ENTERPRISE

BUSINESS & COMMERCIAL NEWSLETTER

WELCOME

Welcome to Albert Goodman’s spring Enterprise newsletter, featuring our brand new look!

After what feels like a long and wet winter, signs of spring have finally arrived and with the rate of inflation continuing to fall, perhaps a little more optimism for the months ahead. All eyes are now on the Bank of England hoping for that first interest rate cut.

The recent budget, which may have been Jeremy Hunts last before the general election, gave rise to a few minor tweaks to the tax system, but nothing significant or ground breaking for SME businesses. I was hoping for an announcement on the reduction in the rate of Corporation Tax, which is now starting to be really felt, but sadly no mention of this.

Away from the budget, the Government have announced an intention to increase the audit limits, with the turnover and gross assets limits increasing to £15m and £7.5m respectively. If delivered, we believe this would be a positive step and will provide businesses with the choice - either continue with an audit voluntarily where beneficial, or take advantage of the exemption and choose to reinvest that time and money elsewhere.

It’s been a busy time recently at Albert Goodman. We are delighted with our new branding launched in March, we saw over 20 staff members run the Weston Half Marathon (you couldn’t miss them in the bright pink tops) and we enjoyed a fantastic night at the Somerset Business Awards, which once again showcased some of Somersets finest who contribute to the diverse and thriving business community that we have in the county. Congratulations again to all of the Winners.

In this newsletter we bring you an update on R&D tax, some changes happening at Companies House and other useful hints and tips on pensions, management accounts and VAT which I hope you find useful.

Mike Cahill Partner

UPCOMING TAX DEADLINES

APRIL 2024

1st Payment of corporation tax liabilities for periods ending 30 June 2023 for small and medium sized companies not liable to pay in instalments.

5th End of the tax year.

7th VAT return and payment for February quarter (online).

19th PAYE/CIS liabilities for month ended 5th April 2024 if paying by cheque. File monthly CIS return.

22nd PAYE/CIS liabilities for month ended 5th April 2024 if paying electronically.

MAY 2024

1st Payment of corporation tax liabilities for periods ending 31 July 2023 for small and medium sized companies not liable to pay in instalments.

7th VAT return and payment for March quarter (online).

19th PAYE/CIS liabilities for month ended 5th May 2024 if paying by cheque. File monthly CIS return.

22nd PAYE/CIS liabilities for month ended 5th May 2024 if paying electronically.

JUNE 2024

1st Payment of corporation tax liabilities for periods ending 31 August 2023 for small and medium sized companies not liable to pay in instalments.

7th VAT return and payment for April quarter (online).

19th PAYE/CIS liabilities for month ended 5th June 2024 if paying by cheque. File monthly CIS return.

22nd PAYE/CIS liabilities for month ended 5th June 2024 if paying electronically.

UNLOCKING TAX BENEFITS: PURCHASING TRADING PREMISES WITH SIPP OR SSAS ARRANGEMENTS

Are you a business owner considering investing in trading premises? If so, have you explored the potential tax advantages of using a Self-Invested Personal Pension (SIPP) or Small SelfAdministered Scheme (SSAS) arrangement? In today’s article, we’ll delve into the benefits of utilising these arrangements for acquiring your business premises.

WHAT ARE SIPP AND SSAS?

Before diving into the advantages, let’s briefly define what SIPP and SSAS entail. Both are pension schemes that offer more flexibility and control over investment choices compared to traditional pension plans.

A Self-Invested Personal Pension (SIPP) is a personal pension plan that allows individuals to make their own investment decisions. On the other hand, a Small Self-Administered Scheme (SSAS) is a pension trust set up by a company for its employees. Both schemes empower you to invest in a wide range of assets, including commercial property.

