It’s become something of a tradition to kick off this welcome page by reflecting on what an extraordinary period it’s been since we last met. In November 2021, when we gathered at Lord’s Cricket Ground for the Asian-Jewish-Business Network’s flagship event, we had experienced a General Election and Brexit and endured two years of a global pandemic.

It’s hard to believe that the last 12 months have seen almost as many epochal moments: war in Europe, soaring energy prices, (another) new prime minister and sweeping tax cuts followed by the pound hitting a record low against the dollar. With the Bank of England projecting a recession and the full impact of energy price rises yet to be fully felt, the coming months are looking increasingly tough for businesses that have only just ridden the storms of covid. At such times, networking opportunities such as today are all the more important.

Just a month after the world bid farewell to Queen Elizabeth II with a state funeral at Westminster Abbey the likes of which may never be repeated, it seems fitting we should be meeting today in the conference centre named in her honour. It was during her record 70-year reign that the face of Britain changed and London blossomed into one of the most diverse cities on earth.

Holding more soft power than anyone else on the planet, The Queen was also key to boosting trading relationships between the UK and it’s allies as she traversed the globe at the request of the foreign office. As is traditional in Judaism, we wish King Charles III and his family ‘long life’until 120 - as he continues Her Majesty’s duties and develops the work for which he is already

well known in bringing diverse communities together.

For the Asian-Jewish Business Networkthe only group of its kind promoting business between the two communities in the UK - this has been a year of continued progress that wouldn’t have been possible without our headline sponsor Axiom DWFM. Our London Club now has nearly 100 members and, with Covid now hopefully behind us, we have managed a full programme of networking events at venues as diverse as the RAF Museum, the Canary Wharf offices of Rational FX and the Atheneum Hotel on Park Lane. Last month, accountancy giant Grant Thornton played host to the launch of our Members Club for Manchester.

Today, we are thrilled to welcome you to our largest event yet at the iconic Queen Elizabeth II Centre in the heart of Westminster. Huge thanks to all our sponsors, those who have taken stands and all those attending, whether you’re new to AJBN or been with us from day one. Over five hours and across three rooms, you will have the opportunity to hear from a range of fantastic speakers, build new contacts and ultimately, we hope, boost your business.

We are delighted once again to be headline sponsor of the Asian Jewish Business Network, the only business networking group in the UK that brings Asian and Jewish business leaders together from across different parts of the UK. It has been an honour to be part of such a big event in previous years. And so it is again this year. We very much welcome this opportunity to continue to develop and strengthen our valued relationship with the Asian Jewish Business Network.

Meanwhile, events in the world in which we live and work continue to move at a rapid pace.

Last year, the impact of Covid was felt by everyone – particularly those in the retail, hospitality and leisure sectors, which was partly mitigated by the Government’s support package. This year has seen other difficulties arise. As the nation emerged from lockdown and life swiftly returned to normal, we have all faced fresh challenges at both a personal and a commercial level – not least the impact of the war in Ukraine which has led to sharply higher global energy prices that inevitably ushered in the return of widespread inflation and higher interest rates. Again, the Government stepped in to help with an extraordinarily large support package to minimize the impact on household and businesses.

Sadly, the announcement of these support measures coincided with another shock to the national psyche: the loss of her late Majesty Queen Elizabeth II, after 70 years as Britain’s head of state, has profoundly affected us all. As one of the greatest leaders the world has ever known, she always embodied the spirit of our great country - an inspirational woman whose remarkable dedication, duty and

service will remain as an example to everyone in Britain, of every faith and background. Our thoughts are with the Royal Family at this sad time, but we also welcome His Majesty King Charles III as our new King and wish him well.

The past year has been eventful for us too.

As a fast-growing, full service law firm with offices in Central London, Edgware, Birmingham, Bristol and Swindon, two major changes have occurred in the past 12 months which have further fuelled our growth. Last November, we announced that Axiom DWFM had acquired Legalmatters and in April this year, we announced the merger between Axiom DWFM and Philip Ross Solicitors. Together, these two developments, combined with organic growth in other parts of the firm, have taken our total number of staff to more than 200 employees.

coming year, we anticipate further growth. Just as the Asian Jewish Business Network will continue to grow, we also have plans to grow strategically in the next year, potentially adding further teams of lawyers to build and strengthen our existing teams. Despite the current challenges, we also have a government with a new leader at the helm who has a positive, upbeat outlook for business. There is every reason to believe that these challenges will be overcome and that the coming year will offer a new beginning for us all.

