Airport profiles: Santiago de Chile

Design & Build: Bengaluru-Kempegowda & Jackson Hole

Plus:

Airport profiles: Santiago de Chile

Design & Build: Bengaluru-Kempegowda & Jackson Hole

Plus:

Airports are leveraging digital twins to gain a comprehensive view of their facilities, to improve operations and security, and to deliver a better passenger experience. With Esri’s geographic information system (GIS) technology, you can create a digital twin to enhance asset control signaling and monitoring (ACSM), derive passenger flow information, and move assets on the runway—all to help optimize airport operations. Discover how GIS is foundational to your airport’s digital twin.

To learn more, go to go.esri.com/esri-airport-digital-twins.

Editor

Joe Bates +44 (0)1276 476582 joe@airport-world.com

Sales Directors

Jonathan Lee +44 (0)208 707 2743 jonathan@airport-world.com

Jon Sissons +44 (0)208 707 2743 jon.sissons@airport-world.com

Advertising Manager

Andrew Hazell +44 (0)208 384 0206 andrewh@airport-world.com

Design, Layout & Production

Mark Draper +44 (0)208 707 2743 mark@airport-world.com

Subscriptions subscriptions@aviationmedia.aero

Managing Director

Jonathan Lee +44 (0)208 707 2743 jonathan@aviationmedia.aero

Editor, Joe Bates, reflects on the continued upturn in global traffic and the ‘connectivity’ theme of this issue of Airport World.

While it is, of course, difficult to predict the future, rising traffic figures across the globe and expectations of better things to come this year would indicate that the aviation industry is finally back on track and set to resume its pre-pandemic growth trajectory in 2024.

If you recall, when speaking at the Airports Innovate conference in Oman last November, Sheikh Aimen Bin Ahmed Al Hosni, CEO of Oman Airports and the then chair of the ACI World Governing Board, told delegates that 2024 would be “a milestone year for aviation” with passenger numbers at the world’s airports exceeding 2019 levels by at least 200 million.

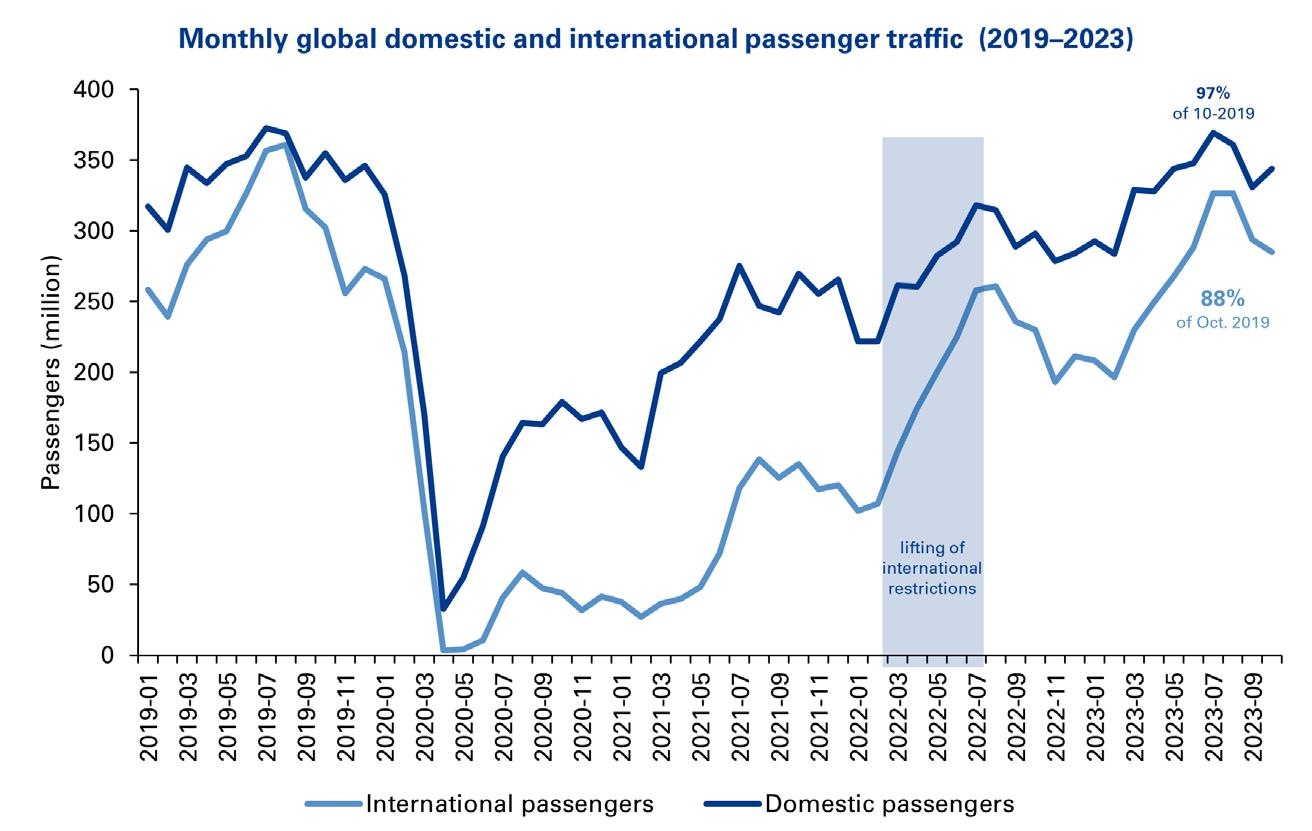

• By 2024, international passenger traffic is forecasted to approach the four billion mark, with domestic passenger traffic reaching 5.7 billion.

• Looking ahead to 2042, international passenger traffic is expected to reach 8.7 billion and domestic passenger traffic to attain 10.6 billion.

• Between 2023 and 2042, advanced economies are expected to have a CAGR of 3.2% for total passenger traffic, whereas emerging and developing economies are expected to have a more robust CAGR of 5.4%.

Published by Aviation Media Ltd PO BOX 448, Feltham, TW13 9EA, UK Website www.airport-world.com

AirportWorld is published six times a year for the members of ACI World. The opinions and views expressed in AirportWorld are those of the authors and do not necessarily reflect an ACI World policy or position.

ISSN: 1360-4341

The content of this publication is copyright of Aviation Media Ltd and should not be copied or stored without the express permission of the publisher.

Looking further into the future, as you will be able to read more about in this ‘connectivity’ themed issue, ACI World’s newly released annual World Airport Traffic Forecasts (WATF) 2023–2052 dataset indicates that global passenger traffic is set to double over the next 20 years, by which time China will have replaced the US as the world’s biggest aviation market.

