that the current prices are still 8.4% higher than the five-year average, showing that the market has not fully stabilised because of the challenges. The high prices caused demand to reduce from Europe, as consumers turned to alternative species, allowing for inventories of salmon to replenish.

Usually, this would cause prices to stabilise, but now the Norwegian government has confirmed the 25% ground rent tax on aquaculture in addition to corporation tax, the stabilisation of prices is uncertain. As the second largest contributor to the Norwegian economy, their government has introduced the tax to improve social benefits to communities where aquaculture farms are based.

Brazil is the largest exporter, contributing 43% of worldwide exports. India and Thailand account for 26.5%, indicating a significant reliance on these nations for global supply.

Favourable weather conditions have boosted Brazil’s production, enabling sugar mills to operate at maximum capacity from June through July. The crushing rate is at the highest it has been in the past decade. Due to the abundance of crops, crushing operations could continue into November or December, weather dependent. In stark contrast, India has encountered challenges, receiving only 71% of its usual monsoon rainfall, causing poor-quality sugar cane crops and reduced yields.

As a result, the Indian government placed a cap on exports reducing these by over 44% compared to last year. Forecasts suggest a further compromised crop next year, hinting at a possible reduction in the export cap, thereby tightening global availability. Similarly, Thailand predicts a significant 20% drop in sugarcane production. With global market dynamics remaining highly volatile, predicting price movements becomes complex. Increasing demands for alternative sweeteners will also affect future prices.

In the last edition of Foodsight, we discussed the Black Sea Grain Corridor, formed in 2022. Its purpose was to allow the export of foodstuff, including grain, from Russia and Ukraine. The aim was to provide more stability for the international grain market. Russia exports the most wheat globally, accounting for more than 18% of international exports. Combined with Ukraine, in 2019, both countries accounted for 25.4% of global exports.

At the beginning of June, prices fell to £189 per metric tonne, its lowest since July 2021, thanks to the security provided by the Black Sea Grain Corridor. In June, the Kakhovka dam in Southern Ukraine burst.

The area near the dam is home to massive agricultural fields, causing concerns about the production of wheat and its effects on the global market. In the days following the dam breaking, prices rose 26% to £230 per metric tonne. This July, Russia pulled out of the Black Sea Grain Corridor agreement.

After the announcement, global prices increased by 6%. By the beginning of August, prices had dropped back down to a similar price to where it was before the grain corridor announcement. However, this is still 29% higher than five years before. With all the contributing factors, the future of the grain market remains unclear.

The conflict in Ukraine has caused a reduction of Russian Alaskan pollock exports, decreasing by over 90% compared to last year, because of limited fleet activity.

China accounted for 64% of the pollock exported by Russia between 2019 and 2023. Attempting to capitalise on this demand, Russia responded by reducing catch quotas for Chinese trawlers in its waters, aiming to boost purchases from Russian suppliers. However, the alterations have led many Chinese buyers to seek alternative sources like the USA, causing these prices to increase because of the additional demand.

Furthermore, whitefish prices, including cod and haddock, have surged due to import tariffs on Russian produce, which formerly constituted over 40% of the global whitefish catch. Consequently, buyers have turned to alternative sources such as Iceland and Norway. Although cod and haddock quotas in these waters expired in July, high European frozen fish inventories should mitigate potential price hikes. Lower Barents Sea catch quotas in 2023 will tighten the cod and haddock supply.

The stock of spawning cod is at its lowest since 2008. As a result, The Institute of Marine Research has proposed additional quota reductions in 2024, indicating the possibility of further market volatility. Current prices are 9% higher than the five-year average.

INDEPENDENT FAMILY FARM USING RENEWABLE ENERGY WITH

AVAILABLE IN SHARING AND SINGLE SERVE BAGS NOT SOLD IN MAJOR SUPERMARKETS

We’re Laura and Robert Strathern, a third-generation farming family growing potatoes in the Colne Valley at the border of Suffolk and Essex. We’re dedicated to farming sensitively and want to leave this beautiful corner of the world better than we found it. Our award-winning crisps are produced on the farm, keeping food miles to a minimum.

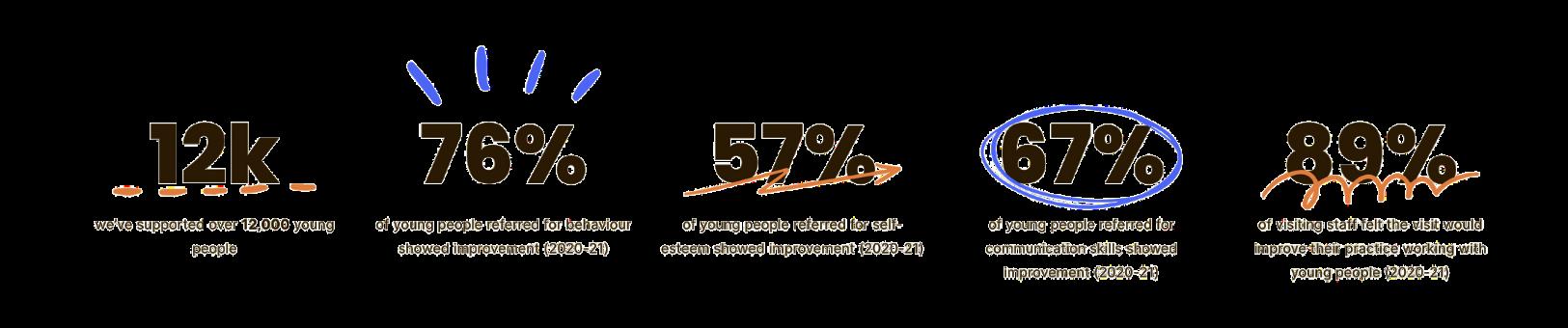

Yes, that’s right! A number of members from our team are going to be running the Bath Half Marathon on 15 October to help fundraise for Jamie’s Farm!

Jamie’s Farm are a charity that uniquely blends farming, family, therapy and legacy into a transformative residential programme with follow-up support. Their impact is a testament to this, revealing that young people leave the farm better equipped to thrive academically, socially and emotionally during their school years and beyond.

Their powerful formula of Family, Farming, Therapy and Legacy, delivered via a five-day residential and a rigorous follow-up programme is designed specifically to improve well-being, boost engagement, improve behaviour and develop essential life skills such as communication and self-awareness. The week also provides valuable professional development for visiting teachers who return to school with renewed relationships with their young people, and tips and skills to sustain the changes back in the classroom.

We genuinely can’t wait to run our hearts out in October to raise money for such an amazing and influential cause and training is well underway!

On 27 April 2023, allmanhall pledged our support to the United Nations Global Compact. This upholds our commitment to embedding best practice through our operational practices and focuses on real results. Are you interested in understanding more about this United Nations Global Compact and the pledge?

Intrigued about the differences when it comes to the 10 commitments of the pledge and the 17 UN Global Goals? Keen to know why on Earth any of this even matters? This simple guide will help you untangle the web...

A voluntary initiative, it is designed to offer a framework for organisations to embed corporate responsibility into their operations. This responsibility covers 4 areas of activity and is broken into 10 clear principles. Assistance in embedding these principles is offered in the form of training and networking. Progress towards implementation is measured in an annual Communication on Progress (or CoP).

How do you embed these principles?

For allmanhall, our greatest impact comes in the form of what produce we source for our clients. This is therefore where we can effect the greatest change and make the most positive difference. Our road to implementation largely relates to the standard setting with our suppliers and working to build a transparent supply chain, committed to the highest specifications and practices.

It is imperative that we have a robust set of checks and measures, to ensure that the suppliers we work with are similarly aligned and can offer transparency into the sourcing of products.

Similarly, this is connected to our commitment to reduce emissions - our suppliers’ scope 1 emissions are our scope 3 emissions. Therefore, collaboration in reduction is imperative if we are to meet our environmental commitments.

This is in line with allmanhall’s mission:

How do these relate to other schemes, such as the Global

The United Nations Sustainable Development Goals, also known as the Global Goals, are a similar set of commitments, this time focused on 17 challenges facing people and the planet.

These require solving by 2030.

