MERRYLANDS MARKET ASSESSMENT

February 2022

Client: ALAND

This report is dated February 2022 and incorporates information and events up to that date only and excludes any information arising, or event occurring, after that date which may affect the validity of Urbis Pty Ltd’s (Urbis) opinion in this report. Urbis prepared this report on the instructions, and for the benefit only, of ALAND (Instructing Party) for the purpose of a Market Assessment (Purpose) and not for any other purpose or use. Urbis expressly disclaims any liability to the Instructing Party who relies or purports to rely on this report for any purpose other than the Purpose and to any party other than the Instructing Party who relies or purports to rely on this report for any purpose whatsoever (including the Purpose).

In preparing this report, Urbis was required to make judgements which may be affected by unforeseen future events including wars, civil unrest, economic disruption, financial market disruption, business cycles, industrial disputes, labour difficulties, political action and changes of government or law, the likelihood and effects of which are not capable of precise assessment.

All surveys, forecasts, projections and recommendations contained in or made in relation to or associated with this report are made in good faith and on the basis of information supplied to Urbis at the date of this report. Achievement of the projections and budgets set out in this report will depend, among other things, on the actions of others over which Urbis has no control.

Urbis has made all reasonable inquiries that it believes is necessary in preparing this report but it cannot be certain that all information material to the preparation of this report has been provided to it as there may be information that is not publicly available at the time of its inquiry.

In preparing this report, Urbis may rely on or refer to documents in a language other than English which Urbis will procure the translation of into English. Urbis is not responsible for the accuracy or completeness of such translations and to the extent that the inaccurate or incomplete translation of any document results in any statement or opinion made in this report being inaccurate or incomplete, Urbis expressly disclaims any liability for that inaccuracy or incompleteness.

This report has been prepared with due care and diligence by Urbis and the statements and opinions given by Urbis in this report are given in good faith and in the belief on reasonable grounds that such statements and opinions are correct and not misleading bearing in mind the necessary limitations noted in the previous paragraphs. Further, no responsibility is accepted by Urbis or any of its officers or employees for any errors, including errors in data which is either supplied by the Instructing Party, supplied by a third party to Urbis, or which Urbis is required to estimate, or omissions howsoever arising in the preparation of this report, provided that this will not absolve Urbis from liability arising from an opinion expressed recklessly or in bad faith.

Urbis staff responsible for this report were:

Director Clinton Ostwald

Associate Director Alex Stuart, Fraser Brown

Senior Consultant Jennifer Williams

Consultant Ryan Wallis

Project code P0038116

Report number 1

© Urbis Pty Ltd

ABN 50 105 256 228

All Rights Reserved. No material may be reproduced without prior permission.

You must read the important disclaimer appearing within the body of this report.

23/02/2022 Merrylands Market Assessment Page 2

COVID-19 AND THE POTENTIAL IMPACT ON DATA INFORMATION

The data and information that informs and supports our opinions, estimates, surveys, forecasts, projections, conclusion, judgments, assumptions and recommendations contained in this report (Report Content) are predominantly generated over long periods, and is reflective of the circumstances applying in the past. Significant economic, health and other local and world events can, however, take a period of time for the market to absorb and to be reflected in such data and information. In many instances a change in market thinking and actual market conditions as at the date of this report may not be reflected in the data and information used to support the Report Content.

The recent international outbreak of the Novel Coronavirus (COIVID-19), which the World Health Organisation declared a global health emergency in January 2020 and pandemic on 11 March 2020, is causing a material impact on the Australian and world economies and increased uncertainty in both local and global market conditions.

The effects (both directly and indirectly) of the COVID-19 Outbreak on the Australian real estate market and business operations is currently unknown and it is difficult to predict the quantum of the impact it will have more broadly on the Australian economy and how long that impact will last. As at March 2020, the COVID-19 Outbreak is materially impacting global travel, trade and near-term economic growth expectations. Some business sectors, such as the retail, hotel and tourism sectors, are already reporting material impacts on trading performance now and potentially into the future. For example, Shopping Centre operators are reporting material reductions in foot traffic numbers, particularly in centres that ordinarily experience a high proportion of international visitors.

The Report Content and the data and information that informs and supports it is current as at the date of this report and (unless otherwise specifically stated in the Report) necessarily assumes that, as at the date of this report, the COVID-19 Outbreak has not materially impacted the Australian economy, the asset(s) and any associated business operations to which the report relates and the Report Content. However, it is not possible to ascertain with certainty at this time how the market and the Australian economy more broadly will respond to this unprecedented event. It is possible that the market conditions applying to the asset(s) and any associated business operations to which the report relates and the business sector to which they belong could be (or has been) materially impacted by the COVID-19 Outbreak within a short space of time and that it will have a lasting impact. Clearly, the COVID19 Outbreak is an important risk factor you must carefully consider when relying on the report and the Report Content.

Any Report Content addressing the impact of the COVID-19 Outbreak on the asset(s) and any associated business operations to which the report relates or the Australian economy more broadly is (unless otherwise specifically stated in the Report) unsupported by specific and reliable data and information and must not be relied on.

To the maximum extent permitted by law, Urbis (its officers, employees and agents) expressly disclaim all liability and responsibility, whether direct or indirect, to any person (including the Instructing Party) in respect of any loss suffered or incurred as a result of the COVID-19 Outbreak materially impacting the Report Content, but only to the extent that such impact is not reflected in the data and information used to support the Report Content.

23/02/2022 Merrylands Market Assessment Page 3

23/02/2022 Merrylands Market Assessment Page 4 Executive Summary 5 Introduction 8 Residential Assessment 12 Demographics 13 Supply 21 Competitor Analysis 25 Demand 32 Retail Assessment 42 Scheme Assessment 43 Trade Area and Spending 50 Competition 55 Case Studies and Success Factors 58 Composition and Performance 67 Office Assessment 72

CONTENTS

EXECUTIVE SUMMARY

23/02/2022 Merrylands Market Assessment Page 5

EXECUTIVE SUMMARY

Project Background

ALAND owns a large development site at 224-240 Pitt Street, Merrylands. ALAND requires market evidence to inform the design of the project and ensure that the offer meets market needs. Urbis has been engaged to assess the market potential for key land uses including residential apartments, retail and office.

Subject Site

The subject site is located adjacent to the Merrylands railway station. The site is relatively well located in regard to local amenity, including retail/entertainment, public transport and employment centres. The development is proposed to comprise retail and open space which will increase amenity available to future residents.

Residential Assessment

Merrylands is a relatively lower socio-economic area of Sydney. Affordability is, therefore, a key driver of the dwelling market, especially for apartments which compete with older townhouses and houses.

Key residential drivers such as public transport, major shopping centres, hospitals, schools and employment precincts have supported the Merrylands apartment market. Overall, the Study Area has averaged around 840 new apartment sales per year, over the past four years.

Residential apartments are supported on the subject site with key findings/recommendations comprising:

• Take-Up: Based on historical and projected demand and competition, the Subject Site could achieve a sales rate of around 30-40 per year (about three per month) in 2023 and pick up to 5-7 per month as the Sydney population recovers from COVID-19. However, there is a risk that the launch of major master-planned projects around the area could increase competition and impact take-up.

• Buyer Mix: It is anticipated that most buyers will be first home buyers, or investors, followed by downsizers.

• Mix: Recommended that most apartments in the development contain two bedrooms and two bathrooms. This product is attractive to both younger

couples and investors, which are likely to be the major buyer segments for the project. One-bedroom apartments are also attractive to some first home buyers and investors, although the majority would be looking for two bedrooms due to the relative affordability in the market. Three-bedroom apartments should account for under 10% of dwellings, with downsizers likely to account for a smaller segment of buyers and families being attracted to affordable townhouses in the area.

• Apartment Sizes and Positioning: The recommended internal sizes shown below are based on a comparison with recent projects with consideration that smaller sizes would assist with affordability.

• Prices: The prices are indicative and will depend on many factors, such as the final design and quality of the project. The project's projected sales prices in $2022 have been estimated based on recent off-the-plan prices and new apartment resales in the area. The prices also consider competition from older house stock, which are an attractive alternative to buyers of three-bedroom apartments (particularly families). The median price for a house in Merrylands was $1.04M in the year to February 2022 with starting prices at around $775,000 for lower quality stock. As such, keeping three bedroom prices at the lower end of the house scale will be important to maintain affordability.

Mix and Indicative Pricing

23/02/2022 Merrylands Market Assessment Page 6

Type Mix Internal Size (sq.m) Indicative Price ($2022) Studio, 0-1 Car 0-5% 40-45 $370,000 - $410,000 1 Bed, 1 Car 25-35% 55-65 $450,000 - $520,000 2 Bed, 2 Bath, 1 Car 60-70% 75-85 $620,000 - $710,000 3 Bed, 2 Bed, 1-2 Car 5-10% 90-110 $770,000 - $880,000

Source: Urbis

EXECUTIVE SUMMARY

Retail Assessment

Key Findings

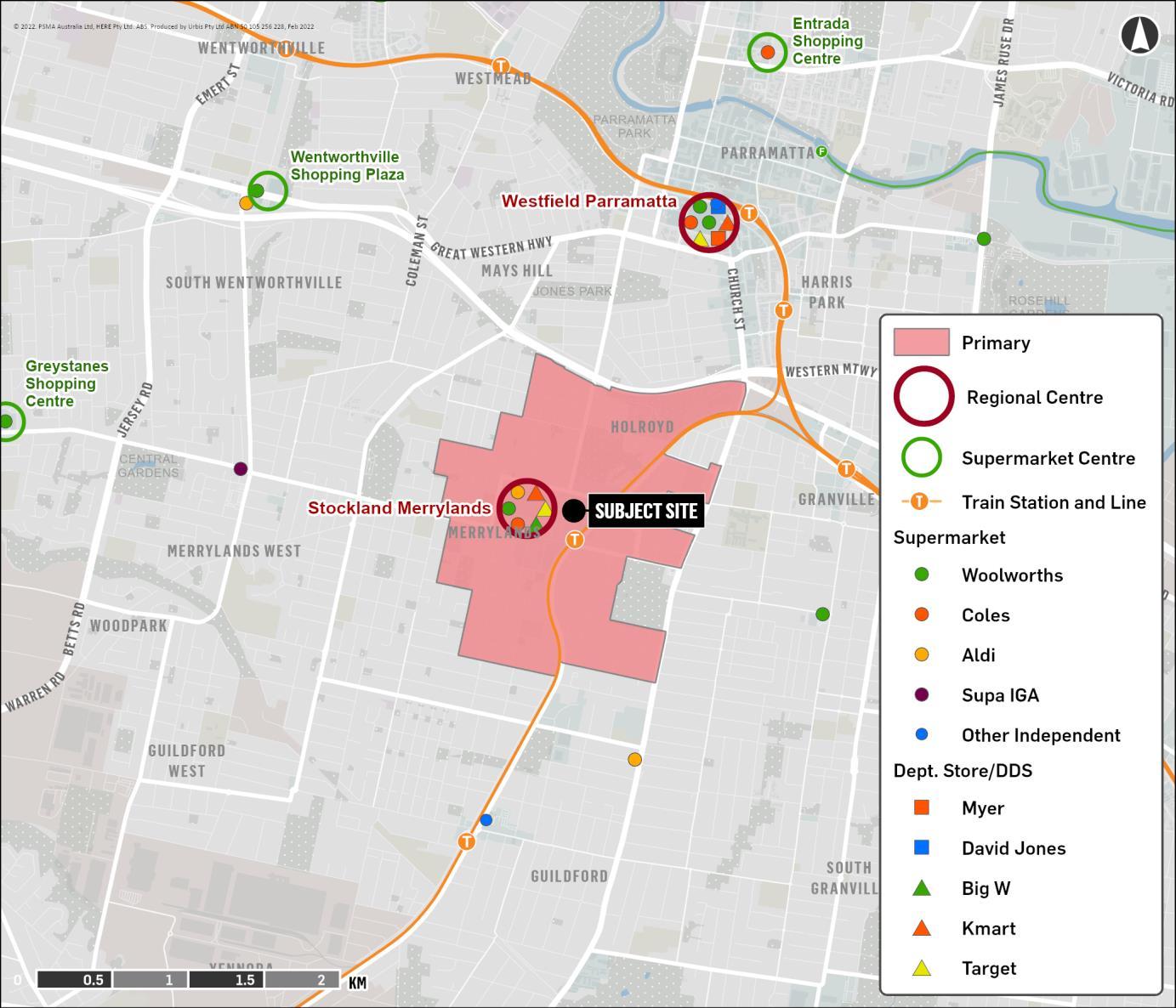

The retail trade area population is estimated at 15,240 at 2022 and is expected to add an additional 5,390 people over the next five years at a growth rate of 6.2% per annum. The strong growth is driven by on-site development and other high density apartment stock coming online in Merrylands. By 2037, the trade area is expected to grow to 24,230, including over 2,800 on-site residents.

There is significant provision of retail floorspace within the Merrylands Town Centre, with Stockland Merrylands located directly opposite the subject site. While there are no other strictly defined shopping centres in the primary trade area, the adjacent Merrylands Road and McFarlane Road have a large provision of strip retail.

ALAND is proposing to develop up to 3,500 sq.m of retail floorspace across the site including some floorspace fronting Pitt Street and the majority of tenancies located within the site and away from key pedestrian thoroughfares.

At 3,500 sq.m, the proposed scheme is large given there is no clear anchor, significant competition from Stockland Merrylands and strip retail along Merrylands Road. A large provision of specialties with no anchor presents high leasing risk, particularly for tenants in secondary locations on Site A&B with limited exposure.

Recommendations

Giving regard to ALAND’s proposed scheme, the strengths and weaknesses of the subject site and the competitive context in Merrylands, Urbis make the following recommendations:

• It is recommended that the quantum of retail floorspace is scaled back to primarily occupy Site C. The lack of exposure and large provision of specialty floorspace in Site A&B creates high leasing risk and it is likely these tenants would underperform. Furthermore, the lack of a clearly defined anchor tenant limits the ability for a large retail provision to be supported on the site.

• A national brand tenant (such as Chemist Warehouse) should be targeted to occupy the larger tenancy in Building A to act as a draw card for the rest of the precinct and minimise leasing risk.

• Supporting retail on Site A&B is very challenging. Activation of the public space and a new road linking the site to Neil Street could help increase foot

traffic, particularly for those tenancies fronting the new road in the middle of the site that don’t benefit from patronage on Pitt Street. This would rely on residents in apartments to the north of Neil Street being able to cross the street and walk through the site to the train station.