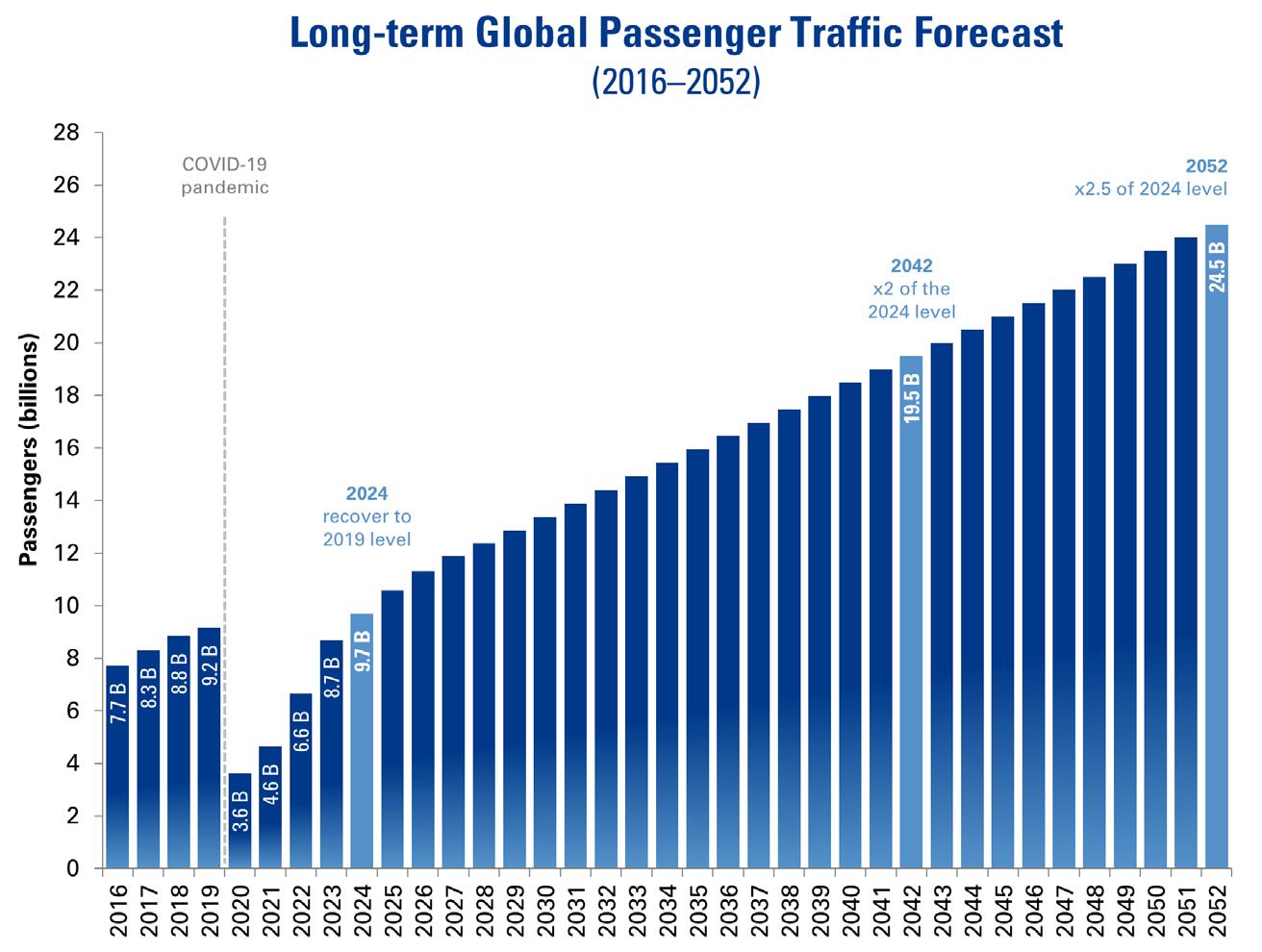

ACI World director general, Luis Felipe de Oliveira, says: “The projections indicate that global passenger traffic is set to reach 9.7 billion by the end of 2024, surpassing pre-pandemic levels, and suggest a doubling by 2042 and a 2.5-fold increase by 2052.

“In the long-term, the global passenger market dynamic is expected to transition from advanced economies towards emerging and developing ones as they experience significant urbanisation and population increases, often combined with rapid economic growth favourably impacting their disposable income and willingness to travel.

“Investing responsibly in current and new infrastructure remains key to ensuring that we can sustainably meet capacity growth to maximise the social and economic benefits of aviation.”

Highlights from the WATF 2023-2052 dataset include:

• Global passenger traffic is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2042 and 3.6% from 2042 to 2052.

In addition to looking at potential future growth and the drivers behind it, the ‘connectivity’ themed section of this issue contains articles about route development; multimodalism; evolving airline route networks; and the importance of engaging with local communities, especially when it comes to getting support for developments projects.

Our main airport feature shines the spotlight on Santiago’s Arturo Merino Benítez International Airport and CEO, François-Régis Le Mière, who tells us more about recent developments at Chile’s gateway to the world and his hopes and expectations for the year ahead.

Elsewhere in the issue we hear from ACI World director general, Luis Felipe de Oliveira, about some of the key connectivity challenges facing airports; take a closer look at Bengaluru-Kempegowda’s new Terminal 2; and report on the completion of the multi-phased terminal renovation and expansion programme at Jackson Hole Airport.

We also report on the latest sustainability efforts from airports across the globe and consider how airports can potentially benefit from the airlines selling more retail products and goods direct to passengers.

Last, but not least, we reflect on connectivity in our regular ‘people matters’ column; and report on the latest news from ACI's World Business Partners (WBP) in an extended four-page section.

I hope you enjoy our first issue of the year and look forward to bringing you more news, views and developments from airports across the globe throughout 2024.

Editor, Joe Bates, reflects on the continued upturn in global traffic and the ‘connectivity’ theme of this issue of Airport World

9

ACI World director general, Luis Felipe de Oliveira, considers some of the key connectivity-related challenges facing airports today.

10

We report on milestone appointments for ACI World and ACI Latin America & Caribbean, the end of year departure of Luis Felipe de Oliveira, the strengthening of ties with China’s airports and a round-table discussion in India.

14

CEO, François-Régis Le Mière, tells Joe Bates more about recent developments at Santiago’s Arturo Merino Benítez International Airport and his hopes and expections for the year ahead.

18

ACI World’s economics data scientist, Hyuntae Jung, and senior director for economics data and analytics, Diederik Meijerink, highlight some of the key findings of ACI World’s new long-term traffic forecast.

20

Airline services and route networks ultimately decide the fate of any airport. As global environmental concerns grow, navigating air service development towards sustainable aviation will be a key challenge going forward, writes George Karamanos.

23

Global connectivity is undergoing subtle changes as the airlines adjust their schedules to the post pandemic market, writes OAG’s chief analyst, John Grant.

Amsterdam Schiphol’s Klaas Boersma reflects on the importance of a shared vision when it comes to embracing multimodality at the world’s airports.

Engaging with communities and taking steps to show the economic benefits of projects can help secure the long-term future of US airports and the regions they serve, writes Ryan Pearce.

Amadeus’ Holger Mattig explains how airports can potentially benefit from new technology that will allow the airlines to sell retail products and other non-aeronautical related goods and services direct to passengers.

The new Terminal 2 at Bengaluru’s Kempegpowda International Airport puts nature and biodiversity at the heart of the passenger experience, writes Andrew Haines, senior associate at Grant Associates.

The Wyoming gateway is arguably a thing of beauty after the completion of its multi-phased terminal renovation and expansion programme.

Airport World takes a closer look at some of the sustainability stories making headlines across globe in the first quarter of the year.

Announcements, news stories and opinions from ACI World Business Partners across the globe.

Richard Plenty and Terri Morrissey reflect on how the global pandemic has changed the way we connect and communicate with each other.

Director General

Luis Felipe de Oliveira (Montreal, Canada)

Chair

Candace McGraw (Cincinnati, USA)

Vice Chair

Jost Lammers (Munich, Germany)

Immediate Past Chair

Aimen Al Hosni (Muscat, Oman)

Treasurer

Arnaud Feist (Brussels, Belgium)

ACI WORLD GOVERNING BOARD

DIRECTORS

Africa (3)

Emanuel Chaves (Maputo, Mozambique)

Fabrice Grondin (Saint-Denis, Réunion)

Mpumi Mpofu (Johannesburg, South Africa)

Asia-Pacific & Middle East (9)

Mohamed Yousif Al-Binfalah (Bahrain)

Fred Lam (Hong Kong, Hong Kong SAR)

SGK Kishore (Hyderabad, India)

Emmanuel Menanteau (Paris, France)

Akihiko Tamura (Tokyo, Japan)

4 Vacancies

Europe (7)

Armando Brunini (Milan, Italy)

Arnaud Feist (Brussels, Belgium)

Jost Lammers (Munich, Germany)

Javier Marin (Madrid, Spain)

Yiannis Paraschis (Athens, Greece)

Augustin de Romanet (Paris, France)

Nazareno Ventola (Bologna, Italy)

Latin America & Caribbean (3)

Ezequiel Barrenechea (Guayaquil, Ecuador)

Mónika Infante (Santo Domingo, Dominican Republic)

Juan José Salmón (Lima, Peru)

North America (6)

Kevin Dolliole (New Orleans, USA)

Deborah Flint (Toronto, Canada)

Joseph Lopano (Tampa, USA)

Candace McGraw (Cincinnati, USA)

Sam Samaddar (Kelowna, Canada)

Roelof-Jan Steenstra (Toronto, Canada)

Regional Advisers to the World Governing Board (10)

Evans Avendaño (Lima, Peru)

Lew Bleiweis (Asheville, USA)

David Ciceo (Cluj-Napoca, Romania)

Seow Hiang Lee (Singapore)

TanSri BashirAhmad Abdul Majid (Delhi, India)

Mohamed Saeed Mahrous (Cairo, Egypt)

Jorge Rosillo (Galapagos, Ecuador)

Brian Ryks (Minneapolis-St Paul, USA)

2 Vacancies

WBP Observer

Esperanza Morales Martin (Global Exchange)

Correct as of February 2024

We report on milestone appointments for ACI World and ACI Latin America & Caribbean, the end of year departure of Luis Felipe de Oliveira, the strengthening of ties with China’s airports and a round-table discussion in India.

