Background of the EOSS

The Energy One Stop Shop (EOSS), which was officially launched by Trade, Industry and Competition Minister, Ebrahim Patel, in July 2023 aims to assist energy project developers by expediting and unblocking bottlenecks experienced with authorisations and permits.

The EOSS is part of the priority action plan of the Energy Mitigation Strategy and is a collaborative effort intended to contribute to resolving the energy crisis and provide much needed administrative guidance and support to developers to provide energy security in the country.

Role of EOSS

• Act as a conduit between developers and authorisation competent authorities.

• Reduce administrative challenges encountered by energy project developers.

• Provide a single window application entry and facilitation process for energy projects.

• Shorten timeframes for project approvals by expediting, fast tracking and removing blockages.

Contact Details:

Email: info@enegyoss.gov.za | Telephone: 012 394 9599 | Website: www.energyoss.gov.za

• Online registration of energy projects on EOSS Portal

Streamlined application process

Conduit between developers and departments

Technical support and advisory services

Linkage with private sector and Industry Associations

Unlocking and unblocking of bottlenecks

Escalation mechanism

Advocacy

• Facilitation of unblocking and unlocking of applications

• Redirecting applications to relevant competent authorities

• Coordination of consultations and engagements between developers and relevant departments

• Support to developers and departments in alleviating capacity challenges

• Provide technical advisory services to developers

• A key source of relevant energy application authorisations to developers

• Engagements between Industry Associations, developers and departments

• Link between private and public sector

• Pursue and resolve challenges that new and existing developers are encountering with their application authorisations

• Escalating challenges that are not being resolved at regional and national and levels

• Assist developers and Industry Associations tackle policy, legal and regulatory elements that retard energy project developments

Rooftop, solar carports, ground-mounted solar, and agrivoltaics represent the best-value energy available to the energy customer in South Africa.

Blue Sky Energy is an expert in the design, procurement and construction of such plants.

Battery energy storage installations provide access to solar energy daily during peak hours when the sun is not shining and enable users to bridge their primary energy needs through grid interruptions. While the levelised cost of hybrid solar and battery storage installations is significantly greater than solar PV only, appropriately sized solutions can be commercially feasible. Would you like to know if your property or business can achieve energy security at the same cost or less than what you are paying currently?

Blue Sky Energy works with leading light steel frame construction suppliers to offer a range of innovative solutions such as agrivoltaics and solar carports.

Have you considered putting your spare space to work? Whether you have low-value land or large parking spaces, bring them to life through solar PV installations that create energy and highvalue spaces such as shade for parking or tunnels for agriculture.

Website: www.blue-sky.energy Email: enquiries@blue-sky.energy

Did you know that Section 12B of the Tax Act allows for the accelerated depreciation of your power generation capex, resulting in a 27.5% saving on your project installation?

CONTACT THE EXPERTS AT BLUE SKY ENERGY RIGHT NOW!

Dear Reader,

As we all know, there has been a proliferation in the sale of solar and battery solutions in South Africa across all sectors, driven by loadshedding. But what of the business case for these applications and solutions? In other words, is the investment worth it?

For commercial solar PV, the answer is an unequivocal yes. The payback period, excluding the s12B tax incentive, allows accelerated depreciation of 120% of capex in year one and is in the region of three to five years. Not bad for a system with a 25-year lifespan.

The battery energy storage business case depends on several factors: the cost of shutting down operations and/or the cost of running diesel generators. An offset against the cost of running diesel gensets alone will result in a payback period in the region of two to three years. Not bad for a system with a 10 to 15-year lifespan.

For most businesses, therefore, solar PV and battery investments are feasible, and in many cases, simply an excellent business decision.

Enjoy your read,

Publisher

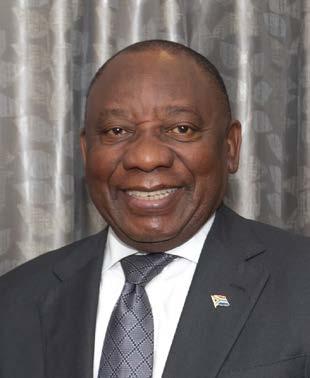

At SIDSSA 2024, President Cyril Ramaphosa announced that South Africa needs R4.8-trillion to achieve its infrastructure goals by 2030. SIDSSA has been pivotal in driving public-private investment for strategic infrastructure projects ( page 22). As project preparation is key to developing a viable project pipeline, government has made interventions to provide a predictable funding regime and consolidate expertise in developing bankable projects.

However, participants active in the South African National Infrastructure Plan need to examine their investment model against the key factors involved in ecological economics. Failure to do so will result in investment continuing its harmful impact on natural, social and constructed ecosystems ( page 26).

Urban Analyst, Llewellyn van Wyk, says that infrastructure development is reductive: the exchange of goods and services between itself and the natural and social ecosystems weakens biological and sociological functionality over time. The exchange flow is one-dimensional (from the resource base to the resource consumer), and the benefits of that resource use are unequally distributed among population groups and prejudicial to future generations.

Van Wyk attests the claim that “infrastructure investment is key to the future of cities” is invalid if that investment is out of line with ecological economics.

As the global population expands, so too does the demand for reliable and renewable energy sources. A solution to this growing demand lies in creating strategic interconnections that allow for increased electricity trade. Energy transmission infrastructure projects are notoriously high-risk and capitalintensive. Read about the $1.3-billion regional transmission infrastructure financing facility on page 18 .

On page 34 , we speak to Professor Linda Godfrey, principal scientist at CSIR, who is helping to inform the transition to a more circular South African economy.

Alexis Knipe Editor

SAPVIA has made a comprehensive submission to the Department of Mineral Resources and Energy (DMRE) on SA’s new Integrated Resource Plan (the IRP 2023).

“SAPVIA commends the DMRE for their work on the IRP. We support its overarching purpose of ensuring electricity security while balancing other key objectives like decarbonisation,” says Dr Rethabile Melamu the CEO of SAPVIA. SAPVIA appreciates the IRP 2023’s two-horizon approach, which splits focus between addressing the immediate crisis and mapping out a long-term plan. However, the industry association’s submission highlights several areas where the draft IRP could be strengthened. The suggestions centre around:

• Ensuring stronger alignment with key related policies and plans, such as the ERA Amendment Bill, Transmission Development Plan, and the South African Renewable Energy Masterplan.

• Providing greater transparency in modelling assumptions and updating technology costs to reflect real-world data.

• Clarifying the role and scale of private sector generation, as current allocations appearunderstated.

• Accounting for future technology advancements and cost reductions in battery energy storage.

• Detailing the costs and timelines of emission retrofit

• Decommissioning scenarios for coal plants.

“To address these issues, SAPVIA recommends accelerating solar PV deployment, significantly raising the distributed generation allocation, investing in transmission infrastructure and reforming the IRP process to be more consultative, transparent and responsive to market realities,” she adds. Acknowledging the ongoing role of fossil fuels in SA’s proposed technology-agnostic supply mix, the submission also emphasises the need to fully consider and articulate the growing economic risks of a carbon-intensive power system in the IRP, as SA balances energy security and decarbonisation imperatives.

“SAPVIA remains committed to working with the DMRE and other stakeholders to shape a dynamic, fit-for-purpose energy plan for SA,” Melamu concludes. “We are confident that renewable energy can power SA’s energy transition while supporting economic growth and social development.”

Enel Green Power and Qatar Investment Authority, through their jointly controlled entity, Enel Green Power RSA, have concluded three long-term Power Purchase Agreements (PPAs) with Air Liquide and Sasol SA to supply 330MW of renewable energy to Sasol’s Secunda site, where Air Liquide operates the world’s largest oxygen production facility. This makes Enel Green Power RSA one of the first renewable energy companies to conclude a set of large-scale wind PPAs in SA for the Commercial and Industrial (C&I) market. The power will be generated by three joint venture-owned wind projects located in Eastern Cape and are expected to be operational by 2026 (see page 60). This 330MW cluster complements the existing platform of over 730MW already in operation and is expected to result in an annual production of more than 1 100GWh.