Both relate to working towards a systemic change in the way we live and work, enabling a brighter future for the planet and its inhabitants. The main difference relates to the process of implementation

• The Global Goals are international aims - endeavouring to solve issues on a Governmental level.

• The principles of the UNGC, on the other hand, are more aligned with what organisations can do within their operations.

Since the Universal Declaration of Human Rights was first ratified in 1948, progress towards the implementation of human rights has been slow. High-minded rhetoric has been at odds with a move towards individualism and free market economics, perpetuating the need for cheap labour, and a limitation of individuals’ access to basic rights.

We need to change our ways of production and consumption. The world needs to adapt.

However, it’s not too late. The rate of improvement within technology during the past century has been unprecedented. We have all the solutions to the challenges facing our species and planet. Now it falls to every individual, business, and nation to begin to collaborate to embed these principles. allmanhall are committed to doing our bit and have pledged as such.

We’re working collaboratively to address the challenges and leave behind us a better world. This is exactly why schemes like the UN Global Compact are so imperativeallowing for collaboration in a way never seen before, using modern technology to allow building a network of businesses keen to do better. There are already over 170,000 businesses that have started this journey, and we’re delighted to be a part of this valuable and vital movement.

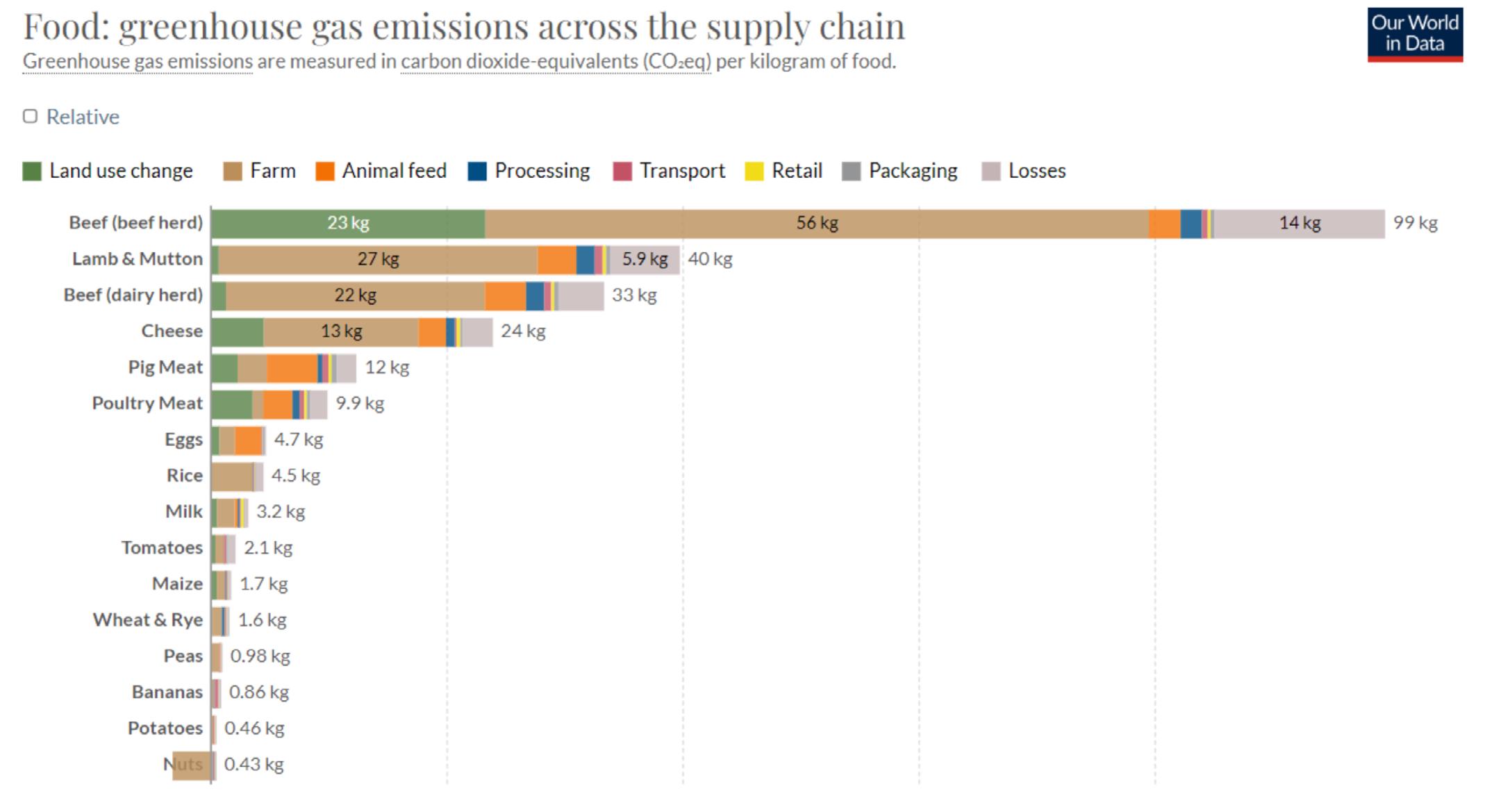

The concept of food miles is, in many ways, a rational one. Everyone knows that transport causes emissions. The closer and more local the better, surely? Less distance must mean less carbon. If we want to save the planet then we should choose local produce. That’s got to be right... no?

Since the early 1990’s, when the food miles concept was developed by Professor Tim Lang, the idea of local is better has been a central theme when it comes to advice surrounding sustainable food choices.

We know this now as robust life cycle analyses of food production have been completed. Whilst transport does have an impact, it is negligible in the face of the largest causes of emissions in the food system value chain - land use change, farming and losses (or waste).