Against a background of seismic change in the UK at a political and economic level, the outlook for the UK property market remains uncertain, although Axiom DWFM maintains a positive outlook and we continue to be very busy.

Predicting the future of the residential housing market or the commercial property market is invariably difficult at any time. But we have now entered a state of flux: the era of low interest rates and low inflation, which have prevailed for more than a decade, now appears to be over.

Although higher interest rates and sharply higher retail prices for consumers are baked in certainties for at least the next 12 months, the outlook for property is less clear. In the residential market, house prices certainly defied the sceptics in 2020 and 2021, rising by 8.5% and 9.5%, respectively.

So far this year, the UK housing market has

Pragnesh Modhwadia Managing partner

continued to be resilient, performing better than anticipated despite the cost of living crisis. The current consensus growth forecast for 2022 stands at around 8%.

Nevertheless, there have been some prominent bearish noises. The Bank of England recently forecast that GDP will shrink for five successive quarters up to Q1 2024. But as the new Conservative leader and our new prime minister, Liz Truss, has indicated “forecasts are not destiny - what we shouldn’t be doing is talking ourselves into a recession.”

In August, the most recent month for which data is available, both the Halifax and Nationwide measure of house prices showed a robust rise in values. Even though the headwinds facing the housing market make a slowdown in price rises seem very likely, the enormous Government support to households from

Idan Liaqat Head of real estate

the cap on energy bills means that a substantial correction in prices now seems unlikely.

The FT recently reported that £150bn energy support plan will help alleviate many households’ fears of soaring gas and electricity bills this winter.

According to the FT, economists agree that the plan is likely to lower the peak of inflation by about 5 percentage points so that instead of peaking around 15 per cent in January, it will stay at around the July level of 10.1 per cent before falling gradually in 2023. Meanwhile economists and financial market traders expect that interest rates will reach 3 per cent by the end

markets, income growth, potential tax cuts, the availability of mortgages, consumer confidence – and perhaps the least predictable, wholesale energy costs as impacted by artificially constricted levels of Russian gas exports.

Despite all of this, housing demand has been surprisingly robust. Much will therefore depend on the actual state of the economy, access to funds from mortgage lenders and affordability for buyers, rather than forecasts, underpinned by economic levers that are being pulled by the new prime minister and Kwasi Kwarteng, the new Chancellor.

The mini budget in September saw a welcome boost as the threshold before stamp duty is paid is set to be raised to £250,000 while for first-time buyers it will be £425,000. Those who anticipate property price falls next year may yet be surprised by the emergence of a relatively robust housing market instead.

spread across the ages of 18 to 55+. A number of, somewhat surprising, results emerged.

Consumers have revealed what they want to see on their high streets, and you may be surprised by the results

The worst of the pandemic may be behind us, but we’re still left with visible battle scars. Along with glass barriers in coffee shops and the occasional “please keep 2m apart” sign, our high streets are blighted by empty stores and boarded windows.

It makes for bleak viewing but for property investors and developers, there could be opportunity. A lot of focus has gone into how our high streets can be rejuvenated, with two key options coming to the forefront. With the nation in desperate need of

suitable - preferably affordable homes - the notion of converting commercial spaces into residential assets emerged as an obvious solution.

Additionally, some have focused on keeping the high street commercial. Several towns have seen their high streets bounce back in recent months, following a rethink on how they’re utilised. Department stores and shops may be on their way out, but restaurants and bars could still be tempting for spenders.

While these are undoubtedly sensible options, investors should focus on what consumers actually want from their high streets. To help narrow this down, MFS conducted a survey of 2,000 UK adults in late August, evenly

It appears that, following two years of chaos and uncertainty, consumers are desperate for calm - almost boring normality. When asked about what services are important to have on a local high street, the top choices consisted of what could be considered the bare minimum. Even in our digital age, some 90% of people consider a Post Office to be either important (38%) or essential (52%). Following this, consumers are prioritising supermarkets; GPs and other healthcare services; and convenience stores.

