CONNECTING PROTECTING WORLD OUR AND

With three market-leading businesses, world-class operations and investments in research and development, we ofer capabilities no one else can. Together, our global team pushes the boundaries of known science—and fnds new ways to connect and protect our world. Visit RTX at Pavilion C2

CONNECTING PROTECTING WORLD OUR AND

With three market-leading businesses, world-class operations and investments in research and development, we ofer capabilities no one else can. Together, our global team pushes the boundaries of known science—and fnds new ways to connect and protect our world.

Visit RTX at Pavilion C2

DAY 1

PARIS AIRSHOW NEWS

JUNE 16, 2025

EVE DEAL KICKS OFF PARIS SPREE

By Charles Alcock

The first deal of the 2025 Paris Air Show was sealed yesterday, when Brazil’s Revo signed a binding contract that will see it operate air taxi services in São Paulo with 50 Eve Air Mobility four-passenger eVTOL aircraft. The spinoff from helicopter group Omni intends to take delivery of the first 10 vehicles in late 2027, with the others to follow as it scales up the operation. These sales are set to be the first of more than 1,000 commercial aircraft orders anticipated at Le Bourget this week. According to analysts at investment group Jefferies,

carriers including IndiGo, Riyadh Air, Cathay Pacific, LOT Polish Airlines, and Turkish Airlines are expected to account for the lion’s share of these. However, there is now doubt about whether Air India will complete orders for around 200 narrowbodies and 40 widebodies as it deals with the consequences of Thursday’s fatal accident involving one of the airline’s Boeing 787s in Ahmedabad (see page 4).

At an event on yesterday morning, Eve CEO Johann Bordais introduced several design changes to the Eve aircraft, unveiling a mockup at the company’s chalet. These include continues on page 46

AINONLINE.COM

DEFENSE

Bell taps Honeywell for MV-75 systems

Tiltrotor to use company’s APU and environmental control system | 30

AIRCRAFT

JetZero milestone

Blended-wing-body airliner passes critical design review | 34

AVIONICS

Southwest fields runway safety system

Airline’s B737s getting SmartRunway/Landing features | 26

ENGINES

GE looks to RISE

As GE9X enters service, company moves to develop its open-fan demonstrator | 8

airshow repor ts

GET THE LATEST AIRSHOW NEWS!

France welcomes the world to the 55th editon of the Paris Air Show.

THE GULFSTREAM

The most innovative feet in Gulfstream history, with expert customer support anytime, anywhere.

Tariff strife, wars, NATO reboot vex industry

By Charles Alcock

Escalating military conflicts, NATO’s future in flux, and aerospace and defense companies absorbing the impact of U.S. tariffs compose a backdrop to what could be the most consequential Paris Air Show in years. The fallout from these vexatious issues seems set to reshape industry alliances and market expectations for aircraft and equipment sales.

But geopolitics will not eclipse the prominent profile of cutting-edge technology this week during the 55th biennial salon at Le Bourget. In the absence of major new airliners or military aircraft, electric aircraft will provide much of the novelty, and industry leaders will debate the growing role of artificial intelligence, future propulsion systems, autonomy, and the interminable struggle to fix stubborn supply-chain weaknesses.

Recent surveys conducted by consulting group Accenture found that 65% of aerospace factory managers are now prioritizing investment in technologies that are “foundational to achieve hyper-automation, such as digital product, process, and systems twins.”

According to Accenture global aerospace and defense lead John Schmidt, the drive to improve productivity is based on the commercial aerospace executives’ expectation of a 61% increase in revenue growth over the next six months, rising to 76% over the next year. He told AIN that this represents “a sign of growing confidence in supply-chain improvements and production scalability.”

Under Trump administration pressure, European NATO member states are now ramping up military spending. However, Schmidt acknowledged this trend could have

unforeseen consequences for U.S. defense contractors. “A shift we’re seeing is a big push for Europe to buy from Europe,” he said.

On Thursday, President Trump signaled that in two or three weeks, he will press ahead with full implementation of tariffs on multiple nations ahead of his previously set July 9 deadline for trade deals to be sealed. Schmidt, who is a board member of the Aerospace Industries Association, told AIN he remains optimistic that concerns raised by U.S. business leaders may be making some impression on the White House.

But the tumultuous unwinding of the tariff strategy has left long-standing European partners of the U.S. industry feeling more like adversaries.

In the meantime, companies are facing additional costs as they scramble to dual-source components. According to Schmidt, they are also scouring contracts to work out whether customers or suppliers will take the worst hit.

Beyond Le Bourget, but much on the minds of several prominent Paris Air Show exhibitors, is the question of what caused Thursday’s fatal accident of an Air India Boeing 787-8 Dreamliner that crashed into a building right after takeoff from Ahmedabad. The accident claimed the lives of 270 people, including all but one of the 242 passengers.

Some airshow exhibitors, including Boeing and engine makers CFM International and GE Aerospace, canceled planned events at the airshow due to the accident. In fact, Boeing Company president and CEO Kelly Ortberg and his counterpart at Boeing Commercial Airplanes, Stephanie Pope, canceled plans to come to Paris.

India’s Aircraft Accident Investigation Bureau appears to still be in the early stages of understanding what caused the first-ever 787 hull loss. The flight data recorder was recovered on Friday but the cockpit voice recorder had yet to be found at press time. z

DAVID M c INTOSH

Bombardier Global 8000

The world’s fastest business jet

As GE9X prepares for EIS, GE Aerospace looks to RISE

By Curt Epstein

GE Aerospace is readying its GE9X engine, which it describes as the “future of widebody” aircraft, for entry into service. According to the company, the engine, which was certified in 2020, has undergone one of its most stringent test programs, having completed 17,000 hours of testing, including 27,000 cycles.

Last year, it successfully underwent 1,600 hours of dust ingestion tests with no deterioration, and at the end of 2024, it completed ETOPS 3K testing—a 3,000-cycle endurance trial required for extended-range twin-engine operations. Scale production and deliveries of the engine have already begun, and a ramp-up is expected in the second half of 2025.

The 110,000-pound-thrust GE9X was purpose-built for the Boeing 777X, which is anticipated to enter service in 2026. It incorporates decades of advancements taken from across the company’s engine lines. The engine fan on the GE9X will use 16 fourth-generation composite fan blades, compared to 22 in the GE90 as installed on the 777-200ER in 1995, and the company is anticipating a 10% improvement in fuel burn over the earlier engine.

Construction of the GE9X also involves significant use of ceramic matrix composites (CMC), which GE pioneered in aerospace propulsion use. CMC, with the same density as aluminum, made its aviation debut in the CFM LEAP engine’s outer shroud in 2016, and

the company has since produced more than 225,000 of the part at its Asheville, North Carolina facility.

GE invested more than $1.5 billion as the turbine engine pioneer in the material, including building its own supply chain, with a new plant in Huntsville, Alabama, to produce silicon carbide fibers, CMC’s basic raw material.

Packed at a density of 1.5 million fibers per square inch in a silicon carbide matrix and given a protective boron nitride coating, the parts are one-third the weight of the titanium counterparts they are replacing.

In addition to that weight savings, the CMC parts also have a much greater high-temperature durability than the legacy metal parts. The GE9X incorporates five CMC components (stage 1 shroud, stages 1 and 2 nozzles, and the inner and outer liners), incorporating 107 parts.

In a pre-Paris Air Show media tour, the company showed off its global research headquarters in Niskayuna, New York, near the state capital of Albany. There, it also showed off the innovations that are being incorporated in its RISE (Revolutionary Innovation for Sustainable Engines) open-fan demonstrator being developed through CFM International with partner Safran. For GE Aerospace, RISE represents the single largest demonstration program in company history and its vision of a more fuel-efficient powerplant for future narrow-body commercial aircraft.

The manufacturer noted that a larger fan diameter relative to the engine core size

GE Aerospace’s first new engine to enter service since the division was spun off last year to form a separate company will be the GE9X, a 110,000-pound-thrust powerplant.

equals a higher bypass ratio, which leads directly to engine efficiency. However, in a traditional ducted fan engine, the encasing nacelle must also increase in size as the fan size increases. There comes a point where the fan becomes so large that any high bypass benefits are negated by the drag from the surrounding nacelle. The solution, according to GE Aerospace: get rid of the duct.

It first experimented with the open-fan architecture during the 1980s with the GE36 unducted fan program. While the counterrotating fan engine promised to deliver turbofan performance with the fuel efficiency of a turboprop, the engine was unpleasantly loud.