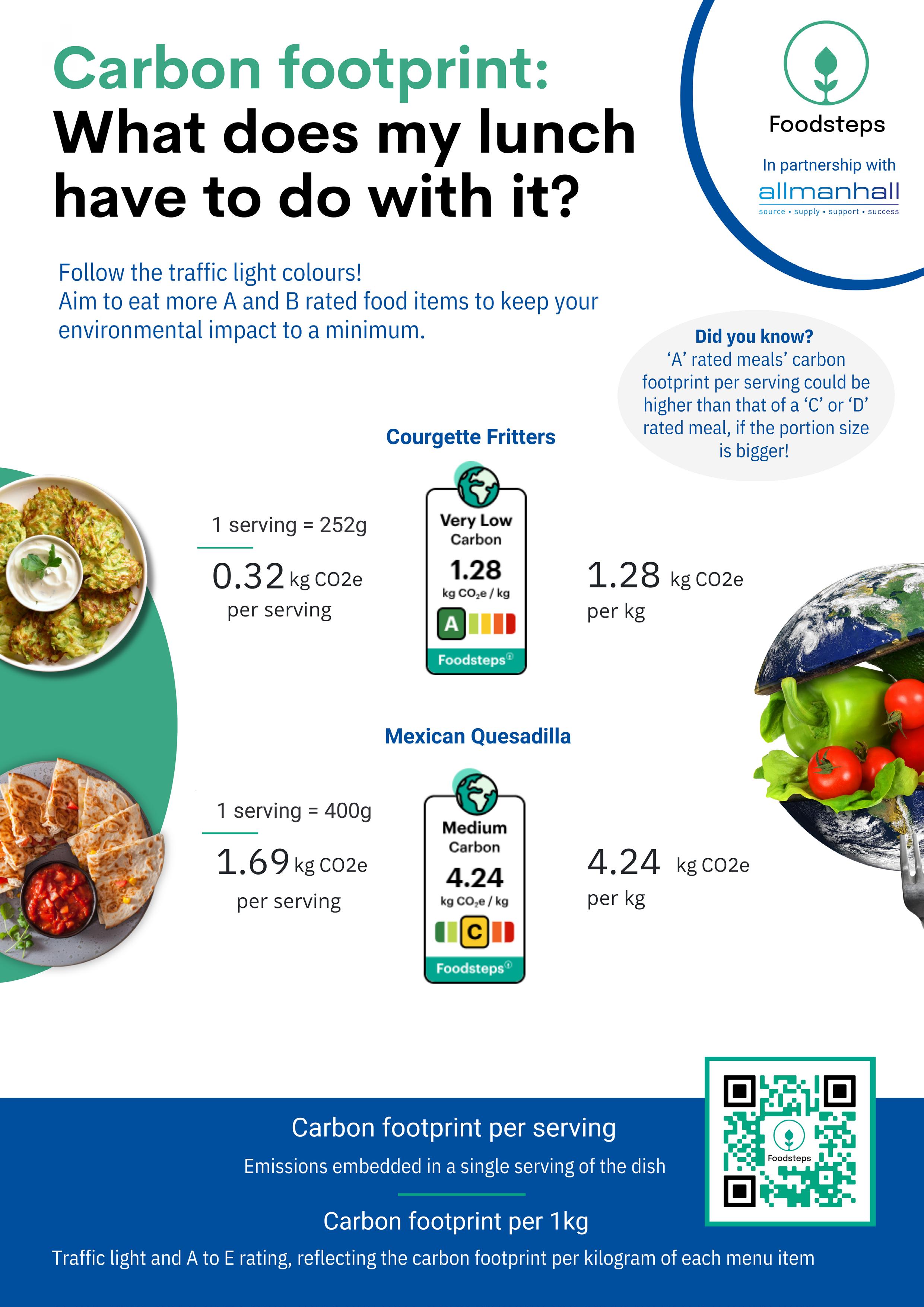

This diagram, based on a study of 38,700 farms across 119 countries, demonstrates the breakdown.

When it comes to beef, the highest impact food, as shown above, travel or transport accounts for less than 1% of the emissions (see diagram). When it comes to overall environmental impact, it matters little if the beef is British, European, or South American - most of the emissions have already been released through land use change and farming processes.

Now, this is somewhat skewed when it comes to airfreighted products, which is an estimated 50 times more impactful than sea-freighted goods. However, air-freighted produce makes up only 0.16% of the food we consume in the UK, the primary focus when making food choices remains - what matters a lot more than where. That said, there is a discussion to be had around ‘how’ which takes land use and farming methods into consideration. This area is the current evolution of the ‘what’ school of thought and you can read more on page 68. Best farm practices can indeed lower emissions intensity.

According to the Eat Lancet commissions report, alongside the analysis of Foodsteps, if the Earth is to meet the 1.5 degrees warming limit by 2050, the intensity of the food we eat needs to be 1.85kgs of CO2e, per kg consumed. If we continue to choose high-impact ingredients and dishes, achieving this target is impossible.

So, how can we lower our food emissions? There are some ways to do so, and the scenarios below show the impact of such actions. The key thing to note is that if we do nothing when it comes to our food system, we will massively overshoot the targets creating a bleak outlook for a planet already in crisis.

So, what can you do? First and foremost, education and understanding is imperative. Truly knowing the impacts of your choices is difficult – as we’ve said, food systems are complex and the now defunct ‘eat local’ rule has historically been a ruinous oversimplification.

As shown in the diagrams on the previous page, some of the highest impact ingredients are typically butchery produce from ruminant animals (cows and sheep – or indeed anything with 2-digit hooves!) due to the fermenting process required to digest their food.

Beyond this, dairy, coffee, chocolate and other forms of animal protein, using current farming methods, have a far greater emissions impact than plant-based alternatives.

However, the realities are often quite confusing and there’s a great deal of nuance to add the complexity. Just when you thought you had it sussed!

Fortunately, there are tools to help and you can start your journey to more enlightened eating today!

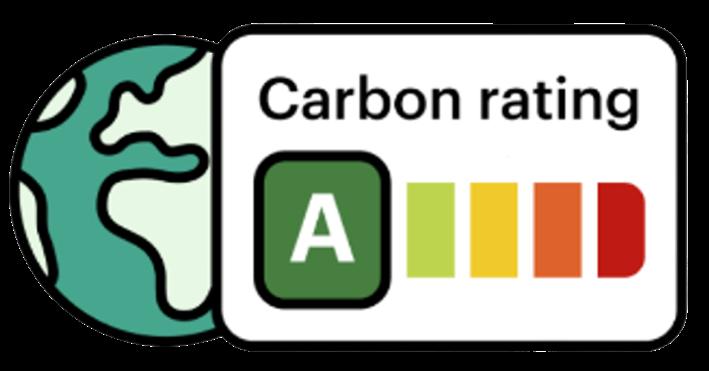

allmanhall have partnered with Foodsteps, a fantastic carbon impact assessment tool to help your organisation assess the environmental credentials of your recipes and communicate the carbon impact of each menu item to your diners, to help them make responsible decisions.

If you’d like a free trial of 5 recipes on Foodsteps, please click here and enter your details on the registration form or contact one of the team at allmanhall for a demo.

We’ll be happy to help you join the growing ranks of our clients carrying out carbon impact assessments for their menus to guide choices and help us all increase our chances of lowering the emissions in line with the Eat-Lancet recommended target.

The UK Government has published its plans to implement its new Border Target Operating Model (BTOM) from 31 October 2023.

The BTOM applies to imports into the UK from all countries; and, for the first time, also incorporates the EU, whose imports into the UK have so far not faced the complete burden of sanitary and phytosanitary checks. These are trade checks to eliminate fraud and ensure that food is safe to eat, and that animals and plants are free from pests and diseases.

The implementation has long been called for by many. Not only has the EU not faced the same level of border controls into the UK as other countries, which is technically illegal, but there has also been a sense of unfairness as expressed by the National Farmers Union (NFU), because UK trade exports to the EU have been facing comprehensive border checks since 01 January 2021.

The new model will involve a risk-based categorisation of foods into low, medium, and high risk. The impact on low-risk foods such as fruit, vegetables, and ambient goods is likely negligible. However, imports of medium and high-risk foods such as dairy and meat will involve much-increased trade friction and cost with the requirements of veterinary inspections, agent and specialist haulier fees, and will be compounded by the imposition of border inspection charges.

While the effects of the BTOM may not be apparent, changes will lead to longer supply chains, increased cost, and less choice.

On a positive note, for UK producers at least, it may also lead to a better trade balance with greater self-sufficiency and domestic supply.