Norton Rose Fulbright SA is pleased to announce its role in advising Pele Green Energy on the landmark Southern Africa first-mover wheeling projects with Anglo-American and EDF as co-shareholders. These pioneering projects involve AngloAmerican mines, smelters and refineries as off-takers, with a combined capacity of 520MW. The transaction represents a pioneering development in the market, showcasing a unique trading platform and off-take structure. It offers an exceptional opportunity to efficiently allocate energy from the projects to off-takers while providing portfolio benefits and risk mitigation.

Mainstream Renewable Power has reached financial closure on 20-year PPAs for a 97.5MW solar PV farm in the Free State with Sasol and Air Liquide. Construction will start this year and power generated will be delivered via the national grid to Sasol and Air Liquide’s operations in Secunda, with energy production to go online in 2025. Mainstream’s GM, Hein Reyneke, says private PPAs are crucial to unlocking the country’s energy constraints. Private off-take agreements enable significant quantities of energy to be delivered quickly, reducing companies’ exposure to rising energy costs.

USE-IT NPO has emerged as a beacon of environmental change by pioneering waste beneficiation and recycling practices. Founded to divert waste from landfills and boost job creation USE-IT’s innovative approach has yielded significant successes over five years. By harnessing cutting-edge technologies, it has turned waste into valuable resources, fostering sustainable business models and SMME development.

Strategic partnerships with local stakeholders facilitate efficient collection and processing of recyclables. Notable successes include the growth of SMMEs like Owethu Sewing, Home Decor, and Educational Toy Project. Moreover, USE-IT’s commitment to innovation extended to township economies, notably through projects like Green KEY Brick, catalysing environmental change both locally and internationally. Community engagement initiatives, including educational programmes and partnerships with waste pickers, underscore USE-IT’s dedication to social impact. Collaborative efforts with schools further promote recycling awareness among the youth.

As a testament to its commitment, USE-IT continues to advocate for environmental stewardship and economic empowerment. With gratitude to supporters like the eThekwini Municipality, USE-IT’s vision persists: to transform waste into opportunity and lead the charge towards a greener future in KZN townships.

Growthpoint Properties has entered into a milestone PPA with Etana Energy for 195GWh of renewable energy a year, representing 32% of its total current annual electricity consumption.

In 2023, Growthpoint signed a PPA with licenced electricity trader Etana Energy to wheel electricity to its commercial property buildings in several jurisdictions nationwide.

The deal has set in motion South Africa’s first multijurisdiction, multi-building, multi-source renewable energy wheeling arrangement and will enable Growthpoint’s tenants to access green energy and reduce their carbon footprint.

Through this agreement, Etana will cover 70% of the power consumed by Growthpoint’s participating buildings, and in some buildings, Growthpoint will provide its tenants with the ability to purchase 100% renewable energy.

Growthpoint has exclusive rights to purchase all of the roughly 30GWh that will be generated annually by a 5MW hydroelectric power plant developed, owned and operated by Serengeti Energy. The project is situated within the Lesotho Highlands Water Scheme (LHWS), which provides the added benefit of effectively generating 24/7 baseload power. Growthpoint has also shown some interest in investing in the power plant by signing a MoU with Serengeti Energy. Serengeti Energy owns and manages renewable energy projects of up to 50MW (mainly hydro) in sub-Saharan Africa and currently operates nine plants in five countries.

Initially targeted for South Africa’s REIPPPP, Serengeti’s focus for this hydro plant shifted, and it advanced the project for the C&I sectors. The project is well-placed to capitalise on the LHWS Phase 2 future expansion. The hydroelectric power plant has reached financial close and is currently under construction. The commercial operation’s date is expected to be 1 July 2025, when it will supply its first electricity to Growthpoint, wheeled via the Eskom grid and traded through Etana. Thereafter, the commissioning of wind and additional solar production from Etana’s portfolio of renewable energy projects connected to the national electricity grid will commence.

Teraco, vendor-neutral data centre provider, has secured its first grid capacity allocation from Eskom and will commence construction of a 120MW utility-scale solar PV energy facility in the Free State. The allocation from Eskom enables Teraco to connect its solar facility to the national electrical grid. The power generated will be wheeled across Eskom and municipal power networks to Teraco’s facilities across South Africa.

“This will be a unique approach in Africa since Teraco will not only own its data centre facilities but also a significant renewable energy source with which to power them, creating a sustainable energy path to support growth,” says Jan Hnizdo, CEO at Teraco. When fully operational, the solar plant is expected to produce over 338 000MWh annually.

Teraco has partnered with JUWI Renewable Energies South Africa and Subsolar to develop the solar PV plant. In a first for Teraco, a green loan has been raised to finance construction of the plant.

Kimberly-Clark has signed a long-term PPA with Energy Partners, which will include the installation of a 2.2MW rooftop system at Kimberly-Clark’s Epping facility, making it one of the largest rooftop solar PV systems in Cape Town. The system is expected to produce 3 478MWh of energy per year, saving more than 3 130 tons of carbon dioxide emissions each year. Construction of the system, which will include 4 000 solar panels, will begin shortly. The system is expected to produce its first clean energy in the second half of this year.

A newly launched scheme from the City of Cape Town allows residents to further leverage the benefits of their solar power systems, selling excess generated energy back to the city for cash instead of credits against municipal bills.

“The improvements in the cost-effectiveness, efficiency and reliability of solar technology in the past decade have been nothing short of remarkable. As we continue to experience a high adoption of solar from customers across the country, we’re excited to elevate those in the City of Cape Town’s experience by facilitating access to the new payback surplus power scheme,” says Andrew Middleton, CEO and co-founder of GoSolr, the company that facilitates the ability to feed in excess energy for all Cape Town customers.

Through the “Cash for Power” programme the city intends to source as much excess solar energy as available from businesses and residential properties to feed back into the city’s grid.

GoSolr, South Africa’s largest subscription-based residential solar provider, offers residents the ability to install solar without any initial capital outlay or investment beyond a month-to-month fee, democratising access to solar power. www.gosolr.co.za

Startling insights into the supply and demand dynamics of South Africa’s expanding carbon market were recently revealed in The Brundtland South African Carbon Market Analysis . These include the stockpiling of carbon tax offsets, a significant supplydemand gap extending to 2043, and the need for increased carbon credit generation at a significant scale.

BY BRUNDTLAND CONSULTING

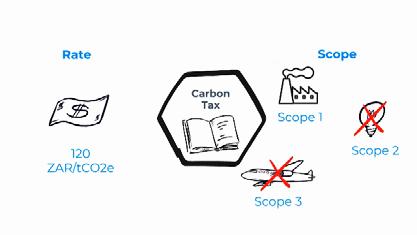

To curb its future greenhouse gas (GHG) emissions, South Africa applies – among others – a combination of carbon tax and carbon market policies. These essential tools for combatting climate change motivate organisations to reduce their GHG emissions to avoid paying higher taxes and incentivise investment in cleaner technologies and practises.

Introduced in 2019, South Africa’s Carbon Tax Act covers 90% of local GHG emissions and includes an offset allowance to offset 5% to 10% of taxable emissions. This increased the local demand for carbon credits and boosted the local carbon market, in which the listing, transfer and retirement of eligible carbon credits as carbon tax offsets (CTOs) is facilitated by the Carbon Offset Administration System (COAS).

