OFFERING MEMORANDUM Real Estate Investment Services 4325 and 4335 nW South tamiami Canal drive | miami | Florida 33126 90 UNITS

DISCLAIMERS AND NOTICES

CONFIDENTIALITY & DISCLAIMER

The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Marcus & Millichap Real Estate Investment Services of Florida, Inc. (“Marcus & Millichap”) and should not be made available to any other person or entity without the written consent of Marcus & Millichap. This Marketing Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. Marcus & Millichap has not made any investigation, and makes no warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCB’s or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects of any tenant, or any tenant’s plans or intentions to continue its occupancy of the subject property. The information contained in this Marketing Brochure has been obtained from sources we believe to be reliable; however, Marcus & Millichap has not verified, and will not verify, any of the information contained herein, nor has Marcus & Millichap conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein.

RENT DISCLAIMER

Any rent or income information in this offering memorandum, with the exception of actual, historical rent collections, represent good faith projections of potential future rent only, and Marcus & Millichap makes no representations as to whether such rent may actually be attainable. Local, state, and federal laws regarding restrictions on rent increases may make these projections impossible, and Buyer and its advisors should conduct their own investigation to determine whether such rent increases are legally permitted and reasonably attainable.

NON-ENDORSEMENT NOTICE

Marcus & Millichap is not affiliated with, sponsored by, or endorsed by any commercial tenant or lessee identified in this marketing package. The presence of any corporation’s logo or name is not intended to indicate or imply affiliation with, or sponsorship or endorsement by, said corporation of Marcus & Millichap, its affiliates or subsidiaries, or any agent, product, service, or commercial listing of Marcus & Millichap, and is solely included for the purpose of providing tenant lessee information about this listing to prospective customers. Activity ID ZAD0240049

SPECIAL COVID-19 NOTICE

All potential buyers are strongly advised to take advantage of their opportunities and obligations to conduct thorough due diligence and seek expert opinions as they may deem necessary, especially given the unpredictable changes resulting from the continuing COVID-19 pandemic. Marcus & Millichap has not been retained to perform, and cannot conduct, due diligence on behalf of any prospective purchaser. Marcus & Millichap’s principal expertise is in marketing investment properties and acting as intermediaries between buyers and sellers. Marcus & Millichap and its investment professionals cannot and will not act as lawyers, accountants, contractors, or engineers. All potential buyers are admonished and advised to engage other professionals on legal issues, tax, regulatory, financial, and accounting matters, and for questions involving the property’s physical condition or financial outlook. Projections and pro forma financial statements are not guarantees and, given the potential volatility created by COVID-19, all potential buyers should be comfortable with and rely solely on their own projections, analyses, and decision-making.

ALL PROPERTY SHOWINGS ARE BY APPOINTMENT ONLY. PLEASE CONSULT YOUR MARCUS & MILLICHAP AGENT FOR MORE DETAILS.

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 2

TABLE OF CONTENTS

INVESTMENT OVERVIEW

• Executive Summary

• Property Tours / Offering Process

PROPERTY DESCRIPTION

• Property Highlights

• Property Photos

• Site Plan

• Floor Plans

FINANCIAL ANALYSIS - MULTIFAMILY

• Rent Roll

• Operating Statement

• Pricing Details

FINANCIAL ANALYSIS - AirBNB

• Rent Roll Summary

• Operating Statement

• Pricing Details

MARKET OVERVIEW

• Miami - Dade Market Overview

• Points of Interest Map

LOCATION OVERVIEW

• Area Overview

• Proposed Projects 4325 and 4335 nW South tamiami Canal drive miami, Florida 33126

INVESTMENT OVERVIEW

EXECUTIVE SUMMARY

Marcus & Millichap and Global Investments Realty, as exclusive listing agents, are pleased to offer for sale Airport Villas, a Class B, 90-unit apartment complex located at 4325 and 4335 NW South Tamiami Canal Drive in the city of Miami, in Miami-Dade County, Florida. Airport Villas was constructed in 1972, and it sits on a 1.86 acre lot. The Property’s unit mix is comprised of 66 one-bedroom/one-bathroom units and 24 two-bedroom/one-bathroom units. Residents enjoy the security of a gated entrance, ample parking (109 spaces), central air-conditioning and heat in all units as well as patios or balconies. The Airport Villas offers residents resort style amenities including a swimming pool, fitness center, on-site laundry, tranquil green spaces, elevators, and an on-site management office.

The Property is located adjacent to the Miami International Airport, one of the largest employers in South Florida. This proper ty is currently operated as long term rentals but the location and zoning permits an owner to operate the property as both long-term and short-term rentals which would increase an investor’s return. Airport Villas has the potential to be the perfect place for tourists, pilots and flight crew who want a comfortable, private, and affordable place to stay for a short period of time.

Airport Villas has benefited from a series of renovations and capital improvements that include a new roof, new paint on the in terior corridors and exteriors of the building, and an update of the fitness center with brand new equipment, a remodeled pool area and lush landscaping.

This is an excellent opportunity for an investor to capitalize on a rare opportunity to acquire a fee simple asset so close to an international airport. There is also non-recourse debt that can be assumed with a 3.45 percent interest rate and interest only payments through July 2 024. The location and the property are irreplaceable. Airport Villas is being offered below replacement cost, and there is upside in rents through hands- on management. In addition, the current market conditions allow an investor to acquire very attractive financing which makes this opportunity even more appealing and increases the return on equity.

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 8

INVESTMENT HIGHLIGHTS

• Irreplaceable Location Adjacent to Miami International Airport

• Below Market, 3.45 Percent Assumable Debt Available

• Very Strong Rental Market in a Dense Infill Location

• Liberal Zoning Which Allows for a Number of Uses Including Short Term Rentals

• Gated Parking with Secured Entrances

• Class A Amenity Package Including Pool, Sundeck and Fitness Center

• Select Units Have Been Renovated

• Units Have Central Air-Conditioning & Heat and Patios or Balconies

• Property has the 40 Year Recertification, Railings and Roof Replaced in Approximately 2013

PROPERTY TOURS

Qualified prospective purchasers will be given an opportunity to tour the Property with the listing team. To arrange a property tour, please contact Maria DiFiore by phone at (954) 245-3482 or by email at maria.difiore@marcusmillichap.com.

OFFERING PROCESS

A Call for Offers Date will be announced to qualified prospective purchasers at a later date. Offers should be delivered to the office of Marcus & Millichap, attention Felipe J. Echarte and Evan P. Kristol, via email to maria.difiore@marcusmillichap.com. To facilitate analysis of offers, offerors are encouraged to provide information relative to funding sources, experience in owning similar properties, familiarity with the market, and any other information that is likely to reflect favorably on the Offeror’s ability to close the proposed transaction in a timely manner.