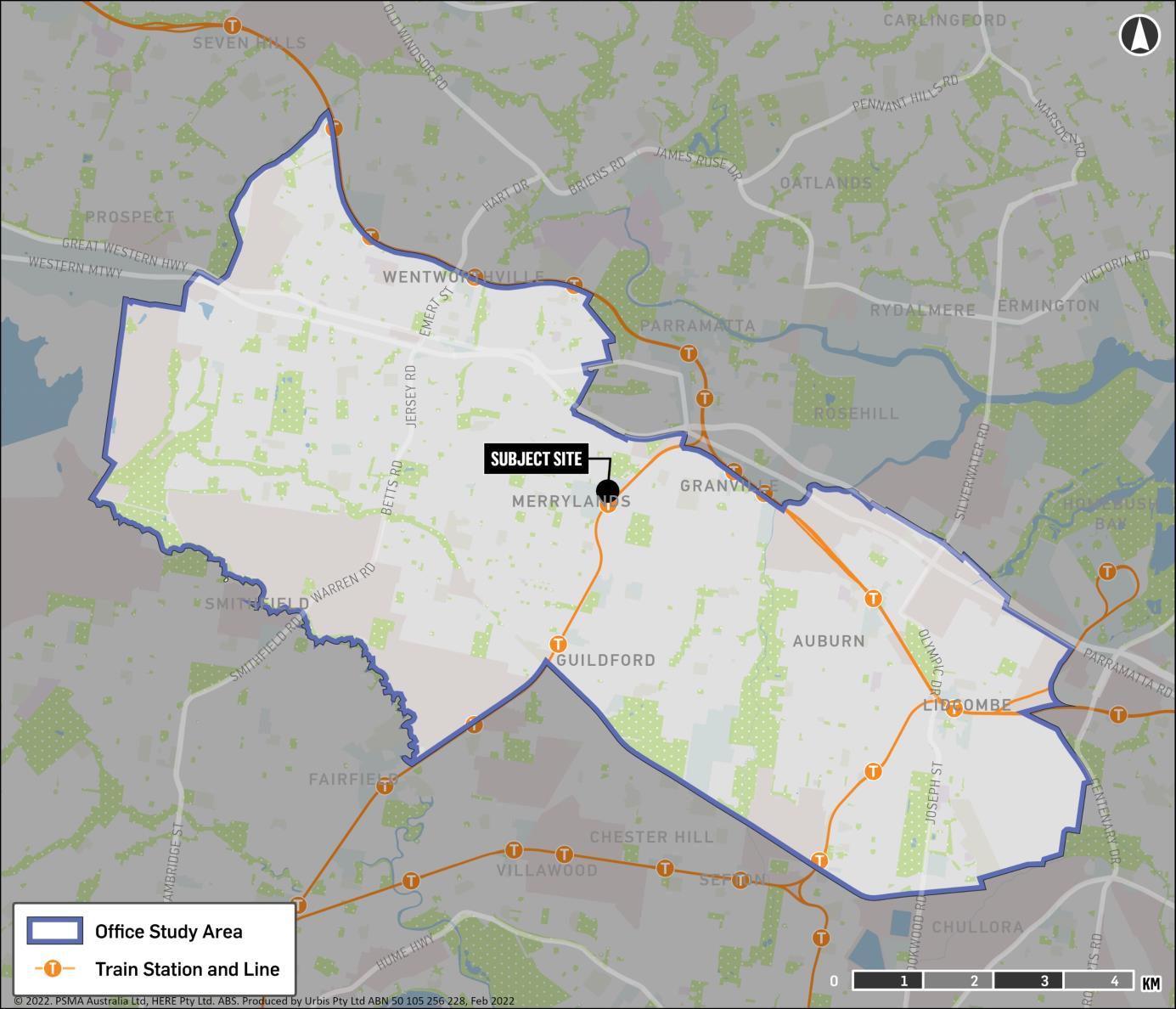

Office Assessment

Total jobs within the Cumberland LGA are expected to grow from 84,300 in 2021 to 97,800 by 2031, equating to an additional 13,500 jobs. Office jobs are expected to account for 3,300 of these additional jobs over this period. Applying an office job density of 15 sq.m per worker equates to an estimated 55,400 sq.m of office floorspace demand by 2031. Given that the concept plans provide for around 1,225 sq.m of office space at the subject site, this would account for 2.2% of demand for additional office space in the Cumberland LGA in 2031.

A market share of 5% is considered reasonable, given that the subject site lies within the Merrylands town centre and is close to the Merrylands train station. Therefore, the Subject Site should support the proposed amount of office space by 2024-25.

The subject site is not well suited for traditional office-based industries such as finance and insurance or administrative and support services; however, it could attract government service tenants, real estate agents and managers, solicitors and tax agents. There is also potential for alternative uses that could be explored on the site, including education/training or medical tenants.

23/02/2022 Merrylands Market Assessment Page 7

INTRODUCTION

23/02/2022 Merrylands Market Assessment Page 8

INTRODUCTION

Project Background

ALAND owns a large development site at 224-240 Pitt Street, Merrylands (“Subject Site”). ALAND requires market evidence to inform the final design of the project to ensure that the offer meets the market needs.

Urbis has been engaged to assess the market potential for the following land uses:

• Residential apartments

• Retail

• Office.

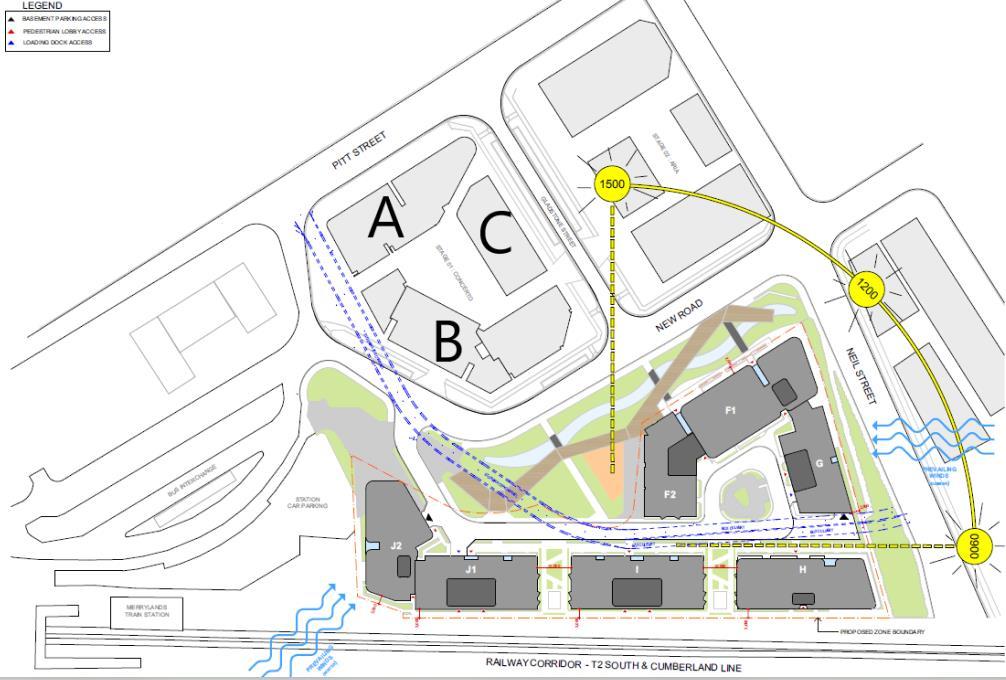

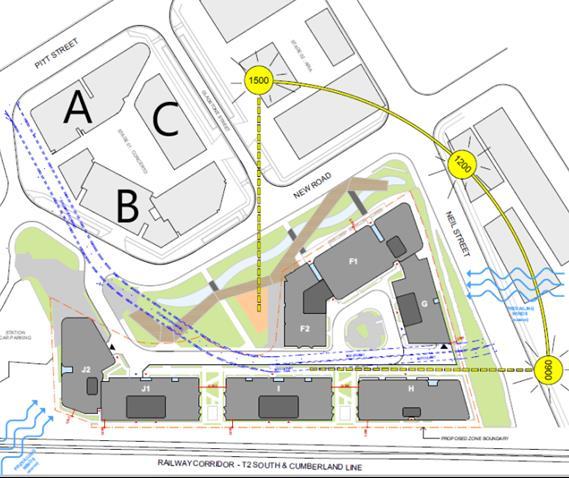

The table below shows the scheme that is compliant with current planning controls and a proposed scheme based on changing the FSR and height currently allowable for building site J2.

ALAND has advised that they are also considering the potential increase in ground floor retail space across Site A&B to around 2,000 sq.m, which would take total retail floorspace across the site to around 3,500 sq.m.

23/02/2022 Merrylands Market Assessment Page 9 Compliant Scheme Proposed Scheme Site Building Residential Units (no.) Retail (sq.m) Commercial (sq.m) Residential Units (no.) Retail (sq.m) Commercial (sq.m) C A 177 821 1,225 177 821 1,225 C B 165 592 165 592 C C (D) 23 78 23 78 A&B F1 180 180 A&B F2 54 305 54 305 A&B G 32 32 A&B H 127 127 A&B I 95 95 A&B J1 81 81 A&B J2 78 258 230 258 Total 10 1,012 2,054 1,225 1,164 2,054 1,225

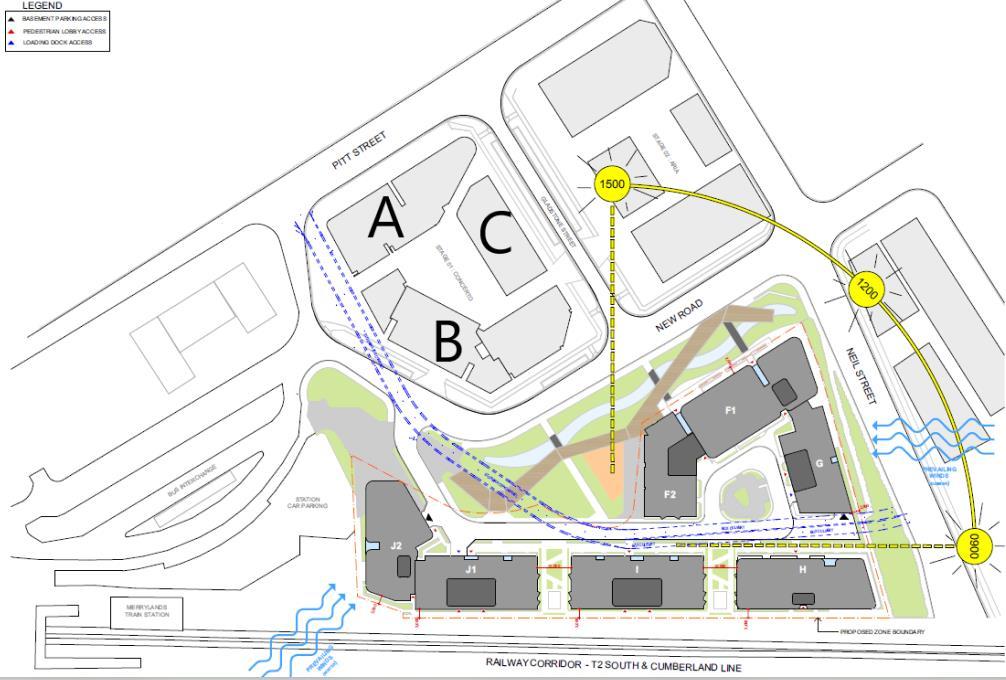

The Scheme

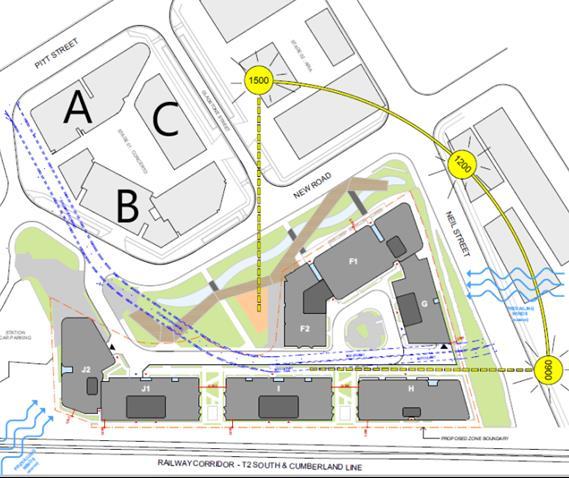

SUBJECT SITE

Key Findings

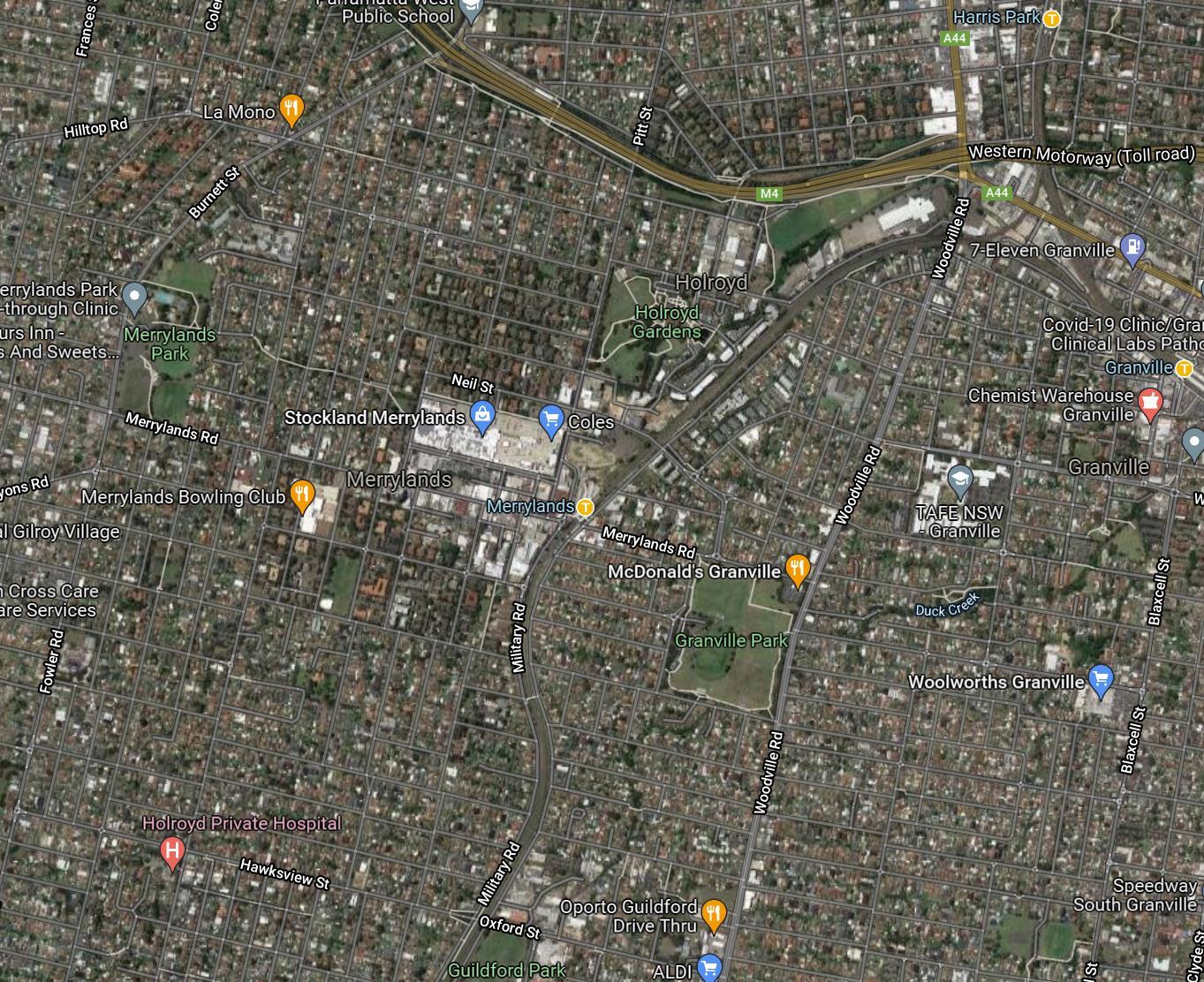

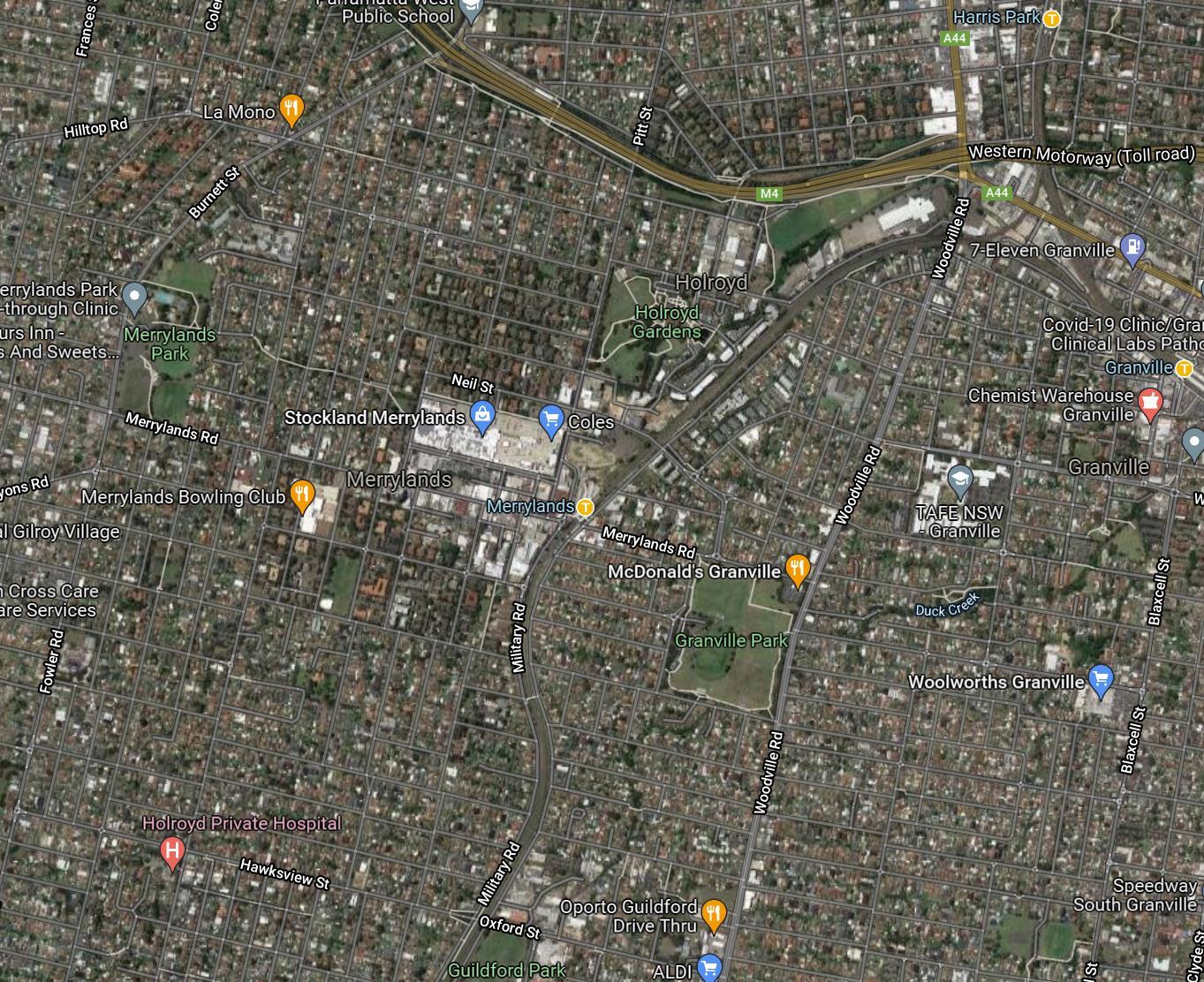

The subject site is located at 224-240 Pitt Street, Merrylands and comprises an area of around 2.4 hectares.

