ANNUAL SNAPSHOT 01

Farmer-shareholders approve strategic investment partnership with Dawn Meats Group

Significant increase in profitability following disciplined, back-to-basics approach

Rebound in global pricing and demand in global markets

Continuing cost reduction

Capacity optimisation to match livestock flows

Record market share in beef

Business reset and strategy refresh deliver tangible results

Continuing improvements across Health & Safety to ensure our people return home safe and well each day

CHAIRMAN & CHIEF EXECUTIVE REVIEW

CHAIRMAN & CHIEF EXECUTIVE REVIEW

Alliance Group has had plenty of highs and lows in its 77-year history, but this past year has been one of the most significant.

In October, our farmer-shareholders made the decision to back a $276 million strategic partnership with Dawn Meats Group, one of Europe’s leading red meat processors.

This investment restores balance sheet strength, secures thousands of jobs across regional communities and will ensure Alliance has the scale and reach to compete and thrive in global markets.

While the decision was driven by financial necessity, it has also positioned Alliance for long-term success.

After two challenging seasons, it became clear that while farmers wanted a stronger balance sheet, many were unwilling to contribute further capital. The Board explored every credible option and concluded that Dawn Meats was the right long-term partner.

The partnership has brought together two complementary businesses -- Alliance’s leadership in lamb and strong presence in Asia, China, and North America with Dawn’s strength in beef and its extensive European market access.

It provides the financial stability, capability and reach required to continue building value while ensuring the interests of our farmers are safeguarded.

BACK TO BASICS

Following a full reset of the business, the company’s disciplined, back-to-basics approach -- focused on creating more market value, returning more value to farmers, and driving greater enterprise efficiency -- has guided every decision and delivered tangible results.

Over the past 12 months, we have strengthened the business by cutting unnecessary costs, optimising processing capacity, enhancing farmer offerings and investing in smarter technology.

We have lifted efficiency across the value chain, reduced inventory levels by around half compared with the same time last year, improved sales velocity, and, for the first time in three years, funded capital expenditure directly from free cash flow.

Operational improvements also lifted lamb and beef yields, reflecting improvements in plant performance and processing reliability. These gains are already making a meaningful difference to returns for farmers.

GLOBAL MARKETS

Across our key markets, pricing and demand remained positive, providing a welcome boost after two challenging years when many farmers’ businesses faced losses on the back of a sharp correction in ovine pricing in China.

While trading conditions in China remained difficult, our diversified approach helped balance overall performance. Strong demand in North America, Europe, and the United Kingdom contributed to the positive result.

Beef demand was particularly strong in the United States, where herd numbers are at their lowest for 75 years and domestic consumption remains high. That strength flowed through to farm-gate returns.

Our long-standing customer relationships again proved their value, helping maintain pricing stability and reliability for our farmers.

TECHNOLOGY

Technology has played a central role in Alliance’s turnaround. The new Enterprise Resource Planning (ERP) system improved transparency, strengthened financial control, and enhanced decision-making across the business.

Combined with disciplined cost management, sharper execution and processing improvements, these changes created a leaner, more agile company able to respond quickly to changing market conditions.

LOOKING AHEAD

The past year has been about getting back to basics: running the business efficiently, making better use of every dollar and rebuilding trust and confidence with farmers.

There’s still a lot of work to do, but the foundations are now in place.

We want to thank our farmers for their ongoing support. Their loyalty and commitment have been critical as we reshaped the business.

With the reset complete and our back-tobasics approach embedded across the business, Alliance is well placed to achieve our ambition of creating a high-performing company to benefit our people, our farmers, and our customers.

We would like to thank Team Alliance and the Board of Directors for their dedication and commitment in what was a very challenging year for the business.

A special note of thanks to the Directors who are retiring -- Sarah Brown, Chris Day, Don Morrison, Gray Baldwin and Richard Greer -their contributions have all played an integral role in the success of the business.

We look forward to an exciting future alongside our new partner Dawn, with the capability to thrive and deliver sustainable returns -- helping ensure livestock farming remains a competitive and valued land use well into the future.

Mark Wynne Chairman Willie Wiese Chief Executive Niall Browne, Chief Executive of Dawn Meats

MORE MARKET VALUE CREATION 04

MORE MARKET VALUE CREATION

MORE MARKET VALUE

Creating more market value remains at the core of Alliance Group’s strategy.

Over the past 12 months, we have been relentless in our focus on capturing the best possible returns for every animal processed and ensuring that value flows directly back to our farmershareholders.

The turnaround in company performance reflects disciplined market execution, stronger customer partnerships and a sharper focus on aligning sales with carcass optimisation.

For our farmers, this means more value returned to farm and a stronger, more resilient business.

CHINA

The past year highlighted the strength of diversification in our global markets. China, while remaining our largest single market by volume, proved to be the most challenging.

Consumer confidence was subdued, inventories were high, and pricing pressure was intense. Our approach was measured: rather than chasing volume, we prioritised stability and value, carefully managing exposure and protecting overall company returns.

NORTH AMERICA

By contrast, North America was a standout.

Record low herd numbers combined with record high protein consumption created exceptional trading conditions.

Alliance’s reputation for reliability, consistently delivering to specification and on time, enabled us to deepen trust with long-term customers.

This reliability, alongside the premiumisation of protein in the market, created strong opportunities for our Lumina and Handpicked programmes. Both flourished, adding significant value and helping drive greater carcass optimisation.

UNITED KINGDOM AND EUROPE

In the United Kingdom and Europe, protein shortages lifted demand and pricing.

Our Lumina and Handpicked Lamb brands maintained a premium despite rising commodity prices, with our UK Handpicked launch selling out immediately.

Continental Europe also rewarded provenance and quality, with chilled shipments commanding strong margins at a time when many competitors struggled with supply.

MIDDLE EAST

In the Middle East, Alliance refreshed our strategy, strengthening relationships with key customers in Jordan, Saudi Arabia and the Emirates.

This repositioning created fresh retail and food service opportunities and enhanced brand presence, with encouraging early signs including new listings and distributor feedback showing increased interest in Alliance branded products.

SHIFTING WITH DEMAND

Consumer behaviour also shifted over the year.

Globally, retail channels strengthened as households dined out less and traded down within categories. A flow-on effect of this change was that more people favoured home dining. Alliance adapted quickly, developing new retail-ready formats and pack sizes aligned with consumer preferences. This responsiveness helped secure new business, balance channel mix, and further improve value capture.

Our sales model has also been transformed, allowing us to respond more quickly to market changes and capture value closer to prevailing prices.

ERP DRIVEN EFFICIENCY

Supported by the new ERP system, which provides real-time visibility of inventory and sales data, Alliance's closing weighted average age of inventory went from 76 days to just 15. This dramatic improvement not only freed up working capital but also sharpened responsiveness, improved sales velocity and reduced exposure to volatility.

Through disciplined execution in global markets, targeted premiumisation and innovation, Alliance has delivered on its promise of maximising value for farmers while laying the foundations for long-term growth.

MORE ENTERPRISE EFFICIENCY 05

MORE ENTERPRISE EFFICIENCY

ENTERPRISE EFFICIENCY & OPERATIONAL GAINS

While stronger global markets have underpinned improved performance, equally important has been Alliance’s transformation in enterprise efficiency.

This has not been about headline-grabbing initiatives, but rather a disciplined, consistent commitment to doing the basics exceptionally well.

Gains in yield, waste reduction, labour stability, non-livestock procurement and sustainability have together delivered tens of millions of dollars in value, helping Alliance return to profitability.

PLANT NETWORK PERFORMANCE

Across the plant network, performance has improved significantly.

Mataura achieved a record season with major yield gains and strong uptime. Lorneville processed 203,000 more ovine, benefiting from both scale and efficiency improvements, while Levin also delivered material performance gains.

Beef and offal yields were a particular highlight, with tighter coordination between sales and processing ensuring cuts matched customer specifications. This alignment between market demand and plant execution is now embedded across the business and is lifting returns.

SUSTAINABILITY & WASTE REDUCTION

Waste reduction initiatives also contributed materially to both cost savings and sustainability. Skins once sent to landfill are now fully rendered, delivering $4.5 million in annual savings and reducing emissions.