TAX BENEFITS GALORE

One of the most compelling reasons to consider purchasing trading premises through a SIPP or SSAS arrangement lies in the array of tax advantages they offer:

1. Tax Relief on Contributions:

Contributions made to a SIPP or SSAS are eligible for tax relief, subject to certain limits. This means that investing in your business premises through these arrangements can provide immediate tax benefits by reducing your taxable income.

2. Tax-Free Growth:

Any rental income generated from the trading premises held within a SIPP or SSAS is sheltered from income tax. Moreover, any capital growth on the property is also free from capital gains tax, allowing your investment to grow more efficiently over time.

3. Inheritance Tax Planning:

Assets held within a SIPP or SSAS are typically outside of your estate for inheritance tax purposes. This means that upon your passing, the value of your trading premises held within these arrangements may not be subject to inheritance tax, providing a valuable planning opportunity for passing on wealth to your beneficiaries.

4. Pension Contributions and Corporation Tax:

For businesses making contributions into a SSAS or SIPP arrangement, these are generally considered an allowable

business expense, reducing the company’s taxable profits and potentially lowering its corporation tax liability.

Buying a property through your pension scheme can have lots of long term benefits, however, it should be noted that there are additional costs and mechanisms to be aware of, these include:

Lease and rent reviews - This will be required periodically and involve professionals such as surveyors and solicitors.

Fees – SIPPs and SSAS’s that allow for property purchases typically charge higher fees than standard arrangements to take into account the work involved with the property.

Illiquidity – If all your pension fund is tied up in a commercial property it will make it difficult for your scheme to make lump sum payments. You may have to mortgage the property or wait for cash from rental income to build up.

Diversification – Putting all of your eggs in the one property basket.

CONCLUSION

In conclusion, purchasing trading premises through a SIPP or SSAS arrangement can offer significant tax benefits for business owners. From tax relief on contributions to taxfree growth and income in retirement, these arrangements provide a tax-efficient way to invest in property while planning for your future financial security.

However, it’s crucial to seek professional advice from a qualified financial advisor or tax specialist before making any decisions. They can help you navigate the complexities of pension schemes and ensure that your investment aligns with your longterm financial goals.

By leveraging the tax advantages of SIPP or SSAS arrangements, you can not only secure your business premises but also enhance your overall financial well-being in the process.

COMPANIES HOUSE REFORM

We are now starting to see some practical impacts of the Economic Crime and Corporate Transparency Act.

From 4th March when the annual confirmation statement is submitted to Companies House, the following two additional bits of information must be given:

An e-mail address.

Confirmation that the intended future activities of the company will be lawful.

We have obtained confirmation that the e-mail address will not be available on the public record and for now, will not be used as a primary form of communication.

Other changes which have now been brought in are as follows:

REGISTERED OFFICE ADDRESSES

A registered office is now defined as being an ‘appropriate address’. What this means is that a companies registered office address must be somewhere that:

A document addressed to the company and delivered by post or hand would be expected to come to the attention of a person acting on behalf of the company and;

The delivery of documents there is capable of being recorded by the obtaining of an acknowledgement of delivery.

These changes mean that the use of PO Boxes will no longer be possible.

REGISTRAR’S POWERS

The registrar has greater powers to query and challenge information that appears to be incorrect or inconsistent with information already held. There will also be stronger checks on company names which may give a false or misleading impression to the public.

Annotations will be added to the register to let users know about potential issues with previously filed information and steps will start to be taken to clean up the register by data matching to identify and remove inaccurate information.

There are further changes expected in the coming months and we will keep you updated on these.

It has also been announced that Companies House fees are increasing with effect from 1 May 2024.

Full details of the increases can be seen here Changes to Companies House fees - Changes to UK company law. The annual confirmation statement fee is increasing from £13 to £34.

DIVIDEND NUDGE LETTERS

From 5 February, HMRC have been issuing ‘nudge’ letters to taxpayers where they suspect there may be unreported company dividends or distributions by the taxpayer.