The site is located at the northern gateway to the Merrylands Railway Station.

Surrounding land uses comprise:

• Railway land and the Sydney Trains T2 Inner West and Leppington and T5 Cumberland railway lines to the east and south

• The Merrylands town centre to the west including Stocklands Merrylands on the western side of Pitt Street.

• Retail, commercial and residential apartments to the north

The majority of higher density residential apartments and taller buildings in Merrylands are currently located along McFarland Street, Neil Street, Pitt Street, Dressler Close, Merrylands Road, Treves Street and along the railway line.

Subject Site

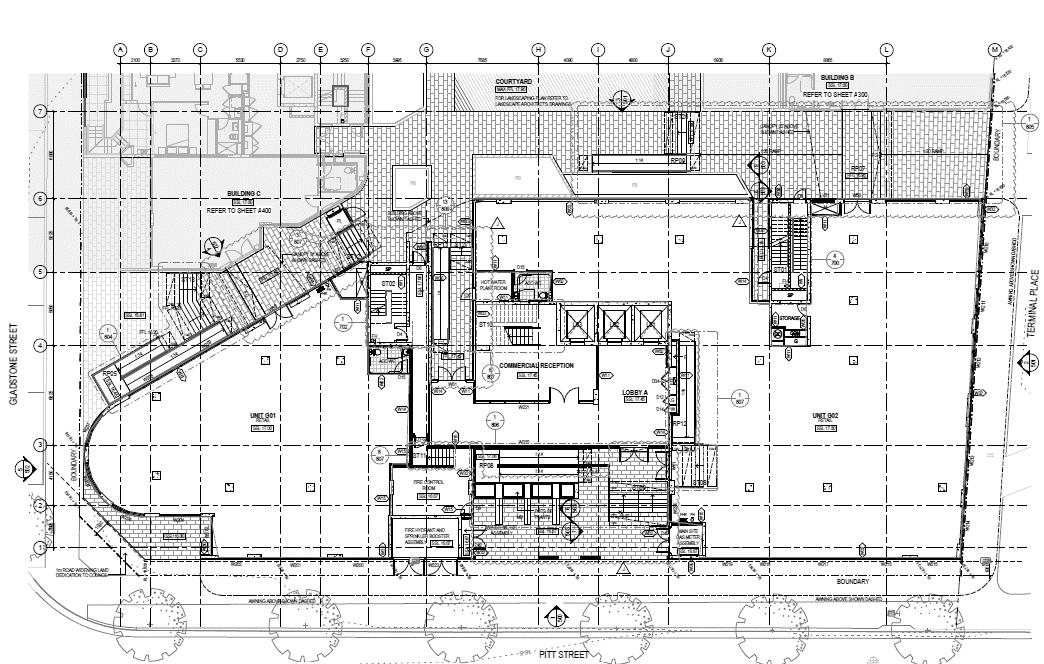

23/02/2022 Merrylands Market Assessment Page 10 Site C Sites A&B

DRAFT PLANS

Key Characteristics

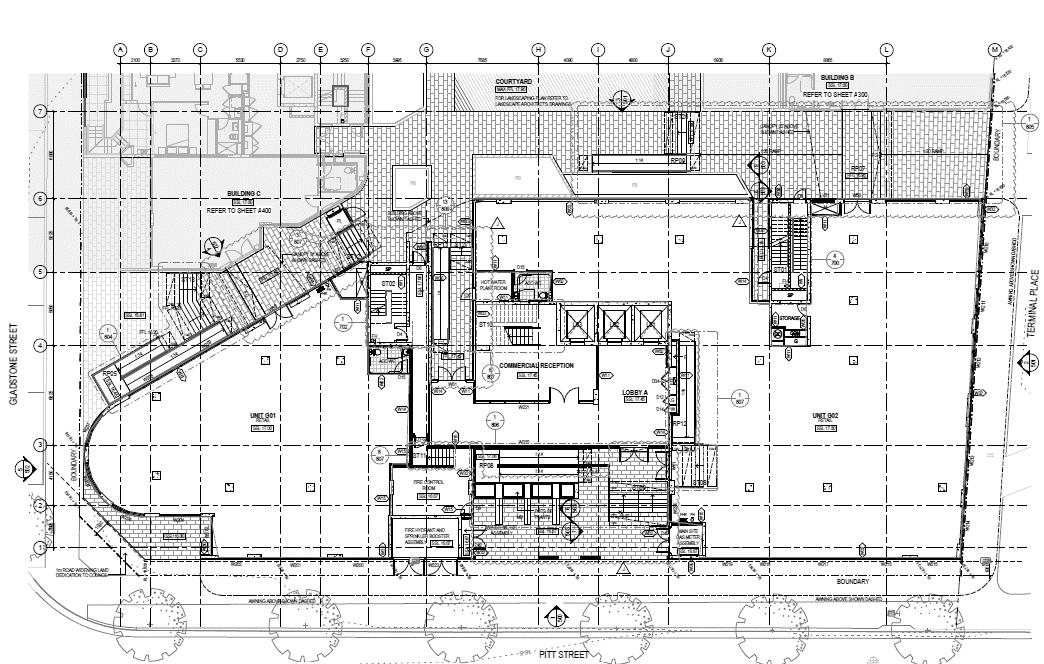

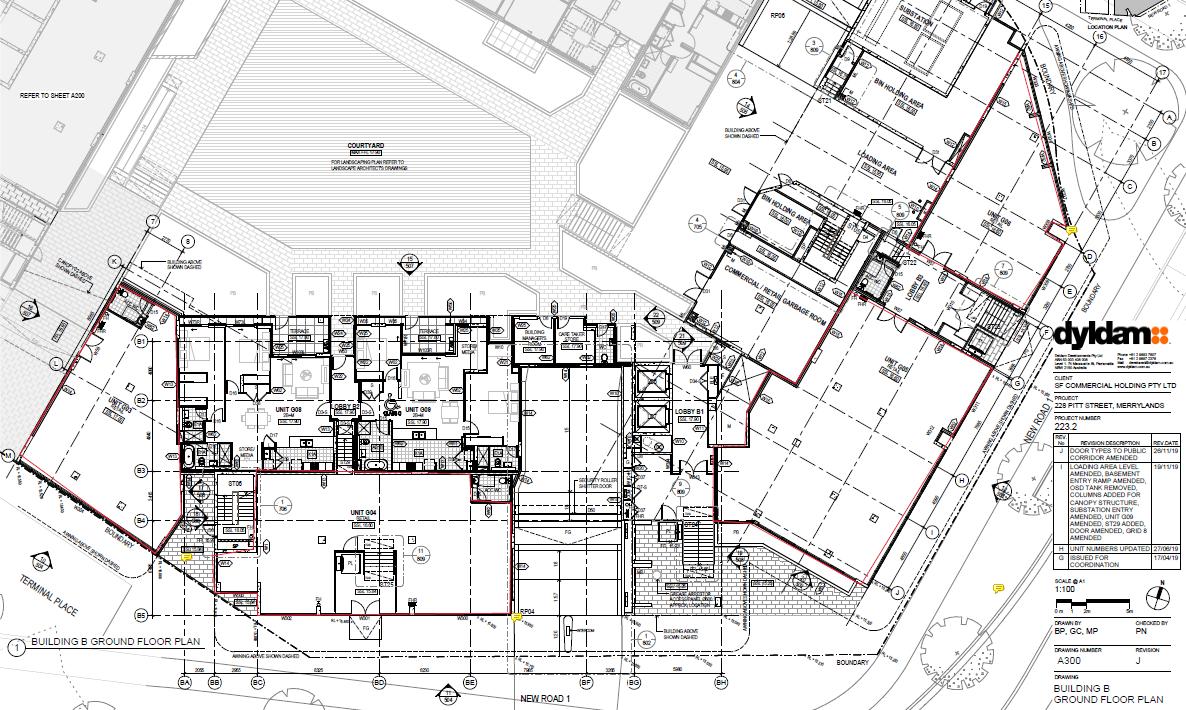

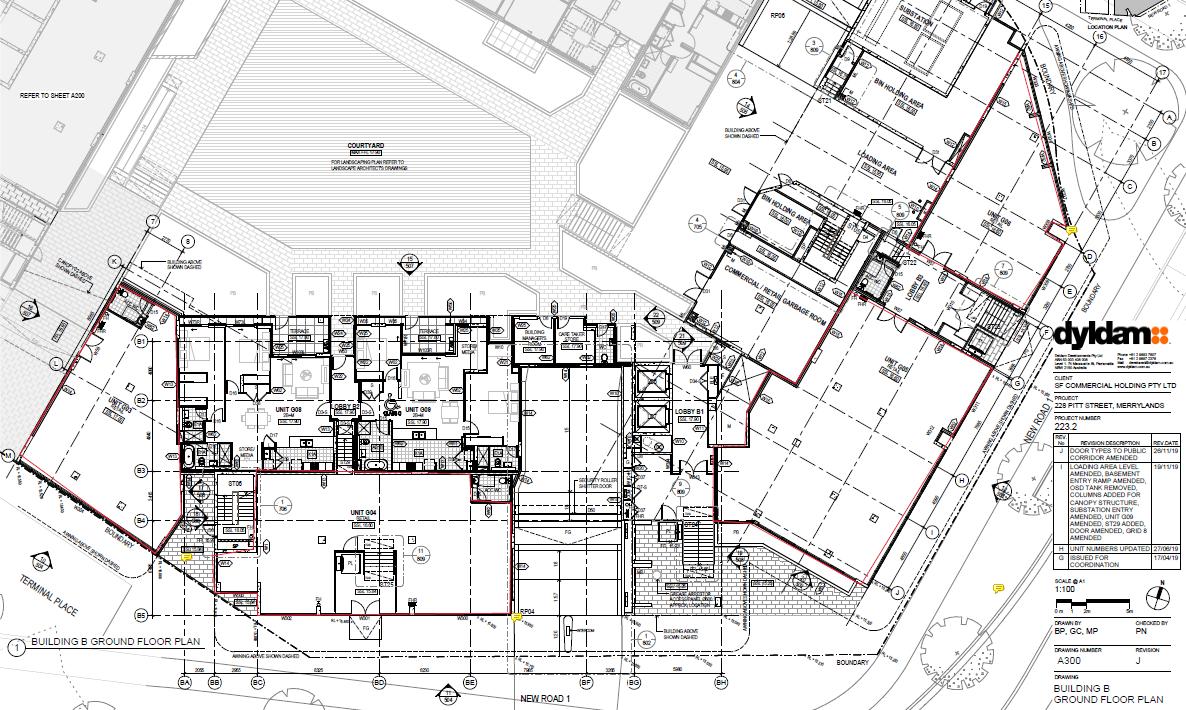

The draft plans for the mixed-use development comprise ten buildings surrounding a new central public park and civic space on the site. Two new roads linking Neil Street to Pitt Street will separate the buildings in Site A&B and Site C.

Site C is proposed to consist of three buildings (A, B and C) with a total of 365 residential units.

• Studio: 4.7%

• 1 Bed: 26.8%

•

2 Bed: 60.0%

• 3 Bed: 8.5%

These buildings will include retail tenancies on the ground floor (1,491 sq.m) above five levels of basement car parking 460 for cars. Building A also contains 1,225 sq.m of commercial office space. The proposed apartment mix includes:

Site A&B is proposed to contain seven buildings including 799 residential units above between 550 – 2,000 sq.m of retail space. The proposed scheme would change the compliant height and FSR for Building J2 from 16 storeys to 25 storeys.

Draft Plans - Ground Level

23/02/2022 Merrylands Market Assessment Page 11 Site Studio, 1 bath, 1 car 1 bed, 1 bath, 1 car 1 bed, 1 bath, 2 car 1 bed + media or study, 1 bath, 1 car 2 bed, 1 bath, 1 car 2 bed, 2 bath, 1 car 2 bed, 2 bath, 2 car 2 bed + media or study, 2 bath, 1 car 2 bed + media or study, 2 bath, 2 car 3 bed, 2 bath, 2 car 3 bed + media, 2 bath, 2 car C 17 43 2 53 19 128 8 51 13 30 1

Site C Sites A&B

RESIDENTIAL ASSESSMENT

12

DEMOGRAPHICS

23/02/2022 Merrylands Market Assessment Page 13

MOVER ANALYSIS

Migration Trends

The map outlines migration statistics for the subject site location. Specifically, the map shows the place of residence for current 2016 Merrylands - Holroyd Statistical Area 2 (SA2) residents in 2011. The findings are used to inform the Study Area analysis by indicating where people have moved from and what areas may be considered to be comparable to the subject site. Key findings from the map include:

• Approximately 19.1% of residents who moved to a new address in the Merrylands - Holroyd SA2 in 2016 previously resided in another address within the Merrylands - Holroyd SA2 in 2011. This highlights the propensity for people to move locally as they have established connections to the area.

• Around 29.1% of current 2016 MerrylandsHolroyd residents (that changed address) resided overseas in 2011, which is above the Sydney average and indicates the market will have a high portion of overseas residents.

• The other most common SA2s where 2016 Merrylands - Holroyd residents previously lived include:

• Guildford West - Merrylands West (5.3%)

• Granville – Clyde (4.3%)

• Parramatta – Rosehill (3.3%).

• The majority of local migration to the MerrylandsHolroyd area has come from the surrounding SA2s within the Cumberland and Parramatta LGAs. The map highlights that the migration has been relatively localised. Employment and cost of housing are likely to be key drivers of this movement data.