McGraw becomes

Candace McGraw, CEO of Cincinnati/Northern Kentucky International Airport (CVG), has become the first female chair of ACI World.

McGraw will head the ACI World Governing Board (WGB) that consists of 28 leading airport CEOs nominated by the regional ACI Boards, plus the immediate past chair.

The ACI WGB directs the organisation through strategic discussions on key subjects for airport operators that reflect the concerns and interests of ACI members for the benefit of travellers and communities worldwide.

Her appointment was approved at the ACI World Annual General Assembly in Barcelona in June 2023, and she will hold the post until December 2025.

McGraw has been involved in the ACI WGB since 2018 and was appointed ACI World vice chair in January 2022, succeeding Sheikh Aimen bin Al Hosni, CEO of Oman Airports.

Talking about her appointment, McGraw said: “I am honoured to serve as chair of the ACI World Governing Board. I thank Sheikh Aimen bin Al Hosni, our immediate past chair, for his leadership these past several years. Nothing is more important to me than the future of this industry.Whether thinking about the long-term needs of ACI, how we can be a strong partner in the global aviation industry, or what we can do to accelerate the adoption of practices to ensure sustainable aviation, we are stronger as one.

"I commit to lead our World Governing Board with a sense of purpose and collaboration and appreciate the trust that has been placed in me.”

ACI World director general, Luis Felipe de Oliveira, said: “We are thrilled to welcome ACI World’s new chair, Candace McGraw. Guided by her vision, we are confident that our organisation will chart a course towards a bright future and unlock new horizons in our mission to elevate the interests of airports worldwide.”

McGraw became CEO of CVG in July 2011 and has over 30 years’ experience in aviation, legal affairs, and public administration.

As of January 2024, Jost Lammers, CEO of Munich Airport, succeeds McGraw as ACI World’s new vice chair, also for a two-year term running until December 2025.

This year will be the last one in the hot-seat for ACI World director general, Luis Felipe de Oliveira, who has announced his decision to step down from his role at the end of 2024.

His departure is driven by family reasons, as de Oliveira expresses his desire to return to Europe with his family after four impactful years at the helm of ACI World.

Taking on the role during the unprecedented challenges posed by the global pandemic, de Oliveira steered ACI World through the most severe crisis ever experienced in the aviation sector. While challenges remain in the airport industry and will require long-term attention, he leaves with a sense of mission accomplished, having elevated the organisation to new heights.

“Leading ACI World as director general over the past four years has been a great honour,” said de Oliveira. “The mission that ACI champions, the benefits it weaves for our global members, our devoted staff who bring its vision to life, and the boundless social and economic impact of a flourishing aviation industry, all stir the embers of my spirit.

“My commitment to this noble cause will remain steadfast in my final year as ACI World director general. It is with a heavy heart that I announce my departure, but with a sense of accomplishment and gratitude to the organisation. As I reflect on my next professional chapter with my family, I’m filled with optimism and drive to tackle new challenges.”

ACI World, ACI Asia-Pacific & Middle East (ACI APAC & MID), and the China Civil Airports Association (CCAA) have signed a Memorandum of Understanding (MoU) to strengthen the co-operation of Chinese airports.

The ACI-CCAA MoU will see the parties collaborate on several initiatives, including:

• Airport customer experience through the ACI Airport Service Quality (ASQ) programme

• ACI Global Trainings and Assessments, including the APEX in Excellence peer assessment programme

• Decarbonisation through the new ACI APAC & MID Net Zero Roadmap programme

• ACI and CCAA events in China.

ACI APAC & MID director general, Stefano Baronci, said: “China will continue to be one of the most vibrant aviation markets, and is expected to contribute 21% to the additional growth in global traffic by 2041.

Mónika Infante, CEO of Dominican Republic airport operator, AERODOM, is the new president of the Board of Directors of the ACI Latin America and Caribbean (ACI-LAC) for the term 2024-2025.

Infante, who is the first woman to lead the association since it was founded in 1991, described her appointment as an honour, and pledged to do her best to help build a more resilient and sustainable industry.

She enthused: “ACI-LAC is an effective and respected voice, acting as a unique centre of expertise. Looking to the future and its challenges, it reinforced the relevance of ACI-LAC to drive important initiatives together with all our partners, authorities and stakeholders in favour of liberalisation, sustainability and decarbonisation of the industry.”

ACI-LAC’s director general, Rafael Echevarne, said: “Mónika is the first woman to lead this organisation after serving in various roles on the ACI-LAC Board. I am sure that with her support and leadership our association will be full of new initiatives for the industry, our members and the region, especially in the areas of sustainability, innovation and technology, among others.”

“In order to cater to this growth, Chinese airports must make substantial preparations for efficient operations, addressing evolving passenger needs, and implementing sustainable measures for environmental protection.

“We hope this MoU will further strengthen the already strong ties between our relationships with CCAA, and will serve as a platform to promote ACI programmes to the airports in China as part of our mission to promote excellence in airport operations and management.”

While ACI World director general, Luis Felipe de Oliveira, noted: “The re-opening of China in 2022, the second largest aviation market after the United States, remains a critical boost to global activity and to passenger traffic, both domestically within the Chinese aviation market and for international travel.

“The Asia-Pacific region, where China plays a key role, is expected to rebound in 2024, reaching 85.3% of 2019 levels. Our deepest gratitude to CCAA for its warm hospitality, as we look forward to fortifying our partnership in a multitude of ways, including enhancing the customer experience, honing professional skills and accreditations, championing decarbonisation and organising airport events around the world, with Chinese airports at the forefront.”

ACI Asia-Pacific & Middle East’s director general, Stefano Baronci, is pictured at Wings India 2024 in Hyderabad in early January, where he took part in a thought-provoking round-table discussion on ‘Airports of the Future: Driving Investments & Financing for Multimodal Connectivity’.

Baronci underscored the importance of enhancing international connectivity in India and learning from the best practices of airport competitors in the region and beyond. Making airports in India economically and environmentally sustainable can only be reached through an effective partnership between the aviation stakeholders, including the government.

Welcome to IGA Academy at iGA Istanbul Airport, where knowledge meets practice.

Positioned at the crossroads of expertise and training excellence, iGA Istanbul Airport stands as a pivotal force in shaping the future of the aviation industry. Embrace the forefront of innovation with its comprehensive training programs at IGA Academy, where excellence knows no bounds.

IGA Academy proudly boasts prestigious accreditations, including ICAO Trainair Plus Program Membership, ACI Training Center Accreditation, and IATA’s Regional Training Partnership. Recognized by key organizations such as the Transportation Security Administration (TSA) of the United States, EUROCAE, and EUROCONTROL, our academy establishes itself as the industry benchmark, asserting its role as the Global Training Hub at the heart of the world.

Fostering a culture of cooperation, not competition, IGA Academy actively promotes knowledge sharing through collaborative agreements with other airports, contributing significantly to the aviation ecosystem. As the second-largest provider of secondees globally, our academy plays a vital role in advancing the industry in collaboration with aviation partners.

Ranked second among institutions offering the most international aviation training in Europe, IGA Academy trained over 400 aviation professionals from 120 different organizations in 2023.

Committed to the principle of ‘No Countries Left Behind,’ IGA Academy fulfills its social responsibility by supporting quality education access for less developed countries, ensuring balanced industry growth. Recognized with over twenty national and international awards, our academy stands as a symbol of excellence globally.

IGA Academy places significant emphasis on the professional development, talent management, and career guidance for iGA Istanbul Airport employees. With over 30 internationally accredited instructors, our goal extends beyond Türkiye, reaching a global scale.

Join IGA Academy on the journey of shaping the future of aviation and making a lasting impact on the global aviation landscape.

https://akademi.igairport.aero/en/ academy@igairport.aero

CEO, François-Régis Le Mière, tells Joe Bates more about recent developments at Santiago’s Arturo Merino Benítez International Airport and his hopes and expections for the year ahead.

With an ongoing upgrade to the domestic terminal and one of the most modern international terminals in Latin America, Santiago’s Arturo Merino Benítez International Airport (SCL) is looking forward to the future with optimism.

Nuevo Pudahuel – a consortium formed by VINCI Airports (40%), Groupe ADP (45%) and Gestione Concessioni (15%) – pledged to invest in upgrading Chile’s international gateway to the world in its winning bid for the concession to operate the airport in 2015, and it has been true to its word.

Indeed, in the nine years that Nuevo Pudahuel has been responsible for the operation and development of the airport, it has invested over $1 billion on new infrasfructure at SCL.