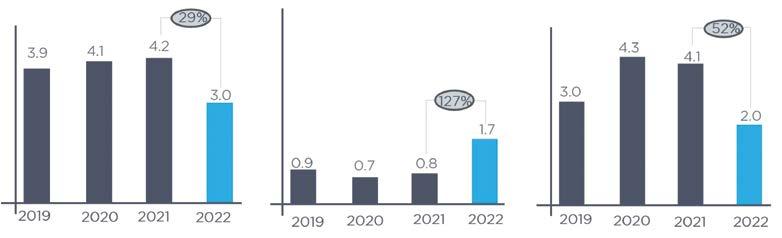

The recent Brundtland South African Carbon Market Analysis investigated the movement of carbon credits as CTOs across the COAS registry between 2019 and 2022 and revealed important insights into the supply and demand dynamics of our expanding local carbon market.

Almost none of the CTOs currently listed in the COAS will expire. Instead, their value increases each year due to annual carbon tax rate hikes, which – as per the amended Carbon Tax Regulations – increases from R159 for the 2023 tax period to R462 for the 2030 tax period.

As such, holders of CTOs are likely to sell or retire these only later, when it is more financially attractive. Brundtland’s analysis shows that a significant number of CTOs are being stockpiled in the COAS registry. In fact, CTOs retired on COAS decreased by 52% in 2023 (at the end of the 2022 tax filing season), as holding onto the CTOs may be more lucrative.

In addition, the listing of new CTOs dropped by 29%. A potential factor in reduced listing activity may be the stockpiling of carbon credits on the registry of the issuing carbon standard. These changes have led to a more than doubling of the stockpile, as shown in Figure 1.

CTOs from some project types are only eligible until the end of the 2025 tax period, end of phase 1 (extended). These CTOs constitute a lower share of listings in 2023 compared to 2022. The largest share of CTOs in the stockpile are eligible for use after 2025. This will enable companies who have accumulated CTOs to capitalise on the substantial tax rate increase of 30% which occurs from 2025 to 2026.

Analysis further shows that the criteria for post-2025 eligible CTOs significantly limit the supply, advancing the gap between supply and demand. Currently, several projects generate pre-2025 eligible CTOs, however, few projects are generating post-2025 eligible CTOs. Although it is expected that this group of CTOs will increase, this supply is only additional to a subset of currently eligible projects, resulting in the dip in supply seen in 2026 in the graph on next page.

Brundtland’s analysis further revealed a continuous supply-demand gap for CTOs, extending at least until 2043. The cumulative deficit amounts to approximately 143.5-million CTOs for the period 2023 to 2050, also illustrated in the graph below.

The demand for CTOs is expected to increase between 2026 and 2035, primarily driven by higher demand from the energy sector. The projected demand analysis considers the effect of carbon tax

on the energy and industrial sectors, as they will aim to reduce their emissions by 5% to 10% through using CTOs. The demand projection also considers the implication of South Africa’s Nationally Determined Contribution (NDC) and assumes a linear trajectory to net-zero emissions in 2050.

This illustrates that there is a need for increased carbon credit generation at a significant scale. It is crucial to acknowledge that engaging in projects that generate carbon credits can be challenging, considering the expertise required for project implementation, the complexity to measure and verify emission reductions and the

regulatory compliance requirements. Further, the eligibility criteria for carbon credits under the South African Carbon Tax is restrictive, for example, excluding activities that had received an energy efficiency allowance under section 12L of the Income Tax Act.

The supply and demand dynamics of South Africa’s expanding carbon market will affect many local companies as they face increasing carbon taxes and tougher competition for the already-tight supply of CTOs that will be in ever-greater demand.

greeneconomy/report recycle Mind the Gap, a deficit of 143.5-million CTOs across the various tax phases.

THOUGHT [ECO]NOMY

THE

providing capital to address the world’s most pressing challenges

Green Economy Journal speaks to Mike Adsetts, CIO at Momentum Investments, about impact investment, the strategy that generates positive, measurable social and environmental impact while also achieving acceptable financial returns.

Mike Adsetts, Chief Investment Officer, Momentum Investments.

Mike Adsetts, Chief Investment Officer, Momentum Investments.

A common starting point for implementing impact investing in practice is the United Nations’ Sustainable Development Goals (SDGs). The member states of the United Nations adopted the 17 SDGs with 169 targets in 2015 as part of the 2030 Agenda for Sustainable Development. These goals form part of an extensive globally coordinated action plan to end poverty and reduce inequality, while also protecting the planet, tackling climate change and spurring economic growth. The goals recognise that social and environmental issues affect everyone and thus apply to every country, irrespective of their “developed” or “developing” economic status. Sustainable development embodies the idea of doing well by doing good.

Impact investing includes profit as one of its main objectives, so while there is a commitment to social and environmental impact, investors still earn a market rate of return.

Impact investments should form part of your investment portfolio because of the following benefits:

Diversification benefits. The investments are more likely to be unlisted, private market assets, so they won’t move in tandem with public market assets. Risk and return drivers are also different to

public market assets. Assets in regulated industries provide stable cashflows even through times of economic weakness.

Alternate sources of return. There would typically be an illiquidity premium embedded into these assets, which a holder would be able to access over the long term. Additional returns to equity holders through balance sheet refinancing is also a common occurrence in infrastructure projects.

Inflation hedge. Revenues generated by underlying investments are adjusted by an inflation factor, which benefits investors. In addition, concession agreements and other off-take agreements are long-term, meaning greater cash flow certainty.

Demonstrable positive impact and financial returns. This investment would provide a physical infrastructure that would be of economic utility. There would be measurable outputs from each project in terms of positive societal impact.

We define responsible investing (RI) as an investment process that includes ESG factors into our process. Issues like increasing regulation, the growing need for risk mitigation and a heightened social conscience can be addressed by integrating ESG factors into our investment process. We acknowledge that we are in a privileged position to act as fiduciary to our clients and

stakeholders. We consider the ESG risk of our investments to be relevant to the performance of the overall objective – across all asset classes, sectors, markets and through time.

This is an approach to investment that explicitly acknowledges the relevance to the investor of ESG factors and of the long-term health and stability of the market. It recognises that the generation of long-term sustainable returns is dependent on stable, wellfunctioning and well-governed social, environmental and economic systems. We ensure ESG integration through various governance structures within our business.

Each of the factors can affect companies in different ways and can be integrated into an evaluation approach. For example, carbon emissions can be measured and potential carbon tax liabilities factored into a company valuation.

Other factors are nuanced and may require a more judgemental approach. Governance risks and the red flags around them need to be considered. The famous example here is Steinhoff and how the governance failures led to a dramatic destruction of value.

The hardest ones to quantify tend to be social factors and once again a qualitative impact perspective can be considered.

Investors can do research on the investment managers to see if they uphold the principles of RI. At Momentum Investments, we: Advocate. We participate in market-related industry events and serve on the responsible investing committee of the industry body the Association of Savings and Investments South Africa (ASISA).

Report on progress. We show investors that we take our duty to act in their best interests to heart by publishing our poxy history, our stewardship report, and our responsible investment and climate change investment policies, among others.

Seek disclosure. We have a register that shows how we engage with companies that we invest in to keep them accountable.

Are active owners. We use our influence to help maintain a well-governed corporate South Africa.

Integrate ESG. We have a responsible investing committee that serves as an oversight function of responsible investing practices across the investment team. We follow an integrated ESG approach across all our asset classes.

Have integrity. We keep to and observe all rules and regulations which seek to uphold the principles of responsible investment.

Sustainable development embodies the idea of doing well by doing good.

By incorporating social and environmental targets into their investment strategies, investors can align their impact objectives to the SDGs and track their contribution towards achieving these goals. Using metrics that reflect their effect on specific SDGs, investors can address how they are contributing to a sustainable and equitable future.

There is a huge need for impact investing with considerations like levels of liquidity, deal availability and size, and role players involved needed to be considered. There is still a lot of work that needs to happen to increase trust levels between the public and private sectors with Public Private Partnerships (PPPs) still not finding significant traction. All of this has resulted in relatively limited deals.