Migration Data

23/02/2022 Merrylands Market Assessment Page 14

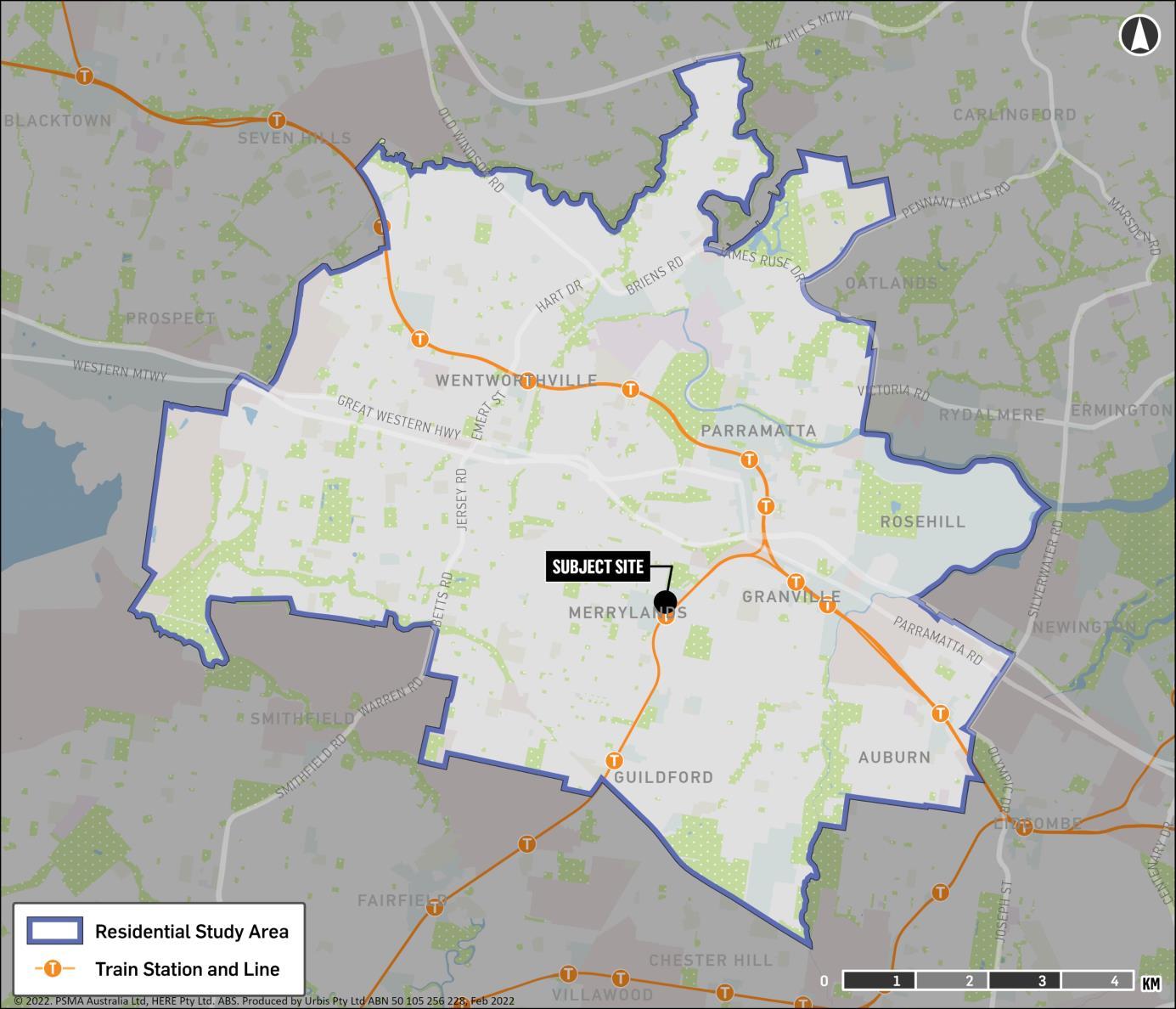

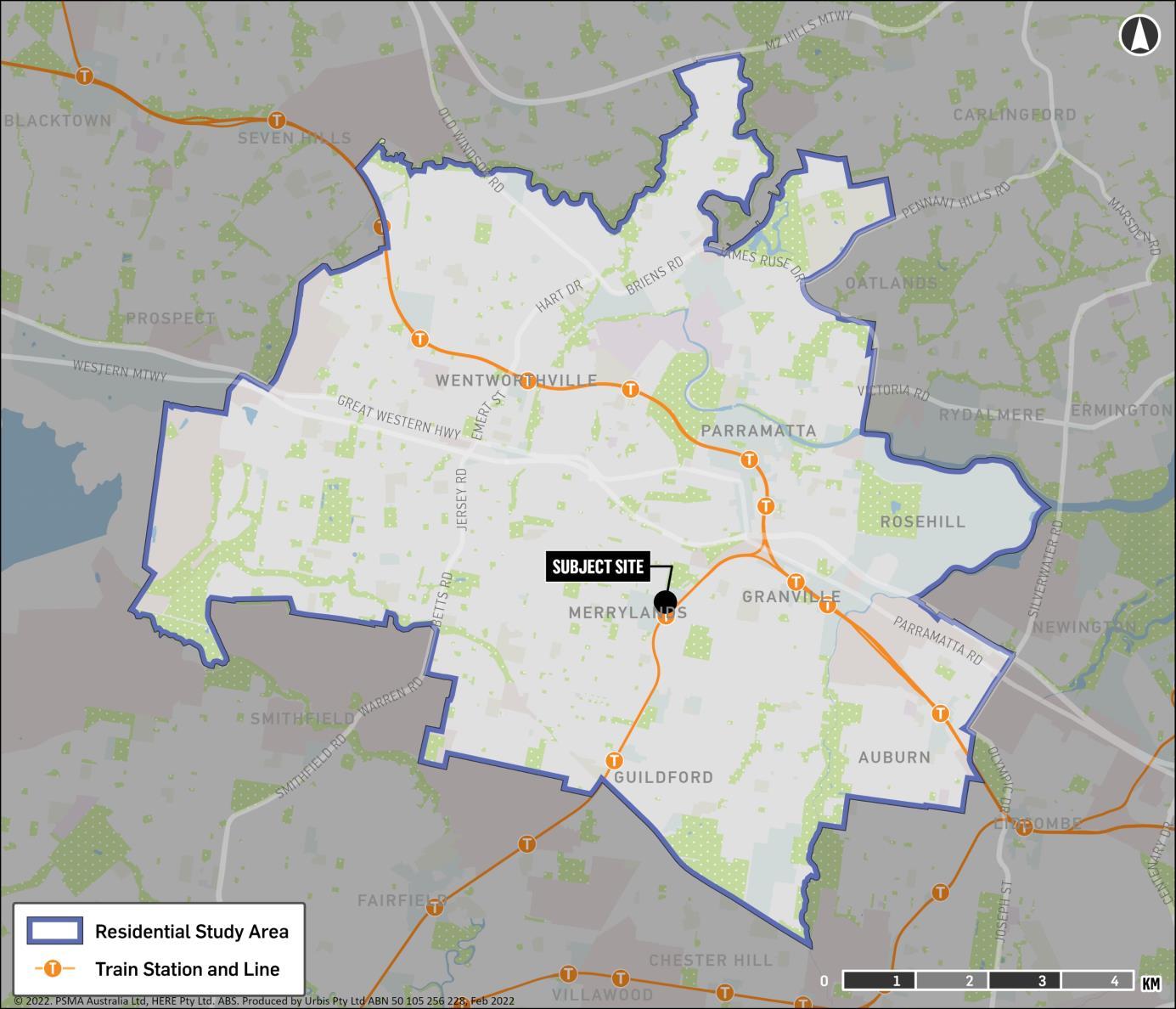

STUDY AREA

Definition

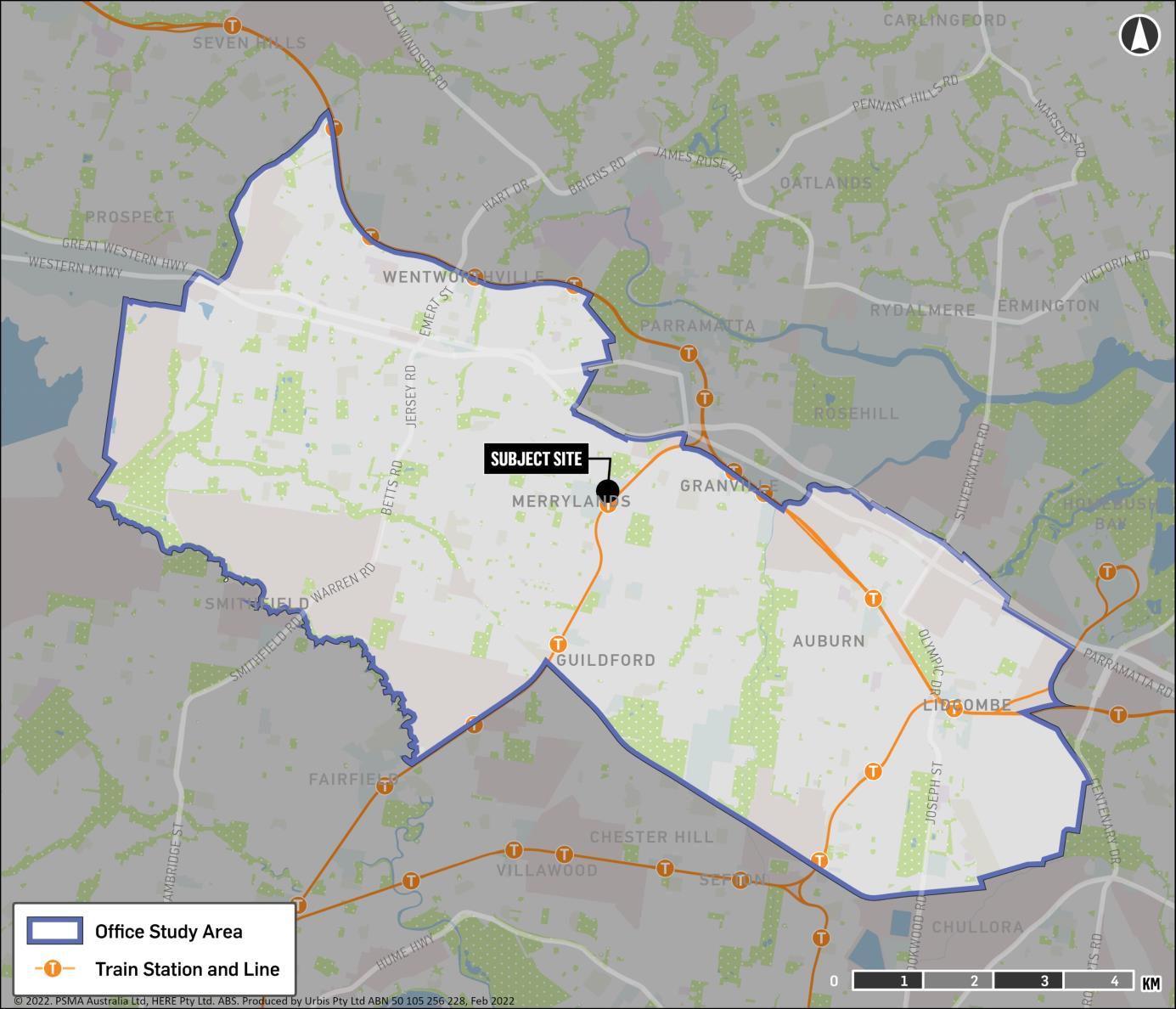

The map opposite outlines the Study Area that has been adopted for the assessment of the residential market. The Study Area is generally bounded by:

• The Smithfield, Wetherill Park and Yennora Industrial areas to the south

• Prospect Reservoir to the west

• The M2 and Seven Hills Industrial Area to the north

• Silverwater Industrial Area, Parramatta and Duck Rivers to the east.

The Study Area indicates that Merrylands is part of the Parramatta residential market, comprising primarily of the Cumberland and Parramatta LGAs (as highlighted by the migration analysis). The Study Area also aligns with the recent buyer profile of apartment projects in the Merrylands Study Area, which have generally attracted a large proportion of local buyers.

Study Area

23/02/2022 Merrylands Market Assessment Page 15

HISTORICAL POPULATION GROWTH

Growth Trends

The rate and extent of future population growth in the Study Area will have a substantial bearing on future demand for residential dwellings.

The population in the Study Area has recorded growth from 249,232 in 2011 to 300,963 in 2020 at an average growth rate of 2.1%.

From 2019-2020, population growth was low at 1,425 people. The Study Area witnessed a net outflow from internal migration. This was more than offset by net overseas migration and natural increase in 2019-20.

The three years prior, from 2016-17 to 2018-19, are more likely to be reflective of the future population components. Over this time approximately 26,591 came from net overseas migration and 10,990 came from a natural increase, net internal migration reflecting households moving from the region, accounted for -17,872 people over the period. This reflected net growth of 26,591 residents. Overall, Metropolitan Sydney records a net outflow of internal migration as households look to move to more affordable locations.

The components of growth in the Study Area differ from the Greater Sydney average, in that it relies more heavily on international migration and experiences a significantly greater net internal migration loss.

With COVID-19 having resulted in the closure of international borders, net international migration was down from 8,472 in 2018-2019 to 5,819 in 2019-2020.

Study Area Historical Population Growth

23/02/2022 Merrylands Market Assessment Page 16 Source:

Source:

0.0% 0.6% 1.2% 1.8% 2.4% 3.0% 3.6% 0 50,000 100,000 150,000 200,000 250,000 300,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Growth Rate Population Population % Growth -10,000 -5,000 0 5,000 10,000 15,000 2017 2018 2019 2020 Share of Annual Growth Natural

Net

Net

Study Area Population Growth by Component, 2016-2017 to 2019-2020

ABS

ABS

Increase

Internal Migration

Overseas Migration

PROJECTED POPULATION GROWTH

Implications

The rate and extent of future population growth in the Study Area will have a substantial bearing on future demand for residential dwellings.

Prior to the onset of the COVID-19 pandemic, the NSW Government forecast population growth to slow down from 2.2% per annum from 2016-21 to 1.5% per annum from 2026-31. COVID-19 will likely impact population growth in the area in the short term. The Cumberland and Parramatta LGAs are likely to witness a similar impact to Greater Sydney. While the LGAs are more reliant on international migration, they are benefiting from a shift in population from inner city areas to the suburbs and a rising birth rate.

The chart shows the projected age distribution within the Study Area from 2016 to 2036. The proportion of residents aged 40 and above is forecast to increase from 39% in 2016 to 45% by 2036. This cohort is anticipated to represent a growing market segment for apartments in the future as older residents look to downsize and workers look for accommodation close to the growing Parramatta CBD and surrounding industrial areas.

Overall, the population of the Study Area is projected to grow at a slowing rate over the next decade, with the time taken for the COVID-19 recovery having an impact in the short term.

Projected Study Area Population Growth by Age

23/02/2022 Merrylands Market Assessment Page 17

20% 20% 21% 21% 20% 12% 12% 11% 11% 11% 31% 31% 29% 26% 24% 22% 22% 24% 26% 27% 15% 16% 16% 17% 18% 0% 20% 40% 60% 80% 100% 2016 2021 2026 2031 2036 Age Distribution Aged 0-14 Aged 15-24 Aged 25-39 Aged 40-59 Aged 60+

Source: NSW Department of Planning, Industry and Environment

HOUSEHOLD GROWTH

Key Findings

The proportion of couple families with children in the Study Area is projected to stabilise at 40% over the 15 years to 2036. This is in contrast to an increase in the proportion of lone person households from 19% to 21%. This will increase the demand for studio and one-bedroom apartments.

The proportion of couples is expected to fall slightly and single parent families are projected to increase slightly over the 20-year period. The average household size is projected to fall from 2.88 in 2016 to 2.78 in 2036 as a result of the increase in one person households over the period.

Study Area Household Projections

Household Size Projections

23/02/2022 Merrylands Market Assessment Page 18

Source: NSW

of Planning, Industry and Environment Region 2016 2021 2026 2031 2036 Cumberland LGA 3.03 3.01 2.98 2.96 2.93 Parramatta LGA 2.75 2.72 2.71 2.69 2.66 Study Area 2.88 2.85 2.83 2.81 2.78 Metro Sydney 2.78 2.73 2.71 2.69 2.66 20% 20% 20% 19% 19% 40% 40% 40% 40% 40% 10% 10% 11% 11% 11% 5% 5% 5% 5% 5% 19% 19% 19% 20% 21% 5% 5% 5% 5% 5% 0% 20% 40% 60% 80% 100% 2016 2021 2026 2031 2036 Household Type Share Couple Couple with children Single parent Other family households Lone person Group Source: ABS Census; Urbis

Source: NSW Department of Planning, Industry and Environment

Department

DEMOGRAPHIC CHARACTERISTICS

Characteristics

The chart summarises the key demographic characteristics of the Study Area population compared to the Greater Sydney average. It is based on 2016 Census data and illustrates the differing characteristics of residents. The Study Area population in 2016 was characterised by:

• A relatively lower socio-economic area with personal incomes around 21% below the Sydney average. This data highlights that affordability is a key driver of housing demand.

• A relatively higher proportion of families (especially couples with children of 14 years or younger), indicating there will be demand for 2+ bedroom apartments.

• Around 20% of households are single-person households, indicating some demand for onebedroom apartments in the area. However, demand will be lower than in other areas in Sydney where there are more students and lone person households.

• Almost half of the households are renters, indicating there will be some interest from investors in the area.

• Around 30% of households are purchasing their homes, which reflects a significant portion of households looking to enter the housing market in the Study Area.