In addition to the ongoing $60 million redevelopment of the domestic terminal (Terminal 1) and opening a new $1 billion international terminal (Terminal 2), it has invested in four new buildings for government agencies (Customs, local and state police and Chile’s Agricultural and Livestock Services), two boulevards, more than 7,000 parking spaces, new cargo warehouses, two bus terminals and new spaces such as a theatre and an events room.

And the new additions will be needed as passenger numbers are now firmly on an upward trajectory again after the global pandemic, reaching 23 million (+25%) in 2023, which is just 5.3% down on the record 24.6 million that passed through the airport in 2019.

Looking back at 2023, does Nuevo Pudahuel CEO, François-Régis Le Mière, consider it to have been a good, bad or average year for Santiago’s Arturo Merino Benítez International Airport?

“I would say that it was a year of recovery and improvement for the airport after the COVID-19 restrictions were finally lifted in the first half of the year,” says Le Mière.

“New airines such as Arajet and Estelar helped boost the traffic recovery as did a number of new destinations and increased frequencies on existing routes, most notably by Chilean airlines LATAM, Sky Airlines and Jetsmart. All, of course, increased the range of services and options for our passengers.

“Last year was also memorable as we began refurbishing works to Terminal 1 after finishing the construction of the new international terminal (T2), which doubled Santiago Airport’s capacity, adding 45 more boarding gates, more than 80 retail and F&B outlets and a number of new services.”

SCL unveiled a new look Arrivals area in Terminal 1 in December 2023 (pictured above) as part of a project to equip the facility to handle up to 20 million passengers per annum by 2025.

The “refurbishment and remodelling” project includes the transformation of different areas of the terminal, two new departure zones, as well as the construction of a new T1-A building, which will add more than 17,000sqm of capacity, allowing for an additional eight additional boarding gates and extra retail/F&B outlets.

Speaking in December at the inauguration of the new Arrivals area, Chile’s Minister of Public Works, Jessica López, said: “This facility is fundamental for our economy, since thousands of people, who travel to work or to visit touristic sites in Chile, travel through this terminal.

“After 11 months of work, we are inaugurating the new national arrivals area, which is within the framework of this final project that will benefit nearly 20 million passengers annually.”

The new Arrivals area doubles the number of baggage claim carousels from six to twelve; and offers a new official transportation area. It also includes new shops and services, is lighter and brighter than before and has improved signage.

Le Mière says: “The Arrivals area is the meeting point for our travellers coming from all over Chile, who represent 60% of all airport passengers.

“Considering the significant increase in travel within the country, due to the rise of the low-cost airlines, both this area and the building as a whole required not only an expansion, but also a modernisation of its services.

“This work is aligned with the commitment of Nuevo Pudahuel and its shareholder groups to provide a high-standard infrastructure and the best passenger experience, with all the services, comfort and technologies our guests require.”

He notes that the modernisation programme coincides with 30th anniversary of the building, which opened in February 1994.

According to Le Mière, the revamped terminal will be more spacious, aeshetically pleasing and boast more shops and services, new flight information screens, and new bathrooms to ensure that its facilities are on a par with those in the international terminal.

The construction of the new T1-A building is the key development of the second phase of the revamp of the domestic terminal, which is the last major project in Nuevo Pudahuel’s master plan for Arturo Merino Benítez International Airport.

Upon completion, the totally remodelled facility will have 42 boarding gates – 20 more than it has today.

Since its opening in February 2022, more than 18.3 million passengers have travelled through Terminal 2, which has changed the face of international travel to Santiago by effectively providing the gateway with the modern facilities it needed to take passenger services and its operational capabilities to the next level.

For starters, the 248,000sqm complex boasts three times the service area of its predecessor and the extra space has allowed for the addition of 45 new boarding gates (it previously had 31) and the

adoption of a host of new technologies that have more than doubled SCL’s capacity from 16 million to 38 million passengers per annum.

New automated technologies deployed in T2 to enhance the passenger processing procedures include 96 self-check-in kiosks, 64 self-bag-drop positions and 55 e-Gates.

“The new international terminal has proved a game-changer for the airport,” states Le Mière. “Terminal 2 is the most modern passenger building in South America.

“It has upgraded the quality of travel for passengers flying from and to Santiago. It is not only a larger facility designed to provide new standards of comfort for passengers, but also a more modern and innovative building, equipped with nearly 100 self check-in kiosks, over 60 self bag drop counters and a baggage handling system that is able to track all baggage efficiently.

“It is also a more efficient terminal as it incorporates natural lighting, as well as energy and water saving technologies.

“In addition to these features, T2 provides more than 6,000 parking lots, 80 retail and F&B shops and several services that aim to give passengers the best travel experience.

“Finally, the building incorporates lively public boulevards, an events room, two bus terminals, an open 250-seat theater and various spaces for the arts.”

He notes that building the international terminal was a tremendous challenge that took five years to complete, but as a result of its construction, international passengers transiting through the airport today have more space, commercial areas and restaurants than ever before.

Le Mière certainly has no doubt that its facilities have enhanced the airport experience of all passengers travelling on international flights out of Santiago.

A landscaped plaza connects the two terminals on the landside, affording open-air views to the main entrances of both buildings.

The airport continues to expand its route network with 20 airlines today operating non-stop services to 42 destinations across Chile, Latin America and the Caribbean, Oceania, North America and Europe.

GSN3:

GSN4:

GSN5:

ACI World’s economics data scientist, Hyuntae Jung, and senior director for economics data and analytics, Diederik Meijerink, highlight some of the key findings of ACI World’s new long-term traffic forecast.

ACI World’s newly released World Airport Traffic Forecasts (WATF) 2023–2052 sheds light on the trajectory of air traffic over the next three decades.

This year’s version of our annual flagship publication shows that global passenger traffic is set to double over the next 20 years, by which time China will have replaced the US as the world’s biggest aviation market. But what else can we expect? Let's take a closer look at what the future holds.

The latest WATF report extends its horizon by an impressive 10 years, offering a comprehensive 30-year outlook on airport traffic forecasts worldwide. Drawing data from 141 countries, including 29 new additions, the report provides granular forecasts for passengers, air cargo volumes, and aircraft movements.

Optimism abounds as the forecast predicts that global passenger traffic in 2024 will surpass the 2019 level for the first time since the onset of the pandemic.

The projection is that 9.7 billion passengers will pass through the world’s airports this year. If accurate, the total will represent a 6% increase over pre-pandemic levels, showing that the industry is on a path towards full recovery.

However, the pace of growth is expected to stabilise in the coming years, influenced by macroeconomic factors such as inflation, GDP fluctuations, and geopolitical tensions.

A glance at year-to-date figures for October 2023 revealed a robust recovery trend, with total passenger traffic up by 28% compared to the previous year 2022. International travel, in particular, has witnessed a notable resurgence, indicating pent-up demand for cross-border journeys.

Looking further ahead, projections suggest a steady growth trajectory for global passenger traffic, with a compound annual growth rate (CAGR) of 4.3% expected between 2023 and 2042. While initial post-pandemic years may see accelerated growth, rates are expected to normalise by 2052.

The top 20 markets by total passenger traffic forecast depict a shifting landscape, in terms of both domestic and international passenger traffic.

While the United States has traditionally held the top spot, China is projected to surpass it by 2042 in terms of international passenger traffic. By 2052, China is expected to maintain its dominance in both domestic and international air travel.

Meanwhile, emerging economies like Indonesia, Turkey, and Thailand are poised to climb the ranks, reflecting their growing importance in the global aviation market. These shifts underscore the evolving dynamics of air travel and the increasing interconnectedness of economies worldwide.

The top markets by total passenger traffic forecast table at the bottom of page 19 gives you some idea of what the future might hold for global passenger traffic.

While passenger traffic takes the spotlight, the air cargo market is also showing signs of recovery. After a slight dip in 2023, global air cargo volume is projected to rebound in 2024, with a 6% year-on-year growth rate.

Long-term forecasts indicate steady growth in air cargo tonnage, albeit at a slower pace compared to passenger traffic.

In conclusion, the aviation industry's resurgence underscores its vital role in global connectivity and economic growth.

Airports prioritise passenger safety, environmental sustainability, community engagement, and employee wellbeing as integral components of their operations.

Despite the challenges posed by the pandemic and geopolitical uncertainties, the future of air travel shines bright, offering ample opportunities for growth and innovation. As we navigate the skies ahead, let us remain steadfast in our commitment to a safe, sustainable, and thriving aviation sector.

Air travel is vital in facilitating global mobility, trade, and tourism. However, the rapid growth of the aviation industry is gradually hitting the obstacle of environmental impact and long-term sustainability. Balancing the need for air service development with environmental preservation is becoming increasingly crucial.