When these barriers are overcome, there will be increasing opportunities in energy, logistics and water infrastructure.

Chief sustainability officers from some of the world’s largest companies were interviewed for KPMG’s global survey on ESG governance and organisation, to gain a deeper understanding of how companies are structuring their set-up and teams for sustainability and responding to a wave of new regulation and increased pressure for transparency on ESG. Almost all respondents reported high ambitions for ESG in their organisations, with half now viewing sustainability as a strategic issue that is embedded in core business operations. With ESG covering a wide area of societal and governance issues, the challenge for many businesses can be deciding what to prioritise. Decarbonisation and the race to net zero were the topics most often included in their corporate ESG strategy, with diversity, equality and inclusion and human rights in the value chain as the next most-mentioned theme.

The question now facing many business leaders is who should make the ultimate decision on ESG as it increasingly becomes embedded in a company’s fabric. The CEO is responsible for sustainability in almost half of the organisations surveyed, with a dedicated chief sustainability officer as the second most popular option. The remaining respondents revealed a wide variety of roles taking charge of ESG – from head of supply chain and manufacturing to the chief risk officer.

Reporting on ESG has generally been a voluntary exercise. Still, some jurisdictions are in the process of making it compulsory, most significantly the EU through its Corporate Sustainability Reporting Directive (CSRD). Nearly half of the researched organisations plan to report under CSRD for the 2024 financial year, with nearly a fifth more planning to do so in 2025.

Nearly three-quarters of organisations in this research have six or fewer full-time equivalent staff working on non-financial reporting, and more than half have three or fewer. Just over half expected to see an increase in this number, with the remainder anticipating numbers to stay the same.

Just under half of the organisations in this research have ESG topics in their core corporate key performance indicators (KPIs), with more than a quarter including them in management-level performance reviews.

Almost half of the organisations interviewed produce internal indicators every quarter and several use monthly reporting for certain measures. Annual is the most common frequency for external reporting used by more than three-quarters of organisations, with the remaining respondents doing so quarterly.

ESG KPIs are used in calculating executive pay in most of the organisations researched, with just over half using these for short-term and two-fifths for long-term incentives. Just under half have between 16% and 25% of variable executive pay linked to ESG indicators.

In the past 18 months, South African businesses have installed over 3GW of rooftop capacity alone, which has relieved some pressure from the national grid. However, as they try to replace more of Eskom electricity with renewable power, many businesses are targeting short-term wins at the expense of sacrificing significant long-term value.

BY DISCOVERY GREENDiscovery Green recently analysed over 200 business consumption profiles and 30 renewable energy generation sites, which have revealed insights into the popularity of solar and the need for a diversified approach to renewable energy procurement among South African businesses.

It’s clear that the growing awareness of the possibility of wheeling from utility-scale solar generation plants, has boosted investment to the sector. Solar has become an attractive proposition because it offers a cost-effective solution to replace roughly 50% of many businesses’ current grid-drawn electricity. However, many businesses are falling into a trap that makes their transition to clean electricity more expensive than it should be.

The Head of Discovery Green, Andre Nepgen, believes that businesses could be paying less for their renewable energy procurement through a more strategic approach, which is sorely needed especially because South Africa grapples with a historically low-energy availability factor.

The biggest insight from Discovery Green’s data is that businesses often reach a tipping point of wasted generation after installing approximately 50% of their total energy needs in solar capacity. This is caused by a common mismatch between solar generation profiles and business consumption patterns. Because renewable energy is paid for at the point of generation and not at the point of consumption, this mismatch leads to significant wasted generation and cost implications when businesses try to push their renewable energy capacity beyond this 50% threshold.

“A mismatch of renewable energy generation and consumption occurs because businesses typically consume 40% of their energy during standard hours, usually daytime weekdays; 45% during offpeak hours, usually nighttime or low-usage weekends; and 15% during peak hours, usually rush hour mornings and early evenings. On the other hand, solar generation typically results in 60% of energy being produced during standard hours, 22% during off-peak hours and 18% during peak hours,” explains Nepgen.

The low level of coverage offered by solar energy in isolation is not the only factor a business must consider. Once the business has covered 50% of its consumption profile with solar capacity, its leftover consumption pattern shifts dramatically. Instead of using electricity mostly around off-peak and standard hours, only around 15% of its consumption is standard, 10% is during peak time, and a staggering 75% is consumed during off-peak hours. No renewable energy generation technology can match this profile without the business having to pay an exorbitant premium for wasted generation. So, to

cover this remaining 50% of its energy requirement with renewable energy becomes economically prohibitive.

“The usual advice given to businesses is that they should consider using batteries to store excess solar energy and redistribute it during the evening off-peak periods. But the economic outlay for implementing that significantly exceeds the cost of traditional utility power from Eskom,” says Nepgen.

“Our view is that battery storage is a more economically viable alternative to diesel in high loadshedding scenarios, but not to regular electricity usage. Green hydrogen is similarly expensive. Wind generation presents a comparable economic challenge, as it can only cover approximately 65% of the needs of a business before energy wastage occurs. Additionally, South Africa lacks a liquid market for renewable energy, further complicating the procurement of renewable energy to offset shortfalls,” adds Nepgen. The consequence is that any business that wants to convert its energy consumption to 100% renewable energy, currently does so by paying a premium due to an untenable amount of wasted energy.

“This is a quintessential example of winning the battle but losing the war. Given that renewable energy is clean, can already be produced at a rate cheaper than conventional grid sources, and can even be contracted for at a stable long-term price in real terms, there is a clear alternative way forward,” says Nepgen.

Discovery Green’s proposed solution is simple yet profound: diversification. By collaborating with industries with different consumption patterns, Discovery Green has created a consumption portfolio that optimises businesses’ energy usage. For instance, a manufacturing company that halts operations during summer holidays could partner with the hotel industry, which experiences increased demand during this period, to utilise its excess energy.

“This approach not only reduces costs, but also enhances competitiveness and sustainability. By combining different industries and their consumption profiles, we have found that a portfolio can achieve a much higher percentage of renewable energy coverage for everyone without generating wasted energy. The data shows that if one industry alone could only reach 50% of renewable energy coverage, a portfolio of three could reach 75%, and the more industries added, the higher this number becomes,” says Nepgen. The law of large numbers also helps as the overall volatility of a portfolio decreases. A diversified platform can absorb more randomness in consumption.

Nepgen argues that embracing a diversified portfolio approach to renewable energy procurement can unlock the potential for higher renewable energy percentages, benefiting both individual companies and the economy.

The Discovery Green Renewable Energy Platform draws together a wide range of businesses and their energy consumption profiles at scale and connects with leading renewable energy providers that have been successful in large-scale private sector development and government programmes. By doing so, the platform has the benefit of diversification and economies of scale, in bringing you clean energy. The Journal speaks to Andre Nepgen, Head of Discovery Green.

Please provide an overview of Discovery Green. Discovery Green is a renewable energy platform that brings together scale, expertise, actuarial modelling and sophisticated systems to make it simple and affordable for businesses to run on renewable energy.

How is Discovery Green revolutionising renewable energy in South Africa?

Every business consumes electricity differently, both in terms of the amount of consumption (MWh or kWh) and time of consumption (peak, off-peak or standard). For most businesses, a renewable power plant will generate too much electricity during certain times and not enough during others. This creates a mismatch between the generation and consumption of renewable energy, which in turn, reduces the affordability and efficiency. A consequence of this is having to pay for renewable energy that is not being consumed, or not consuming enough, thereby missing out on potential savings and emission reductions. There is a fine balance here that requires diversification, scale and sophisticated modelling.

Discovery Green is the only platform that provides companies with a 90% or more replacement of their expensive, dirty electricity with affordable, clean, wheeled energy as a standard offering.

What is Discovery Green’s objective?