HMRC have reviewed the company accounts and, where there has been a large drop in reserves but a similar level of dividend or distribution has not been reported on the respective taxpayers’ returns, a letter may be sent out.

The letter invites the taxpayer to review their affairs and to either make a disclosure online if they have unreported income to disclose or to let HMRC know that they have no further income to declare. The letters provide 30 days for the taxpayer to respond.

It is important to note that these letters should not just be ignored. Failure to respond could lead to a compliance check and a charge for higher penalties.

If you receive a letter like this, please feel free to contact me or your usual Albert Goodman point of contact.

INCOMING R&D TAX RELIEF CHANGES

Research and Development tax relief is changing. In this article I outline the key changes and consider how this may affect businesses with a summary of actions you may need to take to benefit from this valuable relief.

Key Points:

From 1 April 2024, a new and less-generous R&D incentive will come into existence for SME businesses in the UK and may bring with it complications around which company in the R&D supply chain will be eligible to claim tax relief on a qualifying project.

The headline rate of tax relief will generally be between 15p-16p of tax savings for every £1 spent on qualifying R&D activities undertaken by eligible companies (down from the more beneficial rate of 25p-33p in every £1).

Under the new incentive, it is possible that the ownership of R&D projects could be pushed up the supply chain meaning customers, rather than the suppliers doing the R&D work, may be in a position to make the claim for R&D tax relief.

In an attempt to simplify the complexities surrounding R&D tax relief, the new incentive being introduced will effectively merge together the two historic incentives (the SME and RDEC schemes).

A separate incentive will remain available for highintensity R&D loss-making SME companies that meet certain thresholds (namely, that 30% of its of total expenditure for an accounting period relates to qualifying R&D).

How does the new R&D incentive work?

The new incentive will affect accounting periods starting on or after 1 April 2024 (e.g. a company with an accounting year-end of 31 March 2025).

The mechanics will largely follow that of the historic RDEC scheme in that R&D tax relief will be awarded as an above-the-line credit at a rate of 20% of the total qualifying R&D expenditure. This credit can then potentially be offset against a company’s corporation tax liability or, where no liability exists, potentially issued as payable cash credit.

The amount payable as a cash credit can be restricted based on the other tax liabilities owed by a company

or capped at a certain amount dependent on the total PAYE/NIC liabilities incurred on relevant workers.

Allowable expenditure for the relief will generally follow that of the historic SME scheme rules: staff costs, subcontractor costs, externally provided workers, software costs, consumables costs and payments to subjects involved in clinical trials will all potentially be qualifying.

Except in rare circumstances, expenditure incurred on overseas activities will not be eligible for inclusion in a claim.

All companies will still be required to submit the mandatory Additional Information Form to HMRC prior to the submission of any claim for R&D tax relief.

How does the new incentive

affect companies doing R&D on behalf of customers?

Companies who undertake R&D within the context of a contractual arrangement for their customers will need to be aware of how the new incentive is to operate.

Contracted out R&D has been a contentious and technical matter for a number of years.

Where a customer anticipates that R&D is needed in order to fulfil a contract, the company (supplier) doing the work will be unable to make a claim for R&D tax relief.

Where a customer is indifferent, or unaware, to the fact that R&D may be needed in order to fulfil a contract then the company (supplier) doing the work will be able to make a claim for R&D tax relief.

Where a customer is ineligible to make a claim (e.g. it is a company based overseas, or an entity not subject to corporation tax in the UK), then the company (supplier) will be able to make a claim for R&D tax relief.

Where a company doing in-house R&D of its own accord intentionally contracts out some of the R&D to a third-party, the company can make a claim for R&D tax relief on both the in-house and third-party costs.

Where customer-facing R&D is being undertaken, each contractual arrangement must be assessed individually, alongside the activities and relationship between customer and supplier, to understand which scenario may be applicable.

What are the benefits of the new incentive?