Insight

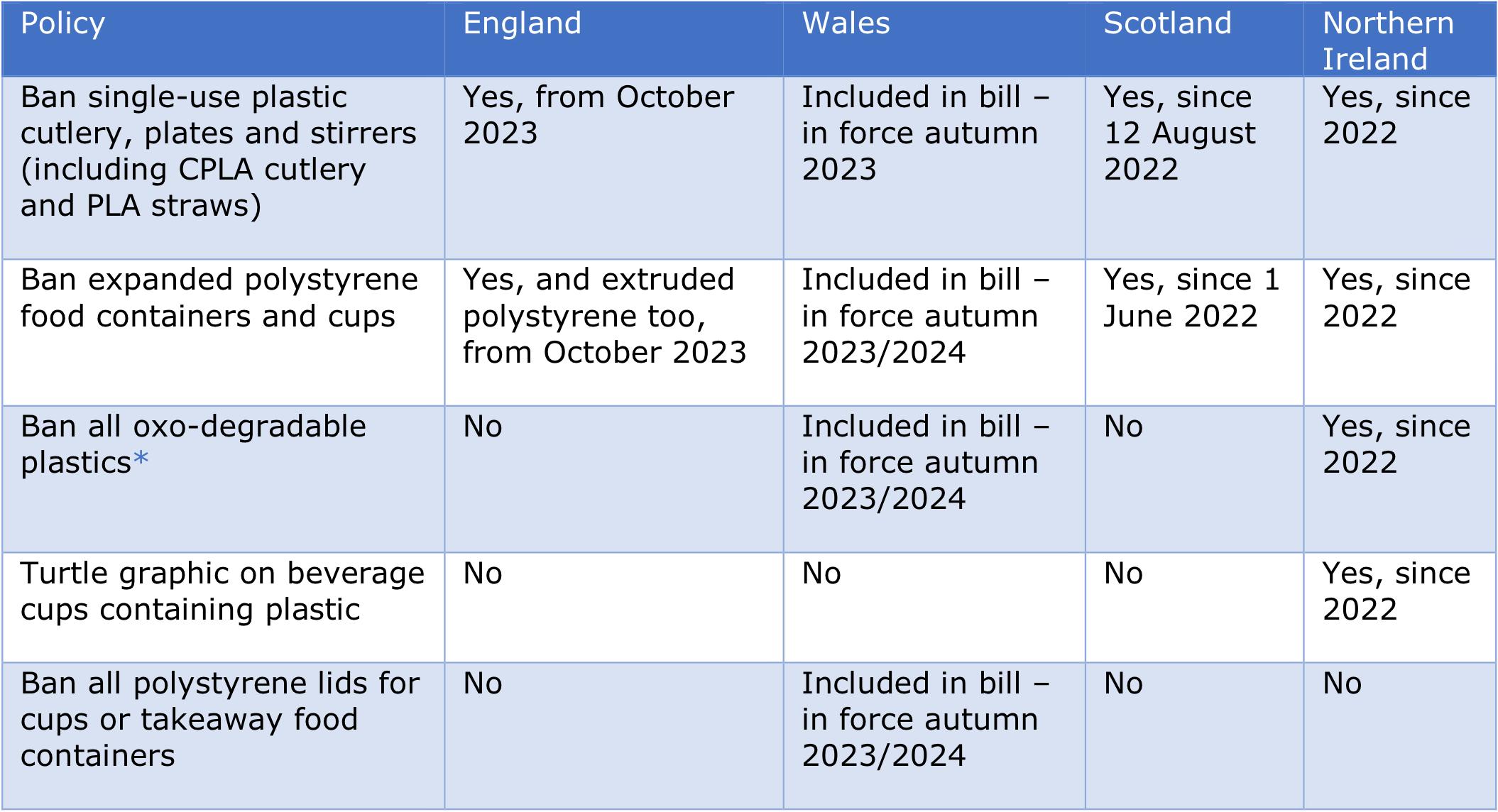

From 1 October 2023, the new ban on single-use plastic will be enforced as law in England and Wales, aligning these nations with the rest of the UK. This initiative is a key step in the UK Government's aim to nudge the country's consumption habits and lessen the impact of plastic waste on the environment.

This new legislation aligns with the EU's directive, established in 2019, which outlines ambitious goals for reductions in plastic usage across Europe by 2025. The UK's commitment to the environment, as outlined in the 25-Year Environment Plan, is to eliminate all avoidable plastic waste by 2042. The urgency stems from the impact of plastic pollution, with its lengthy degradable timeline, inflicts severe harm on the environment, and contributes significantly to greenhouse gas emissions throughout its lifecycle.

The forthcoming plastic ban is poised to cover a range of single-use plastic items, including plates, trays, bowls, cutlery, balloon sticks, and specific types of polystyrene cups and food containers. These items, often discarded after a single use, have been a substantial contribution to plastic pollution and environmental degradation.

Under the new legislation, it will be illegal to provide banned products to consumers from 1 October 2023. Affected caterers and foodservice providers should be aware that the ban includes:

• Plastic drink stirrers

• Disposable plastic plates – excluding plates,

• trays, and bowls that are used as packaging,

• in shelf-ready pre-packaged food items as

• defined in The Packaging Regulations 2015

• regulation 3.

Author Alastair Cupper Group Procurement Manager

• Single-use plastic cutlery – including single-use plastic knives, forks, spoons and chopsticks made of plastic, including standard-size or mini-size cutlery or a combination of cutlery, such as sporks.

• Expanded polystyrene containers, such as takeaway food and drink containers.

Legislations do vary throughout the nations:

*Oxo-degradable plastics are created through a process whereby a bio-additive (such as starch) is added to traditional plastic and are falsely marketed as compostable and biodegradable. Examples include 'degradable' cutlery, which can be made from a blend of bio-additives and plastics and are neither compostable nor biodegradable. Are compostable and biodegradable plastics suitable alternatives?

Concerns have been raised about the potential impacts of compostable and biodegradable plastics in closed-loop environments. While these materials are marketed as eco-friendly, their effectiveness in realworld conditions is variable, potentially contributing to plastic pollution.

So, how can these products be distinguished?

As more ‘sustainable plastics’ are introduced to the market,

consumers are faced with the decision of which products to buy and how to dispose of them. The current confusion around the disposal of biodegradable plastic products, as well as the lack of infrastructure for dealing with them at the end of their use, will mean biodegradable plastics will have adverse effects on the environment.

A biodegradable plastic is a material that can be broken down naturally by bacteria or other living organisms and returned to the environment without pollution.

A compostable plastic is similar in that materials are broken down and recycled by mimicking the conditions created by nature. Whilst there is no timescale for a product to be biodegradable, a compostable material must degrade within 12 weeks.

Just as biodegradable materials will not necessarily degrade everywhere, those that are compostable are so under varied conditions.

For food and drink packaging, this means that the materials will not biodegrade in home composting conditions, but only in industrial conditions, such as an IVC plant. And dependent on counties and councils, the facilities that create these conditions are usually not in place. When reviewing the use of biodegradable and compostable plastics, it is important to consider how to deal with them in the existing system as well as how they will fit into a future circular economy:

The Government's stance emphasises the necessity for compostable plastics to undergo proper industrial composting for effective degradation. The limited industrial composting capacity across the UK poses challenges for managing compostable plastics, and with the latest ban including PLA cutlery, the Government's longerterm plan may be more aligned to 'circular economy' recycling schemes.

Considering these complexities, the ultimate effectiveness of the ban hinges on its coverage of items derived from biobased, biodegradable, or compostable plastics. Another alternative that might be encountered when exploring sustainable packaging solutions are terms such as “aqueous,” or “water-based” coatings. These were initially considered the ‘future’ in recyclable packaging, promising solutions to recycling challenges and regulatory concerns.

Conventional linings to coffee cups like PLA or PE are ‘glued’ to the paper or sprayed onto the paper, leaving a coating on the paper’s outermost layer. Instead, aqueous lining is painted onto the food packaging material. Most of the water-based coating soaks into the paper fibres (rather than forming an outer layer), thus constituting a structural component of the coating.

This distinction gives rise to the notion of sustainability, as it is presented as "plastic-free" since it is not either PLA and PE lined, but in fact, this coating still contains plastic polymers as it is made out of particles that derive from it such as polystyrene or acrylic. So why do some manufacturers promote this packaging as plastic-free? Simply because the coating can evade the current legal definition of plastic and accounts for less than 10% of the total weight of the packaging, passing the composting and paper recycling tests. However, when broken down, the residual from the paper are plastic particles.

The latest guidance from the EU Single-Use Plastic Directive (SUPD) stipulates that by the end of 2023, aqueous lining can no longer be considered plastic-free due to the presence of these petrochemical polymers. As a result, it must be appropriately labelled for sale and use within the EU to promote responsible disposal practices. In the UK, the Foodservice Packaging Association (FPA) has recently expressed the opinion that these claims are misleading consumers and do not comply with the UK Green Claims Code which is similarly aiming at preventing greenwashing in the industry. Whilst the UK stance is not as virtuous as the EU, the emerging global education and commitment to the environment will lead to enhanced knowledge and hopefully the elimination of misleading marketing. enhanced knowledge and hopefully the elimination of misleading marketing.

In response to these challenges, sustainable alternatives are emerging in the market. Companies like Vegware and Notpla are introducing products made from sustainable materials such as seaweed and plants. Notpla's offerings extend to edible packaging solutions, revolutionizing the concept of single-use packaging.

As far as innovation in food packaging goes, it may be seen that edible packaging is one of the more unconventional concepts, with the consumer effectively eating the packaging as part of the product and so eliminating it from causing pollution. An example of this innovation is the creation of spoons made from jowar flour, offering a playful and innovative alternative to plastic. While this product can contribute to waste reduction, it should be noted that its practicality is somewhat limited, with edible cutlery often losing structure when wet. More suitable and cost-effective alternatives to plastic cutlery include wooden and paper utensils. Birchwood cutlery is a pre-existing plant-based substitute for plastic.

Expanded polystyrene originates from crude oil and is a plastic resin. EPS poses numerous environmental issues. It cannot be recycled, lacks biodegradability, and tends to break into microplastic particles, escaping landfills and spreading throughout ecosystems. With bans on EPS already in effect in Scotland and Northern Ireland, the impending ban has less attention, as many foodservice establishments have already transitioned to more sustainable alternatives.

allmanhall has identified one company in particular offering viable alternatives: Notpla.