Key Demographic Characteristics

23/02/2022 Merrylands Market Assessment Page 19 Source: ABS, Urbis -25%-20%-15%-10% -5% 0% 5% 10% 15% 20% 25% Variation from Sydney Average $39,817 $90,155 68% 8% 34.1 3.0 22% 29% 11% 5% 7% 5% 20% 48% 24% 30% 56% Avg. Per Capita Income (15-64 aged) Avg. Household Income White Collar (%) Tertiary Student Average Age Avg. Household Size Couple family with no children Couple family with children < 15 Couple family with children > 14 One parent family with children < 15 One parent family with children > 14 Group Household Lone Person Household Renter (%) Owner (%) Purchaser (%) Born Overseas Merrylands

TARGET BUYER MARKET

Key Findings

In 2020, approximately 31% of people in households within the Study Area were aged between 25-39, which is higher than the Greater Sydney metropolitan area (25%). The area boasts strong demand drivers for younger singles and couples, including proximity to jobs, public transport and amenity. The competitor analysis also highlights that recent projects in the Study Area have attracted a number of local first home buyers due to the relative affordability. This segment will be attracted to the two-bedroom bedroom product and one-bedroom units to a lesser extent.

Approximately 48% of households in the Study Area are renters, which is significantly higher than Greater Sydney (36%). The area boasts solid rental drivers, including proximity to jobs, hospitals, transport and amenity. The competitor analysis highlights that recent projects in the Study Area have attracted local investors. This segment will be attracted to the one-bedroom and two-bedroom products.

The catchment is home to a relatively lower proportion of people aged 60+ than the Sydney average. However, the projected increase in the ageing population will increase demand for suitable units, allowing retirees to free up money by downsizing and selling their homes. This age segment will be attracted to the larger twobedroom and three-bedroom products. The proximity to major local medical facilities, including the Westmead Health District, is also likely to be attractive to this age cohort.

Buyer Segments

First Home Buyers

Investors

Downsizers

23/02/2022 Merrylands Market Assessment Page 20

Source: Urbis

SUPPLY

23/02/2022 Merrylands Market Assessment Page 21

APARTMENT SUPPLY

Key Findings

This section assesses the existing and proposed supply of residential dwellings in the Study Area. Dwelling completions for the Study Area between 2016-17 to 2020-21 averaged around 3,230 per annum. The completion rate spiked considerably in 2016-17 (reaching 4,285 dwellings) before declining to a low in 2019-20. Apartments will continue to dominate development activity in the Study Area due to the lack of vacant land for house development.

New dwelling approvals peaked in 2017-18, although this did not flow through to completions in 2019-2021. This lack of transfer indicates that many projects have not moved to construction as the apartment market softened.

New dwelling approvals decreased in 2018-19 and 2019-20 due to the slowdown in the apartment market and COVID-19 at the start of 2020. This decline indicates that completions are likely to remain relatively low in the short to medium term. Before bouncing-back on the 2020-21 rise in approvals. Overall, with the exception of 2019-20 (due to COVID-19) new building approvals have been fairly consistent over the five years.

Dwelling Completions, Study Area

New Building Approvals, Study Area

23/02/2022 Merrylands Market Assessment Page 22

Source:

Average1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2016-17 2017-18 2018-19 2019-20 2020-21 Number of dwellings obtaining Building Approval Apartments Houses Semi Detached Average 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 2016-17 2017-18 2018-19 2019-20 2020-21 Number of Dwellings Completed Flats/Units/Apartments Houses Townhouses

Source: ABS Small Area Completion estimates and NSW Department of Planning, Industry and Environment

ABS

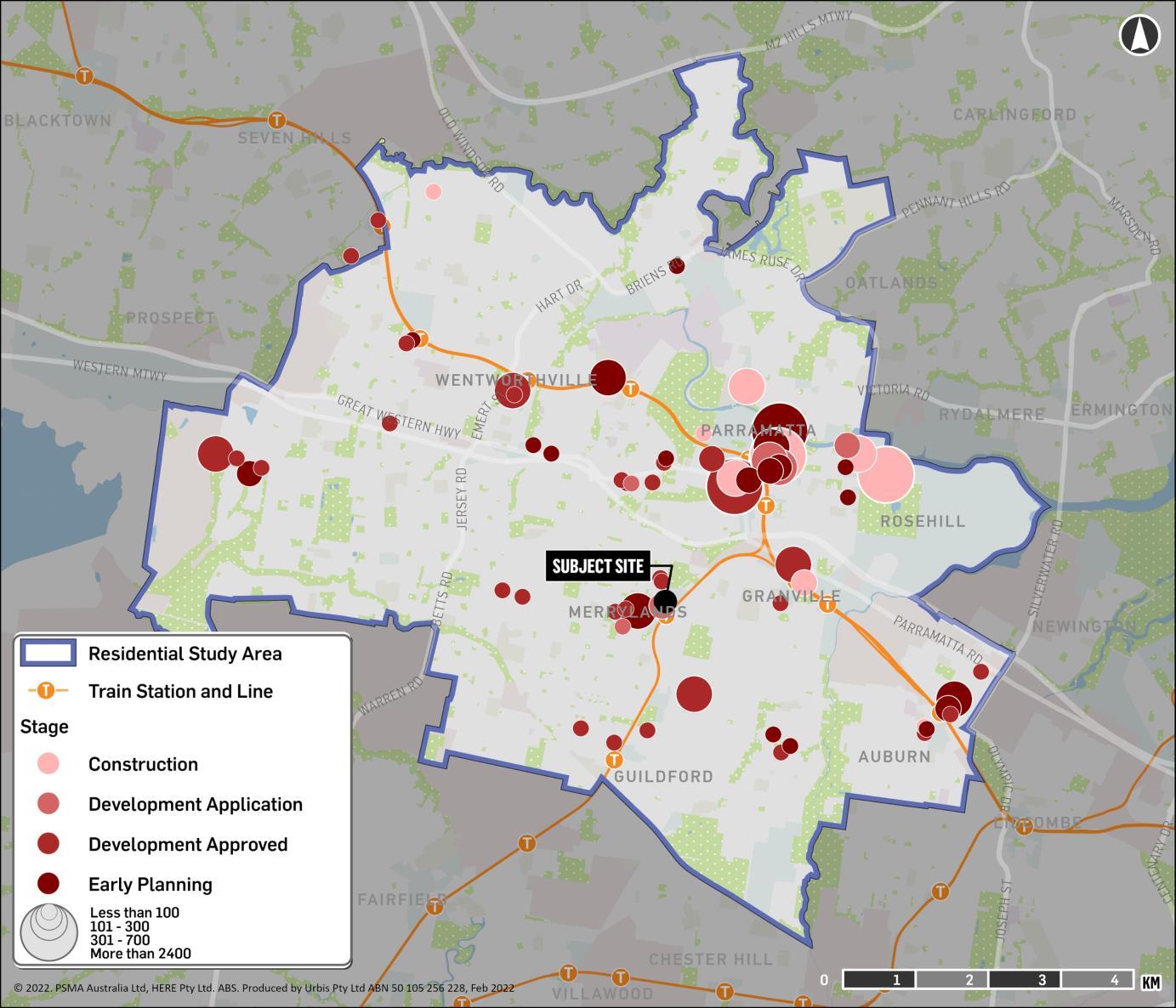

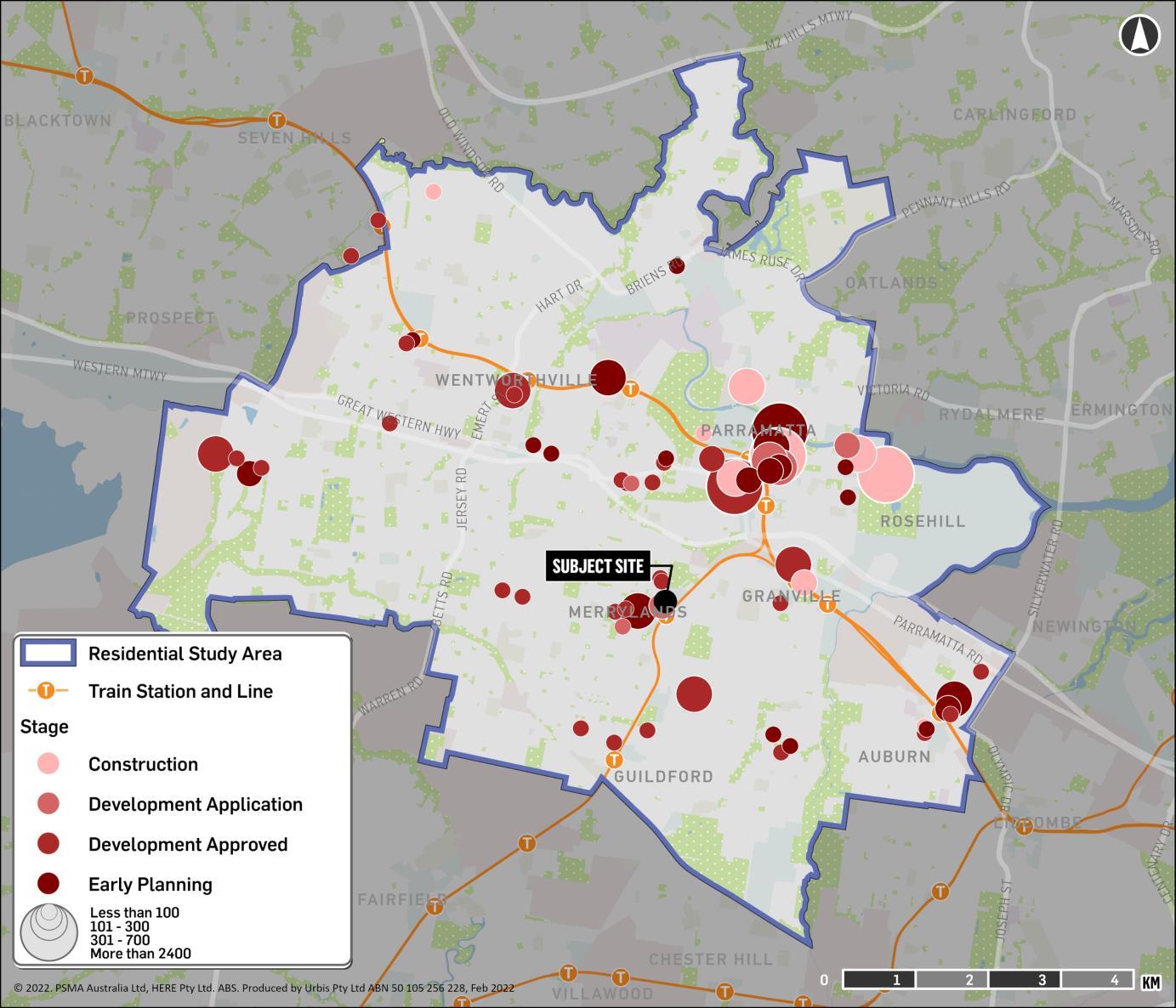

Key Findings

According to Cordell Connect and Urbis research, there are around 96 proposed apartment projects (with 25+ units) within the Study Area that have the potential to be completed over the next eight years, comprising a total of 12,963 units. These projects are either under construction, have achieved development approval or have applied for development approval.

Approximately 4,186 dwellings have commenced construction, with 8,276 having achieved development approval and 1,352 in the development application stage.

There are an additional 5,110 units in the early planning stages which could commence over the next ten years. The majority of these are located in Parramatta, although the largest is located at the James Hardie Redevelopment Site at 181 James Ruse Drive and 1 Grand Avenue, Camellia. This proposal includes approximately 2,400 residential apartments and over 14,000 sq.m of retail/commercial gross floor area. The concept is for 14 buildings ranging from 7-16 storeys. There is considerable uncertainty regarding if and when this project could proceed.

Study Area Proposed Apartments and Status

FUTURE RESIDENTIAL SUPPLY

23/02/2022 Merrylands Market Assessment Page 23

0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2022 2023 2024 2025 2026 Number of Units

Source: Cordell Connect; Urbis Apartment Essentials

Construction Development Approval Development Application

FUTURE RESIDENTIAL SUPPLY

Key Findings

The majority of larger apartment projects in the pipeline are located around the various town centres within the Study Area. This includes strong development activity in:

• Parramatta – Accounts for the majority of supply in the Study Area. Parramatta has a median unit price of $605,000, which is above the Study Area average

• Merrylands - Median unit price of $460,000, which makes the area a relatively affordable option.

• Granville - Median unit price $470,000

• Auburn - Median unit price $550,000

While many projects are also located along major transport corridors, there are a number of projects scattered throughout the Study Area, indicating large development sites are becoming more difficult to source in high demand locations.

Future Residential Apartment Supply

23/02/2022 Merrylands Market Assessment Page 24

COMPETITOR ANALYSIS

23/02/2022 Merrylands Market Assessment Page 25

COMPETITION SUMMARY

KEY COMPETING LOCATIONS PRICING

• Competing locations are those which are competing directly for potential buyers with the subject site. They are:

• Positioned at the affordable end of the market

• Have apartment developments located close to amenity

• Provide easy access to high frequency public transport networks.

• Merrylands is a key competing market for the younger demographic. The high range of amenities (shopping, entertainment, cafes, restaurants and licensed venues) within short walking distance of apartments has proven attractive to young buyers and renters.

• Locations in close proximity to train stations like Merrylands (such as Parramatta, Granville and Westmead) are attractive to investors as there is a strong market for younger people looking to rent in areas with good access to jobs in surrounding town centres, Parramatta and the Sydney CBD.

DWELLING MIX

• The majority of projects in the Study Area comprise primarily of one and two bedroom units. This mix reflects the combination of relative affordability in the region meaning many of buyers are looking for more space and flexibility offered by two bedroom units and the proximity to employment areas attracting a high number of lone person households. Of the profiled projects, the average mix was:

• Studio: 7.3%

• 1-Bed: 32.4%

• 2-Bed: 54.3%

• 3-Bed: 6.0%

• The above mix is consistent with what is generally observed in western-Sydney locations which consist of a mix of families, couples and individuals. Two of the five projects had studio apartments, which is likely due to its proximity to the Parramatta CBD and the Westmead hospital precinct which would generate demand from single person households.

• With a relatively smaller downsizer market in the region, the market historically being a younger demographic and strong competition from townhouse and houses in the surrounding area, 3-bedroom apartments have accounted for only 6% across the projects.

• Understanding pricing in the current market is challenging, as there has been limited sales activity from both off-the-plan and new apartment resales. Quality apartment accommodation (while starting to improve) is still limited which is keeping prices lower.

• Mason and Main represents the closest comparable to the subject site based on location. However, the subject site is considered to be a superior location due to proximity to the Merrylands Train Station. The development is advertising a starting price of $610,000 for two-bedroom, twobathroom units according to the agents.

• The recently completed projects in Merrylands also represent a relevant comparison in terms of location though the subject site development is anticipated to be of a higher quality and provide better onsite amenity. These completed projects have recorded a mix of prices ranging from around $465,000 to $530,000 for a one-bedroom unit and from $515,000 to $699,000 for a two-bedroom twobathroom unit.

• In the nearby suburb of Granville a recently completed unit development (in a comparable location close to the local train station and amenities) recorded one-bedroom prices ranging from $399,000 to $494,000 and two-bedroom, twobathroom units ranging from $645,000 to $777,000

23/02/2022 Merrylands Market Assessment Page 26

MASON AND MAIN

Developer Coronation Property

Location 249-259 Merrylands Road, 52-54 McFarlane Street

Merrylands

Council Area Cumberland

Location

Characteristics

• Located within Merrylands Town Centre

• 50 metres to Stocklands Merrylands

• 500 metres to Merrylands Train Station

• 1.1 km Merrylands East Public School

• 2.6 km Merrylands High School

Completion May 2025

Project Launch July 2021

Status Construction

Total Units 794 (Buildings 1-3: 433 BTR , Buildings 4-5: 361 BTS)

Property Description

• Five mixed use apartment buildings of 13-25 storeys, 23 retail and 11 commercial tenancies, Childcare centre

• Balconies and intercoms

• Delonghi stainless steel appliances, gas cooktop, dishwasher, floorboards, built-in wardrobes and air conditioning.

Parking 936 spaces

Ancillary Facilities Swimming Pool and Outdoor entertainment area including BBQ areas and resort-style cabanas and sun beds.