Revisiting the concept in 2021 with the launch of RISE, GE credits the recent evolution of “exascale” supercomputers for accelerating the program’s development. GE Aerospace’s partnership with the U.S. Department of Energy’s Oak Ridge National Laboratory has given it access to Frontier, one of the world’s fastest and most powerful computers. That has enabled it to conduct countless virtual tests of fan blade shapes to deliver not only the best fuel efficiency and thrust, but also a vastly improved acoustic signature. The company has found that once manufactured, the performance of the actual components exactly matches the virtual models.

GE Aerospace, which has 44,000 commercial engines in service, including those from its CFM joint venture, expects to have a RISE engine on wing by the end of the decade. z

Digital twins cut costs, accelerate production

By Hanneke Weitering

As more aerospace companies adopt digital twins to streamline engineering and manufacturing processes, the benefits of the technology have grown increasingly evident: significantly lower production costs and faster, more efficient workflows.

Digital twins, which fuse reality with digital models and simulations, can help companies optimize every stage of the product development cycle, from engineering through scaled manufacturing, operations, and even maintenance.

Siemens, which has helped numerous aerospace OEMs to modernize their processes with digital twins, has seen customers cut their manufacturing costs in half, according to Todd Tuthill, vice president for aerospace, defense, and marine industry at Siemens Digital Industries Software. Tuthill told AIN that major aerospace and defense primes using Siemens’ digital twins for aircraft development have reduced engineering rework costs from 20% to about 1%.

With the help of Siemens and its Xcelerator software suite, California start-up JetZero

believes it can get a 250-passenger blendedwing-body airliner certified and in service in just five years—“a really incredibly aggressive timeframe for a brand new airframe,” Tuthill acknowledged. For comparison, that’s approximately two-thirds the amount of time it took Boeing and Airbus to certify their latest cleansheet designs, the 787 and A350, respectively.

“They can’t afford mistakes,” he said of JetZero, which has garnered investment from major air carriers including Delta, United, and Alaska.

“The digital twin allows them to fly the aircraft before it’s built, and it allows them to build the aircraft before the factory exists,” he explained.

“I want to make the mistakes really early. I want to do them in a digital world, so I can correct them before I’m ever in a physical world. And that’s what a digital twin allows you to do. It allows you to build, fly, operate, and do all the things with the aircraft before it really exists.”

In addition to aircraft design, digital twins are being used by JetZero and others in the aerospace industry to plan and simulate production lines. Building a production facility for a new aircraft requires several hundred million dollars, and mistakes in the planning process are costly to fix once a factory is up and running.

“I can’t wait to build a factory to find out I [designed] a factory wrong,” Tuthill said. With digital twins, manufacturers can simulate workflows and identify potential issues before breaking ground on a factory. Having a digital twin of a production line could also help to streamline the process of obtaining an FAA production certificate, in addition to the aircraft type certificate.

In JetZero’s case, “They’re betting their company on our technology—that they’re going to design it right the first time [and] that their manufacturing will be production-certified on time,” he said.

Immersive Engineering

At the Paris Air Show this week, attendees can see a new evolution of Siemens’ digital twin technologies in action at the company’s chalet, where it is demonstrating an immersive engineering experience that it says will open the door to the “industrial metaverse.”

In an industrial metaverse, engineers and technicians can visualize and interact with virtual 3D models, or digital twins, in realworld industrial settings while maintaining natural vision. Siemens is working with Sony to introduce this technology using Sony’s SRH-S1 headset as a platform.

Scheduled for commercial launch in December, the NX Immersive Designer fuses augmented reality, generative artificial intelligence, and natural language processing capabilities to give users an immersive and interactive experience.

The headset features high-definition 1.3type OLED microdisplays with 4K resolution, and it uses proprietary rendering technology to enable real-time, high-definition, and realistic renderings of 3D objects, according to Siemens. It comes with ring and pointer controllers optimized for intuitive interaction with 3D objects and precise pointing, and users can interact with the interface using voice commands.

For science fiction aficionados, the immersive engineering technology that Siemens is developing might sound like something akin to the holodeck seen in “Star Trek.” According to Tuthill, that’s essentially what it is, or at least where it’s headed. “The holodeck is going to be around pretty soon, and we are one of the leading companies in technology delivering that,” he said. z

Siemens demos its new NX Immersive Designer software on Sony’s XR headset at the Paris Air Show.

Since its first delivery to a European customer in 1977 and the opening of its Le Bourget office in 1983, Embraer has built a solid presence in Europe.

As a truly global aerospace company, Embraer operates in 9 European countries with over 2,250 direct employees across the continent.

Driven by innovation and strategic partnerships, Embraer remains committed to evolving Europe’s aerospace ecosystem.

The M-346 is on offer as a trainer for a U.S. Navy requirement.

Textron and Leonardo pitch M-346 for U.S.

By David Donald

Leonardo is collaborating with Textron Aviation Defense to offer the M-346 to the U.S. Navy to answer its Undergraduate Jet Training System (UJTS) requirement. This program, which has generated a number of requests for information dating back to 2018, aims to replace the Boeing/BAE Systems T-45 Goshawk in the advanced fast-jet training role. The two companies announced their joint bid last September.

Developed from BAE’s Hawk Mk 60, the T-45 entered service in 1991, and the aging fleet is experiencing increasing reliability and obsolescence issues. More than 220 were built, of which around 190 remain in service. The UJTS program envisions a minimum total of 145 new aircraft to replace them, to be built at a rate of 25 aircraft per year at full production.

Competition comes from the Boeing T-7— already selected by the U.S. Air Force for its next-generation trainer needs—and the Lockheed Martin/Korea Aerospace T-50. Textron and Leonardo are stressing the low risk and ready availability of its offer, which is known as the M-346N in its Navy-specific version.

According to the Italian-U.S. partnership, the M-346 represents a highly capable trainer tailored to meet the needs of modern combat aircraft, such as the Lockheed Martin F-35. In addition to flying skills, the aircraft’s systems allow it to be used to instruct cockpit

management and information processing, which is an increasingly important element of the modern training syllabus.

Carrier Training Needs Shift

A key capability of the T-45 is its ability to operate from carrier decks, but advances in carrier approach technology may have rendered this niche requirement unnecessary. The majority of carrier landing training is already conducted ashore in Field Carrier Landing Practice sorties. The Navy’s new Precision Landing Mode (PLM) system—as installed in F/A-18s, EA-18s and F-35Cs—significantly reduces the number of control inputs required from the pilot, with a dramatic improvement in safety. Moreover, the F-35C has a measure of autoland capability.

The Navy may decide that these factors allow the removal of the carrier landing requirement from the UJTS program if the aircraft are equipped with PLM. The enormous cost required to re-engineer airframes and undercarriages to cater for the loads experienced during arrested recoveries is likely to be deemed too high a price to pay for a rarely-used capability. There is also the option of retaining a handful of T-45Cs to provide carrier landing experience for students.

Orders for Leonardo’s M-346 now exceed 120, the latest of which is a sale of 12 to Austria. Among the operators are influential air arms such as Israel, Italy, Poland, Qatar, and Singapore. z

Latest specialmission King Air debuts in Paris

Textron Aviation’s newest Beechcraft King Air multi-mission demonstrator is making its international debut at the company’s pavilion during the Paris Air Show. The aircraft is based on the current King Air 360 version and is outfitted with extended-range fuel tanks, wing hardpoints installed in the factory, and a large cargo door.

Introduced in 2020, the King Air 360 is powered by Pratt & Whitney Canada’s PT6A-67 turboprop with dual oil coolers and autothrottle. Range, cruise speed, rate of climb, and hot-and-high performance are all improved compared with the earlier 350. An updated pressurization system lowers cabin altitude by 10%, while for multi-mission tasks, the cockpit is compatible with night-vision imaging systems. Air ambulance versions have already been acquired by Greece and Peru.

Textron also markets a special-missions version of the lighter King Air 260. The 260 forms the basis of the company’s T-54A aircraft for the U.S. Navy’s multi-engine training system requirement, which replaces the earlier Beechcraft T-44C Pegasus (based on the King Air 90). In April last year, Textron delivered the first two of up to 64 T-54As to the Navy.

An international version, launched last year, achieved its first major sale in January and was selected by Canada for the Future Aircrew Training (FAcT) program. Seven will be supplied to SkyAlyne and KF Aero, which are managing FAcT. D.D.

The special-mission King Air 360 builds on Textron’s multi-mission expertise.

CONNECTING PROTECTING WORLD OUR AND

With three market-leading businesses, world-class operations and investments in research and development, we ofer capabilities no one else can. Together, our global team pushes the boundaries of known science—and fnds new ways to connect and protect our world.

Visit RTX at Pavilion C2

China shocks with 6th-gen fighters

By David Donald

In December 2010, China sent shockwaves through the West’s defense industry when the first images of the Chengdu J-20 stealthy interceptor appeared as it undertook taxi tests prior to its first flight in January 2011. Fourteen years later, China’s aviation industry has created another shock by revealing two prototypes of what appear to be sixthgeneration fighters.

