Belle Meade Village presents the exclusive opportunity to enter Nashville’s most affluent and highest barrier-to-entry neighborhood at scale.

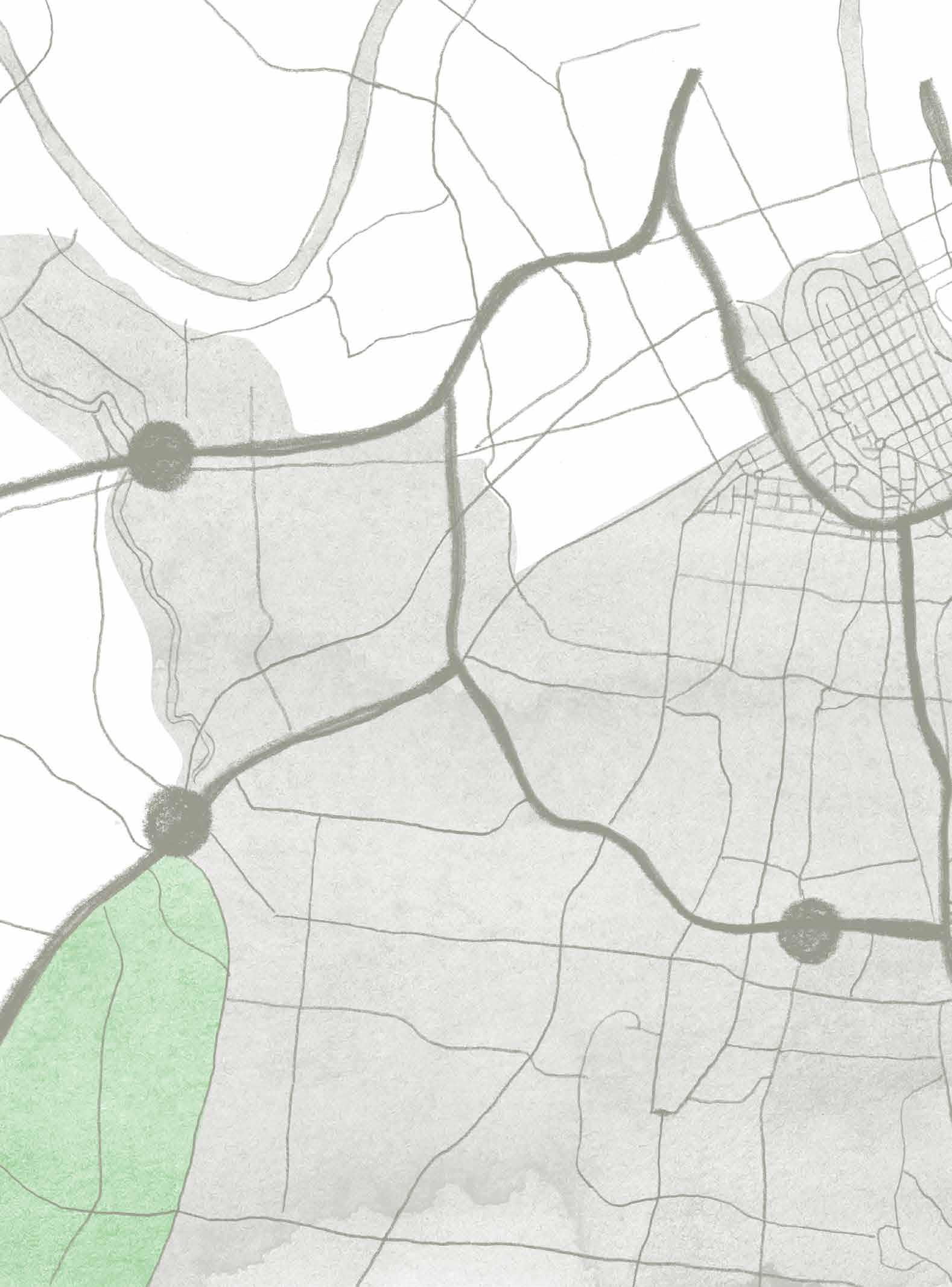

Belle Meade Village (the "Project") will transform an underutilized 15.5-acre site at the entrance to Nashville’s historic Belle Meade community into an iconic retail and residential village.

The Belle Meade Retail Village will include seven three-story buildings and common areas, forming a cosmopolitan retail and entertainment center inclusive of over 40 storefronts, a member’s club, health and wellness, cafés, and restaurants across 160,000 square feet of leasable space.