With Environmental, Social and Governance (ESG) becoming the most mentioned theme in airport and airline annual and quarterly reporting, it is increasingly essential for airports to incorporate the sustainability parameter into their air service development strategies.

While route development and sustainability have, up to now, seemed to be an oxymoron concept, airports are deliberately trying to find initiatives to incentivise more sustainable flights. And to be very clear, sustainable with regards to ESG and not to the profitability of a route.

Air service development refers to attracting and maintaining new airlines, routes, and passengers to airports. It has become an integral part of most airports’ business strategies. It involves collaboration between airports, airlines, tourism boards, and local governments to stimulate demand, enhance connectivity, and drive economic growth.

There are currently more than 1,000 airports around the world that are actively implementing air service development strategies to pursue new airlines and routes.

Therefore, the prime aim of increasing airport traffic differs from the goal of reducing its environmental impact, especially CO2 emissions and noise. On the other hand, new routes and frequencies bring substantial benefits to an airport and its serving region, such as job

creation and positive economic impact. It is, therefore, critical to find a balance, which will differ for every airport.

Although the aviation industry accounts for 2.5% of global carbon emissions, it is still considered a significant contributor to climate change, facing hostility from many states and institutions, especially in Europe.

While airlines and airports fully feel the elephant in the room and are increasingly adopting sustainability initiatives to address this issue, they are still losing the communication and policy war.

This has a direct impact on their license to operate and grow. Flight caps at airports, the difficulty of building new runways and terminals, and the extension of curfews, for example, pressure the airport's operation and capacity to attract more flights and airlines.

Although the Jetblue issue at Amsterdam Schiphol Airport has now been resolved, it is an excellent example of how route development can be impacted. It was initially among the airlines at Schiphol set to be denied take-off and landing rights for summer 2024. Airlines were informed of the Airport Coordination Netherlands' new restrictions, which are part of an ongoing controversy around the Dutch government’s continuing efforts to curb traffic, reduce emissions, and minimise noise at Amsterdam Schiphol.

In the meantime, JetBlue filed a complaint with the US Department of Transportation (DOT) against the Netherlands and the European Union over the planned cuts at Schiphol, claiming they violated the US–EU Air Transport Agreement, while also requesting the DOT ban KLM from New York-JFK if the proposed curbs were implemented.

It is, therefore, evident that such actions can result in a chain reaction which has far more significant repercussions.

France’s decision to ban short-haul domestic flights for journeys that would take less than two and a half hours by train is a parameter that should be considered when French airports redraft their air service development strategies. At the same time, it is a regulation that should be expected to be gradually introduced in other countries as well.

Therefore, government policies, international agreements and regulations play a crucial role in shaping the sustainability of the aviation industry.

While measures such as emissions trading schemes, carbon taxes, and incentives for sustainable aviation practices can incentivise airlines and airports to reduce their environmental impact, they should also ensure the ongoing network development of airlines and airports.

The whole aviation industry is involved in the sustainability fervour, but airlines and airports are the most exposed to the public. Together with ACI and IATA, they have been exploring all the domains that could assist them in reaching their targets, including becoming carbon-zero by 2050.

Advancements in technology are driving innovation in sustainable aviation. New technologies and sustainable aviation fuels (SAF) will eventually help cut emissions by around 80%.

When we look at airports, their efforts focus primarily on minimising energy consumption and reducing carbon emissions and noise. It is becoming apparent that their sustainability strategies should also include air service development.

Airports must start including the airlines’ environmental footprint and economic impact in their evaluation parameters of airline performance and development. Moreover, they need to include initiatives in their air service development strategies that would incentivise more sustainable operations by airlines.

Airports have already implemented some of the examples below. Still, they must start thinking proactively and creatively about measures that would support routes and airlines which better align with carbon minimisation targets and ensure sustainable air service development:

1. Sustainability-based Route Assessment: Besides calculating potential revenue and profit contribution, airports should also analyse routes based on the following criteria:

• Which routes and airlines deliver the highest load factors, assuming greater efficiency outweighs negative per-passenger carbon impact?

• Which routes and airlines provide more extensive social and economic benefits than the resulting carbon impact?

• Which are the most environmentally friendly aircraft operated by operating and prospective airlines?

• Which airlines have the capacity to change aircraft to match supply and demand better dynamically?

• Which routes balance demand types, directionality, and cabin class usage.

2. Green Landing Fees: Implementing green landing fees is familiar primarily for European airports. Based on aircraft emissions, they can incentivise airlines to operate more fuel-efficient and environmentally friendly aircraft. Airlines flying newer, more fuel-efficient aeroplanes or using sustainable aviation fuels could receive discounts or exemptions on landing fees. At the same time, those operating older, less efficient aircraft would pay higher fees. Airports like Athens are

already investigating such pricing policies, while Heathrow and Zurich already have them in place, primarily for noise.

3. Marketing Support: Provide marketing support and promotional opportunities to airlines with more sustainable routes. Airports can collaborate with airlines to highlight the environmental benefits of flying specific routes, such as reduced carbon emissions or noise impact, to attract environmentally conscious travellers.

4. Joint Communication Initiatives: Passenger education and awareness are essential for sustainable air travel. Travellers can contribute to sustainability by choosing airlines with strong environmental credentials, offsetting carbon emissions, and adopting eco-friendly travel habits. Airlines and airports can also play a role in educating passengers about sustainable travel options, promoting responsible tourism practices, and addressing flight shaming. Moreover, we should remember that sustainability includes the airport’s positive impact on society and the economy. This area is where airports should not be shy about communicating as they are significant catalysts in their respective regions and countries.

5. Infrastructure Support: Invest in infrastructure improvements that support sustainable aviation, such as electric ground support equipment, renewable energy installations, and charging stations for electric aircraft. By providing the necessary infrastructure, airports can make it easier for airlines to adopt sustainable practices.

6. Recognition Programmes: Implement recognition programmes to acknowledge airlines that demonstrate leadership in sustainability. This could include awards for airlines that reduce emissions, implement innovative environmental initiatives, or operate the most sustainable routes, like ACI’s Airport Carbon Accreditation.

7. Stakeholder Engagement: Engage with stakeholders, including airlines, local communities, environmental organisations, and government agencies, to develop sustainability goals and action plans collaboratively. By involving stakeholders in decisionmaking, airports can build consensus and support for sustainable aviation initiatives.

Air service development and sustainability are not mutually exclusive goals but complementary objectives requiring careful planning and collaboration. By embracing sustainable aviation technologies, implementing effective policies, and fostering collaboration across the industry, stakeholders can ensure that the benefits of air travel are balanced.

Depending on which part of the world an airport is in, irrespective of its size, it will face the sustainability challenge sooner or later. Achieving sustainable aviation is ultimately essential for the aviation industry's long-term viability and the planet.

George Karamanos is managing director of Dubai-based KPI Aviation and Marketing Solutions, which provides tailored marketing solutions to airports, airport operators and tourism organisations.

Global connectivity is undergoing subtle changes as the airlines adjust their schedules to the post pandemic market, writes OAG’s chief analyst, John Grant.

The great pandemic recovery is complete, well unless you are still waiting for the elusive Chinese international traveller to reappear, then most markets in the world are back to 2019 capacity levels and a few are even ahead.

That does, of course, ignore the four years of lost capacity growth and presumably subsequent demand, although to be fair, Boeing and Airbus may have struggled to deliver the required levels of new aircraft.

So, panic over, it’s all back to normal with the big airlines remaining profitable, the inevitable churn of start-up carriers, airline mergers, Chapter 11 filings, airports pouring more concrete and sustainability back at the top of everyone’s agenda. But are things really back to normal or have things changed forever?

While the headline numbers may look pretty similar to four years ago, 5.5 billion scheduled airline seats in 2023 compared to the 5.7 billion of 2019, the actual structure of that capacity has changed.

Faster out of the blocks thanks to the likes of Ryanair and some ultra-US low-cost carriers (LCCs), there is no doubt that the low-cost sector has gained capacity share over the traditional legacy sector.

A 3.4% gain in share to 34.6% of global capacity in 2023 versus 2019 may seem modest, but it equates to 132 million more seats per annum, while the legacy market is still some 345 million adrift of the high-water mark of 2019.

Can we expect the LCC share to creep higher? Probably, but not to a point where it overtakes the legacy share, although famous last words springs to mind!

Markets are also changing as aviation grapples with sustainability, and particularly with the dilemma of inter-modal connectivity. The combination of government pressure and profitable operations makes domestic services in markets with alternate train networks increasingly unsustainable.