The Owner reserves the right to change the schedule at any time without notice or to remove the Property from the market. The Owner will consider only those proposals submitted at the prior invitation of the Owner or its Agent, Marcus & Millichap. The Owner reserves the right to negotiate with any party on an exclusive basis at any time. The Owner also reserves the unrestricted right to reject any and all proposals.

For further information, please contact:

FELIPE J. ECHARTE

SENIOR VICE PRESIDENT INVESTMENTS

Tel: (954) 245-3444

Felipe.Echarte@MarcusMillichap.com

LICENSE: FL SL696115

EVAN P. KRISTOL

EXECUTIVE MANAGING DIRECTOR INVESTMENTS

Tel: (954) 245-3459

Evan.Kristol@MarcusMillichap.com

LICENSE: FL SL640466

JOEL RODRIGUEZ

PRINCIPAL / BROKER - GLOBAL INVESTMENTS REALTY

Tel: (786) 285-7739

joel@glirealty.com

Office: 305.635.3005

235 NE 25th Street

Miami, FL 33137

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 11

PROPERTY DESCRIPTION

PROPERTY DESCRIPTION DETAILS

Property Address –4325 and 4335 NW South Tamiami Canal Drive, Miami, FL 33126

Folio Numbers - 01-3132-014-1240 & 1260

No. of Apartments – 90

Avg. Unit Size – 707 Sq. Ft.

Year Built – 1972

No. of Stories – 3

Construction – Concrete Block Construction

Site Acreage – 1.86 Acres

Parking – 109 Spaces On-Site

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 15

EXTERIORS

INTERIORS

GYM

OFFICE

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 24 NW South Tamiami Canal Drive Fitnes Center Pool 4335 4325 SITE PLAN

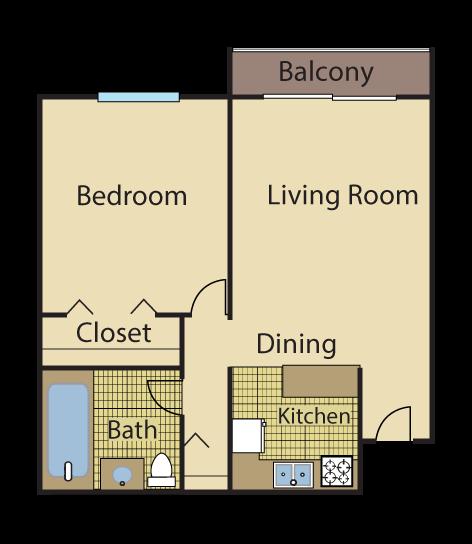

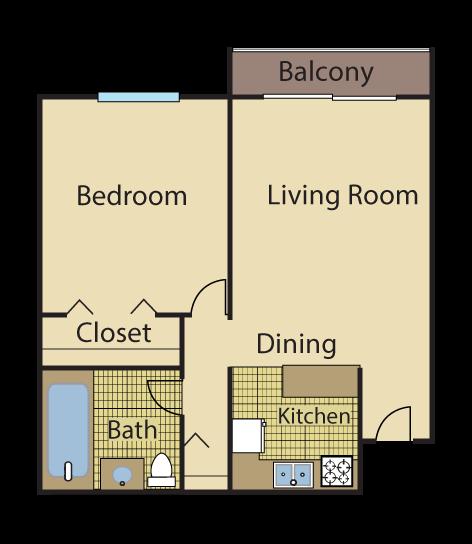

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 25 One Bedroom / One Bathroom 680 sq ft Two Bedroom / One Bathroom 780 sq ft FLOOR PLANS

FINANCIAL ANALYSIS

MULTIFAMILY MODEL

MULTIFAMILY MODEL - RENT ROLL DETAIL

As of December, 2022

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 28 SCHEDULED SCHEDULED POTENTIAL POTENTIAL Square Rent / Rent / SF/ Rent / Rent/ SF/ UNIT UNIT TYPE Feet Month Month Month Month 4325-101 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4325-102 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4325-103 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-104 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-105 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-106 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4325-107 One Bed/One Bath 680 $1,350 $1.99 $1,750 $2.57 4325-108 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-109 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4325-110 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4325-111 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-112 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-113 One Bed/One Bath 680 $1,350 $1.99 $1,750 $2.57 4325-114 Two Bed/One Bath 780 $1,700 $2.18 $2,000 $2.56 4325-115 Two Bed/One Bath 780 $1,550 $1.99 $2,000 $2.56 4325-201 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4325-202 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4325-203 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-204 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-205 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4325-206 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-207 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-208 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4325-209 One Bed/One Bath 680 $1,350 $1.99 $1,750 $2.57 4325-210 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4325-211 One Bed/One Bath 680 $1,650 $2.43 $1,750 $2.57 4325-212 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4325-213 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4325-214 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4325-215 Two Bed/One Bath 780 $1,600 $2.05 $2,000 $2.56 4325-301 Two Bed/One Bath 780 $1,650 $2.12 $2,000 $2.56 4325-302 Two Bed/One Bath 780 $1,800 $2.31 $2,000 $2.56 4325-303 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-304 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4325-305 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4325-306 One Bed/One Bath 680 $1,350 $1.99 $1,750 $2.57 4325-307 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57

