Taking care of our members

At Allegacy, we often talk about establishing goals and action plans to achieve those objectives. It could be purchasing a new home, setting up a college fund, or starting your own business. Whatever the goal, there are important choices to be made along the way. We love working with our members to ensure those choices are smart ones that help you reach your milestones (see pages 10-11).

I’ve set a lot of personal and professional goals in the 45 years working for Allegacy. Without those goals, I could never have experienced the journey from switchboard operator to chief executive officer. And I could never have done it alone. Along the way, I’ve had empowering mentors, inspiring colleagues, and collaborative teammates who helped me make smart choices, in much the same way we help our members every day.

So when I announced last fall my own plan to retire at the end of this year, I did it with confidence and optimism. Confidence that I could achieve the goal. Optimism that retirement would hold exciting new adventures for me. Confidence that the Allegacy leadership team was well-prepared for the transition. Optimism that our credit union would continue to grow and thrive, and be the very best it could be.

That’s what smart planning is all about. Many people have asked me why I announced my retirement more than a year in advance of the actual date. Coincidentally, I took the same approach we take with our members when setting goals. When we know where we want to be months or years from now, we have time to get there and to get it right. That’s why organizations have short-term goals and long-term plans. The same goes for individuals.

Planning for my own retirement meant setting goals for myself and my family (my husband Chris said he was looking forward to having his wife back!) and for my Allegacy family, including staff and members. There were milestones to be achieved along the way, including the selection of a new CEO to lead Allegacy through the transition and beyond. We all celebrated when we achieved that goal and announced the appointment of Nathanael Tarwasokono as our new President and CEO.

As my journey continues, I take notes, recording my thoughts along the way and tracking my progress toward goals. Each time I reach a milestone, I feel the same kind of excitement I feel when Allegacy rolls out a new product or service or opens a new financial center! There’s nothing like the excitement of achieving goals after the hard work of planning!

I have been blessed in my life. I believe I have achieved more than I could ever have asked for. My wish for each of you is to feel what I feel – to have confidence in your financial choices, to enjoy the planning process, and to know that a goal set is a goal that can be reached.

Please be alert.

Be aware of an increase in targeted scams and cautious when it comes to your account security. Never give out personal information. When in doubt, call us at 336.774.3400 to confirm or to report suspected fraud.