Under the new incentive, the rules surrounding subsidised R&D expenditure have now become obsolete. This means that, regardless of whether a company is in receipt of grants or subsidies in respect of its R&D projects, it will not have to make any additional or separate claims for tax relief nor be penalised at a lower rate of relief for that subsidised work.

The PAYE/NIC cap rules under the new incentive take the form of the existing SME PAYE/NIC cap rules. These are more generous than the existing cap rules.

A separate incentive remains available for high-intensity R&D SME companies who spend 30% of their total expenditure on qualifying R&D. This will enable eligible loss-making SMEs to access a payable cash credit at the traditional 14.5% rate.

What are the drawbacks of the new incentive?

The 15p-16p rate of relief will be lower than most SMEs will historically have been used to. This reduction in generosity has arisen because of the increased cost of funding the incentive.

The complexities around contracted out R&D will cause headaches for customers and suppliers of R&D alike. The expectations of what R&D and non-R&D work will be required may need to be communicated at an early stage between customers and suppliers to provide better clarity on ownership of R&D. New contracts may be drafted where clauses asserting the right to R&D relief may become relevant.

Overseas R&D expenditure will generally be ineligible for inclusion in the claim. Exceptions to this rule will be where the expenditure meets the definition of qualifying overseas expenditure which includes: circumstances

where it would be wholly unreasonable to undertake R&D in the UK because of geographical, environmental or social factors; or where legal or regulatory requirements require the activity to take place in a specific territory. The cost of labour and/or workplace availability are explicitly ruled out as being a reason for overseas expenditure to be eligible.

What should our business do next?

Companies could be at risk of sleepwalking into a detrimental scenario whereby their customer-facing R&D efforts may no longer be eligible for R&D tax relief so it will be important for businesses to re-acquaint themselves with the terms and clauses of their contracts.

Companies may also be unaware of the implications that a reduced rate of tax relief could have on their cashflow as the generosity of the relief could reduce expected tax savings by upwards of 40%. It will be important to evaluate R&D budgets, the expected tax savings, and what time and resource may be required to actually undertake a claim for R&D tax relief whilst having to adjust to the new rules.

A number of companies undertaking R&D are not familiar with the requirements of the mandatory Additional Information Form. The level of detail required may be more substantial than claimants are historically used to and leaving it late to gather this detail can prove problematic. Project-by-project record-keeping is a must going forwards.

Albert Goodman are pleased to continue to support innovative companies with their R&D claims in the light of these significant changes and if you would like to speak with one of our specialist advisers, please do get in touch.

ANNUAL TAX ON ENVELOPED DWELLINGS… THE TAX YOUR ENTITY MAY BE FORGETTING

Does your entity own an interest in residential property?

If so, ATED may apply to your business.

The Annual Tax on Enveloped Dwellings (“ATED”) is a tax charged annually on the ownership, by a non-natural person (NNP), of a ‘chargeable interest’ in residential property in the UK. An NNP can be a company, a partnership with a corporate partner, or a collective investment scheme.

Valuation of Properties

Last year was of particular importance for ATED, as all residential properties were revalued for the purposes of assessing whether a return needed to be made. If an NNP holds an interest in a residential property, where the property is valued at more than £500,000 at 1 April 2022 or, if a property is acquired after this date and costs more than £500,000, then a return is needed whether or not any tax is due. If you think that this applies to you, then please contact us.

Property Interest

The NNP has to hold all or part of the beneficial interest in the property, which may be a freehold or leasehold interest. The charge payable by the NNP is based on the entire residential property’s value, not just the percentage interest held by the NNP.

For example, an NNP owning 50% of a freehold property valued at £1.5m is liable to ATED based on a 100% interest, so would fall into the £1m - £2m band and not the £500,000 - £1m band.

Chargeable Periods and Valuations

Chargeable periods for ATED run from 1 April to 31 March, so the next return due will be for the year ended 31 March 2025. However, the main return is made in advance, so has to be filed by 30 April 2024, only 30 days after the start of the chargeable period. Any ATED charges must be paid at the same time as the returns are filed.