On December 26—the birthday of the People’s Republic’s founding father Mao Zedong— photos appeared on Chinese social media of both prototypes in a seemingly coordinated “unofficial” unveiling. The possible capabilities of both aircraft place them loosely in the category of the sixth-generation aircraft being developed in Europe and the U.S. As such, the new designs represent a significant advance in Chinese airpower potential in the coming years, and the likelihood that they might enter service some years before their Western counterparts being developed through initiatives such as Future Combat Air System, Next Generation Air Dominance, and Global Air Combat Program.

The types, speculatively identified as the J-36 and J-XDS (or J-50), are products of China’s two main fighter houses, Chengdu and Shenyang, respectively. They share certain similarities, with wide, flat, chined noses, sleek profiles, blended wings, and a lack of vertical tail surfaces. The Chengdu aircraft employs a pair of split flaps on each wingtip that can be

used asymmetrically for yaw control, whereas the J-XDS has swiveling wingtips to achieve the same effect. In both cases these surfaces can be used symmetrically to act as air brakes.

Chengdu’s J-36 is a large aircraft, as evidenced from initial photographs depicting it in flight with a J-20S chase aircraft. It has three engines, with two fed by caret-shaped intakes located beneath the wings, and the central engine fed by a diverterless supersonic inlet mounted on the spine behind the cockpit. All three powerplants exhaust in a shrouded row. The wing is a double-delta diamond shape, with both leading- and trailing-edge control surfaces. The undercarriage units all have twin wheels, the main units having a tandem arrangement.

The adoption of the unconventional powerplant layout appears to be aimed at increasing internal capacity for fuel and weapons, with one large internal bay being able to accommodate long-range air-to-air and air-to-ground missiles. There are also two smaller bays.

Air Superiority Platform or Bomber?

Overall, the shape suggests that it is designed for high speed, low observability, long range, and carrying sizeable weapon loads. The operational role for such an aircraft has led to considerable speculation. While the U.S. Air Force leans towards the view that the J-36 is intended for the long-range air superiority role, others have speculated that it could be a regional bomber, or a launch platform for long-range attack missiles. It has also been

Western defense analysts are unsure whether the Chengdu J-36 fighter is intended for a long-range air superiority role, or is a bomber or launch platform for long-range attack missiles.

suggested that it could form the manned command and control hub for other aircraft— both manned and unmanned.

First noted flying with a J-16 chase aircraft, Shenyang’s twin-engined J-XDS is smaller and appears to be tailored for a fighter role. It features a cranked-arrow wing with two Vee-shaped diverterless supersonic intakes situated broadly level with the wing/fuselage joint, with a distinct “tunnel” between the engine trunks. The engines have two-dimensional thrust-vectoring nozzles.

As with the J-36, the design has internal ventral weapons bays. The J-XDS has a prominent electro-optical targeting system fairing beneath the nose, whereas a similar system is mounted in a flush installation between the radome and cockpit in the Chengdu design. The J-XDS has a twin nosewheel unit, with single wheels on the main landing gear.

In the first unofficial photographs to appear of the type, it was unclear if the J-XDS had a cockpit, leading to speculation that it was an uncrewed aircraft, but subsequent images reveal that it has a cockpit underneath a low-profile canopy. In addition to the moveable wingtips, the control surfaces comprise four trailing-edge surfaces on each wing, and full-span leading-edge flaps that are reportedly capable of being deployed asymmetrically.

Both J-36 and J-XDS have been mooted as having carrier operation potential, although this would seem to have more potential for the smaller J-XDS. z

The Shenyang J-XDS is one of two new Chinese fighter designs now challenging Western air combat strategy.

Cabin accessibility can drive passenger comfort

By Charles Alcock

The prospect of being unable to fly in a comfortable and dignified manner is driving millions of travelers away from airlines, and Collins Aerospace views it as its mission to reverse this trend.

According to Stan Kottke, president of Collins’ Interiors business unit, around 6.4 million wheelchair users in the U.S. alone are choosing not to travel because they will not be properly supported by the air transport industry.

“Aviation is changing, and if we are not proactive about this, we are leaving people out,”

Kottke told AIN. In his view, it makes sense for airlines to invest in new cabin technology to capitalize on shifting travel trends, such as growing numbers of retirees booking leisure trips for which they want more comfort.

Collins’ engineers are almost ready to offer a new approach to accommodating passengers in motorized wheelchairs in a way that avoids the need to permanently remove one or more seats from the cabin. The Prime concept involves a new type of galley wall that can fold into the wall, allowing a wheelchair user to board and then be safely seated next to a traveling companion or carer.

Once the passenger is in place, flight attendants can fold out a modified galley monument that includes features such as a height-adjustable

tray, a tablet device holder, power outlets, reading lights, speakers, and a flight attendant call button. The system has been developed through consultation involving passengers with reduced mobility, airlines, and technical advisors.

“We’re developing solutions that don’t have an economic downside for the airline, and this way the passenger count stays the same,” said Kottke, adding that this approach is better than separating passengers from their wheelchairs, which can weigh up to 250 pounds, and having to stow them in the hold of the aircraft.

From a regulatory point of view, many wheelchairs are already compliant with aviation requirements and can safely be secured in the cabin. Collins is now working with several airlines on plans to retrofit existing narrowbody fleets.

Similar innovation is coming to airliner lavatories. The RTX group subsidiary is working with Boeing on the ability to quickly combine two separate lavatory units into one large space that would be more comfortable for passengers with mobility challenges, with room for a carer as well. According to Kottke, the temporary configuration can be set up in less than three minutes.

More Flexible Cabin Monuments

The design breakthrough for Collins has been to stop seeing cabin hardware, or

Left: The ADAPT system informs the crew of unique passenger needs.

Right top and bottom: By introducing movable galley monuments in airliners, Collins Aerospace accommodates passengers traveling in their own wheelchairs.

“monuments,” as immovable. “Ultimately, monuments in the cabin have been very fixed for years, and we’ve done a lot of work to introduce transformable monuments, such as pull-out bars,” Kottke explained.

Turning to software, Collins is also focused on how passengers could increasingly use their personal electronic devices to control in-seat equipment. This Adapt system would be accessed via an app, and the company has developed prototypes with increased functionality for airlines to consider.

The feature is part of Collins’ latest Maya concept for business class seats. This also incorporates the Arise system which automatically adjusts each seat in response to inputs such as body pressure, temperature changes, and active vibration caused by aircraft movement.

Data is gathered from sensors that are part of the company’s InteliSence technology, which uses machine learning techniques to activate changes. The Maya concept also features an ultrawide OLED entertainment display, the Q-Tech system for dampening noise levels around each seat, and Hypergamut lighting, which promotes production of melatonin to help passengers sleep on longhaul flights across timezones.

According to Kottke, airliner cabins have typically been renewed every 10 years, but he sees this happening more frequently as carriers look to capitalize on changing travel trends. Around 30% to 40% of Collins’ interiors business now involves retrofits, giving it plenty of motivation to invest in improved seating, galleys, and lavatories. z

Major OEMs agree on airliner market demand

By Charlotte Bailey & Charles Alcock

Airbus and Boeing are neatly aligned in their assessment of demand for new airliners over the next 20 years, with both having published market forecasts on the eve of the 2025 Paris Air Show. The U.S. airframer is predicting just 180 more deliveries in this period than its European rival—43,600 versus 43,420.

The companies’ analysts are also in harmony as to the dominance of narrowbody jets, with Boeing predicting that 75% of its deliveries will be from the single-aisle 737 family and Airbus saying that 81% of demand will be for A320s and A220s. There is also consensus around the dominant role airlines in the Asia-Pacific and Middle East regions will play as drivers of increased demand.

Embraer also published a global market outlook report on Thursday, estimating deliveries of 10,500 jet and turboprop aircraft with fewer than 150 seats over the next two decades, and with a collective value of $680 billion. The Brazilian airframer sees North America and Europe still accounting for the lion’s share of new jets in this category, at 30.7% and 22.8%, respectively. By contrast, Asia-Pacific countries are expected to account for 36% of turboprop deliveries.

“Five years after the onset of the pandemic, many of the structural changes it triggered have proven to be quite long-lasting,” said Arjan Meijer, Embraer’s president and CEO of commercial aviation. “In our first post-pandemic market outlook, we highlighted the transition from globalization to a more polarized geopolitical outlook. Today, as countries and regions pursue greater strategic autonomy, the demand for regional access will continue to grow.”