Gym and workout space

Take-up Rates The project was launched in July 2021. The apartments in buildings 13 are going to be developed as build-to-rent and buildings 4-5 are build-to-sell and are available for sale off the plan.

The agent has not provided take-up rates for the build-to-sell apartments

Buyer Profile Not provided by agent

Note: * Asking starting sales prices as at February 2022.

Note: ^ Advertised rental estimate from https://masonandmain.com.au/residences/.

Source: Sales agents and Mason and Main website

23/02/2022 Merrylands Market Assessment Page 27

Type Mix (no.) Internal Size (sq.m) Expected Price Range* Expected Weekly Rental Range^

129 42 From $394,000 $420-$470

Bed, 1 Bathroom 264 50-60 From $480,000 $490-$560

Bed, 2 Bathroom 379 75-85 From $610,000 $550-$650

Bed, 2 Bathroom 18 98-103 From $879,000 $680-$720

Studio

1

2

3

THE TERRACE, MERRYLANDS

Developer Ham & Sons Pty Ltd

Location Building 1, 84-86 Railway Terrace, Merrylands

Council Area Cumberland

Location Characteristics

• Located on the Eastern side of the railways line from the Subject Site

• 400 metres to Merrylands Train Station

• 700 metres to Stockland Merrylands

• 1km to Merrylands East Public School

• 3.3km Merrylands High School

Completion March 2021

Project Launch March 2016

Status Built Total Units 33

Property Description

• Seven-storey residential development.

• Gas cook top & hot water system

• Timber floor throughout

• Air Conditioning and Air Purifier

• Dishwasher & Dryer

Parking 41 spaces

Ancillary Facilities Basement parking for 36 vehicles and five at grade spaces. Outdoor entertainment area, fully fenced.

Associated landscaping.

Take-up Rates The project launched in March 2016.

From May 2020 to completion sales occurred at an average of around one to two per month.

Buyer Profile Not provided by agent. Based on analysing the properties with rental data or asking rents available, around 20% of the building is owned by investors.

RECENT SALES

Note: * Actual sales prices from 2020 Source: Pricefinder

23/02/2022 Merrylands Market Assessment Page 28

No. Type Sale Date Price 28 2 Bed, 2 Bath, 1 Car 1/011/2021 $600,000 24 2 Bed, 2 Bath, 1 Car 1/11/2021 $595,000 4 2 Bed, 2 Bath, 1 Car 21/05/2021 $570,000 21 3 Bed, 2 Bath 22/04/2021 $635,000 5 2 Bed, 2 Bath, 1 Car 11/03/2021 $570,000 11 2 Bed, 2 Bath, 1 Car 08/03/2021 $570,000 2 1 Bed, 1 Bath, 1 Car 2/03/2021 $465,000 Type Mix (no.) Internal Area (sq.m) Price Range* Recent and Asking Weekly Rental Range 1 Bed, 1 Bathroom 3 50 $465,000-$530,000 $400-$450 2 Bed, 2 Bathroom 27 76-79 $515,000-$600,000 $450-$510 3 Bed, 2 Bathroom 3 106-117 $632,000-$660,000 $545

SKYE AT THE MILLS

Developer Landmark Group

Location Buildings 3 and 4, 1-7 Neil Street, Merrylands

Council Area Cumberland

Location

Characteristics

• Located near the border between Merrylands and Holroyd.

• 500 metres to Merrylands Train Station

• 700 metres to Stockland Merrylands

• 1.3 km to Merrylands East Public School

• 3.5 km to Merrylands High School

Completion 2022

Project Launch February and September 2017

Status Construction

Total Units 311 (Building 3 - 178, Building 4 - 133)

Property Description The property consists of two residential towers of 12storeys, Apartments feature:

• Open plan living spaces

• Kitchen with gas cooktop and dishwasher

• Internal laundry and dryer

• Air-Conditioning and security intercom

Parking Basement car parking for 438 vehicles & 195 bicycles over 3 levels.

Ancillary Facilities Landscaping.

Total communal open space 1,883 sq.m

Take-up Rates The Mills project launched in February 2017 and is estimated to have averaged around four per month.

Buyer Profile From analysing the properties with rental data or asking rents available, around 50% of the building has been purchased by investors.

Note: * Refers to achieved and asking sales prices range from 2020. Source: Urbis Essentials and Pricefinder

23/02/2022 Merrylands Market Assessment Page 29

Type Mix (no.) Internal Size (sq.m) Price Range* Recent and Asking Weekly Rental Range 1 Bed, 1 Bath 118 55-72 $490,000-$507,000 $390-$410 2 Bed, 2 Bath 168 75-104 $625,500-$699,000 $400-$480 3 Bed, 2 Bath 25 95-111 $722,500-$750,000 $490-$570

ARCADIA GARDENS

Developer Special Land Development Pty Ltd

Location 23-27 Paton Street, Merrylands West

Council Area Cumberland

Location

Characteristics

• Located between Merrylands and Merrylands West.

• 2.6 km to Merrylands Train Station

• 1.9 km to Greystanes Shopping Centre

• 900 metres to Merrylands High School

• 1.5 km to Merrylands Public School

Completion June 2020

Project Launch October 2016

Status Built

Total Units 65

Property Description Five storey apartment building with secure underground parking. All apartments come with:

• Gas kitchen with polyurethane and polytec cupboards, 40mm stone bench tops, stone splash back and stainless-steel Westinghouse appliances

• Plush carpet, mirrored and glass built-in wardrobes, LED down lights and air conditioning

Parking Basement & at grade carparking giving total parking for 132 vehicles & 44 bicycles.

Ancillary Facilities Communal roof top terrace and landscaping

Take-up Rates Sold at an average rate of around one per month over 2019.

Buyer Profile Not provided by agent

RECENT SALES

Note: *Refers to properties sold from H2 2019 to current or current advertised sale prices

Agent Discussions, Pricefinder RP Data and Urbis

23/02/2022 Merrylands Market Assessment Page 30

Type Mix (no.) Internal Area (sq.m) Price Range* Recent and Asking Weekly Rental Range Studio 3 57-58 $375,000 $330-$340 1 Bed, 1 Bath 4 48-78 $375,000-$399,000 No rentals 2 Bed, 1 Bath 17 75-83 $500,000-$550,000 $400-$460 2 Bed, 2 Bath 35 71-97 $517,000-$560,000 $400-$490 3 Bed, 2 Bath 6 92-107 $600,000-$665,000 $490-$540

No. Type Sale Date Price 3 2 Bed, 1 Bath, 1 Car 11/12/21 $515,000 15 2 Bed, 2 Bath, 1 Car 3/12/21 $545,000 33 2 Bed, 1 Bath 3/12/21 $515,000 31 2 Bed, 2 Bath, 1 Car 30/10/21 $560,000 39 2 Bed, 2 Bath, 1 Car 16/10/21 $538,000 55 2 Bed, 1 Bath, 1 Car 19/03/21 $500,000 30 3 Bed, 2 Bath, 1 Car 2/02/21 $610,000

Source:

GRANVILLE PLACE

Parking Basement carparking over 5 levels for a total of 730 vehicles & 337 bicycles.

Ancillary Facilities Features include a lawn, outdoor lounging zones, barbeques, playground, hammock grove and a podium oasis.

Take-up

Developer Develotek Property Group and Ausbao Pty Ltd

Location Buildings 1-3, 14-38 Cowper Street, Granville

Council Area Cumberland

Location Characteristics

• Located within Granville Town Centre

• 50 metres to Granville Train Station

• 250 m walk to Granville Swimming Centre

• 230 m walk to Granville Memorial Park

• 4 km to the Westmead healthcare precinct

Completion November 2021 and 2022

Project Launch March 2018

Status Built

Total Units 620

Property Description

• Three towers of 14-storeys, 21-storeys and 22storeys mixed-use building comprising commercial/retail including Woolworths Metro, restaurants, café's, gym, specialty stores, childcare and medical centre. Apartments feature:

• Timber flooring in living room

• Fisher and Paykel appliances and ducted air conditioning.

As of December 2019 the project was 76% sold and only five remain for sale in the building . Equated to a sales rate of around three units per month from launch date to November 2019.

Buyer Profile Not provided by agent

RECENT SALES

Note: * Refers to achieved sales prices range from 2020. Asking prices as at February 2022.

Source: Urbis Essentials, Developers Urban Design Report and Cordells

No. Type Sale Date Price 1305 2 Bed, 2 Bath 1/09/2021 $671,000 801 1 Bed, 1 Bath 2/08/2021 $478,500 306 2 Bed, 2 Bath 30/07/2021 $658,000 1103 3 Bed, 2 Bath 29/07/2021 $852,000 1502 3 Bed, 2 Bath 7/07/2021 $893,000 1204 2 Bed, 2 Bath 25/06/2021 $766,000 1603 3 Bed, 2 Bath 25/06/2021 $920,000

23/02/2022 Merrylands Market Assessment Page 31

Type Mix (no.) Internal Size (sq.m) Price Range* Recent and Asking Weekly Rental Range 1 Bed, 1 Bath 184 49 $399,000-$494,000 Asking: $460,000 $380-$420 2 Bed, 2 Bath 378 86 $645,500-$777,000 Asking: $666,000 $470-$550 3 Bed, 2 Bath 58 94 $770,000-$870,000 Asking $750,000 $560-$680

Rates

SUMMARY OF UNIT MIX AND SALES RATES

*Where lists were not available an indicative average was calculated and checked with agents

^ Internal areas exclude balconies and car spaces

Source: Urbis, Pricefinder, RP Data and Agents

23/02/2022 Merrylands Market Assessment Page 32 Project Suburb Status Yield Type Mix (no.) Average Internal Size^ (sq.m) Sales Prices Indicative Average Price per sq.m* Commentary Mason and Main Merrylands Construction 794 Studio 129 42 $394,000 $9,381 Starting advertised prices as at February 2022. Subject site is similar, but slightly better located in closer proximity to the train station. Includes 433 BTR units 1 Bed, 1 Bath 264 55 $480,000 $8,727 2 Bed, 2 Bath 379 80 $610,000 $7,625 3 Bed, 2 Bath 18 100 $879,000 $8,790 The Terrace Merrylands Built 33 1 Bed, 1 Bath 3 50 $465,000-$530,000 $9,950 Inferior location and amenity to Subject Site 2 Bed, 2 Bath 27 77 $515,000-$600,000 $7,492 3 Bed, 2 Bath 3 104 $632,000-$660,000 $6,176 Skye at The Mills Merrylands Construction 311 1 Bed, 1 Bath 118 61 $490,000-$507,000 $8,074 Inferior location and amenity to the Subject Site 2 Bed, 2 Bath 168 81 $625,500-$699,000 $7,851 3 Bed, 2 Bath 25 101 $722,500-$750,000 $7,292 Arcadia Gardens Merrylands West Built 65 Studio 3 57.5 $375,000 $6,522 Inferior location and amenity to Subject Site 1 Bed, 1 Bath 4 59 $375,000-$399,000 $7,457 2 Bed, 1 Bath 17 78 $500,000-$550,000 $6,658 2 Bed, 2 Bath 35 84 $517,000-$560,000 $6,215 3 Bed, 2 Bath 6 97.5 $600,000-$665,000 $6,410 Granville Place Granville Built 618 1 Bed, 1 Bath 184 49 $399,000-$494,000 $9,388 Closer to Parramatta CBD and, therefore, a slightly superior location to the Subject Site. Similar amenity. 2 Bed, 2 Bath 378 86 $645,500-$777,000 $7,744 3 Bed, 2 Bath 58 94 $770,000-$870,000 $8,191

Key Findings

DEMAND

23/02/2022 Merrylands Market Assessment Page 33

LOCAL AMENITY AND DEMAND DRIVERS

Key Findings

There are four key drivers of residential housing demand relevant to the proposed development at Merrylands.

The table on the following page provides a brief description of these drivers and the implications for the subject site. The subject site ranks highly against several of the key success drivers with good proximity to public transport, retail/entertainment, schools and employment centres. The development is anticipated to comprise retail and open space which will increase amenity available to residents. Limited views are a constraint to the site.

Surrounding Amenity

Access to Amenities and Services

Transport Accessibility and Infrastructure

Employment Opportunities

23/02/2022 Merrylands Market Assessment Page 34

View corridor towards Holroyd Gardens

SUBJECT SITE

Merrylands Train Station Granville TAFE

Stockland Merrylands

Granville Train Station

Holroyd Private Hospital

Holroyd Gardens

Granville Park

Merrylands Park

Woolworths Granville

DRIVERS OF RESIDENTIAL DEMAND

Key Demand Drivers for Residential Development Factors Components

1. Attractive Views and Surrounding

A good outlook that includes views of the ocean/ harbour, surrounding region, and northernly aspects that maximise light and climate benefits, increase demand and price point.

2. Transport Accessibility and Infrastructure

Access to good public transport and road infrastructure are important to potential purchasers and renters. Particularly, linkages to the CBD, airport and major employment centres.

Future infrastructure projects can revitalise areas, improve connectivity and linkages, create new jobs and reshape the existing community.

✓ North Aspects

✓ Regional Views

x Premium Views

Implications for the Subject Site

• The apartments on the upper levels will offer views across the region. These regional views will be attractive to some buyers, though unlikely to be a major selling point.

• The proximity to the railway line may impact take-up due to the noise produced by passing trains. As a result, noise minimisation similar to other projects in the area will need to be considered in the design.

✓ Train

✓ Main Roads

✓ Bus

x Future Metro

• Merrylands Station is located approximately 20 metres north of the Subject Site. This station operates on the T2 Inner West and Leppington and T5 Cumberland Railway Lines which offers connectivity to major employment hubs including the Parramatta, Sydney and Liverpool CBDs.

• The Cumberland Highway is a main north-south arterial road servicing vehicles travelling to and from Merrylands towards North-West Sydney and Liverpool.

• The M4 Motorway is the main east-west arterial road servicing people connecting from Blue Mountains to the CBD.

23/02/2022 Merrylands Market Assessment Page 35

DRIVERS OF RESIDENTIAL DEMAND

Factors

3. Amenities and Services

Locations that have easy access to shops, public transport, parks, entertainment and dining options, medical facilities and school will be highly demanded as residential locations. These factors remain high on the priority lists of those looking to rent or buy.

Components

Implications for the Subject Site

✓ Shops, Cafes/ Restaurants

✓ Open Space/ Recreational Space

✓ Schools

✓ University/TAFE

✓ Health Services

• Stockland Merrylands Shopping Centre, the largest shopping centre in the suburb, the closest Super Regional centre is Westfield Parramatta approximately 2.8 km south-west of the Subject Site.

• The subject site is serviced by several schools within a 3.5 km driving distance including Merrylands East Primary School (1.1 km), Parramatta West Public School (2.3 km), Merrylands Public School (2.5 km) and Merrylands High School (3.1 km). However, there are no schools within an easy walking distance

• The WSU International College and Sydney Graduate School Of Management SGSM campuses Parramatta, WSU Westmead and University of New England Parramatta are located within 5km of the site via car or public transport. TAFE NSW Granville campus is located 2.4 km from the Subject Site.

• The subject site is less than 5km drive from the Westmead Health and Education Precinct and 2.2km from Holroyd Private Hospital.

4. Employment Opportunities

Residents often prefer to live close to work, enabling them to minimise travel times and improve work/life balance.

✓ Local jobs

✓ Sydney CBD

✓ Parramatta CBD

✓ Aerotropolis

• A large portion of Cumberland LGA residents work locally within the Council area. There are several employment centres including the Parramatta and Sydney CBDs and surrounding industrial areas where residents also commute to work.

• According to Journey to Work Data, approximately 14.9% of residents within Cumberland travel to the Parramatta CBD for work followed by Sydney CBD (14.3%). The train line provides direct access to these centres.

• The Western Sydney Airport will be a major catalyst for employment growth within the western suburbs of Sydney with potential for around 28,000 people to be employed in the Aerotropolis by 2030. There is potential for a North South Rail Link from Macarthur to St Marys via the new airport, which would improve access to jobs.

23/02/2022 Merrylands Market Assessment Page 36

MEDIAN PRICES & SALES

Key Findings

The Cumberland and Parramatta LGAs cover the majority of the Study Area and have been assessed to understand apartment sales trends.

The median unit price in the Cumberland LGA peaked at $600,000 in the second half of 2017. Prices then declined to $550,000 in the first half of 2019. Activity and prices subsequently rebounded increasing to $575,000 by the end of 2021.