Rendering plants were upgraded to increase meal production, ensuring more value is captured from each animal while meeting higher environmental standards.

At Mataura, the commissioning of an advanced wastewater UV treatment system set a new benchmark for industry performance and reinforced Alliance’s commitment to responsible operations.

On decarbonisation, heat pumps are now operating at all South Island plants, reducing reliance on coal and diesel. At the same time, targeted efficiency projects, such as reducing hot water use, ensure new systems can be right-sized, lowering both long-term costs and emissions.

WORKFORCE & SAFETY

Workforce stability has improved markedly with reliance on labour hire reduced to negligible levels.

Our Manufacturing Excellence programme has embedded a culture of continuous improvement across processing sites.

This has equipped teams to deliver consistently higher standards and positioned Alliance to perform strongly in peak seasons.

Safety has also remained a clear priority, with internal audits identifying and closing critical gaps. The strengthening of emergency response teams at Lorneville, Pukeuri and Mataura has lifted preparedness and compliance across the company.

PROCUREMENT & VALUE

Procurement discipline and overhead reductions further strengthened performance.

By consolidating non-livestock procurement, Alliance improved its bargaining power and offset inflationary pressures on energy and inputs.

Corporate overheads were reduced, and capital investment was prioritised to essential safety and compliance projects, asset replacement, and fast pay-back projects, ensuring resources were directed to where they added the most value.

These improvements across yield, waste, labour, procurement and sustainability are not isolated gains.

They are part of a wider cultural shift that embeds discipline and continuous improvement at every level of the business.

Together, they are building a leaner, stronger and more resilient Alliance — one that can consistently deliver sustainable returns to farmer-shareholders in the years ahead.

06

MORE VALUE FOR

FARMER SHAREHOLDERS

MORE VALUE FOR FARMER SHAREHOLDERS

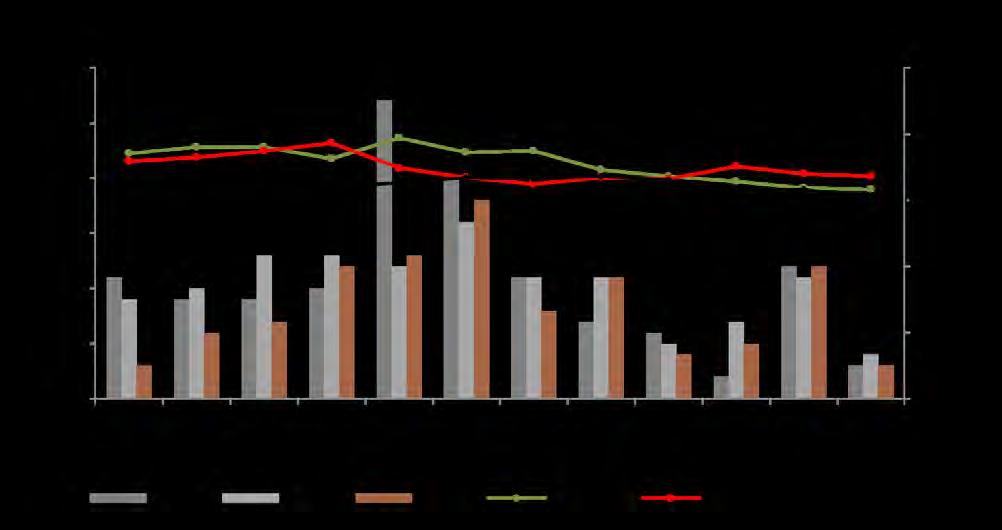

The 2024-25 season has been one of the most challenging and dynamic in recent years, shaped by extreme weather events, shifting livestock flows, and a highly competitive procurement environment.

Yet despite these pressures, Alliance Group and its farmers have demonstrated real resilience and adaptability.

SEASON OVERVIEW

The season began with severe storms across Southland, Otago, and Canterbury in September/ October, resulting in the loss of close to one million lambs.

The cold, wet spring that followed slowed livestock growth and recovery, delaying livestock readiness for processing through the early summer months.

At the same time, the longer-term effects of land-use change — particularly conversions to forestry/carbon farming, became more apparent, with national sheep and cattle numbers falling further than expected.

By mid-summer, conditions had reversed. Warmer, dry weather through January to March created strong pasture growth in many regions, prompting farmers to hold stock longer to maximise weights and take advantage of improving prices.

This tightened livestock availability and created intense procurement competition across the industry, particularly from February onwards.

For the third consecutive year, there was no significant peak in livestock flows or processing backlogs, other than a brief two-week period in May when dairy cows came on. This allowed the company to maintain steady processing throughout the season and continue to deliver efficiency benefits.

SUPPORTING OUR FARMERS

In a season of volatility, Alliance continued to work closely with farmers to help them navigate changing conditions.

To maintain plant efficiency, we sourced additional livestock beyond forecasts and traded a record 1.5 million store-lamb equivalents — our highest ever.

We also facilitated the transfer of significant livestock volumes across regions, including more than 650,000 lambs from Southland to Canterbury in late autumn, ensuring both breeders and finishers could meet their respective needs.

Through our store stock and advanced payment programmes, we provided valuable on-farm support, helping farmers manage cash flow and reinvest in their businesses.

The company’s store stock programme has continued to grow, delivering strong commercial returns to breeders with no commission charge, while our advance payment programme remains an important tool for farmers needing working capital during tighter months.

FARMGATE RETURNS

After two difficult years, the sharp recovery in farmgate prices was welcome and timely. Lamb schedules lifted by more than $2 a kilogram over the season, while beef returns improved by around $3 a kilogram.

These gains reflected a combination of strengthening global market prices and intense procurement competition in the latter part of the season.

Importantly, the total payments made to farmers were significantly higher than in prior years, with a greater share of value flowing back to the farm gate.

This improvement has enabled many farmers to restore cash flow, reinvest in fertiliser and maintenance and strengthen their financial position after an extended period of pressure.

REWARDING QUALITY

Our commitment to rewarding farmers for producing quality livestock remains at the heart of the company’s strategy.

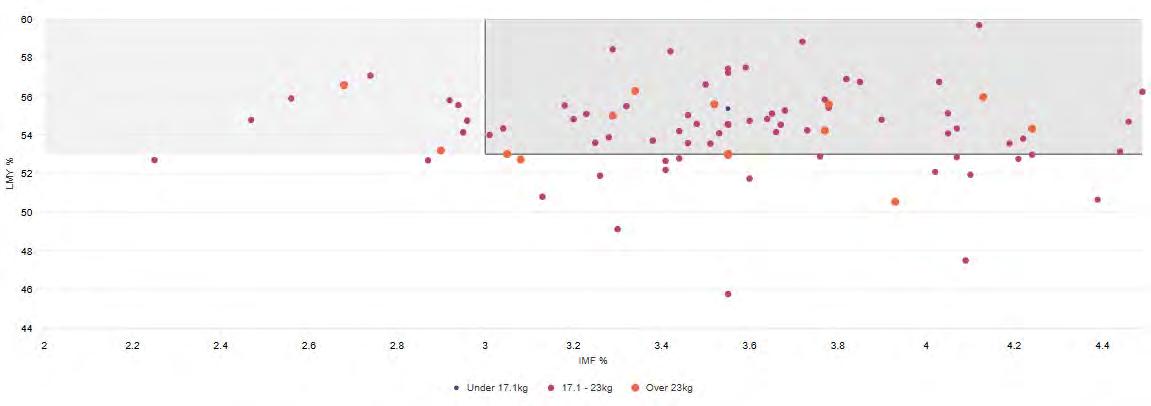

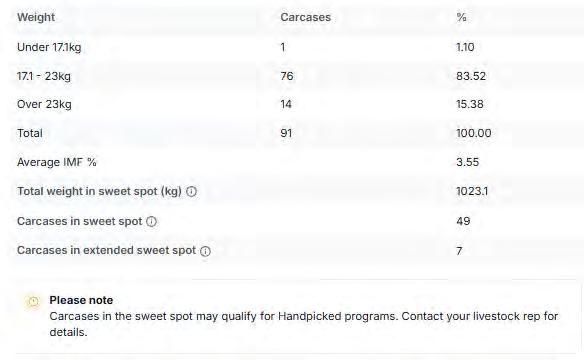

The expansion of our premium programmes, including Pure South Handpicked Beef and Lamb, and the continued roll-out of MEQ technology, have created new opportunities for farmers to benefit from objective measurement and market premiums.