Boeing’s analysis shows aircraft manufacturers not keeping pace with rising air transport traffic levels, which rose by 60% between 2012 and 2024. Meanwhile, deliveries over that

period were down 5%. In their view, the global passenger fleet ended last year with a shortage of 1,500 airliners.

Looking ahead, the U.S. group now sees fleet replacement demand rising faster to account for 21,100 of the new aircraft to be delivered between now and 2044. Fleet growth accounts for the rest of the projected total, according to Boeing. Airbus projects that 18,930 of the airliners delivered through 2044 will be replacing aging equipment.

Airbus analysts did take some account of the anticipated impact of the U.S. trade tari ff s, concluding that this could lead to a small GDP dip this year and next before rebounding. Antonio Da Costa, the European airframer’s head of commercial aircraft market analysis and forecast, told reporters in a pre-show briefing that industry sentiment on this challenge seems to have improved since earlier in the year when President

Donald Trump rolled out his tariff plan on the so-called Liberation Day (April 2).

“The impact has been baked into the forecast and we are expecting a minor correction apart from North America, where there could be a [more serious] temporary impact,” he commented. “Our forecast does assume that the Liberation Day tariffs won’t have a Covidlevel impact on trade, but if that scenario took place, we would be talking about other scenarios [in terms of demand for airliners].”

While Airbus has lowered its forecasts from last year due to weakening global GDP, Da Costa said projections have remained “very much” in the same area as the “growth years of the 2010s.” An expanded middle class and growing urban population (1.5 billion and 1.2 billion people worldwide, respectively) are projected to help drive a continued demand for air travel, which is already typified by global load factors having risen from 73% in 2004 to 83% in 2024.

Modest traffic growth in the more mature markets of Europe and North America will see a shift of market share to the Asia-Pacific and Middle East regions. Airbus estimates these will eclipse North America and Europe to account for some 60% of global passenger share by 2044. z

Embraer is forecasting a market for 10,500 short-haul airliners over the next 20 years.

Certifying innovation

The Catalyst engine is the first new centerline, clean-sheet advanced turboprop of the 21st century to be certified to the latest standards. Designed and manufactured entirely at GE Aerospace sites in Europe, it incorporates industry leading technologies and features that make it the ideal architecture to develop more sustainable propulsion systems.

Paris plays key role in U.S. trade negotiations

By Kerry Lynch

A large U.S. contingent returns to Paris for the biennial airshow as the industry faces surging demand across the board and, at the same time, turbulence surrounding tariffs that are bringing new levies on an industry that has enjoyed a duty-free status for decades.

For the Aerospace Industries Association (AIA), the show presents an opportunity to highlight to the global stage that the U.S. remains open for business. Importantly, in the context of the Trump administration’s contentious tariff policy, the group also views it as an opportunity to signal to political leaders in Washington, D.C., that the U.S. industry has long delivered a positive trade balance for the national economy.

In fact, Capitol Hill is expected to send its largest contingent yet to the Paris Air Show. AIA is hosting delegations from both the House and Senate during events at the opening of the week-long event.

Meanwhile, as the White House mulls the future of tariffs and engages in global negotiations, AIA released an economic study to highlight the positive impact of U.S. companies.

Prepared by PwC, the study found that the U.S. commercial aerospace industry produces $545.2 billion in total economic output (including $306.9 billion in aerospace

products), contributes $284 billion to the GDP, supports 1.6 million jobs, and produces $157.2 billion in total labor income. Further, the study highlights that, with the exception of petroleum and coal, aerospace is the only manufacturing sector in the U.S. to maintain a positive trade balance over decades.

“The American commercial aerospace industry drives economic growth by every measure,” said Eric Fanning, AIA president and CEO. “From creating well-paying jobs, to investing in cutting-edge research and development, to supporting a healthy supply chain, our industry is a success story across the board. Our new report makes clear the need for a strong policy and trade framework that protects and promotes this high-value, export-driven sector for the long term.”

Tariffs Unnecessary for U.S. Aerospace

The report comes as the White House has launched a “Section 232 National Security Investigation of Imports of Commercial Aircraft and Jet Engines” to explore how aerospace trade impacts the U.S. economy and national security. This research has drawn a mixed reaction within the industry, with some fearing that it may be used to provide a basis for expanding tariffs, while others see it as an opening to educate on the importance

For the Aerospace Industries Association, the Paris Air Show presents an opportunity to highlight to the global stage that the U.S. remains open for business.

of maintaining trade relations and how it has benefited the U.S. industry.

Fanning told AIN that he believes the investigation presents an opportunity. “It’s critically important that the U.S. government understands that in many ways, [the] aerospace and defense industry is already where the current administration is trying to get to across industries [with ongoing trade negotiations]. We already have it, so we want to protect that,” he said.

That positive trade balance—spanning most of 70 years—is also part of “the big message” that AIA hopes to convey this week, Fanning said. “We always want to make sure people are aware of the impact that the industry has on our economy, not just our security, but in the current context of refocusing our trade relationships.”

He added that it takes a long time to build an industrial base such as the U.S. has. “It’s a reminder that the world wants to buy what America produces, and it’s in our interest to make sure they can do that. It is a reminder on both sides of the negotiations that are taking place globally between the United States and other countries that it’s important to keep that market open.”

Fanning acknowledged that with orders, various sides of trade negotiations are using what leverage they can. But he noted that as orders have been pulled and then reinstated, it has validated the desire for American products.

“That’s a lot of negotiations, and I think there’s going to be continued turbulence until we get to some resolution,” he said. “But the companies are prepared for that. I think their customers are prepared for that and are working through it.”

Electric aircraft vie for attention at Paris salon

By Charles Alcock

Electric aviation pioneers are back on the Paris Air Show stage, vying for attention from prospective customers and, no less importantly, investors. Much has transpired in the advanced air mobility (AAM) sector since the last biennial airshow at Le Bourget, not least among eVTOL aircraft developers but also with efforts to reinvent regional air services with electric and hybrid-electric airplanes coming to the fore.

Two years ago, Volocopter made headlines at the Paris show as it mapped out how it intended to have its two-seat VoloCity eVTOL vehicle certified by EASA in time to operate flights during the 2024 Paris Olympic Games. That proved to be unrealistic, and by the end of last year the German company was fighting to escape from insolvency before being rescued by the Chinese owners of Austria-based Diamond Aviation.

Another high-profile German AAM company wasn’t so fortunate. Lilium was forced to shut its doors after a rescue plan led by a group of European and North American investors failed to produce the promised fresh capital needed to continue work on its six-passenger Lilium Jet.

This year’s show will provide visible proof that electric aircraft are getting ever-closer to earning revenues for their backers. Beta Technologies’ Alia CX300 airplane is being featured this week in the flying display as it continues a European tour that will culminate in it being delivered to launch customer Bristow in July. The Vermont-based company believes it can complete FAA type certification for the CX300 by year-end and then get its sibling, the Alia 250 eVTOL vehicle, approved in 2026.

Both versions of the all-electric Alia aircraft can carry one pilot and up to five passengers or 1,250 pounds of cargo. The CX300 prototype has demonstrated a range of 336 nm, while the Alia 250 has a projected range of 250 nm.

Other eVTOL frontrunners at Le Bourget this week include Silicon Valley’s Joby and Archer, which have attracted $1 billion-plus war chests, with backers including leading automotive groups. Both of these companies are flight testing prototypes, and Embraer spin-off Eve Air Mobility is preparing to begin flight trials with its four-passenger vehicle later this year. z

NEWS CLIPS

General Atomics AeroTec Systems has partnered with AEE Aircraft Electronic Engineering for the redevelopment of the engine interface unit and central warning system—a component that evaluates engine data, level indicators, and flap positions—for the Dornier Do228 NXT special-mission aircraft. The companies said the new interface has a form-fitfunction replacement with a backward-compatible design that is future-proof.

Airbus, BoostAeroSpace, Collins Aerospace, Liebherr, and Thales have joined forces to launch DECADE-X (Digital Ecosystem for Aerospace and Defense), a nonprofit association that aims to “drive the development of a sovereign, interoperable and secure digital ecosystem.” The organization will prioritize supply-chain resilience, product industrializations, product conformity, traceability and regulation compliance, and sustainability. “Those key objectives will drive DECADE-X to lead the aerospace and defense industry into a new era of innovation,” said chairman Pierre-Emmanuel Raux.

Airbus Helicopters has unveiled HTeaming, a system that allows helicopter crews to take full control of uncrewed aerial systems while in flight. The system includes a tablet for interfacing, a modem, and four antennas to be installed on the helicopter. It was tested in a Spanish Navy helicopter last month, with more trials planned in the upcoming months.

Constellium has successfully remelted aluminum from retired aircraft for repurposing as materials that meet performance standards for newproduction aircraft. They aim to scale up the process for industrial application and demonstrate the “full recyclability of end-of-life metallic airframes.”