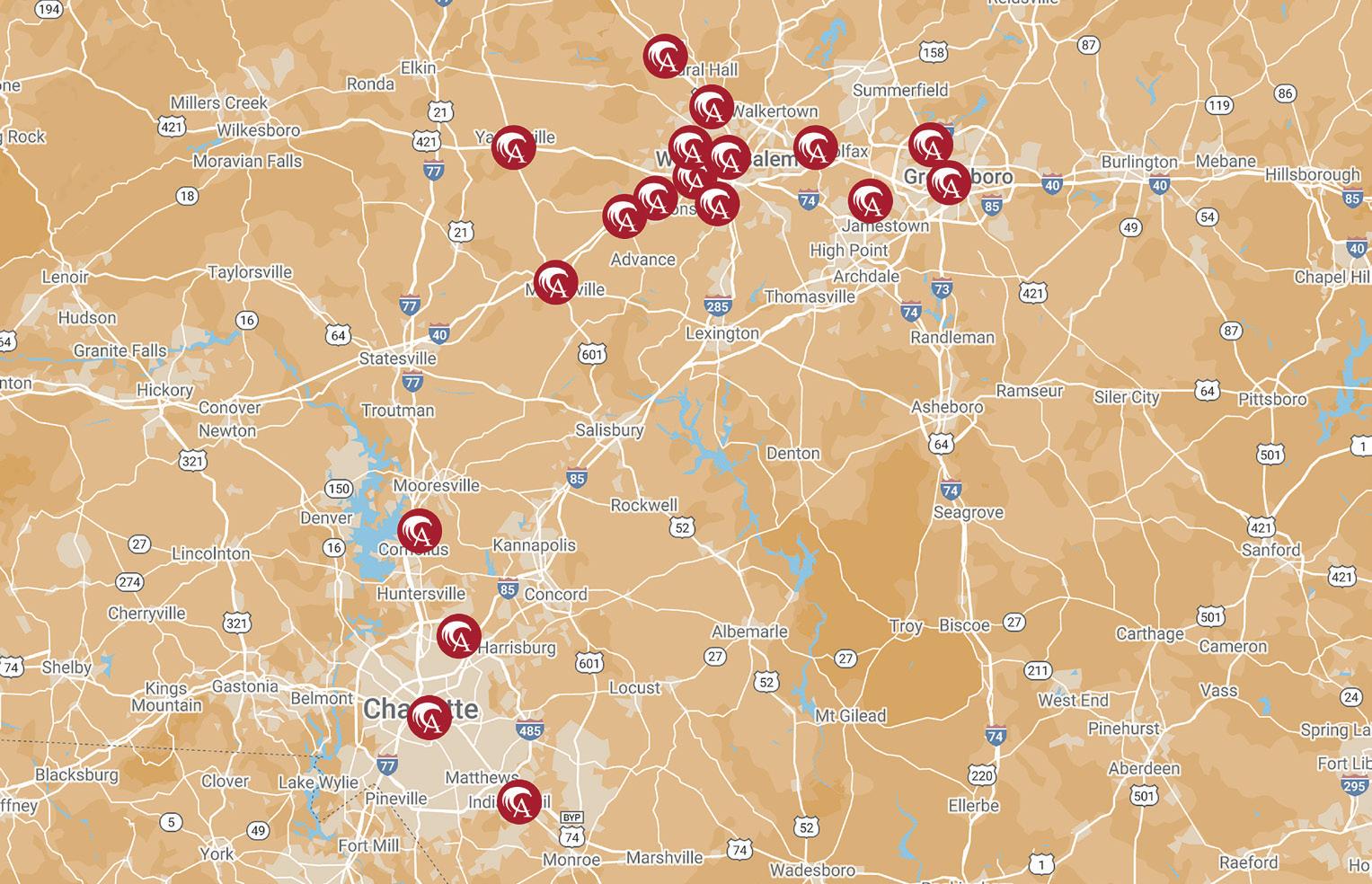

Expanding in the southern region. Many of you live in or travel through this area for work, family and fun. Adding another Financial Center gives you even more access to Allegacy financial staff and services, as well as drive-thru Interactive Teller Machines (ITMs) for 24/7 self-service banking.

Growing allows us to continue providing competitive rates and products, enhanced services and digital tools — not to mention the greater impact we can make by doing more for the communities we serve.

See how your membership helps to support your community.

allegacy.org/impact-report

It’s that time of year when we all hit the gym! Make the most of it with an Allegacy AllHealth Wellness Savings Account to make exercise financially rewarding, too. Earn more on your savings when you work out at any YMCA of Northwest NC or the UNCG Kaplan Center.

• No monthly service fee

• The more you go, the more you earn*

• Federally insured by NCUA

Learn more or open an account online. allegacy.org/savings/allhealth-wellness

*Effective as of 7.1.23. Rates are variable and subject to change. Federally insured by NCUA.

As you look for ways to start building for your future, it’s good to have some general guidelines to help you set goals and stay on track.

1. Start by setting your budget: A good goal is to set aside 20% of your income every month for savings and to keep essential expenses, such as housing and utilities, to about 50% of your income. The other 30%? That’s for nonessentials and short-term goals.

2. Have an emergency fund: Experts* recommend having enough savings to cover essential expenses for three to six months. If you’re just getting started, don’t worry. Set smaller savings goals and build up your emergency fund over time.

3. Consistency is key: By putting away a set amount every month, you might be surprised at how quickly your savings grows, especially when you take advantage of a higher-yield savings account like an Allegacy Money Market.

Make the most of your money with an Allegacy Money Market with tiered rates on savings and access to withdraw funds. Learn more or open an account online. allegacy.org/savings/money-market

When you own your home, spring is prime time for making improvements both inside and out. One of the smartest ways to pay for upgrades is with a home equity loan or line of credit from Allegacy.

A home equity loan lets you use the value of your home (minus what you still owe on your mortgage loan) to pay for all kinds of projects — from upgrading your landscaping to replacing your roof or any other renovations or repairs.

APPLY ONLINE

allegacy.org/home-equity-loans

All loans are subject to credit and property approval. Rates are based on your credit history and profile. Rates and terms are subject to change without notice. Allegacy is federally insured by NCUA. Allegacy is an Equal Housing Lender.

A consolidation loan can make the path to paying things off easier.

The first step to building wealth is getting rid of loans or credit card balances with higher interest rates. A consolidation loan from Allegacy lets you simplify with a competitive rate to help you pay everything off faster.

• Competitive rates to save you more

• Easy, predictable payments

• Smarter terms to fit your budget

See if a consolidation loan is right for you.

allegacy.org/personal-loans/consolidation

Start planning today for the future you imagine.

Take charge of your financial future today with personal guidance, strategic investments, and tailored retirement + education planning from Allegacy Investment Group, available through CFS*.

After completing a careful review, together we can create a personalized plan to help you wherever you are in life. Whether you need to prepare for education expenses, save for retirement, or simply enhance your overall financial wellbeing, our experienced team is here to help you make it happen.

Talk with us about how a little planning today can give you peace of mind for your future.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Allegacy Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

allegacyinvestmentgroup.org

View balances, transfer money, pay bills, manage budgets and more with Allegacy’s WebBanking™ and Mobile App. It’s free and secure.

SIGN UP ONLINE for WebBanking access today! allegacy.org/account-access