If you acquire a property during the chargeable period, you have 30 days to file the return following completion. For new builds or conversions, you have 90 days from when the property is registered for Council Tax or from the date of first occupation (for new builds) or completion (for conversions).

The charge will depend on where the valuation/cost sits within prescribed bandings, as set out below.

Available Reliefs

There are many reliefs available which may reduce the charge to nil, however the relief rules are complex. The most common reliefs include the following:

The property is used in a commercially run property letting business or is held as part of the trading stock by a property development, or property trading business.

Qualifying properties open to the general public in certain circumstances.

Properties occupied by certain employees/partners.

Farmhouses/cottages occupied by qualifying farm workers.

Providers of social housing.

If an NNP wants to claim one of the reliefs, it has to file a return to do so.

Be aware that most reliefs are not available when there is, or has been, a “non-qualifying individual” (“NQI”) in occupation, which is broadly anyone connected with the NNP. If this occurs, there will most likely be an ATED charge, which can get very expensive, very quickly and in many cases will mean that a prior relief will have to be withdrawn or prevented for a period going forwards.

Penalties

We have seen a lot of cases recently where HMRC have been very strict on penalties and interest, resulting in these quickly mounting up.

Failure to file correctly or on time, or to pay on time, will lead to penalties and interest charges, even where there is no tax due. For example, if a return should have been filed by 30 April 2024 and is not filed until 1 May 2025, a penalty of up to £1,600 could be charged, even if there was no tax to pay.

Action Required

The rules are complex and, if incorrectly applied, can easily result in interest and penalty charges being levied.

If you are concerned that your company (NNP) may be subject to the ATED regime and would like more information, then please contact us.

Isobel Stephenson Tax Assistant Manager isobel.stephenson@albertgoodman.co.uk

Isobel Stephenson Tax Assistant Manager isobel.stephenson@albertgoodman.co.uk

Emma Cowie Tax Semi Senior

Emma Cowie Tax Semi Senior

LANDLORD REGRETS NOT UNDERTAKING “KYC” ON ITS TENANT

We are VAT specialists, and don’t do much if any, excise duty work, but I felt bound to comment on a recent case and consider how this could impact our clients/local community.

Tideswell Ltd owns industrial units. A new customer –“John”- wanted to rent some space for storing pallets. Tideswell didn’t have a vacant unit available, so it decided to enter into an informal arrangement whereby John would pay £600 +VAT a month to share a Unit also used by Tideswell. Once a separate Unit became free, Tideswell intended to enter into a formal lease. In the meantime, no ID checks were undertaken by Tideswell.

Tideswell regularly unloads goods for its customers, and signs for deliveries on their behalf. Tideswell unloaded several pallets for “John” and signed for their delivery.

HMRC subsequently raided the Unit and found “John’s” pallets contained 2 million cigarettes on which duty hadn’t been paid.

Being in possession of illicit cigarettes is a strict liability offence, even if they do not belong to you. This saves HMRC having to prove that the person with the goods (e.g. a lorry driver arriving at Dover with excisable goods in the trailer) was actively involved in smuggling them.

HMRC seized the cigarettes and issued Tideswell with a demand for £1 million in duty and penalties.

The point here is that although it is clear that someone other than Tideswell should have paid duty before the cigarettes arrived at Tideswell’s unit, HMRC is required to demand the duty against the earliest duty point they can establish on

the evidence they have.

This means that Tideswell’s only valid challenge to the Assessment would be if Tideswell could identify where, when, how, and by whom, the Excise Duty should originally have been paid. As Tideswell pointed out, it is HMRC that has the investigative resources and evidence to do this, but the burden was on Tideswell.

Although the apparent unfairness of this clearly troubled the Tribunal, in reality, Tideswell hadn’t been able to provide anything useful to help HMRC identify an earlier duty point and pursue “the crooks.”