The Residences at Belle Meade Village will include 92 luxury condominiums across two boutique eight- and ten-story buildings. Masterfully composed to appeal to refined home buyers, The Residences will feature an expansive 16,000-square-foot amenity floor and access to a private five-acre park.

Nashville has been ranked the hottest job market in the country by The Wall Street Journal(1) and the highest metro area for economic growth by CNBC.(2) The market further benefits from no state income tax and boasts the lowest state and local taxes paid per capita.

Belle Meade, Tennessee, one of the wealthiest markets in the country, is a legacy-rich residential enclave five miles from downtown Nashville. Beloved for its rolling green hills, the area has long been home to many of Music City’s leading residents, with a median home value of over $3.0 million.(3)

Set for completion in early 2028, Belle Meade Village will serve as the new gateway to Belle Meade, creating an unparalleled destination at the entrance to Nashville’s most established residential corridor. Designed to meet the demands of the city’s growing affluent population, Belle Meade Village will offer a curated mix of luxury condominiums, lifestyle, dining, and retail in an effort to create long-term value for both the community and investors.

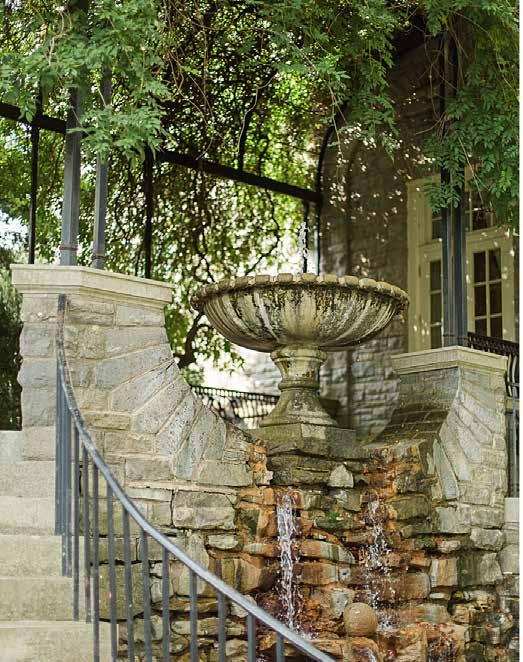

Taking inspiration from enduring benchmarks like Highland Park Village in Dallas, Belle Meade Village will introduce high-quality walkable spaces that enhance the daily experience for residents, shoppers, and families.(1)

A hyper-local project with a global perspective, Belle Meade Village has already attracted interest from high-end multinational retail tenants and both local and out-of-town prospective buyers of condominium residences.

Key Site Elements

15.5 acres

580,000-square-foot mixed-use development

70% of site dedicated to green space and parks

Residential

92 luxury residences, 3,100 square feet average

16,000 square feet of amenities

Private 5-acre park

Retail & Lifestyle

160,000 square feet of leasable space

40+ retail storefronts, members clubs, and food & beverage spaces

Protected Green Space

Six acres of public green space

Restoration of Richland Creek

Creation of pedestrian-friendly greenway

Over the past 5+ years, the Nashville market has seen explosive growth in population, rents, and home values, as the area’s attractive labor market, quality of life, and cultural scene have taken root in the national public consciousness. The average home value in Nashville has grown 63.5% since 2020, versus the U.S. average of 47.1%.(1) Over the same span, Nashville’s population expanded at a CAGR of 1.6%,(2) more than triple the U.S. average of 0.5%, and net inmigration to the metro has reached 100 new residents each day.(3)

The city ranks among the top in the nation for attracting highly educated technology talent, leading all major metropolitan areas in tech employment growth. This momentum is fueled by major employers such as Amazon, with over 5,000 jobs, and Oracle, with more than 8,500 jobs.(1) Nashville also benefits from a strong tourism market, with the airport serving 24.5 million passengers in fiscal year 2024, an 11.9% increase over 2023, which was also a record-breaking year.(2)

Nashville boasts one of the strongest metropolitan economies in the United States.