We help businesses meet their decarbonisation goals and provide savings and certainty to the cost of electricity. In doing so, we are

supporting the development of private electricity generation in South Africa and lessening the impact of loadshedding over time.

Please give an overview of your products.

We have developed two products aimed at addressing the two potential needs of any business. The first, the Green Saver, finds the highest point on the Energy Frontier and maximises the financial savings and emission reductions for businesses. The second, the Green Guarantee, allows businesses to fully run on renewable energy and reduce their emissions.

What is renewable energy wheeling?

Renewable energy wheeling involves the purchase of privately generated electricity connected to the national grid. Large, utilityscale renewable power plants are constructed in areas of the country with attractive wind and solar resources. The renewable energy that is generated is fed into the national grid at the point of generation and the business (or “off-taker”) enters into a purchasing agreement with the private power generator to be credited for the consumption of this power.

We help businesses meet their decarbonisation goals and provide savings and certainty to the cost of electricity.

How does wheeling reduce a company’s emissions?

Wheeling of renewable energy will reduce a business’s scope 2 emissions. For most non-industrial businesses, scope 2 emissions account for most greenhouse gas emissions. Wheeling of renewable energy is often the most effective way to achieve carbon neutrality.

Why should businesses maximise renewable energy coverage?

When choosing low renewable energy coverage, renewable energy suppliers may wish to wheel cheap solar power to businesses during standard periods. This may set businesses up to pay higher tariffs for renewable energy in future when coverage levels are increased, to begin offsetting a skewed residual consumption profile.

There is a financial benefit to maximising coverage of renewable energy now as opposed to filling up demand in incremental steps. Delays in maximising renewable energy coverage means businesses would do without the full potential savings available from renewable energy wheeling.

There are also limited renewable energy plant sites available with the ability to connect to the national grid. The unpredictability of future grid availability may lead to uncertainty in future renewable energy prices.

A holistic approach to ESG-linked funding can unlock additional funding benefits for businesses. Understanding the various elements in the ESG umbrella and the interplay between them, coupled with determining the right funding instrument and type of funding arrangement, appropriate metrics, reporting obligations and intervals is key to this.

BY NATASHA PATHER, PARTNER, WEBBER WENTZELESG-linked financing is a hot topic in the finance arena. What does it mean for you? To begin, let’s define “ESG”. “ESG” is an umbrella term encompassing three broad spheres –environmental aspects, social causes and governance issues. These three spheres are often considered mutually exclusive, but this is frequently not the case, and they can each be much broader than they first appear.

A great practical example of the interlinked nature of ESG is a renewable energy project. There are obvious potential environmental benefits to the construction and operation of a renewable energy project. When you look closer, however, it is easy to see how the implementation of that project can have farreaching social implications for the immediate local community and broader society – job creation, contributing to relieving the energy crisis and income generation, to name a few – while the manner of implementation, quantifying and reporting on performance, as well as ensuring compliance with the relevant regulatory regimes falls firmly within the “governance” sphere.

Businesses tend to focus on the environmental aspects, as these are easiest to identify and quantify, but the social and governance

Sustainable financing is typically a better fit for larger corporates.

aspects can be equally important levers when negotiating your funding arrangements. The interplay between these aspects is key to unlocking value in funding arrangements.

In the South African market, we generally see two types of ESGlinked funding made available to corporate borrowers – sustainable financing and use of proceeds financing (also sometimes known as green loans or social loans). Here are a few high-level risks and benefits of each and when they might be suitable for your business:

Sustainable financing is a type of funding that allows borrowers to measure their performance against a set of predetermined key performance indicators (KPIs). Depending on the level of performance achieved against those KPIs, the borrower can obtain a

financial benefit, such as a margin reduction or access to additional funding for which that borrower may otherwise not be eligible. A failure to perform against one or more KPIs can sometimes also result in a margin ratchet, which was not the case in the early days of sustainable financing. Depending on the number of KPIs and level of performance with individual KPIs and the margin ratchet or reduction may be structured on a tiered basis.

Naturally, this arrangement requires detailed and accurate information to be delivered timeously to and verified by the funders. Suitable KPIs are usually determined with reference to the nature and extent of the business of the borrower or its group, its operational requirements and what is achievable and sustainable, without compromising on the business’ product.

This type of funding typically takes the form of a loan instrument, rather than a bond, commercial paper or other securities, as the number of funders is generally limited (and thus the borrower is more easily able to manage these information requirements with a smaller pool of funders).

Depending on the nature of the business of the borrower, its creditworthiness and various other factors, other financial institutions may also not be able to participate in the instrument, which would limit uptake in the broader market.

Sustainable financing is typically a better fit for larger corporates who already have their own corporate social responsibility programmes geared towards one or more ESG objectives and have the relevant information and verification systems and relationships in place, as well as the requisite financial resources to implement these.

Funders may be willing to accept pre-existing KPIs determined by the borrower where it can be shown that adequate consideration and objective assessment has gone into determining these KPIs, however, they may wish to set their own KPI targets or verify that the proposed targets are sufficiently ambitious.

In the UK and European markets, there appears to be an emerging trend of requiring more aggressive KPI targets, both upfront and year-on-year, to avoid allegations of greenwashing. The basis for these allegations within the funding space specifically seems to be that the funders’ intervention has not caused the “good behaviour” for which both these corporates and funders are being rewarded through financial incentives. We may see a similar trend for more aggressive KPI targets in future in the South African market and perhaps more punitive margin ratchets and structuring.

The benefits of a sustainable financing arrangement are that a borrower can:

• Save on its interest costs (and often in circumstances where it is already complying or aligning with its own internal objectives)

• Potentially access additional funding that it may otherwise not be eligible to access

The risks are that:

• Failure to comply could result in an increased interest cost

• If the KPI targets are not set at appropriate levels, one could potentially face allegations of greenwashing

Use of proceeds financing focuses on the purpose against which the proceeds are applied. This funding arrangement can be either a loan (or similar instrument) or a security, such as bonds, notes or other commercial paper. Listed bonds and notes tend to largely be limited to the use of proceeds financing due to many of the factors mentioned above.

This type of funding is appropriate where it is possible to link the purpose to which the funding will be applied to an ESG-linked cause. This purpose could take various forms, such as a once-off expenditure, for example, the installation of a solar-powered system, a multi-stage project, such as the construction of a greenfields development; or a brownfields expansion, or even a longer-term, ongoing initiative such as a housing or education development programme.

We initially saw several “green bonds” or “green loans” (also known as sustainability-linked funding instruments) where the proceeds were used to fund an environmentally friendly or climatebased initiative. There has been a recent rise in the number of social funding instruments (targeting, for example, housing or employment initiatives), “blue” funding instruments (targeting ocean-based initiatives) and sustainability funding instruments (which combine characteristics of green and social instruments).

A benefit of this type of funding is that it can be more accessible for a broader range of borrowers or issuers, ranging from governments, project companies and big corporates to smaller enterprises looking to fund an ESG-linked purpose. There are even products available now to individuals who are looking to fund alternative energy sources for their homes. In addition, access to the listed and unlisted bond market may provide additional funding opportunities for a range of borrowers.

It is a key requirement for the borrower or issuer to disclose how the proceeds are applied for this type of funding. This may include a report on initial expenditure and subsequent reporting on the actual and anticipated impact of the funded initiative.

There are similar risks and benefits for this type of funding –namely, a potential margin ratchet for non-compliance, on the one hand, and a margin reduction and/or access to additional funding on the other. Greenwashing also remains a risk if, for example, the purpose to which the loan proceeds are applied does not actually benefit, or even indirectly support an initiative that actively harms the relevant cause.

Additional bond market considerations may also apply if the funding instrument is a debt security. These include, on the one hand, access to a different, potentially broader pool of funders (each with their own internal investment criteria) and the ability to determine the pricing of the instruments up front. On the other hand, the listed bond space is also subject to additional regulatory requirements, which may impose further reporting obligations and pose other regulatory pitfalls.