Alliance is among the few companies globally able to reward farmers for both eating quality and yield using independent, objective data.

Returns from marbling in lamb, for example, are now approaching those achieved through our Lumina Lamb programme.

In beef, farmers using MEQ feedback are making more informed breeding and finishing decisions, achieving premiums of up to 60 cents per kilogram.

Participation in these premium programmes continues to rise strongly, with close to 800,000 lambs expected to be processed through the Handpicked programme in the coming season.

MEQ probe showing the scan score for a carcase on the chain.

MARKET SHARE AND SPECIES PERFORMANCE

Lamb market share was initially lower in October and November as a result of the capital raise livestock deductions but strengthened steadily from January onwards as committed supply increased.

Mutton volumes were consistent with prior years, while beef throughput grew significantly as we continued to execute our strategy of increasing beef processing.

Our venison market share eased following the closure of the Smithfield plant, although new partnerships such as the Elk Collective are beginning to rebuild momentum.

DELIVERING VALUE

Alliance remains focused on delivering value to our farmer-shareholders through stable processing, fair pricing, and quality-based rewards.

Our investment in technology, digital tools and livestock representative capability has improved communication and data flow, strengthening on-farm relationships and service delivery.

Together with our farmers, we have weathered climate challenges, sustained performance, and created a stronger foundation for the year ahead.

LAMB SWEET SPOT

BEEF IMF

SUPPORTING OUR PEOPLE AND COMMUNITIES

SUPPORTING OUR PEOPLE AND COMMUNITIES

TEAM ALLIANCE

At Alliance, our people are at the heart of everything we do. Their commitment and care underpin our success and define what it means to be part of Team Alliance.

In 2025, we continued to build a workplace where our people can thrive, one that attracts, develops and retains talented individuals who share our values and take pride in producing world-class New Zealand red meat.

Over the past year, we embedded “The Way We Work” across all sites, and invested in training and wellbeing initiatives that support our people to grow and succeed.

Despite ongoing industry challenges, engagement and retention remain strong, a testament to the resilience and commitment of our people.

During the year, we:

+ Expanded leadership and development programmes to all sites

+ Continued embedding our values and “The Way We Work” into recruitment, performance, and recognition systems

+ Improved recruitment and on-boarding processes to ensure we have the right people, in the right roles, at the right time

HEALTH, SAFETY AND WELLBEING

Nothing matters more than ensuring our people return home safe and well every day.

Over the past year, we continued to strengthen our safety systems, leadership accountability, and culture of care across all our sites.

We completed the third year of our internal health and safety programme, with an overall compliance rate of 76 per cent, and continued our focus on fatality risk management and prevention.

Key highlights include:

+ Fatality risk management remains an important focus for Alliance. The company has progressed to the next phase of our plan to develop Bow Tie Risk Models on potentially fatal events, which highlight the critical controls required to prevent a serious incident. These in turn have led to “in field” critical control verification checks, which provide us the reality check that high hazard work activity is performed safely.

+ All our plants received compliance assessment visits from WorkSafe New Zealand during the year which included discussions with elected health and safety representatives.

+ New ACC annual audit standards took effect this year to enable Alliance to remain in the ACC Accredited Employer Programme. It was pleasing to achieve a full pass on the standards, which were a higher level than previously required.

While we continue to report Total Recordable Injury Frequency Rate (TRIFR), we are increasingly using lamb equivalents processed per recordable injury to measure progress relative to throughput. As a forward-looking indicator, we use audit outcomes against our Safety Management System (SMS).

Safety Performance

TRIFR: FY25 TRIFR: 15.1 versus FY24 TRFIR: 16.8, which represents a 10% improvement. Lamb equivalents per recordable injury: FY25: 77,179 versus FY24: 72,420, which represents a 7% improvement.

These results show continued progress toward our goal of eliminating harm and embedding a proactive, prevention-first culture across the company.

GROWING CAPABILITY

We continued to invest in the growth and development of our people through structured training, apprenticeships and leadership development programmes.

Our training pathways help employees gain both internal certifications and nationally recognised qualifications.

LEADERSHIP DEVELOPMENT

Our flagship leadership programme, The Way We Lead, continued to grow, with 37 leaders completing the programme during FY25.

Cohort 1, Aug 2024 – Jan 2025 | 19 leaders

Cohort 2, July – November 2025 | 18 leaders

Alongside initiatives such as People Foundations and 7 Habits of Highly Effective People, these programmes are equipping our leaders to create safe, engaged, high-performing teams.

SUPPORTING OUR COMMUNITIES

Alliance is deeply connected to the communities where we live and work. We take pride in supporting initiatives that make a real difference to the lives of our people and their families.

SUPPORTING FUTURE TALENT

Each year, Alliance supports the next generation through bursaries for the children of our employees and shareholders.

PARTNERSHIP WITH RONALD MCDONALD HOUSE SOUTH ISLAND

NZ Certificate in Meat Processing — Bronze Induction LCP (30841) 263

NZ Certificate in Meat Processing — Halal (LCP) 2

NZ Certificate in Meat Processing Meat Manufacturing (Silver) (35955) 27

NZ Certificate in Business — Team Leadership (Silver) 44

*Total number of people who achieved the certification

CELEBRATING OUR PEOPLE

In April, we held our first-ever Alliance values awards.

It was a special afternoon as Team Alliance came together for the virtual awards ceremony to celebrate our cumulative success, high performers and culture champions.

The awards presented a unique and special opportunity for us to pause, reflect and recognise the hard work and dedication of Team Alliance and showcase the outstanding individuals who demonstrate our Alliance values and Way We Work behaviours every day.

In 2025, we continued our support for Ronald McDonald House South Island, which provides accommodation and care for families with children receiving hospital treatment away from home.

Our partnership helps ensure families, like Jess' (pictured below), can stay together and feel supported during some of their most difficult times. This year, our people once again got behind the cause and volunteered while Alliance donated meat products for family dinners. Together, we’re helping make life a little easier for families facing big challenges — an expression of the care and community spirit that runs through Team Alliance.

Employee Family Member Bursary: Sarah Puller — Studying degree in Agricultural Science, majoring in Environmental Management at Lincoln University

Shareholder Undergraduate Bursary: Charlie Withers — Studying Bachelor of Commerce (Agriculture) at Lincoln University

These bursaries help young people connected to Alliance pursue studies that will strengthen New Zealand’s primary industries and rural communities.

Jess in 2023 with all her school achievements.

GOVERNANCE 08

BOARD OF DIRECTORS

Mark Wynne Chairman

Don Morrison Supplier Representative

Jared Collie Supplier Representative

Matt Iremonger Supplier Representative

Mark joined the Board in December 2021 and was elected Chair in April 2024. He is also Chair of Quayside Holdings, a large Tauranga-based endowment fund. He has extensive experience in senior executive roles, including CEO of Ballance Agri-Nutrients, Regional President (South Asia) for Kimberly-Clark, and senior roles across Asia, the Middle East and New Zealand for Fonterra Brands.

Richard Greer Supplier Representative

Richard was elected in 2023. With his wife Kylie, he runs Sunnyside Station in Western Southland, a 1600-hectare sheep, deer and beef farm. They are also involved in a tourism business, combining farming with diversification. Richard brings valuable insights into both traditional and emerging rural enterprises.

Chris Day Independent Director

Appointed to the Board in December 2024, Chris is an independent director with extensive corporate, leadership and governance experience. He is the Chief Financial Officer of Foodstuffs South Island Limited and is a director of Datacom Group Limited.

At Alliance, Chris is Chair of the Audit and Risk Committee.