NO. 1

METRO WITH MOST ECONOMIC GROWTH - CNBC

NO. 1 NO. 1 NO. 1

REAL ESTATE MARKET U.S. & CANADA - ULI

LARGEST INCREASE FOR 6 FIGURE JOBS AMONG LARGE U.S. METROS - BIZJOURNAL

NO. 1 NO. 1

LOWEST STATE AND LOCAL TAXES PAID PER CAPITA - TAX FOUNDATION

IN U.S. FOR ADVANCE INDUSTRY JOB GROWTH - BROOKINGS INSTITUTION

NO STATE INCOME TAX

HOTTEST JOB MARKET IN THE COUNTRY - THE WALL STREET JOURNAL

LOWEST STATE DEBT PER CAPITA IN THE COUNTRY - TENNESSEE STATE GOVERNMENT

Benefiting from Nashville’s thriving market dynamics, and located only five miles southwest of Nashville’s central business district is Belle Meade, Tennessee. This legacy-rich community is home to many of Music City’s leading residents and is one of the wealthiest cities in the nation. Belle Meade boasts a median home value in excess of $3.0 million(1) and an average household income more than four times the national average.(2)

Belle Meade is a prestigious, sophisticated, and historic enclave nestled in Nashville, Tennessee. Renowned for its affluent demographics, the neighborhood boasts one of Nashville’s highest concentrations of high-net-worth residents, ensuring a discerning clientele with unparalleled discretionary income. This exclusivity is further amplified by the scarcity of competing developments in retail and condominium sectors, presenting a rare opportunity to craft a premium offering that fulfills an unmet demand.

Belle Meade’s illustrious reputation is built upon its seamless blend of historic allure and modern luxury, fostering stability through consistent property value appreciation and making it a secure haven for long-term investments.

As the site of the preeminent nineteenth-century stud farm for the American Thoroughbred industry, Belle Meade’s equestrian heritage is central to the neighborhood’s legacy and identity. At the turn of the twentieth century, Belle Meade developed into the exclusive residential enclave defined by Neoclassical and Georgian estates for which the area continues to be known today.

Strategically located, Belle Meade offers the perfect harmony of serene suburban living with effortless access to Nashville’s vibrant urban core—an irresistible combination for both residents and upscale brands. The introduction of a new project here will not only complement the area’s refined character but also create unparalleled synergy between premium brands and the community’s elite residents. The mixed-use development represents an exclusive opportunity to create generational value within one of Nashville’s best-known legacy communities.

Demographic data further reflects the unique positioning of Belle Meade. The city’s average reported household income is over $500,000 annually, with over 70% of households reporting income of more than $200,000, compared to greater Nashville’s average household income of $109,160 and 12.4% of households reporting over $200,000 annually.(1)

Similarly, the median home value is reported at more than $3.0 million in Belle Meade, where more than 89.0% of homes report a value in excess of $1,000,000 and the homeownership rate is estimated at 97.7%. In contrast, the city of Nashville reports a median home value of $436,000 and a 52.5% homeownership rate (67.3% for Tennessee overall).(2,3)

Belle Meade’s positioning in the context of greater Nashville is most comparable to Highland Park, a similar neighborhood in the city of Dallas. Highland Park is located approximately three miles north of downtown Dallas, and the town offers similar demographics to Belle Meade. Both Highland Park and Belle Meade report an average household income of over $500,000(1), representing more than four times the average household income of Nashville and Dallas, respectively, while the average listed home value in each submarket is approaching $4.1 million,(4) more than seven times the market average. However, since Dallas expanded and matured as a city before Nashville, its upscale district has seen significant development and offers a variety of housing, shopping, food & beverage, and wellness options that are not yet available to the wealthy denizens of Belle Meade.

The Belle Meade community is presently underserved across all product types, with the exception of large single family estate homes. This lack of supply is further underscored when compared to other desirable Nashville neighborhoods. For example, outside of the tourist district downtown the neighborhoods of Green Hills and 12 South represent the highest retail rents in the market, complementing the residential options in these areas. In early 2024 it was reported that retail rents in 12 South had nearly tripled over the past three years, according to JLL, with asking rents as much as $120 per square foot.(1) In the past year, asking rents have continued to escalate, with newly delivered spaces now regularly asking $150 per square foot or more.

In Green Hills, home to the Mall at Green Hills, rents have long been the top of local market, as the Mall has been able to provide high income shoppers with a mix of luxury brands and high end stores. Global fashion and jewelry brands have been known to pay over $150 per square foot in the Mall, with some smaller spaces garnering in excess of $200 per square foot.

Retail districts in Green Hills and 12 South both benefit from wealthy local clientele as well as from tourism traffic. For reference, the current median listing price of homes in Green Hills and 12 South is $1.3 million and $1.8 million, respectively, while the median listing price in Belle Meade is $4.7 million.(2) These areas are all at a premium to the broader Nashville median listing price of $555,000.(2) Benefiting from a convenient location near many well-heeled shoppers and a modern open-air design, Belle Meade Village is favorably positioned to attract both emerging luxury brands and established labels seeking a more vibrant alternative to the enclosed Mall at Green Hills.