Once these essentials have been ticked off, only then do they concern themselves with restaurants, cafes, and pubs. Even here, extravagance appears to take a back seat. At the very bottom of our results sat boutique shops and gyms, with only 13% and 11% of people respectively deeming them essential. Indeed, across all age groups, only 27% of respondents said they’d be willing to pay a premium to be near a “great” local high street.

Consumers may not care all that much about living near the most luxurious shops or restaurants, but there is still potential for property investors to benefit from sprucing up a high street. Those aged 18-34 – the generation set to start making their first steps onto the housing ladder over the coming years – 51% revealed that having a “vibrant local high street” is important for them when choosing where to live. Also, this age group contained the largest number of people (41%) who moved because of the decline in their local high streets since 2020.

So, if property investors want to

Consumers have revealed what they want to see on their high streets, and you may be surprised by the results

target his up-and-coming generation, where could they look? Fortunately, our research also identified several regions where high streets are in need of a bit of TLC.

Despite various efforts launched in recent months to support retail businesses, just 20% of all respondents said their local high street is better now than it was before the pandemic. A few specific areas appear to really be struggling, including the East Midlands (15%), West Midlands (16%), Wales (14%), and the South West (11%).

These regions may present plenty of opportunity for buyers. According to research from HBB Solutions, the midlands contain many “slow-selling homes” that have also seen significant price reductions. Here, the market appears desperate for buyers, who could bag a bargain.

Wales has also emerged as a key market for new-builds. Between April 2021 and 2022, new-build prices in

Wales jumped 21.7. For comparison, across the whole of the UK during the same period, average property prices only rose by around 12%. Additionally, over the last year or so, property prices in the South West of England rose by 15.2%, reaching record highs in the process.

For those with bigger budgets, the capital may also present opportunity. Those who do cherish having a healthy high street nearby are likely to live in London, where 56% of respondents stating it is an important element in helping them choose where to live. This was the highest number seen across the whole country.

Property in London is notoriously expensive, with the latest Halifax House Price Index showing a typical home now costs well over £550,000.

But, there’s no getting away from the fact that no matter how high prices get, there’s few signs of an oncoming slowdown in the big smoke. Prices in London recently saw the fastest

growth seen in 6 years as workers returned to their offices, even in the face of a cost-of-living crisis. And even with just a few months left to go, London house prices could rise by a further £27,000 by the end of 2022, according to Benham and Reeves.

Many consider their high streets to be the heart of a community. As such, seeing them struggle can be upsetting for families who feel a connection with their locality. But, where property investors step in, we could easily restore them to their full potential.

We work with landlords with 2+ bedroom properties in London to maximise their returns through our suite of services for HMOs and other shared homes.

Better returns

Landlords on average earn 60% more with Lyvly compared to an estate agent.

Excellent property care

Our in-house team clean and check your property so you know it's in safe hands.

The best tenants, on demand

We have a waiting list of careerminded professionals looking for a Lyvly home to live in.

To request a valuation or to find out more, contact us on the details above.

contact us on the details above.

As featured in

As featured in

As featured in

For made to measure property finance with more flexibility, consider the alternatives.

Who would have thought that the world could change so much in such a short period of time, yet since the beginning of 2020 the UK left the EU, COVID 19 and Lockdown brought us to a standstill, Donald Trump was impeached, the Abraham Accords were signed, the effects of manmade climate change were felt in earnest, supply chains came under threat, Russia invaded Ukraine, Boris Johnson was replaced by Liz Truss and, most importantly of all, GlobeInvest Ventures came into being.

The Historic Ties that Bind and Building Wealth through Relationships Post Brexit, and with the renewed capacity to negotiate our own Free Trade Agreements especially with The Commonwealth (a voluntary association of 56 independent and equal countries in Africa, Asia, the Americas, Europe and the Pacific),

we’re here to help boost trade between member countries and beyond to create prosperity for all whilst helping those who cannot help themselves.

And in case you didn’t already know, The Commonwealth alone is home to 2.5 billion people/onethird of the world’s population and includes both advanced economies and developing countries alike.

All too often the ‘V’ in Venture Capital stands for Vulture. Quick success almost always results in equally rapid extinction as the rate of environmental change outpaces the ability to adapt, and while growth follows the knife; the start-up ecosystem in particular needs a different more considered holistic approach, lest baby is thrown out with the bathwater.