There are even products available now to individuals who are looking to fund alternative energy sources for their homes.

Blended finance gives institutional investors access to impact outcomes that suit their risk appetites while enabling emerging economies to access the financial resources required to support their transition. It is a critical component of the global climate solution. We speak to Kevin Anderson, head of strategic initiatives, CFM.

Please provide an overview of Climate Fund Managers (CFM). CFM is a leading climate-centric blended finance fund manager. Established in 2015, CFM is a joint venture between the Dutch entrepreneurial development bank, FMO, and Sanlam InfraWorks, part of the Sanlam Group of South Africa. Our purpose is to end the climate crisis. We do this by raising and deploying climate finance funds in partnership at scale and at pace. Our focus is the emerging markets (Africa, Asia and Latin America) where communities and the environment are most vulnerable to, and impacted by, climate change.

CFM currently manages two circa [US]$1-billion blended finance equity infrastructure funds focused on climate change mitigation and adaptation in the emerging markets: (1) Climate Investor One focused on renewable energy and (2) Climate Investor Two focused on water, sanitation and ocean infrastructure. We are currently implementing

further blended finance initiatives in the green hydrogen and energy transition sectors, the GAIA loan fund focusing on financing climate mitigation and adaptation projects across the Global South, power transmission with a specific focus on green grids and in the future, a resilient cities-focused fund.

Please tell us about the Regional Transmission Infrastructure Financing Facility (RTIFF). The Regional Transmission Infrastructure Financing Facility (RTIFF) is a unique partnership between the Southern Africa Development Community (SADC) countries, the Southern Africa Power Pool (SAPP) and CFM and is the incarnation of the SDG 17: partnerships.

RTIFF will mobilise the substantial investment capital required to invest in new cross-border transmission infrastructure as well

as relevant in-country transmission infrastructure required for regional electricity trading to enable SAPP members to increase and improve trading volumes, alleviate congestion on the existing network, incorporate new and green regional power generation resources, improve reliability and create adequate redundancy in the system. It is estimated that interconnection across SAPP via strategic transmission corridors can save the SADC region circa $37-billion to $42-billion in Net Present Value (NPV) by 2040.

The fund’s vision is to fulfil the mandate as prescribed by SAPP and its SADC members to manage RTIFF, a $1.3-billion target facility focused on improving strategic interconnection and cross-border energy transmission in the Southern Africa region.

The facility will improve energy transmission within and between the 16 SADC member states and other power pools, generating longterm energy supply security and the resulting increased economic benefits correlated to higher electrification levels. It will promote climate resilience and adaptation by including sustainable energy sources and replacing fossil-based sources. A key idea of RTIFF is to encourage the adoption of renewables and the most efficient use of hydro resources, thus driving the energy transition.

What are the current challenges of cross-border energy transmission in Southern Africa?

The process of providing sustainable power to a region can be broken down into three primary activities: generation, transmission and distribution. While generation typically gets the lion’s share of the world’s attention, one cannot underestimate the importance of delivering that power to the people who need it, wherever they may be. Limited transmission and distribution infrastructure within and between countries is the biggest challenge in the region. The development of interconnectors between SADC member countries is crucial for moving power from energy-rich countries to those that cannot meet the demand for affordable, reliable, clean energy or those that have a mandate to decarbonise.

What is the biggest barrier facing developers of energy transmission infrastructure projects?

As the global population grows, so too does the demand for sustainable, reliable and renewable sources of energy. However, when it comes to the production of power, not all countries are created equal, and the solution to this growing demand lies in establishing strategic interconnections that allow for increased electricity trade. Energy transmission infrastructure projects are notoriously high-risk and capital-intensive, making them challenging to fund independently through sovereign capital alone.

RTIFF’s blended finance model overcomes this by utilising public capital to balance risk and enable private capital to enter. The facility will improve energy transmission within and between the 16 SADC member states and with other power pools, generating long-term energy supply security, economic growth and climate resilience through the inclusion of sustainable energy sources.

This facility will accelerate the development of strategic interconnections and integrated transmission infrastructure across Southern Africa by providing stakeholders with access to the financing they desperately need. RTIFF will provide power companies and project developers working to tackle transmission issues with access to patient capital and development expertise to establish strategic interconnections that allow for increased electricity trade.

Please outline the fund life of RTIFF.

The facility, which launches with $20-million in commitments from SAPP, targets a first close of $500-million in 2025 to be raised from public and private sector investors locally and internationally and a final close of $1.3-billion within 24 months. The facility will have a fund life of up to 20 to 25 years.

Detailed due diligence is underway to identify suitable projects. So far, we have identified eight high-priority transmission projects for RTIFF. More details regarding the due diligence and findings will be shared in due course.

The two funds (development and construction) within RTIFF will each require a dedicated fundraising initiative initially targeting donor funders (such as governments, DFIs and philanthropy funders). Parallel to this, the fund will also engage regional and international commercial and institutional capital providers.

The SAPP is an interregional organisation, a cooperation of 12 Southern African countries represented by their national power utilities and some private utilities under the auspices of the SADC. SAPP members; Angola, Botswana, Democratic Republic of the Congo, Eswatini, Lesotho, Mozambique, Malawi, Namibia, South Africa, Tanzania, Zambia and Zimbabwe, have created a common power grid between their countries. The SAPP operates a competitive electricity market in the SADC region. The SAPP’s main role is to ensure that the countries develop power solutions in collaboration. This involves sharing resources; therefore, transmission is key. There is no energy transition without transmission.

There is no energy transition without transmission.

Why is interconnection across SAPP via strategic transmission corridors so important?

Electrification is vital for economic development and for building thriving communities. To quantify the potential economic benefits: SAPP has identified eight high-priority transmission projects for RTIFF, currently in the due diligence phase, which will bring estimated economic benefits of $4.3-billion in NPV.

Please expand on the necessity of investing in transmission grids. There is a deep need to mobilise blended finance at scale and speed to enable the rollout of additional grid infrastructure in the region. The lack of investment in grid infrastructure is one of the reasons for ongoing blackouts in many parts of Southern Africa. With 180-million people living in the region exposed to ongoing power disruptions, universal access to reliable electricity will improve people’s health, safety, financial inclusion and economic activities. If we don’t invest in grids today, we will face gridlock tomorrow. This is even more pressing from an energy transition perspective as the world needs to embrace green electrons on the grid.

What can mobilising blended finance at scale do for the power sectors in Africa?

It’s a game-changer. It removes the barriers that prevent energy infrastructure projects from getting off the ground, converting plans into reality, creating tangible resource assets and viable solutions to the energy challenges experienced by millions of people in Africa daily. With public capital absorbing the risk, private capital can step in to set projects in motion.

greeneconomy/report recycle

Our purpose is to end the climate crisis.

CFM has applied its standard blended finance fund

and design in creating RTIFF. RTIFF will comprise a $100-million target “Development Fund” to provide concessional capital and development expertise, including support on viability studies, legal and financial structuring, planning and ESG compliance; and a $1.2-billion target “Construction Fund” that will make direct investments through the provision of construction finance and value-add expertise for project builds.

The clean energy transition requires a fundamental transformation of power systems, including much higher levels of digitalisation at scale across all grid domains, from generation to transmission and distribution to end-use. Strong policy attention is required to scale up investments in smarter and more resilient grids in emerging and developing economies where electricity consumption is set to grow at a rapid rate while also providing greater levels of electricity access.

Investments in smarter and more resilient grids will be necessary to accommodate the greater deployment of renewable energy and enhance energy security. Digital technologies designed for power systems are instrumental in unlocking essential system services required to integrate high shares of variable renewable energy. They can also provide solutions to leverage data flows, connectivity and management across the whole electricity system. To unlock these digital opportunities, adequate planning, investment and policy action are needed. This report guides energy policymakers on ways to enable and drive investments in smart and resilient electricity grids. It also gives suggestions on how to start creating an environment that supports the effective use of innovative digital technologies within the electricity sector. It draws on examples and case studies to show the wide range of digital opportunities and solutions that can help governments implement efficient and smart power systems.