MULTIFAMILY MODEL - RENT ROLL DETAIL

As of December, 2022

4325-308 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4325-309 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4325-310 One Bed/One Bath 680 $1,350 $1.99 $1,750 $2.57 4325-311 One Bed/One Bath 680 $1,450 $2.13 $1,750 $2.57 4325-312 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4325-313 One Bed/One Bath 680 $1,350 $1.99 $1,750 $2.57 4325-314 Two Bed/One Bath 780 $1,600 $2.05 $2,000 $2.56 4325-315 Two Bed/One Bath 780 $1,950 $2.50 $2,000 $2.56 4335-101 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4335-102 Two Bed/One Bath 780 $1,500 $1.92 $2,000 $2.56 4335-103 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-104 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4335-105H One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-106 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-107 One Bed/One Bath 680 $1,550 $2.28 $1,750 $2.57 4335-108 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-109 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-110 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-111 One Bed/One Bath 680 $1,200 $1.76 $1,750 $2.57 4335-112 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-113 One Bed/One Bath 680 $1,550 $2.28 $1,750 $2.57 4335-114 Two Bed/One Bath 780 $1,450 $1.86 $2,000 $2.56 4335-116 Two Bed/One Bath 780 $1,525 $1.96 $2,000 $2.56 4335-201 Two Bed/One Bath 780 $1,800 $2.31 $2,000 $2.56 4335-202 Two Bed/One Bath 780 $1,600 $2.05 $2,000 $2.56 4335-203 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4335-204 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-205 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-206 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4335-207 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-208 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-209 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-210 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4335-211 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-212 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-213 One Bed/One Bath 680 $1,600 $2.35 $1,750 $2.57 4335-214 Two Bed/One Bath 780 $1,300 $1.67 $2,000 $2.56 4335-216 Two Bed/One Bath 780 $1,500 $1.92 $2,000 $2.56 4335-301 Two Bed/One Bath 780 $1,800 $2.31 $2,000 $2.56 4335-302 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4335-303 One Bed/One Bath 680 $1,500 $2.21 $1,750 $2.57 4335-304 One Bed/One Bath 680 $1,450 $2.13 $1,750 $2.57 4335-305 One Bed/One Bath 680 $1,550 $2.28 $1,750 $2.57 4335-306 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-307 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4335-308 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4335-309 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4335-310 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4335-311 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4335-312 One Bed/One Bath 680 $1,400 $2.06 $1,750 $2.57 4335-313 Two Bed/One Bath 780 $1,750 $2.24 $2,000 $2.56 4335-314 One Bed/One Bath 680 $1,300 $1.91 $1,750 $2.57 4335-316 Two Bed/One Bath 780 $1,600 $2.05 $2,000 $2.56 T Total 63,600 $132,525 $2 08 $163,500 $2 57

MULTIFAMILY MODEL - RENT ROLL SUMMARY

As of December, 2022

Unit Distribution

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 30 # OF AVG SQ RENTAL AVERAGE AVERAGE MONTHLY AVERAGE AVERAGE MONTHLY UNIT TYPE UNITS FEET RANGE RENT RENT / SF INCOME RENT RENT / SF INCOME One Bed/One Bath 66 680 $1,200 - $1,650 $1,403 $2.06 $92,600 $1,750 $2.57 $115,500 Two Bed/One Bath 24 780 $1,300 - $1,950 $1,664 $2.13 $39,925 $2,000 $2.56 $48,000 TOTALS/WEIGHTED AVERAGES 90 707 $1,473 $2.08 $132,525 $1,817 $2.57 $163,500 GROSS ANNUALIZED RENTS $1,590,300 $1,962,000 Notes: SCHEDULED POTENTIAL $2.56 SF $2.56 SF $2.56 SF $2.56 SF $2.57 SF $2.57 SF $2.57 SF $2.57 SF $2.57 SF $2.58 SF $1,600 $1,650 $1,700 $1,750 $1,800 $1,850 $1,900 $1,950 $2,000 $2,050 One Bed/One Bath Two Bed/One Bath Rent per SF/Month Rent per Month Unit Type Unit Rent Rent Rent SF One Bed/One Bath 73% Two Bed/One Bath 27%

MULTIFAMILY MODEL - OPERATING STATEMENT

Notes and assumptions to the above analysis are on the following page.

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 31 INCOME Current Year 1 NOTES PER UNIT PER SF Rental Income Gross Potential Rent 1,962,000 2,060,100 22,890 32.39 Loss / Gain to Lease (371,700) 18.9% 0 0 0.00 Gross Scheduled Rent 1,590,300 2,060,100 22,890 32.39 Physical Vacancy (47,709) 3.0% (61,803) 3.0% [1] (687) (0.97) TOTAL VACANCY ($47,709) 3.0% ($61,803) 3.0% ($687) ($1) Effective Rental Income 1,542,591 1,998,297 22,203 31.42 Other Income 10,800 10,800 [2] 120 0.17 7,500 7,500 83 0.12 TOTAL OTHER INCOME $18,300 $18,300 $203 $0.29 EFFECTIVE GROSS INCOME $1,560,891 $2,016,597 $22,407 $31.71 EXPENSES Current Year 1 NOTES PER UNIT PER SF Real Estate Taxes 200,499 371,221 [3] 4,125 5.84 Insurance 167,782 167,782 [4] 1,864 2.64 18,540 18,540 [5] 206 0.29 38,418 38,418 [6] 427 0.60 24,725 24,725 [7] 275 0.39 18,080 18,080 [8] 201 0.28 45,000 45,000 [9] 500 0.71 8,520 8,520 [10] 95 0.13 9,630 9,630 [11] 107 0.15 72,000 72,000 [12] 800 1.13 3,840 3,840 [13] 43 0.06 4,560 4,560 [15] 51 0.07 Operating Reserves 22,500 22,500 [16] 250 0.35 Management Fee 54,631 3.5% 70,581 3.5% [17] 784 1.11 TOTAL EXPENSES $688,725 $875,396 $9,727 $13.76 EXPENSES AS % OF EGI 44.1% 43.4% NET OPERATING INCOME $872,166 $1,141,201 $12,680 $17.94

All Other Income Laundry Income Utilities - Electric Utilities - Water & Sewer Cable, Phone & Internet Trash Removal Repairs & Maintenance Landscaping Pest Control Payroll Elevator Service Pool Sevice

MULTIFAMILY MODELOPERATING STATEMENT NOTES

NOTES TO OPERATING STATEMENT

[1] Airport Villas is historically operates at 98% occupancy. Vacancy is based on 3% of the Gross Scheduled Rent in both current and proforma.

[2] Laundry income is based on $120 per unit per year.

[3] 2021 Property taxes are $200,499, proforma taxes are assuming an 80% reassessment, times the 2021 millage rate minus a 4% early payment.

[4] The insurance figure is from the 2022 P&L.

[5] The electric figure is from the 2022 P&L annualized.

[6] The Water/Sewer figure is from the 2022 P&L annualized.

[7] The cable, phone & Internet figure is from the 2022 P&L annualized.

[8] The trash removal figure is from the 2022 P&L annualized.

[9] Repairs and maintenance is assumed at $500 per unit per year.

[10] The landscaping figure is from the 2022 P&L annualized.

[11] The pest control figure is from the 202 2 P&L annualized.

[12] Payroll is assumed to be $800/unit per year.

[13] The elevator service figure is from the 2022 P&L annualized.

[14] The pool service figure is from the 2022 P&L annualized.

[15] Reserves is assumed at $250 per unit per year.

[16] Management fee is calculated at 3.5%.