Raw PE, raw VC, and raw show me the money isn’t always the best approach, as by its very nature it stifles and over-centralises true innovation and sustainability. The

same applies to thinking that an IPO is the only way out – it’s not. Working with innovators and founders for the long-term as equal shareholders is by far a better way to create true intergenerational wealth.

With so many business funders ‘going with the flow’ and struggling to get their message across, now is very much the time to put People on an equal footing with the Businesses they run. Thus, we’re people focused implementers and innovators - We either find a way, or we make one.

In other words, real Venture Capitalism not exploitative Vulture Capitalism.

The UK is the home to the highest number (41 to be precise) of European Unicorns. The UK, India and Israel are well on their way to become the

‘Stellar Super-Unicorn Nurseries and Incubators’ that really does benefit all. But Unicorns are delicate individual creatures, and like the world on which they/we live and depend upon for our very existence and survival, it is often the disrupters and those daring to be different that sustainably thrive and survive to reproduce.

That’s why GlobeInvest Ventures in association with Global Asset Portfolio revel in daring to be different and disrupting the way new and existing business is funded. With that in mind, we’ve launched a fully insured capital guaranteed infrastructure and trade finance bond that’s been specifically designed for Certified Sophisticated Investors, Ultra High Net Worth Individuals, Family Offices and Sovereign Wealth Funds with the sole aim of bringing true ‘sustainability’ to the funding market.

About GlobeInvest Ventures

In short, we’re a cross-border investment and business advisory firm with a strong focus on investment opportunities in private equity, real estate, social housing, water resources, waste management, fin-tech, healthcare, med-tech, start-ups, reg-tech, financing, and M&A

GlobeInvest Ventures are proud to support the Gurkha Welfare Trust.

The team here at GlobeInvest Ventures are delighted to be Conference Sponsors for the AJBN Annual Flagship Event.

GlobeInvest Ventures is a Hybrid India and United Kingdom business with a strong focus on both investments and forming strategic partnerships with like-minded souls in order to help those who cannot help themselves, and to build Wealth through Relationships through impact investing and ESG.

That'swhyGlobeInvestVenturesinassociationwithGlobalAssetPortfoliorevelindaringtobedifferent anddisruptingthewaynewandexistingbusinessisfunded.Withthatinmind,we’velaunchedafully insuredcapitalguaranteedinfrastructureandtrade financebondthat’sbeenspecificallydesignedfor CertifiedSophisticatedInvestors,UltraHighNetWorthIndividuals,FamilyOfficesandSovereignWealth Funds with the sole aim of bringing true ‘sustainability’ to the funding market.