Taking in an aspect across Britain’s verdant fields, with their uniformly grown crops standing tall, one could be forgiven for thinking that this ‘natural’ process benefits both people and the planet. We’ve been farming for thousands of years. In fact, agriculture is the primary catalyst that led to the development of civilisation as we know it today, and a change from a more nomadic, roaming existence.

Unfortunately, however, the current intensive farming of land for food is damaging the planet. Currently, farming systems are only productive through a great deal of human intervention to ensure high yields. An ever-growing global population and demand for food create further pressure still.

Fields are intensively tilled, sprinkled (I’m being generous) with substances to meet our demands, heavily watered, and planted with a single crop, year after year. As the soil becomes overloaded with toxins and low in nutrients, more intervention and chemicals are required, to ensure the same yields. Eventually, the soil is no longer capable of supporting life; a process called desertification. This carries with it further environmental concerns, most notably flood risk, and a complete lack of biodiversity.

Globally, from multiple sources, an estimated 40% of our farmed land already has degraded soil, and if nothing changes that figure will continue to rise.

“What about organic farming?”, I hear you cry? I refer to you the piece by farmer Joe Evans, on page 68 which touches on the limitations and unintended carbon-emitting consequences of organic methods, opining that “the world has moved on from organic...

Everyone needs to eat, and stopping farming to allow the land to heal would put more pressure on an already challenged food system and exacerbate the risks around food security.

Fortunately, an alternative does exist and it’s gaining traction... regenerative farming. now it’s all about regenerative farming; growing food and environmental benefits together.”

This is not a new concept – it harks back to pre-industrial methods of food production. So, rather than an innovation, really this is a more back-to-basics approach. This is exactly as it sounds - a form of farming which regenerates rather than harms the land and associated biodiversity. Regenerative farming works in tandem with nature rather than attempting to dominate it. And it is exactly how Wildfarmed are approaching agriculture, adopting principles to transform present-day farming...

Wildfarmed is the brainchild of Andy Cato, one-half of the electronic music duo, Groove Armada! With the realisation that the current system of farming and food production is broken, he began looking for new principles to apply to his own farming methods. He came across an Agricultural Testament, a book published in 1940 by Albert Howard. This became Andy Cato’s transformational manual.

principles include:

•working with nature

•planting poly cultures that work in harmony

•allowing for increased soil health

•and improved carbon sequestration.

Author Theo Kuehn Sustainability Manager

After regenerating his own farm, Andy Cato has embarked on a quest to build a set of principles to help others. Wildfarmed has defined farming standards which you can read about here - https://www.wildfarmedstandards.co.uk/.

Now based on a National Trust Site not far from Swindon, the Wildfarmed movement is gaining momentum and the methodology has been seen to be undeniably effective in:

•Repairing soil

•Improving biodiversity

•Increased yields (after an initial dip)

Most promisingly, due to the carbon sequestered by the increased soil health, Wildfarmed have been able to claim that their flour is inherently carbon negative, storing 1.5kgs of carbon for each 1kg of flour produced.

To give this some context, flour typically emits 0.6kgs of carbon per 1kg produced. At the time of writing, 60 farms have signed up for the scheme, and more are onboarding. allmanhall are looking forward to working with the team at Wildfarmed and to bringing their exceptionally delicious products to our clients’ kitchens and dining rooms.

Client spotlight

Currently 3 sites, Taylor and Taylor are a group of family owned residential care homes in the process of rapid expansion. They have several high-end openings already planned, and more on the horizon.

They approached food procurement experts allmanhall looking to achieve scalable cost savings and efficiencies to support their growth, without any detrimental impact on the excellent quality of their food offering and residents’ pleasure.

Group Executive Chef, Chris Rees initially started discussions with allmanhall, very mindful that a successful growth strategy, staying true to Taylor and Taylor’s high standards and focus on resident experience and wellbeing, would require a longterm partnership approach and shared values.

Author Jo Hall Communications & Development Director

From day 1, the care and attention provided by allmanhall has been exceptional. The team truly listen to us, to what our challenges are and are always willing to help in any way they can.

Taylor and Taylor’s desire was to achieve at least a 5% food cost saving and to ensure ongoing effective management of catering budgets despite food inflation. The required outcomes also included quality produce, consistency of supply and the ability to continue buying certain brands, high-end cuts of meat and excellent fish.

Visibility of data and access to reports and insight to help inform decisions was identified as key, as was ease of ordering and management of stock and deliveries on a more day-to-day basis. Administrative efficiencies and support for growth ambitions, from a solution that is both scalable and sustainable, were also essential. The entreaty for continued exceptional quality and constant improvement came across very clearly.

allmanhall undertook a like-for-like benchmark using recent invoice data from Taylor and Taylor. Through this analysis and negotiations with suppliers, allmanhall identified cost savings – with no detriment to produce quality or dramatic changes to delivery windows –of 11.4%. More than double the initial objective.

While the benchmark was underway, allmanhall delivered tech demos of the catering control platform that Taylor and Taylor would benefit from, to ensure it met their needs. Samples and on-site supplier meetings were also arranged on behalf of the homes, to confirm that the quality was to the required standard.

Analysis vs Taylor and Taylor’s previous supplier indicated 20%+ cost savings. allmanhall have also been proactive with regards to suggestions for enhanced control and management of food spend, to further facilitate growth and scalability.

As well as providing useful operational functionality like stock taking & standing orders, the catering control platform would also give access to management reports, facilitate central billing and convert all supplier invoices into 1 per month (per home or per cost centre as preferred). Taylor and Taylor were impressed with the administrative efficiencies and time savings. Reassured that the solution proposed would meet their needs for a procurement partner, Taylor and Taylor decided to proceed with allmanhall.

A new butchery solution was implemented to help Chris and the team with a specific supplier challenge they had been experiencing prior to working with allmanhall. Meanwhile, the mobilisation of all other suppliers was expertly managed by allmanhall, on behalf of the homes, as well as setting up accounts, delivery windows and order sheets with suppliers.

allmanhall have been on hand throughout and continue to provide support and manage the supply chain for Taylor and Taylor. From handling supply challenges so the team can focus on catering for residents, to introducing new suppliers or products.

From mitigating and negotiating down proposed price increases to providing refresher training on platforms as needed.

As well as setting up accounts, delivery windows and order sheets with suppliers. allmanhall also took care of the homes’ catering team training. This included acquainting them with the catering control platform and EDI invoicing procedure, through handson training sessions as well as videos to refer back to and a point of contact should they need future helpdesk support.

The consolidation of invoices into 1 per month is a huge win. “ ”

The homes benefit from tablets to help them place orders, access buy rights, delists and product availability updates, as well as to facilitate stock taking to reduce their wastage. These tablets also provided access to The Pass, allmanhall’s client portal, that makes useful resources and reports so simple to access.

The team at allmanhall have been on hand throughout and continue to provide support and manage the supply chain for Taylor and Taylor. From handling supply challenges so the team can focus on catering for residents, to introducing new suppliers or products.

From mitigating and negotiating down proposed price increases to providing refresher training on platforms as needed. From dramatically reducing the number of monthly invoices the accounts team are processing to just 1 per home to exploring innovations when it comes to medical consumables and other items... allmanhall are providing support to Taylor and Taylor at every level. There is Director level involvement, not just for strategy but also to ensure day-to-day priorities are addressed and the very best service is received. Be it credit notes or crate collection, no job is too small and allmanhall makes sure everything gets sorted!

allmanhall are delivering food cost savings to the client’s satisfaction and have gone on to carry out a review of all spending, broken down by home and with insights regarding categories, cost per resident and recommendations regarding product alternatives, to drive further cost savings for Taylor and Taylor.

Next steps? Ongoing cost savings and efficiencies, dayto-day as well as longer-term planning and strategy sessions at a leadership team level... but first allmanhall are organising a wine-tasting event as a treat for the residents at one of the homes! allmanhall and Taylor and Taylor agree that incredible experiences for the people that matter most are at the heart of everything they do.

“We have relations with people across the allmanhall team – all there to help and to advise or resolve depending on what we need. With challenges around labour shortages and food inflation, this is valued. It frees up the team and gives us peace of mind. I would recommend allmanhall’s services to others in the care sector.”