For-sale Residences at Belle Meade are uniquely positioned to take advantage of the shortage of new luxury condominiums and the aging existing supply, coupled with the competitive market area’s affluent demographics and continued growth of high-income households. The latest market data indicates a median home value in the area of over $3.0 million, with dozens of sales in 2024 above the mark and several beyond $10.0 million, even reaching $32.0 million for one estate.(1) For reference, the current condo sales record in the market is $15.0M, or $3,794 psf, for a Four Seasons penthouse unit that sold in late June 2024, after finding a buyer within a day of hitting the market.(2) However, this record is already expected to be surpassed, as a unit in the upcoming Paramount condo tower downtown is reported to be under contract for a price in excess of $25.0 million.(3)

The for-sale residential opportunity at Belle Meade Village benefits from the strict zoning restrictions throughout the adjacent City of Belle Meade, where zoning code does not allow for residential density whatsoever. As a result, there are minimal alternatives in the area to the large estates with well-manicured grounds that define the neighborhood. As the population of long-term Belle Meade residents ages and is supplemented by wealthy newcomers from areas where denser high-end residential product is common, AJ believes there is significant pent-up demand for a different type of residential product in Belle Meade and has conceptualized for-sale condo opportunities to meet this demand. In Spring 2025, The Concord Group (TCG), an industry-leading market-research and analytics firm, completed an in-depth supply-and-demand study projecting a 602-unit shortfall in the competitive market area through 2029.

The Residences will represent the pinnacle of luxury condo product available in Nashville. The business plan includes the delivery of 92 spacious condominium residences averaging 3,100 square feet, each appointed with best-in-class interiors and finishes curated by boutique design firm Meyer Davis. Enhanced by an outdoor pool deck, premium fitness facilities, and distinctive community spaces, the development is tailored to affluent buyers seeking a low-maintenance lifestyle that preserves their elevated standard of living within Belle Meade’s exclusive neighborhood.

The Project has an estimated total capitalization of approximately $678 million, including approximately $495 million of development spend. Condominium sales and refinance of the retail village are expected to close in 2028, with the aim of returning significant equity to investors.(1)

The retail component of Belle Meade Village is positioned to benefit from the demand from both consumers and brands for thoughtful experiential shopping in a setting that provides a unique sense of place.

Many brands would prefer a destination retail center in west Nashville but to date there has not been a viable option. The location, storytelling, and dynamic tenant roster at Belle Meade Village will support this retail offering as the best-in-class option in Nashville.

As demonstrated in mature retail markets nationwide, high-street storefronts command rents several multiples higher than even premier Class A shopping centers. This is driven by unparalleled foot traffic, brand visibility, and the prestige of a prime address. Class A retail corridors in Nashville, including 12 South and The Mall at Green Hills, continue to show significant growth, but the city still lacks a true high-street retail destination.(1)

Underwritten rents at Belle Meade Village reflect first generation lease rates only, excluding the significant lift frequently realized at renewal in comparable markets such as Miami and Dallas. In Miami, asking retail rents are $500 PSF NNN on the main streets of the Miami Design District, a 67.0% increase YOY in 2024.(2) At Dallas' Highland Park Village, rents have risen from roughly $35 PSF in 2009 to an estimated $275 - $300 PSF today, a nearly 10X increase.

In the accompanying table, Class A Retail in Dallas is reflective of leases signed in suburban Class A centers, with luxury fashion, high-end athleisure and other sought-after premium tenants. Nashville Class A Retail is reflective of signed leases in the city’s most active retail submarkets, Green Hills and 12 South, with well-known high-end international fashion and jewelry brands.

Underwritten base rent PSF figures reflect rents AJ feels are achievable by thoughtfully curating a mix of tenants including internationally acclaimed fashion houses, artisan restaurants, contemporary & local brands, and a private members' club. Base rent assumptions do not reflect the additional upside available upon next-generation leasing and inclusion of percentage rent.

Located just outside of Dallas’ urban core, Highland Park Village exemplifies how a thoughtfully curated neighborhood of international boutiques, artisan restaurants, hotels, and residences can create a cohesive destination cherished by locals and visitors alike. Businesses are encouraged to create unique experiences in their stores, while Spanish terracotta planters and tree canopies surround pedestrians, who often refer to the village not as a shopping center but as a community asset.