Come and speak to us at our stand

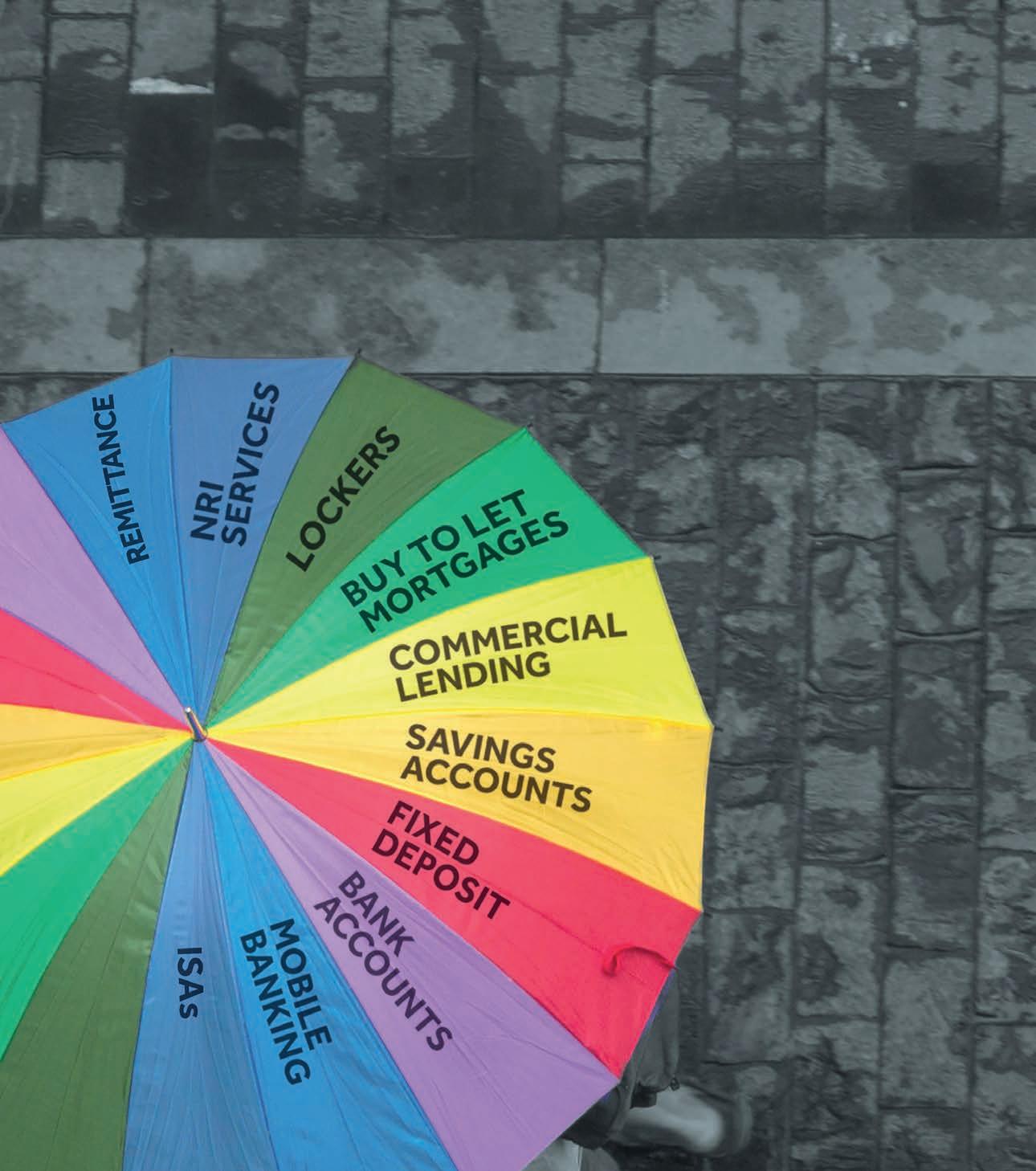

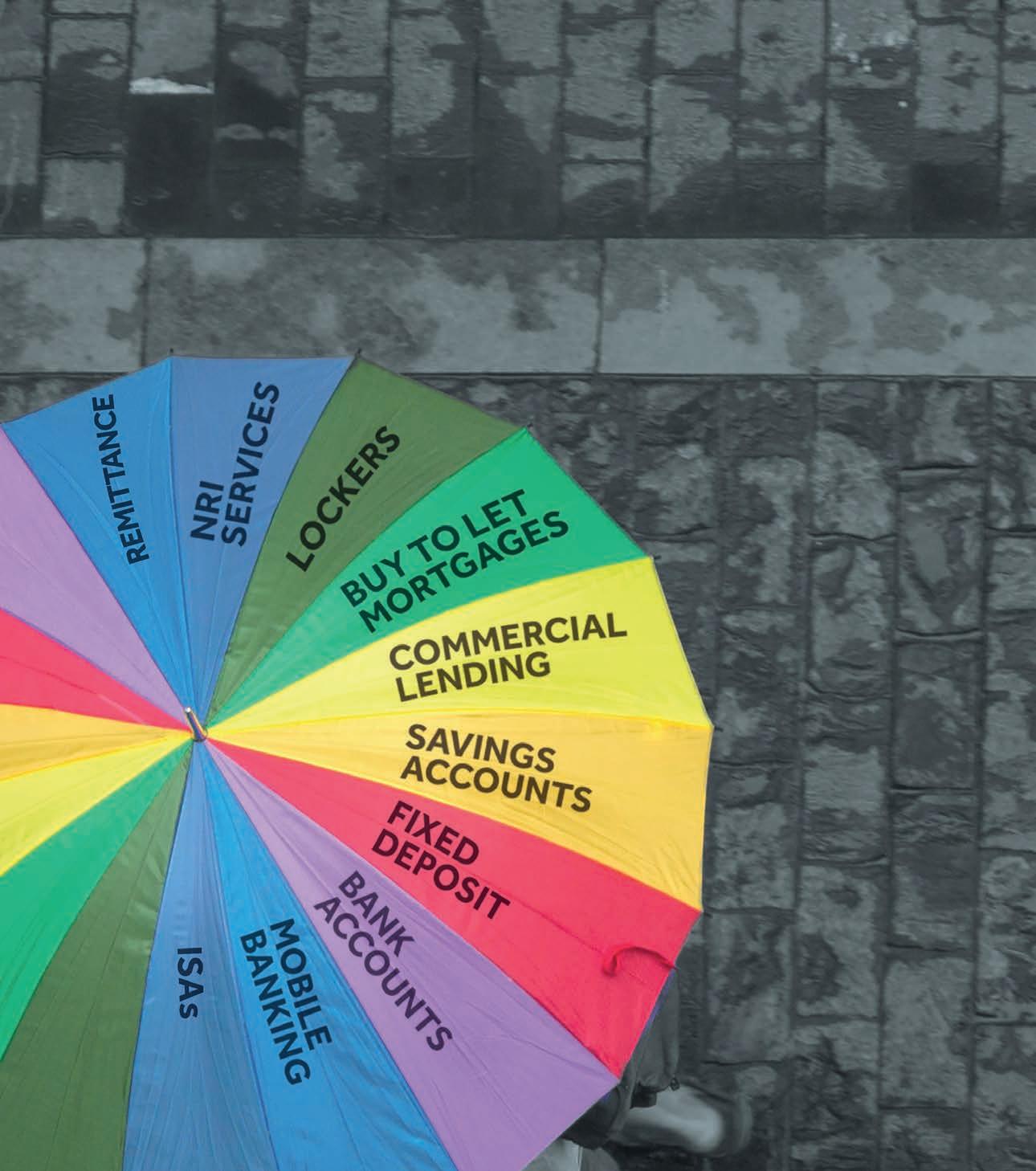

The Affinity Associates Group are an international firm of Accountants, Business Advisors, IT Professionals, and Independent Financial Advisors. We currently operate out of seven offices in the United Kingdom, with back office support of three offices in India, and one in Dubai.

We are passionate about the business that we are in, and we take great pride in our personalised approach to managing each client relationship and their respective requirements. Our Mission;

To provide exceptional quality, every time.

Authorised and regulated for public accounting practice and audit work by both ICAEW and ACCA, the Financial Services division of the Group holds an FCA license.

Providing the below services across four distinct divisions, The Affinity Associates Group aims to provide a complete packaged service to our Clients and to other Practicing Accountants here in the UK.