The Parramatta LGA experienced a median apartment price peak in the first half of 2017 and followed a similar trend to Cumberland LGA with the trough in prices occurring during the first half of 2019 with a median of $650,000. Activity and prices have since risen with a median of $706,000 achieved in the first half of 2021.

Average price growth within the LGAs has averaged 5.3% p.a. for Cumberland and 4.7% for Parramatta (off a higher base) over the last decade. The number of yearly unit sales in the LGAs has fluctuated from 3,840 to 9,650 per year with an average of 5,870 per annum since the start of 2007.

Study Area Apartment Price Growth

Note: Data is from December 2010 to December 2021. Sales from 2019-2021 are underreported as does not include off-the-plan sales that are yet to settle.

Source: Pricefinder

23/02/2022 Merrylands Market Assessment Page 37

$575,000 $700,000 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 0 1,000 2,000 3,000 4,000 5,000 6,000 Jun-07 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15 Jun-16 Dec-16 Jun-17 Dec-17 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Median Sale Price Number of Apartment Sales Cumberland Council Number of Sales City of Parramatta Council Number of Sales Cumberland Council Median Price City of Parramatta Council Median Price

RENTAL MARKET

Key Findings

The rental market provides a good indication of the state of the residential market, with rents and vacancy rates responding quickly to supply and demand dynamics. The rental market throughout Sydney was tight from June 2010 to June 2018, with vacancies remaining between 1.0% and 2.5%. In the following three years, the market softened, with vacancy rates increasing to around 4.0% in May 2020, according to SQM Research. The biggest spike in this period was from 3.0% in March 2020 to 4.0% in May 2020, due to COVID-19 impacting the absorption of new supply and tenants ending leases. The Merrylands rental market has generally followed a similar trend to the broader Sydney market. However, vacancy rates have diverged since the onset of COVID19, as people have moved to suburban locations and new supply has been completed in Merrylands.

A vacancy rate of 3.0% generally indicates the rental market is in equilibrium. A lower vacancy rate suggests the market is undersupplied, and this can result in rental growth. A higher vacancy rate indicates excess rental properties that can result in landlords lowering rents. The chart bottom right depicts median rents in the Cumberland and Parramatta LGAs, compared to Greater Sydney for one and two-bedroom units. Rental growth in apartments has decreased in the LGAs and Sydney region over the past four years. Rents in the four years to September 2021 fell by 14.0% for one-bedroom units in Sydney, with a slightly lower decline for the Cumberland (-8.6%) and Parramatta LGAs (-10.9%). Two-bedroom units were similar, although the decline was more pronounced in the LGAs compared to Sydney; Cumberland (-13.6%) and Parramatta (11.5%). Driven by the vacancy decline, the trend appears to have turned, with growth or stable rents occurring in the September quarter of 2021.

Rental Vacancy Rate

Apartment Rental Growth

23/02/2022 Merrylands Market Assessment Page 38

Source: SQM Research; Urbis

$350 $380 $410 $460 $200 $250 $300 $350 $400 $450 $500 $550 $600 Greater

Greater

1-Bed Cumberland 1-Bed Cumberland 2-Bed Parramatta 1-Bed Parramatta 2-Bed 3.2% 2.6% 0% 1% 2% 3% 4% 5% 6% Dec-11 Apr-12 Aug-12 Dec-12 Apr-13 Aug-13 Dec-13 Apr-14 Aug-14 Dec-14 Apr-15 Aug-15 Dec-15 Apr-16 Aug-16 Dec-16 Apr-17 Aug-17 Dec-17 Apr-18 Aug-18 Dec-18 Apr-19 Aug-19 Dec-19 Apr-20 Aug-20 Dec-20 Apr-21 Aug-21 Dec-21 Residential Vacancy Rate Equilibrium Merrylands Postcode 2160 Greater Sydney

Source: NSW Department of Communities and Justice

Sydney 2-Bed

Sydney

TAKE-UP RATES

Key Findings

The table highlights the take-up of key apartment projects in Merrylands, Merrylands West and Granville launched over the last five years. Of the apartment complexes listed, the subject property is most comparable to Granville Place. Overall, the Study Area has averaged around 840 new apartment sales per year over the past four years. Sales rates have been decreasing over the past four years, with the impact of COVID-19 resulting in sales being below average in 2020 and 2021.

The outlook for apartment sales is positive, with confidence returning to the market, population growth expected to rise as borders reopen, and houses' relative unaffordability pushing first home buyers further west and towards apartment living.

Sales Rates for Projects

Note: * Average take-up over core sales period

Sales in Study Area

23/02/2022 Merrylands Market Assessment Page 39

Development Suburb Launch Total Units Estimated Takeup per Month* The Terrace Merrylands Mar-16 33 0.5 Lumiere Granville Jan-18 44 1.0 Atelier Granville Mar-16 33 0.5 Skye at the Mills Merrylands Sep-17 311 4.0 Acadia Gardens Merrylands West Oct-16 65 1.0 Aurora Granville Oct-16 463 3.7 Granville Place Granville Mar-18 620 3.0 New Apartment

Source: Pricefinder 0 200 400 600 800 1000 1200 2018 2019 2020 2021 Number of New Unit Sales Average

Source: Marketing agents, Pricefinder, Urbis

MARKET DEMAND

Demand and Market Share

It is challenging to estimate Subject Site take-up due to the considerable impacts of COVID-19 and uncertainty regarding the economic and property market recovery.

Before the COVID-19 pandemic, The NSW Department of Planning, Industry and Environment forecast Metropolitan Sydney population to increase by around 1.8% per annum from 2021-2036, equating to the demand of around 38,700 additional dwellings per year. The responses to COVID-19 are expected to result in declining population growth, mainly due to a fall in international migration due to border closures. As a result, Urbis forecasts Metropolitan Sydney population growth to slow in FY2021 and FY2022 before increasing once borders reopen.

In line with recent trends, apartments in Metropolitan Sydney will likely account for around 50% of dwelling demand in 2022, before increasing to 55% in 2035 as land for houses and townhouses is developed. The Study Area could achieve a share of around 8% of

Projected Net Take-Up

future apartment demand in Metropolitan Sydney, which is in line with the historical average of 7.8% from 2011 to 2020. Parramatta is likely to account for 50% of demand, with Merrylands, Auburn and Granville likely to take up the next largest demand shares in the Study Area. Based on these calculations, around 400 units are supportable in the Study Area in FY2022, increasing to 1,680 in 2035.

Given the development's scope, the proposed site will likely complete over several years starting from 2023 based on take-up and anticipated planning and construction timeframes.

Based on assessing the quantum, location and characteristics of the proposed competitive supply in the Study Area, the Subject Site development could potentially achieve a market share of between 4% and 5% of new apartment demand per year from 2023 onwards. The assumed market share is based on:

• The Subject Site is adjacent to the train station,

which is closer than competitive projects, but several are still within walking distance. Including the right mix of retail and amenity within the building will help improve the positioning. Overall, the project is considered of above-average competitiveness within the Study Area.

• There are around 24 projects (with 25+ units) currently under construction in the study area, which would equate to a 4% proportional market share for the subject site.

• The projects proposed to be completed from 20222026 equate to around 22 per year. Actual completion levels will depend on market conditions and the ability of developers to gain pre-sales and finance.

These adopted market shares equate to around 30-65 apartments per year in the low scenario and 40-85 apartments per year in the high scenario.

23/02/2022 Merrylands Market Assessment Page 40

2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Metropolitan Sydney Dwelling Demand 10,647 19,522 29,009 36,277 39,840 35,246 35,841 36,446 37,062 37,688 36,814 37,419 38,033 38,658 Proportion that are Apartments 50% 50% 51% 51% 52% 52% 52% 53% 53% 54% 54% 55% 55% 55% Metropolitan Sydney Apartment Demand 5,315 9,828 14,725 18,567 20,558 18,336 18,796 19,266 19,747 20,239 19,924 20,408 20,903 21,409 Study Area Share of Apartment Dwellings 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% 7.83% Study Area Apartments Demand 416 770 1,154 1,455 1,611 1,437 1,473 1,509 1,547 1,586 1,561 1,599 1,638 1,677 Cumulative Study Area Apt Demand 416 1,186 2,340 3,795 5,405 6,842 8,315 9,824 11,371 12,957 14,518 16,117 17,755 19,432 Cumulative Study Area Apt Supply 1,596 3,083 6,072 9,521 10,258 11,920 12,064 12,660 12,872 12,872 12,872 12,872 12,872 12,872 Supply Demand Gap -1,180 -1,897 -3,732 -5,726 -4,852 -5,078 -3,750 -2,836 -1,501 84 1,645 3,244 4,882 6,560 Market Share of Subject Site Low Scenario 4% 4% 4% 4% 4% 4% 4% 4% 4% 4% 4% 4% 4% High Scenario 5% 5% 5% 5% 5% 5% 5% 5% 5% 5% 5% 5% 5% Annual Subject Site Take-Up Low Scenario 31 46 58 64 57 59 60 62 63 62 64 66 67 High Scenario 38 58 73 81 72 74 75 77 79 78 80 82 84

RECOMMENDATIONS

Demand

The table outlines the recommended mix and indicative pricing ($2022) for the subject site.

Mix

The recommendation is that most apartments in the development contain two bedrooms and two bathrooms. This product is attractive to both younger couples and investors, which are likely to be the major buyer segments for the project. Onebedroom apartments are also attractive to some first home buyers and investors, although the majority would be looking for two bedrooms due to the relative affordability in the market. Three-bedroom apartments should account for under 10% of dwellings, with downsizers likely to account for a smaller segment of buyers and families being attracted to affordable townhouses and houses in the area.

Size

The recommended internal sizes are based on a comparison with recent projects smaller sizes would assist with affordability and likely result in shorter marketing periods.

Prices

The prices are indicative and will depend on many factors, such as the final design and quality of the project. The project's projected sales prices in $2022 have been estimated based on recent off-the-plan prices and new apartment resales in the area. The prices also consider competition from older house stock, which are an attractive alternative to buyers of three-bedroom apartments (particularly families). The median price for a house in Merrylands was $1.04M in the year to February 2022 with starting prices at around $775,000 for lower quality stock. As such, keeping three bedroom prices at the lower end of the house scale will be important to maintain affordability.

Take-up

Based on historical and projected demand and competition, the Subject Site could achieve a sales rate of around 30-40 per year (about three per month) in 2023 and pick up to 5-7 per month as the Sydney population recovers from COVID-19. However, there is a risk that the launch of major master-planned projects around the area could increase competition and impact take-up.

The take-up rates above are based on the adopted price ranges. Discounting prices is likely to result in a higher achievable take-up rate.

Recommended

23/02/2022 Merrylands Market Assessment Page 41

Type Mix Internal Size (sq.m) Indicative Price ($2022) Studio, 0-1 Car 0-5% 40-45 $370,000 - $410,000 1 Bed, 1 Car 25-35% 55-65 $450,000 - $520,000 2 Bed, 2 Bath, 1 Car 60-70% 75-85 $620,000 - $710,000 3 Bed, 2 Bed, 1-2 Car 5-10% 90-110 $770,000 - $880,000

Mix and Prices

Source: Urbis

RETAIL ASSESSMENT

23/02/2022 Merrylands Market Assessment Page 42

SCHEME REVIEW

23/02/2022 Merrylands Market Assessment Page 43

ALAND’S PROPOSED SCHEME

Key Findings

The proposed scheme provided to Urbis outlines the provision of ~2,000 to 3,500 sq.m of shopfront floorspace, split across seven buildings. The development is split into two components, separated by a new road which will allow for a new access point to the Merrylands town centre from Neil Street.

The western part of the development known as Site C (Buildings A, B and C) has exposure to this new road and also to Pitt Street, the main northsouth connection into and out of Merrylands. There is around 1,500 sq.m of retail space within Site C.

The eastern component (Buildings F-J) are more internalised, separated from the new road by public open space. Retail uses have the potential to interface with this new parkland area, allowing for outdoor dining, however suffer from a lack of exposure along Pitt Street. There is currently around 550 sq.m of retail space proposed though ALAND has advised they are considering increasing supply to around 2,000 sq.m.

The schemes are reviewed in detail in the following pages, highlighting the key considerations relating to potential constraints, challenges and opportunities.

Development Plans

23/02/2022 Merrylands Market Assessment Page 44

Source: ALAND

BUILDING A

Limited activation along Pitt Street and Terminal Place. No retail entrances.

23/02/2022 Merrylands Market Assessment Page 45

a major constraint No exposure to entrance

Level change is

entrance Level change

ALAND

Level change is a major constraint Internalised

Source:

BUILDING B

Centralised lobby and level change are major constraints

entrance

Level change

23/02/2022 Merrylands Market Assessment Page 46

Internalised

Source: ALAND

23/02/2022 Merrylands Market Assessment Page 47

BUILDING C

Level change Internal entrance with no exposure

Source: ALAND

BUILDINGS F-J (SITE A&B)

Source: ALAND

Limited exposure to the north

Limited exposure to the north

Exposure to the north blocked by tree line

No through road limits passing traffic

23/02/2022 Merrylands Market Assessment Page 48

SWOT ANALYSIS

Strengths

• Buildings B and J2 have reasonable accessibility and exposure to those moving through from the station.

• Building A has a strong frontage to passing trade along Pitt Street.

• Large floor area proposed allows for a critical mass of facilities and precinct development (e.g. a dining precinct, services precinct etc).

• Open space within the development is unique within the Merrylands town centre and is a key strength to be emphasised and built upon.

• Provision of dedicated parking for retail customers

• Proximity to Merrylands Station and public transport interchange

Weaknesses

• The site has varying levels of exposure to Pitt Street. Building A has the greatest level of exposure to vehicle traffic but pedestrian activation at this part of Pitt Street is limited given the Stockland Merrylands carpark entrance on the western site of Pitt Street.

• Other than Buildings B and J2, the other buildings have moderate levels of exposure to passing pedestrians moving through from the station.

• The area is relatively internalised, though the future on-site residential population will drive some level of activity.

Opportunities

• Opportunity to provide a new retail precinct and new community focal point for existing and future residents

• There is currently very limited outdoor dining options in Merrylands. Outdoor dining and public open space would assist in creating a new meeting place for the local community

Threats

• Strong and entrenched competition from Stockland Merrylands limits the potential for retail at the subject site, especially supermarket type anchors.

• The existing retail offer along Pitt Street and Merrylands Road features a broad offer, albeit predominantly independent retailers. There is a risk of oversaturation in particular categories (e.g. grocers, hair and beauty)

• Per capita spending metrics for the trade area are 22% below the average for Greater Sydney.