The Tribunal decided that Tideswell’s Directors had been naïve, rather than knowingly involved, so it could reduce the penalty slightly, but Tideswell was still liable for the duty (over £750,000, plus a 12% penalty).

Could this happen in Somerset/Dorset? It does look as though “John” chose Tideswell to stash his cigarettes on the basis Tideswell’s premises was in a rural location and the unsophisticated and naïve owner (the Tribunal’s description) didn’t spot the potential risk or see the need for detailed ID check.

Steve Chamberlain VAT Senior Manager steve.chamberlain@albertgoodman.co.uk

Steve Chamberlain VAT Senior Manager steve.chamberlain@albertgoodman.co.uk

PCP/HP – HIDDEN FIGURES?

On 11 January 2024, the Financial Conduct Authority (FCA) launched a major investigation into the multi-million-pound finance market. There have been a large number of complaints into 100’s of lenders allowing brokers (car dealerships etc) to inflate the interest rates on personal car finance agreements, enabling brokers to receive larger commissions. This was known as Discretionary Commission Arrangements (DCA’s) until the FCA banned them in 2021.

However, the worst part is that consumers were not aware of these arrangements. It has been estimated that around 40% of the agreements taken out roughly between April 2007 and January 2021 had this hidden DCA.

While the FCA conducts its investigation, it has paused complaints made after 17 November 2023 and will continue to pause complaints up until the scheduled deadline of 25 September 2024. However, this doesn’t mean you can’t make an enquiry into your agreement now to see if you had this DCA, and if so, make a complaint. This pause essentially delays the finance companies 8-week response time while information is gathered and investigated.

SO, COULD YOUR ARRANGEMENT POSSIBLY HAVE A DCA?

The answer to this is… maybe, depending on who your finance lender was and whether a DCA was on your agreement.

There are checklists and tools available online so you can check to see if it’s worth making an enquiry into your current or preexisting finance agreement. This means you can make the enquiry yourself, without going to third party claim management companies who would take a percentage of any successful claim.

To summarise the points, DCAs could have been applied to:

Vehicles bought on finance, used primarily for personal use, regardless of whether the agreement is ongoing or paid off in full (Business agreements could be included but use needs to still be primarily personal).

After April 2007 but before 28 January 2021.

On Hire Purchase (HP) or Personal Contract Purchase (PCP) (This does not include personal contract hire).

There is no guarantee that anyone is due compensation because of this. There is always a small possibility that the FCA could finish its investigation and rule in the end that no further action is to be taken but it might be worth reviewing existing or historic agreements that you have taken out and find out if it was a DCA contract. You will then be in a good position to claim, if the FCA rule that compensation should be paid.

MANAGEMENT ACCOUNTS: KNOW YOUR BUSINESS BETTER!

How good are you at using your accounting software reports and do you use them to their full potential? This article will give you some tips and help you understand your figures better.

Good management reporting is a key discipline to maintain an informed and proactive business. If you can’t get your hands on a useful and timely report, you may find opportunities pass you by and unfavourable results become more likely.

All bookkeeping software has basic reporting features, but you need to know how to interpret these for them to matter. Here are some tips for you to apply to your management accounting approach:

WHAT REPORTS ARE GOOD TO REVIEW?

Aged Receivables and Aged Payable reports – Your software will be able to run a snapshot of everyone who owed you money and who you owed money to as at a specific date. Regularly chase up money you’re owed as it boosts cash which you can then use to pay off your suppliers.

Profit and loss – Look at your detailed profit or loss and investigate any abnormal balances. Does a certain cost look too high? It could be a duplicate in your records. Also, use the report to assess profit levels and consider your pricing. Remember – profit doesn’t equal cash! Consider a cash flow report if you’re making a lot of profit but never seem to have much money in the bank.