-Chris Rees, Group Executive Chef

Insight

Currently, seafood serves as a vital animal protein source for approximately three billion people worldwide, accounting for 17% of the global animal proteins consumed.

Global seafood consumption has more than doubled in the past 50 years. This has emphasised the need to fish more sustainably to prevent further damage to our oceans. We must balance increasing global demands with safeguarding the ability of future generations to do the same.

Seafood production generates fewer carbon emissions than conventional protein sources and has many health benefits including Omega-3s, which benefit cardiovascular health by reducing blood fat spikes after meals, enhancing plaque stability in blood vessels, and regulating blood thickness. Moreover, seafood has been linked to better brain health, with fish-eaters experiencing reduced risk of neurodegenerative conditions like dementia and exhibiting larger brain volumes.

Despite the global increase in consumption, the UK’s consumption is still relatively low, with only a quarter of adults consuming any oily fish and less than 16% of young adults consuming two or more fish portions weekly.

Many dietitians are recommending increasing the amount of seafood a person should consume because of these benefits. However, if we are to increase our consumption for our own health, it is essential to ensure that our actions do not harm the health of marine ecosystems.

Author Tom Codling Buyer

To improve the sustainability of seafood, consumers and foodservice organisations must be aware of where their seafood comes from, whether it is farmed or wild-caught. This will allow the making of better-informed choices, limiting the damage caused by harmful practices and promoting more sustainably sourced seafood within global supply chains.

allmanhall is utilising ratings from organisations like the Marine Conservation Society (MCS) to help identify sustainable options.

The Marine Conservation Society provides sustainability ratings for approximately 130 species:

• Species that are rated one and two are considered the best choices.

• Species rated three and four should be considered carefully as there could be fishing regions that need improvements before they can be fished sustainably.

• Any species rated five should be avoided.

• Fish feed sources: Carnivorous species like salmon often rely on wild-caught fish, requiring careful management to prevent threats to wild populations. Other feed ingredients like soy and palm oil are also crucial considerations.

• Environmental impacts: Concentrated waste effects, such as excrement and chemicals, can significantly harm local ecosystems. Breeding between wild and escaped farmed fish can lead to faster-growing offspring, impacting species’ survival in their natural habitat.

• Fish welfare: Ensuring fish welfare is crucial to maintaining the health and welfare of the fish. For example, avoiding overcrowding (typically 2-4% pen occupancy for salmon).

• Regulations: Regulations vary by country and require appropriate and effective enforcement to promote responsible practices and protect marine ecosystems.

• Stock status: Size and health of populations are pivotal. Small stocks risk collapse which would disrupt the wider food chain.

• Management practices: Laws on catch limits and closed seasons need assessment for appropriateness, enforcement, and monitoring to ensure sustainable fishing.

• Capture methods: Effects on habitat (seabed, protected areas) and risks like bycatch affecting non-target, vulnerable species (sharks, dolphins, turtles) are considered.

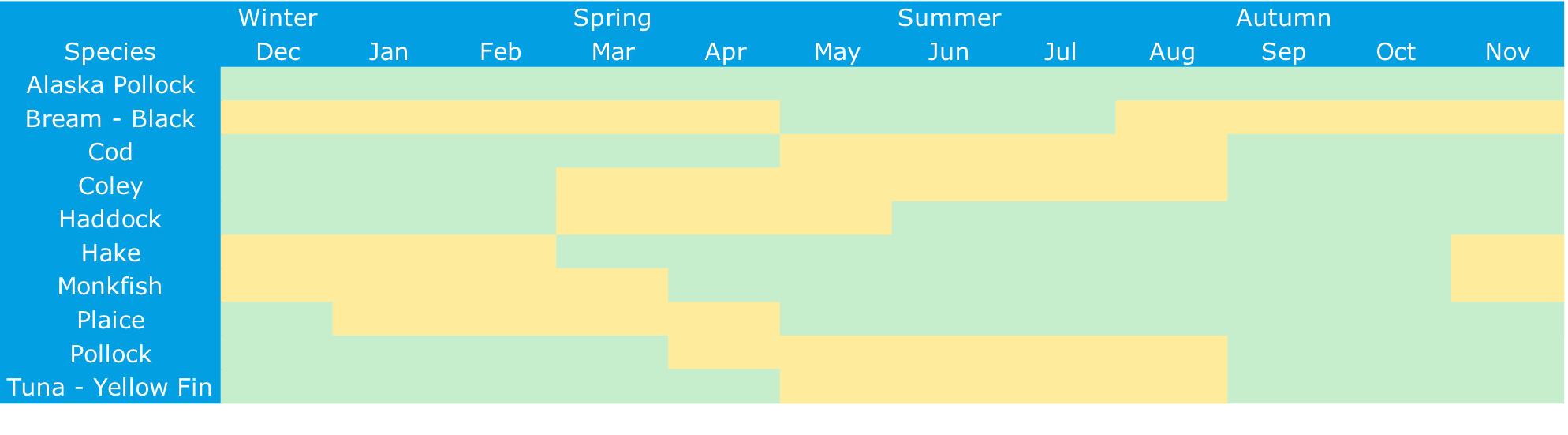

allmanhall recommends only purchasing best choice options, ratings one and two. These ratings indicate that the species is at a lower risk of being overfished and are not associated with harmful fishing practices. A current example of a species considered the best choice is hake whereas monkfish is currently rated five. By incorporating a variety of seafood species into our menus, we can reduce pressure on specific species and promote sustainable fishing practices. By procuring products that are in season you will get the best quality at a lower cost than purchasing a species that is out of season. Additionally, purchasing seafood in season allows populations to replenish during their reproductive cycles ensuring plentiful supplies for the future.

As a signatory to the UN Global Compact, allmanhall is committed to achieving the sustainable development goal of conserving and responsibly utilising our oceans. This emphasises the worldwide significance of effectively managing marine ecosystems, a goal to which everyone can contribute.

To enhance transparency in our supply chains, allmanhall is taking proactive measures by challenging suppliers to provide detailed information on catching methods and locations for each product, along with current MCS ratings. This approach will enable our clients to make better-informed decisions when designing menus, ensuring their choices align with sustainable practices and support the health of our oceans.

As we move into autumn, extreme weather will continue to cause price instability. Supply and production are challenging for staples such as potatoes, rice and wheat.

Chip and processing potato prices are forecasted to continue to rise due to low yields across Europe following yet anither challenging growing season. We are already starting to see Dutch processing potatoes up 70% year on year.

We expect further increase of the price of rice as India limits exports to curtail their escalating domestic inflation caused by a disruptive monsoon season. Indian price rises were up 38% in the year to July.

Whilst wheat prices displayed signs of easing, concerns then mounted over ukrainian exports after military activity intensified in the region.

There is also some doubt over yields as below average rainfall in Canada and Europe could lead to lower global production meaning wheat prices may not fall just yet, after all.

The impact of these weather events is universal as global demand shifts based on availability and price and often impacts those who have the least. Exacerbating the already fragile situation, forecasts suggest a pervasive El Niño event later in the year. This could trigger extreme and potentially destructive weather events acros the globe and result in even more disruptions when it comes to global harvest.

More detail can be found on page 62 of this edition of Foodsight, where Procurement and Sustainability Director Mike Meek provides a food inflation forecast into 2024.

Author John Hirst Procurement Manager

How allmanhall are helping, for the long term...

ACS International Schools have now been working with allmanhall as their procurement partner of choice for over 10 years. Founded in 1967 to serve the needs of global and local families, ACS International Schools educate over 3,500 students, aged 2 to 18, day and boarding, from more than 100 countries. Their schools are all nonsectarian and co-educational.

They operate in-house catering for all residential and day students and staff, 7 days a week. When ACS first appointed allmanhall in 2012, their requirement was clear - to benefit from allmanhall’s substantial purchasing power and negotiating expertise to generate financial savings, without compromising quality or continuity of supply. They also had the desire to integrate with allmanhall’s industry-leading catering software platform solution, and to reduce the administrative burden of processing numerous monthly invoices to just 1.