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 32

MULTIFAMILY MODEL - PRICING DETAILS

OPERATING DATA

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 33

Price $22,750,000 Down Payment $11,375,000 50% Number of Units 90 Current Year 1 Price Per Unit $252,778 Gross Scheduled Rent $1,590,300 $2,060,100 Price Per SqFt $357.70 Less: Vacancy/Deductions 3.0% $47,709 3.0% $61,803 Rentable SqFt 63,600 Total Effective Rental Income $1,542,591 $1,998,297 Lot Size 1.86 Acres Other Income $18,300 $18,300 Approx. Year Built 1972 Effective Gross Income $1,560,891 $2,016,597 Less: Expenses 44.1% $688,725 43.4% $875,396 Net Operating Income $872,166 $1,141,201 RETURNS Current Year 1 Reno Cash Flow $872,166 $1,141,201 CAP Rate 3.83% 5.02% 0 00% Debt Service $712,049 $712,049 GRM 14.31 11.04 0.00 Net Cash Flow After Debt Service 1.41% $160,117 3.77% $429,152 Cash-on-Cash 1.41% 3.77% -6.26% Principal Reduction $184,046 $184,046 Debt Coverage Ratio 1.22 1.60 0.00 TOTAL RETURN 3.03% $344,163 5.39% $613,198 FINANCING 1st Loan Current Year 1 Loan Amount $11,375,000 Real Estate Taxes $200,499 $371,221 Loan Type New Insurance $167,782 $167,782 Interest Rate 4.75% Utilities - Electric $18,540 $18,540 Amortization 30 Years Utilities - Water & Sewer $38,418 $38,418 Year Due 2032 Cable, Phone & Internet $24,725 $24,725 Loan information is subject to change. Contact your Marcus & Millichap Capital Corporation representative. Trash Removal $18,080 $18,080 Repairs & Maintenance $45,000 $45,000 # OF UNITS UNIT TYPE SQFT/UNIT SCHEDULED RENTS MARKET RENTS Landscaping $8,520 $8,520 66 680 $1,403 $1,750 Pest Control $9,630 $9,630 24 780 $1,664 $2,000 Payroll $72,000 $72,000 0 Elevator Service $3,840 $3,840 0 Pool Sevice $4,560 $4,560 0 Operating Reserves $22,500 $22,500 Management Fee $54,631 $70,581 IRR Year IRR Unlevered IRR Levered TOTAL EXPENSES $688,725 $875,396 5 9.91% 14.08% Expenses/Unit $7,653 $9,727 7 9.47% 13.00% Expenses/SF $10.83 $13.76 10 8.85% 11.78% EXPENSES INCOME SUMMARY Two Bed/One Bath One Bed/One Bath

MULTIFAMILY MODEL - LOAN ASSUMPTION

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 34

OPERATING DATA Price $22,750,000 Down Payment $12,870,000 57% Number of Units 90 Current Year 1 Price Per Unit $252,778 Gross Scheduled Rent $1,590,300 $2,060,100 Price Per SqFt $357.70 Less: Vacancy/Deductions 3.0% $47,709 3.0% $61,803 Rentable SqFt 63,600 Total Effective Rental Income $1,542,591 $1,998,297 Lot Size 1.86 Acres Other Income $18,300 $18,300 Approx. Year Built 1972 Effective Gross Income $1,560,891 $2,016,597 Less: Expenses 44.1% $688,725 43.4% $875,396 Net Operating Income $872,166 $1,141,201 RETURNS Current Year 1 Reno Cash Flow $872,166 $1,141,201 CAP Rate 3.83% 5.02% 0 00% Debt Service $340,860 $450,657 GRM 14.31 11.04 0.00 Net Cash Flow After Debt Service 4.13% $531,306 5.37% $690,543 Cash-on-Cash 4.13% 5.37% -2.65% Principal Reduction $110,749 $110,749 Debt Coverage Ratio 2.56 2.53 0.00 TOTAL RETURN 4.99% $642,055 6.23% $801,292 FINANCING 1st Loan Current Year 1 Loan Amount $9,880,000 Real Estate Taxes $200,499 $371,221 Loan Type Assumed Insurance $167,782 $167,782 Interest Rate 3.45% Utilities - Electric $18,540 $18,540 Amortization 30 Years Utilities - Water & Sewer $38,418 $38,418 Year Due 2032 Cable, Phone & Internet $24,725 $24,725 Loan information is subject to change. Contact your Marcus & Millichap Capital Corporation representative. Trash Removal $18,080 $18,080 Repairs & Maintenance $45,000 $45,000 # OF UNITS UNIT TYPE SQFT/UNIT SCHEDULED RENTS MARKET RENTS Landscaping $8,520 $8,520 66 680 $1,403 $1,750 Pest Control $9,630 $9,630 24 780 $1,664 $2,000 Payroll $72,000 $72,000 0 Elevator Service $3,840 $3,840 0 Pool Sevice $4,560 $4,560 0 Operating Reserves $22,500 $22,500 Management Fee $54,631 $70,581 IRR Year IRR Unlevered IRR Levered TOTAL EXPENSES $688,725 $875,396 5 9.91% 14.08% Expenses/Unit $7,653 $9,727 7 9.47% 13.10% Expenses/SF $10.83 $13.76 10 8.85% 14.38% EXPENSES INCOME SUMMARY Two Bed/One Bath One Bed/One Bath

FINANCIAL ANALYSIS AirBNB MODEL

AirBNB - RENT ROLL SUMMARY

As of December, 2022

Unit Distribution

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 38 # OF AVG SQ RENTAL AVERAGE AVERAGE MONTHLY AVERAGE AVERAGE MONTHLY UNIT TYPE UNITS FEET RANGE RENT RENT / SF INCOME RENT RENT / SF INCOME One Bed/One Bath 66 680 $3,041 - $3,041 $3,041 $4.47 $200,706 $3,041 $4.47 $200,706 Two Bed/One Bath 24 780 $3,650 - $3,650 $3,650 $4.68 $87,600 $3,650 $4.68 $87,600 TOTALS/WEIGHTED AVERAGES 90 707 $3,203 $4.53 $288,306 $3,203 $4.53 $288,306 GROSS ANNUALIZED RENTS $3,459,672 $3,459,672 Notes: SCHEDULED POTENTIAL $4.35 SF $4.40 SF $4.45 SF $4.50 SF $4.55 SF $4.60 SF $4.65 SF $4.70 SF $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 One Bed/One Bath Two Bed/One Bath Rent per SF/Month Rent per Month Unit Type Unit Rent Rent Rent SF One Bed/One Bath 73% Two Bed/One Bath 27%

AirBNB - OPERATING STATEMENT

Notes and assumptions to the above analysis are on the following page.