In Germany, domestic capacity has halved from 35 million seats in 2019 down to 17 million in 2023, and in France, a 20% reduction in domestic seats may have been enforced on some airlines, but there’s no turning back.

Elsewhere, in the Netherlands, the government’s obsession with reducing air transport movements at Amsterdam Schiphol is a bit like “turkeys voting for Christmas” in an aviation economy so dependent on connecting traffic; the recent short-term concessions are purely concessions and quite what the economic impact on the country will be seems an irrelevance, unless you are KLM or Schiphol!

Changing market structures are part of aviation’s evolution, of course. Forty years ago, for instance, who would have thought that Dubai would be the centre of global connectivity or that Doha would be a powerful hub airport.

Likewise, could anyone ten years ago have expected India to be growing as rapidly as it has in the last five years or that the booming Chinese domestic market would be challenged by HighSpeed Train (HST) services that are a fraction of the cost of an airline ticket and hugely time effective?

Technology has also impacted markets; the corporate traveller –or at least finance directors – love video conferencing, leaving airlines with vacant business class capacity, HST services are increasingly popular; and next generation aircraft are extending operating ranges for airlines around the world, which begs the question of what will happen to that most valuable of traveller – the connecting passenger.

There are many routes that would either not exist or operate at the levels of frequency they do today without connecting traffic, and there are just as many airports that would see their businesses nearly halved without that valuable connecting traffic.

Without doubt, a successful airport/airline relationship is a pre-requisite for connecting traffic, as is a very liberal approach to air

service agreements, and it’s no surprise that airports such as Amsterdam Schiphol (AMS), Singapore Changi (SIN) and Dubai International (DXB) have led the field.

The table above shows a selection of global hub airports, and is designed to illustrate their respective dependencies on their base carriers, which range from a near total reliance on Qatar Airways in the case of Doha (85%) and American Airlines (82%) at Dallas/Fort Worth through to more balanced shares at locations such as Amsterdam (51%) and Singapore with a 35% share.

It’s hard to believe that a four times daily Southampton or Teesside service to Amsterdam would be warranted without large amounts of connecting traffic or that London–Doha requires ten flights a day jetting off to any point in the world except Doha!

Airports that rely on connecting traffic are, of course, at the mercy of intense competition, whilst the airlines face a daily challenge with ticket prices, which remain the key routing criteria for most economy travellers who aren’t attracted by expansive lounges or the tax-free shopping at airports.

Confirming that point, Swissair, Sabena and Malev in Europe all trod that path to failure at one point or other leaving airports stranded with plenty of space and sudden requirements for recovery plans.

Changes of strategy can also change an airport's strategic value. American Airlines, for example, has quietly cut back its presence at Chicago O’Hare by 23% since 2019, dropping over 17,500 flights per annum; all perfectly timed for a new runway that opened in 2020!

Many have forecast the demise of hub airports, A350s and B787s were supposed to encourage the development of the long and thin routes, and they have to a degree, although from hubs rather than smaller market to smaller market.

Similarly, the A320XLR family and eventually the Boeing equivalent have accessed emergent mid-range markets that previously neither had the right aircraft types for operation or were perhaps too early in their development, proving right place and right time can be so important.

Turkish Airlines' expansion into Central Asia since 2019 has been nothing less than remarkable and built off the use of narrow-bodied next generation aircraft operating sectors of up to five and a half hours, which allows for round crew trips which is both cost and resource effective with many overnight sectors.

Indeed, in the last four years, Turkey's national carrier has expanded its network from 2,835 flights in 2019 to 4,593 in 2023, a 62% increase whilst adding six new destinations to their operation.

With connectivity via Russia now difficult for many travellers, Turkish have not only built a large local market, but benefit from connecting flows to North America and Western Europe, in part based on the efficiency of new aircraft technology.

Air India’s aspirations for a super hub in Delhi and their complete network reorganisation and new fleet orders is predicated on the basis of creating connectivity, using their fleets of narrow-bodied aircraft to complement their long-haul trunk routes.

By 2030, India will rank first in terms of population, Delhi will have risen to at least the third largest city on the planet, and the disposable income and desire for travel amongst residents will fuel a surge in travel.

Every day somewhere something changes in aviation, it may be a new electric power tug, a new aircraft delivery (well, maybe) or a new route launch. All these small initiatives increase the economic value that the industry creates every day, change occurs slowly and, most importantly safely, which is why the power of hubs and especially super-hubs will grow and grow for the foreseeable future.

Naturally, there will always be challengers seeking to disrupt. The Kingdom of Saudi Arabia’s Saudi Vision 2030 and ongoing Riyadh and Jeddah developments, for example, may in the future challenge the current status quo in aviation, and nobody yet can say what impact electric vertical take-off and landing (eVTOL) technology will have on the industry.

However, perhaps reassuringly for the industry, with no game changing ‘big bang’ events on the horizon, aviation’s competitive landscape will continue to gravitate towards hub airports.

Iam obviously biased, but the journey airports have made over the last 50 years to become key social and economic generators, synonymous with global trade and connectivity, still amazes me.

They are prestigious and ambitious, they compete on a global scale, are scrutinised and loved, and, for most of us, the starting point for some of our greatest adventures as they connect us with the rest of the world.

As we all know, airports are more than just about accommodating air traffic movements or a seamless passenger flow through the terminals. Airport have a role to play on all levels of scale. At Amsterdam Schiphol, we aim to facilitate connectivity on all levels of scale, from wide-body intercontinental aircraft to cycle lanes and pedestrian zones.

This perspective is not necessarily new, although I dare venture to claim that airport operators and owners tend to lean more towards the aircraft side than the other modalities. What is new, in my opinion, is that the distinction between modalities and levels of scale is fading, and there is an increased integration of different forms of transport.

Arguably, two major trends are reshaping the way airports should develop – the growing demand for sustainable solutions; and the enormous pace of digitisation.

Sustainable mobility is on the rise, with advancements like biofuels and electric, hydrogen, and solar technologies gradually replacing fossil fuels. This public demand is joined by social responsibility and regulations as air travel needs to significantly reduce its impact on the environment.

Looking at sustainability issues from Schiphol’s perspective, we commissioned The Netherlands Aerospace Centre (NLR) and research institute CE Delft to investigate what is needed in order to bring the airport’s CO2 emissions in line with the Paris Agreement.

Research showed that at least a 30% reduction in CO2 (when compared to 2019) is needed for Schiphol and European aviation to be on track in 2030. To achieve that, a strengthened national and international policy is needed. Given the strong international nature of aviation, it is essential that the polluter pays.

Furthermore, in the Netherlands we are advocating for a quieter, cleaner and better Schiphol, that is more in balance with our surroundings, in line with our '8-point plan' unveiled last year.

Simultaneously, digital innovations make it a lot easier to travel on multiple modalities: faster, cheaper, safer, and more efficient and more sustainable.

Digital platforms are becoming more and more mature. Therefore, we see the emergence of cross-modality and cross-operator mobility services. These services shall enable passengers to seamlessly plan, book, and pay for journeys across various operators and modes of (sustainable) transport.

Sharing information between transportation operators here is essential, and requires companies to look beyond their natural interest and see a bigger picture.

Multimodal journeys are expected to leverage the strengths of different transportation modes. However, the success of such journeys hinges on the efficiency of transfers between modalities, which occur at transit hubs like airports, rail stations, and public transit terminals.

To optimise these transfers and enhance the passenger experience, the concept of multimodality is gaining more and more traction in boardrooms. Multimodal hubs where multiple transportation modes converge and offer bundled services that streamline the journey for travellers are going to be the new normal.

Multimodality, I firmly believe, will be the driver for the next wave of transport oriented development. And, as such, multimodalconnectivity is destined to become one of the unique drivers for foreign direct investments.

While the European Commission has advocated for the transformation of airports, ports, and stations into multimodal connection platforms back in 2011, the transition is still in its early stages.

Airports, in particular, hold immense potential to develop into multimodal hubs due to their existing infrastructure and integration capabilities. However, the current focus of most airport hubs remains

primarily on facilitating transfers within air travel rather than between different modes of transportation

Nevertheless, there are some lighthouse examples of airports clearly focusing on becoming more. And the sector is beginning to see more airlines advocating for air-rail integration and multimodal services.

To become multimodal hubs, airports must adapt and innovate to accommodate high-quality transfers between various travel modalities and embrace a similar passenger-centric approach between different transport options.