The flexibility offered by allmanhall meant this could be 1 per site or per cost centre – led and controlled by the needs of the school team.

The initial benchmark conducted by allmanhall demonstrated 10% cost savings.

More recently, allmanhall undertook a tendering exercise which helped mitigate price increases and fix certain catering-related costs.

The client also received a 10-point plan which, if all steps were implemented, would deliver an additional £60,000+ cost savings.

Just this spring allmanhall delivered a fresh produce and dairy review on behalf of ACS to critically evaluate and ensure the best solution. Furthermore, analysis a few months ago showed allmanhall to be consistently demonstrating 9.9% market competitiveness.

Over the years, allmanhall have constantly worked to leverage further savings for ACS. allmanhall’s team of expert buyers produce bespoke reports for the management team to assist them with achieving enhanced savings through ‘Buy Rights’.

The most recent of these demonstrated a further 2% saving on the multi-temp category, accounting for 2% cost reduction on 52% of the combined group spend. This type of range management is a proactive approach to supporting good buying practice.

The team at allmanhall, as procurement professionals, regularly inform ACS of more competitive alternatives on all product lines. The choice, however, still remains with ACS and there is, always, flexibility.

The support and ability to enable the best food for the best cost over the years mean ACS see allmanhall as an essential partner.

“We regard the allmanhall team as absolute experts in their field, delivering the best food at the best prices along with the best support. We find allmanhall proactive in managing price increases and even decreases, and extremely responsive when needed.

Nothing is too much trouble. I and my team of chefs particularly appreciate that allmanhall ‘get’ school catering and also that they are truly independent; meaning that we are treated like an individual client and not beholden to the whims of a huge contract caterer behind the scenes.

They are a truly essential service – not an overhead at all but a critical partner without whom we could not achieve the support or savings we see today.”

Chris Ingram Head of Catering, ACS International Schools

Author Jo Hall Communications & Development Director

Add up to 5 recipes or food items for FREE and see the carbon impact data, instantly!*

Foodsteps is so easy to use and great for communicating and understanding carbon impact assessments of your food.

Together, you and your diners can make a difference.

If you like what you see, simply ask allmanhall for advice about the best option for you and how to access competitive rates.

Scan to sign up for your FREE 5 recipe trial today!

Providing our services, all on one platform!

Starting originally as a way for our clients to view their invoices, as well as some other key management information, The Pass has quickly grown and adapted to become a key platform amongst our clients...

We regularly update our provided market reports, research, news and even supplier catalogues so that they can always stay that one step ahead, which in catering, is absolutely ideal!

Can you believe we provide even more than what we mentioned above? We also have low-carbon recipes backed by Foodsteps on there and a Chef’s Corner which is brimmed with useful content to help caterers in their everyday life.

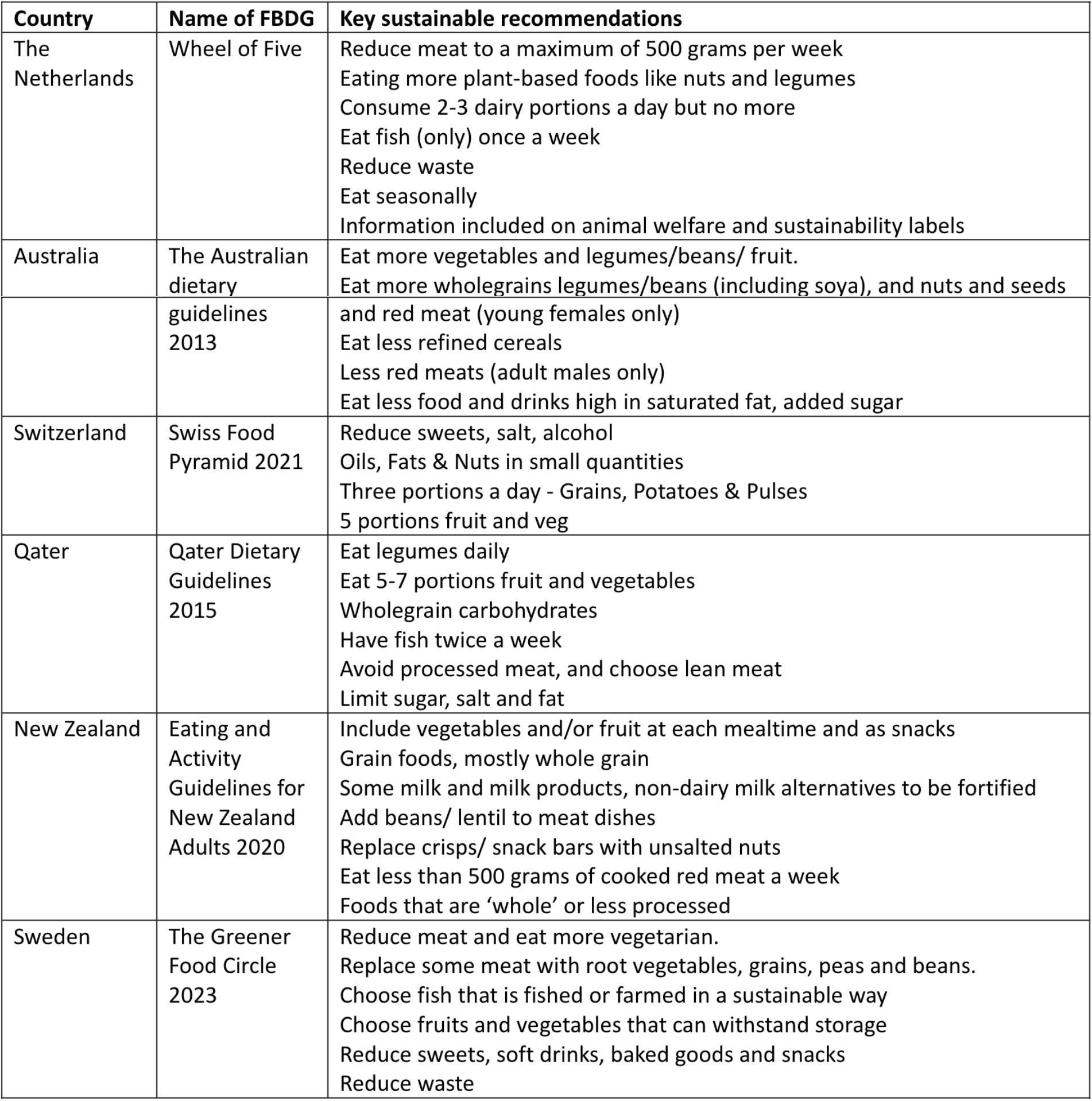

Food-based dietary guidelines (FBDGs) are the political government-endorsed policies that form the recommendations for healthy diets for that country. They form the basis for food, nutrition, health and agricultural policies, the advice given by medics, dietitians/nutritionists and catering in schools and hospitals. Therefore, dietary guidelines, can be used as a positive impact to create significant change.

It is vital we start changing the way we eat to protect our planet; food systems are responsible for a third of global anthropogenic GHG emissions. Despite WHO and the UN FAO calling out to all countries to adapt their FBDGs to incorporate more sustainable factors, many still fall short of providing truly sustainable recommendations, with some countries advising against plant-based diets. Some countries that do suggest reducing animal products often don’t provide good advice on how to make this change.

Here we look at some of the FBDGs around the world, to see if sustainability is considered in their guidelines and how we compare in the UK.

A recent study analysed by FBDGs to assess their sustainability, 95 FBDGs were looked at, which covered 100 countries (as some countries share guidelines).

They found most guidelines do not encourage sustainable

Author Tess Warnes Dietitian

The top 10 countries with FBDG most aligned with sustainable dietary recommendations according to this study were:

1.Netherlands

2.Australia

3.Switzerland

4.Qatar

5.New Zealand

6.UK

7.Hong Kong

8.USA

9.Sweden

10.Belgium (Flemish)

Table 1. Some of the countries FBDG’s that are most aligned with sustainable dietary recommendations.

Other countries were found to not be so positive about plant-based eating, for example, Slovenia’s FBDG discourages a vegetarian diet, warning of the dangers of following a vegetarian diet. Additionally, Italy described vegetarian diets as “a fashion” and suggested that those who follow such diets misunderstand the recommendation to follow a diet that is high in plant-based foods. Several countries also advised against a vegan diet, including France, Germany and Italy.