Highland Park Village represents the premier mixed-use destination in the South. The center first opened in 1931, but it was the current owner who acquired the heirloom property in 2009 and embarked on updating the Village’s tenancy to curate a thoughtful mix of both high-end luxury/fashion offerings along with locally owned and operated businesses serving the neighborhood. As a result, rents have gone from the top of the market in the Dallas area to some of the highest in the nation, while still offering a compelling value to tenants who generate significant revenue from locations in the shopping center.

The City of Belle Meade zoning code does not allow for residential density within the limits of its jurisdiction. As a result, there are minimal alternatives in the area to the large estates with well-manicured grounds that define the neighborhood today. As the population of long-term Belle Meade residents ages and is supplemented by wealthy newcomers from areas where more dense high-end residential product is common, AJ believes there is significant pent-up demand for a different type of residential product in Belle Meade and has conceptualized the Belle Meade Village condominiums to meet that demand.

The Residences will be the highest-end luxury residential property in Nashville. The 92 units are firmly targeted at wealthy residents in search of the lower-maintenance condo lifestyle that maintains their high standard of living while allowing them to stay in the exclusive Belle Meade neighborhood. With average unit sizes of approximately 3,100 square feet, top-tier interiors and finishes by boutique design firm Meyer Davis, and expansive amenity offerings including an outdoor pool deck, fitness spaces and unique community areas, The Residences represent a compelling residential lifestyle for Nashville’s most discerning buyers in their favorite neighborhood.

The condominium portion of the Project is expected to deliver in early 2028. Pre-sales will commence in late 2025, building momentum toward an initial target closing of approximately 85.0% of residences in Q1 2028, with remaining residences expected to close in Q2 2028.

Sales assumptions for The Residences represent a substantial discount to the Four Seasons Nashville, which lacks the scale, retail village, and walkability of Belle Meade Village. Relative to 2024 sales at the Four Seasons Nashville of approximately $2,000 PSF, the Conservative Case and Base Case equate to a 27.0% and 14.0% discount, respectively.

Additionally, 2024 condo sales at the Four Seasons Nashville averaged prices 38.0% higher than in 2022, highlighting the potential for a substantial price uplift on remaining inventory following the initial release.(1)

Belle Meade Village will serve as a fully-walkable and connected enclave, offering residents pedestrian connections to the Sylvan Park neighborhood and McCabe Park via the activation of Richland Creek and the extension of the Greenway. Green space will comprise over 70% of the site. A five-acre private park will serve as an exclusive amenity for The Residences at Belle Meade Village owners. 37

Adventurous Journeys (“AJ”) Capital Partners is a vertically integrated real estate investment manager founded in 2008. The firm repositions real estate to create value in timeless spaces, scalable businesses and branded platforms.

AJ has built a track record of delivering transformative real estate by applying placemaking, inspired design, and hospitality principles to spaces overlooked or undervalued by traditional investment firms.

The firm’s current portfolio includes $5.9 billion of assets across 100+ properties and 50+ geographic markets.1 AJ is primarily focused on mixed-use communities, hospitality, and residential sectors.

AJ is headquartered in Nashville with offices in Chicago, London, and Miami. Deeply analytical and powerfully creative, AJ’s team brings expertise and passion to every facet of the real estate investment life cycle.

Everything we do tells a story.

AJ applies hospitality and residentially inspired design principles to identify and transform underutilized real estate into highly coveted spaces that define their neighborhoods for years to come.

AJ has an opportunistic approach that is primarily focused on mixed-use communities, hospitality, and residential sectors. Within these three areas, AJ creates value through a focus on individual assets, specific geographies, or through entire branded real estate businesses.

AJ has deep experience successfully executing mixed-use projects (retail, office, residential), hotels, and food and beverage concepts. To date, AJ’s most significant project in Nashville is a development in Wedgewood Houston, which repositioned a historically industrial and underutilized neighborhood approximately one mile south of the center of the CBD into “Wedgewood Village,” a leading destination for global luxury, retail, entertainment, and restaurant brands. AJ’s Wedgewood Village projects create an 18-acre mixed-use campus comprised of three phases collectively representing more than 1.6 million square feet and featuring high-profile tenants.

Phase I encompassed the redevelopment of the historic May Hosiery Mills campus into the home of world-class tenants, including Apple Music, Hermès, Pastis, boutique hotel and private members’ club Soho House, and AJ’s headquarters. Phase II included the construction of ~200,000 SF of Class A creative office space and a 273-unit luxury apartment complex on the site known as Nashville Warehouse Company. Nashville Warehouse Co. is home to notable tenants, including Live Nation, the Academy of Country Music, and ASCAP.