• Internalised streets may suffer from limited passing trade as they do not connect to other destinations

23/02/2022 Merrylands Market Assessment Page 49

TRADE AREA AND SPENDING

23/02/2022 Merrylands Market Assessment Page 50

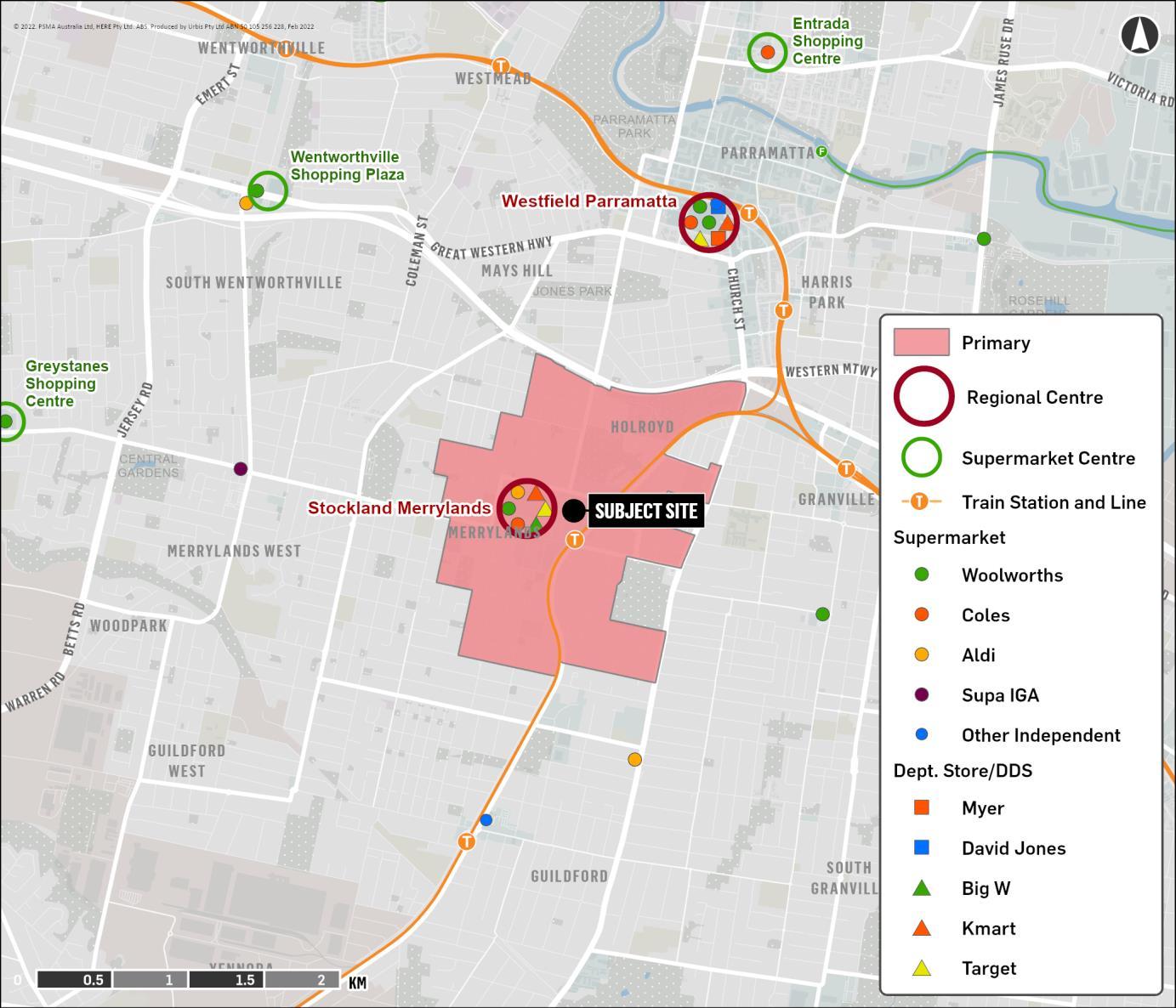

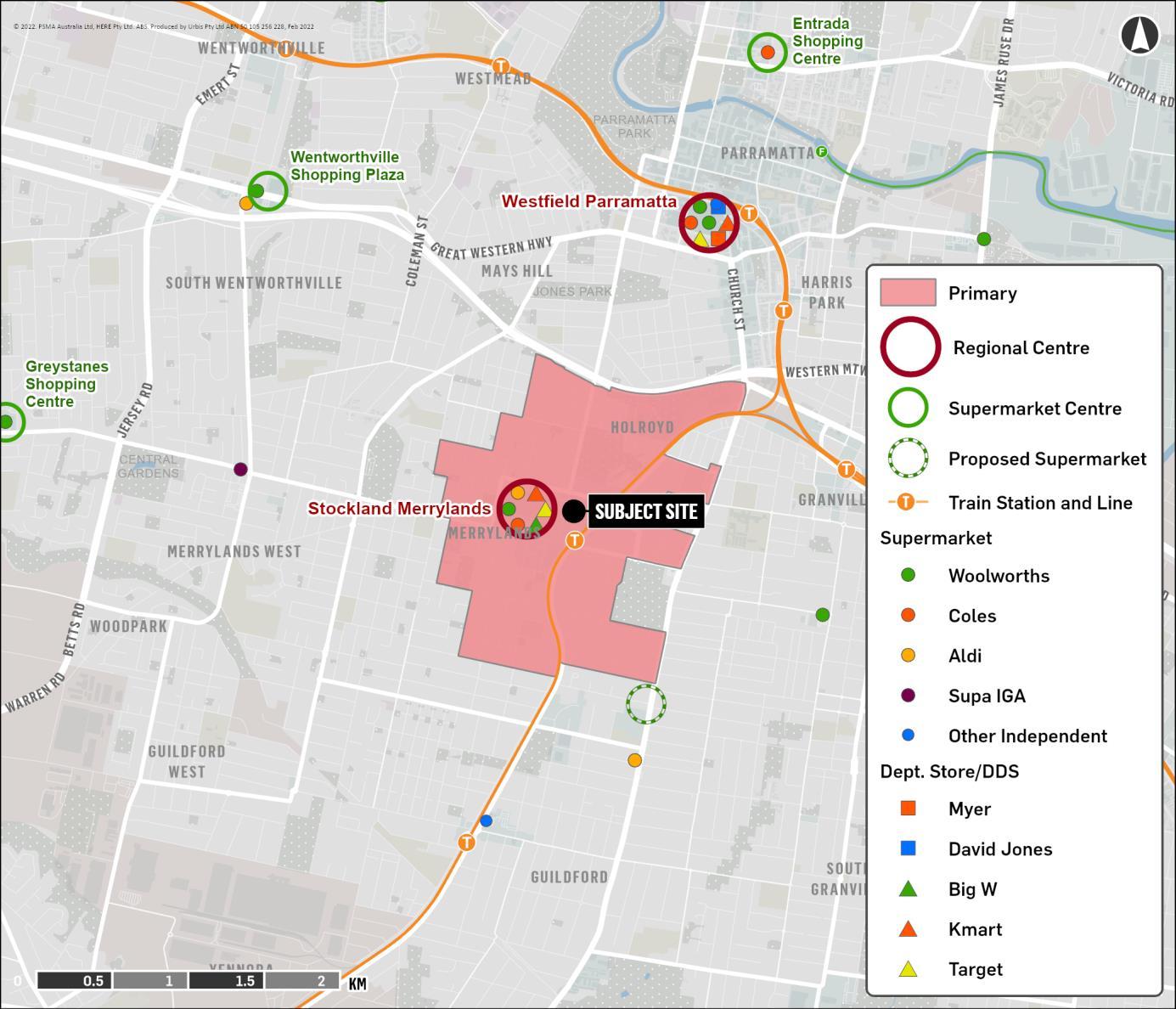

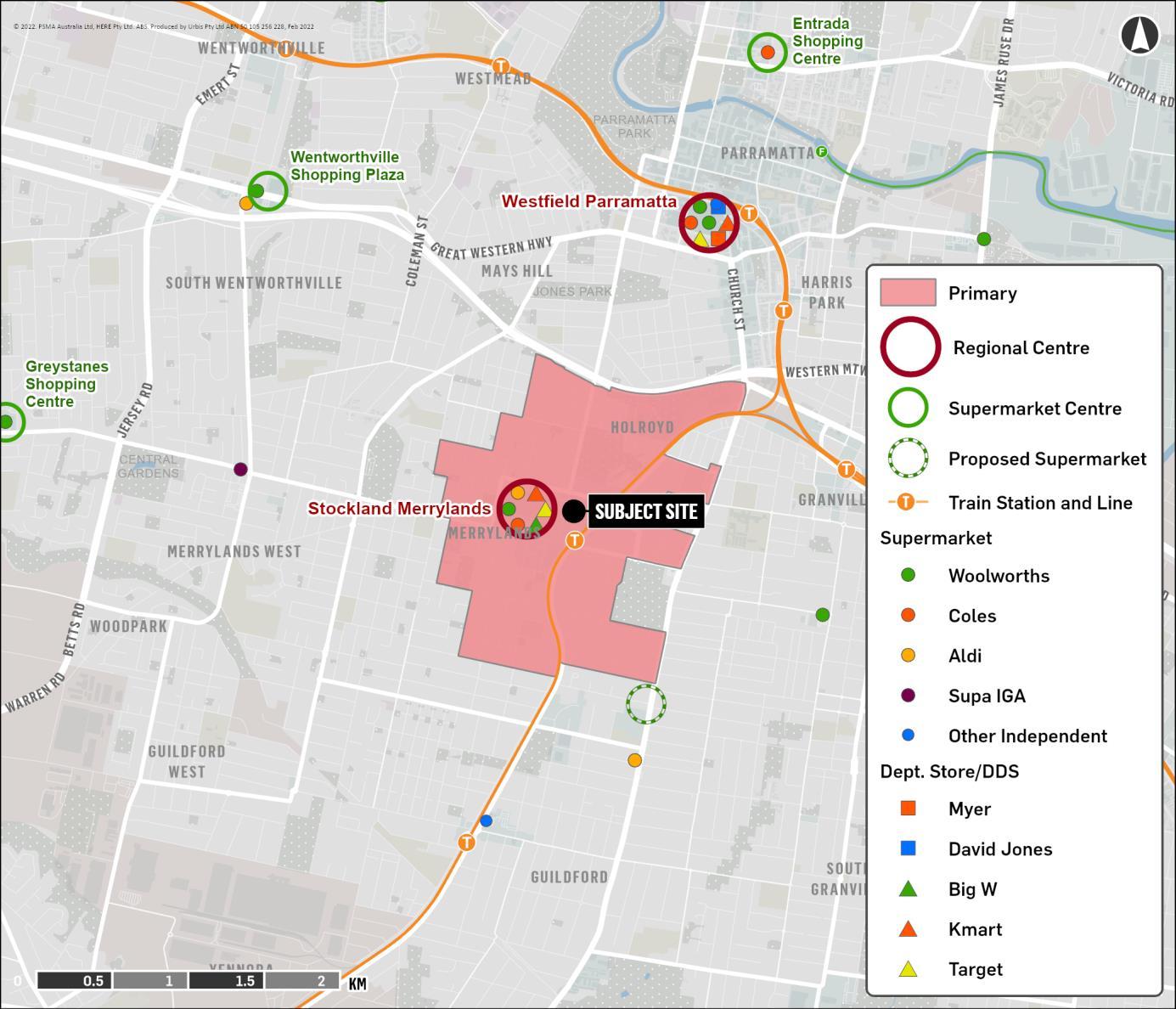

TRADE AREA DEFINITION

Key Findings

The trade area for the retail component of the proposed development has been based on a 10minute walk time, reflecting the likely draw of foot traffic around Merrylands. A description of each trade area sector is as follows:

• On Site – captures the on-site residents from the residential component of ALAND’s development. The timing and scale of residential development has been provided by ALAND.

• Primary – covers a 10-minute walking catchment from the subject site, excluding onsite residents. The primary extends to the M4 Motorway in the north to capture Holroyd, Woodville Road in the east, Myall Street in the south and Clarence Street in the west.

It is likely that retail on the subject site would draw business from beyond the trade area such as those using Merrylands Station or in the area to shop at Stockland Merrylands.

Merrylands Trade Area

23/02/2022 Merrylands Market Assessment Page 51

TRADE AREA POPULATION

Key Findings

The chart opposite shows the population forecast for the trade area by calendar year. Forecasts are based on ABS Estimated Resident Population data, Transport for NSW population projections, assumptions relating to the impacts of COVID on short term growth rates and assumptions relating to the short term development pipeline for the trade area, including on-site development.

The trade area population is estimated at 15,240 at 2022 and has only grown by ~160 people since 2017. However, the trade area is expected to add an additional 5,390 people over the next five years, a growth rate of 6.2% per annum. The strong growth is driven by on-site development and other high density apartment stock coming online in Merrylands.

By 2037, the trade area is expected to grow to 24,230, including over 2,800 on-site residents. Over the 10 years to 2037, an additional 3,600 people are expected to move into the area at a growth rate of 1.6% per annum.

New dwelling approvals (NDA’s) within the trade area over the last seven years are illustrated on the chart opposite. Excluding FY21, approvals have averaged ~260 per annum, driven by apartments. The large jump in FY21 of 804 approvals supports the rapid population growth forecast over the next five years.

Given Merrylands is largely built out, future growth is likely to come from high density apartment living around Merrylands Station.

Population Forecast

New Dwelling Approvals 23/02/2022 Merrylands Market Assessment Page 52

Source:

ABS; Urbis

268 103 352 241 377 135 352 804 0 250 500 750 1,000 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 Townhouses & Apartments Houses 15,080 15,240 19,100 20,030 21,410 1,530 2,820 2,820 15,080 15,240 20,630 22,850 24,230 0.0% 2.0% 4.0% 6.0% 8.0% 0 5,000 10,000 15,000 20,000 25,000 30,000 2017 2022 2027 2032 2037 Annual Growth Rate (%) Population (No.) Primary On Site Annual Population Growth (%)

Source: ABS; TfNSW; Urbis

TRADE AREA DEMOGRAPHICS

Key Findings

The key socio-economic characteristics of the Merrylands trade area, as sourced from the 2016 ABS Census, are highlighted below:

• The trade area is less affluent than average with per capita and household incomes levels 30% and 26% below the Greater Sydney average respectively.

• The age profile of residents is younger than Sydney with an average age of 33.0 compared to 36.8. The biggest variation is in the 25-39 years cohort, indicating a majority of residents are in the household formation age.

• The relatively low proportion of trade area residents living in separate houses indicates that apartment living is accepted in Merrylands. Only 27.1% living in a detached dwelling compared to 57.4% for Greater Sydney.

• The proportion of family households is in line with Sydney at 48.5%.

• White collar workers account for a below average proportion of the population, at 12.1% lower than the Metro Sydney average. The trade area’s workforce is largely skewed towards employment in health care, retail trade and construction.

• The proposition of overseas born residents in the trade area is 63.1%, 23.9 percentage points above the Sydney average. The retail offer at the site will need to be tailored to this demographic, particularly given the high proportion of residents of Asian and Middle Eastern backgrounds.

Trade Area Socio-Demographic Profile

23/02/2022 Merrylands Market Assessment Page 53

Trade Area Sydney Var'n to Sydney Income Metrics: Per Capita Income 28,350 40,234 -30% Average Household Income 79,170 106,502 -26% Age Profile: % 0-14 years 19.7% 18.7% +1.0% % 15-24 years 13.0% 13.1% -0.1% % 25-39 Years 34.1% 23.5% +10.6% % 40-59 Years 20.8% 25.9% -5.1% % 60+ Years 12.4% 18.9% -6.5% Average Age 33.0 36.8 -3.8 Household Metrics: % Separate House 27.1% 57.4% -30.3% % Family Households 48.5% 48.0% +0.6% % Owned Outright 19.2% 31.0% -11.8% Average Household Size 2.90 2.78 0.12 Other Metrics: % White Collar Workers 62.6% 74.7% -12.1% % Overseas Born 63.1% 39.2% +23.9%

Source: ABS; Urbis

TRADE AREA SPENDING

As shown in the chart opposite, average per capita spending levels across the trade area are 22% below that of Greater Sydney, with all product groups below average.

Per capita spending on food is 16% below the average and non-food is 30% below average. The two strongest product groups are food & groceries (13%) and food catering (-17%), indicating that retail at the subject site should be food focussed.

The total retail expenditure capacity of the trade area is estimated to grow from $188 million in 2022 to $343 million by 2037 (real terms, inclusive of GST), reflecting an average annual growth of 4.1%.

The strong population growth projections help offset the relatively weak spend per capita figures. The total retail spending market is expected to almost double in real terms over the next 15 years.

Per Capita Spending Variation from Sydney Average Spending Forecast (Real $2022, incl. GST)

Food & Groceries Liquor Food Catering Apparel H'wares E'tronics Bulky Goods Leisure General Retail Services Total Retail Annual Growth = Pop Growth + Spend Per Capita Growth On Site: 2022 0 0 0 0 0 0 0 0 0 0 0 2027 8 1 4 2 0 1 2 1 1 1 20 n.a. n.a. n.a. 2032 14 1 7 4 1 2 3 2 2 1 38 14.0% 13.0% 0.9% 2037 15 1 7 4 1 3 4 2 3 1 40 0.9% 0.0% 0.9% Primary: 2022 75 7 35 18 3 10 16 7 11 6 188 2027 97 9 46 25 5 14 21 10 15 7 249 5.8% 4.9% 0.8% 2032 103 10 50 28 5 16 24 11 17 8 271 1.7% 0.9% 0.9% 2037 112 11 55 32 7 19 28 12 19 9 303 2.3% 1.4% 0.9% Total Trade Area: 2022 75 7 35 18 3 10 16 7 11 6 188 2027 104 10 50 27 5 15 23 11 16 8 268 7.4% 6.5% 0.8% 2032 117 11 57 31 6 18 27 12 19 9 309 2.9% 2.0% 0.9% 2037 127 12 62 36 7 22 31 14 22 10 343 2.1% 1.2% 0.9% 23/02/2022 Merrylands Market Assessment Page 54

1. Spending figures are inclusive of GST and exclusive of inflation

Source