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 39 INCOME Short Term Rentals NOTES PER UNIT PER SF Rental Income Gross Scheduled Rent 3,459,672 [1] 38,441 54.40 Physical Vacancy (691,934) 20.0% [2] (7,688) (10.88) TOTAL VACANCY ($691,934) 20.0% ($7,688) ($11) Effective Rental Income 2,767,738 30,753 43.52 Other Income 5,400 [3] 60 0.08 131,400 [4] 1,460 2.07 TOTAL OTHER INCOME $136,800 $1,520 $2.15 EFFECTIVE GROSS INCOME $2,904,538 $32,273 $45.67 EXPENSES Short Term Rentals NOTES PER UNIT PER SF Real Estate Taxes 371,221 [5] 4,125 5.84 Insurance 167,782 [6] 1,864 2.64 54,000 [7] 600 0.85 38,418 [8] 427 0.60 45,000 [9] 500 0.71 18,080 [10] 201 0.28 67,500 [11] 750 1.06 8,520 [12] 95 0.13 9,630 [13] 107 0.15 108,000 [14] 1,200 1.70 3,840 [15] 43 0.06 4,560 [17] 51 0.07 Operating Reserves 33,750 [18] 375 0.53 Management Fee 145,227 5.0% [19] 1,614 2.28 TOTAL EXPENSES $1,075,527 $11,950 $16.91 EXPENSES AS % OF EGI 37.0% NET OPERATING INCOME $1,829,010 $20,322 $28.76

All Other Income Laundry Income Utilities - Electric Utilities - Water & Sewer Cable, Phone & Internet Trash Removal Repairs & Maintenance Landscaping Pest Control Payroll Elevator Service Pool Sevice

AirBNB - OPERATING STATEMENT NOTES

NOTES TO OPERATING STATEMENT

[1] Short Term income is based on $100/night for 1-bedrooms and $120/night for 2-bedrooms

[2] Short Term Vacancy is based on 20% of the Gross Scheduled Rent.

[3] Laundry income is based on $60 per unit per year.

[4] Other income includes, parking fees, resort fees, etc.

[5] 2021 Property taxes are $200,499, proforma taxes are assuming an 80% reassessment, times the 2021 millage rate minus a 4% early payment.

[6] The insurance figure is estimated to be $1,667 per unit per year because of short term rental operations.

[7] The electric figure is estimated to be $600 per unit per year.

[8] The Water/Sewer figure is from the 2021 P&L.

[9] The cable, phone & internet figure is estimated to be $45,000.

[10] The trash removal figure is estimated to be $250 per unit per year.

[11] Repairs and maintenance is assumed at $750 per unit per year.

[12] The landscaping figure is estimated to be $139 per unit per year.

[13] The pest control figure is from the 2021 P&L.

[14] Payroll is assumed to be $1,200/unit per year.

[15] The elevator setvice figure is from the 2021 P&L.

[16] General Administrative is assumed to be $150 per unit per year.

[17] The pool service figure is from the 2021 P&L.

[18] Reserves is assumed at $375 per unit per year.

[19] Management fee is calculated at 5%.

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 40

[20] [21] [22] [23] [24] [25] [26] [27]

AirBNB - PRICING DETAILS

OPERATING DATA

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 41

Price $22,750,000 Down Payment $11,375,000 50% Number of Units 90 Short Term Rentals Price Per Unit $252,778 Gross Scheduled Rent $3,459,672 Price Per SqFt $357.70 Less: Vacancy/Deductions 20.0% $691,934 Rentable SqFt 63,600 Total Effective Rental Income $2,767,738 Lot Size 1.86 Acres Other Income $136,800 Approx. Year Built 1972 Effective Gross Income $2,904,538 Less: Expenses 37.0% $1,075,527 Net Operating Income $1,829,010 RETURNS Short Term Rentals Cash Flow $1,829,010 CAP Rate 8.04% ##### Debt Service $636,032 GRM 6.58 0.00 Net Cash Flow After Debt Service 10.49% $1,192,978 Cash-on-Cash 10.49% ##### Principal Reduction $215,387 Debt Coverage Ratio 2.88 0.00 TOTAL RETURN 12.38% $1,408,366 FINANCING 1st Loan Short Term Rentals Loan Amount $11,375,000 Real Estate Taxes $371,221 Loan Type New Insurance $167,782 Interest Rate 3.80% Utilities - Electric $54,000 Amortization 30 Years Utilities - Water & Sewer $38,418 Year Due 2032 Cable, Phone & Internet $45,000 Loan information is subject to change. Contact your Marcus & Millichap Capital Corporation representative. Trash Removal $18,080 Repairs & Maintenance $67,500 # OF UNITS UNIT TYPE SQFT/UNIT SHORT TERM RENTS Landscaping $8,520 66 680 $3,041 Pest Control $9,630 24 780 $3,650 Payroll $108,000 0 Elevator Service $3,840 0 Pool Sevice $4,560 0 Operating Reserves $33,750 Management Fee $145,227 TOTAL EXPENSES $1,075,527 Expenses/Unit $11,950 Expenses/SF $16.91 EXPENSES INCOME SUMMARY Two Bed/One Bath One Bed/One Bath

MARKET OVERVIEW

MIAMI-DADE MARKET OVERVIEW

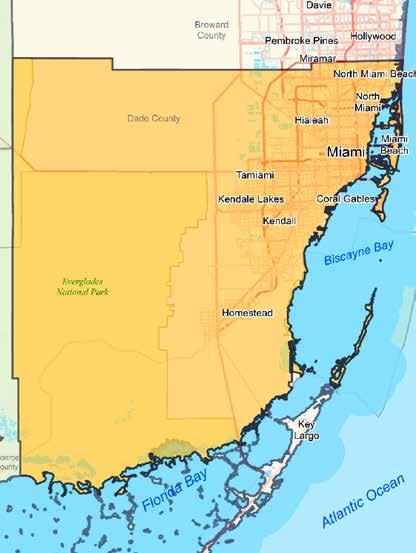

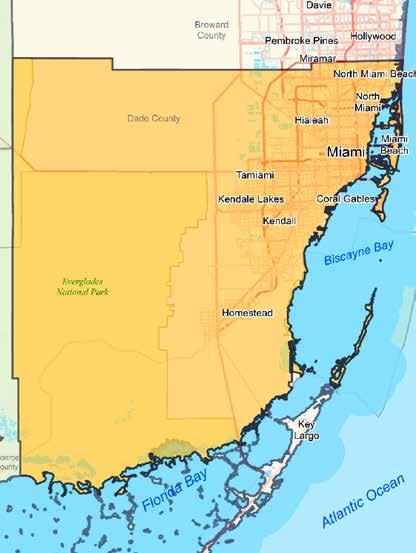

Miami-Dade County is a gateway to South American and Caribbean markets and a tourist destination. The 2,400-square-mile county extends from the Florida Everglades east to the Atlantic Ocean. It is bordered to the north by Broward County and to the south by the Florida Keys. The main portion of the city of Miami lies on the shores of Biscayne Bay and is separated from the Atlantic Ocean by barrier islands, the largest of which holds the city of Miami Beach. The metro, with a population of roughly 2.7 million, is located entirely within Miami-Dade County. Miami is the most populous city, with slightly more than 442,300 residents, followed by Hialeah with roughly 234,800 people.