Building on the success of these first two phases, AJ has capitalized on demand for additional product and programming by expanding the project to the third phase, known as Wedgewood Village. Wedgewood Village consists of seven buildings currently underway, with future development capacity including additional office, retail, entertainment, and multifamily offerings. Phase III has already achieved exceptional leasing momentum. Tenants have committed to over 100,000 SF of the 235,000 SF office space, a 4,300-seat live -music venue, a 40,000 SF specialty wellness facility, and over 20,000 SF of retail and F&B space, well ahead of construction completion. Proposals are outstanding for all remaining commercial spaces with a target of completing lease up in advance of construction completion.

AJ’s collective placemaking efforts across its Wedgewood Village platform have transformed this once industrial and underutilized part of town into one of Nashville’s most dynamic submarkets. Increasing demand from all segments – office, retail, restaurant, residential, and entertainment – are evidence of the successful placemaking efforts that continue to pay dividends and drive further growth throughout the 18-acre assemblage.

This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any security, including limited partnership interests in AJ Belle Meade Plaza Fund LLC as managed by AJ Capital Management LLC (together with its affiliates “AJ Capital,” “AJ,” “our,” or “we”). As it pertains to AJ Belle Meade Plaza Fund LLC, an offer will be made only by the definitive Confidential Private Placement Memorandum, Subscription Agreement and other offering materials and transaction documents and other additional information provided to potential investors, including through any investor portal (collectively, the “Offering Materials”). This presentation is for information purposes only, is confidential and may not be reproduced or distributed. This presentation is qualified in its entirety by the Offering Materials, all of which should be carefully read prior to any investment in AJ Belle Meade Plaza Fund LLC. None of the information contained herein has been filed or will be filed with any governmental or self-regulatory authority of any applicable jurisdiction. No governmental or regulatory authority has passed or will pass on the merits of this presentation. Any representation to the contrary is unlawful.

The purchase of limited partnership interests in AJ Belle Meade Plaza Fund LLC will be suitable only for sophisticated investors who fully understand and are willing to assume the risks involved in an investment in AJ Belle Meade Plaza Fund LLC. Statements in this presentation are made as of October 2025, unless stated otherwise, and neither the delivery of this presentation at any time nor any sale of the limited partnership interests described herein shall under any circumstances create an implication that the information contained herein is correct as of any time after such date. This presentation is not intended to be relied upon as the basis for an investment decision, and is not, and should not be assumed to be, complete. The contents herein are not to be construed as legal, business, or tax advice, and each prospective investor should consult its own attorney, business advisor, and tax advisor as to legal, business, and tax advice.

Except as may be otherwise expressly described in the Offering Materials, AJ Belle Meade Plaza Fund LLC will not have any interest in any of the real estate projects described herein. There is no guarantee that AJ Belle Meade Plaza LLC will be able to invest in similar opportunities. In considering any performance information contained herein, prospective investors should bear in mind that past performance is not necessarily indicative of future results, and there can be no assurance that AJ Belle Meade Plaza Fund LLC will achieve comparable results. No assurance can be given that

AJ Belle Meade Plaza LLC’s investment objective will be achieved or that an investor will receive a return of all or any part of such investor’s investment. Investment results may vary significantly over any given time period. Target investment criteria is included for illustrative purposes only. AJ Belle Meade Plaza Fund LLC generally is not restricted from making investments outside of these criteria.

Any investment in AJ Belle Meade Plaza Fund LLC is subject to various risks. A description of certain risks involved with an investment in AJ Belle Meade Plaza Fund LLC can be found in the Offering Materials; such risks should be carefully considered by prospective investors before they make any investment decision. AJ Belle Meade Plaza Fund LLC reserves the right to modify any of the terms of the offering and the limited partnership interests described herein. Recipients of this presentation agree that AJ Belle Meade Plaza Fund LLC, its affiliates and their respective partners, members, employees, officers, directors, agents, and representatives shall have no liability for any misstatement or omission of fact or any opinion expressed herein. This presentation, the Offering Materials and the information contained herein and therein consists of confidential proprietary information and is the sole property of AJ Capital Partners LLC. Each recipient further agrees that it will (i) not copy, reproduce, or distribute this presentation or the Offering Materials, in whole or in part, to any person (including any employee of the recipient other than an employee directly involved in evaluating an investment in AJ Belle Meade Plaza LLC) without the prior written consent of AJ Belle Meade Plaza LLC; (ii) keep permanently confidential all information contained herein and in the Offering Materials that is not already public; and (iii) the recipient agrees to return this presentation and the Offering Materials to AJ Belle Meade Plaza Fund LLC upon its request.