Ascendance and Airbus have partnered to explore hybrid-electric technology. “This partnership with Airbus validates our vision: delivering practical, realistic technology that meets the demands of modern aviation. It marks a new milestone in our commitment to making cleaner, more accessible air travel a reality,” said Ascendance CEO and co-founder Christophe Lambert.

DAVID M c INTOSH

Beta Technologies’ all-electric Alia CX300 is part of the airshow flying display.

DISCOVER UNRIVALLED COMFORT IN OUR G700

Embrace a new era of private travel at the Paris Airshow. Step on board the Gulfstream G700 and experience how we transform every mile into an indulgence.

a leap.

Because in aviation there’s only one direction – forward.

Southwest now fielding runway safety system

By Kerry Lynch

Southwest Airlines has begun installing Honeywell’s SmartRunway and SmartLanding technology on its Boeing 737 fleet, the aerospace manufacturer announced today. The capability, enabled through the Honeywell Enhanced Ground Proximity Warning System (EGPWS), adds aural and visual alerts to help increase flight crew situational awareness during taxi, takeoff, and landing.

Under an agreement signed in November, plans call to activate the SmartRunway and SmartLanding update through 2027 on more than 700 aircraft. The first revenue flight with the software enabled was in March.

The technology will warn pilots of some areas of safety concern during taxi and landing. These include wrong surface operations where a pilot may mistakenly be preparing to take off on a taxiway instead of a runway or on a runway that is too short, as well as attempt to land on the wrong runway, explained Thea Feyereisen, distinguished technical fellow for aerospace technologies at Honeywell.

It also will alert when an aircraft may be coming in too high and/or too fast, creating the potential for runway excursions, Feyereisen added.

“We see an increase in the number of wrong surface and runway excursion examples. We had an incident in the U.S. earlier this year

where a [Boeing] 737 mistakenly tried to take off from a taxiway instead of a runway. There was an incident in San Francisco in 2017 where an A320 narrowly missed a collision with four other aircraft when it mistakenly lined up with a taxiway instead of a runway for landing,” Feyereisen cited as examples.

SmartRunway and SmartLanding will provide aural alerts, but back that up with text warnings. As an example, she said if at 1,000 feet the pilots haven’t deployed the flaps, they would receive a flaps alert both aurally and via text.

“If they are too high, above 450 feet, they will get a ‘too high’ or ‘too fast,’ and ‘unstable’ as well. If they haven’t touched down in the first approximately one-third of the runway, they would get a long landing callout, and it also provides distance remaining,” she said. “The alerts are not bells or jingles, they’re very specific, saying exactly what the problem is.”

Feyereisen estimated that there are a couple of dozen different alerts the system provides. She noted that the aural alerts are more critical “because typically pilots are eyes out” during taxi or landing. “The aural alert is really what captures their attention, and then if there’s any question, there is a text alert as well.”

Feyereisen acknowledged that some runway surface safety technologies may be available to air traffic controllers in the tower. But there is an inherent delay from when controllers receive the alert and when they can convey to

Honeywell’s SmartRunway/ Landing features are being added to Southwest Airlines’ all-Boeing 737 fleet. The technology improves pilot situational awareness during taxi, landing, and takeoff.

the aircraft operator, particularly if someone is talking on the radio at the same time.

The SmartLanding/Runway technology has been around for about a decade, originally called Runway Awareness Alerting System (RAAS). It’s been approved on Airbus and Boeing airplanes.

However, over the past decade the system has continued to evolve with more and expanded features, such as alerts for landing or taking off on taxiways and the addition of an altimeter monitor. Feyereisen estimated that about 25% of the world’s airline fleet has some version of RAAS installed.

This evolution continues with Honeywell testing its next generation, Surface Alerts (SURF-A), which is targeted for certification in 2026. This alerting system uses GPS data, ADS-B, and analytics to provide aural and text alerts of potential runway traffic.

Airlines have the option of customizing the features, she noted. For example, they can decide when to alert for distance remaining on the runway—5,000 feet remaining versus 4,000 feet or 3,000 feet. “They may choose to have that one as only a display and not the aural alert,” Feyereisen explained.

She underscored the importance of increased adoption of these kinds of technologies. “Air traffic doubles every 15 years,” Feyereisen said, and “aircraft in general are getting smaller. More 737s and A320s are being sold than 747s.

“We’re not building a whole lot of new runways. Aircraft are coming in closer and closer to get the throughput. The math speaks for itself in terms of the density of operations that are happening…and the number of incidents increasing.” z

The new combat helicopter

The AW249 has been designed to dominate future battlefield operations. This next generation combat helicopter is equipped with the latest technologies to energise Future Operation Concepts, across a range of operational scenarios, being able to promptly and effectively respond to traditional, asymmetric and hybrid threats. Fully equipped to provide advanced net-centric capabilities for Multi-Domain operations, the AW249 represents a generational leap in combat capabilities, ensuring operational superiority at all times. Visit us at Le Bourget, Stand 250

Pratt & Whitney celebrates 100 years of engine innovation

By Hanneke Weitering

Pratt & Whitney marks its centennial this year, celebrating 100 years of aircraft engine innovations while marching full-speed ahead to the next generation of more efficient and sustainable propulsion technologies.

According to Michael Winter, the chief scientist at Pratt & Whitney parent company RTX, changes in engine architecture over the past 100 years have led to several step-changes in capabilities. For example, the invention of the air-cooled radial engine in the 1920s improved the thrust-to-weight ratio by a factor of 2.5 compared with earlier piston engines.

Founded in 1925 by Frederick B. Rentschler, pioneer of the air-cooled radial engine design, Pratt & Whitney’s first engine was the R-1340 Wasp, which led to the popular Wasp series of engines that are still in service today. At the time, the Wasp engine family delivered unprecedented performance and reliability improvements that transformed military and commercial aviation. During World War II, the Ohio-based manufacturer produced more than half a million of those engines, mostly for use by U.S. defense forces.

Pioneering Early Jet Engine Architectures

When gas turbine technology began to take off in the 1940s, the U.S. government wouldn’t

allow Pratt & Whitney to pursue the technology because it needed a steady supply of Wasp engines, Winter explained. “After the war ended, the order book just literally hit a cliff, and the company needed to decide: how do we get into gas turbine engines?” The answer was the axialflow, twin-spool turbine engine—the J57.

“We needed to have a different architecture to get back into the game,” Winter said, “and so what they invented with the J57 in 1958 was a twin-spool gas turbine.” This engine architecture uses two concentric shafts, or spools, to drive two sets of compressors and turbines.

“Instead of really just relying on hot gas spewing out the back to make it go faster and forward, what we came up with was to put a fan in the front like a propeller, and to have that be on a separate shaft,” Winter explained. “You have the same basic machine on the inside—the compressor, a combustor, and a turbine that spins really fast—but now there’s a big, long shaft that turns a fan in the front, and then there’s a turbine in the very back that basically makes that fan go. So now it’s a combination of push and pull. That led to about a 15% efficiency change.”

The J57 became the world’s first 10,000-poundthrust aircraft engine and remained the most powerful jet engine on the market for years. “It was originally done for a military engine, but it enabled the economics that let commercial aviation in the 1960s really take off,” Winter said. Originally built for the Boeing B-52 bomber, the J57 evolved into what would become the company’s first commercial turbojet engine, the JT3C, which powered Boeing’s 707 and the Douglas DC-8. It was subsequently developed into the J52, a scaled-down version that powered the U.S. Navy’s A-6 Intruder attack aircraft and Hound Dog cruise missile.

In 1958, the company introduced the JT3D, a turbofan version of the JT3C turbojet, on Boeing’s 747. The JT3D added an up-front fan to the existing architecture that increased thrust by 35% and reduced fuel burn by 15% to 22%, according to Pratt & Whitney.

Geared Turbofans Enter the Scene

Over the course of the next few decades, engine technology didn’t change much. Fans were getting bigger, and the amount of bypass—air that bypasses the engine core and gets accelerated by the fan to produce more thrust—increased as well, leading to modest efficiency gains. The next big step change in engine efficiency didn’t arrive until 2015, when Pratt & Whitney introduced an ultrahigh-bypass engine known as the Geared Turbofan (GTF), which entered service with the Airbus A320neo series.

With the introduction of the GTF engine, Pratt & Whitney delivered a solution to a paradoxical problem that had plagued engine makers since the 1950s. “The challenge was that

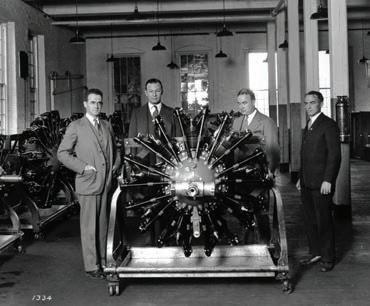

P&W founder Frederick Rentschler poses in front of a Wasp-powered Vought O2U Corsair.