Don was elected in 2013. He farms sheep and cattle on 465 hectares at Waikaka Valley, Southland, through DG & BC Morrison Limited. Don also serves as director of Pure Taste NZ Limited, Te Ao Kakano Limited, and Ahika Journeys Limited, and is Chairman of W9. He is also a member of the Alpha Sheep Genetics Group.

was

Along with his wife Prue and their three sons, he operates a 1325-hectare sheep, cattle and dairy farm in Central Southland.

Jared is also a director of Ballance Agri-Nutrients, Benmore Downs Limited, and Platinum Dairies Limited. He serves as Chair of the Jeff Farm Management Board and is facilitator for the Takitimu Discussion Group.

Ross Bowmar Supplier Representative

Ross was raised in Southland and now farms with his wife Jess and family at a high-country sheep and beef station in Canterbury’s Rakaia Gorge. He holds a Masters in Agricultural Economics from Michigan State University and spent a decade with Archer Daniels Midland in international agricultural processing. He also serves as a director on EA Networks.

Sarah Brown Independent Director

Sarah lives in Manawatu and owns a sheep and beef farm.

She has held senior marketing and consumer insight roles with Lion Nathan, Colmar Brunton, Australian Pork, Boehringer Ingelheim, Diageo and Goodman Fielder International. She sits on the board of Dairy Goat Co-op (Chair of People and Culture) and runs an international marketing consultancy, advising clients across Australia, Asia and New Zealand.

At Alliance, Sarah chairs the People Committee.

Gray Baldwin Supplier Representative

Gray Baldwin and his wife Marilyn winter milk 850 cows, on an all-autumn calving system, on their 707ha property near Lichfield in South Waikato. The property includes substantial areas of maize and forestry land.

Gray’s past co-op governance roles include nine years with Ballance and ten years with LIC. Gray is also a director of Bioeconomy Science Institute and Farmlands.

His qualifications are a Masters in Agricultural Science and a Diploma in Business Administration (Massey) and a Masters in Theology (Otago). In 2015 he attended the Summer Institute of Co-operative Leadership at the University of Missouri. Gray also completed the Fonterra Governance Programme in 2010.

Matt was elected to the board in 2024 as a supplier representative.

Farming 40,000 SU sheep and beef on Banks Peninsula and 2,300 dairy cows across 3 dairy units in Canterbury, Matt was a Nuffield Scholar in 2023 and a past winner of the Deloitte Fast 50 Agribusiness.

Matt is passionate about capturing market value efficiently, returning it to farmers, and strengthening the balance sheet.

Jared

elected in 2015.

EXECUTIVE LEADERSHIP TEAM

Executive

Dr Aneesha Varghese-Cowan Chief Financial Officer

Willie was appointed CEO in March 2023. Prior to this he was General Manager Manufacturing, a role he held since December 2017.

Having led significant Manufacturing and FMCG businesses in both Australia and South Africa as well as Private Equity, Willie is experienced in the implementation of strategies that deliver performance improvements in complex businesses.

Willie has Mast ers degrees in Electrical Engineering, Industrial Engineering and Business Administration; from the University of the Witwatersrand, Johannesburg.

Murray Behrent

General Manager Livestock and Shareholder Services

Aneesha was appointed as Chief Financial Officer in 2024 and brings more than 25 years of finance transformation and governance experience across agribusiness, manufacturing, pharmaceuticals and blockchain technology in New Zealand and internationally.

Aneesha is a Chartered Accountant, holds a Masters in Taxation Studies from the University of Auckland and a Doctorate in Business Administration (with excellence) focusing on the future of the NZ red meat industry from the University of Otago, and is a Fellow of CPA Australia.

Aneesha is committed to building financial resilience, strategic transparency, and long-term value for the company and its shareholders.

Kirstie Gardener General Manager People & Culture

Murray joined Alliance in 1990 and has worked in multiple livestock-related roles. Appointed GM in October 2023 after serving as interim from June 2023. Murray has led major projects including the Farm Assurance Programme, Livestock Transport Accreditation, Central Progeny Test, and Via Scan Yield Grading.

Nigel Jones

General Manager Supply Chain and Planning

Appointed GM in May 2023 after serving as GM Strategy since 2015. Nigel has also held senior supply chain and logistics roles at Fonterra. He holds degrees in Accountancy and Finance, an MSc in Supply Chain and Logistics from Cranfield University, and has completed executive training at Stanford University.

Kirstie joined Alliance in April 2025. She is a seasoned executive and brings a wealth of experience in human resources, having held senior roles across a range of sectors and organisations, including ANZCO, Lyttleton Port Company, Solid Energy, and Holcim.

Sheena Henderson Global Marketing Director

Sheena has over 30 years of experience in global food and agribusiness, including leadership roles at Fonterra. She has also been a professional director for more than 15 years, providing governance and advisory services. She holds BSc and BBS degrees from Massey University.

Wayne joined Alliance in December 2023 after 32 years in red meat processing, including 23 years at Silver Fern Farms where he was Operations Manager for Sheep and Venison. Most recently he was COO Processing and Special Projects at Harvest Road Group in Western Australia. Wayne holds a Bachelor of Technology (First Class Honours) and an MBA (Distinction) from Massey University.

Appointed in January 2024, James has built his career in the red meat industry, previously holding senior global sales roles at Ovation NZ, with 10 years working in the United Kingdom, Europe and North America.

Since joining Alliance in 2019, he has led planning, optimisation, and plant management.

He holds a Bachelor of Physical Education and a Bachelor of Commerce (Otago), with postgraduate study in Managerial Finance and Executive Leadership training at Stanford University.

and Company

Nicole joined Alliance in 2022 as part of the legal team and was promoted to General Counsel and Company Secretary in 2024.

Before joining Alliance, Nicole gained extensive experience as legal counsel at Philips International and Pharming N.V., both based in the Netherlands, and advised large corporate, iwi, and local government clients while in private practice in New Zealand.

In addition to her role at Alliance, Nicole served as an Associate Director of Central Plains Water Limited from 2023 to 2024. Nicole and her husband Rob own a small sheep and beef farm in Darfield.

Bruce was appointed Chief Transformation Officer in July 2025.

He has been with Alliance Group since 1994, most recently serving as Group Contribution Optimisation Manager. Over his long career with the company, Bruce has held a range of senior roles, including 17 years as Plant Accountant at the Pukeuri processing plant and six years as Commercial Manager for Manufacturing.

Bruce is a director of Silere Alpine Origin Merino and serves as the alternate for CEO Willie Wiese on both the High Health Alliance (HHA) Board and the Meateor Board.

He holds a Bachelor of Commerce, majoring in Information Science, and a Graduate Diploma in Accounting from the University of Otago.

Willie Wiese Chief

Wayne Shaw General Manager Safety and Processing

James McWilliam Global Sales Director

Nicole Godber General Counsel

Secretary

Bruce McCrone Chief Transformation Officer

CORPORATE GOVERNANCE

Alliance Group is a co-operative company owned by more than 4,100 farmers who supply livestock to the company for processing and then selling the resulting meat and co-products to international markets.

BOARD OF DIRECTORS

The Company’s constitution states that there should be no more than ten directors at any time, with at least six and no more than eight being elected by shareholders. One-third of the elected directors must retire by rotation each year and may stand for re-election.

Due to the Dawn Meats transaction, a new governance structure will be implemented for the coming year which was set out in the Scheme Booklet.

BOARD RESPONSIBILITIES

The board holds statutory responsibility for the company’s affairs and activities. Dayto-day operations are managed by the chief executive, under the board’s delegation. The Board approves the company’s long term strategic direction, the annual business plan, and the capital expenditure budget. It also oversees specific project expenditures outside of normal authority and reviews the company’s performance against business plan objectives. Additionally, the board ensures regulatory compliance, upholds high ethical standards, and promotes the company’s role as a responsible corporate citizen, particularly focusing on employee health and safety and environmental sustainability. Conflicts of interest are registered and recorded by all directors, and succession planning is undertaken to ensure the necessary skill set remains available.

BOARD MEETINGS

Twelve Board meetings are scheduled annually, with additional meetings held as needed. Directors receive comprehensive management reports before these meetings. The board encourages the chief executive to involve employees who can offer valuable insights.

BOARD COMMITTEES

The board has established three committees to support governance and decision-making. Each operates under its own terms of reference and reports back to the board.