Projections with respect to investments are based on the projected operating performance of such investments as contained in AJ’s business plans for such investments as of October 2025, except as otherwise noted herein. The performance figures have not been audited and may be subject to change. While AJ’s projected performance with respect to investments within the portfolio is based on AJ’s good faith assumptions that AJ believes are reasonable (including (a) estimates of property cash flows, (b) average daily room rates and occupancy for hotel investments, (c) future capitalization rates, (d) interest rates, (e) operating and other expenses, (f) ability to obtain projected financing (both debt and/or equity), (g) taxes, (h) development costs and plans, (i) legal and contractual restrictions on transfer that may limit liquidity and holding period, (j) timing and

manner of expected exit, (k) the timing or outcome of any litigation or other disputes, (l) ability to obtain entitlements, and (m) overall future market conditions and/or growth), the actual realized returns on investments within the portfolio will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the time and manner of sale, all of which may differ from the underlying assumptions on which the projected performance data contained herein are based. Assumptions regarding the timing and manner of expected exit for each individual investment are based on AJ’s business plan and judgment of the appropriate holding period for each individual investment, but holding periods could differ materially from those assumed and, if so, such valuation would cause the actual realized IRR to be different from the projected IRR reflected herein. In addition, there are many risk factors that could cause AJ’s assumptions to prove to be incorrect. These risks could cause the actual performance of investments within the portfolio to be materially different from the current projected performance. There are many risk factors that could cause such assumptions to prove to be incorrect including (i) future operating results; (ii) interest rates; (iii) availability and costs of financing; (iv) economic and market conditions at the time of disposition; (v) date of expected exit; (vi) increases in costs of materials or services beyond projections; (vii) force majeure events (e.g., terrorist attacks, extreme weather conditions, earthquakes, war); (viii) supply/demand imbalances; (ix) currency fluctuations; (x) litigation and disputes relating to investments with joint venture partners or third parties; (xi) changes in zoning and other laws; (xii) inability to obtain necessary licenses and permits; (xiii) competition; (xiv) changes in tax law and tax treatment and disallowance of tax positions; and (xv) other factors beyond the control of, or otherwise determined to be applicable by, AJ, AJ Belle Meade Plaza Fund LLC and their respective affiliates. No single methodology or approach is necessarily used in the determination of the value of projected cash inflows or outflows, and such methodologies and methods vary by investment. These projections are solely for purposes of this presentation, and there can be no assurances that projections for investments within the portfolio reflect the amounts that will ultimately be realized and there can be no assurances that AJ will be able to achieve the business plans for each investment. For these and other reasons, investors should not rely on any projected performance information in making a decision to invest in AJ Belle Meade Plaza Fund LLC.

The projected IRR, multiple, and other calculations presented herein are hypothetical and based on historical and future projected cash flows from inception through the end of AJ Belle Meade Plaza Fund LLC’s term, except as otherwise disclosed. IRR means a compounded, annualized internal rate of return (XIRR Function in Excel). IRRs are generally calculated assuming that all cash flows for the applicable investment occurred on the last day of the month in which the cash flow occurred or is projected to occur. Certain short-term or interim cash flows to or from, or in connection with, an investment may be excluded from the IRR calculation, as applicable. Gross IRRs do not reflect any deductions for management fees, operating expenses, other fund expenses or allocation of carried interest. Net Projected IRRs generally are not net of income taxes or other taxes borne or to be borne by the applicable vehicle or its investors. Multiples are generally calculated by summing the total actual and/or projected cash inflows and dividing by the total actual and/or projected (in each case, as applicable) cash outflows for a particular investment. Certain expenses directly attributed to an investment but incurred by a fund may be reflected as cash outflows for such particular investment. Certain short-term or interim cash flows to or from, or in connection with, an investment may be excluded from the Multiple calculations, as applicable. For Multiples, the calculation is based on the actual and projected distributions by a fund divided by the total actual and projected capital contributions to a fund, respectively, except as noted herein. Gross Multiples do not reflect any deductions for management fees, operating expenses, other fund expenses or allocation of carried interest. These projections, including projections of future market conditions, were made as of October 2025. Cash flow assumptions for these unrealized transactions use projected cash flows based on assumptions believed to be reasonable by AJ, including market conditions, default rates, exit strategies and availability and costs of financing. Actual market conditions, exit strategies and availability and costs of financing may differ from AJ’s projections, causing actual returns and distributions to be lower. Actual returns and distributions will depend on, among other factors, future operating results, the value of the assets, leasing and tenant activity and the market conditions at the time of any sale, lease or other transaction, related transaction costs and the timing and manner of sale, all of which are uncertain and may differ from the assumptions and circumstances on which the projected valuations used are based. Cash flow and distribution calculations do not take into account the effect of any tax withholdings that may be required to be made as a result, or in respect, of any specific investor. The ability to achieve a given targets and projections may be affected by numerous factors including, but not limited to, investment values, cash flow, environmental and structural factors, ratings and market conditions. AJ Belle Meade Plaza Fund LLC intends to employ leverage and, accordingly, the targeted projected reflected herein are based on