Balance sheet – Check out your loan balances and check interest is being recorded correctly. Also check that you haven’t got old balances that aren’t moving. It could be that a receipt or payment has accidentally been coded to a profit and loss category as an expense rather than to clear loan balances.

HOW CAN I MAKE MY REPORTS MEANINGFUL?

Use relevant nominal codes

Each bookkeeping software has its own chart of accounts with default nominal codes. There’s always room to rename or add more. So, if you have multiple product lines and want to track their separate performances, why not stop coding to just “sales” and create new specific nominals. Or you could rename sales to rent received for example, if that would be more relevant to your business.

Just be careful not to create too many codes, otherwise it’ll be information overload and may cause confusion.

Good record keeping

Always use comparatives

Use variance analysis in % terms

Ever heard of “rubbish in, rubbish out”? If your record keeping is inconsistent, your reporting will be as well. You should check and review inputted data prior to finalisation of any management accounts. For instance, you may want to check the bank balance in your software agrees to your banking platform.

You’ve probably noticed that your year-end accounts always have the current year presented next to the previous year. This is so that the numbers can be compared to one another to help us interpret them. A top tip is to always have a comparative in your management accounts. Your bookkeeping software reports are generally customisable in this way.

Along with comparatives, expressing movements between periods, be it months or quarters, can help you understand whether income and expenses are up or down. Always do this in percentage (%) terms as a figure on its own will not tell the same story. For instance, if I told you sales were up by £10,000 you might think that’s good, until I told you turnover last period was £1,000,000. As a percentage that’s just a 0.01% increase.

Review management reports frequently

KPIS & TARGET SETTING

Depending on your business nature and size, the frequency of reporting will vary. However, I’d recommend at least once a quarter you review your financial reports in detail. It will allow you to stay agile and get on top of issues immediately. If you prepare VAT returns, it could become part of that quarterly process.

One of the important ways to measure success is to have targets or key performance indicators (KPIs). These should be a mixture of quantitative and qualitative to give a well-rounded view of how your business is performing.

Good KPIs follow the SMART approach. Click here to find out more if you’ve not heard of this before. In short, your targets should be specific and achievable to motivate people.

Some KPIs you may wish to consider:

Staff happiness – do quarterly surveys to understand how your staff are feeling. This can help with employee retention.

Customer happiness – actively seek feedback from customer (Google reviews, Trip Advisor etc) and set targets/monitor the average rating review you get in a month. Great for understanding your customer wants and needs.

Working capital cycle – set a target for working capital. This is how many days you fund your aged receivables and inventory (stock) compared to how long it takes to pay off your suppliers.

Gearing – what is your debt-to-equity ratio? Have you got more loans than cash and retained earnings? Great to understand if you have bank loan covenants or wish to raise future finance.

Albert Goodman can offer help regarding your management reporting in several ways, including but not limited to cloud software support, large data processing and customising reports. Let me or your usual AG contact know if this could be of benefit to you, or even if you would like some help setting yourself some KPIs!

Hillman Business Services Senior

Hillman Business Services Senior

XERO TIPS AND TRICKS

Switching back to the old invoicing style in Xero

We have received some feedback from our staff and clients that the new Xero sales invoice screen can be hard to navigate. You can still access the old style of invoice in you click this link at the bottom of the Xero invoicing screen:

Troubleshooting live link to HMRC VAT filing from within Xero

As you most likely know, Xero links to your HMRC VAT filing portal to enable you to submit new returns and view your submission history.

However, this link will need to be re-instated every 18 months and occasionally it can disconnect before that point.

Reconnecting it is super easy, but sometimes it can go wrong – so here are the instructions to reinstate the link and common problems that prevent re-connection.

Reconnect Xero to HMRC

Go to Accounting>VAT Return and click on ‘Connect to HMRC’

When prompted click the green ‘Continue’ button, then Sign into Government Gateway

From here you will be prompted to enter your government gateway ID and password

Now select the ‘allow access’ button.