AUDIT AND RISK COMMITTEE

The Audit and Risk Committee consists of five directors and is chaired by Chris Day. It is responsible for overseeing, reviewing, and advising the board on risk management, financial reporting, internal and external audit activities, treasury matters and internal control frameworks.

PEOPLE COMMITTEE

The People Committee also has four directors and is chaired by Sarah Brown. This committee oversees the company’s people strategy and assists the board on policies and procedures related to remuneration and performance management. It plays a key role in the appointments, remuneration, and reviews of directors, the chief executive and senior management.

CAPITAL STRUCTURE BOARD COMMITTEE

The Capital Structure Board Committee is comprised of five directors and is chaired by Mark Wynne. The Committee is responsible for overseeing the company’s capital raise, announced earlier this year, and proposals on overall capital structure. The Committee supports the board in its discussions on optimal capital structure to support the company’s strategic goals.

ASSOCIATE DIRECTOR APPOINTMENT

The Associate Director is appointed at the board’s discretion for a 12-month term. While they attend all board meetings, they do not have voting rights. The board elected to leave this position vacant for the 2024 – 2025 year.

COMMUNICATIONS WITH SHAREHOLDERS

Alliance strives to keep shareholders informed of significant developments affecting the company. Information is shared via the Alliance Group website, Annual Report and the fortnightly e-newsletter “Brief Bites”. This year the board called a Special General Meeting to consider the Dawn Meats Transaction. Additionally, this year the company undertook 24 roadshow meetings to discuss the Dawn Meats transaction.

DIRECTOR MEETING ATTENDANCE

The following shows the percentage attendance of directors (based on their tenure) at board and committee meetings for the year ended 30 September 2025.

OUR FINANCIAL STATEMENTS

OUR FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 September 2025

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 September 2025

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 September 2025 Components

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 30 September 2025

The notes to the Group financial statements form an integral part of these financial statements.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENT S

IN THIS SECTION

The notes to the financial statements within sections A to F include information that is considered relevant and material to assist the reader in understanding changes in the Group's financial position or performance. Information is considered material if:

- the amount is significant because of its size and nature;

-it is important for understanding the results of the Group;

-it helps explain changes in the Group’s business; or

-it relates to an aspect of the Group’s operations that is important to future performance.

ABOUT THIS REPORT

Reporting entity

Alliance Group Limited (the Company) is a for-profit entity domiciled in New Zealand and registered under the Companies Act 1993 and the Co-operative Companies Act 1996. The Company is an FMC Entity in terms of the Financial Markets Conduct Act 2013 and prepares its financial statements in accordance with this Act and the Financial Reporting Act 2013.

These consolidated financial statements are for the Company and its subsidiaries (together referred to as "Group") and the Company's interests in associates as at and for the year ended 30 September 2025.

The Group is primarily involved in meat processing and export sales.

Statement of compliance and basis of preparation

The financial statements have been prepared:

-in accordance with Generally Accepted Accounting Practice (GAAP) in New Zealand and comply with International Financial Reporting Standards (IFRS) and the New Zealand equivalents (NZ IFRS), as appropriate for a for-profit entity;

-on a going concern basis; and

-in New Zealand dollars, with all values rounded to the nearest thousand dollars unless otherwise stated.

In preparing the Group financial statements, all material intragroup transactions, balances, income and expenses have been eliminated. Subsidiaries are consolidated on the date on which control is obtained to the date on which control is lost.

The financial statements are prepared for the 52-week period ending 27 September 2025 (last year: 52-week period ending 28 September 2024) due to the 4-4-5 calendar used by the Group.

This method is used to ensure comparability given the weekly trading cycles of the Group. For simplicity, the financial statements and accompanying notes will be presented and referred to as at 30 September year end.

Going concern

The financial statements have been prepared on a going concern basis, which assumes that the Group will be able to continue in operation for the foreseeable future and meet its obligations as they fall due.

At balance date, the Group current liabilities exceeded current assets by $158.1m (last year: $178.2m). This is due to the short-term nature of the interest-bearing loans and borrowings of $209.7m (last year $220.8m). These debts are classified as current as the facility matures on 18 December 2025. The proceeds from the capital raise will be primarily used to repay the short-term debt returning the group to a positive working capital position.

At balance date, the Group was in the process of securing additional capital to fund its operations and meet its obligations as they fell due. Whilst an agreement with Dawn Meats had been signed prior to year end, several conditions were still required to be met at balance date including shareholder vote, OIO and High Court approval.

Going concern (Cont)

Dawn Meats Corporate Group (“Dawn Meats”) is headquartered in Ireland, and is investing in Alliance through its nominated investment vehicle Delmec Unlimited, a company incorporated in the Isle of Man.

On successful completion of the capital raise and repayment of significant debt including discharging Westpac New Zealand from the banking syndicate, a continuation of the facility until maturity date has been agreed as per the amended facilities agreement signed on 26 September 2025, refer to note C7.

Subsequent to balance date, all material conditions have been met securing sufficient funding to support its ongoing operations and meet its financial obligations for at least the next twelve months. The transaction is set to be completed in early December 2025 and the proceeds to be received in full at that time.

The Directors have incorporated the capital raise and new banking terms into the forecast for the next financial year.

As a result, the Directors have concluded that the going concern basis of preparation is appropriate, and no material uncertainty exists at the date of approving these financial statements. Refer to note F5 — Events after balance date for more information on the Capital Raise.

Foreign currency

Transactions denominated in a foreign currency are converted at the exchange rates at the dates of the transactions. Foreign currency assets and liabilities (such as receivables and payables) are translated at the rate prevailing at balance date.

The assets and liabilities of international subsidiaries are translated to New Zealand dollars at the closing rate at balance date. The revenue and expenses of these subsidiaries are translated at rates approximating the exchange rates at the dates of the transactions.

Exchange differences arising on the translation of subsidiary financial statements are recorded in the foreign currency translation reserve (equity). Cumulative translation differences are recognised in the income statement in the period in which any international subsidiary is disposed of.

The principal functional currency of international subsidiaries is the British Pound Sterling; the closing rate at balance date was 0.4307 (last year: 0.4741).

Other accounting policies

Other accounting policies that are relevant to an understanding of the financial statements are provided throughout the notes to the financial statements. The accounting policies have been consistently applied to the periods in these financial statements. Where applicable comparatives have been amended to align with current year’s expenses.

Critical judgements and estimates

The preparation of financial statements requires management to exercise its judgement in applying the Group's accounting policies. Estimates and judgements are reviewed by management on an on-going basis, with revisions recognised in the period in which the estimate is revised and in any future periods affected. Areas of estimate or judgement that have most significant impact on the amounts recognised in the financial statements are:

-Note B1 Impairment

-Note B2 Inventories

-Note B3 Intangible assets

-Note D2 Derivative financial instruments

-Basis of preparationGoing Concern

Comparatives

Some comparative balances have been reclassified and restated to conform with changes in presentation and classification adopted in the current period.

A. FINANCIAL PERFORMANCE

IN THIS SECTION

This section explains the financial performance of Alliance providing additional information about individual items in the income statement, including:

-accounting policies, judgements and estimates that are relevant for understanding items recognised in the income statement.

-analysis of Alliance's performance for the year by reference to key areas including: revenue, payments to our farmers, expenses and taxation.

A1 REVENUE

Other operating income materially consists of recovery of expenses and rental income (last year: recovery of expenses and rental income)

Segment Reporting

In the following table, revenue from the sale of goods is disaggregated by geographical market. 20252024 $000$000

1,036,829970,469

395,565370,992

2,057,8631,772,215

Revenue measurement and recognition

Revenue from the sale of goods is measured at an amount that reflects the consideration expected to be received in exchange for transferring those goods. The measurement is based on the transaction price, net of commissions, volume rebate, and excludes amounts incurred on behalf of the customer.

In respect of export sales, the largest category of sales, the Group has determined that there are two performance obligations. The Group is obligated under the contract to supply specified goods and arrange and pay for shipping and insurance on behalf of the customer. Control of goods passes, and the service of arranging shipping and insurance is complete, at the point when the goods have been loaded onto the first point of carriage, to be delivered to the customer’s chosen destination. Revenue is recognised at this point in time.