Payroll & P11d Wills Company Secretarial Commercial Lending Audit & Assurance Services Insurance & Protection

Statutory Financial Accounts Preparation

Residential & Buy to Let Mortgages

Inheritance Tax Planning Bookkeeping, VAT, & Management Accounting Retirement & Investment Planning Tax planning & compliance for; Individuals, Partnerships, Companies, LLPs, & Trusts

Outsourced services to UK accountancy practices

Managed IT services; Hosted Desktop (Daas); Outsourced services to other businesses Microsoft 365; Business Continuity; Server Solutions; Internet Connectivity

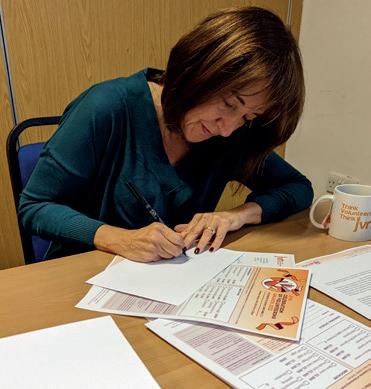

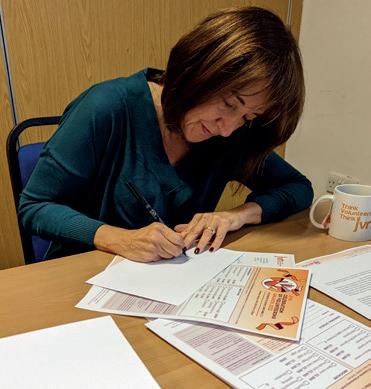

Falguni Desai, Business Growth Coach, started working with Radshaw Solicitors in July 2021, as the world was recovering from the effects of the global pandemic.

Falguni is an experienced Business Growth Coach. Prior to that, she was a corporate lawyer for 20 years. Her professional experience and proven ActionCOACH methodology delivers great results for her clients.