This is something we are aiming to explore and develop at Amsterdam Schiphol in collaboration with Railforum – an independent knowledge network for the public transport and rail sector with more than 2,500 members from 173 companies, governments and organisations.

Many airport planners will know that Schiphol Airport is fortunate as it is located on top of the European Ten-T network, the main rail network both within the Netherlands and Europe.

Physical proximity of these two modalities (air and rail) is not an issue. Almost 50% of Schiphol's O&D passengers use the train to get to and from the airport. It becomes more challenging when one aims to integrate international train services (instead of short-haul flights) to connect to long-haul or vice versa as this blurs the lines on a national, northwest-European and global scale.

Bringing together integrated air and rail links relies heavily on understanding the unique attributes and similarities of the two modes. Train timetables, for example, work differently (hourly repetition) to the (slot driven) schedules of airline networks.

Getting the right connections and guaranteeing the service is a whole new ball game for all parties involved. We all want to play this game, but we are still trying to understand and make the rules. There are some diverging interests and there aren’t yet many guidelines to work with (yet).

At Schiphol, we closely collaborate with the airlines and rail operators, with the rail infrastructure and capacity planners, and the national government as we believe that a truly successful implementation requires a platform to discuss and get to know each other’s sectors.

This paved the way for our joint collaboration on a pilot project between KLM and Eurostar Thalys, and we all learned a lot from the experience.

We discovered, for example, that information and wayfinding promoting the air-rail services were clear issues. As a result, we have started to include flight numbers for the train service on FIDS boards in the terminal.

KLM and Schiphol also created a special instruction video for transferring passengers. While NS (Dutch Railways) included flight numbers on their signage above the train tracks. These are relatively simple adjustments that improve the air-rail product.

In order to address air-rail ambitions in the long run, we have started multi-stakeholders strategy sessions that explore various scenarios. The five previously mentioned parties aim at understanding each other’s responses and needs in different future scenarios, guided by the Technical University of Delft.

These multi-sector, public and private scenario sessions are not necessarily geared to formulating a single cross-sector strategy, but more designed to paint a clear picture for policymakers, infrastructural investment needs, and business service design challenges. They therefore provide a narrative to the cross sectoral game we are starting to play.

In parallel, we work with the rail sector parties in Railforum, and through the Taskforce International Rail Transport – which contributes to the promotion of a single European rail system – we developed a set of recommendations for the European Committee and Dutch national government on how to improve international rail connections.

These include, among others, sharing data, creating awareness on cultural differences, improving international rail transport competitiveness, taking the cross-border network as a starting point, supporting a pilot project and providing slack capacity.

Ultimately, truly becoming multimodal as an airport requires that all relevant stakeholders share in a vision, share in ambition and are willing to learn from each other and set aside their differences and interests and work on the bigger picture.

It requires flexibility and a sincere interest to work in multiple fields and to learn from each other. Isn’t that what life is about anyway?

Klaas Boersma is the senior strategic advisor on master planning at Amsterdam Schiphol Airport, board member of Railforum, and helps drive the airport’s intermodal agenda.

Engaging with communities and taking steps to show the economic benefits of projects can help secure the long-term future of US airports and the regions they serve, writes

It was an adage that drove development in the western United States: When the railroad came to town, you thrived. When it left, you died.

While a bit hyperbolic, that transportation revolution was transformative, not only for travel and commerce, but for development. As Union Pacific proudly notes in its history, more than 7,000 cities and towns west of the Missouri River began as depots and water stops.

Arguably, the job the railroad had as an economic driver has today been assumed by the world's airports. From the busiest on the planet, Atlanta Hartsfield-Jackson (ATL), to smaller gateways such as Huntsville (HSV) and Bessemer Municipal (EKY) in the US state of Alabama, airports of all sizes have a direct impact on the economic vitality and prosperity of the cities and regions they serve.

As ACI-North America noted in its pre-COVID issued 2017 report, Taking America Beyond the Horizon: The Economic Impact of Commercial Service Airports, airports in the US account for $1.4 trillion in annual economic activity and support nearly 11.5 million jobs.

Yet, for as high profile as airports can be in their communities, what are often unseen are their infrastructure needs, whether those needs be due to age or use that has exceeded the facility's original scope.

The same ACI report notes that airport infrastructure improvements in the US top $115 billion, with most airport funding coming through sources other than taxpayer funds.

That last fact is key, as airport owners and operators eye improvements and upgrades to their facilities and airfields. While user fees are often the primary source of revenues for airport operators, fees alone usually aren’t enough to pay for upgrades and improvements.

Ryan Pearce.Knowing not only where to access the funds but how those funds must be used is as vital as the plans that drive an airport improvement project.

By today’s economics, airport improvements and expansions are as much about land-use and a financing exercise as they are about engineering and security. Putting together the pieces can stretch an airport manager beyond their comfort zone, especially for small to midsize airports.

Stepping back from the details, though, to see a project in a holistic light, managers can successfully elevate infrastructure improvement to economic development.

Like the railroads that brought economic prosperity to towns they visited, commercial airports, including general aviation (GA) facilities, have the same effect. A joint report released in April 2023 by the National Association of State Aviation Officials and the American Association of State and Highway Transportation Officials found that for every dollar invested in GA airports, $75 was returned on average by companies utilising those facilities.

This trickle-down effect is real and demonstrates how airport projects are community development projects. With this lens, airports have a spectrum of community expertise at their disposal that they can lean on to develop an appropriate plan for their projects.

Beginning with airport boards, these advisory groups usually are staffed with people who are invested in the community and bring insights into the area’s needs and potential that an airport can help meet or seed.

Beyond recognising the demand for more hangars or a larger runway, they could identify opportunities to complement an airport’s transportation value with elements to attract technology companies or act as an education centre.

Industrial development authorities also give project teams a partner to identify and secure federal and state incentive packages, tax breaks, or grants to advance projects. Because engineers and architects work with the FAA for all airport improvement reviews, they see where funding drives a project. Partnering with industrial development staff, they can represent the interests of the owner and help navigate the myriad of funding streams that can secure a project’s goal.

Focusing on the business development opportunities of an airport project allows airport managers and boards to provide investors with a clear picture of what their investment could look like and how that facilities business activities in the community.

Yet, for the community members, what inspires some can also aggravate others. Traffic, both in the air and on the ground, as well as noise and light pollution created by the traffic or the construction, itself, can easily generate opposition to a project. Navigating the issues that could adversely affect a project takes working knowledge of zoning mandates and guidelines in addition to the vision for where an airport can take a community.

For airport leaders, this means communicating both how their projects will proceed in addition to how they will serve the community.

In this respect, help can often be found from the engineering and design teams that have navigated these political waters before on other projects – and sometimes in different industries.

Indeed, they can be a valuable resource for airport project managers by helping them develop appropriate outlines and explanations that support an airport’s business plan for the community to see.

This exercise can have a dual purpose, helping owners identify sustainable revenue sources that support operations through five, 10 or 20-year plans. Fuel flow, landing, parking fees, concessions – the right

For Butch Roberts, CEO of the Port of Huntsville, the profusion of office buildings, warehouses and aviation industries surrounding North Alabama’s Huntsville International Airport (HSV) is a natural progression of the economic development efforts that the airport has been a part of for more than 50 years.

“The quality of our relationships with regional government and community organisations invested in the economic growth of our region has allowed us to work closely together to produce the kind of prosperity and employment that is the envy of cities across the country,” says Roberts.

This economic development partnership helps promote local assets that attract commercial enterprises to the booming Huntsville area, including access to commercial passenger flights, intermodal transportation by rail and air, and available land to develop.

HSV is situated on 7,400 acres and serves nearly 1.5 million passengers with 13 non-stop flights on five airlines. Other Port of Huntsville operating entities are the Jetplex Industrial Park, Spaceport, and International Intermodal Center, linking Huntsville to the global economy.

The Port of Huntsville is located near Redstone Arsenal – home to more than 70 organisations including the US Army, NASA, and the FBI.

portfolio of documents outlining how to develop potential revenue sources can help airport leaders position operations for a maximum return on investment.

As demonstrated, a community engagement strategy is a good business practice because what occurs within the boundaries of an airport reaches far beyond its property and can impact on both land development and residents.

For any airport improvement project to be successful in today’s climate, airport operators need to be mindful of those impacts and think long-term.

What are the population growth trends? What are the distribution trends that could influence air freight? What are the trends in environmental regulations? What are the corporate or industrial investment trends that could put more demand on air service?

In Huntsville, regional population growth of 16% in the past decade followed the area’s development as a vital aerospace and manufacturing hub. The growth not only impacted on the international airport but also nearby Pryor Field Regional Airport (DCU) in Decatur.