Measurement & recognition

Interest income or expense is recognised using the effective interest rate method.

Financial expenses comprise interest expense on borrowings including related fees and losses on interest rate hedging instruments and the interest component of lease payments.

A3 PERSONNEL EXPENSES

Included within cost of sales in the income statement are wages and salaries of $315.5m (last year: $336.3m). The remaining personnel expenses are included within administrative expenses, sales and marketing expenses. In addition to the capital raise costs disclosed in note C5, transaction costs of $995,120 have been incurred to 30 September 2025 and are included within personnel expenses under administrative expenses in the income statement.

Measurement & recognition

Provision is made for benefits owing to employees in respect of wages and salaries, annual leave, long service leave and short term and long term employee incentives for services rendered. Provisions are recognised when it is probable they will be settled and can be measured reliably. They are carried at the remuneration rate expected to apply at the time of settlement. Obligations for contributions to defined contribution pension plans are recognised as an expense in the income statement when they are due.

Liabilities recognised in respect of long service leave are measured at the present value of the estimated future cash outflows expected to be made by the Group in respect of services provided by employees up to the reporting date.

Measurement & recognition

and also excludes items that will never be

A4.2Deferred tax

Movement in temporary differences during the year

plant and equipment

Balance at 1 October 2023 (3,421)2344,5852,472 957 28,05432,881

Recognised in income (680)1,2095,192(252)(417)21,95927,011

Recognised in equity (1) - - -(1)

Reallocate prior year between current and deferred tax (403) -(807)(934) -1,878(266)

Balance at 30 September 2024 (4,505)1,4438,9701,28654051,891 59,625

Balance at 1 October 2024 (4,505)1,4438,9701,286 54051,89159,625

Recognised in income (7,042)(803)(4,253)(81)(1,689)10,745(3,123)

Recognised in equity 3 - - -3

Reallocate prior year between current and deferred tax (1,591)(162)(593) 76 -2,081(189)

Balance at 30 September 2025 (13,135) 478 4,1241,281(1,149)64,71756,316

Based on future cashflow forecasts in the Group's five-year integrated plan, the Group considers it probable that future taxable profits will be available against which the tax losses can be recovered, and therefore related deferred tax asset can be realised.

Measurement and recognition:

Deferred tax is income tax that is expected to be payable or recoverable in the future as a result of the unwinding of temporary differences. These arise from differences in the recognition of assets and liabilities for financial reporting and for the filing of income tax returns. Deferred tax is recognised on all temporary differences, other than those arising from goodwill and the initial recognition of assets and liabilities in a transaction (other than in a business combination) that affects neither the accounting nor taxable profit or loss.

Deferred tax is calculated at the tax rates that are expected to apply to the year when a liability is settled or an asset realised, based on tax rates and tax laws that have been enacted or substantively enacted at balance date.

B. OPERATING ASSETS

IN THIS SECTION

This section shows the assets the Group uses in the processing of red meat products supplied by our New Zealand farmers in order to generate operating revenues. Key revenue generating assets include:

-Property, plant and equipment

-Inventories

-Intangible assets

-Right-of-use assets

B1 PROPERTY, PLANT AND EQUIPMENT

B1 PROPERTY, PLANT AND EQUIPMENT (CONT)

Measurement & recognition

Owned assets

Items of property, plant and equipment are measured at cost less accumulated depreciation and impairment losses.

Cost includes expenditures that are directly attributable to the purchase of the asset. The cost of self-constructed assets includes the cost of materials and direct labour, any other costs directly attributable to bringing the asset to a working condition for its intended use and the costs of dismantling and removing the items and restoring the site on which they are located. Purchased software that is integral to the functionality of the related equipment is capitalised as part of that equipment.

Where parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items of property, plant and equipment.

Work in progress relates to expenditure on items of property, plant and equipment which are not yet available for use. When an asset is made available for use it is transferred from work in progress to the relevant asset category and depreciated across its useful life.

Impairment

The carrying value of property, plant and equipment are reviewed at each reporting date. If an indicator of impairment exists, then the recoverable amount is estimated. An impairment loss is recognised in the income statement if the carrying amount exceeds the recoverable amount.

Disposals

The gain or loss arising on the disposal or retirement of an item of property, plant and equipment is determined as the difference between the sale proceeds and the carrying amount of the asset and is recognised in the income statement.

Depreciation

Depreciation of property plant and equipment assets is calculated on a straight-line or diminishing value basis. This allocates the cost of an asset, less any residual values (estimated value at time of disposal) over the estimated remaining useful life of the asset. Leased assets are depreciated over the shorter of the lease term and their useful lives.

Key judgement

The Group makes estimates of the remaining useful lives of assets, which are as follows;

-Buildings 15 - 67 years

-Plant and equipment

2.5 - 25 years

The residual value and useful lives are reviewed and if appropriate adjusted, at each reporting date.

The Group makes estimates or exercises judgement in assessing indicators of impairment, forecast future cash flows, and determining other key assumptions used for assessing fair values (less cost of disposal) or value in use.

Impairment tests

While the group has seen improvements in the performance from prior year, posting a net profit before tax of $24.6m, it has continued to be impacted by tough trading conditions and the high cost of debt. This has led the Group to conclude that indicators of impairment, under the accounting standard, exist as at year end.

Where an indicator of impairment is identified, accounting standards require that an impairment test is performed for each cash-generating unit (“CGU”). To assess the recoverable amount of the net assets of the Group, management has considered several relevant valuation data points: the fair value of the Group with reference to the Dawn Meats capital raise (refer note F5), independent valuations prepared by Northington Partners and Deloitte and management developed discounted cash flow models using the value in use (“VIU”) method for the CGU. An impairment loss is recognised if the carrying amount of an CGU exceeds its recoverable amount.

The key assumptions used in the estimation of the recoverable amount are set out below. The values assigned to the key assumptions represent the Group’s assessment of future trends in the industry and have been based on data from both external and internal sources.

The VIU calculation used five-year future cash flows based on Board approved business plans and is discounted based on a weighted average cost of capital ("WACC") of 12.13% pre-tax (8.73% post tax). The cash flow forecast included specific estimates for five years and a terminal growth rate of 2.00% thereafter. Cash flows are based on historical margin levels of between 2.00% and 4.00%, stable livestock volumes, and management’s views on market trends, pricing and yields.

B1 PROPERTY, PLANT AND EQUIPMENT (CONT)

The Group is confident in the results of the planned initiatives, and the results of the VIU indicated significant headroom above the carrying amount of the assets.

The group has carried out sensitivity analysis and determined the following reasonably possible changes in key assumptions, across the forecast period, and their impact on headroom:

Changes in key assumption Decrease in headroom

5% reduction in contribution margin* ($) (91,399)

0.5% increase in discount rate (50,801)

5% reduction in livestock volumes (186,667)

increase in capital expenditure (72,206)

*Contribution margin includes livestock costs and plant operation costs but excludes some processing overheads costs, therefore is not directly comparable to measures within the consolidated income statement. Contribution margin is a key measure that the Group reviews to measure performance and a key measure included within the discounted cashflow model. Based on the sensitivity analysis, the Group believes that a reasonable deterioration in an individual key assumption, in isolation, would not cause the carrying amount of the assets to exceed or be near to their recoverable amount. An improvement in the key assumptions would increase the headroom further.

As a result of the assessment, as at 30 September 2025, the Directors consider that the fair value of the CGU, exceeds the net assets of the Group and no impairment is required.

B2 INVENTORIES

Measurement & recognition

Inventories are valued at the lower of cost and net realisable value.

Cost: Consistent with other meat processors, the Group utilises the “retail method” to value trading stocks, in accordance with NZ IAS 2 - Inventory, to value the cost of inventory. Under the “retail method”, the cost of trading stock inventory is ascertained by deducting from sales value an estimated profit margin expected to be earned on the future sale of inventory. Net realisable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and the estimated costs necessary to make the sale. Estimated selling price is determined based on a valuation hierarchy where the Group looks to use directly observable prices on trading stocks where possible. In the first instance the Group will use values on committed sales orders to determine estimated selling price. In the event that the inventory is not on a committed sales order then estimated selling price will be determined with reference to post year end sales price. In the event that the inventory item in question is not on a committed sales order or sold post year end then forecasted selling price will be used. If the forecast sales price was increased by 10% then this would increase profit by $1.5m (last year: $2.0m). If the forecast sales price was decreased by 10% then this would decrease profit by $1.5m (last year: $2.0m).