Radshaw Solicitors, founded and run by Adela Manzoor in 2015, was a thriving law firm ready to take the next steps but needed some concentrated direction to help her ensure that her business was in the right position for the post-COVID-19 landscape.

Adela approached Falguni to help rationalise what needed to be done to grow her company sustainably. Having a law background herself, Falguni was a perfect match.

Radshaw Solicitors needed a strategic revamp; it required direction and support to expand its client base, diversify its services and build foundations for the long term.

Working together for over one year, Falguni and Adela have given Radshaw Solicitors a clear direction, growth goals, a new brand identity and a strong workforce, ensuring that the firm is fit for the future and will rival its biggest competitors.

Falguni’s coaching has helped me grow my business from strength to strength, which would not have been possible without her help and guidance. I opted for Falguni’s coaching group as I liked her coaching style. Not only does she help in the sessions I have with her but also takes the time to check in throughout the week. She is a great connector and has placed me with so many opportunities that I would not have otherwise thought of. She has provided me with the push that I needed and also really has you thinking about different aspects of the business that you would not usually think of.

have achieved so much in time that I did not think was possible. My team has grown, and my business is moving in a direction I didn’t think it could ever.

Experience has shown that it’s in a client's best interest to discuss potential tax and penalty issues with an independent tax specialist as early as possible. The right help at the right time ensures HMRC are effectively managed, and that enquiries, investigations and disclosures are concluded commercially and expeditiously.

Has your client received a business enquiry or investigation letter from HMRC?

Has your client received a disclosure 'nudge letter’ suggesting overseas investments have not been declared?

If the answer is ‘yes’ to either question or there is another HMRC related matter, then get in touch with us today.

Our specialist, industry recognised team, led by ex HMRC Senior Inspector Amit Puri, are available for a discreet, confidential and no-obligation exploratory conversation.

We have made hundreds of tax disclosures to HMRC over the years and consistently work hard to protect our clients under investigation, where the regular agents don’t have the resources and the niche skillset.

Our Tax Investigations & Disputes specialists are highly adept at managing client interactions with HMRC, to ensure processes run smoothly and our clients' interests are best protected. We provide that all important trusted 'buffer' between our clients and HMRC.

Founder & managing partner

Ex-Tax Inspector with HMRC and subsequently Head of Tax Investigations & Disputes teams, Amit has over 18 years of specialist, high quality tax investigative & resolutions experience.

Pure Tax

the trading name of Pure Tax Support Services LLP, a

liability partnership registered in England & Wales with registration

Its registered office is 2nd Floor,

60-66 Wardour Street, London, W1F 0TA, where a list

members

available for inspection

REIM CAPITAL IS A SPECIALIST UK REAL ESTATE LENDER TO PROPERTY DEVELOPERS, ENTREPRENEURS, AND INVESTORS ACROSS THE UK.

CAPITAL IS A SPECIALIST UK REAL ESTATE LENDER TO PROPERTY DEVELOPERS, ENTREPRENEURS, AND INVESTORS ACROSS THE UK.

REIM OFFERS A RANGE OF 1ST & 2ND CHARGE BRIDGING LOANS

REIM OFFERS A RANGE OF 1ST & 2ND CHARGE BRIDGING LOANS

AGAINST UK REAL ESTATE ASSETS, INCLUDING BOTH RESIDENTIAL AND COMMERCIAL.

AGAINST UK REAL ESTATE ASSETS, INCLUDING BOTH RESIDENTIAL AND COMMERCIAL.

FURTHER INFORMATION OR TO SEE REIM CAPITAL'S PRODUCT GUIDE,

FURTHER INFORMATION OR TO SEE REIM CAPITAL'S PRODUCT GUIDE,

CONTACT:

Square,

Whether you’re transferring money overseas for your new life in the sun, investing in high value goods or simply making regular international money transfers, Currencies 4 You will help you achieve more for your money

Whether you’re importing or exporting, have an overseas payroll or simply receive payments in a foreign currency, Currencies 4 You will help you achieve more for your money and help mitigate exposure to volatile currency fluctuations.

We help our clients tell their story to the right audiences, the right way, in the right places, at the right time.

We help our clients tell their story to the right audiences, the right way, in the right places, at the right time.

We help our clients tell their story to the right audiences, the right way, in the right places, at the right time.