The FAA estimates that airport development will exceed $62 billion in the next four years. Small and medium hubs are predicted to represent the fastest part of that infrastructure growth.

With the right partners, the right plan, and right approach, managers and owners of these vital components to the US’s air traffic ecosystem can ensure that their communities thrive for the long-term by securing the future of their airport.

Ryan Pearce, PE, is vice president of aviation with Goodwyn Mills Cawood. He can be reached at ryan.pearce@gmcnetwork.com

Amadeus’ Holger Mattig explains how airports can potentially benefit from new technology that will allow the airlines to sell retail products and other non-aeronautical related goods and services direct to passengers.

Are airports ready for the airlines moving to offer and order retailing, and what will it mean for airports?

It’s all change in the airline industry as carriers accelerate long discussed plans to become ‘modern retailers’.

The move will see airlines invest in a new generation of technology that can help them better understand travellers, and package compelling offers to them in a similar way to digital pioneers such as Amazon and Netflix.

Estimates vary on how much additional revenue this approach to retailing could generate, but a recent report from McKinsey suggests it could be as much as $45 billion a year by 2030.

As this transformation progresses, air travellers can expect a whole raft of improvements to the aviation experience, many of them at the airport.

And despite attention being focused on the ‘retailing’ aspect and how airlines can better package offers containing flight, hotel, cars and destination products, this transformation is about much more than simply selling packages, and promises cost savings, too.

As well as creating ‘offers’, airlines intend to retire decades-old data structures like tickets, electronic miscellaneous documents and passenger name records. Instead, a record of what a traveller has purchased will be housed in a single ‘order’.

Products can be easily added or removed from an order in advance of travel and third-party products can also be easily included. If something changes, the order is updated, and any third party involved – like a hotel, partner airline or travel agency – can be far more easily notified.

It is expected that this change will drastically improve aviation operations, ultimately leading to better experiences for travellers. There are several implications for airports.

As we wave goodbye to tickets (and other traditional documents associated with flying), the way passenger servicing happens at the airport can change, too.

There’s much greater scope for passenger servicing to happen using travel credentials stored on the traveller’s mobile device, in combination with biometrics.

This was recently demonstrated through an IATA organised pilot with a major airline, supported by Amadeus and several other partners. During this trip, passengers chose from a range of personalised airline offers. Following selection by the passenger, a single order record was created.

As a result, passengers were able to pre-apply for visas as required, and these documents were stored on the traveller’s mobile phone, alongside digital representations of their passports.

All passengers that chose to share their digital passports from a digital wallet on their phone with the airline received a ‘ready-to-fly’ confirmation via text message.

And those passengers that opted to share their biometric data with the airline in advance were also able to pass through every airport service point including check-in, bag-drop, lounge access and boarding ‘hands-free’, that is, without needing to present paper documents.

The pilot leveraged Amadeus’ digital identity solutions alongside technology from a range of other partners.

Managing disruption today is difficult as the industry lacks common platform technology that can bring all airport stakeholders together, although this situation is changing, and we at Amadeus are very active in this area.

The transformation happening in the airline industry is a key enabler for better disruption management. Improved analytics means Operational Control Centre agents' visibility of how airline operations are performing is improving and new technology can help airlines propose the best action for recovery.

For example, the move to single order records will significantly simplify reaccomodation, by housing all information about the booking in one place that can be more easily updated when plans change.

In this new world, passengers can expect to be presented with new travel options quickly. These options will also be of a higher quality and computed based on a deeper understanding of the traveller’s trip context.

As airline technology becomes cloud-native by default, it’s also easier to link previously separate applications together, like crew management and passenger systems. Doing so helps an airline to better co-ordinate its own response during disruption to create new operational plans that consider all the various dimensions involved.

It also means airlines are in a better position to more quickly share information with airport stakeholders so that resources can be better allocated.

Here there is a significant opportunity to better empower the Airport Operational Control Centre (AOCC). When disruption occurs airlines and airports need to be in constant contact to fit airport capacity to evolving airline plans. Today, this interaction is largely manual, relying on phone calls and emails. But AOCCs are now beginning to overhaul their technology.

Dynamic dashboards covering key metrics, like runway capacity, turnaround efficiency, and on-time performance, provide a real-time view of airport capacity and performance. By drawing on third-party data streams, airports can see the likelihood and potential impact of impending bad weather before it happens.

But perhaps most importantly, these dashboards are complemented by flight-centric, unified communication channels so airports can make all this information available to their airline partners through collaborative platforms.

This brings key stakeholders together around shared metrics so better decisions can be made more quickly and more collaboratively.

It’s a step-change from the fragmented systems and legacy communications channels typically in use today.

As airlines invest in new technology that can better package offers of third-party products, based on a deeper and more comprehensive understanding of the traveller, airports stand to benefit.

In addition to hotels, car rental and destination services, it will also be possible for airlines to include airport products within their packages. Of course, this already happens to a degree, but the process of providing details of an airport’s services – such as parking, fast-track security, lounge access, duty free, F&B offerings – and many other services will become much easier.

The important point here is that the understanding of the individual traveller will improve significantly as data is brought together to achieve a single customer view. It’s this additional intelligence that means the correct airport services can be offered to travellers at the right moment.

Airlines can increasingly provide a shop window for airport services, intelligently packaging and recommending them to passengers based on their specific needs. This will help airports overcome one of their primary commercial challenges – the difficulty of merchandising their services in advance of travel.

Airports don’t typically hold direct relationships with travellers at scale, which limits their commercial window to the period a traveller is actually inside the terminal. Yet sales of a whole raft of nonaeronautical services could increase considerably if they were intelligently recommended to travellers in advance.

Supporting airlines to be better retailers at the airport Airlines want to delight passengers and turn the airport into a retailing hotspot. They aspire to make consistent offers of airline and third-party products like transfers or destination services from any airport service point, for example, at the kiosk.

Here airports can play an important role by considering the technology infrastructure necessary to present airline offers at the airport. This renewed focus on retailing means common use airport service points need to be tightly integrated to all airlines involved and able to best represent an airline’s offer and its brand.

Airports also need to consider how payment will be made across these touchpoints. Too often today, payments made at common use service points aren’t reconciled to the booking.

This means airlines can’t easily link the services they’ve sold to individual travellers and results in a costly manual reconciliation process. Even worse, travellers at some airports still need to walk across the terminal to pay for additional services at the airline’s own service desk – hardly the retailing experience of the future.

Airlines are transforming to become traveller-centric retailers, and it’s happening right now. For example, Saudia has just chosen Amadeus’ newly launched technology for retailing, servicing and delivery.

As the pace of change accelerates, airports can play an important supporting role that will make their terminals more attractive to their airline partners and passengers.

Holger Mattig is Amadeus’ senior vice president for product management, airport and airline operations.

The lush landascapes within its walls make Terminal 2 at Bengaluru Kempegowda International Airport one of the most unique and greenest airport buildings on the planet.

Indeed, India’s ‘Garden City’ airport wanted it this way with operator, Bangalore International Airport Limited (BIAL), promising that it would deliver an ‘airport terminal in a garden’ that would reinvent the idea of a traditionally stressful and bustling airport landscape.

The lead architect for the showpiece project was Skidmore, Owings & Merrill (SOM), with Grant Associates, designers of the iconic Gardens by the Bay in Singapore, in association with SOM, taking the lead on the green landscaping.

As a result, the new terminal at Bengaluru Kempegowda (BLR) is unlike any other in the world. Its innovative design offers passengers an immersive and authentic nature-focused experience, with the the flora throughout the complex meticulously sourced from diverse ecological habitats in the state of Karnataka and across India.

We believe that the chosen plants spread across the terminal's interior help showcase the splendour of nature and Karnataka's vibrant culture. Adding to the garden-like environment is the extensive use of natural materials including bamboo cladding and local natural stone.

Lush internal and external gardens punctuate the passenger's journey, with the centrepiece being a breathtaking 10-metre-tall green wall that runs the length and breadth of the terminal adorned with over 450 extraordinary plant species.

The planting not only captivates the eye but also contributes to the terminal's environmental conditioning, all nourished by an automated irrigation system fed by harvested rainwater.

Talking about Terminal 2 prior to its opening, BIAL’s managing director, Hari Marar, told Airport World that he wanted the terminal to be a leader in its use and adoption of new technology; have so many ‘green’ areas that it is viewed almost as a terminal in a garden; be known for its environmental and ecological stewardship; and be a facility that celebrates and showcases the rich heritage and culture of the Indian state of Karnataka.