BUSINESS-FRIENDLY ENVIRONMENT

The metro has no local corporate or personal income taxes, which attracts businesses and residents to the area

INTERNATIONAL GATEWAY

Miami is a gateway for international trading activities, tourism and immigration, connecting to airports and ports around the world.

MEDICAL COMMUNITY

The county contains the largest concentration of medical facilities in Florida, drawing residents needing services throughout the state.

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 44

METRO HIGHLIGHTS

MIAMI-DADE ECONOMY

• Various industries provide a diverse economy. Trade, international finance, healthcare and entertainment have become major segments in the local business community.

• A strong tourism industry has developed with ties to Latin America and the Caribbean.

• Tourism and trade depend on a large transportation sector. PortMiami and Miami International Airport are both major contributors to employment and the economy.

• The Miami metro gross metropolitan product (GMP) expansion is expected to be on par with the U.S. GDP in 2020 and retail sales for the county are also rising.

MAJOR AREA EMPLOYERS

Baptist Health South Florida

University of Miami

American Airlines

Miami Children’s Hospital

Publix Supermarkets

Winn-Dixie Stores

Florida

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 45

Power & Light Co. Carnival Cruise Lines AT&T Mount Sinai Medical Center TRADE, TRANSPORTATION AND UTILITIES CONSTRUCTION 25% EDUCATION AND HEALTH SERVICES OTHER SERVICES INFORMATION 4% 16% 2% 4% MANUFACTURING PROFESSIONAL AND BUSINESS SERVICES GOVERNMENT FINANCIAL ACTIVITIES LEISURE AND HOSPITALITY 3% 15% 12% 12% 7% SHARE OF 2017 EMPLOYMENT

ECONOMIC GROWTH Miami-Dade GMP U.S. GDP Annual Change 8% 4% 0% -4% -8% 00 02 04 06 08 10 12 14 16 18 20* * Forecast

N

« Airport Villas

1. Miami International Airport

2. International Links Melreese Country Club (Future Site of Miami Freedom Park)

3. Miami Springs Golf & Country Club

4. LoanDepot Park

5. Jackson Memorial Hospital

6. Little Havana

7. Miami Design District

8. Phillip and Patricia Frost Museum of Science

9. Bayfront Park

10. Hialeah Park Racing & Casino

11. Adrienne Arsht center fo performing arts

12. University of Miami Medical Center

1 2 3 4 5 6 10 11 12 13 8 9 7

13. Vizcaya Museum

EDUCATION

ARTS & ENTERTAINMENT

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 47

SPORTS

MIAMI-DADE DEMOGRAPHICS

• The metro is expected to add nearly 102,000 people over the next five years. During the same period, approximately 40,100 households will be formed, generating demand for housing.

• The homeownership rate of 48 percent is below the national rate of 57 percent, maintaining a strong rental market.

• The cohort of 20- to 34-year-olds composes 21 percent of the population.

2019 POPULATION BY AGE

QUALITY OF LIFE

Miami-Dade County has developed into a cosmopolitan urban area offering a vibrant business and cultural community. The metro has an abundance of popular attractions. Miami hosts the Capital One Orange Bowl and is home to several professional sports teams, including the Miami Dolphins, the Miami Marlins and the Miami Heat. The county has a broad array of cultural attractions, historical sites and parks. These include the Adrienne Arsht Center for the Performing Arts, Zoo Miami and Everglades National Park. The region is home to a vibrant and diverse culture, family-friendly neighborhoods, a plethora of shops and restaurants, and beautiful weather and beaches. It also offers easy access to Latin America and the Caribbean.

POPULATION: 2.7M Growth 2019-2024* 3.7%

$48,000

$60,800

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 48

0-4 YEARS 6% 5-19 YEARS 20-24 YEARS 25-44 YEARS 65+ YEARS 45-64 YEARS 17% 6% 28% 27% 16% 2019

2019 HOUSEHOLDS:

2019-2024* 4.2% 2019 MEDIAN AGE:

U.S. Median:

MEDIAN HOUSEHOLD INCOME:

U.S.

* Forecast Sources: Marcus & Millichap Research Services; BLS; Bureau of Economic Analysis; Experian; Fortune; Moody’s Analytics; U.S. Census Bureau

958K Growth

40.1

38.1 2019

Median:

LOCATION OVERVIEW

AIRPORT VILLAS LOCATION OVERVIEW

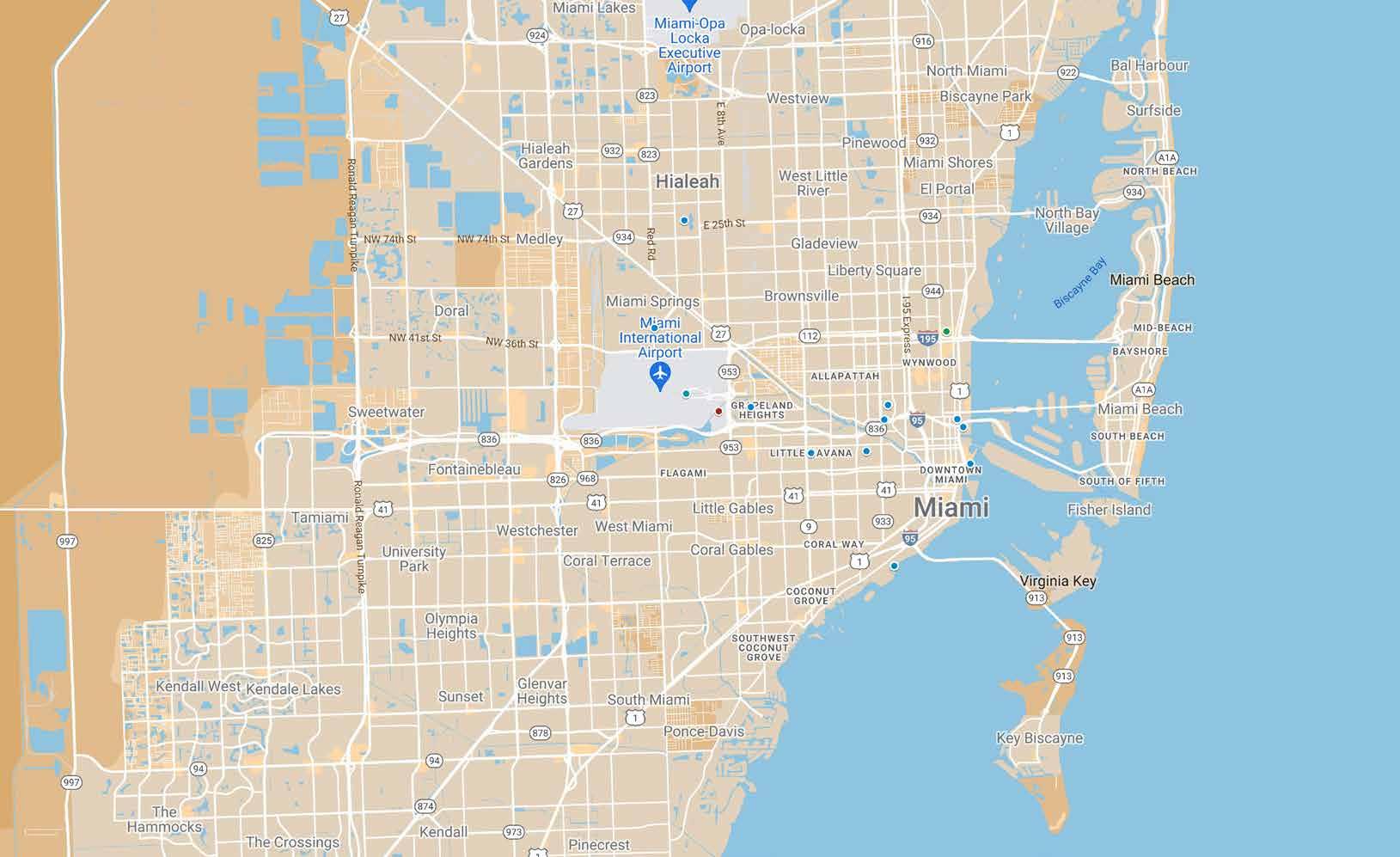

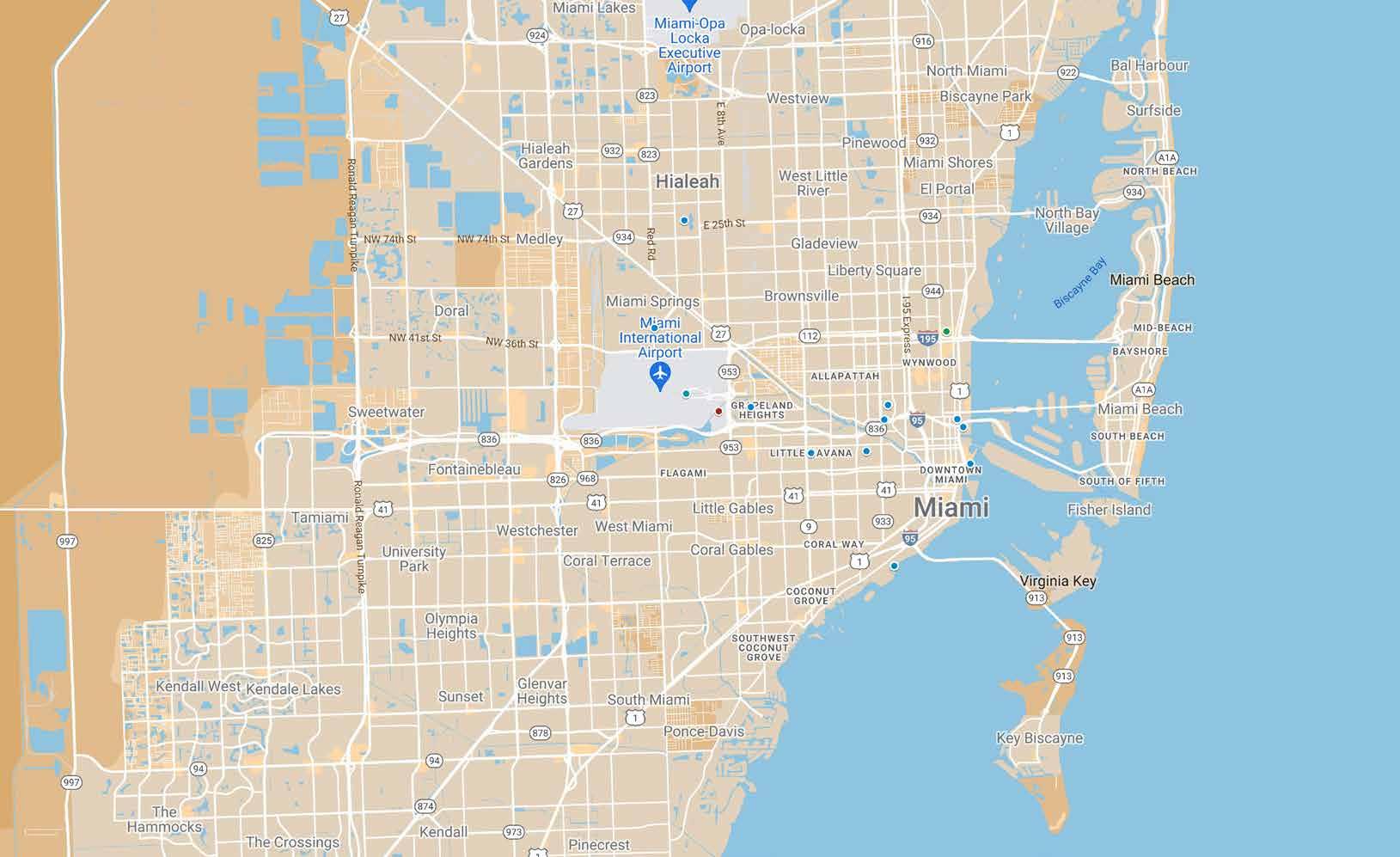

Located in the heart of Miami, Airport Villas Apartments is positioned as one of the most desirable rental buildings in the Miami-Airport submarket. The property is located adjacent to the Miami International Airport and just west of Le Jeune Road (SW 42nd Avenue). This is a rare opportunity to acquire a fee simple asset adjacent to an international airport.

Airport Villas Apartments offers convenient access to major traffic arteries such as the Dolphin Expressway (836), the Palmetto Expressway (826), the Airport Expressway (112), and Interstate 95. Moreover, Le Jeune Road and Okeechobee Road are within short driving distance and generate most of the commercial activity in the area.