Livestock is valued at fair value.

Key judgement

The Group determines the sale values used to calculate the cost of inventory by reference to: -contract sale prices, or -for uncontracted inventory, the future anticipated realisable value.

Work in progress additions above primarily relate to expenditure on the Enterprise Resource Planning (ERP) system, Alliance's core IT system, which will be transferred to software as it is made available for use. The ERP system is being transferred to software in stages as the relevant components of the system are made available for use.

Substantial expenditure on internally developed software continues to be capitalised as work in progress. The software has not yet reached the stage where it is available for use and has therefore not been transferred to intangible assets. Management has assessed the recoverability of these costs and determined that no impairment or write-down is required at this time.

The amortisation of resource consents and software is included in Administrative expenses.

B3 INTANGIBLE ASSETS (CONT)

Measurement & recognition

Resource consents

Costs incurred in obtaining resource consents for processing sites are capitalised and amortised from the granting of the consent on a straight line basis for the period of the consent.

Software

Costs associated with acquiring and developing identifiable software assets controlled by the Group are capitalised at cost and amortised over the expected life of the asset. The costs of internally generated identifiable software assets controlled by the Group comprise all directly attributable costs necessary to create, produce, and prepare the asset to be capable of operating in the manner intended by management.

Goodwill

Goodwill that arises upon an acquisition is included in intangible assets. Following initial recognition, goodwill is measured at cost less any accumulated impairment losses.

Work in progress

Work in progress relates to expenditure on items of intangible assets which are not yet available for use. When an asset is made available for use it is transferred from work in progress to the relevant intangible asset category and amortised across its useful life.

New Zealand Units

New Zealand Units are purchased to offset carbon emissions under the New Zealand Emissions Trading Scheme. The units are measured at cost and expensed using weighted average method. Units are surrendered during the year to meet our obligations under the New Zealand Emissions Trading Scheme.

Key judgement

The Group makes estimates of the remaining useful lives of assets, which are as follows;

- Software 2 – 15 years

- Resource consents 5 – 35 years

The residual value and useful lives are reviewed and, if appropriate, adjusted at each reporting date.

asset or to restore the underlying asset or the site on which it is located, less any lease incentives received.

The right-of-use asset is subsequently depreciated from the commencement date to the end of the lease term.

C. MANAGING FUNDING

IN THIS SECTION

This section explains how the Group manages its capital structure and working capital along with the various funding sources.

C1 CAPITAL MANAGEMENT

The Group's capital includes share capital, reserves and retained earnings.

The Board's objective when managing capital is to maintain a strong capital base to ensure the Group is able to undertake future growth opportunities and maximise the return to shareholders. The Board considers a strong capital base is necessary to protect the Group from volatility and changes in capital and operating market conditions. During the year, the Group made changes to standard shareholding requirements in relation to livestock supply to provide an increase in shareholder equity over time.

The Board monitors forecast capital inflows and outflows, and the level of shareholding relative to shareholders’ supply to ensure that the company retains a strong capital base, with a key reference point being the shareholders equity ratio.

The equity ratio calculated as total equity relative to total assets is a non-GAAP (generally accepted accounting practice) measure. Non-GAAP financial information does not have a standardised meaning prescribed by GAAP and therefore may not be comparable to similar financial information presented by other entities.

C2 SHARE CAPITAL

Co-operative shares 20252024 000’s 000’s Shares on issue at 1 October 106,581103,906

Shares allotted during the year 2,6056,870

Shares surrendered during the year (4,721)(4,195) Shares on issue at 30 September 104,465106,581

C2 SHARE CAPITAL (CONT)

All co-operative shares are fully paid up and have a par value per share of $1.

At 30 September 2025 there were no share issues pending (last year: 1.415 million shares).

All shares have equal voting rights and shareholders are entitled to one vote per share. The maximum individual shareholding is 2.2 million shares (last year: 2.2 million shares). Upon winding up, shares rank equally with regard to the company’s residual assets.

Shares are issued and surrendered at their nominal value under the company’s constitution and the Co-operative Companies Act 1996. Co-operative shares may be surrendered where shareholders have not transacted with the company for five years or do not have the capacity to be a transacting shareholder.

Capital raise costs incurred as part of the Dawn Raise transaction will be offset against equity next financial year on successful completion. Details of the costs incurred to date are disclosed in Note C5. C3 RESERVES 20252024

Foreign

(6,172)(10,861)

(4,100)1,930

(10,272)(8,931)

Measurement and recognition

Foreign currency translation reserve

The foreign currency translation reserve comprises all foreign currency differences arising from the translation of the financial statements of foreign operations as well as from the translation of financial instruments that hedge the company’s net investment in a foreign subsidiary.

Cash flow hedge reserve

The cash flow hedge reserve comprises the effective portion of the cumulative net change in the fair value of cash flow hedging instruments related to hedged transactions that have not yet been settled.

C5 TRADE AND OTHER RECEIVABLES (CONT)

The status of trade receivables at the reporting date is as follows:

Measurement and recognition

Trade receivables are measured on initial recognition at fair value, and are subsequently carried at amortised cost. Receivables are reviewed on an individual basis to determine whether any amounts are unrecoverable and a specific provision is made. The provision for expected credit losses is the estimated amount of the receivable that is not expected to be paid. Debts known to be uncollectible are written off as bad debts to the income statement immediately.

In assessing the collectability of receivables the Group considers the customer's credit history and historical recovery performance and trends.

The Group has derecognised trade receivables that have been sold to the bank under the receivables financing agreement and where the Group has determined that substantially all the risks and rewards have been transferred to the bank. The Group has assigned $30m (last year: $17.5m) of receivables as at 30 September 2025, of which $5.9m (last year: $2.5m) has been derecognised.

Costs incurred by the group in relation to the capital raise (primarily external advice and analysis) have been recognised separately as disclosed above. If the transaction is successful the amounts will be capitalised against equity, if unsuccessful, will be expensed in the income statement.

Costs of $535,724 associated with potential investment projects have been recognised as a prepayment. If the transaction is successful the amounts will be capitalised against the investment. If the project is unsuccessful or abandoned, all costs will be expensed in the income statement.

C6 TRADE PAYABLES, OTHER PAYABLES AND PROVISIONS

1,0231,243

Provisions for restructuring at Smithfield 20252024 $000$000

C6 TRADE PAYABLES, OTHER PAYABLES AND PROVISIONS (CONT)

Measurement and recognition

Trade payables and other accounts payable are recognised when the entity becomes obliged to make future payments resulting from the purchase of goods and services. The entity has financial risk management policies in place to ensure that all payables are paid with in the credit timeframe.

A provision is recognised when the Group has a present legal or constructive obligation as a result of a past event, it is probable that an outflow of economic benefits will be required to settle the obligation, and the provision can be reliably measured.

C7 INTEREST BEARING LOANS AND BORROWINGS

20252024

$000$000

Secured bank loans - current 180,000200,000

Other loans - current 29,74620,766

Other loans - non-current -10,300 Bank credit facilities 18,4241,641

C8 LEASE LIABILITIES (CONT)

Measurement and recognition

Lease liabilities are initially measured at the present value of the lease payments that are not paid at the commencement date. The lease payments are discounted using the Group’s incremental borrowing rate, being the rate that the Group would have to pay to borrow the funds necessary to obtain an asset of similar value in a similar environment under similar terms and conditions.

Lease payments included in the measurement of the lease liability comprise fixed payments, variable lease payments that are based on an index or a rate, amounts expected to be payable under a residual value guarantee, and any exercise price the Company is reasonably certain to exercise.

The lease liability is measured at amortised cost using the effective interest method. The lease liability is increased to reflect interest expense incurred on the lease liability and reduced to reflect the cash lease payments made.