P&W’s George Mead, Fred Rentschler, Don Brown, and Andy Wilgoos with the 1,000th Wasp engine.

The Wasp engine assembly line in East Hartford, Connecticut, began production in 1929.

with the turbine in the back, the faster it spins, the more efficient it is, but with the fan in the front, the slower it spins, the more efficient it is. So it’s always been a paradox,” Winter explained. “Pratt & Whitney broke that paradox by putting a gearbox into the part right where the fan is, so the fan could slow down.” This enabled a 16% efficiency gain and 75% less noise than previous generation engines.

In 2021, Pratt & Whitney announced an updated version called the GTF Advantage. The 34,000-pound-thrust turbofan cut fuel burn for the A320neo by just 1% while delivering 4% to 8% more takeoff thrust. More durable materials and increased airflow in the engine’s hot section reduce operating temperatures and increase time-on-wing by easing maintenance requirements. Both EASA and the FAA certified the GTF Advantage earlier this year.

Beating the Heat

Inside the GTF engine, as the air travels through stages of a compressor, air pressure and temperature rise. Along with higher temperatures and pressures comes greater thermal efficiency, but that efficiency gain is limited by the maximum temperature that the metals inside the engine can withstand. “The one thing that kept us from going to higher thermal efficiency was that the temperatures were too hot,” Winter said. “We’re above the melting point of the metals.”

Pratt & Whitney’s solution to this durability problem was to turn the turbine blades into what Winter called the “world’s most sophisticated heat exchangers” through a combination of special coatings and thousands of tiny laser-drilled holes. The holes allow cooling air on the inside of the turbine blades to ooze out,

much like in an air-hockey table, he explained.

Because that “cooling” air coming from the compressor is still hot enough to melt rock, Pratt & Whitney added special coatings to make the metals inside the engine more heat-resistant. According to Winter, these coatings include nickel-based superalloy crystals and ceramic matrix composites.

At Pratt & Whitney’s turbine airfoil production facility in Asheville, North Carolina, engineers use highly automated machinery to drill and coat the turbine blades with superalloys. The company built the 1.2 million-sq-ft facility, which became operational in 2023, to support high-volume production in response to growing demand for the GTF and F135 engines.

Pratt & Whitney has invested about $1 billion into the Asheville blade-and-vane plant, including a recent $285 million project to build an advanced casting foundry to produce the airfoil structures to be drilled and coated.

In 2023, the Asheville facility produced approximately 200,000 high-pressure turbine airfoils. Following the facility’s expansion, the company aims to produce 300,000 parts per year. The facility currently employs around 900 people, and by 2028 Pratt & Whitney aims to increase that number to more than 1,200 employees.

Electrification Is the Future

Winter predicts that, in the future, all commercial jet engines produced by RTX and even its competitors will use some form of the geared-turbofan architecture. And while that basic architecture may not change

much, he believes there’s still plenty of room for improvement.

“The airframe companies have said that, until they see double-digit improvements, they won’t make a new airplane. And we do see a path forward to do that,” he said, noting that a key enabling technology will be hybrid-electric powertrains.

“If you look at thermal efficiency relative to what theoretically is possible, we’ve come about halfway. And so there is one way ahead of us, but the temperatures and pressures are higher, which is why we’re building these new factories here in the United States—to be able to take advantage of those and reach for those greater efficiencies.”

At the same time, Pratt & Whitney and Collins Aerospace, its sister company under RTX, are actively engaged in several hybridelectric aircraft programs. These include the RTX hybrid-electric flight demonstrator, which aims to start flight-testing a hybridized Dash 8 turboprop next year. z

The Asheville facility focuses on the machining, coating, and finishing of airfoil components.

EASA and the FAA certified the GTF Advantage engine for the Airbus A320neo aircraft this year.

Pratt & Whitney invested $1 billion in a turbine airfoil production facility in Asheville, North Carolina.

Bell selects Honeywell for MV-75 APU, ECS

By David Donald

Honeywell has been selected to provide the Bell MV-75 tiltrotor with its environmental control system (ECS) and auxiliary power unit (APU), it said Monday at the Paris Air Show. Previously designated as the V-280 Valor, the tiltrotor was selected to answer the U.S. Army’s Future Long-Range Assault Aircraft requirement in December 2022.

Bell Textron announced the official MV-75 designation for the production aircraft last month, honoring the Army’s founding year, 1775. A demonstrator has been flying since December 2017.

Both Honeywell subsystems draw on a long history of providing reliable and efficient equipment for military and commercial applications. The ECS for the MV-75 is part of the company’s Attune family of thermal management systems and requires minimal changes to adapt it to the tiltrotor. It uses the latest high-density cooling technology that brings significant benefits in

terms of size, weight, and power requirements, such as a 35% weight reduction. The high-speed centrifugal compressor is 20% more efficient than previous units.

In the meantime, the APU is a secondary power/hydraulic supply system based on Honeywell’s 36-150, of which more than 10,000 are flying on more than 20 platform types. They include the UH-60 Black Hawk and AH-64 Apache that form the backbone of the U.S. Army’s current assault and attack fleets, with considerable benefits in terms of logistics, sustainability, and existing knowledge base. The APU requires a new gearbox to adapt it to the MV-75 but is otherwise similar to the current 36-150.

The MV-75 tiltrotor will have an adapted version of the 36-150 APU used in the U.S. Army’s current Apache and Black Hawk fleets.

Honeywell’s selection to provide these subsystems is based not only on their high performance, but also represents a lowrisk approach as both the ECS and APU are demonstrating their high reliability on a variety of platforms daily.

Recently, the U.S. Army announced that it wished to accelerate the entry into service of the MV-75, bringing forward the initial planned date of 2030 by up to two years, albeit at the expense of some testing. The maturity of Honeywell’s subsystems suggests that they will not hinder that process, which is targeting the first MV-75 flight in 2027 following a critical design review next year. z

Dassault’s Rafale

returns to conformity

The Dassault Rafale on display this week in Paris is equipped with conformal fuel tanks mounted on each side of the spine. The feature is making a Le Bourget comeback 24 years after it was first shown by Dassault on the Rafale B01 two-seat prototype, which was fitted with two 1,150-liter tanks. The conformal fuel tanks—which can either increase range and endurance or free up underwing hardpoints for more stores—were not adopted by the Armée de l’Air et de l’Espace (French air and space force) at the time but could now play a part in the Rafale’s development roadmap.

VoltAero’s revamped hybrid makes debut

By Charles Alcock

VoltAero has unveiled the first example of its revised design for the Cassio 330 hybrid-electric regional airplane. The French company is displaying a mockup of the five-passenger model this week at the Paris Ai r Show.

According to VoltAero CEO and chief technology officer Jean Botti, the engineering team changed the Cassio 330 from an earlier design with a twin boom and tailplane to a more conventional T-shaped tail in response to certification concerns that surfaced in discussions with EASA. They have also adopted a series hybrid powertrain with a pair of Safran EngineUs electric motors and pusher propellers, instead of a single large propeller.

Botti told AIN that while the series hybrid configuration with a turbogenerator providing propulsive power for the motors and recharging batteries is not quite as energy-efficient as the earlier parallel hybrid powertrain, it will clear the company’s path to achieving type certification under CS23 rules at the end of 2027. He said that having two aft-mounted

motors will give the Cassio 330 more flexibility for commercial operations, given current restrictions on commercial single-engine IFR flights.

VoltAero intends to adopt its original propulsion architecture for the larger Cassio 480 and 600 models it aims to bring to market later. Montpellier-based regional airline Airways Aviation has placed provisional orders for 15 Cassio 330s.

The manufacturer aims to start flight testing in the first half of 2026. “At first, we will only fly with the thermal power because we don’t want to mix all the [power] variables, but at the same time, we would validate the hybrid powertrain [on the ground],” Botti said. “After we do the first round of flights by mid-2026, we will integrate the powertrain with the aerostructures to validate [the complete aircraft] in 2027.”

Last week, VoltAero announced it is offering a parallel hybrid powertrain for use with kit-built aircraft. The HPU 210 combines a 60-kilowatt electric motor, and a battery with a Kawasaki H2SX thermal engine that provides up to 150 kilowatts of electric power. z

FN shows off its guns for helos

Weapons integrator FN is highlighting two of its latest developments this week at the Paris Air Show, including the first showing of a U.S. Air Force external gun system for Sikorsky HH-60W helicopters in the global marketplace. The Belgian company o ers weapon systems for both fixed-wing and rotorcraft platforms, including crew-served weapons and forward-firing systems for helicopters.