Airport Villas Apartments is close to major Miami entertainment locations. The Brickell and Downtown areas, the city of Doral, and the city of Coral Gables are all within a 10-minute drive. Major employers are also a short commute from the property and include Miami International Airport, Miami-Dade College Medical Center, Baptist Health of South Florida, The University of Miami, Carnival Cruise Lines, Royal Caribbean Cruises, and Florida International University. Major tourist destinations such as The Dolphin Mall, The Mall of the Americas, and Miami International Mall are within short driving distance as well.

The main terminal for Miami International Airport (also known as MIA) is situated just five minutes away from the property. MIA is the leader in international freight and the world’s largest gateway to Latin America and the Caribbean servicing over 60 passenger airlines and 38 cargo and

freight airlines. Over 387,581 flights carrying 39.5 million passengers travel through and around MIA every year and the airport is in the process of major expansion.

Miami International Airport (MIA) and the general Aviation Airport’s annual economic impact is $32.8 billion. MIA and related aviation industries contribute 272,395 jobs directly and indirectly to the local economy, which equates to one out of every 4.1 jobs. Miami International Airport was ranked as the best mega airport for passenger satisfaction in the eastern U.S. and Florida by J.D. Power. On a 1,000-point scale, MIA achieved a score of 801 – second among mega airports in North America only to Phoenix Sky Harbor International Airport, which earned a score of 805. Mega airports are those with 33 million or more passengers per year - the busiest airports in the study. MIA was able to jump from 11th place in last year’s study to 2nd place overall in North America while serving a record-high 46 million passengers in 2019 – an increase of nearly one million passengers over the previous year.

The close proximity to MIA translates into a competitive advantage for Airport Villas Apartments, since it serves as a perfect location for airport employees and pilots on both a short or long-term basis.

MIAMI INTERNATIONAL AIRPORT

FUTURE SITE OF MIAMI FREEDOM PARK

BLUE LAGOON OFFICE MARKET

MIAMI INTERNATIONAL AIRPORT

MIAMI INTERNATIONAL AIRPORT

Miami-Dade College Medical Center

Located in the heart of the Miami Health District, the Medical Campus is home to state-of-the-art facilities and more than 20 educational options, including bachelor’s degree programs and training certificates.

AREA ATTRACTIONS

Royal Caribbean Cruises

A global cruise holding company incorporated in Liberia and based in Miami, Florida, US. It is the world’s secondlargest cruise line operator, after Carnival Corporation.

Baptist Health of South Florida

Not-for-profit healthcare organization and clinical care network in Miami as well as Broward and Palm Beach Counties. Baptist Health has 11 hospitals (Baptist Hospital, Baptist Children’s Hospital, Bethesda Hospital East, Bethesda Hospital West, Boca Raton Regional Hospital, Doctors Hospital, Fishermen’s Community Hospital, Homestead Hospital, Mariners Hospital, South Miami Hospital and West Kendall Baptist Hospital).

Florida International University

Florida International University is a public research university with its main campus in University Park, MiamiDade County, Florida. Founded in 1965, the school opened its doors to students in 1972. It has become the largest university in South Florida, and the second-largest in Florida.

The University of Miami

A private research university in Coral Gables, Florida. As of 2020, the university enrolled 17,811 students in 12 separate colleges and schools across nearly 350 academic academic majors and programs, including the Leonard M. Miller School of Medicine in Miami’s Health District, a law school on the main campus, and the Rosenstiel School of Marine and Atmospheric Science on Virginia Key.

The Mall of the Americas

An enclosed shopping mall located at 7795 West Flagler Street next to the Palmetto Expressway in Miami, Florida. The anchor stores are The Home Depot, Costco, Marshalls, Ross Dress for Less, and a Florida Department of Highway Safety and Motor Vehicles office.

Sources: https://www.mdc.edu/medical/campus-information/parking.aspx, https://www.cerner.com/client-achievements/south-miami-dade-hospital-reaches-himss-stage-6-7, https:// welcome.miami.edu/, https://www.royalcaribbean.com/gbr/en/about-us, https://www.miamiandbeaches.com/thing-to-do/shopping/mall-of-the-americas/2888

PROPOSED DEVELOPMENT PROJECTS

MIAMI FREEDOM PARK PROJECT

Miami Freedom Park will become a recreation destination that all Miamians can enjoy, providing 58 acres of public parks and green space, a tech hub, restaurants and shops, soccer fields for the community, a 25,000 stadium for Inter Miami, and many more features.

The project will not utilize any city dollars as it is 100% privately funded by club ownership. Miami Freedom Park received overwhelming support from City of Miami residents, having received more than 60% voter approval last November’s referendum. With this vote, the residents have indicated that they want the City to negotiate and execute a lease for the proposed land for specific project.

Miami Freedom Park will deliver an array of benefits to the community unlike any other sports-related development in our city. It will pay fair market value rent, as well as living wages for all onsite employees. Miami Freedom Park will contribute more than $40 million in annual tax revenue to the City of Miami, Miami-Dade County, State of Florida and Miami-Dade County Public Schools, and will create 15,000 direct and indirect jobs.

Sources: https://www.intermiamicf.com/club/facilities/miami-freedom-park

This information has been secured from sources we believe to be reliable, but we make no representations or warranties, express or implied, as to the accuracy of the information. References to square footage or age are approximate. Buyer must verify the information and bears all risk for any inaccuracies. Marcus & Millichap is a service mark of Marcus & Millichap Real Estate Investment Services, Inc. © 2021 Marcus & Millichap. All rights reserved. Activity ID ZAD0240049. 53

MLS STADIUM

MULTIPURPOSE FIELDS

BIKE PATHS

PUBLIC PARK ACCESS

Felipe.Echarte@MarcusMillichap.com

LICENSE: FL SL696115

Evan.Kristol@MarcusMillichap.com

LICENSE:

Listed by EVAN P. KRISTOL

MANAGING DIRECTOR INVESTMENTS

OFFERING MEMORANDUM Exclusively

EXECUTIVE

Tel: (954) 245-3459

RODRIGUEZ

/ BROKER - GLOBAL INVESTMENTS REALTY Tel:

285-7739

FL SL640466 JOEL

PRINCIPAL

(786)

ECHARTE

joel@glirealty.com Office: 305.635.3005 FELIPE J.

INVESTMENTS

SENIOR VICE PRESIDENT

Tel: (954) 245-3444

FORT LAUDERDALE OFFICE

North Andrews Avenue, Ste. 100 Fort Lauderdale, Florida 33309 235 NE 25th Street Miami, FL 33137

5900

MIAMI INTERNATIONAL AIRPORT

MIAMI INTERNATIONAL AIRPORT