The PR Office

We help our clients tell their story to the right audiences, the right way, in the right places, at the right time.

31-35 Kirby Street London EC1N 8TE

The PR Office

The PR Office

31-35 Kirby Street London EC1N 8TE

e: enquiries@theproffice.com t: +44 (0)20 7284 6969 www.theproffice.com

The PR Office 31-35 Kirby Street London EC1N 8TE

31 35 Kirby Street London EC1N 8TE

e: enquiries@theproffice.com t: +44 (0)20 7284 6969 www.theproffice.com

e: enquiries@theproffice.com t: +44 (0)20 7284 6969 www.theproffice.com

e: enquiries@theproffice.com t: +44 (0)20 7284 6969 www.theproffice.com

At Aventus we like to understand our clients’ ambitions and business needs and make them important to us. Whether you require accounting assistance at a corporate or personal level, we are equipped to act as your audit, tax and accounting advisors. Our focus is on listening, assessment and activation to achieve targeted goals for our clients.

Our clients are a range of UK fast growing businesses seeking to increase efficiency of their finance function, high net worth individuals and global inbound businesses setting up in the UK.

We are part of a global network of businesses that desire international expansion.

Visit aventuspartners.co.uk to find out more, or contact us at admin@aventuspartners.co.uk

from home,

g-term,

lon

lon g-term,

from home,

from home,

group of

the areas of education,

Our Helpline can help you find the answers to the most challenging problems. We can tell you about our services: care homes, community centres, support for people living with

and their families

online events and activities. And if we can’t help you ourselves, we’ll help you find someone who can.

if you need advice

human face,

Set in 300 acres of stunning Hertfordshire countryside, The Grove is the ultimate five star retreat. Lovingly restored, the former home of the Earls of Clarendon is situated just 18 miles from London, and is home to an award winning spa, championship golf course and mouth-watering restaurants.

Scan QR code to find out more or book a visit.

Asian Business Association (ABA), a interest group within London Chamber of Commerce and Industry (LCCI), is the premier voice and forum for Asian businesses in London. Led by Tony Matharu, Chairman, Integrity

Group.

The best businesses thrive in times of economic turmoil – this is something we’re firm believers of at OakNorth Bank and we’ve seen time and again.

e saw it during COVID when we lent £50m to Arora Group, the property investment, construction, and hotels business founded by Surinder Arora, providing the business with the financial firepower to take advantage of opportunities arising from the pandemic. We saw it when we lent £3.7m to Ottolenghi, Yotam Ottolenghi’s famed restaurant and deli chain, to help cover working capital throughout the pandemic. In the months following the first UK lockdown, the company expanded its online shop with dinner boxes, prepare at home meal kits, and a tableware licensing deal, as well as growing its Ottolenghi Ready range. In May 2021 it moved its production unit and online warehouse to a larger site in Holloway, north London, which allowed it to support further expansion of its delis and retail product range. The combination of these efforts meant the business managed to achieve a positive EBITDA despite going

through another pandemic-hit year in 2021, and is now operating at a higher earnings margin than pre-pandemic.

But historically when facing an economic downturn, decreasing interest rates was the key tool in central banks’ toolbox to stimulate economic activity. This time however, that tool is unlikely to be used as central banks use increasing interest rates to tackle inflation.

So, what does this mean for businesses? Those that have over-levered themselves could now face difficulties in raising capital, especially as funders seek to protect their own balance sheet. As past recessions have shown, in a downturn, funders tend to tighten their criteria and suck liquidity out of the market. Lenders will be looking to proactively manage their troubled credits and will provide less leniency on covenants than they would have been willing to in the past. They will become

more cautious and focus on existing borrowers, rather than originating new loans so there’ll be limited liquidity to new customers.

At OakNorth Bank however, it’s business as usual for us. We’re used to operating in challenging periods – since our launch in September 2015, we’ve faced two unprecedented events: Brexit and COVID – and we continued lending and supporting businesses throughout both. That’s probably why more than 40% of our borrowers are repeat customers, and why 80% of our new lending comes via referrals from delighted customers. So, if you’re a business looking to sure up working capital for the challenging times ahead, or a loan to pursue opportunities that may arise from the downturn (acquisitions, management buyouts, growth, etc.), then do get in touch with us and we’ll see if we can help.

The world has changed –what does this mean for businesses and their ability to secure a loan?