In 2017, Sikorsky selected FN to develop a system to meet the requirements for an airborne flex-fire weapon for the HH60W Jolly Green II combat search-andrescue helicopter chosen by the U.S. Air Force. The result was the external mount gun system (EMGS), of which more than 60 have been delivered to date for fitment in the HH-60W’s cabin windows, in both port and starboard installations.

Weapons supported by the EMGS are FN’s M3M, modified GAU-21, and unmodified GAU-18/A 0.50-caliber heavy machine guns, and the M134 7.62mm Minigun. In “door-gun” mode, the weapons are crew-served thanks to the flexible mount but can also be locked in a forward-firing position for operation by the pilot. This hybrid system provides the helicopter with defense to the front and sides in a compact system designed to minimize footprint within the HH-60’s cabin.

Also on display in Paris is the latest version of FN’s widely used medium door pintle (MDP) turning system, a door-gun mount for the M3M machine gun. By employing advanced composite materials, the MDP weighs 40% less than previous models, while retaining the full strength of its predecessor.

MDP has been qualified to meet MILSTD-810G requirements and validated to meet 20g crash safety requirements. The lightweight version is ready for serial production, and discussions are underway with OEMs and end-users. D.D.

The redesigned Cassio 330 mockup makes its debut here in Paris.

DAVID M c INTOSH

StandardAero tapped for Green Taxi cert

By Sarah Rose

StandardAero and Green Taxi Solutions (GTS) are collaborating to obtain supplemental type certificate (STC) approval for an aircraftinstalled, electric taxiing system designed to reduce emissions, fuel burn, and noise during ground operations. “Aligning with StandardAero allows us to bring this technology to market with the certification experience and operational

credibility needed for broad adoption,” said GTS founder and president David Valaer.

Announced this week at the Paris Air Show, the partnership is backed by a $5.6 million grant from the FAA’s Continuous Lower Energy, Emissions, and Noise (CLEEN) program. The company is aiming for FAA certification by 2027 and has received a “no technical objection” letter from Airbus following a successful demo on an A320.

Boeing’s Ghost Bat swoops in for the assist

By September, Boeing Australia hopes to have demonstrated how its MQ-28A Ghost Bat collaborative combat aircraft (CCA) can fit into a force mix. The uncrewed airplane will employ autonomous behavior to team with crewed assets such as F/A-18s, EA-18Gs, F-35As, and the E-7 Wedgetail airborne early warning aircraft. As of late last year, the CCA had proven its abilities to establish communications links with other aerial assets, as well as fuse and share data from sensors and payloads.

The “loyal wingman” was developed to answer a Royal Australian Air Force requirement, and the first air vehicle flew for the first time in February 2021. Eight Block 1 MQ-28As have been built and have racked up more than 100

hours of flight testing, conducted from the Woomera range in South Australia.

“With the airframe largely proven by early 2024, we’ve spent the past 12 to 18 months focusing on developing and proving mission systems,” said MQ-28 global program director Glen Ferguson. “We’re now at the stage where we have successfully proven the platform’s ability to team with multiple aircraft, and we continue

Additional approvals are planned from EASA and Brazil’s ANAC. The company is in “active collaboration” with Delta Air Lines, SkyWest, and Alaska Airlines.

The GTS system allows aircraft to taxi using only their auxiliary power unit (APU), eliminating the need to engage main engines. While the APU does use jet fuel to operate, it consumes approximately 85% less fuel than the main engines during taxiing. According to the companies, the system uses electric motors mounted on the main landing gear and connects to the existing APU through an onboard inverter and control system.

GTS estimates that each equipped aircraft could save up to 80,000 gallons of fuel annually, equating to about $250,000 in operational costs. The system also aims to reduce brake wear and improve turnaround times, particularly at congested airports.

StandardAero brings extensive experience in certifications across commercial and military platforms. The company’s in-house team has secured dozens of STCs and international approvals.

StandardAero officials said the retrofit-friendly system is a practical, near-term answer to ground emissions challenges without requiring major changes to airport infrastructure. z

to further develop the mission system’s skills.”

Three Block 2 variants feature several improvements, representing the first operational capability standard. Work is underway to establish a final assembly line at Wellcamp Airport near Toowoomba, Queensland, which is scheduled to start production in 2028.

In addition, focusing on the RAAF requirement, Boeing is exploring export opportunities for its CCA, which is acting as a pathfinder for this emerging capability. D.D.

The Ghost Bat uses autonomous behavior to team with crewed aircraft.

Aircraft retrofitted with the electric Green Taxi system could each save 80,000 gallons of fuel annually.

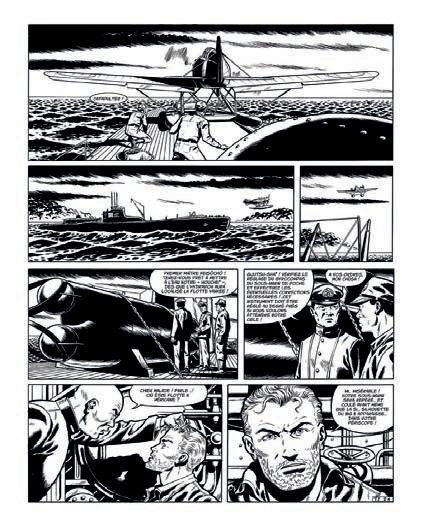

Students in Aviation Sans Frontières’ “Wings of the Future” workshop built this Nynja ultralight aircraft that is offered for sale at the Paris Air Show.

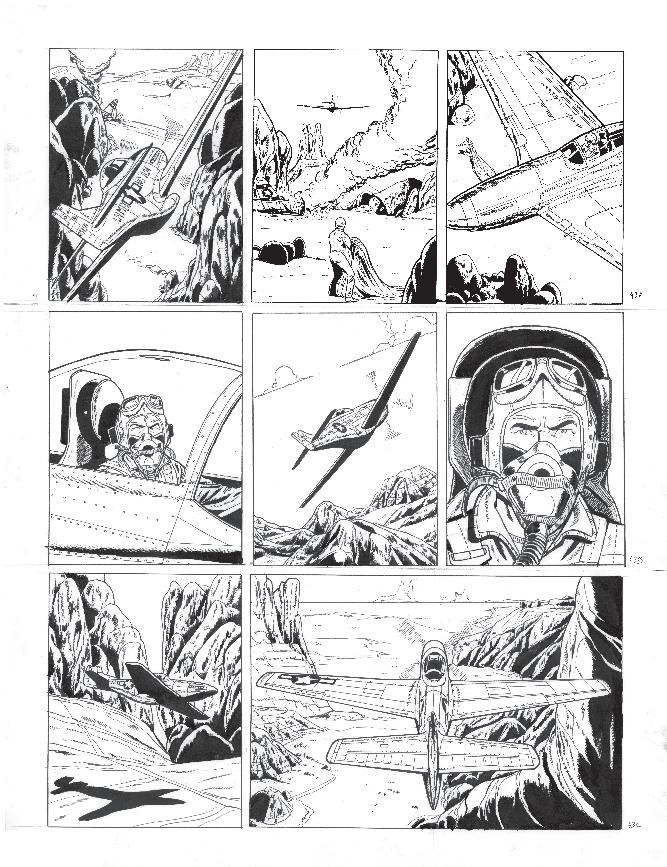

Artcurial to raise funds for Aviation Sans Frontières

By Sarah Rose

Artcurial will host a charity auction on June 18 in Paris to support Aviation Sans Frontières (ASF), a nonprofit using aviation for global humanitarian efforts. Held during the Paris Air Show at Le Bourget Airport, the event

will raise funds for ASF’s hospital plane initiative—a mobile medical unit designed to deliver care in remote regions.

“This reflects a principle close to my heart: putting the best of aviation at the service of those who need it most,” said actor and pilot José Garcia, the event’s sponsor.

Actor and pilot John Travolta, who donated a signed pilot uniform, added, “I have deep admiration for the humanitarian mission they carry out.”

ASF president Gérard Feldzer emphasized the urgency: “Only your generosity will allow us to finance new projects such as our hospital plane and humanitarian drones.”