SIDSSA brings together critical role-players in the infrastructure investment space who are galvanised around a key goal of accelerating an infrastructure-led economic recovery plan for South Africa.

In his keynote address at the 2024 Sustainable Infrastructure Development Symposium of South Africa (SIDSSA), President Ramaphosa announced that South Africa needs R4.8-trillion to achieve its infrastructure goals by 2030 (R1.6-trillion in public sector infrastructure investment and R3.2-trillion from the private sector).

Platforms such as SIDSSA, in tandem with the establishment of Infrastructure South Africa (ISA) in 2020, have been pivotal for driving public-private investment in strategic projects.

ISA has unblocked a total of R25-billion worth of projects in the renewable energy space using the Infrastructure Development Act to fast-track government authorisations.

“We have been able to unlock more than 195 licenses, permits and approvals within 47 projects alone. South Africa established the Infrastructure Fund to unlock more private investment in the infrastructure pipeline using a variety of blended financing tools. So far, 13 mega blended finance projects or programmes have been approved to date,” Minister of Public Works and Infrastructure, Sihle Zikalala, revealed. “Infrastructure should be a flywheel of our country’s economic recovery.”

The operationalisation of the Infrastructure Fund has seen a steady growth in the portfolio of blended finance projects that use small fiscal allocations to de-risk public infrastructure projects and raise finance in debt capital markets. Blended finance projects, which leverage private-sector financing, are also growing steadily. In 2024, 11 such projects, with a total investment value of R45-billion, are expected to reach financial close.

As project preparation is key to developing a viable project pipeline, government has made interventions to provide a predictable funding regime and consolidate expertise in developing bankable projects through ISA. ISA is re-orientating project preparation to enable export sectors, manufacturing and the green economy and projects that contribute to inclusivity by broadening the participation of local content. This approach is being applied to the top 12 priority projects that fall under South Africa’s 2024/2025 infrastructure pipeline to drive public and private sectorled development.

“We will be able to enhance an integrated planning and proper procurement process important for infrastructure development in South Africa,” stated President Ramaphosa.

Representing a total investment value of R2.1-billion, the country’s first LNG import terminal at Richards Bay aims to import between one-million and five-million tons of LNG per annum. The Durban Container Terminal Pier 1’s capacity will be expanded to 3.6-million 20-foot equivalent units (TEUs) through the construction of seven additional deep-water berths and storage space. A new berth (A100) for liquid bulk will be constructed to handle imported LNG at the Port of East London. Serving as the main liquid fuels supply hub of Nelson Mandela Bay and surrounding areas, the project represents a R2.2-billion investment.

Project Ukuvuzelela is a transnational, high-capacity rail corridor for automotive volumes that involves upgrading the rail line from Gauteng to the Eastern Cape and will serve to take pressure off the KwaZulu-Natal corridor and the Port of Durban as the sole port for imports and exports in the area. The overarching target is to have bi-directional rail transportation of a minimum of 150 000 fully-built units per year by 2026.

Government will launch an infrastructure strategy aimed at refurbishing 104 health facilities throughout South Africa, valued at R1-billion. Meanwhile, the Department of Public Works and Infrastructure has laid out plans to improve educationrelated infrastructure.

• LNG Import Terminal; KwaZulu-Natal

• Durban Container Terminal Pier 1; KwaZulu-Natal

• Berth A100 for Liquid Bulk; Eastern Cape

• Ukuvuselela; National

• Refurbishment of Health Facilities; National

• Schools Project; National

• Eskom Mossel Bay Gas; Western Cape

• Eskom Tubatse Pumped Hydro Storage; Limpopo

• Rooiwal Phase 2 Wastewater; Gauteng

• Amathole Water Bulk Supply Augmentation; Eastern Cape

• Nkhomazi SEZ; Mpumalanga

• Namakwa SEZ; Northern Cape

Infrastructure should be a flywheel of our country’s economic recovery.

In a bid to combat South Africa’s ongoing energy crisis, the country’s state-owned oil company, PetroSA, announced plans in March 2023 to build a network of gas-fired power plants in Mossel Bay. Furthermore, Eskom’s proposal to build a Tubatse Pumped Hydro Storage project with a generation capacity of 1.5GW received the green light from the Department of Mineral Resources and Energy in 2022.

Phase 2 of the Rooiwal Wastewater Treatment Works will involve upgrading the plant’s treatment capacity by 80-million litres per day of wastewater, coupled with the desilting of sludge at the Leeukraal dam. The proposed Amathole Water Bulk Supply Augmentation Programme targets the improvement of water resource availability and is set to gazette progress on the municipalities’ water scheme project and infrastructure upgrades.

Multi-billion-dollar Special Economic Zones (SEZs) in the municipalities of Nkomazi and Namakwa are expected to significantly stimulate economic activity, industrial development, trade and job creation in Mpumalanga and Northern Cape, respectively. The Nkomazi SEZ aims to stimulate primary agricultural production and agro-processing, while the Namakwa SEZ seeks to drive economic growth in one of South Africa’s most mineral-rich areas.

According to Mameetse Masemola, acting head of ISA, $5.7-trillion is required to close the infrastructure investment gap in South Africa by 2050. “Our mandate is to close the infrastructure investment gap. Our work is to ensure projects are viable and bankable while ensuring alignment with the Infrastructure Development Act. We are also prioritising private-public partnerships, and at the same time, working with authorising departments to unblock project rollout bottlenecks” said Masemola.

Among the Strategic Integrated Projects (SIPs), the energy portfolio has the biggest project pipeline, covering transmission, gas, renewables and green hydrogen and comprising more than 100 projects amounting to R240-billion. The green hydrogen programme, estimated at R300-billion and including 14 projects, is an important part of the country’s just transition. Almost 95% of projects deployed have been private sector-led, including renewable energy projects developed under South Africa’s Renewable Independent Power Producer Programme (REIPPP), Embedded Generation Programme and Just Energy Transition Programme. Of the energy sector projects, 25 are under construction under Bid Window 5 of REIPPP, with five having reached financial close.

Commenting on ISA’s current and future project pipeline, Masemola stated that the agency has secured R600-million from the South

Project preparation is key to developing a viable project pipeline.

SIDSSA 2024 was organised by the Investment and Infrastructure Office under the Presidency, in collaboration with the Association of African Exhibition Organisers. The National African Federation for the Building Industry joins as an association partner, while the DBSA is the official sponsor of the event.

African Treasury to fund projects with a high GDP impact over the next three years and which have not attracted funding in previous years.

“We have mobilised R25-billion through the National Treasury, which we will use to raise over R70-billion from the private sector to fund infrastructure projects. We are ready to engage with investors to fund water, human settlement, logistics and energy projects,” added Mohale Rakgate, head of the South Africa Infrastructure Fund.

The project pipeline is presented to potential investors by the Development Bank of Southern Africa (DBSA) and similar institutions, who get the projects off the ground and ensure that the infrastructure is developed.

Through the work that has been done in transforming the infrastructure landscape, the total value of the country’s SIPs has grown from R340-billion in 2020 to R540-billion now. South Africa’s Deputy President Mashatile announced that the country currently has R233-billion worth of infrastructure projects in construction, with R170-billion worth in the procurement phase and 18 projects valued at R10-billion have been completed.

Tel: 087 897 2720 | 076 099 7150

Email: ramaja@adoforcesa.co.za

Website: www.adoforceSA.co.za

21 Dennis Pooley Street, New East End, Bloemfontein 9301

To see ourselves becoming the key pioneers of the concept of reasonable designing and constructing for our time and the future, thus becoming the leader in the electrical contracting field.