assumptions relating to portfolio construction and the anticipated amount of leverage incurred with respect to such portfolio. The use of leverage has the effect of increasing the potential risk and returns with respect to leveraged investments, and for positive returns, unlevered performance generally will be lower than performance reflecting the use of leverage.

Any hypothetical performance has been provided for illustrative purposes only, and is not necessarily, and does not purport to be, indicative, or a guarantee, of future results. Hypothetical performance includes any performance targets, projections, multifund composites, pro forma returns adjustments or other similar presentations, and represents performance results that no individual fund, portfolio or investor has actually achieved. The preparation of such information is based on underlying assumptions, and because it does not represent the actual performance of any fund, portfolio or investor, it is subject to various risks and limitations that are not applicable to non-hypothetical performance presentations. For example, because cumulative multi-fund composite performance reflects different funds managed through various economic cycles, it is not, nor intended, to be representative of, the anticipated experience of an investor in a single fund. Any preparation of hypothetical performances involves subjective judgments. Although AJ believes any hypothetical performance calculations described herein are based on reasonable assumptions, the use of different assumptions would produce different results. For the foregoing and other similar reasons, the comparability of hypothetical performance to the prior (or future) actual performance of a fund is limited, and prospective investors should not unduly rely on any such information in making an investment decision.

In addition to the historical information, this presentation contains “forward-looking statements.” The words “forecast”, “estimate”, “project”, “intend”, “expect”, “should”, “believe”, and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors, including those discussed in the Offering Materials, which may cause the Fund’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. In addition, new risk and uncertainties may arise from time to time. Accordingly, all forwardlooking statements should be evaluated with an understanding of their inherent uncertainty. We assume no obligation to update or revise these forward-looking statements for any reason, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future. Past performance is not necessarily indicative of future results and there can be no

assurance that the Fund or investments by the Fund, as the context requires, will achieve comparable results or that projected returns, if any, will be met. The Fund has not commenced operations and no performance of the Fund is presented. There can be no assurance or guarantees that the Fund’s investment objectives will be realized or the Fund’s investment strategy will prove successful. Investors must have the financial ability and willingness to accept the significant risks associated with investment in the Fund which may lead to a loss of all or a portion of their investment in the Fund. The performance information summarized herein has not been audited.

Certain economic and market information contained herein has been obtained from published sources prepared by third parties and, in certain cases, AJ Capital, and has not been updated through the date hereof. While such sources are believed to be reliable, AJ Capital has not independently verified such information and does not assume any responsibility for the accuracy or completeness of such information. It should be noted that the financial information contained herein has not been audited.

This presentation may contain material, non-public information. The recipient should be aware that U.S. federal and state securities laws may restrict any person with material, non-public information about an issuer from purchasing or selling securities of such issuer or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities in reliance on such information.

No third-party firm or company names, brands or logos used in this Presentation are AJ’s trademarks or registered trademarks, and they remain the property of their respective holders and not AJ.

This Presentation identifies a number of benefits inherent in AJ’s services and operations on behalf of the Fund, although the Fund is also subject to a number of material risks associated with these benefits, as further identified in the Fund’s definitive documents. Although AJ believes that it, its personnel and the services they provide to the Fund or development will have competitive advantages in identifying, diligencing, developing, leasing, managing and ultimately selling investments on behalf of the Fund, there can be no guarantee that AJ will be able to maintain such advantages over time, outperform third parties or the financial markets generally or avoid losses. For additional information regarding risks and potential conflicts of interest regarding an investment in the Fund, please see the risk factors in the Fund’s Confidential Private Placement Memorandum.

Contact:

Cooper Manning coop@ajcpt.com

Kerstin Hjelm khjelm@ajcpt.com