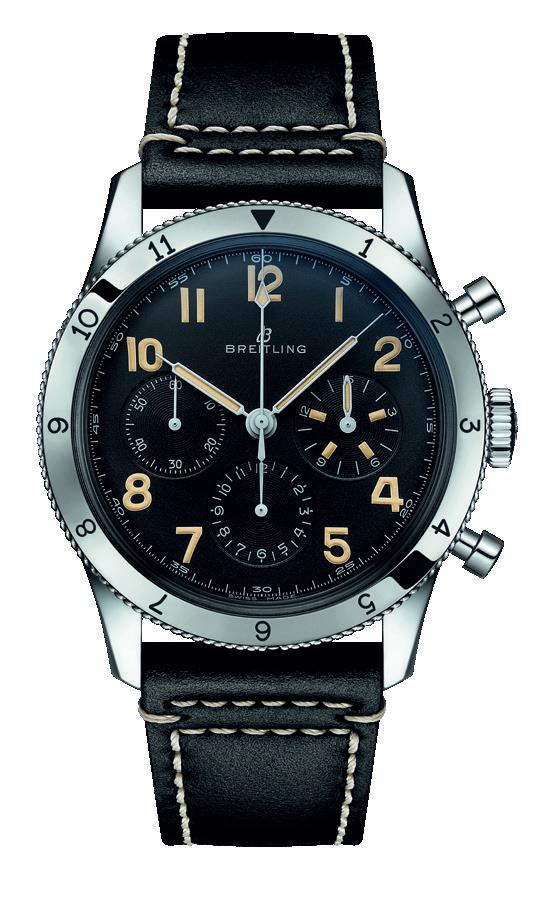

The auction, led by Stéphane Aubert, will feature rare aviation experiences and memorabilia. Highlights include a zero-gravity flight aboard the Airbus Zero G airplane, a helmet from the Patrouille de France aerobatics team, and a Messerschmitt KR200 three-wheeled microcar once used by comedian Coluche. Other items include a Falcon jet wind tunnel model from Dassault Aviation, original artwork, and a Breitling AVI watch engraved for the event. A Nynja ultralight aircraft built by students in ASF’s “Wings of the Future” workshop will also be exhibited and offered for auction during the Paris Air Show.

Proceeds will support ASF’s missions, including medical evacuations, humanitarian logistics, and youth aviation programs. ASF operates a fleet of Cessna Caravan singleengine turboprops based in Africa. z

Hungary’s air force to receive first of a dozen L-39 Skyfox trainers

The Hungarian air force is set to take delivery of the first of a dozen L-39 Skyfox light jets following the completion of pilot training in late May with Czech manufacturer Aero Vodochody. Under a contract signed in April 2022, Hungary ordered eight aircraft configured as jet trainers and another four fitted out for reconnaissance roles, with deliveries initially expected in 2024.

According to Aero Vodochody, the flight crew training began with theoretical instruction and exercises involving the two-seater’s rescue equipment. This was followed by type training for instructor qualification, which then progressed to night flying and operations with the L-39’s training and tactical system, developed for fourth- and fifth-generation pilot training.

Certified to European Union and NATO standards, the L-39 can also be used in light combat roles with up to five hard points available for munitions. Beyond the Western military market, customers also include the Czech air force. The Skyfox model, based on the original L-39 Albatros, has also had export success with Viet -

Aero Vodochody’s L-39 Skyfox is the next-generation upgrade of the Czech manufacturer’s successful L-39 Albatros multi-role light jet.

nam’s air force. It is powered by a Williams International FJ-44-4M engine and features a Genesys Aerosystems avionics suite and glass cockpit.

Aero Vodochody is an aerostructures production partner for airframers including Airbus, Embraer, Leonardo, and LET Aircraft Industries. C.A.

JetZero’s blended-wing-body airliner passes critical design review

By Hanneke Weitering

In the quest to conjure the next generation of commercial airliners, U.S. start-up JetZero believes it could give Boeing and Airbus a run for their money. The California-based company is poised to shake up the commercial airline market with a novel type of airplane that hardly resembles any aircraft in service today.

Meet the Z4, a blended-wing-body (BWB) aircraft with a highly aerodynamic and lightweight airframe that JetZero says will deliver up to a 50% reduction in fuel burn and greenhouse gas emissions compared with traditional tube-and-wing airplanes that are currently in service, even while using the same conventional engines. The company has purposefully eschewed options for electric propulsion, including hybrid and hydrogenbased powertrains, on the grounds that these would slow certification and impose performance compromises.

JetZero’s first full-scale technology demonstrator, expected to make its first flight in 2027, will run on a pair of Pratt & Whitney PW2040 high-bypass turbofan engines, but it has not yet pinned down a supplier for the production version of the aircraft. Collins Aerospace, a Pratt & Whitney sister company under RTX, has agreed to provide the engine nacelles for the demonstrator. JetZero is developing the demonstrator aircraft with backing from NASA and the U.S. Air Force.

Closing the Mid-Market Gap

With a range of 5,000 nm and capacity for 200 to 250 passengers, the Z4 fills a gap in the market between large narrowbodies and small widebodies—a gap both Boeing and Airbus have sought to fill by introducing longer variants of existing single-aisle aircraft.

JetZero says its aircraft could offer a future replacement for some of Boeing’s larger 737 variants and out-of-production 757 and 767 models, as well as Airbus’s A320 family,

particularly the A321neo. It first announced its plans at the Paris Air Show in 2023 and in recent months major carriers United and Delta have both announced backing for the program.

“This is kind of the New York to L.A. plane… but imagine if that same plane could also do transatlantic [flights] no problem, middle of America to the middle of Europe. That’s this plane,” JetZero chief product officer Scott Savian told reporters last month during a briefing at the company’s Long Beach, California headquarters, where a full-scale mockup of the aircraft’s interior was on display in a hangar.

Reimagining the Cabin

While JetZero is reinventing the wheel with a new type of airframe, it is also seizing the opportunity to completely reimagine the cabin. “We’re at the limits of the current geometry,” Savian said of the old tube-andwing design. “As soon as we move into this airframe, then we open doors to an entirely new world, not only in efficiency.”

Savian explained that the BWB concept “completely changes the way the cabin, the experience, the operations of an airline work.”

For example, the layout with six cabin bays and an extra large door will streamline the boarding process. When stepping aboard, “you immediately go left, right, or center—no

JetZero aims to replace traditional airliners with a blended-wing-body aircraft with conventional engines.

blocking up, no queues. Every single cabin you have direct access to. So, if you’re lucky enough to be in business class, you don’t have to watch 250 people go through the plane after you.”

Whereas most long-haul airplanes take at least 90 minutes to turn around between flights, JetZero’s streamlined cabin layout will reduce that time down to about 30 minutes, according to Savian.

Passengers will no longer have to walk through the galley when boarding, and flight attendants may appreciate the somewhat secluded and spacious central galley—located far away from the lavatories. “We’re not going to prepare your meal next to the toilet anymore,” he said.

The lavatories are all designed to be spacious and handicap-accessible as a standard feature, and they are located outside the cabin bays. “If you’re in one of those seats near a lav, you will not have people queuing up from the lavatory next to you the entire flight,” Savian remarked.

The improved passenger experience combined with the reduced fuel consumption and operating cost of the Z4 has garnered attention from airlines including United, Delta, and EasyJet. In April, United announced an order for up to 200 Z4 aircraft.

As the aviation industry works toward its collective goal of net-zero carbon emissions by 2050, much of the engineering focus has surrounded alternative fuel sources and novel propulsion technologies like electric, hybrid, or hydrogen powertrains. Rather than wait for new propulsion technologies to get certified and enter service to begin decarbonizing, JetZero is taking advantage of existing technologies as it works to commercialize a concept that dates back to the 1920s.

NASA Roots

JetZero traces its origins to a joint NASAMcDonnell Douglas BWB program in the 1990s that was led by JetZero co-founder and chief technology officer Mark Page. That program culminated in the successful flight of a 17-footlong BWB demonstrator in 1997. After that, NASA continued to invest in BWB research and test BWB demonstrators, including the Boeing X-48, but no commercial programs ever emerged from all that work—until now.

“What a phenomenal thing to be able to start a company on the back of a billion dollars in research across decades with the world’s experts,” JetZero co-founder and CEO Tom O’Leary said during the briefing in May.

O’Leary and Page founded JetZero in 2021 after working together on Beta Technologies’ Alia electric airplane and eVTOL program. The company went public in 2023, the same year it won a $235 million U.S. Air Force contract to design, build, and fly the full-scale BWB technology demonstrator by 2027 in partnership with Northrop Grumman and Scaled Composites. The Pentagon is considering JetZero’s BWB concept as a contender for its requirements for a new airlifter and air-to-air refueling platform.

However, O’Leary stressed, the Z4 demonstrator is not intended for an assessment of its potential for military applications. “It’s a commercial aircraft demonstration; there are zero military requirements,” he said. “The only requirement that the Air Force asked us to work on was L over D—lift over drag—just demonstrate the airframe and bring it to commercial production, because once that happens, then the Air Force and other military operations could really just deploy it as a derivative, which is similar to what’s done right now.”

Critical Design Review Complete