Visionary

To promote designing and constructing approaches that allow the participation of stakeholders and leading them to their future.

To be part of the dream of our clients and other stakeholders and inspire them to achieve more.

Leadership

To be strategic partners to our clients in the planning and constructing the roadmap to achieving their endeavours.

Lucas Ramaja Dingaan Director

Lucas Ramaja Dingaan Director

Ecological economics focuses on the connection between humans and the natural environment (their actual life-support system) and, unlike mainstream economics which often prioritises efficiency and growth, it focuses on sustainability, development and the interplay between economic processes and physical reality.

BY LLEWELLYN VAN WYK, B. ARCH; MSC (APPLIED), URBAN ANALYSTKey aspects of ecological economics that have a bearing on infrastructure development could be stated as follows:

1. Nature-centred perspective. Ecological economics treats the economy as a subsystem of Earth’s larger ecosystem. It argues that the human economy is embedded in nature, and economic processes are biological, physical and chemical processes and transformation. 1 It recognises that human activities have a significant ecological footprint , impacting natural resources and generating waste .

Cities account for 80% of global GDP and will host 75% of the world’s population by 2050. 2 Between now and 2030, 1.5-million people are expected to arrive in urban areas every week. 3 Climate change is one of the indirect impacts of urbanisation and accounts for 11% to 16% of global biodiversity loss. 4 Without substantial transformation of the paradigm of urban development, urban expansion equates to increased greenhouse gas emissions, more climate change impacts and increased biodiversity loss.

2. Limits and opportunities. Unlike traditional economics, ecological economics acknowledges the limits of economic growth and the opportunities for sustainable development. It emphasises the importance of scale, distribution as well as the role of natural and social externalities 5

Business as usual is no longer an option – 44% of global GDP in cities is estimated to be at risk of disruption from nature loss. 6 Between 1990 and 2015, the urban population increased an average of 1.9 times; in the same period, the urban footprint increased an average 2.5 times. 7 Not surprisingly, urban areas are responsible for over 75% of global carbon emissions. 8

3. Intergenerational equity. Issues related to intergenerational equity, irreversibility of environmental change , and uncertainty of long-term outcomes guide ecological economic analysis and valuation. 9 Climate action failure, extreme weather and biodiversity loss have been ranked as the top three risks humanity will face in the next 10 years. 10 More than 1.4-billion people living in the world’s largest urban centres are at high or extreme risk of environmental disaster. 11 These impacts, resulting from actions of this and past generations, will lock in impacts on many future generations.

4. Normative approach. Ecological economists challenge mainstream economic approaches, such as cost-benefit analysis ,

The development and maintenance of the constructed ecosystem (infrastructure) is reductive.

by asserting that economics is inherently normative (prescriptive) rather than purely descriptive . They propose alternative methods, such as positional analysis , which incorporates time and justice considerations. ,12,13

Positional analysis is much like a traditional SWOT analysis where the strengths, weaknesses, opportunities and threats associated with a particular action are assessed. It provides a more structured approach to understanding the current context and making informed decisions to achieve desired outcomes. This will involve gathering data, conducting assessments and identifying key factors influencing the situation. More crucially, it will evaluate impacts across a wider canvas of issues including the natural and social environments, over much longer time frames, and determine who the beneficiaries will be and who stands to lose.

A classic example of how this is not done is the conventional approach to road building. A traditional cost-benefit analysis will look at the cost of the road versus the benefits to the users and to the local economy. It will not include in its assessment the impact of the road on the natural environment (beyond a very narrowly frames environmental impact study) and the concomitant immediate biodiversity loss, the ongoing biodiversity loss from emissions associated with transport and the impact of the road on areas it cuts across. Roads also act as social barriers in many ways, including physical barriers; cutting off access to resources; creating a divide in access to transportation; raising safety concerns as well as creating psychological barriers influencing perceptions of belonging and identity.

5. Shared perspectives. Ecological economics shares common ground with fields like feminist economics , emphasising sustainability, justice and care values. 14 It also includes a concept known as eco socialism which refers to the relationship between capital and ecology. 15 Whereas eco socialism places more value on the “commons” by emphasises the need for a fundamental restructuring of society to achieve a more equitable distribution of wealth and resources while ensuring the protection of the environment, typical infrastructure investment is more narrowly focused on the benefits to the investor. A highly visible example of this is the minimal contribution new buildings make to adjoining properties and the public realm.

I previously referenced the work of ecological economists Malte Faber and Robert Costanza, particularly the emphasis they placed on its focus on nature, justice and time. They stressed issues of intergenerational equity, irreversibility of environmental change, uncertainty of long-term outcomes and sustainable development guiding ecological economic analysis and valuation.

Robert Costanza argues that cities can be understood as complex and emergent social-ecological-technological systems (SETS) where social includes issues such as culture, economics and governance; ecological embraces climate and the biophysical and technological includes engineered and built environment dimensions. 16 The authors of the cited paper provide insights on transdisciplinary approaches for developing transformation strategies for complex urban systems and related enablers from local-to-national scales.

Of importance to this think piece is the context sketched by the authors of what transformation may mean in an urban context: they state “transformation means the changes needed to address a significant gap between longer-term societal aspirations and the current status, typically requiring simultaneous change across multiple interdependent urban sub-systems (for example, across land use, transport, energy and environmental systems to achieve interlinked outcomes); and enablers refers to the underpinning urban capacities necessary to support multiple such transformation”. 17

In a study done in 1996, Costanza emphasised the need to bridge the gap between human activities and ecological systems, advocating for an integrated approach to economics and environmental science.18 This was followed up in 1997 with a study co-authored by Constanza and others which quantified the economic value of ecosystem services and highlighted their importance for human well-being. 19

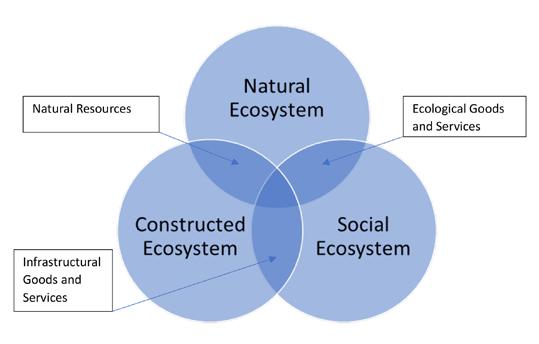

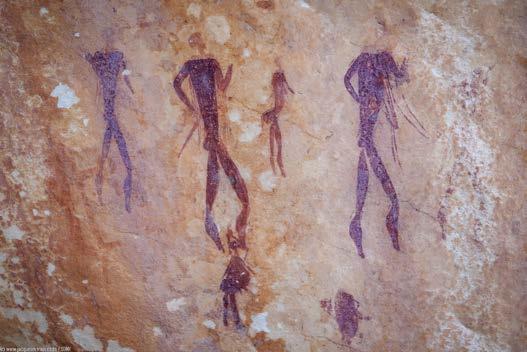

Constanza’s categorisation of SETS correlates well with the human ecological model I have included (Figure 1). In mainstream economics the three core components would typically be described as natural, social and infrastructure capital, akin to an asset. However, the ecological lens requires that they be understood as ecosystems –intricate communities where life and environment coexist, shaping our planet’s diversity and balance.

Ecologists show great interest in the transition zones between biomes as it is here that a unique environment is created. Similarly, it is within the interstitial spaces (transition zones) between the natural, social and constructed ecosystems that the challenges of infrastructure development come into sharp focus. It is possible to view these interstitial spaces through several lenses: for purposes of this think piece, I am using the exchange of goods and services between the ecosystems.

Figure 1 identifies three interstitial spaces: natural/constructed, natural/social and constructed/social.

Not surprisingly, urban areas are responsible for over 75% of global carbon emissions.