This should now return you to the VAT dashboard and you should be reconnected. However, if this does not work the most common issue is that you have tried to connect Xero to the wrong Government Gateway ID.

The following steps will help you check that you have the

correct Government Gateway ID to enable Xero to link to your MTD VAT dashboard.

Verify your Government Gateway ID

Sign into your government gateway using the following address:

https://www.gov.uk/log-in-register-hmrc-onlineservices

Click the ‘Sign in’ button and enter the credentials that you used to connect Xero above.

This will take you to your business tax dashboard and should show a list of services that you can access.

If VAT is not listed on your Government Gateway dashboard check any other gateway ID’s that you have until you find the one that VAT is connected to. Once you have found the correct ID, go back to Xero and follow the steps to ‘Reconnect Xero to HMRC’ above.

In most cases, this will resolve the problem – if not please feel free to contact us for further help.

Bank accounts - statement balance versus balance in Xero

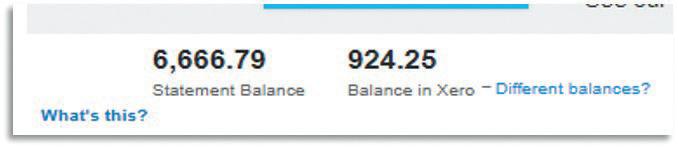

You may have seen this at the top of your bank reconciliation or banking dashboard within Xero:

So, what exactly is the difference and should we worry if the balances do not match?

Balance in Xero – this is the running total of all the transactions that have ever been entered into your

bank account from within your accounts. Ideally, these transactions will be identical to the transactions that appear on your statements provided by your bank.

Statement Balance – this is the balance that Xero calculates as your bank balance based on the bank feed, imported statements and accounting transactions that have been marked as reconciled.

It is important to regularly check if your calculated Statement Balance in Xero accurately reflects the balance provided by your bank as this will be one of the key starting points for the production of your financial accounts.

Starting Bank Balance

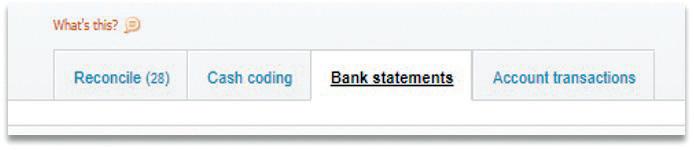

The first item to consider is how the bank feed was set up. Did the bank account in question have a balance in it when the feed was started and was this included in Xero? Navigate to the bank account and click on the bank statement tab as shown here:

If you then scroll to the bottom right-hand side of this page and click the link to end it will take you to the very first transactions that were entered.

Look through the transactions of the first day to see if there is an item that imports the balance from your bank account at that point. If this is missing, your contact at Albert Goodman will be able to assist you in adding the starting balance for your bank account.

Duplicated or missing items in the bank feed

Once you have made sure the starting point is right, scroll through the bank statements tab as above and check the balance at regular intervals – perhaps quarterly to start with – to ascertain where the error developed.

The items on the Bank Statements tab in Xero should mirror your statements supplied by your bank. If they don’t there could be 2 issues:

Missing items – if the bank feed has lapsed it may be that there is a period of time where there were no transactions imported from your bank. Your contact at Albert Goodman can give you further advice on how to import these or you can refer to the online Xero help guides that can be accessed by clicking the help button in the top right of the blue bar in Xero.

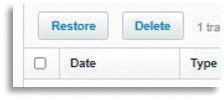

Duplicated items – occasionally the bank will import duplicated items. If you have not already reconciled these items, you can simply tick the box at the left-hand side of the duplicated item and then click the ‘Delete’ button. Contact us for advice if you are not sure!

If you have any top Xero tips, please do let us know and we can feature them here for others to benefit from! Alternatively, if you need any help with Xero matters, please email the cloud team xero@albertgoodman.co.uk