In another recent publication, most FBDGs were found to not be compatible with a set of global environmental targets related to climate change and environmental resource use.

In the UK, the national dietary based guidelines are The Eatwell Guide (2018), Public Health England. Recommendations include:

• A third of the diet to be fruit and vegetables and a third to be starchy carbohydrates.

• In the protein section, plant-based proteins are listed first to encourage the intake of these.

• Fish twice a week, with oily once a week.

• No more than 70g of red or processed meat a day.

• To include dairy or alternatives with advice on what alternatives to choose.

• To eat less saturated fat, less sugar.

• Increase fibre.

EAT-Lancet dietary recommendations

The Carbon Trust analysis of the Eatwell Guide found following this diet has a 32% lower environmental impact than the current UK diet, attributed to several factors, including an increase in potatoes, fish, bread, vegetables and fruit, alongside reduced amounts of meat, dairy and sweet foods. However, a recent publication has highlighted that the Eatwell Guide is not as sustainable as the EAT-Lancet dietary recommendations, which sets out scientific targets for a healthy diet from a sustainable food production system that operates within planetary boundaries.

Action is needed to ensure all FBDGs emphasise the importance of sustainability within all aspects of our diet. However, are FBDGs the answer? A recent publication has shown that less than half of all countries with national FBDGs fulfilled any of their recommendations, and no country simultaneously fulfilled all recommendations. In the UK less than 0.1% of people are adhering to the Eatwell Guide’s sustainable recommendations.

FBDGs need to reflect what we should be doing for our health and for our environment to guide policies and individuals, but alone they don’t bring about change. Drastic changes are needed at all levels to drive meaningful change in people’s diets. The government needs to make radical changes to all aspects of life: our environment, policies, procurement, farming and education in schools, to name a few, so sustainable eating is the norm; assessable, affordable and an easy choice.

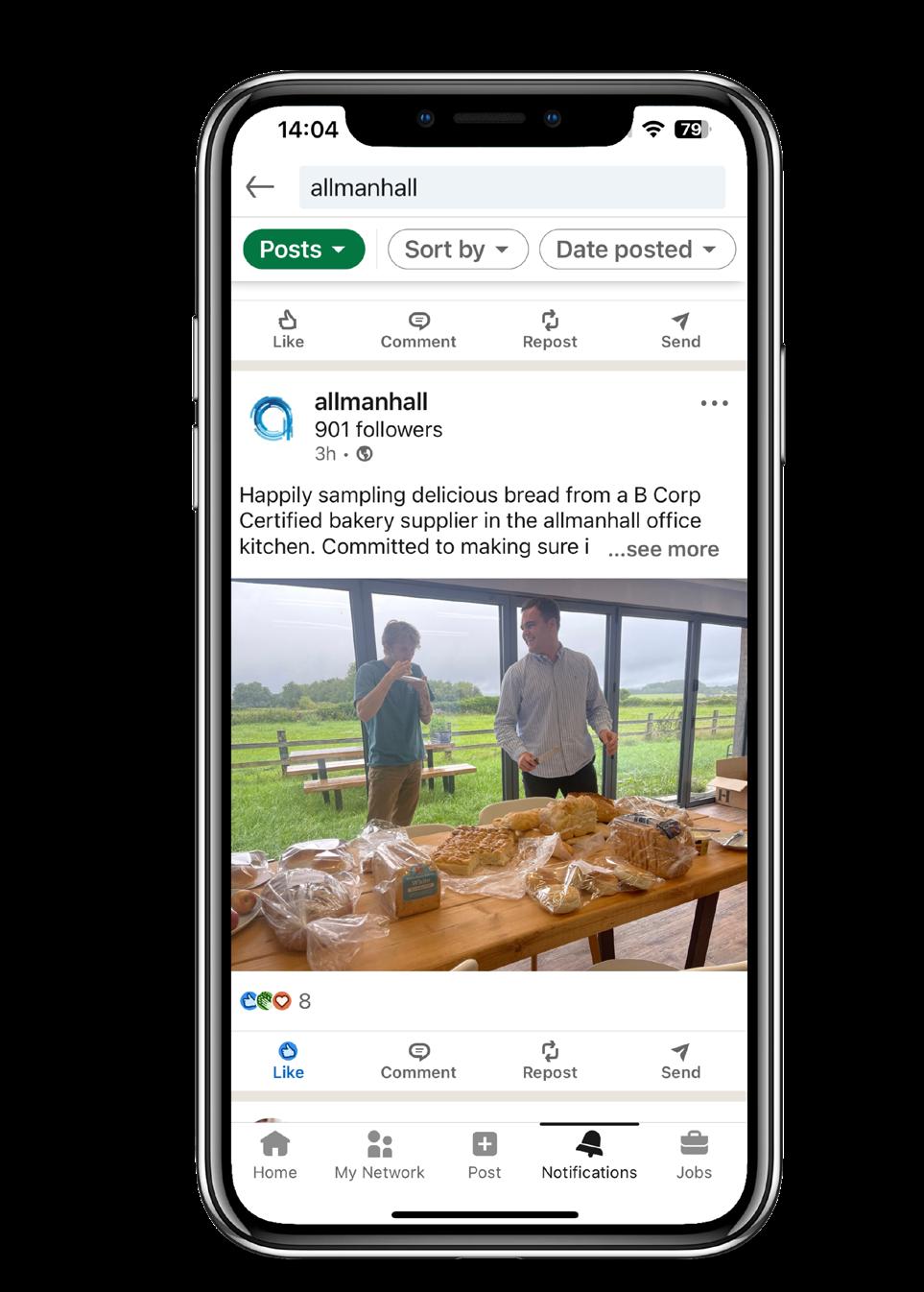

If you have a LinkedIn account, be sure to follow @allmanhall for the latest market updates, industry news, foodie insights, sustainability guidance, recipe inspiration, and much more!

As well as sharing insights and updates, we regularly collaborate with partners including Foodsteps, UN Global Compact and Jamies Farm.

You will also get to see behind-the-scenes photos of our team and what we get up to!

Your guide to new & innovative products, from brands including...

• Devil’s Kitchen

• Rubies in the Rubble

• Fairfields Farm

• Wildfarmed Flour

• Moving Mountains

• Quorn Foods

RUBBIES VEGAN MAYO CRYOVAC POUCH FOR DISPENSING UNIT

RUBBIES TOMATO CRYOVAC POUCH FOR DISPENSING UNIT 3 X 3KG

FAIRFIELDS

FAIRFIELDS

FAIRFIELDS

Having likely reached peak UK CPI food inflation, where rates reached an uprecedented 19.1% during March and 19% in April, it is an opportune time to explore the inflationary outlook for 2024.

Insight Author Mike Meek Procurement & Sustainability Director

Historically, the longterm trend for food inflation sits below the general rate of inflation, often to the detriment of those involved in the UK agricultural sector, where farmers receive the smallest share of associated food product profit behind manufacturers and retailers.

Whilst this long-term trend has continued to make UK food prices cheaper over time, it has also helped to accentuate recent rates of food inflation, which in March were the highest in forty-five years. Food inflation impacting factors include weather and its effects on plantings and harvest yields, energy, geopolitics and Government Policy.

Food inflation is also best influenced by currency exchange rates, trade policy as well as freight and labour costs on the supply side. Consumer spending on the demand side also affects inflation.

It is easy to see why food costs have risen so drastically. In some instances, fossil fueldependent fertilizer prices rose by 200%, natural gas by 350%, agricultural diesel by 59% and agricultural commodities such as wheat rose by over 50% within twelve months.

Climate patterns like La Nina have also recently negatively impacted global harvest yields.

On the demand side, buying behaviour has also changed to limit the full effects of rising prices with increased bulk buying, a move to cheaper brands, the exploration of ownlabel goods and a focus on reducing food waste.

With prices taking up to six months to transmit through the supply chain, food inflation will remain stubbornly high in the near term as long production cycles, fixed price agreements, contract terms and inventories need to feed through to take advantage of declining input prices.

Anecdotally, many businesses report that they have yet to pass on the full effects of food inflation to consumers.