Lease liabilities are remeasured when there is a change in future lease payments arising from a change in an index or rate, if there is a change in the Company's estimate of the amount expected to be payable under a residual value guarantee, or if the Company changes its assessment of whether it will exercise a purchase, extension or termination option. When the lease liability is remeasured, a corresponding adjustment is made to the carrying amount of the right-of-use asset.

Lease expenses

The Income Statement includes expenses relating to short term leases of $0.5m (last year: $0.6m) and expenses relating to leases of low value assets of $0.7m (last year: $1.1m). Depreciation of right of use assets is reported in note B4. Interest on lease liabilities are reported as financial expenses (see note A2).

The Group has considered the potential impact of lease payments should it exercise all extension options and has determined that the amounts are negligible.

On 11 September 2025 the group entered into an extension with the syndicate to extend the current Syndicated Facilities Agreement to 18 December 2025. Subsequently on 26 September 2025, the group entered into a deed amending and restating the Syndicated Facilities Agreement, including revised facility limits and covenants which is conditional on successful completion of the capital raise with Dawn Meats further extending the maturity date to 31 October 2026. A successful capital raise and the resulting cash injection, repays a large portion of the facility resulting in the retirement of Westpac New Zealand from the Syndicate.

Measurement and recognition

Borrowings are initially measured at fair value, net of transaction costs. They are subsequently measured at amortised cost (using the effective interest method). Fees for establishing new borrowings are spread over the term of those borrowings.

The loan facility is a syndicated facility with four AA- rated banks and three A rated banks. It comprises a 12 month Seasonal Facility. The loan facility is secured against the property and assets of the Group given under a Security Trust Deed. As such all Group's inventory is effectively pledged as security for the borrowing facility. The Seasonal Facility is tailored to reflect the seasonal working capital cycle.

Other loans are funds received from the Provincial Growth Fund to fund qualifying projects and receivables factoring with Hong Kong and Shanghai Banking Corporation (HSBC).

C9 EMPLOYEE BENEFITS 20252024 $000$000

22,59920,629

Measurement and recognition

Provision is made for benefits owing to employees in respect of wages and salaries, annual leave, long service leave and short term and long term employee incentives for services rendered. Provisions are recognised when it is probable they will be settled and can be measured reliably. They are carried at the remuneration rate expected to apply at the time of settlement. Obligations for contributions to defined contribution pension plans are recognised as an expense in income statement when they are due.

of lease liabilities 917 891

D. FINANCIAL INSTRUMENTS USED TO MANAGE RISK

IN THIS SECTION

This section explains the financial risks that the Group faces and how these risks are managed. This includes reviewing the hedging instruments used to manage risk.

D1 MANAGEMENT OF FINANCIAL RISKS

The Group is subject to a variety of financial risks relating to its operations that are managed by the Group's Treasury Policy. This policy provides guidance to management on minimising the exposure to these risks and the use of derivative financial instruments.

The Group is exposed to the following risks which arise during the normal course of business.

- Credit risk

- Commodity risk

- Liquidity risk

- Interest rate risk

- Foreign currency risk

Management of the Group's key financial risks

D1.1Credit risk

Credit risk is the risk of financial loss to the Group if a customer or counter-party fails to meet its financial obligations.

The group is exposed to concentrations of credit risk principally in relation to cash and cash equivalents, and derivatives. The Group mitigates this by transacting with six major trading banks.

Exposure to credit risk also arises in relation to trade debtors. Refer to note C5 for the status of trade receivables. This risk is managed through a credit approval process and on-going monitoring being undertaken. Offshore debtor credit risk is also partially managed by the use of confirmed letters of credit from reputable banks.

There are no significant concentrations of credit risk in relation to trade debtors. The carrying amount of financial assets represents the group’s maximum credit exposure. A provision for impairment of receivables is established using the expected credit losses model, which is based on forward-looking analysis which considers historical provisioning rates and relevant macro-economic factors.

D1.2Commodity risk

The Group is exposed to commodity pricing risk on inventory, in particular trading stock, which is managed through negotiated supply contracts.

D1.3Liquidity risk

Liquidity risk represents the group’s ability to meet its contractual obligations as they fall due.

The primary objective is to ensure that sufficient liquidity is available to meet the Group’s short and long term cash obligations.

The secondary objective is the optimal use of cash resources to minimise total funding costs.

The primary source of liquidity will be from foreign currency and domestic receipts. The secondary source will generally be from prior arranged borrowing facilities with financial institutions. The funding facilities negotiated will need to reflect sufficient headroom to accommodate the various uncertainties associated with the nature of the business and industry.

The finance division prepares an annual budget and a revolving 12-week cash flow forecast profiling expected cash flows and projected liquidity requirements. These projected liquidity requirements are monitored against funding facilities to ensure sufficient liquidity resources are available.

In general, the group generates sufficient cash flows from its operating activities to meet its obligations arising from its financial liabilities and maintains adequate banking facilities to cover potential shortfalls.

D1 MANAGEMENT OF FINANCIAL RISKS (CONT)

The Group is required to disclose the expected timings of cash outflows for each of its financial liabilities. The amounts in the table below are the contractual undiscounted cash flows (including interest), so will not always reconcile to the amount disclosed on the statement of financial position.

Loans and borrowings 231,066231,066219,987 779 10,300-Trade and other payables 175,903175,903175,903 -

Bank credit facilities 1,6411,6411,641Lease Liabilities 14,51314,5131,639 3,945 3,5225,407-

D1.4Interest rate risk

The Group is exposed to interest rate risk on movements in floating interest rates on loans and borrowings.

The Group adopts a policy of ensuring that between 0 - 100% (dependant on the facility type, see breakdown below) of its interest rate risk exposure is at a fixed rate. This is achieved partly by entering into fixed-rate risk instruments and partly by borrowing at a floating rate and using interest rate swaps as hedges of the variability in cash flows attributable to movements in reference interest rates.

The Group determines the existence of an economic relationship between the hedging instrument and hedged item based on the reference interest rates, tenors, repricing dates and maturities and the notional or par amounts. If a hedging relationship is directly affected by uncertainty arising from IBOR reform, then the Group assumes for this purpose that the benchmark interest rate is not altered as a result of interest rate benchmark reform.

The Group assesses whether the derivative designated in each hedging relationship is expected to be effective in offsetting changes in cash flows of the hedged item using the hypothetical derivative method.

The Group manages interest rate volatility to cash flow using pay-fixed interest rate swap (IRSs) and forward rate agreements (FRA's).

Interest rate risk

D1 MANAGEMENT OF FINANCIAL RISKS (CONT)

Interest rate sensitivity

The following table shows the estimated pre-tax impact on the group of a general 100 basis point (BPS) change in interest in respect to interest rate derivatives that the company had in place at balance date:

D2 DERIVATIVE FINANCIAL INSTRUMENTS

What is a derivative?

A derivative is a type of financial instrument typically used to manage the interest rate and foreign exchange risks that the Group faces due to its business operations. The different types of derivative used are:

Forward Exchange Contracts:

A contract between two parties (for example, a bank and a customer) where one party agrees to sell or buy a fixed amount of a currency, at an agreed rate, on a certain date. The agreed foreign exchange rate is referred to as the forward rate.

Foreign exchange option:

100 BPS increase in interest rates -(147) -2,087

100 BPS decrease in interest rates -(1,881) - (2,123)

D1.5Foreign currency risk

The Group operates internationally, and is subject to the risk of financial losses arising from adverse exchange rate movements in USD, EUR, GBP, CAD, JPY and AUD. Risks arise due to the risk associated with the cash receipts made in currency exposure other than the functional currency. To manage the foreign exchange risks the Group enters into financial market derivatives. All foreign exchange contracts on hand at balance date are expected to impact the income statement within 12 months.

The Group's policy is for the critical terms of the forward exchange contracts to align with the hedged item.

The Group determines the existence of an economic relationship between the hedging instrument and hedged item based on the currency, amount and timing of their respective cash flows. The Group assesses whether the derivative designated in each hedging relationship is expected to be and has been effective in offsetting changes in cashflows of the hedged item using the hypothetical derivative method.